Affordability

Government’s release of housing data nothing more than a photo op

Media Statement: July 7th, 2016

Weaver Criticizes Government’s Laughably Incomplete Housing Data

For Immediate Release

Victoria B.C. – “The BC Government has already allowed the housing market to become a crisis, and now they are sitting on their powder keg holding press conferences based on 19 days worth of data,” said Andrew Weaver, MLA for Oak Bay – Gordon Head and Leader of the B.C. Green Party. “They have dropped the ball on this file — completely dropped the ball.”

“19 days worth of data is completely meaningless. This would be like me arguing that since the Canucks didn’t play any games between June 10 and the 29th, Vancouver doesn’t have a hockey team. It’s just laughable.

“Despite promises made in the 2016 budget, the government has failed to deliver any data on the occurrence and impact of beneficial ownership changes in bare trust owned properties. I have been asking for the data for three years now.

“When properties are registered in bare trusts and beneficial ownership is flipped there is no change in title at the Land Title Office. When there is no change of title there is no property transfer tax paid and no data collected by the BC government.

“The minister said our province has seen higher rates of house flipping in the past, but that data is based on registered sales only. There are a lot of houses out there that are flipping through changes in beneficial ownership, and those people are not paying property transfer tax.”

– 30 –

Media contact:

Mat Wright

Press Secretary – Andrew Weaver MLA

Email: Mat.wright@leg.bc.ca

Cell: 250 216 3382

Twitter: @MatVic

Backgrounder

At present, anyone other than a first-time or new-home (< $750,000) buyer who buys a house must pay property transfer tax upon transfer of title at the Land Title Office. The tax owed is calculated as 1% of the first $200,000, 2% on the amount greater than $200,000 and less than $2,000,000 and 3% on the portion above $2,000,000.

But there is a glaring loophole that is being exploited more and more frequently by wealthy individuals and corporations. That loophole involves having the property held in what is known as a “bare trust”.

A bare trust is a legal entity that allows for the separation of beneficial and legal ownership. The beneficial owner of a property is the person or persons who make all the decisions concerning such things as rent, repairs, management, sale etc.; they are also the person or persons who receive all the revenue from and arrange financing for the property. The trustee of the bare trust has no substantive decision-making capacity as they simply act upon the instructions of the beneficial owner. Typically the trustee is a corporation that has no other purpose but to act as a trustee for the bare trust and for which the beneficial owner owns all the shares.

Suppose you own a $10,000,000 home that you want to dispose of. If you simply transferred title, like most of us do when we sell a home, the purchaser would have to pay $278,000 in property transfer tax.

But if instead the property is in a bare trust where the trustee is a company, then you will pay no tax. All you have to do is sell your shares in the company for 1$ (the company has no assets anyway), and sell the “beneficial ownership” rights of the property to a third party via a “bare trust agreement” which is not registered at the Land Title Office. Since no change in title occurs, no tax is paid.

Ontario has a similar property transfer tax system in place but they have plugged the loophole. They apply the property transfer tax upon change in beneficial ownership, not just change in the title registered as the Land Title Office. This could and should be done in British Columbia to ensure everyone is treated fairly.

Bill 10 — Budget Measures Implementation Act, 2016

Today in the legislature I rose to speak at second reading on Bill 10, Budget Measures Implementation Act 2016. The budget implementation bill is an omnibus bill that proposes to bring into law the various measures outlined in the government’s budget.

In any budget there are always aspects that one can support and other aspects that one cannot support. You’ll see from my speech below that this budget implementation bill is no different.

For example, the budget implementation bill extends the BC Seniors’ Home Renovation Tax Credit to individuals with a disability. This is a welcome change. Extending the Tourism Accommodation Assessment Relief Act applicability to rural areas, something that was supported through a motion from the Union of BC Municipalities, is also an important step forward.

But unfortunately, the government has missed the boat on addressing the affordability crisis in Vancouver. And the Prosperity Fund is nothing more that a political stunt. Below I reproduce the text of my speech; I also link to its video.

You’ll see from the text that the Minister of Advanced Education was heckling me throughout my speech. Honestly, it was rather off putting and I would have expected better. It got so bad that when Leonard Krog, MLA for Naniamo, was speaking after me, I stood on a point of order as I could not even hear what he was saying.

Text of my Speech

A. Weaver: I was busy booking a flight to Vancouver, expecting a Liberal member opposite to stand up and defend their budget, offer insight as to why this budget implementation act is a good one. Instead, all they resort to is chirping little bits here and little bits there.

I rise to speak to Bill 10, Budget Measures Implementation Act, 2016. As you know, this bill essentially lays out the implementation across a diversity of bills — amendments here, amendments there — to implement government priorities as outlined in the budget speech.

There are a number of aspects to this. Number one, of course, is the introduction of the prosperity fund, the so-called $100 billion prosperity fund, a fund that was promised to British Columbians in the last election during a Hail Mary pass of hope that was given by this government to British Columbians in a desperate attempt to try to get elected — 100,000 jobs, $100 billion prosperity fund, debt-free B.C., elimination of PST, thriving schools and thriving hospitals, and on and on. A pot of gold at the end of the LNG rainbow was promised to each and every British Columbian.

In a desperate attempt to try to fulfil this outlandish promise — this promise that anybody in the natural gas industry knew was absurd, this promise that only the Liberals themselves convinced themselves had any dream of reality — when it finally….

Interjection.

A. Weaver: I hear sighing coming across the benches over there. The reality is, if you go back and look at the presentation given by the Deputy Minister of Energy and Mines to the clean energy conference in 2012, you would see, in that presentation, natural gas prices projected to increase into the $20 to $30 range in the months and years ahead.

There is not a single person internationally who would ever have thought natural gas prices were going to increase like that, in light of the fact that everybody has discovered horizontal fracking technology, that Russia is so close to China and has reserves almost 20 times those of natural gas, that Iran, which has the largest reserve in the world, would have its….

Interjection.

A. Weaver: The Minister of Advanced Education is truly quite pompous over there. What is so remarkable, is that I know his own colleagues think he’s a pompous person as well. So it would be quite…. It’s very difficult to actually continue with this.

Interjection.

Deputy Speaker: Order, please.

A. Weaver: Thank you, hon. Speaker. I’m glad to have some order back in here.

The prosperity fund is, as I pointed out, a desperate attempt to try to look like government is responding to its promise in the provincial election. When you actually look at this $100 million prosperity fund, it really is only $25 million, because 50 percent of that is going to be used to pay down debt. That’s $50 million. Another $25 million is going to be used for government priorities. What are those government priorities? Let me lay them out for you.

We’re going to see, over the course of the next year, a bunch of little tidbits — election tidbits — offered to British Columbians in the same vein as was offered in the last election, promises of this and promises of that. Say whatever it takes to get through lunch. Then say whatever it takes to get to dinner, and say whatever it takes again to get through to the next day.

There is also the Property Transfer Act that’s being modified in the budget implementation act. Government’s response to an affordability crisis in Vancouver, rather than standing back and recognizing that there are three reasons for this affordability crisis, or their speculative housing market: (1) lack of enforcement of the Real Estate Services Act; (2) a preponderance of vacant homes and owners of those vacant homes not being required to pay the true cost, the social cost, of leaving vacant properties…. That is — now, I know the Minister of Advanced Education has a hard time when I start to use economic language — the externalities associated with vacant homes have not been internalized to the people with those vacant homes. Those externalities are a social cost. And the third reason is the existence of loopholes that allow people to avoid paying property transfer tax or register on title where they live.

It was with the latter that I do appreciate the government introducing two aspects of policy. One is with respect to bare trustees now being required to say who they are. The second one, of course, is that on title, you will now have to declare if you are a Canadian citizen or not. The problem with this is that should have been extended to also require you to list if your primary residence is in another province, as other provinces do in British Columbia.

Interjection.

A. Weaver: Sorry — as other provinces do in Canada.

My goodness, I could only imagine having to live in a house with the Minister of Advanced Education. While I am straight, I would have divorced this man within a matter of moments, as he is simply intolerable. His hubris, his pomposity, his arrogance is so intolerable, it makes one want to be ill. But with that, I will move on.

Even the minister’s opposite are laughing, because they all agree with me as well, I know.

The property transfer tax. The government’s response, rather than dealing with the issue, is to incentivize further speculation. How do I say that? Well, one piece of policy that’s introduced is an elimination of property transfer taxes on new homes under $750,000. At first glance, one might think that’s a good thing.

But what is this incentivizing? What it’s incentivizing , but what it’s incentivizing is the purchase of older homes, the ripping down of those older homes and constructing of townhouse developments. Creating more supply may sound like a good thing, but unfortunately, it’s not addressing the critical issue, which is internalizing the social costs of leaving homes vacant.

It simply incentivizes our speculative economy, an economy that this government thinks is actually diversified and stable but, I would argue, is very, very flimsy, because it is being buttressed by an artificial, speculative housing market in greater Vancouver and now coming to the CRD. That is not a healthy situation. We only have to go to Scottsdale or Phoenix, Arizona, to see what happens to an economy that is built on a speculative housing market. It keeps going, and then there’s the big crash. And this government, like it has done with LNG, will blame global market foes that we have no control over. But they do have control. There are things that could be done now.

This government should be putting a price on leaving vacant properties empty. Putting a price on those vacant properties does two things. One, it incentivizes renting of those properties. It makes people want to rent those properties, which puts downward pressure on rental prices. Two, it actually reduces, then, the demand on new homes, because there are more people in rental homes.

Internalizing the externalities — making vacant homes have to pay the social cost. This can be done in a revenue-neutral fashion. The money raised through the tax of vacant homes could be used, for example, to help house the homeless. It could be used, for example, to give rental subsidies. It does not have to be a money grab for government.

Government has a responsibility to use the tools it has to ensure that the market is fair. The housing market in Vancouver is not a free market. It is a market failure. It’s a failure because the social cost is not being paid, and the only way to do that is actually put a price on leaving your homes vacant.

Bare trust is another one that I’ve mentioned over the last couple of years as a loophole that was originally put in place a long time ago — back in the 80s, I believe, even before the so-called dreaded 90s.

Hon. A. Wilkinson: That must have been around the 16th century

A. Weaver: Maybe it was around the 16th century, but I don’t believe anything the Minister of Advanced Education says, because he’s so pompous. Everything he says, you’re supposed to believe. And I believe none of it. He loses credibility when he continues to chirp that way.

The problem with registering properties in bare trusts and then flipping beneficial ownership of a bare trust means that you don’t change title. There is no change of title in the land title office, and that means there is no property transfer tax paid. Government has proposed to study this. But we know what result we’re going find out. We’re going to find that there’re a lot of houses out there that are flipping not on titled but through beneficial ownership.

Now, Ontario understands this. Ontario understands this. They are the other jurisdiction in Canada that has a property transfer tax. But where they apply the property transfer tax is on beneficial ownership change, not on title change. They don’t apply it on title change. They apply it on beneficial ownership change.

If I am foreign company and I’d like to buy a property and speculate it in Vancouver, here’s what I might do. I might purchase the property and put it in a bare trust. Then I might start flipping this bare trust, the ownership or the corporation that owns this bare trust, and sell it. It can be….

Interjection.

A. Weaver: Hon. Speaker, may I ask you to please address the Minister of Advanced Education and ask him that I have a right to speak in the Legislature without having to listen to his pomposity? Frankly, enough is enough.

Deputy Speaker: Order, Minister.

Interjection.

A. Weaver: Thank you, hon. Speaker.

I agree with the Minister of Health. They have to listen to him, but I don’t have to listen to him.

Coming back to the bare trust, coming back to the example I was giving, a company can put an individual…. I know there’re a whole bunch of entities can own the bare trust, and they can sell it. They can flip it a multitude of times. They can start to flip it amongst shell companies themselves. But never at any time are we changing title, and no property transfer tax has changed.

And this government has no idea who owns it, because they’re not tracking…. At least they will, coming up. But they were not tracking the bare trustees and those who have beneficial ownership. But rather than spending time tracking it, they should be actually disincentivizing by applying the property transfer tax on transfer of beneficial ownership.

Now, with that said, there are, of course, aspects of this budget implementation act that I do support. I mean, continuing the flow-through mining share credit, the flow-through share agreement, for another year seems reasonable. It has been working quite well to incentivize investment in the mining sector in British Columbia.

The Tourist Accommodation (Assessment Relief) Act changes are responding to a UBCM resolution to extend the assessment relief to rural regions.

The B.C. seniors home-renovation tax credit — extending that to individuals with a disability. It’s hard to find anything wrong with that proposal.

And the food donation tax credit — it’s an interesting idea, but I worry. I have spoken to people at Mustard Seed and elsewhere, food bank agencies. There’s a worry here — that has to be, actually, carefully regulated and examined — that this could be misused for dumping of product that has no value and is being used as a loophole to get a tax credit.

For example, let’s suppose I’m a company that has, in reserve, 10,000 barrels of molasses, and I can’t sell it. But now I give it to a food bank at fair market value. The market value is essentially zero because I can’t sell it, but there will be some nominal fee attached to it. This food bank is then ending up with 10,000 barrels of molasses that it has no use for.

What matters with this food donation tax credit is that the devil is in the details — that is, implementation is not being used as a means and a way of avoiding dealing with product that no one wants. How many litres of molasses do we need? And there are other examples that can occur like this.

I understand that it makes sense that, perhaps, the local farmer here in North Saanich has a few extra crates of, say, apples and, you know, he’d like to donate those to the local food bank and get a small tax credit. That seems reasonable. Why not just deal with the problem, however, in the first place?

Why are we actually having to deal with giving away food to food banks? What is wrong with our economy? What is wrong with our social programs? What is wrong with our society when we even have to introduce this tax credit in the first place? That’s the real question.

The question is not the food donation tax credit, which everybody can get behind in some way. The real question is: why is it that we, as our society here in British Columbia, one of the wealthiest places in the world — not just in North America but in the world — has to introduce a food donation tax credit? What next? A used clothes donation tax credit? Shoe donation tax credit? Used sportswear donation tax credit? It’s a slippery slope, and it’s not addressing, again, the fundamental inequities in our province that this budget should be addressing.

What’s not in this bill? A number of things are not in this bill, and I will look forward, in committee stage, to discussing some aspects of this.

I’ve had a number of people contact me, concerned about the increase in property transfer tax for homes valued over $2 million. That may seem like it’s a tax on the wealthy. It may seem at first glance, but let’s suppose you’re living in Vancouver. You grew up in Vancouver, and you’re a family of four.

Mom and Dad get pretty old, and Mom and Dad are so old that they need to leave their house. But Mom and Dad want to give their children their house. There’s concern that in doing so, those children, who could barely be affording to live in Vancouver anyway, would be subject to the increased property transfer tax and then move into a home that they couldn’t afford to buy, but it was a family home.

The problem, of course, here is that $2 million may seem like a lot, but it’s not a lot in Vancouver. So care has to be put in place to ensure that during the transfer of title between family members, this doesn’t occur.

Now, I get that if the house was put in a trust and it was transferred within family members, nobody would pay tax. But most of us don’t buy our houses in trusts. Most of us buy them as individuals, and we leave them to others or we try to give them to our children. There’s a little element there that government needs to some care over.

What is also not in this, in the budget implementation act and the budget in general…. There’s absolutely nothing to do with climate leadership. Now, I say that with some irony. I recognize that the Minister of Health has a Chevy Volt. It’s not a pure electric car, but it is pretty good. He lives in Kamloops — I get it — and he wants to drive to Victoria. I applaud him for a Chevy Volt.

Interjections.

A. Weaver: You have to. Yeah.

The electric car subsidy — that qualifies — is a good thing. I have a Nissan LEAF —100 percent electric. It’s a good thing.

Interjections.

A. Weaver: The Minister of Advanced Education goes off on a tangent again, because he wants to hear his own voice.

Do I pay road tax? Yes, I pay road tax. When I go over the Port Mann Bridge in Vancouver, I pay road tax.

Interjections.

Deputy Speaker: Members, order.

A. Weaver: Apart from the electric vehicle, there is nothing, zero, about climate leadership. Why is that important? Because right now, today, in Vancouver, first ministers are meeting with the Prime Minister to discuss climate leadership.

What do we have here in this House on that day? An introduction of another bill — another bill to give away our resource to the LNG industry, as we are continually desperate to try to find ways and means that they don’t have to account for their greenhouse gases. Or we can change the international rules to pretend that some greenhouse gases are not really greenhouse gases.

That is what this government thinks is climate leadership. The irony is that it’s on the day that we’re supposed to be talking about this in Vancouver.

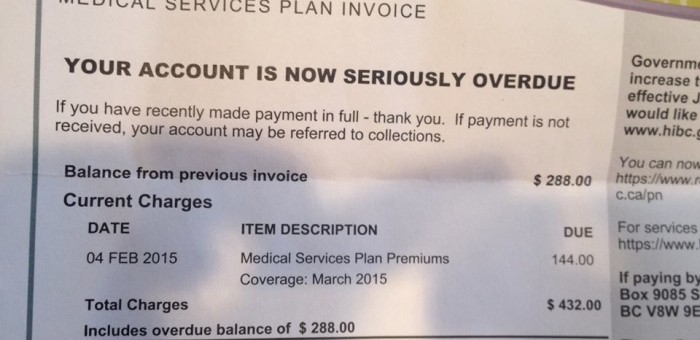

What’s also not in here, in this budget, is anything of substance in terms of MSP reform. This tinkering around the edges in the budget, not so much in the implementation act….

Where, for example, are steps being taken to fulfil government’s promise that each and every British Columbian would have a GP by the end of 2015? Each and every British Columbian would have access — this is a promise — to a general practitioner by 2015.

Well, I hope you aren’t looking for a GP in this area, because there is not a single GP south of Duncan that is accepting new patients.

While the government is quite desperate to fulfil its promise of wealth and prosperity through an industry that’s not going happen and basically gives away our resource in a desperate attempt to get an agreement, they’re not willing to deal with another promise — the “GP for everyone” promise.

I could go on and on, and I know the Minister of Advanced Education would love me to. But with that, I’ll conclude with one final statement.

When you look at this Budget Measures Implementation Act and you look at the individual boutique exemptions here or the little addition there, what you get is a sense of what this government is doing.

This government has lost its sense of vision. It has lost its sense of vision of what a prosperous British Columbia looks like. They’re fixated on a speculative housing market. They’re fixated on LNG.

They don’t understand what a diversified economy is. It’s not an economy that’s propped up with an artificial, speculative, Scottsdale-style housing market until we can maybe get LNG ten years from now or twenty years from now. That’s not a diversified economy.

They don’t understand what’s going on with the elements of our society that are struggling to make ends meet.

This budget, through its implementation, is something that cannot be supported for what’s not in it, not so much for the boutique tax credits that are in it but for what’s not in it: assistance to those who can barely make ends meet, structural changes to things like the MSP, dealing with the affordability crisis in means and ways that actually ensure that it’s dealt with, instead of incentivizing the problem still further, and dealing with an issue that was simply not addressed in the budget — education.

Who are we as a society if we don’t value the next generation, the generation in our schools and colleges today, as the important asset of our future? LNG is not important in the big picture. Our next generation is important. They are the citizens of tomorrow. They are the ones who will build the economy of tomorrow.

They are the ones who will take care of us when we’re older. They are the ones who will discover the cures for various diseases that you and I will get as we get older.

But there is nothing, nothing at all in this, for education, whether that be K to 12, whether that be early childhood education or whether that be post-secondary education. That is the single biggest disaster of this budget: it does not do anything for the next generation. That is why I cannot support it.

Video of my Speech

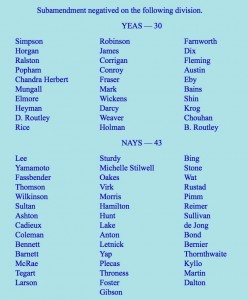

BC Liberals Reject Progressive Approach on MSP Premiums

Today in the legislature we were debating an amendment to the motion that the Speaker do now leave the Chair for the House to go into Committee of Supply”. The BC NDP added the following text:

“That the government recognize the cumulative effect of the increases in MSP taxes, hydro rates, ICBC premiums, and other fees and hidden taxes, on British Columbia families.”

I took the opportunity to subamend the amendment by adding:

“And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue neutral manner to create a progressive health care levy.”

The BC NDP supported my subamendment which was defeated by the Liberal majority (vote reproduced below). I also supported the BC NDP amendment that was also defeated by the BC Liberals.

In voting the way they did on my subamendment, the BC Liberals made it very clear that they are not interested in fixing the regressive nature of the MSP premiums. I found this very odd in light of the fact that the Premier recently stated, “Here is the thing about the MSP system is it is antiquated, it is old, and the way people pay for it generally doesn’t make a whole tonne of sense…“. If you ask me, this is nothing short of a caucus vote of non confidence on the Premier’s position on the MSP Premium file.

Below is the text (and video) of my speech in support of the BC NDP amendment and my subamendment.

Text of my Speech

A. Weaver: It gives me great pleasure to rise in support of the motion put forward by the member for Nelson-Creston and seconded by the member for Port Coquitlam: “That the Speaker do now leave the Chair for the House to go into Committee of Supply be amended by adding the following, ‘That the government recognize the cumulative effect of the increases in MSP taxes, hydro rates, ICBC premiums, and other fees and hidden taxes, on British Columbia families.'”

I rise in support of this for numerous reasons. The first, of course, is that this government is proud of its triple-A credit rating and its balanced budget. I am proud of the balanced budget. However, the choices this government has made are such that it is those who can least afford it who are the ones paying the costs of balancing the budget.

It’s a biased budget, one that puts the poor, those with disabilities, those who can barely make ends meet and families second. It puts vested interests, the development industry, first and foremost.

This government touts the fact, through self-congratulatory rhetoric, that it is fiscally responsible. Let me be very clear: this government is fiscally reckless.

Take Site C, for example — the biggest item by far in the budget that is not being addressed in detail, an item with an $8.7 billion price tag that will almost certainly come around $12 billion to $13 billion when all is said and done. It’s a project that received virtually no attention in this budget and only had one line item to it. That’s Site C, as mentioned previously, by the minister before me.

The Premier recently stated that she wanted to move this project “past the point of no return,” but in her haste to get to yes, she is throwing fiscal caution to the wind. The government is pushing forward with a massive pet project that was created for a yet-to-materialize LNG industry — a project that has seen numerous cost overruns already, and yet it has barely started.

This government is plowing forward with a substantial risk that is borne on the backs of B.C. taxpayers — those who are not only paying the price through increases in MSP premiums, through increases in hydro rates, through increases in ICBC premiums, but who also being burdened with debt for years to come for a yet-to-materialize LNG industry, a project that has seen, as I mentioned, numerous cost overruns.

The government wants to appear to be fiscally responsible, but it’s gambling with our tax dollars. Why are we pushing ahead with a project that is riddled with legal challenges and massive environmental consequences? Why is the government not taking a step back and putting the interests of regular working people first and foremost? The British Columbians who actually vote the MLAs in here — why are they not putting their interests first?

Why is this government not taking that step back? British Columbians want this government to wait for the report from the Auditor General, who is currently examining the Site C project, and learn whether this project is actually fiscally sound. Frankly, to push ahead is simply reckless.

With Site C, it’s easy to see we’re going into a big debt for a project we don’t need, and in doing so we are flooding our energy market with taxpayer dollars that are actually driving investment out of our province. And again, to make ends meet, we increase MSP rates. We increase hydro rates and on and on and on.

Just two weeks ago, the Canadian Wind Energy Association announced that it was closing its office and leaving B.C. because the government and B.C. Hydro are just not interested. Last year we saw the same thing with EDP Renewables — no interest from the government for a roughly $1 billion wind power investment off southern Vancouver Island. That company has walked as well.

Despite the potential in this province, clean energy investment is leaving British Columbia in droves. The B.C. Liberals’ dream — they continue to dream of LNG — has not materialized, but they’re still using billions of taxpayer money to gamble on projects designed to support it. They are pushing risky projects past the point of no return and, in so doing, clean tech investment out of our province.

Let’s take a look at these LNG figures that the Minister of Environment has presented in the budget, figures that were supposed to help fuel a prosperity fund instead of it being fuelled through MSP premium increases and so forth, which this amendment is attempting to address.

I love talking about LNG. I love talking about it, just like I loved talking about the tooth fairy when I was a little child. Those of us outside the government’s self-congratulatory circle of hyperbola know that they had….

Hon. A. Wilkinson: Hyperbole. “Hyperbola” is a mathematical term.

A. Weaver: Hyperbole. Thank you to the Minister for Advanced Education for pointing out that hyperbola is a mathematical term.

Those of us outside of government’s self-congratulatory circle of hyperbole already know that they have no hope of tapping into an LNG market in the short term, no hope whatsoever. No amount of tax cuts, no amount of subsidies to the industry, no amount of praying to the LNG god…. We just know it’s not going to happen. They’ve tried and failed.

This year’s budget shifted the LNG story to a future supply-demand gap slotted to emerge ten years from now. Uh-oh. Never mind the “unforeseen global conditions.” So how are we going to make ends meet? We’re going to tax those who are least able to afford it through increases in MSPs, increases in hydro rates and so forth, which is exactly what this amendment is trying to quantify and recognize.

Now we’re talking about LNG in, say, the mid-2020s, something that I’ve been saying for quite some time. Yet the government’s track record of repeatedly failing to predict the LNG future even months in advance does not instill in me, let alone in British Columbians, with any confidence as to what their projected supply and demand will be like in 2030.

On the demand side, there are challenges as well. While the increasing competitiveness of the renewables, as recently highlighted by economists, it seems unlikely that demand projections, illustrated by the curious unlabelled graph in the 2016 budget document, will be accurate either. Simply making up numbers.

This government is chasing a falling market, in which it was a late player, and throwing good money after bad. Let’s take a look at this prosperity fund in a little more detail. This is a fund that the government promised to implement through vast amounts of moneys coming from LNG revenues. Instead, we see increases to the MSP premium, hydro rates, and so on, in order to fund the prosperity fund on the back of individual taxpayers.

I have always advocated that it’s our responsibility as legislators to not think merely of today’s British Columbians but also those of future generations who will follow us — though in a more responsible, realistic manner than the government’s “LNG for our grandchildren” rhetoric mantra.

Indeed, this is the main reason I chose to run for office in first place. But the fact is that if this government were serious about reducing the debt of this province, they would not grow the debt of this province each year. They would not create a loophole allowing them the ability to not pay down the debt with surplus revenues but, in fact, use taxpayer money for political posturing, which is what the prosperity fund is all about.

It gets worse. My fears were confirmed when I looked into the specifics of the prosperity fund being funded through taxes on those who can least afford it — the subject of the amendment before us. Let’s break it down. We have $100 million going into this prosperity fund this year and, according to this year’s budget, no further investments in our province’s savings account in any subsequent year. That’s hardly prudent fiscal planning. And curious, it’s in a year leading up to the election.

Of that $100 million, this government is putting a full half of it towards debt retirement. Hang on. That’s not $100 million. It’s $50 million in the prosperity fund. But then they actually say that only 25 percent of the $100 million will be saved, while the last 25 percent will go towards “government priorities.” Clearly, MSP premiums are not the government’s priority.

What is the government priority? Probably boutique handouts as we move into the election year in May of next year. In fact, when we tone down the self-congratulatory rhetoric that this government is issuing and tune into the actual numbers, we find that this government’s $100 million prosperity fund is actually a one-time investment of $25 million. This is a blatant misrepresentation of how tax dollars are being spent.

Also, the government tried to mislead the voters of B.C. that their empty promises are not actually empty. They’re doing this to create a potential political play to try to tempt the opposition to vote against prosperity. That’s shameful — nothing more than political posturing in the hope that they can turn around and say that the opposition votes against prosperity.

This opposition votes for prosperity. But prosperity is more than just the bottom line in the so-called prosperity fund. It’s prosperity in social prosperity. It’s environmental prosperity. It’s fiscal prosperity. It’s triple-bottom-line prosperity. For this government, prosperity simply means prosperity for those who happen to give them large donations to ensure that they remain in power. It is not a prosperity for all British Columbians. It is a very limited prosperity.

With that in mind, and in light of the fact that the motion to amend the statement “That the Speaker do now leave the Chair” is before us, I will, at this time, introduce notice to subamend that motion with the idea of adding the following:

I move the following subamendment:

[Be it resolved that the motion “That the Speaker do now leave the Chair” be amended by adding the following:

“That the government recognize the cumulative effect of increases in MSP taxes, hydro rates and ICBC premiums, and other fees and hidden taxes, on British Columbia families,”

And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue neutral manner to create a progressive health care levy.]

Deputy Speaker: So, Member, are you going to speak on the amendment to the amendment?

A. Weaver: Correct.

Deputy Speaker: Okay. Carry on.

On the subamendment.

A. Weaver: On the subamendment, I have but one statement. I am going to quote Tom Fletcher from Black Press, president of the legislative press gallery. The quote is this. “Green leader has it right.”

The Vote

Video of my Speech

am

The truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is — W. Churchill

Today in the legislature I rose to speak to the budget. Every MLA is give 30 minutes to respond to budget. My staff and I’d prepared so much material that I barely got through half of what I had planned to address. But there will be more opportunities in the weeks ahead to outline why I will not support this budget.

Below is the text of my speech. I also append a video further down.

Text of My Speech

A. Weaver: It gives me great pleasure to rise and speak to this debate, particularly after the member for Comox Valley, who classified the world and this House as one of two sides: the world of optimism on that side and arguably, in his mind, the world of pessimism on this.

I’d like to quote Winston Churchill:

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”

I am an optimist. I understand what it means to be an optimist, but unfortunately, I don’t think Winston Churchill was thinking of this government when he came up with that quote.

In fact, there is another quote attributed to Winston Churchill more applicable to the statements that emanated from the opposite side, and the quote is this:

“The truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is.”

What you are going to hear from this side of the House is a truthful assessment of the Budget 2016, not one filled with rhetoric, not one filled with promises, not one filled with half truth, but one that looks at it carefully and points out what is good and what is not good without the hyperbolic, hysterical rhetoric, so common, emanating from those on the other side.

I rise in this debate puzzled by the direction this government is heading. Frankly, it has become clear to me that this government is really out of new ideas — completely out of new ideas, lost, lost their way, given that LNG is not playing out the way they thought it would be.

The budget speech we heard on Tuesday was high on self-praise but represents little in terms of fundamental change. We continue to chase markets we are not part of with LNG while bringing forward no clear plan to build on our strengths let alone the challenges we face.

While it was encouraging that this government incorporated some policy changes that British Columbians have been advocating for, for the most part, they represented halfway measures that do little to attack the underlying issues that are presenting challenges for so many British Columbians.

First let me discuss the issue of housing. To make good policy, you need good data. I was encouraged to read the government has adopted additional tools that will allow them to gather much-needed contextual information about the housing market.

The new requirement for property purchasers to identify their nationality is a step forward that I’ve been urging this government to take for two years.

Frankly, I wonder how they’re going to do it without actually bringing the private member’s bill, which is precisely the same as what is being proposed by government. I look forward to debating the private member’s bill that’s before the House as we speak.

I’m glad that government listened on this. Likewise, I was also pleased to see that bare trusts will now face more examination, and the government will have the data it needs to address this. Gathering more information about bare trustees is certainly better than ignoring the problem all together. I’d like to stress this: this loophole still remains open — open to exploitation.

To say that we need to gather information from scratch implies we have an entirely different market to that of Ontario. Ontario’s housing market in Toronto is just as hot as that in Vancouver, with speculation running amok. Yet in Ontario, they have a mechanism to track this and actually generate revenue to limit the amount of speculation occurring.

While that may largely be true, for example, that we need to gather information from scratch for efficiency’s sake, I do think we have a promising opportunity to learn from what has happened in Ontario and to act pre-emptively to close this loophole.

For example, Ontario has a similar property transfer tax system in place, but they have plugged the loophole and they did it very simply. All they did was apply the property transfer tax upon change in beneficial ownership, not just change in title registered at the land title office.

The wealthy offshore buyers can flip houses numerous times by simply registering the first purchase as a bare trust owned by a corporation and flip the corporation shares from owner to owner to owner without ever changing land title and without ever paying a penny of property transfer tax.

I know this is being done because I have spoken to developers. I have spoken to mortgage lenders, and I’ve spoken to those who are involved in the real estate industry.

This change could and should be done in British Columbia to ensure everyone is treated fairly. However enlightening information may be in its own right, it’s meaningless without appropriate action. We need to get moving on these issues, and government doesn’t seem to have a plan, like so many other things.

This also seems to be the case with the government’s change to the property transfer tax. Increasing property transfer tax rates to 3 percent on homes over $2 million is another adjustment that I agree with in principle. But with affordability as the top issue on the minds for so many people across the province, making it more expensive to flip luxury homes is a progressive step. There’s no question it’s a progressive step forward.

Unfortunately, this too could be rendered meaningless if the loopholes in our housing markets are ignored. In fact, it may be that the government loses taxes in the short term as more sellers engage in and exploit those loopholes to avoid the increase in taxes.

Furthermore, with the $750,000 property tax break for new homes, the government is incentivizing housing development while doing nothing to dampen speculation — again, failing to close the loopholes affecting the market right now.

Contrary to the minister’s dismissive comment that this is a Point Grey issue, the housing problem is affecting communities across British Columbia and it is greatly impacting our provincial economy. On my street alone, where I live in Gordon Head, a house sold. The sold sign came on when the house was listed. It was sold to foreign buyers. Two months later, the sold sign came on again, as the house was flipped. It was cash transactions in both cases. This is not a problem exclusive to Metro Vancouver. It’s a problem now emerging in the capital regional district and other markets in British Columbia.

The costs we are shouldering in society are not just economic, they’re social. The passionate, determined, young people we need to support our communities and lead them into the future are being priced out by people who can afford to buy houses and leave them empty.

Ever wonder why there’s a traffic jam on the Second Narrows Bridge in Vancouver going north? It should make no sense, because people on the North Shore work, by and large, in Vancouver. The reason is because nobody who’s working in those homes — the electricians, the plumbers, the trades — are able to live in that region, and so they’re commuting from halfway across Vancouver across bridges. And the government’s response — rather than dealing with the problem, the affordability problem — is to start talking about building bigger roads and bigger bridges. Again, not addressing the problem, it’s avoiding the problem being dealt with and kicking the can down the road further.

The role of government is to take direct action and to direct the actions of citizens. We incentivize what we like, and we discourage that which we don’t. We need to close loopholes and disincentivize the preponderance of empty houses, because as it currently stands, the government is failing to do an adequate job of either. There’s a glaring market failure. The preponderance of vacant homes in Vancouver has a social cost attached to it. That externality needs to be internalized so that vacant owners pay the true cost of that vacant home.

The government’s response, rather than recognizing the market failure and internalizing externalities, incentivizes more development and further speculation. This is a government that is completely out of control and completely at a loss or understanding of fundamental market instruments. That does not deal with the imminent problem. It kicks the can down the road further, so to speak. The imminent crisis needs to be dealt with through the implementation of market instruments available to government. Those instruments alone will correct this market failure.

Frankly, the single most effective policy that government could do would be to implement a price, a levy or a tax on homes that are left vacant. This government is building the economy of Scottsdale in British Columbia as we speak. It’s an artificial economy, fuelled by speculation and requiring continued development and building of houses in order to sustain itself.

Government is misleading British Columbians by suggesting that we have a diversified economy. Our economy right now is being driven by wild speculation and offshore money coming into British Columbia to actually buy these homes, and developers building more — selling, flipping, buying, speculating.

There is only one end solution for that infinite growth in a finite system, and that will be a collapse, a collapse of pretty strong proportions that this government will start — as they have done with LNG — to blame on unforeseen global forces. Well, we can see it happening right now, and there’s nothing unforeseen about it. What is unforeseen is any will or any policy emanating from the government to actually address the key issues of today in British Columbia.

Putting up a levy on vacant homes will encourage more owners to lease their vacant homes, which in turn will put downward pressure on rent costs in Vancouver and elsewhere. The revenue generated from this levy could actually be used to pay the social costs arising from non-affordability within Metro Vancouver and emerging here in the capital regional district: the costs of the homeless, the enhanced judicial system process that is required to deal with the increasing homeless problem in our province. The reduction of services for mental health can be addressed. We can start to actually raise the living allowance, which hasn’t changed in I can’t even remember how many years.

One of the saddest moments in this House since I was elected in 2013 happened about 20 minutes ago when the member for Comox Valley stood and truly believed that somehow $11 a month is actually a great step forward, after seeing no increase in fees for years and years and years.

The people of British Columbia deserve better. They deserve a government that’s honest to them, a government that actually does not try to sell itself as something it’s not, a government that recognizes that there is a social problem out there and that $11 a month is not going to solve it. Frankly, the price of cauliflower has gone up $8, say, in about three months. Basically, what we’re saying is that you can almost meet the increase in your grocery bill, but not quite, with this $11 a month. Shameful, truly shameful that this was lauded as a sign of progress.

In summary, the government’s balanced budget increasingly is relying on revenue from an artificial, overinflated housing market. They are benefiting from the issues that are causing so many affordability concerns amongst British Columbians and taking no real concrete steps to address this. The government needs to address this market failure, and the 2016 budget represents another missed opportunity to do so.

Now to MSP. On MSP, the government has brought forward a small, half-step approach to making this fee a little bit more fair for the people of British Columbia. I commend them for taking that one small half-step. It may not be much, but at least we are moving in the right direction. Making children exempt from paying MSP premiums and increasing the assistance available are both positive changes to a fundamentally unfair system.

Despite the changes to MSP premiums announced on Tuesday, we still have a system that doesn’t work, however, for most British Columbians. To use the Premier’s words, as the opposition did so well earlier today in question period, it’s a system that is “antiquated…old, and the way people pay for it generally doesn’t make a whole ton of sense.” Those are the Premier’s words. I agree. The opposition agrees. But somehow the government doesn’t agree with itself. I’m not sure what’s going on.

Hundreds of thousands of people in this province are currently behind in their MSP payments. That’s a ton of bureaucracy, needlessly employed in enforcing an antiquated, old system. That’s what the Premier said. I agree. Bureaucracy — dare I say that’s red tape?

Shame if it is, because of course we know that the government doesn’t like red tape and in fact has gone so far that we now have red-tape-reduction day, making us truly a laughing stock across Canada. Every, single person that I have actually raised this to and mentioned that red-tape-reduction day is now on the same par as Terry Fox Day, Holocaust Memorial Day, Douglas Day, B.C. Day and Family Day looks at me and says: “What?” They couldn’t believe it. This government believes it, but it says whatever it takes to get through lunchtime.

The reality is, the biggest component of red tape in the entire sector of government is the administration of the MSP premium which the Premier, through her own words, says is antiquated, old and doesn’t make a whole lot of sense.

Okay, let’s remove some red tape. No, they create more red tape, more thresholds, more exemptions, etc. Absolutely unbelievable.

Plus, when we delve into the details of this policy change, what we see is actually a tax hike. The people of British Columbia have spoken loud and clear about how they are having trouble with this tax, yet this government has raised the amount of money they take from it — a new $111 million in taxes, a head tax. That’s what it is — a head tax, which, after the premium assistance is accounted for, makes it an increase of $77 million in revenue. That’s $77 million as a head tax, because that’s what it is — a poll tax or a head tax, nothing else.

Who is paying for this new revenue? Well, a couple that earns a combined $45,000 or more a year will see their Medical Services Plan increased by $240 a year. Whoa, hang on. That’s more, a greater MSP premium. I thought it was going down.

Senior couples with a slightly higher income face the same increase. Yet when I was at the Monterey centre, when this issue was first brought to me almost a year and a half ago, the demographic that brought it to me were the seniors who were struggling on fixed income to actually pay it. Here, the government is listening. It’s listening to its corporate funders. It’s not listening to the people of British Columbia, because the group that can least afford it — those on fixed income — are getting a $240-a-year hit. That’s hardly fair. That’s not fair at all.

A couple with two children will pay $72 more a year. These are significant increases in medical premiums. Let’s be clear that a combined income of $45,000 is not that much in Metro Vancouver or greater Victoria.

A single adult who earns less than $42,000 is eligible for premium assistance, but a couple earning $3,000 more is facing an increase of $240 a year. This is yet another example of how this government does not understand simple fundamental market instruments. You incentivize that which you like. You use your market instruments to put a tax or disincentivize that which you don’t.

This introduction of the MSP program is incentivizing divorce in the province of British Columbia. It’s saying to couples: “You should not be couples, because if you get married” — this is families first — “or you become common law, we’re going to charge you $240 a year more.” Does that make sense? No it doesn’t. But that’s what this government is putting forward.

Let’s look at Ontario as a case example in how we could charge MSP differently. In Ontario, health care premiums are paid through personal income tax systems. Rather than a flat-rate levy, this approach avoids the regressive nature of the monthly premium as rates rise with income to a maximum annual level.

For example, as I’ve outlined for a couple of years now, in Ontario, the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums at all.

The argument that we need to keep this tax separate from other taxation methods so that British Columbians know that health care is not free is ridiculous. British Columbians know that health care is not free. They know that building bridges and highways is not free. They know that education is not free. To treat them as if they don’t is disrespectful. It is disrespectful of the people of British Columbia.

They know that their taxes go towards the services that government provides. If the government still insists that British Columbians need to understand how much health care is costing our province, then there is a simple solution — a simple line on the income tax return, like that exists for EI and CPP, called health care premium, which is progressively calculated just like EI and CPP are. It would solve the problem. It would deal with the issue that unions have negotiated benefits because it would still pay for it. It would be done in a progressive instead of a regressive system, just like it was done in Ontario.

In fact, this was the method advocated for in the 2002 Senate report that recommended the federal premium to help pay for health care costs — the health care of Canadians. The federal role made a strong case that premiums constituted a visible and equitable means of supported health care spending, so long as they varied in proportion to income. It’s not me making it up. It’s Senate expert panels that are providing information in forming this policy.

Now let’s turn to new services. Another item in this budget that received considerable attention was the boost to the Ministry of Children and Family Development. Now, without a doubt, I’m encouraged to see that the government seems to finally be paying attention to our most vulnerable — a topic that the official opposition has brought forward time and time and time again during question period.

It seems like they may have done more harm than good, unfortunately. For nine years, there’s been a freeze on the disability rate at $906 a month. At first glance, a $77 increase for disability assistance looks like a step in the right direction. If we take into consideration the loss of transportation subsidies, which in some cases amounts to $66 a month — the numbers were messed up in question period; I am assuming that tomorrow the minister will correct the numbers that she quoted out in question period — this budget represents an increase of only $11 a month — $11 a month — that the member for Comox Valley was so proud to tout to British Columbians in solving the social woes of those most unfortunate with disability in our society.

That’s hardly a success. In fact, with the increases in transportation in some areas going up — just look at the capital regional district, dramatic increases — this is actually a net loss, or will be a net loss, and government exempts itself from having to deal with the increasing costs of transportation. I am sure this was not their intention, but clearly this is not an outcome that will make life all that much better for the most vulnerable in B.C. In some cases, it will down the road make life a little more difficult.

On a more positive note, the $95 million set aside for wildfire protection, the $10 million for search and rescue plus the $55 million set aside for emergency preparedness and prevention initiatives are welcome news. Indeed, they’re among the only budget items I could find, although not attributed to, but that address one of the biggest threats to our province’s economy — climate change.

Let’s look at climate change. We are paying the cost of climate change in this province already. This past year, we saw record temperatures across our province. We saw drought precipitated by a lack of snow pack, and forest fires raged across our province. The January 2016 globally average temperature shattered the previous record by 0.16 degrees and was more than a full degree Celsius above the 20th-century average.

In B.C., we simply stand by and watch happen and go to Paris and say: “Look, we are leaders.” Others call you leaders; you don’t call yourself leaders. In British Columbia, we are not leaders on the mitigation of climate change. We were leaders, but that is long past.

I brought forward a motion, for example, to discuss a matter of urgent public importance last summer. At issue was whether we as legislators were acting with sufficient urgency and demonstrating the appropriate leadership on preparing for and mitigating the escalating impacts of climate change in our province. Unfortunately, my motion went nowhere.

Directing the actions of society through the fiscal instruments available to government is one of the most powerful tools we have. But here in 2016, we have a budget that barely mentions the biggest problem we face as a global society. We heard from the minister that “Budget 2016 continues to build on B.C.’s leadership in clean technology and climate action. Climate change is a global issue, and the Premier has made it clear that B.C. will remain a climate action leader. And we have been able to move forward with that leadership on climate change while also growing our economy” was another quote.

Yet in the budget itself, there is scant mention of climate change. And the funding put aside doesn’t so much build on B.C.’s leadership in clean tech, as they said, but only supports one policy: the continuation of their existing electric vehicle program. That’s it. No more. Climate leadership, to this government, means continuation of an electric vehicle incentive. Nothing more. Hardly going to help the majority of our society.

Admittedly, I did benefit from that. I did get an electric vehicle. But there are many who this will not benefit. And I wonder how many in government have actually taken this incentive and got an electric vehicle. Probably a small number. Very small number. I’d guess zero.

Interjections.

A. Weaver: It’s not true? So that’s good. I’d like to have a list of all government MLAs who own an electric vehicle come my way, and I’d be happy to praise them publicly. But we’ll see.

The construction of Site C dam has put the final nail in the coffin of the clean-tech sector in British Columbia. Shocking. The Canadian Wind Energy Association has just left B.C., citing the existence of greener pastures elsewhere. Well, let me tell you. There will be greener pastures here in just a little more than a year, when this government is sitting on this side of the bench and the rest of us are sitting on that side of the bench.

A $1 billion investment on Vancouver Island involving a partnership between EDP Renewables…. This isn’t pipedream stuff. This is real investment, not of taxpayer money but of industrial money, on Vancouver Island through partnership between EDP Renewables. First Nations and TimberWest,. It’s gone. They’ve walked from B.C. because of a lack of leadership by this government. Frankly, that’s reckless economics, in my view. It’s reckless mismanagement of our economic system.

British Columbians are fed up with this rhetoric. World leaders of this. World leaders of that. We’ll all be happy and wealthy and wise, blah, blah, blah. That’s what we’re hearing. But enough is enough. This government is out of ideas.

They’ve misled British Columbians about the prospects of LNG. They look out for their vested interests, and they say whatever it takes to get through lunch, whatever it takes to get to dinner, then whatever it takes to get through a day and on and on. They say whatever it is in the desperate hope that British Columbians are not paying attention. But they are.

The carbon tax remains flat, and leadership on climate change mitigation is largely absent. As I’ve heard nothing about this, I look forward to, hopefully, hearing something in the fall, where the government once more kicks another file down the road.

Government has ignored the agriculture sector until just recently, just like they ignored the tech sector until last August, when four civil servants were tasked to come up with a conference. That’s the government’s idea: “Let’s have a conference on agriculture. That’s leadership.” But we do have a leadership opportunity here in B.C. in the knowledge economy of the 21st century.

I was recently up in Prince George and saw firsthand how the tech industry could actually partner with our resource sector to take our strategic advantage and build our economy. Why is this government not investing $6 million to provide broadband redundancy to Prince George to allow Prince George to take advantage of its cooler climate to become a tech hub and bring the resource and tech sectors together, to be the home for data distribution centres like Google wants to be?

Six million dollars would be the biggest economic drive for that region, with the introduction of broadband redundancy, that that region has seen for decades.

Yet this government would rather spend $8 billion on a project for energy that’s not necessary because there’s no LNG and Alberta has said no. That’s their view of economics. What you got? My six million bucks is my view of economic prosperity.

Now let’s talk about the biggest item by far in this budget, an item with an $8.7 billion price tag. That’s kind of there in one line. The Premier recently stated that she wanted to move this project past the point of no return — another irresponsible statement by this Premier. Yet we have no LNG industry, and just today we hear from First Nations in the Peace region that they will soon be in court, as the injunction is coming to play out as B.C. Hydro tries to stop protesters.

I have so much more I could talk about, but I do see we’re on the green light. I could talk about LNG. I would love to talk about the prosperity fund. I have probably another half-hour speech, and I’m looking forward to being able to do that. Probably, I should be making an amendment right now to the budget speech so that I could actually talk about this stuff. But let me just say that what we should be doing in British Columbia is building on our strengths. We should be demonstrating leadership….

Some Hon. Members: More. More.

A. Weaver: If you would like more, members opposite….

Hon. Speaker, with your permission, I’ll speak for another half-hour. Would that be possible? Maybe I’ll give away too many ideas.

Finally, starting to take action, real action on the issues of affordability, directing our economy for the future prosperity rather than political talking points and making B.C. a leader on the issues of our time is what I had hoped this budget might do. Unfortunately, in my view, while there’s a lot of popular language in this, it’s found wanting on many, many points. Probably, the most cynical aspect of this budget is the prosperity fund, the $100 million prosperity fund, which, when you peel it down, is actually only a $25 million fund. And it’s a $25 million fund of taxpayer money.

Video of My Speech

A Litany of Broken Promises – My Response to the Throne Speech

This afternoon in the legislature I delivered my response to the Speech from the Throne. I hope you’ll find it of interest to read the text (or watch the video) of my speech where I look at unfulfilled promise after unfulfilled promise that this government has made over the last three years.

Text of My Speech

A. Weaver: I rise to take my place in a debate that I suspect, honestly, will be going on for next year and a half — a debate that is about the direction the province is going; a debate about what the future could look like for British Columbia; a debate that I’m eager to participate in.

But this throne speech did not give us the ability to debate because there were virtually no ideas. Gone is the over-the-top rhetoric about LNG that has so defined this government’s approach. Replacing it, however, is a familiar drum beat that I remember hearing in 2012 before the last election. The world is a scary place. Only this government has prevented complete collapse.

And yet, to make such a claim would defy logic, given this government’s record over the last four years. I remember sitting here bright eyed in 2013, having just been elected, and listening to a throne speech that stated the government would “bring the liquefied natural gas opportunity home, creating tens of thousands of new jobs and leading to the establishment of the B.C. prosperity fund, which will be protected by law to eliminate our debt.”

Three years later, this is clearly an empty promise, an unfulfilled vision that was never based in reality, a history that this government is quick to forget. British Columbians are hardly going to feel assured that this government has a concrete plan, given the direction indicated by the Speech from the Throne.

The undercurrent of their retreat away from their highly rhetorical promises of 2013 is the idea that there was no way the government could possibly have known that LNG would be delayed. “Unforeseen global conditions are posing new challenges,” Tuesday’s speech read.

But these challenges, I would argue, were largely foreseeable, of course. For the past few years, experts from a variety of fields have been outlining just how unlikely it would be for this industry to come to British Columbia as promised.

Since 2012, I’ve been saying that this was nothing but a pipe dream. Since 2012, nothing has happened in this industry, because the world is oversupplied in natural gas. China now has excess gas. It is a seller on the international marketplace. And the price of future contracts would mean that, in British Columbia, we would literally have to pay people to take our natural gas.

Finally, Iran, the world’s largest reserve of natural gas — almost 20 times that of all Canada combined — has recently had sanctions lifted.

Is there anyone out there who still believes anything this government has to say when it talks about LNG? I think it’s important for us to look at just how much was promised in order to understand why the government’s refrain that “success is not for quitters” is not simply, yet again, empty rhetoric. But not only that. It’s a dangerous approach to the management of public resources.

In 2011, the Premier said that she planned to take an “aggressive approach to the development of the natural gas sector,” and she was confident that British Columbia could “create a prosperous LNG industry that would bring local jobs to our communities and deliver important dollars into our economy.”

Her office predicted that the Kitimat liquefied natural gas plant would be “operational by 2015.” Nothing much happening in Kitimat in the area of LNG.

Interjections.

A. Weaver: And, yes, I have been to Kitimat, and I have toured the Rio Tinto Alcan plan, and there is a lot going on there, certainly.

But, in fact, there is no LNG development going on in Kitimat. In fact, the pipeline that was being processed there has simply had construction stop, and yet again and again, final investment decisions are kicked down…. The can is kicked down the road for years to come.

The NDP, citing jobs for under-employment, communities and a “better market in Asia,” were quick to support the development of an LNG industry, initially. I will say, of course, that they have seen the light, and they too recognize the empty promises, that this government let British Columbians down.

I suspect, frankly, that “if we have a facility in Kitimat and markets in Asia, then the activity in the northeast is going to continue to be hot rather than flat,” said the Leader of the Opposition in 2011. “The risk to our coastline from LNG is insignificant. The benefit to British Columbians is quite significant,” he added a few days later

The B.C. Liberals continue pushing their LNG — and until recently, supported by the NDP. In 2012, for example, the NDP said they were comfortable with fracking and supported increasing B.C.’s greenhouse gases in the name of reducing those in Asia. “We have been fracking in British Columbia for a long, long time, decades in fact.”

In fact, that’s true. Vertical fracking has been going on in British Columbia for many decades but not horizontal fracking. Horizontal drilling is a relatively new construct both in British Columbia and the rest of the world, which is one of the reasons that there is no market for B.C. gas, because everyone in the world is using horizontal fracking now — not just British Columbia.

In 2013, the Premier’s “aggressive approach” morphed into her entire re-election strategy, one based solely on the LNG industry. Massive promises were made to British Columbians: a debt-free B.C. by the end of 2020s, a $100 billion prosperity fund, 100,000 jobs, elimination of the provincial sales tax, $4.3 billion in extra government revenue by 2020, $1 trillion in the new economic activity. The list went on and on. To quote again…. “This opportunity is very real for all the people of our province,” she said.

In 2014, this chamber once again heard that “LNG was a once in a lifetime opportunity to create 100,000 new jobs and a prosperity fund to eliminate the provincial debt.” Despite all scientific evidence to the contrary, we heard that this LNG fiction was the “greatest single step to fight climate change.” That’s almost a laughable quote.

As a climate scientist, I couldn’t believe what I was hearing, and I spoke against the idea. Climate leadership aside, which this government is so sorely lacking, it was clear that the economics simply weren’t there to support an LNG industry on the scale of what was promised, and a number of energy analysts were voicing similar concerns. Nonetheless, onwards we go.

The Premier told us that her “plan to foster a competitive LNG industry was showing results.” She was so confident in her vision that by April 30 of 2014, she stated that her government was meeting with key investors to “take the last crucial steps towards final decisions.”

By the end of the year, her plan was, by any account, looking a little iffy. The deal with Petronas wasn’t going so well, despite the Premier’s assurance that they were “absolutely on schedule” and that they were “going to get there on the timeline that they had set.”

The 7 percent tax that was originally proposed had been cut in half. The imminent deals that were just around the corner were dwindling in number. I stated in this House that this was an industry of “high stakes promises and low stakes delivery.” I asked the government repeatedly about their backup plan, if the predicted LNG windfall did not materialize.

The response from the hon. Minister of Natural Gas was that they “know they will be successful on this file.” No backup plan. Not necessary. None.

Hon. T. Lake: Four balanced budgets. That’s a pretty good backup plan.

A. Weaver: And the balanced budgets are being done, as the Minister of Health is pointing out, on the backs of individual British Columbians through things like speculation in the real estate industry and medical service premium increases, which…. As we saw today, 65,712 British Columbians from around the province signed a petition saying: “Stop this.”

The government will listen or not listen, at their peril, because these 65, 712 voters will be there in 2017 to send this government a message, bringing ten or 12 folk along with each and every one of them.

Come 2015, the government was still touting the LNG promises, albeit those promises had diminished significantly. The price of oil had fallen to the floor, while the government looked the other way and continued to insist that LNG was a “generational opportunity.”

By this point, however, the government had gone quiet on the big-ticket promises, and our Premier’s timeline had changed. Having an LNG plant operational by 2015 clearly wasn’t happening. But she insisted now that they were on target to have “three projects by 2020 up and running.” That’s a bit like kicking the can down past the next election — desperate, absolutely desperate, to try to get one — not two, but one —final investment decision.

This government had a rare, unusual summer session for the sole purpose of legislating an agreement that ultimately amounted to a sellout of our resource — a desperate attempt to land an industry one final investment deal. That deal was and remains environmentally reckless, fiscally foolhardy and socially irresponsible.

It is undoing all of our climate leadership, as recently emphasized by a Canadian report on the environmental assessment in the area. Admitting what we already knew by the end of 2015, the Premier said: “Timelines were probably going to be different” than what she promised.

Running parallel to the government’s over-the-top statements on LNG was a continued advancement of the Site C dam. The massive undertaking is perhaps the clearest example of how irresponsible this government is with public resources. The whole reason for building Site C, as the Premier stated in 2013, was because it was needed “for powering up these huge LNG facilities.” Whoops. What LNG facilities?

This project was originally priced at $6.6 billion in 2010, $7.9 billion in 2011, and as of 2014, the estimate was set at $8.8 billion. I’m willing to stake a large bet today that it’ll come in around $13 billion when all is said and done, and this will be an example of public subsidy for an industry that is not going to come to B.C. anytime soon — all to power these LNG facilities that we’re not going to have, with none appearing to be close.

Now, we have with this apparent excess energy, whose production has crippled the clean energy sector in British Columbia, we hear that Site C may help to power Alberta. Well, there’s a new idea, and we’ll put more public money subsidizing a transmission line to allow us to do so. To me, this sounds like a desperate attempt to salvage a bad idea that anybody outside of government’s inner circles would have realized was not timely and not cost-effective and irresponsible. A bad idea that happened to support another bad idea.

Here is the critical point. We have not seen one single investment decision in five years of political rhetoric about how promising the LNG sector is for our province — not a single investment decision to help fund all those big election promises, not a single investment decision, period.

I want to return to this line we heard on Tuesday — “that success is not for quitters.” That success demands “steadfast attention.” I would suggest that success is knowing when to stop throwing good money after bad ideas and having the courage to admit that you were wrong — that is, after all, what a fiscally responsible government would do. That is what a fiscally responsible Green government would do.

Anybody who has ever been in the stock market knows, you don’t double down chasing a stock. Just ask anybody who invested in Nortel back in the day when it went from over $100 to pennies and change.

Despite the clear lack of progress in developing an LNG record, the Minister of Natural Gas stated last month that those who question this abysmal track record are “pessimists, short-sighted, reluctant to admit that LNG is making progress and securing long-term prosperity for all of us.”

Indeed, rather than switching tracks, they are switching to being derogatory and defensive of their failed strategy, while superficially referencing a diversified economy they have done little, if anything, to support. The Premier herself said the world is being divided in two: the people that will “say no to everything” and the people who would “want to find a way to get to yes.” I’m not sure what science the forces of no bring together up there, except that it’s not really about the science, it’s not really about the fish, it’s just about trying to say no. It’s about fear of change. It’s about fear of the future. It’s about derogatory statements like this Premier is making — a complete and utter lack of understanding of the fundamental issues facing British Columbians that she would have the gall to say that.

Is there any reason why voter turnout in recent by-elections was only 20 percent? The people of British Columbia are fed up with this political rhetoric. They will vote for change in the future, but they will vote for change like the federal government voted for change, like the American Republicans and Democrats are voting for change in their leadership, they will vote for change to get this government out of power. It has been in far too long. It’s sending the signals to British Columbians that they do not want to hear.