Affordability

Bill 23: Land Owner Transparency Act

Yesterday in the BC Legislature we debated Bill 23: Land Owner Transparency Act, 2019 at second reading. This is an important bill that is aimed at increasing transparency in property ownership. The bill requires beneficial owners of corporations, partnerships and trusts to file a transparency declaration when there is a transfer of legal title of property or a change in beneficial ownership. It further requires pre-existing beneficial owners to file a declaration. However, the bill will not affect individual property owners who are listed on title at the Land Title Office.

Transparency International Canada, the Canadian Chapter of Transparency International, is an anti-corruption NGO that recently published an extensive analysis of the scale of anonymous ownership of Canadian companies and Trusts. Their 2016 report states:

“Analysis of land title records by TI Canada found that nearly half of the 100 most valuable residential properties in Greater Vancouver are held through structures that hide their beneficial owners. Nearly one-third of the properties are owned through shell companies, while at least 11 percent have a nominee listed on title. The use of nominees appears to be on the rise; more than a quarter of the high-end homes bought in the last five years are owned by students or homemakers with no clear source of income. Trusts are also common ownership structures for luxury properties; titles for six of the 100 properties disclose that they are held through trusts, but the actual number may be much higher as there is no need to register a trust’s existence.“

For over five years I have been calling on government to plug a loophole that lets corporations and wealthy individuals avoid paying BC’s property transfer tax. Plugging this loophole would bring tens of millions of dollars into provincial coffers and correct an injustice that unduly penalizes ordinary BC families. While Bill 23 does not close the loophole, it does provide government with important information about beneficial property ownership in British Columbia. This will allow government to get a sense of the scale of the problem without actually solving it. I am hopeful that once the data starts rolling in, government will quickly recognize that the bare trust loophole must be closed to ensure that property transfer tax is applied on a transfer of beneficial ownership not on a transfer of title.

Below I reproduce the video and text of my second reading speech in support of this important bill.

Video of Speech

Forthcoming

Text of Speech

A. Weaver: That took me a little bit by surprise, as it was so succinct, the previous speaker. She was so timely in her words that she was speaking in, I think, support — caveated support — to this bill, but I’m not quite sure. I was indeed listening.

It gives me pleasure to rise and stand in very strong — let me be very clear — unequivocal support of Bill 23, Land Owner Transparency Act, at second reading. This is something that is long overdue in British Columbia. I am absolutely delighted that the government is stepping up to create the important registry required to ensure that partnerships, trusts and corporations that own property in British Columbia have beneficial ownership registered in such a registry.

This legislation will require owners of such corporations and partnerships and trusts to file a transparency declaration when there is a transfer of legal title of property or change in beneficial ownership. Pre-existing beneficial owners will also be required to file a declaration. It doesn’t apply to individual owners. The ownership information of individuals is already publicly available through the land title office, as we know. You and I have to do that whenever we buy a property.

Therein lies the problem. This is an issue that I’ve been raising in this Legislature since not long after I got elected in 2013, within the context of what was going on, when I asked question after question after question to the then B.C. Liberal government about what they were going to do to close the so-called bare trust loophole, which is continuing to this day to be used to avoid paying property transfer tax and to avoid disclosure of who is buying or is not buying property in British Columbia.

This is a first step there. This is a requirement that beneficial ownership now be declared in the registry.

Let me give you an example about why that’s important. Let’s suppose I want to speculate in the Victoria or Vancouver real estate market. I assign somebody to go and buy a property — to buy that property and put it in a trust. I’m going to put it in a trust. There may be a corporation that owns that trust. The beneficial owners of that corporation may be some people who were there initially to buy that property and develop the corporation. Those individuals have no need to disclose the owners of the shares of the corporation that owns the trust. The trust is on title. The trust is all that’s on title. No matter how many times those shares in that corporation change, no matter how many times not only the beneficial but the majority ownership of that corporation changes, there is no change of the registered owner at the land title office. It is the trust, the bare trust.

We had examples of properties being flipped, typically high-end properties being flipped from owner to owner to owner, not through the sale and change of land title, but through the change of the transfer of the shares of the corporations that owned the trust that owned the land title. All the time avoiding property transfer tax, because you only pay transfer tax on transfer of title, not on transfer of beneficial ownership, which is an area that I hope government, at some point in the future, will move towards closing.

I understand the rationale that they’re bringing forward now. They want to gather the data first to see how the scale of the problem is, in order to deal with the problem rather than going straight to deal with the problem. I have some sympathy from that argument. It’s taken some time to get here, but we are here, and I’m absolutely delighted that we are here. The registry that will be here will be publicly searchable, but with some information only accessible by government and law enforcement for reasons that were articulated by the minister in her opening remarks.

The bill also allows individuals to apply to omit information if their health or, as the minister alluded to, safety is at risk from public disclosure. You might imagine, for example, the issue of someone fleeing domestic violence or someone in the witness protection program. It would be kind of odd to have the beneficial ownership of a property of someone in witness protection to be actually in their original name. So there are reasons that we have that.

Coming back to the background for this article, the confidence and supply agreement the B.C. NDP and the B.C. Greens signed back in 2017 states as follows: we will collectively focus on shared values to “make housing more affordable by increasing supply of affordable housing and take action to deal with the speculation and fraud that is driving up prices.” The B.C. Green caucus has been calling for this for I don’t know how long. We know we’ve been calling on government to eliminate the ability of buyers to hide their identities through shell companies, numbered companies and trusts.

We’ve been calling on them to improve transparency in the land title registry — not only this government, but the previous government before that — and to improve the land title and corporate registry by requiring the disclosure of beneficial ownership. Disclosure is critical to actually dealing with any issues that may be out there. We also have been, for quite some time, pleading with government to make existing and new data more regularly and freely accessible to researchers and the public. We hope that as the registry is created, and was promised in Budget 2018, that this will be the case.

This registry is, without a doubt, a significant step forward for transparency that ends hidden ownership. As we know, hidden ownership is intricately tied into speculation tax avoidance and money laundering in our housing market. One of the issues raised by the minister, and prior to that, by the member from Point Grey when in opposition, was the notion of shadow flipping, a notion where I put in a contract to purchase a property, but it’s me or my assignee who purchases that property. So I might, with the member for West Vancouver–Capilano…. I may buy his property. I may put an offer on his property with “the MLA for Oak Bay–Gordon Head, or assignee.” The member for West Vancouver–Capilano might say: “That’s a great offer. I want it.” But my “or assignee” clause is such that I could actually start assigning this contract to whoever I want, who can reassign it to whoever they want, who can reassign it to whoever they want, and they can jack up the price as we go along.

Now, steps have been taken. I think it was the previous government, or was it this government? I can’t remember. This place becomes a blur after a while. But certainly, we now have legislation that requires that any profits realized after the shadow flipping goes on actually go back to the original seller of the property.

So the member for West Vancouver–Capilano would not lose out if I were shadow flipping. Nevertheless, the transfer of the properties in between those stages would not be required even today to be disclosed.

This registry is critical. All stages of the process — transparency. The use of shell companies, as I mentioned, and trust and proxy ownership structures has obscured who has owned property in this province, undermining efforts at gathering and analyzing and allowing for an analysis of large-scale tax evasion and the data used to support this.

A report by Transparency International found that government can’t identify the owners — now get this — of almost half of Metro Vancouver’s most expensive homes. Government, whether it be Metro Vancouver or the city of Vancouver or the province or the federal government…. No government knows who more than half of the high-end properties in Vancouver…. We don’t know who owns them.

What a recipe for abuse. It’s just unbelievable this has been allowed to go on for so long. It’s absolutely unacceptable. This bill will close that. It will ensure that transparency is there.

We know that wise accountants, who know full well about the existence of the bare trust loophole, have been advising clients to avoid paying the property transfer tax by buying their property in a trust. If I, for example, were to buy a property in a trust…. Any house that I wanted to live in I buy in a trust instead of me. As soon as I buy it in a trust…. The very first time it happens, you will pay the property transfer tax. But every single time that that house is traded from thereon in, you will never pay any property transfer tax as you transfer the shares of the corporation that owns the trust from one to another.

This is one of the reasons why the higher-end homes, so many of them, have been put into trusts. When they flip, there is no property transfer tax, and the property transfer tax can be expensive.

There are also means and ways of hiding foreign ownership behind…. Some of that was indeed closed, again, by the previous government after much pestering.

We know that some of the money laundering has taken advantage of this, too, in Metro Vancouver. We still await Peter German’s report. We still await at least another chapter. We got one chapter. There’s got to be more coming. It’s clear…. We continue to push, and I will be doing so in the weeks ahead, for a public inquiry. We need a full-scale public inquiry into money laundering in this province. It is inexcusable that we have had as much as $5 billion laundered through Vancouver’s real estate market since 2012, distorting housing prices, particularly in the high-end markets.

We know…. I forget how many thousand homes are empty in the member’s riding, the member for West Vancouver–Capilano. I met with the council and mayor of West Vancouver–Capilano, who were at odds, not knowing what to do to actually go after the owners of these vacant homes that they simply are leaving there, not paying the social cost that has been historically developing by these homes being left vacant and distorting a market that would otherwise not be where it is, if it weren’t for someone laundering and nefarious activities going on.

We know, for example, just in 2016, over $1 billion of Vancouver’s property transactions have links to Chinese organized crime. Over $1 billion in one year alone had links to Chinese organized crime. That’s not counting any Russian organized crime, any Canadian organized crime, any American organized crime. Just one. It’s rampant in Vancouver, and we’ve sadly got a reputation internationally for being the home to the so-called Vancouver model of money laundering. Not a nice thing to be known for.

The president of the Law Society of B.C. stated: “This groundbreaking move by the B.C. government will increase the transparency of land ownership in B.C. and make it more difficult to use arrangements for tax evasion, fraud and money laundering. British Columbians will benefit from a fairer and more transparent real estate market.” Those are pretty powerful words of support from the president of the Law Society of British Columbia. I think that’s a strong independent endorsement of this legislation.

Transparency International has applauded the establishment of this registry — another pretty strong endorsement from an international organization. And a former director of FINTRAC has said that the province is now leading the country with this legislation. I can tell you, hon. Speaker, that if there is one thing I want British Columbia to be, it is a leader. We’re seeing, finally, leadership and transparency in the real estate sector in our province, and for that, the minister deserves a great deal of credit. I thank her, and I thank this government for bringing this forward.

You know, if ever there was a moment that we have second-guessed our decision in 2017 as to whether or not we support this side or that side in terms of a minority government, let me tell you that legislation like this makes us not question for a second that we did the right thing. The Liberals opposite had many, many years to deal with this, but they ignored it. I can’t remember how many times I stood up in this Legislature and posed questions to the then Finance Minister, asking him when he would take steps to deal with the transparency and beneficial ownership and close the bare trust loophole that was being used to avoid paying property transfer tax and also being used to launder money. The public record of this is available on my blog site. You can see it there, going back years. The answers I was getting were platitudes, because, to be honest, the members opposite simply had no idea. They had been in government too long. They’d lost ability to determine what the issues were. And there is absolutely no doubt in my mind that this issue is before us.

S. Bond: Relevance.

A. Weaver: Thank you to the member for Prince George–Valemount for calling for relevance. Thank you. And the reason why I called it to your colleague — because every time anybody in our caucus stands up, you have the audacity to stand up and call relevance, yet you’re not willing to accept others calling relevance to the other side. So it’s part of the hypocrisy that we see. I enjoy the conversation, and I will make this relevant, hon. Speaker, before you must tell me to make this relevant.

Coming back to the bare trust loophole, as I noted, I’ve been calling on government for years to deal with this, and frankly, this is a step in the right direction. Hopefully, government will move forward to closing this. I know that the market had discounted this, both the real estate market and the accounting market. They had both already discounted that government was going to close the bare trust loophole. They didn’t, but now they’re collecting data and that probably will lead it up to move for it.

Looking at this, we also need to expand this progressive approach to transparency, also to the corporate registry. Right now, the corporate registry is not searchable by director name, and as it’s hampering transparency and accountability, hopefully we’ll be able to see this transparency that we’re seeing here with respect to land-ownership move into the corporate registry as well. The Attorney General has called this issue a deliberate or grossly negligent decision that limits transparency, a benefit to firms and individuals who wish to evade accountability. I urge government as well to move beyond this and to change the corporate registry to fix this problem, in line with the spirit of the legislation before us today.

In conclusion, this legislation is an important step forward for opening up hidden ownership in real estate in British Columbia. And it’s timely. I’m very pleased the government has done it. And it’s just a shame that we’ve got to get to the position we’re in after so many years of neglect in this sector. We need to go further and crack down on tax avoidance, using the ownership structures that the data will be collected, and I’m looking forward to government stepping in to close that bare trust loophole, which many use to avoid paying property tax. I look forward to seeing information in the registry and will continue to push for action on this file and get to the root of the housing crisis.

With that, I do note the time. I would like to move adjournment of the debate and reserve my right to continue at the next sitting of the House after today.

A. Weaver moved adjournment of debate.

Addressing delegates to the 2019 AVICC annual convention

Today I was afforded the opportunity to address delegates at the 70th annual convention of the Association of Vancouver Island and Coastal Communities held in Powell River. As noted on their website:

“The Association of Vancouver Island and Coastal Communities (AVICC) is the longest established area association under the umbrella of the Union of BC Municipalities (UBCM). The area association was established in 1950. It now has a membership of 53 municipalities and regional districts that stretches from the North Coast Regional District down to the tip of Vancouver Island and includes Powell River, the Sunshine Coast, the Central Coast and the North Coast. The Association deals with issues and concerns that affect large urban areas to small rural communities.“

Below I reproduce the text of my speech.

Text of Speech

I have had the distinct honour of standing before this group of leaders on a number of occasions – and each time I am grateful for the opportunity to address you.

By my count, the AVICC represents 53 distinct cities, towns, villages, districts or regional districts, stretching from the southern tip of Vancouver Island, all the way up to the Northern tip of the North Coast Regional District.

Each of you in this room has taken on an incredible responsibility to represent your friends and neighbours, helping chart a path forward for your community. For those of you who have been in office for a number of years, I think you will agree with me that the challenges that face us are getting harder to deal with and more complex, and that more than ever we need a vision that takes those challenges head on.

I will get to talking about the challenges – and even more important the opportunity that I believe we have in front of us. But before I do, I think it’s important to first acknowledge just how much we all have in common.

A couple of weeks ago, reporter Justin McElroy with CBC News published an article chronicling his four month, 12,000 kilometer trip across our beautiful province. By his count, he visited forty different communities, and had this to say about his experience:

“While our cities and towns are unique, the political dilemmas they face are pretty similar.

People need a place to live, whether it’s stable rental buildings or modular homes. They need to get around more easily, whatever form of transportation they take. They need jobs from evolving industries, and generally worry about losing those in traditional sectors. And they need to feel they’re making the world a better place for their children.

…No matter which B.C. communities we went to, that contrast existed. Every place is its own — but the conflicts and solutions to their political issues generally aren’t.”

I think this is a critical starting place. Whether it’s the challenges we face, or the opportunities we want to seize, we have more in common with each other then we have things that set us apart. And, I believe more than ever, we are all in this together.

So let’s talk about the largest challenge we face, especially on the coast – but also about the solutions that are readily available and right in front of us.

Over the last 150 years, Earth has made a transition from the past, when climate affected the evolution of human societies, to the present, in which humans are affecting the evolution of the climate.

Today we are at a pivotal moment in human history; our generation will be responsible for deciding what path the future climate will take.

You and I, as elected officials, will either be complicit in allowing climate change to despoil our world – or we can lead the way and choose a new future.

I don’t need to tell you that communities across BC – including the communities represented by the very people in this room – are on the frontier of climate change.

No level of government feels the impacts greater nor as directly as you do as municipalities.

I could spend every minute I have left one this stage with you enumerating the impacts that climate change is already having on our way of life.

You, as local leaders, see first hand the impacts on your communities. The evacuations. The water restrictions. The rivers that are drying up. The loss of species in our coastal ecosystems like the Orca or the Steelhead. The economic impacts to industries like fishing and tourism – industries every community in this room relies on is as risk.

More than anything, I think we are starting to see the impact that this instability and insecurity is having on the people who live in our communities. The insecurity – the uncertainty of where we are going – can sometimes feel overwhelming. The sense of powerlessness is the face of such a grand challenge can feel paralyzing.

To this, I say let’s look to the next generation for the drive and energy we need to overcome this feeling.

A couple of weeks ago our province witnessed tens of thousands of students walking out of class, joining the millions who marched worldwide, demanding climate action. They carried signs that read “We should be preparing for the future, not fighting for it!” and “The climate is changing, why aren’t we?”

The words of Greta Thunberg, whose actions have inspired so many – including the marches that took place – ring particularly loud for me.

“I am doing this because nobody else is doing anything. It is my moral responsibility to do what I can,” she says. “I want the politicians to prioritise the climate question, focus on the climate and treat it like a crisis.”

She is speaking to us. All of us in this room, asking us to rise to this challenge with real actions. We are the ones who can set our province on a path that shows the next generation that we will take responsibility for addressing the problems that they risk inheriting from us.

And here’s the thing – while it will absolutely take courage to see them through, the solutions are right in front of us, and will make our lives better.

So let’s talk about the path forward and how all of us collectively can build a path forward for our communities.

I’ve spoken a number of times about my vision for how BC can position itself as a leader in the 21st century economy. This may look different for every community, but there are certain things we all share in common

I believe BC has three strategic advantages over virtually every other region in the world.

- The quality of life and natural environment allows us to attract and retain some of the best and brightest minds from around the globe — we are a destination of choice.

- We have a highly skilled and educated workforce. Our high school students are consistently top ranked internationally. They are smart, well trained and they are ready to go to work.

- We have access to renewable resources — energy, water, and wood — like no other jurisdiction. We have incredible potential to create a clean, renewable energy sector to sustain our growing economy.

To capitalize on these advantages, we need to start planning beyond the next election cycle. We need to focus on building a new economy that works for all of us — not just the privileged few. Policies must be based on principles and evidence, not political calculation and opportunism.

And governments must put people’s interests first – ahead of entrenched industry – because building healthy, safe, secure communities needs to be prioritized in a changing world.

I have been pushing government to prioritize the health and well-being of British Columbians since I was elected almost six years ago

By tackling climate change, with carefully designed policies, B.C.’s economy can grow in new ways. And as I said before – these solutions will actually improve our lives. That is because the only solutions to the climate challenge are ones that see us tackle inequality and focus on the health and well-being of British Columbians.

I want to give some examples of these solutions.

Earlier this spring the government released “Connecting Coastal Communities,” a report by special advisor Blair Redlin. This report outlined that over the next 9 years, 14 contracts will be needed for new vessels, and this doesn’t include retrofits of existing vessels.

However, right now BC seem fixated on giving these contracts to shipyards in other countries so that we can build vessels that use LNG.

Contrast this with Norway, who recently made headlines increasing reliance on electric ferries. And guess what? The battery technology they are using is made in Burnaby.

There is so much potential for made in BC ferries, using made in BC electrification technology which reduce GHG emissions and create local employment.

While we are accomplishing this, we can and should be rolling BC Ferries back into our provincial transportation network. I believe that ferries are a part of the highway system. They are relied on to get kids to school and for communities to access the healthcare system they pay for, That’s why it is essential that our ferry services don’t exist to maximize profits, but rather to serve the public interest. That’s why they’re there.

In forestry we must focus on the opportunities that arise when we prioritize the protection of out old growth forests.

Vancouver Island and our coastal communities have some of the most majestic forests left on the planet, drawing people from around the world.

The BC Green Caucus believes we need to protect what little old growth is left. These forests provide essential functions for our communities, protecting biodiversity, supporting watershed health and helping keep the very water we drink clean – not to mention the role they play in storing carbon.

By protecting our old growth forests, we can enhance the resilience of our communities – both the environment they rely upon, and our local economies.

There is a huge opportunity to support a retrofit program for our coastal mills to process second growth timber, and focus on developing a value added industry. This can go hand in hand with enhancing local ownership over these resources to ensure communities see the benefits, as well as have the responsibility to steward our public resources.

On another front, we have brought forward benefit company legislation, which would carve out a more deliberate space in our economy for businesses that want to pursue values beyond maximizing profits. B.C. is already home to a number of incredibly innovative, socially responsible companies that want to play a bigger role in addressing the biggest challenges we face. And I think that it is critical that we harness this power of business to help us find solutions, and to create prosperity in an environmentally sustainable and socially responsible way. This should not be a task for governments alone. This legislation is one step to help us do this.

And, alongside making these changes, we should also be changing how we determine what success means in our economy. We need to move beyond a sole focus on economic growth measured by GDP, where we don’t incorporate the effects of the economic production and consumption on our environment or the health and well-being of British Columbians. Instead, we should be using a genuine progress indicator to measure the success of our economy. An indicator that captures I’m excited to say that we’re working with our partners in government to develop a GPI for BC.

Making the changes needed in our economy won’t be a straight path. But the challenges in front of us are political – not technical.

Two weeks ago that was on display in the BC Legislature as all 83 members of the BC NDP and BC Liberal caucuses voted to provide new tax credits to a large fossil fuel company which will see the creation of the largest point source of GHG emissions in British Columbia.

This is a disappointing and counterproductive step. Governments can no longer have it both ways. They cannot advance status quo, polluting industries and be committed to tackling climate change and pursuing an economic pathway ground in well-being.

It is wrong to spend so much energy to expand fossil fuel tax credits and the race to the bottom economics of the fossil fuel industry.

So what do we do in the face of these actions that move us backward? We must meet them head on, showing the courage to challenge “business as usual” and the leadership to show a better pathway.

We should be using our time and resources to build the opportunity we have in BC to leverage our strengths and build a sustainable and innovative economy, and the imperative we face in getting our communities ready for climate change. This should be the time when parties are competing to present the boldest plans to British Columbians to position us for success in this new reality.

On this note I want to recognize the leadership the Mayor Lisa Helps and the City of Victoria are showing.

Their motion shows the courage to directly challenge the pursuit of LNG in this province in the face of the climate crisis, and the leadership to provide a path forward. I want to read directly from part of the motion:

“THEREFORE BE IT RESOLVED that UBCM call on the Provincial government to end all subsidies

to fossil fuel companies and to invest the money instead in climate change mitigation and adaptation activities being undertaken by local governments in a predictable and regularized funding formula…”

This is what is needed. I applaud this courage. This leadership.

The specific ways in which climate change challenges our communities may differ, but we must be united in responding to it.

I would like to end this speech with an open invitation to each of you to work with my colleagues on I to advance this vision.

Taking meaningful action, making real change, requires partnership.

I would welcome your ideas, your concerns, and your stories of success so that together we can create the bold change needed to ensure our communities can thrive as we navigate the 21st century. I look forward to the discussions to come.

Bill 20: Medicare Protection Amendment Act

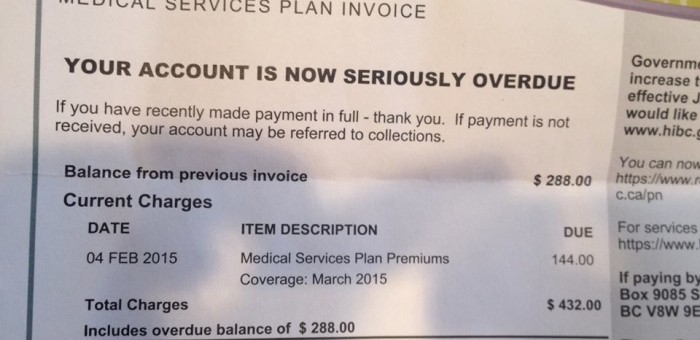

Yesterday in the legislature we debated Bill 20: Medicare Protection Amendment Act, 2019 at second reading. This bill eliminates the collection and payment of MSP premiums through several sectional repeals of the Medicare Protection Act. The bill also requires the commission to notify a beneficiary when their enrollment is being canceled. The bill introduces transitional provisions to allow the commission to collect outstanding premium debt.

As you will see from my second reading speech, reproduced in video and text below, MSP premiums have existed in British Columbia in one form or another since 1968. Successive NDP, Socred and BC Liberal governments retained or increased this form of regressive taxation for more than 50 years. It wasn’t until the BC Greens made this an issue in 2015 that the BC NDP and BC Liberals could not ignore that action was taken.

I am sincerely grateful to the seniors at the Monterey Centre in Oak Bay who brought this issue to my attention in 2014. As a consequence I initiated a campaign to eliminate the MSP in January 2015. Over the following two years I raised the issue numerous times in the Legislature including tabling a petition with over 65,000 signature on it, responding to myriad emails, and encouraging British Columbians to contact their local MLA to raise awareness on the issue.

In the end, all three parties agreed to move towards the elimination of MSP in the 2017 election campaign. No party could afford to ignore the regressive nature of this form of taxation in light of the widespread attention British Columbians were now giving it. Further details are provided in the speech below.

Video of Speech

Text of Speech

A. Weaver: It gives me great pleasure to rise and stand and speak in support of Bill 20, the Medicare Protection Amendment Act, 2019. This bill enables the elimination of the regressive approach to MSP premiums in the province of British Columbia.

I’d like to start by correcting history, because history is often overlooked. A lot of people are trying to take credit for what’s going on with MSP reform today. I can tell you that MSPs were introduced in British Columbia in 1968. That’s 51 years ago. Successive Socred governments, Liberal governments, NDP governments have come and gone, and each and every government has done nothing to eliminate MSPs. Not once.

It wasn’t until the mid-2000s that this form, this approach, this regressive approach, was turned into a form of indirect taxation, through the B.C. Liberals, a one-size-fits-all approach to taxation. In essence, a head tax, a head tax that led to rather myriad issues.

This issue became front and centre in British Columbia in January of 2015, an issue that the B.C. Green Party brought to the Legislature in January of 2015, with a call for the elimination of MSPs. Both the official opposition at the time and the government at the time will recall I introduced a petition with 65,721 signatures on it that was put together by Michelle Coulter, from Ucluelet.

I introduced another petition of about 7,000 names who contacted the B.C. Green Party. I also proposed at that time an alternate means of actually eliminating the MSP that maintained the revenue. It was at that time that overwhelming public support started pressuring the B.C. Liberal government at the time, and the NDP opposition jumped on it.

So as people reflect upon this historic event today, I would suggest to them that they should look no further than the influence of the B.C. Green caucus on government policy to get us to the elimination of MSPs when, as a single MLA sitting in this House in 2015-2016, we as a group turned this into a provincial election issue and had people fighting over themselves trying to determine who would eliminate it first.

I say that again with sincerity and by pointing to the history. So 1968 was when we introduced MSP premiums in British Columbia. The very progressive Barrett government of the 1970s didn’t touch MSP premiums. The Liberal and Socred governments thereafter didn’t touch…. I daren’t even say this, because I’m so sick and tired of hearing about the 1990s, but nevertheless, in the 1990s, another NDP government didn’t eliminate MSP premiums.

Those last 16 years that we’ve heard so often didn’t eliminate MSP premiums. But I would suggest that it was in those last 16 years that, actually, public pressure and public concern rose. The reason why is people started to recognize that this was tax creep. It was tax creep happening in a truly regressive fashion, in a one-size-fits-all fashion. Whether you earned $3 million a year or $30,000 a year, you were paying the same premium.

What we proposed, what the B.C. Greens proposed in 2015, was a different way of looking at the funding of the premium, a funding that mirrored what goes on now presently in Ontario. While we applaud that the government has eliminated MSP, we would not have done it this way. We would not have done it this way, because the way the government has chosen is to singularly pass that cost on through an employer health premium.

Now I recognize, and we support the notion, that there was room to grow the employer health premium in British Columbia, as we were by far the lowest employer health premium in terms of employee paying in the country — the payroll tax, in essence. However, the approach we took is that we believe it’s important to place a value on a service, but that value should actually reflect your ability to pay.

We had proposed a measure that followed and mirrored what is done in Ontario, where each and every person in Ontario has an item called an Ontario health care premium. That’s a progressive amount, much akin to what we see in employment insurance and the Canada Pension Plan. You have a third line. It’s called Ontario health premium, which, for low income, is precisely zero dollars, and if you earn over $200,900, I think it is, you pay something like $900 a year — a progressive amount. So there is a value to the health care services — a small cost, based on your ability to pay — which ensures, then, that revenue comes in, but in a progressive fashion. That was our approach.

That was an approach that would have actually not led to the double-dipping situation we have for this single fiscal year. It’s an approach that would have also recognized that across British Columbia, there are many collective agreements where the signing of those agreements has actually included costed benefits, which is the employer paying the medical services premiums. That’s a costed settlement against an agreement that a union, a collective bargaining unit, has actually costed against the salary settlement.

Now, unfortunately, through the elimination of the MSP premium, what has happened is that costed settlement against past settlements is now vaporized. So those benefits, which were accrued and negotiated away by unions from north to south and east to west…. They now can look back and say to their union members: “We have lost that ability to negotiate for that thousand or whatever dollars a year that was coming off.”

I’m actually quite shocked that the NDP decided to choose this approach, because they have thrown under the bus, in essence, every single member of a labour union in the province of British Columbia that had a negotiated settlement that included the medical services premium being costed against that settlement in terms of the actual past negotiations. That’s, in essence, something like $1,000 that has come off each worker’s costed rights. The unions in British Columbia should be up in arms over the NDP approach, because now that costed benefit has vaporized.

Those previous salary settlements could have had that extra amount that was costed to pay the premium added to salary and other benefits. I’m surprised, honestly. I’m surprised that we haven’t heard protests from the unions. Well, maybe not, in light of some of the other kinds of things we’ve seen in areas where they’ve been given…. But that, to me, is quite remarkable.

That progressive approach would have avoided many of the problems that we see with the implementation, particularly for this year. It is this year that there’s a problem with the double-dipping. It would have recognized the costed settlements that were in place with existing collective agreements. It would have respected that amount, moving forward, by allowing members who gave up that money, gave up that in a negotiation, the right to have that come back to their actual negotiated package.

You know, in 2001 and 2002, the B.C. Liberals rose the MSP premium something like 50 percent. Then they froze it for six years, and then again, in 2009 and 2010, they started to increase it again, 4 to 5 percent each year, until 2015. By 2017, all categories of MSP premiums — individuals, families of two, families of more than two — had doubled since the B.C. Liberals took office in 2001. That started to create dissent within the broader public in British Columbia — the sense that there was an unfairness, which is why we had so much support for this initiative that we took on in 2015. As I mentioned, 65,721 signatures were on a petition put forward by Michelle Coulter that I brought to this Legislature. I believe I introduced that in 2016.

It was an issue that I know there wasn’t a single MLA in this room that did not receive many thousands of emails on, from chain emails across the province.

I’m glad that government today and the opposition at the time, and the Greens, in the election campaign, were all climbing over ourselves to say who would eliminate MSP premiums first. I don’t think…. In fact, one of the moments in the 2017 leaders’ debate I thought was quite a fine moment, from my perspective — selfishly, he says — was when I asked the now Premier: “So let me get this right. In your campaigning for MSPs, what you’re planning…. You have a plan to develop a plan to come up with a plan.” That was the NDP approach. And he agreed, remarkably.

In fact, one of the plans to develop a plan to come up with a plan was to create a committee — an MSP Task Force. Government actually put such a committee together before the budget last year, and then decided that government knew best exactly how it was going to move forward with the elimination of the MSP, despite the fact that the committee had yet to actually return their reports.

So while the committee was talking about a variety of measures and metrics and ways that the revenue could be replaced, whether it be through a sugar tax or whether it be through a small employer health tax or whether it be through a health care premium, government decided to go its own way and go 100 percent with the health care premium.

That’s government’s prerogative and government’s choice. As I say, again, I’m surprised that there wasn’t uproar within the union movement in this province, because I can tell every single union member in this province that has had, historically, MSP premiums paid by their employers, that they’ve just lost out a thousand bucks plus, at least, for each and every one of them, from a negotiated previous costed settlement against what they were owed and deserved because that was costed against their settlement.

It’s actually quite remarkable that government has gone this way. And yes, I know this full well because I have acted as chief negotiator twice in bargaining agreements where we have actually costed our MSP premiums against a negotiated settlement. So yes, I know this to be true.

With that said, I do applaud the fact that we are, indeed, moving towards the elimination of MSP. The co-benefit that is not often talked about is that there’s an entire bureaucratic structure that is no longer needed. There are literally tens of thousands, maybe even hundreds of thousands, of letters that are emailed every month saying: “This is what your MSP premium for this month will be.” If you think about 100,000 letters going out at $1 a letter, that’s $100,000 a month for a start, but it’s much, much more than that.

We also know that there is a very serious problem in terms of collecting long-term debts that have been accrued in the MSP premium. Part of it is unknowing debt — there are those who can’t pay — but there are also those very egregious examples out there where people have gone away and not realized that they, apparently, owed MSP. They come back to rather large bills.

I’ll give you a real-world example. A student might be working in British Columbia for one summer after graduating from high school. Say they graduate from high school in June, they attend their convocation, and they work through the months of July and August. They might have a union job. They might actually be in a union job where they look at their paycheque and they realize that, as part of their employment, the employer was paying MSP.

So they go and take their job. It’s their first job straight out of high school. They see that the employer is paying the MSP, but they don’t really know what that is. Then they decide that they’re going to go to Europe for college. They go to Europe for four years; they leave the province of British Columbia. They may go to France or Britain or Germany or Sweden or Norway and attend a collage there for four years. Then, perhaps, they might want to come back to Victoria or Vancouver and work in British Columbia.

Well, guess what. The second they come back to British Columbia, they get a bill. They get a bill for four years of MSP premiums plus accrued interest because they did not opt out of MSP when they left the country to go to these other jurisdictions, for which they were 100 percent covered by the local jurisdiction. When you’re a student in England, you’re covered. If you’re a student in other jurisdictions across Europe, you’re covered. But you’re expected to continue to pay here unless you physically opt out.

Now, the number of people who physically opt out has been so small, you could almost count it on a hand, because people didn’t know they had to do that. The number of people who had these outrageous bills presented to them upon their return is huge. Therein lies the problem.

We know that what happens is that a young person — and there are many examples of this — will come back from abroad. They’ll get the bill, and they have a choice: do they pay this bill they think they owe, even though they weren’t eligible — or they may have been eligible, but they didn’t use it, or even know they did — or do they not? In many cases, they don’t.

What happens then is that collection agencies start to come after them. Then they have a credit rating…. They’re starting off in their life. They may have worked for one summer — one summer — in a union job. They didn’t that that company that was paying them actually was paying the MSP. They come back four years later, and they get a bill for thousands and thousands of dollars. They don’t know what this is about. And then the collection agent comes after them, and on and on it goes.

That’s no longer going to be the case, and that’s a good thing. That’s a good thing, because we don’t need those collection agencies. We have a lot of debt on the books that is going to have to be forgiven, I suspect, or collected by some other means, but at least we’re moving forward and beyond this.

Again, coming back to this. This was a campaign issue from the B.C. Liberals. They didn’t want to be left out. Fifty percent cut, they planned. When the B.C. NDP ran, they campaigned to eliminate….

They didn’t really articulate how. Frankly, I don’t think they actually figured it out, because their plan was to develop a plan to come up with a plan, and the plan was going to be first developed by a committee that was developing a plan that they ignored.

They staggered their way through, and they decided to come through with this employer health tax approach. That’s their prerogative. We understand that. We recognize that they are government, and they have these choices to make. While we support the overall notion of MSP being reformed, we don’t believe that that was the appropriate way to go in its entirety. A small component, yes.

The B.C. NDP campaigned on cutting the MSP, and they initially did it by 50 percent. In actual fact, what they did was basically leave in place the B.C. Liberal budget, which had already reduced it by 50 percent. They had promised to move on to the entire elimination, which is where we are right now.

The first step of the MSP premium, reducing by 50 percent, happened in Budget 2018. Here we are now moving forward with the completion, through this tax. Again, when I look at this…. We’ve had a platform issue even in 2013 — going back to the history. In 2013, we were calling on the elimination. It actually was formally put forward repeatedly in 2015 and 2016. As I stated, I’m very, very pleased that we’re actually at this position now.

Overall and in conclusion, since 2015, we’ve outlined a number of regressive natures…. One of the things that we’ve outlined, as well — and I hope the Minister of Health takes note — is that right now we’re penalized in British Columbia for being a destination of choice for elderly Canadians.

Why I say that is that it’s very simple to calculate the amount of money that is spent on health care and weight that as a function of age. We know that the average age in British Columbia is lower than the average age in other provinces. We know that the federal Canada health transfer is based on the number of people, with no age weighting to that number of people. So we know that when you do a simple weighted average….

We know how much health care money is spent as a function of age. We know it increases exponentially toward the latter years of your life. We know that when you take the age profile of the province and you weight the Canada health transfer by that age profile, B.C. is short by something in the order of $200 million of Canada health transfer money that should be coming to us, based on an age-related approach.

We know that people in British Columbia may work in the oil sands in Alberta during their younger years. They may be paying provincial taxes in Alberta. They may be working in the Hibernia fields. They may be working in a factory in Ontario. Then in the latter stages of their life, they may choose to come back and live in a place where there’s no snow in the winter. Where is that place? That place is often Vancouver Island.

We know this is going on in Canada. That is the beauty of this great nation that we have: we allow people to freely go from east to west and north to south. We encourage people to come here, and we have a long history of being a home…. In fact, Victoria — I’ve grown up here. I don’t know whether it’s still called this, but it certainly was called this when I was a younger person: the city of newlyweds and nearly deads. I’m one of those few people who has moved from the age of newlywed to nearly dead. There are not many of us out here, but I am….

Interjection.

A. Weaver: Maybe. The member for Chilliwack-Kent is suggesting I’m speaking too soon. I hope so. Certainly, I’ve watched the growth of this town over the last 57 years, and my goodness, it has grown. It has grown and become more diversified. It’s quite exciting.

But coming back to that Canada health transfer. I sincerely hope that we do have the pressure being put on the federal government to reflect upon the nature of the Canada health transfer and the unfairness of people paying their taxes in other provinces and then retiring to British Columbia.

I would suggest that it is entirely defensible to argue that the Canada health transfer should be weighted by age, based on the amount of health care spending we do as a function of age. I’ve done the calculation. And 200 million bucks? We could use that. I’m sure the minister could use 200 million bucks. We could fund all sorts of drugs, like Orkambi, for example. I’m just joking. But we could — $200 million is nothing to sneeze at. This is something that I hope they’ll encourage.

Anyway, with that said, I do commend the Minister of Health. I mean that sincerely. We in British Columbia are very lucky and fortunate to have a minister who goes so deep on files and is truly committed to this file. We’ve seen some very good things happen in this province. This is one of them. Again, I don’t necessarily like the way the funds are being replaced, but I do certainly have full confidence in the Minister of Health, the direction he’s taking this province in health care.

With that, I’ll take my place and thank him for his good work.

On Money Laundering and the BC Lottery Commission

Today during question period I rose once more to ask about the issue of money laundering in British Columbia casinos. As you’ll see from the responses to my question, the Attorney General was quick to point fingers at the BC Liberal Member from Langley East.

Below I reproduce the video and text of our exchange.

Video of Exchange

Question

A. Weaver: I must say, it feels like I’m rising midway through an episode of the Twilight Zone here today in this Legislature. Frankly, while last night I was busy trying to prep up on the money laundering going on, it seems like far too many members of this chamber were enjoying casino night a little bit too much and probably are a little grumpy as they lost far too much money there last night.

Over the past eight months, we’ve learned that senior officials at the B.C. Lottery Corporation repeatedly demonstrated wilful blindness to the problem of money laundering in B.C. casinos. But now we know they went further. In fact, they went directly against the regulators’ recommendations and increased betting limits, per hand, to over 1,000 times the maximum betting amount allowed in Ontario. I’ll say that again — 1,000 times larger than you can bet in Ontario.

Now, I can only assume that senior officials and people perhaps in the minister’s or former minister’s office were blinded by the revenue stream. They appear to be singularly focused on hitting revenue targets and bringing in more government revenue with little, if any, concern as to whether the law was being broken or if it was fuelling an opioid or housing crisis.

My question to the Attorney General is this: what controls has he put in place within the B.C. Lottery Corporation to ensure that meeting revenue targets does not come at a price of condoning suspected illegal activity?

Answer

Hon. D. Eby: We’ve made a number of significant changes in the just over a year that we’ve been in government to address the issues that the member has been talking about. Some of the most important, I think, are around separating the revenue-generation functions, the revenue-generation piece at B.C. Lottery Corporation, from the regulator piece. Having those under the same roof is obviously an issue. So we have given the gaming policy and enforcement branch authority to regulate and oversee the B.C. Lottery Corporation. Giving them this authority and this power is a really important piece and something that was obviously missing. Why was the regulator not overseeing the conduct of the B.C. Lottery Corporation?

Beyond that, the member knows about basic things we’ve done — telling the casinos you’re not allowed to accept bulk cash anymore, that revolutionary idea that immediately ended the practice of bringing duffle bags full of cash into our casinos — after we formed government.

Now, I know the member for Langley East doesn’t like to hear about this. But he was there….

Interjection.

Mr. Speaker: Member.

Hon. D. Eby: If there is a public inquiry, he’ll have his chance.

Now, these are very serious issues. We’ve taken very serious steps. I thank the member for the serious question, and I wonder when the member for Langley East will rise and ask a question about this.

Mr. Speaker: Leader, Third Party, on a supplemental.

Supplementary Question

A. Weaver: We have no shortage of questions to ask on this file, and we will continue to do so until we start to get answers through the calling from public inquiry.

Here’s the next question. In February 2015, after finally contacting the RCMP organized crime unit about possible money laundering going on in their casinos, the CEO of the B.C. Lottery Corporation continued to strategically focus on attracting players willing to pay $100,000 per hand. When questioned about his decision, he said this: “We know them very well. We know their source of wealth. We know all their personal information. They need to share that with us for regulatory reasons.” That’s a quote from the CEO of the B.C. Lottery Corporation.

What we found out through the e-pirate investigation, is that it eventually became clear that these VIPs, the same ones that the CEO apparently knew so well, were part of an organized crime scheme linked to the fentanyl crisis. Yet the CEO Of the B.C. Lottery Corporation still is there.

My question is to the Attorney General. How can British Columbians have any confidence that those involved in perpetrating money laundering in B.C. are being held accountable for their actions, particularly given the reluctance of this government to launch an independent public inquiry?

Answer

Hon. D. Eby: The member knows why we have not yet called a public inquiry. That’s because we have been acting quickly to address the issues that the previous government left for us, the giant, gaping loopholes in our casino industry that allowed this activity to continue up until the point that we actually formed government.

Interjection.

Mr. Speaker: Member. Member, we will hear the response.

Hon. D. Eby: Now, I hear the member for Langley East saying that there’s an issue with the police. I would say there was an issue with the police when the member for Langley East called the RCMP to criticize a member for going on the news and saying we had a money-laundering problem and causing him to be disciplined. Now, that was a problem.

We’ve taken a number of steps to ensure….

Interjections.

Hon. D. Eby: He also disassembled the policing team that was dedicated to investigating casinos.

But regardless, we’ve replaced the board at B.C. Lottery Corp entirely. We have confidence in the team at B.C. Lottery Corp. to be a good partner in addressing these issues. We’ve given oversight to the gaming policy and enforcement branch to oversee what’s happening at the B.C. Lottery Corp. to ensure that the public can have confidence. And we’re all trying to move forward on this — well, with some notable exceptions.

When will the attorney general call a public inquiry into money laundering in British Columbia

Yesterday the Attorney General received the second Peter German report on the state of money laundering in British Columbia. In addition, the Minister of Finance received a report from the Expert Panel on Money Laundering. Both of these much awaited reports will provide information with which to inform a potential public inquiry into money laundering in BC.

This was the subject of my Question during Question Period today (see video and text reproduced below). As you will see from the responses, the government has stated that it will review the reports before they are eventually made public. A public inquiry is still being considered.

Video of Exchange

Question

A. Weaver: We learned last week that a controversial senior-level intervention was made by officials in the Finance Ministry in order to maximize casino revenue. Incredibly, the intervention to increase betting limits to $100,000 per hand, despite repeated warnings from the regulator, was deemed to be “in the public interest” by the former Minister of Finance.

Let me reiterate. Allowing $100,000 betting limits to be played at casinos, despite clear warning signs from the regulator, was deemed to be “in the public interest.” I don’t know how many of you have played blackjack or poker with $100,000 stakes. I’d suggest not an awful lot. Shocking, it is.

My question is to the Attorney General. Each week more and more information is brought to light. An ever-growing list of questions is emerging. Pressure for an independent public inquiry continues to grow. The federal Minister of Border Security and Organized Crime Reduction has indicated he is open to a request from the province for supporting an inquiry. He now has two special reports in front of him. Does he think he has enough evidence to call for a public inquiry?

Answer

Hon. D. Eby: Thank you to the member for the question. Yes, this is an important day. The Minister of Finance has received a report from her team, from Maureen Maloney, and has received Dr. German’s report, which, as the member knows, looks at issues around luxury cars, issues around horse racing and issues around real estate.

Dr. German’s report alone is more than 300 pages. We’ve just received it. We’ll be going through it to do a couple of things — to make sure that the public release doesn’t compromise any law enforcement investigations and doesn’t unfairly impugn the reputation of any individuals. Then we’ll be releasing it to the public. The reason for that is exactly the reason that the member has identified. The people deserve to know what’s been going on in British Columbia, what happened under the previous government and why we need to take the measures that we’re taking to get things under control.

They made a number of serious errors in judgment. We don’t know whether it was wilful blindness or negligence.

Interjections.

Mr. Speaker: Members.

Hon. D. Eby: The member who is shouting at me is one of the key members, obviously. I understand why he’s defensive about it, but the truth will out.

Mr. Speaker: The leader, Third Party, on a supplemental.

Supplementary Question

A. Weaver: Thank you to the Attorney General for his answer.

Last week the Attorney General said this: “The larger issue that I understand British Columbians are concerned about is really political accountability and to identify if there is rot in the system, to have that rot weeded out through a public inquiry system.” He’s absolutely correct. We need political accountability, which is why the B.C. Green caucus has been calling for an independent inquiry for over a month now. It’s why thousands upon thousands of people have signed petitions calling for one and why several organizations, municipalities and unions have also called for one.

Last week the Attorney General also said: “The Premier has been clear about keeping the option open to a public inquiry.”

My question is to the Attorney General. When will we know if government is serious about launching a public inquiry?

Answer

Hon. D. Eby: The member will know that our emphasis has been on identifying what’s been happening and on stopping that activity from continuing. That’s been the big priority. The member raises the issue of accountability, especially political accountability. I do think that’s a very important issue — not just for the member, not just for me and not just for the government but, certainly, for all British Columbians. We’ll be looking at the reports we’ve received, and the Premier and the government will make a decision about a public inquiry if necessary.