BC craft beer risk getting squeezed out of market

The local craft beer industry – renowned for its high employment, community involvement, and tourism draw – is being squeezed out by recent adjustments to B.C.’s liquor taxation and wholesale pricing policies. The new economic structure makes it increasingly difficult for private liquor retail stores (LRS) to make a profit selling craft beer, even though consumer demand continues to rise, and therefore limits local breweries’ presence in the marketplace.

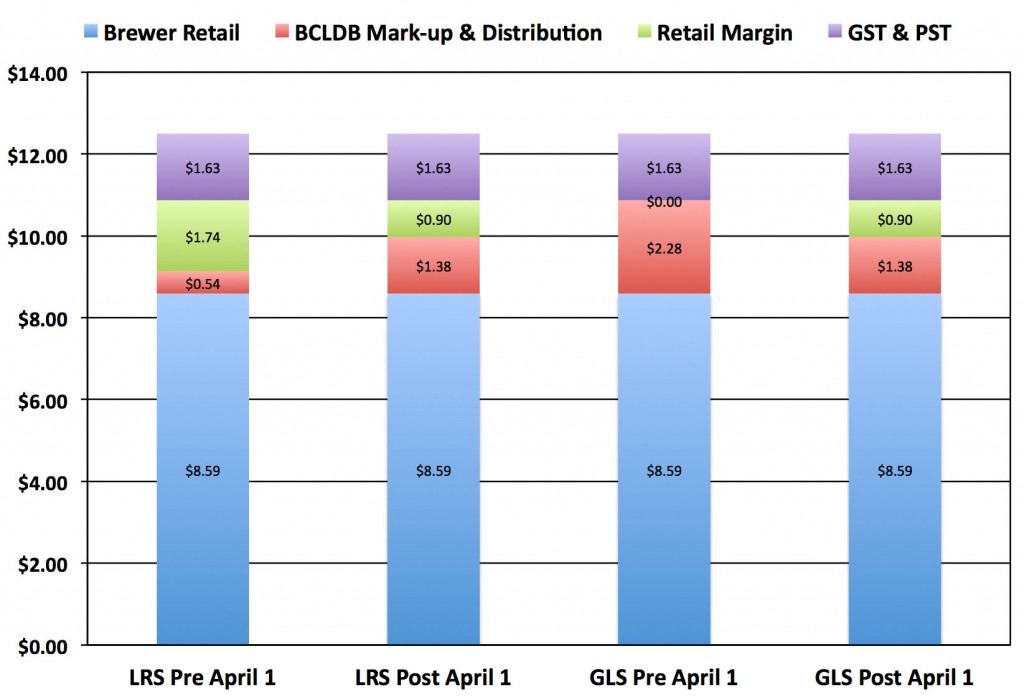

Historically, the beer tax mark-up was allocated in three distinct steps (see blue curve in Figure 1) depending on brewery size (measured in hectolitres, abbreviated hl) that generally translated to small, medium, and large facilities. Small breweries, of which there are 75-80 in B.C., represent the fastest growing sector. There are roughly 10 breweries that qualified as mid-size, two that are “large” (in the 150,000 to 200,000 hl range) and four very large global brewers. On April 1st a graduated mark-up tax was introduced (red curve in Figure 1), giving the large producers a substantial tax break.

Figure 1. The majority of breweries in B.C. produce fewer than 15,000 hectolitres (hl) annually (1.5 megalitres) and were previously taxed at a significantly lower rate than the large scale breweries with the production capacity of 160,000 – 400,000 hl (16-40 megalitres), as illustrated by the tiered blue line. The new mark-up tax rate, indicated by the red graduated line, provides large beer corporations with a substantial tax break relative to small producers and increases the wholesale price for craft beer. In addition, a “sweet spot” is created at 201,000 hl (20.1 megalitres). Beyond that price, the mark-up begins to increase again. A proposed solution is illustrated by the green line. The solution is obtained by fitting a quadratic function between (0 hl, $0.40/litre), (201,000 hl, $0.67/litre) and (350,000 hl, $1.08/litre). Beyond 35 megalitres annual production, the red and green curves are identical.

Now I recognize that the old system had its problems. There were two distinct discontinuities (jumps) in the volume tax-rates (blue curve in Figure 1). The first discontinuity or tax hike occurred at 15,000 hl while the second occurred at a production level of 160,000 hl. The introduction of these discontinuities would certainly be regressive towards companies wanting to grow. This follows since they created incentives to produce up 14,999 hl but not grow to over 15,000 hl just like an incentive was added to ensure no more than 159,999 hl were produced. Clearly this unfortunate barrier to success needed to be fixed.

The government proposed the red line in Figure 1. It is smoother and more continuous and so more gradually ties the increase in the tax rate to volume of production. But the government’s proposed solution doesn’t resolve the existence of a disincentive to growth. If simply moves it to 201,000 hl. And here’s the problem. In making the change, small craft breweries were hit with a double-whammy as the revised tax shift also constrained the ability of the LRS to carry their product.

The changes, which were implemented without consultation with local breweries, are already having an impact. In May, I met Sean Hoyne from Hoyne Brewing Co. and Murray Langdon, the general manager of Vancouver Island Brewery, to discuss their concerns.

Under the new wholesale/taxation regimes, the price of large production beers, such as Molson or Budweiser, will remain relatively unchanged. The relative wholesale price the LRS will pay to stock craft beers, however, has risen. Both Hoyne and Langdon have already noticed that the LRS are reducing their orders and failing to restock once their local features have sold. It’s not that stores don’t want to carry these products, or that customers don’t want to buy them – support for local beers has grown exponentially over the past few years – but the new wholesale price tags on craft beer have rendered them unprofitable for private operators.

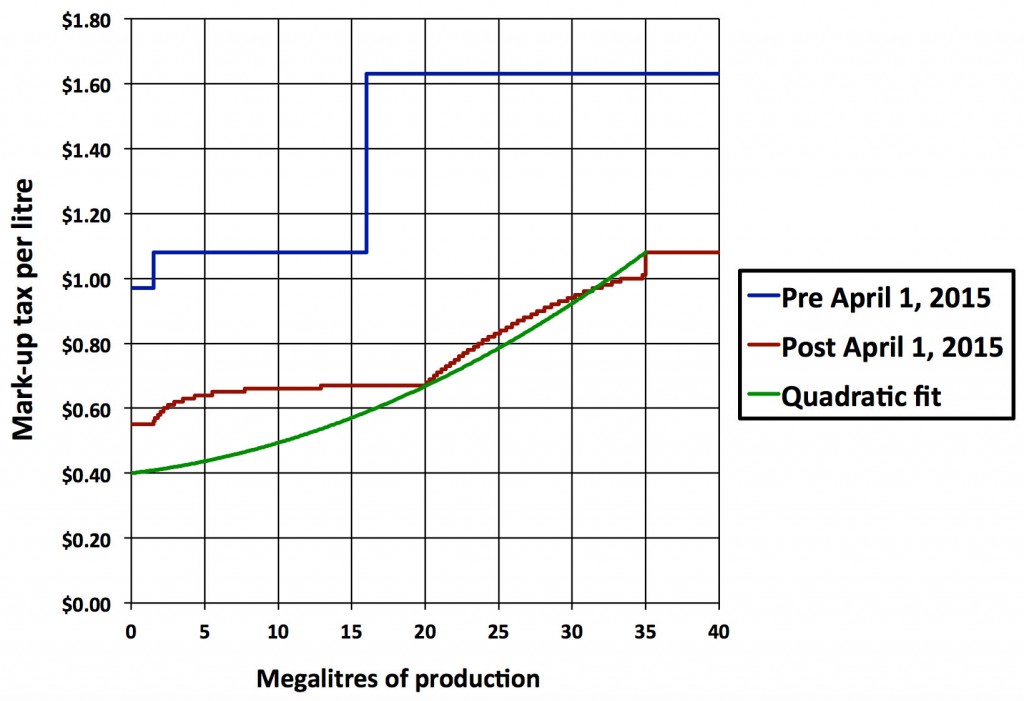

Figure 2. Example of the effect of the new pricing on liquor retail stores (LRS) and BC government liquor stores (GLS). The specific example is taken for a six pack of 355ml cans from a brewer producing less that 15,000 hl annually listing for $12.50. As this graph illustrates, the changes to BC liquor distribution board (BCLDB) mark-up and distribution rates have significantly reduced the profit margin on craft beer for the LRS, while increasing it for the GLS.

Although changes to the wholesale model were presented by the government as “leveling the playing field” between the LRS and government run BC Liquor stores (GLS), the reality has been different. Prior to April 1st The LRS received a 16 per cent subsidy on wholesale costs, now they are being charged the same price as the GLS.

By removing the subsidy that allowed the LRS to purchase liquor at a slightly reduced price, they have reduced the ability of these small businesses to stock local craft beer at a rate competitive with their government-owned counterparts. Under the new wholesale pricing scheme the GLS, which are subsidized by the wholesale arm of the Liquor Distribution Branch, stand to gain more market share in the liquor sales sector. Furthermore, successful larger breweries like Pacific Western have inadvertently been set up to win at the cost of local craft beer.

To stay competitive with the GLS, the LRS will have to reduce their profit margin on craft beer (making it not worth the shelf space), raise consumer prices (thereby driving customers to the GLS), or stop carrying it all together.

In a statement, the Justice Minister described the changes as follows:

“BC Liquor Stores are now expected to compete with private liquor retailers — and as such, have been given a more equitable set of rules to follow — placing them at the same starting line as their competitors. We have created more separation between the retail and wholesale arms of the Liquor Distribution Branch, with BC Liquor Stores now purchasing at the same wholesale price as other retailers and having the option to offer extended hours, Sunday openings and refrigeration. We’re applying the 1km rule to all full-service liquor stores, both private in government, to help protect the investment of the private store owners. Our goal is to help stores and business owners be successful and to increase consumer convenience around B.C.”

And during question period in the B.C. legislature she defended them:

“On the first of April we do indeed begin the new wholesale pricing regime. That means that instead of having a series of discounts, price, price off and so on — a very complicated system — what we have now is a single system that applies to all purchasers. Every purchaser, whether you be an LRS, a rural agency store or a government store, you will all pay the same wholesale price for your liquor — your wine, your beer, your spirits… The overall price of the product will be roughly the same on April 1 as it is on March 31 — minor adjustments but roughly the same price.”

These “minor adjustments” risk compromising the viability of the nascent British Columbia craft beer industry. However, relatively simple changes to the volumetric approach to mark-up taxes can be made to ensure that BC made craft beer can remain profitable for the LRS. In Figure 1 (green line) I fit a quadratic between the three points (0 hl, $0.40/litre), (201,000 hl, $0.67/litre) and (350,000 hl, $1.08/litre). This quadratic fit benefits all BC brewers in that it eliminates all barriers to growth. It can further be coupled with small adjustments to the Liquor Distribution Board retail mark-up to recover the government revenue from the reduced low volume tax rate (see Figures 1 and 2). With the craft beer sector only representing about 3%-6% of the overall beer sector (according to the Liquor Distribution Board), these subtle changes will once more allow the craft beer industry to thrive in BC.

It’s become far too common these days for government to introduce regulations with no consultation with affected stakeholders. In the present case, it has led to unforeseen consequences on the BC Craft Beer industry. But these can easily be remedied. So let’s get on with it.

Media Release

Media Statement – June 8, 2015

B.C. Craft Beer risk getting squeezed out of market

For Immediate Release

Victoria, B.C.– Changes in its wholesale pricing and liquor policies brought forward by the B.C. Government put small B.C. craft breweries at a disadvantage, and risk compromising the viability of this nascent industry, says Andrew Weaver, Deputy Leader of the BC Green Party and MLA for Oak Bay-Gordon Head.

The new policies make it increasingly difficult for private, often family-owned, liquor stores – the catalyst for the recent growth in local breweries – to make a profit on the sale of craft beer. This is the result of wholesale price mark-ups, the elimination of a subsidy previously offered to private liquor stores, and the Liquor Board’s policy of government liquor stores not increasing their retail prices.

Despite Minister Anton’s claims that the government was “leveling the playing field” within the liquor sector, and her assurance that prices would not increase, local producers are already being pushed out of the market.

“The recent changes to our liquor policy are making it unprofitable for private liquor stores to sell craft beer in BC.” said Andrew Weaver. “And as a consequence, it is impacting the viability of our craft beer industry.”

By jacking up the wholesale cost of BC Craft beers to small business retail outlets, they in turn must dramatically increase the price to the consumers to justify the shelf space. In doing so, they are no longer competitive with government liquor store pricing.

“The BC Liberals are putting the interests of a few large breweries and their government owned stores ahead of small business retail outlets and B.C.’s craft beer industry” notes Andrew Weaver. “There are simpler ways of adjusting the wholesale market to level the playing field imposing punitive effects on the BC Craft beer industry.”

The new wholesale pricing model introduced earlier this year eliminated the 3-tiered beer tax system, where allocation was based on production capacity, in favour of a more graduated mark-up tax that sees large and small producers pay similar tax mark-ups. The graduated mark-up could be easily tweaked to create a truly level playing field.

-30-

Media contact

Mat Wright

Press Secretary – Andrew Weaver, MLA

Cell: 250 216 3382

Mat.Wright@leg.bc.ca

Comments are closed.