Why bother with the MSP task force if you aren’t willing to listen to them?

Yesterday I rose during Question Period to ask the Minister of Finance why she would forge ahead and announce the Employers’ Health Tax prior to her very own MSP task force submitting their final report.

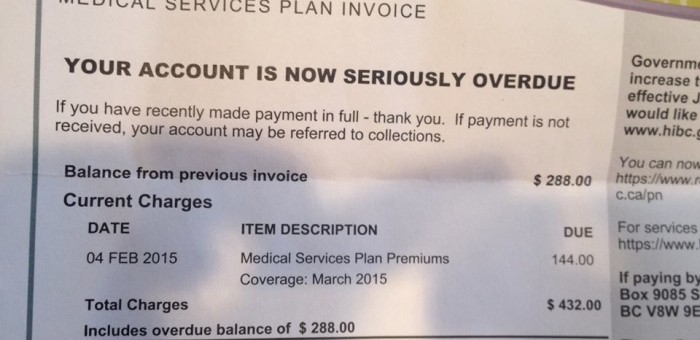

Recall that on November 2, 2017, the BC Government announced the establishment of an MSP Task Force. The mandate of the Task Force is to provide government with advice on how to replace lost revenue when MSP premiums are eliminated. The Task Force will be issuing its final report on March 31, 2018.

I remain perplexed as to why the Minister of Finance rushed into the Employers’ Health Tax. In doing so, she has created a suite of unforeseen budgetary problems for schools, hospitals, municipalities and other large employers. In addition, she has ignored what the interim report from the MSP Task Force stated:

A payroll tax would reduce the competitiveness of B.C. businesses at a time when they are facing several competitiveness challenges.

and

We feel that it is important that revenue be replaced by a combination of measures in order to best mitigate the negative impacts of each.

The only conclusion one can reach is that the Minister of Finance either (a) read the MSP Task Force interim report but chose to ignore its key recommendations, or (b) rendered her decision to implement the employers health tax prior to the interim report actually being available.

Below I reproduce the video and text of my Question Period exchange with the Minister of Finance.

Video of Exchange

Question

A. Weaver: Yesterday I asked the Minister of Finance why her government forged ahead with the employers health tax without waiting just a few more weeks for the final report to come in from her MSP Task Force. In response, the minister assured us that she took the task force interim report into account when making her decision.

Okay, let’s take a look and see what the task force actually said in this interim report. They said this, “We are leaning towards a combination of a personal income tax surcharge, a small payroll tax and additional ideas” as the best way to replace the revenue. Instead, this government went in the exact opposite direction, putting the entire burden on employers through this payroll tax.

My question to the Minister of Finance is this: given that the expert task force recommended against exactly what you’ve chosen to do with the employers health tax, how do you justify this decision?

Answer

Hon. C. James: Thank you to the Leader of the Third Party for his question. We did receive the interim report. We felt it was important to move ahead on the elimination of medical service premiums on behalf of British Columbians. Leaving the regressive tax in place did not make sense, and we were able to manage it in this budget.

We had increased personal income tax for the top 2 percent of income earners in September’s budget. I’m not sure what the member is asking — whether he’s committed to increasing personal income taxes. But we felt that because we’d already made the decision around the top 2 percent of income earners that this was a balanced approach.

Supplementary Question

A. Weaver: Well, to enlighten the minister, what I’m asking is: why do you have a task force to do something if you’re not going to listen to what they’re doing and actually make decisions before they’ve done what they said they’re going to do?

In fact, the MSP Task Force had more to say. On the payroll tax, which is the direction this government has chosen to go, they said this. “A payroll tax would reduce the competitiveness of B.C. businesses at a time when they are facing several competitiveness challenges.” This concern about business competitiveness is precisely why the task force was leaning towards a combination of measures to make up the revenues, not just by a payroll tax.

They specifically stated this. “We feel that it is important that revenue be replaced by a combination of measures in order to best mitigate the negative impacts of each.“

My question to the Minister of Finance is this. Did the minister either:

a) read the MSP Task Force interim report but choose to ignore its key recommendations, or

b) render her decision to implement the employers health tax prior to the interim report actually being available?

It has to be one. Is it (a) or (b)?

Answer

Hon. C. James: As I already said to the member, we received the interim report. We are ultimately accountable as government. It is our job to receive the report, make a decision based on the information that was there. We received the interim report. We made our decision. We believe it’s a balanced approach, as I said. The member may have a difference of opinion. The member may be interested in looking at personal income tax, and that’s the member’s prerogative. We made a decision as government.

I would also remind the member that, if we are looking at competitiveness when it comes to businesses here in British Columbia, two of the key issues that businesses have been calling for action on over and over again are the issue of child care and the issue of housing. We moved on both of those to address competitiveness and recruitment and retention of employees in British Columbia.

Comments are closed.