Living the Pipe Dream: Basing BC’s Economy on Bubble Economics

It’s a daily occurrence these days. The BC Liberals tout the future prosperity of British Columbia as lying in the export of liquefied natural gas (LNG) to Asia. The NDP, in their characteristic fashion, quietly agree and let the Liberals take the heat on the economic projections.

The overvaluation of global oil, gas and coal reserves has led to recent warnings from reputable financial experts and organizations that a new financial risk could impact markets, corporate and government revenues as early as 2015 (see for example the recent article in The Guardian and this video).

There is no mention in either the BC Liberal or NDP platforms or policies of this systemic risk to the economy of British Columbia. They continue to pursue budget and spending projections almost solely based on resource revenue. Addressing this risk requires all parties to be forthright and publicly recognize that it exists. It will further require all parties to work together to achieve solutions that ensure a prosperous future for all British Columbians.

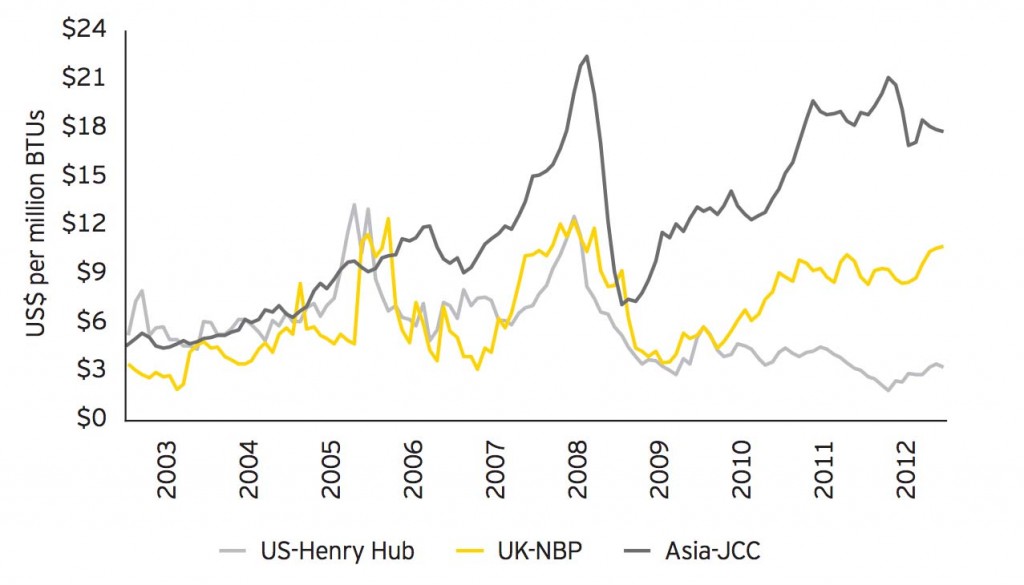

So what is all the fuss really about? Figure 1 shows the trend in the spot gas price in the United Kingdom, United Sates and Asia since 2003. The dramatic increase in the strength of the Chinese economy, coupled with the glut of natural gas in the North American market (due to widespread use of relatively modern horizontal fracking technology) has led to an equally dramatic spread in the spot price of natural gas between Asia and North America.

Figure 1: Trends in the spot price of natural gas in the US, UK and Asia in US$ per million BTUs (British Thermal Units). Source: Ernst & Young Report: Global LNG. Will new demand and new supp mean new pricing?

The argument is initially compelling. In British Columbia we have extensive natural gas reserves in the northeast sector of our province. If we can ship this gas to Asia, we stand to make a lot of money. But as you might expect, it’s not that simple. Let’s take a look at the facts:

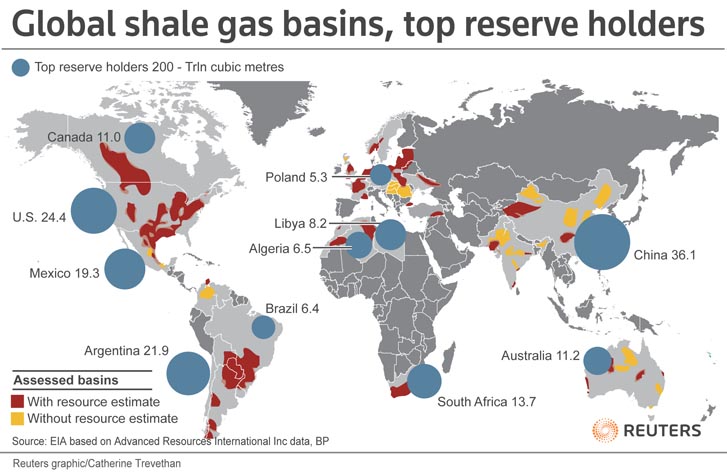

Fact 1: China has more than three times the reserves of shale gas as contained in all of Canada (Figure 2)

Fact 2: The US has more than twice the shale gas reserves as Canada (Figure 2)

Figure 2: Global shale gas reserves for countries assessed (light grey) in trillions of cubic metres. Dark grey regions were not assessed. Source: Forbes.com: China closer to joining shale gas fracking craze.

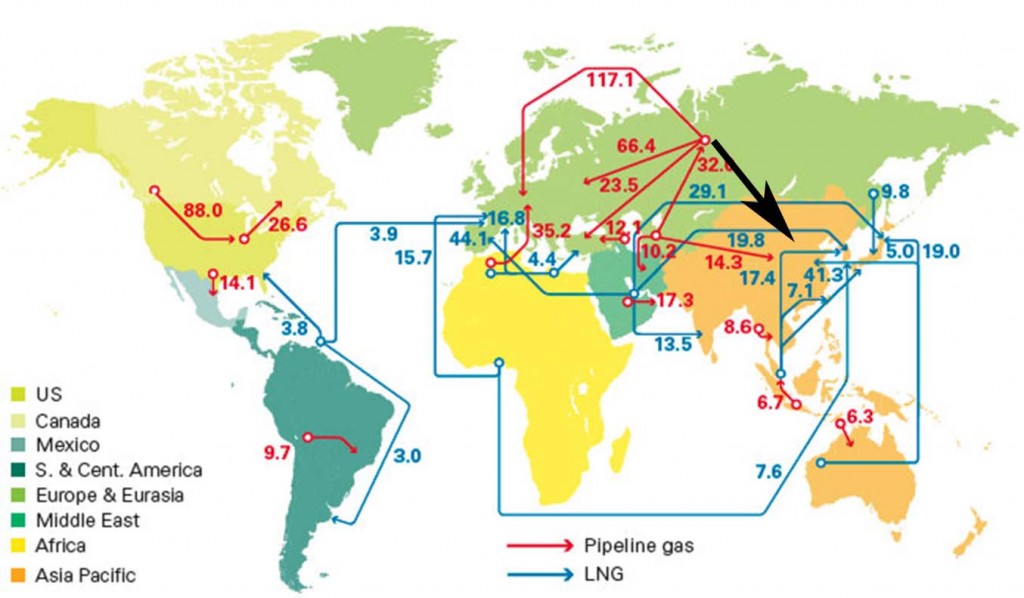

Fact 3: Australia is already shipping LNG to Asia and has similar reserves to all of Canada combined (Figures 2 and 3).

Fact 4: Russia is currently not shipping significant quantities of natural gas to China (Figure 3).

Fact 5: The United States presently imports LNG and so has terminals already built on its coast (Figure 3).

Fact 6: British Columbia does not have LNG terminals on the coast. It will take many quite a few years for them to be built.

Figure 3: Major trade movement of natural gas in 2011. The units are millions of tonnes. Blue indicates LNG; Red indicates pipeline transport. Source: British Petroleum Statistical Review of World Energy 2012.

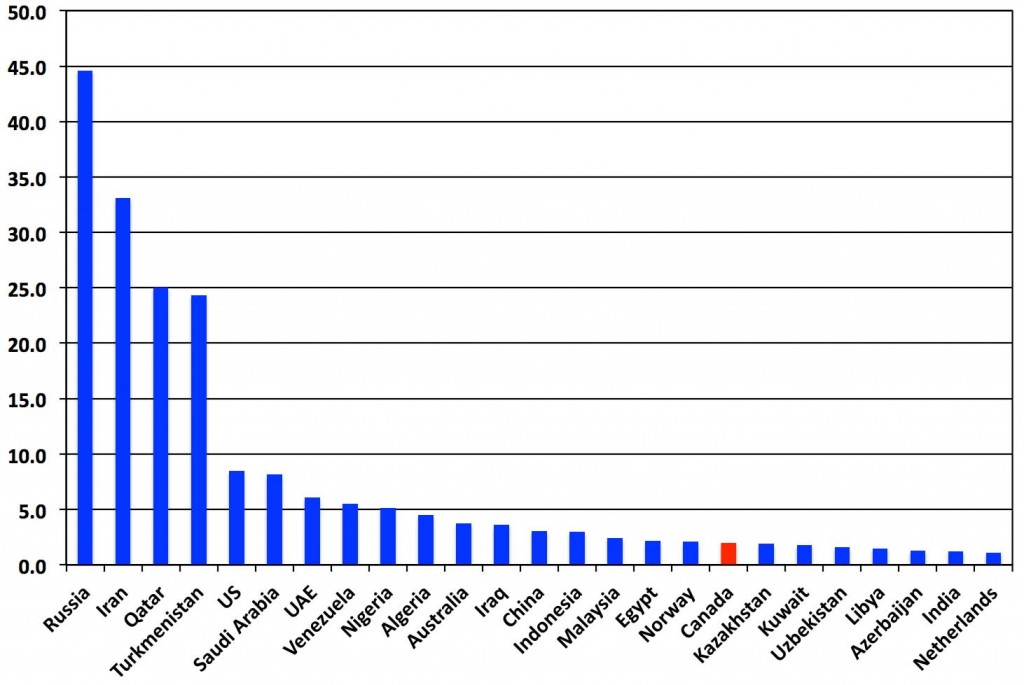

Fact 7: Russia has more than 20 times the proven natural gas reserves contained in all of Canada (Figure 4).

Fact 8: Canada has only 1% of the world’s proven natural gas reserves (Figure 4; British Petroleum Statistical Review of World Energy 2012).

Fact 9: China has signed long term contracts for natural gas supply with Russia (Source: United Press International). This natural gas would be supplied by traditional pipelines and would not need to be liquefied.

Fact 10: Experts are predicting a major economic crisis due to inflation of energy stock prices and the requirement for much of these resources to stay in the ground (Source: 1: The Guardian; 2:Unburnable carbon 2013: Wasted capital and stranded assets). Others are questioning the economics of BC LNG already (Source: Straight.com, Christy Clark’s dreams about natural gas revenue are starting to look like hot air).

Figure 4: Ranked magnitude of the proven reserves of natural gas in the top twenty countries, Canada is indicated in red. Source of data: British Petroleum Statistical Review of World Energy 2012.

It is simply a pipe dream to believe that by the end of this decade, the same natural gas price differential will exist between North America and Asia. It is also much cheaper to pipe natural gas directly from Russia to China than it is to liquefy it and ship it from North America. And as we have seen above, there is much, much more natural gas located in Russia. British Columbians deserve better.

In 2001, KPMG released its Cleantech Report Card for British Columbia. In it they identified 202 cleantech organizations in British Columbia whose revenues had increased 57% from $1.6 billion in 2008 to $2.5 billion in 2011. They noted that the industry was estimated to employ 8,400 people in 2011 with an average salary of $77,000. In their summary, KMPG state:

“while still young, the BC cleantech sector shows tremendous opportunity for growth. It’s a sector worth encouraging and promoting globally. It creates high-paying jobs and investment opportunities for British Columbians’, it’s export-oriented, and it’s helping to improve the sustainability of the planet.”

Just a few weeks ago, the LA times noted that in the United States, Green Jobs Grow Four Times Faster than Others. That is, there was a 4.9% increase in green jobs in the US from 2010 to 2011, compared to only 1.2% for all jobs. In total, there are 3.4 million green energy jobs in the US and 2.6% of all jobs are now in the green sector. They also pointed out that there was a 42% increase in clean energy business and development investment from 2010 to 2011 with the total now being $48 billion.

Let’s work together to ensure BC implements energy policy that manages the transition to a low carbon economy and guarantees British Columbians a prosperous future for generations to come. And positioning our province to become global exporters of new clean technology instead dirty fossil resources of is something all British Columbians would be proud of.

Comments are closed.