BC Legislation Fails to Deal with Housing Crisis

There are few topics more sprawling, or of more importance, than the state of real estate in British Columbia.

This summer, the legislature was called back into session with two weeks’ notice for the last week of July to debate Bill 28, the Miscellaneous Statutes (Housing Priority Initiatives) Amendment Act, 2016. The bill had four main purposes:

- It added an additional 15% property transfer tax to residential real estate purchased by foreign nationals or foreign-controlled corporations. (‘Foreign nationals’ are individuals who are not Canadian citizens or permanent residents of Canadian.)

- It amended the Vancouver Charter to allow the City of Vancouver to implement a vacancy tax.

- It created a Housing Priority Initiatives Fund for provincial projects that will be seeded with $75 million and a portion of the new tax revenue. (It is worth noting that Public Accounts documents indicate that the government brought in $500 million more in property transfer tax revenue this year than anticipated, suggesting to me that the initial injection in the Housing Priority Initiatives Fund should be higher.)

- It implemented recommendations to re-regulate the real estate industry.

The bill also closed the Bare Trust loophole that I have been asking the government to address for a number of years. Unfortunately it is only being applied to the Vancouver market and only to purchases made by foreign buyers. The loophole is still open to allow wealthy Canadian individuals, corporations or real estate speculators wanting to avoid paying the property transfer tax.

The legislation passed unanimously with the 65 BC Liberal and BC NDP MLAs present on the day all voting in support of the legislation. While I had a prior commitment and so was unable to be present at the time the vote was taken, I would have voted against the legislation. Please let me explain why.

The bill is not without significant limitations.

First, its narrow geographic scope and wrongful inclusion of non-residents who pay taxes and contribute to our economy. The tax should not be applied to those who are deemed residents for income tax purposes, like Hamed Ahmadi who spoke to CBC about the difficult position Bill 28 has put him in. Mr. Ahmadi was hired by BC Hydro after receiving his PhD at UBC, his permanent residency application is complete but still being processed. Long before the new property transfer tax was announced, he had signed a contract to purchase a condo in Coquitlam for $360,000. Mr. Ahmadi now has the choice of paying the government an additional $54,000 or facing a potential law suit from the seller if he backs out of the contract. Our communities are enriched and strengthened by people like Mr. Ahmadi. A tax on foreign nationals and corporations should be used to target the global elite who are using B.C. homes as safety deposit boxes while living and paying taxes elsewhere, not those who are here to build a life for themselves and their families. And this would have been relatively simple to fix by ensuring that people possessed a social insurance number or were deemed Canadian residents for income tax purposes.

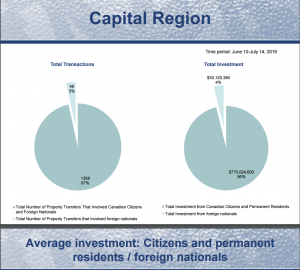

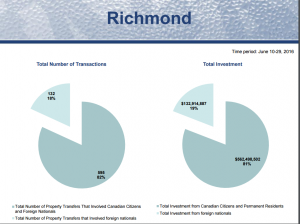

Second, the 15% surtax only applies in the Metro Vancouver area. What the BC Liberals did was take a policy measure that was introduced in Hong Kong in October 2012 and “has been especially effective in reducing speculation by wealthy Mainland Chinese” and simply applied it to Metro Vancouver. But unlike Hong Kong, which is a Special Administrative Region of the People’s Republic of China and acts like a nation in a nation, Metro Vancouver is a small part of a larger province in an even larger country. The surtax will likely only serve to punt the speculative housing market into neighbouring communities like Nanaimo, Greater Victoria and Kelowna. I can’t help but wonder if this is a tax we will end up apologizing for in the years ahead.

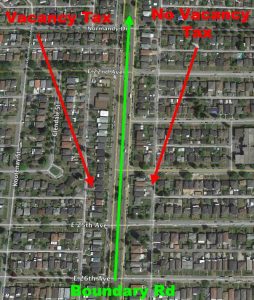

Third, the addition of the Vacancy Tax only into the Vancouver Charter and not the Community Charter as well (which other communities like Victoria and Oak Bay have been calling for) makes no sense at all. For example, on one side of Boundary Road (in Vancouver) a vacancy tax could be applied; on the other side of the street (in Burnaby), it would not. This doesn’t solve anything and in my view is nothing more than a political stunt aimed at pitting community against community without actually stepping up to show leadership.

Third, the addition of the Vacancy Tax only into the Vancouver Charter and not the Community Charter as well (which other communities like Victoria and Oak Bay have been calling for) makes no sense at all. For example, on one side of Boundary Road (in Vancouver) a vacancy tax could be applied; on the other side of the street (in Burnaby), it would not. This doesn’t solve anything and in my view is nothing more than a political stunt aimed at pitting community against community without actually stepping up to show leadership.

While I am supportive of the creation of the Housing Priority Initiatives Fund and taking away the self-regulatory powers of the real estate council in the Real Estate Services Act, the piecemeal approach taken overall by the BC Liberals may well exacerbate and broaden, rather than effectively deal with the affordability problem in British Columbia.

I pointed out in February that I’d been raising the issue of affordability and speculation in the housing market for more than two years (long before it was even on the BC NDP or BC Liberal radar) and that there are at least three dimensions to the problem:

(1) incentivized government speculation;

(2) a preponderance of vacant homes, and

(3) non-enforcement of illegal realtor transactions.

The BC Liberal response, supported by the BC NDP was to only partially deal with (1) — closing the bare trust loophole for foreign nationals — and only dealing with (2) in the city of Vancouver. In addition, they botched the implementation of the contents of my Land Title Amendment Act. This was a bill that I introduced to the legislature in July 2015 whose purpose was to gather data on who was purchasing properties in British Columbia

Bill 28 aside, we are still lacking a comprehensive plan when it comes to the affordability crisis facing British Columbians. We needed the government to come to the table with practical and province-wide solutions, instead they held tight to their six talking points.

The provincial government’s arrogant refusal to take the affordability issue seriously until they were threatened by the polls has compromised a fundamental right by reducing people’s very ability to find a home. This is not just a “Point Grey” problem as the government previously joked. When I questioned the Minister of Finance about what he was doing to address the housing crises last July he said, “The average price of housing in Vancouver, is actually lower than many people think. You can still purchase a home in Vancouver for under $400,000.” This summer, the Premier said we need to protect the dream of home ownership for the middle class. Sounds nice, but in reality Vancouver has become the most unaffordable market ever recorded in Canadian history. Prices have been rising 30% year on year, the average house price sits at more than 1.8 million, and markets in multiple other jurisdictions are following suit. The divide between the housing reality in B.C. and the government’s understanding of the situation is staggering. We are long past “affordable.”

Rental Market

Skyrocketing real estate markets across the Lower Mainland and Southern Vancouver Island are dragging the rental market with them. Frances Bula recently wrote in The Globe and Mail, “as people are shut out of the housing market, more people have no choice but to remain as renters who are competing for a limited supply of housing in a system that has treated renters like second-class citizens for decades.” She’s right, and for people who are young, non-white, have mental health issues, unemployed, recent immigrants, poor, disabled, or have pets, finding a safe, affordable home can seem nearly impossible in markets with vacancy rates around 0.6% like Vancouver and Victoria.

With constrained real estate mobility, people have little choice but to stay in suites that would have previously been viewed as shorter-term student rentals and I am getting increasingly concerned about where the young people in my riding are going to live this upcoming school year. A representative from Camosun College told us that he too is very worried about the situation. He described it as a complete crisis with some students living in cars and others forced into over-crowed, expensive, shared suites.

We so desperately need more designated long term rentals and co-op housing in B.C. Spaces that people can make their home, places that welcome children and pets and have some outdoor space. Homes for people who will rent for large portions of their life, either by necessity or choice.

On that note, Gregory Henriquez, the architect who designed the Woodward’s building in Vancouver, is calling on young architects “to act as a bridge between the grassroots need of a community and the bottom-line demands of commerce” to build cities that are diverse, inclusive, and equitable. He believes more rental units are needed in Vancouver, citing that “we are so far past the threshold of affordability that the goal of providing home ownership for everyone is almost impossible. Right now, 50 per cent of people rent, and the others own. We have not had a huge rental supply in a generation.” Mr. Henriquez told The Globe and Mail’s Kerry Gold that he “believes civic intervention is necessary to incentivize the right kind of development”

Cooperative housing arrangements are another promising avenue, bridging the gap between the rental and homeownership markets. As B.C. Green Party housing critic Zarah Tinholt has said, “Cooperative housing provides shareholders a long-term, sustainable home.” The financing of co-ops involves a down payment or “membership share” for each unit. In B.C. the down payment is usually under $5,000 but they range between $900 and $15,000 with monthly rents and maintenance costs between $600 and $2500. Co-ops can make incredible homes and diverse communities, supporting multi-generational people with varying income levels.

In BC, few cooperative housing developments have been built since the 1990s when the federal government released its social housing responsibility to the province and existing units have many year wait lists. Given our current housing crisis, and the province’s new Housing Priority Initiatives Fund, I believe that the B.C. Liberals, in conjunction with municipalities and the federal government, need to step in to help housing cooperatives with land acquisition and planning costs.

Data

Each level of government has various tools available to them that they can use to tackle the housing crisis from different angles. The Vancouver Charter, for example, allows the municipality to charge developers a ‘community amenity contribution’ – a percentage of the value that they receive through rezoning that can be put towards a new park, community centre, social housing, or artist studios.

To guide these initiatives we need, and have needed for years, more comprehensive data about the trends impacting our housing market. The information about buyer nationality that the province began collecting this June is a start, but making major policy decisions based on five weeks of data – as they did with Bill 28 – is far from ideal. In fact it might be viewed as reckless.

To guide these initiatives we need, and have needed for years, more comprehensive data about the trends impacting our housing market. The information about buyer nationality that the province began collecting this June is a start, but making major policy decisions based on five weeks of data – as they did with Bill 28 – is far from ideal. In fact it might be viewed as reckless.

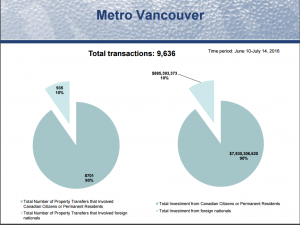

The first set of data released by the province, collected over just 19 days in June, suggested foreign nations were involved in about 5% of overall real estate transactions. The second data set, collected over five weeks through June and into July, put that rate closer to 10%.

Between June 10th and July 14th foreign nationals spent more than $1 billion on B.C. real estate. 86.5% of their investments were focused in the Metro Vancouver region and $886 million were invested in the Lower Mainland market – accounting for about a tenth of Metro Vancouver’s $8.8 billion in housing sales.

Between June 10th and July 14th foreign nationals spent more than $1 billion on B.C. real estate. 86.5% of their investments were focused in the Metro Vancouver region and $886 million were invested in the Lower Mainland market – accounting for about a tenth of Metro Vancouver’s $8.8 billion in housing sales.

Knowing that we are going to be faced with challenging housing decisions for years to come, we ought to start collecting more data now so we can design informed policy. Determining who is purchasing homes, and how many, in BC would allow the government to identify the flow of foreign investments, the role corporations are playing, and whether we are seeing speculation in our market coming from other regions of Canada. Tracking house flipping, when investors buy a house to quickly resell it at higher price, is an important aspect of understanding an over-inflated market. Imposing a sales tax on homes sold within one or two years of purchase could be an effective way of curbing house flipping but, again, it is a policy that should be founded in comprehensive data.

Studying the impact of Airbnbs, I suspect, would shed a lot of light on changes happening in the rental market. Anecdotally, we know of nearly a dozen people who have moved out of their rental suites for one reason or another only to see it pop up on Airbnb. For its part though, Airbnb has already said it’s open to some restrictions tailored to tight rental markets like Vancouver’s, including banning hosts from using the popular online platform to run a business renting out multiple units, but governments (municipal and provincial) will need solid data to move forward with such policies.

Studying the impact of Airbnbs, I suspect, would shed a lot of light on changes happening in the rental market. Anecdotally, we know of nearly a dozen people who have moved out of their rental suites for one reason or another only to see it pop up on Airbnb. For its part though, Airbnb has already said it’s open to some restrictions tailored to tight rental markets like Vancouver’s, including banning hosts from using the popular online platform to run a business renting out multiple units, but governments (municipal and provincial) will need solid data to move forward with such policies.

Long term and ongoing data collection is vital to the development of effective housing policy options in B.C.

International Markets

In the meantime, we can turn to other hot-market jurisdictions to analyze what they are doing to help their citizens find affordable homes.

The situation in the Lower Mainland mirrors that of New York where, as the New York Magazine put it, people with “garden-variety affluence – the kind of buyers who require mortgages – are facing disheartening price wars as they compete for scarce inventory with investors who may seldom even turn on a light switch.” Real estate in New York has been notoriously expensive for years. With a housing price-to-income ratio of 6.1 compared to Vancouver’s 10.6, however, it has actually become more affordable, relatively speaking, because residents have greater access to high paying employment and more job mobility. It also has an efficient transit system for workers to get to those jobs, something Vancouver continues to struggle with, and a considerable amount of social housing. The New York City Housing Authority is the largest public housing authority in North America and owns 178,557 apartments in 2,563 residential buildings. Co-op city alone provides affordable housing for some 35,000 people along the Hutchinson River. (It is important to note, however, that the strict limits on gross income used in the New York model have been criticized for creating communities that are not socioeconomically diverse. And, despite the impressive number of affordable housing units by B.C. standards, more are needed.)

While New York’s affordable housing is reserved for those living under or near the poverty line, in Vienna 60% of residents live in subsidized suites. “There is a general political consensus that society should be responsible for housing supply, and that housing is a basic human need that should not be subject to free market mechanisms; rather, society should ensure that a sufficient number of dwellings are available,” wrote Christoph Reinprecht in Social Housing in Europe.

When it comes to navigating the presence and impact of non-resident ownership around the world, various policies are utilized to level the playing field between the world’s rich and local citizens. In Switzerland, for example, the government assigns quotas to the country’s 26 cantons, limiting the number of residential properties that can be sold to foreigners. Mexico takes a different approach by restricting foreigners from buying real estate within 50 kilometres of the coast or 100 kilometres from the borders. In Australia, the government collects information on the real estate bought by foreign investors, compiles it in an annual public report, and only allows them to purchase newly built homes. The Australian government also heavily taxes foreign purchasers and threatens non-compliance with significant fines and jail time. The UK charges a capital gains tax between 18 and 28 per cent on the sale of residential properties that are secondary homes or foreign-owned. A progressive tax is also applied to homes worth more than a million pounds. And Hong Kong, after which BC mirrored its foreign tax, has a 15% surcharge on homes purchased by non-permanent residents.

Community Vision

In the midst of all the differing opinions about root causes, bandaid fixes and competing data sets, however, we must not lose sight of the fundamental question that underpins everything — what do we want our communities to look like in coming years?

British Columbia faces a choice: Do we want our real estate market to provide homes for people who want to live in and contribute to the wonderful communities around our province? Or, should we continue to fuel a bubble economy propped up by the influx of foreign investment in our real estate sector?

Given the severity and reach of the housing crisis, a reactive piecemeal policy approach debated over four days in the summer amounts to little more than blowing out birthday candles in the midst of a house fire and to me the answer is clear.

British Columbia is more than just the playground for the wealthy. We need to ensure that our communities will be livable, that small businesses will thrive, and that the next generation will see opportunities to start families in our cities.

We need a province-wide, coordinated approach involving all levels of government and across all communities. We need a data-driven policy framework that will close the loopholes being exploited by people with ultrahigh net worth, get tax cheaters out of our market, clamp down on questionable real estate practices, increase rental and co-op stocks and put regulatory and taxation frameworks in place for non-resident ownership – we need to build off Bill 28, think provincially, and focus on the future of our communities.

Celebrating Local Businesses in our Community – Godfrey’s Luggage & Leather Repairs & Sales

Myrna Boyle has been working at Godfrey’s Luggage & Leather Repairs & Sales for 50 years. She can fix about 15 bags (and wallets, brief cases, golf bags) a day and, to the delight of her customers, doesn’t plan on stopping any time soon.

I brought a broken suitcase with me to our meeting, as I have done many times before, and got a ticket instructing me to pick it up in a week’s time. “Unless there is a rush?” she checked, “Any travel plans?” Mrs. Boyle’s work is very reasonably priced, for her to fix the zipper on this bag it will run me about $16. Other repairs are more extensive, of course, but luggage that would otherwise be thrown out can be made good as new in Mrs. Boyle’s capable hands. “Some take a long time, you have to do it right.” The odd item is too far gone, she says, and she doesn’t hesitate let people know if it is. “For other things I’ll say ‘no, I don’t think you should spend the money on that.’”

I brought a broken suitcase with me to our meeting, as I have done many times before, and got a ticket instructing me to pick it up in a week’s time. “Unless there is a rush?” she checked, “Any travel plans?” Mrs. Boyle’s work is very reasonably priced, for her to fix the zipper on this bag it will run me about $16. Other repairs are more extensive, of course, but luggage that would otherwise be thrown out can be made good as new in Mrs. Boyle’s capable hands. “Some take a long time, you have to do it right.” The odd item is too far gone, she says, and she doesn’t hesitate let people know if it is. “For other things I’ll say ‘no, I don’t think you should spend the money on that.’”

Mrs. Boyle also has a contract with West Jet and helps them repair items damaged in transit, as bags often drop into the luggage carousal in a different state than when their owner last saw them at the airport baggage drop-off. She also repairs luggage for other airlines as well.

Richard Godfrey started the business in the mid ‘40s and Mrs. Boyle started working as his assistant 20 years later in the mid ‘60s. When Mr. Godfrey died suddenly in 1976 Mrs. Boyle took over. “Mr. Godfrey also used to make leather badges for the police and fire departments. He hadn’t taught me how to do it, but when he died I took over and had to learn quickly so I could support his family.”

Richard Godfrey started the business in the mid ‘40s and Mrs. Boyle started working as his assistant 20 years later in the mid ‘60s. When Mr. Godfrey died suddenly in 1976 Mrs. Boyle took over. “Mr. Godfrey also used to make leather badges for the police and fire departments. He hadn’t taught me how to do it, but when he died I took over and had to learn quickly so I could support his family.”

Police badges aside, the business hasn’t changed much in the last 70 years. They moved from central downtown to their current location in 1988 and recently bumped their opening hour from 8:30 to 9:30am – “I thought I might like to sleep in” – other than that it has been business as usual.

An assistant comes in for two hours a week to help tidy up and manage merchandise, but Mrs. Boyle manages the shop and does all the work herself. “I just love her, she’s excellent,” she said of her assistant.

Mrs. Boyle has dedicated clients who have been coming to her for years. “I have such lovely older clients. They bring me cookies and say ‘I hope you never close.’ I’m as old as they are!”

Thinking back to the time I lost track of the engagement ring I was hiding from my soon to be wife in our luggage, I asked Mrs. Boyle if she has every found anything interesting in the bags people bring in to be fixed. Without missing a beat she laughed and described the rather intimate toy she once found in a bag brought in by a rather “demure” lady. “Oh, I didn’t say anything. I just discretely put it in one of the pockets,” she explained with a chuckle.

Thinking back to the time I lost track of the engagement ring I was hiding from my soon to be wife in our luggage, I asked Mrs. Boyle if she has every found anything interesting in the bags people bring in to be fixed. Without missing a beat she laughed and described the rather intimate toy she once found in a bag brought in by a rather “demure” lady. “Oh, I didn’t say anything. I just discretely put it in one of the pockets,” she explained with a chuckle.

Mrs. Boyle doesn’t have a website, or computer for that matter, but the landline in her shop works just fine and she’s happy to accommodate clients who drop by with repair jobs. She has some luggage (new and consignment) for sale in store, and said she used to sell other Canadian leather goods but stopped when her supplier went out of business. “If I can’t get the good Canadian ones I don’t want any at all.” I know there are a lot of talented people in Victoria who make leather goods so I asked if she would be willing to restock if a local designer wanted to display some items. “I would be most interested!” she said.

“It breaks my heart to see those little businesses close,” Mrs. Boyle said as we chatted about all the local businesses we have seen come and go in Victoria. Godfrey’s Luggage & Leather Repairs & Sales speaks to a historic value of repairing, reusing, and caring for ones belongings. Though society’s buying habits have become increasingly disposable, Godfrey’s endurance when many other small businesses have closed over the last 70 years shows that value has not been lost.

“It breaks my heart to see those little businesses close,” Mrs. Boyle said as we chatted about all the local businesses we have seen come and go in Victoria. Godfrey’s Luggage & Leather Repairs & Sales speaks to a historic value of repairing, reusing, and caring for ones belongings. Though society’s buying habits have become increasingly disposable, Godfrey’s endurance when many other small businesses have closed over the last 70 years shows that value has not been lost.

Godfrey’s is open Tuesday to Saturday from 9:30am to 5:00pm. If you have any purses, wallets, luggage, or golf bags that need repairing give Mrs. Boyle a call at 250-388-5262 or pop in to see her at 2508 Douglas Street, Victoria, V8T 4M1.

Celebrating Local Businesses in our Community – Axine Water Technologies Inc.

At times, discussing the challenges facing our environment – especially as it pertains to expansive issues like water pollution – can be overwhelming and discouraging. While these worries are not misplaced, it’s important to talk about solutions and appreciate improvements too. Yes, there are a lot of obstacles ahead of us, but there are also a lot of amazing people in BC working to improve the way we interact with the environment. Clean tech, in particular, is an incredibly inspiring sector.

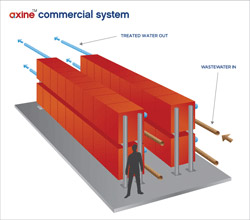

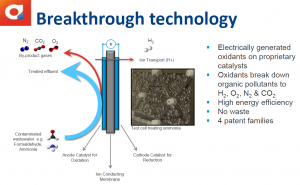

In March, before the spring legislative sitting got too busy, I had the distinct honor of visiting a clean tech company that is transforming the way industrial companies treat their wastewater; Axine Water Technologies Inc., based on UBC’s Vancouver campus. Jonathan Rhone, Axine’s Chief Executive Officer, and Jessica Verhagen, the Business Development Executive, walked me through the basics of their electrochemical technology and took me on a tour of their facility. It was a morning that left me marveling at human ingenuity and excited about the potential for progress in reducing the environmental impact of a wide range of industries.

In March, before the spring legislative sitting got too busy, I had the distinct honor of visiting a clean tech company that is transforming the way industrial companies treat their wastewater; Axine Water Technologies Inc., based on UBC’s Vancouver campus. Jonathan Rhone, Axine’s Chief Executive Officer, and Jessica Verhagen, the Business Development Executive, walked me through the basics of their electrochemical technology and took me on a tour of their facility. It was a morning that left me marveling at human ingenuity and excited about the potential for progress in reducing the environmental impact of a wide range of industries.

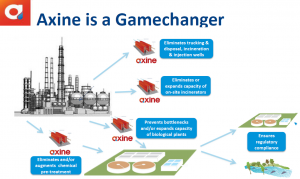

Axine has developed an innovative, low cost, chemical-free way for large companies to clean industrial wastewater by removing high concentrations of complex, toxic organics and ammonia. Their system has simultaneously solved a multi-billion dollar headache for companies, and a staggering environmental problem.

Axine has developed an innovative, low cost, chemical-free way for large companies to clean industrial wastewater by removing high concentrations of complex, toxic organics and ammonia. Their system has simultaneously solved a multi-billion dollar headache for companies, and a staggering environmental problem.

Over 10 billion pounds of toxic chemical wastewater are produced annually from chemical, pharmaceutical, petroleum product, and electronic manufacturers in the US. As Jonathan told me in our meeting, that wastewater is becoming more complex, hazardous, difficult, and expensive to treat, posing a growing threat to communities and industry.

“Billions of gallons are so toxic that the only solution is to truck it off-site to be incinerated or pumped into a deep injection well,” he continued. Jessica added that these wastewaters are subject to increasingly stringent regulations, putting pressure on industry to find the lowest cost solutions.

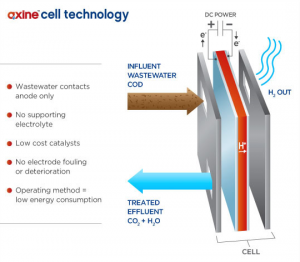

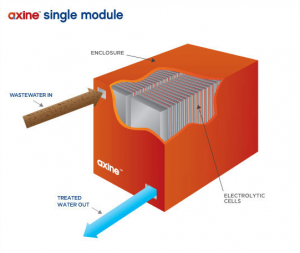

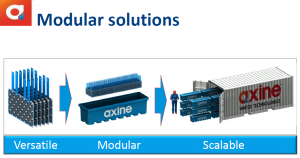

In a system that requires far less electricity than other electrochemical processes, Axine uses electrolytic cells to create free radicals that react with organic compounds, breaking them down into water, nitrogen, a small amount of carbon dioxide and a high-quality stream of hydrogen. Cells are combined in a modular system that is scalable, versatile, and easily adjusted to accommodate different volumes. It requires no chemicals, produces no sludge and can be used to process a wide range of industrial effluent. Once treated, cleaned water can be reused on site, greatly reducing overall industrial water use.

In a system that requires far less electricity than other electrochemical processes, Axine uses electrolytic cells to create free radicals that react with organic compounds, breaking them down into water, nitrogen, a small amount of carbon dioxide and a high-quality stream of hydrogen. Cells are combined in a modular system that is scalable, versatile, and easily adjusted to accommodate different volumes. It requires no chemicals, produces no sludge and can be used to process a wide range of industrial effluent. Once treated, cleaned water can be reused on site, greatly reducing overall industrial water use.

Their system can be integrated into existing treatment plants to target specific pain points without disrupting operations, Jonathan explained. “Our service model enables customers to access the technology with minimal capital investment and technology risk. We eliminate off-site trucking and disposal, reduce production bottlenecks, increase water reuse and ensure compliance with discharge standards.”

To see their design in action Goran Sparica, their Senior Vice President of Engineering and Operations, took me on a tour of their lab. Amongst the engineers in lab coats were a series of sealed off compartments with glass windows. Some seemed to have wastewater mid-treatment, with murky water on one side and clear water on the other.

To see their design in action Goran Sparica, their Senior Vice President of Engineering and Operations, took me on a tour of their lab. Amongst the engineers in lab coats were a series of sealed off compartments with glass windows. Some seemed to have wastewater mid-treatment, with murky water on one side and clear water on the other.

“Very toxic,” Goran mentioned as we passed a fridge filled with hazardous waste. Stopping at their field pilot prototype Goran explained how waste-water can be treated in 24 hours, noting that there is nothing like this in the world, “we’re the first to do it.”

Though there is huge interest in their technology from China and India, they are going to finish testing in North America before they further explore that market.

To help the sector compete globally, however, the clean tech sector in B.C. and Canada will need industry-specific leadership from provincial and federal governments. Axine was among the nearly 200 clean technology companies from across Canada that wrote to the federal government last month, asking for focused budgetary support.

To help the sector compete globally, however, the clean tech sector in B.C. and Canada will need industry-specific leadership from provincial and federal governments. Axine was among the nearly 200 clean technology companies from across Canada that wrote to the federal government last month, asking for focused budgetary support.

The clean tech industry in Canada is composed of more than 800 firms that are environmentally safe, diverse, and employ more than 50,000 people. By 2022 it is expected to be a $50 billion dollar industry. It is Canada’s fastest growing sector.

Back on a smaller scale, Jonathan spoke fondly of the company they are developing. “We have incredible employees. Lots of young people who are so passionate about what they’re doing. We’re having a ton of fun, solving environmental problems on the ground floor and building a more sustainable economy.”

MLA Town Hall: Sexual Violence on BC Campuses

MLA Town Hall: Sexual Violence on BC Campuses

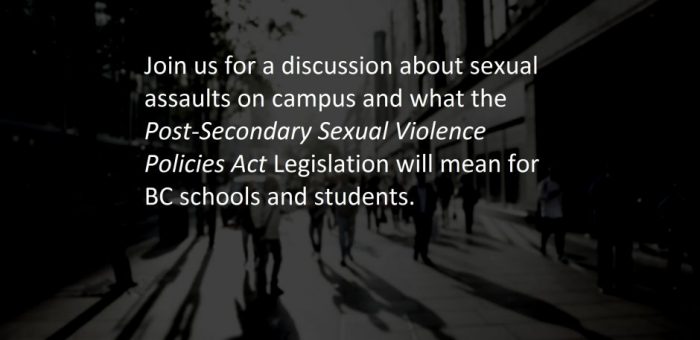

On Wednesday, May 4th 2016 we will be hosting an MLA Town Hall on sexualized violence on BC campuses with a panel of frontline speakers and experts. The event will start with a talk from MLA Andrew Weaver about his legislative efforts to address this issue, as well as an update on the progress of his bill, the Post-Secondary Sexual Violence Policies Act. Following Dr. Weaver, each panelist will speak about their connection to the issue as well as their ongoing efforts to prevent and address instances of sexual assault.

Panelist will include:

- The Victoria Sexual Assault Centre

- The UVic Student Society

- Trauma Therapist Barbara Allyn

- TRU Student Jean Strong

Plenty of time will be reserved for questions, comments, and discussion about how we can tackle this incredibly important issue and what the legislation will mean for BC post-secondary schools and students. This is a topic that effects everyone in our community, and everyone is welcome to attend.

The event will take place from 7:00pm to 9:00pm at the University of Victoria, Student Union Building (3800 Finnerty Road), in the Vertigo Room. Doors will open at 6:30pm and seating will be on a first-come, first-serve basis.

Please feel free to circulate this invitation to other people or groups who may also have an interest in joining us. And for more information, don’t hesitate to contact our office by email: andrew.weaver.mla@leg.bc.ca by phone: 250 – 472 – 8528 or on facebook.

Toad Road yet no Abode

Given the myriad challenges facing wildlife in our province, one of the best things we can do to protect biodiversity in B.C. is to leave key habitat areas intact. As the global climate warms and precipitation patterns shift, having a complete ecosystem within which animals and plants can try to adapt will be essential, and frankly the least we can do given the dire situation many species are in.

Given the myriad challenges facing wildlife in our province, one of the best things we can do to protect biodiversity in B.C. is to leave key habitat areas intact. As the global climate warms and precipitation patterns shift, having a complete ecosystem within which animals and plants can try to adapt will be essential, and frankly the least we can do given the dire situation many species are in.

This is not news to the government, of course. For species ranging from mountain caribou to spotted owls and goshawks, the Ministry of Environment is quick to reference habitat loss as a contributing, if not the main, factor in population declines:

“human activities associated with resource extraction are the ultimate threats to caribou in British Columbia. Human development fragments and alters caribou habitat…“

“[The spotted owl] is at risk in this province because much of its habitat has been adversely affected by logging or lost due to land development.“

“The laingi subspecies of Northern Goshawk requires large areas of old-growth and mature forest. Large-scale timber harvesting removes much suitable nesting and foraging habitat… Because of this, the laingi subspecies is believed to be in jeopardy, and is on the British Columbia Red List.“

Likewise, the government cites habitat destruction as one of the greatest impacts on western toad populations in B.C.

“Development in and around wetlands can destroy or isolate populations.“

To a lesser extent, though still of importance, migrating toads are often killed by traffic as they try to cross roads.

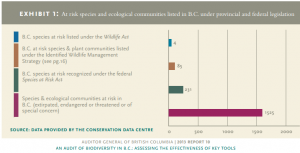

Western toads are considered a species of conservation concern by the government of British Columbia and have been designated a status of special concern by the Committee on the Status of Endangered Wildlife in Canada (COSEWIC). In theory, they are protected under the B.C.’s Wildlife Act.

While BC has the most biodiversity in Canada, it is also one of two provinces (the other being Alberta) that has no provincial endangered species legislation. Sadly, BC is the home of more than 1,500 species currently at risk of extirpation or extinction.

Summit Lake, just outside the village of Nakusp in the Kootenay region, is a key breeding area for western toads. Every year, usually around the end of August, young toadlets migrate from the shoreline of Summit Lake, across Highway 6, to upland habitat where they will live for four or five years before they return to the lake to breed. The mass migration sees upwards of a million little toads attempting the crossing, with tens of thousands getting run-over in the process.

Summit Lake, just outside the village of Nakusp in the Kootenay region, is a key breeding area for western toads. Every year, usually around the end of August, young toadlets migrate from the shoreline of Summit Lake, across Highway 6, to upland habitat where they will live for four or five years before they return to the lake to breed. The mass migration sees upwards of a million little toads attempting the crossing, with tens of thousands getting run-over in the process.

Hoping to help, nearby communities hold an annual Toadfest where people carrying the migrating western toads from the curb to the forest in buckets. The provincial government has also tried to address the problem by building directional fences leading to toad tunnels that allow the toads to safely cross under the highway. This amounts to an innovative solution and $200,000 investment in the protection of an increasingly threatened species. In the Ministry of Transportation and Infrastructure’s employee newsletter about their work they described the mass movement of western toads from Summit Lake to the forest as “among the great wildlife migrations in the world.”

Unfortunately, the story doesn’t end there. After being safely escorted across the highway, via toad tunnel or bucket, the toads will now find themselves in a forest slotted for logging. Road building began last week and there are plans in the works to clear cut the 30 hectares where the toads hibernate.

Unfortunately, the story doesn’t end there. After being safely escorted across the highway, via toad tunnel or bucket, the toads will now find themselves in a forest slotted for logging. Road building began last week and there are plans in the works to clear cut the 30 hectares where the toads hibernate.

To their credit, the Nakusp and Area Community Forest (NACFOR) logging company has drafted a toad management plan and identified small habitat features that they’ll try to leave intact. I commend NACFOR for exploring ways in which they can continue to harvest the timber while also being mindful of this species of special concern, but it is really the government that should be in the leadership role here.

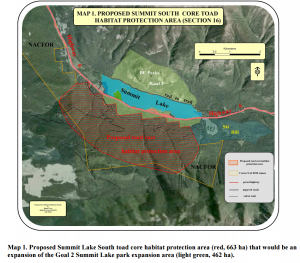

Protection of core terrestrial habitat – defined as “the spatial delineation of 95% of the population that encompasses terrestrial foraging, breeding, and overwintering habitats rather than buffers” – is seriously recommended in the scientific literature for amphibians (Semlitsch and Bodie 2003, Browne and Paszkowski 2010, Crawford and Semlitsch 2007). If the existing provincial park at Summit Lake were expanded to include the forest within roughly two kilometers of the lake the protection of core terrestrial habitat would likely be achieved, wildlife biologist Wayne McCrory said in his analysis of the situation.

Protection of core terrestrial habitat – defined as “the spatial delineation of 95% of the population that encompasses terrestrial foraging, breeding, and overwintering habitats rather than buffers” – is seriously recommended in the scientific literature for amphibians (Semlitsch and Bodie 2003, Browne and Paszkowski 2010, Crawford and Semlitsch 2007). If the existing provincial park at Summit Lake were expanded to include the forest within roughly two kilometers of the lake the protection of core terrestrial habitat would likely be achieved, wildlife biologist Wayne McCrory said in his analysis of the situation.

The province has been criticized for failing to set aside adequate habitat to protect caribou, spotted owls and goshawks and this toad situation illustrates just how reluctant the B.C. government is to remove forest from the logging land base. The key western toad forest habitat around Summit Lake is a relatively small, very specific area that could be included into the existing provincial park. This would represent a minor exemption from their 9,816 hectare total operating base.

The creation of the toad tunnel represented an admirable step forward for the government’s approach to wildlife issues. Granting approval to log their core terrestrial habitat represents more of a smoking bulldozer ride back – squashing all their advancements in the process.

The creation of the toad tunnel represented an admirable step forward for the government’s approach to wildlife issues. Granting approval to log their core terrestrial habitat represents more of a smoking bulldozer ride back – squashing all their advancements in the process.

“Be an advocate for amphibians – protect toads and their habitat in your neighbourhood,” reads the government’s BC Frog Watch website.

Good advice, that I respectfully urge the BC government to follow by protecting western toad habitat around Summit Lake before it’s too late.