Affordability

BC’s Seniors Advocate Town Hall in Oak Bay March 9

British Columbia’s Seniors Advocate Isobel MacKenzie is hosting a senior’s public town hall meeting in Oak Bay on March 9, 2015 from 1:00pm to 3:00pm. The purpose of the event is to engage seniors in a conversation about improving the lives of BC seniors. The Seniors Advocate wants to hear from seniors and their families who live in the Oak Bay, Saanich, Esquimalt and Greater Victoria areas about what is working and not working for seniors in our communities.

The event will be co-hosted by the Oak Bay Seniors Activity Association and it will be held in the Garry Oak Room at Monterey Centre, located at 1442 Monterey Avenue in Oak Bay.

The Office of the Seniors Advocate lists upcoming events on their website and their office can also be contacted by phoning Toll-free 1-877-952-3181 (or 250-952-3181 in Victoria) if you have questions or comments.

Further details are available in the town hall event poster.

Using the 2014-15 Budget Surplus in a Housing First Strategy

Today in the legislature I was up during Question Period. I took the opportunity to question government on their strategy for affordable housing. The Minister of Finance recently announced that there’s more than a $444 million surplus in this past year’s budget. I attempted to provide a compelling case to government that the costs of inaction are greater than the costs of action. In particular I pointed out that using the one-time budget surplus to make capital investments in housing would reduce ongoing operating commitments in health, social and justice systems.

While the Minister’s response to my initial question was certainly not what I was hoping for, I was very pleased with his response to my supplemental question. Below is the transcript of our exchange:

QUESTION

Victoria’s Coalition to End Homelessness estimates that it costs about $25,500 a year to maintain a shelter bed in the capital regional district. On the other hand, the cost to run new supportive housing is only about $16,700 per unit per year. The cost of providing additional rental supplements, including support, is even lower, at $6,800 per unit annually.

The evidence is clear. Since Utah launched its homelessness reduction strategy, a strategy that involved — you guessed it — giving homes to the homeless, they’ve reduced chronic homelessness by 72 percent, and they’ve saved an average of $8,000 per person in health, social and justice system costs.

The same is true elsewhere. For example, the Canadian Observatory on Homelessness calculated that for each dollar spent on housing and supports for the chronically homeless, about $2 in savings is found in health, social and justice services.

The Minister of Finance recently announced that there’s more than a $444 million surplus in this past year’s budget.

My question to the Minister Responsible for Housing is this. Will the government commit to using the one-time budget surplus to make capital investments in housing in order to reduce ongoing operating commitments in health, social and justice systems?

RESPONSE

Hon. R. Coleman: Thanks to the member opposite for the question. I’m always happy to get up and actually talk about housing in this House, which is seldom, because we don’t usually ask these questions. The fact of the matter is that in British Columbia we are home to the most successful housing strategy in Canadian history, right here in British Columbia.

In the last five years alone over 6,000 people that were formerly homeless in this province are no longer homeless because of the outreach workers, the money that’s been invested, and the people being connected to housing and supports by our people across the province.

We’ve purchased over 50 buildings across the province of B.C. and renovated for housing and have also spent over half a billion dollars, just in the last couple of years, in building additional housing supports for people. In addition to that we also, today, in total, have 100,000 households in British Columbia that receive some form of support in their housing in British Columbia.

There are, today, 27,000-plus families in households receiving rent assistance where they live, in communities across British Columbia. The budget for housing has tripled in the last number of years simply because of the commitment of this government to the success of dealing with homelessness, mental health and addiction.

SUPPLEMENTARY QUESTION

I recognize that this is not answer period, but my question was not about what the government has done. My question is about what the government will do in the future.

The reality is that recent analysis showed the least affordable cities in the world were Hong Kong and Vancouver. In fact, in the top five in Canada, four of them were in B.C.: Victoria, Kelowna, Fraser Valley, Vancouver. They’re all in the top five. Toronto is the only one that wasn’t from BC.

The reality is that if you’re living on income assistance, you are getting a total of $375 as your housing allowance, whereas the average person on income assistance is paying $501 in Victoria. If a landlord were to actually follow the rental tenancy office allowable rents, rents could have increased 30 percent since 2007, the time that this rental income assistance has remained fixed from.

The evidence is very clear. The costs of inaction are simply greater than the costs of action.

I reiterate my question. When will the government commit to (a) increasing that shelter allowance and dealing with British Columbia’s homelessness problem, and (b) providing more affordable housing to actually deal with this problem, which is a tax on our social, health and other justice systems?

RESPONSE

Hon. R. Coleman: To the member opposite, the B.C. Housing budget for capital is actually pretty good for the next number of fiscal years. It has continuously been put in the three-year fiscal plan as we sit down and work with communities like Victoria, identify sites like we have in Victoria for three buildings that we’ve recently done and other buildings we’ve bought and renovated, partnerships that we do with the non-profit sector in order to be able to connect that sector in to being there for the people whose housing they’re going to operate.

I’m happy actually…. To the member opposite, if you want to come and have a visit, we can actually explore some of your ideas. One thing I do know, when we wrote the housing strategy in 2005 — which is, by the way, again the most successful one in this country — we opened it up to being open to ideas.

The whole idea around it was that if we actually saw something in Portland or Utah or somewhere else and we thought it could work here in British Columbia, we were not disinclined at all, in our minds, to steal a good idea that might help the citizens of this province. That’s why the housing ministry, B.C. Housing, has such a dynamic mandate, in order to go out and look for their solutions on behalf of B.C. citizens.

Nothing about us without us: Highlights from our town hall

“If we sit down and talk about the problem together, maybe we can come up with some solutions” – Bernice Kamano, Greater Victoria Coalition to End Homelessness Speakers Bureau

Sometimes the most important conversations are the most difficult to have. However, those conversations become much easier when they occur in an open, compassionate and inclusive environment. And that is exactly the type of environment I had the honour of being a part of last night for my Town Hall event — Poverty and Homelessness: The Difficult Conversation.

Before I delve into what was shared and what we learned last night, I’d like to once again offer my sincere thanks to Reverend Al Tysick for the time and work he put in to ensure that his family could make it to our event. I’d also like to express my deep gratitude to Reverend Al’s family and friends for sharing their profoundly moving personal stories with us. To our four wonderful panelists, I thank you on behalf of everyone in the audience for taking the time out of your busy schedules to offer us your valuable insight into the issue of poverty and homelessness. And special thanks to Cairine Green for graciously volunteering to moderate the evening. I am also blessed to be supported by truly incredible constituency and legislature staff and volunteers. Without their assistance, our town hall would simply never have happened.

Before I delve into what was shared and what we learned last night, I’d like to once again offer my sincere thanks to Reverend Al Tysick for the time and work he put in to ensure that his family could make it to our event. I’d also like to express my deep gratitude to Reverend Al’s family and friends for sharing their profoundly moving personal stories with us. To our four wonderful panelists, I thank you on behalf of everyone in the audience for taking the time out of your busy schedules to offer us your valuable insight into the issue of poverty and homelessness. And special thanks to Cairine Green for graciously volunteering to moderate the evening. I am also blessed to be supported by truly incredible constituency and legislature staff and volunteers. Without their assistance, our town hall would simply never have happened.

“We don’t need to come up with new solutions, they are already there. We need to get politicians and policy to enact the solutions.” – Bruce Wallace, assistant professor in the School of Social Work at the University of Victoria

While the discussions last night may not have provided any new, groundbreaking solutions to bring an immediate end to homelessness and poverty in Greater Victoria, they did highlight the best practice solutions that already exist and what needs to be done to put them into practice.

Some of the key issues that were discussed by our panelists included:

1) systemic failures, such as lack of government strategies for ending homelessness (both nationally and provincially) and people falling through the cracks when accessing services that are in place;

2) structural issues, including low incomes, high rents and lack of affordable and supportive housing;

3) personal circumstances, such as mental health, unemployment and family situations.

Research has found that best practice solutions to these issues include:

1) Housing First policies – like those implemented in Medicine Hat and Utah;

2) provincial poverty reduction plans – as has been proposed by the BC Poverty Reduction Coalition;

3) increasing minimum wage – which is more than $8/hour below living wage in our region;

4) increasing income assistance – which hasn’t changed in almost 10 years despite inflation and higher living costs.

“Solutions are based on philosophies that don’t resonate with aboriginal people” – Bernice Kamano

Another important issue that was highlighted last night and that too often gets overlooked when discussing poverty and homelessness is the disproportionate number of aboriginal people living on the street. In Vancouver, at least 30% of the street population identify themselves as aboriginal. Meanwhile aboriginal people make up only 2% of the city’s entire population. Given these deplorable statistics, there is a clear need for services and solutions that address the unique needs and challenges faced by aboriginal people. But creating these solutions can only be done by giving the aboriginal community a voice when planning and making decision to eradicate homelessness.

Another important issue that was highlighted last night and that too often gets overlooked when discussing poverty and homelessness is the disproportionate number of aboriginal people living on the street. In Vancouver, at least 30% of the street population identify themselves as aboriginal. Meanwhile aboriginal people make up only 2% of the city’s entire population. Given these deplorable statistics, there is a clear need for services and solutions that address the unique needs and challenges faced by aboriginal people. But creating these solutions can only be done by giving the aboriginal community a voice when planning and making decision to eradicate homelessness.

To address this need, Bernice Kamano and Andrew Wynn-Williams, Executive Director for the Greater Victoria Coalition to End Homelessness, shared with us the Coalitions current efforts to create an Aboriginal Coalition to End Homelessness. This new coalition would bring together both elected and hereditary chiefs and other members of the aboriginal community to examine the key issues behind and the solutions to the high rates of poverty and homelessness amongst aboriginal communities.

To address this need, Bernice Kamano and Andrew Wynn-Williams, Executive Director for the Greater Victoria Coalition to End Homelessness, shared with us the Coalitions current efforts to create an Aboriginal Coalition to End Homelessness. This new coalition would bring together both elected and hereditary chiefs and other members of the aboriginal community to examine the key issues behind and the solutions to the high rates of poverty and homelessness amongst aboriginal communities.

“I am a messenger for things I have learned from people, including many in the audience tonight” – Charlayne Thornton-Joe, Victoria City Council

While the presentations by the panelists proved thoughtful and informative, the true highlight of the evening was the open discussion that ensued afterwards. It is not often that you find yourself in an at-capacity lecture hall, discussing issues surrounding poverty and homelessness with those who are currently homeless, those working on the front lines to end homelessness, elected officials and other members of the community.

While the presentations by the panelists proved thoughtful and informative, the true highlight of the evening was the open discussion that ensued afterwards. It is not often that you find yourself in an at-capacity lecture hall, discussing issues surrounding poverty and homelessness with those who are currently homeless, those working on the front lines to end homelessness, elected officials and other members of the community.

In an open-minded, inclusive and caring environment people were able to express their frustrations, share their stories and better understand what it means to live in poverty. Questions and comments were diverse and included inquiries about Guaranteed Livable Income policies, the need for affordable housing, the reliance on a charity model and use of emergency shelters as housing, and the costs to society of inaction versus action.

The solutions to these problems are not ones that any one person can provide. They require long-term planning, commitment and collaboration from non-profit organizations and all levels of government. However, that does not mean there is nothing that you as an individual can do to make a difference. One of the last questions that was asked may prove most meaningful to many of you: “What can average, everyday people do when faced with homelessness on the street?”

The solutions to these problems are not ones that any one person can provide. They require long-term planning, commitment and collaboration from non-profit organizations and all levels of government. However, that does not mean there is nothing that you as an individual can do to make a difference. One of the last questions that was asked may prove most meaningful to many of you: “What can average, everyday people do when faced with homelessness on the street?”

For the answer to this question our panelists directed us to the people in the audience that could respond to this question best — Reverend Al’s family. Their answer was simple and unanimous: be compassionate. Smile, say hello, have a conversation. Don’t act like they’re invisible. Treat them like you would anyone else you pass on the street, because we’re all just people and we all need to know that someone cares.

I made a commitment yesterday — a commitment to continue raising awareness and offering solutions to systemic issues of poverty and homelessness over the weeks and months ahead. And I promised that at our next town hall, we will come to you Reverend Al and family.

I made a commitment yesterday — a commitment to continue raising awareness and offering solutions to systemic issues of poverty and homelessness over the weeks and months ahead. And I promised that at our next town hall, we will come to you Reverend Al and family.

Photos Credit: Britt Swoveland

New Ways of Funding BC’s Health Care System

“There is a difference between equity and equality and treating everyone exactly the same may not always be fair” – Dr. Livio Di Matteo

Over the past couple months, I have emphasized the need for government leadership and increased government funding if we are to truly tackle poverty and homelessness in our province. Over the course of the next few articles I will begin to outline what government leadership might look like and identify where that funding could come from. In this first post, I focus on health care funding and the Medical Services Plan premium that unfairly burdens low and fixed income British Columbians as well as small business owners with an overly heavy tax burden. In addition, I provide details concerning British Columbia’s under representation in the federal funding allocation for provincial Health Care via the Canada Health Transfer (CHT). As I will demonstrate, British Columbia is receiving $153 million less that it should through this program.

Regressive versus Progressive taxation.

The various forms of taxation available to government generally fall into two broad categories: 1) Progressive taxes; 2) Regressive taxes.

Progressive taxes, such as income or corporate tax, are based on the premise that those who can afford to pay more, should pay more. That is, higher income earners would pay larger taxes than lower earners. This premise forms the foundation of our income tax systems right across the country.

However, in recent years, there has been a general tendency towards reducing various forms of progressive taxation and replacing the lost revenue through increases in a variety of regressive taxes. Regressive taxes, such as the Provincial Sales Tax, are taxes that do not reflect one’s ability to pay. In other words, everyone pays the same, regardless of how much your earn. Perhaps the most obvious example of this is British Columbia’s Medical Services Plan (MSP) premiums.

What is the Medical Services Plan (MSP)?

As noted on the Ministry of Health website “The Medical Services Plan (MSP) insures medically-required services provided by physicians and supplementary health care practitioners, laboratory services and diagnostic procedures.” The MSP requires anyone living in BC for six months or longer to pay monthly premiums for health care coverage. While some individuals can apply for premium assistance, these subsidies dry out as soon as a person earns a net annual income of $30,000 or more. Those who earn more than $30,000 must currently pay a monthly flat fee of $72. This means that an individual who earns $30,000 per year pays the same MSP premium as an individual who earns $3,000,000 per year. And so, it is evident that MSP premiums are perhaps the most regressive form of taxation in BC.

MSP Premiums become even more regressive when you factor in who actually pays them. The fact is, many large employers pay all or part of an employee’s MSP premium as part of a negotiated taxable benefit of employment. But for many, if not most, low and fixed income British Columbians, as well as small business owners, they must pay the costs themselves.

In 2000, the MSP premium for a single individual was $36 per month. Today, that same individual pays twice as much (the same amount that a family of three or more paid 15 years ago). At the same time, personal and corporate income taxes have experienced significant cuts, the consequences of which I will explore further in future posts. The resulting major shifts in taxation have led to the provincial government now bringing in almost as much revenue from MSP premiums as it does from corporate income taxes. In the 2014/15 British Columbia budget, revenue from MSP premiums was expected to be 2.271 billion dollars whereas corporate tax revenue was estimated to be 2.348 billion dollars.

While one can make the argument that reducing MSP premiums allows for lower rates of other taxes, these benefits are often only felt by the wealthiest of the population. In fact, “when all personal taxes are considered (income, sales, property, carbon, and MSP premiums), the higher your income, the lower your total provincial tax rate”. So, while most BC households paid around the same total tax rate back in 2000, with those in the top income bracket paying slightly more, under the current system the wealthiest 20% of households now pay a lower total tax rate than the rest of the population.

Not only do these tax cuts not benefit the majority of British Columbians, but we also must then pay for these cuts in the form of reduced social services. Over an 11-year period, from 2000 to 2011, BC’s tax revenues fell by 1.6% relative to the size of the provincial economy (GDP) resulting in a revenue deficit of about $3.5 billion.

Why do we pay MSP Premiums?

Some may wonder why we have to pay provincial MSP premiums in the first place. After all, we are the only province in Canada to require them. The rest of Canada have moved away from monthly premium charges and instead use general tax revenues, primarily provincial income taxes that are based on taxpayers’ ability to pay, to acquire the funds needed to pay for Medicare services. In fact, after the Alberta government announced its plans to eliminate their premium charges for Medical Services Plan Coverage in 2008, BC was left as the only province to continue to charge these individual flat-rate premiums.

The answer is simple. It’s a choice that successive British Columbia governments have made. It’s a choice to favour regressive over progressive taxation. It’s a choice that puts the interests of the wealthy over the interests of low and fixed income British Columbians as well as small business owners. And the choice is made, in part, to maintain the illusion of low taxes.

The Canada Health Act and Canada Health Transfer

The federal Canada Health Act sets the standards for all provinces and requires coverage for all necessary care provided in hospitals and by physicians. But health care is ultimately the responsibility of the province.

General revenues from the Federal Government provide funding for health care to the provinces and territories through the Canada Health Transfer (CHT). Up until this past year, the CHT consisted of two components: a cash transfer and a tax transfer. Though CHT is allocated on a per capita basis, the cash transfer was not. Instead, the CHT cash transfer would take into account the value of provincial and territorial tax points and the fact that provinces do not have equal economies and, therefore, have unequal capacity to raise tax revenues. This meant that provinces with the highest revenue raising ability received lower per capita CHT cash payments than other provinces.

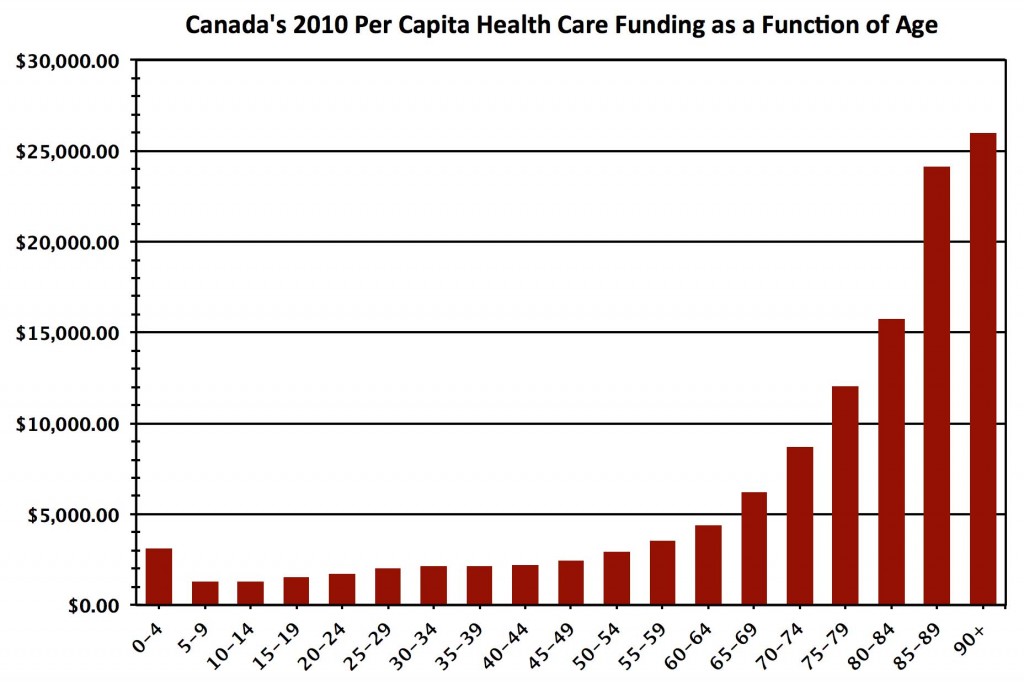

However, since January 2014, CHT allocations are now determined solely on an equal per capita cash basis. While this new system means that all provinces will receive equal transfer payments based on population size, I believe that this is not the most equitable way to proceed, particularly in light of provincial age demographics and associated health care costs. Take for example BC, a province many view as a popular retirement destination. It is common practice for individuals who have lived and worked – and therefore paid taxes – elsewhere, to move to BC later in life. However, with national trends showing that seniors’ health care costs more than that of any other age group, this can put a significant strain on our provincial health care system — one that cannot afford to go unaccounted for (see Figure 1).

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Let’s unpack this further. In the 2014-15 budget year, the Federal Government Canada Health Transfer amounted to 32.1 billion dollars distributed across all provinces. In 2014 Canada’s population was estimated to be 35,540,400, and British Columbia’s population was estimated to be 4,631,300. Alberta has a similar population to that of British Columbia (see Table below).

| Province | Population | Ages 0-14 | Ages 15-64 | Ages 65+ |

| Alberta | 4,121,700 | 18.3% | 70.4% | 11.3% |

| BC | 4,631,300 | 14.6% | 68.4% | 17.0% |

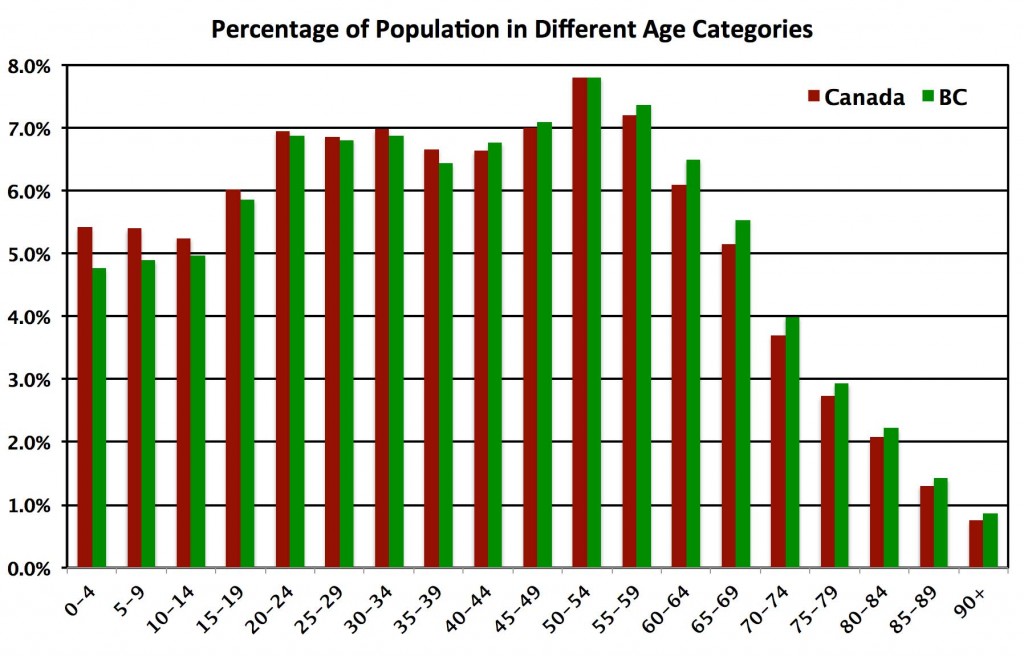

As clearly evident in Figure 2, British Columbia had a smaller percentage of its population in every age group under the age of forty than the Canadian average. The opposite is true for those over the age of forty. Compared to Alberta, British Columbia is home to nearly 70% more seniors. A quick glance back at Figure 1 immediately highlights the glaring inequity in the fixed CHT dollar per person transfer formula. British Columbia has a higher proportion of seniors than the rest of Canada and it is this age demographic that requires more health services. The funding should reflect the actual cost of service delivery.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

It’s a relatively straightforward calculation to weight the CHT transfer to each province by its age demographic and associated health care delivery cost. Rather than receiving 13.0% ($4.183 billion) of the total CHT funding (reflecting 13.0% of Canada’s population residing in British Columbia), we should receive 13.5%. While this may not seem like a lot, it translates into 153 million dollars that British Columbia must find from other sources.

Nevertheless, no matter the method that CHT payments are allocated, these federal transfers only cover a portion of BC’s annual healthcare expenditures. The remaining expenses are financed out of general revenues raised by tax and non-tax sources, with MSP premiums presently contributing over $2 billion per year.

Alternatives to MSP Premiums

While here in BC we do not have the fiscal resources to stop charging MSP premiums without replacing the revenues, there are alternative, and more progressive, options we could be exploring. We need look no further than provinces like Ontario and Quebec, where health premiums are paid through personal income tax systems, rather than flat-rate levies. This approach avoids the regressive effects of monthly premiums, as rates rise with income to a maximum annual level. For example, in Ontario the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums, and in Quebec the maximum annual contribution is $1,000 for taxable incomes over $150,000. At the same time the British Columbia government should lobby for its fair share of CHT revenue — a share that reflects our demographics and the actual cost of delivering health services.

It is time for BC to replace MSP premiums with a more progressive and equitable approach to financing our health care system. Whether this means following in the steps of Ontario and Quebec with an income tax-based approach, or simply raising other taxes, such as corporate tax rates, as the Canadian Centre for Policy Alternatives (CCPA) found after conducting extensive research on what British Columbians think about taxes:

“[British Columbians] know more revenues are required if we are going to tackle the major challenges we face, like growing inequality and persistent poverty, climate change, and the affordability crisis squeezing so many families. And we know higher revenues are needed to sustain and enhance the public services…In short, [we] are ready for a thoughtful, democratic conversation about how we raise needed revenues and ensure everyone pays a fair share.”

Regulation of the Debt Settlement Industry

On January 5th I sent a letter to Minister Anton seeking clarification as to whether or not legislation was going to be introduced to regulate the debt settlement industry. Similar legislation exists in other provinces (e.g. Ontario and Nova Scotia as well as in a number of US States). Below is the text of the letter. I have yet to receive a reply.

January 5th, 2015

Hon. Suzanne Anton

Minister of Justice

Room 232, Parliament Buildings

Victoria, B.C.

V8V 1X4

Dear Minister Anton:

I am writing you with regards to forthcoming legislation that would regulate the debt settlement industry.

In July of 2012, CTV news reported that the Ministry of Justice said that “In order to better protect consumers and families living in poverty, the B.C. government will provide legislative changes to regulate businesses that provide debt consolidation services and regulate advance fees paid.”

Since that time there has been little information from government about when we can expect to see this legislation.

Debt management companies prey upon some of the most vulnerable British Columbians. Rather than providing a solution to an individual’s debt issue, these companies seek to profit off the situation. A number of provinces including Ontario, Alberta and Nova Scotia have passed legislation to end these abusive practices within their jurisdictions. I think it is past time that British Columbia passes our own regulations which offer proper protection to our citizens.

Can the Minster provide me with an update as to what stage this legislation is currently at, and when we can expect it to be brought before the BC legislature?

Thank you for your time on this matter. I hope you had a wonderful holiday break with friends and family.

Sincerely,

Andrew Weaver

MLA Oak Bay-Gordon Head