Bill 29 – Property Taxation (Exemptions) Statutes Amendment Act

Today in the Legislature I rose to speak in support of Bill 29 – Property Taxation (Exemptions) Statutes Amendment Act, 2015.

Bill 29 ensures that there is consistent treatment across the province with respect to the way independent schools are subjected to municipal property taxation. Presently only the land immediately under a school building is exempt from municipal taxation. While most municipalities extend the exemption to the rest of the school property (playgrounds, playing fields etc.) there have been a few exceptions and some municipalities are contemplating the idea.

Below is the text of my speech at second reading.

Text of 2nd Reading Speech

A. Weaver: It gives me great pleasure to stand and speak in support of Bill 29, Property Taxation (Exemptions) Statutes Amendment Act. My riding is particularly interesting in that there are presently six…. Well, there are five high schools now, but after the election boundaries are redefined, there’ll be six high schools. Three of them are public schools, and three of them are independent schools. Oak Bay, Lambrick, Mount Doug — public schools. St. Michaels and Maria Montessori are presently in the riding and independent schools. Glenlyon Norfolk, soon to be in the riding, as well, is another independent school.

We have much to be proud of, of our education system in British Columbia. Despite what some might have said, Canada ranks at the very top, internationally, in the program for international student assessment scores, particularly in the area of sciences and reading. If we look at the 2012 science rankings, worldwide, No. 1 was Shanghai, China. No. 2, Hong Kong, China. No. 3, Singapore. No. 4, Japan. No. 5, Finland. And No. 6, British Columbia.

Now, when you compare that to 2003, in fact, two of those — Shanghai and Singapore — were not part of the 2003 assessment. So in essence, British Columbia would have been ranked No. 4, worldwide, in terms of science achievement, whereas in 2003, British Columbia was ranked No. 6. So we have much to be proud of in British Columbia with respect to our science education.

The same is true with our language arts. In 2003, No. 1 in the world was Finland. Alberta was No. 2, and British Columbia, No. 3. Since 2002, a number of other jurisdictions have participated in the international PISA. So we see Shanghai and Singapore moving up. British Columbia dropped to No. 6, which would have been fifth if you accounted other jurisdictions that weren’t there.

But what is really important to note is how it did relative to other provinces in Canada and the much-touted Finnish education system. I’ll come to Finland in a second, because in 2003, Finland ranked No. 1 in science, No. 3 in mathematics and No. 1 in reading. British Columbia was sixth in science, fifth in mathematics and third in reading.

Now, what’s indicative of a government that has somewhat lost touch with developing advancements in education, for reasons unknown to anybody, the B.C. government sent a young person to Finland to study the Finnish system. I understand that if you’re looking at the 2003 PISA assessments, you might want to understand the Finnish system. But in 2012, British Columbia was above Finland in mathematics, was above Finland in reading and was tied, statistically so, in science. There’s much to be proud of about our education system in British Columbia, and we do not need to study the Finnish system to find that out.

We are the top-ranked province in Canada, in terms of science education as well as reading, and yet that was not the case in 2003. Alberta was the top-ranked province in all three areas covered by PISA. But there is one area that B.C. does have some trouble with and I would argue that this has nothing to do with the quality of our teachers in British Columbia, but rather as the quality of the means and the ways they’re being trained to teach mathematics.

Mathematics is the one subject where B.C. has dropped, relative to other jurisdictions, in the move that has moved mathematics from learning the times tables by rote memorizing — learning by memorization, a critical aspect of learning mathematics — and moving into trying to understand what that means. You should know that seven times eight is 56, right off the bat. That’s a critical building block. But you shouldn’t necessarily have to know in grade 3 that….

M. Farnworth: Nine times seven?

A. Weaver: Sixty-three, and nine times nine is 81.

But today in school you’re not taught nine times seven is 63. You’re taught that nine times seven is ten times seven minus one times seven. Now, that’s an abstract idea that many people in elementary education simply can’t grasp. If you want to know why we’re going down in maths, you have only to look at the way our teachers are being trained in the universities, not the quality of the teachers themselves. Apart from mathematics, we rank at the very top internationally.

I will not listen to those who bemoan the state of our education system in B.C. We rank second to no other province in terms of quality, and we’re one of the top nations internationally and certainly the top nation in the western hemisphere.

What does that have to do with the bill? Well, it has to do with treating independent schools the same as public schools. Presently, the contents of this bill are actually in play in the Vancouver Charter already. The Vancouver Charter is quite specific in terms of what can or cannot be included in property taxation. This bill essentially says to the rest of the province that we’re going to be consistent. Whether you be in Victoria, Prince George, Kelowna, whether you be in Fernie, whether you be in Haida Gwaii, Prince Rupert, schools will be treated one and the same in terms of their property taxation.

Many people often don’t realize that we’ve had independent schools in Canada since the 17th century when the first Catholic schools were established in Quebec. In many jurisdictions, we have publicly funded school boards that fall along denominational lines. In Ontario and Alberta, for example, we have Catholic school boards and we have non-Catholic school boards. They’re both public school systems that go back to Confederation days. Here in B.C., we would call Catholic schools independent schools, where in other provinces, they’re considered part of the public system.

We have other potential problems which exist presently. Let’s suppose right now that we have a Catholic school on church property. How does that fall within the property taxation realm? Is it a church? Is it an independent school? Is it in the Catholic school board? No. This needs to be cleared up. While this bill is very short in terms of length, it’s important in terms of substance, because it actually closes a lot of potential problems that could create a potpourri of odd property taxations across the province.

One of the things that I support in this bill is the fact that it does not apply to things like endowment lands, things like houses for staff, for example, if there may be some independent schools that provide housing for their teachers. There may be some other independent schools that have large endowment lands. These are not being covered under this legislation. It’s simply the school and that which is typically used in school.

There are benefits for that. A school in my riding, Glenlyon — well, soon to be my riding; half the school is in my riding — for example, has a lovely Astro Turf field that is used by the local community in partnership, the Bays United soccer community. They have a public relationship with the independent school, yet there is a potential — it’s not right now — for that to be taxed, even though the public is benefiting from this field that is used by all.

In summary, then, first off I would like to recognize that we do have an outstanding education system. It does not help our education system when we continue to bemoan the problems in it instead of celebrating the successes in it. Sure, there are problems in our education system. There are problems in everything around us. But we will not move this education system forward if all we do is fixate on the negative that’s in it.

Secondly, I think fairness is critical. This bill provides fairness, recognizing that there are other provinces where independent schools, like the Catholic system, are actually part of the public system, whereas in B.C. we’ve never had Catholic school boards. Finally, it does not exclude some of the extraneous properties attached with an independent school. Those will be subject to municipal taxes.

With that, I thank you for your time. I’m only sad that the new Minister of Education is no longer sitting beside me, but across the hall. I do appreciate your office, hon. Speaker, and of those House Leaders, in preparing me here in the Legislature for two upcoming by-elections so that my colleagues can sit beside me.

Video of 2nd Reading Speech

The Vote

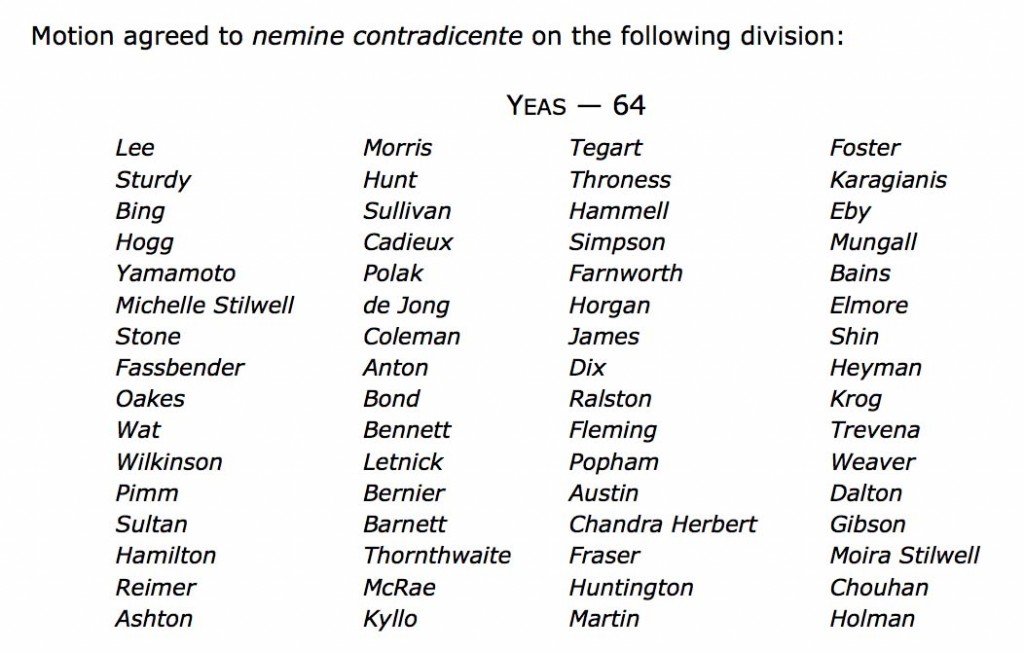

Second reading of Bill 29 approved unanimously on a division.

2 Comments

Bill 29 is law, that does not respect electors rights and duties under the local property school taxation law, The School ACT. Children are not to be charged with their own education under that law, and the provincial MLA are to assure that in their riding parental income and the tax code, does not give some children a more advantageous class size and composition, than other children. Any MLA that ignores that law, and has their children charged to under a mandatory education law, cannot vote for Bill 29 as they are in a conflict of interest. Children do not have access, even when disabled to the private healthcare facility offered by independent schools to those children who can afford to pay. Local electors under court case law, have been told that they are not entitled to tax the locals for their choice to pay Board access fees, for what under Statute Law is to be free. When neither the opposition or the Attorney General respect rule of law, local electors are not being served under any public interests. Independent Boards are not equal to public Boards, they serve what is a market, and a system of discrimination against disabled children and neighborhood children, who they do not choice as they select out locals who cannot beg for the fees to access the lower classroom composition and class size and the private healthcare professionals under a Regional Healthcare Facility license. It is a sad day for democracy, when all levels of government take positions of discrimination against the children, treated them as those money determines access to opportunity. The fact that lands that are private are not a local electors duty to be forced to pay for, driving up their taxes for a market, where children are commodities for access to international money to lower the private contract fees of the parents, who sold off public education, without regard to the electors rights and duties or the rights of children to not be charged or denied access to equal quality education and healthcare, locally where they live, is indicative of a democracy, where the law is competing against the law, pitting citizens against each other. Private contracted Boards can prey on children, segregating them without regard to Statute Law, which does not permit any MLA to advocate for them and against the Statue that they are required to obey, which states that children cannot be charged for their own mandatory education and schools are to be secular in B.C. The fact that an MLA will advocate to ignore their own laws and courts decision regarding access to public school taxation for those who do not want their children in our public schools, is immoral. Democracy was to be the great equalizer, where children were offered an equal educational opportunity and under our universal healthcare equal treatment of their special needs. Instead we have a Bill, which demonstrates that children are being treated unequally, divided by private contracts, as though an predatory Board is equal to an elected Board. To see you suggest that local property taxpaying electors, who believe morally in equal education opportunity, have no rights in this city because the private are entitled to use them for their own private interests, is indicative, like Ms. May said, that she is advocating for our public interests as a member of the legal profession, under a belief that environmental legal positions should not pit a private interest against a public interest. under rule of law where the costs of the private is born by the public. This Bill 29 is a private interest taking over what is a public interests. When you do not respect the equality rights of s. 15 citizens and their children, public children, some even provincial wards, who are waiting on public healthcare and public education waiting lines, while the entitled class of independent parents help themselves to public finance, under the inequality structure of administration of education law and taxation, you demonstrate a lack of understanding who the public is and what public education means. If you do not respect the law that children are to attend schools that are free and secular, then I would suggest you run your party of the right to change that law, and make children beg for access to quality healthcare and education under one law, but to say private schools are equal to public schools is to govern with ignorance. Democracy can change that law that was supposed to mean that access what equitable and open equally to all, not based on parents wealth and school Board’s that discriminate against children who live on the block where they offer their privileged education to those children who pay. But do not claim that a democracy can hold two competing laws, laws that treat their children and their electors unequally.

I’m not sure I understand your point. This bill was supported by all parties in the house. It essentially put into law that which was already being practiced.