Children and Family

In Support of BC NDP Gender Identity & Expression Human Rights Bill

In question period today I had originally planned to ask government a question concerning the preservation of old growth forests on Vancouver Island. But since the relevant Minister was not available to respond in Question Period today, I had to be nimble and switch direction.

Earlier in the day, the BC Green Party had issued a release (reproduced below) encouraging B.C. Premier Christy Clark to embrace the Gender Identity and Expression Human Rights bill introduced to the Legislature yesterday by BC NDP MLA Spencer Chandra-Herbert. I took the opportunity to see if I could get the Premier to commit to consider bringing in her own bill. Such a bill would modify the Human Rights Code to add explicit language identifying discrimination based on gender identity or expression as unacceptable in British Columbia.

Real leadership acts on good ideas regardless of where they come from. Real leadership has the well being of British Columbians at the heart of every decision. I am convinced that the Premier can be persuaded to make this a priority.

But as I note below, I understand that at times it’s very difficult to actually want to bring forward good legislation and rise above the partisanship when personal insults, vitriol and allegations are hurled back and forth.

The speaker ruled that I referred too extensively to the Private Member’s bill and so called for the next question without compelling an answer from the Premier. While obviously disappointed, I am still hopeful that the Premier will see the wisdom and merit in Spencer’s bill and rise above the catcalling that has been hurled her way during Question Period. After all, it’s 2016.

Question

A. Weaver: Yesterday was a very fine day in British Columbia, as the government introduced the Sexual Violence and Misconduct Policy act. I was very pleased to see the government introduce this, and we’ll be debating it further.

Yesterday was also an important day, because another bill was brought to the Legislature, a bill entitled Gender Identity and Expression Human Rights Recognition Act. In that bill, ten words and a comma were proposed, ten words and comma which will have enormous implications to the acceptance — telling British Columbians that we are an accepting society. It’s essentially putting forward changes to the Human Rights Act.

Madame Speaker: Member.

A. Weaver: Yes?

Madame Speaker: The bill is before the House, currently.

A. Weaver: Correct.

My question to that, with respect, hon. Speaker, is as follows. Will the Premier consider…?

Madame Speaker: Member.

A. Weaver: Hon. Speaker, my question, then, is this: will the Premier introduce legislation along the lines of allowing changes to the human rights code to identify gender identity and expression as reasons not to have discrimination in British Columbia? This will send a signal to British Columbia, an important signal to British Columbia that we are an accepting society.

Madame Speaker: The bill is before the House. Next question; new question.

Additional Question

A. Weaver: I understand, hon. Speaker, in this House that, at times, personal allegations are hurled back and forth, and at times it’s very difficult to actually want to bring forward good legislation and rise above the partisanship. However, when good ideas are brought to this House, surely we can all rise above this partisanship.

Yesterday we had a good idea brought to this House. The good idea that was brought to this House was to say to the people of British Columbia that we will not discriminate against gender identity and gender expression.

My question to the government is: will the government consider introducing their own legislation to actually add words with respect to gender expression and gender identity in the human rights code to ensure that they are not discriminated against?

Madame Speaker: Member, the bill has been received, and first reading has been sent down for second reading.

Next question.

Media Release

VICTORIA, B.C. – Andrew Weaver, Leader of the B.C. Green Party and MLA for Oak Bay–Gordon Head, today encouraged B.C. Premier Christy Clark to embrace the Gender Identity and Expression Human Rights bill introduced to the Legislature yesterday by B.C. NDP MLA Spencer Chandra-Herbert.

“Yesterday was a highlight of my time in political office because I was able to set aside political differences with the government and put forward good public policy in the form of the Sexual Violence and Misconduct Policy Act,” Weaver said. “Not every issue is partisan. In fact, good public policy should unite the Legislature. The issue of sexualized violence on B.C. campuses is one example. Mr. Chandra-Herbert’s bill is another.”

“I am sincerely hoping that Premier Clark will throw her government’s support behind this bill, as she has done with the B.C. Green Party bill to address sexualized violence at B.C. campuses. The B.C. Green Party has publicly supported Mr. Chandra-Herbert’s bill each time he has tabled it. As Premier Clark demonstrated in the case of the Sexual Violence and Misconduct Policy Act, real leadership acts on good ideas regardless of where they come from. Real leadership has the well being of British Columbians at the heart of every decision.”

– 30 –

Media contact

Mat Wright – Press Secretary

Office of MLA Andrew Weaver

1 250-216-3382

mat.wright@bcgreens.ca

Video of Questions

A Private Members Bill to Protect RDSPs and RESPs from Creditors

Today in the legislature I introduced a private members Bill M208 – Court Order Enforcement Amendment Act, 2016. The bill adds Registered Disability Savings Plans (RDSPs) and Registered Education Savings Plans (RESPs) to the list of plans protected under the act.

If a person files for bankruptcy in B.C., their RRSPs are protected from being seized by creditors. However, the same protection does not exist for RESPs or for RDSPs. A child should not have their education investment seized due to misfortune that befalls their parents. Alberta has protected RESPs; we should follow suit.

I asked the Minister of Justice about this problem in question period two years ago. At the time, the Minister said that it was an important issue and that she’d be glad to work with me to move it forward. Yet two years have now passed and still nothing has changed. Seeing as I haven’t seen any meaningful progress from the government on this simple legislative change, I decided to offer them a possible solution.

Text of Bill Introduction

A. Weaver: I move a bill, intituled Court Order Enforcement Amendment Act, 2016, of which notice has been given in my name on the order paper, be introduced and read a first time now.

Motion approved.

A.Weaver: Registered Retirement Savings Plans (known as RRSPs) were first introduced federally in 1957. Legislation enabling Registered Retirement Income Funds (known as RRIFs) was subsequently brought forward in the late 1970’s.

RRSPs and RRIFs are protected in this, and most other provinces, from creditors in the case of personal bankruptcy. Protecting these funds provides a glimmer of hope that individuals undergoing bankruptcy will not be destitute in their old age.

In 2008 Federal legislation was passed to allow for the creation of Registered Disability Savings Plans (RDSPs). The RDSP is a federal, tax-deferred, long-term savings plan for people with disabilities who want to save for the future.

Unfortunately, under our outdated Court Order Enforcement Act, 1996, RDSPs are not listed as a registered plan in BC’s legislation and are therefore not exempt from creditor protection. Should an individual with an RDSP go into debt, their savings in the RDSP will not be protected from seizure. The same is true for Registered Education Savings Plans (known as RESPs).

Recognizing that a child should not have their education investment seized due to a misfortune that befalls their parents, the Alberta government also passed legislation two years ago protecting from creditors.

This Bill amends the Court Order Enforcement Amendment Act to ensure that RESPs and RDSPs are protected by law from creditors.

I move that the bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Motion approved.

BILL M208, Court Order Enforcement Amendment Act, 2016, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Video of Bill Introduction

Bill M205: Post-Secondary Sexual Violence Policies Act

Today in the legislature I introduced Bill M205: Post-Secondary Sexual Violence Policies Act. This bill, based on similar legislation in Ontario, aims to address the pervasive occurrence of sexualized violence plaguing universities, colleges and other post-secondary institutions in British Columbia. It creates a legal responsibility for them to develop and maintain policies that would work to prevent the occurrences of sexual violence and provide support for victims. The act would allow university- and college-specific policies to be developed that would meet the needs of students, including education and protection, while working to create a safe environment for all students to come forward to report a sexual assault.

The preponderance of sexualized violence on the campuses of post-secondary institutions affects all of us. It’s time for our government to stand up and say that enough is enough. With your support and collective voice we will be able to improve the safety of post-secondary experiences for everyone.

Below is the text and video of my introduction of the bill. If needed, the contact information for sexual assault support and crisis centers throughout British Columbia are also listed below.

Text of Bill Introduction

BILL M205 — POST-SECONDARY SEXUAL

VIOLENCE POLICIES ACT, 2016

A. Weaver: I move introduction of a bill intituled Post-Secondary Sexual Violence Policies Act, 2016.

Motion approved.

A. Weaver: It is estimated that one in four female university students will be sexually assaulted during the relatively short amount of time they spend on campus.

If that number seems startling, then keep in mind that when the University of Ottawa recently did a student survey on the issue, 44 percent of female students experienced some form of sexual violence or unwanted sexual touching. Within our province, we’ve heard of numerous assaults that have taken place over the last few weeks, with a variety of different responses.

It is with this in mind that I introduce the Post-Secondary Sexual Violence Policies Act. This bill requires colleges and universities to have sexual violence policies that set out the process that will apply when incidents and complaints of sexual violence are reported. It is critical that we establish a legal requirement for our post-secondary institutions to have sexual violence policies that educate, protect and support our students. This legislation would actively involve students in the development of these policies and ensure that universities are adequately reporting and responding to incidences of sexual assault.

I move that this bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Bill M205, Post-Secondary Sexual Violence Policies Act, 2016, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Video of my introduction of the bill in the legislature today.

Video of Bill Introduction

Online and Phone-in Resources

- VictimLinkBC is a toll-free, confidential, multilingual multilingual telephone service available across B.C. and the Yukon 24 hours a day, 7 days a week. It provides information and referral services to all victims of crime and immediate crisis support to victims of family and sexual violence, including victims of human trafficking exploited for labour or sexual services, 1-800-563-0808

- 24 hour sexual assault crisis and information line, based in Victoria, 250–383-3232

- Qmunity Resource Centre provides counselling, resources, programs and peer support to the lesbian, gay, transgender, bisexual communities. (604) 684-5307.

- Youth In BC, provides an online chat program to connect victims with support. Available noon to 1am in BC and the Yukon.

City Specific Support and Crisis Centers

Victoria Sexual Assault Centre

3060 Cedar Hill Road #201

(250) 383-3232

http://vsac.ca/

Kamloops Sexual Assault Counselling Center

235 First Avenue #601

(250) 372-0179

http://www.ksacc.ca/

Women Against Violence Against Women

Vancouver, BC V6J 5C2

(604) 255-6344

http://www.wavaw.ca/

B C Society for Male Survivors of Sexual Abuse

3126 W Broadway

(604) 682-6482

http://bc-malesurvivors.com/

Prince George Sexual Assault Centre

5130N Nechako Rd.

(250) 564-8302

https://clbc.cioc.ca/record/CLB0654

SOS Society

Prince George, 193 Quebec St

(250) 564-8302

http://www.sossociety.net/

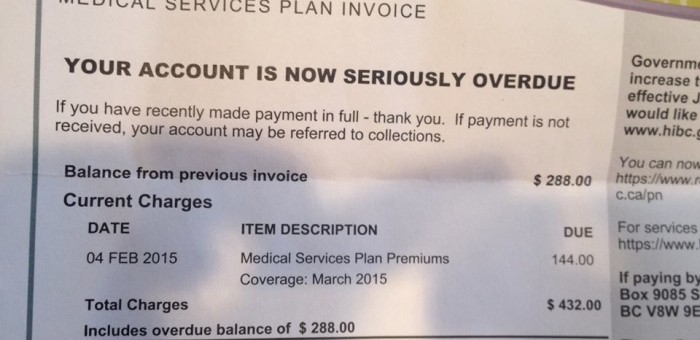

BC Liberals Reject Progressive Approach on MSP Premiums

Today in the legislature we were debating an amendment to the motion that the Speaker do now leave the Chair for the House to go into Committee of Supply”. The BC NDP added the following text:

“That the government recognize the cumulative effect of the increases in MSP taxes, hydro rates, ICBC premiums, and other fees and hidden taxes, on British Columbia families.”

I took the opportunity to subamend the amendment by adding:

“And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue neutral manner to create a progressive health care levy.”

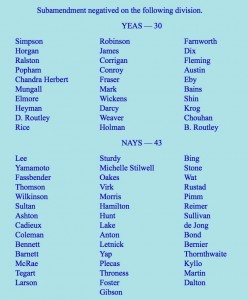

The BC NDP supported my subamendment which was defeated by the Liberal majority (vote reproduced below). I also supported the BC NDP amendment that was also defeated by the BC Liberals.

In voting the way they did on my subamendment, the BC Liberals made it very clear that they are not interested in fixing the regressive nature of the MSP premiums. I found this very odd in light of the fact that the Premier recently stated, “Here is the thing about the MSP system is it is antiquated, it is old, and the way people pay for it generally doesn’t make a whole tonne of sense…“. If you ask me, this is nothing short of a caucus vote of non confidence on the Premier’s position on the MSP Premium file.

Below is the text (and video) of my speech in support of the BC NDP amendment and my subamendment.

Text of my Speech

A. Weaver: It gives me great pleasure to rise in support of the motion put forward by the member for Nelson-Creston and seconded by the member for Port Coquitlam: “That the Speaker do now leave the Chair for the House to go into Committee of Supply be amended by adding the following, ‘That the government recognize the cumulative effect of the increases in MSP taxes, hydro rates, ICBC premiums, and other fees and hidden taxes, on British Columbia families.'”

I rise in support of this for numerous reasons. The first, of course, is that this government is proud of its triple-A credit rating and its balanced budget. I am proud of the balanced budget. However, the choices this government has made are such that it is those who can least afford it who are the ones paying the costs of balancing the budget.

It’s a biased budget, one that puts the poor, those with disabilities, those who can barely make ends meet and families second. It puts vested interests, the development industry, first and foremost.

This government touts the fact, through self-congratulatory rhetoric, that it is fiscally responsible. Let me be very clear: this government is fiscally reckless.

Take Site C, for example — the biggest item by far in the budget that is not being addressed in detail, an item with an $8.7 billion price tag that will almost certainly come around $12 billion to $13 billion when all is said and done. It’s a project that received virtually no attention in this budget and only had one line item to it. That’s Site C, as mentioned previously, by the minister before me.

The Premier recently stated that she wanted to move this project “past the point of no return,” but in her haste to get to yes, she is throwing fiscal caution to the wind. The government is pushing forward with a massive pet project that was created for a yet-to-materialize LNG industry — a project that has seen numerous cost overruns already, and yet it has barely started.

This government is plowing forward with a substantial risk that is borne on the backs of B.C. taxpayers — those who are not only paying the price through increases in MSP premiums, through increases in hydro rates, through increases in ICBC premiums, but who also being burdened with debt for years to come for a yet-to-materialize LNG industry, a project that has seen, as I mentioned, numerous cost overruns.

The government wants to appear to be fiscally responsible, but it’s gambling with our tax dollars. Why are we pushing ahead with a project that is riddled with legal challenges and massive environmental consequences? Why is the government not taking a step back and putting the interests of regular working people first and foremost? The British Columbians who actually vote the MLAs in here — why are they not putting their interests first?

Why is this government not taking that step back? British Columbians want this government to wait for the report from the Auditor General, who is currently examining the Site C project, and learn whether this project is actually fiscally sound. Frankly, to push ahead is simply reckless.

With Site C, it’s easy to see we’re going into a big debt for a project we don’t need, and in doing so we are flooding our energy market with taxpayer dollars that are actually driving investment out of our province. And again, to make ends meet, we increase MSP rates. We increase hydro rates and on and on and on.

Just two weeks ago, the Canadian Wind Energy Association announced that it was closing its office and leaving B.C. because the government and B.C. Hydro are just not interested. Last year we saw the same thing with EDP Renewables — no interest from the government for a roughly $1 billion wind power investment off southern Vancouver Island. That company has walked as well.

Despite the potential in this province, clean energy investment is leaving British Columbia in droves. The B.C. Liberals’ dream — they continue to dream of LNG — has not materialized, but they’re still using billions of taxpayer money to gamble on projects designed to support it. They are pushing risky projects past the point of no return and, in so doing, clean tech investment out of our province.

Let’s take a look at these LNG figures that the Minister of Environment has presented in the budget, figures that were supposed to help fuel a prosperity fund instead of it being fuelled through MSP premium increases and so forth, which this amendment is attempting to address.

I love talking about LNG. I love talking about it, just like I loved talking about the tooth fairy when I was a little child. Those of us outside the government’s self-congratulatory circle of hyperbola know that they had….

Hon. A. Wilkinson: Hyperbole. “Hyperbola” is a mathematical term.

A. Weaver: Hyperbole. Thank you to the Minister for Advanced Education for pointing out that hyperbola is a mathematical term.

Those of us outside of government’s self-congratulatory circle of hyperbole already know that they have no hope of tapping into an LNG market in the short term, no hope whatsoever. No amount of tax cuts, no amount of subsidies to the industry, no amount of praying to the LNG god…. We just know it’s not going to happen. They’ve tried and failed.

This year’s budget shifted the LNG story to a future supply-demand gap slotted to emerge ten years from now. Uh-oh. Never mind the “unforeseen global conditions.” So how are we going to make ends meet? We’re going to tax those who are least able to afford it through increases in MSPs, increases in hydro rates and so forth, which is exactly what this amendment is trying to quantify and recognize.

Now we’re talking about LNG in, say, the mid-2020s, something that I’ve been saying for quite some time. Yet the government’s track record of repeatedly failing to predict the LNG future even months in advance does not instill in me, let alone in British Columbians, with any confidence as to what their projected supply and demand will be like in 2030.

On the demand side, there are challenges as well. While the increasing competitiveness of the renewables, as recently highlighted by economists, it seems unlikely that demand projections, illustrated by the curious unlabelled graph in the 2016 budget document, will be accurate either. Simply making up numbers.

This government is chasing a falling market, in which it was a late player, and throwing good money after bad. Let’s take a look at this prosperity fund in a little more detail. This is a fund that the government promised to implement through vast amounts of moneys coming from LNG revenues. Instead, we see increases to the MSP premium, hydro rates, and so on, in order to fund the prosperity fund on the back of individual taxpayers.

I have always advocated that it’s our responsibility as legislators to not think merely of today’s British Columbians but also those of future generations who will follow us — though in a more responsible, realistic manner than the government’s “LNG for our grandchildren” rhetoric mantra.

Indeed, this is the main reason I chose to run for office in first place. But the fact is that if this government were serious about reducing the debt of this province, they would not grow the debt of this province each year. They would not create a loophole allowing them the ability to not pay down the debt with surplus revenues but, in fact, use taxpayer money for political posturing, which is what the prosperity fund is all about.

It gets worse. My fears were confirmed when I looked into the specifics of the prosperity fund being funded through taxes on those who can least afford it — the subject of the amendment before us. Let’s break it down. We have $100 million going into this prosperity fund this year and, according to this year’s budget, no further investments in our province’s savings account in any subsequent year. That’s hardly prudent fiscal planning. And curious, it’s in a year leading up to the election.

Of that $100 million, this government is putting a full half of it towards debt retirement. Hang on. That’s not $100 million. It’s $50 million in the prosperity fund. But then they actually say that only 25 percent of the $100 million will be saved, while the last 25 percent will go towards “government priorities.” Clearly, MSP premiums are not the government’s priority.

What is the government priority? Probably boutique handouts as we move into the election year in May of next year. In fact, when we tone down the self-congratulatory rhetoric that this government is issuing and tune into the actual numbers, we find that this government’s $100 million prosperity fund is actually a one-time investment of $25 million. This is a blatant misrepresentation of how tax dollars are being spent.

Also, the government tried to mislead the voters of B.C. that their empty promises are not actually empty. They’re doing this to create a potential political play to try to tempt the opposition to vote against prosperity. That’s shameful — nothing more than political posturing in the hope that they can turn around and say that the opposition votes against prosperity.

This opposition votes for prosperity. But prosperity is more than just the bottom line in the so-called prosperity fund. It’s prosperity in social prosperity. It’s environmental prosperity. It’s fiscal prosperity. It’s triple-bottom-line prosperity. For this government, prosperity simply means prosperity for those who happen to give them large donations to ensure that they remain in power. It is not a prosperity for all British Columbians. It is a very limited prosperity.

With that in mind, and in light of the fact that the motion to amend the statement “That the Speaker do now leave the Chair” is before us, I will, at this time, introduce notice to subamend that motion with the idea of adding the following:

I move the following subamendment:

[Be it resolved that the motion “That the Speaker do now leave the Chair” be amended by adding the following:

“That the government recognize the cumulative effect of increases in MSP taxes, hydro rates and ICBC premiums, and other fees and hidden taxes, on British Columbia families,”

And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue neutral manner to create a progressive health care levy.]

Deputy Speaker: So, Member, are you going to speak on the amendment to the amendment?

A. Weaver: Correct.

Deputy Speaker: Okay. Carry on.

On the subamendment.

A. Weaver: On the subamendment, I have but one statement. I am going to quote Tom Fletcher from Black Press, president of the legislative press gallery. The quote is this. “Green leader has it right.”

The Vote

Video of my Speech

am

The truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is — W. Churchill

Today in the legislature I rose to speak to the budget. Every MLA is give 30 minutes to respond to budget. My staff and I’d prepared so much material that I barely got through half of what I had planned to address. But there will be more opportunities in the weeks ahead to outline why I will not support this budget.

Below is the text of my speech. I also append a video further down.

Text of My Speech

A. Weaver: It gives me great pleasure to rise and speak to this debate, particularly after the member for Comox Valley, who classified the world and this House as one of two sides: the world of optimism on that side and arguably, in his mind, the world of pessimism on this.

I’d like to quote Winston Churchill:

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”

I am an optimist. I understand what it means to be an optimist, but unfortunately, I don’t think Winston Churchill was thinking of this government when he came up with that quote.

In fact, there is another quote attributed to Winston Churchill more applicable to the statements that emanated from the opposite side, and the quote is this:

“The truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is.”

What you are going to hear from this side of the House is a truthful assessment of the Budget 2016, not one filled with rhetoric, not one filled with promises, not one filled with half truth, but one that looks at it carefully and points out what is good and what is not good without the hyperbolic, hysterical rhetoric, so common, emanating from those on the other side.

I rise in this debate puzzled by the direction this government is heading. Frankly, it has become clear to me that this government is really out of new ideas — completely out of new ideas, lost, lost their way, given that LNG is not playing out the way they thought it would be.

The budget speech we heard on Tuesday was high on self-praise but represents little in terms of fundamental change. We continue to chase markets we are not part of with LNG while bringing forward no clear plan to build on our strengths let alone the challenges we face.

While it was encouraging that this government incorporated some policy changes that British Columbians have been advocating for, for the most part, they represented halfway measures that do little to attack the underlying issues that are presenting challenges for so many British Columbians.

First let me discuss the issue of housing. To make good policy, you need good data. I was encouraged to read the government has adopted additional tools that will allow them to gather much-needed contextual information about the housing market.

The new requirement for property purchasers to identify their nationality is a step forward that I’ve been urging this government to take for two years.

Frankly, I wonder how they’re going to do it without actually bringing the private member’s bill, which is precisely the same as what is being proposed by government. I look forward to debating the private member’s bill that’s before the House as we speak.

I’m glad that government listened on this. Likewise, I was also pleased to see that bare trusts will now face more examination, and the government will have the data it needs to address this. Gathering more information about bare trustees is certainly better than ignoring the problem all together. I’d like to stress this: this loophole still remains open — open to exploitation.

To say that we need to gather information from scratch implies we have an entirely different market to that of Ontario. Ontario’s housing market in Toronto is just as hot as that in Vancouver, with speculation running amok. Yet in Ontario, they have a mechanism to track this and actually generate revenue to limit the amount of speculation occurring.

While that may largely be true, for example, that we need to gather information from scratch for efficiency’s sake, I do think we have a promising opportunity to learn from what has happened in Ontario and to act pre-emptively to close this loophole.

For example, Ontario has a similar property transfer tax system in place, but they have plugged the loophole and they did it very simply. All they did was apply the property transfer tax upon change in beneficial ownership, not just change in title registered at the land title office.

The wealthy offshore buyers can flip houses numerous times by simply registering the first purchase as a bare trust owned by a corporation and flip the corporation shares from owner to owner to owner without ever changing land title and without ever paying a penny of property transfer tax.

I know this is being done because I have spoken to developers. I have spoken to mortgage lenders, and I’ve spoken to those who are involved in the real estate industry.

This change could and should be done in British Columbia to ensure everyone is treated fairly. However enlightening information may be in its own right, it’s meaningless without appropriate action. We need to get moving on these issues, and government doesn’t seem to have a plan, like so many other things.

This also seems to be the case with the government’s change to the property transfer tax. Increasing property transfer tax rates to 3 percent on homes over $2 million is another adjustment that I agree with in principle. But with affordability as the top issue on the minds for so many people across the province, making it more expensive to flip luxury homes is a progressive step. There’s no question it’s a progressive step forward.

Unfortunately, this too could be rendered meaningless if the loopholes in our housing markets are ignored. In fact, it may be that the government loses taxes in the short term as more sellers engage in and exploit those loopholes to avoid the increase in taxes.

Furthermore, with the $750,000 property tax break for new homes, the government is incentivizing housing development while doing nothing to dampen speculation — again, failing to close the loopholes affecting the market right now.

Contrary to the minister’s dismissive comment that this is a Point Grey issue, the housing problem is affecting communities across British Columbia and it is greatly impacting our provincial economy. On my street alone, where I live in Gordon Head, a house sold. The sold sign came on when the house was listed. It was sold to foreign buyers. Two months later, the sold sign came on again, as the house was flipped. It was cash transactions in both cases. This is not a problem exclusive to Metro Vancouver. It’s a problem now emerging in the capital regional district and other markets in British Columbia.

The costs we are shouldering in society are not just economic, they’re social. The passionate, determined, young people we need to support our communities and lead them into the future are being priced out by people who can afford to buy houses and leave them empty.

Ever wonder why there’s a traffic jam on the Second Narrows Bridge in Vancouver going north? It should make no sense, because people on the North Shore work, by and large, in Vancouver. The reason is because nobody who’s working in those homes — the electricians, the plumbers, the trades — are able to live in that region, and so they’re commuting from halfway across Vancouver across bridges. And the government’s response — rather than dealing with the problem, the affordability problem — is to start talking about building bigger roads and bigger bridges. Again, not addressing the problem, it’s avoiding the problem being dealt with and kicking the can down the road further.

The role of government is to take direct action and to direct the actions of citizens. We incentivize what we like, and we discourage that which we don’t. We need to close loopholes and disincentivize the preponderance of empty houses, because as it currently stands, the government is failing to do an adequate job of either. There’s a glaring market failure. The preponderance of vacant homes in Vancouver has a social cost attached to it. That externality needs to be internalized so that vacant owners pay the true cost of that vacant home.

The government’s response, rather than recognizing the market failure and internalizing externalities, incentivizes more development and further speculation. This is a government that is completely out of control and completely at a loss or understanding of fundamental market instruments. That does not deal with the imminent problem. It kicks the can down the road further, so to speak. The imminent crisis needs to be dealt with through the implementation of market instruments available to government. Those instruments alone will correct this market failure.

Frankly, the single most effective policy that government could do would be to implement a price, a levy or a tax on homes that are left vacant. This government is building the economy of Scottsdale in British Columbia as we speak. It’s an artificial economy, fuelled by speculation and requiring continued development and building of houses in order to sustain itself.

Government is misleading British Columbians by suggesting that we have a diversified economy. Our economy right now is being driven by wild speculation and offshore money coming into British Columbia to actually buy these homes, and developers building more — selling, flipping, buying, speculating.

There is only one end solution for that infinite growth in a finite system, and that will be a collapse, a collapse of pretty strong proportions that this government will start — as they have done with LNG — to blame on unforeseen global forces. Well, we can see it happening right now, and there’s nothing unforeseen about it. What is unforeseen is any will or any policy emanating from the government to actually address the key issues of today in British Columbia.

Putting up a levy on vacant homes will encourage more owners to lease their vacant homes, which in turn will put downward pressure on rent costs in Vancouver and elsewhere. The revenue generated from this levy could actually be used to pay the social costs arising from non-affordability within Metro Vancouver and emerging here in the capital regional district: the costs of the homeless, the enhanced judicial system process that is required to deal with the increasing homeless problem in our province. The reduction of services for mental health can be addressed. We can start to actually raise the living allowance, which hasn’t changed in I can’t even remember how many years.

One of the saddest moments in this House since I was elected in 2013 happened about 20 minutes ago when the member for Comox Valley stood and truly believed that somehow $11 a month is actually a great step forward, after seeing no increase in fees for years and years and years.

The people of British Columbia deserve better. They deserve a government that’s honest to them, a government that actually does not try to sell itself as something it’s not, a government that recognizes that there is a social problem out there and that $11 a month is not going to solve it. Frankly, the price of cauliflower has gone up $8, say, in about three months. Basically, what we’re saying is that you can almost meet the increase in your grocery bill, but not quite, with this $11 a month. Shameful, truly shameful that this was lauded as a sign of progress.

In summary, the government’s balanced budget increasingly is relying on revenue from an artificial, overinflated housing market. They are benefiting from the issues that are causing so many affordability concerns amongst British Columbians and taking no real concrete steps to address this. The government needs to address this market failure, and the 2016 budget represents another missed opportunity to do so.

Now to MSP. On MSP, the government has brought forward a small, half-step approach to making this fee a little bit more fair for the people of British Columbia. I commend them for taking that one small half-step. It may not be much, but at least we are moving in the right direction. Making children exempt from paying MSP premiums and increasing the assistance available are both positive changes to a fundamentally unfair system.

Despite the changes to MSP premiums announced on Tuesday, we still have a system that doesn’t work, however, for most British Columbians. To use the Premier’s words, as the opposition did so well earlier today in question period, it’s a system that is “antiquated…old, and the way people pay for it generally doesn’t make a whole ton of sense.” Those are the Premier’s words. I agree. The opposition agrees. But somehow the government doesn’t agree with itself. I’m not sure what’s going on.

Hundreds of thousands of people in this province are currently behind in their MSP payments. That’s a ton of bureaucracy, needlessly employed in enforcing an antiquated, old system. That’s what the Premier said. I agree. Bureaucracy — dare I say that’s red tape?

Shame if it is, because of course we know that the government doesn’t like red tape and in fact has gone so far that we now have red-tape-reduction day, making us truly a laughing stock across Canada. Every, single person that I have actually raised this to and mentioned that red-tape-reduction day is now on the same par as Terry Fox Day, Holocaust Memorial Day, Douglas Day, B.C. Day and Family Day looks at me and says: “What?” They couldn’t believe it. This government believes it, but it says whatever it takes to get through lunchtime.

The reality is, the biggest component of red tape in the entire sector of government is the administration of the MSP premium which the Premier, through her own words, says is antiquated, old and doesn’t make a whole lot of sense.

Okay, let’s remove some red tape. No, they create more red tape, more thresholds, more exemptions, etc. Absolutely unbelievable.

Plus, when we delve into the details of this policy change, what we see is actually a tax hike. The people of British Columbia have spoken loud and clear about how they are having trouble with this tax, yet this government has raised the amount of money they take from it — a new $111 million in taxes, a head tax. That’s what it is — a head tax, which, after the premium assistance is accounted for, makes it an increase of $77 million in revenue. That’s $77 million as a head tax, because that’s what it is — a poll tax or a head tax, nothing else.

Who is paying for this new revenue? Well, a couple that earns a combined $45,000 or more a year will see their Medical Services Plan increased by $240 a year. Whoa, hang on. That’s more, a greater MSP premium. I thought it was going down.

Senior couples with a slightly higher income face the same increase. Yet when I was at the Monterey centre, when this issue was first brought to me almost a year and a half ago, the demographic that brought it to me were the seniors who were struggling on fixed income to actually pay it. Here, the government is listening. It’s listening to its corporate funders. It’s not listening to the people of British Columbia, because the group that can least afford it — those on fixed income — are getting a $240-a-year hit. That’s hardly fair. That’s not fair at all.

A couple with two children will pay $72 more a year. These are significant increases in medical premiums. Let’s be clear that a combined income of $45,000 is not that much in Metro Vancouver or greater Victoria.

A single adult who earns less than $42,000 is eligible for premium assistance, but a couple earning $3,000 more is facing an increase of $240 a year. This is yet another example of how this government does not understand simple fundamental market instruments. You incentivize that which you like. You use your market instruments to put a tax or disincentivize that which you don’t.

This introduction of the MSP program is incentivizing divorce in the province of British Columbia. It’s saying to couples: “You should not be couples, because if you get married” — this is families first — “or you become common law, we’re going to charge you $240 a year more.” Does that make sense? No it doesn’t. But that’s what this government is putting forward.

Let’s look at Ontario as a case example in how we could charge MSP differently. In Ontario, health care premiums are paid through personal income tax systems. Rather than a flat-rate levy, this approach avoids the regressive nature of the monthly premium as rates rise with income to a maximum annual level.

For example, as I’ve outlined for a couple of years now, in Ontario, the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums at all.

The argument that we need to keep this tax separate from other taxation methods so that British Columbians know that health care is not free is ridiculous. British Columbians know that health care is not free. They know that building bridges and highways is not free. They know that education is not free. To treat them as if they don’t is disrespectful. It is disrespectful of the people of British Columbia.

They know that their taxes go towards the services that government provides. If the government still insists that British Columbians need to understand how much health care is costing our province, then there is a simple solution — a simple line on the income tax return, like that exists for EI and CPP, called health care premium, which is progressively calculated just like EI and CPP are. It would solve the problem. It would deal with the issue that unions have negotiated benefits because it would still pay for it. It would be done in a progressive instead of a regressive system, just like it was done in Ontario.

In fact, this was the method advocated for in the 2002 Senate report that recommended the federal premium to help pay for health care costs — the health care of Canadians. The federal role made a strong case that premiums constituted a visible and equitable means of supported health care spending, so long as they varied in proportion to income. It’s not me making it up. It’s Senate expert panels that are providing information in forming this policy.

Now let’s turn to new services. Another item in this budget that received considerable attention was the boost to the Ministry of Children and Family Development. Now, without a doubt, I’m encouraged to see that the government seems to finally be paying attention to our most vulnerable — a topic that the official opposition has brought forward time and time and time again during question period.

It seems like they may have done more harm than good, unfortunately. For nine years, there’s been a freeze on the disability rate at $906 a month. At first glance, a $77 increase for disability assistance looks like a step in the right direction. If we take into consideration the loss of transportation subsidies, which in some cases amounts to $66 a month — the numbers were messed up in question period; I am assuming that tomorrow the minister will correct the numbers that she quoted out in question period — this budget represents an increase of only $11 a month — $11 a month — that the member for Comox Valley was so proud to tout to British Columbians in solving the social woes of those most unfortunate with disability in our society.

That’s hardly a success. In fact, with the increases in transportation in some areas going up — just look at the capital regional district, dramatic increases — this is actually a net loss, or will be a net loss, and government exempts itself from having to deal with the increasing costs of transportation. I am sure this was not their intention, but clearly this is not an outcome that will make life all that much better for the most vulnerable in B.C. In some cases, it will down the road make life a little more difficult.

On a more positive note, the $95 million set aside for wildfire protection, the $10 million for search and rescue plus the $55 million set aside for emergency preparedness and prevention initiatives are welcome news. Indeed, they’re among the only budget items I could find, although not attributed to, but that address one of the biggest threats to our province’s economy — climate change.

Let’s look at climate change. We are paying the cost of climate change in this province already. This past year, we saw record temperatures across our province. We saw drought precipitated by a lack of snow pack, and forest fires raged across our province. The January 2016 globally average temperature shattered the previous record by 0.16 degrees and was more than a full degree Celsius above the 20th-century average.

In B.C., we simply stand by and watch happen and go to Paris and say: “Look, we are leaders.” Others call you leaders; you don’t call yourself leaders. In British Columbia, we are not leaders on the mitigation of climate change. We were leaders, but that is long past.

I brought forward a motion, for example, to discuss a matter of urgent public importance last summer. At issue was whether we as legislators were acting with sufficient urgency and demonstrating the appropriate leadership on preparing for and mitigating the escalating impacts of climate change in our province. Unfortunately, my motion went nowhere.

Directing the actions of society through the fiscal instruments available to government is one of the most powerful tools we have. But here in 2016, we have a budget that barely mentions the biggest problem we face as a global society. We heard from the minister that “Budget 2016 continues to build on B.C.’s leadership in clean technology and climate action. Climate change is a global issue, and the Premier has made it clear that B.C. will remain a climate action leader. And we have been able to move forward with that leadership on climate change while also growing our economy” was another quote.

Yet in the budget itself, there is scant mention of climate change. And the funding put aside doesn’t so much build on B.C.’s leadership in clean tech, as they said, but only supports one policy: the continuation of their existing electric vehicle program. That’s it. No more. Climate leadership, to this government, means continuation of an electric vehicle incentive. Nothing more. Hardly going to help the majority of our society.

Admittedly, I did benefit from that. I did get an electric vehicle. But there are many who this will not benefit. And I wonder how many in government have actually taken this incentive and got an electric vehicle. Probably a small number. Very small number. I’d guess zero.

Interjections.

A. Weaver: It’s not true? So that’s good. I’d like to have a list of all government MLAs who own an electric vehicle come my way, and I’d be happy to praise them publicly. But we’ll see.

The construction of Site C dam has put the final nail in the coffin of the clean-tech sector in British Columbia. Shocking. The Canadian Wind Energy Association has just left B.C., citing the existence of greener pastures elsewhere. Well, let me tell you. There will be greener pastures here in just a little more than a year, when this government is sitting on this side of the bench and the rest of us are sitting on that side of the bench.

A $1 billion investment on Vancouver Island involving a partnership between EDP Renewables…. This isn’t pipedream stuff. This is real investment, not of taxpayer money but of industrial money, on Vancouver Island through partnership between EDP Renewables. First Nations and TimberWest,. It’s gone. They’ve walked from B.C. because of a lack of leadership by this government. Frankly, that’s reckless economics, in my view. It’s reckless mismanagement of our economic system.

British Columbians are fed up with this rhetoric. World leaders of this. World leaders of that. We’ll all be happy and wealthy and wise, blah, blah, blah. That’s what we’re hearing. But enough is enough. This government is out of ideas.

They’ve misled British Columbians about the prospects of LNG. They look out for their vested interests, and they say whatever it takes to get through lunch, whatever it takes to get to dinner, then whatever it takes to get through a day and on and on. They say whatever it is in the desperate hope that British Columbians are not paying attention. But they are.

The carbon tax remains flat, and leadership on climate change mitigation is largely absent. As I’ve heard nothing about this, I look forward to, hopefully, hearing something in the fall, where the government once more kicks another file down the road.

Government has ignored the agriculture sector until just recently, just like they ignored the tech sector until last August, when four civil servants were tasked to come up with a conference. That’s the government’s idea: “Let’s have a conference on agriculture. That’s leadership.” But we do have a leadership opportunity here in B.C. in the knowledge economy of the 21st century.

I was recently up in Prince George and saw firsthand how the tech industry could actually partner with our resource sector to take our strategic advantage and build our economy. Why is this government not investing $6 million to provide broadband redundancy to Prince George to allow Prince George to take advantage of its cooler climate to become a tech hub and bring the resource and tech sectors together, to be the home for data distribution centres like Google wants to be?

Six million dollars would be the biggest economic drive for that region, with the introduction of broadband redundancy, that that region has seen for decades.

Yet this government would rather spend $8 billion on a project for energy that’s not necessary because there’s no LNG and Alberta has said no. That’s their view of economics. What you got? My six million bucks is my view of economic prosperity.

Now let’s talk about the biggest item by far in this budget, an item with an $8.7 billion price tag. That’s kind of there in one line. The Premier recently stated that she wanted to move this project past the point of no return — another irresponsible statement by this Premier. Yet we have no LNG industry, and just today we hear from First Nations in the Peace region that they will soon be in court, as the injunction is coming to play out as B.C. Hydro tries to stop protesters.

I have so much more I could talk about, but I do see we’re on the green light. I could talk about LNG. I would love to talk about the prosperity fund. I have probably another half-hour speech, and I’m looking forward to being able to do that. Probably, I should be making an amendment right now to the budget speech so that I could actually talk about this stuff. But let me just say that what we should be doing in British Columbia is building on our strengths. We should be demonstrating leadership….

Some Hon. Members: More. More.

A. Weaver: If you would like more, members opposite….

Hon. Speaker, with your permission, I’ll speak for another half-hour. Would that be possible? Maybe I’ll give away too many ideas.

Finally, starting to take action, real action on the issues of affordability, directing our economy for the future prosperity rather than political talking points and making B.C. a leader on the issues of our time is what I had hoped this budget might do. Unfortunately, in my view, while there’s a lot of popular language in this, it’s found wanting on many, many points. Probably, the most cynical aspect of this budget is the prosperity fund, the $100 million prosperity fund, which, when you peel it down, is actually only a $25 million fund. And it’s a $25 million fund of taxpayer money.