Economy

Reintroducing legislation to support companies pursuing environmental & social goals

On May 14, 2018 I first introduced Bill M216: Business Corporations Amendment Act, 2018. This bill passed second reading on May 17, 2018 but was not called for committee debate during the 3rd session of the 42st parliament. As such, I reintroduced a slightly revised version of the bill today: Bill M209: Business Corporations Amendment Act, 2019.

This bill proposes amendments to the Business Corporations Act and will create a new Part 2.3 in the Act that enables companies to become benefit companies. These companies will have to meet certain requirements, including:

- Committing in their articles to operate in a socially responsible and environmentally sustainable manner, and to promote specific public benefits;

- The directors must act honestly and in good faith to pursue public benefits and consider the interests of persons affected by the company’s conduct

- Reporting publicly against an independent third party standard.

The choice to become a benefit corporation status is completely voluntary and has no impact on other existing corporations, other corporate forms, taxes or government regulation

It’s generally recognized that Canadian corporate law does not have a strict “shareholder primacy” rule as the US does, so directors of companies in Canada have more discretion to pursue a broader mandate beyond maximizing shareholder profits. However, this legislation is needed to

- Provide clarity for directors and shareholders about the nature and mandate of the company – avoid the risk of a shareholder challenge regarding the director’s duties;

- Provide certainty for impact investors of the nature and mandate of the company;

- Enable companies to attract capital while being true to their mission as they grow;

- Protect the vision of the founders of benefit companies from shareholder challenges;

- Provide a simple framework for companies to adhere to that is legally and commercially recognized.

This legislation would also encourage more companies to pursue a socially responsible and environmentally sustainable approach to business, creating beneficial outcomes for society as a whole and leveraging the power of business to help us to tackle significant social and environmental challenges.

Below I introduce the video and text of the introduction of this bill. I also attach a copy of the media release that we issued today.

Video of Introduction

Text of Introduction

A. Weaver: I move that a bill intituled Business Corporations Amendment Act, 2019, of which notice has been given in my name on the order paper, be introduced and read a first time now.

This bill amends the Business Corporations Act, adding a new part to the act that would give companies in British Columbia the ability to incorporate as benefit companies. This legislation would support companies that choose to put the pursuit of social and environmental goals at the heart of their mission. Benefit companies would embed a commitment into their articles to operate in an environmentally sustainable and socially responsible way and to pursue public benefits.

B.C. is home to a number of incredibly innovative and socially responsible companies that want to play a bigger role in addressing the challenges we face collectively. This legislation is one that government can support and encourage business to take on this critically important role in our society.

Mr. Speaker: The question is first reading of the bill.

Motion approved.

A. Weaver: I move that the bill be placed on the orders of the day for second reading at the next sitting of the House.

Bill M209, Business Corporations Amendment Act, 2019, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Media Release

B.C. Greens introduce legislation to support companies pursuing environmental and social goals

For immediate release

April 10, 2019

VICTORIA, B.C. – The B.C. Green caucus introduced legislation today to provide a legal framework for B.C. businesses committed to pursuing social and environmental goals to incorporate as benefit companies under theBusiness Corporations Act.If passed, the bill would become the first Private Member’s Bill from an opposition party to be passed directly into law in British Columbia.

“B.C. Greens are showing a path forward, both by supporting companies committed to pursuing a triple bottom line who choose to embed social responsibility and environmental sustainability right into their corporate DNA, and also by demonstrating yet another way a small caucus can offer leadership within a stable minority government,” said MLA Andrew Weaver, leader of the B.C. Green Party.

“B.C. is home to incredibly innovative companies that want to play a bigger role in addressing the challenges and opportunities we face – climate change, rapid changes in the nature of work, the gig economy, rapid technological advances, and growing income inequality,” said Weaver. “This legislation is part of positioning our province to be a leader on the cutting edge of global economic trends. We are seeing shifts in consumer patterns and behaviour, particularly among younger demographics sensitive to their social and environmental impact. By becoming the first jurisdiction in Canada to create benefit companies, B.C. can best position our economy for success.”

Government recognizes the impact B.C. businesses make in their communities, and has been supportive of the concept of benefit companies.

“I want to thank our partners in the Green Party Caucus for bringing this idea forward,” said Carole James, Minister of Finance. “Many B.C. businesses are leaders in building sustainable and socially responsible practices into their enterprises. We’ve worked closely with our minority government partners to create this opportunity for B.C. businesses to choose a new corporate structure that includes their social and environmental goals.”

The legislation amends the Business Corporations Act, and would enable companies to incorporate as a new type of company in B.C., a benefit company. Benefit companies would embed into their articles two commitments: operating in a responsible and sustainable manner, and pursuing specific public benefits. Directors of benefit companies would need to balance this broader mandate against their traditional duty to pursue the best interests of the corporation. Companies would also need to report their progress against an independent third-party standard. This legislation would ensure that mission-driven companies can stay true to their mission as they grow, and it would help them to attract capital by providing investors with certainty about the mandate of the company without being overly prescriptive with regards to how companies must spend profits.

“B.C. is already home to number of socially responsible companies,” said Weaver. “But government should do more to support those companies that want to create environmental and social value. More companies want to follow the leadership of the early adopters, so let’s give them the framework that will best support them as they take on this critical work.”

Quotes:

Catherine Warren, CEO, Vancouver Economic Commission-

“As Vancouverites and British Columbians, we are proud to be a hub for bold, mission-driven companies, so it comes as no surprise to us that B.C. could pass the first benefit company legislation in the country. Jobseekers, international businesses, and investors with common values come here to build on common ground. The Vancouver Economic Commission is focused on inclusive, resilient economic development and prosperity for all. We recognize that we can always do more – to help local companies lead for people, planet, and prosperity – and VEC’s sees this legislation as one way to ensure that social and environmental values advance tomorrow’s economy.”

Chris Arkell, co-founder of Sea to Sky Removal-

“As a company focused on waste management in the construction industry, we wanted to hold ourselves to the highest available standard of public accountability. Unlike traditional corporations, companies like ours are committed to considering the impact of their decisions not only on their shareholders, but also on their stakeholders – workers, suppliers, community, consumers, and the environment. This legislation would strengthen our ability to maintain our core values even as future directors, management or ownership changes may happen.“

Michelle Reid, sustainability czar, Mills Office Productivity-

“We have been a B.C.-based family business for 70 years. Multiple generations of our family have continued our founder’s commitment to delivering office products ethically and sustainably. This legislation sends a strong signal to the market that businesses like ours are moving in the right direction. We thank the B.C. Greens for showing the way forward for more companies to join us in doing the right thing for our customers, our community and our planet.”

Quick Facts:

What does this legislation do?

- This legislation provides a simple framework for companies to adhere to that is legally and commercially recognized and creates a higher standard, by requiring that:

○ Directors act with a broader purpose with respect to society and the environment, and balance this commitment against the best interests of the company.

○ Companies promote a specific “public benefit”, or a positive effect.

○ Directors must publish an annual report that describes the company’s activities in relation to their benefit commitments, and they must select an independent third party standard to report their work against.

- This legislation creates clear expectations about the nature and mandate of the company and provides protections for directors who choose to prioritize public benefits, not only profits.

- It will provide certainty for impact investors of the nature and mandate of the company.

- It will enable companies to attract capital while being true to their mission as they grow.

- It will protect the vision of the founders of benefit companies by embedding the environmental and social benefits into the company’s mandate.

How do benefit companies differ from Community Contribution Companies (C3s)?

- Government introduced C3 legislation in 2012 as a hybrid option between for-profit businesses and non-profit enterprises.

- C3s and benefit companies are complementary ways for government to support a spectrum of socially and environmentally responsible business.

- C3s are subject to restrictions related to their allocation of profits and their transfer of assets, while benefit companies would have no such restrictions.

How can a company become a benefit company?

- A company can become a benefit company by altering its notice of articles to include the required benefit statement through a special resolution, which would require two-thirds approval to pass.

- A company would need to include in its articles a commitment to operate in an environmentally sustainable and socially responsible manner, and to promote one or more specific public benefits.

-30-

Media contact

Macon McGinley, Press Secretary

+1 250-882-6187 |macon.mcginley@leg.BC.ca

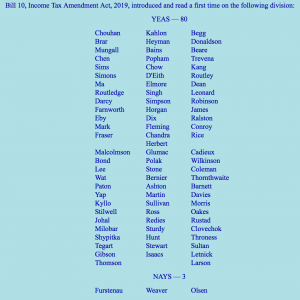

BC NDP & BC Liberals reveal they’re really two sides of the same coin

Last week the BC NDP and BC Liberals joined forces to pass Bill 10, Income Tax Amendment Act, 2019. This bill created tax credits and a fiscal regime for what will become the single largest point source of carbon emissions in Canada’s history two days after a government report confirmed that Canada is warming at twice the rate as the rest of the world, with the North, the Prairies and northern British Columbia pushing to nearly three times the global rate.

The BC Greens already voted against the Bill at first reading and at second reading (where we introduced three amendments to kill the bill that were all defeated). During our numerous speeches, Adam Olsen, Sonia Furstenau and I argued that it’s time politicians level with British Columbians about the economic and environmental consequences of this historic betrayal of future generations.

During committee stage of the bill, my BC Green colleagues and I voted against each section of the bill. It was during this stage that I was also able to find out that LNG Canada has no requirement to hire locally, despite BC NDP promises to the contrary. In addition, I was able to determine that the BC NDP have a moving definition of what “cleanest LNG in the world:” actually means.

| Section 1 | Section 2 | Section 3 | Section 5 | Title |

|---|---|---|---|---|

|

|

|

|

|

When section 4 of the bill was discussed at Committee Stage, the BC Liberals proposed an amendment that would strike out section 4b in the following:

4 The following Acts are repealed:

(a) Liquefied Natural Gas Income Tax Act, S.B.C. 2014, c. 34;

(b) Liquefied Natural Gas Project Agreements Act, S.B.C. 2015, c. 29.

That is, the BC Liberals did not want their Liquefied Natural Gas Project Agreements Act repealed.

While the amendment was being debated there were a dozen or so MLAs in the chamber, and when the Assistant Deputy Speaker called for a verbal vote on the amendment the “Ayes” won. This simply means the MLAs in the chamber collectively said “Aye” louder than those saying “Nay” (I stayed silent). Given that the BC NDP lost the verbal vote, a number of them (and I) called for “Division” (a standing vote). Not interested in quibbling about how the deckchairs on the Titanic should be arranged as it starts to sink, I left the room. My colleagues Adam and Sonia were in other meetings in the building and were not present.

While the amendment was being debated there were a dozen or so MLAs in the chamber, and when the Assistant Deputy Speaker called for a verbal vote on the amendment the “Ayes” won. This simply means the MLAs in the chamber collectively said “Aye” louder than those saying “Nay” (I stayed silent). Given that the BC NDP lost the verbal vote, a number of them (and I) called for “Division” (a standing vote). Not interested in quibbling about how the deckchairs on the Titanic should be arranged as it starts to sink, I left the room. My colleagues Adam and Sonia were in other meetings in the building and were not present.

The standing vote led to a tie: 41 BC Liberals for the amendment; 41 BC NDP against it. The 3 greens were not interested in amending a section we were about to vote against and so were not present. The tie was broken by the Assistant Deputy Speaker (a BC Liberal) and so the amendment passed, but not without controversy. The Assistant Deputy Speaker is supposed to be a non-partisan role.

The standing vote led to a tie: 41 BC Liberals for the amendment; 41 BC NDP against it. The 3 greens were not interested in amending a section we were about to vote against and so were not present. The tie was broken by the Assistant Deputy Speaker (a BC Liberal) and so the amendment passed, but not without controversy. The Assistant Deputy Speaker is supposed to be a non-partisan role.

In cases where there is a tie, there is a convention that should be followed to preserve confidence in the impartiality of the Speaker’s office. But here, the Assistant Deputy Speaker voted her “conscience” and the amendment passed. Moments later the amended section was put to a vote. Adam Sonia and I voted against that.

On Thursday last week the bill came up for third reading. Adam, Sonia and I rose to speak a final time. Sonia was shut down early by the speaker and so was unable to move an amendment to send the bill to a Legislative Committee. Adam and I both moved amendments, that Sonia spoke to, as we tried to persuade the BC NDP and BC Liberal MLAs the scale of the sellout embodied in Bill 10. Sadly, our two amendments failed and third reading passed.

| Amendment to Committee | Hoist Amendment | Third Reading |

|---|---|---|

|

|

|

Below I reproduce my third reading speech as well as my speech to Adam’s hoist motion in both text and video format. I also reproduce a copy of the media release that we issued once Bill 10 passed.

Without a doubt, witnessing the BC NDP and the BC Liberal MLAs collectively vote against the three BC Greens fourteen times on this bill made it abundantly clear to me:

The BC Liberals and the BC NDP are two sides of the same neo-liberal coin.

3rd Reading Videos

| 3rd Reading & Motion to Send to Committee | Hoist Motion |

Text of 3rd Reading Speech

A. Weaver: I must say I am deeply troubled and deeply disturbed by the precedent set today in this Legislature at a time when it is quite clear from the standing orders as to the rules and regulations with respect to reading at third reading. We have been following very clearly the rules as demonstrated in the standing orders. I rise to speak to speak at third reading against this same bill.

My colleague from Cowichan Valley didn’t have the opportunity to bring forward this important information that has been brought to light during the debate, important information that is required by members of this chamber in order to make their decision, important information that reflects on the very nature of the bill-debating before us. The natural gas tax credit. The changes in the calculations that are being put forward.

It is only through a complete understanding of the complexities of the nuances in this bill, in the context of the global picture, that we are able to make an informed decision in this House. To have my colleague — to have her shut down in debate because of an interpretation that I believe is flawed is simply outrageous.

I do apologize for my comments here, but never before have I — in sitting here for six years in this chamber — seen what I believe to see: an interference of a member’s right to enter a debate on an issue subject to the standing orders that we have had guide this place for generations. I continue, as to provide the important information.

I see the House Leader for the government. They’re talking to the Speaker. I would suggest that is out of order as well in this moment here. So I continue.

Deputy Speaker: Member, the Chair would welcome any comments related, relevant, to Bill 10. So nobody is stopping anybody making those comments. I would urge the member to limit those comments just to the bill. Please carry on.

A. Weaver: These comments are to Bill 10. Bill 10, as has being articulated here, introduces three things. One, it tries to repeal the LNG Income Tax Act.

I would like to publicly note that right now, the House Leader of the government is providing advice to the Speaker in the Chair. In my view, that is outrageous. That is not something that should be happening. This is a non-partisan position. To see witness the Speaker getting advice being provided is surprising.

On to Bill 10.

Deputy Speaker: Member, please take your seat. The Chair will again urge all members who wish to speak on this bill in third reading: keep your comments relevant to the bill. That’s all we are asking for. The member wishes to continue? Please proceed.

A. Weaver: I do wish to continue, and I do apologize for challenging the decision there. But as I said, it’s troubling. I will continue on focusing solely on the bill, the number of points raised in the bill.

As I pointed out, there are three points in there. The first, of course, is the repealing of the LNG Income Tax Act. The second is the repealing of the Petronas agreement, the LNG project development agreement, which we now know — through the rather interesting amendment put forward by the opposition that has passed — will not be repealed as part of this. We enjoyed watching those deliberations and interesting to see how that moved forward.

We also know that the B.C. NDP, in this bill, are trying to retain the giveaway, the natural gas tax credit giveaway that is embedded in the original LNG Income Tax Act. We have three aspects of this bill. We have articulated in second reading time and time again….

I see in the gallery a young group of children, and I welcome them to this place. I would suggest to them, as we continue to explore this bill and the ramifications of this bill, that members in this House actually think about their future, members in the House actually recognize that this generational sellout embodied in this giveaway is not doing their future any good. Frankly, it is a betrayal of their future.

As my colleague from Cowichan Valley tried to articulate, there have been a numerous number of articles appearing that have highlighted the reason why this bill and the actual elements in it are inconsistent with the government’s goal to try to reduce greenhouse gas emissions. It is inconsistent to give away a tax credit to this industry that would not otherwise be here in British Columbia in a desperate attempt to try to deliver what Christy Clark couldn’t. That’s it. That’s the only rationale I can see behind this moving forward.

As my colleague from Saanich North and the Islands, who will speak after me, brings forward information on the bill, I would hope that members opposite, members in the B.C. Liberals, who have been saying for so long that they do not believe that this giveaway is actually fiscally responsible…. The member for Langley East was quite clear in that regard. The member from Abbotsford — not only was the member for Abbotsford West clear, his deconstructing of the job narrative that was supposed to be here was compelling. This government did not provide any information to back its claims that this agreement embodied in this bill would actually hire British Columbians.

In fact, just today I received an email from a contractor up in the north who validated the concerns I raised about Boskalis hiring temporary foreign workers. Today I received that email.

We are going to vote on a bill at third reading where information provided at the committee stage was either not provided in entirety or not delivered. We have yet to be given information. We were told in committee stage that we had to ask the Minister of Jobs, Trade and Technology questions before we get answers to the issues of how this would affect jobs. Those questions were delivered to the Finance Minister in committee stage, yet we did not get answers to those questions. How is it possible that we could actually vote in favour of bill where the answers were not forthcoming to fundamental questions raised by members of opposition and by members in the Green Party at committee stage?

It seems to me that if ever there was a reason to actually not continue forward and vote on this, if ever there was a reason to actually send this bill to committee for further deliberation and debate, that information would be the fact we didn’t get answers. It’s for that reason that I move:

[That the motion for third reading of Bill (No. 10) intituled Income Tax Amendment Act, 2019 be amended by deleting all the words after “that” and substituting therefore the following:

“Bill (No. 10) not be read a third time now but that the subject matter be referred to the Select Standing Committee on Finance and Government Services.”]

A. Weaver: The rationale for proposing that this bill be sent to committee, as put forward to you a few seconds ago, is that the information we were trying to seek at committee stage was not forthcoming.

The information about jobs, the information about where the $23 billion was going to come from, the fiscal breakdown, was not forthcoming. The information on contractors, who was going to be contracting — not forthcoming. Information on emissions and whether this initial final investment decision is actually a pathway to a four-train system — not forthcoming.

It is only through the exploration of this matter further at committee stage, it is only by bringing in expert testimony — the expert testimony from people like Katharine Hayhoe, who my colleague from Cowichan Valley tried to bring forward here…. She tried to actually bring that information to this chamber, to allow members to actually inform themselves prior to a vote.

The only means and ways that members truly will be able to actually recognize the scale of climate change, the scale of what is before us here with this bill, in terms of the generational sellout of those young children and their friends up in the gallery…. It is only through exploring this at committee stage that we will actually be able to get to the bottom of whether or not this truly is in the best interest of British Columbians.

We know that members of government’s caucus have not even been briefed on the details of this bill, and we have, as three Green MLAs, had to brief them on the details of this bill. It is sad that we have, in this chamber, so many MLAs who have not spent the time to actually go and get the information on what we’re debating before us.

That is why a committee, a legislative committee exploring this issue, bringing forward recommendations, deliberations on what is supposed to be a big project for B.C. but is, in reality, the single biggest point source of emissions that this country has ever seen, at a time that this government’s claiming it’s championing climate change policy.

This needs to go to committee, and I certainly hope members in the government will join us in supporting this, for democracy is about seeking input. It’s about making decisions based on evidence. It’s about going to the communities across British Columbia — whether it be the farmers, the farmers in the Peace, who came to us, who came to our caucus to brief us on the profound issues they have with the way the fracking is happening on their farmland, that they are considered second-class citizens.

The fact that the committee would be able to explore the views of the youth of today — the views of the youth of today who today, across this country, are getting ready for Friday. It’s another day of walkouts in schools, another day of walkouts as youth point to the political leaders and say: “You are ignoring us. You’re not going to have to live the consequences of the decisions you are making. Yet we are, and you are not including us. You are not thinking about our future in your decisions. You are thinking about your re-election. You’re thinking about what it takes to score a tick box in a ‘I did what Christy Clark couldn’t.’ And you’re doing what you think is actually the best thing that you can do based on focus groups, polling testing, etc., not doing what’s right, not doing what’s principled.”

It is sad. The saddest moment, for me, again coming back to why this should be sent to committee, is I look to what was raised when I was interviewed by CFAX this morning…. I was challenged by Al Ferraby, and I enjoy being challenged. I was challenged by Al Ferraby, who said: “What’s this about you not wishing to participate in a vote?” And we talked about that. He said: “What’s this about the member for Abbotsford West with this phrase?”

Well, I could talk about this later. But the point I’m trying to make is that I’m hoping, for the first time in the six years I’ve been here, members in government, back bench, will reflect upon these words, reflect upon those children in the gallery, as they stand up at third reading and determine the future of this bill — the future of this bill which my colleagues, numerous times over the last few days, have pointed out betrays our climate commitments, betrays future generations, provides false promises to the people in northwestern B.C., who are already seeing the temporary foreign workers coming in.

We know that the only way to actually get to the bottom of these very important questions is through committee, because we did not get the answers at committee stage. We need to send this to a standing committee.

Again, wouldn’t it be a joyous occasion if members opposite, who have criticized this deal for being fiscally irresponsible…. We agree with them. We agree with them that it’s fiscally irresponsible. If they then joined us in voting to send this to committee, to allow a committee to actually explore the level of fiscal irresponsibility embodied in this bill, to challenge the claims, give us the chance to explore with the Minister of Jobs, Trades and Technology what the real job deals are. Have there been secret sweet deals signed with certain people about bringing in temporary foreign workers?

With that, I’ll take my place and certainly hope that others will join me in supporting this amendment

Text of Speech in Support of Hoist Amendment

A. Weaver: I rise to speak very briefly in support of my colleague’s, the member for Saanich North and the Islands, hoist amendment on the bill.

My colleague, I think, has made a very, very compelling case as to why we need the additional six months’ time to reflect upon it. More so, I would suggest, members in this House, have not received the information that they need to make a decision. I’ve heard many talk about the importance of evidence-based decision-making. It’s something that’s fundamental to who we are as members of the B.C. Green caucus. I’ve heard others in this place talk about the importance of that. Yet, we know that the information, the evidence on which to make such a decision, has not been presented to us here in committee stage.

We know that this bill has three components to it. It has a component to repeal the Liquefied Natural Gas Project Agreements Act. There’s a component to repeal the LNG Income Tax Act. And there was, at the same time, a component of the bill to retain the tax credit — the corporate welfare on steroids — that existed within the LNG Income Tax Act. We know, in what has got to be described as a bizarre set of things that have happened here, that we’ve broken precedent in this place. We’ve broken historical precedent in Westminster parliamentary democracies during the course of these debates, not once, but twice during the course of these debates. That, in and of itself, I would suggest should give us pause to reflect upon this bill with the additional time that we would get through this hoist amendment.

We had an amendment put forward by the B.C. Liberals, an amendment to quibble about where the deck chairs on the Titanic should be prior to the Titanic sinking to the bottom of the ocean. We had an amendment that actually led to a tie vote — 41-41. With respect, in the long, rich tradition of Westminster parliamentary democracies, we had a precedent set that goes directly against the historic nature of this building, where a Chair votes out of conscience in a partisan manner with the opposition. This is outrageous. It’s outrageous, given that we, at the same time in the U.K., had the ruling set out why the Speaker in the U.K. ruled with government. That is the role in a Westminster parliamentary democracy of a Chair, to ensure that the debates flow forward.

That was our first precedent-setting decision. Very, very unfortunate. But that was not the only one. The second one, too, gives reason to pause as to why we need to reflect upon this bill for a few more months, because clearly, the process in this place, leaves a lot to be desired. That was my colleague from the Cowichan Valley, who spent many, many hours going through the media to determine what information was missing, in order to inform members on the decision that was going to be made today — information that was not present, not given during committee stage, information that she took upon herself to find and bring forward. She was shut down at third reading. The member was told to sit down. Her voice was silenced. Outrageous.

Two times during the course of the last 48 hours, two times we’ve had such statements. That is why it’s critical for us to reflect upon this.

With that, I’ll take my place and suggest to members opposite that this is the time for us to actually reflect upon the implications of this. I certainly hope we’re joined in voting in support of my member’s amendment.

Media Release

BC enables landmark emissions source same week report finds Canada warming at twice the global rate

For immediate release

April 4, 2019

VICTORIA, B.C. – Today, the BC NDP and BC Liberals passed into law tax credits and the fiscal regime for what will become the single largest point source of carbon emissions in Canada’s history two days after a government report confirmed Canada is warming at twice the rate as the rest of the world, with the North, the Prairies and northern British Columbia pushing to nearly three times the global rate.

“This legislation is not only lacking vision to bring BC into a competitive economic future, it is compounding the massive challenges we have before us today in the form of extreme weather events: massive fires, droughts, and flooding,” said Dr. Andrew Weaver, leader of the BC Greens and award-winning lead author of four United Nations Intergovernmental Panel on Climate Change reports. “The BC NDP and BC Liberals are together sending BC down the wrong path with new fossil fuel subsidies and the expansion of the oil and gas sector while much of the world is transitioning to a clean economy based on innovation and sustainability.

“Our caucus used every tool at our disposal to oppose this legislation. We forced 14 votes in order to give MLAs repeated opportunities to stand up and vote against this bill, to vote with their conscience, and to question whether this was the path they support our province pursuing. When the BC Liberals brought forth an amendment to the bill itself, our caucus chose to abstain; we will take no part in debating, passing or defeating an amendment on a piece of legislation we fundamentally oppose. Every MLA who felt conflicted in supporting giving massive tax breaks to what will become the single largest point source of carbon emissions in Canada’s history right after endorsing CleanBC’s objectives to reduce BC’s emissions, should have voted against this legislation.”

The BC NDP have ignored the rising economic costs of the environmental impact from the increase in floods, forest fires and drought that this project’s emissions will contribute to when they talk about its potential benefits. Last year, BC’s forest-fire spending increased from an average of $214 million to $568 million. Floods cost $73 million last year and studies show a major Fraser River or coastal flood could cause damages up to $30 billion.

“What is so disappointing about the passage of this bill is not only that the costs will fall squarely on communities across the province – but that there is a viable alternative in front of us,” said MLA Sonia Furstenau of Cowichan Valley. “Rather than put our effort into working with communities and First Nations across the province to implement an economic roadmap that increases their resilience to climate change, we have yet another government that has worked hard to aggressively secure tax cuts for a new major fossil fuel development.”

“There were 83 legislators from both the BC Liberals and BC NDP who supported a project that will pollute until after our children have retired,” said MLA Adam Olsen. “Now, more than ever, BC needs the Greens to be here in government. We may just be three MLAs, but we will continue to do everything in our power to set BC on a sustainable course. We must allow science to inform our policy if we want to ensure our children inherit a world worth living in.”

-30-

Media contact

Macon McGinley, Press Secretary

+1 250-882-6187 | macon.mcginley@leg.bc.ca

Redefining what “cleanest LNG in the world” actually means

Today I rose during committee stage debates for Bill 10, Income Tax Amendment Act, 2019 to explore how government could possibly suggest that LNG Canada’s facility in Kitimat would be the cleanest in the world and so exempt from increases in the carbon tax above $30/tonne. As I have mentioned numerous times in the past, LNG Canada have no intention of using electricity in the compression of natural gas. They will burn natural gas, thereby emitting vast quantities of CO2 in the process.

Yet Freeport LNG in Texas is already using GE electric compressors thereby eliminating greenhouse emissions in that phase of LNG production. It is unclear to me how it will be possible for LNG Canada to claim that they are the cleanest facility in the world. The responses I received from the minister were entirely unhelpful in shedding light on this issue.

I reproduce the text and video of our exchange below.

Text of Exchange

A. Weaver: Thank you to the member for Langley East for those questions.

I have a number of questions to build on this theme. I, too, am having a very difficult time understanding how LNG Canada could make a set investment decision with the uncertainty in terms of what is, in fact, the cleanest LNG in the world. My first question to the minister is: is she aware of Freeport LNG in the United States?

Hon. C. James: I know the member will have had many of these conversations, I’m sure, with the Minister of Environment, as well, as he looks at developing the specifics. The specifics aren’t developed as yet, but obviously, the Freeport LNG and the coal-fired electricity that they utilize will be part of the range of plants that will be looked at and the indicators that will be developed by the minister.

A. Weaver: Again, so we’re going to define an LNG plant as an LNG plant. We’re not defining an LNG plant as some hypothetical production upstream where someone gets electricity from or not, because there are a multitude of ways. You can go on the spot market, and you can buy wind power at 2½ cents a kilowatt hour. You can go on the spot market, and you can by coal power at night pretty cheap. You could buy natural gas from Alberta and avoid the carbon tax.

The relevant question in defining “cleanest LNG in the world” is the facility, and as we know, Freeport LNG uses General Electric compressors, electric compressors, to compress the natural gas.

We know, under the B.C. Liberals, that they initially signed an agreement with LNG Canada. I believe it was 8.2 cents a kilowatt hour to get electricity if they moved forward, and there was the industrial rate if they actually used electricity in the compression. We also know that the B.C. NDP basically exempted LNG Canada from the requirement of using electricity in the compression and gave them the same 5.4 cents a kilowatt hour, I think it is, industrial rate.

We know that we could not, today, deliver into that industrial rate for the requirement of LNG Canada unless two things are done: either (1) we call upon the Columbia River entitlement, or (2) we build enhanced capacity. This government has chosen to build that enhanced capacity through the building of Site C, as opposed to distributed renewable at a fraction of the cost. So we know that the ratepayer is going to end up paying ten to 15 cents a kilowatt hour for the electricity produced at Site C to sell it to LNG Canada for its other operations at 5.4 cents a kilowatt hour. It’s pretty crazy economics.

Even with that, LNG Canada will be using natural gas in the compression — not electricity, natural gas. That natural gas has been given to them for free, in essence, because of the royalty structure in place, again, by the B.C. Liberals at the time to incentivize deep wells, which were difficult and were risky back it must be almost 20 years ago, 18 years ago. But now it’s applied to 99 percent of wells, including all shallow wells.

So we give them the natural gas essentially royalty free — 3 percent or something ridiculous — to actually use in compression, a Crown resource being given away to this company to use in the compression. Now we’re hearing that we’re going to actually exempt them for carbon tax increases above $30, and we are hearing that LNG Canada have actually made a final investment decision. Yet they’re doing so under this cloud of uncertainty, which is also….

I come back to the first question here. How is it that the minister can now suggest at all that LNG Canada have any hope to have access to $30 a tonne, in light of the fact that they are not using electric compression? Because there is no way you can weasel out of any other way but saying they are not the cleanest in the world. How can the minister, other than trying to redefine what an LNG plant is by assigning coal-fired electricity emissions hypothetically, by forgetting about the fact that a lot of the gas in the U.S. is conventional, as opposed to unconventional gas up in B.C., which has rather much larger fugitive emissions…?

How can the minister actually stand here and tell this House that LNG Canada has some certainty that they’ll make the $30 limit on carbon tax? What other agreements have they signed?

Hon. C. James: I appreciate the information that the member is providing. I know that consultations, as we’ve talked about, continue to go on. The Minister of the Environment is working on the specifics, and I know the Green caucus is part of those consultations, as industry is part of those consultations. So certainly, I know those discussions will occur.

I’m obviously not going to talk about the specifics that the minister is in the process of developing. That’s for the minister to discuss. I know there’ll be lots of opportunities for those conversations both in the consultations that will occur but also in estimates, if the member feels there are opportunities there.

To the member’s specific question around the agreement: were there additional pieces written into the agreement? The agreement is the agreement. It is in front of the members. It is in front of the public. These are the measures that we have agreed to. Again, they’re LNG Canada’s estimates, and their estimates that they believe they will fit the criteria of the program. That’s the determination they utilized.

A. Weaver: It would be a fair question to ask this: how are you defining — when I say “you,” it is the government, not the minister — what an LNG facility is for the purpose of calculating emissions? We actually have definitions in existing legislation. Are you changing those definitions? How is it possible that you could allude to electricity — which has been done — produced through the burning of coal? How could you possibly include that in a definition of what an LNG facility is?

Hon. C. James: I refer the member to page 22 — the last paragraph, which talks about LNG facilities. It says about the LNG facility: “It will include fugitive emissions, venting, natural gas combustion at the LNG facility and emissions from electricity supplied to the facility from the British Columbia electrical grid.” That’s in the agreement. But again, specifics are being developed by the minister and will be determined as that process continues.

A. Weaver: How are you going to compare this in LNG Canada, in B.C., to another facility not in B.C.? Is it also from natural gas supplied by B.C.? To what extent is there a requirement to actually use gas from B.C.? There is no requirement in the legislation. We can use gas from Alberta.

To me, there’s just nothing defined here. We’re actually being asked to take a leap of faith. We’re asked to take a leap of faith: “Trust us. We know that LNG Canada can meet the $30 a tonne exemption, because they think they can.” We’ve got no articulation of any rules at all.

We’ve got no mention of electric compression. We’ve got no mention of where the gas will come from in that calculation. Is it sourced gas from B.C., or is a fraction from Alberta? Is it fracked shale gas, or is it conventional gas? Is it Horn River gas, which is dry? Is it Montney play gas, which is wet? Is it gas from the U.S. that’s coming up? It’s just a grand leap of faith.

Like the member for Langley East, I cannot believe that LNG Canada signed on to this unless they were given specific certainty that, in fact, the only carbon tax they will pay is the first $30, and everything above that will be exempt. I cannot believe that they signed this. So I ask the minister this: has the minister at any point, or anyone in her government, assured LNG Canada that all they will pay is $30 a tonne of carbon tax, yes or no?

Hon. C. James: No.

Video of Exchange

It turns out LNG Canada has no requirement to hire locally

Yesterday in the legislature Bill 10, Income Tax Amendment Act, 2019 was being debated at committee stage.

As I noted during my second reading speech, if enacted, this bill would repeal the LNG Income Tax Act as amended in April 2015, as well as the Liquefied Natural Gas Project Agreements Act. The bill also creates yet another tax credit for the natural gas sector.

During committee deliberations yesterday I took the opportunity to unpack an outrageous government claim that LNG Canada would be committed to hiring locals. Well to no surprise to those of us who have been following this for a while, there is no such requirement. In fact, and further, government has no tools at its disposal to insist that LNG Canada preferentially hire British Columbians during the construction phase.

Below I reproduce the video and text of my exchange with the Finance Minister.

We will resume committee stage debates today.

Video of Exchange

Text of Exchange

A. Weaver: I’ve been listening quite attentively, trying to get some information with respect to the jobs, because I have clearly witnessed the same language that was emanated from government, as well as LNG Canada. “We’re going to be hiring British Columbians.”

I know for a fact that right now Boskalis is dredging in Kitimat, and I know for a fact that Boskalis uses a Newfoundland company to bring in employees. That is a distance from LNG Canada, and I know for a fact that those employees are not from British Columbia. I know for a fact that those employees that were from British Columbia did not last very long on the Boskalis dredge because they were summarily fired for raising safety issues.

I come back to what the member for Abbotsford West was suggesting. Is the minister saying that she has no mechanism at all to ensure that any of these jobs are actually for British Columbia citizens other than the goodwill of LNG Canada because they said they’re going to try?

Hon. C. James: Thank you for the question. I think we’ve spoken about a great deal of this over the last few hours but happy to run through it again.

We have, as I said, a job strategy with LNG Canada, a commitment around the support that will be there for local hire first, including apprentices on this project. The job numbers, as I said, we have built in when it comes to assumptions around revenue — very conservative numbers. But we certainly expect thousands of jobs for British Columbians.

I can’t speak to the specifics that the member raises. I’m happy to take that information and have that conversation. But as I said, the local hire first, including the requirements around contractors using local hire first, is a very important piece that is in place. The contractor is bound by that local hire first, which I think, again, is a very important factor in making a decision around whether local jobs are going to be in place.

Then, again, there’s the work that’s already being done in Kitimat and the number of locals — 600 people — already working since December. You know, over 45 percent of those were from Kitimat alone, in that area. That’s, again, showing the support that needs to be in place for these jobs.

A. Weaver: I recognize that that’s been read in a couple of times to the record. My very specific question is this: is there a single mechanism that the government has to ensure that the jobs will be from B.C. — yes or no?

Hon. C. James: The answer is the jobs strategy, put together and negotiated with LNG Canada and negotiated together, which requires local first, which requires the contractors to also be utilizing the local first, which requires apprentices and makes a commitment around the dollars that have already been put in place by LNG Canada.

A. Weaver: So we now have an LNG jobs plan. What are the ramifications for LNG Canada if that document is ignored? Does the government have any teeth to that document — yes or no?

Hon. C. James: I think the biggest strategy is making sure that this project is successful. That is a commitment that not only we have as government but obviously LNG Canada has when it comes to their investment. The fact that they have a number of contracts with communities across the pipeline strengthens that kind of commitment as well.

A. Weaver: Again, coming back to the question, the question was: does government have a single measure to actually ensure that British Columbians are hired — yes or no?

Hon. C. James: I think I’ve answered that question. Again, the commitment is the four conditions that we put in place. The commitment is the agreement by LNG Canada to meet those four conditions and the commitment to the people of British Columbia to follow through on that.

A. Weaver: With respect, there is a duty in committee stage to get answers, to get answers to questions. The question was very simple. There is a jobs plan. I understand that. Let us suppose LNG Canada ignores that. What avenues, what teeth, does government have that will ensure that LNG Canada does make sure they hire British Columbians first?

The reason why I raise that is that the minister said that what’s critical is the success of this project. How do you define success? Well, success involves triple bottom line. There’s a social aspect to that, and one of those is hiring British Columbians. Because both the minister and the Premier, and several others, were very proud that this was going to bring 10,000 jobs.

Yet I come back to the question, and I think we are owed an answer to this: does government have any mechanism — yes or no? — to ensure that LNG Canada actually hires local? This is not a difficult question, and in this chamber, it is a duty and a responsibility of government to provide a yes or no answer to this question. I’m afraid it is not acceptable to pivot off to some kind of loosely worded commitment letter, which has no legal standing. I would like to know what legal tools this government has to ensure that British Columbians are hired first, because they said they would.

I’ve offered you one specific example, the example of Boskalis, a dredger up there that uses a contractor to get labour in Newfoundland. That labour is coming from all across Canada and elsewhere. It is not coming from British Columbia, and I know that for a fact, because I know people who were fired for raising safety issues.

What metrics does government have to ensure that LNG Canada is hiring British Columbians?

Hon. C. James: I know the member wants a simple yes-or-no answer, and I’m not being obstructionist. I’m being upfront with the member about the process that was utilized to come to our four conditions that had to be met by LNG Canada.

This was a back-and-forth process. This was a discussion around how important it was to meet the commitments, how important it was to reach these four conditions, how critical they were to us as a government and critical to British Columbians, we feel. I talked about the four conditions. One of those are jobs for British Columbians.

We did go back and forth around the letter. We did go back and forth around a strategy on jobs. We did go back and forth around the climate action and the importance of making sure that we address that in part of our CleanBC. We did go back and forth around First Nations and a real partnership with First Nations.

Again, on the jobs piece, the member has the copy of the letter. He will make his determination about whether that, from his perspective, holds LNG Canada to meet these commitments or not.

But, certainly, from our perspective as government, when you are taking a look at a project this large, when you are taking a look at the kind of investment that’s there, when you are taking a look at the reputation of the company coming in to do a long-term project in British Columbia, and when you’re taking a look at the fact that this project will not be successful unless the communities are engaged and taking part….

I think it’s part of the example that we’ve seen with the work that they did with First Nations along the pipeline. Again, we’ve seen many projects that have not come forward in British Columbia because they did not build that community partnership. They did not, in fact, engage the communities.

This is a very different project from that perspective. They have engaged the communities, and those communities will be critical for them to be able to be successful in this project. Therefore, as I said, we feel that the jobs strategy provides that support.

A. Weaver: I’m getting a little frustrated. I’ve asked a very simple question. What tools does government have at its disposal to ensure that the company follows through with its intention to actually hire British Columbians? I’m not asking for all the rhetoric around “my four conditions.” I’m asking for the specific tools that the government can use.

I’m asking the same question, and I recognize I’ve asked it several times. I have not got an answer to this question. I have got rhetoric about other stuff. The question is very direct and very simple. What tools does a government have at its disposal to ensure that the letter that they’re trusting LNG Canada to do is used to ensure that British Columbians are hired?

The minister can just say we don’t have any, and that’s fine. But I think she owes it to this chamber here to say what those tools are. Failing to do so, I think, frankly, is not what we’re meant to do at committee stage. We need answers to provide further guidance to the people of British Columbia.

Hon. C. James: I think that the biggest tool that government has is the success or non-success of the project. From my perspective, that is the biggest tool that is in place. In order to have the success or non-success of the project, it requires a relationship. It requires negotiations. It requires building that between the partners.

In fact, if you will speak to the Premier, I know he’ll also make those kind of comments around the work that that took to get to this place. The success of the project, from my perspective, and those relationships and the negotiations are the critical tools that government continues to have in this project.

A. Weaver: This is very frustrating, because now we have a circular argument. The success of the project is defined by bringing jobs to British Columbians, and the tools that the government has available to it are the success of the project. That’s a classic chicken and the egg. What is it? Is the project successful by definition, because they’re bringing it in? Therefore, it must have people in B.C.? It just doesn’t make sense. Clearly, the only take-home message I can have from this exchange is government has no tools.

What the statements are about hiring British Columbians is nothing short of unsubstantiated political rhetoric that, frankly, British Columbians should have cleared up. It’s quite embarrassing that this government would suggest to British Columbians that they’re going to be hiring British Columbians.

I’ve given you one example. The only example that I know of that is actually ongoing now, the dredging, where that company, Boskalis, is hiring a contractor in Newfoundland. The employees up there are not from B.C. Some of them are from Newfoundland, some from the oil patch, some temporary foreign from the Netherlands. And government has yet to provide any information as to how they’re going to ensure B.C. jobs.

But it gets worse than this. My final question on this: has the minister actually suggested that their four criteria were met? They never actually once, since prior to the 2017 election campaign, defined what those criteria were. What does it mean to say that it fits within our climate targets? What does it mean to say that truth and reconciliation has been looked at? What does it mean to say that it’s a good deal for British Columbia?

In essence, the question is, then, this. Why has the minister not, at any point in the last two years, at any time, ever once, put up metrics that would say: “These are how we’re defining success, and these are what we’re looking for to ensure that our four conditions are met”?

Frankly, all we’ve been told is, “Trust us,” and that is clearly what government’s wanting, for us to trust them. But it’s very difficult to do so when I look in this document here, which I won’t use as a prop. I’ll just read the title: “Operating Performance Payment Agreement.” I don’t see any requirement in there. When I look at some of this other stuff, “LNG Investment Fiscal Framework,” I don’t see a requirement there. I see a lot of rhetoric.

The question, coming back to it: what are the metrics? What metrics did government use to actually determine that their four criteria were met? Simple.

Hon. C. James: Thank you very much to the member. The member talks about what success will be. From my perspective, yes, success is meeting the four conditions. The Premier laid them out and talked about the four conditions. We will be held, as a government, accountable for meeting those commitments to British Columbians, as we should be — as we should be and as the company should be. That’s going to be critical.

I know the member was directly involved in the discussion around LNG emissions and including LNG emissions in our CleanBC program. Again, I expect the member to hold us accountable for that. I expect him to ensure that that occurs and that the discussion occurs.

Fair return. Again, I expect members to ask questions about whether we believe that’s a fair return or if they have other ideas or other approaches.

Partnerships with First Nations. Certainly the expectation around the elected bands along the route who have signed on to the LNG agreement and the work that continues to be done, I think, again, talks about how we will be successful.

So I think it is important to come back to those four conditions. I know the member felt that that didn’t provide him with an answer, but I think it’s critical and important, and I think we will be held accountable as to whether we’ve met those conditions or not.

A. Weaver: Well, this is the problem I’m having. It is impossible to hold the government to account when they’re not forthcoming with the answers to very simple questions that I’ve articulated. The four criteria, which, frankly, are nothing more than an election slogan, are this.

One, “Proposals must include express guarantees of jobs and training opportunities for British Columbians.” Well, we’ve heard today, from very extensive questioning from opposition and my further attempts to get something, that the government has no ability, clearly, no ability at all to guarantee any British Columbians any jobs. That clearly was never met. You could not have met criteria No. 1, because you’ve got no requirement of any jobs.

Two, “Proposals must provide a fair return for our resource.” Well, given that government has never once articulated since two years now what a “fair return” is, how do we know that we’ve got a fair return? I’ve suggested, through the analysis of the deep-well credits in second reading and elsewhere and through what I’ve described as a generational sellout and the giving away of this, that and the other in a desperate attempt to land what Christy Clark couldn’t, that, in fact, you’re not getting a fair return, because not once has government articulated what that return will be.

We haven’t seen the numbers, and it’s worse than that. We can’t even get information on simple questions like: “What is that $23 billion going to…? Where is it coming from?” We get rhetoric. We get no substance. So, clearly, criteria No. 2 was never met, because government actually hasn’t articulated what a fair return is.

Number 3: proposals must respect and make partners of First Nations. Well, we know that there are some, quite a lot, that have partnerships. Wet’suwet’en — still some issues, but government there abdicated its responsibility and essentially left it up to LNG Canada to deal with the Wet’suwet’en Unist’ot’en Camp, and what can they do? The only thing they can do is seek injunctive relief and get the police in there to move them. The government clearly did not do what you would expect on a leader-to-leader, government-to-government negotiation point of view, so I’m not so sure that No. 3 is being met.

Number 4: proposals must protect air, land, water, including living up to our climate commitments. Well, I’ve seen no analysis from government as to the air quality within the Terrace–Kitimat valley. As you know, Rio Tinto Alcan just did a substantive upgrade to their resource facility — increase sulphate emissions, reduce greenhouse gas emissions. There’s a very problem in terms of the air quality in that watershed. I’ve heard no discussion. I’ve heard no criteria, no check — “We can do it.”

I do recall a report that was written a number of years ago where the Liberals explored what the consequence to the air quality in the valley would be, and it was very troubling. It was very, very troubling — a number of years back. It was, actually, in terms of…. It was. You probably don’t remember it. I looked at it very well. I know the author of it.

And living up to our climate commitments. Well, that has yet to be seen. Certainly we know that we can only get, with all of the policies that have been identified, just 75 percent of the way there. So how can you say that it’s fitting into living up to our climate commitments when we still haven’t articulated the other 25 percent of getting to those climate commitments? That was the basis of my reasoned amendment.

What’s happening here today is a charade. It’s literally just a charade. We have no substantive, quantitative analysis of any of these criteria. We’re told: “Trust us. We’ve met it.” We’ve clearly tried to find what metrics government’s using. They haven’t. It’s embarrassing. And so I go back to my original second reading speech, and I think what happened is that LNG Canada walked in to the new government and said: “We’re out of here unless you do this.” And they said: “What do you want us to do?” And they said: “This, this, this, this, this.” And, out of their depth in negotiations, completely out of their depth, they said yes.

LNG Canada has got a good deal here. I’m not so sure you can actually articulate how British Columbia has, and we haven’t heard a single answer to any of the questions that I have raised. This is very troubling.

With that I’ll leave it. I know that the member for Abbotsford West was suggesting a break, and I’m perfectly open to such a break now as well, if the Chair believes we should do so.

Hon. C. James: I’ll just respond to the question, and then…. I know that the members want to take a break. And, you know, I think it’s…. I respect the member in bringing forward the issues. I respect the member. We know that our Green partners are against LNG development. We understand that, and I think the member is very articulate in raising his issues and concerns. But when we take a look at the success in meeting the four conditions and meeting our commitments to British Columbia as a government who looks at how we balance our promises, economically, socially, and environmentally, and our commitments to reconciliation, I, in fact, am very proud of the four conditions that we’ve put in place and the work that we’ve done to be able to address those.

Jobs for British Columbia. Again, I come back to the jobs strategy around, around “locals first” around the support for apprentices on the project. When it comes to partnerships with First Nations — 20 bands, all of the bands, elected bands, along the route who have signed on, who have partnerships, who see this as an opportunity for economic development and for growth for their communities and opportunities for their members to be able to be working.

The fair return for British Columbians — $23 billion when it comes to support for programs and services here in British Columbia, including action around climate. I think it’s critical. And I know we’ll get a chance to talk about those as well as we go through this process and other processes through the budget.

Protection for our air, land and water, the fact that we required LNG emissions to be included as part of CleanBC and brought forward a commitment around CleanBC, over $900 million in the budget to commit to environmental protections. I think it speaks to our commitment as a government around addressing environmental issues and the fact that we’ve been able to sit down with a large company and get to a final investment decision that recognizes how important that is and requires us to live up to this.

Do I expect the member to continue to raise concerns and continue to hold us accountable for this? Yes, I do. I expect that that’s exactly what the member will do and what other members will do and what the people of British Columbia should do as well.

With that, Chair, we will take a ten-minute break?

The Chair: The member has a question. Then we’ll have a break.

A. Weaver: A brief follow-up because the issue of $23 billion was raised again. Could the minister please articulate how that $23 billion is calculated and not just generally but actually specifically? That number has been batted around a lot. It used to be $40 billion; now it’s $23 billion.

Despite asking a multitude of times, not once have I got an answer as to what makes up the $23 billion and where that number came from.

Hon. C. James: I’m happy to answer that question when we come back from recess.

The Chair: The House is recessed for ten minutes.

The committee recessed from 5:31 to 5:44 p.m.

Hon. C. James: The member asked a question around the $23 billion and where the $23 billion came from. We did offer a briefing, an opportunity to go through that, but I know the member wasn’t able to make it. I just wanted to let the member know we can provide that opportunity, the documents around the generic LNG project and the highs and lows that we’ve been talking about. That information will be public. It’s going to go up on the site, so we can provide an opportunity for the member to get the materials and then ask questions as we go on. I expect committee stage will continue, and there will be an opportunity for the member to ask questions, if that works for the member.

Ongoing generational sellout continues as BC NDP doles out new tax credits in quest to entice LNG Canada

Today the BC NDP introduced Bill 10, Income Tax Amendment Act, 2019. If enacted, this bill would repeal the LNG Income Tax Act as amended in April 2015, as well as the Liquefied Natural Gas Project Agreements Act. The bill also creates yet another tax credit for the natural gas sector.

So while the BC Government continues to claim it is taking steps to aggressively reduce greenhouse gas emissions, they are making plans to add the single biggest point source of such emissions in Canadian history. It’s time politicians level with British Columbians about the economic and environmental consequences of this historical betrayal of future generations.

Below I reproduce the press release that my colleagues and I released. We also voted against the introduction of the bill at first reading (vote also reproduced as well).

Media Release

LNG legislation antithetical to government’s commitment to CleanBC, innovative economic vision

For immediate release

March 25, 2019

VICTORIA, B.C. With its introduction of LNG legislation today, government is now officially pulling the province in two different directions in its fight against climate change.

“Continuing to push for LNG development is short-sighted and works directly against CleanBC objectives,” said Dr. Andrew Weaver, leader of the B.C. Greens and lead author of four United Nations Intergovernmental Panel on Climate Change reports. “After years of criticizing the BC Liberals for their generous giveaway of our natural gas resources, the BC NDP have taken the giveaway to a whole new level. The legislation brought forward by this government is a generational sellout.

“We have only identified a pathway to take us only 75 percent of our 2030 emissions goals, yet we know that LNG Canada will emit an additional 3.45 megatonnes of greenhouse gases every year within our province alone, contributing massively to this gap. Government is demonstrating hypocrisy by supporting both LNG and CleanBC. They want to have their cake and eat it, too.

“We must adapt to the 21st century economy by investing in renewable energy infrastructure and transforming our province into a destination for innovative industries to thrive. Truly implementing CleanBC provides one such path for a carbon-neutral economy, one in which British Columbians are free from fossil fuels not just as an energy source, but in their jobs and everyday lives.

“The International Renewable Energy Association recently reported that there are over 10 million jobs in renewable energy. At the 2016 United Nations Climate Change Conference, 48 countries have agree to make 100 percent of their energy production renewable by the year 2050. The rest of the world is moving into the future while this government is tethering us to the past.”

MLA Sonia Furstenau is the caucus spokesperson for the environment.

“Communities are already facing significant impacts from climate change,” said Furstenau. “Whether it’s wildfires, floods, drought, species’ extinction, or crop failures, BC’s communities are at the frontlines of this fight. Pursuing LNG is tying our communities to an industry that is contributing to these challenges, while failing to invest in a sustainable, low carbon future.”

“Just last week over a million students – including a few thousand on the steps of the BC legislature – called for their governments to act on climate now,” added MLA Adam Olsen. “The legislation tabled today is the exact opposite of the action that our youth need from us. Climate change is happening now and we have a responsibility to take action.”

The BC Green caucus remains committed to implementing CleanBC’s vision sustainable economic vision.

“BC Green caucus will be voting against this legislation every step of the way,” Weaver said. “In minority governments, there are disagreements between partners. This is one of those. We will use our opportunities to speak to make our case to the 84 other legislators that LNG is the wrong path to pursue. BC Green caucus will not allow this legislation to deter it from continuing to contribute to this government in the historical, meaningful ways it has already on so many fronts: CleanBC, campaign finance reform, environmental assessment reform, professional reliance reform, funding for wild salmon, student debt and childcare relief.

“Unfortunately, with this legislation, we allow LNG Canada to make history for all the wrong reasons: it may be the single largest point source of carbon emissions in the country’s history,” said Weaver. “Is this what we really want our province to be known for?”

-30-

Media contact

Macon McGinley, Press Secretary

+1 250-882-6187 |macon.mcginley@leg.bc.ca