Finance

Attempting to get clarity on the BC NDP “Speculation” Tax

Today in Question Period I took the opportunity to see if I could get more details from the Minister of Finance on the BC NDP’s so-called “Speculation Tax”.

Last week I was very critical of the way the BC NDP introduced this tax. Ironically it doesn’t even address speculation in the real estate sector.

I remain unconvinced that the BC NDP know what outcome they are trying to achieve with their tax measure. It’s clear to me from the Minister’s responses to my questions (reproduced in video and text below) that they don’t understand the difference between a vacancy tax and a speculation tax. In fact, under the Vancouver Charter, that city have already imposed a vacancy tax.

A better way forward would be to enable all local governments (not just Vancouver) to introduce vacancy taxes if they felt it was in their community’s interest. At the same time, a speculation tax could be applied exclusively to properties owned by offshore individuals and entities, the bare trust loophole could be closed and a flipping tax could be applied when the same property is sold multiple times in a short time period.

Fortunately there is still time to fix what the BC NDP have proposed.

Video of Exchange

Question

A. Weaver: There’s no doubt that we need to take bold action to address the drivers in our housing crisis. A fundamental component of this is clamping down on speculation. But the government’s botched speculation tax doesn’t in fact target speculation.

A speculator is someone who buys a property solely to flip it. A speculator is someone who parks offshore money in our real estate, hoping to protect themselves from the turmoil in global markets. A speculator is someone who uses bare trusts to avoid paying property transfer taxes, thereby allowing multiple sales and resales with no change in title.

A speculator is not someone who pays taxes here and owns a vacation cottage. These folk are not trying to capitalize on our out-of-control housing market.

My question to the Minister of Finance is this. The minister has said that her aim is to make sure she gets speculators out of the market. Does the minister consider British Columbians with vacation homes to be speculators? Or will she ensure that they are fully exempt from this tax? If so, how will she do it?

Answer

Hon. C. James: Thank you to the member, the Leader of the Third Party. I appreciate the question, and I appreciate his support for a speculation tax.

We were left, in this province, with a crisis when it comes to the housing market, because the other side ignored the issues and the crisis that people were facing around affordability. We’ve seen rents skyrocket. We’ve seen families who can’t afford to live in the community that they work in. So our goal is to ensure that British Columbians can afford to work and live in their own province.

We’re including measures in the speculation tax that will protect British Columbians. We are looking at getting people out of the market who are using our housing market as a stock market. The specifics will come. We’re continuing to listen to the issues that people raise, including the member at the end. We will make sure that housing is affordable for British Columbians. That’s our aim, and that’s what the speculation tax will do.

Supplementary Question

A. Weaver: The government has had years to consult with British Columbians. Instead, it brings in a poorly thought out tax measure whose interpretation seems to change every time the minister or Premier is in a press scrum.

As far as I can understand from the tax information sheet still on the government’s website, British Columbians with second homes have to pay the tax, and then they get a non-refundable tax credit after the fact. Low or moderate-income British Columbians will, in many cases, not even be able to use the tax credit. But if you’re very wealthy, you get the full benefit of the credit. That doesn’t make any sense. It penalizes people with moderate and low incomes and further entrenches the idea that home ownership is reserved only for the wealthiest.

Hon. Speaker, my question, through you to the Minister of Finance, is this: will the minister reconsider this tax credit model to ensure that British Columbians with vacation homes are actually protected from the effects of this speculation tax?

Answer

Hon. C. James: I would say to the member, once again, that we introduced the speculation tax as part of our 30-point plan to address affordable housing in British Columbia. I said in the budget lockup and on budget day that the details would be coming. We are listening to British Columbians, including the member and other people who have put forward ideas. We have been working on those issues since we introduced the speculation tax.

The specific concerns that the member raises are issues that are already on the table, which we are reviewing and looking at as we implement the tax. As I’ve said all along, details will come. The aim is to make sure that we get speculators out of the market.

I would say to the member that if you are an individual who owns four empty houses and you’re leaving them vacant in Vancouver, you are speculating in the housing market. We will be addressing that, and we will be addressing affordable housing for British Columbians.

Calling out BC NDP for botching up tax measures & nonexistent legislative agenda

In the legislature today, second reading of Bill 8 – 2018: Supply Act (No. 1), 2018 was up for debate.

The Supply Act is the bill that allows government to spend money. It is typical for the Supply Act to have two parts. The first, which was debated today, provides government the power to spend money for the next two months (April and May, 2018). The second, which will be debated once budget estimates have concluded, will allow government to spend for the rest of the fiscal year (to March 31, 2019).

There is a long history of all parties in the legislature supporting Supply Acts (both the BC Liberals and BC Greens continued the tradition with this Act). The reason is obvious. If they are not supported, government cannot spend money. All services stop and government shuts down. While this occurs periodically in the United States, it is not common in Canada.

Nevertheless, I took the second reading opportunity to outline how concerned my BC Green Caucus and I are with the lack of vision and legislative agenda these past 8 months. We are also profoundly troubled with the fact that the government has badly botched two recent tax measures which have created uncertainty and chaos in market.

I spent a fair amount of time specifically highlighting the “Speculation Tax” which is actually not a speculation tax. Rather, it is a “paper wealth tax” that has been poorly thought out, doesn’t deal with speculation, and hurts British Columbians. The BC NDP have badly botched this measure and its interpretation by the Minister has been changing on a near daily basis.

The BC Greens understand the importance of tempering exuberance in the out of control housing market and have specifically called for a New Zealand-style ban on foreign purchases as per our call for bold action. We also outlined numerous other measures that could be implemented including the importance of closing the Bare Trust loophole as was done in Ontario.

The BC Greens understand the importance of tempering exuberance in the out of control housing market and have specifically called for a New Zealand-style ban on foreign purchases as per our call for bold action. We also outlined numerous other measures that could be implemented including the importance of closing the Bare Trust loophole as was done in Ontario.

The Speculation Tax and Employer Health Tax both need the introduction of legislation prior to them taking effect. Such legislation is expected in the fall. Fortunately we have time to pressure government to fix the problems embedded in their poorly thought out approach to deal with speculation.

As evident in the speech reproduced in video and text below, I specifically ask the Minister of Finance to stop making up tax policy on the fly, in press conferences. Continuing to do so creates nothing but uncertainty and chaos in the market chaos. British Columbians deserve better.

Video of Speech

Text of Speech

A. Weaver: I rise to speak to the Supply Act. I thank the member for Prince George–Valemount for her comments and the minister for her introduction of the bill.

This bill, as the member for Prince George–Valemount pointed out, is, essentially, following tradition, where, after the budget is announced and estimates are brought forward, a portion of the budget getting us through this legislative period is requested up front to ensure that people get paid, in essence — that government can operate, that capital projects can go forward.

In this Supply Act, we’re approving 2/12, or 1/6 — quite remarkably, not to do fractional division, 2/12 is 1/6 — of the total amount of the main estimates, as well as one-third — you could have said 4/12, if you wanted, as opposed to one-third — of the capital budget. I won’t be proposing amendment on that, although I think it is sloppy mathematics.

On a slightly different note, I do have a number of concerns, serious concerns, with respect to the Supply Act because the Supply Act is making assumptions with respect to the implications of the budget. And, of course, the budget, which we’ve discussed, has got some assumptions in it.

You know, I and my colleagues are frustrated here in the B.C. Green caucus. We’re frustrated because on July 18 of 2017, this government was sworn in. We are now nearly eight months since government was sworn in, and we’re still questioning what legislation is going to be brought forward. In the 19 days of debate — we’re in our fourth week now, of debate here — here we are, and what’s being brought forward?

We’re getting the Supply Act to debate — fine. Fully four of the eight bills that the government has introduced, including this Supply Act, are really housekeeping bills or bills that every government has to bring in. We have the bill, of course, to ensure the supremacy of the parliament. I won’t talk to that, obviously, because that’s a different debate. We have the Budget Measures Implementation Act. Of course, I’m not going to speak to that bill, either. It’s another debate.

And we have the now famous Miscellaneous Statutes Amendment Act, which we’re all waiting with bated breath to debate as we define things like Pacific daylight-saving time. These are what the government’s agenda is. This is troubling.

Let’s go back to 1972 — July 24, 1972, when an election was called. On August 30, 1972, a new NDP government was formed. In the first session of that 30th parliament in the fall, they sat for nine days, and they passed 13 bills. In the second session, they passed 93 bills in 61 days — 93 bills.

This government has had 16 years in opposition to come up with an agenda, and now we’re being asked to approve a supply act when we don’t actually know what that agenda is. We’re 19 days in, and we’ve seen precisely four non-traditional bills to debate, one of which is the supply act.

You know, we’re troubled about a number of the assumptions in this bill that are leading to the supply act. We have seen government talk about an employers health tax. We’ve seen government talk about a speculative tax. We’re not sure what they mean when they’re talking about it.

I had thought, after conversations and reading the media, that a speculation tax wasn’t going to apply to British Columbians. Silly me for actually listening to the Premier and the Finance Minister say that in media scrums. But then I see an interpretive bulletin that actually says that what’s going to happen, leading to estimates that we have to approve here, is that in fact, if you’re a B.C. resident, you’re getting a tax credit. That’s what the interpretive bulletin says: you’re going to get a tax credit.

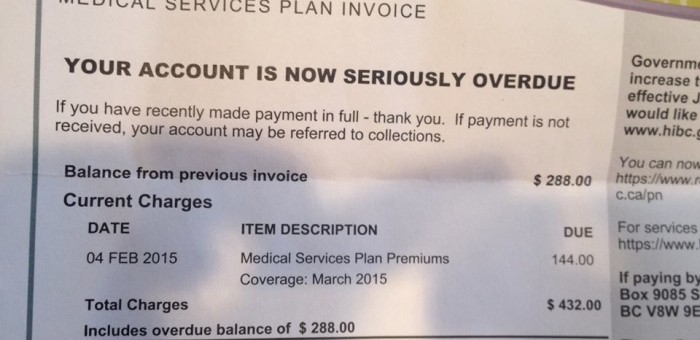

You tell that to the constituents of mine or other colleagues across who aren’t earning any income but happen to own a family cottage on a lake that happens to be in the boundary of Nanaimo regional district or on one of the Gulf Islands — that now that person is going to be charged $12,000 a year as a speculation tax. They’ll get a tax credit, sure, but they’ve got no income on which to apply that tax credit. How’s that a speculative tax?

This government clearly believes that this real estate market is a market from which they can sap revenue. We’ve asked: what is the outcome? What are the outcomes you’re looking for your measures? That has yet to be defined.

We see projected budget increases, and then stabilization of revenue, coming from things like this so-called speculation tax. If it was a speculation tax, you would hope it’d go to zero. It’s being applied, in our sense, as a paper wealth tax. We feel that what’s happening here is that policy and finance and tax measures are being made up in press scrums.

The market needs certainty. What are your outcomes? We have got a supply bill that’s made budget estimates assuming income from a speculation tax whose implementation has literally changed three times since the budget was announced.

Is it going to apply to Gulf Islands? Is it going to apply to the city of Kelowna? The city of Kelowna, where the rental accommodation right now is critically dependent on owners renting their houses to students for eight months of the year and using those houses in the summer for either vacation rentals or to live in themselves. This is critical for the Kelowna economy, yet we call that a speculation. No, they’re playing a critical role to rental properties there.

We understand that Vancouver’s out of control. We understand that the Vancouver market’s completely out of control, and we understand that it was far too long to deal with it. But the revenues here, we’re uncertain of. We’re frustrated, because we don’t know what the agenda of the government is, we don’t know the direction that they’re going in the housing market, and all they’ve done is signal to the market that it’s going to be chaotic times ahead because we haven’t articulated what this critical new measure is to broader society. That’s not how tax measures are going to be brought in.

We proposed, of course, dealing with the problem, which was the foreign capital that’s flowing into this province. This would have given certainty here, because we would have assumed that, when you start to tax that foreign capital or you actually eliminate the source, you know those revenues are going to go to zero.

But this government, in the supply bill, is actually counting on those revenues and basically taxing the grandmother in Oak Bay who happens to have a house from 150 years of family on Saltspring Island that they want to leave to their children.

How many MLAs here have properties on the Gulf Islands? How many government MLAs have properties on the Gulf Islands? Well, one just has to look through the disclosure. I can tell you it’s a number of them. Are they getting a surprise, knowing that they’re going to pay $12,000 a year, if it’s worth 600 bucks? So $12,000 a year, but they’ll get a tax credit. They get a healthy salary here. Okay, that’s fine. But most of them don’t.

We’re very worried down here. We’re worried that the government is actually falling into the trap that they have branded on themselves over many years, which is one of not being able to be fiscally responsible with the money, the hard-earned taxpayers’ money, in our economy. That is troubling. It’s very troubling.

You know, obviously, we support the supply bill. Obviously, we must have a continuation of the government operating and all the schools and hospitals around this province. Obviously we must support this bill. But we want government to stand back and reflect upon what it’s been doing.

It has had 16 years — or the dreaded 17 years, depending on where you count; 16 or 17 years — to develop a legislative agenda. We are now 19 days into this session, and we’ve had nothing.

We stuck our necks out. We recognized that British Columbians wanted a change. We recognized that they wanted to have people put first. We recognized that they wanted a child care plan, which we see in the Supply Act. We recognized they wanted real measures done in the housing market. We recognized that they wanted bold action in the housing market. What have we got? A tepid response that, frankly, is botched up from its first introductions through the present day we are here.

I’m worried, because let me say that the measures that are being brought forward are not dealing with the problem there. If you want to tax speculation, tax speculation. But we’re not actually taxing speculation here. You could still here: buy a townhouse; take possession; flip that townhouse four times; pay zero property transfer tax because you bought it in a bare trust.

Government has known about this for months and years and railed on the B.C. Liberals to close that bare trust loophole. Have they done it? No. Why? Because they have to collect more data. How much more do we need to study these issues? How much more studying do we need? Clearly, too much, in that case, but what about the employer health benefit? Well, we don’t need to study that, even though we have a MSP tax panel to actually do just that.

We decide, as reflected in this Supply Act, that we know what the answer is. We struck a panel of distinguished academics who put their careers and credibility on the line to write a report on which government is going to base decisions, and government determines the way it’s going to deal with before their interim report is there. And it had to, because you don’t make budgetary decisions two days after an interim report is done.

What does that say that government is actually doing? Is it listening to the experts? Only on what it wants to listen to. Only on what it wants to delay, what it wants to kick down the road.

It’s not listening on the employer health premium — again, a piece of tax policy that, as far as we can tell, was introduced, realized it was done inappropriately. Now we’ve got the MSP panel coming in with their final report clearly articulating that they don’t approve or recommend the direction government has taken. How’s government going to respond? They’ve boxed themselves into a corner. They’re going to respond in a way that going to hurt schools and hospitals all across this province.

Now, they’ll say: “Okay, we’re going to cut it for the average person.” Yes, they will. They’ll cut it for the average person. And I get that there are unions out there — I was one of those negotiators — who’ve negotiated MSPs as part of a collective agreement, and it was costed against the settlement. I understand that. But what you do then…. I mean, there are also unions right now going back to their employer, saying: “You’re not going to have to pay that. Give us the money back.” Now the employer is getting doubly hit, because they’re going to get a health care tax. Not only are they going to get a tax, they’re going to get an increased tax.

I don’t understand the logic of this government not thinking this through and not recognizing that there are models out there and that you don’t hit the economy with a baseball bat. You recognize that there are problems. You send a signal to market, and you do so slowly, and you don’t make policy up in each individual press scrum.

I will quote one of the legislative reporters here who accurately assessed some emails, which my constituency office was sending out, suggesting that in fact the speculation tax wasn’t going to apply to British Columbians — because we heard, in press conferences, this government say just that.

They said just that — that it’s not going to apply to British Columbians. But in fact, it does. It’s applying, through a tax credit, not only in the problem area of Vancouver but in downtown Kelowna, which will absolutely devastate their economy, and in Parksville. The member for Parksville-Qualicum talked about a development that likely won’t go ahead. Parksville is a community that caters to — guess what — snowbirds, people from the prairies who are trying to escape the cold winters and come to Parksville for four or six months a year to live. Sometimes they rent out their home in the summer, for summer vacations. It’s a community whose entire economy is based on tourism — snowbirds and others.

What about if we go to Cultus Lake? I had a passionate plea from a citizen from Langley who said they just bought a house. They’ve been saving their life for a place in Cultus Lake. They’ve entered into a contract, and now they have to move from the contract and get out of it, out of fear that the speculation tax will apply to them. They’re afraid that they’re going to be sued, because government hasn’t given the market certainty as to the direction it wants to go. This is unacceptable.

We’re debating the Supply Act, where the government is asking: “So give us 2/12.” It should be 1/6. That’s actually a beautiful demonstration, Hon. Speaker, of what I’m saying. Get the numbers right. British Columbians deserve that. They deserve a signal. They deserve a real estate sector that actually deals with the problem — not Whac-a-Mole, where you put a foreign buyers’ tax in Victoria, and one in Nanaimo regional district. Guess what. You go to Cowichan Valley regional district.

There’s no difference between Cowichan Valley, CVRD, GVRD and Nanaimo. There are just a few arbitrary roads in between. So we Whac-a-Mole down here; we Whac-a-Mole up there. When you Whac-a-Mole in Nanaimo regional district, you’re going into the rural communities of Coombs and Errington regions. They’re not actually communities that have any housing problem. You’re going into these rural communities and Whac-a-Moling there. Meanwhile, you’re leaving Cowichan Valley open — pristine farmland that is being bought up and turned into mansions. But you’re not dealing with that.

The CEO of the Royal Bank has identified what the problem is. We know what that problem is. CIBC has identified the problem, by clamping down on foreign mortgages. This government is actually not viewing what the problem is. Instead, they’re viewing this tax, to generate revenue in the Supply Act that we’re debating, solely as a form of income to fund its other expenditures. That is reckless, and we deserve better. We deserve government to declare its agenda. We’ve given them a full eight months now, and we are waiting. We continue to wait to know what direction: what are they going to introduce? You promised a bunch of things. I sat here for years and watched private member’s bill after private member’s bill being introduced.

I come back to Dave Barrett. Ironically and sadly, we celebrated his life last week. In his first session in the spring, his government passed 93 bills, many of which are around today — one bill every three days over the short term. Here we are, government saying: “Trust us. We have an agenda. Give us some money now. We’ll kick it down the can, and we’ll vote again later. But we’re not really going to tell what you that agenda is, even though we’ve had so much time to do so. What we’re going to do is make up tax policy, on the fly in press scrums, creating chaos in the market.”

We deserve better. So while I stand in support of this Supply Act, because we must pay the government, I could say we have very serious issues with the budget implementation.

Interjections.

A. Weaver: Well, people are joking: “Well, you have to support the Supply Act.” We have to. If we don’t support the Supply Act, basically, nobody gets paid, whether it be in schools or hospitals. The government shuts down. I mean, they do that in the U.S. all the time, and it seems to be okay, but we don’t want to do that here. We don’t want to do that here in Canada.

With that said, I say that now we have very serious issues with the way government is implementing the speculators tax and very serious issues with how the government is implementing the employers health tax. We have nothing now before us in legislation. We’re told it’s coming in the fall. Government has months to fix it. I expect them to fix it, because frankly, right now it’s unacceptable. Frankly, right now we need to have certainty.

I plead on government to stop making up tax policy on the fly, in press conferences. Give us certainty, so we know what’s going on, and stop scaring people across the province. They’re contacting me. They’re contacting our colleagues across…. They’re contacting members here. We deserve better.

Why bother with the MSP task force if you aren’t willing to listen to them?

Yesterday I rose during Question Period to ask the Minister of Finance why she would forge ahead and announce the Employers’ Health Tax prior to her very own MSP task force submitting their final report.

Recall that on November 2, 2017, the BC Government announced the establishment of an MSP Task Force. The mandate of the Task Force is to provide government with advice on how to replace lost revenue when MSP premiums are eliminated. The Task Force will be issuing its final report on March 31, 2018.

I remain perplexed as to why the Minister of Finance rushed into the Employers’ Health Tax. In doing so, she has created a suite of unforeseen budgetary problems for schools, hospitals, municipalities and other large employers. In addition, she has ignored what the interim report from the MSP Task Force stated:

A payroll tax would reduce the competitiveness of B.C. businesses at a time when they are facing several competitiveness challenges.

and

We feel that it is important that revenue be replaced by a combination of measures in order to best mitigate the negative impacts of each.

The only conclusion one can reach is that the Minister of Finance either (a) read the MSP Task Force interim report but chose to ignore its key recommendations, or (b) rendered her decision to implement the employers health tax prior to the interim report actually being available.

Below I reproduce the video and text of my Question Period exchange with the Minister of Finance.

Video of Exchange

Question

A. Weaver: Yesterday I asked the Minister of Finance why her government forged ahead with the employers health tax without waiting just a few more weeks for the final report to come in from her MSP Task Force. In response, the minister assured us that she took the task force interim report into account when making her decision.

Okay, let’s take a look and see what the task force actually said in this interim report. They said this, “We are leaning towards a combination of a personal income tax surcharge, a small payroll tax and additional ideas” as the best way to replace the revenue. Instead, this government went in the exact opposite direction, putting the entire burden on employers through this payroll tax.

My question to the Minister of Finance is this: given that the expert task force recommended against exactly what you’ve chosen to do with the employers health tax, how do you justify this decision?

Answer

Hon. C. James: Thank you to the Leader of the Third Party for his question. We did receive the interim report. We felt it was important to move ahead on the elimination of medical service premiums on behalf of British Columbians. Leaving the regressive tax in place did not make sense, and we were able to manage it in this budget.

We had increased personal income tax for the top 2 percent of income earners in September’s budget. I’m not sure what the member is asking — whether he’s committed to increasing personal income taxes. But we felt that because we’d already made the decision around the top 2 percent of income earners that this was a balanced approach.

Supplementary Question

A. Weaver: Well, to enlighten the minister, what I’m asking is: why do you have a task force to do something if you’re not going to listen to what they’re doing and actually make decisions before they’ve done what they said they’re going to do?

In fact, the MSP Task Force had more to say. On the payroll tax, which is the direction this government has chosen to go, they said this. “A payroll tax would reduce the competitiveness of B.C. businesses at a time when they are facing several competitiveness challenges.” This concern about business competitiveness is precisely why the task force was leaning towards a combination of measures to make up the revenues, not just by a payroll tax.

They specifically stated this. “We feel that it is important that revenue be replaced by a combination of measures in order to best mitigate the negative impacts of each.“

My question to the Minister of Finance is this. Did the minister either:

a) read the MSP Task Force interim report but choose to ignore its key recommendations, or

b) render her decision to implement the employers health tax prior to the interim report actually being available?

It has to be one. Is it (a) or (b)?

Answer

Hon. C. James: As I already said to the member, we received the interim report. We are ultimately accountable as government. It is our job to receive the report, make a decision based on the information that was there. We received the interim report. We made our decision. We believe it’s a balanced approach, as I said. The member may have a difference of opinion. The member may be interested in looking at personal income tax, and that’s the member’s prerogative. We made a decision as government.

I would also remind the member that, if we are looking at competitiveness when it comes to businesses here in British Columbia, two of the key issues that businesses have been calling for action on over and over again are the issue of child care and the issue of housing. We moved on both of those to address competitiveness and recruitment and retention of employees in British Columbia.

Bill 4: BC Innovation Council Amendment Act

Yesterday in the Legislature we debated Bill 4: British Columbia Innovation Council Amendment Act. This bill renames the BC Innovation Council as Innovate BC and expands its mandate.

As noted in the government’s press release issued in conjunction with the tabling of the bill,

Innovate BC will absorb all the programs and services currently delivered by the BC Innovation Council, in addition to expanding its mandate. These changes will ensure that B.C. is more competitive nationally and globally, and can attract additional investment to scale up the provincial tech ecosystem.

Below I reproduce the text and video of my speech in support of this bill.

Text of Speech

A. Weaver: It gives me pleasure to rise and speak in support of Bill 4, British Columbia Innovation Council Amendment Act. As speakers before me have articulated, this act has two major changes. One, of course, is changing the name of the British Columbia Innovation Council Act to Innovate BC Act. This is important, and I’ll come to that in a second.

The second major change, which I think is very important to emphasize, is that the mandate of Innovate BC, the new organization, will be expanded. In particular, the details as outlined in the previous act, the specific objectives of the council per se in the previous act — that section 3 of the act that’s being modified — is going to have an addition now which says that Innovate B.C. will also “offer tools, resources and expert guidance to entrepreneurs and companies in British Columbia, including in respect of building capacity to access new markets and attract investment.”

Now this is important because, while not specifically stated there, what this is recognizing is the recent appointment of Alan Winter as British Columbia’s innovation commissioner. What the innovation commissioner, of course, is going to be the advocate for the B.C.’s new Innovate B.C. agency.

Why it’s important to change the name? There’s a couple of reasons. When a new organization comes in, it’s often the time to switch the directors of a new organization, to give it a sense of new purpose and new vision and new direction. And we’re quite inspired by Mr. Winter and all that he has done for British Columbia, both in his capacity as CEO of Genome B.C. as a small business, of a large business — just a wealth of experience in innovation across a diversity of areas.

The creation of an innovation commission and the position of innovation commissioner is something that was embedded in our confidence and supply agreement with the B.C. NDP, and we’re grateful to be able to work with them to move this forward. In fact, the so-called CASA agreement states that one of our goals, collectively, is to:

“Establish an innovation commission to support innovation and business development in the technology sector and appoint an innovation commissioner with a mandate to be an advocate ambassador on behalf of the B.C. technology sector in Ottawa and abroad. The mandate and funding of the innovation commission will be jointly established by representatives of both the B.C. Green caucus and the B.C. New Democratic government. And the innovation commission will be created in the first provincial budget tabled by the New Democratic government.”

That, indeed, has been met.

What’s important here is that when one looks at the establishment of the innovation commission, one recognizes that it’s actually at an opportune time, because the focus here in British Columbia is moving to mirror exactly what is happening in Ottawa, recognizing that we can compete in innovation like no one else. So the emergence of innovate B.C. and the commissioner comes at a time when Ottawa is putting money into these very same programs.

It is critical that we have one single point of contact in terms of melding these programs together, because historically, in British Columbia, innovation has been spread across six different and separate ministries — much like fish farms are, as we’ve discussed in question period.

Technology is exciting here, in British Columbia. In 2015, when we have the best data, there were over 100,000 jobs in more than 9,900 companies in B.C., with wages that, on average, were 75 percent higher than the B.C. industrial average; with average weekly earnings of almost $1,600 a week. It had the fifth consecutive year of growth in 2015, and about 5 percent of British Columbia’s workforce was in the tech sector. That’s more than mining, oil and gas, and forestry combined.

I’ll say that again for those riveted at home. There was 5 percent of British Columbia’s workforce in the tech sector in 2015. That is more than mining, oil, gas and forestry combined.

Now, it’s very odd that somehow, in British Columbia, we continue to perpetuate the notion that we are but hewers of wood and drawers of water and that our economy is based on oil and gas or our economy is based on the extraction of raw materials and shipping of those raw materials elsewhere.

In fact, a full 7 percent of our GDP comes from the tech sector. We know that the overwhelming component of our GDP comes from the real estate sector, a very high fraction of it, but 7 percent is from the tech sector. Again, I’ll come back to that in a second.

We know that in 2016, more than 106,000 people were working in the tech sector. By 2020, it’s projected to be more than 120,000. I would suggest that that will be an underestimate. We know that investment in B.C. tech will be increased by up to $100 million by 2020 and that recently — and I give both sides of the House credit here — there’s been an increase in talent pool and an increase in funding of actual post-secondary institution places to actually promote continued growth of training of highly-qualified personnel in this area. That was an initiative started by B.C. Liberals, continued by B.C. NDP, and one that we support all the way through.

We recognize as a caucus, as a small caucus here, that playing a key role in the tech sector is absolutely central to our economy. We will never, ever, ever compete with a jurisdiction like Angola or Namibia or Indonesia in terms of extracting raw resources straight from the ground, because we internalize social and environmental costs into the cost of doing business in B.C. that may not be internalized in other jurisdictions that don’t have the same social programs that we have and demand that we have here in B.C. or the same standard of environmental protection that we have and demand that we have in B.C.

For us to compete, we can compete by racing to the bottom. The journey into LNG tells us what that leads to — goose egg. Or, we can compete by being smarter and by building on our strategic advantages.

Today in the Legislature, we had a number of interns visiting from Washington state. Talking with these interns from Washington state, the idea of building on strategic strengths came up.

What was interesting is that I was reminded of a story when I was at the University of Washington. There was a fella there. His name was Ed Sarachik. He was my post-doctoral adviser. We were working in some climate modelling area, and Ed said to me: “You know, Andrew, we’re at the University of Washington. We’ve got an IBM 3090 here.” That dates me. It was a vector-based machine. It’s pretty old now. That was in the late 1980s. “We’re never going to compete with NCAR, Princeton or MIT in terms of the powerful computing that they have access to. But we can be smarter and more efficient and more clever, and we can win through efficiency and being smarter.”

He was right that by focusing strategically on things that we could do well, rather than the brute force, race to the bottom approach, we were able do some neat stuff. That’s exactly the same with the tech sector. We can’t compete through digging dirt out of the ground when we’re internalizing these costs. But we can be more efficient. We can be cleaner, and we can export in a more efficient and cleaner way the resources that have historically been a key component of British Columbia’s economy.

Now, one of my favourite companies is a company called MineSense in British Columbia. It turns out — and I didn’t realize that until with the mining delegation, when a bunch of my former students ended up lobbying me about mining — that one of the key founders of MineSense was another former student from UVic. This kind of blew me way. I’m sure as a former teacher, hon. Speaker, you know that you see these former students popping up everywhere, and you wonder how they got from where they were to where they are now.

I’m blown away by that company. It’s a company that’s developed technology to actually assess up front the quality of minerals to determine whether or not it is cost-effective to truck it a long distance to the crusher and process all of that grade, or just push it to the side to be used as fill later.

That’s innovation. That’s efficiency. That allows us to actually compete by actually mining our high-grade minerals without wasting the time of digging up all of the stuff that’s not economical. We can export the minerals and compete through efficiency. But we can also export the technology and compete through technology.

This is why it’s so critical to have Innovate B.C. and the innovation commissioner. Because in B.C., we have a disparate bunch of programs out there, many of which don’t match with programs that exist federally. In talking to CEOs of a diversity of small start-up companies, they’re frustrated. They’re frustrated by the fact that they’ll go through a process to apply for grants federally, and then they’ll have to go through the same process in a slightly different way to apply for grants provincially.

I was excited in speaking recently with the innovation commissioner, Alan Winter, who recognizes that there’s some duplication there that’s not necessary. By streamlining programs, not only do we let innovators be innovative, as opposed to writing the same thing twice, but we actually are able more efficiently to tap into federal money, which actually is good for our economy here in British Columbia.

Now I have some experience in this regard with something British Columbia has known as the B.C. Knowledge Development Fund, an exceptional fund that’s used to lever money from Ottawa through the Canada Foundation for Innovation, which provides funding for large pieces of equipment for universities. I don’t know what the process is like now. But I do know that when I applied and got a supercomputer a number of years back, again, it was a duplication of a process.

The CFI process was rigorous and onerous and took an enormous amount of work to bring together stakeholders from a diversity of groups and organizations. Then we had to just rematch that process with the B.C. Knowledge Development Fund. It seemed to me that if we follow the Quebec model that there’s some duplication there, and we recognized that one process could satisfy everything.

I’m hoping that the innovation commissioner will see, as we move forward, opportunities here. It’s clear to me that we are so very lucky to have Alan Winter as the innovation commissioner. He recognizes, as members opposite have raised, the importance of actually thinking beyond roads as just being things to take people from A to B, but in terms of broadband, it’s critical to getting information from A to B.

It’s clear to me that he recognizes that our rural communities will be empowered upon receiving access to broadband, not only singular broadband but redundancy, as some bigger communities will get.

This is how we’ll compete. When we bring our tech sector…. Tech doesn’t just mean coding apps for the smartphone. Tech means biomedical sciences. Tech means revised forestry handling tools. Tech means thinking of new engineered wood products. Tech means bringing together the forestry sector with innovators in technology who see that you can make new things like insulation from wood products or roofing beams from wood products.

Tech is about innovation, and innovation goes far beyond what often people think that it only is, which is the smartphone app.

Our biomedical industry, as I mentioned, is one. In the automotive industry, we should be having innovation in that here in British Columbia. We should be leaders in the adoption of EVs.

Quantum computing. In British Columbia, we have, in D-Wave, one of the world’s leading companies in quantum computing. This is tech. This is a way for the future. We’ve got fuel cell technology. That’s another form of tech.

Let’s not think that tech is just about smart people with lab coats who have engineering degrees. Tech also requires people to construct and build and highly trained people in a diversity of trades, whether it be electrical, whether it be mechanical, whether it be the construction using carpentry. You need all skills working together to actually take the idea from the lab bench to fruition.

You know, we look at the issue of clean energy, something that I’m desperately hoping this government will pick up. There is so much potential for innovation in British Columbia, whether it be Rocky Mountain Solar, a project that I hope to get the member for Kootenay East excited about shortly. Rocky Mountain Solar is a solar company that has private land. The transmission lines go right through the private land. They’ve passed the standing offer program. They gone through the standing offer program, but they can’t actually get going. They’ve got a partnership with UBC to actually have a research facility there. They could scale up to 45, 50, 75 megatonnes of capacity.

But again, if we’re stuck thinking the old way, the 20th-century way, companies like Rocky Mountain Solar, who want to invest their capital…. They want to construct and build, which requires carpenters and tradespeople, to build capacity for a solar field there — British Columbia’s first and only grid-scale solar facility. It needs innovation, and it needs a champion and a commission that actually can do that within government by bringing together the various diverse groups there.

You know, I’m excited by the Minister of Jobs, Trade and Technology. In particular….

Interjection.

A. Weaver: It’s a mouthful for a poor humble soul like me — Minister of Jobs, Trade and Technology.

Interjections.

A. Weaver: I thought I’d wake a few up there over that. Not allowed to speak if you’re not in your seat there, member from….

I’m excited because in meeting with the civil service who are working in this area, you can see the passion and the desire to make this work. I’m thrilled with the calibre of the civil service who are getting behind this Innovate B.C. initiative. I’m thrilled about what’s coming up in terms of the tech summit that’s going to be happening in the coming months.

We have a very exciting time, but we’ve got to get a handle on a couple things. The innovation commission, or Innovate B.C., the innovation commissioner, can’t do everything. Government is required to set a culture. Government is required to set an environment that allows them to innovate.

What does that mean? That means we’ve got to get a grip on the affordability crisis facing British Columbians. You can be the best innovative person in the world and have the most wonderful idea in the world, but if you can’t get anyone to work with you because they can’t afford to live here, it ain’t going to take off . It’s going to move to New Brunswick or somewhere else.

We also have to ensure that we have a competitive environment in terms of the tax and the education framework. I have some sympathy with members of the opposition who are raising concerns about the employers health tax. It’s not clear to me that the details have been expanded upon fully yet, but this needs to be explored a little more, for a number of reasons.

We have a very odd taxation system in British Columbia. We have this magical barrier of $500,000, above which you start paying, now, an employers health tax, and you also start paying corporate tax.

Now, the problem with that is there’s a natural ceiling which stops innovation and growth. Why would I, if I’m a company making $450,000 a year, want to move up to be a company that’s now making $550,000 a year? I cross that $500,000 threshold. It’s an artificial threshold, but now I’m paying corporate tax and paying the employers health tax.

We need to take a hard look at how we have our taxation system. Step functions are not as conducive to growth as perhaps small linear changes. Again, that will be the role of the government — to explore that more fully.

This is a short bill. It may seem like a minor change, but the implications are profound, because the implications are sending a signal to the market in British Columbia that we’re here for the 21st century. Innovation is going to be the engine and power of our economy, and we want to send a signal to British Columbia that there is an agency. There is a champion to actually ensure that innovation is able to emerge at the lab bench and move through to production down the road.

Let’s ensure that that happens in British Columbia. Let’s ensure that the stories that we hear time and time again of a company building it to $1 million a year and then selling out to a Silicon Valley company…. Let’s create an environment here in British Columbia, not only in Vancouver but across B.C.

The member for Kamloops–South Thompson talks about the tech sector in Kamloops. He’s right. Really exciting things are going on in Kamloops. We’ve got the tech sector in Kelowna — happening there as well. Some concerns about Kelowna in light of some changes to the distance and digital tax credits that were done, dismissed and retroactively applied. Nevertheless, there’s some excitement happening there. But it doesn’t have to stop in Kelowna and Kamloops.

Prince George. If we put broadband redundancy in there, it should be a capital of tech innovation, particularly with the forest and mining sectors. We could go to Terrace. We go to Prince Rupert. All across British Columbia, if we’re able to bring broadband and broadband redundancy in, we’re able to give the innovators in that community a way to actually access high-speed information. I tell you, it’s a lot easier to buy a house in Fort Nelson than it is to buy a house in Richmond.

The beauty and quality of what we offer here in British Columbia is second to none, whether it be in the north, in the east or the south as well.

I’m thrilled to see this emerge — Bill 4. It’s a small change but a mighty change, and I stand in strong support and thank you for your attention on this bill.

Video of Speech

Introducing Employers’ Health Tax before completion of MSP Tax Force report?

For more than three years I’ve been pressuring government to eliminate the unfair and regressive flat rate Medical Services Premium (MSP). In fact the promise to do so was a major BC Green Party platform commitment, and we outlined how we would recoup the lost income by following the lead of Ontario. We were very pleased when government also agreed to eliminate the MSP.

But rather than specifying how the lost revenue would be replaced, the BC NDP decided to set up an expert committee to provide it with advice. And so, on November 2, 2017, the BC Government announced the establishment of an MSP Task Force.

The Task Force will be issuing its final report on March 31, 2018.

Imagine my surprise when BC Budget 2018 outlined the creation of an Employers’ Health Tax to replace the MSP. It seemed very odd to me that government was making such an announcement prior to the Task Force producing their report.

Exploring this was the subject of my exchange in Question Period with the Minister of Finance today. Below I reproduce the video and text this discussion. I hope that government will reflect upon their decision and be open to revisiting it once the Task Force final report is made available.

Video of Exchange

Question

A. Weaver: Let’s be clear: government misled British Columbians on the B.C. Hydro rate. There’s no two ways of saying it. I find it remarkable that they’re trying to claim otherwise.

Government established an MSP Task Force in November to advise it on how best to eliminate the MSP premium and make up the revenue. The task force comprised experts in both economics and public policy. The team analyzed hundreds of submissions from individuals and stakeholders. They consulted with labour and business groups. They undertook an in-depth tax policy analysis. Their report advising on how best to eliminate MSP premiums isn’t due until the end of March. Rather than waiting for the report, government eliminated MSP premiums and instituted an employers health tax.

My question to the Minister of Finance is this. Government established the task force. Government selected the experts, the mandate and the reporting timeline. Why would government forge ahead on this tax change without waiting for the task force to submit their recommendations?

Answer

Hon. C. James: Thank you to the Leader of the Third Party for the question. As the member knows, part of my mandate as Finance Minister is to look at how we can ensure a more fair tax system. The outstanding piece in British Columbia, on an issue of a fair tax system in particular, was the MSP, the fact that MSP was not eliminated. It was the most regressive tax, and it needed to be addressed.

It became clear that this was something that we could accomplish in the budget. We looked at the interim report that came from the MSP panel. We, in fact, agreed with a couple of the pieces that they brought forward, which was to eliminate the premiums all at once, not to do a further phase out, as we had done with the first 50 percent, and to give some advanced notice. Again, that’s why we’ve given a year.

I look forward to their final report. We took into account their interim report. And I’m very proud that we are going to save families and individuals in this province by getting rid of MSP once and for all.

Supplementary Question

A. Weaver: Thank you to the minister for the answer. She’ll get no argument from us about MSP being a regressive form of taxation.

Since government announced the employers health tax, we’ve been hearing concerns from businesses, school boards and local governments regarding its potential negative impacts. We’re hearing concerns about everything, from impact on businesses’ bottom line to the ability of the public service to provide the services they are required to provide.

The MSP Task Force was going to issue a final report in just a few weeks, advising government on the best path to eliminating premiums. When the Minister of Finance established the task force, she said this: “Engaging a panel of respected experts in economics, law and public policy, we will ensure the path we take is fiscally responsible, fair and evidence-based.”

My question to the Minister of Finance is this. In light of the desire to ensure that public policy is informed by evidence, did government ask the task force to expedite their work in order to provide final recommendations before government made a decision on establishing the employer health tax?

Answer

Hon. C. James: We received an interim report from the committee. We made the decision, as government, to move ahead on getting rid of a regressive tax. We felt that was important. We were able to do it in this budget, and we thought this was the right time. We ensured that we gave a year’s notice so that we would be able to work through the challenges.

The member has raised some of the issues that we are hearing and discussing. We are going to continue those discussions to ensure we can cover those bases, but we will be eliminating MSP by 2020. People are saving money — $1.3 billion this year — by the reduction of MSP by 50 percent, and we look forward, as I said, to savings for families and individuals in this province, making life more affordable for the people of B.C.