Issues & Community Blog - Andrew Weaver: A Climate for Hope - Page 38

Speaker vindicated: Shocking allegations of systemic wrongdoing in BC Legislature

Today the Legislative Assembly Management Committee (LAMC) approved the release of the Speaker’s 76 page report entitled:

Report of the Speaker Darryl Plecas to the Legislative Assembly Management Committee concerning allegations of misconduct by senior officers of the British Columbia Legislative Assembly.

In this report the Speaker provides exhaustive details as to what led LAMC to recommend to the House that the Clerk and Sergeant at Arms be placed on administrative leave. The report raises serious questions concerning the conduct of a number of senior Legislative officials, and members of the official opposition.

Below I reproduce our initial media statement. I will be offering further, more detailed, comments shortly.

Media Release

B.C. Green Caucus statement on the release of the Speaker’s report

For immediate release

January 21st, 2019

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, issued the following statement in response to the report written by Speaker Darryl Plecas and released publicly by the all-party Legislative Assembly Management Committee (LAMC):

“The report released today makes serious and shocking claims that have significant implications for public trust in our democratic institutions.

“The B.C. Green caucus fully supports the motions passed unanimously today by the LAMC. These are crucial first steps towards restoring integrity and faith in our provincial government.

“As a caucus we have made democratic integrity a major focus, championing issues such as lobbying reform and campaign finance reform. The people of our province deserve public institutions they can trust. We have never been more committed to seeking the truth and restoring our democracy for the benefit of all British Columbians.

“We will do whatever it takes to ensure that this trust is restored and that British Columbians get answers to the numerous unanswered questions that are raised by this report.

“We will have further comments in the near future once we have had a chance to review this report in detail.”

The full report can be viewed here.

-30-

Media contact

Stephanie Siddon, Acting Press Secretary

+1 250-882-6187 | stephanie.siddon@leg.bc.ca

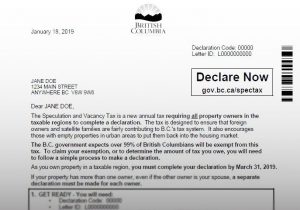

On the botched rollout of BC NDP’s Speculation and Vacancy Tax

Residents across the Lower Mainland, the Capital Regional District, Nanaimo and  Kelowna/West Kelowna are beginning to receive letters from the BC NDP government concerning the Speculation and Vacancy Tax. To the surprise of most, every property owner registered on title will have to fill in a declaration to claim exemption from the tax. Widespread concern has emerged that this form of “negative billing” will lead to myriad problems. I agree.

Kelowna/West Kelowna are beginning to receive letters from the BC NDP government concerning the Speculation and Vacancy Tax. To the surprise of most, every property owner registered on title will have to fill in a declaration to claim exemption from the tax. Widespread concern has emerged that this form of “negative billing” will lead to myriad problems. I agree.

Anyone following BC politics will know that the BC NDP’s Speculation and Vacancy Tax has been, and continues to be, extremely controversial. Shortly after signalling, in February 2018, their intent to introduce tax legislation later in the Fall, it became abundantly clear to me that the BC NDP hadn’t thought the tax measure through. I was very critical of the lack of details and the fact that the tax’s interpretation by the Minister of Finance seemed to be changing on a near daily basis.

I was unconvinced that the BC NDP knew what outcome they were trying to achieve with their tax measure. I arranged for briefings; I met with the Minister of Finance where I outlined my many concerns; I posed questions to her in the legislature (e.g. in Question Period); I met with numerous stakeholders. And I personally responded to many hundreds of emails from around British Columbia.

The BC Green efforts started to pay off. In late March government released a second intentions paper outlining a series of thresholds, exemptions and refinements to the geography of affected areas. While I was supportive of these changes, there was still much work that needed to be done.

And so I arranged for more briefings; I again met with the Minister of Finance to once more outline my ongoing concerns; I posed questions to her in the legislature (e.g in Budget Estimates); I met with numerous other stakeholders. And I personally responded to many more hundreds of emails from around British Columbia.

On June 27 I published online an email that I had started to send out to people about my ongoing concerns over the Speculation Tax. Over the summer I once more arranged for more briefings; I met with the Minister of Finance; I met with numerous other stakeholders. And I personally responded to many more hundreds of emails from around British Columbia.

When the BC NDP finally introduced Bill 45: Budget Measures Implementation (Speculation and Vacancy Tax) on October 16, 2018, I acknowledged that they’d gone a long way towards addressing many of the unforeseen negative consequences that I’d raised with them. Yet there were still several key aspects of the bill that caused my BC Green Caucus colleagues and I to reiterate our ongoing concerns.

Prior to the introduction of the Bill, the BC NDP told our caucus that they viewed Bill 45 as a confidence measure. They argued that it arose from a flagship “budgetary policy” announced as part of the 2018 budget. Our position was that our Confidence and Supply Agreement was very clear:

“While individual bills, including budget bills, will not be treated or designated as matters of confidence, the overall budgetary policy of the Government, including moving to the committee of supply, will be treated as matters of confidence“

As you might imagine, a number of (at times difficult) meetings followed with the BC NDP. Concurrently, my caucus colleagues and I united behind the notion that the only way the BC NDP would secure our collective votes was if, and only if, they supported three further amendments (which were subsequently drafted by Legislative Drafters). These amendments ensured that:

- Mayors from affected municipalities would be part of an annual review process with the Minister of Finance that required the Minister to provide metrics that justified keeping the speculation tax in place in their community;

- revenue raised by the tax would be used for housing initiatives within the region it came from;

- the speculation and vacancy tax rate for all Canadians was the same – this brought the rate for non BC-resident Canadians down from 2.0% to 0.5%.

The amended Speculation and Vacancy tax bill eventually passed in the BC Legislature, but not before I was able to ensure that the Minister provide further clarification on record as to its intent.

At this point it’s important to note that the BC Greens take the enormous responsibility British Columbians have granted us very seriously. Our role in the BC Legislature is to ensure stability, yet accountability. And we did just that. We ensured that the BC NDP government did not fall in their declared confidence measure while at the same time working tirelessly to ensure that many of the unforeseen consequences of the poorly-thought-through Speculation and Vacancy Tax were mitigated.

Several times in our meetings with the Minister and/or her staff, or during the briefings with the Ministry, I raised concerns and questions about government’s proposed negative billing during the implementation of the tax (the BC Liberals were apparently asleep at the wheel and didn’t realize this was involved with its implementation). I suggested that some people might get confused and pay the tax even though they didn’t need to. My concerns were dismissed as I was told that the process was going to be easy and transparent, like what is already in place for people claiming the Homeowner Grant.

Sadly, this has not turned out to be the case and the processes to claim a Homeowner Grant and declare an exemption from the Speculation and Vacancy Tax remain separate. And so, while I am not surprised by the public reaction to the rollout of this tax, I am surprised that the BC NDP hadn’t anticipated this.

The BC Greens remain of the opinion that the BC NDP’s Speculation and Vacancy tax is bad public policy.

We believe that a better way forward would be to enable all local governments (not just Vancouver) to introduce vacancy taxes if they felt it was in their community’s interest. At the same time, a speculation tax could be applied exclusively to properties owned by offshore individuals and entities, the Bare Trust loophole could be closed as was done in Ontario, and a flipping tax could be applied when the same property is sold multiple times in a short time period.

We believe that a better way forward would be to enable all local governments (not just Vancouver) to introduce vacancy taxes if they felt it was in their community’s interest. At the same time, a speculation tax could be applied exclusively to properties owned by offshore individuals and entities, the Bare Trust loophole could be closed as was done in Ontario, and a flipping tax could be applied when the same property is sold multiple times in a short time period.

The BC Greens understand the importance of tempering exuberance in the out of control housing market. In fact, we specifically called for a New Zealand-style ban on off-shore purchases as per our call for bold action. We also outlined numerous other measures that could be implemented.

Moving forward, our caucus will continue to ensure stability, transparency and accountability in the BC Legislature.

Statement on electoral reform referendum results

Today Elections BC released the results of the referendum on proportional representation. The referendum failed with 61.3% (845,235) supporting the current First Past the Post (FPTP) voting system and 38.7% (533,518) supporting a form of proportional representation. Below is the press release my office issued in response to the news.

Media Release

Weaver statement on electoral reform referendum results

For immediate release

December 20, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, released the following statement regarding the results of B.C.’s referendum on electoral reform. Elections B.C. announced today that British Columbians voted to retain the current First Past the Post system.

“We campaigned on proportional representation because representative democracy is one of the 6 core principles of the B.C. Green Party,” said Weaver.

“While we are disappointed with this result, we respect British Columbians’ decision to retain the current First Past the Post system.

“I thank Elections BC for their work administering this referendum. They provided British Columbians with clear, impartial information and accessible opportunities to vote.

“Over the course of the referendum, I had the opportunity to speak with countless British Columbians about their democracy. I was inspired to meet so many citizens who care deeply about modernizing our system of governance so it better reflects the will of the people. I thank everyone who volunteered, voted and worked on the campaign.

“The B.C. Greens remain committed to the principle of representative democracy. As part of this file we have already banned big money and reformed the lobbying industry. We will continue to champion policies that will strengthen B.C’s democracy and make it more responsive to and representative of the people of B.C.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 250-882-6187 | jillian.oliver@leg.bc.ca

British Columbia Multiculturalism Grant program

On December 13th, the Ministry of Tourism, Arts and Culture launched the 2018-2019 British Columbia Multiculturalism Grant Program. The grants are open to registered non-profit and charitable organizations and offer up to $5,000 in funding for activities, programs and events in communities across the province to engage public participation in building cross-cultural and intercultural interaction, trust and understanding, or challenge racism, hate and systemic barriers.

The grants will be available for community projects in two streams:

- International Interaction Stream: Projects that build cross-cultural and intercultural interaction, trust and understanding between people of different ethno-cultural, racial, religious and other backgrounds through a range of activities, programs, events and approaches.

- Anti-Racism and Systems Change Stream: Projects that challenge racism, hate and/or reduce systemic or institutional barriers for under-represented, radicalized and/or other minority groups, especially those that use a collaborative community approach.

The deadline to apply is January 10th, 2019. Please feel free to share the poster promoting the awards.

Right to Roam and the BC Supreme Court

In an Epilogue to a recent groundbreaking ruling, B.C. Supreme Court Justice Joel R. Groves has urged the government to open up public access to lakes around the province.

It is an issue I advanced in the legislature with a Right to Roam private member’s bill tabled twice in 2017.

In my view, this recent ruling and the clear words spoken by Justice Groves underline the need for a law or regulations that will ensure future governments, unlike those previously, fulfill their duties to protect access to public land.

The BC Supreme Court has ruled in favor of public access to lakes on the Douglas Lake ranch, but the decision has implications far, far beyond that. All the lakes in B.C. are owned by the people – and the government needs to act to ensure access to those lakes.

In his decision, issued Dec. 7, Justice Groves ruled in favor of the Nicola Valley Fish and Game Club, which had challenged the Douglas Lake Cattle Company’s right to lock a gate on the road to Minnie Lake and Stoney Lake.

The Club argued the road was public and that the Douglas Lake Cattle Co. had illegally restricted access. The court agreed.

The ruling is expected to open up public access not just to Minnie and Stoney, but also possibly to other lakes on the sprawling Douglas Lake ranch, near Merritt.

In his ruling Justice Groves chastised a succession of provincial governments for allowing the public road on the ranch to remain locked for many years, despite pleas from the public for access to Minnie and Stoney lakes.

“All governing parties have shown a lack of action to enforce the public good,” the judge stated in his ruling.

“What I am saying is that there is plenty of blame upon all politicians and all political parties who have governed this Province since 1990.

“As such, I am not pointing a finger at any particular government individual but, again, it is most unfortunate that all governments holding the obligation of the public trust have failed to take any actions to prohibit what was an illegal obstruction of a public road by a corporate entity, for its own benefit.”

Justice Groves stressed that the government should work to ensure the public has access to lakes around the province.

“This case is about access to lakes,” he stated. “As I say in my reasons . . . it makes no sense to me that the Crown would retain ownership of lakes, only for there to be no access because someone owns initially through Crown grant, or subsequently by purchase, all the lands surrounding the lake,” stated Justice Groves.

He said the government should act to resolve the public access problem now before it gets worse.

“The remedy I am urging on government is this. First off, look at the Trespass Act…Secondly, if you own the lakes of the province, which you do, can you not regulate access? There really is no point to ownership otherwise. The ownership of lake beds is, no doubt in large part, intended to be collectively held for the benefit of all citizens of the province. As that is the case, consider doing what other jurisdictions have done and guarantee access to this precious public resource,” said Justice Groves.

That is precisely what I sought to advance last year when I introduced the Right to Roam Act. The bill aimed to reestablish the rights of British Columbians to access public lands, rivers, streams, and lakes, and to use these spaces to fish, hike and enjoy non-motorized outdoor recreation. Rather than expecting it to pass as drafted, I hoped my bill would further this important discussion in the BC legislature. I would be keen to see other MLAs weigh in on this issue as well.

This is not, and should not be a partisan issue. The government has a responsibility to manage crowns lands to the benefit – and critically the access – of all British Columbians.

It is time the BC government took steps to ensure that the public has the right to access lakes, rivers and streams on public lands. I’ve said it before and now the court has said it. It is time to start unlocking the gates.