Finance

Using the 2014-15 Budget Surplus in a Housing First Strategy

Today in the legislature I was up during Question Period. I took the opportunity to question government on their strategy for affordable housing. The Minister of Finance recently announced that there’s more than a $444 million surplus in this past year’s budget. I attempted to provide a compelling case to government that the costs of inaction are greater than the costs of action. In particular I pointed out that using the one-time budget surplus to make capital investments in housing would reduce ongoing operating commitments in health, social and justice systems.

While the Minister’s response to my initial question was certainly not what I was hoping for, I was very pleased with his response to my supplemental question. Below is the transcript of our exchange:

QUESTION

Victoria’s Coalition to End Homelessness estimates that it costs about $25,500 a year to maintain a shelter bed in the capital regional district. On the other hand, the cost to run new supportive housing is only about $16,700 per unit per year. The cost of providing additional rental supplements, including support, is even lower, at $6,800 per unit annually.

The evidence is clear. Since Utah launched its homelessness reduction strategy, a strategy that involved — you guessed it — giving homes to the homeless, they’ve reduced chronic homelessness by 72 percent, and they’ve saved an average of $8,000 per person in health, social and justice system costs.

The same is true elsewhere. For example, the Canadian Observatory on Homelessness calculated that for each dollar spent on housing and supports for the chronically homeless, about $2 in savings is found in health, social and justice services.

The Minister of Finance recently announced that there’s more than a $444 million surplus in this past year’s budget.

My question to the Minister Responsible for Housing is this. Will the government commit to using the one-time budget surplus to make capital investments in housing in order to reduce ongoing operating commitments in health, social and justice systems?

RESPONSE

Hon. R. Coleman: Thanks to the member opposite for the question. I’m always happy to get up and actually talk about housing in this House, which is seldom, because we don’t usually ask these questions. The fact of the matter is that in British Columbia we are home to the most successful housing strategy in Canadian history, right here in British Columbia.

In the last five years alone over 6,000 people that were formerly homeless in this province are no longer homeless because of the outreach workers, the money that’s been invested, and the people being connected to housing and supports by our people across the province.

We’ve purchased over 50 buildings across the province of B.C. and renovated for housing and have also spent over half a billion dollars, just in the last couple of years, in building additional housing supports for people. In addition to that we also, today, in total, have 100,000 households in British Columbia that receive some form of support in their housing in British Columbia.

There are, today, 27,000-plus families in households receiving rent assistance where they live, in communities across British Columbia. The budget for housing has tripled in the last number of years simply because of the commitment of this government to the success of dealing with homelessness, mental health and addiction.

SUPPLEMENTARY QUESTION

I recognize that this is not answer period, but my question was not about what the government has done. My question is about what the government will do in the future.

The reality is that recent analysis showed the least affordable cities in the world were Hong Kong and Vancouver. In fact, in the top five in Canada, four of them were in B.C.: Victoria, Kelowna, Fraser Valley, Vancouver. They’re all in the top five. Toronto is the only one that wasn’t from BC.

The reality is that if you’re living on income assistance, you are getting a total of $375 as your housing allowance, whereas the average person on income assistance is paying $501 in Victoria. If a landlord were to actually follow the rental tenancy office allowable rents, rents could have increased 30 percent since 2007, the time that this rental income assistance has remained fixed from.

The evidence is very clear. The costs of inaction are simply greater than the costs of action.

I reiterate my question. When will the government commit to (a) increasing that shelter allowance and dealing with British Columbia’s homelessness problem, and (b) providing more affordable housing to actually deal with this problem, which is a tax on our social, health and other justice systems?

RESPONSE

Hon. R. Coleman: To the member opposite, the B.C. Housing budget for capital is actually pretty good for the next number of fiscal years. It has continuously been put in the three-year fiscal plan as we sit down and work with communities like Victoria, identify sites like we have in Victoria for three buildings that we’ve recently done and other buildings we’ve bought and renovated, partnerships that we do with the non-profit sector in order to be able to connect that sector in to being there for the people whose housing they’re going to operate.

I’m happy actually…. To the member opposite, if you want to come and have a visit, we can actually explore some of your ideas. One thing I do know, when we wrote the housing strategy in 2005 — which is, by the way, again the most successful one in this country — we opened it up to being open to ideas.

The whole idea around it was that if we actually saw something in Portland or Utah or somewhere else and we thought it could work here in British Columbia, we were not disinclined at all, in our minds, to steal a good idea that might help the citizens of this province. That’s why the housing ministry, B.C. Housing, has such a dynamic mandate, in order to go out and look for their solutions on behalf of B.C. citizens.

New Ways of Funding BC’s Health Care System

“There is a difference between equity and equality and treating everyone exactly the same may not always be fair” – Dr. Livio Di Matteo

Over the past couple months, I have emphasized the need for government leadership and increased government funding if we are to truly tackle poverty and homelessness in our province. Over the course of the next few articles I will begin to outline what government leadership might look like and identify where that funding could come from. In this first post, I focus on health care funding and the Medical Services Plan premium that unfairly burdens low and fixed income British Columbians as well as small business owners with an overly heavy tax burden. In addition, I provide details concerning British Columbia’s under representation in the federal funding allocation for provincial Health Care via the Canada Health Transfer (CHT). As I will demonstrate, British Columbia is receiving $153 million less that it should through this program.

Regressive versus Progressive taxation.

The various forms of taxation available to government generally fall into two broad categories: 1) Progressive taxes; 2) Regressive taxes.

Progressive taxes, such as income or corporate tax, are based on the premise that those who can afford to pay more, should pay more. That is, higher income earners would pay larger taxes than lower earners. This premise forms the foundation of our income tax systems right across the country.

However, in recent years, there has been a general tendency towards reducing various forms of progressive taxation and replacing the lost revenue through increases in a variety of regressive taxes. Regressive taxes, such as the Provincial Sales Tax, are taxes that do not reflect one’s ability to pay. In other words, everyone pays the same, regardless of how much your earn. Perhaps the most obvious example of this is British Columbia’s Medical Services Plan (MSP) premiums.

What is the Medical Services Plan (MSP)?

As noted on the Ministry of Health website “The Medical Services Plan (MSP) insures medically-required services provided by physicians and supplementary health care practitioners, laboratory services and diagnostic procedures.” The MSP requires anyone living in BC for six months or longer to pay monthly premiums for health care coverage. While some individuals can apply for premium assistance, these subsidies dry out as soon as a person earns a net annual income of $30,000 or more. Those who earn more than $30,000 must currently pay a monthly flat fee of $72. This means that an individual who earns $30,000 per year pays the same MSP premium as an individual who earns $3,000,000 per year. And so, it is evident that MSP premiums are perhaps the most regressive form of taxation in BC.

MSP Premiums become even more regressive when you factor in who actually pays them. The fact is, many large employers pay all or part of an employee’s MSP premium as part of a negotiated taxable benefit of employment. But for many, if not most, low and fixed income British Columbians, as well as small business owners, they must pay the costs themselves.

In 2000, the MSP premium for a single individual was $36 per month. Today, that same individual pays twice as much (the same amount that a family of three or more paid 15 years ago). At the same time, personal and corporate income taxes have experienced significant cuts, the consequences of which I will explore further in future posts. The resulting major shifts in taxation have led to the provincial government now bringing in almost as much revenue from MSP premiums as it does from corporate income taxes. In the 2014/15 British Columbia budget, revenue from MSP premiums was expected to be 2.271 billion dollars whereas corporate tax revenue was estimated to be 2.348 billion dollars.

While one can make the argument that reducing MSP premiums allows for lower rates of other taxes, these benefits are often only felt by the wealthiest of the population. In fact, “when all personal taxes are considered (income, sales, property, carbon, and MSP premiums), the higher your income, the lower your total provincial tax rate”. So, while most BC households paid around the same total tax rate back in 2000, with those in the top income bracket paying slightly more, under the current system the wealthiest 20% of households now pay a lower total tax rate than the rest of the population.

Not only do these tax cuts not benefit the majority of British Columbians, but we also must then pay for these cuts in the form of reduced social services. Over an 11-year period, from 2000 to 2011, BC’s tax revenues fell by 1.6% relative to the size of the provincial economy (GDP) resulting in a revenue deficit of about $3.5 billion.

Why do we pay MSP Premiums?

Some may wonder why we have to pay provincial MSP premiums in the first place. After all, we are the only province in Canada to require them. The rest of Canada have moved away from monthly premium charges and instead use general tax revenues, primarily provincial income taxes that are based on taxpayers’ ability to pay, to acquire the funds needed to pay for Medicare services. In fact, after the Alberta government announced its plans to eliminate their premium charges for Medical Services Plan Coverage in 2008, BC was left as the only province to continue to charge these individual flat-rate premiums.

The answer is simple. It’s a choice that successive British Columbia governments have made. It’s a choice to favour regressive over progressive taxation. It’s a choice that puts the interests of the wealthy over the interests of low and fixed income British Columbians as well as small business owners. And the choice is made, in part, to maintain the illusion of low taxes.

The Canada Health Act and Canada Health Transfer

The federal Canada Health Act sets the standards for all provinces and requires coverage for all necessary care provided in hospitals and by physicians. But health care is ultimately the responsibility of the province.

General revenues from the Federal Government provide funding for health care to the provinces and territories through the Canada Health Transfer (CHT). Up until this past year, the CHT consisted of two components: a cash transfer and a tax transfer. Though CHT is allocated on a per capita basis, the cash transfer was not. Instead, the CHT cash transfer would take into account the value of provincial and territorial tax points and the fact that provinces do not have equal economies and, therefore, have unequal capacity to raise tax revenues. This meant that provinces with the highest revenue raising ability received lower per capita CHT cash payments than other provinces.

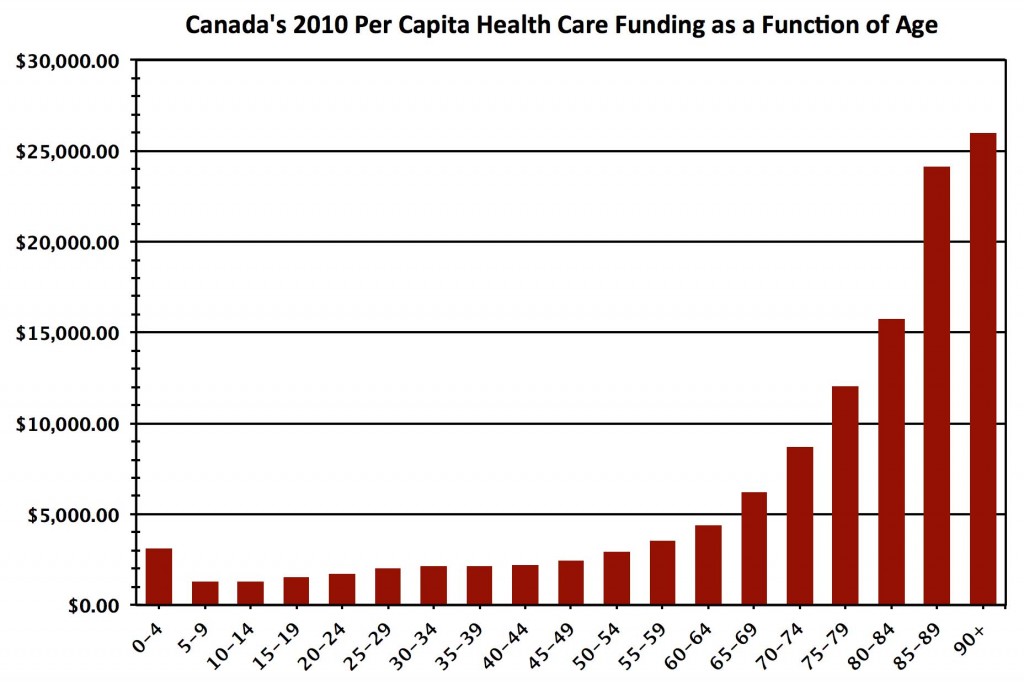

However, since January 2014, CHT allocations are now determined solely on an equal per capita cash basis. While this new system means that all provinces will receive equal transfer payments based on population size, I believe that this is not the most equitable way to proceed, particularly in light of provincial age demographics and associated health care costs. Take for example BC, a province many view as a popular retirement destination. It is common practice for individuals who have lived and worked – and therefore paid taxes – elsewhere, to move to BC later in life. However, with national trends showing that seniors’ health care costs more than that of any other age group, this can put a significant strain on our provincial health care system — one that cannot afford to go unaccounted for (see Figure 1).

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Let’s unpack this further. In the 2014-15 budget year, the Federal Government Canada Health Transfer amounted to 32.1 billion dollars distributed across all provinces. In 2014 Canada’s population was estimated to be 35,540,400, and British Columbia’s population was estimated to be 4,631,300. Alberta has a similar population to that of British Columbia (see Table below).

| Province | Population | Ages 0-14 | Ages 15-64 | Ages 65+ |

| Alberta | 4,121,700 | 18.3% | 70.4% | 11.3% |

| BC | 4,631,300 | 14.6% | 68.4% | 17.0% |

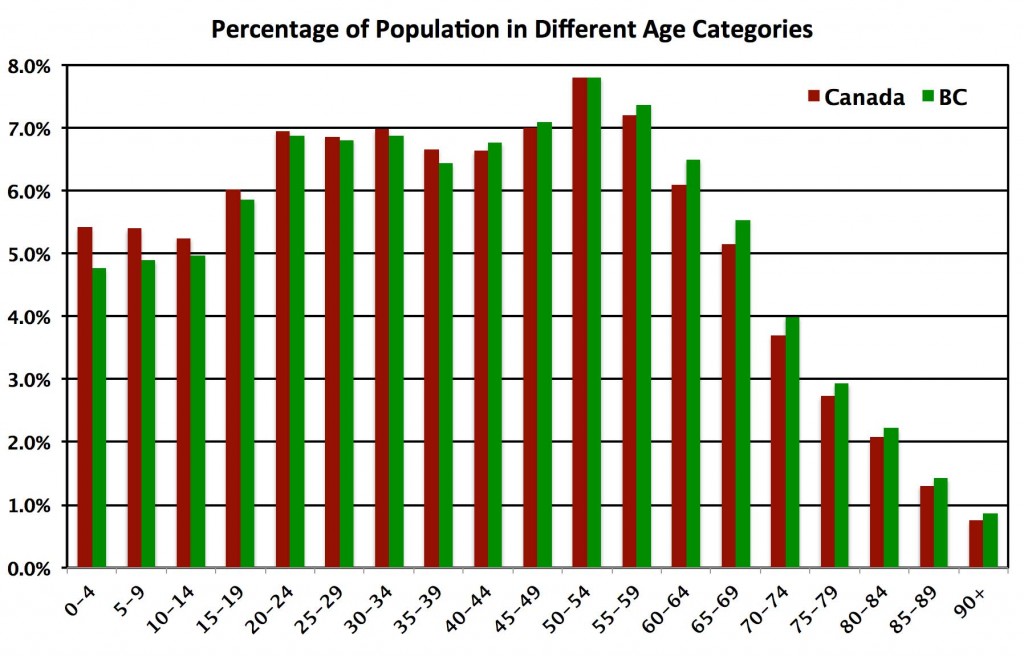

As clearly evident in Figure 2, British Columbia had a smaller percentage of its population in every age group under the age of forty than the Canadian average. The opposite is true for those over the age of forty. Compared to Alberta, British Columbia is home to nearly 70% more seniors. A quick glance back at Figure 1 immediately highlights the glaring inequity in the fixed CHT dollar per person transfer formula. British Columbia has a higher proportion of seniors than the rest of Canada and it is this age demographic that requires more health services. The funding should reflect the actual cost of service delivery.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

It’s a relatively straightforward calculation to weight the CHT transfer to each province by its age demographic and associated health care delivery cost. Rather than receiving 13.0% ($4.183 billion) of the total CHT funding (reflecting 13.0% of Canada’s population residing in British Columbia), we should receive 13.5%. While this may not seem like a lot, it translates into 153 million dollars that British Columbia must find from other sources.

Nevertheless, no matter the method that CHT payments are allocated, these federal transfers only cover a portion of BC’s annual healthcare expenditures. The remaining expenses are financed out of general revenues raised by tax and non-tax sources, with MSP premiums presently contributing over $2 billion per year.

Alternatives to MSP Premiums

While here in BC we do not have the fiscal resources to stop charging MSP premiums without replacing the revenues, there are alternative, and more progressive, options we could be exploring. We need look no further than provinces like Ontario and Quebec, where health premiums are paid through personal income tax systems, rather than flat-rate levies. This approach avoids the regressive effects of monthly premiums, as rates rise with income to a maximum annual level. For example, in Ontario the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums, and in Quebec the maximum annual contribution is $1,000 for taxable incomes over $150,000. At the same time the British Columbia government should lobby for its fair share of CHT revenue — a share that reflects our demographics and the actual cost of delivering health services.

It is time for BC to replace MSP premiums with a more progressive and equitable approach to financing our health care system. Whether this means following in the steps of Ontario and Quebec with an income tax-based approach, or simply raising other taxes, such as corporate tax rates, as the Canadian Centre for Policy Alternatives (CCPA) found after conducting extensive research on what British Columbians think about taxes:

“[British Columbians] know more revenues are required if we are going to tackle the major challenges we face, like growing inequality and persistent poverty, climate change, and the affordability crisis squeezing so many families. And we know higher revenues are needed to sustain and enhance the public services…In short, [we] are ready for a thoughtful, democratic conversation about how we raise needed revenues and ensure everyone pays a fair share.”

Regulation of the Debt Settlement Industry

On January 5th I sent a letter to Minister Anton seeking clarification as to whether or not legislation was going to be introduced to regulate the debt settlement industry. Similar legislation exists in other provinces (e.g. Ontario and Nova Scotia as well as in a number of US States). Below is the text of the letter. I have yet to receive a reply.

January 5th, 2015

Hon. Suzanne Anton

Minister of Justice

Room 232, Parliament Buildings

Victoria, B.C.

V8V 1X4

Dear Minister Anton:

I am writing you with regards to forthcoming legislation that would regulate the debt settlement industry.

In July of 2012, CTV news reported that the Ministry of Justice said that “In order to better protect consumers and families living in poverty, the B.C. government will provide legislative changes to regulate businesses that provide debt consolidation services and regulate advance fees paid.”

Since that time there has been little information from government about when we can expect to see this legislation.

Debt management companies prey upon some of the most vulnerable British Columbians. Rather than providing a solution to an individual’s debt issue, these companies seek to profit off the situation. A number of provinces including Ontario, Alberta and Nova Scotia have passed legislation to end these abusive practices within their jurisdictions. I think it is past time that British Columbia passes our own regulations which offer proper protection to our citizens.

Can the Minster provide me with an update as to what stage this legislation is currently at, and when we can expect it to be brought before the BC legislature?

Thank you for your time on this matter. I hope you had a wonderful holiday break with friends and family.

Sincerely,

Andrew Weaver

MLA Oak Bay-Gordon Head

Bill 6 — LNG Income Tax Act: A Generational Sellout

Today in the legislature I rose to speak strongly against Bill 6 — Liquefied Natural Gas Income Tax Act. In a desperate attempt to fulfill outrageous election promises, the BC Government does what it can to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Below is the text of my speech.

Second Reading Speech

Bill 6 — Liquefied Natural Gas Income Tax Act

In an election where the government was set to fail, a Hail Mary pass was thrown. That pass was the promise of an LNG windfall. It was packaged in a message of hope so compelling it couldn’t be ignored: 100,000 jobs, $1 trillion to the GDP, a 100 billion dollar prosperity fund, the elimination of our provincial debt, thriving schools and hospitals and, most of all, the end of the provincial sales tax.

As we all know, that pass was caught, and we now have a government that is desperate to deliver on its irresponsible political posturing. What we didn’t know until recently was just how far the government was willing to go to try and materialize its LNG pipedream. We had no idea how desperate the government was. We had no idea how costly it would be to give away our natural resources. Now we do, as sadly, those costs are coming to light.

We’re told we are going to “re-engineer B.C.’s education and apprenticeship systems.” You can’t make this step up. Orwellian messaging and actions that we’ve come to expect from the Harper Tories are now gushing forth from this government’s propaganda machine on a daily basis.

We’re being told that we need to dismantle our leadership in climate policy. In fact, perhaps the most ironic aspect of all of this is that those very same civil servants who put together B.C.’s revenue-neutral carbon tax legislation, a piece of legislation praised around the world, have been given the unenviable task of putting together the present tax legislation, which can only be regarded as a generational sellout.

Just today the government puts our Triple-A credit rating at risk in order to subsidize the LNG industry on the back of taxpayers and B.C. Hydro ratepayers.

Let me be very clear. British Columbia has a rich history of natural gas development. There was once a time when B.C. coffers were filled with royalties from this sector, but markets have changed. The revolution in horizontal fracking technology has created a glut of natural gas in the marketplace. Today’s Henry Hub spot price for natural gas is just $3.60 per million Btu. That makes it uneconomical to extract natural gas from the dry-gas fields in the Horn River shales near Fort Nelson, B.C., which require a North American natural gas spot price of around $5 per million Btu to be economical. Sadly, it’s pretty quiet around Fort Nelson right now.

The only reason we are still maintaining a vibrant sector in the Montney Formation around Fort St. John is because of the value in the liquids — not the gas, which in many cases, I’m told, is simply pumped right back into the ground and capped, as there’s no market for it. These so-called condensates are important for mixing with bitumen in order to reduce its viscosity and, hence, allow diluted bitumen to flow in pipes.

Hon. Speaker, I understand why the government wants to search for a market for B.C. gas. There isn’t one in North America, but let’s take a look at this in more detail, at precisely what the government is doing.

On October 29, 2012, the Deputy Minister of Energy, Mines and Natural Gas made a presentation entitled B.C.’s Energy Future at the annual B.C. clean energy conference. The deputy minister outlined B.C.’s plan and its LNG price projections from 2012 well into the future.

Domestic prices were projected to increase linearly from the $3 per million Btu range to about $7.50 per million Btu by the year 2035. Asian import prices for LNG were also projected to increase from about $13 per million Btu in 2013 to about $17 per million Btu in 2035. In essence, the government was predicting a sustained and constant $10 per million Btu spread in the price of domestic versus Asian prices for natural gas.

That $10 per million Btu spread is critical. It’s projected to cost about $6 to $8 per million Btu to get gas to Asia. If we drop much below that $10 spread, it’s not going to be economical for an LNG industry to get going in British Columbia.

For almost two years I have been saying the same thing, and consistently so. Canada has less than 1 percent of the world’s proven natural gas reserves. Russia has about 20 times as much natural gas as all of Canada combined — not only just B.C., but all of Canada. They recently signed 30-year agreements to provide natural gas to China. Their most recent agreements came in at the $9 to $10 per million Btu mark. That’s equivalent to a $5 to $6 spread from the Henry Hub price.

Australia has similar-sized shale gas reserves as Canada and is much farther ahead in the development of its LNG industry. The United States has more than twice the shale gas reserves as Canada, and the U.S. government recently decided to allow natural gas exports. The U.S. already has some of the necessary infrastructure in place on their coastline to facilitate a relatively quick development of an LNG export industry. China could soon be well positioned to take advantage of its own natural gas reserves, which are three times those of Canada.

The reality is that we are simply not competitive at this time. That doesn’t mean we won’t be at some point in the future. Let the market decide when that will be. The role of government is to ensure that externalities are internalized so that certainty exists for industry moving forward.

In this case, we are doing the exact opposite. What we are doing is externalizing internalities on the taxpayer and future generations. Government has the audacity, the arrogance, the hubris to call it itself “business friendly”.

Rather than acting like a pack of cheerleaders, the members opposite should be posing the difficult questions and proposing innovative solutions to create a diversified, sustainable 21st century economy. There is a disappointing lack of critical analysis on the benches across from me. Perhaps those members who cheer the loudest are trying to win favour with the Premier so that they might climb into the inner chamber of the LNG house of cards.

Six years ago our province took a bold step forward. Together, government, industry leaders and academics, as well as First Nations, came together to map out a new path for our province, one predicated on the notion that strong economic growth can and must go in hand with a sustainable environment. We accepted the undeniable truth that as long as we fail to address global warming, we are failing future generations, for we will be burdening them with the economic, social and environmental costs of our actions today.

Since we took that bold step in 2008 we have seen our economy outperform the Canadian average. We have seen up-and-coming industries like the technology sector become the second-largest contributor to private sector growth, supplying 84,000 jobs for British Columbians and revenues of $18 billion a year. We’ve seen mining output and exports double in the last ten years, and we’ve seen more than $18 billion added to our provincial GDP.

We did all this while reducing our carbon emissions by over 4 percent from 2007 to 2012. In fact, published studies have clearly concluded that the 2008 and subsequent climate policies have successfully reduced carbon emissions while still supporting economic growth.

In 2008 our province boldly strolled down a path that was grounded in real leadership and prosperous economic growth. That vision and those policies are being dismantled with this legislation that is now before the House. The fact is that this whole situation comes down to an absence of real leadership.

All of us in this room were elected to lead, yet real leadership demands of us the integrity to acknowledge what we all know: this bill was developed in the context of unspoken yet profound constraints that were imposed by overhyped election promises. In catching their Hail Mary pass, the B.C. Liberal government gave itself the impossible task of delivering on a promise that was never grounded in any realistic expectations or in sound economics.

How can a government ever deliver on the LNG windfall when the economics simply are not there? The answer, of course, is that they can’t. Instead, the government is selling out our future generation with bills like this one, in an effort to appease public expectations. They know, as we all do, that they cannot walk into the next election without having landed at least one LNG plant. Instead of coming clean and being accountable for their actions, the Liberal government is tabling bills like this one, which amounts to nothing more than a generational sellout.

Mark my words, when the B.C. Liberals look back, in 2016, they’ll tell future voters that the economics have changed, that their promises were reasonable until the LNG bubble burst. They will argue in defense that B.C. has one or two extremely small LNG plants in the works, and dozens of companies are still interested, and there will be hundreds of thousands of jobs, and there will be a trillion dollar hit to the GDP when this prosperity is realized “once you elect us back in.”

They will say: “It wasn’t our fault.” They will proclaim that other market measures came to be, to make LNG not a reality in time for this election. But as I’ve pointed out — and I have done so for the last two years — the economics wasn’t there before, it isn’t there now, and it won’t be there for a few years to come, and this hyperbole does not serve the interests of British Columbians at all.

The truth, of course, is that we have known all along that the economics would change, yet because our government is unwilling to show leadership and admit this, the challenge of delivering on their unfounded promise and the constraints that come with having to at least deliver something was passed on to our poor civil servants, who I believe have done their best with a near impossible task.

Indeed, much of the structure of this legislation is quite brilliant. Many of the technical details have been well-thought-out, and I must actually commend the civil servants who’ve drafted the legislation for doing a very fine job in light of the impossible situation in which they were placed.

That being said, the major problems with this bill aren’t in what the civil servants have done with it; they’re in the politics that led to it, the politics that continue and the politics that will take us into the 2017 election.

We cannot consider the LNG tax regime in isolation. It must be considered in the context of Bill 2, the Greenhouse Gas Industrial Reporting and Control Act. That is because together, Bills 2 and 6 help form an economic playing field for LNG companies. While Bill 6 enshrines the tax regime by which B.C.’s revenue sources are determined, Bill 2 enshrines the loopholes through which companies will jump to avoid ever having to cover the full economic costs of their carbon emissions. We cannot ignore that fact in this debate.

There are clear economic costs that come with not addressing global warming, and they are the untold debt that is conveniently, for our government, left out of our accounting books. But those costs will indeed be borne by future generations if those of us here today fail to act in a responsible manner.

Here’s just one example. As the former governor of the Bank of Canada and now governor of Bank of England said just over two weeks ago, “The vast majority of oil and gas reserves are unburnable,” if we wish to avoid the most profound consequences of global warming. He and many others have pointed out evaluations of major energy companies focused only on fossil fuels are potentially overinflated since their unburnable reserves should be viewed as stranded assets.

Yet in B.C. what do we do? We chase a falling market, through mortgaging our future and incurring ever-increasing amounts of generational debt.

I’ve said before that the economics aren’t there and have never been there. For an LNG industry to thrive in B.C. at this time, the truth of this statement and of the government’s LNG hype is perhaps best illustrated with the proposed LNG tax rate.

With the introduction of this bill, we saw the government cut this rate from 7 percent to 3½ percent, throwing out vague statements like: “Well, market conditions have changed since we brought it in.” In doing so, they’ve cut the projected revenue that British Columbians will receive from the LNG income tax by nearly half — if they receive anything, ever, at all.

Why is the government shifting from 7 percent to 3½ percent now? According to the government, it’s because LNG economics have changed. Among other things, they cite an increasing global LNG supply due to competition and a decrease in LNG demand — since China now has a natural gas supply agreement with Russia, and Japan is considering restarting its nuclear power program.

I was absolutely dumbfounded when I read this. I don’t know what the government’s been up to, but I’ve been saying the same thing for two years. Frankly, it’s irresponsible for the government to be saying this now. I wonder where they’ve been for the last two years — including reading a recent Peters and Co. report that estimates that while LNG demand will increase to more than 500 million tonnes per annum by 2030, LNG supply will reach 800 million tonnes per annum by that time.

Why should we be surprised at this? When we witness Russia sign a $400 billion, 30-year agreement with China, we should not be surprised. When we see the U.S. Gulf Coast become the most efficient place in America to build LNG plants and Japan to sign long-term contracts with U.S. suppliers at rates far below expectations in B.C., we should not be surprised. The supply gap is too narrow, and Russia, the United States, Australia, Malaysia and Qatar are places that already have exports and export industries. They’ll be able to fill the gap long before we can even get gas out of the ground and into ships.

None of this is new. Where has the government been for the last two years as everybody in the energy industry, academics and universities and at least one politician in this building have realized all along that this is nothing but a pipedream and B.C. has become the laughingstock of those in the Alberta oil and gas industry because of its approach in this regard? I say that after talking to people from within that industry.

Why is the government continuing to claim that LNG economics are the reason for its sudden decision to cut the proposed LNG income tax rate in half? If this was indeed a surprise for government, then where was it getting its data from before?

I find it concerning that it appears that the government is either only analyzing these strengths now, years after the fact, or that they’ve known about these trends for years, as I and many others have, including those in the Alberta oil and gas industry, which I would be most delighted to trot out in front of the Legislature here, given permission, to say exactly the same thing that I have been saying and this irresponsible government has ignored for the last two years.

Instead, they’ve chosen to pull the wool over British Columbians’ eyes about why they’re changing the rate now. Irresponsible, shameful, and not what we in British Columbia expect from a government that’s supposed to be truthful to the people of British Columbia.

Here’s another problem. The government has said over and over that it was necessary to lower the LNG income tax in order to keep B.C. competitive. Surely in arriving at that determination, the government would have completed economic projections, both in terms of revenue to the province and in terms of costs to the companies for the various tax levels they considered. Yet I haven’t seen any of these. I’m sure that the members beside me haven’t seen any of these.

What precisely is the government making their decisions on? Where are the revenue projections that lead the government to conclude that the lower tax rate would still provide British Columbians with a fair return on their resources? Is it because Shell told them so? Is it because Buddy down the street in the coffee house told them so? Not the oil and gas reps that I’ve talked to. They certainly don’t know where that’s coming from.

Has government made these projections? If so, where are they? If not, then why not? Without conducting realistic revenue projections, how can the government or we as members of this Legislature properly evaluate the validity of this tax regime? The reality is we can’t, and frankly, it’s irresponsible to proceed without this information.

Furthermore, because we don’t have this information, we also don’t have any realistic projections of how long it will take companies to pay off their net operating loss account and capital investment account balances. We therefore have no basis to determine how long the 1.5 percent tax rate will apply for or when the 3.5 percent tax rate will even ever kick in. These are impacts that we need to know if the government is going to make policy decisions grounded in evidence and analysis.

What about the corporate income tax rate? Of course, this isn’t the only tax cut proposed in this legislation. I’m referring here to the natural gas credit towards the B.C. corporate income tax, and under this legislation LNG companies will receive a tax credit equal to a half percent of the cost of natural gas owned by the LNG taxpayer at the LNG facility inlet, which can then be used to cut their B.C. corporate income tax rate from 11 percent to 8 percent.

I have several concerns about this. First, of course, is back to my previous point. We’ve been given no projections of the impact of this tax break. We have no idea what it will have on revenue, and, presumably, of course, the purpose of this tax break is to attract LNG companies to set up headquarters here in B.C. Yet, again, we already have some of the lowest corporate tax rates in Canada, and Canada has some of the lowest corporate tax rates in the world, so presumably, there must be some reason for this. Presumably, we already have competitive rates.

What’s being added by this? Why is the government doing this? Where are the revenue projections? Are there reliable projections on the impact that this will have? Will companies actually relocate because of this? And if so, what impact will that have on our revenue projections? Are these impacts worth the race to the bottom on corporate income taxes that we are engaging in with other jurisdictions that are also competing for those same headquarters?

Again, I find it concerning that I have not seen any analysis from the government as to the projected impacts of this reduction. To be perfectly blunt, I get the sense that the government is just making it up as they go along.

Meanwhile, this corporate tax break also begs the question: why is the government favouring one industry over others? This tax break for LNG industry puts the government’s LNG ambitions ahead of such things as film, tourism, high-tech, forestry, fishing and many other industries which are already here now. It puts a hypothetical fossil fuel industry, with its future stranded assets, ahead of existing 21st-century industries that are already employing many, many more British Columbians and that provide realistic hope for future growth.

Are we so desperate to attract LNG producers that we are willing to leave industries that are already thriving in our province? That already show promise for future prosperity? Are we just going to just throw them by the wayside? If we want to support economic growth through tax policy, why not instead explore measures of further growing these existing industries that have shown success in our province?

Let’s build on our demonstrated strengths and the jobs they provide for British Columbians, not a pipedream that clearly won’t do much for the B.C. economy for several decades to come.

Of course, leaving aside the values question, of whether we should be sacrificing so much to try to materialize an LNG industry, all of these issues ultimately come down to the basic question. Where is that line at which B.C. actually becomes competitive with other jurisdictions, and have we actually hit that line?

Will these tax cuts actually make us that much more competitive to the point that LNG companies would have walked away without them but will now be drawn to B.C. with them? Without the full information, it’s hard to answer these questions, since there is much more to the calculation than simply respective tax rates.

Let me offer one specific example. Regulatory filings show that both the Pacific NorthWest LNG and LNG Canada projects would each likely cost up to $15 billion to build, which would translate roughly to about $1,200 per metric tonne capacity. In contrast, the Cameron LNG project on the U.S. Gulf Coast could take advantage of an existing import facility and would only cost about $7 billion to complete, which is roughly equivalent to $600 per metric tonne capacity.

Several Asian buyers, including Japan, which recently signed contracts, South Korea, India and Indonesia have acknowledged that because of this, the U.S. is likely the most efficient place in North America to build LNG export facilities and have already committed to long-term contracts with the U.S. as a consequence, starting in 2016.

The reality is that the widening of the Isthmus of Panama should open sometime at the end of next year, allowing bigger ships to come into the Gulf ports to pick up LNG at a cheaper price.

Unfortunately, we have no actual revenue projections, again, that we can use as a basis for evaluating whether the tax cuts we are offering are necessary to close the competitive gap with jurisdictions like the U.S that have these added advantages. Instead, we’re being asked, simply based on trust, to take the government at its word that they got it right.

Based on what has become a train wreck of unfulfilled promises, it’s hard for me to do so. Without revenue projections, we cannot make an informed decision on the values question of whether we should be making these sacrifices in the hope that an LNG industry will somehow materialize.

Here’s one of the most egregious aspects of this bill. We’re actually paying firms to clean up their own mess, and my concerns don’t end there, for example. Not only does this legislation lay out a path to give away our natural resources through a series of tax cuts and breaks, it also goes so far as to provide a tax credit to companies when they finally clean up their mess, a mess they made over the course of their operations.

Under this legislation a company would receive a 5 percent tax break relating to the costs of reclamation, remediation and restoration of an LNG facility site. I mean, it should go without saying that LNG companies have a responsibility to restore, reclaim and remediate their sites. This should be a cost of doing business, not something that a company gets a pat on the back for and a cheque in their pocket for doing sometime hypothetically down the road.

I find it, again, deeply concerning that the government is passing some of these costs on to British Columbians through this tax credit. It’s the opposite of polluter pays. It’s polluter gets paid.

If we are so concerned that these companies are going to pack up and leave B.C. with a hazardous mess to clean up, why don’t we mandate that these costs be covered as upfront criteria for doing business in B.C.?

As a final point, I’m concerned about an inconsistency in this bill with respect to taxing emissions reductions initiative from Bill 2. Under Bill 2, as an initiative to reduce their emission intensity, the government is proposing to tax LNG companies for not meeting the emissions intensity benchmark of 0.16 per metric tonnes of carbon dioxide–equivalent per tonne of LNG produced. Mind you, that’s only on the downstream component.

Those taxes count as lost revenue. On the other hand, LNG producers would also be empowered to sell emissions credits that they receive for reducing their emissions below the 0.16 benchmark. This doesn’t make any sense. On the face of it might. It might seem like a good way to motivate firms to reduce their greenhouse gas emissions intensity. However, there’s a troubling inconsistency in how this policy is applied.

Under Bill 6, producers can count the costs of buying emissions credits as lost revenue and, hence, reduce their LNG income tax amount. However, when producers make revenue from selling the credits they receive for reducing their emissions intensity below 0.16 — that benchmark — that revenue is exempt from taxation. In other words, the government is letting the industry have its cake and eat it too, and it’s doing so on the backs of British Columbian taxpayers — who buy the ingredients, prepare the cake and pass it along to the industry.

In conclusion, I cannot help wondering why we aren’t talking — instead of about a regressive tax regime that essentially gives British Columbia’s assets for nothing to companies afar and puts the debt on future generations — about and supporting a diversified 21st-century sustainable economy. We could be debating legislation that would support a range of industries that provide local, well-paying and sustainable employment opportunities over the long term instead of tying our job and our children’s jobs to the boom and bust cycle of fossil fuel industries.

We should instead be looking at the long-term growth in new and up-and-coming industries. Rather than relying on a single industry in one part of the province to provide prosperity — hopeful prosperity, dreamful prosperity — for British Columbia’s future, we could show real leadership and take steps today to develop the diversity of opportunities that exist across the province and to prepare our youth for employment in industries that are already characterized by high growth — such as the clean and high-tech sectors, the film sector, the tourism sector, the forestry sector, the fishing sector. And I could go on and on.

This vision certainly includes innovation in how we develop and use our natural resources, but not in a bubble. Rather, it’s as part of a diversified and sustainable economy. It goes without saying that we must enact policies to ensure that British Columbians benefit from resource extraction when and where that extraction is appropriate.

But this tax regime instead lays out a means to give away our province’s resources in order to land an irresponsible, political promise filled with hyperbole, lacking of substance and void of information and detail.

As we continue to debate the role LNG might play in our economy, let us not forget the real opportunities, the real economic opportunities, of the future and that they lie in fostering long-term sustainable growth in our economy, growth that transitions us to a low-carbon economy. Let’s take that challenge seriously and develop a 21st-century economy for British Columbia. That economy may indeed have a place for a revitalized gas industry in B.C.

If I can leave one message with government, ultimately, it is this. That revitalized gas industry should arise if the market determines it is time for it to do so, not because the government hopes it is time for it to do so. That is a critical aspect of the flaw of this piece of legislation. The government is interfering with the market.

The government has decided that it knows best, that the market for LNG is here and now and is now trying to interfere with the market. Instead of doing what it should do, what it’s tasked to do, which is to internalize externalities and ensure that the market is regulated, they are externalizing internalities and putting those and that burden on the present generation and tomorrow’s generation as well.

We will look back in British Columbia a few years hence and realize that this is a defining time in our province — a province that used to be known as an innovative leader in the technology of today and tomorrow.

Instead, what we have done is we’ve taken a card from the regressive approach of Harper Tory politics, which has a base in the Alberta oil sands industry: “Come hell or high water, get the resource out of the ground and sell it afar. Throw a party today with the resources that we can extract and the money we can take from today’s resource-selling. Let’s not worry about tomorrow.”

Let’s look at places around the world — and the prosperity funds they have — and ask the question: “What is the prosperity fund that Canada has from all of the extraction of its oil and gas wealth over many, many decades?”

The answer is very simple: it is a big fat goose egg. British Columbia, through this legislation, has aligned itself with the federal government, and we, too, in British Columbia can expect this same big fat goose egg as a legacy for the irresponsible tax regime, the irresponsible policies and the irresponsible government we have here trying to force this LNG on a market that’s not ready for it.

Maintaining BC’s AAA Credit Rating while Protecting BC’s Ratepayers

Today in the legislature I was up during Question Period. I took the opportunity to probe the government’s thinking about taking on substantive public debt to construct Site C when there are more cost effective, and less financially risky options available. My concern is the effect burgeoning debt will have on our overall credit rating. If our credit rating drops, the cost of debt servicing will go up thereby affecting government finances. At the end of the day, the ratepayer will also be on the hook for any cost overruns.

MY QUESTION

On April 19 of 2010, I, along with numerous others, travelled to Hudson’s Hope to hear the then Premier, Gordon Campbell, announce that the proposed Site C dam project was moving to the environmental assessment stage. In 2010 the projected construction cost for the dam was $6.6 billion, but by May 2011, that cost had increased to $7.9 billion, a 20 percent increase.

There’s considerable upside uncertainty regarding these costs that could easily reach $10 billion to $12 billion. The final investment decision with respect to Site C now rests with cabinet.

In the past our government has appropriately celebrated the fact that B.C. has maintained a triple-A credit rating. However, in May of this year Moody’s downgraded our outlook from stable to negative, citing concerns about the increasing provincial debt.

My question to the Minister of Finance is this. Is the minister as troubled as I am that the approval of the Site C dam could lead to the downgrading of our credit rating that, in turn, would raise the costs of servicing of all of our provincial debt?

MINISTER DE JONG’s RESPONSE

The member correctly identifies the pride we do have for our triple-A credit rating. It’s a form of report card issued by international agencies, a comparative assessment of how we’re doing, and the marks they have given us the past number of years places us in very, very exclusive company.

Commercial Crowns, like B.C. Hydro, are assessed as self-supported debt rather than taxpayer-supported debt. The other thing I can say to the member is that B.C. Hydro has over the past number of years been assessed a flow-through rating, which means they have the same triple-A rating as the B.C. government. Now, some rating agencies are now extending their analysis to extend to total provincial debt, including self-supporting Crown corporations.

The Minister of Energy has — and will, if given the opportunity — continued to point out the basis upon which a final decision on this project will be made, but I can assure the member and all members that affordability of debt will be one of those considerations.

MY SUPPLEMENTAL QUESTION

We know there are affordable alternatives to Site C, and these alternatives would allow us to meet present and future energy needs without running the risk of incurring increased public debt and potentially damaging our triple-A credit rating.

The fact is that circumstances have changed since 2010. That’s why I no longer believe it’s fiscally prudent to move forward with this project.

In the last few years the costs of wind energy and solar PV have dropped dramatically. In addition, just last month the Canadian Geothermal Energy Association released a report outlining the unheralded potential of B.C.’s yet untapped geothermal resource.

My question to the Minister of Finance is this. Will the government consider expanding the mandate of B.C. Hydro to allow them to develop our geothermal resources? And will the government task B.C. Hydro with issuing new calls for power at a fixed price below the projected cost of power produced from Site C so that the market can prove up these cheaper alternatives — and, subsequently, protect the ratepayer from unnecessary rate hikes?

MINISTER BENNETT’s RESPONSE

Thank you to the member for the question. It’s actually, I think, a positive to be given the opportunity to talk about our electricity policy in the province and how we’re going to obtain the electricity that we’re going to need over the next 20 years. The estimate is that we’re going to need about 40 percent more electricity than we generate today over the next 20 years.

The province obviously has some choices. If you look at the ten-year rates plan that we announced a year ago, you’ll see that we’ve already made some choices in terms of priorities.

Our number one choice in terms of meeting that new demand is conservation. B.C. Hydro is going to attempt to meet the growth in demand through conservation, to the extent of 78 percent of the growth in demand by conservation.

In reference to that same plan that we announced a year ago, we are also going to meet that demand by reinvesting in assets that were built a long time ago on the Peace River system and the Columbia River system and try to generate as much electricity as we can with the current generation assets that we have.

The third thing that we’re going to do is to allow a number of IPP projects that are already in the pipeline to be finished, to be constructed, and we will acquire that electricity as well.

Even after those three responses to this growth and demand, we are going to need at least 1,100 megawatts of electricity over on top of that, and the government has not decided how we’re going to acquire that 1,100 megawatts. I can tell the hon. member that we are, in fact, carefully looking at all of the alternatives.

As a backdrop to this question, I sent the Minister a letter concerning the forthcoming cabinet investment decision on the Site C Hydroelectric project on October 16th 2014. In it, I expressed my profound concern regarding the economic ramifications of making an investment decision in Site C. The letter is reproduced below.

Honourable Mike de Jong

Minister of Finance

Parliament Buildings

Victoria BC V8V 1X4

Dear Minister de Jong,

I am writing to you concerning the forthcoming cabinet investment decision on the Site C Hydroelectric project.

I have serious reservations that this project is not economically competitive with other options and is ultimately not in the best interests of British Columbians.

As I’m sure you are aware, Clean Energy BC just released a new study entitled “Cost Effective evaluation of Clean Energy Projects in the Context of Site C.” In their commissioned report, serious questions were raised about BC Hydro’s project valuations. In particular, concerns were raised regarding the elevated capital cost assumptions that were applied to independent power projects, and the “artificially reduced” calculation for BC Hydro’s WACC. The National Energy Board’s Joint Review Panel (JRP) raised similar concerns including a note that BC Hydro’s cost of capital calculations “should not be allowed to drive choices that would affect the BC economy… for many decades.” The Clean Energy BC report written by London Economics International (LEI) provides clear evidence that alternatives are at par if not more competitive then this project.

Ultimately, the study was critical of the current evaluation that was done for Site C. They wrote: “To assure British Columbia ratepayers receive value for money, LEI recommends that costs for Site C be independently reviewed and market tested against the results of one or more clean energy procurements. Such an approach would be consistent with global best practice in procurement.”

The LEI study reiterates, and in many places substantiates, the concerns that the JRP tasked with reviewing the Site C hydroelectric project raised in their ruling. While the JRP ultimately gave a qualified recommendation to proceed with the project, they were highly critical of the economic forecasting that was used to justify its construction. On page 280 of the Site C Review Panel Report it is noted that “The Panel cannot conclude on the likely accuracy of the Project cost estimates because it does not have the information, time or resources.”

The suggestion that the JRP tasked with reviewing the project lacked the time, information and resources is a very worrying indictment of this project, and makes it all the more important that we take other analyses seriously – and all of them point to viable and economically competitive alternatives.

For example, it is my belief that wind power has been vastly underestimated as an economically competitive alternative to generating the same quantity of power. Globally, we have seen wind become increasing competitive as technological breakthroughs allow for energy to be generated at lower and lower wind speeds at increasingly lower costs. Not accounting for these changes in pricing and technology raise the potential for cost estimates for wind to be overstated. In fact, the economic analysis undertaken by BC Hydro specifically assumes that future costs for wind (and other renewables) would not change. Clearly, all evidence points to the contrary as costs of wind, solar and other forms of renewable energy have dropped dramatically in recent years.

I also want to point out that BC is the only jurisdiction along the Ring of Fire that is not generating power from its geothermal resources. A recent report from CanGEA highlighted the massive potential that this resource has for BC. Geothermal energy would support the creation of a more diversified, resilient power grid, while providing a stable base power source. Perhaps it is time to consider expanding BC Hydro’s mandate to allow it to produce power from geothermal sources.

The potential construction of Site C is rightfully considered a turning point for BC – although in my opinion it sends us down an undesirable path. Site C will crowd out the development of other renewable projects, putting at risk the further development of an industry that is among the fastest growing globally.

Ultimately, I share the your desire to see British Columbia’s economy managed in a way that ensures a sustainable approach that is not burdening future generations with the cost of decisions we make today. The government has in the past appropriately celebrated the fact that British Columbia has maintained a AAA credit rating. I am concerned that this rating would be in jeopardy if BC Hydro, a crown corporation, were to incur another 7.9 billion debt (with substantive uncertainty regarding cost over runs).

Finally, bringing other forms of renewable energy on stream incrementally will allow supply to keep pace with demand. We have our legacy dams that can be used as load levellers if they are viewed as rechargeable batteries with other intermittent energy source providing the recharging capacity. And the Clean Energy Act allows 7% of our electricity supply comes from non renewables, such as natural gas which can help firm up power.

Thank you for seriously considering the economic ramifications of making an investment decision in Site C. There may come a day in the future where Site C is needed, but I would argue that right now, it does not make economic sense to proceed with its construction.

Yours sincerely

Andrew Weaver

MLA Oak Bay Gordon Head