Issues & Community Blog - Andrew Weaver: A Climate for Hope - Page 166

New Ways of Funding BC’s Health Care System

“There is a difference between equity and equality and treating everyone exactly the same may not always be fair” – Dr. Livio Di Matteo

Over the past couple months, I have emphasized the need for government leadership and increased government funding if we are to truly tackle poverty and homelessness in our province. Over the course of the next few articles I will begin to outline what government leadership might look like and identify where that funding could come from. In this first post, I focus on health care funding and the Medical Services Plan premium that unfairly burdens low and fixed income British Columbians as well as small business owners with an overly heavy tax burden. In addition, I provide details concerning British Columbia’s under representation in the federal funding allocation for provincial Health Care via the Canada Health Transfer (CHT). As I will demonstrate, British Columbia is receiving $153 million less that it should through this program.

Regressive versus Progressive taxation.

The various forms of taxation available to government generally fall into two broad categories: 1) Progressive taxes; 2) Regressive taxes.

Progressive taxes, such as income or corporate tax, are based on the premise that those who can afford to pay more, should pay more. That is, higher income earners would pay larger taxes than lower earners. This premise forms the foundation of our income tax systems right across the country.

However, in recent years, there has been a general tendency towards reducing various forms of progressive taxation and replacing the lost revenue through increases in a variety of regressive taxes. Regressive taxes, such as the Provincial Sales Tax, are taxes that do not reflect one’s ability to pay. In other words, everyone pays the same, regardless of how much your earn. Perhaps the most obvious example of this is British Columbia’s Medical Services Plan (MSP) premiums.

What is the Medical Services Plan (MSP)?

As noted on the Ministry of Health website “The Medical Services Plan (MSP) insures medically-required services provided by physicians and supplementary health care practitioners, laboratory services and diagnostic procedures.” The MSP requires anyone living in BC for six months or longer to pay monthly premiums for health care coverage. While some individuals can apply for premium assistance, these subsidies dry out as soon as a person earns a net annual income of $30,000 or more. Those who earn more than $30,000 must currently pay a monthly flat fee of $72. This means that an individual who earns $30,000 per year pays the same MSP premium as an individual who earns $3,000,000 per year. And so, it is evident that MSP premiums are perhaps the most regressive form of taxation in BC.

MSP Premiums become even more regressive when you factor in who actually pays them. The fact is, many large employers pay all or part of an employee’s MSP premium as part of a negotiated taxable benefit of employment. But for many, if not most, low and fixed income British Columbians, as well as small business owners, they must pay the costs themselves.

In 2000, the MSP premium for a single individual was $36 per month. Today, that same individual pays twice as much (the same amount that a family of three or more paid 15 years ago). At the same time, personal and corporate income taxes have experienced significant cuts, the consequences of which I will explore further in future posts. The resulting major shifts in taxation have led to the provincial government now bringing in almost as much revenue from MSP premiums as it does from corporate income taxes. In the 2014/15 British Columbia budget, revenue from MSP premiums was expected to be 2.271 billion dollars whereas corporate tax revenue was estimated to be 2.348 billion dollars.

While one can make the argument that reducing MSP premiums allows for lower rates of other taxes, these benefits are often only felt by the wealthiest of the population. In fact, “when all personal taxes are considered (income, sales, property, carbon, and MSP premiums), the higher your income, the lower your total provincial tax rate”. So, while most BC households paid around the same total tax rate back in 2000, with those in the top income bracket paying slightly more, under the current system the wealthiest 20% of households now pay a lower total tax rate than the rest of the population.

Not only do these tax cuts not benefit the majority of British Columbians, but we also must then pay for these cuts in the form of reduced social services. Over an 11-year period, from 2000 to 2011, BC’s tax revenues fell by 1.6% relative to the size of the provincial economy (GDP) resulting in a revenue deficit of about $3.5 billion.

Why do we pay MSP Premiums?

Some may wonder why we have to pay provincial MSP premiums in the first place. After all, we are the only province in Canada to require them. The rest of Canada have moved away from monthly premium charges and instead use general tax revenues, primarily provincial income taxes that are based on taxpayers’ ability to pay, to acquire the funds needed to pay for Medicare services. In fact, after the Alberta government announced its plans to eliminate their premium charges for Medical Services Plan Coverage in 2008, BC was left as the only province to continue to charge these individual flat-rate premiums.

The answer is simple. It’s a choice that successive British Columbia governments have made. It’s a choice to favour regressive over progressive taxation. It’s a choice that puts the interests of the wealthy over the interests of low and fixed income British Columbians as well as small business owners. And the choice is made, in part, to maintain the illusion of low taxes.

The Canada Health Act and Canada Health Transfer

The federal Canada Health Act sets the standards for all provinces and requires coverage for all necessary care provided in hospitals and by physicians. But health care is ultimately the responsibility of the province.

General revenues from the Federal Government provide funding for health care to the provinces and territories through the Canada Health Transfer (CHT). Up until this past year, the CHT consisted of two components: a cash transfer and a tax transfer. Though CHT is allocated on a per capita basis, the cash transfer was not. Instead, the CHT cash transfer would take into account the value of provincial and territorial tax points and the fact that provinces do not have equal economies and, therefore, have unequal capacity to raise tax revenues. This meant that provinces with the highest revenue raising ability received lower per capita CHT cash payments than other provinces.

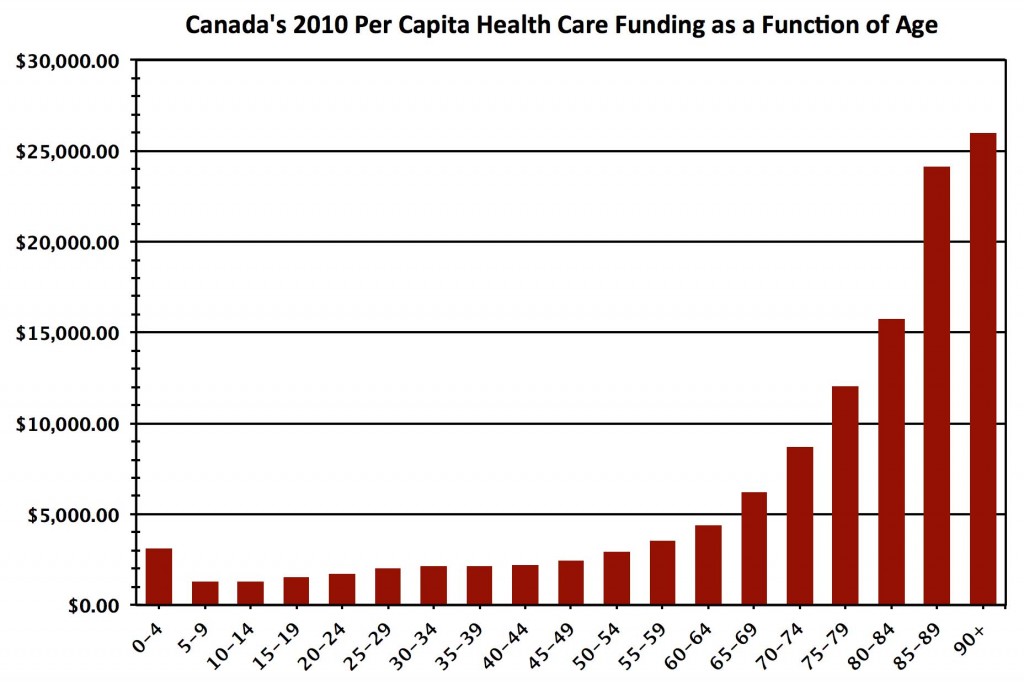

However, since January 2014, CHT allocations are now determined solely on an equal per capita cash basis. While this new system means that all provinces will receive equal transfer payments based on population size, I believe that this is not the most equitable way to proceed, particularly in light of provincial age demographics and associated health care costs. Take for example BC, a province many view as a popular retirement destination. It is common practice for individuals who have lived and worked – and therefore paid taxes – elsewhere, to move to BC later in life. However, with national trends showing that seniors’ health care costs more than that of any other age group, this can put a significant strain on our provincial health care system — one that cannot afford to go unaccounted for (see Figure 1).

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

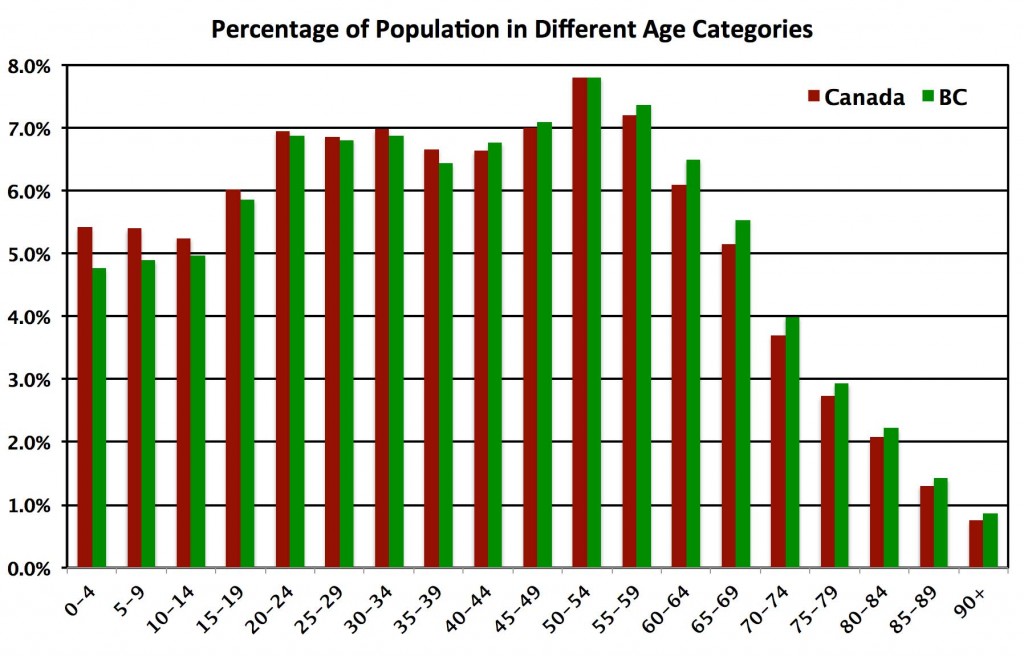

Let’s unpack this further. In the 2014-15 budget year, the Federal Government Canada Health Transfer amounted to 32.1 billion dollars distributed across all provinces. In 2014 Canada’s population was estimated to be 35,540,400, and British Columbia’s population was estimated to be 4,631,300. Alberta has a similar population to that of British Columbia (see Table below).

| Province | Population | Ages 0-14 | Ages 15-64 | Ages 65+ |

| Alberta | 4,121,700 | 18.3% | 70.4% | 11.3% |

| BC | 4,631,300 | 14.6% | 68.4% | 17.0% |

As clearly evident in Figure 2, British Columbia had a smaller percentage of its population in every age group under the age of forty than the Canadian average. The opposite is true for those over the age of forty. Compared to Alberta, British Columbia is home to nearly 70% more seniors. A quick glance back at Figure 1 immediately highlights the glaring inequity in the fixed CHT dollar per person transfer formula. British Columbia has a higher proportion of seniors than the rest of Canada and it is this age demographic that requires more health services. The funding should reflect the actual cost of service delivery.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

It’s a relatively straightforward calculation to weight the CHT transfer to each province by its age demographic and associated health care delivery cost. Rather than receiving 13.0% ($4.183 billion) of the total CHT funding (reflecting 13.0% of Canada’s population residing in British Columbia), we should receive 13.5%. While this may not seem like a lot, it translates into 153 million dollars that British Columbia must find from other sources.

Nevertheless, no matter the method that CHT payments are allocated, these federal transfers only cover a portion of BC’s annual healthcare expenditures. The remaining expenses are financed out of general revenues raised by tax and non-tax sources, with MSP premiums presently contributing over $2 billion per year.

Alternatives to MSP Premiums

While here in BC we do not have the fiscal resources to stop charging MSP premiums without replacing the revenues, there are alternative, and more progressive, options we could be exploring. We need look no further than provinces like Ontario and Quebec, where health premiums are paid through personal income tax systems, rather than flat-rate levies. This approach avoids the regressive effects of monthly premiums, as rates rise with income to a maximum annual level. For example, in Ontario the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums, and in Quebec the maximum annual contribution is $1,000 for taxable incomes over $150,000. At the same time the British Columbia government should lobby for its fair share of CHT revenue — a share that reflects our demographics and the actual cost of delivering health services.

It is time for BC to replace MSP premiums with a more progressive and equitable approach to financing our health care system. Whether this means following in the steps of Ontario and Quebec with an income tax-based approach, or simply raising other taxes, such as corporate tax rates, as the Canadian Centre for Policy Alternatives (CCPA) found after conducting extensive research on what British Columbians think about taxes:

“[British Columbians] know more revenues are required if we are going to tackle the major challenges we face, like growing inequality and persistent poverty, climate change, and the affordability crisis squeezing so many families. And we know higher revenues are needed to sustain and enhance the public services…In short, [we] are ready for a thoughtful, democratic conversation about how we raise needed revenues and ensure everyone pays a fair share.”

MLA Town Hall – Poverty and Homelessness: The Difficult Conversation

As part of our on-going series on poverty and homelessness we will be hosting an MLA Town Hall Forum entitled Poverty and Homelessness: The Difficult Conversation.

The forum will feature four expert panelists including Andrew Wynn-Williams, the executive director of the Greater Victoria Coalition to End Homelessness, Charlayne Thornton-Joe, a Victoria City Councillor and member of the Regional Housing Trust Fund Commission, Bruce Wallace, an assistant professor and researcher at the University of Victoria, and Bernice Kamano, a member of the Greater Victoria Coalition to End Homelessness Speakers Bureau.

Each panelist will give a brief presentation discussing why they got involved in their work, what they believe are the biggest obstacles in addressing poverty and homelessness, and what they see as the best solutions. Following the presentations will be an open Q&A where audience members may bring forth any questions they have for our panelists or for Andrew himself.

The event will take place from 7:00pm to 9:00pm on Wednesday, February 4th, in room A120 of the David Turpin Building at the University of Victoria. The nearest parking is located in the Centennial Stadium parking lot, at a flat rate of $2.50 after 6pm.

We hope you will all join us for what is sure to be an informative and eye-opening discussion on the issues surrounding poverty and homelessness in our community and throughout our province.

Donations of non-perishable food items and cash for the Mustard Seed Food Bank and Our Place Society are welcome.

If you have not been following our series over the last few weeks, please visit the links below to read more. And check back later this week for our next installment.

- Part 1: Homelessness in Greater Victoria

- Part 2: Contributing Factors to Homelessness

- Part 3: Cost Savings of Housing-First

- Part 4: The Government’s Role in Ending Poverty and Homelessness

Aerial Culling of Wolves to Save Endangered Caribou

Over the last few days I have received more than 150 emails and letters from constituents in my riding as well as from British Columbians across our province in reaction to government’s decision to proceed with aerial shooting of wolves as a means of attempting to preserve several endangered herds of caribou. Below is a letter that I sent today to Minister Thomson seeking clarification as to what evidence his Ministry is relying on to suggest that this will be an effective approach. In fact, the evidence appears to be rather clear that enabling the preservation of natural habitat is the single most important conservation tool at the government’s disposal.

January 16th, 2015

Honourable Steve Thomson

Minister of Forests, Lands and Natural Resource Operations

Parliament Buildings

Victoria, BC

V8V1X4

Dear Minister Thomson,

I am writing to you with regards to the government’s recent announcement of a wolf cull to take place in the South Selkirk Mountains and in the South Peace.

I have received numerous emails raising concerns about this initiative. I have reviewed the material provided in the backgrounders attached to the government’s press release, and am left with a number of outstanding questions regarding the appropriateness and potential effectiveness of the government’s response. In particular, in the government’s announcement it states: “Evidence points to wolves being the leading cause of mortality”. I am supportive of science-based initiatives that promote conservation but in this particular case, I cannot find the ‘evidence’ the government is apparently relying upon. Please let me expand upon this.

- In the government document written in 2010 titled “Estimating the Short-term Benefit of Wolf Management to Mountain Caribou Herds”, the author, Steve Wilson, notes in his discussion that “[T]he Southermost herds (South Selkirks and Purcell South) benefit the least from wolf reductions because wolves are not responsible for a significant proportion of caribou mortality in these areas” and that “removal of wolves from very small herds…might be sufficient to stabilize populations but additional management actions will be required to significantly increase herd size”. Furthermore, Wilson notes in his conclusion that “the benefit of wolf reduction will be limited in most small herds although removal of most wolves might be sufficient to reduce or halt population declines.”

Given the comments of this report come with a ministry preamble written in 2012 that notes that “this report is a significant accomplishment and will guide government in moving forward with Mountain Caribou Recovery), how does the government respond to the authors claims that a) The South Selkirks stand to benefit the least from wolf reductions, b) that the removal of wolves are merely a short term solution and that “additional management actions” are necessary to increase herd size, and c) that small herds in general (such as the one in the South Selkirks) benefit the least from the removal of wolves, unless the majority of wolves are removed?

- The government’s 2008 “Interim Strategy for Predator/Prey Management Actions in Support of Mountain Caribou Recovery”, notes that “Although habitat loss and fragmentation is largely the ultimate cause of mountain caribou declines, additional habitat protection will have no positive effect on mountain caribou demography for many years”.

Given this comment, can the Minister please outline the habitat protection activities that have taken place in the South Selkirk Mountains and in the South Peace since this document was written in 2008? It would seem to me that unless clear steps have been taken to address what the ministry cites as the “ultimate cause of mountain caribou declines” the removal of wolves from these areas is nothing but a short term solution that perpetuates a system of mismanagement.

- A 2005 document written by the Mountain Caribou Science Team notes that “While predator management appears to be a straightforward solution to halting subpopulation declines, there are several difficulties with the strategy. First, predator management using hunting regulations might be insufficient to kill the number of predators necessary to recover mountain caribou subpopulations. Second, in the absence of other measures to recover mountain caribou, especially habitat management, predator management would need to be extensive and permanent. As a result, more extensive and socially sensitive measures, such as broad-scale kill programs, might be required. Third, reducing predators alone would likely result in even higher primary prey numbers, and if predator management was to end (for political or logistical reasons), the larger prey populations might support even higher numbers of predators, and/or unstable dynamics in the local predator-prey system.”

This document makes a strong case that a focus on predator management is at best a measure to be taken in conjunction with other management options, and at worst can increase the pressures on prey populations and become an ongoing practice. In light of this, can the Minister please provide a) what additional management activities will take place after the wolf cull to ensure the long-term growth of caribou populations in these regions, and that the predator management does not become increasingly extensive and permanent, and b) additional information that supports the government’s positions that a wolf cull in necessary and won’t subsequently un place the predator/prey dynamic in the region?

- The Conclusion of the February 2013 “Quesnel Highland Wolf Sterilization Pilot Assessment” notes that “There is also no evidence that any methods are causing herds to increase. However, wolf sterilization may be stabilizing Quesnel Highland caribou, or causing a recent increase in abundance. It is important that the project continue to measure responses to recently effective wolf reductions. Messier et al. (2004) suggested the scale of mountain recovery studies in B.C. need to be increased to include ‘control’ herds, and more information should be collected about the internal dynamics of mountain caribou’s responses. My evaluation shows the value of comparison herds, and the need to understand adult and calf survival rates to better explain the nature of short-term caribou responses to wolf treatment”.

The conclusion of this study, while highlighting the possibility that wolf sterilization may be stabilizing in the short term, points to a lack of information about caribou survival rate, and therefore the nature of these short-term responses to predator management. Can the Minister please comment on what additional research is currently being done to better understand caribou survival rates, and how that research is being applied to any decisions concerning wolf sterilization?

- In the documents provided as backgrounder to the government’s decision, there is repeated reference to an October 16th, 2007 announcement for the “Mountain Caribou Recovery Implementation Plan (MCRIP)”. This plan’s goal was to restore the mountain caribou population to the pre-1995 level of 2,500 animals within 20 years.

Can the Minister please provide an update as to the status of the MCRIP, including what current mountain caribou population levels are, and what habitat management activities have taken place to support the planned increase in caribou herd size?

- In the government’s press release there is a note that “The operational plans for both the Selkirks and South Peace have been independently peer-reviewed”.

Can the Minister please provide the supporting documentation for this claim, including the independent peer-reviewed reports that comment on these operational plans?

The primary theme that I have seen in reviewing these documents is that there are significant and legitimate questions still to be asked about the effectiveness of culling wolves to increase the survivability of the Mountain Caribou. It appears to me that so far the government has failed to make the necessary changes to protect the South Selkirk Caribou and South Peace herds from the larger threat of habitat loss, and that now only as these herds approach a critical need for protection, is government initiating a program that will only potentially assist in the short term, and is in itself a study to determine the effectiveness of a wolf cull.

I look forward to your response to my questions, and hope that it will shine more light on this issue.

Sincerely,

Andrew Weaver

MLA Oak Bay-Gordon Head

Regulation of the Debt Settlement Industry

On January 5th I sent a letter to Minister Anton seeking clarification as to whether or not legislation was going to be introduced to regulate the debt settlement industry. Similar legislation exists in other provinces (e.g. Ontario and Nova Scotia as well as in a number of US States). Below is the text of the letter. I have yet to receive a reply.

January 5th, 2015

Hon. Suzanne Anton

Minister of Justice

Room 232, Parliament Buildings

Victoria, B.C.

V8V 1X4

Dear Minister Anton:

I am writing you with regards to forthcoming legislation that would regulate the debt settlement industry.

In July of 2012, CTV news reported that the Ministry of Justice said that “In order to better protect consumers and families living in poverty, the B.C. government will provide legislative changes to regulate businesses that provide debt consolidation services and regulate advance fees paid.”

Since that time there has been little information from government about when we can expect to see this legislation.

Debt management companies prey upon some of the most vulnerable British Columbians. Rather than providing a solution to an individual’s debt issue, these companies seek to profit off the situation. A number of provinces including Ontario, Alberta and Nova Scotia have passed legislation to end these abusive practices within their jurisdictions. I think it is past time that British Columbia passes our own regulations which offer proper protection to our citizens.

Can the Minster provide me with an update as to what stage this legislation is currently at, and when we can expect it to be brought before the BC legislature?

Thank you for your time on this matter. I hope you had a wonderful holiday break with friends and family.

Sincerely,

Andrew Weaver

MLA Oak Bay-Gordon Head

Final Round of Questions Submitted to Trans Mountain

Media Statement: January 15, 2015

Andrew Weaver Submits Final Round of Questions on Trans Mountain Pipeline

For Immediate Release

Victoria B.C. – Today, Andrew Weaver, MLA for Oak Bay-Gordon Head and Deputy Leader of the B.C. Green Party, submitted nearly 100 additional question to Trans Mountain as a part of the second and final round of intervenor Information Requests in the National Energy Board hearings on Kinder Morgan’s proposed Trans Mountain oil pipeline.

The second round of Information Requests marks the final opportunity intervenors will have to test the evidence submitted by Trans Mountain in its proposal. Dr. Weaver’s questions focus on human health risks associated with the project and follow-up on his previous questions relating to the risks, impacts and response capacity associated with a potential oil spill.

“I continue to engage in this process because I believe it’s important to give a voice to my constituents and to British Columbians who worry that their concerns are being ignored,” says Andrew Weaver. “However, I remain deeply concerned that the process itself is fundamentally flawed.”

In the first round of Information Requests, Dr. Weaver submitted nearly 500 questions, while the roughly 400 intervenors collectively submitted over 10,000 questions. Over 2000 of the responses they received from Trans Mountain were officially challenged by intervenors as being inadequate. The National Energy Board (NEB) only ruled in intervenors’ favour in fewer than 5% of the instances, raising significant concerns about the integrity of the process.

“Many of the answers I received in the first round simply didn’t answer the questions I asked,” says Andrew Weaver. “The lack of substantive response from Trans Mountain and the lack of support from the NEB showed a disregard for the essential role that intervenors play in the hearings.”

Intervenors have been increasingly critical of the hearing process, noting that the absence of oral cross-examination has seriously undermined their ability to receive answers to even the most basic questions about the pipeline proposal.

In light of escalating issues with the process, Andrew Weaver continues to call on the B.C. Government to pull out of the Environmental Assessment Equivalency Agreement that it signed with the Federal Government and hold its own, independent hearing process.

“Until the B.C. government reclaims the province’s right to have its own made-in-BC hearing process, actively participating in the NEB hearings is the only way we have to properly represent British Columbians’ concerns and examine the Trans Mountain Pipeline proposal.”

Click here to see the questions submitted to the National Energy Board.

Media Contact

Mat Wright – Press Secretary, Andrew Weaver MLA

mat.wright@leg.bc.ca

1 250 216 3382