Celebrating youth in our community – Olivia Friesen

This is the twenty-seventh installment in our series on exceptional youth where we celebrate the outstanding achievements of youth in the Oak Bay-Gordon Head riding. As we commence this chapter in our series we have chosen to celebrate the accomplishments of two sisters in Oak Bay, Olivia and Anna Friesen. These inspirational young adults are enriching our lives with their passion and commitment to the betterment of society.

Olivia Friesen

Although many younger siblings would feel overwhelmed by the pressure of having an older sister as accomplished as Anna Friesen, Olivia has elected to view her older sister as a role model while still managing to distinguish herself as a different but no less remarkable young individual.

Although many younger siblings would feel overwhelmed by the pressure of having an older sister as accomplished as Anna Friesen, Olivia has elected to view her older sister as a role model while still managing to distinguish herself as a different but no less remarkable young individual.

In grade nine Olivia obtained marks of 100% in Social Studies and Science, 99% in math, and 96% in English. This past year, she followed up her incredible academic performance in her freshman year with an overall average in the upper 90s.

Like her older sister, Olivia is a multidimensional athlete who has found success in nearly every sport she has decided to attempt. Last season, Olivia played on Oak Bay’s elite U16 Vancouver Island Premiere League team (which won their division) and was an important part of the high school junior girls’ team. She is also an excellent field hockey player who is a valuable member of school’s team and has been chosen to participate in the Rising Stars Elite Training Program. To top it off, Olivia runs the 100, 200, and 400 metre dash for the school’s track and field team and competes in long jump, triple jump, and pole vault.

Like her older sister, Olivia is a multidimensional athlete who has found success in nearly every sport she has decided to attempt. Last season, Olivia played on Oak Bay’s elite U16 Vancouver Island Premiere League team (which won their division) and was an important part of the high school junior girls’ team. She is also an excellent field hockey player who is a valuable member of school’s team and has been chosen to participate in the Rising Stars Elite Training Program. To top it off, Olivia runs the 100, 200, and 400 metre dash for the school’s track and field team and competes in long jump, triple jump, and pole vault.

When she was in grade five, Olivia began playing the cello and has evolved to become an integral part of the Oak Bay High School Orchestra. In grade 9, her hard work and dedication was acknowledged by the Orchestra who decided to give her the Most Improved Strings Player Award. Additionally, while at Monterey Middle School, Olivia decided to take up playing the trumpet and is a now a member of the Oak Bay High School Concert Band.

When she was in grade five, Olivia began playing the cello and has evolved to become an integral part of the Oak Bay High School Orchestra. In grade 9, her hard work and dedication was acknowledged by the Orchestra who decided to give her the Most Improved Strings Player Award. Additionally, while at Monterey Middle School, Olivia decided to take up playing the trumpet and is a now a member of the Oak Bay High School Concert Band.

Despite her young age, Olivia has found numerous ways to give back to the local community and is an active member of the school’s environment club. This past year she helped to organize the rubber ducky race, volunteered as a Christmas gift wrapper for the Mustard Seed, and served as a volunteer for the school’s annual Cops for Cancer campaign. In previous years, Olivia has participated in restoration projects at Bowker Creek and Anderson Hill Park. When she was in grade nine, she was one of just six students in her year selected to participate in the Live Different program and would have travelled down to Mexico during spring break to build two houses for disadvantaged families if not for COVID-19.

Despite her young age, Olivia has found numerous ways to give back to the local community and is an active member of the school’s environment club. This past year she helped to organize the rubber ducky race, volunteered as a Christmas gift wrapper for the Mustard Seed, and served as a volunteer for the school’s annual Cops for Cancer campaign. In previous years, Olivia has participated in restoration projects at Bowker Creek and Anderson Hill Park. When she was in grade nine, she was one of just six students in her year selected to participate in the Live Different program and would have travelled down to Mexico during spring break to build two houses for disadvantaged families if not for COVID-19.

As her membership in the school’s environment club would indicate, Olivia is interested in climate change and conservation which she may pursue academically down the road in university. In line with her interests in environmental science, she cites science teacher Derek Schubsole as positive academic influence in her life.

Throughout the COVID-19 pandemic Olivia has done her best to stay positive and keep a daily routine, but like many others, misses the personal interactions that form an important part of her everyday life. She’s looking forward to the start of the new school year after spending the summer working in the Kiwanis Willows Tea room.

Throughout the COVID-19 pandemic Olivia has done her best to stay positive and keep a daily routine, but like many others, misses the personal interactions that form an important part of her everyday life. She’s looking forward to the start of the new school year after spending the summer working in the Kiwanis Willows Tea room.

Given her personal drive and natural talent in so many different areas, we believe that Olivia is destined to continue being a high achiever whose work impacts the lives of numerous others.

Celebrating youth in our community – Anna Friesen

This is the twenty-sixth installment in our series on exceptional youth where we celebrate the outstanding achievements of youth in the Oak Bay-Gordon Head riding. As we commence this chapter in our series we have chosen to celebrate the accomplishments of two sisters in Oak Bay, Anna and Olivia Friesen. These inspirational young adults are enriching our lives with their passion and commitment to the betterment of society.

Anna Friesen

Normally, my office and I prefer to chat with the youth we’re celebrating in person, but given the circumstances, we elected to conduct our conversation with the two sisters via Zoom. When we spoke to them in early August, they were vacationing at their family cabin in the Okanagan with their parents and family friends – one of whom is Logan Graham a young man we have recognized in the past (link to blog post on Logan to be added here).

Normally, my office and I prefer to chat with the youth we’re celebrating in person, but given the circumstances, we elected to conduct our conversation with the two sisters via Zoom. When we spoke to them in early August, they were vacationing at their family cabin in the Okanagan with their parents and family friends – one of whom is Logan Graham a young man we have recognized in the past (link to blog post on Logan to be added here).

Originally from the Okanagan, Anna moved to Victoria in early childhood and attended Willows Elementary School and Monterey Middle School. Now entering her final year of high school at Oak Bay Secondary, Anna is one of the rare individuals with the natural talent and work ethic required to find success in multiple areas.

Originally from the Okanagan, Anna moved to Victoria in early childhood and attended Willows Elementary School and Monterey Middle School. Now entering her final year of high school at Oak Bay Secondary, Anna is one of the rare individuals with the natural talent and work ethic required to find success in multiple areas.

Throughout high school, Anna has consistently demonstrated that she is one of the top students in her grade. In grade 10, she obtained a remarkable 97% average with marks of 100% in math, social studies, and entrepreneurship. This past year, Anna somehow managed best her outstanding grade 10 performance by increasing her average to 98%. In grade 12 she will be taking a full load of math and science courses, including the calculus-math 12 combo, physics, biology, and chemistry. And she’s looking forward to the start of the new school year after spending the summer working in the Kiwanis Willows Tea room.

Outside of the classroom, Anna is a gifted athlete who has performed at a high level in soccer, track, and volleyball. Winner of Oak Bay Secondary’s prestigious Female Athlete of the Year Award in 2019 – a trophy won by former Olympians – she was also the track team’s 2018 Rookie of the Year and won Most Outstanding Junior Track Athlete in 2019. And while she is clearly no slouch in the talent department, she is also a natural leader who is highly regarded by her teammates and coaches, evidenced by her role as captain of her Bays United soccer team.

Outside of the classroom, Anna is a gifted athlete who has performed at a high level in soccer, track, and volleyball. Winner of Oak Bay Secondary’s prestigious Female Athlete of the Year Award in 2019 – a trophy won by former Olympians – she was also the track team’s 2018 Rookie of the Year and won Most Outstanding Junior Track Athlete in 2019. And while she is clearly no slouch in the talent department, she is also a natural leader who is highly regarded by her teammates and coaches, evidenced by her role as captain of her Bays United soccer team.

Although athletics and academics are big parts of Anna’s life, it quickly became apparent in our Zoom conversation with her that she is also passionate about music and fine arts. She is a dedicated member of the Jazz Band in which she plays the tenor saxophone and has taken visual arts and journalism as electives.

Although athletics and academics are big parts of Anna’s life, it quickly became apparent in our Zoom conversation with her that she is also passionate about music and fine arts. She is a dedicated member of the Jazz Band in which she plays the tenor saxophone and has taken visual arts and journalism as electives.

Despite being so busy with her pursuits in the classroom, athletics, and fine arts Anna has also found time to give back to the community. For the last year, she has been involved with Live Different Oak Bay, a group of students that would have travelled to travel down to rural Mexico to build two homes for disadvantaged families during spring break if not for the COVID-19 pandemic. Alongside the other Live Different members, Anna spent over one year volunteering in the Great Victoria community and helping to fundraise for the trip. In addition to Live Different, Anna has volunteered for Oak Bay’s Cops for Cancer campaign, served as a Mustard Seed Christmas Gift wrapper, and has spent time as a youth soccer coach.

Although Anna is quick to point out that there are many teachers who have had a positive influence on her during her time at Oak Bay, she particularly enjoyed taking history with Scott Alexander because of his interest in encouraging in class discussions about the course material and current events. Outside of school, Anna cites her parents and the Graham family as positive influences and role models in her life.

Although Anna is quick to point out that there are many teachers who have had a positive influence on her during her time at Oak Bay, she particularly enjoyed taking history with Scott Alexander because of his interest in encouraging in class discussions about the course material and current events. Outside of school, Anna cites her parents and the Graham family as positive influences and role models in her life.

With university fast approaching, Anna is looking to enter a discipline which combines her interests in science and fine arts such as architecture. Based on her strong track record of success so far, we have no doubt that Anna will excel in whatever program she ultimately chooses and look forward to hearing about her future accomplishments.

Socially & Environmentally Responsible Corporations & Investing: The Opportunity

There is a coming paradigm shift around the purpose of investment and businesses. The last decade has seen growing pressure on corporations to consider the environmental, social, and governance consequences of their investment and management decisions. This more holistic view of the corporation is a necessary and positive development. Corporations do not exist in a vacuum; the societies in which they conduct business are indispensable sources of their success and vitality. Accordingly, corporations have duties to both their shareholders and the societies in which they are embedded. By incorporating these other considerations into their decision-making corporations will not only provide many societal benefits but will enhance profits at the same time.

Increasing numbers of Canadians are coming to believe that companies should stand for something more than profit. Over half of Canadians now lean towards purchasing products from businesses that align with their worldview. Some of this change is likely being driven by the values and interests of millennials and gen-z who make up a growing share of the population. A recent survey by Deloitte provides interesting and important insights into the priorities of these two generations. When asked to identify the three issues they believed to be most important, health care and disease prevention, climate change, unemployment, and income inequality all ranked higher than economic growth.

There are signs that the private sector may be shifting towards more holistic governance models. Many companies are attempting to align their brands with shifting consumer preferences and nascent corporations embrace socially and environmentally conscious business models. In Europe, over two-thirds of the start-ups at the Slush 2019 conference were classified as purpose driven companies, defined as corporations that include one or more of the United Nations Sustainable Development Goals as an integral component of their operations, an increase of about 7% from 2014.

However, actions taken by the state can help to accelerate the shift towards corporations with a defined social purpose. By creating the right regulatory and policy frameworks, government can incentivize socially responsible investment. One step in this direction is the BC Government’s recently announced regulations around benefit companies. Canadian corporate law does not have a formal doctrine recognizing shareholder primacy. However, the new legislation and corresponding regulations will empower corporations to continue addressing pressing social and environmental issues as they scale their operations and make it easier for investors to choose companies that align with their values.

In the future, another avenue that the province could consider promoting to encourage investment with the potential to generate positive social returns are community investment co-ops (CICs). CICs are capital pools that provide residents of a specific region or locality with the opportunity to invest some of their money in local businesses. Individual investors typically elect the fund managers themselves to ensure that the investments made through the vehicle are consistent with their priorities and values. Through CICs, residents can become directly involved in economic development projects within their communities.

Ample capital already exists within the province which could be harnessed by CICs. Each year, millions of dollars exit British Columbia to be invested in other jurisdictions. If the province established a structure designed to incentivize investments into CICs, some of this capital could be redirected into local businesses. At a time in which rural regions in BC are experiencing economic stagnation, CICs could be used to reinvest money generated through regional economic activity into local corporations and start-ups, helping to stimulate rural economies.

Several CICs already exist within BC including the Vancouver Island CIC, the East Kootenay CIC, and the West Kootenay Boundary Investment Co-Op. Some have already received financial support from the government. However, there are a number of legislative and regulatory changes open to the government which could be used to make these investment vehicles more attractive to British Columbians. Some options include creating a tax credit for investors and amending the securities act to make it easier for CICs to generate larger capital pools for investment.

The adoption of a legislative and regulatory framework designed to popularize CICs would not be without precedent. Other jurisdictions have successfully introduced programs centered around social finance, including other Canadian provinces. In 1993, Nova Scotia introduced the Equity Tax Credit which allows residents to claim a tax credit on investments made into provincially based businesses. Six years later, the province created the Community Economic Development Investment Funds (CEDIF) program in an attempt to encourage wider adoption of the tax credit. The program offers a streamlined application process for those seeking to establish a CEDIF and allows investors to claim an income tax credit on their investments in the vehicle. By 2013, Nova Scotians had established 47 CEDIFs which had contributed over $56 million in financing to local businesses, some of which were mission-oriented corporations dedicated to social and environmental causes.

When provided with the opportunity to pursue business models that have the potential to generate positive social and environmental outcomes, many individual investors and nascent corporations will choose to do so. As society begins to redefine its expectations of corporations, the province has the chance to become a world leader in the movement towards socially responsible business. The recently introduced legislation and regulations around benefit corporations represent a positive step in this direction but the province should not stop there.

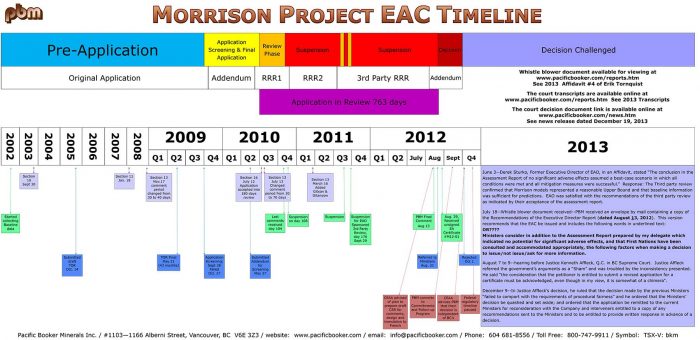

Pacific Booker Minerals and their quest to develop Morrison Mine near Smithers

In 2002, Pacific Booker Minerals began the formal environmental assessment process required to obtain ministerial certification for Morrison Mine, their proposed copper and gold mine near Smithers, BC. A decade later, after $10 million worth of consultations, meetings, and assessments, the company decided to proceed to the next stage of the certification process in which the Environmental Assessment Office (EAO) submits a formal environmental assessment report to the relevant ministers via the executive director. At the time of submission, all indications were that the mine would receive approval. EAO assessment reports had given the project a clean assessment and the company had proposed to undertake measures unprecedented in the copper mining industry to address the project’s environmental risks. Despite the positive environmental assessment, the Executive Director of the EAO chose to recommend that the project be rejected, advice which was followed by Environment Minister Terry Lake. The decision to reject proposed project was ostensibly made due to ongoing concerns about the effects of the project on local salmon populations and water quality in Morrison lake, among other things.

Yet the decision to reject the project on environmental grounds should raise immediate questions about why this project was nixed and not others, given the BC Liberal government’s environmental record in the mining sector. As highlighted in my question posed to the Minister of Energy, Mines, and Petroleum Resources in the House back in March, this is the same government that went to Ottawa in 2014 to lobby the federal government to approve the Prosperity mine, a project that had received two negative assessments by federal review panels. Moreover, the BC Liberals presided over a compliance and enforcement regime that the auditor general described as “inadequate to protect the province from significant environmental risk” and unfunded taxpayer liabilities in the mining industry were estimated at $1.4 billion as of 2017.

The decision to reject the project had serious repercussions for Pacific Booker. Their share price plummeted from $14.95 to $4.95 in one day and many investors lost their life savings. What’s more is that the Ministry failed to inform Pacific Booker of its intention to issue an adverse recommendation and did not provide the company with an opportunity to respond to it, conduct which deviated from the standards outlined in their own user guide.

Rather than face the prospect of beginning the assessment again Pacific Booker decided to enter into litigation with the government over its decision to reject the project. Among other things, the case was fought over whether the Ministry had violated standards of procedural fairness by denying the company the chance to respond to the Executive Director’s recommendation. During the court proceedings, Justice Affleck would describe the environmental assessment process as a “sham” and accuse the province of repeatedly “moving the goalposts” during the assessment process. Perhaps unsurprisingly, the Supreme Court would rule in favour of Pacific Booker, writing that the firm “ought to have been entitled to know at least the essence of the adverse recommendations and ought to have been entitled to provide a written response”.

The ruling from the Supreme Court quashed the decision to reject the mine and ordered the project to be reconsidered by the government. Yet once again, the government elected not to approve the mine and ordered that the project undergo further assessment with the requirement that additional information be collected. Despite repeated exchanges with the environmental assessment office in which Pacific Booker attempted to determine what exactly this additional information is, the firm has been unable to obtain a clear answer from government officials, placing the project in a state of limbo. As of early 2020, the company was still in the process of working through the Supplemental Application Information Requirements with the EAO, in accordance with the order issued by the Ministers.

Based on the previous government’s environmental record in the mining sector (raised earlier), there has been speculation that the decision to reject the mine had little to do with environmental concerns and everything to do with political calculation. What could these political concerns have been? It is difficult to determine one single political factor that led to the decision around the Morrison mine but several interrelated developments which are explored in more detail below provide insight into the political circumstances surrounding the project.

Two ‘Final’ Environmental Assessment Reports

In 2013, before the court proceedings began, a whistleblower provided Pacific Booker with a copy of an assessment report on the Morrison mine dated August 21st. The report contained notable differences from its final version that was ostensibly used to inform the government’s final decision and released publicly. Subsequent emails obtained by the company through a Freedom of Information (FOI) request have revealed that the Minister had requested changes to the original document which should raise questions about the political neutrality of the decision to reject the mine. On July 16th 2014, the project assessment director Chris Hamilton wrote to Sarah Bevan: “Hmm, I recall the first PBM knew about the no was a phone call on Oct 1, a Monday. Could you be thinking about the two versions of the recommendations? One was dated Aug 21, the date of the referral and then Minister Lake had asked for changes to that doc, so the second was dated Sep 20. Could that be it?”

To date, the Ministry has denied any allegations of political interference in the environmental assessment process. In his affidavit in Pacific Booker v British Columbia, David Sturko claimed that: “The clarifications requested by Minister Lake were (a) correction of a factual error relating to the project’s anticipated contribution to Provincial Gross Domestic product, and (b) more specificity regarding the nature and basis of the additional factors I cited in my recommendations at the end of the document”.

The Relentless Pursuit of LNG

For some time, the Lake Babine Nation has been opposed to the Morrison mine. Members of the community have expressed significant concerns about the effects of the project on local salmon populations which are important to the nation for cultural, historical, and economic reasons. When the decision was made to the reject the project, a secondary justification that the director of the EAO provided in his report was the “moderate to strong” strength of the Lake Babine Nation’s claim to aboriginal title in the area. Based on the strong opposition of the nation to the project, it is possible they would have pressed an aboriginal title claim in court to delay or block the project from proceeding.

At the time the project was rejected this appeared to be the only consideration that the province had given to First Nations issues. However, subsequent developments have made political conflict involving the Lake Babine Nation increasingly salient to the delayed progress on the project. In 2016, the Lake Babine Nation cautioned the province that their cooperation on major LNG projects, including the Prince Rupert Gas Transmission line, could be contingent upon the government not overturning its decision on the Morrison mine. Referencing the pipeline, Chief Wilf Adam was quoted in Business in Vancouver as saying: “If they overturn or change their decision in favour of PBM to start this mine, then all gloves are off – and any agreement we made with the province,”.

Raising the issues that have emerged around the Lake Babine Nation is in no way meant to diminish the obligation that the government has to undertake meaningful consultation with indigenous communities before projects can proceed. Resource development needs to be based on equal partnership between all parties with interests at stake in proposed projects. Rather, highlighting the political conflict involving the Lake Babine Nation is meant to bring attention to the fact that decisions involving the Morrison mine may have been influenced by political calculation that had little to do with the proposed project itself.

Project Suspension

Just before the Ministry was ready to release the order requesting further assessment, the Morrison mine was placed under suspension after the Mount Polley Mine disaster, pending the outcome of a provincial review. At the time, the Pacific Booker was the only project that was placed under suspension while the government was investigating the Mount Polley incident. To date, no explanations have been given for why the Morrison mine was suspended and not others. The delay would last for approximately one full year before the order was released.

Pipeline Politics

At the time the project was rejected, the BC Liberals were embroiled in a dispute with Alberta over the construction of the Enbridge pipeline where the most contentious issue in negotiations was revenue sharing. The Liberals took the position that BC would need to receive a higher share of the royalties for the amount of environmental risk the province would absorb in order for the pipeline to proceed. However, comments from some observers had implied that taking this stance placed BC in a weak negotiating position due to the BC Liberal government’s poor environmental record. Further compounding the government’s problems was a looming election in which the NDP had attempted to make the Enbridge pipeline an election issue. Then BC NDP leader Adrian Dix had been heavily critical of the government’s environmental record and had accused the BC Liberals of selling out BC’s interests to the federal government and to Alberta.

Towards a Resolution?

While there is no smoking gun which serves evidence that the province had politicized the environmental assessment process, the suspicious circumstantial evidence that suggests otherwise does little to inspire confidence from British Columbians in their government and has damaged the province’s reputation as a good place to do business. Furthermore, the decision to reject the project has had significant ramifications for Pacific Booker and its investors. Small investors in the project have lost their life savings and have been forced to continue to work well into their retirement years. Based on these factors along, this government has a responsibility to ensure that this project is given a fair hearing in what is now effectively its third environmental assessment.

On the gaps that exist in economic supports available to individuals & businesses during the COVID-19 pandemic

Without a doubt, British Columbia has led the way in North America in terms of introducing measures to curb the spread of the COVID-19 virus in our province. We are very fortunate that so many people are following the advice of Health Minister Adrian Dix and Provincial Health Officer Dr. Bonnie Henry. Thank you to all for staying the course during these difficult times.

Nevertheless, with Canada just over one month into a nationwide lock-down we are beginning to get a better idea of where the gaps are in the existing economic supports and where further relief is needed. Since many of the initial government interventions were broad in scope, needs specific to different industries have been left unaddressed by the existing programs. In BC, a BCC survey found that the current programs were of little use to one third of businesses, with nearly half of businesses with under five employees reporting that they do not find the existing programs to be helpful. Ongoing email exchanges and conversations with British Columbians have also revealed additional gaps in the existing programs. Some of these are highlighted below.

The Tourism Industry is Reeling

Unsurprisingly, sectors dependent on in-person interactions such as the hospitality and tourism industries have been among the hardest hit by the pandemic. For many businesses in the tourism industry, capital expenditures are typically made during the off-season and are offset by revenue generated throughout the summer months. However, the combination of social distancing measures, travel restrictions, and the closure of BC Parks and Natural Reserves has meant that tourism operators have been forced to grapple with hundreds of last-minute cancellations just as their busiest season was about to begin. With many businesses needing to service pre-existing debt loads, the loss of summer revenue has placed them in a precarious position. Exacerbating matters is the fact that many operators have had limited success in negotiations with travel insurance companies around the reimbursement of guests’ travel costs.

Currently, the economic supports introduced by the federal and provincial governments do not adequately address the scale and scope of the challenges that the industry faces, particularly given its seasonality. Assistance offered by the private sector such as deferring loan payments for three months are only stop-gap measures because payments will eventually come due. Additional solutions proposed to address the issues the tourism and hospitality industries are facing have included altering the terms of the existing loan programs to provide longer repayment periods, larger loan guarantees, and determining loan eligibility on a per property basis rather than a per owner basis.

Rent Assistance

One concern common to both individuals and businesses is the ability to pay rent. Even before the current economic crisis began, the high cost of living in urban areas was a pressing issue in federal and provincial politics. Rent prices have been increasing over the last decade and as of November 2019 the average rent in Vancouver was $2,507 per month. In Oak Bay, just under 20% of households fall below the affordability standard, defined as spending 30% or more of income on shelter costs.

Although Ottawa and Victoria have stepped in to provide the Canada Emergency Response Benefit (CERB) and the BC Temporary Rental Supplement Program (BC-TRS) respectively, many individuals have indicated that the existing supports will not be enough to get them through the crisis, particularly given the fact that relief from other recurring expenses such as mortgage payments, property taxes, utility bills, and debt payments are only temporary. If people are unable to make rent payments, hundreds of tenants could be facing eviction when the crisis is over. The impact of missed rental payments would also be acutely felt by landlords, many of whom are reliant upon rental income to make mortgage payments or to support their retirement.

On a commercial level, almost 60 percent of Canadian small businesses have said that they will be unable to pay rent come May 1st. The situation is particularly urgent in the food service industry where three quarters of respondents to a Restaurant Canada survey reported that that rent was a primary source of business debt.

Solutions floated to the issues facing renters and landlords have included increasing the provincial rent supplement, and federal government intervention to support renters by topping up the CERB payment. The recently announced Canada Emergency Rent Assistance program should provide much needed relief to small businesses but will need to be closely monitored to determine if it is ambitious enough. Many small business owners have expressed their reluctance to take on more debt and may require further support in the weeks ahead.

Ongoing Restrictions to the Canada Emergency Wage Subsidy

While making the criteria for the Canada Emergency Wage Subsidy more flexible has helped more businesses qualify for the program, many firms have indicated that they are still slipping through the cracks. Currently, only one third of businesses in BC are confident that they will qualify for wage subsidy, with 28% of businesses reporting that their revenue has not declined enough to meet the eligibility requirements. This issue is particularly pressing for businesses that have experienced revenue declines but are still trying to stay open to provide services to customers. Without additional support many of these businesses will be forced to close and layoff their employees, making an eventual economic recovery all the more difficult.

Unaffordable Childcare Costs

Both the province and the federal government have taken steps to ensure that essential service workers are able to access child-care throughout the pandemic. At the federal level, the CERB has been extended to those forced to care for their children at home and the Canada Child Care Benefit has been increased by $300 per child. In BC, the provincial government has prioritized spaces in child-care centres for essential service workers and has provided access to child-care services for school aged children through schools themselves. Yet despite these measures, essential service employees with children above the age of five are still struggling to find affordable child-care services. In some school districts, schools no longer have the capacity to offer child-care, forcing parents unable to work from home to resort to private options. For many households, the costs of private child-care are too high to remain a viable long-term solution to the lack of in-school supports.

Throughout the pandemic, essential service employees have been deservingly lauded as heroes for their selfless commitment to others. With some of these workers still struggling to find affordable child-care for their children, Ottawa and Victoria need to address the gaps in the existing support network so that workers in essential industries can continue to provide the services that British Columbians count on. If further support does not come soon, essential services workers may be forced to quit their jobs to care for their children at home.

Possible options here could include extending childcare services to out of district students if there are enough spaces available, distributing additional tax credits to families, or making the criteria for the CERB more flexible to cover a portion of the costs of childcare for essential service workers.

Supporting Individuals and Businesses

At the moment, there is a narrow window of opportunity for governments to act to aid struggling sectors and individuals. Many businesses are dangerously close to being forced to permanently close and cannot wait much longer for further assistance. Going forward, the government might focus on ensuring that as many individuals and businesses as possible can access their programs. Given the consequences of not doing enough, I am of the view that it is is better to do too much than to do too little.