Responding to BC Liberal request for emergency debate on legislative process

Today in the legislature Mike de Jong rose and sought leave, pursuant to Standing Order 35, for the legislature to “adjourn its usual business, for the purpose of discussing a definite matter of urgent public importance.” The essence of his request is summarized in the motion below that he proposed that we debate.

“That this House review its own conduct with respect to the events and facts that led to the presentation of a motion on Tuesday, November 20, 2018, placing the Clerk and Sergeant-at-Arms on administrative leave, with a view to ensuring that all of the steps that were taken were consistent with the principles of procedural fairness and natural justice and, if that is found not to be the case, to consider remedial steps.“

Both Mike Farnworth, the government house leader, and I recommended to the Deputy Speaker that he not grant the request. We both argued that it would not be in the public interest for us to be debating this in the Legislature in light of the fact that there is an ongoing criminal investigation.

Shortly after Question Period in the afternoon, the Deputy Speaker rose to offer his ruling. He agreed that it was not appropriate to undertake the debate under Standing Order 35 because of the existence of an active criminal investigation focusing on two permanent officers of the house.

Below I reproduce the video and text of my brief remarks.

Video of statement

Text of Statement

A. Weaver: I join my colleague in government in speaking against the public interest of debating such a matter in this House.

Frankly, it reminds me of a parody site in The Hard Times, where we would have a debate that goes along the lines of “Man with Half the Facts in Heated Debate with Man with Zero Facts.” The danger of having such a debate in the absence of information while a police investigation, a criminal investigation, is ongoing with not one but two special prosecutors, is very worrying. I would argue that it is in the public interest that the police investigation be allowed to proceed unheated from political interference.

With that in mind, I think it would be inappropriate for us to be debating this in the Legislature, in light of the fact that there is a criminal investigation ongoing as we speak. With that, I do recommend that this not be accepted.

Clarifying the intent of the Speculation and Vacancy Tax

Over the course of this week, Bill 45 – 2018: Budget Measures Implementation (Speculation and Vacancy Tax) was being debated during committee stage. During this stage, the BC Green amendments were all approved.

Those who have been following this file will know that I have spent an enormous amount of time on it over the last year. When this tax was first introduced in the February budget it was, in my view, poorly thought through and seemed to be an overly blunt instrument that did not effectively target its key overarching goal of dealing with speculation, affordability and vacancy rates. As I noted in March,

“The Speculation Tax … need[s] the introduction of legislation prior to [it] taking effect. Such legislation is expected in the fall. Fortunately we have time to pressure government to fix the problems embedded in their poorly thought out approach to deal with speculation.”

The bill that was ultimately introduced in October was certainly tempered from that which was originally offered through the first intention paper released by the government earlier this year. Many of the concerns we brought to government had been addressed. While it is still not the approach I would have taken, our amendments improved the bill further and will mitigate many of the key issues I had identified.

During committee stage I rose to ask questions and speak to amendments far too many times to reproduce all the Hansard records. However, I took the opportunity to raise a few specific, yet illustrative examples that were brought to my attention from the myriad emails we received and responded to. Below I reproduce the video and text of my exchange with the Minister on these specific examples.

What’s important is that if you have specific questions as to whether or not the speculation and vacancy tax applies to a property you may own, please note that details information is available at gov.bc.ca/speculationtax. Alternatively, you can email: spectaxinfo@gov.bc.ca or phone 1-833-554-2323.

The bill eventually passed on Thursday.

Videos of Exchanges

| Video 1 | Video 2 | |

| Video 3 | Video 4 | |

| Video 5 | Video 6 |

Text of Exchanges

Example 1 (Video 1): Belcarra – only accessible by air or water

A. Weaver: I enjoy this line of questioning. I think it’s very important to get clarification on the intent of the legislation before us. I have three questions on the definition of “specified area” in this section.

The first is with respect to item (l) in specified area. It refers there…. It just says: “…an island, if any, within an area referred to in paragraphs (a) to (j), if the island is usually accessible only by air or water throughout a calendar year.”

The first question is: why was the term island used there as opposed to a general area within these (a) to (j) that are generally accessible only by air or water? I’ll come to a specific example. Within the broader area, there may be, in fact, regions that are only accessible by air or water, even though they lie within the areas covered in (a) to (i).

Hon. C. James: As the member knows, the exclusion, when we looked at how to refine the geographic areas and looked at, as I mentioned in our discussion yesterday, the issue of how you make sure that most vacation homes are excluded…. We took a look at a number of different options, and one of them was to look at refining the geographic area.

That’s why we’ve said that we exclude islands that aren’t accessible, or that only are accessible by air and water — to be able to address those areas that, again, are difficult for commuting and, therefore, in most cases, are not people who are commuting and buying second homes. They’re mainly vacation homes, which is why we’ve listed it under (l) in that way.

A. Weaver: I very much appreciate the answer and the intent of actually including islands.

Why I raised it is that I heard from a resident of Belcarra, which, as the minister will know, is a lovely piece of the Lower Mainland across from Deep Cove. This person actually owns a property in Belcarra that is not accessible by road and is only accessible by air or water.

It seems that the intent of the legislation was to actually ensure that we’re dealing with urban areas where there are issues of commuting and issues of a rental market that’s being at ease here. Clearly, I would have thought the intent of this legislation would not have been to include somebody with a home in Belcarra that is not accessible by road and only accessible by air or water.

My question to the minister is: to what extent does a person who lives in the region — in one of these designated, prescribed areas — have an ability to actually get government to recognize that the spirit and intent of this legislation probably wasn’t meant to apply to an area which is only accessible by air and water but happens to be in one of these geographical regions?

Is there a mechanism that this person, recognizing the spirit of the minister’s previous statement, could go forward to actually determine whether or not this really is appropriate and they were meant to be covered under the government’s intentions?

Hon. C. James: We did specifically look at Belcarra. Part of the logic was, again, looking at the commuting distance. In fact, the commuting distance from Belcarra…. It’s a very short commute to downtown Vancouver. In fact, it’s a shorter commute from others that go from the Fraser Valley or from other distances — North Vancouver, for example. Five minutes away.

It is a municipality though, and I think this is important. As the member asked: what opportunities are there for discussion around these issues? Belcarra, in fact, is a municipality. I met with the Belcarra folks at UBCM. They will have the opportunity, in an informal setting anytime, but in a very formal setting, as the member knows, with the amendment coming forward, to have an opportunity to be able to argue either the strength or weakness of having the municipality included.

The Chair: Noting the time, we’ll take one more question.

A. Weaver: On this topic. I have one more question after this. I don’t know whether….

The Chair: Of course. As long as the minister can address the questions, we’ll do them.

A. Weaver: It’s just to follow up on that further, very briefly.

I’m not talking about the entire region of Belcarra. But within the broader section of Belcarra, there are parts of Belcarra — properties that happen to have cabins on them — that are only accessible by water or air. Therein lies the issue here.

It may be that the municipality itself meets the intent that the minister sought of a commutable distance. However, it’s not a commutable distance for some aspects of this municipality that extend into areas that are actually not an island but are only accessible by air or water.

Again, my question for a specific individual within this broader municipality: is there a mechanism for that individual to seek an exemption, as per my earlier remarks?

Hon. C. James: Thank you for the question, again. I think we did, in fact, look at the commuting time from some of the areas that were only accessible by boat — five to eight minutes to get to the Lower Mainland — so there are commuting pieces there. There aren’t opportunities other than, obviously, coming forward and raising the issue.

There aren’t opportunities built into the legislation, but I expect that people will have the opportunity to argue that changes should be made, if changes are going to be the made to the tax, including the mayor, who, I’m sure, will represent all the members of the municipality.

Example 2 (Video 1): Mudge Island and Nanaimo

A. Weaver: My final question is very brief. It’s from another concerned couple who approached me. I’m just giving a sampling of them because they illustrate the variety of concerns out there. I believe I know the answer, but I’d like to get confirmation from the minister.

The couple lives on Mudge Island in the Nanaimo regional district. They’re concerned that the tax could afford them and that it could kill the property values on Mudge Island. Can the minister confirm — they live in their home full-time on Mudge Island — that Mudge Island is not included in the regions that are prescribed under the specified areas?

Hon. C. James: I think the first piece that the member raised is primary residence. If it’s a primary residence and they live there full-time, then they aren’t captured. It isn’t captured. It’s only second or third homes. But Mudge Island is not captured by the speculation tax as well.

Noting the time, hon. Chair, I move that we rise, report progress and seek leave to sit again.

Example 3 (Video 2): Owned by couple in different countries

A. Weaver: I wasn’t planning to step up here and ask this question, but I’m very pleased the member for Prince George–Valemount did address this specific issue that I was going to raise under section 8.

I’d just like to ask a follow-up on this. I have the same letter, and we’ve been in communication with the same person. A good example that highlights some of the complexity of the application of this legislation — this particular case. The partnership is a partnership where one of the…. They’re not formally married. They’re living separately. One lives in a jurisdiction other than Canada. That person owns 20 percent ownership in the property that is the condo that is owned by the other partner.

So my question to this: given the fact that this couple are not formally married, if the person living in the foreign jurisdiction were able to rent back to her partner here in Canada, would that exempt her from the speculation tax? Yes or no?

They are not married, according to the court of law in Canada. The one person owns 20 percent of the property that the other person lives in full-time. She’s a 20 percent equity owner in the property. They are not married. That 20 percent equity owner lives in a foreign country.

If they rent that 20 percent share of the property to the partner — who they’re partners with but not legally married — would that exempt them, yes or no?

Hon. C. James: I think the first piece that I want to state is I’m not going to give tax information, as the Minister of Finance, specifically to an individual case. I think that’s really important.

I think individuals…. We are working on exactly the same letter that the member has and that the member from Prince George has as well. We are working through those pieces. There are so many unknowns around where the taxes are paid by the individuals. We don’t know that information. It wouldn’t be right for us to be asking that information, unless they were asking for tax information.

We’re quite happy to look at the situation. There may be a number of pieces that fit, but I don’t want to, as I said, jump on something where I don’t have all the information. But we have committed to making sure that we get the information for them.

Example 4 (Video 3): Extending over two lots

A. Weaver: I have a specific example I wish to offer the minister to seek some clarification. It’s a real-world example.

Let’s suppose that there is a person who happens to have a property that’s very old and lives in the riding of Oak Bay–Gordon Head. That property is a small house on a lot, but it’s actually two lots. One lot has the house; the other has an orchard that’s been in place in perpetuity. For the purpose of speculation tax, this might be considered as two properties. However, it’s only one property. It’s always been one property, and it will remain one property.

The question is: is the extra lot to be viewed, in this category here, as part of a whole property or not? Is there a means and ways that this person would be exempted by the administrator, and how would they be exempted by the administrator in this situation?

Hon. C. James: That would be an example where the individual could take it to the administrator and have it examined. I think the key around rules relating to the property is that the residential property — so if it’s the additional parcel, as the member describes — is used for the residence or for purposes ancillary to or in conjunction with the residence.

So as I said, I wouldn’t give the advice. That’s the job of the administrator. But that would be an example where they could take something to the administrator.

Example 5 (Video 3): Extending across two specified areas

A. Weaver: Thank you. That’s very helpful. I have a final question, and it’s relevant to the riding that I represent and part of the municipality that the minister represents.

There are properties in the capital region district where the actual property spans two municipalities. This is quite common along Foul Bay Road, in Oak Bay, where there are many houses that have part of the house in Oak Bay and part in Victoria. I suspect, without going through all of this, that there may exist properties in the province of British Columbia that actually span a jurisdiction that’s in and a jurisdiction that’s out. How would those be treated, if they do exist? And would the administrator automatically treat them in the in or out district?

Hon. C. James: We had a little bit of this discussion earlier. We found one property in the province, in the areas for the speculation tax, that spans inside and outside.

If a portion is inside, then they will be taxed — or subject to the speculation tax. I shouldn’t say they’ll be taxed, because they may have an exemption for other reasons. But it’ll be included as part of the speculation tax.

A. Weaver: Would the component of the property that’s subject to the speculation tax be the percentage of the lot that’s in the property or the total lot? Why I ask that? Let’s suppose there’s a 12-acre parcel of which 100 square metres is in taxation and the rest is not. Would they be collectively subject to the taxation? Again, these are not examples that I know of, but I know of them in Oak Bay–Victoria, as I’m sure the minister does. But there may be some that we’ll find out about.

Hon. C. James: Again, we found one property that fits that example. It will be the case that if a portion of the property is in, the entire property is subject to the speculation tax. But again, we think that this will be a very rare example. We found one. I don’t expect that there will be other examples.

Example 6 (Video 4): Couple – one in Kelowna, the other in Vancouver

A. Weaver: I have three personal stories I’d like to read and see if I can get the minister’s response. The first concerns a UBC professor I have been in touch with who has, most recently, been teaching at the Okanagan campus in Kelowna. They’ve had a home there since 2013, but they have a condo in Vancouver. His wife is teaching at the Okanagan campus, but he’s now teaching at UBC. They’re both UBC professors, but UBC has two campuses, one in the Okanagan and one at UBC in Vancouver. So he teaches in Vancouver; she teaches in the Okanagan.

He was teaching in the Okanagan. He was hit by the city of Vancouver’s empty homes tax last year and has since moved his primary residence to Vancouver as part of it. So now his primary residence is Vancouver to avoid the Vancouver vacancy tax, and his wife is still teaching at UBC Okanagan. His wife spends much of her time at UBC Okanagan.

My question to the minister is this. Can you confirm that this couple would be exempt because of the commuter marriage exemption that we’re discussing, when this fellow’s wife spends a good deal of time in Kelowna for work purposes?

Hon. C. James: Again, I’ll always put the caveat around: based on the information that’s here…. I certainly encourage people to make sure they phone the tax department and talk to the tax department to get the specifics. But on the information that the member has provided, yes, it appears that if one is working in the other place and one residence is the principal residence of the spouse, yes, they would qualify.

Example 7 (Video 4): Couple – live in North Saanich, work & rent in Vancouver

A. Weaver: Thank you. That’s very helpful.

This one’s a little more complex. And that was my understanding as well. I do appreciate hearing the confirmation, subject to the caveats, of course. They’re, of course, subject to caveats.

Another example is…. This one is very interesting. A couple that I know have been in touch with me. They own a house in North Saanich, which is in the covered regions of the capital regional district. They live in the house on weekends. That’s the only house they own. It is in North Saanich. However, they both work in Vancouver, and they rent a property in Vancouver during the week, although they live in North Saanich. This is relatively common these days in Victoria, where people cannot afford to actually own in Vancouver, so they live in the North Saanich area. They take the ferry on Monday to Vancouver. They work there, and they come back on the weekends. They plan to live permanently there, in North Saanich.

My question is: are they eligible for an exemption in this regard?

Hon. C. James: Again, based on the information provided, it would appear that they would be subject to the tax because it wouldn’t be their principal residence. The home in North Saanich would not be their principal residence. It’s not where they’re spending most of their time, so it does appear that they would be subject to the tax.

But I want to make sure that I’m clear on the caveat that everybody has some additional information, and when people talk to the tax department, they often provide further information that a person wasn’t sharing with an individual when they were talking to them. I would encourage people to make sure that they phone, for those kinds of examples, to make sure that they get the information from the tax department.

Example 8 (Video 4): Live in Surrey, work in Vancouver

A. Weaver: I very much appreciate that. I’m not trying to trap the minister at all. I’m trying to get some clarification and some advice that we can actually provide to these people who are rightfully concerned. Members of the opposition have been doing exactly the same thing. We do understand, of course, that the minister cannot provide tax advice.

It’s a bit odd asking questions in this marriage section, but people have asked us how marriage relates to this. This is a complex tax bill, and where people fit in with their individual cases is quite difficult.

The final example here is another woman. Again, she’s not covered under the commuter marriage, I don’t think. However, it’s odd, so maybe we could get kind of a general sense of the minister’s thinking on this issue.

This is an example of a woman who lives with her ailing mother in a family home in Surrey. So she lives in Surrey, her mother is ailing, and she lives there with her. But the woman actually works in Vancouver. She doesn’t want to take the tunnel, along with the member for Surrey–White Rock, so she has a condo in Vancouver, where she works during the week.

She owns the condo, and she also lives in the family home that she owns with her mother in Surrey. They’re clearly not married, but there clearly is a kind of commuter relationship there.

I’m wondering whether she could be exempt if she rented the family home to her mother? Is there a temporary exemption for something like that? I don’t know how this plays out.

Hon. C. James: With the caveat — I think that’s really important to state. If the individual works in Vancouver and has the Vancouver condo as her principal residence, for example, then her mother would be considered a non-arm’s-length tenant. She doesn’t have to rent; she can live in the house. She would not be paying the speculation tax. But again, lots of caveats around that to make sure it’s based on the principal residence — how much time she’s spending between the two places as well.

A. Weaver: Again, I don’t want to ask the minister to give tax or advice on buying or selling property, but I do think it’s important that we have this discussion and make it available to people so as to hear the kind of thinking of where things are going. The reason why I say this is that this particular person, also the condo that I mentioned in downtown Vancouver, is subject to a strata with a no-rental clause in it. So it gets even more complex there.

Unfortunately, this woman is selling her condo in downtown Vancouver. What I would like to get confirmed is that in fact there is place an exemption for 2018 and 2019 for any strata unit that has a no-rental clause in place. So rash decisions about putting a condo on for sale, when the condo is in a strata unit that has a no-rental clause, are not being forced by this legislation.

Hon. C. James: The member is correct. There is a two-year exemption for condos and stratas that have a requirement that you cannot rent the place out.

A. Weaver: I just want to thank the minister — this is very, very helpful — and the opposition for asking these questions. These are important issues, and having these answers on record is going to be very helpful.

Example 9 (Video 5): Strata accommodation properties & Oak Bay Beach Hotel

A. Weaver: On section 27, we’re talking here about strata accommodation properties. I’m wondering if the minister could please give the members here an idea, an estimate, of what type of properties these are, with some examples?

Hon. C. James: Strata accommodation properties that are classed as residential under the Assessment Act would be strata accommodation property short-term rentals, hotels, strata hotel accommodation that has been classed as class 1 or partially class 1 or partially class 6.

These hotels, a number of years ago, were given favourable property tax treatment, for example, to encourage the construction of these short-term occupancy time-shares, hotels.

I guess a way of describing it would be a cross between a strata complex and a hotel — that’s kind of a description — made up of individual strata lots that are pooled together for the purpose of being rented. That’s, I think, kind of the best description I could give.

A. Weaver: I can give some examples, then. Oak Bay Beach Hotel, for example, is a hotel in my riding that has a long history as a hotel, but it’s actually strata units that are rented out through a property rental agreement, and the zoning actually precludes any other use.

There are others in the minister’s own riding. Some are zoned tourist commercial. There are others in the province of British Columbia. In the tourist commercial zoning, for example, which some are zoned as, you actually have restrictions put on by your municipality, and those restrictions actually limit the ability for you to rent more than six months. So I agree. I think we’re on the same page as to what units are there.

My question, then. I understand that there’s no problem for the next two years — well, through 2019, because 2018 is exempt, as well, for these properties. My concern is: what is government’s intent for afterwards?

These properties are significant economic drivers in the region. Oak Bay Beach Hotel, for example, is one of the single biggest suppliers of property tax to the municipality of Oak Bay. They have very little commercial property in the riding, as well as in other jurisdictions. I’m sure there are, in my friend’s riding in Kelowna, tourism commercial properties that have similar zoning, as well.

Hon. C. James: The member, I’m sure, knows this, but the commercial portion is already not classed as residential, so therefore isn’t covered anyway because it’s often class 6 property.

I think the further review around how we deal with these properties is really the time that we gave, in this act, for two years. It gives an opportunity for discussions with the municipalities, with the property owners, etc., to find a long-term solution. This gives us the opportunity to have those kinds of conversations.

Example 10 (Video 6): Medical Exemption in Nanaimo

A. Weaver: With respect to section 33, I have a personal story I’d like to relate to the minister. I’m not asking for tax advice. I’m recommending people go to the information that the minister provided yesterday on the record, and that will be here. But I’ll just give a sense of the intent, because this is an illustrative example.

This is an example of a couple who recently bought a second home in Nanaimo. They live on a small island nearby with their daughter, and they spend several days a week at the Nanaimo property. They bought it so they could be closer to the hospital. They’re elderly.

The property is worth less than $400,000. It’s a $300,000 property. They don’t want to rent it out, because they’re elderly, they’re concerned about medical issues, and they want to go there if they have to be there for medical reasons. Right now, they only have to be there on and off, but they might have to be there at any time for a more extended period of time.

I’m just asking if the minister could please confirm to me that the couple is not covered by the medical exemption, yet they are covered by the fact that the property is $300,000, which is under the $400,000 exemption.

The idea here is that while they have bought a property to go every now and again, it’s still not being used full-time. They’re not needing it full-time. But because it is

The idea here is that while they have bought a property to go to every now and again, it’s still not being used full-time. They’re not needing it full-time, but because it is under $400,000, they are exempt.

I’m wondering if the minister, without providing tax advice, could confirm that the general spirit of this would be that they would have an exemption because it’s under $400,000, but they’re not eligible for the medical exemption.

Hon. C. James: I appreciate that I must have said it often enough. Based on the information that the member provided — recognizing that the individual should make sure they get tax information from the taxes people — yes, if it’s less than $400,000 there, that will cover it, and they will not pay the speculation tax. As the member says, from the information he has given, they wouldn’t appear to be covered under the illness, but they would be covered under the $400,000.

B.C. Green Caucus statement on official opposition motion on “foreign influence” in politics

Today in the legislature the BC Liberals caught the BC NDP off guard during the monday morning Private Members’ Motions section of the Legislative Orders of the Day. Normally, and standing practice is, that Private Members’ Motions are debated but never voted upon. These motions are only debated on Monday mornings.

What normally happens is that the last speaker to the Private Member’s motion moves adjournment of debate just prior to the lunch break. A new Private Member’s motion is then brought forward the following week. Unanimous consent is required before that new Private Member’s motion is debated in light of the fact that none of the previous motions have been voted on and so dispensed of. This week, and contrary to normal practice and without notice, the last BC Liberal Speaker decided not to move adjournment. The BC NDP were caught off guard by this “political trick” and nobody subsequently rose to speak. The Speaker then closed the debate and the bill moved immediately to a vote. A standing vote was called which occurs 1/2 hour before the end of the normal end of debates on Monday evening.

The motion that was being debated was put forward by John Rustad, the MLA for Nechako Lakes:

Be it resolved that this House recognizes that foreign influence on B.C. public policy issues is unacceptable, and that organizations should be banned from using foreign money for political activities.

Below I reproduce the media release our caucus issued immediately following the vote.

Media Release

B.C. Green Caucus statement on official opposition motion on “foreign influence” in politics

For immediate release

November 19, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, released the following statement on MLA Rustad’s motion on “foreign influence” on B.C. public policy issues.

“While we certainly welcome any opportunity for a good faith policy discussion on how to strengthen the integrity of B.C. politics, we are unclear of the policy implications of this motion,” said Weaver.

“Last year, working with the B.C. NDP, we banned overseas donations to B.C. political parties, along with all corporate and union donations. This is the single most significant policy change ever made to limit direct foreign influence in our politics. Under the previous government, any individual or corporation from anywhere in the world could donate any amount of money directly to the coffers of political parties. We are proud to have been a part of making this change.

“The vague language used in Mr. Rustad’s motion makes it unclear how we could advance a policy on this issue. ‘Organizations’ could apply to businesses, academic institutions and other types of international institutions like the United Nations. Advocating for legislative and policy changes is an important part of the work that both charities and businesses do as members of our vibrant civil society. At the same time, it is important that this advocacy be transparent and fair, and we are proud to have worked with the B.C. NDP to strengthen the rules governing lobbying done by all types of organizations in B.C.

“Canada is proud of its international reputation as a good place to do business and of its engagement on the international stage on important issues like human rights and climate change. Canadians routinely donate to international charities, and Canadian charities do incredible work that our friends abroad support. Similarly, Canadian businesses welcome international investment, as well as the opportunity to do business in other countries. Canadian non-profits and registered charities are already entirely prohibited from engaging in partisan activities. They are restricted to only engaging in non-partisan political activity if it represents no more than 10% of their resources. The contours of this issue are thus far more complex than Mr. Rustad’s motion suggests, and we must ensure that our rules reflect Canada’s openness and are fair for business, non-profits and the public.

“We continue to welcome the opportunity to collaborate with all Members from all parties on sensible, legally enforceable reforms that will strengthen the integrity of B.C.’s democracy.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

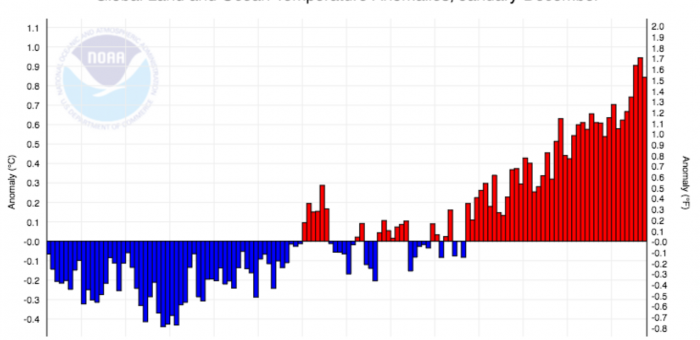

The greatest climate change-related risks & opportunities facing the BC government?

Today during Question Period I rose to ask both the Minister of Energy, Mines & Petroleum Resources and the Minister of Forests, Lands, Natural Resource Operations & Rural Development what the greatest climate change-related risks and opportunities their ministry faces, and how they are prepared to deal with both.

With the upcoming release of the economic vision embodied in the clean growth strategy, it’s critical that every Minister is up to speed on how it will affect their Ministry.

As you will see from the exchange, I was not very impressed with the response I received from the Minister of Energy, Mines & Petroleum Resources. I felt that the response from the Minister of Forests, Lands, Natural Resource Operations & Rural Development was quite good.

Below I reproduce the text and video of the exchange with the Ministers.

Video of Exchange

Question

A. Weaver: In the span of just a few centuries, earth has transitioned from a past when climate affected the evolution of human societies to the present, in which humans are affecting the evolution of the climate system.

Today we are at a pivotal moment in human history. Our generation will be responsible for deciding the path we take and the future climate will take along with us. As elected officials, we’ll either be complicit in allowing climate change to despoil our world or we can lead the way and choose a different path.

Our provincial emissions have risen in four out of the last five years. Every minister has a responsibility to ensure that tackling this issue is within their mandate, as mitigating the impacts of climate change requires an all-of-government approach.

Accounting for 7.2 million tonnes annually, mining and upstream oil and gas production are the biggest contributors. My question to Minister of Energy, Mines and Petroleum Resources is this. What are the greatest climate change–related risks and opportunities facing your ministry and how are you prepared to deal with them?

Answer

I appreciate that for the member this is a very, very important issue that he’s very passionate about and the work that he’s done with this government to address climate change and our climate action plan.

For this ministry, in particular, we have been looking at what we can be doing as a new government to reduce our impact on climate change. The list is quite long. But I know that question period is the opposition’s time, so I won’t try to list everything. I’ll give the member a few examples of some of the things that we’re doing.

A couple of weeks ago I was at UBC talking with architect students about our new program called the better buildings B.C. program, where we’re looking for innovative ideas in terms of how we can reduce our emissions in our buildings throughout the province.

But the member brought up, specifically, mining and oil and gas. One of the things that this government did was we eliminated PST on electricity for businesses. That includes the mining sector. That includes the oil and gas sector. If they can electrify and move away from oil and gas — diesel, for example — to generate the power that they need to do their operations, we’re reducing our greenhouse gas emissions quite significantly. Those are the types of opportunities that we’re looking at.

As the member will note, I also just introduced legislation to reduce our methane emissions as well. There’s lots that we are doing, and I look forward to being able to brief the member fully at another time

Supplementary Question

A. Weaver: I must say, given the scale of the challenge as well as the scale of the opportunity, going and meeting a few people to discuss some ideas is hardly taking advantage of this opportunity and meeting the challenge. I remain quite disappointed in that response, so let me try again.

The B.C. fires of the past two summers were no surprise to the climate science community. Back in 2004, my colleagues and I published a paper in Geophysical Research Letters, pointing out that we could already detect and attribute increasing areas burnt in Canadian forest fires to human activity and, in particular, global warming.

According to the B.C. Wildfire Service, this year was the worst on record. Over 1.35 million hectares were consumed by forest fires. The fires burned homes, endangered lives and released hundreds of megatonnes of CO2. What’s happening in California is no surprise to the climate science community, yet it appears to be a surprise to politicians du jour.

We know that global warming will lead to an increased likelihood of summer drought. This, in turn, will lead to more extensive wildfires. We know that precipitation extremes will increase and that flooding events will be on the rise. This threatens human health, ecosystems and the economy.

While the members opposite are concerned about their survival as a political entity, I’m sitting here asking the minister about the political survival of all of our collective species. To the Minister of Forests, Lands, Natural Resource Operations and Rural Development, what are the greatest climate change-related risks and opportunities facing your ministry, and how are you prepared to deal with both?

Answer

Hon. D. Donaldson: As my colleague mentioned, climate change is a considerable risk for our province and planet, and we are committed to tackling it. The member and the Leader of the Third Party asks — and I appreciate — the question about opportunities and risks.

The risks are in forest systems and ecosystem resilience. Ensuring that into the future, we have forest ecosystems that are resilient to and can adapt to the climate change that we are seeing.

We are seeing it, certainly, in the forest fire situation. It’s had an impact there. Large forest fires that we saw in the past two seasons have had enormous impact on ecosystems. We’ve seen it even more recently in the level 4 drought conditions in the areas that I represent up in the northwest and unprecedented drought that has led to impacts on fisheries resources. You’ve seen the pictures of the riverbeds, extremely dry riverbeds — unprecedented.

We are working on mitigative measures. In June, we hosted the first wildfire and climate change conference. A couple of topics it focused on were creating resilient ecosystems to better adapt to climate change and mitigate wildfires and ensuring effective carbon management. Part of that is our forest carbon initiative. That’s a $290 million federal-provincial initiative that’s focusing on incremental reforestation and improving utilization of waste and reducing slash burning.

Finally, in regards to the question as far as opportunities, we also have long-term research trials, assisted migration and adaptation trials to identify seed sources most likely to best adapt to future climates. We’ve made important progress in 16 months, and we need to do more.

BC Government tables bill to enable ridehailing in British Columbia

The BC Minister of Transportation today tabled Bill 55: Passenger Transportation Amendment Act, 2018. As noted in the government press release, Bill 55 finally paves the way for ride-hailing companies to operate in British Columbia in 2019.

As readers will know, I have been attempting to bring ridehailing to British Columbia for almost three years. In April 2016, February 2017 (prior to the provincial election) and October 2017, I introduced Private Member’s bills which would have allowed this to occur. While I am pleased that government has finally brought this enabling legislation forward, there is still work to do to ensure that ridesharing becomes a reality in British Columbia in 2019.

Below I reproduce the media release the BC Green Caucus issued in response to the tabling of this legislation. My colleague Adam Olsen (our transportation critic) will be representing the BC Green Party on the proposed legislative committee.

Media Release

Weaver: Legislation a step forward, but parties will have to work together to make ride-hailing a reality

For immediate release

November 19, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, says the provincial government’s legislation to introduce ride-hailing today is a long overdue step forward on the issue. Weaver says the all-party committee that will advise on regulations is a promising development because parties will have to collaborate to make ride-hailing a reality.

“While it’s a step forward to actually have legislation in front of us, more work needs to be done to ensure British Columbians have access to ride-hailing in 2019,” said Weaver.

“The fact that an issue with such high levels of public demand has taken so long to see progress is a failure of our political system. It’s obvious that neither of the other parties has been able to find the political will to action this issue in a timely manner. The legislative committee is a promising path forward because it will require all parties to share the responsibility of delivering for British Columbians.

“It’s important that the legislation and regulations strike the right balance so that the province meets its responsibility to ensure public safety and a fair playing field for business while also providing British Columbians with access to the full range of modern transportation options. We have questions about the timeline; although it’s encouraging that ride-hailing companies will be able to apply for licenses by Fall 2019, what British Columbians really want to know is when they will be able to access their services.

“At first glance a key difference between what government has put on the table today and the recommendations of the Hara Report is to require driver training and Class 5 licenses rather than Class 4 licenses. Other jurisdictions, such as Quebec, have seen success with driver training as part of their ride-hailing regulation.

“We look forward to discussing all of these issues in the house as well as canvassing some of them specifically in the legislative committee. We will continue do everything we can to deliver ride-hailing for British Columbians in 2019.”

Weaver has introduced legislation to enable ride-hailing three times. The third time, in Fall 2017, resulted in the subject of the bill being referred to an all-party committee, which held public consultations and delivered a report in February 2018.

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca