Introducing Employers’ Health Tax before completion of MSP Tax Force report?

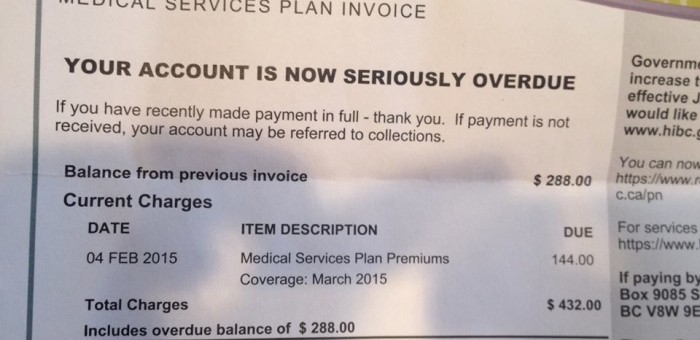

For more than three years I’ve been pressuring government to eliminate the unfair and regressive flat rate Medical Services Premium (MSP). In fact the promise to do so was a major BC Green Party platform commitment, and we outlined how we would recoup the lost income by following the lead of Ontario. We were very pleased when government also agreed to eliminate the MSP.

But rather than specifying how the lost revenue would be replaced, the BC NDP decided to set up an expert committee to provide it with advice. And so, on November 2, 2017, the BC Government announced the establishment of an MSP Task Force.

The Task Force will be issuing its final report on March 31, 2018.

Imagine my surprise when BC Budget 2018 outlined the creation of an Employers’ Health Tax to replace the MSP. It seemed very odd to me that government was making such an announcement prior to the Task Force producing their report.

Exploring this was the subject of my exchange in Question Period with the Minister of Finance today. Below I reproduce the video and text this discussion. I hope that government will reflect upon their decision and be open to revisiting it once the Task Force final report is made available.

Video of Exchange

Question

A. Weaver: Let’s be clear: government misled British Columbians on the B.C. Hydro rate. There’s no two ways of saying it. I find it remarkable that they’re trying to claim otherwise.

Government established an MSP Task Force in November to advise it on how best to eliminate the MSP premium and make up the revenue. The task force comprised experts in both economics and public policy. The team analyzed hundreds of submissions from individuals and stakeholders. They consulted with labour and business groups. They undertook an in-depth tax policy analysis. Their report advising on how best to eliminate MSP premiums isn’t due until the end of March. Rather than waiting for the report, government eliminated MSP premiums and instituted an employers health tax.

My question to the Minister of Finance is this. Government established the task force. Government selected the experts, the mandate and the reporting timeline. Why would government forge ahead on this tax change without waiting for the task force to submit their recommendations?

Answer

Hon. C. James: Thank you to the Leader of the Third Party for the question. As the member knows, part of my mandate as Finance Minister is to look at how we can ensure a more fair tax system. The outstanding piece in British Columbia, on an issue of a fair tax system in particular, was the MSP, the fact that MSP was not eliminated. It was the most regressive tax, and it needed to be addressed.

It became clear that this was something that we could accomplish in the budget. We looked at the interim report that came from the MSP panel. We, in fact, agreed with a couple of the pieces that they brought forward, which was to eliminate the premiums all at once, not to do a further phase out, as we had done with the first 50 percent, and to give some advanced notice. Again, that’s why we’ve given a year.

I look forward to their final report. We took into account their interim report. And I’m very proud that we are going to save families and individuals in this province by getting rid of MSP once and for all.

Supplementary Question

A. Weaver: Thank you to the minister for the answer. She’ll get no argument from us about MSP being a regressive form of taxation.

Since government announced the employers health tax, we’ve been hearing concerns from businesses, school boards and local governments regarding its potential negative impacts. We’re hearing concerns about everything, from impact on businesses’ bottom line to the ability of the public service to provide the services they are required to provide.

The MSP Task Force was going to issue a final report in just a few weeks, advising government on the best path to eliminating premiums. When the Minister of Finance established the task force, she said this: “Engaging a panel of respected experts in economics, law and public policy, we will ensure the path we take is fiscally responsible, fair and evidence-based.”

My question to the Minister of Finance is this. In light of the desire to ensure that public policy is informed by evidence, did government ask the task force to expedite their work in order to provide final recommendations before government made a decision on establishing the employer health tax?

Answer

Hon. C. James: We received an interim report from the committee. We made the decision, as government, to move ahead on getting rid of a regressive tax. We felt that was important. We were able to do it in this budget, and we thought this was the right time. We ensured that we gave a year’s notice so that we would be able to work through the challenges.

The member has raised some of the issues that we are hearing and discussing. We are going to continue those discussions to ensure we can cover those bases, but we will be eliminating MSP by 2020. People are saving money — $1.3 billion this year — by the reduction of MSP by 50 percent, and we look forward, as I said, to savings for families and individuals in this province, making life more affordable for the people of B.C.

One Comment

I think employer tax for health insurance is fair as many employers were already paying employee premiums. If for example the province raised personal income tax to make up lost revenue many employers would win and many employees would loose. (Don’t forget liberals lowered provincial income tax rate since last time NDP were in power)