Community Blog

Soils in the Shawnigan Lake Watershed — More Questions

Back in April I wrote a piece on the wisdom of dumping contaminated soils in the Shawnigan Lake watershed. I visited the region with Shawnigan Lake Area Director Sonia Furstenau. Together with a few other Shawnigan Lake residents, we hiked around on parkland owned by the Cowichan Valley Regional District. I took this opportunity to take a number of photographs. More importantly, I took the opportunity to collect water samples.

Back in April I wrote a piece on the wisdom of dumping contaminated soils in the Shawnigan Lake watershed. I visited the region with Shawnigan Lake Area Director Sonia Furstenau. Together with a few other Shawnigan Lake residents, we hiked around on parkland owned by the Cowichan Valley Regional District. I took this opportunity to take a number of photographs. More importantly, I took the opportunity to collect water samples.

The results of these water samples, together with my observation that a significant amount of fill had over run Lot 21 and was on the neighbouring parkland, led me to subsequently ask the Minister of Energy and Mines and the Minister of Environment questions in Question Period.

The results of these water samples, together with my observation that a significant amount of fill had over run Lot 21 and was on the neighbouring parkland, led me to subsequently ask the Minister of Energy and Mines and the Minister of Environment questions in Question Period.

As background, Lot 21 is the property located at 638 Stebbings Road and is owned by 0782484 B.C. Ltd. For several years, soil has been dumped Lot 21 for later use to backfill the quarry in lot 23. A photograph of the northern boundary wall of deposited soils is shown to the left. This photograph was taken from CVRD Parkland on the north side of Shawnigan Creek.

I outlined in my earlier post that it was apparent to me that substantial amounts of building materials had been placed on Lot 21. There was also clear evidence that runoff from this site failed drinking water standards at the point of entry with Shawnigan Creek. And visually, this water looked nothing like any other water in nearby surface and running water (see image to the right).

I outlined in my earlier post that it was apparent to me that substantial amounts of building materials had been placed on Lot 21. There was also clear evidence that runoff from this site failed drinking water standards at the point of entry with Shawnigan Creek. And visually, this water looked nothing like any other water in nearby surface and running water (see image to the right).

On May 15th I went back to the area to get a better sense as to what metals were contained in the orange sediments under the orange water. Since the water runoff came from Lot 21, my goal was to determine if sediments in this stream were any different from sediments at a control location upstream of Lot 21.

Four different sediment samples were obtained. Two of the samples were collected upstream of Lot 21 in order to obtain a control sample. The first, termed FLOW, in the attached data, was taken in the middle of Shawnigan Creek (see Figure 1 below). FLOW data will be used as the control sample below. The second sample (BANK in the attached data) was located at the bank of Shawnigan Creek immediately adjacent to where FLOW was collected.

Figure 1: Photographs showing me collecting the control sediment sample in the middle of Shawnigan Creek, upstream from Lot 21.

The third and fourth samples were collected where the orange runoff entered Shawnigan Creek (Figure 2), The third, termed CREEK, in the attached data, was taken in Shawnigan Creek right at the location where the runoff enters the creek. The fourth sample was obtained about a metre upstream of the runoff stream. This is termed POOL in the attached data.

Figure 2: Photographs showing me collecting the sediment samples at the location where the Lot 21 runoff meets Shawnigan Creek (left) and in a pool a metre or so upstream of the creek in the covenant along Shawnigan Creek (right).

As in my earlier post, the metal contents in the sediments were determined using an inductively coupled plasma mass spectrometry (ICPMS). The method for the bulk analysis of acid extractable elements (that is trace elements not bound in silicate minerals) was as follows:

1) The vial was shaken to homogenize and all for the removal of an aliquot for analysis (2 mL aliquot for BANK and POOL, 10 mL aliquot for CREEK and FLOW).

2) 10 mL of 8 Molar Environmental Grade Nitric Acid was added and allowed to react overnight.

3) The sample was diluted to 50 mL with 18 mega ohm deionized water.

4) The mixture was shaken to homgenize

5) The sample was put in a centrifuge for fifteen 5 minutes at 3000 rpm to separate out any residual particulate.

All concentrations in the attached data are given in (μg/L). Since there were different amounts of sediments in the individual samples, it is not possible to directly compare their element concentrations. Rather, I will focus on what is called the enrichment factor for each element after normalization with the commonly occurring element Calcium (Ca).

By definition then, the enrichment factor of a mineral XX is:

Enrichment Factor = (XX[sample]/Ca[sample])/(XX[control]/Ca[control])

Here [sample] refers to the concentration in a collected sample (in μg/L) and [control] means the concentration in the control sample (also in μg/L).

The attached data clearly show the presence of an enriched industrial metal content of the POOL Sample.

The following elements were found to be enriched by:

Between three and four times the control values:

Magnesium (Mg), Vanadium (V), Chromium (Cr), Manganese (Mn), Cobalt (Co), Molybdenum(Mo), Caesium (Cs), Barium (Ba), Hafnium (Hf).

Between four and five times the control values:

Lithium (Li), Scandium (Sc), Germanium (Ge), Zirconium (Zr), Tin (Sn).

Between five and ten times the control values:

Niobium (Nb) [enriched 5.29 times higher than control]; Lead (Pb) [enriched 5.19 times higher than control].

Greater that ten times the control values:

Iron (Fe) [enriched 11.69 times higher than control]; Thorium (Th) [enriched 18.60 times higher than control].

After examining the elemental sediment analysis, I am left with a number of serious concerns. The enriched metal values in the sediments under the runoff leaving Lot 21 suggest that their source comes from somewhere upstream and likely within Lot 21 itself. The question I am left with is this:

What, if anything, has been buried on Lot 21 that could produce the Thorium, Lead and other heavy metal enrichment in the sediments?

Celebrating youth in our community – Jillian McCue

This is the nineteenth in our series of stories celebrating the outstanding accomplishments of youth in our community. These inspirational young adults are enriching our lives with their passion and commitment to the betterment of society.

Jillian McCue

I first met Jillian in April 2013. During the election campaign a number of meet and greets were hosted throughout the riding. On this particular evening, we rented the Saanich Fusion clubhouse on Tyndall Road to provide a venue for Gordon Head residents to raise and discuss issues of their choice. Mid way through the evening, a nine-year-old girl entered the clubhouse and asked me if I could ask the audience to sign her petition. I had no idea who she was and I was of course a little leery so I asked the young girl what it was for. She explained that she wanted to petition Saanich to allow miniature goats in back yards like in Seattle. I was impressed by her passion and commitment and offered Jillian McCue the floor to pitch her cause to the crowd. By the time that she was done, every single person in the room had signed the petition. I had no idea that two years later this remarkable young girl would likely realize her dream. After presenting to Saanich Council and subsequently three of its advisory committees, last week Saanich’s Environment and Natural Areas Advisory Committee, chaired by Councillor Dean Murdock, recommended that a feasibility study be conducted and that a pilot project be set up in Jillian’s back yard!

I first met Jillian in April 2013. During the election campaign a number of meet and greets were hosted throughout the riding. On this particular evening, we rented the Saanich Fusion clubhouse on Tyndall Road to provide a venue for Gordon Head residents to raise and discuss issues of their choice. Mid way through the evening, a nine-year-old girl entered the clubhouse and asked me if I could ask the audience to sign her petition. I had no idea who she was and I was of course a little leery so I asked the young girl what it was for. She explained that she wanted to petition Saanich to allow miniature goats in back yards like in Seattle. I was impressed by her passion and commitment and offered Jillian McCue the floor to pitch her cause to the crowd. By the time that she was done, every single person in the room had signed the petition. I had no idea that two years later this remarkable young girl would likely realize her dream. After presenting to Saanich Council and subsequently three of its advisory committees, last week Saanich’s Environment and Natural Areas Advisory Committee, chaired by Councillor Dean Murdock, recommended that a feasibility study be conducted and that a pilot project be set up in Jillian’s back yard!

Jillian is a Grade 6 student at Gordon Head Middle School. She is the youngest of 5 children in her family, with three older brothers and one older sister. Jillian has loved playing soccer since age 7 and will be playing in the Under 13 (Gold) division in the fall – the first year playing on the full size field. She also loves gymnastics and cross-country running.

Jillian is a Grade 6 student at Gordon Head Middle School. She is the youngest of 5 children in her family, with three older brothers and one older sister. Jillian has loved playing soccer since age 7 and will be playing in the Under 13 (Gold) division in the fall – the first year playing on the full size field. She also loves gymnastics and cross-country running.

Jillian is an 11 year old who has for over two years now embarked on a mission. Few youth her age are as engaged as Jillian is in her community and especially in municipal politics. She became keenly interested in miniature goats as pets at the age of nine after she was introduced to two backyard-dwelling goats that belonged to family friends who lived in San Bernardino, California. Jillian, who appropriately was born in the Year of the Goat, took an instant liking to the goats and thought it would be wonderful to have a goat or two in her own back yard. Discovering that Saanich municipal by-laws did not permit the keeping of goats in urban areas, Jillian set out to change that.

Jillian did her homework and undertook her own research. She learned that Seattle City Council had approved keeping miniature goats as pets in 2007. An article in the Seattle Post-Intelligencer noted that “female and neutered goats do not generate significant odors”. Wanting to test this for herself, Jillian embarked upon her own scientific research with the “Goat Poo Smell Study”. The driving questions for her research were:

Jillian did her homework and undertook her own research. She learned that Seattle City Council had approved keeping miniature goats as pets in 2007. An article in the Seattle Post-Intelligencer noted that “female and neutered goats do not generate significant odors”. Wanting to test this for herself, Jillian embarked upon her own scientific research with the “Goat Poo Smell Study”. The driving questions for her research were:

1) Do Victoria residents find that dog poo is more smelly than miniature goat poo?

2) How much more or less smelly is dog poo than miniature goat poo?

and her hypothesis was that goat poo did not smell as bad as dog poo.

Participants in the study (32 in total) rated from 1 to 5 (a Likert Scale) the smelliness of two bags (bag A or bag B) of unidentified droppings (one was from a dog; the other from a goat). Her survey data confirmed her hypothesis. On average, dog droppings smelled twice as bad as goat droppings. The survey was done at an ideal location – Beacon Hill Petting Zoo, a place Jillian loves to visit and play with the miniature goats.

Participants in the study (32 in total) rated from 1 to 5 (a Likert Scale) the smelliness of two bags (bag A or bag B) of unidentified droppings (one was from a dog; the other from a goat). Her survey data confirmed her hypothesis. On average, dog droppings smelled twice as bad as goat droppings. The survey was done at an ideal location – Beacon Hill Petting Zoo, a place Jillian loves to visit and play with the miniature goats.

Armed with her research study, a pro-goat petition signed by 132 people in her neighbourhood (including me from that April 2012 event) and a well put together powerpoint presentation that demonstrated her knowledge about goats, Jillian headed to a Saanich Council meeting in May of this year. Her thoroughly researched and powerful presentation addressed the common misconceptions concerning miniature goats; it also detailed the positive aspects of having backyard goats in urban areas. Jillian easily handled questions posed to her by Councillors after her presentation. After further deliberations, Saanich Council referred the matter to three committees. Jillian had her work cut out for her in the lead up to the three additional presentations she gave in June.

Two years after undertaking this mission, Jillian has learned a tremendous amount about goats and municipal politics. She has met with elected politicians, learned how to execute a petition, conducted research, learned to give persuasive presentations to council and committees and garnered considerable media attention. Television, radio and newspapers all picked up the story, including CTV (twice), CHEK (twice), CBC, CFAX, Ocean 98.5, Times-Colonist and Saanich News. Having to give ten media interviews following an appearance before Saanich Council would be a daunting task for most adults, let alone an 11 year old, but Jillian handled it like a pro. She won’t give up and pledges to persevere with the hope for a positive outcome from Saanich at an upcoming Council meeting.

Two years after undertaking this mission, Jillian has learned a tremendous amount about goats and municipal politics. She has met with elected politicians, learned how to execute a petition, conducted research, learned to give persuasive presentations to council and committees and garnered considerable media attention. Television, radio and newspapers all picked up the story, including CTV (twice), CHEK (twice), CBC, CFAX, Ocean 98.5, Times-Colonist and Saanich News. Having to give ten media interviews following an appearance before Saanich Council would be a daunting task for most adults, let alone an 11 year old, but Jillian handled it like a pro. She won’t give up and pledges to persevere with the hope for a positive outcome from Saanich at an upcoming Council meeting.

We were not surprised when Jillian told us she “always puts her hand up in class” and “likes public speaking and talking to adults”. Apparently, it takes her a long time to deliver papers on her paper route because she frequently stops and talks to people in their gardens along the way.

Jillian’s numerous other activities including babysitting (she has completed the babysitter training course), volunteering her time to help serve homeless people in the community and participating in fundraising events for Hospice and the Cancer Society. In one cancer campaign she shaved her head and raised over $1,000.00 by going door to door in her neighbourhood. Shortly after shaving her head, she was in the city finals for cross country and was mistaken for a boy and placed in the wrong chute – placing her in 58th place when she actually came in 2nd in her girl’s age category race. As the photo to the left illustrates, this was somewhat confusing for Jillian when she received her 58th place participation paper (instead of a 2nd place ribbon), but it all got worked out and, once again, she handled herself with maturity (and good humour).

Jillian’s numerous other activities including babysitting (she has completed the babysitter training course), volunteering her time to help serve homeless people in the community and participating in fundraising events for Hospice and the Cancer Society. In one cancer campaign she shaved her head and raised over $1,000.00 by going door to door in her neighbourhood. Shortly after shaving her head, she was in the city finals for cross country and was mistaken for a boy and placed in the wrong chute – placing her in 58th place when she actually came in 2nd in her girl’s age category race. As the photo to the left illustrates, this was somewhat confusing for Jillian when she received her 58th place participation paper (instead of a 2nd place ribbon), but it all got worked out and, once again, she handled herself with maturity (and good humour).

Jillian loves to create videos and continues to develop her video-editing skills. She has her own website and YouTube channel where, for example, you can see her present an instructional video on how to bake Apple Crisp or her Easy Chocolate Cake. Jillian loves cooking and I must say, she is a great cook! When she heard about me breaking my nose (by walking into a glass window while texting!) she dropped by my house with some of Jillian’s home-baked chocolate cupcakes. Yum!

I guess that’s what’s special about Jillian. She is mature beyond her years. She is thoughtful and compassionate. She is determined and confident. And, she is just a wonderful kid. When asked what her dream job would be in the future, she almost immediately responded (in order) “a soccer player, Prime Minister or a singer”. After watching Jillian navigate the complexities of municipal politics we’re convinced that her determination, skills and ability to take on big challenges, could allow her to achieve all three.

|

Copyright © 2014 Answers Corporation. All rights reserved. |

Celebrating Local Businesses in Our Community – Hootsuite

This is the third in our series highlighting innovation and creativity within our region’s business sector.

Transitioning  With offices in Vancouver, San Francisco, London, Paris, Hamburg, Sao Paulo, Singapore, Boston, Bucharest, and more than 11 million users, including 744 of the Fortune 1000 companies, Hootsuite is the world’s most widely used social media management platform. And it started right here in British Columbia.

With offices in Vancouver, San Francisco, London, Paris, Hamburg, Sao Paulo, Singapore, Boston, Bucharest, and more than 11 million users, including 744 of the Fortune 1000 companies, Hootsuite is the world’s most widely used social media management platform. And it started right here in British Columbia.

When discussing alternatives to an economy fixated on oil and gas I turn to a vision of a province that fosters growth in a diverse range of industries, including nascent sectors like clean tech, bio tech, and high tech. British Columbia has a highly educated workforce that is prepared to take up the challenge and capitalize on the opportunity that transitioning to a 21st century economy presents. We have beautiful cities that talented individuals from around the world want to live in and the potential to increase our renewable energy production to support companies striving to lower their carbon footprint.

While it is easy to talk about these concepts theoretically, it was a great pleasure to see them in action when I visited Hootsuite headquarters in Vancouver last month. Hootsuite is a program that allows people and businesses to manage their social media programs across multiple social networks from one integrated dashboard. In essence, it organizes your social media presence, say on Twitter, Facebook, and LinkedIn, onto one screen that allows you to monitor and post content efficiently.

While it is easy to talk about these concepts theoretically, it was a great pleasure to see them in action when I visited Hootsuite headquarters in Vancouver last month. Hootsuite is a program that allows people and businesses to manage their social media programs across multiple social networks from one integrated dashboard. In essence, it organizes your social media presence, say on Twitter, Facebook, and LinkedIn, onto one screen that allows you to monitor and post content efficiently.

Hootsuite has grown incredibly fast since it was founded in 2008. When it first began the average employee age was 26. That has increased slightly over the years, of course, and with a global staff of 800 and counting the average age is now around 36. It is a young, energetic company that supports the community they have created and the values they share. The health and well-being of Hootsuite employees is clearly a priority and their Vancouver offices have a gym, fitness studio, music room, and nap room, which staff are free to use any time of day or night. There are yoga classes held in the studio five times a week and employees are encouraged to ride their bike to work. A healthy work-life balance, they say, is key. Not surprisingly, they also have a 96% employee retention rate.

Hootsuite has grown incredibly fast since it was founded in 2008. When it first began the average employee age was 26. That has increased slightly over the years, of course, and with a global staff of 800 and counting the average age is now around 36. It is a young, energetic company that supports the community they have created and the values they share. The health and well-being of Hootsuite employees is clearly a priority and their Vancouver offices have a gym, fitness studio, music room, and nap room, which staff are free to use any time of day or night. There are yoga classes held in the studio five times a week and employees are encouraged to ride their bike to work. A healthy work-life balance, they say, is key. Not surprisingly, they also have a 96% employee retention rate.

Along with caring for their staff, Hootsuite also tries to contribute to the larger community. They hold 200 events, workshops, and lectures annually. Millions of non-profits and small businesses are provided with discounted services and training to help them maximize their social media impact. Hootsuite has provided free social media education to thousands of students through their Higher Education Program and Hootsuite CEO Ryan Holmes co-founded The Next Big Thing, a nonprofit foundation that “empowers young entrepreneurs with the peer and mentor network, alternative education, work space and technology they need to succeed.”

Along with caring for their staff, Hootsuite also tries to contribute to the larger community. They hold 200 events, workshops, and lectures annually. Millions of non-profits and small businesses are provided with discounted services and training to help them maximize their social media impact. Hootsuite has provided free social media education to thousands of students through their Higher Education Program and Hootsuite CEO Ryan Holmes co-founded The Next Big Thing, a nonprofit foundation that “empowers young entrepreneurs with the peer and mentor network, alternative education, work space and technology they need to succeed.”

Having a minimal environmental impact has been foundational to Hootsuite since the beginning. Their office is largely paper-free, they use energy efficient appliances and lights, have teleconferences to reduce travel emission, source the food (and beer) in the kitchen locally when possible, and have a workforce that largely commutes by bike or transit.

Having a minimal environmental impact has been foundational to Hootsuite since the beginning. Their office is largely paper-free, they use energy efficient appliances and lights, have teleconferences to reduce travel emission, source the food (and beer) in the kitchen locally when possible, and have a workforce that largely commutes by bike or transit.

Hootsuite tries to look at business more holistically than just revolving around shareholders, they say, which in turn, actually creates more value for shareholders. A recent milestone in their quest to use business as force for good, Hootsuite is now a certified B-Corporation. There are currently over 1,300 certified B-Corps across 41 countries and 121 industries that are leading a global movement to redefine success in business by voluntarily meeting higher standards of transparency, accountability, and performance. B-Corps aim to use business as a solution for social and environmental problems.

I asked representatives at Hootsuite if complying with the rigorous B-Corp standards for environmental and social excellence was difficult for the company, but they said “actually, we were already meeting a lot of their requirements.”

I asked representatives at Hootsuite if complying with the rigorous B-Corp standards for environmental and social excellence was difficult for the company, but they said “actually, we were already meeting a lot of their requirements.”

They began measuring their environmental footprint across all offices, implemented emission reduction plan, and evaluated the diversity of their workforce. After all, they said, “you can’t manage what you don’t measure and the B-Impact assessment compels companies to identify areas for improvement. It provides guidance for what companies should pay attention to.”

Hootsuite is setting a wonderful example for businesses in B.C., demonstrating that companies do not need to compromise their environmental and social values for the sake of their bottom line. “We became a B-Corp because we were looking for a way to measure our impact and see how we stacked up against other socially conscious companies,” said the company’s CEO.

As we transition to a diversified 21st century economy, I hope more B.C. companies will follow suit and be supported as they align with this admirable business model.

BC craft beer risk getting squeezed out of market

The local craft beer industry – renowned for its high employment, community involvement, and tourism draw – is being squeezed out by recent adjustments to B.C.’s liquor taxation and wholesale pricing policies. The new economic structure makes it increasingly difficult for private liquor retail stores (LRS) to make a profit selling craft beer, even though consumer demand continues to rise, and therefore limits local breweries’ presence in the marketplace.

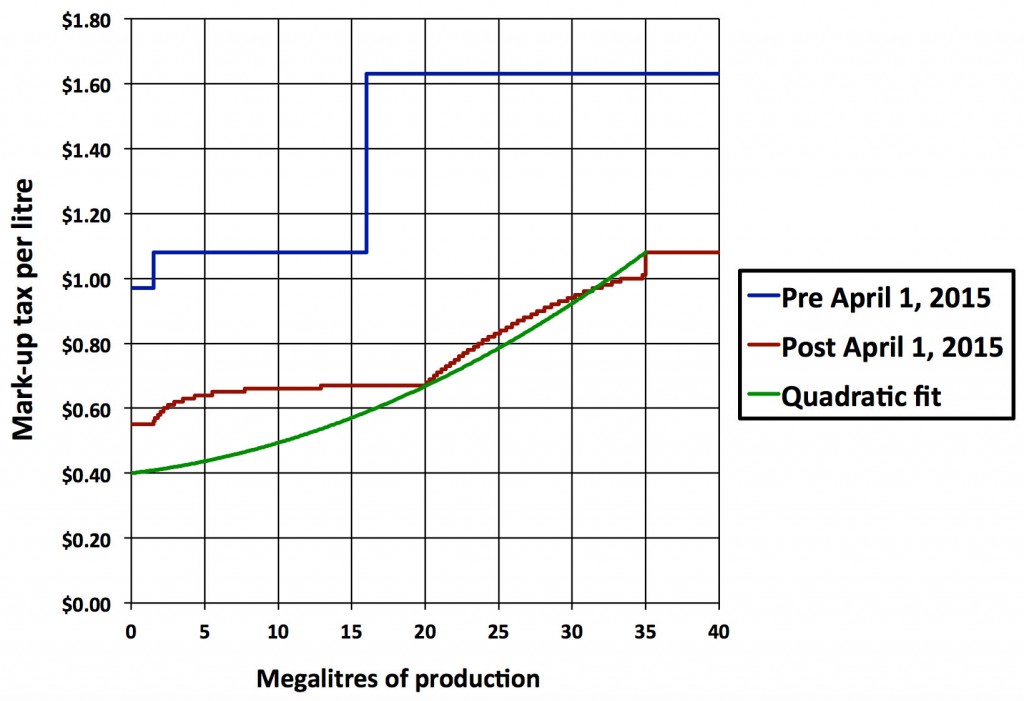

Historically, the beer tax mark-up was allocated in three distinct steps (see blue curve in Figure 1) depending on brewery size (measured in hectolitres, abbreviated hl) that generally translated to small, medium, and large facilities. Small breweries, of which there are 75-80 in B.C., represent the fastest growing sector. There are roughly 10 breweries that qualified as mid-size, two that are “large” (in the 150,000 to 200,000 hl range) and four very large global brewers. On April 1st a graduated mark-up tax was introduced (red curve in Figure 1), giving the large producers a substantial tax break.

Figure 1. The majority of breweries in B.C. produce fewer than 15,000 hectolitres (hl) annually (1.5 megalitres) and were previously taxed at a significantly lower rate than the large scale breweries with the production capacity of 160,000 – 400,000 hl (16-40 megalitres), as illustrated by the tiered blue line. The new mark-up tax rate, indicated by the red graduated line, provides large beer corporations with a substantial tax break relative to small producers and increases the wholesale price for craft beer. In addition, a “sweet spot” is created at 201,000 hl (20.1 megalitres). Beyond that price, the mark-up begins to increase again. A proposed solution is illustrated by the green line. The solution is obtained by fitting a quadratic function between (0 hl, $0.40/litre), (201,000 hl, $0.67/litre) and (350,000 hl, $1.08/litre). Beyond 35 megalitres annual production, the red and green curves are identical.

Now I recognize that the old system had its problems. There were two distinct discontinuities (jumps) in the volume tax-rates (blue curve in Figure 1). The first discontinuity or tax hike occurred at 15,000 hl while the second occurred at a production level of 160,000 hl. The introduction of these discontinuities would certainly be regressive towards companies wanting to grow. This follows since they created incentives to produce up 14,999 hl but not grow to over 15,000 hl just like an incentive was added to ensure no more than 159,999 hl were produced. Clearly this unfortunate barrier to success needed to be fixed.

The government proposed the red line in Figure 1. It is smoother and more continuous and so more gradually ties the increase in the tax rate to volume of production. But the government’s proposed solution doesn’t resolve the existence of a disincentive to growth. If simply moves it to 201,000 hl. And here’s the problem. In making the change, small craft breweries were hit with a double-whammy as the revised tax shift also constrained the ability of the LRS to carry their product.

The changes, which were implemented without consultation with local breweries, are already having an impact. In May, I met Sean Hoyne from Hoyne Brewing Co. and Murray Langdon, the general manager of Vancouver Island Brewery, to discuss their concerns.

Under the new wholesale/taxation regimes, the price of large production beers, such as Molson or Budweiser, will remain relatively unchanged. The relative wholesale price the LRS will pay to stock craft beers, however, has risen. Both Hoyne and Langdon have already noticed that the LRS are reducing their orders and failing to restock once their local features have sold. It’s not that stores don’t want to carry these products, or that customers don’t want to buy them – support for local beers has grown exponentially over the past few years – but the new wholesale price tags on craft beer have rendered them unprofitable for private operators.

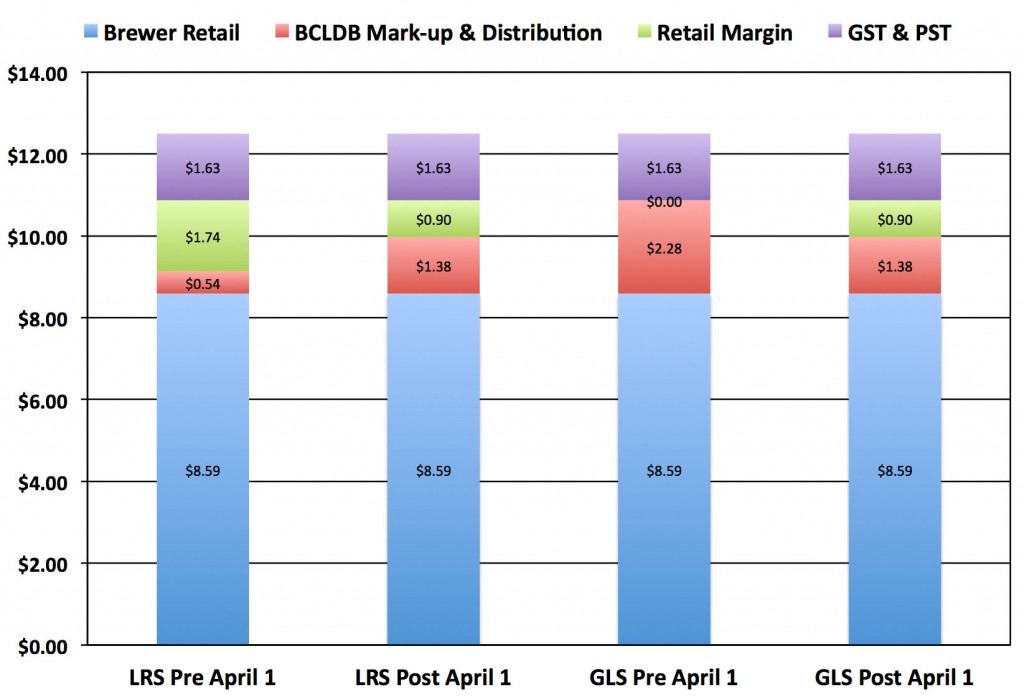

Figure 2. Example of the effect of the new pricing on liquor retail stores (LRS) and BC government liquor stores (GLS). The specific example is taken for a six pack of 355ml cans from a brewer producing less that 15,000 hl annually listing for $12.50. As this graph illustrates, the changes to BC liquor distribution board (BCLDB) mark-up and distribution rates have significantly reduced the profit margin on craft beer for the LRS, while increasing it for the GLS.

Although changes to the wholesale model were presented by the government as “leveling the playing field” between the LRS and government run BC Liquor stores (GLS), the reality has been different. Prior to April 1st The LRS received a 16 per cent subsidy on wholesale costs, now they are being charged the same price as the GLS.

By removing the subsidy that allowed the LRS to purchase liquor at a slightly reduced price, they have reduced the ability of these small businesses to stock local craft beer at a rate competitive with their government-owned counterparts. Under the new wholesale pricing scheme the GLS, which are subsidized by the wholesale arm of the Liquor Distribution Branch, stand to gain more market share in the liquor sales sector. Furthermore, successful larger breweries like Pacific Western have inadvertently been set up to win at the cost of local craft beer.

To stay competitive with the GLS, the LRS will have to reduce their profit margin on craft beer (making it not worth the shelf space), raise consumer prices (thereby driving customers to the GLS), or stop carrying it all together.

In a statement, the Justice Minister described the changes as follows:

“BC Liquor Stores are now expected to compete with private liquor retailers — and as such, have been given a more equitable set of rules to follow — placing them at the same starting line as their competitors. We have created more separation between the retail and wholesale arms of the Liquor Distribution Branch, with BC Liquor Stores now purchasing at the same wholesale price as other retailers and having the option to offer extended hours, Sunday openings and refrigeration. We’re applying the 1km rule to all full-service liquor stores, both private in government, to help protect the investment of the private store owners. Our goal is to help stores and business owners be successful and to increase consumer convenience around B.C.”

And during question period in the B.C. legislature she defended them:

“On the first of April we do indeed begin the new wholesale pricing regime. That means that instead of having a series of discounts, price, price off and so on — a very complicated system — what we have now is a single system that applies to all purchasers. Every purchaser, whether you be an LRS, a rural agency store or a government store, you will all pay the same wholesale price for your liquor — your wine, your beer, your spirits… The overall price of the product will be roughly the same on April 1 as it is on March 31 — minor adjustments but roughly the same price.”

These “minor adjustments” risk compromising the viability of the nascent British Columbia craft beer industry. However, relatively simple changes to the volumetric approach to mark-up taxes can be made to ensure that BC made craft beer can remain profitable for the LRS. In Figure 1 (green line) I fit a quadratic between the three points (0 hl, $0.40/litre), (201,000 hl, $0.67/litre) and (350,000 hl, $1.08/litre). This quadratic fit benefits all BC brewers in that it eliminates all barriers to growth. It can further be coupled with small adjustments to the Liquor Distribution Board retail mark-up to recover the government revenue from the reduced low volume tax rate (see Figures 1 and 2). With the craft beer sector only representing about 3%-6% of the overall beer sector (according to the Liquor Distribution Board), these subtle changes will once more allow the craft beer industry to thrive in BC.

It’s become far too common these days for government to introduce regulations with no consultation with affected stakeholders. In the present case, it has led to unforeseen consequences on the BC Craft Beer industry. But these can easily be remedied. So let’s get on with it.

Media Release

Media Statement – June 8, 2015

B.C. Craft Beer risk getting squeezed out of market

For Immediate Release

Victoria, B.C.– Changes in its wholesale pricing and liquor policies brought forward by the B.C. Government put small B.C. craft breweries at a disadvantage, and risk compromising the viability of this nascent industry, says Andrew Weaver, Deputy Leader of the BC Green Party and MLA for Oak Bay-Gordon Head.

The new policies make it increasingly difficult for private, often family-owned, liquor stores – the catalyst for the recent growth in local breweries – to make a profit on the sale of craft beer. This is the result of wholesale price mark-ups, the elimination of a subsidy previously offered to private liquor stores, and the Liquor Board’s policy of government liquor stores not increasing their retail prices.

Despite Minister Anton’s claims that the government was “leveling the playing field” within the liquor sector, and her assurance that prices would not increase, local producers are already being pushed out of the market.

“The recent changes to our liquor policy are making it unprofitable for private liquor stores to sell craft beer in BC.” said Andrew Weaver. “And as a consequence, it is impacting the viability of our craft beer industry.”

By jacking up the wholesale cost of BC Craft beers to small business retail outlets, they in turn must dramatically increase the price to the consumers to justify the shelf space. In doing so, they are no longer competitive with government liquor store pricing.

“The BC Liberals are putting the interests of a few large breweries and their government owned stores ahead of small business retail outlets and B.C.’s craft beer industry” notes Andrew Weaver. “There are simpler ways of adjusting the wholesale market to level the playing field imposing punitive effects on the BC Craft beer industry.”

The new wholesale pricing model introduced earlier this year eliminated the 3-tiered beer tax system, where allocation was based on production capacity, in favour of a more graduated mark-up tax that sees large and small producers pay similar tax mark-ups. The graduated mark-up could be easily tweaked to create a truly level playing field.

-30-

Media contact

Mat Wright

Press Secretary – Andrew Weaver, MLA

Cell: 250 216 3382

Mat.Wright@leg.bc.ca

Celebrating Local Businesses in Our Community – Synergy Enterprises

This is the second in our series highlighting innovation and creativity within our region’s business sector.

Transitioning to a green economy, one in which businesses prosper symbiotically with the environment, is a concept that has proven easy to romanticize, but difficult to bring to fruition. The cost and logistics of making environmentally friendly adjustments to an established operation often seem prohibitive to business owners. On top of that, the specialized knowledge needed to tackle challenges like reducing a cooperation’s carbon footprint, water use, energy consumption, or waste output can be overwhelming for people already balancing a full schedule and a tight budget.

Helping businesses navigate these obstacles and reach their goals – from local sourcing to increasing efficiency to carbon neutrality – is an ambitious small company called Synergy Enterprises, founded in 2008 in Victoria by Jill Doucette. Jill grew up in Grand Forks, a community of 4,000 in the interior of B.C. built largely on farming and family-run businesses. At 17 she came to Vancouver Island to study biology at the University of Victoria. She was off to a strong entrepreneurial start when, shortly after moving here, she decided she would start a house painting company to pay for school. Jill organized contracts during the school year and spent all summer painting. Still a teenager, Jill was working 100 hours a week, had 17 employees, and was saving enough to finance her degree.

While at UVic Jill took a course on climate and society. It was during that class, she said, that she decided “if you’re going to do business, it has to be a business for good.” She took every environmental elective she could find and volunteered with organizations she admired in an attempt to learn as much as possible. After going to Japan for the World Student Environmental Summit, an experience she said gave her a global perspective and really stressed the need for environmental action in the business sector, she learned how to calculate carbon footprints and got to work. She developed a carbon footprint report format that she used to tell companies what their total emissions were, where they came from, and how they could be reduced. Black Stilt Coffee (now Hillside Coffee and Tea) was the first business Jill made carbon neutral – and the first carbon neutral coffee shop in B.C. She helped them reduce their energy use by 20%, shrink their carbon footprint by 66%, divert 98% of their waste away from landfills, and saved the business far more than they invested in the process.

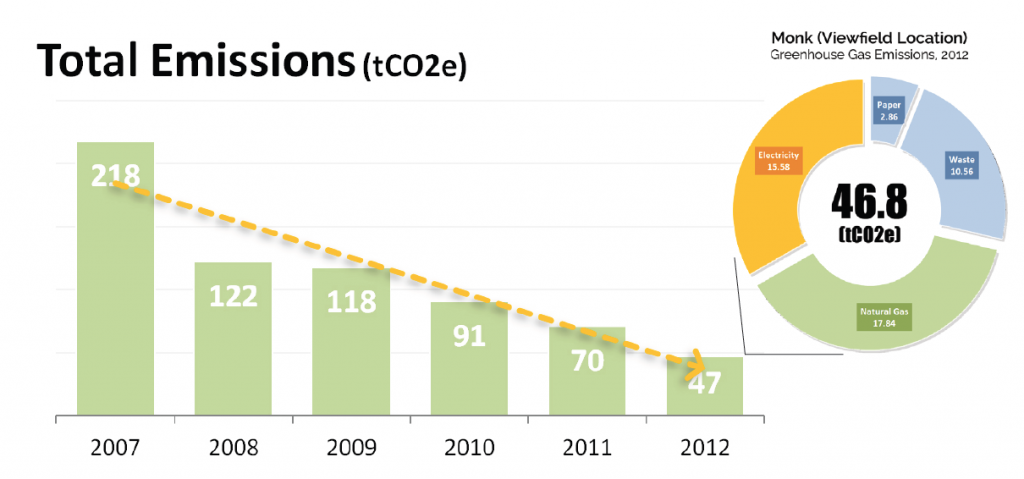

From a marketing perspective the shift was hugely beneficial. Jill measured customer loyalty and staff retention throughout the transition and found a twofold increase in both. Staff stayed twice as a long, no small feat in the restaurant industry, and they no longer needed to advertise to attract new customers – now they had a story that people wanted to be a part of.  Figure 1: Synergy’s Corporate Social Responsibility Report for their client Monk Office, a company that reduced their total emissions by 79% between 2007 and 2012.

Figure 1: Synergy’s Corporate Social Responsibility Report for their client Monk Office, a company that reduced their total emissions by 79% between 2007 and 2012.

Since then, Jill and her team have worked with dozens of other companies from a wide range of industries including The Bay Centre, The Village Restaurants, Eagle Wing Whale Watching Tours, Cascadia Liquor Stores, Canoe Brewpub, Big Wheel Burger, Habit Coffee, and Monk Office. Jill has also been involved in the design and direction of many local non-profits such as the Food Eco District Restaurant Society, an organization of sustainable restaurants in Victoria, the Vancouver Island Green Business Certification program, a sustainability certification program used to evaluate and verify environmentally friendly businesses, Synergy Sustainability Institute, the non-profit branch of Synergy Enterprises that develops sustainability initiatives, and she launched the Vancouver Island Green Economy Hub website to help people find companies and initiatives working to build a green economy on the island. In addition, the proceeds from her two books, Greening Your Office: Strategies That Work and Greening Your Community: Strategies for Engaged Citizens, go to supporting local environmental non-profits.

Synergy’s innovative and enthusiastic approach to creating a green economy in B.C. has helped dozens of local companies reduce their impact on the environment while being mindful of their bottom line. Using data and metrics to quantify a business’s operating practices and their potential for change, Jill and her team take a business perspective to environmentalism. “We appreciate a business’ constraints and work within them,” Jill said.

Transitioning to a green economy may be a daunting concept, but Synergy and their clients are proof that it is not only possible, it’s already happening.

Figure 2: Jill, far left, at the 2012 Eco Star Awards with Synergy’s clients Agenda Office Interiors and Oughtred Coffee & Tea.

Figure 2: Jill, far left, at the 2012 Eco Star Awards with Synergy’s clients Agenda Office Interiors and Oughtred Coffee & Tea.