Community Blog

Nothing about us without us: Highlights from our town hall

“If we sit down and talk about the problem together, maybe we can come up with some solutions” – Bernice Kamano, Greater Victoria Coalition to End Homelessness Speakers Bureau

Sometimes the most important conversations are the most difficult to have. However, those conversations become much easier when they occur in an open, compassionate and inclusive environment. And that is exactly the type of environment I had the honour of being a part of last night for my Town Hall event — Poverty and Homelessness: The Difficult Conversation.

Before I delve into what was shared and what we learned last night, I’d like to once again offer my sincere thanks to Reverend Al Tysick for the time and work he put in to ensure that his family could make it to our event. I’d also like to express my deep gratitude to Reverend Al’s family and friends for sharing their profoundly moving personal stories with us. To our four wonderful panelists, I thank you on behalf of everyone in the audience for taking the time out of your busy schedules to offer us your valuable insight into the issue of poverty and homelessness. And special thanks to Cairine Green for graciously volunteering to moderate the evening. I am also blessed to be supported by truly incredible constituency and legislature staff and volunteers. Without their assistance, our town hall would simply never have happened.

Before I delve into what was shared and what we learned last night, I’d like to once again offer my sincere thanks to Reverend Al Tysick for the time and work he put in to ensure that his family could make it to our event. I’d also like to express my deep gratitude to Reverend Al’s family and friends for sharing their profoundly moving personal stories with us. To our four wonderful panelists, I thank you on behalf of everyone in the audience for taking the time out of your busy schedules to offer us your valuable insight into the issue of poverty and homelessness. And special thanks to Cairine Green for graciously volunteering to moderate the evening. I am also blessed to be supported by truly incredible constituency and legislature staff and volunteers. Without their assistance, our town hall would simply never have happened.

“We don’t need to come up with new solutions, they are already there. We need to get politicians and policy to enact the solutions.” – Bruce Wallace, assistant professor in the School of Social Work at the University of Victoria

While the discussions last night may not have provided any new, groundbreaking solutions to bring an immediate end to homelessness and poverty in Greater Victoria, they did highlight the best practice solutions that already exist and what needs to be done to put them into practice.

Some of the key issues that were discussed by our panelists included:

1) systemic failures, such as lack of government strategies for ending homelessness (both nationally and provincially) and people falling through the cracks when accessing services that are in place;

2) structural issues, including low incomes, high rents and lack of affordable and supportive housing;

3) personal circumstances, such as mental health, unemployment and family situations.

Research has found that best practice solutions to these issues include:

1) Housing First policies – like those implemented in Medicine Hat and Utah;

2) provincial poverty reduction plans – as has been proposed by the BC Poverty Reduction Coalition;

3) increasing minimum wage – which is more than $8/hour below living wage in our region;

4) increasing income assistance – which hasn’t changed in almost 10 years despite inflation and higher living costs.

“Solutions are based on philosophies that don’t resonate with aboriginal people” – Bernice Kamano

Another important issue that was highlighted last night and that too often gets overlooked when discussing poverty and homelessness is the disproportionate number of aboriginal people living on the street. In Vancouver, at least 30% of the street population identify themselves as aboriginal. Meanwhile aboriginal people make up only 2% of the city’s entire population. Given these deplorable statistics, there is a clear need for services and solutions that address the unique needs and challenges faced by aboriginal people. But creating these solutions can only be done by giving the aboriginal community a voice when planning and making decision to eradicate homelessness.

Another important issue that was highlighted last night and that too often gets overlooked when discussing poverty and homelessness is the disproportionate number of aboriginal people living on the street. In Vancouver, at least 30% of the street population identify themselves as aboriginal. Meanwhile aboriginal people make up only 2% of the city’s entire population. Given these deplorable statistics, there is a clear need for services and solutions that address the unique needs and challenges faced by aboriginal people. But creating these solutions can only be done by giving the aboriginal community a voice when planning and making decision to eradicate homelessness.

To address this need, Bernice Kamano and Andrew Wynn-Williams, Executive Director for the Greater Victoria Coalition to End Homelessness, shared with us the Coalitions current efforts to create an Aboriginal Coalition to End Homelessness. This new coalition would bring together both elected and hereditary chiefs and other members of the aboriginal community to examine the key issues behind and the solutions to the high rates of poverty and homelessness amongst aboriginal communities.

To address this need, Bernice Kamano and Andrew Wynn-Williams, Executive Director for the Greater Victoria Coalition to End Homelessness, shared with us the Coalitions current efforts to create an Aboriginal Coalition to End Homelessness. This new coalition would bring together both elected and hereditary chiefs and other members of the aboriginal community to examine the key issues behind and the solutions to the high rates of poverty and homelessness amongst aboriginal communities.

“I am a messenger for things I have learned from people, including many in the audience tonight” – Charlayne Thornton-Joe, Victoria City Council

While the presentations by the panelists proved thoughtful and informative, the true highlight of the evening was the open discussion that ensued afterwards. It is not often that you find yourself in an at-capacity lecture hall, discussing issues surrounding poverty and homelessness with those who are currently homeless, those working on the front lines to end homelessness, elected officials and other members of the community.

While the presentations by the panelists proved thoughtful and informative, the true highlight of the evening was the open discussion that ensued afterwards. It is not often that you find yourself in an at-capacity lecture hall, discussing issues surrounding poverty and homelessness with those who are currently homeless, those working on the front lines to end homelessness, elected officials and other members of the community.

In an open-minded, inclusive and caring environment people were able to express their frustrations, share their stories and better understand what it means to live in poverty. Questions and comments were diverse and included inquiries about Guaranteed Livable Income policies, the need for affordable housing, the reliance on a charity model and use of emergency shelters as housing, and the costs to society of inaction versus action.

The solutions to these problems are not ones that any one person can provide. They require long-term planning, commitment and collaboration from non-profit organizations and all levels of government. However, that does not mean there is nothing that you as an individual can do to make a difference. One of the last questions that was asked may prove most meaningful to many of you: “What can average, everyday people do when faced with homelessness on the street?”

The solutions to these problems are not ones that any one person can provide. They require long-term planning, commitment and collaboration from non-profit organizations and all levels of government. However, that does not mean there is nothing that you as an individual can do to make a difference. One of the last questions that was asked may prove most meaningful to many of you: “What can average, everyday people do when faced with homelessness on the street?”

For the answer to this question our panelists directed us to the people in the audience that could respond to this question best — Reverend Al’s family. Their answer was simple and unanimous: be compassionate. Smile, say hello, have a conversation. Don’t act like they’re invisible. Treat them like you would anyone else you pass on the street, because we’re all just people and we all need to know that someone cares.

I made a commitment yesterday — a commitment to continue raising awareness and offering solutions to systemic issues of poverty and homelessness over the weeks and months ahead. And I promised that at our next town hall, we will come to you Reverend Al and family.

I made a commitment yesterday — a commitment to continue raising awareness and offering solutions to systemic issues of poverty and homelessness over the weeks and months ahead. And I promised that at our next town hall, we will come to you Reverend Al and family.

Photos Credit: Britt Swoveland

Celebrating youth in our community – Robert MacDonald

This is the sixteenth in our series of stories celebrating the outstanding accomplishments of youth in our community. These inspirational young adults are enriching our lives with their passion and commitment to the betterment of society.

Robert MacDonald

During the 2012/2013 academic year, Claremont High School established an innovative new educational program through its Institute for Global Solutions. As noted on the Saanich School District (SD63) website, the Institute provides a “project-based curriculum [that is] designed to equip students with tools and experiences to address the unprecedented environmental and humanitarian challenges of the 21st century –from poverty reduction to climate change and urbanization to sustainable energy.” Now in its 3rd year, the Institute for Global Solutions draws students from across the Capital Regional District to Claremont. Robert MacDonald is one of those students.

During the 2012/2013 academic year, Claremont High School established an innovative new educational program through its Institute for Global Solutions. As noted on the Saanich School District (SD63) website, the Institute provides a “project-based curriculum [that is] designed to equip students with tools and experiences to address the unprecedented environmental and humanitarian challenges of the 21st century –from poverty reduction to climate change and urbanization to sustainable energy.” Now in its 3rd year, the Institute for Global Solutions draws students from across the Capital Regional District to Claremont. Robert MacDonald is one of those students.

In October of last year, I gave a presentation to one of the Global Studies classes at Claremont. As I was leaving the class I bumped into Robert, a confident and articulate young man who teacher Mark Neufeld remarked, “you have got to meet”. Mark proceeded to describe how Robert was recently elected president of the Claremont student council but subsequently declined citing another candidate as a better choice. Needless to say, my curiosity was piqued. And so, Judy Fainstein and I decided to interview Robert to learn more about this remarkable young man.

Now in his Grade 12 year, Robert grew up in Victoria and attended Cordova Bay Elementary and Royal Oak Middle School. In addition to excelling academically, Robert is involved in a diverse array of other activities including, but not limited to, musical theatre, the Pursuit of Excellence Program (which he terms “the club for keeners” and is linked to the Duke of Edinburgh award program) and student government.

Now in his Grade 12 year, Robert grew up in Victoria and attended Cordova Bay Elementary and Royal Oak Middle School. In addition to excelling academically, Robert is involved in a diverse array of other activities including, but not limited to, musical theatre, the Pursuit of Excellence Program (which he terms “the club for keeners” and is linked to the Duke of Edinburgh award program) and student government.

As alluded to above, Robert had a fascinating foray into student government. He joined three other students in seeking the presidency of school council as he believed that “there were a number of issues at school [that] were not being addressed.” One was the lack of change room space for the Claremont Sports Institute of Excellence and their highly regarded lacrosse program. Another involved his concern over declining school spirit; one of his ideas was to revamp the school house system.

During their election campaign, candidates were required to make separate speeches to students in each of grades nine through twelve. Robert recognized that in order to win, he needed to offer a unique speech — one that differentiated himself from his competitors — that was catered to each grade. He chose to use humour in his delivery, admitting that some of his jokes stirred up a fair amount of controversy. After his second speech, Robert had what he described as a “crisis of conscience”. He realized that he’d crafted his speeches with what he thought students wanted to hear, not what he wanted to say. After some reflection, he took a different approach in his speeches to the Grades 11 and 12 classes. This time he focused on praising the positions and views of all candidates and went so far as to suggest that students explore their merits as well prior to voting. But in the end, Robert won the election because of his exceptionally strong performance in the Grades 9 and 10 polls. Robert felt that he had won for all the wrong reasons and that the student in second place “deserved it more than me”. He worked hard to eventually convince her to accept the role and Robert is now content serving as her Vice President.

Claremont’s Institute for Global Solutions is a perfect fit for Robert. He’s described by Mark Neufeld, a founding teacher of the program, as a “very clever student that challenges himself and his teachers. He questions the world around him and seeks solutions. He has great potential to be a major contributor to our transition to a clean energy future”. Robert says he is inspired by Mr. Neufeld and adds, “I think like him and see the need for big changes in this world”.

Claremont’s Institute for Global Solutions is a perfect fit for Robert. He’s described by Mark Neufeld, a founding teacher of the program, as a “very clever student that challenges himself and his teachers. He questions the world around him and seeks solutions. He has great potential to be a major contributor to our transition to a clean energy future”. Robert says he is inspired by Mr. Neufeld and adds, “I think like him and see the need for big changes in this world”.

Robert loves acting and musical theatre and has performed in school productions of Legally Blond, 42nd Street and most recently as 2nd male lead in Grease playing “Kenickie”, where he had a solo performance of the song “Greased Lightning”. He’s also extremely active in sports, including snowboarding, cross country, race walking (finishing 10th in the Provincial Championships last year) and this year he has started curling on the school team. He describes himself as very social in nature and enjoys spending time with friends.

Ever since he was young, Robert’s family has acted as a host for a diversity of international students. These incredibly positive experiences inspired him to become involved in the school’s International Student Peer Advisors Club; last year he was its president. Club members assist international students academically and coordinate events and gatherings to help them fully integrate into the school community, tasks that Robert finds particularly rewarding.

Ever since he was young, Robert’s family has acted as a host for a diversity of international students. These incredibly positive experiences inspired him to become involved in the school’s International Student Peer Advisors Club; last year he was its president. Club members assist international students academically and coordinate events and gatherings to help them fully integrate into the school community, tasks that Robert finds particularly rewarding.

Outside of school, Robert belongs to the Vancouver Island Pointing Dog Club. His family raises Brittany Spaniels and he enjoys the occasional outing to go bird hunting. He lists his hobbies as running, snowboarding and ice skating (his father used to perform in the Ice Capades and is still active in the local skating community). Robert somehow manages to also hold down a part time job as a Sales Associate at Peppers Grocery.

Robert has his sights set on becoming a politician sometime in the future because “I want to change the system”. And Robert has a plan to get there. To commence he will obtain an undergraduate degree in political science and economics. Then he will study for a degree in law so that he can start his own corporate law practice “with a cool lobby”. He has already identified intellectual property law as a primary area of interest. He wants to start off in Toronto, work on Bay Street, subsequently practice in New York and earn a good salary. Yet Robert wants to eventually return to Victoria. He is a man with a plan. When asked why he wants to become a lawyer Robert immediately quipped “I gotta get into law school as I want five kids”.

During the summer of 2014, Robert attended a 3-week youth summer program at the University of Toronto, where he learned about corporate law, civil litigation and criminal law. He really enjoyed staying in student residence at university and having the opportunity to visit the Ontario Provincial Court. He told us “Toronto opened my eyes to possibilities for the future”.

During the summer of 2014, Robert attended a 3-week youth summer program at the University of Toronto, where he learned about corporate law, civil litigation and criminal law. He really enjoyed staying in student residence at university and having the opportunity to visit the Ontario Provincial Court. He told us “Toronto opened my eyes to possibilities for the future”.

In his somewhat casual manner and with his self-deprecating, yet infectious, sense of humour, Robert told us confidently that his life goal was to “make the news” and “take the panhandle back for BC”. Not sure what he meant by the latter, Robert explained that the Alaskan Panhandle was historically part of Canada (and has been the subject of dispute since 1821).

Robert impressed us as an honest, forthright and ambitious young man. He says his friends would describe him as eccentric and non-conformist. But we would describe him as passionate, innovative, creative and a future leader — someone with a sense of direction and purpose. We’re confident that Robert will continue to challenge societal norms and endeavour to break down barriers to change. He’ll make an outstanding ambassador for Claremont’s Institute for Global Solutions and mark our words, we’ll be reading about him on the front page of the Globe and Mail in the not too distant future.

New Ways of Funding BC’s Health Care System

“There is a difference between equity and equality and treating everyone exactly the same may not always be fair” – Dr. Livio Di Matteo

Over the past couple months, I have emphasized the need for government leadership and increased government funding if we are to truly tackle poverty and homelessness in our province. Over the course of the next few articles I will begin to outline what government leadership might look like and identify where that funding could come from. In this first post, I focus on health care funding and the Medical Services Plan premium that unfairly burdens low and fixed income British Columbians as well as small business owners with an overly heavy tax burden. In addition, I provide details concerning British Columbia’s under representation in the federal funding allocation for provincial Health Care via the Canada Health Transfer (CHT). As I will demonstrate, British Columbia is receiving $153 million less that it should through this program.

Regressive versus Progressive taxation.

The various forms of taxation available to government generally fall into two broad categories: 1) Progressive taxes; 2) Regressive taxes.

Progressive taxes, such as income or corporate tax, are based on the premise that those who can afford to pay more, should pay more. That is, higher income earners would pay larger taxes than lower earners. This premise forms the foundation of our income tax systems right across the country.

However, in recent years, there has been a general tendency towards reducing various forms of progressive taxation and replacing the lost revenue through increases in a variety of regressive taxes. Regressive taxes, such as the Provincial Sales Tax, are taxes that do not reflect one’s ability to pay. In other words, everyone pays the same, regardless of how much your earn. Perhaps the most obvious example of this is British Columbia’s Medical Services Plan (MSP) premiums.

What is the Medical Services Plan (MSP)?

As noted on the Ministry of Health website “The Medical Services Plan (MSP) insures medically-required services provided by physicians and supplementary health care practitioners, laboratory services and diagnostic procedures.” The MSP requires anyone living in BC for six months or longer to pay monthly premiums for health care coverage. While some individuals can apply for premium assistance, these subsidies dry out as soon as a person earns a net annual income of $30,000 or more. Those who earn more than $30,000 must currently pay a monthly flat fee of $72. This means that an individual who earns $30,000 per year pays the same MSP premium as an individual who earns $3,000,000 per year. And so, it is evident that MSP premiums are perhaps the most regressive form of taxation in BC.

MSP Premiums become even more regressive when you factor in who actually pays them. The fact is, many large employers pay all or part of an employee’s MSP premium as part of a negotiated taxable benefit of employment. But for many, if not most, low and fixed income British Columbians, as well as small business owners, they must pay the costs themselves.

In 2000, the MSP premium for a single individual was $36 per month. Today, that same individual pays twice as much (the same amount that a family of three or more paid 15 years ago). At the same time, personal and corporate income taxes have experienced significant cuts, the consequences of which I will explore further in future posts. The resulting major shifts in taxation have led to the provincial government now bringing in almost as much revenue from MSP premiums as it does from corporate income taxes. In the 2014/15 British Columbia budget, revenue from MSP premiums was expected to be 2.271 billion dollars whereas corporate tax revenue was estimated to be 2.348 billion dollars.

While one can make the argument that reducing MSP premiums allows for lower rates of other taxes, these benefits are often only felt by the wealthiest of the population. In fact, “when all personal taxes are considered (income, sales, property, carbon, and MSP premiums), the higher your income, the lower your total provincial tax rate”. So, while most BC households paid around the same total tax rate back in 2000, with those in the top income bracket paying slightly more, under the current system the wealthiest 20% of households now pay a lower total tax rate than the rest of the population.

Not only do these tax cuts not benefit the majority of British Columbians, but we also must then pay for these cuts in the form of reduced social services. Over an 11-year period, from 2000 to 2011, BC’s tax revenues fell by 1.6% relative to the size of the provincial economy (GDP) resulting in a revenue deficit of about $3.5 billion.

Why do we pay MSP Premiums?

Some may wonder why we have to pay provincial MSP premiums in the first place. After all, we are the only province in Canada to require them. The rest of Canada have moved away from monthly premium charges and instead use general tax revenues, primarily provincial income taxes that are based on taxpayers’ ability to pay, to acquire the funds needed to pay for Medicare services. In fact, after the Alberta government announced its plans to eliminate their premium charges for Medical Services Plan Coverage in 2008, BC was left as the only province to continue to charge these individual flat-rate premiums.

The answer is simple. It’s a choice that successive British Columbia governments have made. It’s a choice to favour regressive over progressive taxation. It’s a choice that puts the interests of the wealthy over the interests of low and fixed income British Columbians as well as small business owners. And the choice is made, in part, to maintain the illusion of low taxes.

The Canada Health Act and Canada Health Transfer

The federal Canada Health Act sets the standards for all provinces and requires coverage for all necessary care provided in hospitals and by physicians. But health care is ultimately the responsibility of the province.

General revenues from the Federal Government provide funding for health care to the provinces and territories through the Canada Health Transfer (CHT). Up until this past year, the CHT consisted of two components: a cash transfer and a tax transfer. Though CHT is allocated on a per capita basis, the cash transfer was not. Instead, the CHT cash transfer would take into account the value of provincial and territorial tax points and the fact that provinces do not have equal economies and, therefore, have unequal capacity to raise tax revenues. This meant that provinces with the highest revenue raising ability received lower per capita CHT cash payments than other provinces.

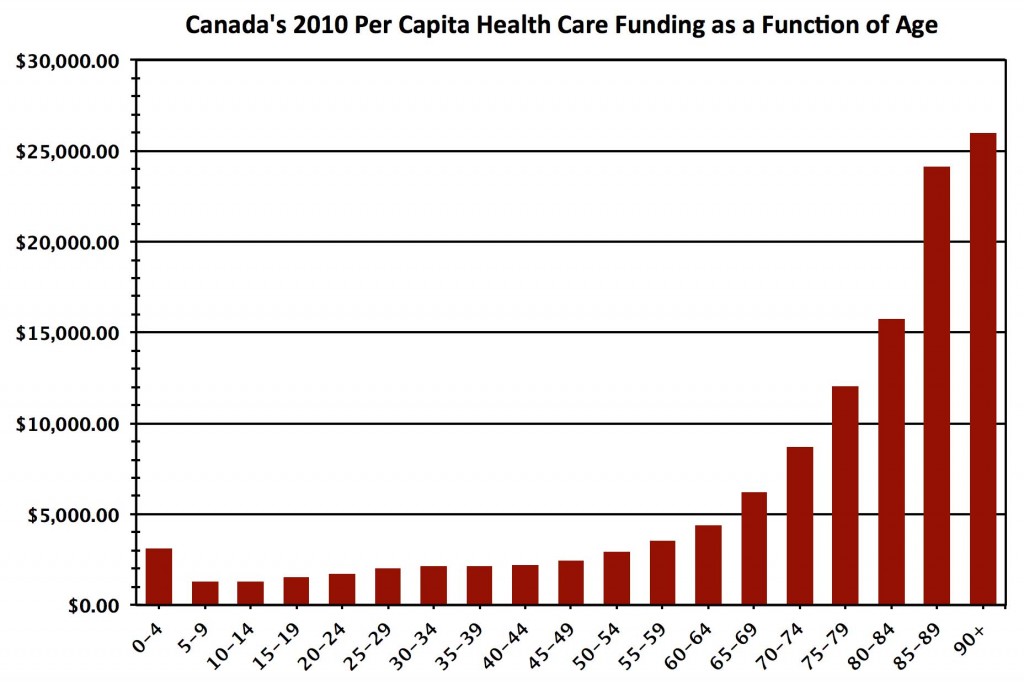

However, since January 2014, CHT allocations are now determined solely on an equal per capita cash basis. While this new system means that all provinces will receive equal transfer payments based on population size, I believe that this is not the most equitable way to proceed, particularly in light of provincial age demographics and associated health care costs. Take for example BC, a province many view as a popular retirement destination. It is common practice for individuals who have lived and worked – and therefore paid taxes – elsewhere, to move to BC later in life. However, with national trends showing that seniors’ health care costs more than that of any other age group, this can put a significant strain on our provincial health care system — one that cannot afford to go unaccounted for (see Figure 1).

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Let’s unpack this further. In the 2014-15 budget year, the Federal Government Canada Health Transfer amounted to 32.1 billion dollars distributed across all provinces. In 2014 Canada’s population was estimated to be 35,540,400, and British Columbia’s population was estimated to be 4,631,300. Alberta has a similar population to that of British Columbia (see Table below).

| Province | Population | Ages 0-14 | Ages 15-64 | Ages 65+ |

| Alberta | 4,121,700 | 18.3% | 70.4% | 11.3% |

| BC | 4,631,300 | 14.6% | 68.4% | 17.0% |

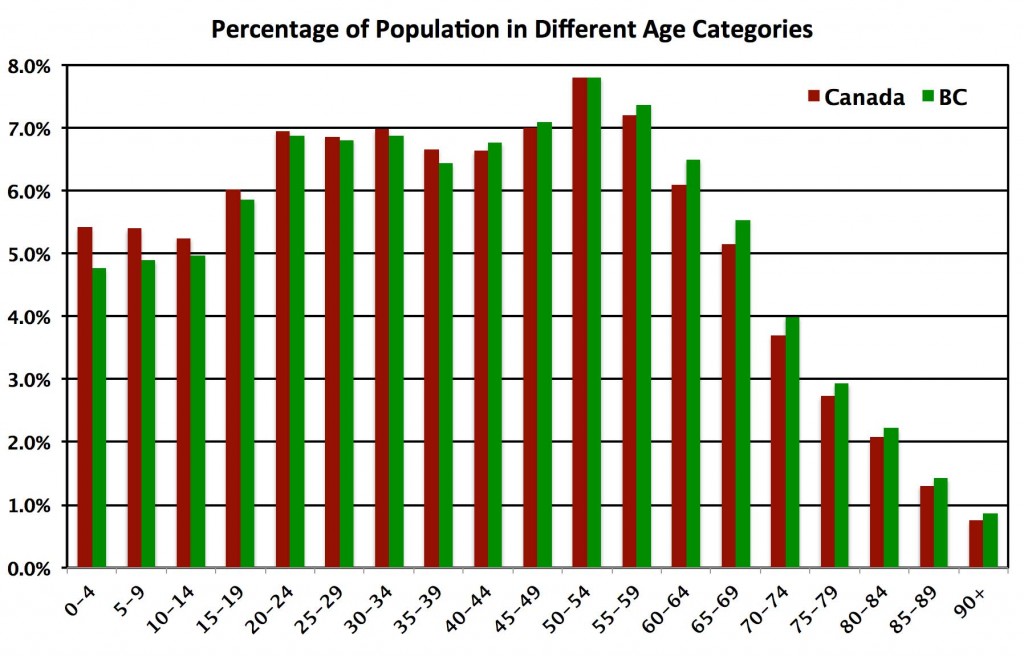

As clearly evident in Figure 2, British Columbia had a smaller percentage of its population in every age group under the age of forty than the Canadian average. The opposite is true for those over the age of forty. Compared to Alberta, British Columbia is home to nearly 70% more seniors. A quick glance back at Figure 1 immediately highlights the glaring inequity in the fixed CHT dollar per person transfer formula. British Columbia has a higher proportion of seniors than the rest of Canada and it is this age demographic that requires more health services. The funding should reflect the actual cost of service delivery.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

It’s a relatively straightforward calculation to weight the CHT transfer to each province by its age demographic and associated health care delivery cost. Rather than receiving 13.0% ($4.183 billion) of the total CHT funding (reflecting 13.0% of Canada’s population residing in British Columbia), we should receive 13.5%. While this may not seem like a lot, it translates into 153 million dollars that British Columbia must find from other sources.

Nevertheless, no matter the method that CHT payments are allocated, these federal transfers only cover a portion of BC’s annual healthcare expenditures. The remaining expenses are financed out of general revenues raised by tax and non-tax sources, with MSP premiums presently contributing over $2 billion per year.

Alternatives to MSP Premiums

While here in BC we do not have the fiscal resources to stop charging MSP premiums without replacing the revenues, there are alternative, and more progressive, options we could be exploring. We need look no further than provinces like Ontario and Quebec, where health premiums are paid through personal income tax systems, rather than flat-rate levies. This approach avoids the regressive effects of monthly premiums, as rates rise with income to a maximum annual level. For example, in Ontario the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums, and in Quebec the maximum annual contribution is $1,000 for taxable incomes over $150,000. At the same time the British Columbia government should lobby for its fair share of CHT revenue — a share that reflects our demographics and the actual cost of delivering health services.

It is time for BC to replace MSP premiums with a more progressive and equitable approach to financing our health care system. Whether this means following in the steps of Ontario and Quebec with an income tax-based approach, or simply raising other taxes, such as corporate tax rates, as the Canadian Centre for Policy Alternatives (CCPA) found after conducting extensive research on what British Columbians think about taxes:

“[British Columbians] know more revenues are required if we are going to tackle the major challenges we face, like growing inequality and persistent poverty, climate change, and the affordability crisis squeezing so many families. And we know higher revenues are needed to sustain and enhance the public services…In short, [we] are ready for a thoughtful, democratic conversation about how we raise needed revenues and ensure everyone pays a fair share.”

MLA Town Hall – Poverty and Homelessness: The Difficult Conversation

As part of our on-going series on poverty and homelessness we will be hosting an MLA Town Hall Forum entitled Poverty and Homelessness: The Difficult Conversation.

The forum will feature four expert panelists including Andrew Wynn-Williams, the executive director of the Greater Victoria Coalition to End Homelessness, Charlayne Thornton-Joe, a Victoria City Councillor and member of the Regional Housing Trust Fund Commission, Bruce Wallace, an assistant professor and researcher at the University of Victoria, and Bernice Kamano, a member of the Greater Victoria Coalition to End Homelessness Speakers Bureau.

Each panelist will give a brief presentation discussing why they got involved in their work, what they believe are the biggest obstacles in addressing poverty and homelessness, and what they see as the best solutions. Following the presentations will be an open Q&A where audience members may bring forth any questions they have for our panelists or for Andrew himself.

The event will take place from 7:00pm to 9:00pm on Wednesday, February 4th, in room A120 of the David Turpin Building at the University of Victoria. The nearest parking is located in the Centennial Stadium parking lot, at a flat rate of $2.50 after 6pm.

We hope you will all join us for what is sure to be an informative and eye-opening discussion on the issues surrounding poverty and homelessness in our community and throughout our province.

Donations of non-perishable food items and cash for the Mustard Seed Food Bank and Our Place Society are welcome.

If you have not been following our series over the last few weeks, please visit the links below to read more. And check back later this week for our next installment.

- Part 1: Homelessness in Greater Victoria

- Part 2: Contributing Factors to Homelessness

- Part 3: Cost Savings of Housing-First

- Part 4: The Government’s Role in Ending Poverty and Homelessness

Celebrating youth in our community – Liticia Gardner

This is the fifteenth in our series of stories celebrating the outstanding accomplishments of youth in our community. These inspirational young adults are enriching our lives with their passion and commitment to the betterment of society.

Liticia Gardner

This past November hardly a day went by without the protest against Trans Mountain drilling on Burnaby Mountain making the news headlines. While many of us sat at home wondering what we could do to show our support for the Burnaby protestors, Liticia was on the front lines. Just two months earlier, upon listening to a passionate, inspirational and motivating speech on Burnaby Mountain, given by Mayor Derek Corrigan, Liticia realized that she could no longer stand by and watch from the sidelines. She had to become involved in local efforts to stop the expansion of the Trans Mountain pipeline. And so Liticia joined the SFU Activist Network on Facebook and began volunteering her time sitting vigil at the blockade that had recently been set up.

This past November hardly a day went by without the protest against Trans Mountain drilling on Burnaby Mountain making the news headlines. While many of us sat at home wondering what we could do to show our support for the Burnaby protestors, Liticia was on the front lines. Just two months earlier, upon listening to a passionate, inspirational and motivating speech on Burnaby Mountain, given by Mayor Derek Corrigan, Liticia realized that she could no longer stand by and watch from the sidelines. She had to become involved in local efforts to stop the expansion of the Trans Mountain pipeline. And so Liticia joined the SFU Activist Network on Facebook and began volunteering her time sitting vigil at the blockade that had recently been set up.

Liticia was born in Kamloops, BC and moved to Victoria when she was eight. She attended James Bay Elementary, Central Middle School, Oak Bay High School and graduated from Reynolds Secondary where she was awarded “Top Psychology Student” in 2012. Like so many of the inspirational youth we have been featuring over the past year, Liticia was extremely active in extracurricular activities during her high school years. For example, while in Grade 12, Liticia started the Best Buddies program at Reynolds, after volunteering as a Best Buddy at Oak Bay High from 2010 to 2012.

Liticia was born in Kamloops, BC and moved to Victoria when she was eight. She attended James Bay Elementary, Central Middle School, Oak Bay High School and graduated from Reynolds Secondary where she was awarded “Top Psychology Student” in 2012. Like so many of the inspirational youth we have been featuring over the past year, Liticia was extremely active in extracurricular activities during her high school years. For example, while in Grade 12, Liticia started the Best Buddies program at Reynolds, after volunteering as a Best Buddy at Oak Bay High from 2010 to 2012.

Some of her other activities at Oak Bay High included organizing a school wide composting program and helping to organize the annual Rubber Ducky Race in Bowker Creek with the schools’ Environment Club. In 2011, Liticia competed in the Youth Philanthropy Initiative and was part of a group of students that achieved a $5,000 grant for the Victoria Youth Clinic, a not-for-profit primary heath care service for youth aged 12 to 24 years.

Some of her other activities at Oak Bay High included organizing a school wide composting program and helping to organize the annual Rubber Ducky Race in Bowker Creek with the schools’ Environment Club. In 2011, Liticia competed in the Youth Philanthropy Initiative and was part of a group of students that achieved a $5,000 grant for the Victoria Youth Clinic, a not-for-profit primary heath care service for youth aged 12 to 24 years.

Liticia is also accomplished in soccer, which she started playing when she was 5 years old. She continues to play in intramural leagues at Simon Fraser University (SFU), where she began university this past September, having previously played competitively on the Bays United Gold Under 18 girls team and with the Lakehill Division 1 Women’s team.

In addition to soccer, Liticia is an avid scuba diver. In April 2013, she was certified with the Open Water certificate in Playa Del Carmen, Mexico while on a trip visiting Mexico, Belize and Guatemala. She immediately fell in love with diving and subsequently participated in ten dives while in Mexico, including two dives in underwater caverns (termed cenotes). Liticia was in awe with the diversity and beauty of the ocean life she witnessed during her numerous reef dives. She plans to undertake her first cold-water dive in Victoria some time this winter.

Following high school, Liticia attended Camosun College for two years. There she took university transfer courses and achieved the Dean’s List status in Winter 2013 with an A+ average. Not surprisingly, Liticia was awarded a Ken Caple College Transfer Entrance Scholarship to SFU where she is currently majoring in Gender, Sexuality and Women’s Studies, with a minor in Geography.

In her heart, Liticia is an activist and an advocate for a number of important social justice and environmental issues, viewing them through a lens of anti-oppression. When asked what caring about social justice meant to her, she immediately responded, “fighting for more equity as opposed to simply fighting for equality”. Liticia is outgoing and passionate and is committed to raising broader public awareness of the fact that some people inherently do not have the same access to much of what many of us take for granted. And she is not afraid to take direct action when she believes advocacy is needed.

In her heart, Liticia is an activist and an advocate for a number of important social justice and environmental issues, viewing them through a lens of anti-oppression. When asked what caring about social justice meant to her, she immediately responded, “fighting for more equity as opposed to simply fighting for equality”. Liticia is outgoing and passionate and is committed to raising broader public awareness of the fact that some people inherently do not have the same access to much of what many of us take for granted. And she is not afraid to take direct action when she believes advocacy is needed.

While at Camosun, Liticia was a member of the Psychology Club and the Women’s Centre. As a member of the University of Victoria Anti-Violence Project, she participated in 40 hours of training on sexualized violence and how to support both targets and perpetrators of violence. Currently working as a volunteer with SFU’s Women’s Centre, Liticia has been involved in the creation of “Safe(r) Places” at the university, where people can come to a safe space to openly discuss issues. She also initiated and runs a “radical mental health group” through Simon Fraser Public Interest Research Group (SFPIRG), hosting bi-weekly meetings on topics around mental health and well being.

Liticia likes to “think outside of the normal”. She cares deeply about issues related to equity, oppression and mental health. Inspired by poet Maya Angelou, whom she describes as “the most eloquent person I have ever heard”, Liticia urged us to listen to Maya recite her poem And Still I Rise. We did and we too were inspired.

Liticia was profoundly affected by the demonstrations on Burnaby Mountain. It was a daily ritual for her to spend time at the blockade, not only reading and doing homework, but also supporting other activists by providing tea, food and access to showers. She told us that “every day was really different” on the mountain; some days were “really empowering” while others were “somber” or “depressing”. She described time when there was a general mood of hopelessness when people “felt the only thing you could do was cross the line”. Liticia was so committed to the blockade that when she learned via text that Kinder Morgan was on site and starting to drill, she “ran all the way across campus and down a muddy path” to immediately take her place at the blockade. Liticia was frequently pictured in media reports standing on the front lines of the blockade. While she saw many of her friends get arrested, she herself did not cross the police line.

Liticia was profoundly affected by the demonstrations on Burnaby Mountain. It was a daily ritual for her to spend time at the blockade, not only reading and doing homework, but also supporting other activists by providing tea, food and access to showers. She told us that “every day was really different” on the mountain; some days were “really empowering” while others were “somber” or “depressing”. She described time when there was a general mood of hopelessness when people “felt the only thing you could do was cross the line”. Liticia was so committed to the blockade that when she learned via text that Kinder Morgan was on site and starting to drill, she “ran all the way across campus and down a muddy path” to immediately take her place at the blockade. Liticia was frequently pictured in media reports standing on the front lines of the blockade. While she saw many of her friends get arrested, she herself did not cross the police line.

Liticia credits her mother with teaching her about “resiliency, hard work and perseverance”. She describes her mother as the “epitome of resiliency”. Liticia was born when her mother Alyshia was only 17 and “we went through a lot together”. Alyshia returned to school after Liticia was born, earning a nursing degree with distinction. For the past year, Liticia has helped her mother with her business Nurse Next Door, handling Human Resources for the business. We quickly recognized that Alyshia has clearly been the most influential person in Liticia’s life. But Liticia also credits Lucas Crawford, a professor in Gender Studies at SFU, as “one of the people who have put a lot of time into me”.

Committing herself to environmental issues will be a life-long pursuit for Liticia. Of this she is certain. Liticia noted that the environment is where Indigenous issues, women’s issues, as well as issues of social class and social justice all come together. Her long-term goal is to become a university professor, undertaking teaching and research in Gender Studies. And when she undoubtedly accomplishes this goal, she’ll inspire a new generation of youth to work towards the betterment of society. Of this, we are certain.