Affordability

Rental market crisis taking root in B.C.

When I analyzed the rental market in my riding of Oak Bay and Gordon Head, in the Greater Victoria area, I wasn’t surprised by how bad it has gotten.

I know the rental availability rate is at 0.6 per cent in Victoria, I have spoken to residents desperately trying to find an affordable home, I have watched skyrocketing housing prices drag the rental market with them, I have heard about homeless UVic and Camosun students sleeping in cars. I wasn’t surprised as I looked through the rental listings on Craigslist, but I was very angry.

For several years now I have been raising housing issues in the legislature. The government has responded dismissively, refusing to acknowledge the housing crisis that loomed before us.

Now, fresh into an election year, protecting the dream of homeownership has apparently become their motto. They are throwing hastily put together, Vancouver-centric band-aid policies at a housing emergency that is reverberating through the entire province.

The B.C. government has failed to protect a fundamental right for British Columbians, and with the start of the school year fast approaching I am getting increasingly concerned about where the university and college students in my riding are going to live. The University of Victoria alone enrols over 21,000 students. Many UVic and Camosun students will live in residence or with family – UVic has about 2,300 residence beds and 180 family housing units but many others will need to find somewhere to rent for the year.

On Aug. 9 my office went through every Oak Bay and Gordon Head rental listing on Craigslist. There were only 106 and they ranged from $700 per month for a one-bedroom basement suite to $10,000 for a six-bedroom house.

Of the 106 listings, 29 fit my vaguely affordable cutoff of less than $1,000 monthly per person. Most of them were multiple bedroom suites that would have to be split between roommates.

The $2,700 three-bedroom unit, for example, could be shared at $900 per occupant. Not exactly cheap for a student without an income, but more attainable than the $1,500 being charged for a 450-square-foot basement suite. With so few listings, though, I do worry that student renters will be chosen last when bidding against professionals or families. I had a staff member contact a few of the listings that I thought would be suitable for roommates to ask if they would consider renting to a group of students and none replied.

For individuals or couples hoping to find a one-bedroom suite for under $1,000 in my riding, on the day I checked there were seven listed. Some listings welcomed higher bids and many apologized for not being able to respond to every inquiry, citing an overwhelming number of applications. But frustrations with the rental market should not be deflected onto landlords, they too are trying to manage costs in an unhinged housing market.

Frustration, anger and outrage about housing in B.C. needs to land squarely with the B.C. government for actively neglecting this issue until it became a crisis.

As Frances Bula wrote in The Globe and Mail, the housing market has long treated renters like second-class citizens and the current housing shortage is further excluding people who are young, non-white, have mental health issues, unemployed, recent immigrants, poor, disabled or have pets. Our government needs to move beyond their dream of homeownership talking point. There is a rental market crisis in British Columbia that is in desperate need of attention. We need policies that work to get people into safe, affordable homes – like those I have repeatedly outlined for the government – and we need it to start now so that come September students won’t be left sleeping on library benches.

Feature image by Nick Kenrick

The growing demoviction crisis in Burnaby – a path forward

Many might not be aware that an emerging, and entirely preventable, crisis in affordable rental accommodation is developing in the Burnaby Metrotown area. Perhaps the reason for this is that neither the government nor the official opposition has been raising this issue publicly. That’s one of the reasons why I accepted an invitation from the Metrotown Residents’ Association to tour the region on August 18th. While my visit to the area generated some excellent local media coverage in Burnaby Now and Vancouver 24 hours, I thought it was important for me to expand upon what I learned from my tour.

Background

The issue that Burnaby is now facing has arisen from recent and imminent changes in policy. The first concerns legislative changes to the Strata Property Act that were passed in Bill 40, Natural Gas Development Statutes Amendment Act, 2015. An obvious question concerns why changes to the Strata Property Act were passed within a Natural Gas Development Statutes Amendment Act. There is, of course, no justifiable reason for this to have occurred. My own opinion is that it was done simply because Richard Coleman is the Minister of Natural Gas Development and also the Minister Responsible for Housing. By burying housing amendments in a natural gas bill the minister was able to deal with his entire portfolio at once. Bill 40 contained provisions that allowed Stratas to be dissolved (and hence the property sold) with only 80% instead of 100% of strata owners agreeing.

The issue that Burnaby is now facing has arisen from recent and imminent changes in policy. The first concerns legislative changes to the Strata Property Act that were passed in Bill 40, Natural Gas Development Statutes Amendment Act, 2015. An obvious question concerns why changes to the Strata Property Act were passed within a Natural Gas Development Statutes Amendment Act. There is, of course, no justifiable reason for this to have occurred. My own opinion is that it was done simply because Richard Coleman is the Minister of Natural Gas Development and also the Minister Responsible for Housing. By burying housing amendments in a natural gas bill the minister was able to deal with his entire portfolio at once. Bill 40 contained provisions that allowed Stratas to be dissolved (and hence the property sold) with only 80% instead of 100% of strata owners agreeing.

The second important policy change is that the municipality of Burnaby is moving towards rezoning low-rise areas to mid- and high-rise in and around the Metrotown skytrain station. While in and of itself this might sound like a fine idea — by increasing density you increase availability of housing stock — the reality is that it is compounding the affordability crisis in the area. Below I’ll attempt to outline why this is the case.

The second important policy change is that the municipality of Burnaby is moving towards rezoning low-rise areas to mid- and high-rise in and around the Metrotown skytrain station. While in and of itself this might sound like a fine idea — by increasing density you increase availability of housing stock — the reality is that it is compounding the affordability crisis in the area. Below I’ll attempt to outline why this is the case.

But first, I’d like to thank the Metrotown Residents’ Association for inviting me to participate on the tour. I’m also grateful to the residents of the Maywood, Marlborough and Cedar Place who took the time to speak with me.

The problem

In recent years there has been a dramatic increase in the number of demolition permits that have been issued by the City of Burnaby. Older, low rise apartment buildings are being bought up at an alarming rate by developers whose intention is to demolish them and turn them into high end condominiums. Now in theory, as I note above this might sound like a great idea. The current stock of rental housing is dated and densification increases housing supply. But in reality, what is happening is that lower income rental housing is being replaced by higher income luxury condominiums. The result is that these lower income people are displaced and have nowhere to go. This is particularly troubling as Burnaby is ranked dead last in terms of affordability in the Canadian Rental Housing Index.

In recent years there has been a dramatic increase in the number of demolition permits that have been issued by the City of Burnaby. Older, low rise apartment buildings are being bought up at an alarming rate by developers whose intention is to demolish them and turn them into high end condominiums. Now in theory, as I note above this might sound like a great idea. The current stock of rental housing is dated and densification increases housing supply. But in reality, what is happening is that lower income rental housing is being replaced by higher income luxury condominiums. The result is that these lower income people are displaced and have nowhere to go. This is particularly troubling as Burnaby is ranked dead last in terms of affordability in the Canadian Rental Housing Index.

Metrotown mall and the Metrotown skytrain station are immediately adjacent to the neighbourhoods that are being affected. The proximity of rapid transit is particularly important to the residents living in the area who rely on it to get to their employment. At the same time, it was evident that the residents moving into the newer high-end condominiums are far more affluent. One can readily see this simply by looking at the cars parked along the residential streets immediately in front of the new constructions as opposed to the older ones.

Metrotown mall and the Metrotown skytrain station are immediately adjacent to the neighbourhoods that are being affected. The proximity of rapid transit is particularly important to the residents living in the area who rely on it to get to their employment. At the same time, it was evident that the residents moving into the newer high-end condominiums are far more affluent. One can readily see this simply by looking at the cars parked along the residential streets immediately in front of the new constructions as opposed to the older ones.

The response by Burnaby’s Mayor has been to blame the provincial and federal government for the problem. I find this odd in that zoning falls squarely within municipal jurisdiction and that municipalities have the power to create standards of maintenance bylaws which can incentivize upkeep of existing stock. They also have wide discretion as to how they use funds acquired from developers through the granting of increased density. Of course, the development of affordable rental housing, like Cedar Place in Burnaby, often requires the investment of resources from multiple levels of government, but it’s simply not good enough to pass the blame to someone else.

Residents in the area that I talked to spoke of the constant stress that they are living with as they wonder if their apartment building will be next. They have tried to organize and meet regularly. Unfortunately, several of them told me that whenever they put up posters advertising their next gathering, the posters are quickly blacked out, like the example shown to the right.

Residents in the area that I talked to spoke of the constant stress that they are living with as they wonder if their apartment building will be next. They have tried to organize and meet regularly. Unfortunately, several of them told me that whenever they put up posters advertising their next gathering, the posters are quickly blacked out, like the example shown to the right.

So what is being done for those being evicted. The honest answer is that virtually nothing is being done. Burnaby council seems to be turning a blind eye as the demoviction problem gets out of hand. Rather than recognizing that the municipality has a moral obligation to look out for the best interests of their constituents, they seem content with the knowledge that property taxes and developer funds acquired through granting increased density will increase the City’s coffers. In fact, Burnaby’s Mayor has been reported to have said “he’s not about to give in to downloading what he says are provincial and federal responsibilities.”

The solutions

Burnaby council doesn’t have to look far to get a sense of what they might do. Under the leadership of Gregor Robertson the City of Vancouver has taken numerous steps to incentivize the development of rental houses. At the same time they successfully petitioned the provincial government to bring in enabling legislation that would allow Vancouver to introduce a vacancy tax that would penalize those purely speculating in the marketplace.

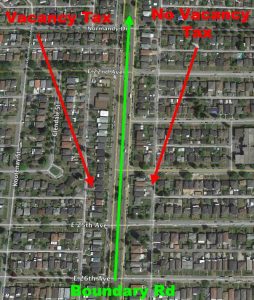

Burnaby did not. In fact, I wrote to Burnaby Mayor and Council in May asking them for their views on the vacancy tax. As I have written about earlier, the addition of the vacancy tax only into the Vancouver Charter and not the Community Charter as well (which other communities like Victoria and Oak Bay have been calling for) makes no sense at all. For example, on one side of Boundary Road (in Vancouver) a vacancy tax could be applied; on the other side of the street (in Burnaby), it would not. I never received a response or even an acknowledgement that my letter was received. In addition, Burnaby has the jurisdictional ability to slow the pace of demovictions to ensure that the construction of affordable, rental accommodation keeps pace with the increased densification.

Unlike the more progressive housing approach of Vancouver, Burnaby’s response to the affordability crisis has been to call on the BC government to allow municipalities to introduce “rental-only” zoning. The BC NDP have also been musing over the possibility of introducing legislation that would allow rental-only zoning options for municipalities. In my view this is not a solution. In fact, I would argue that this has the potential of being disastrous as it would potentially lead to the development of big city ghettos as found in other jurisdictions world wide.

BC Legislation Fails to Deal with Housing Crisis

There are few topics more sprawling, or of more importance, than the state of real estate in British Columbia.

This summer, the legislature was called back into session with two weeks’ notice for the last week of July to debate Bill 28, the Miscellaneous Statutes (Housing Priority Initiatives) Amendment Act, 2016. The bill had four main purposes:

- It added an additional 15% property transfer tax to residential real estate purchased by foreign nationals or foreign-controlled corporations. (‘Foreign nationals’ are individuals who are not Canadian citizens or permanent residents of Canadian.)

- It amended the Vancouver Charter to allow the City of Vancouver to implement a vacancy tax.

- It created a Housing Priority Initiatives Fund for provincial projects that will be seeded with $75 million and a portion of the new tax revenue. (It is worth noting that Public Accounts documents indicate that the government brought in $500 million more in property transfer tax revenue this year than anticipated, suggesting to me that the initial injection in the Housing Priority Initiatives Fund should be higher.)

- It implemented recommendations to re-regulate the real estate industry.

The bill also closed the Bare Trust loophole that I have been asking the government to address for a number of years. Unfortunately it is only being applied to the Vancouver market and only to purchases made by foreign buyers. The loophole is still open to allow wealthy Canadian individuals, corporations or real estate speculators wanting to avoid paying the property transfer tax.

The legislation passed unanimously with the 65 BC Liberal and BC NDP MLAs present on the day all voting in support of the legislation. While I had a prior commitment and so was unable to be present at the time the vote was taken, I would have voted against the legislation. Please let me explain why.

The bill is not without significant limitations.

First, its narrow geographic scope and wrongful inclusion of non-residents who pay taxes and contribute to our economy. The tax should not be applied to those who are deemed residents for income tax purposes, like Hamed Ahmadi who spoke to CBC about the difficult position Bill 28 has put him in. Mr. Ahmadi was hired by BC Hydro after receiving his PhD at UBC, his permanent residency application is complete but still being processed. Long before the new property transfer tax was announced, he had signed a contract to purchase a condo in Coquitlam for $360,000. Mr. Ahmadi now has the choice of paying the government an additional $54,000 or facing a potential law suit from the seller if he backs out of the contract. Our communities are enriched and strengthened by people like Mr. Ahmadi. A tax on foreign nationals and corporations should be used to target the global elite who are using B.C. homes as safety deposit boxes while living and paying taxes elsewhere, not those who are here to build a life for themselves and their families. And this would have been relatively simple to fix by ensuring that people possessed a social insurance number or were deemed Canadian residents for income tax purposes.

Second, the 15% surtax only applies in the Metro Vancouver area. What the BC Liberals did was take a policy measure that was introduced in Hong Kong in October 2012 and “has been especially effective in reducing speculation by wealthy Mainland Chinese” and simply applied it to Metro Vancouver. But unlike Hong Kong, which is a Special Administrative Region of the People’s Republic of China and acts like a nation in a nation, Metro Vancouver is a small part of a larger province in an even larger country. The surtax will likely only serve to punt the speculative housing market into neighbouring communities like Nanaimo, Greater Victoria and Kelowna. I can’t help but wonder if this is a tax we will end up apologizing for in the years ahead.

Third, the addition of the Vacancy Tax only into the Vancouver Charter and not the Community Charter as well (which other communities like Victoria and Oak Bay have been calling for) makes no sense at all. For example, on one side of Boundary Road (in Vancouver) a vacancy tax could be applied; on the other side of the street (in Burnaby), it would not. This doesn’t solve anything and in my view is nothing more than a political stunt aimed at pitting community against community without actually stepping up to show leadership.

Third, the addition of the Vacancy Tax only into the Vancouver Charter and not the Community Charter as well (which other communities like Victoria and Oak Bay have been calling for) makes no sense at all. For example, on one side of Boundary Road (in Vancouver) a vacancy tax could be applied; on the other side of the street (in Burnaby), it would not. This doesn’t solve anything and in my view is nothing more than a political stunt aimed at pitting community against community without actually stepping up to show leadership.

While I am supportive of the creation of the Housing Priority Initiatives Fund and taking away the self-regulatory powers of the real estate council in the Real Estate Services Act, the piecemeal approach taken overall by the BC Liberals may well exacerbate and broaden, rather than effectively deal with the affordability problem in British Columbia.

I pointed out in February that I’d been raising the issue of affordability and speculation in the housing market for more than two years (long before it was even on the BC NDP or BC Liberal radar) and that there are at least three dimensions to the problem:

(1) incentivized government speculation;

(2) a preponderance of vacant homes, and

(3) non-enforcement of illegal realtor transactions.

The BC Liberal response, supported by the BC NDP was to only partially deal with (1) — closing the bare trust loophole for foreign nationals — and only dealing with (2) in the city of Vancouver. In addition, they botched the implementation of the contents of my Land Title Amendment Act. This was a bill that I introduced to the legislature in July 2015 whose purpose was to gather data on who was purchasing properties in British Columbia

Bill 28 aside, we are still lacking a comprehensive plan when it comes to the affordability crisis facing British Columbians. We needed the government to come to the table with practical and province-wide solutions, instead they held tight to their six talking points.

The provincial government’s arrogant refusal to take the affordability issue seriously until they were threatened by the polls has compromised a fundamental right by reducing people’s very ability to find a home. This is not just a “Point Grey” problem as the government previously joked. When I questioned the Minister of Finance about what he was doing to address the housing crises last July he said, “The average price of housing in Vancouver, is actually lower than many people think. You can still purchase a home in Vancouver for under $400,000.” This summer, the Premier said we need to protect the dream of home ownership for the middle class. Sounds nice, but in reality Vancouver has become the most unaffordable market ever recorded in Canadian history. Prices have been rising 30% year on year, the average house price sits at more than 1.8 million, and markets in multiple other jurisdictions are following suit. The divide between the housing reality in B.C. and the government’s understanding of the situation is staggering. We are long past “affordable.”

Rental Market

Skyrocketing real estate markets across the Lower Mainland and Southern Vancouver Island are dragging the rental market with them. Frances Bula recently wrote in The Globe and Mail, “as people are shut out of the housing market, more people have no choice but to remain as renters who are competing for a limited supply of housing in a system that has treated renters like second-class citizens for decades.” She’s right, and for people who are young, non-white, have mental health issues, unemployed, recent immigrants, poor, disabled, or have pets, finding a safe, affordable home can seem nearly impossible in markets with vacancy rates around 0.6% like Vancouver and Victoria.

With constrained real estate mobility, people have little choice but to stay in suites that would have previously been viewed as shorter-term student rentals and I am getting increasingly concerned about where the young people in my riding are going to live this upcoming school year. A representative from Camosun College told us that he too is very worried about the situation. He described it as a complete crisis with some students living in cars and others forced into over-crowed, expensive, shared suites.

We so desperately need more designated long term rentals and co-op housing in B.C. Spaces that people can make their home, places that welcome children and pets and have some outdoor space. Homes for people who will rent for large portions of their life, either by necessity or choice.

On that note, Gregory Henriquez, the architect who designed the Woodward’s building in Vancouver, is calling on young architects “to act as a bridge between the grassroots need of a community and the bottom-line demands of commerce” to build cities that are diverse, inclusive, and equitable. He believes more rental units are needed in Vancouver, citing that “we are so far past the threshold of affordability that the goal of providing home ownership for everyone is almost impossible. Right now, 50 per cent of people rent, and the others own. We have not had a huge rental supply in a generation.” Mr. Henriquez told The Globe and Mail’s Kerry Gold that he “believes civic intervention is necessary to incentivize the right kind of development”

Cooperative housing arrangements are another promising avenue, bridging the gap between the rental and homeownership markets. As B.C. Green Party housing critic Zarah Tinholt has said, “Cooperative housing provides shareholders a long-term, sustainable home.” The financing of co-ops involves a down payment or “membership share” for each unit. In B.C. the down payment is usually under $5,000 but they range between $900 and $15,000 with monthly rents and maintenance costs between $600 and $2500. Co-ops can make incredible homes and diverse communities, supporting multi-generational people with varying income levels.

In BC, few cooperative housing developments have been built since the 1990s when the federal government released its social housing responsibility to the province and existing units have many year wait lists. Given our current housing crisis, and the province’s new Housing Priority Initiatives Fund, I believe that the B.C. Liberals, in conjunction with municipalities and the federal government, need to step in to help housing cooperatives with land acquisition and planning costs.

Data

Each level of government has various tools available to them that they can use to tackle the housing crisis from different angles. The Vancouver Charter, for example, allows the municipality to charge developers a ‘community amenity contribution’ – a percentage of the value that they receive through rezoning that can be put towards a new park, community centre, social housing, or artist studios.

To guide these initiatives we need, and have needed for years, more comprehensive data about the trends impacting our housing market. The information about buyer nationality that the province began collecting this June is a start, but making major policy decisions based on five weeks of data – as they did with Bill 28 – is far from ideal. In fact it might be viewed as reckless.

To guide these initiatives we need, and have needed for years, more comprehensive data about the trends impacting our housing market. The information about buyer nationality that the province began collecting this June is a start, but making major policy decisions based on five weeks of data – as they did with Bill 28 – is far from ideal. In fact it might be viewed as reckless.

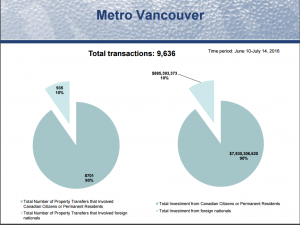

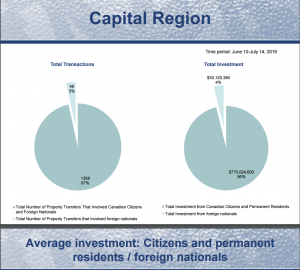

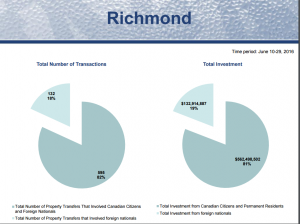

The first set of data released by the province, collected over just 19 days in June, suggested foreign nations were involved in about 5% of overall real estate transactions. The second data set, collected over five weeks through June and into July, put that rate closer to 10%.

Between June 10th and July 14th foreign nationals spent more than $1 billion on B.C. real estate. 86.5% of their investments were focused in the Metro Vancouver region and $886 million were invested in the Lower Mainland market – accounting for about a tenth of Metro Vancouver’s $8.8 billion in housing sales.

Between June 10th and July 14th foreign nationals spent more than $1 billion on B.C. real estate. 86.5% of their investments were focused in the Metro Vancouver region and $886 million were invested in the Lower Mainland market – accounting for about a tenth of Metro Vancouver’s $8.8 billion in housing sales.

Knowing that we are going to be faced with challenging housing decisions for years to come, we ought to start collecting more data now so we can design informed policy. Determining who is purchasing homes, and how many, in BC would allow the government to identify the flow of foreign investments, the role corporations are playing, and whether we are seeing speculation in our market coming from other regions of Canada. Tracking house flipping, when investors buy a house to quickly resell it at higher price, is an important aspect of understanding an over-inflated market. Imposing a sales tax on homes sold within one or two years of purchase could be an effective way of curbing house flipping but, again, it is a policy that should be founded in comprehensive data.

Studying the impact of Airbnbs, I suspect, would shed a lot of light on changes happening in the rental market. Anecdotally, we know of nearly a dozen people who have moved out of their rental suites for one reason or another only to see it pop up on Airbnb. For its part though, Airbnb has already said it’s open to some restrictions tailored to tight rental markets like Vancouver’s, including banning hosts from using the popular online platform to run a business renting out multiple units, but governments (municipal and provincial) will need solid data to move forward with such policies.

Studying the impact of Airbnbs, I suspect, would shed a lot of light on changes happening in the rental market. Anecdotally, we know of nearly a dozen people who have moved out of their rental suites for one reason or another only to see it pop up on Airbnb. For its part though, Airbnb has already said it’s open to some restrictions tailored to tight rental markets like Vancouver’s, including banning hosts from using the popular online platform to run a business renting out multiple units, but governments (municipal and provincial) will need solid data to move forward with such policies.

Long term and ongoing data collection is vital to the development of effective housing policy options in B.C.

International Markets

In the meantime, we can turn to other hot-market jurisdictions to analyze what they are doing to help their citizens find affordable homes.

The situation in the Lower Mainland mirrors that of New York where, as the New York Magazine put it, people with “garden-variety affluence – the kind of buyers who require mortgages – are facing disheartening price wars as they compete for scarce inventory with investors who may seldom even turn on a light switch.” Real estate in New York has been notoriously expensive for years. With a housing price-to-income ratio of 6.1 compared to Vancouver’s 10.6, however, it has actually become more affordable, relatively speaking, because residents have greater access to high paying employment and more job mobility. It also has an efficient transit system for workers to get to those jobs, something Vancouver continues to struggle with, and a considerable amount of social housing. The New York City Housing Authority is the largest public housing authority in North America and owns 178,557 apartments in 2,563 residential buildings. Co-op city alone provides affordable housing for some 35,000 people along the Hutchinson River. (It is important to note, however, that the strict limits on gross income used in the New York model have been criticized for creating communities that are not socioeconomically diverse. And, despite the impressive number of affordable housing units by B.C. standards, more are needed.)

While New York’s affordable housing is reserved for those living under or near the poverty line, in Vienna 60% of residents live in subsidized suites. “There is a general political consensus that society should be responsible for housing supply, and that housing is a basic human need that should not be subject to free market mechanisms; rather, society should ensure that a sufficient number of dwellings are available,” wrote Christoph Reinprecht in Social Housing in Europe.

When it comes to navigating the presence and impact of non-resident ownership around the world, various policies are utilized to level the playing field between the world’s rich and local citizens. In Switzerland, for example, the government assigns quotas to the country’s 26 cantons, limiting the number of residential properties that can be sold to foreigners. Mexico takes a different approach by restricting foreigners from buying real estate within 50 kilometres of the coast or 100 kilometres from the borders. In Australia, the government collects information on the real estate bought by foreign investors, compiles it in an annual public report, and only allows them to purchase newly built homes. The Australian government also heavily taxes foreign purchasers and threatens non-compliance with significant fines and jail time. The UK charges a capital gains tax between 18 and 28 per cent on the sale of residential properties that are secondary homes or foreign-owned. A progressive tax is also applied to homes worth more than a million pounds. And Hong Kong, after which BC mirrored its foreign tax, has a 15% surcharge on homes purchased by non-permanent residents.

Community Vision

In the midst of all the differing opinions about root causes, bandaid fixes and competing data sets, however, we must not lose sight of the fundamental question that underpins everything — what do we want our communities to look like in coming years?

British Columbia faces a choice: Do we want our real estate market to provide homes for people who want to live in and contribute to the wonderful communities around our province? Or, should we continue to fuel a bubble economy propped up by the influx of foreign investment in our real estate sector?

Given the severity and reach of the housing crisis, a reactive piecemeal policy approach debated over four days in the summer amounts to little more than blowing out birthday candles in the midst of a house fire and to me the answer is clear.

British Columbia is more than just the playground for the wealthy. We need to ensure that our communities will be livable, that small businesses will thrive, and that the next generation will see opportunities to start families in our cities.

We need a province-wide, coordinated approach involving all levels of government and across all communities. We need a data-driven policy framework that will close the loopholes being exploited by people with ultrahigh net worth, get tax cheaters out of our market, clamp down on questionable real estate practices, increase rental and co-op stocks and put regulatory and taxation frameworks in place for non-resident ownership – we need to build off Bill 28, think provincially, and focus on the future of our communities.

Responding to Housing Bill

Media Statement: July 25th, 2016

Weaver Responds to Housing Bill

For Immediate Release

Victoria B.C. – “Despite legislation tabled today by the BC Liberals, there is still no comprehensive plan when it comes to the affordability crisis facing British Columbians,” said Andrew Weaver, Leader of the B.C. Green Party and MLA for Oak Bay – Gordon Head. “We need the government to come to the table with practical and province-wide solutions, rather than their six talking points.”

The legislation tabled today gives Vancouver the ability to introduce a vacancy tax. However, no other communities in the Province have been granted such powers.

“This piecemeal approach to the affordability crisis is simply pitting one jurisdiction against another. It makes no sense at all for one side of Boundary Road in Vancouver to potentially have a vacancy tax applied, while a vacancy tax cannot be applied on the other side of the street.

“Any attempt to solve the affordability crisis facing British Columbians needs to start with honestly recognizing the scale of the problem. For many, we are long past the threshold of affordability. This crisis is beginning to reverberate throughout B.C. as people get squeezed out of their communities and are forced to move.

“Skyrocketing real estate markets across the Lower Mainland and Southern Vancouver Island are dragging the rental market with them. Given the severity and reach of the housing crisis, a reactive piecemeal policy approach amounts to little more than blowing out birthday candles in the midst of a house fire.

“The legislation introduced today closes the bare trust loophole for offshore buyers that I have been attempting to get government to address for a number of years now. However, once more this is only being applied to the Vancouver market. All this will accomplish is to push foreign investment into neighbouring jurisdictions, furthering the affordability crisis in areas such as southern Vancouver Island.

“What is needed is a province-wide, coordinated approach involving all levels of government and across all communities. We need to ensure that our communities will be livable, that small businesses will thrive, and that the next generation will see opportunities to start families in our cities.

-30-

Media Contact:

Mat Wright – Press Secretary, Andrew Weaver MLA

1 250 216 3382

mat.wright@leg.bc.ca

Government Recalling Legislation to Pass Vacancy Tax Provisions in Vancouver Charter

Media Statement: July 11th, 2016

Weaver responds to Vacancy Tax

For Immediate Release

Victoria B.C. – Andrew Weaver, Leader of the B.C. Green Party and MLA for Oak Bay – Gordon Head, today responded to the provincial government’s announcement that the House will be reconvened in two weeks in order to pass new legislation concerning the overheated real estate market, including the legislation required for Vancouver to bring in a vacancy tax.

“This government is taking a hands off approach on the most pressing issue facing British Columbians. With this rushed session they are introducing new chaos into an unstable situation. What will the impacts be of one municipality in a connected region acting alone? My guess is that no one really knows.

“This piecemeal approach being taken risks making things worse. What is needed is provincial leadership that brings forward thoughtful solutions for all British Columbians – solutions that ensure that our young professionals and small business owners aren’t simply priced out of the real estate market.

“Earlier this year I pointed out to government that there are at least three dimensions to the issue of affordability and speculation in BC’s housing market:

- incentivized government speculation;

- a preponderance of vacant homes, and

- non-enforcement of illegal realtor transactions.

The government continues to ignore a speculative ‘bare trust’ tax loophole to remains open and allows for the avoidance of paying property transfer tax.

-30-

Media contact:

Mat Wright

Press Secretary – Andrew Weaver MLA

Cell: 250 216 3382

Mat.wright@leg.bc.ca

Twitter: @MatVic

Background Information:

Offering Practical Solutions to Vancouver’s Affordability Crisis

Affordability & Metro Vancouver’s Potential Housing Bubble

Let’s close a tax loophole so big you could drive a bus through it