Economy

Estimates debate with the Premier on demand side measures affecting the price of gas

On Wednesday of this week I rose during budget estimate debates for the Office of the Premier to ask a number of questions concerning demand side measures that affect the price of gas. Prior to me rising, the Leader of the Official Opposition had spent a fair amount of time accusing the Premier of somehow causing the recent rise in the price of gas. I was profoundly disappointed by the behaviour of the Leader of the Opposition. It appeared to me that he was more interested in trying to score cheap political points and finding gotcha moments than he was in trying to probe the supply and demand side of the price of gas.

When my turn came, I asked a series of questions to understand how the recent increase in the price of gas might have affected transit ridership, active transportation and the purchase or electric vehicles. The answers I received from the Premier were very clear — there has been a great effect.

Below I reproduce the video and text of our exchange.

Video of Exchange

Text of Exchange

A. Weaver: I’d like to start by saying I think it’s an important anniversary today. I believe it’s the two-year anniversary of the signing of our CASA agreement. With that I would suggest that this has been a rather unique time in the province of British Columbia with a minority government. I would suggest that the Premier would probably agree that the relationship has been fruitful, collaborative, at times challenging, without a doubt, but nevertheless, reaffirming the commitment that we made in CASA to work together.

That doesn’t mean we agree on everything. It means we that have a process to reflect upon our disagreements, and I would just like to canvass a few of the issues here. In particular, I’d like to start off with some of the issues with respect to the gas prices. I was listening with interest to the comments coming from the official opposition. I was somewhat flummoxed by the kind of apparent petro-stumping that I heard, and somewhat concerned that I did not perceive there to be a desire to actually support British Columbia in standing up for British Columbians, as opposed to supporting the gouging that is going on by certain elements.

I noticed that over the last few months, the Premier and this government have come up under fire, frankly, about the rising gas prices, and the official opposition has done what they can to try to distort the issue — frankly, to blame government — appealing to the worst type of populist politics.

I want to start my questioning by asking the Premier: what tools does he have to affect gas prices?

Hon. J. Horgan: I thank my colleague from Oak Bay–Gordon Head, the leader of the Green Party, for his questions and his interventions here today in the budget estimates for the Premier’s office.

Firstly, I’d like to say that we’re trying to find ways to bring down the cost of gasoline by talking to suppliers, finding ways to bring more supply into our region. That means talking…. Again, as I said to the Leader of the Opposition, we’re working on a plan that has not come yet to fruition, but I think in the next while, if I give it time, I’ll be held to that. But we’re working hard to try to find a way to increase our ability to affect what’s in the pipeline.

What we’ve been trying to do is work with the federal government, get an acknowledgment from our federal government, who now does own the pipe. Although they can’t dictate what goes into it, they have a bunch of mechanisms at their disposal to help us explain how the price went up so high and what we can do to bring it down in the short term.

But in the long term, the member will know, and he and I are both enthusiastic about this, we’re going to be moving away from gasoline in the first place. We want to see more people in electric vehicles. We’re putting in place, as he knows, incentives to see more people using electric cars. I drive a hybrid. You drive a full electric. We’re building charging stations right across British Columbia. I think we have over 1,500 now, or somewhere in that neighbourhood, right across the province.

We’re putting in place infrastructure to reduce the costs over the long term and also have a better environmental outcome. But that’s not happening today. Sorry, Member. The public expects, rightly so, that we will be doing what we can to do to bring on more supply so that prices can go down, so we can make that transition over a longer period of time.

A. Weaver: I concur. I accept the arguments brought forward by the Premier with respect to the ability to affect what’s in the pipeline. I found compelling the arguments that discuss the fact that in fact, the Trans Mountain was not about enhanced refined capacity. It’s all about increased diluted bitumen.

The Premier has referred to a multitude of things that could happen. One of the things that I have a concern on, and I’m going to frame a question in this regard, is that if we look back historically, virtually every year, as long as I have known, gas prices go up in the spring, and they come back in the fall.

The Premier will remember back in…. I forget. Whenever the Axe the Tax campaign was initiated by a previous government, it was during the summer months, right at the peak price, when there were record prices being set. The kind of rhetoric associated with that campaign kind of fell flat as the fall approached, because the price of gas came down.

My question to the Premier is: does he think it is prudent for a government to have a market intervention along the lines of what the member of the official opposition is stating, in light of the fact that essentially every year, we know that the price of gas goes down as we move out of the summer season, and in fact will fall naturally because of traditional supply and demand arguments and enhanced refining after, basically, the long weekend in September?

Hon. J. Horgan: I agree with the member’s premise, but this year seems to be, without any doubt, anomalous relative to others. That 40 cent increase, when only one penny a litre can be put to the carbon tax that we increased on April 1 — that is unusual. There is always an increase in demand during the travelling season. You and I have talked about that. I agree with you. But it’s never been that large. That’s why, when I asked my deputy minister about the margin question, the refining margin, why it had gone from 2½ cents to 24 cents, what happened there? And we did our best through inquiries to get an answer to that question, but we can’t compel people to testify. The Utilities Commission can, and that’s why we’ve punted the question over to them.

In the meantime, we need to continue to talk about how people can get out of their cars. That means investing in transit, which we’re doing in a big way, not just in the Lower Mainland but right across B.C. It means giving incentives to get off of fossil fuels and on to cleaner energy alternatives for our transportation needs. These are all long-term goals that we have in our plan, that you and I worked on together with the Minister of Environment as part of CleanBC. But for today, when people are looking at their summer season, they’re pretty unhappy about this, and I absolutely feel that and understand it. And we are trying to find ways to have temporary relief through mechanisms that we’ve been working on as well as coordination and cooperation from the federal government.

But you’re absolutely right: these cycles are traditional. And the Leader of the Opposition and his crew are saying that it’s a tax question, among others. That’s not the case. Do we have a significant amount of tax in our gasoline — federal transportation, TransLink and so on? Yes, we do, but that does not explain these wild swings, seasonal swings that you’ve suggested.

A. Weaver: I agree with the Premier. The refining margin in British Columbia seems to be out of whack with the rest of the country. I’m hoping that the B.C. Utilities Commission is able to explore this. I look forward to the results.

But on that note, I noticed that the official opposition was focusing on increasing supply, increasing supply, increasing supply. And at one point, they kind of walked away from that. They started introducing this kind of Marxist logic about introducing a price cap, which was just outrageous coming from a free market party. Unbelievable. I think they’ve walked away from this price cap.

Anyway, my question is on the demand side then. I suspect, knowing that, the last time we had some price hikes and the widespread move towards alternate forms of transportation, which did have a legacy effect…. I’m wondering if the Premier has any statistics about uptakes of electric vehicles, uptakes of transit ridership or uptakes of other modes of active transportation that have arisen as a direct consequence of the rising price of gas, and whether or not this has affected the demand side of the equation and whether or not, in fact, demand is dropping in British Columbia.

Hon. J. Horgan: I’m just asking if we can get the uptick in people using transit, because it will be significant. The member is quite right. In times of crisis, people modify their behavior. They do different things. They don’t go, maybe, out to the grocery store every other day. They wait, or they buy larger amounts so they’re not travelling as much.

But I can say, on our incentives to get people into electric vehicles, as you’ll know, we had to increase that budget three times last year, which means that there’s a big demand for people to get out of the lineup for gasoline and a big demand to get into the future, which is electric vehicles. Prices are coming down. They need to come down further so that more people can get into electric vehicles. But people are voting with their feet on this question, taking up the incentives that government is providing. The federal government is now involved as well. This is very good news.

Interjection.

Hon. J. Horgan: The transit numbers are coming. Because we’re short of time, perhaps I’ll just make sure that I can get those numbers to you and I can quantify the three increases. I think we had the budget number in February. We increased in September, Minister of Finance? And then again in November.

The money is available, which is unprecedented to have a program that you increase not once but twice during the course of that fiscal year.

A. Weaver: I just want to canvass just a little more on the gas prices. I think it’s important, because we had so much focus on the supply side and, I would argue, not enough focus on the supply side. The numbers I had heard I got from good sources. I’m hoping to confirm. I recognize that it may be a little outside the scope of the Premier’s estimates and be more into Energy and Mines.

I’ve heard that this year, upwards of 10 percent of all new vehicles in British Columbia have been electric, and pushing 15 percent in the last month. Can the Premier confirm these numbers, as to whether I’m in the right ballpark?

Hon. J. Horgan: The member is quite right. We’ve seen a continued increase in demand, and supply is now having challenges. Providers are having longer wait times to get vehicles. Actually, the member for Delta North managed to get his electric vehicle ahead of you. That’s because there is so much demand.

That, of course, means that Detroit — I say Detroit as the amorphous auto sector — is changing their production plans because they see a change in the marketplace. We see that with the incentives that I talked about, and we’ll be able to provide those numbers to you in some detail afterwards. But there has been a steady increase in demand for non–fossil fuel transportation mechanisms, and I think that is all good news for us. That, of course, requires industry to recognize that, and they have. But because of these longer wait times, they realized they have got to build more cars faster.

A. Weaver: The Premier mentioned the member for Delta North, and I am very jealous. The member for Delta North and I both ordered Hyundai Konas. I did about three months beforehand. He got his about one month before, and mine isn’t even here yet. He was able to go to a dealer that actually ordered them proactively instead of reactively. The Premier is quite right. The supply for these vehicles is troubling.

I’m wondering, on the issue of demand again, to what extent the Premier has explored or with his office explored the work that was done, the report that was done on mobility pricing in the greater Vancouver area. I’m wondering if he’s had any thoughts about where government is going in terms of the issue of mobility pricing — whether or not they’re thinking of that in Metro Vancouver or not.

Hon. J. Horgan: Just on the previous question, May is not finished yet, as you know. So 15 percent of the vehicles sold in May were light-duty EVs. That is unprecedented, as the member knows, and speaks well for the future. I think gas prices are a part of that, absolutely. People are saying: “Well, this might be the time to make that leap.”

We’ve been reducing costs for people — reducing medical services premiums, eliminating them; eliminating tolls; reducing fees for child care. But then on the toll question, the reason we eliminated the tolls…. It was just one area, one piece of infrastructure. When other pieces of infrastructure were being built, there was no toll ascribed to them. And the federal government, of course, has a policy that they will not fund infrastructure that has tolling on it. That meant that the Massey project, for example, was solely on the back of the provincial government.

TransLink has established a mobility committee, and they’ve been working diligently, I guess, for quite some time now. They were supposed to report back in the summer of 2019. We look forward to hearing from the region, the densest part of the province, with what their plans are. This is going to be largely an issue to be dealt with by residents in the Lower Mainland. Of course, we need to work with TransLink, with the Mayors Council to make sure that any mobility program that comes forward makes sense to the travelling public and that it is not onerous.

A. Weaver: To explore this a little further, the Premier mentioned the issue of the Massey Tunnel replacement, and he’s referred to this recently. As an issue, of course, we support the Premier in this regard. The bridge was…. I just didn’t quite understand it; twinning of the tunnel was more sensible.

My question to the Premier is this. As government is exploring this option — and I understand they’re doing it through consultation — are they considering active modes of transportation in the Massey Tunnel as well? Right now you can’t really get across that south arm of the Fraser with bikes and walking. I’m wondering if that is in the cards for a Massey Tunnel expansion if it happens.

Hon. J. Horgan: Yes, it is, Member. I was excited last week when I learned that the regional mayors have come to a consensus that they need to work together to address the congestion problem at Massey. Both the member and I are Vancouver Island members, so when we enter into the Lower Mainland, our first introduction to the challenges of transportation is the Massey Tunnel. That’s our way off the island. Get off the ferry, go through the tunnel, and you’re on your way into Metro. So we’re very seized of that.

The Minister of Transportation is working on that. We’ve got a study underway that will include multimodal transportation. We don’t want to just have the same old, same old, but we need to find a way to get it done in a cost-effective manner. The federal government will participate provided there’s no tolling infrastructure. Now, how mobility pricing fits into that, I think, is a discussion for, I would expect, after the federal election in October. We’ll see what the outcome is there.

But we’re very much aware that we can’t just keep building infrastructure to move cars and trucks. I will also say that in Metro, transit use is 437 million boardings in 2018, up 7.1 percent from the year before. Again, that speaks to…. We have a population increase, of course, but more and more people are choosing to use public transit. We have a safe, effective means of moving people around in our metro area. It’s cost-effective. People like it. And more success will breed more success.

A. Weaver: Those are impressive numbers. Actually, 7 percent is far and above any population growth for Metro Vancouver, I would suggest. That’s actually quite good news. I thank the Premier for that.

I know that one of the other issues with respect to…. I believe the government campaigned on this. I know we did as well. It was exploring the ways to deal with the affordability issue and somehow to incentivize zoning or taxation policies to incentivize density around transit hubs. I’m wondering if government has any exploration into this area about tools that they might use at their disposal to incentivize the densification in urban areas around transit hubs, whether or not that’s being considered.

Hon. J. Horgan: We don’t believe that incentives are required, but we do know that coordination is. That’s why, when I formed the executive council, I put the member for Coquitlam-Maillardville in charge of Municipal Affairs, TransLink and Housing, so that we could put all three of those critical areas under one roof so that we could coordinate our transportation links with density, ensuring that municipal governments, local governments, were participating and understood our objectives, and we understood their objectives.

But when we designate a transit line, density will come to that. But the challenge then becomes: are neighbourhoods prepared for that? That’s where the municipal activity takes place.

We’re confident that these things will come together, but we are also looking at property taxes and how that’s affecting small businesses. That’s become very topical in the past number of months, and that’s part and parcel of zoning issues that become…. This is what is possible here. All of a sudden, the value of the land goes to the possible rather than the real. That has a negative impact on business and on people.

I will say, also, people are lining up and looking at me. City of Vancouver, 2017 — 52.8 percent of all trips were made by walking, cycling or transit. That’s up from 48 percent the year before. Again, a 4 percent increase in activity.

People are voting on these questions with their feet, literally — walking, cycling. Finding other ways to move around reduces their carbon impact, reduces their costs. I believe government’s role is to work as best as we can — and you agree with this — to put in place a framework that will work to get people where they want to be. It makes for a better society. It makes for better communities.

Impromptu statement on global warming and intergenerational equity

Yesterday in the legislature I rose during Members’ statements to give an impromptu statement on global warming and intergenerational equity. The BC Liberals, as part of their petulant shenanigans during the last day of sitting of the BC Legislature, decided that they would boycott the two minute statements that occur everyday. As a consequence, several members scrambled to fill their normal speaking slots.

Below I reproduce the video and text of this statement.

Video of Statement

Text of Statement

A. Weaver: It gives me a great pleasure to rise, on this, the last day of the session, to deliver a two-minute statement.

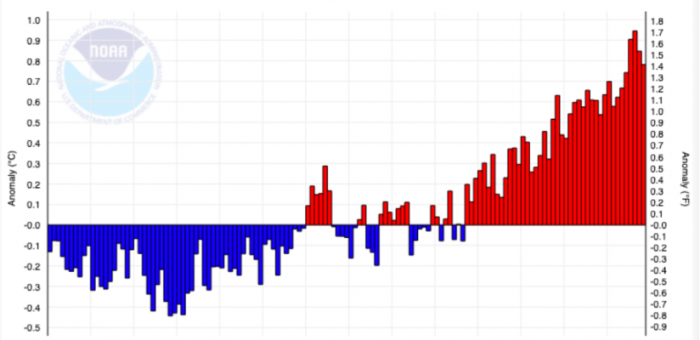

Prior to coming up to the Legislature today, I did what I often do. I took a look at the seasonal climate forecast for this part of the world. The seasonal climate forecast for the summer of 2019 in British Columbia is this: extraordinarily high probabilities of higher than normal temperatures and dryer than normal conditions. What does that lead to? That leads to yet another suite of conditions that will lead to forest fires in British Columbia.

I remind members that back in 2004, Nathan Gillett, Mike Flannigan, Francis Zwiers and I published a paper in Geophysical Research Letters where we identified the fact that we could detect and attribute the increased area burnt in Canada of forest fires directly to human activity. Since that time, similar papers have come out for Siberia, for the eastern U.S., for Europe and elsewhere. We know that the increasing forest fires in our country is a direct consequence of global warming.

In fact, the science of global warming goes back to 1824, when Jean-Baptiste Joseph Fourier was the first to recognize that the atmosphere was transparent to incoming solar radiation but was effective at blocking outgoing longwave radiation and kept the surface area of the planet warmer to allow life to flourish.

In 1861, John Tyndall, best known for his incredible sideburns, actually developed an amazing instrument that allowed us to detect the different radiative absorption properties of a diverse array of greenhouse gases.

In 1896, Svante Arrhenius, a famous Swedish Nobel laureate was the first to actually directly calculate the increasing warming associated with increasing carbon dioxide levels.

And in 1936, George Calendar was the first to make multi-century predictions as to what would happen as a direct consequence of increasing carbon dioxide.

In fact, the very first national assessment was done in 1979 — the year they graduated from high school — where Jule Charney from MIT was tasked with assessing what human contribution to climate change was. At that time, the best scientific estimate of the warming associated with increasing greenhouse gases was between 1½ and 4½ for a doubling of carbon dioxide. That number has not changed for 35 years of scientific research.

As we leave to the summer, I ask members to consider this. The question of global warming boils down to a single question. Do we the present generation owe it to future generations, in terms of leaving behind to them the quality environment that we were blessed with inheriting?

Intergenerational equity is the question — for those who make the decisions today don’t have to live the consequences of the decisions they made if the next generation will. I suspect those in the gallery, those children in the gallery looking down upon us today, would suggest that indeed it behooves us to put intergenerational equity front and centre in our decision-making.

Calling for a closer look into construction industry labour code policy

Today in the BC Legislature we continued our debate on Bill 30: Labour Relations Code Amendment Act, 2019 at committee stage. Recall from my second reading speech, this bill amends the labour relations code to make a number of changes to enhance protections for workers and implement the recommendations of an independent expert review panel.

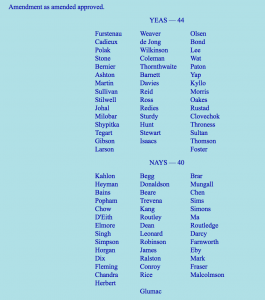

During debate on section 6 of the bill, the BC Liberals proposed an amendment concerning when and how raids can and should be allowed for. In particular, their amendment to section 6 was designed to bring the government’s proposed changes more in line with the recommendations of the independent panel.

Supporting evidence-based policy that restores protections for workers and ends pendulum swings in the labour code have been priorities for the B.C. Greens.

Supporting evidence-based policy that restores protections for workers and ends pendulum swings in the labour code have been priorities for the B.C. Greens.

My colleagues, staff and I engaged numerous stakeholders to develop a deeper understanding about the forces at play and concluded — as did the panel — that construction labour law is particularly unique. Because of these unique challenges, which include the transient versus stationary nature of the work place, we believed that it was essential to not simply pass Bill 30 legislation and move on. The construction industry and its workers deserve a thorough review; this hasn’t happened since at least 1998.

The B.C. Green caucus is in strong support of creating an independent panel mandated to address the unique realities of the construction sector, and to expand upon the recommendations of the current Labour Relations Code Review Panel. Until such an independent review is conducted, we felt it was prudent to follow the advice set out by the current review panel, and therefore supported the amendment (which allowed it to pass – see vote above). If a deeper dive identifies challenges with this, I hope that all members of the House would be prepared to support additional changes. We have heard loud and clear that there are numerous questions that remain unanswered and want to ensure a process is established that can get politicians objective analysis and recommendations to act upon.

More than anything, BC Greens believe that the legislation, which passed committee stage today, will go a long ways towards ending the ideological labour code tug-of-war that has been allowed to dominate labour code policy in BC for the past 30 years. We believe it will bring fairness, certainty and stability back to the labour code.

More than anything, BC Greens believe that the legislation, which passed committee stage today, will go a long ways towards ending the ideological labour code tug-of-war that has been allowed to dominate labour code policy in BC for the past 30 years. We believe it will bring fairness, certainty and stability back to the labour code.

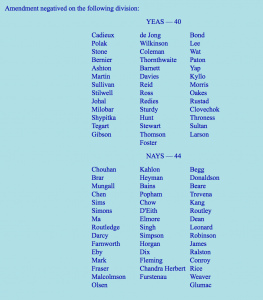

The BC Liberals also introduced a second amendment to section 8 of this bill that we could not support (for reasons outlined below – see vote to the left) as we believed it strayed from the intent of the independent panel’s recommendation.

While this bill took up an enormous amount of our caucus and staff time, I personally found the debates to be an excellent example of how the BC Legislature functions at its best. At all times, and at all stages of the debate, the decorum in the chamber was one of mutual respect. It was clear that Harry Bains, the BC NDP Minister of Labour and the opposition critics were passionate in their views but respectful in understanding the difference of opinions in the room.

I look forward to working with both government and the official opposition to further advance a labour policy review for the construction sector.

Below I reproduce the video and text of my speeches to the two amendments. I also provide a copy of some brief rebuttal remarks I made after the Minister of Labour spoke. At the end of this post, I reproduce the media statement our office released after the passage of the bill.

Videos of Committee Stage Debates

| 1st Amendment | Further Remarks | |

| 2nd Amendment |

Text of Speech in Support of 1st Amendment

A. Weaver: I rise to take my place to speak to the amendment that was brought forward by the member for Shuswap.

As we know, Bill 30 is a unique piece of labour legislation. It’s one of the first pieces of labour law that has received the broad support of members in this House.

Over the last 30 years, we’ve watched as labour policy in this province swings back and forth like a pendulum as government changed and as ideological fights play out. Putting an end to these pendulum swings, which create instability and division, was essential for our caucus. We further believe, as a caucus, in supporting evidence-based policy that ensures the protection of workers.

In this regard, the work of the expert review panel was essential. They made balanced and thoughtful recommendations as to how we could and should update our labour code in the province of British Columbia.

The amendment before us today, brought forward by the member for Shuswap, addresses one of the very few areas where what the government brought forward in the legislation before us differs from what the panel recommended.

Over the last few months, my colleagues, staff and I engaged with numerous stakeholders to develop a deeper understanding about the various forces at play in this issue of labour policy. What we learned through extensive consultation engagement is that construction labour law in the province of British Columbia is particularly unique. Yet my colleagues and I know that we are not the experts.

What rose from our engagement is the realization as to how essential it is to not simply pass the legislation, as is amended, and to move on from these issues, but rather to take the time to look deeper into construction labour law.

There are a number of challenges facing the construction industry that we firmly believe need to be explored further, including, of course, the question raised in the amendment before us concerning when and how raids can and should be allowed for. The panel itself acknowledged that there are construction-specific issues that relate to the changing labour code.

The B.C. Green caucus understands the profoundly unique nature of the construction industry. There are a number of examples that can be given. We know, for example, that in public sector unions or public sector sites, often people are in the same place for their job — on the construction site. We know that safety is often front and centre in deliberations on the site. We know that workers move from site to site to site. We know that is a very different type of working environment than, say, a stationary environment where you work in the same place.

We understand the special challenges that exist. We understand that there are unions like CMAW, like IUOE and others who actually are end-to-end project unions. We know, also, that present rules within the B.C. Federation of Labour do not allow unions to raid other unions in the Federation. So in the spirit of fairness and openness and transparency, this, to us, must be collectively addressed.

We understand that the construction sector needs a review. We understand that changes need to be there. But we also understand that the terms of reference of the panel precluded them from singling out this sector to actually provide a separate report and suite of recommendations for the construction sector.

In our view, we accept the numerous voices that told us that what they were seeing — whether you’re a representative from a union like CLAC or a union like IUOE or a union that wasn’t in the building trade, represented by the B.C. Fed — is that they’re looking for a fair and level playing field.

That is exactly what we’re looking for, one that’s grounded in evidence, not in ideology.

I come to this again, and I say this. IUOE, an end-to-end organizing union — let us suppose, hypothetically, that they go to a construction site and recognize that on that construction site, the workers there are being represented by an additional union, and that environment is not safe. Or, perhaps, there’s a multitude of unions. The IUOE, right now, is prohibited from raiding into those areas, if said unions there already are members of the B.C. Federation of Labour.

Now I come to the nurses’ union, when there was concern within the licenced practitional nurses with respect to them being represented by the health employers union. The concern was such that the licensed practition nurses felt that they would be better represented by the nurses’ union. A raid happened. The response, of course, was that the nurses’ union was kicked out of the B.C. Federation of Labour.

Is that fair? Is that actually what we’re aspiring to, here in the province of British Columbia? No. I think we’re aspiring to fair and transparent workplaces — that is, fair for all, not just for the chosen few and not just for those who have stood forward and actually have stronger influence, perhaps, with government than others.

That is why we are calling on the government to undertake a comprehensive, independent review of the construction sector, in addition to supporting the amendment before us now. There does not appear, in British Columbia, to have been a comprehensive review of this industry since 1998.

Now I’m not counting the kind of — what I would argue is a very one-sided — so-called review that occurred in the early 2000s, when the Liberals took over back then, because the building trades weren’t invited to the table. I’m not accounting a self-reflective review that’s also happened.

A proper fundamental review of how labour policy should be applied in the construction sector, I think, is long overdue in this province, because we know that in other provinces in the country, like Ontario, there are a hybridization of labour laws — one that treats stationary workplaces and one that treats transient workplaces or places where you’re not on the same site every day. We cannot expect the same labour policy to apply to stationary and transitory workplaces. The fact that we’re trying to squeeze a square peg into a round hole, to take bits and pieces of what the independent expert committee has recommended, is troubling to the caucus, because we appeal to experts for our advice.

We know, and we understand, and we heard from the construction sector that many of the sweeping changes that have been brought historically hurt that sector. We appreciate that. We understand that. We heard that. That is why we urge the government to commission a further sectoral review of labour laws in the construction sector. We support an independent review. We support a timely independent review, one with short time frames and one that looks at the unique realities of this sector of the economy and expands on the recommendations of the current labour relation code review panel.

In my view and in my caucus’s view, by doing this, we can ensure that we bring forward policy to this table that does create a fair, balanced, level playing field, grounded in evidence, not ideological or historical positions. I think, ultimately, that’s what most workers want. They want the opportunity for a fair and open workplace.

Until such time as this separate review can take place, we felt it was prudent to follow the advice set out by the current review panel and, therefore, support the amendment to ensure its language is reflected in this legislation. If a deeper dive identifies challenges with this, I hope that all members of this House would be open and prepared to support additional changes. Our caucus is. We’ve heard loud and clear that there are numerous questions that remain unanswered and want to ensure that a process is established that gets politicians objective analysis and recommendations to act upon.

More than anything, we believe, as a caucus, that we must end this ideological tug-of-war that has been allowed to take place in our province for far too long. It is not about union versus employer. It is not about worker versus employer. It is about doing what’s right to create a fair and balanced work environment for all workers in British Columbia. I think that that only will happen if we actually target this industry with a separate, independent, thoughtful review of the construction sector.

Further Remarks to 1st Amendment

A. Weaver: I just wanted to rise and address a couple of the comments there. I do appreciate the minister, and I think we’re very well served in British Columbia by the minister, who is very fair and open with his deliberations and so forth. I would say that, in listening to the minister’s speech there, he said a few things that were flags to me.

He talked about the fact that this was stopping workers from having a right to…. It does no such change. What we’re saying is that the expert panel recommendations were there as a suite. They were not there to pick and choose. We recognize and we’ve supported all of the recommendations. The important successorship changes — we supported that. In this particular case, what we’re saying is that we don’t think the expert panel did the work that needs to be done to carve out the construction sector and to look at that independently.

Now, the minister has suggested that he has the solution. That’s his view, and that’s fine. It’s his prerogative to have that. Our position is that we don’t have that information. We don’t have that information on which to make a decision in this area, because I suspect that the construction industry would have a lot more that might have to change if we actually went to a review.

I honestly don’t think the construction industry, in the province of British Columbia, has been served well. I don’t think they’ve been served well for many, many years. I come back to the issue that, if there are many sites, those will be represented by a multitude of other unions. But if you are a trade union — a building trade — you cannot raid into those unions. The minister says that that’s their right. It is their right, but it’s also our right as British Columbians to ensure that the playing field is level.

This is not about trying to create an us versus them — us versus CLAC or us versus Unifor or us versus the nurses. This is about recognizing that labour law must represent the diversity of views that are out there and be inclusive and respectful and grounded in evidence that will probably not get what everyone wants but builds forth to a policy that we can actually grow from, as opposed to a pendulum swinging back and forth.

That is one of our singular objectives: to ensure stability, consistency and certainty. We’re not convinced, and certainly no evidence was put for us, that with the change to the summer months, in fact, that will be maintained with an annual, as opposed to the existing recommendation within the panel.

With that, I’ll take my place.

Text of Speech against 2nd Amendment

A. Weaver: I rise to provide support to the minister with respect to his views on this amendment. We understand where the official opposition is coming from. On page 18 of the expert report — as the minister said, it is a superb report — the experts state as follows: “A successor union should be able to apply to the board to have a collective agreement reopened, and the board should have discretion to grant such relief in extraordinary circumstances, having regard to its section 2 duties. This would permit the exercise of this discretion where, for example, terms of the collective agreements are clearly inferior to the norm in the sector.”

The words there were contained in the preamble leading up to the formal recommendation. As the minister pointed out, we believe that in fact the expert panel were, in their recommendations, very thoughtful in terms of the exact usage of language. Were we to add the words “extraordinary circumstances” into the recommendation, I would suggest that this is actually going a step further, because the panel was actually quite careful in not using the words in the actual recommendation.

With that, I will take my place, noting that we will not support this amendment.

Media Release

B.C. Green Caucus Calls for Closer Look Into Construction Industry Labour Code

For immediate release

May 28, 2019

VICTORIA, B.C. –Supporting evidence-based policy that restores protections for workers and ends pendulum swings in the labour code are priorities for the B.C. Greens, and the expert panel’s recommendations should be expanded on to address the unique challenges presented by the construction industry.

“My colleagues, staff and I engaged with a number of stakeholders to develop a deeper understanding about the forces at play and have concluded- as did the panel- that construction labour law is particularly unique,” B.C. Green party leader Andrew Weaver said. “Because of these unique challenges, we believe it is essential that we do not simply pass this legislation and move on. The construction industry and its workers deserves a thorough review, which it hasn’t had since at least 1998. The B.C. Green caucus is strongly in support of a panel mandated to address the unique realities of this sector of the economy, and expands on the recommendations of the current Labour Relation Code Review Panel.

“Until such a time that a separate review, one more focused on the challenges of the constructor sector, can take place, we feel it is prudent to follow that advice set out by the current review panel, and therefore support the amendment to ensure its language is reflected in the legislation. If a deeper dive identifies challenges with this, I hope that all members of this House would be prepared to support additional changes. We have heard loud and clear that there are numerous questions that remain unanswered and want to ensure a process is established that can get politicians objective analysis and recommendations to act upon.”

The B.C. Green caucus supports other significant provisions of this legislation, which take important steps forward to better protect workers and ensure balance in workplaces. These include:

- Extending successorship provisions to protect workers in building cleaning/janitorial services, security services, bus transportation services, non-clinical health care services, and food services;

- Improved access and protection of collective bargaining;

- Removing education as an essential service.

“More than anything, BC Greens believe this legislation will go a long ways towards ending the ideological tug-of-war that has been allowed to destabilize the province’s labour code for the past 30 years.”

These amendments are necessary adjustments to existing labour law, but there is more work to do to address the other fundamental challenges facing the economy.

“Unfortunately, what continues to be missing from the conversation is a focus on how we can adapt our labour laws to support people grappling with the changing nature of work,” Weaver said. “From increases in precarious, gig-based jobs, to the increasing use of contractors instead of employees, British Columbians are dealing with huge changes to job stability and income security, and our laws aren’t keeping up.”

The B.C. Green caucus consults with government to improve fairness for workers and ensure balance in the workplace as part of the Confidence and Supply Agreement.

-30-

Media contact

Macon McGinley, Press Secretary

B.C. Green caucus

+1 250-882-6187 |macon.mcginley@leg.bc.ca

Public Consultation on the 2020 BC Provincial Budget

The Select Standing Committee on Finance and Government Services Committee’s Budget 2020 Consultation is taking place in June, 2019.

British Columbians can share their priorities and recommendations for the next provincial budget by speaking with the Committee at a public hearing in-person or via teleconference, making a written, audio or video submission or completing an online survey.

Registration to reserve a speaking time will be available beginning Monday, May 27 on the Committee’s website.

Teleconference opportunities are available by calling 250-356-2933 or 1-877-428-8337 (toll-free in BC).

Speaking times will be 10 minutes – 5 minutes for the presentation and 5 minutes for questions from Committee Members.

The Committee will be holding public hearings in 15 communities from June 10-14 and June 17-21:

Colwood, Kimberley, Castlegar, Kelowna, Kamloops, Courtenay, Qualicum Beach, Vancouver, Prince Rupert, Kitimat, Prince George, Fort St. John, Quesnel, Abbotsford and Surrey.

In accordance with the Legislative Assembly’s commitment to accessibility, public hearings take place in accessible settings. Every effort will be made to accommodate any additional accessibility requirements, including the need for interpretive services.

The opportunity to make a written, audio and video submission, or complete the online survey will be available beginning June 3, 2019 on the Committee’s website.

The public consultation takes place every year and the Committee considers the priorities expressed by the public and develops recommendations for the next provincial budget. Your input and the Committee’s recommendations are included in a report to the Legislative Assembly that is publicly released on or before November 15. This year, the Committee intends to release its report by late July/early August.

For full details on how you can participate, visit the website

To receive updates on the consultation, email FinanceCommittee@leg.bc.ca to be added to the email distribution list.

The deadline for all input is Friday, June 28 at 5:00 p.m.

Committee stage for Bill M209: Business Corporations Amendment Act, 2019

On Tuesday and Wednesday of this week we debated Bill M209: Business Corporations Amendment Act, 2019 at committee stage. As noted earlier, this is my Private Members’ bill that proposes amendments to the Business Corporations Act and will create a new Part 2.3 in the Act that enables companies to become benefit companies.

Below I reproduce the text and video of the entire debate at committee stage. The bill passed Committee Stage and third reading and now awaits Royal Assent. I also append at the end the media release my office issued upon passing of the bill.

Videos of Committee Stage Debates

| May 14 | May 15 |

Text of Committee Stage debate (May 14)

BILL M209 — BUSINESS CORPORATIONS AMENDMENT ACT (No. 2), 2019

The House in Committee of the Whole (Section A) on Bill M209; R. Glumac in the chair.

The committee met at 4:17 p.m.

On section 1.

A. Weaver: It gives me great pleasure to rise at committee stage for this bill. As the members are aware, this is a rather novel process and procedure here, so I hope members will bear with me, as it might take slightly longer than usual.

The Minister of Finance is here with her staff. Unfortunately — or fortunately — I’m not able to communicate with her staff. I may have to ask questions of the minister of a technical nature with respect to the broader Business Corporations Act, in which case, she would respond to the question via information from her staff through consultation with them.

My staff, Sarah Miller and Stephanie Siddon, are back there in the public gallery, and I may have to walk over to them to chat with them in the public gallery because they’re not able to be present behind us.

This is interesting. We’re sort of breaking new ground here, so I thank everyone for their indulgence as we move forward.

M. Lee: Well, with those words of introduction by the member, I’d just like to ask if we could we could just have a general understanding in terms of this particular bill and the way that it was drafted. What model was used for the purpose of this bill?

A. Weaver: Could I start by asking for a clarification as to what the member means by the term “model?”

M. Lee: Well, for example, the other word that could be used is “precedent.”

A. Weaver: Right now in Canada, there are no other provinces that have a benefit company legislation. So in essence, there is no precedent in the Canadian context on which this legislation is based.

M. Lee: Were there any other precedents used from any other jurisdiction?

A. Weaver: The process involved in the drafting of this bill was extensive, over the period of about two years. We started…. Initially the issue was brought to us by members in the business community who were concerned that there was no avenue for which they could incorporate to recognize the direction they wished their company to go.

In British Columbia, the member will be aware that we have the C3 networks brought to us by small business — that in fact this does not work for some of them because of the asset lock associated with C3s. So we essentially drafted this through extensive consultation with independent lawyers, with third-party advocates, with the business community. We held stakeholder engagement meetings in Vancouver several times, and we worked through the legislative drafters.

In the legislation, there was our legislative drafter assigned to us who put the draft together. We had many iterations of that. We worked through the Ministry of Finance to get feedback from the Ministry of Finance as well. They, too, had comments that we tried to incorporate. That led to the bill that is before us today.

The member will recall that I first introduced the bill last spring and left it on the order paper for a six-month period. It died on the order paper at the end of the fall session. The goal of doing that was to gather feedback from broader stakeholders to ensure that we were reflecting that feedback in this particular bill.

M. Lee: Thank you for that response. In terms of the level of consultation, can the member please just provide some further detail around the types of groups and the level of response and feedback that was received?

A. Weaver: Over the past year, we consulted with a number of stakeholders, as I mentioned, including business leaders, owners of C3s. It was very important to us that the C3 community was supportive of this direction we’re proposing. We met with stakeholders in that community, both C3 businesses as well as some key advocates who were involved in advocating for the C3 business model here in British Columbia, as well as lawyers.

We also consulted on the legislation in the fall of 2018 with lawyers from the Canadian Bar Association, in particular, to ensure that it fit well within the Canadian law context. We met with several academics at various times, and we had round tables with business owners several times, twice actually, and a few dozen people came in that regard.

M. Lee: Well, I think it’s important, of course, in this process. We have also heard, as a B.C. Liberal caucus, from members of the community who have specific considerations, which we’ll be talking about during the course of the review of this bill, section by section.

Just with that in mind, from the time that this original bill was tabled in the spring session, what changes and what considerations have been made to the original form of the bill versus this current one?

A. Weaver: The bill refines the previous version of the bill introduced last spring to better fit into the current statutes. We took the last draft, the one that the member referred to, into consultation. We sent it to the Canadian Bar Association to get feedback from them. It removed the requirement….

The key change was that we removed the requirement for benefit companies to change their name, as the feedback we got from stakeholders was that this would be viewed as cumbersome and a significant barrier to adoption. There were a few subtler changes that were made with respect to the role, the duties of acting directors. A slight change there and also another small change with respect to section 157, under section 7 of our act here.

M. Lee: In terms of the considerations about this bill, it has been said, of course, that the B corp. original framework comes in the U.S. context. So what differences are in this current bill that are different from the B corp. model?

A. Weaver: This bill does not refer to B corp. in any way, at any time. The B corp. is a third-party verifier of benefit companies in the U.S. context. So there is no reference of B corp. in this legislation.

M. Lee: We will certainly talk about the necessity of having a third-party standard-setting body when we get to section 5 of the bill. But in terms of the actual framework in the U.S. context, what differences are there between this legislation from similar legislation in the United States?

A. Weaver: I developed, in consultation with ministry staff, stakeholders legislation in the context of Canadian law and British Columbian law. We did not focus on U.S. law, so I am not able to answer the question to the member’s satisfaction because I did not base this on anything to do with U.S. law.

M. Lee: So again…. Well, let me reserve the question, then, in terms of standard-setting bodies to that particular section.

In terms of any other considerations around how benefit corporations would work in Canada, were there any tax considerations that were driving part of the drafting of this bill?

A. Weaver: Tax considerations were not front and centre — or actually considered — in the drafting of the bill. Our concern in drafting the bill was providing a mechanism and a process to allow those companies which wish to incorporate as benefit companies a process to do that. It would ensure that directors would be able to, and under the benefit company legislation, they must act beyond just the fiduciary responsibility and the benefit company legislation provides an avenue to do that.

To the member’s question. I suspect what he’s…. Correct me if I’m wrong, but what I suspect he’s trying to get at here is: why do we need this legislation in Canada versus the United States?

We know that it’s generally recognized that Canadian corporate law does not have a strict shareholder primacy that they have in the U.S. We recognize that. So directors of companies in Canada already have more discretion to pursue a broader mandate beyond maximizing shareholder profits. We recognize that.

We also recognize that directors of ordinary companies are held to the standard of acting honestly and in good faith with a view to the best interest of the company. It’s likely that this standard is sufficient right now to allow directors to consider other stakeholders beyond shareholders. We understand that.

However, we’ve heard from many businesses operating in this space which choose to pursue a triple bottom line, that approach to business. This legislation before us would help them feel secure in pursuing their mission.

For example, the legislation would provide a simple standardized framework for companies to adhere to that is legally and commercially recognized. It would provide clarity for directors and shareholders about the nature and mandate of the company and its goals. It would provide reassurance to individuals wishing to be directors of benefit companies that they are free to pursue the triple bottom line, and it would provide certainty for impact investors of the nature and mandate of the company.

Finally, it would enable companies to attract capital while being true to their mission as they grow. That’s an important distinction from the C3s, which, in British Columbia, were brought forward as a model, but it is a model that is also associated with an asset lock, which has precluded many impact investors from actually investing in the said C3 companies.

The legislation would also encourage more companies to pursue socially responsible and environmentally sustainable approaches to business, creating beneficial outcomes for society as a whole and leveraging the power of business to help us tackle significant social and environmental change.

I hope that’s addressing where the member is going.

M. Lee: It’s more than addressing where I was going, but I’m happy to have that conversation at this point. We had some of this discussion, of course, at second reading.

Certainly we continue to hear, in the community, questions about the need for this particular legislation. To ask the question this way, in the description that the Leader of the Third Party has talked about in terms of the need for this particular bill, when he looks at that list of items, what are the particular items that aren’t already provided for under the Business Corporations Act, in terms of corporations that are able to function, with these good purposes in mind, that isn’t already provided under the current act?

A. Weaver: There’s a rather extensive answer to this question, because I think it’s an important question. I’ll start by noting that it’s important for us to recognize that Canadian law is distinct from U.S. law. The member has referred to B corp., which is a U.S. third-party verifier.

We don’t have the shareholder primacy concerns here in Canada that they have in the U.S. However, case law in Canada has made it quite clear that directors of Canadian companies may consider other shareholders in their decision-making.

This bill before us goes much further in that difference. It recognizes the difference. It holds directors of benefit companies to an even higher standard. Rather than saying “directors may,” directors of benefit companies must consider their impact on environment and on people affected by the company’s conduct, and they must balance this duty with their traditional duty to the best interests of the company. That is a very important difference between existing law and what benefit companies are doing.

This would represent a novel and significant development in our law. In light of this significant addition to the duties of the directors, we wanted to ensure that the directors are willing to take this extra step and aren’t opening themselves up to substantially more liability by trying to do good. That’s why we chose to provide these protections in the legislation.

The legislation moves beyond existing legislation. It reduces risk for those directors and companies that wish to move down into triple-bottom-line approach.

We further consulted extensively with the B.C. branch of the Canadian Bar Association, and the lawyers who reviewed the legislation as part of this consultation did not actually raise the concerns that the member is suggesting. In fact, practising lawyers who work with clients in this space…. These are the ones in the field who are working with clients who have asked about this. They argue that the protections for the directors included in this legislation are critical. They have been recommending to their clients that they not actually go beyond the kind of fiduciary responsibility because of the additional risk that is being taken up. We sought to find a middle ground here between accountability and protection from directors that is reflected in this legislation.

The member may refer to the rather well-known BCE case. I will suggest that that case is the one that made it quite clear in case law in Canada that, in fact, directors may go and consider issues beyond the fiduciary responsibility. However, the federal government recently, in their budget measures implementation acts, actually codified this BCE as legislation in the federal statute.

In our view, as I said, this is an important addition that is not covered under existing case law in the context of the broader bill.

M. Lee: I think we’re in general agreement there are good purposes to have companies act in a responsible and sustainable manner with the aims of elements of what is described in public benefit. Certainly, I can appreciate the reduction of director liability that is spelled out in this bill. And again, we will get to that section of the bill, but I think it’s important, at the outset, to understand the overall framing of the bill and the reason for it.

This is the reason why, when I look at our corporate act, the Business Corporations Act, and the case law that surrounds that act and other similar legislation in this country, it obviously does not preclude companies from reporting on their environmental management, their impact on communities and their local community activities, for example, in places in which they operate.

Certainly, when you look at any annual report or any public disclosure required for any publicly traded company, you have that level of the disclosure and measure around the aims of that corporation.

What I’m hearing from the member, of course, is that the difference under this bill is that those particular aims are being spelled out specifically, and as a result, we need to lower director responsibility in terms of how they might be held accountable for meeting that public benefit.

I guess it does invite the conversation around what is the member’s view on what is good corporate citizen behavior in this country. And though we have an expectation under our corporate statutes today that companies that are incorporated under the Business Corporations Act — corporations that don’t get incorporated under this new act if it passes…. What is the expected standard of those companies to act in the same way that we might see for a benefit company?

A. Weaver: Thank you. I appreciate the question.

First off, to clarify, this legislation does not affect the fiduciary responsibility of a director at all. It’s no difference between a benefit company and any other company.

However, in the case of the benefit component of the benefit company, the liability is reduced from a pecuniary one to one that is simply injunctive relief. So what we’re saying is that in the case of the benefit, the reduced liability is in the injunctive relief.

To the member’s case about: “We expect good corporate citizens in British Columbia….” Well, we might expect that, but the only way to test that is to go to court if you don’t like a decision, and that would preclude the average person from actually taking that step. We have some examples where companies have wanted to actually stand up and do more.

The recent example of Loblaws, for example. Shareholders rejected a proposal by Loblaws that wanted to talk about considering moving forward with the living wage. So shareholders very recently reject this proposal. So now Loblaws, if they were to introduce that, could open themselves up to a challenge, because the shareholders rejected the proposal on living wage.

Had Loblaws incorporated as a benefit company, and in their benefits they had specifically stated articles that were there to ensure that their employers were treated in a particular fashion, then the protections would be there for their directors to actually introduce the living wage in their workforce without the fear of actually having a legal challenge to them that would lead to financial penalties.

They could have injunctive relief sense — they could be told not do that — but with the benefit provisions there, it protects companies from doing what they want to do. The Loblaw example is a great counter-example to what happens when we don’t give an avenue for companies to actually do the good they want to do, because shareholders don’t want them to do that.

So while in theory, in the theoretical world, the notion that companies right now may do good if they wish — and the BCE ruling underpins that, and now federally, the federal government is moving through to enshrine that in their Budget Implementation Act — it’s still in optional fashion.

We believe — and the fact that many companies came to us with this as an example of their frustration — that it was critical to actually provide this opportunity to allow companies to move towards this kind of new approach. It is innovative. It’s novel. It’s been incorporated in a number of states in the U.S., as the member alluded to, as well as Italy and a few other jurisdictions. And as we move forward, I think you’ll see that the uptake is quite exciting.

M. Lee: I think it’s important to understand the distinction and the aims of this bill. It’s also important to keep in mind the unintended consequences that might occur with some of the provisions of this bill, which we’ll get to. But I think it’s important to say that I would have thought that, as members of the Legislative Assembly, we have every expectation that companies will meet many of the objectives of this bill, and they’re able to do that.

Certainly, in terms of shareholder proposals under the Business Corporations Act, there are requirements for when a shareholder puts forward a proposal to a general meeting of shareholders for a company. That’s something that, for good governance purposes, it’s necessary to set out in that set of protocols. But here, just to ensure that…. When we start playing with and adjusting the responsibilities of the directors, and also how public benefit will be defined — which is in the public interest of this province, presumably — these are the areas of the bill that we’ll be exploring.

But I just wanted to at least have on the record that discussion to understand the general thinking behind this bill. So thank you for that.

Sections 1 to 3 inclusive approved.

On section 4.

M. Lee: If I could invite the member to just walk through with us the requirements of where a benefit report will be maintained as per the provisions of the Business Corporations Act, subsection 42(1)(q.2).

A. Weaver: Section 46 of the act is modified to add after No. 4, which states: “Any person may, without charge, inspect all of the records that a company is required to keep under section 42, other than the records referred to in section 42 (1) (l) to (o) and (r) (iii), if the company is a public company, a community contribution company, a financial institution or a pre-existing reporting company.” That’s subsection 46(4).

We’re suggesting to add 46(4.1), which adds, as well, that: “Any person may, without charge, inspect the copy of the benefit report that a benefit company is required to keep under section 42(1)(q.2).” The location of keeping the records is no different from any other company.

Section 4 approved.

On section 5.

M. Lee: I first wanted to ask the question about the public benefit definition. It’s been commented upon to us that this actually is a weaker definition than what’s appearing under equivalent charity legislation, whether it’s societies or others. Could the member comment on comparing this definition versus other similar definitions for charitable organizations?

A. Weaver: I’m going to ask the minister, after I’ve responded, whether she has any additional insight. When we move beyond the immediate bill, it’s a little more difficult, without the depth of expertise, to know how some things relate in other areas.

I will say that what we did is we focused quite extensively on the Business Corporations Act, section 51.91, which is part 2.2, Community Contribution Companies. In that, there’s a definition called community purpose. In there, it’s defined as this: “Community purpose means a purpose beneficial to (a) society at large, or (b) a segment of society that is broader than the group of persons who are related to the contribution company, and includes, without limitation, a purpose of health, social, environmental, cultural, educational or other services, but does not include a prescribed purpose.”

We modelled our definition of benefits based on the definition of community purpose as per the community contribution companies, the legislation of which was brought forward by the previous government.

To continue, if I go to the…. I must get to my bill here. With respect to the public benefit, here what we tried to do was we tried to be inclusive to ensure that we weren’t prescriptive of exactly what that benefit would be, inclusive to allow a class of persons, as outlined here, as well as the environment. So it’s broader, but it’s modelled after the C3 legislation.

I’ll take my place and perhaps the minister may supplement that.

Hon. C. James: I think the definition is there. It’s a broader definition. That’s basically the difference. It’s more expansive, a broader definition than the member was describing. So I wouldn’t describe it in the way the member described it. I would describe it as a more expansive, broader definition.

M. Lee: I guess the linkage on this would be, looking forward, something we’d consider under the same section. So I guess we can speak to it, if we can jump back and forth, because section 5 of the bill obviously has numerous subsections, which I certainly would like to go over.

Just where public benefits is utilized, under subsection 51.993(a)(ii), for example, it says that the: “director or officer of a benefit company… must (a) act honestly and in good faith with a view to (ii) promoting the public benefits specified in the company’s articles.”

Was there a consideration around the use of the word “promoting,” as opposed to some other word that actually might reflect action?

A. Weaver: With respect to the word “promote,” we did not seek alternate words for the word “promote” there. However, the key aspect of 51.993(1), in our view, is…. And the action is in (b), where it states specifically that the director or officer of a benefit company must “balance the duty under section 142 (1) (a), with the duty under paragraph (a) of this subsection.” The balancing aspect is the action that we believe is needed.

M. Lee: I think we’ll be on section 5 for some time, given the nature of the provisions that are all under section 5. Maybe we could just speak to the balancing aspect there. In terms of the way this was drafted, it appears that one reading of this provision may be that when you look at the actual section in the Business Corporations Act, under subsection 142(1)(a), that sets out the requirements of how a director must act “honestly and in good faith with a view to the best interests of the company.” And as the member spoke to, “best interests of the company” has been really thoroughly canvassed and defined under case law as to what that means, in terms of a more expansive definition interpretation.

Sub (b), “exercise the care, diligence and skill that a reasonably prudent individual would exercise in comparable circumstances, (c) act in accordance with the Act and regulations, and (d) subject to paragraphs (a) to (c), act in accordance with the memorandum and articles of the company” — which, of course, in the articles, can state a specific set of purposes for which that company is incorporated. That exists today I note.

In terms of the sub (b) portion of 51.993(1)(b), as the member just mentioned, there is language that says “balance the duty.” So could I ask the member for how this provision with that lead-in language is intended to be interpreted? And does it qualify the existing standard of director responsibility under subsection 142(1) of the Business Corporations Act?

A. Weaver: Thank you to the member for the question. Section 142 of the act, as the member noted, says that “(1) a director or officer of a company, when exercising the powers and performing the functions of a director or officer of the company, as the case may be, must (a) act honestly and in good faith with a view to the best interests of the company.” Stop there. Nothing in the bill changes (b), (c) or (d) in section 142.

However, what we’ve done here is say in Bill M209, 51.993(1)(b), that one must balance what’s in the best interests of the company — that’s 142.1(a)— with the thing immediately above it. That is that the directors are expected to “act honestly and in good faith with a view to (i) conducting the business in a responsible and sustainable manner, and (ii) promoting the public benefits specified in the company’s articles.”

This is the subtle difference. We are adding that section, which suggests that we’re now saying that those two must be balanced with 142.1, which is the duty to “act honestly and in good faith with a view” to the best interest of the company. So we’re extending this beyond just the company, without touching the (b), (c), (d), which are the “exercise the care, diligence and skill, etc., act in accordance with the act, ect., and subject to paragraphs (a) to (c) etc.”

M. Lee: I just suggest with the drafting that’s here that the word “balance” may suggest that there’s a greater priority where there may be some conflict with how a director is to meet their duties, whether it’s duties to act in the best interests of the corporation or duties to promote the public benefits as set out in the company’s articles, which would be an example of how we would fit those two provisions together.

Let me ask, first of all, whether the member, in terms of the consultation, has received comment on this particular provision? Because we certainly have received letters recently, in the last few days, about concerns around this particular provision, for example.

A. Weaver: I think I would have received the same emails, because I believe the member and I were copied on the same emails. There were three people who contacted us who had very similar concerns. We had many others who contacted us who did not share those concerns.

In this case, I think what we’re trying to do here is…. We recognize the word “balance” is one that needs to be coupled with some more protection for directors, which is why we’ve added just the injunctive as opposed to monetary relief.

In the bill, down in section 5 of 51.993, you’ll see there it says: “Despite any rule of law to the contrary, a court may not order monetary damages in relation to any breach of subsection (1).” The reason why we’ve done that is because, in the attempt to balance the best interests of the company with promoting the public benefits and conducting the business in a responsible manner, we recognize that we want to protect directors who are trying to do that. So injunctive relief is available to shareholders, but not monetary relief with respect to the benefit component of it.

We have received extensive feedback from a variety of people. This issue was raised by a couple. We disagreed with that, as did others.

M. Lee: I appreciate the view of the member in terms of the feedback he’s received of concerns.

I don’t know that it’s necessarily a numbers situation in terms of greater quantity in favour versus against, so to speak, for concerns. I do recognize the concerns that have been shared with the member and myself and others, other colleagues in our B.C. Liberal caucus here.

But I think the other way of coming at balance is actually to read this against 51.993(3), which does speak specifically to this specific example I gave, because in each case, it refers to section 142(1)(a) of the act. That specifically, explicitly says the “director or officer of a benefit company does not contravene the duty under section 142 (1) (a) of this Act due only to the director…acting in accordance with subsection (1) of this section.”

I guess the way this is drafted, it does turn back on itself in the sense that you’re not found to be in breach of that section of the act, which is to “act honestly and in good faith with a view to the best interests of the company,” as long as you’re balancing the purposes of promoting the public benefit specified in the company’s articles with that particular duty.

It would suggest that in a situation where a director may be found not to have acted in the best interests of the company, that director would not be in breach of what is a section of the corporations act which applies to every other director for the companies that we spoke about earlier in this province, as long as that director was attempting to balance the other public benefits that are specified in the company’s articles.

In my view, what that would suggest is that there is, effectively, a lowering of standards, let’s say, because that director no longer has to meet what is set out in the act in section 142(1)(a). Is there a concern that the way this bill has been drafted and composed, we’re effectively enabling directors of benefit companies to meet a lower standard?

Hon. C. James: The Finance Ministry, as we’ve said, has gone through the bill and has taken a look at the clauses. Just to touch on this piece, certainly our interpretation is that you still have the duty to act in the best interests of the company. None of this changes that. That requirement is still there, and adding duties doesn’t actually take away from that clause, doesn’t take away from the requirement still to meet the best interests of the company.

It adds the balance, I think, as the member has described. As he suggested, it talks about the balance, but it in fact, in our interpretation from the Finance Ministry, does not take away the requirement and the duty to still act in the best interests of the company. That still remains in the legislation, and that would be our interpretation.

A. Weaver: Just to clarify, that is our interpretation as well, and I thank the minister for providing that.

M. Lee: I did mention earlier that I will have a series of questions relating to section 5. They’re quite encompassing in terms of the main nature of this bill. I appreciate the response from the Minister of Finance as well as the member.

I would like to just come back, then, to section 51.993(3) of this bill, under section 5. Just on a plain reading of the words that are there in (3), it does say that the director does not contravene the duty under section 142(1)(a) of the act. So in what circumstances would a director acting in accordance with subsection (1) of this section be seen not to have contravened that particular section? What does that director need to do?

A. Weaver: I’m going to ask the Minister of Finance to provide some further clarification, but to address this first, I’d like to draw the member’s attention to 51.993(3). The key words there are “due only.” It says here: “A director or officer of a benefit company does not contravene the duty under section 142 (1) (a) of this Act due only to the director or officer acting in accordance with subsection (1) of this section.”

To give a specific example, let’s suppose, hypothetically, I’m Loblaws and I decide that I would like…. Because I’m a benefit company and in my articles, I have an article that I believe it’s important to pay living wages, and I believe it’s important to treat employees in a certain way — some articles in that regard. The fact that I’m doing that and that is a benefit as defined in 51.993(1)(a), that by itself does not undermine my ability to act in good faith, with the view of the best interests of the company.

That is essentially saying that if a director, due only to trying to apply the benefit as articulated in 51.993(1)(a)…. Due only to that, that in and of itself does not undermine the director’s ability to act honestly and in good faith with the view to the best interests of the company. I think it’s quite clear, and the keywords are “due only.” Perhaps the minister could expand on that.

Hon. C. James: I think the keyword, as the member has said, is “only” in this section, from our read. It spells out that a shareholder wouldn’t be able to sue a director focusing on the additional duties that have been put in so the sustainable manner, etc., would mean they contravened their requirement to act in the best interests of the company.