Finance

Bill 10 — Budget Measures Implementation Act, 2016

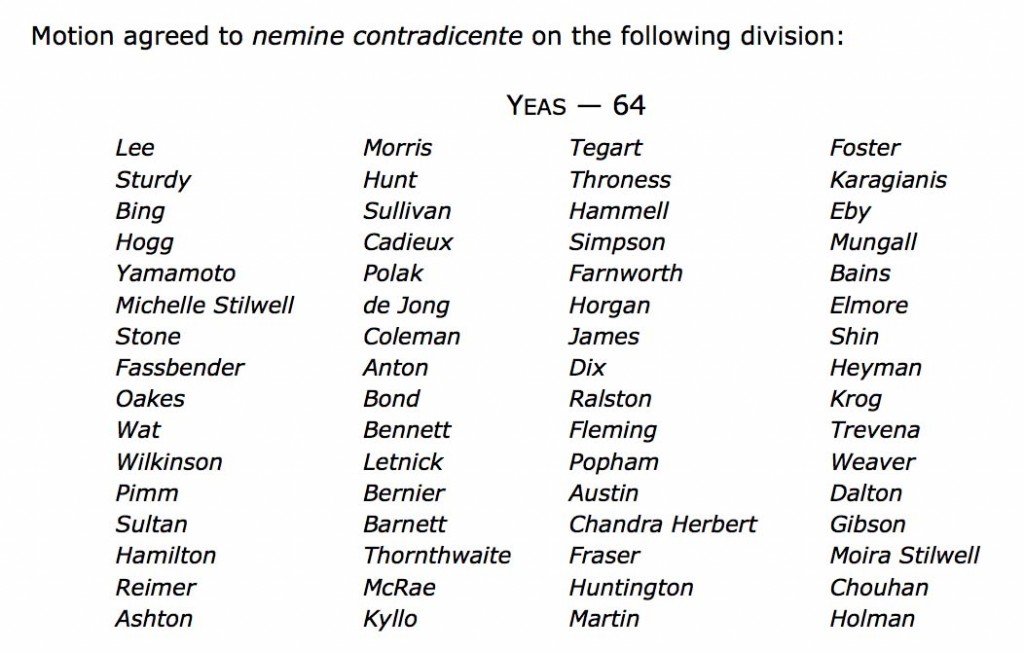

Today in the legislature I rose to speak at second reading on Bill 10, Budget Measures Implementation Act 2016. The budget implementation bill is an omnibus bill that proposes to bring into law the various measures outlined in the government’s budget.

In any budget there are always aspects that one can support and other aspects that one cannot support. You’ll see from my speech below that this budget implementation bill is no different.

For example, the budget implementation bill extends the BC Seniors’ Home Renovation Tax Credit to individuals with a disability. This is a welcome change. Extending the Tourism Accommodation Assessment Relief Act applicability to rural areas, something that was supported through a motion from the Union of BC Municipalities, is also an important step forward.

But unfortunately, the government has missed the boat on addressing the affordability crisis in Vancouver. And the Prosperity Fund is nothing more that a political stunt. Below I reproduce the text of my speech; I also link to its video.

You’ll see from the text that the Minister of Advanced Education was heckling me throughout my speech. Honestly, it was rather off putting and I would have expected better. It got so bad that when Leonard Krog, MLA for Naniamo, was speaking after me, I stood on a point of order as I could not even hear what he was saying.

Text of my Speech

A. Weaver: I was busy booking a flight to Vancouver, expecting a Liberal member opposite to stand up and defend their budget, offer insight as to why this budget implementation act is a good one. Instead, all they resort to is chirping little bits here and little bits there.

I rise to speak to Bill 10, Budget Measures Implementation Act, 2016. As you know, this bill essentially lays out the implementation across a diversity of bills — amendments here, amendments there — to implement government priorities as outlined in the budget speech.

There are a number of aspects to this. Number one, of course, is the introduction of the prosperity fund, the so-called $100 billion prosperity fund, a fund that was promised to British Columbians in the last election during a Hail Mary pass of hope that was given by this government to British Columbians in a desperate attempt to try to get elected — 100,000 jobs, $100 billion prosperity fund, debt-free B.C., elimination of PST, thriving schools and thriving hospitals, and on and on. A pot of gold at the end of the LNG rainbow was promised to each and every British Columbian.

In a desperate attempt to try to fulfil this outlandish promise — this promise that anybody in the natural gas industry knew was absurd, this promise that only the Liberals themselves convinced themselves had any dream of reality — when it finally….

Interjection.

A. Weaver: I hear sighing coming across the benches over there. The reality is, if you go back and look at the presentation given by the Deputy Minister of Energy and Mines to the clean energy conference in 2012, you would see, in that presentation, natural gas prices projected to increase into the $20 to $30 range in the months and years ahead.

There is not a single person internationally who would ever have thought natural gas prices were going to increase like that, in light of the fact that everybody has discovered horizontal fracking technology, that Russia is so close to China and has reserves almost 20 times those of natural gas, that Iran, which has the largest reserve in the world, would have its….

Interjection.

A. Weaver: The Minister of Advanced Education is truly quite pompous over there. What is so remarkable, is that I know his own colleagues think he’s a pompous person as well. So it would be quite…. It’s very difficult to actually continue with this.

Interjection.

Deputy Speaker: Order, please.

A. Weaver: Thank you, hon. Speaker. I’m glad to have some order back in here.

The prosperity fund is, as I pointed out, a desperate attempt to try to look like government is responding to its promise in the provincial election. When you actually look at this $100 million prosperity fund, it really is only $25 million, because 50 percent of that is going to be used to pay down debt. That’s $50 million. Another $25 million is going to be used for government priorities. What are those government priorities? Let me lay them out for you.

We’re going to see, over the course of the next year, a bunch of little tidbits — election tidbits — offered to British Columbians in the same vein as was offered in the last election, promises of this and promises of that. Say whatever it takes to get through lunch. Then say whatever it takes to get to dinner, and say whatever it takes again to get through to the next day.

There is also the Property Transfer Act that’s being modified in the budget implementation act. Government’s response to an affordability crisis in Vancouver, rather than standing back and recognizing that there are three reasons for this affordability crisis, or their speculative housing market: (1) lack of enforcement of the Real Estate Services Act; (2) a preponderance of vacant homes and owners of those vacant homes not being required to pay the true cost, the social cost, of leaving vacant properties…. That is — now, I know the Minister of Advanced Education has a hard time when I start to use economic language — the externalities associated with vacant homes have not been internalized to the people with those vacant homes. Those externalities are a social cost. And the third reason is the existence of loopholes that allow people to avoid paying property transfer tax or register on title where they live.

It was with the latter that I do appreciate the government introducing two aspects of policy. One is with respect to bare trustees now being required to say who they are. The second one, of course, is that on title, you will now have to declare if you are a Canadian citizen or not. The problem with this is that should have been extended to also require you to list if your primary residence is in another province, as other provinces do in British Columbia.

Interjection.

A. Weaver: Sorry — as other provinces do in Canada.

My goodness, I could only imagine having to live in a house with the Minister of Advanced Education. While I am straight, I would have divorced this man within a matter of moments, as he is simply intolerable. His hubris, his pomposity, his arrogance is so intolerable, it makes one want to be ill. But with that, I will move on.

Even the minister’s opposite are laughing, because they all agree with me as well, I know.

The property transfer tax. The government’s response, rather than dealing with the issue, is to incentivize further speculation. How do I say that? Well, one piece of policy that’s introduced is an elimination of property transfer taxes on new homes under $750,000. At first glance, one might think that’s a good thing.

But what is this incentivizing? What it’s incentivizing , but what it’s incentivizing is the purchase of older homes, the ripping down of those older homes and constructing of townhouse developments. Creating more supply may sound like a good thing, but unfortunately, it’s not addressing the critical issue, which is internalizing the social costs of leaving homes vacant.

It simply incentivizes our speculative economy, an economy that this government thinks is actually diversified and stable but, I would argue, is very, very flimsy, because it is being buttressed by an artificial, speculative housing market in greater Vancouver and now coming to the CRD. That is not a healthy situation. We only have to go to Scottsdale or Phoenix, Arizona, to see what happens to an economy that is built on a speculative housing market. It keeps going, and then there’s the big crash. And this government, like it has done with LNG, will blame global market foes that we have no control over. But they do have control. There are things that could be done now.

This government should be putting a price on leaving vacant properties empty. Putting a price on those vacant properties does two things. One, it incentivizes renting of those properties. It makes people want to rent those properties, which puts downward pressure on rental prices. Two, it actually reduces, then, the demand on new homes, because there are more people in rental homes.

Internalizing the externalities — making vacant homes have to pay the social cost. This can be done in a revenue-neutral fashion. The money raised through the tax of vacant homes could be used, for example, to help house the homeless. It could be used, for example, to give rental subsidies. It does not have to be a money grab for government.

Government has a responsibility to use the tools it has to ensure that the market is fair. The housing market in Vancouver is not a free market. It is a market failure. It’s a failure because the social cost is not being paid, and the only way to do that is actually put a price on leaving your homes vacant.

Bare trust is another one that I’ve mentioned over the last couple of years as a loophole that was originally put in place a long time ago — back in the 80s, I believe, even before the so-called dreaded 90s.

Hon. A. Wilkinson: That must have been around the 16th century

A. Weaver: Maybe it was around the 16th century, but I don’t believe anything the Minister of Advanced Education says, because he’s so pompous. Everything he says, you’re supposed to believe. And I believe none of it. He loses credibility when he continues to chirp that way.

The problem with registering properties in bare trusts and then flipping beneficial ownership of a bare trust means that you don’t change title. There is no change of title in the land title office, and that means there is no property transfer tax paid. Government has proposed to study this. But we know what result we’re going find out. We’re going to find that there’re a lot of houses out there that are flipping not on titled but through beneficial ownership.

Now, Ontario understands this. Ontario understands this. They are the other jurisdiction in Canada that has a property transfer tax. But where they apply the property transfer tax is on beneficial ownership change, not on title change. They don’t apply it on title change. They apply it on beneficial ownership change.

If I am foreign company and I’d like to buy a property and speculate it in Vancouver, here’s what I might do. I might purchase the property and put it in a bare trust. Then I might start flipping this bare trust, the ownership or the corporation that owns this bare trust, and sell it. It can be….

Interjection.

A. Weaver: Hon. Speaker, may I ask you to please address the Minister of Advanced Education and ask him that I have a right to speak in the Legislature without having to listen to his pomposity? Frankly, enough is enough.

Deputy Speaker: Order, Minister.

Interjection.

A. Weaver: Thank you, hon. Speaker.

I agree with the Minister of Health. They have to listen to him, but I don’t have to listen to him.

Coming back to the bare trust, coming back to the example I was giving, a company can put an individual…. I know there’re a whole bunch of entities can own the bare trust, and they can sell it. They can flip it a multitude of times. They can start to flip it amongst shell companies themselves. But never at any time are we changing title, and no property transfer tax has changed.

And this government has no idea who owns it, because they’re not tracking…. At least they will, coming up. But they were not tracking the bare trustees and those who have beneficial ownership. But rather than spending time tracking it, they should be actually disincentivizing by applying the property transfer tax on transfer of beneficial ownership.

Now, with that said, there are, of course, aspects of this budget implementation act that I do support. I mean, continuing the flow-through mining share credit, the flow-through share agreement, for another year seems reasonable. It has been working quite well to incentivize investment in the mining sector in British Columbia.

The Tourist Accommodation (Assessment Relief) Act changes are responding to a UBCM resolution to extend the assessment relief to rural regions.

The B.C. seniors home-renovation tax credit — extending that to individuals with a disability. It’s hard to find anything wrong with that proposal.

And the food donation tax credit — it’s an interesting idea, but I worry. I have spoken to people at Mustard Seed and elsewhere, food bank agencies. There’s a worry here — that has to be, actually, carefully regulated and examined — that this could be misused for dumping of product that has no value and is being used as a loophole to get a tax credit.

For example, let’s suppose I’m a company that has, in reserve, 10,000 barrels of molasses, and I can’t sell it. But now I give it to a food bank at fair market value. The market value is essentially zero because I can’t sell it, but there will be some nominal fee attached to it. This food bank is then ending up with 10,000 barrels of molasses that it has no use for.

What matters with this food donation tax credit is that the devil is in the details — that is, implementation is not being used as a means and a way of avoiding dealing with product that no one wants. How many litres of molasses do we need? And there are other examples that can occur like this.

I understand that it makes sense that, perhaps, the local farmer here in North Saanich has a few extra crates of, say, apples and, you know, he’d like to donate those to the local food bank and get a small tax credit. That seems reasonable. Why not just deal with the problem, however, in the first place?

Why are we actually having to deal with giving away food to food banks? What is wrong with our economy? What is wrong with our social programs? What is wrong with our society when we even have to introduce this tax credit in the first place? That’s the real question.

The question is not the food donation tax credit, which everybody can get behind in some way. The real question is: why is it that we, as our society here in British Columbia, one of the wealthiest places in the world — not just in North America but in the world — has to introduce a food donation tax credit? What next? A used clothes donation tax credit? Shoe donation tax credit? Used sportswear donation tax credit? It’s a slippery slope, and it’s not addressing, again, the fundamental inequities in our province that this budget should be addressing.

What’s not in this bill? A number of things are not in this bill, and I will look forward, in committee stage, to discussing some aspects of this.

I’ve had a number of people contact me, concerned about the increase in property transfer tax for homes valued over $2 million. That may seem like it’s a tax on the wealthy. It may seem at first glance, but let’s suppose you’re living in Vancouver. You grew up in Vancouver, and you’re a family of four.

Mom and Dad get pretty old, and Mom and Dad are so old that they need to leave their house. But Mom and Dad want to give their children their house. There’s concern that in doing so, those children, who could barely be affording to live in Vancouver anyway, would be subject to the increased property transfer tax and then move into a home that they couldn’t afford to buy, but it was a family home.

The problem, of course, here is that $2 million may seem like a lot, but it’s not a lot in Vancouver. So care has to be put in place to ensure that during the transfer of title between family members, this doesn’t occur.

Now, I get that if the house was put in a trust and it was transferred within family members, nobody would pay tax. But most of us don’t buy our houses in trusts. Most of us buy them as individuals, and we leave them to others or we try to give them to our children. There’s a little element there that government needs to some care over.

What is also not in this, in the budget implementation act and the budget in general…. There’s absolutely nothing to do with climate leadership. Now, I say that with some irony. I recognize that the Minister of Health has a Chevy Volt. It’s not a pure electric car, but it is pretty good. He lives in Kamloops — I get it — and he wants to drive to Victoria. I applaud him for a Chevy Volt.

Interjections.

A. Weaver: You have to. Yeah.

The electric car subsidy — that qualifies — is a good thing. I have a Nissan LEAF —100 percent electric. It’s a good thing.

Interjections.

A. Weaver: The Minister of Advanced Education goes off on a tangent again, because he wants to hear his own voice.

Do I pay road tax? Yes, I pay road tax. When I go over the Port Mann Bridge in Vancouver, I pay road tax.

Interjections.

Deputy Speaker: Members, order.

A. Weaver: Apart from the electric vehicle, there is nothing, zero, about climate leadership. Why is that important? Because right now, today, in Vancouver, first ministers are meeting with the Prime Minister to discuss climate leadership.

What do we have here in this House on that day? An introduction of another bill — another bill to give away our resource to the LNG industry, as we are continually desperate to try to find ways and means that they don’t have to account for their greenhouse gases. Or we can change the international rules to pretend that some greenhouse gases are not really greenhouse gases.

That is what this government thinks is climate leadership. The irony is that it’s on the day that we’re supposed to be talking about this in Vancouver.

What’s also not in here, in this budget, is anything of substance in terms of MSP reform. This tinkering around the edges in the budget, not so much in the implementation act….

Where, for example, are steps being taken to fulfil government’s promise that each and every British Columbian would have a GP by the end of 2015? Each and every British Columbian would have access — this is a promise — to a general practitioner by 2015.

Well, I hope you aren’t looking for a GP in this area, because there is not a single GP south of Duncan that is accepting new patients.

While the government is quite desperate to fulfil its promise of wealth and prosperity through an industry that’s not going happen and basically gives away our resource in a desperate attempt to get an agreement, they’re not willing to deal with another promise — the “GP for everyone” promise.

I could go on and on, and I know the Minister of Advanced Education would love me to. But with that, I’ll conclude with one final statement.

When you look at this Budget Measures Implementation Act and you look at the individual boutique exemptions here or the little addition there, what you get is a sense of what this government is doing.

This government has lost its sense of vision. It has lost its sense of vision of what a prosperous British Columbia looks like. They’re fixated on a speculative housing market. They’re fixated on LNG.

They don’t understand what a diversified economy is. It’s not an economy that’s propped up with an artificial, speculative, Scottsdale-style housing market until we can maybe get LNG ten years from now or twenty years from now. That’s not a diversified economy.

They don’t understand what’s going on with the elements of our society that are struggling to make ends meet.

This budget, through its implementation, is something that cannot be supported for what’s not in it, not so much for the boutique tax credits that are in it but for what’s not in it: assistance to those who can barely make ends meet, structural changes to things like the MSP, dealing with the affordability crisis in means and ways that actually ensure that it’s dealt with, instead of incentivizing the problem still further, and dealing with an issue that was simply not addressed in the budget — education.

Who are we as a society if we don’t value the next generation, the generation in our schools and colleges today, as the important asset of our future? LNG is not important in the big picture. Our next generation is important. They are the citizens of tomorrow. They are the ones who will build the economy of tomorrow.

They are the ones who will take care of us when we’re older. They are the ones who will discover the cures for various diseases that you and I will get as we get older.

But there is nothing, nothing at all in this, for education, whether that be K to 12, whether that be early childhood education or whether that be post-secondary education. That is the single biggest disaster of this budget: it does not do anything for the next generation. That is why I cannot support it.

Video of my Speech

The truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is — W. Churchill

Today in the legislature I rose to speak to the budget. Every MLA is give 30 minutes to respond to budget. My staff and I’d prepared so much material that I barely got through half of what I had planned to address. But there will be more opportunities in the weeks ahead to outline why I will not support this budget.

Below is the text of my speech. I also append a video further down.

Text of My Speech

A. Weaver: It gives me great pleasure to rise and speak to this debate, particularly after the member for Comox Valley, who classified the world and this House as one of two sides: the world of optimism on that side and arguably, in his mind, the world of pessimism on this.

I’d like to quote Winston Churchill:

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”

I am an optimist. I understand what it means to be an optimist, but unfortunately, I don’t think Winston Churchill was thinking of this government when he came up with that quote.

In fact, there is another quote attributed to Winston Churchill more applicable to the statements that emanated from the opposite side, and the quote is this:

“The truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is.”

What you are going to hear from this side of the House is a truthful assessment of the Budget 2016, not one filled with rhetoric, not one filled with promises, not one filled with half truth, but one that looks at it carefully and points out what is good and what is not good without the hyperbolic, hysterical rhetoric, so common, emanating from those on the other side.

I rise in this debate puzzled by the direction this government is heading. Frankly, it has become clear to me that this government is really out of new ideas — completely out of new ideas, lost, lost their way, given that LNG is not playing out the way they thought it would be.

The budget speech we heard on Tuesday was high on self-praise but represents little in terms of fundamental change. We continue to chase markets we are not part of with LNG while bringing forward no clear plan to build on our strengths let alone the challenges we face.

While it was encouraging that this government incorporated some policy changes that British Columbians have been advocating for, for the most part, they represented halfway measures that do little to attack the underlying issues that are presenting challenges for so many British Columbians.

First let me discuss the issue of housing. To make good policy, you need good data. I was encouraged to read the government has adopted additional tools that will allow them to gather much-needed contextual information about the housing market.

The new requirement for property purchasers to identify their nationality is a step forward that I’ve been urging this government to take for two years.

Frankly, I wonder how they’re going to do it without actually bringing the private member’s bill, which is precisely the same as what is being proposed by government. I look forward to debating the private member’s bill that’s before the House as we speak.

I’m glad that government listened on this. Likewise, I was also pleased to see that bare trusts will now face more examination, and the government will have the data it needs to address this. Gathering more information about bare trustees is certainly better than ignoring the problem all together. I’d like to stress this: this loophole still remains open — open to exploitation.

To say that we need to gather information from scratch implies we have an entirely different market to that of Ontario. Ontario’s housing market in Toronto is just as hot as that in Vancouver, with speculation running amok. Yet in Ontario, they have a mechanism to track this and actually generate revenue to limit the amount of speculation occurring.

While that may largely be true, for example, that we need to gather information from scratch for efficiency’s sake, I do think we have a promising opportunity to learn from what has happened in Ontario and to act pre-emptively to close this loophole.

For example, Ontario has a similar property transfer tax system in place, but they have plugged the loophole and they did it very simply. All they did was apply the property transfer tax upon change in beneficial ownership, not just change in title registered at the land title office.

The wealthy offshore buyers can flip houses numerous times by simply registering the first purchase as a bare trust owned by a corporation and flip the corporation shares from owner to owner to owner without ever changing land title and without ever paying a penny of property transfer tax.

I know this is being done because I have spoken to developers. I have spoken to mortgage lenders, and I’ve spoken to those who are involved in the real estate industry.

This change could and should be done in British Columbia to ensure everyone is treated fairly. However enlightening information may be in its own right, it’s meaningless without appropriate action. We need to get moving on these issues, and government doesn’t seem to have a plan, like so many other things.

This also seems to be the case with the government’s change to the property transfer tax. Increasing property transfer tax rates to 3 percent on homes over $2 million is another adjustment that I agree with in principle. But with affordability as the top issue on the minds for so many people across the province, making it more expensive to flip luxury homes is a progressive step. There’s no question it’s a progressive step forward.

Unfortunately, this too could be rendered meaningless if the loopholes in our housing markets are ignored. In fact, it may be that the government loses taxes in the short term as more sellers engage in and exploit those loopholes to avoid the increase in taxes.

Furthermore, with the $750,000 property tax break for new homes, the government is incentivizing housing development while doing nothing to dampen speculation — again, failing to close the loopholes affecting the market right now.

Contrary to the minister’s dismissive comment that this is a Point Grey issue, the housing problem is affecting communities across British Columbia and it is greatly impacting our provincial economy. On my street alone, where I live in Gordon Head, a house sold. The sold sign came on when the house was listed. It was sold to foreign buyers. Two months later, the sold sign came on again, as the house was flipped. It was cash transactions in both cases. This is not a problem exclusive to Metro Vancouver. It’s a problem now emerging in the capital regional district and other markets in British Columbia.

The costs we are shouldering in society are not just economic, they’re social. The passionate, determined, young people we need to support our communities and lead them into the future are being priced out by people who can afford to buy houses and leave them empty.

Ever wonder why there’s a traffic jam on the Second Narrows Bridge in Vancouver going north? It should make no sense, because people on the North Shore work, by and large, in Vancouver. The reason is because nobody who’s working in those homes — the electricians, the plumbers, the trades — are able to live in that region, and so they’re commuting from halfway across Vancouver across bridges. And the government’s response — rather than dealing with the problem, the affordability problem — is to start talking about building bigger roads and bigger bridges. Again, not addressing the problem, it’s avoiding the problem being dealt with and kicking the can down the road further.

The role of government is to take direct action and to direct the actions of citizens. We incentivize what we like, and we discourage that which we don’t. We need to close loopholes and disincentivize the preponderance of empty houses, because as it currently stands, the government is failing to do an adequate job of either. There’s a glaring market failure. The preponderance of vacant homes in Vancouver has a social cost attached to it. That externality needs to be internalized so that vacant owners pay the true cost of that vacant home.

The government’s response, rather than recognizing the market failure and internalizing externalities, incentivizes more development and further speculation. This is a government that is completely out of control and completely at a loss or understanding of fundamental market instruments. That does not deal with the imminent problem. It kicks the can down the road further, so to speak. The imminent crisis needs to be dealt with through the implementation of market instruments available to government. Those instruments alone will correct this market failure.

Frankly, the single most effective policy that government could do would be to implement a price, a levy or a tax on homes that are left vacant. This government is building the economy of Scottsdale in British Columbia as we speak. It’s an artificial economy, fuelled by speculation and requiring continued development and building of houses in order to sustain itself.

Government is misleading British Columbians by suggesting that we have a diversified economy. Our economy right now is being driven by wild speculation and offshore money coming into British Columbia to actually buy these homes, and developers building more — selling, flipping, buying, speculating.

There is only one end solution for that infinite growth in a finite system, and that will be a collapse, a collapse of pretty strong proportions that this government will start — as they have done with LNG — to blame on unforeseen global forces. Well, we can see it happening right now, and there’s nothing unforeseen about it. What is unforeseen is any will or any policy emanating from the government to actually address the key issues of today in British Columbia.

Putting up a levy on vacant homes will encourage more owners to lease their vacant homes, which in turn will put downward pressure on rent costs in Vancouver and elsewhere. The revenue generated from this levy could actually be used to pay the social costs arising from non-affordability within Metro Vancouver and emerging here in the capital regional district: the costs of the homeless, the enhanced judicial system process that is required to deal with the increasing homeless problem in our province. The reduction of services for mental health can be addressed. We can start to actually raise the living allowance, which hasn’t changed in I can’t even remember how many years.

One of the saddest moments in this House since I was elected in 2013 happened about 20 minutes ago when the member for Comox Valley stood and truly believed that somehow $11 a month is actually a great step forward, after seeing no increase in fees for years and years and years.

The people of British Columbia deserve better. They deserve a government that’s honest to them, a government that actually does not try to sell itself as something it’s not, a government that recognizes that there is a social problem out there and that $11 a month is not going to solve it. Frankly, the price of cauliflower has gone up $8, say, in about three months. Basically, what we’re saying is that you can almost meet the increase in your grocery bill, but not quite, with this $11 a month. Shameful, truly shameful that this was lauded as a sign of progress.

In summary, the government’s balanced budget increasingly is relying on revenue from an artificial, overinflated housing market. They are benefiting from the issues that are causing so many affordability concerns amongst British Columbians and taking no real concrete steps to address this. The government needs to address this market failure, and the 2016 budget represents another missed opportunity to do so.

Now to MSP. On MSP, the government has brought forward a small, half-step approach to making this fee a little bit more fair for the people of British Columbia. I commend them for taking that one small half-step. It may not be much, but at least we are moving in the right direction. Making children exempt from paying MSP premiums and increasing the assistance available are both positive changes to a fundamentally unfair system.

Despite the changes to MSP premiums announced on Tuesday, we still have a system that doesn’t work, however, for most British Columbians. To use the Premier’s words, as the opposition did so well earlier today in question period, it’s a system that is “antiquated…old, and the way people pay for it generally doesn’t make a whole ton of sense.” Those are the Premier’s words. I agree. The opposition agrees. But somehow the government doesn’t agree with itself. I’m not sure what’s going on.

Hundreds of thousands of people in this province are currently behind in their MSP payments. That’s a ton of bureaucracy, needlessly employed in enforcing an antiquated, old system. That’s what the Premier said. I agree. Bureaucracy — dare I say that’s red tape?

Shame if it is, because of course we know that the government doesn’t like red tape and in fact has gone so far that we now have red-tape-reduction day, making us truly a laughing stock across Canada. Every, single person that I have actually raised this to and mentioned that red-tape-reduction day is now on the same par as Terry Fox Day, Holocaust Memorial Day, Douglas Day, B.C. Day and Family Day looks at me and says: “What?” They couldn’t believe it. This government believes it, but it says whatever it takes to get through lunchtime.

The reality is, the biggest component of red tape in the entire sector of government is the administration of the MSP premium which the Premier, through her own words, says is antiquated, old and doesn’t make a whole lot of sense.

Okay, let’s remove some red tape. No, they create more red tape, more thresholds, more exemptions, etc. Absolutely unbelievable.

Plus, when we delve into the details of this policy change, what we see is actually a tax hike. The people of British Columbia have spoken loud and clear about how they are having trouble with this tax, yet this government has raised the amount of money they take from it — a new $111 million in taxes, a head tax. That’s what it is — a head tax, which, after the premium assistance is accounted for, makes it an increase of $77 million in revenue. That’s $77 million as a head tax, because that’s what it is — a poll tax or a head tax, nothing else.

Who is paying for this new revenue? Well, a couple that earns a combined $45,000 or more a year will see their Medical Services Plan increased by $240 a year. Whoa, hang on. That’s more, a greater MSP premium. I thought it was going down.

Senior couples with a slightly higher income face the same increase. Yet when I was at the Monterey centre, when this issue was first brought to me almost a year and a half ago, the demographic that brought it to me were the seniors who were struggling on fixed income to actually pay it. Here, the government is listening. It’s listening to its corporate funders. It’s not listening to the people of British Columbia, because the group that can least afford it — those on fixed income — are getting a $240-a-year hit. That’s hardly fair. That’s not fair at all.

A couple with two children will pay $72 more a year. These are significant increases in medical premiums. Let’s be clear that a combined income of $45,000 is not that much in Metro Vancouver or greater Victoria.

A single adult who earns less than $42,000 is eligible for premium assistance, but a couple earning $3,000 more is facing an increase of $240 a year. This is yet another example of how this government does not understand simple fundamental market instruments. You incentivize that which you like. You use your market instruments to put a tax or disincentivize that which you don’t.

This introduction of the MSP program is incentivizing divorce in the province of British Columbia. It’s saying to couples: “You should not be couples, because if you get married” — this is families first — “or you become common law, we’re going to charge you $240 a year more.” Does that make sense? No it doesn’t. But that’s what this government is putting forward.

Let’s look at Ontario as a case example in how we could charge MSP differently. In Ontario, health care premiums are paid through personal income tax systems. Rather than a flat-rate levy, this approach avoids the regressive nature of the monthly premium as rates rise with income to a maximum annual level.

For example, as I’ve outlined for a couple of years now, in Ontario, the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums at all.

The argument that we need to keep this tax separate from other taxation methods so that British Columbians know that health care is not free is ridiculous. British Columbians know that health care is not free. They know that building bridges and highways is not free. They know that education is not free. To treat them as if they don’t is disrespectful. It is disrespectful of the people of British Columbia.

They know that their taxes go towards the services that government provides. If the government still insists that British Columbians need to understand how much health care is costing our province, then there is a simple solution — a simple line on the income tax return, like that exists for EI and CPP, called health care premium, which is progressively calculated just like EI and CPP are. It would solve the problem. It would deal with the issue that unions have negotiated benefits because it would still pay for it. It would be done in a progressive instead of a regressive system, just like it was done in Ontario.

In fact, this was the method advocated for in the 2002 Senate report that recommended the federal premium to help pay for health care costs — the health care of Canadians. The federal role made a strong case that premiums constituted a visible and equitable means of supported health care spending, so long as they varied in proportion to income. It’s not me making it up. It’s Senate expert panels that are providing information in forming this policy.

Now let’s turn to new services. Another item in this budget that received considerable attention was the boost to the Ministry of Children and Family Development. Now, without a doubt, I’m encouraged to see that the government seems to finally be paying attention to our most vulnerable — a topic that the official opposition has brought forward time and time and time again during question period.

It seems like they may have done more harm than good, unfortunately. For nine years, there’s been a freeze on the disability rate at $906 a month. At first glance, a $77 increase for disability assistance looks like a step in the right direction. If we take into consideration the loss of transportation subsidies, which in some cases amounts to $66 a month — the numbers were messed up in question period; I am assuming that tomorrow the minister will correct the numbers that she quoted out in question period — this budget represents an increase of only $11 a month — $11 a month — that the member for Comox Valley was so proud to tout to British Columbians in solving the social woes of those most unfortunate with disability in our society.

That’s hardly a success. In fact, with the increases in transportation in some areas going up — just look at the capital regional district, dramatic increases — this is actually a net loss, or will be a net loss, and government exempts itself from having to deal with the increasing costs of transportation. I am sure this was not their intention, but clearly this is not an outcome that will make life all that much better for the most vulnerable in B.C. In some cases, it will down the road make life a little more difficult.

On a more positive note, the $95 million set aside for wildfire protection, the $10 million for search and rescue plus the $55 million set aside for emergency preparedness and prevention initiatives are welcome news. Indeed, they’re among the only budget items I could find, although not attributed to, but that address one of the biggest threats to our province’s economy — climate change.

Let’s look at climate change. We are paying the cost of climate change in this province already. This past year, we saw record temperatures across our province. We saw drought precipitated by a lack of snow pack, and forest fires raged across our province. The January 2016 globally average temperature shattered the previous record by 0.16 degrees and was more than a full degree Celsius above the 20th-century average.

In B.C., we simply stand by and watch happen and go to Paris and say: “Look, we are leaders.” Others call you leaders; you don’t call yourself leaders. In British Columbia, we are not leaders on the mitigation of climate change. We were leaders, but that is long past.

I brought forward a motion, for example, to discuss a matter of urgent public importance last summer. At issue was whether we as legislators were acting with sufficient urgency and demonstrating the appropriate leadership on preparing for and mitigating the escalating impacts of climate change in our province. Unfortunately, my motion went nowhere.

Directing the actions of society through the fiscal instruments available to government is one of the most powerful tools we have. But here in 2016, we have a budget that barely mentions the biggest problem we face as a global society. We heard from the minister that “Budget 2016 continues to build on B.C.’s leadership in clean technology and climate action. Climate change is a global issue, and the Premier has made it clear that B.C. will remain a climate action leader. And we have been able to move forward with that leadership on climate change while also growing our economy” was another quote.

Yet in the budget itself, there is scant mention of climate change. And the funding put aside doesn’t so much build on B.C.’s leadership in clean tech, as they said, but only supports one policy: the continuation of their existing electric vehicle program. That’s it. No more. Climate leadership, to this government, means continuation of an electric vehicle incentive. Nothing more. Hardly going to help the majority of our society.

Admittedly, I did benefit from that. I did get an electric vehicle. But there are many who this will not benefit. And I wonder how many in government have actually taken this incentive and got an electric vehicle. Probably a small number. Very small number. I’d guess zero.

Interjections.

A. Weaver: It’s not true? So that’s good. I’d like to have a list of all government MLAs who own an electric vehicle come my way, and I’d be happy to praise them publicly. But we’ll see.

The construction of Site C dam has put the final nail in the coffin of the clean-tech sector in British Columbia. Shocking. The Canadian Wind Energy Association has just left B.C., citing the existence of greener pastures elsewhere. Well, let me tell you. There will be greener pastures here in just a little more than a year, when this government is sitting on this side of the bench and the rest of us are sitting on that side of the bench.

A $1 billion investment on Vancouver Island involving a partnership between EDP Renewables…. This isn’t pipedream stuff. This is real investment, not of taxpayer money but of industrial money, on Vancouver Island through partnership between EDP Renewables. First Nations and TimberWest,. It’s gone. They’ve walked from B.C. because of a lack of leadership by this government. Frankly, that’s reckless economics, in my view. It’s reckless mismanagement of our economic system.

British Columbians are fed up with this rhetoric. World leaders of this. World leaders of that. We’ll all be happy and wealthy and wise, blah, blah, blah. That’s what we’re hearing. But enough is enough. This government is out of ideas.

They’ve misled British Columbians about the prospects of LNG. They look out for their vested interests, and they say whatever it takes to get through lunch, whatever it takes to get to dinner, then whatever it takes to get through a day and on and on. They say whatever it is in the desperate hope that British Columbians are not paying attention. But they are.

The carbon tax remains flat, and leadership on climate change mitigation is largely absent. As I’ve heard nothing about this, I look forward to, hopefully, hearing something in the fall, where the government once more kicks another file down the road.

Government has ignored the agriculture sector until just recently, just like they ignored the tech sector until last August, when four civil servants were tasked to come up with a conference. That’s the government’s idea: “Let’s have a conference on agriculture. That’s leadership.” But we do have a leadership opportunity here in B.C. in the knowledge economy of the 21st century.

I was recently up in Prince George and saw firsthand how the tech industry could actually partner with our resource sector to take our strategic advantage and build our economy. Why is this government not investing $6 million to provide broadband redundancy to Prince George to allow Prince George to take advantage of its cooler climate to become a tech hub and bring the resource and tech sectors together, to be the home for data distribution centres like Google wants to be?

Six million dollars would be the biggest economic drive for that region, with the introduction of broadband redundancy, that that region has seen for decades.

Yet this government would rather spend $8 billion on a project for energy that’s not necessary because there’s no LNG and Alberta has said no. That’s their view of economics. What you got? My six million bucks is my view of economic prosperity.

Now let’s talk about the biggest item by far in this budget, an item with an $8.7 billion price tag. That’s kind of there in one line. The Premier recently stated that she wanted to move this project past the point of no return — another irresponsible statement by this Premier. Yet we have no LNG industry, and just today we hear from First Nations in the Peace region that they will soon be in court, as the injunction is coming to play out as B.C. Hydro tries to stop protesters.

I have so much more I could talk about, but I do see we’re on the green light. I could talk about LNG. I would love to talk about the prosperity fund. I have probably another half-hour speech, and I’m looking forward to being able to do that. Probably, I should be making an amendment right now to the budget speech so that I could actually talk about this stuff. But let me just say that what we should be doing in British Columbia is building on our strengths. We should be demonstrating leadership….

Some Hon. Members: More. More.

A. Weaver: If you would like more, members opposite….

Hon. Speaker, with your permission, I’ll speak for another half-hour. Would that be possible? Maybe I’ll give away too many ideas.

Finally, starting to take action, real action on the issues of affordability, directing our economy for the future prosperity rather than political talking points and making B.C. a leader on the issues of our time is what I had hoped this budget might do. Unfortunately, in my view, while there’s a lot of popular language in this, it’s found wanting on many, many points. Probably, the most cynical aspect of this budget is the prosperity fund, the $100 million prosperity fund, which, when you peel it down, is actually only a $25 million fund. And it’s a $25 million fund of taxpayer money.

Video of My Speech

Offering Practical Solutions to Vancouver’s Affordability Crisis

Today in the Legislature I offered a number of practical steps that government could take to address Vancouver’s growing affordability crisis. It’s been more than two years now since I first raised these issues. As noted below, there are at least three dimensions to the problem: 1) government incentivized speculation; 2) preponderance of vacant homes; 3) non-enforcement of illegal realtor transactions.

First, I reintroduced a Private Member’s Bill entitled Bill M201 Land Title Amendment Act, 2016. If enacted, this bill would amend the Land Title Act to reintroduce and expand provisions that were previously in the Act. Such provisions will help determine who is purchasing property in BC. It would allow the government to determine foreign investment flows, the role corporations are playing, and whether we are seeing speculation in our market coming from other regions of Canada.

Second, while government has finally committed to take action to ensure enforcement of the Real Estate Services Act, nothing is being done to address the growing number of empty homes in Metro Vancouver. It’s beginning to happen here in the CRD as well. In addition, government has allowed a speculative tax loophole to remain open. Previously I’ve referred to this as a loophole so big you could drive a bus through it.

During question period I asked government about both of these. I asked about closing the Bare Trust loophole and whether government will introduce legislation that taxes vacant properties in urban areas in a revenue-neutral fashion to ensure that the money becomes available to pay the social costs associated with the lack of affordable housing. This would also incentivize the renting of vacant homes, thereby increasing affordability by increasing rental supply.

As you will see from the response I got from Minister de Jong (ignoring the banter with Minister Andrew Wilkinson who was heckling me), I am cautiously optimistic that we will see something in the budget to address at least some of the issued I raised. I’ll be reporting back on this after the release of the budget next Tuesday.

Below I reproduce the Question Period exchange. Following that I append the text and video of my speech as I introduced Bill M201 Land Title Amendment Act, 2016. Finally, I include a copy of the media release that we sent out today.

Text of Question Period Exchange

A. Weaver: I must admit I found that rather entertaining, if not…. I’m searching for an answer within the rebuttal there. But for more than two years now I’ve been raising the issue of affordability and speculation in the housing market.

There are at least three dimensions to this:

(1) incentivized government speculation;

(2) a preponderance of vacant homes, and

(3) non-enforcement of illegal realtor transactions.

I just reintroduced a bill to amend the Land Title Act, thereby providing government with access to critical information needed to understand who is actually buying properties in our province. Government inaction plays a substantive role in fostering speculation. The bare trust loophole that I’ve raised several times in this House for several years allows wealthy individuals and corporations to avoid registering at the land title office and so avoid paying B.C.’s property transfer tax.

Interjection.

A. Weaver: The Minister for Advanced Education clearly does not understand fundamental real estate, or he would actually understand here a little bit more about where I’m going with this.

Will the Minister of Finance introduce legislation to close the loophole — that we are the only province in the country that still allows to exist — by following the lead of Ontario to actually apply the property transfer tax upon change in beneficial ownership instead of change in title? And if not, why not?

The Minister of Advanced Education should know better than to actually pretend this is not an issue in British Columbia, because it is. I speak to real estate developers, I have spoken to mortgage lenders, and I know that this loophole is being used in British Columbia for speculative purposes and to avoid paying property transfer tax.

Hon. M. de Jong: I think there are two issues, and to be fair, the member has raised them at various times and today used another tool of the Legislature to highlight one of them: the collection of information. I’m going to be a little cautious about what I say today except to acknowledge that the unregistered transferring of interests in real property in British Columbia does have an impact. It also does have an impact on the amount of property transfer tax and the mechanism by which we collect the property transfer tax.

I am cautiously optimistic that when the member has an opportunity to see some of the provisions of the budget that will be tabled on Tuesday of next week, he will find at least some aspects of that document to find favour with that will respond to some of the concerns that he’s outlined today.

Madame Speaker: Oak Bay–Gordon Head on a supplemental.

A. Weaver: I hope on that day when I see that, the Hon. Minister of Advanced Education will eat some humble pie, but I suspect that may not happen.

Interjection.

A. Weaver: Hon. Speaker, I have to respond. The minister suggests I have a PhD in climate change. I don’t. I have a PhD in applied mathematics. This points the fact that the members opposite clearly are not able to get their facts right on so many issues.

When I was door-knocking in Coquitlam–Burke Mountain in one area a few weeks ago, I passed empty houses — empty house after empty house. I went so far as to estimate that one in three of the homes that I knocked the door on were empty. Houses, townhouses and condos that remain empty are driving up the price of real estate, making housing less and less affordable for far too many British Columbians.

Will the Minister of Finance introduce legislation similar to what’s being considered elsewhere — in particular, Sydney, Australia, where the exact same problem is happening — that taxes vacant properties in urban areas in a revenue-neutral fashion to ensure that the money becomes available to pay the social costs associated with the lack of affordable housing?

Hon. M. de Jong: I feel like a spectator at the Cambridge-Oxford regatta here.

Let me say this. I will say candidly I’m not entirely drawn to the specific example that the member cites, with respect to the Australian jurisdiction.

I will say this. I think the idea that is captured within the private member’s bill that he has tabled earlier today has merit and relates to the need and the advisability of beginning by ensuring that we have a reliable database that tells us more about what is taking place in the market.

Beyond that, I’ll have to ask the member to be patient for a few more days.

Video of Question Period

Text of my Speech

A. Weaver: It’s with great pleasure that I move introduction of a bill intituled Land Title Amendment Act, 2016.

Motion approved.

A. Weaver: I’m pleased to be reintroducing a bill that offers government one of the tools it needs to begin to properly assess and act upon the affordability-in-housing crisis affecting Metro Vancouver and emerging here in the capital regional district as well.

There’s been significant conversation in the past few months about the role that speculation is playing in our market. The government came out with a number of documents purporting that foreign investment wasn’t a factor. These studies were vague and lacked any links to clear, rigorous evidence that supported the claim.

It’s with this in mind that I bring this bill forward today. The bill amends the Land Title Act to provide the government with the means of determining who is purchasing property in B.C. This includes both foreign investment flows — the role that corporations are playing in purchasing property — and if we have significant speculation coming from other places in Canada.

To be clear, this bill is not about identifying what specifically is driving housing prices to unsustainable rates, but, rather, to ensure that the government is informing itself so any future policy measures are based on a better understand of what is happening with our provincial real estate industry.

I move that the bill be placed on the orders of the day for second reading at the next sitting of the House after today.

———

Bill M201, Land Title Amendment Act, 2016, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Video of my Speech

Accompanying Media Release

Media Release – February 11th, 2016

Andrew Weaver questions government action in the housing market

For immediate release

Victoria, BC – Andrew Weaver, Leader of the Green Party and MLA for Oak Bay – Gordon Head, says that government policy is contributing to the rampant speculation in Vancouver’s housing market and that it could take simple steps to start addressing the issue now.

“Speculation in Vancouver’s housing market is not a new issue” says Weaver. “Suddenly, with the potential of fraud occurring the Premier has called on the Real Estate Council to take action. However there are a number of steps the Provincial government could take right now to clamp down on this out-of-control problem.”

Earlier today Weaver introduced a Private Member’s Bill titled the Land Title Amendment Act. The legislation would allow government to track the source of home purchases throughout the Province to better understand the effects that foreign and domestic speculation is having in BC.

“Tracking who owns property through a simple amendment to the Land Title Act would give government the information it needs to see the role foreign ownership is actually having in our marketplace.”

Weaver also used question period to probe the Minister of Finance about whether the government would act to close a loophole that contributes to incentivizing the speculative real estate market in B.C.

“Legal entities like the bare trust, whether by design or by omission, are helping drive the speculative real estate market in B.C.,” said Weaver. “It is essential that we begin to ratchet down on these practices so that houses aren’t simply treated as commodities, but as essential building blocks for healthy communities.”

The bare trust loophole allows wealthy individuals and corporations to avoid registering at the Land Title Office and so also avoid paying BC’s Property Transfer Tax.

Weaver also probed the Minister of Finance about any action that will be taken to follow what other jurisdictions are doing, and explore the use of a tax on vacant properties, in a revenue neutral fashion, in order to help pay for the costs associated with the lack of affordable housing.

“There are at least three dimensions to this problem in Metro Vancouver: government incentivized speculation; preponderance of vacant homes and non-enforcement of illegal realtor transactions,” said Weaver. “While it is great that this government is finally starting to pay attention to what is happening in the Lower Mainland housing market, their first step has been to call upon others for action. The reality is there are a number of actions that this government could take to address all three aspects of this issue. I’m am calling on them to take these steps.”

-30-

Media Contact

Mat Wright

Press Secretary – Andrew Weaver MLA

Cell: 250 216 3382

Mat.wright@leg.bc.ca

Twitter: @MatVic

Leadership of the BC Green Party

At the UVic University Club on November 24, 2015 I formally announced my intention to seek the leadership of the BC Green Party. And on December 7, 2015 I was elected by acclamation as our new leader. Below is the text of the speech that I gave at the announcement. In the speech I outlined the reasons why I sought the leadership and I offered a vision for a prosperous future for all British Columbians.

Introduction

Thank you Elizabeth. You’ve been an absolute inspiration to me. And I am honoured that you were able to make it to tonight’s event knowing that you will be heading to the COP21 meeting in Paris imminently.

I’m also very grateful to Claire Martin for coming over from Vancouver to act as our MC. I know that she’s also off to COP21 shortly. And I am especially grateful to Butch Dick from the Songhees nation for welcoming us tonight.

Finally, this event tonight would never have happened if it weren’t for the efforts of the incredible group of individuals that I have the honour of working with: Judy Fainstein, Mat Wright, Evan Pivnick and Karin Lenger along with all of the volunteers. Thank you.

It’s humbling for me to see so many people here. I sincerely appreciate you all joining me this evening and I look forward to answering your questions and chatting with you one on one afterwards.

The University Club in which we stand has a special meaning to me. It first opened in 1967 in the old army hut that stands today as E-Hut. I remember as a little boy being taken by my parents to visit Santa at the annual Christmas parties, including the very first one they hosted. Over the years I’ve had many dinners and attended countless functions in the old E-Hut facility. And in 1982, when Phase II of the University Club was completed — the building we are in now — I had just started my final year of undergraduate studies.

I left Victoria in 1983 and it wasn’t until 1992 that Helen and I returned to our hometown. As a young faculty member I joined the newly created School of Earth and Ocean Sciences, appropriately located in E-Hut, the former location of the University Club. In 1992, if someone would have told me that I would be standing in the University Club as the elected BC Green Party MLA for Oak Bay Gordon Head, I would have thought they were crazy.

I was a scientist. I was a teacher and I had no interest in politics.

Yet two decades later, in the fall of 2012, Jane Sterk, after a number of previous attempts finally convinced me to run in the May 2013 provincial election.

I had spent many years understanding the basic physics of the past, present and future climate system. It became evident that global warming was emerging as the defining challenge of our time, and that there were enormous opportunities available to those jurisdictions that were first to act boldly in transitioning to a low carbon economy.

I advised governments at all levels on available policies that could allow them to seize those opportunities. And I saw British Columbia begin to show leadership by doing just that.

But as the government then shifted all of its efforts, and all of its hopes, to the LNG pipedream, I saw us lose that leadership. I watched as we went from leaders in developing a 21st century economy, to laggards, scurrying back to the 20th century, hoping for an out-dated and unrealistic LNG windfall. For three years now I’ve been saying the same thing. The economics simply does not work for BC to build a thriving LNG industry any time soon.

As I watched our provincial leadership unravel, I was reminded of something I would tell my students. If you want your government to show leadership on the issues that you care about, I would tell them that you need to elect people who will act on your concerns. Or, if you feel like none of the candidates is seriously addressing the issues you are worried about, you should consider running for office yourself.

Ultimately, I decided that I needed to take my own advice. I ran for office because I saw an opportunity to help build a vision that would put our province on a path of developing a 21st century diverse and sustainable economy. Now, after 2 1/2 years in office, it’s clear to me that this is more important than ever.

In the shadows of the massive challenges that we face, our province needs new leadership.

Leadership that offers a realistic and achievable vision grounded in hope and real change.

Leadership that places the interests of the people of British Columbia — not vested union or corporate interests— first and foremost in decision-making. And it’s not only today’s British Columbians that we must think about, it’s also the next generation who are not part of today’s decision-making process.

Leadership that will build our economy on the unique competitive advantages British Columbia possesses, not chase the economy of yesteryear by mirroring the failed strategies of struggling economies.

Leadership that will act boldly and deliberately to transition us to 21st century economy that is diversified and sustainable.

Leadership that doesn’t wait for public opinion — but rather builds it.

It’s clearer to me now than ever before. The province needs new leadership bringing new ideas, new direction and new people to the legislature. For too many decades British Columbia has had to put up with our two-party dichotomy of dysfunction.

On the left there’s the BC NDP. Frankly there’s nothing new or anything particularly democratic about the BC NDP. On the right we have the BC Liberals. And there is absolutely nothing liberal about the BC Liberals.

Too often British Columbians vote for the BC Liberals not because they like what they stand for, but rather because they dislike what the BC NDP stand for. Too often British Columbians vote for the BC NDP not because they like what they stand for, but rather because they dislike what the BC Liberals stand for. And therein lies our opportunity.

The BC Greens will offer British Columbians candidates, ideas and policy that they can vote for, instead of vote against. It’s time for us to create a third viable option.

And so, with the knowledge of the opportunities and challenges that lie ahead, I announce my candidacy for the Leadership of the BC Green Party.

To an Economic Vision for the 21st Century

We have a unique opportunity in British Columbia to be at the cutting edge in the development of a 21st century economy.

Our high quality of life and beautiful natural environment attract some of the best and brightest from around the globe —we are a destination of choice. Our high school students are consistently top ranked — with the OECD specifying BC as one of the smartest academic jurisdictions in the world. And we have incredible potential to a create clean, renewable energy sector to sustain our growing economy. When we speak about developing a 21st century economy — one that is innovative, resilient, diverse, and sustainable — these are unique strengths we should be leveraging.

Unfortunately, instead of investing in a 21st Century economy, our government has banked all its hopes on an irresponsible, unrealistic fossil fuel windfall, with its Liquefied Natural Gas sector. We are already seeing these promises unravel as we chase a falling stock, doubling down on the way.

A 21st century economy is sustainable — environmentally, socially and financially. We should be investing in up-and-coming sectors like the clean tech sector, and creative economy that create well-paying, stable long-term, local jobs and that grow our economy without sacrificing our environment.

We should be using our strategic advantage as a destination of choice to attract industry to BC in highly mobile sectors that have difficulty retaining employees in a competitive marketplace. We should be using our boundless renewable energy resources to attract industry that wants to brand itself as sustainable over its entire business cycle, just like Washington and Oregon have done. We should be setting up seed funding mechanisms to allow the BC-based creative economy sector to leverage venture capital from other jurisdictions to our province. Too often the only leveraging that is done is the shutting down of BC-based offices and opening of offices in the Silicon Valley.

We should fundamentally change the mandate of BC Hydro. BC Hydro should no longer be the builder of new power capacity. Rather, it should be the broker of power deals, transmitter of electricity, and leveller of power load through improving British Columbia power storage capacity. Let industry risk their capital, not taxpayer capital, and let the market respond to demands of cheap power.

Similarly, by steadily increasing emissions pricing, we can send a signal to the market that incentivises innovation and the transition to a low carbon economy. The funding could be transferred to municipalities across the province so that they might have the resources to deal with their aging infrastructure and growing transportation barriers.

By investing in the replacement of aging infrastructure in communities throughout the province we stimulate local economies and create jobs. By moving to this polluter-pays model of revenue generation for municipalities, we reduce the burden on regressive property taxes. Done right, this model would lead to municipalities actually reducing property taxes, thereby benefitting home owners, fixed-income seniors, landlords and their tenants.

Yes, we should be investing in trade skills, as described, for example, under the B.C. jobs plan. But we should also be investing further in education for 21st century industries like biotech, high tech and clean tech. It’s critical that we bring the typically urban-based tech and rural-based resource sectors together. Innovation in technology will lead to more efficient and clever ways of operating in the mining and forestry industries. Just last week, for instance, I was told the story of a BC-based technology innovator partnering with a local mine to dramatically improve the efficiency and environmental footprint of their mining operations. Rather than hauling thousands of unnecessary tonnes of rock to a crusher for processing, the new technology allowed the rocks to be scanned for gold content on site. This meant that prior to trucking, the company could determine if it was more cost-effective to simply put the rock to one side for use as fill later.

Natural gas has an important role to play. But, we should use it to build our domestic market and explore options around using it to power local transport. BC businesses such as Westport Innovations and Vedder Transport have already positioned British Columbia as an innovative global leader in this area.

We should be investing in innovation in the aquaculture industry, like the land-based technologies used by the Namgis First Nation on Vancouver Island who raise Atlantic salmon without compromising wild stocks.

The logging industry is booming yet we send record amounts of unprocessed logs overseas. Now is the time to retool mills to foster a value-added second growth forestry industry.

These are just a few ideas that could help us move to the cutting edge in 21st the century economy.

Fundamental to all of these ideas is the need to ensure that economic opportunities are done in partnership with First Nations. And that means working with First Nations through all stages of resource project development – from conception to completion.

To the issue of Affordability

A 21st century economy must also be an affordable one.

Right now, over half a million British Columbians are currently living in poverty. Today’s report issued by the BC Child and Youth Advocacy coalition noted that one in five children overall in BC live in poverty. More than 50% of children in single-parent families live in poverty. This is unacceptable.

The government responds to these facts with the same old mantra: It can’t do more until the economy grows. Yet, we hear year after year from the government that the economy is growing. The fact is, we have seen growth, we have money to invest, and we know that if we invest capital smartly we will actually save in operating costs. So let me offer just one or two ideas of where we should start:

Let’s fix the Registered Disability Savings Plans and Registered Educational Savings Plans. Currently, RDSPs and RESPs do not receive the same protection that RRSPs and RRIFs do when a family or individual is faced with bankruptcy. This means that when faced with bankruptcy, these already vulnerable individuals lose the one thing that would otherwise provide a glimmer of hope for a financially stable future. By simply providing creditor protection for disabled individuals and children’s education funds we can make the pathway out of poverty that much easier for those individuals experiencing bankruptcy. And let me be clear: This is a policy change—it doesn’t cost anything.

At the same time we know from other jurisdictions, that by providing chronically homeless individuals with a home through Housing First Policies, we not only provide individuals with a basic human right — shelter — but also better health outcomes, all while realizing long-term, overall net savings to government.

Medicine Hat saw a 26% decrease in emergency shelter use in just four years and has housed over 800 people, including over 200 children. Utah has reduced chronic homelessness by 72% as of 2014. A housing first pilot project in Denver, Colorado found emergency related costs and incarceration costs declined by 72.95% and 76% respectively, while emergency shelter costs were reduced by an average of $13,600 per person. Canada’s own At Home/Chez Soi study found that for every $10 invested in housing first services there was an average savings of $21.72.

And we need to deal with rampant speculation in our housing market. Simple steps like closing the Bare Trust Loophole would be effective. Or, as I introduced in a private members bill earlier this year, providing government the means of determining who is purchasing property in B.C. This includes determining both foreign investment flows, the role that corporations are playing in purchasing property and if we have significant speculation coming from other places in Canada.

The solutions to our province’s affordability crisis are out there, and those solutions themselves are affordable. We just need to invest in them. Given everything we know, the question becomes this: how can we afford not to?

To the issue of Health Care

The need for affordability must extend to quality health care too.

We can be proud that B.C. was recently ranked the healthiest province in Canada. This ranking shines a positive light on the healthy lifestyle choices British Columbians make each day. Yet, while we celebrate our successes, we must also remember that our health care system faces serious challenges.

With a highly regressive health care funding system, an aging population, major gaps in primary care, and surgery waitlists lasting anywhere from months to years, it is time for government to take a serious look at how our Health Care System is funded and administered.

British Columbia is the only province in Canada that continues to charge MSP premiums. Such premiums unfairly burden low and fixed income British Columbians with an overly heavy tax burden. With individuals earning a net annual income of $30,000 paying the same monthly flat fee as those earning $3,000,000 per year, it is evident that MSP premiums are perhaps the most regressive form of taxation in B.C.

Instead of charging MSP premiums, we should look at shifting to alternative, more progressive options such as was done in Ontario and Quebec. Rather than flat-rate fees, health premiums can be paid through the personal income tax systems. This avoids the regressive effects of flat-rate premiums and diminishes the additional costs associated with administering the MSP program.

But it can’t stop there. We also need to address the growing gaps in primary care. Doctor shortages and long wait times to get an appointment have led to increased use of walk-in clinics and emergency room services. Unfortunately, this can be costly for both patients and our health system, as a lack of follow-up and co-ordination can mean problems are missed or poorly managed.

Let’s look at investing more in Nurse Practitioners to help close some of these gaps and provide the high quality and timely care that British Columbians pay for and need. Let’s find more effective ways of funding these Nurse Practitioners. Let’s re-examine our approach to the delivery of chronic care services. Relying on acute care services, such as walk-in clinics and hospital emergency rooms, to deal with chronic health issues is both costly and inefficient.

Let’s consider increasing community and at-home care programs, which have been shown to provide better care at a more affordable cost. And let’s lobby the Federal government for our fair share of Canadian Health Transfer revenue, a share that reflects our demographics and the actual cost of delivering health services.

The possibilities for improving our health care system are plenty. As our population continues to age and gaps in primary health care continue to grow, it is more important now than ever to commit to re-examining how we provide affordable, quality health care in B.C.

To the issue of Education

Public education represents perhaps the most important investment government can make for the prosperity of our province. Each and every one of us has attended school and that experience has shaped who we are, what we do and how we contribute to society. And public education is absolutely critical in teaching the next generation of British Columbians to think critically, contribute responsibly to society, and become the leaders of tomorrow.

Given this, why have we not shown more leadership in the Education sector?

At the end of the strike last year, the government spoke about “an historic six-year agreement…which means five years of labour peace ahead of us.”