Issues & Community Blog - Andrew Weaver: A Climate for Hope - Page 63

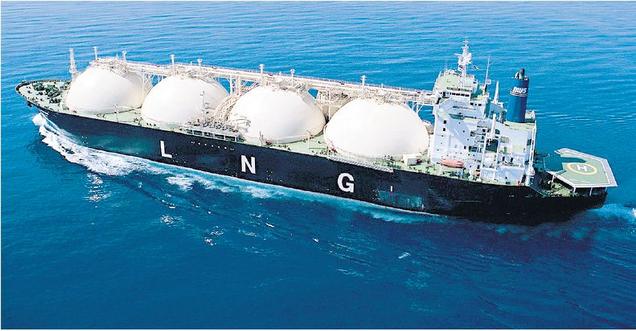

Responding to the BC government’s new regulatory framework for LNG

The BC government today outlined its proposed regulatory framework for LNG proponents such as LNG Canada. In particular, the BC government sent a letter on Monday to Mr. Andy Calitz, CEO of LNG Canada, providing specific details. While the BC Green Caucus has not seen a copy of the letter that the BC Government sent, we were consulted on the government’s high level policy objectives as outlined in their media briefing and release today.

Given that the BC Green caucus believes in the importance of giving industry certainty as to our positions and intentions, we also sent Mr. Calitz a letter that is reproduced in text form below. In our letter we are very clear that:

- The B.C. Green Caucus does not, and will not, support exempting new LNG companies from carbon tax increases as this defeats the purpose of the carbon pricing.

- Extending the carbon tax to fugitive emissions is a core component of our confidence and supply agreement with the BC NDP.

- The confidence and supply agreement requires government to implement a climate action strategy to meet B.C.’s legislated emissions reduction targets of not less than 40% below 2007 levels by 2030 and 80% below 2007 level by 2050

Our firm position is that it is incumbent upon government to assess the LNG Canada project through the lens of meeting these greenhouse gas reduction targets and specifically identify a pathway to meet them. This should be done in a manner that protects existing industries that provide jobs and economic activity that British Columbians rely on.

As it stands, and despite being in office for 8 months, the BC Government still has not identified any concrete measures to reduce greenhouse gas emissions. As I pointed out in February, it is not possible to on the one hand claim you have a plan to meet our targets and then on the other hand start promoting the expansion of LNG.

As noted in the essay I wrote, in 2016, British Columbia actually lost $383 million from exploration and development of our resource. That’s because the tax credits earned exceeded the sum of the income received from net royalties and rights tenders combined. In the fiscal year ending March 31, 2017, British Columbia earned total revenue of only $3.7 million, a 99.9% drop from 2010 (BC earned 1000 times more revenue in 2010 from natural gas than we did in the last fiscal year).

It makes no sense to continue the generational sellout and further extend the government handout to a hypothetical LNG industry by offering ratepayer-subsidized electricity (read Site C) of 5.4 ¢/kWh (less than half what you or I pay and less than half of what it will cost to produce the electricity from Site C). It makes no sense to exempt LNG companies from being required to use electric drives for compression of natural gas to achieve this discounted electricity rate.

And in addition, expectations are that the federal government would further exempt LNG Canada from tariffs on fabricated steel imports. This would ensure that most of the infrastructure would be built in Asia and shipped to BC. At the same time, the BC Government will exempt LNG proponents from the Provincial Sales Tax (PST) for construction. So much for the multi-billion dollar investment, revenue and job creator for British Columbia.

Finally, it remains to be seen if LNG demand will increase in light of the fact that Japan, the world’s largest LNG importer, is restarting nuclear reactors that were shutdown following the Fukushima incident. In fact, just this week a major Japanese electric power company is putting its LNG contracts up for sale.

In the ongoing saga of British Columbia’s desperate attempt to land a positive final investment decision from a major LNG proponent, the generational sellout continues. In a typical race-for-the-bottom fashion, the BC NDP are proposing still further subsidies to LNG proponents.

While I appreciate the Premier’s commitment to putting in place a plan to reduce emissions to 40% below 2007 levels by 2030 and 80% below 2007 levels by 2050 and to put a price on fugitive emissions, I cannot see how this is possible if the LNG Canada proposal goes ahead. It would require every aspect of our BC economy (except LNG Canada) to collectively cut emissions by more than half in twelve years and by 95% by 2050.

As outlined in our media release below, there are significant opportunities to grow B.C.’s economy while meeting our climate targets that do not include LNG. For instance, the supercluster funding announced last month is expected to generate 50,000 jobs and $15 billion in economic activity in B.C. in the next 10 years.

In summary, the BC Green Caucus will not support any legislation brought forward to grant the exemptions outlined above.

Media Release

B.C. Green Caucus releases letter to LNG Canada clarifying position on government’s LNG approach

For immediate release

March 22, 2018

VICTORIA, B.C. – The B.C. Green Caucus released a letter sent to LNG Canada clarifying the Caucus’ position on the government’s proposed LNG regulations. The letter, sent on Monday March 19, came after the Caucus was was made aware of the the details of the government’s proposed LNG regime. The letter is intended to give industry maximum clarity, as the minority government requires the B.C. Green Caucus’ votes for general stability and to pass legislation.

“There are significant opportunities to grow B.C.’s economy while meeting our climate targets,” said Andrew Weaver, leader of the B.C. Green Party. “For instance, the supercluster funding announced last month is expected to generate 50,000 jobs and $15 billion in economic activity in B.C. in the next 10 years. Future development must fit within our climate targets, and the numbers on LNG simply don’t add up.”

The B.C. Green Caucus does not support extending the proposed measures to support existing Emissions Intensive Trade Exposed (EITE) industries as currently conceived to prospective LNG companies – a policy that would in effect freeze the carbon tax at $30/tonne for certain facilities. CASA commits government to extend the carbon tax to fugitive emissions, and the Caucus expects that this will include the natural gas industry. Further, the Caucus is concerned that increasing B.C.’s emissions through LNG developments will place an undue burden on existing industries and the public to reduce their emissions beyond what is already required.

“Not only is a plan to meet our climate commitments a core component of our Confidence and Supply Agreement (CASA) which forms the stability of this government, it is essential for ensuring we do not betray our duty to future generations.” Weaver continued. “When it became clear that the government intended to propose measures that are incompatible with B.C.’s ability to meet our climate targets, we felt it was our responsibility to communicate to LNG Canada that if these measures were to go ahead unamended, we would no longer have confidence in government.

“To be clear – our Caucus is fully committed to working in partnership with the B.C. NDP government to enact a plan to meet our climate targets and in attracting the investments we need to build a 21st century economy. We will continue to hold this government to account on all its promises, including our responsibility to the next generation and our international commitments to act on climate change.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

Text of BC Green Caucus Letter

Mr. Andy Calitz

CEO, LNG Canada

March 16, 2018

Dear Mr. Calitz,

We are writing regarding your ongoing discussions with the Government of British Columbia on your proposed project, LNG Canada in Kitimat, B.C.

As you know, British Columbia currently has a minority government, where the votes of our three caucus members provide confidence in Premier Horgan’s NDP government. The basis of our confidence is the Confidence and Supply Agreement (“CASA”) signed May 30, 2017 which binds our two caucuses to act on the principle of “good faith and no surprises.” As such, the government must consult with our caucus on all matters, and it must uphold the agreed-upon policies and initiatives enshrined in it. Our caucus has been consulted on the letter sent from the government to LNG Canada. We are writing to let you know our position on the government’s proposal in order to provide you with the fullest possible scope of information.

First, extending the carbon tax to fugitive emissions is a core component of CASA. We have assurances from the government that this extension is forthcoming pending a determination of the necessary technologies and regulations to measure them. To be clear, it is our expectation that the carbon tax on fugitive emissions will be extended to all sources of these emissions. This will have impacts on a number of industries and future proposed projects, including yours.

Second, CASA requires government to implement a climate action strategy to meet B.C.’s legislated emissions reduction targets. Therefore, all future development must fit within our province’s commitment to the Pan-Canadian Climate framework to meet our emissions reduction targets, as well as soon to be legislated targets for British Columbia specifically. As such, it is incumbent upon government to assess your project through this lens and to specifically identify how it will accomplish the emission reductions required to meet our targets of not less than 40% below 2007 levels by 2030 and 80% below 2007 level by 2050. This must be done in a way that limits harm to other existing industries that provide jobs and economic activity that British Columbians rely on.

Finally, CASA commits government to implement an increase of the carbon tax by $5 per tonne per year beginning April 1, 2018. Our intention was to ensure that across the entire economy a clear market signal was sent that incentivized low GHG producing activity, as well as spurred innovation and investment in the new economy. We were made aware over the course of our consultations with government that the proposed measures to support Emissions Intensive Trade Exposed (EITE) industries would be extended to LNG as well. These measures would have the effect of rebating up to 100% of the carbon tax that was paid beyond the $30 per tonne, based on how the greenhouse gas production intensity compares to the global cleanest benchmark.

While our caucus is supportive of these measures for the many existing industries in B.C. that already provide jobs and economic activity for our province – many of whom made their investment decisions in a previous regulatory environment – our caucus does not support extending the EITE as currently conceived to a proposed LNG industry.

If such a measure goes forward without amendment we do not see how a climate action plan, as agreed to in CASA, would have any legitimate pathway forward to reach our GHG reduction targets. As such, our caucus would no longer have confidence in government, as they would not be living up to their commitments laid out in CASA.

We believe that British Columbia must make its GHG reduction targets and climate action plan the centerpiece of its economic strategy. Our focus must be on prioritizing innovation within our economy and seeing new investments that ensure we are leaving the next generation with real opportunities to prosper. We are deeply encouraged that the companies engaged in your joint venture are investing heavily in renewable energy and other clean technologies. B.C. has a highly educated workforce, world-class research institutions and a wide range of innovative companies. We would welcome the opportunity to work with you in a manner that builds on these opportunities while helping us meet B.C.’s GHG reduction targets, as committed to under the Paris Climate Accord.

We would be happy to discuss our position in detail with you.

Sincerely,

Andrew Weaver

MLA, Oak Bay Gordon Head and Leader, B.C. Green Party

Sonia Furstenau

MLA, Cowichan Valley and Deputy Leader, B.C. Green Party

Adam Olsen,

MLA, Saanich North and the Islands

Introducing two bills to protect gender identity and expression privacy rights

Yesterday in the legislature I had the pleasure of introducing five remarkable youth: Megan Walker, Grayson Threlfall, Astrid Nielson-Miller, Alex Bradley and Avery Williams. They, together with 20 other British Columbia youth, are working with Dr. Lindsay Harriet at the University of Victoria on writing a book about what it’s like to grow up as a transgender person in 2018. Their project is called The Transgender Tipping Point.

But their good work goes far beyond the book that they are writing. A few weeks ago I met with youth working on this project. One of them raised the important notion that two key bills, the Freedom of Information and Protection of Privacy Act and the Personal Information Protection Act did not protect gender identity and expression or contained gendered language that did not instill confidence in the transgender community concerning the interpretation of the act.

But their good work goes far beyond the book that they are writing. A few weeks ago I met with youth working on this project. One of them raised the important notion that two key bills, the Freedom of Information and Protection of Privacy Act and the Personal Information Protection Act did not protect gender identity and expression or contained gendered language that did not instill confidence in the transgender community concerning the interpretation of the act.

I agreed and so worked with them, together with a legislative intern Kayla Phillips, to draft amendments to these bills. Today I introduced both the Freedom of Information and Protection of Privacy Amendment Act, 2018 and the Personal Information Protection Amendment Act, 2018.

Below I reproduce the video and text of the introductions as well as our accompanying press release. I look forward to work with my colleague Spencer Chandra Hebert in the BC NDP to see if we cant get these bills passed in a timely fashion.

Video of Bill Introductions

Text of Bill Introductions

BILL M208 — FREEDOM OF INFORMATION AND PROTECTION OF PRIVACY AMENDMENT ACT, 2018

A. Weaver: I move that a bill intituled the Freedom of Information and Protection of Privacy Amendment Act, 2018, of which notice has been given in my name on the order paper, be introduced and read a first time now.

The right to privacy is well established in British Columbia, as is the right to be free from discrimination because of gender identity and expression. Under the Freedom of Information and Protection of Privacy Act, however, gender identity and expression is not recognized as a category of personal information that must be protected when its disclosure may harm a third party.

In addition to proposed changes to ensure the protection of gender identity and expression in freedom-of-information releases, the bill also proposes a move to gender-inclusive language. This would demonstrate a commitment to protect the personal information of gender identity and expression in the legislation to an even larger extent and provide the act with an update making it more representative of the people it is meant to protect.

I wish to recognize the young members in the gallery today, who have been quite instrumental in bringing this to my attention, as well as the good work done by the member for Vancouver–West End, whose championing of this in the Legislature over many years has also informed me and others as to the importance of acts like these.

Mr. Speaker: The question is first reading of the bill.

Motion approved.

A. Weaver: I move that the bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Bill M208, Freedom of Information and Protection of Privacy Amendment Act, 2018, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

BILL M209 — PERSONAL INFORMATION PROTECTION AMENDMENT ACT, 2018

A. Weaver: I move that a bill intituled the Personal Information Protection Amendment Act, 2018, of which notice has been given in my name on the order paper, be introduced and read a first time now.

The protection of people’s private and personal information is essential, especially when the information could have negative impacts or when its release was not consented to. Too often, personal information regarding gender identity or expression is revealed.

This amendment would replace 16 instances of gendered language throughout the act with gender-neutral language. By explicitly making a point of doing this, it reinforces to those who may rely on the act that gender identity and expression is important personal information that should not be revealed without that party’s consent. This bill will build trust between those who wish to keep their gender identity and expression private and those they seek guidance from concerning personal and confidential issues.

I would like to thank for this, as well, the youth in the gallery above, for bringing this to my attention, and once more to the member for Vancouver–West End, who was an advocate for language and issues like this over the years and has also made this an important topic of discussion in the Legislature.

Mr. Speaker: The question is first reading of the bill.

Motion approved.

A. Weaver: I move that the bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Bill M209, Personal Information Protection Amendment Act, 2018, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Media Release

March 15, 2018

Weaver introduced private members bills to protect and acknowledge diverse gender identities

For immediate release

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, introduced two private members bills to that would further the rights of British Columbians with diverse gender identity and expression. The bills are amendments to the Freedom of Information and Protection of Privacy Amendment Act (FIPPA) and the Personal Information Protection Amendment Act (PIPA).

“Personal information such as sexual orientation, race, ethnicity and religious affiliation is already protected under FIPPA, in 2018 we should absolutely include gender identity and expression,” said Weaver.

“People with diverse gender identity and expression still face discrimination and far too often violence. It is essential that this information be protected to ensure it is not be released without their consent.”

Weaver was made aware of the need for these changes after meeting with local trans youth from The Trans Tipping Point Project, a UVic initiative organized by Dr. Lindsay Herriot and Kate Fry, with young trans people from across Canada.

“It was an amazing feeling to speak truth to power, and to be heard and listened to, and then have something done about it. I am incredibly thankful for the opportunity, and to everyone who supported us in making this happen,” said Avery Williams, one of the Trans Tipping Point Project youth.

The amendment to FIPPA would ensure that information regarding an individual’s gender identity and expression cannot be revealed by the head of a public body, and that it must be redacted in Freedom of Information Requests. The amendment to PIPA would replace instances of gendered language (he and she) with gender neutral language, reinforcing the principle that gender identity is important and is personal information that should not be revealed without consent.

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

Bill M210 — Family Day Amendment Act, 2018

On February 9, the BC government announced that in 2019, Family Day would move from the second to the third Monday in February. In fact, I had earlier introduced a Private Member’s Bill in 2017 to do just this and so the BC Green caucus was thrilled that the BC NDP supported this BC Green initiative.

But such an announcement needs to be coupled with either a legislative or regulatory change. In light of the fact that it is now over a month since the announcement was made and that the act had yet to be changed either way, I felt it was important to reintroduce the bill to remind government of its commitment. As such yesterday I introduced, for the second time, the Family Day Amendment Act.

Below are the video and text of the bill’s introduction.

Video of Bill Introduction

Text of Bill Introduction

A. Weaver: I move that a bill intituled the Family Day Amendment Act, 2018, of which notice has been given in my name, be introduced and read a first time now.

This is the second time that I’m introducing this bill, which, if enacted, would amend the Family Day Act to prescribe that the third Monday in February each year is observed as Family Day. This amendment would align the date of B.C.’s Family Day with family days and other public holidays across the rest of Canada and in the United States.

The purpose of Family Day is to highlight the importance of family and bring families together, not cater to corporate lobbyists in the ski industry. In B.C., we observe Family Day a week earlier than all other provinces. Families spread out beyond B.C. aren’t able to be together. Federal employees and many who work in business are forced to work Family Day, since it is a business day everywhere else.

On February 9, the Premier announced that beginning 2019, Family Day would shift as outlined in this bill. Unfortunately, that cannot occur without a change in legislation. To assist government, I’m bringing forward this bill in the hope that the ball is not dropped. I would have brought this forward earlier had I realized we had such a light legislative agenda this session.

Mr. Speaker: The question is first reading of the bill.

Motion approved.

A. Weaver: I move that the bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Bill M210, Family Day Amendment Act, 2018, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Reintroducing a bill to lower the voter age in British Columbia to 16

Today in the BC Legislature I reintroduced a bill that would lower the voter age in British Columbia to 16. This is the third time I’ve introduced this bill. I’ve provided a detailed rationale for it here, here and here, and expanded upon it further in a Vancouver Sun article that was published today.

Below I reproduce the video and text of my introduction of the bill, as well as the media statement that we released.

Video of Introduction

Text of Introduction

A. Weaver: It gives me great pleasure to introduce a bill that, if enacted, would lower the voting age to 16 in British Columbia.

The voting age in British Columbia was not always 18. Federally, it wasn’t until 1970 that the Canada Elections Act was amended to drop the voting age from 21 to 18. In British Columbia we made the jump in two steps. First, in 1952 we dropped the voting age from 21 to 19, but it wasn’t until 1992 that we made the subsequent change to lower the age to 18.

Around the world, more and more jurisdictions are openly discussing the notion of dropping the voting age to 16, and, in fact, a growing number have actually done so. Austria, Argentina, Brazil, Germany and Scotland are but a few of the jurisdictions that have extended voting rights to 16-year-olds.

There’s ample evidence to suggest that the earlier in life a voter casts their first ballot, the more likely they are to develop voting as a habit throughout their lifetime.

Sadly, in the 2017 election, only 56 percent of youth aged 18-24 and only 46 percent of young adults aged 25-34 voted here in British Columbia. Compare that to the provincial average of 61 percent and to the 75 percent of seniors aged 65-74 who voted.

It’s also a common misconception that 16-years-old are not as informed and engaged in political issues as older voters. The research, however, says otherwise.

Sixteen- and 17-year-olds are old enough to drive, pay taxes, get married and sign up for the military. They should have a say in the direction our province is heading as they ultimately inherit what we leave behind.

Mr. Speaker: The question is first reading of the bill.

Motion approved.

A. Weaver: I move that the bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Bill M205, Election Amendment Act, 2018, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Media Release

Weaver re-introduces bill to extend voting rights to 16 and 17-year olds

For immediate release

March 13, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, introduced a Private Member’s bill to lower the voting age to 16 in B.C. This is the third time Weaver has introduced the bill.

“Young British Columbians have the greatest stake in the future of our province; they should have a say in the decisions our politicians make,” said Weaver.

“Yesterday, Elections B.C. announced that only 56.24% of 18-24 year olds and 46.35% of 25-35 year olds voted in our last provincial election. Voting rights have been extended to 16 year-olds in Scotland, Argentina, Austria and Brazil. Evidence from those jurisdictions shows that enfranchising these young voters has led to substantially higher levels of political participation.

“Moreover, research shows that the cognitive skills required to make calm, logically informed decisions are firmly in place by age 16. Young citizens of British Columbia are old enough to drive, pay taxes and sign up for the military. They are also the leaders of tomorrow. They should have a say in the direction we are heading, as they will inherit what we leave behind. B.C. should take this chance to strengthen our democracy and lower the voting age to 16.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

Wondering why zero emission vehicles aren’t exempt from the PST surtax

Yesterday during committee stage of Bill 2: Budget Measures Implementation Act, 2018 I rose to ask the Minister of Finance why her ministry did not exempt zero emission vehicles from the PST surtax that they are now applying to higher end cars. As I note in the text and video exchange reproduced below, early adopters of new technology typically heavily subsidize the research and development (R and D) costs of such technology. These early adopters play a critical role in ensuring that new innovations ultimately become affordable for mainstream society.

In my opinion, zero emission vehicles should have been exempted from this surtax.

Text of Exchange

A. Weaver: The question I have for this section, I’ll ask it once and not repeat it for the other sections. It’s with respect to different types of classes of vehicles. I recognize that the minister had outlined the existing legislation and the taxes that apply below $125,000.

My question to the minister is this. To preface it, it’s that we know, in certain sectors, that early adopters are the ones that pay the R and D for new technology to emerge. If we go and look at flat screen televisions, the people who bought the first flat screens paid thousands and thousands of dollars. Now they’re literally giving them away when you sign deals — left, right and centre.

My question is: did the minister or her staff not think about exempting hydrogen fuel cell electric vehicles from this tax? That is, with recognition that it is those early adopters that are paying the R and D in this new and emerging technology that allows others to actually buy these technologies, which is a direction we want to go.

So my question is: why did the ministers not exempt zero-emission vehicles from this additional PST? Ultimately, we want to tax that which we don’t want, and we want to not tax that which we do want. These are zero-emitting vehicles.

Hon. C. James: Thank you to the member for the question. In fact, we did take a look at battery-electric vehicles available in British Columbia. We did look at prices. The member is quite right. It’s obviously an area we want to incent support for.

If you take a look…. I’ll just give you some prices of the base models. I recognize that there are models that could be much more extreme than this. But if you look at the base models, for example, of Teslas — a Model 3 or Model S or Model X — those are all under $125,000. We feel that that fits within the existing bill.

A Nissan LEAF, for example, is $35,000; a Fortwo electric drive, $29,000. If you take a look at the prices — a BMW i3 is $50,000 — they’re all well within the range and under the $125,000. We felt that that was a reasonable approach and didn’t penalize, as the member has suggested, the kind of behaviour that we want to incent.

A. Weaver: Just to follow up, though. In fact, as the technologies emerge…. You couldn’t buy a hydrogen fuel cell. We don’t know whether that’s going to be the technology of tomorrow. But suppose a company decides to put that on the market. It’s zero-emitting. We don’t know that that…. We would want to let the early adopters actually pay the price, if they want to have that niche article, and not tax them.

In addition, we’re now talking about driverless vehicles. The high-end Teslas…. The Model X actually has a driverless component to it, and to get $125,000…. It goes rather quickly, and also the other exemptions for above 50 and above 67 too.

Again, I recognize the minister says that they took a look at the cars. But the reality is that the reason why we can buy a Nissan LEAF now for $35,000 is precisely because people were willing to pay $100,000 plus for those Teslas, and you got the investment in the battery technology that led to the mass production of the smaller cars.

Again, I would hope that the minister would recognize that this has been viewed very negatively within the electric vehicle sector of our society because of the fact that it’s not differentiating between those cars that pollute and those cars that don’t. It’s being viewed simply as a punitive measure on those early adopters who are trying to actually get the market going in the direction they wish it to go.

Hon. C. James: Thanks to the member. I appreciate that. But again, when we’re taking a look at an increase in the purchase price of vehicles over $125,000 and over $150,000, I think that’s a reasonable approach. It doesn’t mean that those won’t be adjusted over time as additional vehicles come on the market.

I certainly know that most companies are looking at, when they get their vehicles on the market, as much affordability as they can. There are certainly other incentives that are often offered, whether it’s a rebate for an electric vehicle or otherwise. There are other kinds of rebates that occur as well.

We felt that this was a fair process. As I said, when I take a look at the models that are on the market, I think even Tesla…. When you’re looking at $122,600, that’s still a fairly pricey vehicle. We think $150,000 and $125,000 are a reasonable approach.

But I take the member’s point and understand that, always, there are opportunities to go back and take a look, as I said earlier, at a number of taxes we’ve talked about. There are always opportunities at the end of each year to take a look at their impact, to take a look at whether they’ve been effective or not and adjust as may or may not be needed.