A Renewed Call to Eliminate MSP Premiums

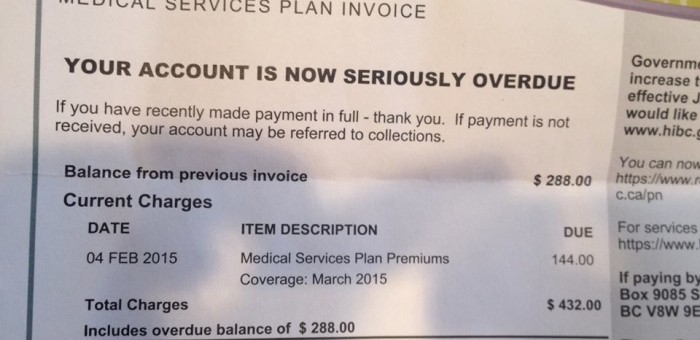

In case you weren’t aware, life just got a little more expensive for British Columbians.

Medical Service Plan (MSP) Premiums have just gone up again. This tax is applied to anyone living in BC for six months or longer and requires them to pay monthly premiums for health care coverage. While some individuals can apply for premium assistance, these subsidies dry up as soon as a person earns a net annual income of $30,000 or more.

Healthcare costs money. There’s no denying that we need to support the medical services we rely on.

However the way MSP Premiums work in British Columbia is regressive, hurting those who can least afford it.

It’s time we followed the path Ontario has taken and rolled the MSP Premiums into our income tax system.

The Problem

Currently in BC a person who earns $30,000 a year pays the same rate for their MSP Premiums as someone who is earning $3,000,000 a year. This is what it means to have a regressive tax – what you pay is not based on what you make.

Currently in BC a person who earns $30,000 a year pays the same rate for their MSP Premiums as someone who is earning $3,000,000 a year. This is what it means to have a regressive tax – what you pay is not based on what you make.

MSP Premiums become even more regressive when you factor in who actually pays them. The fact is, many large employers pay all or part of an employee’s MSP premium as part of a negotiated taxable benefit of employment. But for many, if not most, low and fixed income British Columbians, as well as small business owners, they must pay the costs themselves.

And they have been going up constantly.

Back in 2000, the MSP premium for a single individual was $36/month. Today that same individual pays more than twice as much, now up to $75/month. Just since 2010 there has been a 40% increase. For a family of three your new rate as of January 1st 2016 is $150/month, up from $142/month.

Let me put this another way: The BC Government rakes almost as much revenue in from MSP Premiums as it does from corporate income tax.

The government’s response has generally been to point out that it does have some premium assistance available. But this too is not without significant issues.

First, the assistance program is an opt-in program rather than an opt-out. One academic paper found that 26% of families that earned less than $30,000 a year were not enrolled in the system.

Second it would be a mistake to assume that once you are earning $30,000 a year that this is now an affordable tax.

Before moving on I’d like to acknowledge, with thanks, Lindsay Tedds at the UVic School of Public Administration for her thoughtful blog post on this issue.

MSP Premiums are a regressive tax that are contributing to the issue of affordability so pervasive in our province. What do we do about it?

The Solution

The answer to my previous question is very straightforward. British Columbia should follow the path taken by Ontario in 2004 when they introduced the Ontario Health Premium (OHP), and rolled it into their income tax system.

In Ontario if you earn $20,000 or more a year you pay the OHP. It ranges from $0 if your taxable income is $20,000 or less, and goes up to $900 per year if your taxable income is more than $200,600. Instead of the mail-out system we have in BC, the OHP is deducted from the pay and pensions of those with employment or pension income that meets the minimum threshold. The full range of premium rates in Ontario for those at different incomes can be viewed here.

Remember – only Ontario’s top earners are paying $900 per year. Right now people in British Columbia are paying $900 a year regardless of whether they earn $30,000 or $3,000,000 a year.

Next Steps

It is past time that the BC Government adopt this straightforward change. Last year, when I brought this issue up there was an outpouring of interest and support for the idea. Even the government indicated that they weren’t opposed to talking about it.

Yet, a year later, nothing has changed except that MSP Premiums have once again gone up.

This needs to be corrected. The 2016 budget will be tabled on February 16th 2016. Please join me in calling on our government to implement this common sense change for inclusion in this year’s budget.

One thing is certain, as Leader of the BC Green Party I can attest to the fact that a BC Green Party government would eliminate the regressive monthly MSP premiums. Instead, a BC Green government would introduce a progressive system in which rates are determined by one’s earnings. And a net administrative savings to taxpayers would arise in rolling MSP premiums into the existing income tax system.

7 Comments

MSP premiums are quite obviously discriminatory when single people living together in a non marriage relationship but sharing expenses can pay no msp but a family is penalized by adding their incomes together. The deductions allowed do not alleviate this disparity.

My husband and I are stuck on the family plan. My 2 children have long ago grown and left the home. I am retired early due to health reasons. My income before taxes was under 10,000. Needless to say my money goes for food, life insurance and to save a little for presents for my grandchildren. My husband is still working and his salary is just over $30,000. This goes toward rent,utilities, bus transportation, prescriptions,etc. We live paycheque to paycheque. I asked the MSP office if we could stop the family plan because I qualify for the lower level but I was told no. It was explained that our combined income disqualified us. I told them he would pay his at the regular rate and I would pay them at the lower rate which I qualify for. I was told the only way this could happen is if we were divorced and provide them with the divorce documents. End of discussion.

I really hope and pray that something can be done to change the system. Premier Clark doesn’t have a clue how BC people are being spread so thin.

i AGREE WHOLE HEARTEDLY THAT THE mEDICAL SERVICES PLAN SHOULD BE COVERED BY TAXES, AS IT IS IN MOST OTHER PROVINCES, THAT WAY YOU KNOW FOR SURE THAT THE LOWEST INCOME PEOPLE ARE PAYING LESS, ALSO YOU MAY MISS THE bILL IN THE REST OF YOUR EMAILS, AND FAIL TO PAY THE FEE, EARLY ENOUGH.

That happened to us as well. My husband was born in the UK but came to Canada when he was 3. He moved to BC when he was 12 and has lived here since.(he is now 60). We moved out of the province and were dinged for $1,500…and then…THEN they had the gall to say that he might have come to Canada illegally and he now needed proof of landed immigrant status. What a laugh. This man has worked and paid taxes in BC all his working life. He has a drivers licence…..can vote and even got a security pass to go and work at the naval shipyard here in Victoria, but he can’t get medical?????? My first thought is was that this was just another cash grab, and I still think that.

I also wholeheartedly support your stand on this issue, and my wife and I are both covered by our employer, so we stand to lose, not gain by your proposal. However, it is clear that the current system is highly regressive, and unfair to many people in BC, especially those with limited income.

The only thing I would question is your claim that you “have no idea why” things are this way. I would suggest that it is fairly obvious who benefits from a regressive tax structure, and, therefore, who supports its existence–the wealthy. Unfortunately, our current government responds far more to the wealthy, than to the average citizen. The problem is further compounded by the low voting levels of those at the bottom income levels. Governments like ours simply don’t care about, nor respond to, the needs of those at the bottom.

I wholeheartedly support you on this issue. I’m a stay at home mom and my husband is a student, but we’re still required to pay MSP premiums because assistance is based on your income from 2 years ago. I called Revenue Services BC and asked if there was a program for a family in our situation. I was told that there is not so we are essentially borrowing money from the government (via student loans) to pay the government for health care. This makes no sense! Also, the assistance isn’t based on the size of your family. A family of 4 living on $22,000 is well below the poverty line but this is the income required (regardless if you’re single or have 8 children) to qualify for full subsidization.

Vanya, thank you for your feedback. Your story is typical of many, many stories I have been told. To add to your story, if you and your husband lived in, say, the UK, you would be covered under their health care system. But upon your return to BC, you would get a bill retroactively asking you to pay MSP for all the years you were away. If you said “we were in Europe covered by their system”, you would get a “that doesn’t matter” response. If you refused to pay, collection agencies would get involved. Our regressive, unfair approach to funding healthcare needs to change. Our proposal to use the present income tax system (which would save administrative overhead and hence the province money) as is done in Ontario, would be an obvious way forward. We’ve been paying “head tax” premiums since 1968. Successive Socred, NDP and Liberal governments have not fixed this. I have no idea why. The solutions are staring us in the face.