Issues & Community Blog - Andrew Weaver: A Climate for Hope - Page 171

LNG tax legislation rushed at expense of British Columbians

Today, on the final day of the fall sitting, I used my last speaking opportunity in the House to offer MLAs an opportunity to reconsider what I believe to be prematurely introduced LNG tax legislation.

At third reading I moved an amendment that would have sent Bill 6 – The Liquefied Natural Gas Income Tax Act to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises.

This legislation would benefit from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

During the committee stage for the bill after 2nd reading, I also identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC.

In my view it was premature for us to consider passing a piece of tax legislation that contained no information about revenue projections and no substantive justification for the massive corporate tax breaks and incentives.

Our government has claimed that the revenue accruing from an LNG industry would bring British Columbia a $1 trillion boost to its GDP, a $100 million prosperity fund, 100,000 jobs, the elimination of its provincial debt, the elimination of the PST and thriving hospitals and schools. These are bold claims that so far have not been supported by any clear or reliable evidence.

Bill 6 was supposed to contain the details, supported by revenue projections, to substantiate these claims. Unfortunately, we never received anything of the sort. It is perplexing to me that both the government and the official opposition would vote to support this LNG tax legislation when absolutely no quantitative information has been provided about how it will impact British Columbians.

In moving the amendment I offered the government, the official opposition, and the public an opportunity to explore both the opportunities and possible pitfalls associated with this Bill in greater detail.

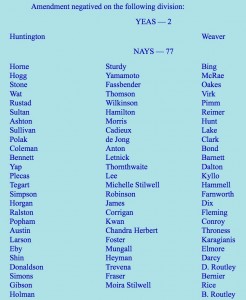

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

The fact that the two independent MLAs were the only ones to suggest this Bill is incomplete in its current state is startling. British Columbia deserves real political leadership that is honest about the opportunities and the risks associated with any hypothetical LNG development.

While the government has described British Columbia’s LNG opportunity as a generational opportunity, this bill can only be described as a generational sellout.

The Amendment

I move that the motion for third reading on Bill 6, Liquefied Natural Gas Income Tax Act be amended by deleting all the words after “That” and substitute the words “the bill be not now read a third time, that the order for third reading be discharged, the bill withdrawn from the Order Paper and the subject matter referred to the Select Standing Committee for Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills.”

Speech to the Amendment

I wish to speak to the amendment and the reason why I brought it forward.

Through this committee stage, a number of issues have been clarified. There have been questions that would benefit exploration at committee stage. In particular, there are questions on revenue projections, the modelling, the assumptions into the modelling that have not been forthcoming and transparent in terms of us, as a legislature, to be able to assess this legislation.

There is section 32(c). There are issues that came up there with respect to a loophole for earned credits that could be sold by a company and the income from that not being claimed as taxable, yet the person purchasing it can claim the income as a deduction.

There are questions in section 46 with respect to the rates being left out. We haven’t got some guidance as to what that rate is in the formula there.

There are questions with respect to section 47 regarding a potential LNG loophole for tax avoidance through capital acquisitions and leaving the 1.5 percent LNG tax rate for significant times.

There are questions on section 122 with respect to the polluter-gets-paid as a polluter-pay model.

There are questions on section 172 that we did not have as much time as I would have wished to explore, in particular the one-half percent natural gas tax credit.

I would think that with such an important piece of legislation, which a government believes is outlining a direction for this province for years ahead, this legislation would benefit from a more thoughtful analysis at committee stage, at which point third parties could be brought in for consultation, including the public, including First Nations and including the companies involved, so that all in this Legislature are able to see the negotiations and the input that is required for such legislation to move forward.

This is the reason that I brought this amendment forward now, hon. Speaker.

Thank you very much for your time.

The Vote

Banning the sale of shark fins: Over to the Minister

Last week the Minister of Agriculture committed to meeting with me to discuss how the province of British Columbia could end the sale, trade and distribution of shark fins in British Columbia. On Monday of this week we met. At the meeting I promised to put together a package of information that he committed to pass along to Ministry staff for a thorough review.

I am pleased to report that I presented the Minister with a binder containing detailed and comprehensive information outlining the rationale for implementing legislation to ban the sale, trade and distribution of shark fins in British Columbia. Below I reproduce the letter and the table describing the information contained in the binder.

Please note that the information in Tab 10 is especially pertinent to British Columbia. BC has a highly regarded and sustainable spiny dogfish industry. BC legislation could include a specific exemption for spiny and smooth dogfish that are lawfully caught by a licensed fisher.

I am very grateful to Margaret McCullough and the GNS Fin Free Students, Julia Baum at the University of Victoria, Nicholas Dulvy at Simon Fraser University, Gabriel Wildgen at Humane Society International/Canada, and Nicholas Wright at Wright Business Law in Toronto for their assistance and/or advice as I put together this package.

Letter to the Minister

Dear Minister Letnick,

I very much appreciated you agreeing to meet with me on Monday, November 24 to further discuss the question I posed to you in the legislature on Thursday, November 20. As you will recall, I asked whether or not the Province would consider introducing legislation to ban the sale, trade and distribution of shark fins in British Columbia.

In the meeting, I agreed to provide you with a package of information that you committed to passing along to Ministry staff for a thorough review. Please find attached a binder containing such information.

The binder is separated into fifteen sections whose contents are summarized below.

Thank you again for taking the time to meet with me to discuss this important issue. I very much look forward to your further correspondence.

Yours sincerely

Andrew Weaver

MLA Oak Bay Gordon Head

Summary of Binder Contents

Tab |

Contents |

Description of Contents |

| 1 | Summary Letter | Copy of this letter |

| 2 | Legal Opinion | Legal opinion provided by Nicholas Wright, Barrister & Solicitor, to Humane Society International/Canada. The opinion states: “British Columbia has the authority to ban the sale, trade and distribution of shark fins through constitutional provisions pursuant to section 92(13) and section 92(16) of our constitution.” |

| 3 | Scientific Studies | Four key scientific papers are included.1) Worm et al., 2013: Global catches, exploitation rates, and rebuilding options for sharks. Marine Policy, 40, 194-204.I quoted from this study in Question Period. In this study, Worm and his colleagues produced three independent estimates of the average rate that sharks are killed per year. These estimates ranged between 6.4% and 7.9%, all exceeding 4.9% per year — the amount needed to keep populations stable.2) Dulvy et al., 2014: Extinction risk and conservation of the world’s sharks and ray. eLIFE: eLife 2014;3:e00590. http://dx.doi.org/10.7554/eLife.00590.001Dulvy (from SFU) and his colleagues examined the extinction threat of 1,041 species of sharks and rays. One quarter of all of these species, particularly larger species in shallow waters that are harvested in the finning industry, are threatened with extinction. Only 37.4% of all species are considered safe.

3) Ferretti et al., 2010: Patterns and ecosystem consequences of shark declines in the ocean. Ecology Letters, 13, 1055-1071. Ferretti and colleagues examined the effects that declining populations of large sharks have had on marine biodiversity. They found that human predation of these large sharks has had a significant effect on marine communities of other species. 4) Clarke et al., 2012: Population trends in Pacific oceanic sharks and utility of regulations on shark finning. Conservation Biology, 27, 197–209. Clarke and colleagues found declining shark populations in the Pacific Ocean and noted “targeted fishing for sharks in some regional fisheries heighten concerns for sustainable utilization”. |

| 4 | Media – Global | Several examples of media coverage from around the world on the topic of shark finning. |

| 5 | Media – US | Several examples of US media coverage of shark finning. Delaware, Hawaii, Illinois, Maryland, Massachusetts, New York, as well as California, Oregon, and Washington have all banned the sale of shark fins. |

| 6 | Media – Canada | Two examples from Canadian media coverage of shark finning. |

| 7 | Media – BC | A few examples from BC media coverage of shark finning. Of particular note is the article pointing out the success of the UBCM resolution as well as the CTV news article that points out that fins from sharks that are now on the UN CITES list (tab 14) were found for sale in Vancouver. |

| 8 | Weaver blog | Copies of all blog posts on my website: AndrewWeaverMLA.ca that concern shark finning. |

| 9 | Global legislation | A list of jurisdictions around the world that have regulations on shark finning. |

| 10 | BC Dogfish + US Legislation | Information concerning the well-managed, sustainable, British Columbia spiny dogfish industry.In addition, I have included sample legislation from New York State. New York also has a sustainable dogfish industry. They included a specific exemption for spiny and smooth dogfish that were lawfully caught by a licensed fisher. |

| 11 | BC Municipal Legislation | Information concerning municipal legislation in North Vancouver and Port Moody where shark fin possession, sale, trade and distribution bans have been passed. |

| 12 | Polling info | Polling results from March 2013 conducted by Environics Research Group for Humane Society International – Canada. The poll indicates only 13% of Canadians oppose a ban on importing shark fins to Canada. |

| 13 | IUCN SSG Position | Position statement of the United Nations International Union for the Conservation of Nature (IUCN) Shark Specialist Group (SSG) on shark finning. Note that Dr. Nicholas Dulvy, co-chair of the IUCN SSG, is a Canada Research Chair in Marine Biodiversity and Conservation at Simon Fraser University.The position statement notes: “shark finning …threatens many shark stocks, the stability of marine ecosystems, sustainable traditional fisheries, food security and socio-economically important recreational fisheries.” |

| 14 | UN CITES | Copy of the United Nations Convention on International Trade in Endangered Species of Wild Fauna and Flora together with its appendices. The list includes five orders in subclass Elasmobranchii (sharks). The five orders are: Carcharhiniformes (Ground Sharks), Lamniformes (Mackerel Sharks), Orectolobiformes (carpet sharks), Pristiformes (swordfish) and Rajiformes (skates). |

| 15 | CITES Parties | List of Parties to the Convention on International Trade in Endangered Species of Wild Fauna and Flora indicating that Canada ratified the agreement on April 10, 1975. |

|

“5Media” is not one of the 4 million topics at Answers.com.Would you like to search the web?

Copyright © 2014 Answers Corporation. All rights reserved. |

Just how effective can a spill response be off our coast?

This post is part of an ongoing series in which MLA Andrew Weaver will be sharing key information from inside the National Energy Board hearings on Kinder Morgan’s Trans Mountain pipeline proposal. To see previous posts, please click here.

How do you actually clean up an oil spill?

And why is it that, on average, only 5-15% of oil is ever recovered from a spill?

There are a lot of factors that impact the effectiveness of clean-up efforts: Response time, size of the spill, weather conditions, number of personnel available to respond, availability of equipment, etc.

One of the biggest factors is simply the equipment itself. Oftentimes, the equipment only works under certain conditions, so I decided to explore this a bit further. I wanted to determine under what conditions the equipment works—and how often it doesn’t.

Here’s what I found:

Skimmers and boom lines are two of the most important pieces of equipment used to clean up an oil spill. Whereas boom lines are used to contain oil in an enclosed space, skimmers are used to recover spilled oil from the surface of the ocean.

As you can imagine, both booms and skimmers work best when the ocean is calm. As wave height increases, the oil spreads beyond the boom lines and mixes below the surface, making it hard to recover with skimmers.

In fact, the Western Canada Marine Response Corporation (WCMRC)—the organization responsible for responding to oil spills in B.C.—lays out all of this information for us.

It turns out that booms and skimmers work best when waves are less than 1m tall. As soon as waves are taller than 1m, booms and skimmers are “difficult to execute and become less effective” (p. 29). Once the wave height reaches 1.5 m, skimming and booming operations would be stopped entirely because they are so ineffective.

We sometimes have a pretty stormy coast, so I asked Kinder Morgan to identify the amount of time each year that wave height is:

- Less than 1m (skimmers and booms are effective)

- Between 1m and 1.5m (skimmers and booms are less effective)

- More than 1.5m (skimmers and booms are stopped entirely)

Unfortunately, in their response Kinder Morgan grouped all wave heights that are less than 1.5 m into one category, so we don’t know how often their response would be “less effective”. That said, we do know what percentage of the year spill response simply will not work due to wave heights higher than 1.5m.

It turns out that, on average, between 10% and 20% of the year WCMRC would not be able to use skimmers or booms because the waves are too high. In fact, WCMRC wouldn’t even be required to respond to an oil spill for that much of the year.

If, however, we take the data from Race Rocks—an island just outside of Victoria—it quickly rises to 40% of the year. That’s essentially three days a week, every week, when spill response would be stopped because the waves are too high.

Let me reiterate—those numbers do not include the time when spill response is less effective but still possible. Kinder Morgan still hasn’t clearly provided us with those numbers.

Now, I sincerely hope we never have a spill on our coast. But I believe strongly that we need to be prepared— just in case. What these numbers suggest is that for 10%-40% of the year we are not prepared at all.

And that’s a problem.

Seniors Advocate Seeking Applicants for Council of Advisers

The Office of the Seniors Advocate is seeking applicants to set up a council of advisers and interested seniors are invited to apply.

The council will be made up of seniors from around the province, who will bring their diverse experience and perspective on seniors issues. It will bring forward issues and concerns and will review projects, reports and recommendations developed by the Office of the Seniors Advocate. The council will meet four times per year, by phone or in person.

There will be 25-30 council members appointed and terms will initially be from one to three years.

Seniors who would like to serve on the council must submit their applications by December 18, 2014.

The Office of the Seniors Advocate has collaborated with the Council of Senior Citizens’ Organizations of BC (“COSCO”) to develop selection criteria. COSCO is an umbrella organization made up of seniors’ organizations and individuals from every area of BC.

Interested seniors can also get more information by phone at 1-877-952-3181 (250-952-3181 in Victoria) or by email at info@seniorsadvocatebc.ca

More information about the Council of Senior Citizens’ Organizations of BC can be found on their website.

Geothermal more economical than Site C

Today I attended a press conference hosted by the Canadian Geothermal Energy Association (CanGEA) announcing the release of a new report entitled: “Geothermal Energy: The Renewable and Cost Effective Alternative to Site C”. Immediately following the start of the press conference, we released the press statement below.

Over the last two years, I have repeatedly called on the government to explore innovative new opportunities in the clean technology sector. Most recently, I issued a press release calling on the provincial government to broaden BC Hydro’s scope to allow for the development of a geothermal power capacity in the province of British Columbia.

I’ve also expressed concern regarding the effect of burgeoning debt on our overall credit rating should Site C be approved. This is particularly relevant in light of the existence of more cost-effective alternatives.

Below is the text of our press release.

Media Statement: November 25, 2014

Geothermal more economical than Site C

For immediate release

Victoria, B.C. – Andrew Weaver, MLA for Oak Bay – Gordon Head and Deputy Leader of the B.C. Green Party welcomes the findings of the Canadian Geothermal Energy Association (CanGEA) report, released today, entitled “Geothermal Energy: The Renewable and Cost Effective Alternative to Site C”.

Key findings of the report include:

- Geothermal unit energy cost conservatively estimated at 7.3¢/kWh compared to BC Hydro’s 8.3¢/kWh for Site C.

- Geothermal plant construction equalling the energy output of the proposed Peace River dam is estimated at $3.3 billion compared to at least $7.9 billion for Site C.

- Geothermal plants provide more permanent jobs that are distributed across British Columbia.

- For the same power production, the total physical and environmental footprint of geothermal projects would be substantially smaller than Site C.

British Columbia has significant potential to develop geothermal and other renewable energy projects throughout the province. Such projects would distribute energy production where it is required and allow power to be brought online as demand increases.

“This is a timely report that clearly validates geothermal energy as a viable, more cost-effective alternative to Site C,” notes Andrew Weaver. “Geothermal projects are cheaper to build, provide power at a more economical rate, have a minimal environmental footprint, and generate more permanent jobs throughout the province.”

“In light of this new announcement, it’s clear that the government should not proceed with the Site C project at this time,” said Weaver. “There are simply too many cheaper alternatives available to protect the ratepayer. The clean energy sector is eagerly awaiting a more fiscally-responsible investment decision that would provide employment and development opportunities across the province.”

The full CanGEA report can be found at www.cangea.ca.

-30-

Media Contact

Mat Wright – Press Secretary, Andrew Weaver MLA

Mat.Wright@leg.bc.ca

Cell: 1 250 216 3382