LNG tax legislation rushed at expense of British Columbians

Today, on the final day of the fall sitting, I used my last speaking opportunity in the House to offer MLAs an opportunity to reconsider what I believe to be prematurely introduced LNG tax legislation.

At third reading I moved an amendment that would have sent Bill 6 – The Liquefied Natural Gas Income Tax Act to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises.

This legislation would benefit from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

During the committee stage for the bill after 2nd reading, I also identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC.

In my view it was premature for us to consider passing a piece of tax legislation that contained no information about revenue projections and no substantive justification for the massive corporate tax breaks and incentives.

Our government has claimed that the revenue accruing from an LNG industry would bring British Columbia a $1 trillion boost to its GDP, a $100 million prosperity fund, 100,000 jobs, the elimination of its provincial debt, the elimination of the PST and thriving hospitals and schools. These are bold claims that so far have not been supported by any clear or reliable evidence.

Bill 6 was supposed to contain the details, supported by revenue projections, to substantiate these claims. Unfortunately, we never received anything of the sort. It is perplexing to me that both the government and the official opposition would vote to support this LNG tax legislation when absolutely no quantitative information has been provided about how it will impact British Columbians.

In moving the amendment I offered the government, the official opposition, and the public an opportunity to explore both the opportunities and possible pitfalls associated with this Bill in greater detail.

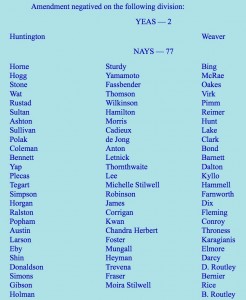

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

The fact that the two independent MLAs were the only ones to suggest this Bill is incomplete in its current state is startling. British Columbia deserves real political leadership that is honest about the opportunities and the risks associated with any hypothetical LNG development.

While the government has described British Columbia’s LNG opportunity as a generational opportunity, this bill can only be described as a generational sellout.

The Amendment

I move that the motion for third reading on Bill 6, Liquefied Natural Gas Income Tax Act be amended by deleting all the words after “That” and substitute the words “the bill be not now read a third time, that the order for third reading be discharged, the bill withdrawn from the Order Paper and the subject matter referred to the Select Standing Committee for Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills.”

Speech to the Amendment

I wish to speak to the amendment and the reason why I brought it forward.

Through this committee stage, a number of issues have been clarified. There have been questions that would benefit exploration at committee stage. In particular, there are questions on revenue projections, the modelling, the assumptions into the modelling that have not been forthcoming and transparent in terms of us, as a legislature, to be able to assess this legislation.

There is section 32(c). There are issues that came up there with respect to a loophole for earned credits that could be sold by a company and the income from that not being claimed as taxable, yet the person purchasing it can claim the income as a deduction.

There are questions in section 46 with respect to the rates being left out. We haven’t got some guidance as to what that rate is in the formula there.

There are questions with respect to section 47 regarding a potential LNG loophole for tax avoidance through capital acquisitions and leaving the 1.5 percent LNG tax rate for significant times.

There are questions on section 122 with respect to the polluter-gets-paid as a polluter-pay model.

There are questions on section 172 that we did not have as much time as I would have wished to explore, in particular the one-half percent natural gas tax credit.

I would think that with such an important piece of legislation, which a government believes is outlining a direction for this province for years ahead, this legislation would benefit from a more thoughtful analysis at committee stage, at which point third parties could be brought in for consultation, including the public, including First Nations and including the companies involved, so that all in this Legislature are able to see the negotiations and the input that is required for such legislation to move forward.

This is the reason that I brought this amendment forward now, hon. Speaker.

Thank you very much for your time.

5 Comments

It seems Ms. Clark has taken a page from the play book of Stephen Harper when it comes to ignoring the concerns and questions of voters. Thank you for communicating clearly and logically about these important matters that will concern this province for generations to come.

Thank you Andrew for representing the BC taxpayers in this issue. It is hard to believe how “broken” our system appears to be. I am sure that it must be difficult to continue butting heads, but rest assured that your efforts are noted, especially as dissatisfaction with the Liberals grows. Hopefully in the next election we can vote in some helpers.

I am a green horn in the political realm just paying attention in the last few years as my gut opposed the direction of the Federal Government and now the BC Provincial government.

I applaud your clear thinking and am wondering if you & Vicky Huntington as independents are open to free thinking while the majority of MLA’s are feeling pressure from a type of party whip

System.

On an off side, I heard you present at the screening of the ‘Directly Affected’ film in Victoria earlier this month. I was impressed with the integrity of all on the panel, the MC & the young film maker and felt a strong sense that I found ‘my clan’

Pleasup continue to be a watch dog in the jokes of a better future.

Hello Victoria, indeed neither Vicky nor I are told how to vote by our party whip! The BCNDP and the BC Liberals are both instructed how to vote. As such, they all vote in unison.

Dear MLA,

WE CONCUR 100 % WITH YOUR ANALYSIS AND YOUR OBJECTIONS TO THE BILL AND TO THE GOVERNMENT’S PROCESS.

WE APPLAUD YOUR INTEGRITY AND YOUR PASSION IN THIS MATTER AND IN ALL MATTERS THAT WILL AFFECT THE FUTURE OF THIS PROVINCE.

HOW CAN WE HELP.?