Jobs

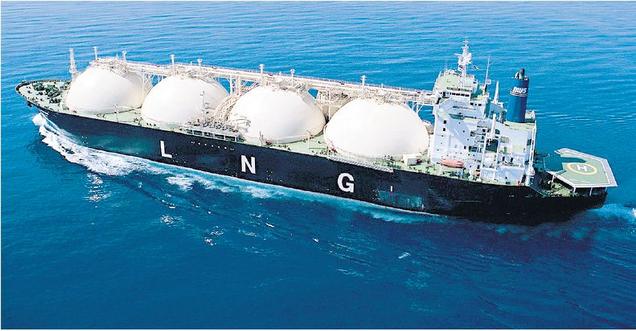

It’s time politicians level with British Columbians about LNG

Over the last month there has been a flurry of media interest concerning whether or not British Columbia can meet it’s legislated and promised greenhouse gas reduction targets while simultaneously developing an LNG industry. The short answer is no, it’s impossible. In what follows I outline why this is so. I also outline why this is a defining issue for my continued support of this minority government.

1. British Columbia’s legislated greenhouse gas reduction targets

In 2007, at a time when British Columbia was emerging as an international leader in the quest to reduce greenhouse gases, the Greenhouse Gas Reduction Targets Act was passed. This act committed British Columbia to:

- reduce emissions by 2020 to at least 33% less than the level of those emissions in 2007;

- reduce emissions by 2050 to at least 80% less than the level of those emissions in 2007;

It further tasked the government with developing interim targets for 2012 and 2016.

Later that year the government set up a Climate Action Team whose mandate included, among other things, advising what these interim targets should be. The resulting report recommended:

-

- By 2012, the growth in emissions must be reversed and emissions must begin to decline significantly, to between five and seven per cent below 2007 levels;

- By 2016, the decline in emissions needs to accelerate. In order to ensure that B.C.’s 2020 target can be reached, emissions should fall to between 15 and 18 per cent below 2007 levels by 2016.

In November 2008, upon completion of the Climate Action Team’s report, the government announced that it would establish a greenhouse gas reduction target of 16% below 2007 levels by 2012 and 18% by 2016. And at the same time, a suite of policy measures were implemented. As can be seen in the figure below, annually-averaged British Columbia emissions began to reduce.

On November 3, 2010 Gordon Campbell resigned as premier which initiated a search for a new Leader of the BC Liberal Party. Christy Clark won the subsequent BC leadership race and was sworn in as premier on March 14, 2011. After an unsuccessful attempt to win a seat in the Point Grey riding during the May 2013 provincial election, now Premier Christy Clark was eventually elected in a July 10, 2013 Kelowna West byelection.

Why this political history is important is that the change in leadership immediately signaled a change in direction for British Columbia. Almost immediately, the new Christy Clark government started to dismantle the climate policies put in place by her predecessor. One of her very first pronouncements was that natural gas would now be defined as “clean” thereby signalling the beginning of the BC Liberals’ reckless quest to capture a pot of LNG gold at the end of an ever-moving rainbow.

This pronouncement became law on July 24, 2012 as British Columbia’s Clean Energy Act was modified to exclude natural gas used to power LNG facilities. As early as June 2012, journalists were already asking how on British Columbia could venture into the LNG export industry while at the same time meeting its legislated greenhouse gas reduction targets. The political spin began.

2. Why I agreed to run as a BC Green Party candidate in the 2013 provincial election

It was during this same post-Campbell period that I was heavily involved in the writing of Chapter 12: Long-term Climate Change: Projections, Commitments and Irreversibility of the soon to be released Working Group I contribution to the 5th Assessment Report of the Intergovernmental Panel on Climate Change (IPCC). The last thing on my mind was contemplation of a possible move to BC politics.

Several times during 2012 the then Leader of the BC Green Party, Jane Sterk, approached me about running for office in the 2013 provincial election. It wasn’t until September of that year, the 4th time I was asked, that I final agreed to do so.

Over the years I have given hundreds of public lectures on the science of global warming. I also developed a course at the University of Victoria entitled EOS 365: Climate and Society.

Over the years I have given hundreds of public lectures on the science of global warming. I also developed a course at the University of Victoria entitled EOS 365: Climate and Society.

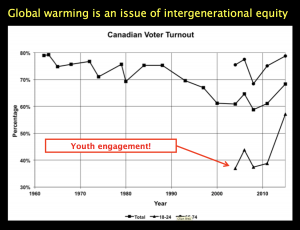

In my last lecture of that course, or towards the end of my public lectures, I typically provide a summary. I use the image to the right to boil the entire issue of global warming down to one question:

Do we, the present generation, owe anything to future generations in terms of the quality of the environment that we leave behind?

Science can’t answer that question. But science tell us why this is ultimately the question that needs to be asked.

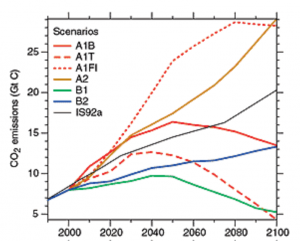

The figure, taken from the 4th Assessment report of the IPCC shows six panels with three in each column. The first column shows projected change in annually-averaged surface air temperature (as averaged over many climate models) over the decade 2020-2029 relative to the 1980-1990 average. The second column shows the same thing over the decade 2090-2099 relative to the 1980-1990 average. The three rows show the results when the climate models are forced by human-produced greenhouse gas emissions that follow three distinct trajectories (B1, A1B, A2).

The first (B1) has carbon dioxide (CO2) emissions which peak mid century then decline to below 1990 levels by the end of the century (see figure to the left taken from the IPCC 3rd Assessmnet Report). The CO2 emissions used in the second row (A1B) grow significantly until mid century and then decline slightly thereafter. The third scenario (A2) reveals CO2 emissions that grow throughout the 21st century. Each of these scenarios were developed using assumptions of future population growth, economic growth, energy usage and numerous other socioeconomic factors.

The first (B1) has carbon dioxide (CO2) emissions which peak mid century then decline to below 1990 levels by the end of the century (see figure to the left taken from the IPCC 3rd Assessmnet Report). The CO2 emissions used in the second row (A1B) grow significantly until mid century and then decline slightly thereafter. The third scenario (A2) reveals CO2 emissions that grow throughout the 21st century. Each of these scenarios were developed using assumptions of future population growth, economic growth, energy usage and numerous other socioeconomic factors.

Since 2000, after which CO2 emissions were estimated in the figure above, humans have been following the higher trajectories. In 2017 emissions from industrial activities and changes in land use were 10.0 GtC (Gigatonnes of Carbon) and 1.1 GtC, respectively, for a total of 11.1 GtC.

The results shown in the six paneled-figure above tell us that the amount of warming over the next century is very sensitive to our future emissions of greenhouse gases. But they also tell us that policy decisions made today will have little effect on the warming over next several decades. The climate change we have in store for the next 20-30 years is pretty much in the cards because of past policy decisions. That’s because of something I like to call socioeconomic inertia (we don’t build a coal-fired power plant today just to tear it down tomorrow — our built infrastructure has a turnover time associated with it).

It’s no wonder that our political leaders are having such a difficult time introducing the policies needed to ensure a reduction in greenhouse gases. Politicians are typically elected for short terms. Every four years or so there is a new election.

Let’s suppose that there is a health care crisis in a particular city. A politician may get elected on the grounds that he or she will deal with this crisis. A hospital might get built. During the next election campaign the politician can point to the hospital and say to his or her constituents: “Look. I listened to you. We built a hospital to deal with your local health-care problem”. That politician may get reelected. Now let’s suppose you are a politician who introduces a regulation limiting greenhouse gases. Or you might add a tax or levy to greenhouse gas emissions. The effects of this policy would not be realized during your political career. In fact, they may not be realized in your entire lifetime. They would start to have an effect in the lifetime of the next generation. That’s hardly something you can point to in the next election campaign. There is no immediate benefit.

So if indeed we believe that we have any responsibility for the well-being of future generations in terms of the quality of the environment that we leave behind, we have no choice but to immediately start to implement the policy measures required to reduce greenhouse gas emissions. Waiting to act will mean waiting until its too late. There’s a very simple analogy that illustrates why.

Suppose you put a pot of cold water on a stove and turn the element to high. The water won’t boil right away. It takes time for the water to heat up. If suddenly it gets too hot, and you decide to turn the element down, it also won’t cool right away. That’s because of the large heat capacity of the water. The analogy to global warming is direct. The element on the stove corresponds to the level of greenhouse gases in the atmosphere whereas the pot of water represents the oceans which cover 71% of the Earth’s surface.

Students and members of the public in my classes and lectures would invariably ask: “What can I do to make a difference?”. I would respond that there are three things anyone and everyone can do:

- Use your purchasing power to send a signal to the market by buying products that when produced, delivered, or used, are low greenhouse-gas emitting.

- Exercise your right to vote and ensure you vote for someone who is willing to put in place the policy measures required to reduce greenhouse gas emissions.

- Education: tell everyone you know to do 1) and 2).

In my 3rd year Climate and Society class I would typically ask how many people voted in the last election. It wouldn’t be unusual to see only about 50% of the class put up their hands. I’d then ask why people chose not to vote and the answers included statements like: “my vote doesn’t matter” or “all politicians are the same, they just care about themselves and getting reelected.”

In my 3rd year Climate and Society class I would typically ask how many people voted in the last election. It wouldn’t be unusual to see only about 50% of the class put up their hands. I’d then ask why people chose not to vote and the answers included statements like: “my vote doesn’t matter” or “all politicians are the same, they just care about themselves and getting reelected.”

I’d show the figure to the right illustrating Canadian voter turnout as a function of time (now updated to include the 2015 general election). I’d talk about the fact that global warming is not really an issue that will affect seniors over the age of 65 (for reasons outlined above) and that 70-80% of this demographic typically vote. I’d suggest that it is important for those who will inherit the consequences of today’s decisions (or lack thereof) to participate in our democratic process to ensure that their interests (the long term consequences) are incorporated into decision-making. I’d suggest that if they didn’t like the names on the ballot then they should consider running themselves or encouraging someone to run that they can support.

Ultimately, when Jane Sterk approached me that 4th time in September 2012, I took a look in the mirror and told myself that I would be a hypocrite if I were not willing to follow the advice I was willing to offer others. And so I agreed to run as a matter of principle and on May 14, 2013 I was elected as a BC Green Party MLA representing the riding of Oak Bay Gordon Head. My journey from scientist to politician is the focus of the Robert Alstead’s feature documentary entitled Running on Climate.

3. British Columbia’s reckless efforts to land an LNG industry

By now, the results of the 2013 general election in British Columbia are but history. Campaigning on the promise of 100,000 jobs, a $100 billion prosperity fund, a $1 trillion increase in GDP, thriving schools and hospitals, and the potential elimination of the PST, Christy Clark and the BC Liberals won a bigger majority government than they had going into that election.

While the BC NDP were campaigning for “Change for the better, one practical step at a time” (whatever that means), I was busy calling out the BC Liberal promises as nothing more than unsubstantiated hyperbole. In one of my first blog posts as a newly elected MLA, I penned an article entitled: Living the Pipe Dream: Basing BC’s Economy on Bubble Economics. This was based on some Powerpoint presentations I had given during the election campaign. In that article I stated:

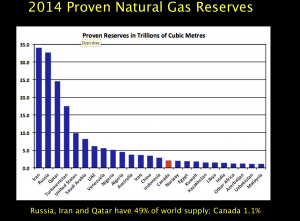

It is simply a pipe dream to believe that by the end of this decade, the same natural gas price differential will exist between North America and Asia. It is also much cheaper to pipe natural gas directly from Russia to China than it is to liquefy it and ship it from North America. And as we have seen above, there is much, much more natural gas located in Russia. British Columbians deserve better.

I pointed out that the widening of the Isthmus of Panama was about to be completed and that the southern US, a historical importer of LNG, already had the infrastructure on the coast to become an exporter. They were set to meet any upcoming supply gaps in the Asian market. I pointed out that Australia had massive LNG projects about to come online. I pointed out that Russia, with about 20 times all of Canada’s shale gas reserves, had entered into multi-decade contracts to deliver natural gas to China. And Russia’s natural gas reserves are largely conventional and so much cheaper to extract. More recently, I pointed out that Iran, containing the world’s largest reserves of natural gas, just had sanctions lifted. But that didn’t stop the BC Liberals from desperately trying to deliver the impossible.

I pointed out that the widening of the Isthmus of Panama was about to be completed and that the southern US, a historical importer of LNG, already had the infrastructure on the coast to become an exporter. They were set to meet any upcoming supply gaps in the Asian market. I pointed out that Australia had massive LNG projects about to come online. I pointed out that Russia, with about 20 times all of Canada’s shale gas reserves, had entered into multi-decade contracts to deliver natural gas to China. And Russia’s natural gas reserves are largely conventional and so much cheaper to extract. More recently, I pointed out that Iran, containing the world’s largest reserves of natural gas, just had sanctions lifted. But that didn’t stop the BC Liberals from desperately trying to deliver the impossible.

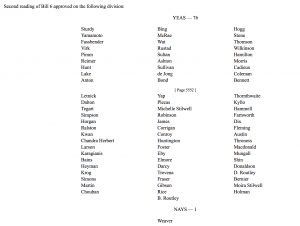

In the fall of 2016, the BC Liberals brought in Bill 6, the Liquefied Natural Gas Income Tax Act. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second reading (see the image to the right).

In the fall of 2016, the BC Liberals brought in Bill 6, the Liquefied Natural Gas Income Tax Act. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second reading (see the image to the right).

During the committee stage for the bill after 2nd reading, I identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC. And then, at third reading, I moved an amendment that would have sent Bill 6 to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises. The bill would have benefitted from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading. In my view they were still gun shy as being perceived as “the party of no” and against resource development.

Clearly the LNG Income Tax Act wasn’t generous enough and the pot had to be sweetened further with the introduction of the 109 page LNG Income Tax Amendment Act (Bill 26) a few months later. While this bill closed a few glaring loopholes I had identified in Bill 6, Bill 26 introduced what I considered to be an unacceptable revision that granted the minister the power to use regulation to allow corporations involved in the LNG industry to use their natural gas tax credit to pay an 8 percent corporate tax instead of 11 percent. Back in the fall, when I put an amendment to send this to committee, I specifically stated in speaking to that amendment that one of the reasons this had to go to committee was because “I would have wished to explore, in particular the one-half percent natural gas tax credit.”

But it doesn’t end there. The BC Liberals still could not land a positive investment decision for a major LNG facility. And so, the legislature was called back for an unusual summer session to pass Bill 30: Liquified natural gas project agreements act. As I noted earlier when I addressed the bill at second reading, in a ever more desperate attempt to fulfill outrageous election promises, the BC Liberals did what they could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come.

I offered a Reasoned Amendment to this bill. In speaking to the amendment I looked across the aisle to the MLAs opposite. I asked them to ask themselves one question. How do they think history will judge them? I argued that the generation of tomorrow will look back and will say: “This generation sold us out.” They will look back at this government’s decisions here to pass this bill with disdain, with shock, with disbelief and ask why?

By this time the BC NDP realized just how outrageous the sellout was becoming and they joined me in supporting my amendment and voting against the bill at second reading.

What we should do: Bill 30 should be repealed.

Bill 30 set the stage for the BC Government to approve the Project Development Agreement that it had already signed with Pacific Northwest LNG on May 20, 2015. One of the key conditions of the deal, however, was that Petronas had to make a final investment decision on Pacific Northwest LNG by June 2017. Petronas decided to kill the project instead.

In light of this, I recently asked the new Minister of Energy, Mines and Petroleum Resources if the long-term royalty agreement would be terminated as it was the government’s legal right to do so. In my view it literally gave away our resource and now it is being viewed as a starting point for negotiations with other companies who want to lower the bar still further. The Minister responded that she would have more information later. I await such information.

What we should do: This expired long term royalty agreement should be terminated.

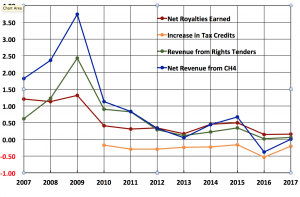

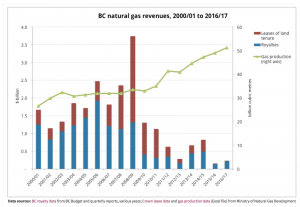

If you thought the LNG deals couldn’t get any richer, you are in for a surprise. British Columbia has had in place a deep-well royalty program since 2003. It was designed to enable the provincial government to share the costs of drilling in B.C.’s deep gas basins. But recently it transformed into a massive subsidy to incentivize horizontal drilling, including shallow wells and hydraulic fracturing. There should be no surprise that British Columbia now earns very little in royalties from its natural gas royalties (see figure to the left taken from an article written by Marc Lee in PolicyNote.ca). Worse still is that there are more than $3.2 billion in unclaimed royalty credits than can be applied against future royalties.

If you thought the LNG deals couldn’t get any richer, you are in for a surprise. British Columbia has had in place a deep-well royalty program since 2003. It was designed to enable the provincial government to share the costs of drilling in B.C.’s deep gas basins. But recently it transformed into a massive subsidy to incentivize horizontal drilling, including shallow wells and hydraulic fracturing. There should be no surprise that British Columbia now earns very little in royalties from its natural gas royalties (see figure to the left taken from an article written by Marc Lee in PolicyNote.ca). Worse still is that there are more than $3.2 billion in unclaimed royalty credits than can be applied against future royalties.

What we should do: The deep-well royalty program should be terminated.

There is more. In Bill 19: Greenhouse Gas Industrial Reporting and Control Amendment Act, 2016, the BC Liberals repealed existing Cap and Trade enabling legislation and allowed new entrants in the LNG industry to have “flexible options” for their initial operations. The first 18 months of a new operation’s existence would “allow for time for testing and other initial activities that may affect emissions and production levels.” The bill also opened up the BC Carbon registry to non-regulated operations (companies and municipalities). The BC NDP and I voted together in opposition to this Bill.

What we should do: Cap and Trade enabling legislation for heavy emitters should be reintroduced.

Unfortunately, the BC Liberals committed even more to LNG proponents. As former Premier Christy Clark stated in the November 2014 announcement of an agreement between BC Hydro and LNG Canada “This agreement is an important step forward towards getting the LNG industry up and running”. Initially the agreement promised to provide power to LNG facilities at a rate of 8.3¢ per kilowatt hour (kWh), before applicable taxes. This rate subsequently dropped to 5.4¢ per kWh (the same as the industrial rate used by other heavy consumers) in the late fall of 2016.

But here’s the problem. In order for BC Hydro to deliver into these contracts, it would need new power. This is where Site C comes in. Site C, when completed, would produce 5,100 gigawatt hours (GWh) of electricity per year.

If you pick up your bi-monthly BC Hydro bill you will see that residential customers presently pay a Tier 1 rate of 8.3¢ per kWh for the first 1350 kiloWatts of electricity and a Tier 2 rate of 12.9¢ per kWh for everything in excess of that. Site C, is now projected to cost $10.7 billion (and rising). With BC hydro’s growing debt, one thing we can be certain of is that these rates will increase. In essence, what the BC Liberals started (and the BC NDP continued) was a massive ratepayer electric subsidy of a nonexistent LNG industry. You and I will pay more than twice what LNG proponents have to pay while at the same time taking on billions of dollars of ratepayer supported debt. If this sounds like a bad deal, it gets worse.

As early as October 2103, I pointed out that it no longer made any fiscal sense to proceed with Site C. Not only was its cost escalating, but the cost of renewables was plummeting. In the last eight years alone, costs for wind power declined by 66 percent. And the costs are predicted to continue to fall. Bloomberg, for example, predicts that onshore wind costs will fall by 47 percent by 2040 and offshore costs will fall by 71 percent. In fact, Alberta just announced it is proceeding with the development of 4000 megawatts of wind energy at a cost of only 3.7¢ per kilowatt hour, well below what Site C will end up costing.

Solar energy tells a similar story. Costs have decreased by 68 percent since 2009, and they’re projected to decrease by a further 27 percent in the next five years. We have a window of opportunity now to harness renewables and build power that puts us on the cutting edge of innovation and provides local jobs and benefits. Furthermore, we are not using our existing dams efficiently and they could be used to level the load from these intermittent sources (and so act like rechargeable batteries).

Building Site C will cost much more than just its construction price tag. It will also cost us lost opportunities in terms of distributed, stable, high paying, long term jobs in renewable energy production.

What we should do: Site C should not proceed.

I reiterate, the reality is that there is a global glut in natural gas supply and despite what some might claim, oil and gas activities play a very minor role in BC’s economy. As I mentioned earlier, the royalties and net revenue from the natural gas sector in British Columbia have plummeted in recent years (see also figure below). In fact in 2016, British Columbia actually lost $383 million from exploration and development of our resource. That’s because the tax credits earned exceeded the sum of the income received from net royalties and rights tenders combined. In the fiscal year ending March 31, 2017, British Columbia earned total revenue of only $3.7 million, a 99.9% drop from 2010 (BC earned 1000 times more revenue in 2010 from natural gas than we did in the last fiscal year).

Figure: Net royalties earned (after claiming tax credits) [red]; net increase of unclaimed tax credits [orange]; net revenue from tendering the rights to natural gas [green]; the sum of these three (i.e. the net revenue to the province from our natural gas resource) [blue]. The scale is in billions of dollars. Each year represents the fiscal year ending March 31 of that year. Thanks to Norman Farrell for providing me the data that he collated from BC Public Accounts, BC Budget and Fiscal Plans, and the Auditor General’s Information Bulletin 1 (May 2011).

What we should do: Stop doubling down on the economy of yesterday and instead focus on our strategic strengths as we diversify for the economy of tomorrow (see section 5).

4. Meeting our 2030 greenhouse gas reduction targets – the line in the sand

During the 2017 election campaign the BC NDP campaigned on a promise to introduce measures to dramatically reduce greenhouse gas emissions in our province. In particular, they promised:

Our plan commits to achieve BC’s legislated 2050 greenhouse gas emission reduction target of 80 percent below 2007 levels and will set a new legislated 2030 reduction target of 40 per cent below 2007 levels.

The BC Liberals had no plan. Obviously the BC Green plan for climate leadership was far reaching.

While the details of their plan were scant, there is no doubt that the BC NDP commitment to reduce greenhouse gas emissions to 40% below 2007 levels by 2030 was the defining issue for me when it came to determining who we would support in a minority government. And so, embedded within the confidence and supply agreement that we signed with the BC NDP is this:

a. Climate Action

As evidenced in the figure at the top of this post, British Columbia emitted 64.7 megatonnes of CO2 equivalent (CO2e) in 2007. By 2030, the BC NDP have committed to reducing emissions to 38.8 megatonnes CO2e and by 2050 this number drops to 12.9 megatonnes. As of today, British Columbia has no plan to reach either of these targets. So how does the addition of a major LNG facility muddy our ability to meet these targets?

Pembina Institute undertook a careful analysis of the emissions that would arise if the LNG Canada proposal in Kitimat would go ahead. Recall from the earlier discussion that in the race to the bottom, British Columbia continues to give away the farm in a desperate attempt to land this facility. Pembina conservatively calculated that when upstream (fugitive emissions from natural gas extraction) were included, the completed LNG Canada plant would add an additional 8.6 megatonnes CO2e by 2030 and 9.6 megatonnes CO2e by 2050.

Let’s look at these numbers a slightly different way. In 2015 British Columbia reported 63.3 megatonnes CO2e in emissions. If we add the emissions associated with the LNG Canada proposal, we would need to reduce emissions from 71.9 megatonnes CO2e to 38.8 megatonnes CO2e by 2030 and from 72.9 megatonnes CO2e to 12.9 megatonnes CO2e by 2050. That’s a 46% and 82% reduction, respectively.

We know that LNG Canada emissions would be in addition to existing emissions. LNG Canada would not build the new facility today just so that they can tear it down tomorrow. We can safely assume it would be producing emissions throughout the period from 2030-2050. This means that for all other aspects of the British Columbia economy, emissions would have to drop from 63.3 megatonnes CO2e in 2015 to 30.2 megatonnes CO2e in 2030 and to just 3.3 megatonnes CO2e in 2050. That’s a drop of 52% and 95%, respectively.

If the LNG Canada proposal goes ahead, then every aspect of our economy will have to collectively cut emissions by more than half in twelve years and by 95% by 2050. This is simply not feasible given socioeconomic inertia in our build infrastructure. I’ll expand on this more in a forthcoming post where i explore British Columbia’s sector specific emissions in more detail.

Some will argue that British Columbia should get credit for any potential emissions reductions that would occur if China, for example, were to use our natural gas and transition away from coal. The problem with this argument is two-fold.

1) International reporting mechanisms do not allow one nation to get credit for such fuel switching in another nation. China gets credit for their domestic emissions reductions, not British Columbia. British Columbia cannot simply rewrite international reporting rules developed through the United Nations Framework Convention on Climate Change (UNFCCC). In addition, it’s not even clear whether or not such fuel switching would occur.

2) More importantly, there is no evidence to suggest that when a lifecycle analysis is considered, replacing coal in China with LNG that originated in BC would actually reduce emissions.

Here’s why.

Methane has a global warming potential that is 84 times that of carbon dioxide over a 20 year horizon. This means that on a molecule per molecule basis, methane is 84 times more powerful than carbon dioxide in its warming ability. It’s 28 times more powerful over a 100 year time frame. And so, it’s important to ensure that the effects of methane are accounted for in a lifecycle analysis.

Unfortunately, it is well known that there are pervasive problems with the estimating and reporting of fugitive emissions in British Columbia. For example, a recent St. Francis Xavier study suggested that BC’s actual fugitive emissions were upwards of 2.5 times higher than what was being officially reported. A particularly policy-relevant and recently published study also highlights troubles and lack of consistency with subnational estimating and reporting of fugitive emissions. In fact, uncertainties are so high that in yet another insightful analysis, that estimated which nations it was best to ship BC LNG to in order to get the best bang for the buck in terms of GHG emissions, it specifically stated:

“It is critical to note that the significance of the results does not lie with the ultimate magnitude of the values, where uncertainties remain due to the evolving nature of upstream fugitive emissions measurements. Instead, the important conclusion is the potential for variability in carbon intensity of LNG across countries.“

That is, while the relative merits of shipping to one country over another was quantified, the authors recognized that uncertainties in fugitive emissions precluded a conclusion as to whether the lifecycle analysis led to a net greenhouse gas benefit. In particular they noted,

“Results include two Canadian studies, both of which report total life cycle greenhouse gas emissions notably lower than those reported by the others, ranking the lowest and second lowest values in the collected data.”

and

“The Canadian datasets would benefit from disaggregating emissions, such that areas in need of research and improvement can be identified.”

5. In Summary: A vision for the future

Over the course of this essay, I hope that I’ve been able to explain why my continued support of the BC NDP in this minority government is conditional on them implementing a realistic and achievable plan to meet the 2030 greenhouse gas reduction targets. I initially got into politics for the reasons articulated above. I could no longer look my family, friends, students and colleagues in the face knowing that I let future generations be sold out when I had the chance to stop it from happening. This is a principled decision for me and the reason why I refer to it as a line in the sand.

It is not possible to on the one hand claim you have a plan to meet our targets and then on the other hand start promoting the expansion of LNG. It’s a bit like Mr. Trudeau’s recent doublespeak where he says that we need to triple the capacity of the Kinder Morgan pipeline in order to meet our climate commitments. That is, we need to increase emissions to reduce emissions!

In section 3, I outlined the numerous ways the BC Government can take steps to stop the generational sellout embodied in the great LNG giveaway. I will continue to work to push them in this regard.

In the shadows of the massive challenges that we face, our province needs a new direction.

A new direction that offers a realistic and achievable vision grounded in hope and real change.

A new direction that places the interests of the people of British Columbia first and foremost in decision-making. And it’s not only today’s British Columbians that we must think about, it’s also the next generation who are not part of today’s decision-making process.

A new direction that will build our economy on the unique competitive advantages British Columbia possesses, not chase the economy of yesteryear by mirroring the failed strategies of struggling economies.

A new direction that will act boldly and deliberately to transition us to 21st century economy that is diversified and sustainable.

A new direction that doesn’t wait for public opinion — but rather builds it.

We have a unique opportunity in British Columbia to be at the cutting edge in the development of a 21st century economy.

Our high quality of life and beautiful natural environment attract some of the best and brightest from around the globe —we are a destination of choice. Our high school students are consistently top ranked — with the OECD specifying BC as one of the smartest academic jurisdictions in the world. And we have incredible potential to a create clean, renewable energy sector to sustain our growing economy. When we speak about developing a 21st century economy — one that is innovative, resilient, diverse, and sustainable — these are unique strengths we should be leveraging.

A 21st century economy is sustainable — environmentally, socially and financially. We should be investing in up-and-coming sectors like the clean tech sector, and creative economy that create well-paying, stable long-term, local jobs and that grow our economy without sacrificing our environment.

We should be using our strategic advantage as a destination of choice to attract industry to BC in highly mobile sectors that have difficulty retaining employees in a competitive marketplace. We should be using our boundless renewable energy resources to attract industry, including the manufacturing sector, that wants to brand itself as sustainable over its entire business cycle, just like Washington and Oregon have done.

We should be setting up seed funding mechanisms to allow the BC-based creative economy sector to leverage venture capital from other jurisdictions to our province. Too often the only leveraging that is done is the shutting down of BC-based offices and opening of offices in the Silicon Valley.

We should fundamentally change the mandate of BC Hydro. BC Hydro should no longer be the builder of new power capacity. Rather, it should be the broker of power deals, transmitter of electricity, and leveler of power load through improving British Columbia power storage capacity. Let industry risk their capital, not taxpayer capital, and let the market respond to demands of cheap power.

Similarly, by steadily increasing emissions pricing, we can send a signal to the market that incentivizes innovation and the transition to a low carbon economy. The funding could be transferred to municipalities across the province so that they might have the resources to deal with their aging infrastructure and growing transportation barriers.

By investing in the replacement of aging infrastructure in communities throughout the province we stimulate local economies and create jobs. By moving to this polluter-pays model of revenue generation for municipalities, we reduce the burden on regressive property taxes. Done right, this model would lead to municipalities actually reducing property taxes, thereby benefitting home owners, fixed-income seniors, landlords and their tenants.

Yes, we should be investing in trade skills, as described, for example, under the B.C. jobs plan. But we should also be investing further in education for 21st century industries like biotech, high tech and clean tech. It’s critical that we bring the typically urban-based tech and rural-based resource sectors together. Innovation in technology will lead to more efficient and clever ways of operating in the mining and forestry industries.

Natural gas has an important role to play. But, we should use it to build our domestic market and explore options around using it to power local transport. BC businesses such as Westport Innovations and Vedder Transport have already positioned British Columbia as an innovative global leader in this area.

We should be investing in innovation in the aquaculture industry, like the land-based technologies used by the Namgis First Nation on Vancouver Island who raise Atlantic salmon without compromising wild stocks.

In forestry we send record amounts of unprocessed logs overseas. Now is the time to retool mills to foster a value-added second growth forestry industry.

These are just a few ideas that could help us move to the cutting edge in 21st the century economy.

Fundamental to all of these ideas is the need to ensure that economic opportunities are done in partnership with First Nations. And that means working with First Nations through all stages of resource project development – from conception to completion.

I am truly excited about the prospects that lie ahead in this minority government. British Columbia has so much to offer and we can and shall be a leader in the new economy. And the recent announcement of the appointment of Dr. Alan Winter as the new Innovation Commissioner is an exciting step in this direction.

Congratulations BC Digital Technology Supercluster on receiving federal innovation funding

Today the Federal Government announced the results of its Innovation Superclusters Initiative. I am absolutely thrilled that the B.C.-based Digital Technology Supercluster consortium was selected as one of five successful national programs to share a portion of $950 million in federal innovation funding. As noted in the BC government’s announcement, more than $500 million in private sector funding has also been committed to the BC-based supercluser project.

Below I attach our media release congratulating the Digital Technology Supercluster consortium.

Media Release

Weaver congratulates B.C.-led supercluster on federal innovation funding

For immediate release

February 15, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, congratulated the B.C. Digital Technology Supercluster on receiving a portion of the federal innovation funding.

“B.C.’s growing tech sector will lead the future economic growth of this province,” said Weaver.

“I have had the pleasure of meeting with a number of the companies involved in the Canada’s Digital Technology Supercluster. They are diverse, innovative and deeply committed to seeing success in British Columbia. I extend my sincere congratulations to the team and look forward to watching them grow.

“I am particularly encouraged by the engagement of the resource sector in this supercluster. Technological innovation goes far beyond the excellent startups in our cities – there is an incredible opportunity to bring innovation together with our resource sector to create jobs and economic growth across the province.

“I am proud to be part of championing innovation in this province. Two of our key platform commitments – the Innovation Commissioner and the Emerging Economy Task Force – are being implemented as part of our Confidence and Supply Agreement with the government. We will continue to advocate for policies and initiatives that will ensure that B.C. is a leader in the immeasurable opportunities of the 21st century economy.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

Welcoming provincial measures to support B.C. wines

On February 10, the BC Green caucus called on the BC Government to take steps to promote the BC wine industry in light of Alberta’s recent petty announcement that it was initiating a boycott.

We are delighted that the BC Government today announced a number of measures to support and promote the BC Wine Industry.

Below is the media release we issued in response to this announcement.

Media Release

B.C. Green Caucus welcomes provincial measures to support B.C. wines

For immediate release

February 14, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, welcomed the government’s measures to support the B.C. wine industry. Weaver previously called for a number of the same measures on February 10.

“I am glad that our government is standing up for this signature B.C. industry,” said Weaver.

“We called for a number of these measures last week because our wine industry represents the exact type of business we should be championing in this province. B.C.’s wineries are innovative, homegrown businesses that generate significant economic activity for communities across the province. After seeing the previous government relentlessly chase economically unviable sunset industries like LNG, it is frankly refreshing to see our government focus on sustainable local businesses.”

“I had the opportunity to meet with a number of Okanagan wineries over the past couple weeks. We have heard many exciting ideas about how we can better support them. Smaller wineries in particular benefit from a focus on tourism that brings people to B.C. We will continue to push for measures that will help B.C. wineries of all sizes thrive.”

Adam Olsen, B.C. Green Party spokesperson for Agriculture, added, “I am delighted that Minister Popham is stepping up to support B.C wine. B.C.’s wine industry generates $2 billion worth of economic activity and they’re growing: between 2003 and 2016, the number of B.C. wineries increased from 81 to to 273. We are only seeing the beginning of the success for this incredible industry.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

Statement on Fair Wages Commission report

Today the British Columbia Fair Wages Commission released its first of two reports. The establishment of a Fair Wages was a key component of our Confidence and Supply Agreement with the BC NDP.

We are very pleased with the recommendations of the Commission as I outline in our release media release reproduced below

Media Release

Weaver statement on Fair Wages Commission report

For immediate release

February 8, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, issued the following statement in response to the Fair Wages Commission final report.

“We proposed the Fair Wages Commission with the goal of depoliticizing the process of setting minimum wage in B.C,” Weaver said.

“We support raising the minimum wage: ultimately, all British Columbians should have livable incomes. We know that our economy will be made even stronger when people can afford to live where they work, have adequate income and time to spend with their families and on their health, and have disposable income to help fuel local businesses.

“I am glad that a key recommendation of the report is to establish a permanent commission to keep politics out of minimum wage discussions, and I strongly urge the government to commit to this recommendation. This commission should be empowered with the explicit mandate of analyzing the impacts of minimum wage increases and recommending changes going forward based on evidence.

“It is essential that we ensure changes to the minimum wage are done within the broader context of the changing economy, and in a responsible way that minimizes adverse effects while maximizing benefits to British Columbians. As we move towards the goal of livable incomes for all British Columbians, we must put evidence first and proactively address the changes on the horizon. We look forward to working further with the government to explore innovative solutions, such as basic income, to the growing issues of precarious work and technological automation.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

Seeking bold action: BC Green caucus release housing priorities for Budget 2018

Over the last few months my caucus colleagues, legislative staff and I undertook extensive research and consultation as we developed our housing policy priorities for input into the Budget 2018 consultation process. Today we released the results of our analysis during a press conference at the Creekside Community Centre in Vancouver. Entitled Seeking Bold Action: Housing Priorities for Budget 2018, our policies place an emphasis on curbing speculation and the role of global capital in our housing market.

Over the last few months my caucus colleagues, legislative staff and I undertook extensive research and consultation as we developed our housing policy priorities for input into the Budget 2018 consultation process. Today we released the results of our analysis during a press conference at the Creekside Community Centre in Vancouver. Entitled Seeking Bold Action: Housing Priorities for Budget 2018, our policies place an emphasis on curbing speculation and the role of global capital in our housing market.

The affordability crisis is devastating communities across our province. In particular, despite significant evidence of the role of speculation in driving up prices, successive governments have failed to act on the demand side.

In February the NDP Government will table their first full budget. They have a critical opportunity in front of them to take real action on housing affordability and protect the future for people of all ages and demographics in our cities.

Developing constructive solutions to the affordability crisis has been our top priority and we have already communicated our suggestions directly to government.

Below I reproduce my opening remarks at the press conference along with a copy of our press release.

Opening remarks

Today, I’m pleased to release a document outlining our priorities for action from this government on housing affordability.

In February the NDP Government will table their first full budget. They have a critical opportunity in front of them to take real action on housing affordability.

British Columbians have waited for action on this file from government for far too long.

People have watched as years of government inaction have allowed house prices to spiral out of control, as neighbourhoods empty and people are forced to make huge sacrifices to live in our cities.

This must not be allowed to continue. We need bold action now to tackle this crisis and make our cities vibrant, welcoming, and affordable.

Houses are not commodities – like gold or potash – which can be bought, sold, and traded exclusively for profit.

Homes are where people live, and they are the centre of our communities.

Yet our province is turning into a playground for the wealthy and our real estate a bank account for the wealthy.

Our cities have become a place for speculators to park their capital and reap huge returns, while ordinary British Columbians struggle to find a suitable place to live.

The skyrocketing price of real estate is precluding young people and families from buying homes in our cities.

Sky-high rents and near 0% vacancy levels in several communities are forcing renters to contend with huge competition, and to live in cramped and unaffordable accommodation.

As a result, young people are finding it increasingly difficult to see a future for themselves in our cities.

Small businesses in our cities are struggling to make rent, pay their property taxes and attract workers.

I’ve heard from many industries, especially our growing tech sector, that are struggling to attract and retain talent, because people can’t afford to live in our cities.

This is becoming a threat to our economy and must be fixed.

in January, an Insights West Survey found that 50% of British Columbians said that housing, homelessness and poverty was the #1 issue in BC. That’s up from 36% in August, and 14% in 2015.

Yesterday, a poll released by Angus Reid found that half of British Columbians want to see the housing market cooled. Just 14%, and just 1 in 5 existing homeowners, want to see prices continue to climb.

As part of our agreement with the NDP, we have the opportunity to share our priorities with them through budget consultations.

In this document, we summarize our input into the consultations and outline our priorities on housing affordability.

First and foremost, we want to see government take strong steps to curb speculation and restrict the impact of global capital on our housing market.

There is a great deal of evidence that foreign money is having a significant impact on our housing market, driving up prices well beyond what local incomes can afford.

Moreover, both global and domestic speculators are treating our houses as commodities to be bought, sold and traded exclusively for profit. They are reaping huge gains and pricing out people with average incomes who live and work in our cities.

But despite this, the provincial government has been hesitant to take action on global demand or on speculation. We think this needs to change with this budget.

When businesses can’t hire employees, when students are forced to shell out $800 a month to live in a tiny room, when our young people can’t see a future for themselves here, we need to realize that we are in an emergency.

Let’s take action to ensure that our houses are for homes first.

We believe that a crucial action government should take is to restrict the foreign purchasing of property in BC.

People who don’t live, work, and pay taxes here should be prohibited from purchasing existing property here. We can follow the lead of a number of other jurisdictions around the world, like New Zealand, that have done exactly this.

We also want to see government implement a speculators tax that targets absentee owners who own property in BC but do not pay adequate income taxes here. If the NDP does not pursue restrictions on foreign ownership, it is critically important that they include a speculator’s tax like this in this budget.

Government should levy a tax on flipping, to discourage the rapid flipping of property for profit, which drives up prices and adds no value to communities.

This government needs to take steps to protect the ALR from the impacts of speculation, including restricting the foreign ownership of ALR land and working with local governments to limit house sizes.

And we want to see loopholes closed that allow people to avoid paying taxes, including the bare trust loophole and ensuring that the foreign buyers tax applies to purchases of ALR land, partnerships, and pre-sales.

Our second priority is ensuring that we free up existing supply and ensure that new supply meets the needs of average British Columbians, not wealthy speculators.

A key part of achieving this goal is working with and empowering local governments to tackle the crisis, with the support of the province.

The province should work with local governments to regulate and restrict short-term rentals, to to encourage property owners to return units to the long-term rental supply.

The province should give all local governments the ability to tax empty homes, like they’ve done for the City of Vancouver, to discourage absentee ownership and raise revenues at the municipal level for housing initiatives.

And, the province should help local governments rethink zoning to increase the right kind of supply.

We also want to ensure that government deals with the impacts of the crisis on British Columbians in a responsible way, that does not put further inflationary effects on the market.

The irresponsible and risky BC HOME partnership should be repealed, and assistance to renters should be means-tested, streamlined and effective, to ensure help is going to those who need it most.

Finally, it is critical that government improve data collection and transparency, disseminate to support decision-making and to crack down on tax evasion and fraud.

To summarize

The scale of this crisis requires bold, decisive action if we are to make our cities livable and affordable.

Our cities should be places where people can afford to live where they work:

- where young people feel optimistic about their future;

- where small businesses thrive;

- And where neighbourhoods are vibrant and full of life.

This is the kind of society we should be building, and we will continue to pressure government to ensure that they deliver.

Thank you.

Media Release

Weaver releases B.C. Green Caucus housing policy priorities in Vancouver

For Immediate Release

January 31, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, released a summary of his Caucus’ housing policy priorities today in Vancouver. The Party’s Confidence and Supply Agreement with the B.C. NDP commits both parties to collaborate to make housing more affordable by increasing supply and dealing with the role of speculation and fraud. The policy document released today is a summary of the B.C. Green Caucus’ recommendations to government for the upcoming provincial budget.

“The affordability crisis is devastating communities across our province,” said Weaver. “In particular, despite significant evidence of the role of speculation in driving up prices, government has failed to act on the demand side. Our policies place an emphasis on curbing speculation and the role of global capital in our housing market.

“British Columbians have awaited action for far too long. It is time to move past rhetoric and get to work delivering solutions. We are putting forth realistic, evidence-based policies so that our consultations in this minority government are more transparent, and so that we can keep the pressure on government to take action.”

The measures the B.C. Green Caucus is urging government to implement include:

1. Curb speculation and the impact of global capital

- Restrict foreign purchasing of property

- Implement a speculators tax

- Implement a tax on flipping

- Close the bare trust loophole

- Close loopholes in the foreign buyers tax

- Implement ALR restrictions

2. Increase the supply of affordable housing

- Work with local governments to regulate and restrict short term rentals

- Give local governments the ability to tax empty homes

- Help local governments rethink zoning

3. Enhance financial stability for home-buyers and renters

- Eliminate the BC HOME partnership

- Instead of a universal “renters’ rebate”, provide means-tested support for renters

4. Improve transparency and data

- Collect more data on buyers and sellers of real estate

- Close loopholes enabling some investors to hide their identities

- Disseminate data more freely and regularly

“Everyday we are hearing stories from all corners of the province about the impact of this crisis, from young people forced to move out of province, to businesses who are struggling to pay rent and attract workers due to the cost of living,” added Adam Olsen, B.C. Green Party spokesperson for housing and municipal affairs.

“This is not healthy for our economy and it is not healthy for our communities. Our communities should be places where people from all walks of life can thrive. We will continue to push for bold action on this file so that we can ensure all of B.C.’s communities are vibrant, healthy and affordable.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca