Jobs

Jobs, Economy and Northern Gateway

Photo above: Matt Babicki and Edson Ng, G4 Insights Inc.

The National Energy Board’s Joint Review Panel (JRP) has now released its final report approving the Enbridge Northern Gateway pipeline project. The project would see 525,000 barrels of the heavy oil diluted bitumen (dilbit) transported across British Columbia each day and loaded onto super tankers for shipment to international refineries. The project is yet another manifestation of a pattern of digging up Canada’s raw resources and shipping them to other countries with no value-added manufacturing or refining done locally. Yet what makes this proposal particularly problematic is the significant economic and environmental risk that we in B.C. face, should a spill occur.

If you look at the numbers, B.C. is projected to receive roughly $1.2 billion in tax revenue from the Northern Gateway pipeline over the span of 30 years—that’s only $40 million a year towards a $44 billion provincial budget. Yet, according to the UBC Fisheries Economic Research Unit, the economic cost of a single major tanker spill is estimates to be between $2.4 and $9.5 billion—that’s between 2 and 8 times more than the total 30-year economic benefit of the pipeline—in one spill.

Meanwhile, to date no oil spill response study has been able to account for dilbit; studies have only analyzed what would happen in the case of a spill from more commonly shipped crude oil. Unfortunately dibit is unlike other crude oils in that whereas most oils will float on the surface, up to 50% of dilbit will sink. Once that happens, we don’t know where it will go, how it will interact with currents and tides or how we could reasonably clean it up. In some areas it is projected that only 3% of floating crude oil could be cleaned up in the event of a spill. That number is already dismally low. With dilbit it would be even lower. According to the Department of Fisheries and Oceans’ own recent submission to Treasury Board: “Behaviour models specific to dilbit spills do not exist, and existing commercial models for conventional oil do not allow parameter specific modifications.”

Yet, we have an opportunity now to shift away from our old economic model of selling our raw resources solely for short-term profit and instead position ourselves for the long-term.

Let me offer two examples.

If we are going to develop the tar sands, and if we must transport oil along our coast, then at the very least let’s refine it first. This would offer two benefits: First, it would offer greater economic benefit for all British Columbians, as we would benefit from a value-added refining and spin-off petrochemical industry instead of shipping those jobs to Asia. Second, it would significantly decrease the environmental impact of a marine-based oil spill, as refined oil products (such as gasoline, diesel, or jet fuel) are much easier to clean up than dilbit. Let me be clear, this on its own is not an ideal solution and it does not protect us from the ecological consequences of a marine-based oil spill, but it certainly mitigates the risk when compared to shipping dilbit.

However, building a future economy based solely on the exploitation of a depleting resource will not steer us towards the low-carbon pathway that so many other nations are choosing to follow. That’s why British Columbia should seize the opportunity of promoting the expansion of our clean technology (cleantech) industry. With our abundance of renewable natural resources, our highly educated workforce, our-business friendly tax structure and our reputation for innovation, British Columbia is uniquely positioned to become a leader in this sector—a sector that focuses on the production, storage, transmission and end-use of renewable energy. Just yesterday I toured Burnaby-based G4 Insights Inc’s portable thermochemical facility designed to produce compressed natural gas for vehicular transport from wood waste. We need to grow our nascent cleantech companies, like G4 Insights, rather than allow them to be scooped up and exported to the US. The cleantech sector offers long-term, high-paying and local jobs. Yet developing this industry to its full potential requires the market to be sent a strong signal from government that this is the direction we want to head.

However, building a future economy based solely on the exploitation of a depleting resource will not steer us towards the low-carbon pathway that so many other nations are choosing to follow. That’s why British Columbia should seize the opportunity of promoting the expansion of our clean technology (cleantech) industry. With our abundance of renewable natural resources, our highly educated workforce, our-business friendly tax structure and our reputation for innovation, British Columbia is uniquely positioned to become a leader in this sector—a sector that focuses on the production, storage, transmission and end-use of renewable energy. Just yesterday I toured Burnaby-based G4 Insights Inc’s portable thermochemical facility designed to produce compressed natural gas for vehicular transport from wood waste. We need to grow our nascent cleantech companies, like G4 Insights, rather than allow them to be scooped up and exported to the US. The cleantech sector offers long-term, high-paying and local jobs. Yet developing this industry to its full potential requires the market to be sent a strong signal from government that this is the direction we want to head.

Today’s JRP’s decision is simply a recommendation to the Federal Government. Ultimately it will be Prime Minister Stephen Harper and his cabinet who decide if the Northern Gateway pipeline project is approved. My challenge to both our Federal and Provincial governments is this: Let’s keep dilbit out of our coastal waters, keep the jobs in Canada, and position ourselves for tomorrow by building Canada’s capacity for cleantech.

It’s time to say ‘no’ to coal and ‘yes’ to jobs

British Columbia presently mines, transports and ships metallurgical coal used in the steel industry in Asia. These are where B.C. jobs are focused. However, the proposed Port Metro Vancouver, Texada Island and even recent Prince Rupert expansion of coal exports, is largely for thermal coal produced in the United States that is burned to produce electricity. North American markets are drying up for this thermal coal due to an explosion of shale gas production. Shale gas burns much cleaner and more efficiently than coal. Even China recently announced plans to significantly reduce their use of coal.

Washington, Oregon and California have all said no to the export of this excess thermal coal through their ports. So should British Columbia.

This is not about lost B.C. jobs or economic growth. It’s about turning the Best Place on Earth or Beautiful British Columbia into a petro province and the message that this sends internationally.

The premier recently toured Asia touting B.C. natural gas as a means of reducing Asian greenhouse gas emissions arising from the burning of thermal coal. Even in the case of Japan, which is shutting down its nuclear reactors, the premier is arguing that B.C. should earn credits for potential greenhouse gas reductions. She argues that Japan could build coal-fired electricity plants if they don’t switch to natural gas — arguably a bit like me saying “give me a credit or I’ll buy an SUV instead of a hybrid.”

The B.C. government needs to be consistent with its approach to greenhouse gas management. We need to send a strong signal to the market that our principles: that the well-being of future generations of British Columbians are not for sale.

But this isn’t just about saying no to development. We can instead promote real opportunities for the growth of stable, well-paid BC jobs.

The Port of Prince Rupert is the third largest port on the west coast of North America and the closest to Asia. Prince Rupert also benefits from having the lowest-grade passes through the Coast and Rocky mountain ranges. This means that ships can get to Asia three days faster than from any other North American port, and trains can be longer, and burn less diesel, as they transport goods eastward.

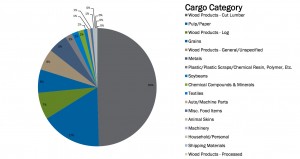

The modern Fairview container facility built in 2007 is a highly efficient direct ship-to-train system used for both importing and exporting goods to and from Asia. Most of the exports are wood products, grains, metals, and other resources and most of the imports are manufactured goods (see Figure).

Figure: Prince Rupert cargo category exports (left) and imports (right) by percentage of total. Source: Prince Rupert Harbour Authority.

The potential for job growth at this port is profound. Presently the container facility does not have a capacity for destuffing and restuffing containers upon their arrival from Asia. Let’s suppose a company like Walmart or Costco wants a large order of fridges, stoves, ipods, kettles, shoes and cell phones all manufactured in China. Right now, containers would come into the Port of Prince Rupert; they would be loaded onto a train and shipped to east or to the mid-west US where destuffing/restuffing would occur (in Chicago, for example). There is no reason why the containers couldn’t be destuffed and all of the Walmart or Costco orders restuffed together in their own containers in Prince Rupert instead of in Chicago. Such a process would involve hundreds of jobs and would give North American distributors faster and potentially less costly access to their inventory.

So together let’s say no to coal and yes to jobs.

Video – Andrew Weaver: Economy and Environment are one

July 3rd, 2013 Andrew Weaver made British Columbia and Canadian history as the first provincially elected Green Party member to speak in the legislature. The BC Liberal government, opposition and independent parties and members are debating the provincial budget in the current summer session, which estimate updates on revenue and spending due over the coming weeks.

July 3rd, 2013 Andrew Weaver made British Columbia and Canadian history as the first provincially elected Green Party member to speak in the legislature. The BC Liberal government, opposition and independent parties and members are debating the provincial budget in the current summer session, which estimate updates on revenue and spending due over the coming weeks.

The BC Liberal government has based medium and long term revenue targets largely on Liquefied Natural Gas (LNG) production and exports, which Andrew Weaver has aptly pointed out throughout the campaign, in the media and now in the House, is predicated on a price, and demand, which might not exist.

To base our economy on LNG is to risk subjecting BC’s economy to the boom and bust roller coaster of global fossil fuel pricing, with all its twists, turns and drops. Meanwhile, investors are increasingly highlighting the possibility of a global carbon bubble and the real economic risks that surround it. To attempt to lay all our eggs in this one basket, on the hope that we will be the one exception — the one jurisdiction that will defy history and economics— is to base our future on very unstable ground.

Yet even if we defy the odds, coast through the boom and bust cycles and breeze through the carbon bubble, we cannot achieve our provincial carbon targets while we double down on LNG. We will have no choice but to abandon our continent-leading, climate commitments. That’s not politics, it’s science. And the numbers just don’t add up. The carbon emissions associated with LNG development are simply too high to allow us to meet those targets.

However, there is a way forward – policies supporting clean technology and energy development – ones that were initiated by a BC Liberal government in 2008, and seemingly abandoned now.

You can watch the Hansard video of Andrew Weaver’s inaugural speech here.

Living the Pipe Dream: Basing BC’s Economy on Bubble Economics

It’s a daily occurrence these days. The BC Liberals tout the future prosperity of British Columbia as lying in the export of liquefied natural gas (LNG) to Asia. The NDP, in their characteristic fashion, quietly agree and let the Liberals take the heat on the economic projections.

The overvaluation of global oil, gas and coal reserves has led to recent warnings from reputable financial experts and organizations that a new financial risk could impact markets, corporate and government revenues as early as 2015 (see for example the recent article in The Guardian and this video).

There is no mention in either the BC Liberal or NDP platforms or policies of this systemic risk to the economy of British Columbia. They continue to pursue budget and spending projections almost solely based on resource revenue. Addressing this risk requires all parties to be forthright and publicly recognize that it exists. It will further require all parties to work together to achieve solutions that ensure a prosperous future for all British Columbians.

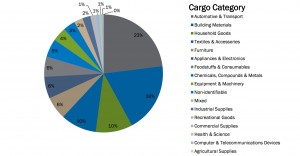

So what is all the fuss really about? Figure 1 shows the trend in the spot gas price in the United Kingdom, United Sates and Asia since 2003. The dramatic increase in the strength of the Chinese economy, coupled with the glut of natural gas in the North American market (due to widespread use of relatively modern horizontal fracking technology) has led to an equally dramatic spread in the spot price of natural gas between Asia and North America.

Figure 1: Trends in the spot price of natural gas in the US, UK and Asia in US$ per million BTUs (British Thermal Units). Source: Ernst & Young Report: Global LNG. Will new demand and new supp mean new pricing?

The argument is initially compelling. In British Columbia we have extensive natural gas reserves in the northeast sector of our province. If we can ship this gas to Asia, we stand to make a lot of money. But as you might expect, it’s not that simple. Let’s take a look at the facts:

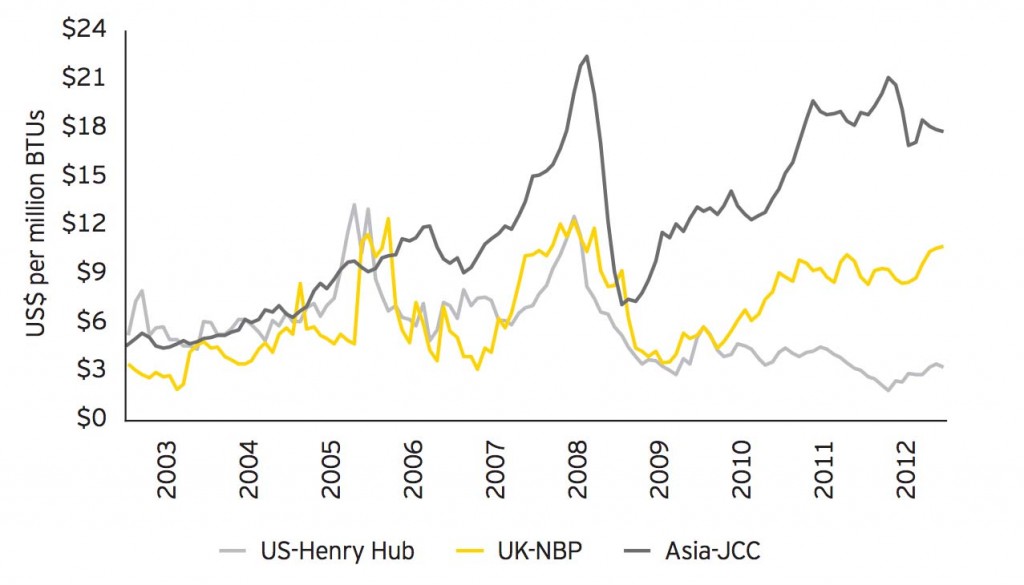

Fact 1: China has more than three times the reserves of shale gas as contained in all of Canada (Figure 2)

Fact 2: The US has more than twice the shale gas reserves as Canada (Figure 2)

Figure 2: Global shale gas reserves for countries assessed (light grey) in trillions of cubic metres. Dark grey regions were not assessed. Source: Forbes.com: China closer to joining shale gas fracking craze.

Fact 3: Australia is already shipping LNG to Asia and has similar reserves to all of Canada combined (Figures 2 and 3).

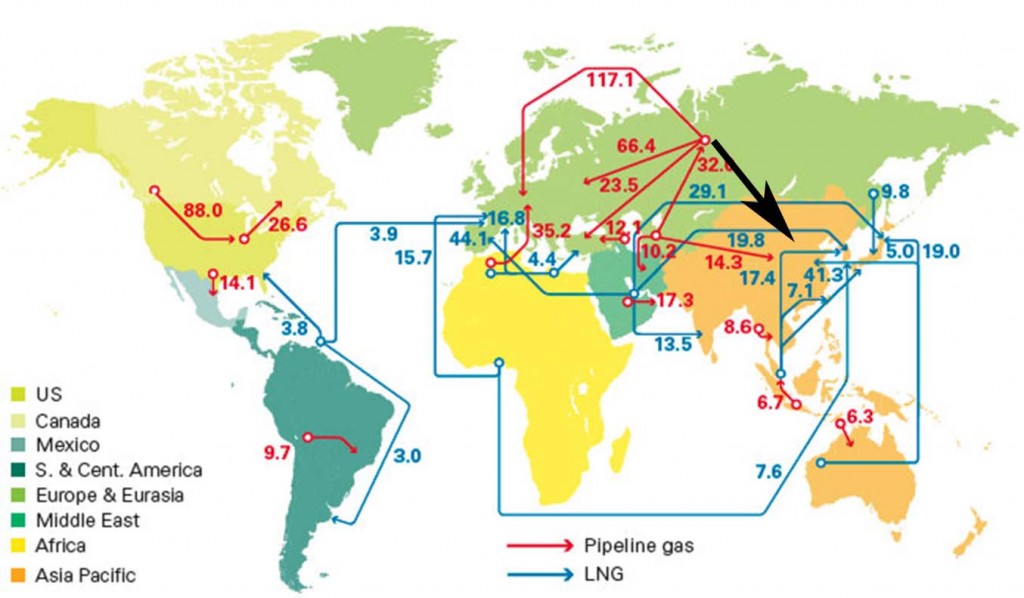

Fact 4: Russia is currently not shipping significant quantities of natural gas to China (Figure 3).

Fact 5: The United States presently imports LNG and so has terminals already built on its coast (Figure 3).

Fact 6: British Columbia does not have LNG terminals on the coast. It will take many quite a few years for them to be built.

Figure 3: Major trade movement of natural gas in 2011. The units are millions of tonnes. Blue indicates LNG; Red indicates pipeline transport. Source: British Petroleum Statistical Review of World Energy 2012.

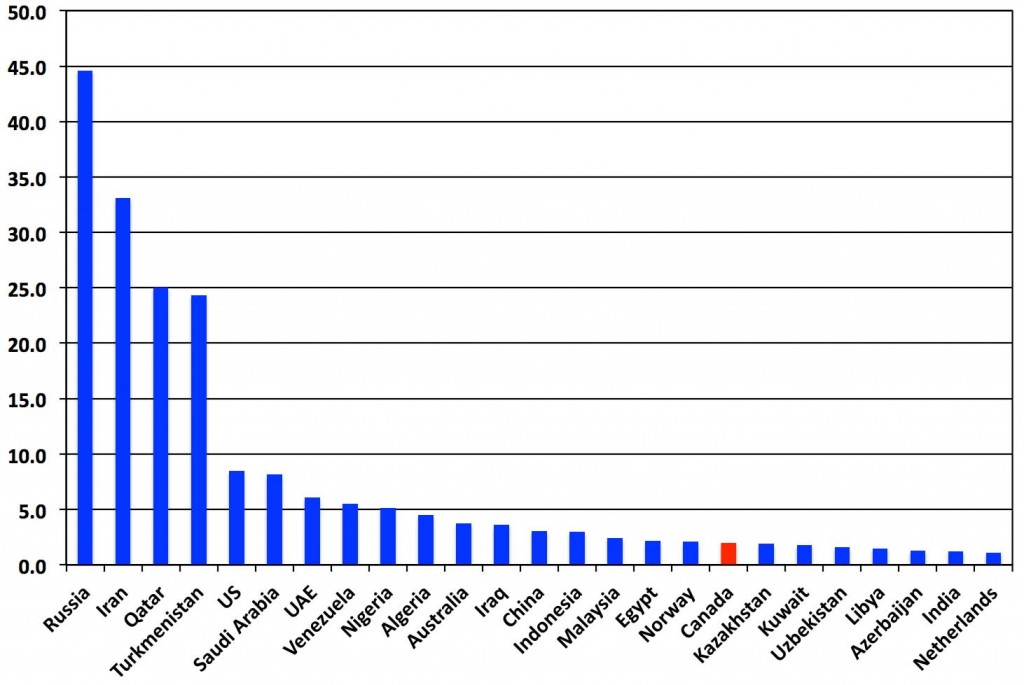

Fact 7: Russia has more than 20 times the proven natural gas reserves contained in all of Canada (Figure 4).

Fact 8: Canada has only 1% of the world’s proven natural gas reserves (Figure 4; British Petroleum Statistical Review of World Energy 2012).

Fact 9: China has signed long term contracts for natural gas supply with Russia (Source: United Press International). This natural gas would be supplied by traditional pipelines and would not need to be liquefied.

Fact 10: Experts are predicting a major economic crisis due to inflation of energy stock prices and the requirement for much of these resources to stay in the ground (Source: 1: The Guardian; 2:Unburnable carbon 2013: Wasted capital and stranded assets). Others are questioning the economics of BC LNG already (Source: Straight.com, Christy Clark’s dreams about natural gas revenue are starting to look like hot air).

Figure 4: Ranked magnitude of the proven reserves of natural gas in the top twenty countries, Canada is indicated in red. Source of data: British Petroleum Statistical Review of World Energy 2012.

It is simply a pipe dream to believe that by the end of this decade, the same natural gas price differential will exist between North America and Asia. It is also much cheaper to pipe natural gas directly from Russia to China than it is to liquefy it and ship it from North America. And as we have seen above, there is much, much more natural gas located in Russia. British Columbians deserve better.

In 2001, KPMG released its Cleantech Report Card for British Columbia. In it they identified 202 cleantech organizations in British Columbia whose revenues had increased 57% from $1.6 billion in 2008 to $2.5 billion in 2011. They noted that the industry was estimated to employ 8,400 people in 2011 with an average salary of $77,000. In their summary, KMPG state:

“while still young, the BC cleantech sector shows tremendous opportunity for growth. It’s a sector worth encouraging and promoting globally. It creates high-paying jobs and investment opportunities for British Columbians’, it’s export-oriented, and it’s helping to improve the sustainability of the planet.”

Just a few weeks ago, the LA times noted that in the United States, Green Jobs Grow Four Times Faster than Others. That is, there was a 4.9% increase in green jobs in the US from 2010 to 2011, compared to only 1.2% for all jobs. In total, there are 3.4 million green energy jobs in the US and 2.6% of all jobs are now in the green sector. They also pointed out that there was a 42% increase in clean energy business and development investment from 2010 to 2011 with the total now being $48 billion.

Let’s work together to ensure BC implements energy policy that manages the transition to a low carbon economy and guarantees British Columbians a prosperous future for generations to come. And positioning our province to become global exporters of new clean technology instead dirty fossil resources of is something all British Columbians would be proud of.

A Cleaner Path Towards Economic Prosperity for All British Columbians

An issue that I raised during the election campaign, and continue to bring up after getting elected, is the need to ensure BC implements energy policy that manages the transition to a low carbon economy and guarantees British Columbians a prosperous future for generations to come. I am deeply concerned that both provincial parties have developed platforms based on a future economy driven by the expansion of fracking and natural gas extraction in northeastern BC and the export of liquified natural gas to China. Both of these platforms fail the triple bottom line test of economic, social and environmental sustainability.

New technologies available around the world have meant that unconventional natural gas reserves are becoming easier to bring on line. The consequence is falling natural gas prices as there is a growing glut in the market. In fact, the US Department on Energy notes that China possesses the world’s largest recoverable shale gas resources, more than three times that contained in all of Canada. Even the US has more than twice the shale gas resource than Canada.

New technologies available around the world have meant that unconventional natural gas reserves are becoming easier to bring on line. The consequence is falling natural gas prices as there is a growing glut in the market. In fact, the US Department on Energy notes that China possesses the world’s largest recoverable shale gas resources, more than three times that contained in all of Canada. Even the US has more than twice the shale gas resource than Canada.

The NDP and Liberal position that their platform will create jobs is also short sighted. Very few long-term jobs will be created; the rest are short-term construction jobs that will need to be filled rapidly and likely by transient offshore or out-of-province workers. In fact, there are four times as many jobs in the film industry as in the oil, gas and mining sectors combined. An alternate approach might be to recognize that our existing natural gas resources have potential within the transportation sector as a transitional fuel. The potential for economic and job growth in this sector is large.

Under the previous BC administration, BC developed a leadership role in renewable energy technologies and the clean tech sector in general. Rather than supporting the growth in these industries, our current political parties are putting forward platforms that will make it harder and harder for these industries to compete. If BC cannot show leadership in this area, I don’t know who can. Without strong, independent voices in our legislature, I fear all the good work that has been achieved over the last few years will fall by the wayside.

I have been a strong supporter of Independent Power Producers (IPPs) playing a significant and growing role in BC’s electricity sector. I commend Gordon Campbell for showing leadership by engaging IPPs in producing an increasing share of BCs electricity market. It appears that this leadership is disappearing with the focus on northeastern BC’s natural gas and the weakening of the Clean Energy Act.

It is difficult for the clean tech sector to strategically invest in BC if there is no certainty in the procurement or regulatory process. This is particularly important as we move forward with the potential electrification of a growing fraction of the transportation sector. It is clear to me that industry understands the potential in BC for the clean tech sector. But industry needs to know that government also understands the potential for this sector.

BC Hydro’s lack of transparency and regularity in issuing calls for power is also of concern. A process needs to be established to allow local communities to have input into the type and scale of power projects that they would like to see developed. Engaging local communities with industry early in the process can establish a sense of local ownership and buy-in.

I believe BC needs to move forward as a renewable energy powerhouse in the North American market. In fact, I would like to see the Clean Energy Act amended to require that 100% of our electricity be produced by renewables and to increase the amount of power that BC exports. As we move towards the electrification of larger components of the transportation fleet and emissions pricing becomes a reality in a growing number of places (including California now with their cap and trade system), it is pretty clear to me that there will be increasing demand for renewables in the future. With strategic planning, BC can be a major supplier of this “green” energy.

BC is blessed with some very large capacitors (hydro dams) that could be better utilized in the years ahead. There is no reason why we cannot start to implement a smart grid system that is integrated across BC and into wider North American markets. With smart planning, large capacitors would play a major role in terms of load levelling (and water can even be pumped back up hill if there is excess winds, for example).

Large crown corporations with their burgeoning administrations and slow and opaque process of decision making are not known for their innovation and risk-taking. BC Hydro, in its current form may not be equipped to play the visionary role they need to perform. I think the role of government is to set the regulatory environment (i.e. Clean Energy Act, emissions pricing etc) and to provide a long-term vision for BC’s energy future. As a Crown Corporation, BC Hydro could become the visionary planning, advisory and contracting body that guides BC to become the energy powerhouse that it needs to be. With predictability and a plan, industry will find the solutions.

The Green Party of BC is unique in that it does not whip its members. I have made it clear that I will be moving forward with a campaign to promote renewable energy and clean tech on the provincial scene. That is why I spent the last months talking with a number of people within the clean tech sector. My approach fits in well with the Green Party platform and recognition of the need to move forward with clean energy production. Obviously I will also address numerous issues local to my constituency but, as Deputy Leader, I will be addressing provincial issues on behalf of the party and will make transitioning to renewable energy an important provincial imperative