Jobs

The Monumental Failure of BC Liberal’s LNG Hyperbole — What’s Plan B?

Today in the legislature during Question Period I rose to quiz the government on its irresponsible and misleading claims concerning our LNG potential. I’ve been pointing out the same thing for three years. An LNG industry in BC is not going to be an economic reality any time soon — the numbers just don’t add up. Yet during this time the BC Liberals have given us three years of hot air and broken promises. Franky, the LNG Emperor has no clothes and it’s time that British Columbians are told the truth.

As I pointed out two weeks ago, Goldman Sachs has forecast a 13 percent drop in LNG prices in 2017 and a further 23 percent drop by 2018. And the U.S. starts shipping LNG in January of 2016. The forecast spot price in Japan is $6.13 in 2016, compared to $7.49 now. Goldman Sachs has projected a $5.19 spot price for landed LNG in Japan in 2017 and a $4.75 spot price in Japan for 2018. It’s looking more and more like British Columbianas will have to literally pay people to take our gas.

During Question Period, I posed two questions to the Minister of Natural Gas Development. Frankly, in my view, his answers were shocking. But I will let you be the judge.

As a direct response to the absurd responses I received, immediately after question period I stood and moved that the house proceed to an emergency debate pursuant to Standing Order 35 on a plan for B.C.’s economy in light of the monumental failure of this government’s plan for LNG and the urgent need to transition to a low-carbon economy. I am grateful for the support of the BC NDP in my attempt to stimulate such a debate. The government argued such a debate was not needed and in the end, the speaker ruled on the side of the government.

Below I reproduce the Question Period exchange. I also provide the video and text of the discussions as to whether or not we should have the emergency debate.

Video of Question Period Exchange

Question

A. Weaver: In the lead-up to the last election, British Columbians were sold a bill of goods by this government. The promise of 100,000 jobs, a $100 billion prosperity fund, a $1 trillion hit to GDP, a debt-free B.C. and on and on.

This government has spent the last three years touting B.C.’s imminent LNG industrial boom. They sent a signal to the market that if industry wanted to do business in B.C., it had better have something to do with LNG.

We were summoned for an urgent summer session of the Legislature to debate the project development agreement for Petronas’ LNG proposal, yet the months continue to pass. The global market supply of gas gets bigger and bigger. Company after company move on to other jurisdictions, and this government remains silent about a plan B.

My question to the minister is this: given the monumental failure of this government’s plans for LNG, what is plan B for the B.C. economy?

Answer

Hon. R. Coleman: I’ve only got two minutes?

Madame Speaker: Please proceed.

Hon. R. Coleman: The only monumental failure in this House is that member’s inability to understand how important natural gas could be to the GHGs in the world sent from British Columbia.

Let’s give the member a little recap. We have a conditional FID. We have a project development agreement and one major project in Prince Rupert. We have environmental assessment certificates on three or four additional projects. We have 20 proposals in British Columbia for LNG, opportunities in B.C. Just yesterday, hon. Member, I was at Tilbury where they’re actually building a tank and expanding the Tilbury operation for Fortis for LNG to go into places like Hawaii. At the same time….

I know the member has an issue with First Nations having opportunities and changing their lives and the opportunity of a generation about LNG. But just yesterday the Tsawwassen First Nation announced that they’re going to do a referendum on accepting a proposal from a company, Mitsui, to put an LNG plant on their property in Tsawwassen for the future of their community.

We have 28 pipeline benefit agreements across the north for communities of First Nations, who will see an opportunity for trades, opportunities and a change in the lives of their young people, an opportunity for jobs.

We are moving forward with LNG. I know it drives the member crazy but that’s the way it is, hon. Member.

Supplementary Question

A. Weaver: Well, I think we should change the name of the ministry to the ministry of gas and hot air, based on that speech.

In just two short weeks, leaders from around the world will descend on Paris to attend the 21st Conference of the Parties to the United Nations framework convention on climate change. Next week the Premier will attend a first ministers meeting in Ottawa to come up with a national strategy prior to Paris.

Yet our government’s promise of wealth and prosperity from a hypothetical LNG industry is entirely inconsistent with a B.C. — let alone a national — strategy to reduce green house gas emissions. What will the government do today to invest in B.C.’s economy in light of the monumental failure of its LNG plans and the urgent need to transform to a low-carbon economy consistent with international efforts?

Answer

Hon. R. Coleman: Maybe the member ought to do a little bit of research. I know he thinks he’s an expert on this, but maybe he should go to China and see just how bad the air is and know that the cleanest-burning fossil fuel in the world can actually change the lives and health outcomes for hundreds of millions of people.

If he did, he would recognize that the world needs a transition fuel to reduce pollution, reduce GHGs in the atmosphere, take the particulates out of the air, give people better health outcomes. At the same time, while doing that, help the economy in British Columbia to improve the lives Asia, by bringing LNG from British Columbia to Asia to help them deal with a significant problem — at the same time, getting the maximum benefit from a resource that British Columbians have every right to get the benefit from.

Text of Request for Emergency Debate

A. Weaver: Again, I rise pursuant to Standing Order 35. As advised in Standing Order 35, I gave the Chair advance notice, and I’ve provided a written statement of the matter proposed to the Clerk.

By leave, I move that the House do now adjourn to discuss a matter of urgent public importance — namely, a debate concerning an economic backup plan for British Columbia given the complete collapse of this government’s all-in strategy on LNG and the urgent need to transition to a low-carbon economy.

This government spent the last three years touting B.C.’s imminent LNG industrial boom. They sent a signal to the market that if you wanted to do business here in B.C., it had to be something to do with LNG. Clearly, not the signal that many sectors wanted to hear.

From the answers in question period, it’s clear that government has no plan B. It’s clear that they have no climate strategy. Frankly, it’s clear that they’re rudderless.

As legislators, we have a duty to the people of British Columbia to urgently turn our attention towards a debate for plan B for B.C.’s economy prior to next week’s first ministers’ meeting in Ottawa and the upcoming UNFCCC meeting in Paris.

As section 35 demands, there is no other time in this session to debate such a plan for B.C.’s economy in light of the monumental failure of this government’s plan for LNG and the urgent need to transition to a low-carbon economy.

Hon. M. de Jong: I’m also obliged to the member for having not only provided the Chair but having provided me with advanced copy of his comments, which I should say bear a striking similarity to his comments in question period. That is not altogether insignificant, because one of the issues….

I must say that I am sorely tempted, given the nature of the subject advanced, to suggest that the House accommodate the member. But I am obliged to point out that the rules governing the application of Standing Order 35 are very strict and very specific, and that is for good reason.

The urgency of debate and the opportunity for debate. The member has just indirectly alluded, on this particular issue, to the opportunity that has existed in this chamber to make submissions on this very point. He did so mere moments ago in his participation in question period.

His remarks provided me with the opportunity to go back and review what he had to say earlier in this chamber, in September, in a debate that took place around energy matters, and again, I applaud him for his consistency, and I point out that I remain unconvinced about his approach and his arguments.

Nonetheless, the more important feature is that there has been ample opportunity. It is the urgency of debate, not the urgency of the matter itself. For that reason alone, I would suggest that the member in his submission to the Chair has failed to make the case for invoking section 35.

M. Farnworth: Just following on the Government House Leader’s comments, I know when this issue was raised back earlier in the summer session, the official opposition indicated that it would be supportive of a debate around the climate change and the conference in Paris.

That still remains our position. So if it was the Speaker’s view that, in fact, the motion moved by the member from Oak Bay, we would be supportive of the ability to have that debate.

Video of Request for Emergency Debate

Celebrating Innovation in Okanagan’s Agricultural Community

BC’s Agricultural Economy

Many of us take for granted the importance of agriculture in the BC economy. When combined with our seafood and food and beverage manufacturing, this so-called agrifoods sector contributes 1.9% of our provincial GDP.

When you look at farm cash receipts (the money received from the sale of agricultural commodities plus any direct program payments made to support or subsidize the agriculture sector), a whopping $2.8 billion flowed into the BC economy in 2013. According to statistics compiled by BC’s Ministry of Agriculture,

“Total farm cash receipts from the sale of crops, including grains, oilseeds, tree fruits, berries, grapes, field and greenhouse vegetables, floriculture, nursery, forage and other crops, amounted to nearly $1.4 billion in 2013, up 2.7 per cent over 2012 and up 12 per cent over the previous five year average. Total livestock receipts, from the sale of cattle, hogs, poultry, eggs, dairy, honey and other animals and animal products, amounted to more than $1.4 billion, up one per cent over 2012 and up eight per cent over the previous five year average.“

“Total farm cash receipts from the sale of crops, including grains, oilseeds, tree fruits, berries, grapes, field and greenhouse vegetables, floriculture, nursery, forage and other crops, amounted to nearly $1.4 billion in 2013, up 2.7 per cent over 2012 and up 12 per cent over the previous five year average. Total livestock receipts, from the sale of cattle, hogs, poultry, eggs, dairy, honey and other animals and animal products, amounted to more than $1.4 billion, up one per cent over 2012 and up eight per cent over the previous five year average.“

British Columbia also exports its agricultural products around the world. In 2013, agricultural exports amounted to $1.8 billion. Our top five export markets are: 1) United States [76%]; 2) China [4%]; 3) Japan [4%]; 4) Taiwan [2%]; 5) Hong Kong [2%].

What’s more, there were 19,759 farms in British Columbia in 2011, the last year for which census data are available, with 98 % of them being family-controlled farms and with over 54% of their farm operators being 55 years of age or older.

A conversation with Richard Bullock

British Columbia is broken up into eight agricultural regions and last week I had the distinct pleasure of touring around the Okanagan region to meet with local civic leaders and business owners to get a sense of the opportunities and challenges facing the Okanagan.

British Columbia is broken up into eight agricultural regions and last week I had the distinct pleasure of touring around the Okanagan region to meet with local civic leaders and business owners to get a sense of the opportunities and challenges facing the Okanagan.

The Okanagan, has long been known for its tree fruit and grape production (and hence its wine industry), so what better place to start the tour than a meeting in Kelowna with, and at the family farm of, Richard Bullock, the past Chair of the Agricultural Land Commission. As the former president of the BC Fruit Growers’ Association, BC Tree Fruits Ltd., and Sun-Rype Products Ltd., and as a former Director of the Canadian Federation of Agriculture and Chair of the British Columbia Farm Industry Review Board, Mr. Bullock is certainly a wealth of information. He provided valuable advice concerning the need for Agricultural policies to be focused on the regional scale that reflect both the type and scale of producer. We also explored the importance of ensuring that water infrastructure, including reservoirs, keep pace with agricultural development as well as means and ways that smaller Okanagan tree fruit growers can compete against large-scale grow operations in other jurisdictions, such as Washington State.

Mr. Bullock was extremely bullish on the agricultural industry in BC stating that he had “never seen the excitement in agriculture before in the last 10 to 15 years”. The numbers back up his sentiments. Agriculture exports increased by 12% in 2014 to $2 billion.

Mr. Bullock was extremely bullish on the agricultural industry in BC stating that he had “never seen the excitement in agriculture before in the last 10 to 15 years”. The numbers back up his sentiments. Agriculture exports increased by 12% in 2014 to $2 billion.

As I noted above, one of the challenges for Okanagan tree fruit growers is keeping fruit prices competitive with the larger growers in the United States and elsewhere. While the low Canadian dollar will surely provide a windfall for BC growers, other local farms have found innovative ways of ensuring that their business is resilient to market fluctuations. One of them, and one that I had the distinct honour of touring, is Davison Orchards Country Village in Vernon.

Davison Orchards Country Village

Davison Orchards has been in the Davison family since 1933 and it is now operated by Tom and Tamra Davison (the 3rd generation). Their children (Lance and Laura – the 4th generation) and Tom’s parents (Bob and Dora – the 2nd generation) all work on the farm. Davison orchards offers everything: producing food; capitalizing on tourism opportunities; selling produce and value-added food products (pies, jams etc.) directly to the consumer; offering a location to host private events. What’s more, their on-site café redefines what it means to live on a 100-mile diet as many of the menu items come directly from their farm.

Davison Orchards has been in the Davison family since 1933 and it is now operated by Tom and Tamra Davison (the 3rd generation). Their children (Lance and Laura – the 4th generation) and Tom’s parents (Bob and Dora – the 2nd generation) all work on the farm. Davison orchards offers everything: producing food; capitalizing on tourism opportunities; selling produce and value-added food products (pies, jams etc.) directly to the consumer; offering a location to host private events. What’s more, their on-site café redefines what it means to live on a 100-mile diet as many of the menu items come directly from their farm.

The Davison family is committed to the long-term sustainability of their land and their goal “is to produce fresh, high quality fruit and vegetables in a safe, sustainable and environmentally sensitive manner.” Several hundred thousand people a year visit the Davison orchards which employs upwards of 100 people during the May 1-October 31 season. Everything on the property is sold directly to consumers and the family also supports other farmers in the area by buying their produce and products and subsequently retailing them at their location.

I was extraordinarily impressed at the innovation and creativity exhibited by Tom and Tamra, who gave me the tour of their property. They outlined how people move around from job to job to ensure they can offer stable employment opportunities. For example, the baker becomes the jam maker as the need arises. They also explained to me that it was tough for a small, ~100 acre orchard, to compete in the apple sector when over 100 million 18 kg boxes of apples are picked a year in Washington State just south of the border. But the remaining 1/3 acre of apples left in their orchard certainly allows them to offer visitors first-rate home-baked apple pies.

I was extraordinarily impressed at the innovation and creativity exhibited by Tom and Tamra, who gave me the tour of their property. They outlined how people move around from job to job to ensure they can offer stable employment opportunities. For example, the baker becomes the jam maker as the need arises. They also explained to me that it was tough for a small, ~100 acre orchard, to compete in the apple sector when over 100 million 18 kg boxes of apples are picked a year in Washington State just south of the border. But the remaining 1/3 acre of apples left in their orchard certainly allows them to offer visitors first-rate home-baked apple pies.

Davison Orchards has become one of the most visited tourist attractions in the area. In fact, Trip Advisor presently lists them as #1 of 35 things to do in Vernon based on 269 reviews earning them a Certificate of Excellence. And their Facebook page is continually updated with what’s in season, ongoing activities and interesting stories about the workings of the orchard.

Davison Orchards has become one of the most visited tourist attractions in the area. In fact, Trip Advisor presently lists them as #1 of 35 things to do in Vernon based on 269 reviews earning them a Certificate of Excellence. And their Facebook page is continually updated with what’s in season, ongoing activities and interesting stories about the workings of the orchard.

Davison orchards has figured out how to thrive through innovation. They’ve accomplished this by not only producing fresh and value added food products that they sell on site, but also through recognizing the tremendous opportunities in the tourism sector. The family-friendly atmosphere they have created means that there are fun things to do for everyone in a family — young and old. It’s a wonderful example of success in the agriculture industry.

Summerhill Pyramid Winery

I was also delighted to have the opportunity to be taken around Summerhill Pyramid Winery by its CEO, Ezra Cipes. This allowed me to learn more about the Okanagan’s thriving wine industry.

I was also delighted to have the opportunity to be taken around Summerhill Pyramid Winery by its CEO, Ezra Cipes. This allowed me to learn more about the Okanagan’s thriving wine industry.

Summerhill Pyramid Winery is quite unique. It was Canada’s largest organic wine producer and BC’s first winery to receive (in 2012) Demeter Biodynamic certification. Established in 1991 on land purchased in 1986 by Ezra’s parents Stephen and Wendy Cipes, Summerhill comprises eighty acres of land of which only forty are planted with grapes. As part of the Demeter certification, twenty acres of the Summerhill property were placed under a restrictive covenant with The Land Conservancy of BC to ensure that biodiversity and natural habitat were protected. An additional twenty acres comprise meadows and composting areas.

Winemaker Eric von Krosigk co-founded Summerhill in 1991 with the Cipes. He left temporarily in 1994 once the winery was up and running and rejoined Summerhill again in 2006. Ezra took over the day-to-day operations of Summerhill in 2008 and a year later, Summerhill Pyramid Winery was named Canadian Wine Producer of the Year at the International Wine and Competition in London, England. Today, Summerhill produces around 30,000 cases of wine a year, supports another 200 acres of other family-owned vineyards by buying their grapes, and supports around 40 full time employees. In 2014, they wrote paychecks for 270 people.

Winemaker Eric von Krosigk co-founded Summerhill in 1991 with the Cipes. He left temporarily in 1994 once the winery was up and running and rejoined Summerhill again in 2006. Ezra took over the day-to-day operations of Summerhill in 2008 and a year later, Summerhill Pyramid Winery was named Canadian Wine Producer of the Year at the International Wine and Competition in London, England. Today, Summerhill produces around 30,000 cases of wine a year, supports another 200 acres of other family-owned vineyards by buying their grapes, and supports around 40 full time employees. In 2014, they wrote paychecks for 270 people.

Like Davison Orchards, Summerhill has recognized the incredible opportunities in tourism and through offering value-added services (a restaurant and a location for wedding receptions). Fully 55% of Summerhill’s wine is sold on-site with 2,000 cases passing through their restaurant and wedding reception operations.

Like Davison Orchards, Summerhill has recognized the incredible opportunities in tourism and through offering value-added services (a restaurant and a location for wedding receptions). Fully 55% of Summerhill’s wine is sold on-site with 2,000 cases passing through their restaurant and wedding reception operations.

Summerhill takes tourism seriously. When we arrived at Summerhill Pyramid Winery last Tuesday, the parking lot was full and a bus load of Asian tourists were admiring the beautiful views of Lake Okanagan. They have fully restored a cabin used by one of the original settlers to the area and built a replica of a scared earth First Nation house nearby (unfortunately this was being renovated when we visited). In addition, a nature/historical walk was being prepared through their property.

It should be no surprise to find out that Summerhill also received a Certificate of Excellence from Trip Advisor. But of course, and most importantly, the wine was exceptional. In the end I bought a bottle of 1998 Cipes Ariel after sampling it at the winery. The Vancouver Sun has described this as “one of the finest sparkling wines ever made in British Columbia” and I can certainly attest to it being perhaps the finest I have ever tasted.

It should be no surprise to find out that Summerhill also received a Certificate of Excellence from Trip Advisor. But of course, and most importantly, the wine was exceptional. In the end I bought a bottle of 1998 Cipes Ariel after sampling it at the winery. The Vancouver Sun has described this as “one of the finest sparkling wines ever made in British Columbia” and I can certainly attest to it being perhaps the finest I have ever tasted.

Summary

Echoing the words of Richard Bullock, it’s an incredibly exciting time for agriculture in British Columbia. We have enormous potential to continue to grow our agricultural sector in the years ahead both through the direct production of food and, as demonstrated by the two successful examples of innovative and creativity that I highlight above, through developing and offering value added food products and services (including tourism). But as the climate continues to warm as a direct consequence of increased atmospheric loading of greenhouse gases, we have to be careful to ensure that this industry has the capacity to adapt to the changing climate. As this past summer has demonstrated, a warming climate has many potential benefits for British Columbia’s agricultural sector in the short term but, without adequate access to freshwater for irrigation, trouble looms ahead.

Global warming will bring a water storage, not a water shortage problem. Overall precipitation will increase, but it will come in fewer, more extreme events, interspersed between longer periods of little or no precipitation. There will be an increased risk of flooding. The precipitation will be skewed to the winter, with a greater likelihood of rain instead of snow as the century progresses. And summer drought will become more common. There will be lots of water around, but it will come at times when it’s not needed and not at times when it is needed. But with proper foresight, adaptive planning and reservoir management, British Columbia should be well positioned to successfully nurture and sustain its vibrant agricultural sector and communities.

Celebrating Local Businesses in Our Community – Hootsuite

This is the third in our series highlighting innovation and creativity within our region’s business sector.

Transitioning  With offices in Vancouver, San Francisco, London, Paris, Hamburg, Sao Paulo, Singapore, Boston, Bucharest, and more than 11 million users, including 744 of the Fortune 1000 companies, Hootsuite is the world’s most widely used social media management platform. And it started right here in British Columbia.

With offices in Vancouver, San Francisco, London, Paris, Hamburg, Sao Paulo, Singapore, Boston, Bucharest, and more than 11 million users, including 744 of the Fortune 1000 companies, Hootsuite is the world’s most widely used social media management platform. And it started right here in British Columbia.

When discussing alternatives to an economy fixated on oil and gas I turn to a vision of a province that fosters growth in a diverse range of industries, including nascent sectors like clean tech, bio tech, and high tech. British Columbia has a highly educated workforce that is prepared to take up the challenge and capitalize on the opportunity that transitioning to a 21st century economy presents. We have beautiful cities that talented individuals from around the world want to live in and the potential to increase our renewable energy production to support companies striving to lower their carbon footprint.

While it is easy to talk about these concepts theoretically, it was a great pleasure to see them in action when I visited Hootsuite headquarters in Vancouver last month. Hootsuite is a program that allows people and businesses to manage their social media programs across multiple social networks from one integrated dashboard. In essence, it organizes your social media presence, say on Twitter, Facebook, and LinkedIn, onto one screen that allows you to monitor and post content efficiently.

While it is easy to talk about these concepts theoretically, it was a great pleasure to see them in action when I visited Hootsuite headquarters in Vancouver last month. Hootsuite is a program that allows people and businesses to manage their social media programs across multiple social networks from one integrated dashboard. In essence, it organizes your social media presence, say on Twitter, Facebook, and LinkedIn, onto one screen that allows you to monitor and post content efficiently.

Hootsuite has grown incredibly fast since it was founded in 2008. When it first began the average employee age was 26. That has increased slightly over the years, of course, and with a global staff of 800 and counting the average age is now around 36. It is a young, energetic company that supports the community they have created and the values they share. The health and well-being of Hootsuite employees is clearly a priority and their Vancouver offices have a gym, fitness studio, music room, and nap room, which staff are free to use any time of day or night. There are yoga classes held in the studio five times a week and employees are encouraged to ride their bike to work. A healthy work-life balance, they say, is key. Not surprisingly, they also have a 96% employee retention rate.

Hootsuite has grown incredibly fast since it was founded in 2008. When it first began the average employee age was 26. That has increased slightly over the years, of course, and with a global staff of 800 and counting the average age is now around 36. It is a young, energetic company that supports the community they have created and the values they share. The health and well-being of Hootsuite employees is clearly a priority and their Vancouver offices have a gym, fitness studio, music room, and nap room, which staff are free to use any time of day or night. There are yoga classes held in the studio five times a week and employees are encouraged to ride their bike to work. A healthy work-life balance, they say, is key. Not surprisingly, they also have a 96% employee retention rate.

Along with caring for their staff, Hootsuite also tries to contribute to the larger community. They hold 200 events, workshops, and lectures annually. Millions of non-profits and small businesses are provided with discounted services and training to help them maximize their social media impact. Hootsuite has provided free social media education to thousands of students through their Higher Education Program and Hootsuite CEO Ryan Holmes co-founded The Next Big Thing, a nonprofit foundation that “empowers young entrepreneurs with the peer and mentor network, alternative education, work space and technology they need to succeed.”

Along with caring for their staff, Hootsuite also tries to contribute to the larger community. They hold 200 events, workshops, and lectures annually. Millions of non-profits and small businesses are provided with discounted services and training to help them maximize their social media impact. Hootsuite has provided free social media education to thousands of students through their Higher Education Program and Hootsuite CEO Ryan Holmes co-founded The Next Big Thing, a nonprofit foundation that “empowers young entrepreneurs with the peer and mentor network, alternative education, work space and technology they need to succeed.”

Having a minimal environmental impact has been foundational to Hootsuite since the beginning. Their office is largely paper-free, they use energy efficient appliances and lights, have teleconferences to reduce travel emission, source the food (and beer) in the kitchen locally when possible, and have a workforce that largely commutes by bike or transit.

Having a minimal environmental impact has been foundational to Hootsuite since the beginning. Their office is largely paper-free, they use energy efficient appliances and lights, have teleconferences to reduce travel emission, source the food (and beer) in the kitchen locally when possible, and have a workforce that largely commutes by bike or transit.

Hootsuite tries to look at business more holistically than just revolving around shareholders, they say, which in turn, actually creates more value for shareholders. A recent milestone in their quest to use business as force for good, Hootsuite is now a certified B-Corporation. There are currently over 1,300 certified B-Corps across 41 countries and 121 industries that are leading a global movement to redefine success in business by voluntarily meeting higher standards of transparency, accountability, and performance. B-Corps aim to use business as a solution for social and environmental problems.

I asked representatives at Hootsuite if complying with the rigorous B-Corp standards for environmental and social excellence was difficult for the company, but they said “actually, we were already meeting a lot of their requirements.”

I asked representatives at Hootsuite if complying with the rigorous B-Corp standards for environmental and social excellence was difficult for the company, but they said “actually, we were already meeting a lot of their requirements.”

They began measuring their environmental footprint across all offices, implemented emission reduction plan, and evaluated the diversity of their workforce. After all, they said, “you can’t manage what you don’t measure and the B-Impact assessment compels companies to identify areas for improvement. It provides guidance for what companies should pay attention to.”

Hootsuite is setting a wonderful example for businesses in B.C., demonstrating that companies do not need to compromise their environmental and social values for the sake of their bottom line. “We became a B-Corp because we were looking for a way to measure our impact and see how we stacked up against other socially conscious companies,” said the company’s CEO.

As we transition to a diversified 21st century economy, I hope more B.C. companies will follow suit and be supported as they align with this admirable business model.

BC craft beer risk getting squeezed out of market

The local craft beer industry – renowned for its high employment, community involvement, and tourism draw – is being squeezed out by recent adjustments to B.C.’s liquor taxation and wholesale pricing policies. The new economic structure makes it increasingly difficult for private liquor retail stores (LRS) to make a profit selling craft beer, even though consumer demand continues to rise, and therefore limits local breweries’ presence in the marketplace.

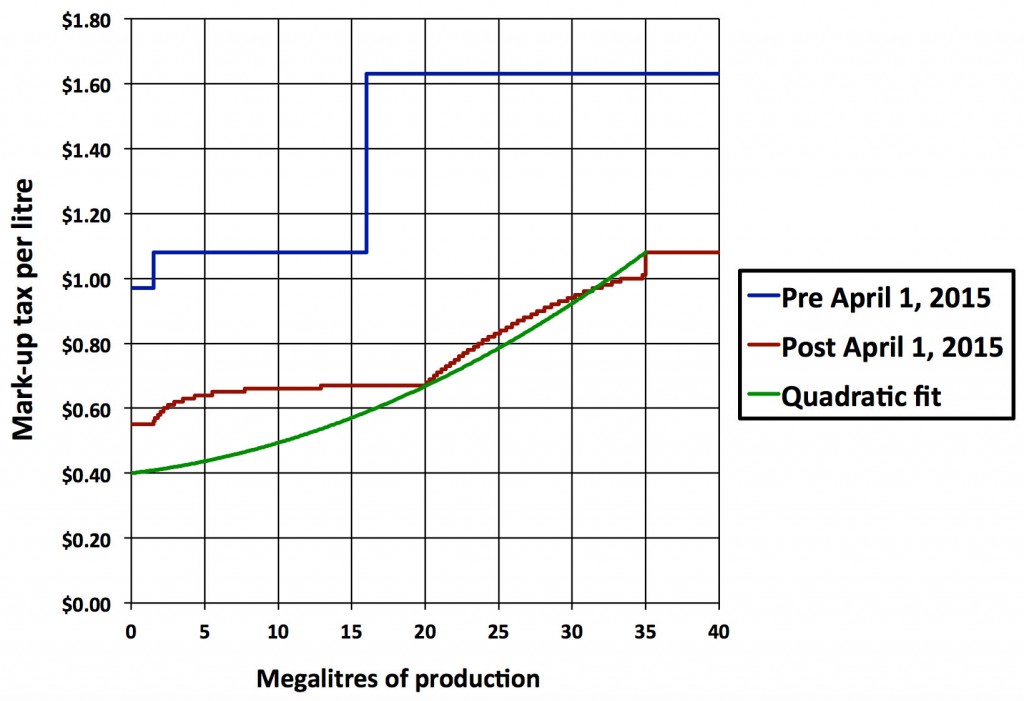

Historically, the beer tax mark-up was allocated in three distinct steps (see blue curve in Figure 1) depending on brewery size (measured in hectolitres, abbreviated hl) that generally translated to small, medium, and large facilities. Small breweries, of which there are 75-80 in B.C., represent the fastest growing sector. There are roughly 10 breweries that qualified as mid-size, two that are “large” (in the 150,000 to 200,000 hl range) and four very large global brewers. On April 1st a graduated mark-up tax was introduced (red curve in Figure 1), giving the large producers a substantial tax break.

Figure 1. The majority of breweries in B.C. produce fewer than 15,000 hectolitres (hl) annually (1.5 megalitres) and were previously taxed at a significantly lower rate than the large scale breweries with the production capacity of 160,000 – 400,000 hl (16-40 megalitres), as illustrated by the tiered blue line. The new mark-up tax rate, indicated by the red graduated line, provides large beer corporations with a substantial tax break relative to small producers and increases the wholesale price for craft beer. In addition, a “sweet spot” is created at 201,000 hl (20.1 megalitres). Beyond that price, the mark-up begins to increase again. A proposed solution is illustrated by the green line. The solution is obtained by fitting a quadratic function between (0 hl, $0.40/litre), (201,000 hl, $0.67/litre) and (350,000 hl, $1.08/litre). Beyond 35 megalitres annual production, the red and green curves are identical.

Now I recognize that the old system had its problems. There were two distinct discontinuities (jumps) in the volume tax-rates (blue curve in Figure 1). The first discontinuity or tax hike occurred at 15,000 hl while the second occurred at a production level of 160,000 hl. The introduction of these discontinuities would certainly be regressive towards companies wanting to grow. This follows since they created incentives to produce up 14,999 hl but not grow to over 15,000 hl just like an incentive was added to ensure no more than 159,999 hl were produced. Clearly this unfortunate barrier to success needed to be fixed.

The government proposed the red line in Figure 1. It is smoother and more continuous and so more gradually ties the increase in the tax rate to volume of production. But the government’s proposed solution doesn’t resolve the existence of a disincentive to growth. If simply moves it to 201,000 hl. And here’s the problem. In making the change, small craft breweries were hit with a double-whammy as the revised tax shift also constrained the ability of the LRS to carry their product.

The changes, which were implemented without consultation with local breweries, are already having an impact. In May, I met Sean Hoyne from Hoyne Brewing Co. and Murray Langdon, the general manager of Vancouver Island Brewery, to discuss their concerns.

Under the new wholesale/taxation regimes, the price of large production beers, such as Molson or Budweiser, will remain relatively unchanged. The relative wholesale price the LRS will pay to stock craft beers, however, has risen. Both Hoyne and Langdon have already noticed that the LRS are reducing their orders and failing to restock once their local features have sold. It’s not that stores don’t want to carry these products, or that customers don’t want to buy them – support for local beers has grown exponentially over the past few years – but the new wholesale price tags on craft beer have rendered them unprofitable for private operators.

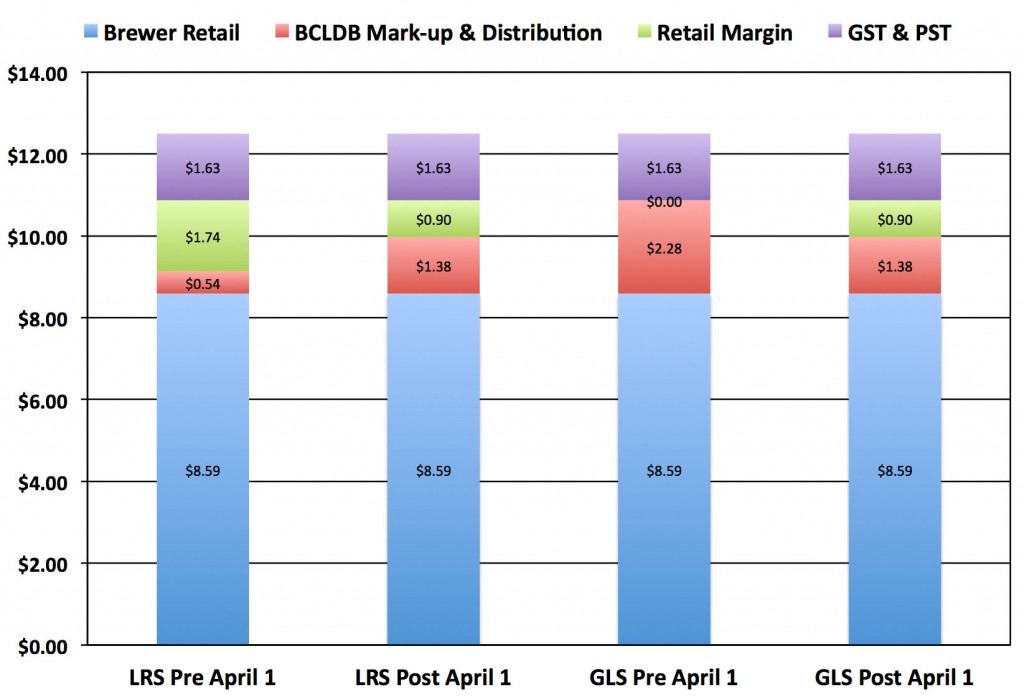

Figure 2. Example of the effect of the new pricing on liquor retail stores (LRS) and BC government liquor stores (GLS). The specific example is taken for a six pack of 355ml cans from a brewer producing less that 15,000 hl annually listing for $12.50. As this graph illustrates, the changes to BC liquor distribution board (BCLDB) mark-up and distribution rates have significantly reduced the profit margin on craft beer for the LRS, while increasing it for the GLS.

Although changes to the wholesale model were presented by the government as “leveling the playing field” between the LRS and government run BC Liquor stores (GLS), the reality has been different. Prior to April 1st The LRS received a 16 per cent subsidy on wholesale costs, now they are being charged the same price as the GLS.

By removing the subsidy that allowed the LRS to purchase liquor at a slightly reduced price, they have reduced the ability of these small businesses to stock local craft beer at a rate competitive with their government-owned counterparts. Under the new wholesale pricing scheme the GLS, which are subsidized by the wholesale arm of the Liquor Distribution Branch, stand to gain more market share in the liquor sales sector. Furthermore, successful larger breweries like Pacific Western have inadvertently been set up to win at the cost of local craft beer.

To stay competitive with the GLS, the LRS will have to reduce their profit margin on craft beer (making it not worth the shelf space), raise consumer prices (thereby driving customers to the GLS), or stop carrying it all together.

In a statement, the Justice Minister described the changes as follows:

“BC Liquor Stores are now expected to compete with private liquor retailers — and as such, have been given a more equitable set of rules to follow — placing them at the same starting line as their competitors. We have created more separation between the retail and wholesale arms of the Liquor Distribution Branch, with BC Liquor Stores now purchasing at the same wholesale price as other retailers and having the option to offer extended hours, Sunday openings and refrigeration. We’re applying the 1km rule to all full-service liquor stores, both private in government, to help protect the investment of the private store owners. Our goal is to help stores and business owners be successful and to increase consumer convenience around B.C.”

And during question period in the B.C. legislature she defended them:

“On the first of April we do indeed begin the new wholesale pricing regime. That means that instead of having a series of discounts, price, price off and so on — a very complicated system — what we have now is a single system that applies to all purchasers. Every purchaser, whether you be an LRS, a rural agency store or a government store, you will all pay the same wholesale price for your liquor — your wine, your beer, your spirits… The overall price of the product will be roughly the same on April 1 as it is on March 31 — minor adjustments but roughly the same price.”

These “minor adjustments” risk compromising the viability of the nascent British Columbia craft beer industry. However, relatively simple changes to the volumetric approach to mark-up taxes can be made to ensure that BC made craft beer can remain profitable for the LRS. In Figure 1 (green line) I fit a quadratic between the three points (0 hl, $0.40/litre), (201,000 hl, $0.67/litre) and (350,000 hl, $1.08/litre). This quadratic fit benefits all BC brewers in that it eliminates all barriers to growth. It can further be coupled with small adjustments to the Liquor Distribution Board retail mark-up to recover the government revenue from the reduced low volume tax rate (see Figures 1 and 2). With the craft beer sector only representing about 3%-6% of the overall beer sector (according to the Liquor Distribution Board), these subtle changes will once more allow the craft beer industry to thrive in BC.

It’s become far too common these days for government to introduce regulations with no consultation with affected stakeholders. In the present case, it has led to unforeseen consequences on the BC Craft Beer industry. But these can easily be remedied. So let’s get on with it.

Media Release

Media Statement – June 8, 2015

B.C. Craft Beer risk getting squeezed out of market

For Immediate Release

Victoria, B.C.– Changes in its wholesale pricing and liquor policies brought forward by the B.C. Government put small B.C. craft breweries at a disadvantage, and risk compromising the viability of this nascent industry, says Andrew Weaver, Deputy Leader of the BC Green Party and MLA for Oak Bay-Gordon Head.

The new policies make it increasingly difficult for private, often family-owned, liquor stores – the catalyst for the recent growth in local breweries – to make a profit on the sale of craft beer. This is the result of wholesale price mark-ups, the elimination of a subsidy previously offered to private liquor stores, and the Liquor Board’s policy of government liquor stores not increasing their retail prices.

Despite Minister Anton’s claims that the government was “leveling the playing field” within the liquor sector, and her assurance that prices would not increase, local producers are already being pushed out of the market.

“The recent changes to our liquor policy are making it unprofitable for private liquor stores to sell craft beer in BC.” said Andrew Weaver. “And as a consequence, it is impacting the viability of our craft beer industry.”

By jacking up the wholesale cost of BC Craft beers to small business retail outlets, they in turn must dramatically increase the price to the consumers to justify the shelf space. In doing so, they are no longer competitive with government liquor store pricing.

“The BC Liberals are putting the interests of a few large breweries and their government owned stores ahead of small business retail outlets and B.C.’s craft beer industry” notes Andrew Weaver. “There are simpler ways of adjusting the wholesale market to level the playing field imposing punitive effects on the BC Craft beer industry.”

The new wholesale pricing model introduced earlier this year eliminated the 3-tiered beer tax system, where allocation was based on production capacity, in favour of a more graduated mark-up tax that sees large and small producers pay similar tax mark-ups. The graduated mark-up could be easily tweaked to create a truly level playing field.

-30-

Media contact

Mat Wright

Press Secretary – Andrew Weaver, MLA

Cell: 250 216 3382

Mat.Wright@leg.bc.ca

Celebrating Mining Week in British Columbia

This week we celebrate mining in British Columbia. From May 3-9 events will be held across British Columbia to highlight the importance of mining to British Columbians.

B.C.’s mining industry is one of the pillars of our economy. In 2013, the year for which most recent data is available, the mining sector contributed $8.5 billion to BC’s GDP and employed 10,720 British Columbians. It further contributed $511 million in tax revenues to provincial coffers. Mining forms the backbone of many rural communities throughout the province, supplying us with the resources we need to enjoy the prosperity we are so fortunate to have in B.C.

Our mining industry continues to play a pivotal role in facilitating the transition to a 21st century economy. For example, without metallurgical coal, we cannot manufacture steel. Without graphite, we cannot build lithium ion batteries.

It is for this reason that I travelled to the Kootenays in April to learn more about the opportunities and challenges facing our Mining Industry in B.C. What follows is a brief report on two tours I did while I was there.

Teck Resources Ltd Metallurgical Coal Operations

Employing roughly 7,960 people and contributing $6.5 billion in gross mining revenue, Teck Resources Ltd is Canada’s largest diversified resource company, with many of its assets in metallurgical coal mining. I reached out to Teck Resources because I believe it’s important to have a clear understanding of British Columbia’s coal industry.

Employing roughly 7,960 people and contributing $6.5 billion in gross mining revenue, Teck Resources Ltd is Canada’s largest diversified resource company, with many of its assets in metallurgical coal mining. I reached out to Teck Resources because I believe it’s important to have a clear understanding of British Columbia’s coal industry.

Five of Teck Resources’ thirteen mines are located in the Elk Valley in the Kootenays where they extract metallurgical coal. While I was there, I had the opportunity to meet with representatives from Teck Resources and to tour their Coal Mountain operations.

Those who have read my previous coal-related posts know how important I believe it is to distinguish between thermal coal, which is used for coal-fired power plants, and metallurgical coal, which is used in the production of steel. Metallurgical coal is used to produce coke. This is done via heating the coal to very high temperatures (>1000°C) in the absence of oxygen. The resulting almost pure carbon is then mixed with iron ore to create the molten iron that is turned into steel.

Thermal coal, on the other hand, is the single biggest contributor to greenhouse gas emissions in the world. It is also the most widely available of all fossil fuels and we produce very little of it here in British Columbia. Thermal coal has smaller carbon content and higher moisture content that metallurgical coal thereby precluding its use in steel making.

Thermal coal, on the other hand, is the single biggest contributor to greenhouse gas emissions in the world. It is also the most widely available of all fossil fuels and we produce very little of it here in British Columbia. Thermal coal has smaller carbon content and higher moisture content that metallurgical coal thereby precluding its use in steel making.

The overwhelming majority of thermal coal that is shipped through British Columbia ports is sourced from the United States. That coal travels through B.C. ports because Washington, Oregon, and California have taken a stand to curb their own thermal coal exports. To quote from the governors of Oregon and Washington “We cannot seriously take the position in international and national policymaking that we are a leader in controlling greenhouse gas emissions without also examining how we will use and price the world’s largest proven coal reserves.” Here they were acknowledging that the United States has the largest reserves of thermal coal in the world (237,295 million tonnes) and that their domestic market is dropping as natural gas generation increases and more renewables are brought on stream.

Teck Resources produces metallurgical (not thermal) coal here in British Columbia. The fact is that metallurgical coal is essential for building everything from windmills to electric cars because without it, you cannot have steel. Teck Resources’ five metallurgical coal mines in the Elk Valley employ about 4,000 people and together contributed $140 million in taxes to the province in 2014. Touring Teck Resources’ Coal Mountain mining operation offered an excellent view into the scale and complexities of modern metallurgical coal mining in British Columbia. I was extremely impressed by steps Teck has taken to ensure their metallurgical coal operations were as environmentally sensitive as possible. These include their approaches to reclamation, greenhouse gas reductions, acquisition and preservation of parkland for future generations, and their state of the art water treatment operations that will commence in the Fall of this year.

Teck Resources produces metallurgical (not thermal) coal here in British Columbia. The fact is that metallurgical coal is essential for building everything from windmills to electric cars because without it, you cannot have steel. Teck Resources’ five metallurgical coal mines in the Elk Valley employ about 4,000 people and together contributed $140 million in taxes to the province in 2014. Touring Teck Resources’ Coal Mountain mining operation offered an excellent view into the scale and complexities of modern metallurgical coal mining in British Columbia. I was extremely impressed by steps Teck has taken to ensure their metallurgical coal operations were as environmentally sensitive as possible. These include their approaches to reclamation, greenhouse gas reductions, acquisition and preservation of parkland for future generations, and their state of the art water treatment operations that will commence in the Fall of this year.

Now, Teck Resources does not only produce metallurgical coal. They also own and operate Highland Valley Copper and the integrated zinc and lead smelting facility in Trail. If we actually include all of Teck Resources’ operations in our province, this one company accounted for 21% of all BC exports to China in 2013. That year Resources directly employed 7,650 full-time workers with an average salary of $100,000 per year. They are expanding their operations in British Columbia and presently there are 28 job openings within the company.

Eagle Graphite

Whereas Teck Resources is British Columbia’s largest mining company, many of B.C.’s junior mining companies are quite a bit smaller. Eagle Graphite Mine is one of them.

Whereas Teck Resources is British Columbia’s largest mining company, many of B.C.’s junior mining companies are quite a bit smaller. Eagle Graphite Mine is one of them.

Located in the Slocan Valley, Eagle Graphite is one of only two flake graphite producers in North America and the only one in British Columbia. Graphite is an essential component of lithium ion batteries, which are used in electric vehicles. In fact, about 95% of a lithium battery is made up of graphite. About 50 kilograms of graphite is contained in an electric car, 10 kilograms in a hybrid vehicle and 1 kg in an electric bike. Laptops and mobile phones contain about 100 grams and 15 grams, respectively.

Located in the Slocan Valley, Eagle Graphite is one of only two flake graphite producers in North America and the only one in British Columbia. Graphite is an essential component of lithium ion batteries, which are used in electric vehicles. In fact, about 95% of a lithium battery is made up of graphite. About 50 kilograms of graphite is contained in an electric car, 10 kilograms in a hybrid vehicle and 1 kg in an electric bike. Laptops and mobile phones contain about 100 grams and 15 grams, respectively.

By the end of the decade, graphite demand for electric vehicles produced in North America is projected to increase substantially, far exceeding current supply. The team at Eagle Graphite has been working hard to take advantage of this projected supply gap by proving their reserves and developing methods to efficiently extract graphite from their quarry reserves. And one of the interesting tidbits I picked up on the tour was that golf course grade sand is the by-product of producing graphite!

Touring Eagle Graphite offered a helpful insight into the opportunities and challenges faced by smaller mining firms.

Summary

My brief trip to the Kootenays highlighted the diversity of resource opportunities that have been capitalized upon in the area. What impressed me most at the locations I visited were the steps taken by all companies involved to ensure sustainability of their industry for decades to come with minimal environmental footprint. Whether it be Teck Resource’s Elk Valley coal operations or their Trail smelter powered by the Waneta Dam, Eagle Graphite’s small operation, Canfor’s Elko Mill, or Columbia Power’s Waneta Expansion Project, everyone I met was beaming with pride at the work that they do, their safety records, and the care they take to ensure their operations are as clean and sustainable as possible. After all, these people are locals and the industrial operations are literally in their backyard.

Finally, a highlight of my trip truly had to be that I can now say triumphantly “I’ve been to Yahk and Back”.