Finance

Green MLA calls Pacific NorthWest LNG-BC Government MOU “shocking and irresponsible”

Media Statement – May 20, 2015

Green MLA calls Pacific NorthWest LNG-BC Government MOU “shocking and irresponsible”

For Immediate Release

Andrew Weaver, MLA for Oak Bay-Gordon Head and Deputy Leader of the B.C. Green Party, says that the signing of the Memorandum of Understanding between the B.C. Government and Pacific NorthWest LNG is a truly shocking and irresponsible act.

“This is the act of a desperate government,” says Andrew Weaver. “For over two years I’ve been saying the same thing. Oversupply in the global natural gas markets means that the economics simply do not support the Liberal’s irresponsible LNG hyperbole. Rather than acknowledging the folly of their pre-election promises, they take the reckless and desperate approach of essentially giving away a resource while simultaneously proposing to hamstring future governments from looking out for the interests of British Columbians.”

The Memorandum of Understanding, signed between Pacific NorthWest LNG and the B.C. Government is a precursor to the controversial project development agreements that are designed to give LNG producers more certainty by making it costly for future governments to change royalty and tax rates.

The project development agreements are being used to get around the fact that by law a government cannot impose limitations on the powers and actions of future governments. They can, however, make it costly, both financially and politically, for a future government to withdraw from an existing agreement.

“By signing this agreement, the government is effectively putting the interests of one corporation ahead of British Columbians. This government has already rewritten environmental laws, rewritten the way royalties are assessed on industry, and advanced a very favourable tax regime for the industry. Now they are hamstringing future governments. British Columbians are getting a raw deal from a government that is putting politics ahead of good economics. They should be outraged.”

Ironically, this latest event in B.C.’s ongoing LNG debacle comes at a time with the Asian LNG June spot price averaging around $7.12 per million BTU. A recent Macquarie Private Wealth analysis pinned the break even price for BC LNG at between $8.37 and $9.77 per million BTU.

Media contact

Mat Wright

Press Secretary – Andrew Weaver MLA

1 250 216 3382

mat.wright@leg.bc.ca

Select Standing Committee on Health Won’t Examine MSP Reform

Over the course of the last few months I have been working to raise awareness about the regressive approach British Columbia is taking to fund health care via flat-rate MSP premiums. I’ve been pressuring both the government and the official opposition to support a more progressive approach like that in place in Ontario.

I’ve written about this earlier and tabled a petition in the legislature of 6,662 British Columbians who agreed. Furthermore, during question period, I asked the Minister of Finance if the government would empower the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged. The Minister responded that he believed the mandate of the committee was sufficiently broad for “members of the committee, and those that they might invite in, to have the kind of conversation that the member is alluding to”.

Following up on the Minister’s response, I formally wrote to the Chair of the Select Standing Committee on April 17 asking two specific questions regarding the possibility of initiating a conversation with respect to the funding of MSP in British Columbia.

I received a response to my letter today.

The response was, to say the least, most disappointing. The Chair of the committee stated that “they consider only those matters that are referred to them by the Legislative Assembly”. Given the Minister’s response to my question during question period, this statement is most perplexing.

What’s even more troubling is that further in the letter, the Chair of the committee states:

“The Committee is currently working to identify potential strategies to ensure the sustainability and improvement of our health care system while ensuring its financial sustainability.”

Moving MSP premium funding from a regressive to a progressive system of funding is precisely one of the key ways we can ensure the financial sustainability of our healthcare system. I am astonished that the Committee has apparently not recognized this.

For those interested, the Select Standing Committee on Health has the following members:

Linda Larson Liberal, Boundary-Similkameen (Chair)

Judy Darcy NDP, New Westminster, (Deputy Chair)

Donna Barnett Liberal, Cariboo-Chilcotin

Dr. Doug Bing Liberal, Maple Ridge-Pitt Meadows

Sue Hammell NDP, Surrey-Green Timbers

Richard T. Lee Liberal, Burnaby North

Dr. Darryl Plecas Liberal, Abbotsford South

Jennifer Rice NDP, North Coast

Bill Routley NDP, Cowichan Valley

Dr. Moira Stilwell Liberal, Vancouver-Langara

Bill 23(46): A Multigenerational Sellout as a Final Act of Desperation

Today in the Legislature we discussed Bill 23, The Miscellaneous Statutes Amendment Act at the committee stage. As I noted earlier, the bill contained a profoundly troubling Section 46 which granted the Minister unparalleled powers to enter into secret deals with LNG companies concerning natural gas royalty rates. At second reading I outlined my concerns in detail. Bruce Ralston, NDP MLA from Surrey-Whalley, and I supported each other, including our amendments, as we unpacked the implications of this bill. Below is the text of some of my contributions. I also provide a link to the Hansard video for Part I.

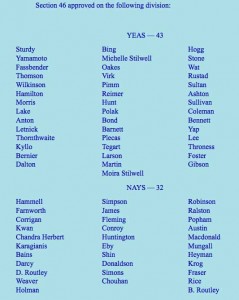

In the end both of my amendments as well as Bruce Ralston’s amendment were defeated. All members of opposition voted against section 46 as detailed below.

Video of Part I

Transcript of Part I

A. Weaver: Now, I recognize that government is rather desperate to land the $30 billion investment, and in so doing, we’re just seeing a $1 billion investment walk from Vancouver Island EDPR and TimberWest trying to put a billion-dollar wind farm investment…. Of course, government is not interested in that, because they’re desperate to fulfil this pipedream.

The concerns I have here…. I’ll ask a very direct one. In light of the fact that everything is up to the minister’s discretion, in essence, to enter into secret deals — presumably handed to him or her by a company, because this government has lost all credibility on this particular file — one of the things that they might do, for example, is work out a royalty rate that might actually be $1 billion less than it would otherwise be so that the company could then find a billion dollars to perhaps give to the First Nation to get title over their land. This is the kind of stuff that the public does not trust government on because of this legislation, where there’s nothing that precludes government working out a back deal to say: “Well done. Good for you to get your title rights recognized. Good for you to negotiate a cost. But we in the province of British Columbia will pay that cost, and we’ll pay that cost by changing this royalty rate in secrecy so that the company doesn’t actually pay it.” The province of British Columbia pays it.

My question to the minister is this, why does he need this level of secrecy, this level of secrecy here that he does not even need to give the Lieutenant-Governor-in-Council, his cabinet colleagues, notification as to what deals he is making? Does this minister honestly believe that the millions of people living in British Columbia trust him and only him to negotiate royalty rates for generations to come because somehow he knows what’s going on, and no one else does?

Hon. R. Coleman: I will walk past the ignorance of the question and just go to my answer. If the member would look and do some research with regards to the legislation, the power given to the minister to do this comes from Lieutenant-Governor-in-council, which is cabinet — the ability to do this. And if there’s any change in revenues or things that have to be adjusted on a financial basis, the minister, as I know, with regards to my service plan, my letters of expectations with my responsibility to government…. Anything that affects the government fiscally, I have to take back to Treasury Board.

I think it’s inappropriate for the member to think that it’s just the minister that’s making this decision. In addition to that, if the member would like to look at section 78.1, subsection (3), it also says that “The minister must, as soon as practicable, publish an agreement entered into under (1) but may withhold from publication anything in the agreement that could be refused to be disclosed under” — an act that governs us all — “the Freedom of Information and Protection of Privacy Act.” The only thing that would be not disclosed in that, I believe, would be if there was something that was significantly different or something that was — technology over whatever — with regards to the design of a plant or something that may have an effect on the competitive side or the marketplace before it was disclosed by the company in the appropriate manner.

If a request were made under that act, the disclosure of the agreement has to take place. It’s our full intent to make these agreements public.

A. Weaver: Well, in fact, I have read this legislation rather carefully. I’ve been following this file very carefully for the last two years. Frankly, what I’ve been saying for all that time is playing out here. Here’s another sellout.

In fact, if you read 78.1(2), it says the following: “The approval of the Lieutenant Governor in Council is not required for the minister to enter into an agreement under subsection (1)….” I don’t know what the minister doesn’t see about that, but it specifically says that “the Lieutenant Governor in Council is not required for the minister to enter into an agreement under subsection (1) (a) in the prescribed circumstances, or (b) in respect of a prescribed class of agreements.”

In essence, this is saying that the minister can essentially enter into an agreement…. The province of British Columbia, all of us, believe that we have such confidence in this minister that we are going to let him — and only him — go into an agreement with a multinational corporation. This has got to be some kind of a joke.

What is the justification that the minister needs these exclusive powers to go and enter into agreements without his cabinet colleagues knowing, without the Premier having to even know, but giving him power under section 78.1(2) to do this? What gives him the right? This is not an autocracy. Why does the minister think it is?

Hon. R. Coleman: If you read the section, it says: “in the prescribed circumstances, or (b) in respect of a prescribed class of agreements.” These are determined by Lieutenant-Governor-in-Council and allow the minister to sign them as a delegated authority to do so.

The characteristics of these agreements — in prescribed circumstances and in the class of agreements — are dealt with long before they’d ever get to an agreement with regards to what’s in them and what the minister can sign or cannot sign.

So basically, what it effectively does…. It does what most pieces of legislation do and delegates authority, after certain prescriptions and outlines have been prescribed by government, to a minister that he can execute on behalf of government.

Video of Part II

Transcript of Part II

A. Weaver: Coming back to section 46, section 78.1(2)(a) and (b) where it describes: “The approval of the Lieutenant Governor in Council is not required for the minister to enter into an agreement under subsection (1) (a) in the prescribed circumstances, or (b) in respect of a prescribed class of agreements.”

The minister recently said that the type of agreements that he or she or whoever the minister will be can enter into are controlled by cabinet. But we have no indication as to what “prescribed circumstances” are. We have no indication as to what “prescribed class of agreements” are.

It could be — and I seek confirmation from the minister — that a prescribed class of agreements could be any agreement to extract natural gas from the Montney region in British Columbia and export it anywhere in Asia. That’s one possible interpretation, and “under the prescribed circumstances,” that the minister has the time to do so. Essentially, this would grant the minister…. We have no sense of this.

Is what I just said precluded from that? What constraints are being placed on the minister to enter into these agreements without consulting, without the need for the Premier, without the need for cabinet, without the need for anyone, obviously, except the proponent to know about what the agreement is? This set of prescribed circumstances and agreements is so large and vague, it could include anything.

Hon. R. Coleman: It gives to the Lieutenant-Governor-in-Council, in prescribed circumstances or in respect of a prescribed class of agreements, to allow the minister to execute them. Those will be prescribed in regulation through Lieutenant-Governor-in-Council, not arbitrarily by the minister.

A. Weaver: I guess that’s my point. I reiterate what I said earlier. In light of the fact that this government is so desperate to sign agreements with now one company — it’s, I guess, given up on a number of others — there is a lack of trust. There’s a lack of trust that this section is not going to be anything more than “prescribed class of agreements” is with Petronus, for example, or with any company involved in the Montney play that wants to sell gas to Asia. So there is a great deal of uncertainty with this.

This amendment does simply not instill confidence in British Columbians that the government actually has any sense of direction or actual clue as to what they’re doing. They’re making it up as they go along, moving it from a generational to now, as my friend from Nanaimo–North Cowichan points out, a multigenerational sellout in a desperate attempt to try to land a company.

Let me just follow up with a direct question here. If the minister signs an agreement under subsection (2) and then after giving it to the Lieutenant-Governor-in-Council — now it’s signed — the Lieutenant-Governor-in-Council receive this, and they then determine that they don’t like it, that the minister overstepped his or her bounds, my question is: what ability does the Lieutenant-Governor-in-Council have to overturn an agreement that was signed by a minister under section 78.1(2)?

Hon. R. Coleman: I know that the NDP and the independents in this House don’t support liquefied natural gas as an industry for the future of the British Columbia. I know that. I know the member is clearly after that in his mind, and that’s fine.

But if the member will think about the legislation, it allows regulations to be developed that specify the circumstances or describe the types of agreements that the minister can enter into. Don’t get to write the agreements. The Lieutenant-Governor-in-Council actually prescribes that in regulation. And by the way, every week the decisions by the Lieutenant-Governor-in-Council on regulations are published. That information, in and around the agreements, would be published, and the minister could only execute under those terms. If he went outside those terms, because of the regulation being in place, it wouldn’t be a legally enforced agreement.

A. Weaver: With respect, this has nothing to do about being against or for natural gas. This has to do with economic folly and irresponsible promises by this government in an election campaign that they cannot fulfil. Here we see desperation in legislation. We see one after another as they so desperately try to land a single contract.

The reality is…. I’m going to read this again. I have read this legislation. It says as follows: “The approval of the Lieutenant Governor in Council is not required for the minister to enter into an agreement under subsection (1) (a) in the prescribed circumstances, or (b) in respect of a prescribed class of agreements.” It doesn’t say in respect to an agreement that has been reached and agreed to by cabinet already. It says in prescribed circumstances or a prescribed class of agreements, which is incredibly vague, no matter how you interpret that.

Again, to the minister. If he believes that these circumstances or agreements really curtail or constrain what he is able to sign, why doesn’t he tell us what they are? Why doesn’t he table here today what is actually meant by prescribed circumstances or a prescribed class of agreements? Right now it can be anything. Will the minister table examples of what these are?

Hon. R. Coleman: I’ll reiterate it. I do know the member opposite doesn’t support liquefied natural gas as a new industry for British Columbia. Even in that case, this is a piece of the legislation that allows for regulations to be developed that specify the circumstances that the minister could actually enter into and sign an agreement on behalf of the province of British Columbia.

The regulation is a law, hon. Member. The minister has to follow that law in those prescribed circumstances and in respect of the prescribed class of agreements. He has to do that, because that is defined in regulation. The regulation is developed when legislation is passed.

A. Weaver: Again, to correct the record, I have never said I am against liquefied natural gas. In fact, if you go back to estimates, you will see that I have been arguing strongly for promoting domestic sector use, including the use of liquefied natural gas in our ferry systems in British Columbia, long before the government actually came up with that direction and idea.

This is not about liquefied natural gas. This is about irresponsible economic outlook — that the government is going in with no financial underscoring. They seem to be the only ones in the world that believe this is going to play out, and they’re desperate to do so.

Coming back to the question. The reality is, as the minister would like us to believe, that somehow he’s going to be constrained in entering into these agreements, that the regulations will be developed after the fact.

There is no trust on this file anymore. So there is no trust. The government is simply not trusted to be acting in the best will of the people on this particular file. We’ve seen, time after time after time, broken promises, changing legislation. We bring in an act, an LNG act. We then completely change the LNG tax act only a few months later.

It’s for this reason that I have a second amendment that I wish to put here to actually add another check in place. This is on the order paper. It’s adding a section (8) to 78. So it’s 78.1(8), which says the following:

[SECTION 46, by adding the underlined text as shown:

(8) The Lieutenant Governor in Council may, without penalty, pull out of an agreement entered into under subsection (2) within six months of the time at which the minister provided the Lieutenant Governor in Council with the full text of the agreement.]

A. Weaver: The reason why I’m doing this is I don’t trust the minister. The opposition doesn’t trust the minister. The people of B.C. don’t trust the minister. International companies don’t trust the minister. The minister has no trust on this file.

Hon. R. Coleman: I guess he will have to understand what the law means with regards to regulation.

I should tell the member opposite that I spent eight years with the RCMP. You can’t throw an insult at me that’s going to bother me. So try as you must, it just isn’t going to work.

On the other side, the flip side, I know the member opposite doesn’t think that we have opportunities on liquefied natural gas in British Columbia. Like I said to him in debates of a while ago, I want to be invited to the dinner when he has to eat those words. It will happen in the not too distant future, I believe.

Over the next year or two, you’ll see a number of these projects go ahead. They’ll go ahead not because the international community mistrusts the minister. It’s because the minister has built a relationship with the industry across the world and with financiers to the fact that they actually believe this government will deliver on what it says it will do and, therefore, will come to B.C. and invest.

The Vote

Interview on BC1

Bill 10 — Budget Measures Implementation Act, 2015

On Tuesday, March 24, I rose to speak to Bill 10, Budget Measures Implementation Act, 2015. The purpose of this bill is to implement the budget described in the government’s Budget Speech. Bill 10 contained amendments to the Carbon Tax Act, Income Tax Act, Motor Fuel Tax Act, Provincial Sales Tax Act, Small Business Venture Capital Act, and Tobacco Tax Act, together with a number of other general and consequential amendments. As noted in my speech at second reading (reproduced below), no one will agree with everything in the Bill and no one will disagree with everything in the Bill.

To give some context to my opening remarks, please note that George Heyman, MLA for Vancouver-Fairview, spoke immediately before me and ended with this statement:

Middle-class families, children and youth who are looking to their future, who are looking to jobs in a diverse, modern, growing B.C. economy — whether it’s in the tech sector, the creative sector or a cleaned-up resource sector — wait and continue to wait.

Apparently, it looks like they will have to wait a very, very long time, until at least 2017, before they see a government plan that builds an economy for the future.

A. Weaver: I do agree with the member, and I look forward, as either leader or someone in the Green Party forming that government, to offer British Columbians that vision that the member so eloquently put forward.

This Bill 10, Budget Measures Implementation Act, really contains no surprises. It outlines what the government has mentioned it would do as part of its budget speech. There’s some good and some bad, as there always is in all budget speeches. Of course, nobody in this House will agree with everything in here; no one in this House will disagree with everything in here.

Let me outline a few of the things that I think are worthy of highlighting, as I do believe they are important steps. For example, discharging liabilities from retroactive changes, in sections 1 and 2. Amending, through streamlining, the Carbon Tax Act. Coming over again to look at the B.C. mining flow-through expenditure, the flow-through of mining tax credits.

Now, on this particular case I would like to see some evidence that this actually is benefiting industry in British Columbia and not at the expense of small household investors. Without constraints added to the flow-through tax credit, there’s a danger that the capital can come in and that shares can be dumped on the market. Unsuspecting private investors buy up these shares at an above-market value and simply cannot sell them. So there is some concern about the flow-through mining tax credit, but overall, I think it does incentivize mining investment in British Columbia.

As the previous member pointed out, the digital post-production tax credit…. A very fine piece of legislation, I think, here as well as extending the training tax credits and changes to the Motor Fuel Tax Act.

This bill is…. It’s not so much troubling about what’s in it; it’s about what’s not in it. What we have in British Columbia is the second-highest income inequality in the country and the highest wealth inequality in the country. We’re the only province without a comprehensive poverty reduction plan. We have 500,000 people living in poverty, 160,000 of those being children.

This is a problem. As soon as you see a disparity between the wealthy and the poor growing with time and a decreasing middle class, you start to see the emergence of unstable societies. Human history is full of examples of where such unstable societies end up.

We look at some of the tax credits that are added in here, which make good headlines but, frankly, are boutique tax credits that are similar to what we’re seeing out of the federal Tories and that benefit very few. It benefits those who don’t need them.

A $12.65 per child for fitness equipment…. Now, the people who could benefit from $12.65 aren’t buying fitness equipment. They’re trying to put food on the table. And $12.65 in fitness equipment really is not doing much for anybody. It’s rewarding those who would actually be buying it anyway. By buying it anyway, they can afford to buy it anyway.

Coming to the B.C. education coaching tax credit. This is so egregious I don’t know where to start — $25.30. Picking on teachers who happen to volunteer to do some coaching or they’re an “eligible coach.”

What about all those teachers who buy art supplies out of their own pocket? What about all those teachers who buy school supplies out of their own pocket? These are not eligible deductions because they’re employees of the school board, yet they spend their own money on it. What about all those teachers who are volunteering and taking kids on field trips? What about all those other teachers who are struggling with class sizes and compositions that are so unbearable that the burnout rate is incredibly high?

Here we give $25.30 — that’s a case of beer after a soccer game — as a tax credit to coaches. To be honest, it’s insulting. It makes a good headline, “B.C. Government Rewarding Coaches,” and the subtext is: “by giving them $25.30 if they dedicate hundreds of hours to after-school coaching.” Hon. Speaker, $25.30 to somebody struggling to make ends meet is a big deal; $25.30 to a coach may buy that case of beer when they watch Sunday afternoon football.

There are other aspects in here that are troubling. As I outlined earlier, we have the highest wealth inequality in the country and the second-highest income inequality in the country. This does not bode well for a future society, one where the discrepancy between rich and poor grows.

There are real challenges for the middle class in British Columbia that we do not see in a budget measures act. These challenges are for small business owners struggling to make ends meet, struggling to pay bills, struggling to meet payroll, struggling to pay MSP for their families. There are those who are living and trying to afford a place to live in Vancouver or Victoria, where the rents are substantially higher than any income assistance they might get.

There are those who can afford to pay more in our society. Those in our society who can afford to pay more, when you talk to them, are willing to pay more, provided that they know where that money is being spent. This is a problem with this bill here. The government is actually finding little boutique credits to give away, but it does not outline a vision as to where it could actually better our society through the injection of funds that we so desperately need in issues like education, social services and others.

We have a very fine debt-to-GDP ratio. I will give the government that. But what we also have is a dramatically declining ratio of percentage of revenue to the government as a percentage of overall GDP. This government has made choices such that health care funding as a percentage of GDP has remained fixed, but education funding and social service funding as a percentage of GDP have dropped dramatically since this government came to power. Why is that the case? It’s because revenue has not kept pace.

Now we hear the mantra — you would expect to see this here — “We will help the middle class when B.C. is wealthy and prosperous” from hypothetical LNG that, as you know, will never materialize. But when it does, we will all be wealthy and prosperous. “We’ll wait until then.” Well, these people can’t wait until then. These people who are so desperately trying to make ends meet don’t find any tax break in here.

Well, I guess they have the increase, the $18,327 to $19,000, before anyone pays any provincial income tax. In fact, that’s a good thing, but one questions as to where this number comes from and what studies were actually done to determine that the 19 with three zeros after it was the appropriate number that should have been done.

With that said, I look forward to exploring the details of this further in committee stage. As I reiterate, in my view, the problem with this budget implementation act is not so much what’s in it, but what’s not in it. With that, I’ll sit, as I see the member for Surrey-Whalley has just arrived.

Moving Forward with MSP Premium Reforms

On Monday, February 23 2015, I tabled the BC Green Party petition of 6,662 British Columbians calling on the government to replace the regressive MSP premium poll tax with a more fair and equitable option to fund health care services in British Columbia.

Today in the legislature I was up during Question Period. I used this opportunity to question government on the possibility of empowering the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged in British Columbia?

As you will see from the exchange below, I was pleasantly surprised by the answer that I received. My response to the Minister’s use of a quote from Tommy Douglas is that Quebec and Ontario bring Health Care Premiums into their progressive income tax system as a line item that shows people what they are paying.

QUESTION

A. Weaver: In early January the good health committee at the Monterey seniors’ centre invited me to a conversation on health care. Collectively, these seniors were profoundly concerned about the impact that our regressive approach of charging flat-rate MSP premiums was having on their ability to make ends meet. And this is in the rather affluent riding of Oak Bay–Gordon Head.

Since raising this issue last month, I have heard from thousands of British Columbians who agree with me that it’s time to replace MSP premiums with a fair and equitable option. Fortunately, just yesterday the Government House Leader activated the Select Standing Committee on Health, a committee that could be empowered to examine this issue.

My question to the Minister of Finance is this: will he empower the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged in British Columbia?

RESPONSE

Hon. M. de Jong: Thanks to the member for the question. There will, through the estimates process, be an opportunity to discuss the question of the amount we collect and some of the relief that exists for almost a million British Columbians from paying full premiums. The member’s question is more specific, and that is whether or not this is a legitimate or appropriate topic for discussion by the committee.

I took the liberty of quickly checking the terms of reference. I think the power exists now. I think the committee, charged as it is to examine the projected impact of the provincial health care system on demographic trends to the year 2036 on a sustainable health care system for British Columbians…. Similarly, the motion that was before the House just a few days ago asked the committee to “outline potential alternative strategies to mitigate the impact of the significant cost drivers” identified in the original report and “consider health capital funding options.”

I think that’s probably sufficiently broad for members of the committee, and those that they might invite in, to have the kind of conversation that the member is alluding to, and it will be interesting to see what results from that conversation.

SUPPLEMENTARY QUESTION

A. Weaver: I must admit I was not expecting that answer. I am pleasantly surprised, and I’m thrilled that the committee will, I hope, seek and explore means and ways of funding the MSP premium more progressively.

The reason why I’m asking this is that the time is right. The Maximus contract was renewed in 2013. I recognize there was a five-year renewable clause in it. Now is the time to work with Maximus to find new ways of not only saving government money — because this is about efficiency as much as it is about delivering services to people who can afford it, with means and ways that allow them to have these services affordably — but it’s about making it fair. It’s about bringing the revenue generation into the income tax system.

So my question to the minister is this. Will the minister consider, as every other province in the country does, bringing in our funding to MSP premiums through the income tax system, whether it be as a line item or as part of general revenues, to avoid the unnecessary bureaucracy associated with chasing after people who have recently lost their jobs and are being charged premiums based on last year’s income tax rate, chasing people who didn’t know they actually had to pay premiums because they are living abroad and so on? Will the minister consider this approach of using our income tax system for actually raising these premiums?

RESPONSE

Hon. M. de Jong: Two things come to mind. I don’t want to prejudge or presuppose what the committee might present in terms of thoughts or recommendations on this. I confess to a certain bias, and that runs counter to the suggestion that the member has offered about eliminating a very specific charge, tax levy, in favour of general taxation provisions.

If the committee is going to have the conversation…. I ran across this in anticipation of some of the conversations, and I wonder if I can share it with the House. It’s from a former Member of Parliament from B.C., an NDP Member of Parliament, who said this:

“I want to say that I think there is value in having every family and every individual make some individual contribution. I think it has psychological value. I think it keeps the public aware of the cost and gives the people a sense of personal responsibility.

I would say to members of this House that even if we could finance the plan without a per capita tax, I personally would strongly advise against it. I would like it to be a nominal tax, but I think there is psychological value in people paying something for their cards.“

That wasn’t just any Member of Parliament. Before he was a Member of Parliament he was the Premier of Saskatchewan. That was Tommy Douglas in 1961, addressing a special session that created.

I hope the committee will be mindful of all of these ideas as it considers these matters.

Following Question Period, we issued a media release on the exchange. It is reproduced below.

Media Release

Media Statement: February 26, 2015

Health Committee Empowered to Examine MSP Premium Reform

For Immediate Release

Victoria B.C. – Today, in response to a question from Andrew Weaver, MLA for Oak Bay-Gordon Head and Deputy Leader of the B.C. Green Party, the Government House Leader and Minister of Finance agreed that the Select Standing Committee on Health would have the power to examine progressive ways of financing the Medical Services Plan and report on its findings.

“There are clear, progressive alternatives to MSP premiums that would be efficient, cost effective and affordable,” said Andrew Weaver. “I was pleasantly surprised that the Minister agreed that part of the Committees mandate could be to examine these alternatives.”

Currently, British Columbia is the only province in Canada charging a separate, flat-rate fee for medical premiums. The MSP rate is rising under the 2015 Budget by 4% – from $72 to $75 per month for individuals and from $130.50 to $136 for families. The same fee applies to anyone, whether they earn $30,000 or $3,000,000 in a year.

In contrast, both Ontario and Quebec made medical premiums a line item in their personal income tax return. By doing so, they maintained an essential revenue source for health care while reducing the burden on low and fixed income individuals.

MSP premiums are forecast to bring in nearly $2.3 billion in the 2014/15 fiscal year approaching the amount of revenue that is accrued from corporate income taxes. Reforming how this revenue is collected by, for instance, making MSP a line-item in the annual personal income tax return, would turn this regressive tax into one that is fairly applied based on income, while saving costs associated with administration and non-payment collection.

“I understand that the government has concerns about how changes to this tax would affect their financial objectives,” said Andrew Weaver. “Empowering one of our standing committees allows these objectives to be preserved, while also exploring how MSP Premiums can be made to be more affordable for British Columbians. I look forward to presenting practical alternatives to this committee and working with them to bring reform to the way MSP Premiums are charged in our Province.”

-30-

Media Contact

Mat Wright – Press Secretary, Andrew Weaver MLA

Mat.Wright@leg.bc.ca

Cell: 1 250 216 3382