Economy

Bill 48: Temporary Foreign Worker Protection Act

Today in the legislature we debated Bill 48: Temporary Foreign Worker Protection Act at second reading. This legislation seeks to improve protection for workers and the accountability of recruiters and employers. It requires the licensing of foreign worker recruiters and employers; establishes a criteria for issuing registrations; and imposes tougher penalties for recruiters and employers who violate the legislation. It also allows government to recover and return to workers illegal fees charged by recruiters. Finally, this bill creates two registries (one for foreign worker recruiters and one for employers) via a cost-free and accessible online process.

Below are the text and video of my speech in support of this bill.

Text of Speech

A. Weaver: I rise to take my place in second reading debates on Bill 48, Temporary Foreign Worker Protection Act, an act that’s been introduced by the minister to ensure protection for temporary foreign workers.

I rise to speak in support of this bill. Like the member for Chilliwack, we, too, raised a number of questions and concerns that I hope to see or be explored further in committee stage. Overall, I think this is good legislation and takes us generally in the right direction.

Temporary foreign workers play a critical role in our economy and our society, whether they’re working in the agriculture sector or as home care aides, whether they’re filling seasonal employment. For example, recently, many of us attended the Union of B.C. Municipalities meeting in Whistler. The hotel I was staying at was clearly largely employed by temporary foreign workers from New Zealand and Australia, who clearly were coming to British Columbia to gain some experience and gain some expertise in skiing.

I have a great deal in common with them. When I was their age, I was a temporary foreign worker in Australia. I was there for a year, getting the better of the surf and the sand and the Aussie rules football. It was a very rewarding experience for me back in 1988, as I’m sure it was for those young people in Whistler today.

Temporary foreign workers play many critical roles in such trades as the seasonal employment, and for many, actually, we find that it’s a pathway for eventual citizenship. Canada, as a nation — built on the hard work of immigrants — welcomes new Canadians on an ongoing basis.

In fact, just this morning, a young boy in grade 5 at a school that was visiting this Legislature, from Glenlyon, in my riding, just literally became a Canadian citizen. This was a very big deal for him — that today, he became Canadian.

Temporary foreign workers come to B.C. through multiple programs, including the temporary foreign worker program, the seasonal agricultural worker program and the international mobility program. As the member from Chilliwack pointed out, in 2017 alone, the federal government issued over 47,000 work permits for foreign nationals destined for B.C., and 17,000 of these were temporary foreign workers.

We’re second only to Ontario in terms of the total number of temporary foreign work permits that have been issued. Industries like agriculture, forestry, fishing and hunting account for nearly half of the temporary foreign workers in British Columbia — like 9,000 workers. Eighty-three percent of those permits are located in the Lower Mainland, 5 percent in Thompson-Okanagan and 4 percent on Vancouver Island.

Again, as somebody…. When I was at the University of Victoria, and my wife was also faculty there, and we had young children, we, too, took advantage of the temporary foreign worker program and were able to bring to Canada a now-Canadian, somebody who was working in Hong Kong as a nanny. She was able to come to British Columbia on such a caregiver program and spend three years with us before becoming a Canadian citizen. Now she’s married here. She’s contributing to the Canadian economy. Her husband is here as well.

We benefited greatly, as a family, from being able to bring a temporary foreign worker here. I’m sure other members in this chamber have similar stories about the importance of temporary foreign workers.

One of my son’s friends had very serious health issues and required 24-hour care — his father did, rather — in the home. And, again, that care was provided by live-in, temporary foreign workers, 24 hours a day. Again, it was simply not possible to find the people, Canadians, who would be able to or willing to serve in such a capacity. Again, in this case, we had a loving home. Temporary foreign workers come, spend a few years, are now Canadian and contributing to our economy and bringing their rich, diverse cultures to Victoria, in this case, but British Columbia and Canada in general.

However, not everyone has the kind of employer that provides a nurturing, safe environment. Temporary foreign workers can be amongst some of the most vulnerable in our society. In a new country, many will face a language barrier. They may be unfamiliar with their rights and our laws, and they are at risk for exploitation and abuse.

For this reason, the legislation before us is important to support, because it addresses this particular aspect. It begins to put in place a means and mechanism to actually ensure that temporary foreign workers are not exploited. The legislation will improve protection for workers and the accountability of recruiters and employers.

For example, it will do a couple of things. It’ll create two registries, one for foreign worker recruiters and one for foreign worker employers, via a cost-free — that’s important — on-line process. It’ll allow, also, government to recover and return to workers illegal fees charged by recruiters. In particular, government could impose tougher penalties for noncompliance, including a loss of licence or registration, financial penalties — $50,000 for an individual, $100,000 for a corporation; that’s an awful lot of money — and up to one year imprisonment. The legislation will improve government information about temporary foreign workers, and recruiters and employers will also be required to disclose their relationships with recruiter organizations in various companies.

These are important, some of these changes. We know of, or we’ve heard stories of, examples where recruiters collect a fee from temporary foreign workers. They end up working here. There are examples we’ve heard stories of where passports are held from temporary foreign workers, and exploitation sets in.

Much of this bill, obviously, is modeled after the employer standards act, and it follows the lead of other jurisdictions like Manitoba and Saskatchewan, which already have temporary foreign worker registries in place. Last week one of our press gallery, Les Leyne, reported out that B.C. is considered to be well behind the pack in upholding standards and pursuing complaints. This was reported out in one of his articles he wrote. This is important to note, that this legislation does actually deal with bringing us in line with some of the other jurisdictions.

In 2018, the B.C. budget for the Minister of Labour received a $3 million increase in funding over three years to support initiatives for compliance and enforcement, improve protections for vulnerable workers and support fair and balanced treatment of workers and employers in B.C.

Within that context, we know that the legislation coming before us is legislation that has got monies associated with it to ensure that it’s delivered in a manner that will actually meet the objective it is being put together to address. Most recruiters and employers will seek to do their best for employers. We know that. But this legislation is targeting those who try to skirt the rules a little bit to ensure that there is unsafe working and living conditions, for example, are dealt with to ensure that temporary foreign workers cannot be treated inappropriately for fear of complaining about their jobs, they might lose their jobs. So they might be sent home in debt. There is a whole bunch of issues that are being dealt with here that for which this bill is trying to ensure safe conditions exist.

This bill will require recruiters and employers who seek out and hire temporary foreign workers. Registration. They will require them to register. By doing so, the government will be able to identify and respond to bad operators for the benefit of all stakeholders involved. In essence, this levels the playing field for both employers and recruiters by addressing the few bad operators out there who take advantage of temporary foreign workers and hence, reap the benefit.

When this first came in, I feared that this bill to establish the temporary foreign worker registry would have created an unfair burden for employers — the small employers, not so much the bigger employers, but the small employers — the employer who is perhaps a spouse who is looking for help for a caregiver for their ailing partner or a family who is looking for a caregiver for their child.

Small business. I was initially concerned that this might be regulatory red tape but oversight and costs. I was reassured after receiving a briefing from the ministry that this is, indeed, not the case. In fact, the fact that is free is not a financial burden, and the fact that it’s looking like it will be an online process that will take 15 minutes or so to fill out in terms of the registry. It seems to me that that is not onerous in light of the fact as an employer of a temporary foreign worker in a caregiver capacity you already have to register for a GIC number. You have to register with CPP and EI deductions, etc. So this is relatively pale in comparison to what already exists.

Overall, I am pleased with this legislation. Again, creating a safer environment and a safer experience for temporary foreign workers will have a net positive impact on B.C. I will also agree with the member for Chilliwack who spoke about some of the work that was done by the previous government in this area.

I remember very fondly working with the then-minister of, I guess it was Jobs, now the member for Prince George–Valemount, who together and collectively, we were able to introduce legislative change to no longer make it allowable for an employer in British Columbia to require an employee to wear high heels or footwear otherwise deemed to be unsafe.

In fact, I can tell you if you go to bars around this area you will find that most people are no longer wearing high heels. Very often, people come up and are very pleased by that legislation. Government listened, government responded, and now you’ve got soft flats happening in bars across British Columbia. That’s actually an important health and safety achievement that we’ve got here.

Finally, I’ll say that I do commend the minister for looking out for workers. But I hope the minister can also recognize that we have to look out for not only temporary foreign workers but our own workers in British Columbia. The fact that British Columbia is dragging its heels in terms of introducing legislation or introducing now order-in-council to actually address the presumptive clause for mental illness in a number of professions. Frankly, we could follow the lead of some provinces and actually assume a presumptive clause for all mental illness for all workers covered under the Workmen’s Compensation Board.

The reason being, of course, is if you have exposure to mental illness having to recant and retell your stories time and time again in order to prove that it is your workforce that actually is the result of or caused that mental illness, can be very onerous, and frankly, can be detrimental to the overall well-being and subsequent recovery of workers in B.C.

So I look forward to further efforts that the Minister of Labour will have in this regard in the weeks and months ahead

Video of Speech

Bill 44, Budget Measures Implementation (Employer Health Tax) Act, 2018

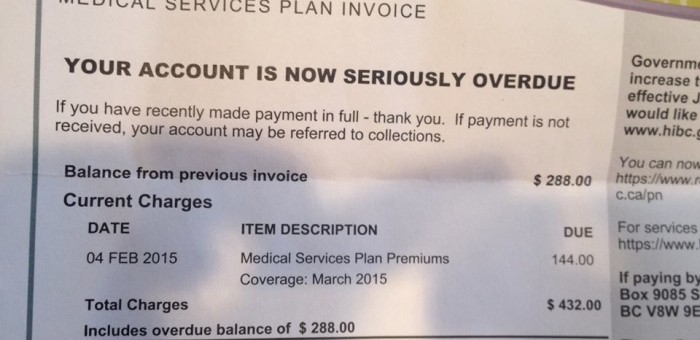

Today in the Legislature Bill 44, Budget Measures Implementation (Employer Health Tax) Act, 2018 was debated at second reading. This bill introduces a payroll tax to replace the income that is being lost through the elimination of MSP Premiums.

As I outline in my second reading speech reproduced below, the BC Greens have been campaigning to eliminate MSP premiums since 2015. In fact, the overwhelming public support we received on this topic meant that both the BC Liberals and the BC NDP could not ignore it in the 2017 election campaign.

I also point out in the speech below that the BC Greens would have replaced the income through alternate means (a progressive health care levy). Nevertheless, and on balance, in our view the benefits of eliminating the form of regressive taxation embodied in the MSP outweigh the negative effects of increasing payroll taxes.

Text of Speech

A. Weaver: I rise to take my place in the debates on Bill 44, Budget Measures Implementation (Employer Health Tax) Act, 2018. This bill, as we have heard, is a bill that’s proposing to replace the moneys that were lost in eliminating the MSP premium by a payroll tax applied on employers.

The payroll tax would be at a rate of 1.95 percent for employers having a payroll submitted of over $1½ million. It would be nothing for a payroll below $500,000, and if the remuneration paid by the employer is greater than $500,000 but not greater than $1½ million, the tax to be paid would be 2.925 percent of the amount by which remuneration paid exceeds $500,000. The idea here is to bring the payroll tax in British Columbia to a level similar to…. I think it’s the second-lowest in the country.

Now, I’ve been working on this issue of MSP premiums for quite some time. I’d like to give a little bit of the history of this, but first, let me start off by saying that we as a caucus wholeheartedly endorse the elimination of MSP premiums. It’s something we campaigned on, something we’ve been working on for many years.

We would not have done it this way. We recognize that this is not the approach we would have taken. With that said, we understand government has chosen to do it this way. I’ll outline the process by which this is come to, and ultimately…. In the two-part presentation, my colleague from Saanich North and the Islands will also speak a little bit about some of the impacts that we have to be careful of with respect to medium-sized business — not so much large business or small business, but medium-sized business. I’ll cover much of the history and the rationale for this approach.

Let me say that I’ve spoken to numerous, numerous people on this issue. I have spoken to leaders within the business community. I have spoken to small business, intermediate business. I know that for some large businesses, this is actually viewed as very positive. Those companies that right now have negotiated contracts such that they have to pay the MSP premium for their employees once those employees retire — typically much larger, huge firms that have negotiated that in collective agreements — are very pleased that the government is no longer requiring MSP premiums to be collected. In their case, they see this as no longer having to cover the retired people who used to work in their organization. At least, I’ve been told that by the people I’ve spoken to in that area.

People in small business, despite some of the fearmongering that we hear, are largely unaffected. If your payroll is below $500,000, you aren’t affected. In fact, you benefit, because as individuals, you no longer have to pay the MSP premium.

It’s in the intermediate area that we have to be careful — to ensure that what we don’t do in introducing this is affect the competitiveness of our medium-size industry and affect the ability of medium-size industry to grow in British Columbia. My colleague from Saanich North and the Islands will cover that in more detail.

I brought this issue to the Legislature back in 2015. It was an issue that was brought to me directly from a town hall that I had in my riding with seniors — in the Monterey Centre, no less. The issue that was raised was the issue of health care premiums, and how some of these seniors there were very concerned about the health care premium that they were paying, and how it was not a progressive form of payment; it was a very regressive one-size-fits-all payment. In looking at this, I completely agreed.

Actually, if you go back, you will see that there was a post that I wrote on my MLA blog on January 21, 2015, where I outline some of the regressive natures of the health care premium and the way that it’s one-size-fits-all — in essence, a form of a head tax. It’s essentially a one-size-fits-all approach that had an incredibly, large bureaucracy associated with it.

I outlined in this post some of the issues with respect to the debt that’s incurred. I pointed out, for example….

I knew examples of people who went away to college in another country or another jurisdiction. They might have worked for a few weeks before going there, and their employer might have paid their health care premium on their behalf. Then they went away somewhere, and they were no longer working at this place. They were just students working casual work. They come back, and MSP presents them with a massive bill for all the years they were away.

Retroactively, they were being required to pay for services that they’d never had access to, nor were they actually using, you know, in the case of students who went to Europe. In many of the European nations, the health care would be covered under the essential rules that govern health care — in Britain or France or other jurisdictions — so they didn’t need MSP. Because they wouldn’t use it there.

They would come back after a couple of years away, and there would be the big bill. Now, of course, there were collection agencies starting to get involved. People were getting angry phone calls. This kind of very punitive approach was neither effective nor, in my view, managed well, in terms of requiring an administrative overhead.

Every single month, British Columbians from north to south, east to west, were getting in their mail an MSP bill. It’s costing us a buck per letter to send out these bills every single month. I can’t even estimate what the cost for the mailouts would have been, but I would imagine that it would be large. Every single month, you know, people would open their bills, they’d write their cheques, some would forget, some would defer, debt would increase, collection agencies would come about.

This was a very inefficient system, and inefficiency is something that we as a caucus believe is not in the best interest of good fiscal management and good fiscal policy.

I’m surprised that it has been in place for so long. In fact, a form of MSP premiums has been in place since the 1960s. So it’s not that the Liberals can claim any high road, or, frankly, that the previous NDP governments can claim any high road. Simply, since as long as I’ve basically been following what’s going on in British Columbia — I was a little kid before that — MSP premiums have been in place. They survived government after government after government as a regressive approach to funding health care.

It’s regressive, because it does not reflect your ability to pay. In most of our taxation system, we tend to favour moving towards progressive systems: if I have the ability to pay more than perhaps you do, I pay a little bit more.

In speaking with many, many British Columbians over the last five years, I understand that there’s a willingness in British Columbia for people who have the ability to do so, to pay a little bit more, because there’s a recognition that in a society like ours, it’s important that the difference between those who have and those who don’t have not get too large, because that leads to social instability, and social instability is not good for anyone.

So it’s with quite great pleasure that I was in the budget, listening to the fact that MSP premiums were going to be removed.

But we’ll come back to some of the history of that a little later.

I should say, at this juncture, I am the designated speaker on this file, and I won’t be too long but I might, perhaps, run just slightly over the allocated 30 minutes. I see the member from Peace River South was applauding when I said I wasn’t going to be too long, and I promise that I won’t.

Coming back to 2015, there were a number of headlines going on in news media at the time, picking up our public call to eliminate MSP premiums and to make it into a progressive system as opposed to a regressive system. Pundits started writing. At that time, one of the headlines said: “Advice for the B.C. Finance Minister on MSP Premiums: Listen to the Green Party.” In there, we were given a lot of credit for leading the charge on eliminating MSP premiums. What it said, which I quite liked — and I’ll link to this as I put this on my website later — was as follows: “Perhaps the B.C. Green Party knows more about economics and tax policy than many give them credit for.”

Well, I would hope so because the chair of our policy committee is a senior economist, with more than 30 years of experience in the B.C. government. We have an economic adviser team that is second to none, and we look forward to continuing providing critique on economic plans brought to this Legislature, from an evidence-based point of view.

On February 26, 2015, again, I wrote a piece in my blog highlighting a petition I tabled here in the Legislature on February 23. That petition was 6,662 British Columbians calling on the government to replace the regressive MSP premium poll tax with a fair and equitable option to fund health care services.

On February 26, in the Legislature, I was up during question period. I used the opportunity to ask the, at that time, Minister of Finance whether or not he would empower the Select Standing Committee on Health to examine innovative and progressive ways of revising how MSP premiums are charged in British Columbia. The minister actually responded that, in fact, it was within their existing mandate to do just that. So on April 13 of that year, I wrote a letter to the select standing committee, seeing whether that committee would be willing to actually to consider exploring, as part of its mandate — it was a sitting committee — innovative ways of reducing the MSP premiums.

I got a letter back from the select standing committee that said that they were not willing to consider that at that time. That’s most disappointing. That was in May of 2015. The response, to say the least, was disappointing. The chair of the committee stated: “They consider only those matters that are referred to them by the Legislative Assembly.”

Given the minister’s response, it didn’t make any sense to me that the minister said it is within their mandate to do this and then the chair of the committee says that it’s not in their mandate to do this because they haven’t been given a mandate.

Well, I was somewhat perplexed as to that. In fact, I was very troubled by the fact that the chair, in the letter that I received, said: “The committee is currently working to identify potential strategies to ensure the sustainability and improvement of our health care system, while ensuring its financial sustainability.” How on earth could the committee be looking at that and not to be considering innovative ways of replacing MSP with other forms of taxation.

You know, I think the B.C. Liberals missed the boat on the MSP premium. This was an issue that was very, very dear to the hearts of most British Columbians. They couldn’t understand why we continued to have this regressive system — the only province to do such a regressive approach. A one-size-fits-all tax, whether you’re literally earning…. Well, it changed a little bit with time. But back in 2015, you’re earning $33,000 a year or $33 million a year — you pay the same amount. That’s not fair. I think British Columbians recognized that that wasn’t fair.

At the time, what we proposed and what we campaigned on was not what governments introduced. We proposed following along the lines of what Ontario does, which was to introduce something called a health care premium. That health care premium would have been progressive. It would have been collected like EI; collected like CPP.

But there would be another thing called a health care premium that, in negotiated contracts with unions and employers, you might have had your employer pay. That amount would be a progressive amount. In Ontario, if you earned under $20,000, you pay nothing a year. If you earned over, I think it’s $200,900 or something like that, you pay $900 a year.

This was a system we proposed to do here because in talking to British Columbians, people earning hundreds of thousands of dollars a year don’t mind paying a little bit more for health care than those who are struggling to make ends meet.

It’s patently unfair that someone struggling to pay the bills at the end of the week to keep their children in child care, to actually ensure that they have clothes, is paying an amount similar to somebody who has literally bought a Lamborghini on Monday and flies to Paris for a dinner on Tuesday. This was unfair, and British Columbians across our province believe that to be so. I’ll come to some evidence for that in a second in another petition that was brought to the Legislature by me.

In addition, one of the things we argued at the time in 2015 is that British Columbia really has not advocated effectively to Canada in terms of the Canada health transfer. Right now, we are getting between $200 million and $300 million a year less than we should be getting in the Canada health transfer. The reason why is that Canada health transfer is simply based on how many people are in your province.

Now we know if you look at the demographics of British Columbia that our province is older on average than most other provinces. We know a lot of British Columbians, for example, younger British Columbians historically — now they’re working at home — would go to places like northern Alberta, work there and then come back here and retire. We know, for example, that when people are working in a jurisdiction like Alberta or Manitoba or Ontario, they’re working and paying taxes there, and they retire here.

We also know that the amount that you cost the health care system — another way of phrasing it — is the amount that is spent on you as an individual in the health care system is a direct function of how old you are in that….

Well, it’s not a direct function. That’s actually mathematically incorrect. It’s more like it’s exponentially related to how close you are to your final years. You spend a little more than average when you’re very young, and then you spend very little on health care here in British Columbia per person.

But the tail of that is very, very high. At the most we spend on people in health care is in the last years of their life. Yet, we know British Columbians across our province come here from other provinces. They have worked elsewhere, but we are the most beautiful place to live in. With respect to my family who live in Winnipeg, who wants to live in Winnipeg in your retirement with minus-30-degree weather and mosquitoes in the summer when you can live a block from Beacon Hill Park?

There’s a reason why people come and retire here. But the money for health care does not follow them. So what we have been pushing for is government to actively advocate at the national level to ensure that the Canada health transfer reflects the actual real expenses on medicare that is age related. It’s a very legitimate argument. We know people pay taxes elsewhere, and they use their health care in another place. I hope this present government will pick that up, and the Health Minister will continue to do that.

I will give credit to the former Minister Terry Lake who initially did make some steps in this regard. But I don’t think enough has happened. Coming back to the MSP premium, in January of 2016, the B.C. Business in Vancouver, a magazine that is very much focused on the economy, what’s good for business in British Columbia, had an article and the headline of the article was this: “If the B.C. Liberals Reall Want to Cut Red Tape, They Should Chop MSP.”

This was around the time that we were celebrating the soon-to-be-forgotten Red Tape Reduction Day. That legislation brought forward that created along with Douglas Day, Family Day, Terry Fox Day and Holocaust Memorial Day. There’s one more that I forget. We’ve got Red Tape Reduction Day.

But this article was pointing out that we, as the B.C. Green Party, were promising to reform MSP as one of the first things we would do. Again, I outlined the means and ways we would have done it were we given the situation to have a majority in this Legislature which clearly we don’t, since there’s three of us here. But we still are very supportive of the elimination of this regressive tax.

On January 7, 2016, we issued, as a party, another renewed call to eliminate MSP premiums. At the time, I pointed out that the tax is applied to anyone living in B.C. for six months or longer and requires them to pay monthly premiums for health care coverage. While some individuals can apply for premium assistance, these subsidies soon dry up as soon as a person’s income reaches $30,000.

Back in 2000, I pointed out then that the MSP premium for a single individual was $36 a month. And today — today being January 7, 2016 — the same individual pays more than twice that, or paid more than twice that, at $75 a month.

Just since 2010 there’d been a 40 percent increase for a family of three. The new rate on January 1, 2016 was $150 a month, up from $142 the previous year.

So it was very clear to people following the budgets brought in by the previous Liberals that at least over the last half-dozen years or so, MSP premiums were viewed as an indirect way of taxation without actually increasing personal income taxes. What was so regressive about that whole approach was that the taxation was precisely that: regressive. Picking on people who are making ends meet is not something British Columbians supported.

It was reflected in, I think, some of the minds of people going to that decision on ballot-box day as to who they voted for. They felt it was important that this tax be eliminated. It was campaigned on and promised by both the B.C. NDP and the B.C. Greens. The B.C. Liberals had campaigned on…. And they did. They reduced it by 50 percent, and the NDP kept that in place, so credit to the B.C. Liberals on that. However, it was clear that this is something that British Columbians wanted to be dealt with sooner than later.

On February 11, 2016, in this Legislature, I had the distinct honour of presenting a petition that had been put together by a woman named Michelle Coulter from Ucluelet that had 65,721 signatures on it. That’s an awful lot of British Columbians. They were calling, again, on the B.C. government to abolish the regressive approach to collecting MSP premiums. As the petition stated, it said B.C. should follow the lead of other provinces in eliminating its flat-rate MSP premiums.

You know, even in February of 2016, in the throne speech, the B.C. NDP, at the time, suggested an amendment to that throne speech. We were debating the amendment. That was the B.C. NDP added the following words, “that the government recognize the cumulative effect of the increases in MSP taxes, hydro rates and ICBC premiums and other fees and hidden taxes, on British Columbia families. ” Those words were added after. It says that we ask “‘the Speaker do now leave the Chair’ for the House go into the Committee of Supply.” I guess that would have been the budget, amending the budgetary speech.

I supported their amendment, but added a second subamendment at the time. One of the things I added was…. I was grateful to the B.C. NDP, who supported this subamendment, which was to say and to add on to that “And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue-neutral manner to create a progressive health care levy.” That was the amendment, supported by the B.C. NDP.

It’s not what they’ve done. They have taken it down the payroll tax. Again, our approach was to do the health care levy, which would have gone in the income tax system, as I outlined earlier. Again, I would have suggested that it was….

I was surprised, actually, given the two parties that are currently sitting on this side of the aisle — although one of them is in government, one is in opposition — that the now opposition didn’t listen to the people of British Columbia, who were really calling out for this. This was a no-brainer — good, important piece of public policy to go after a regressive tax that’s mired in red tape, because of the collection aspects of it, that was disliked by all and sundry, that was more efficient to get rid of.

I cannot understand why the B.C. Liberals did not campaign on eliminating this regressive tax. Frankly, I think it was a strategic error on their part. I look forward to them supporting this now to say that, in fact, maybe this isn’t how they would have done it either. This is not the way I would have done it. This is not the way they would have done it.

But I tell you, if the government is going to eliminate MSP premiums, we have to weigh out the benefits of elimination with the negative aspects of what they’re doing to get the revenue. On the balance of things, I cannot disagree with government that on the balance of things, the benefit of eliminating this regressive taxation outweigh the way the negative effects…. There are real negative effects with medium-size business.

That is something that I can support, and I hope the members opposite support it, not just say no for the sake of it but recognize that what they’re doing here in supporting this bill is supporting British Columbians — people, regular people, people who are paying every single month, the payment, whether they can afford to or not.

They have an opportunity here in the House to stand up and support this legislation, and I certainly hope that they do. Even though I recognize, as they probably do, that this is not how I would have done it.

In 2017, governments changed, and the B.C. government announced that it was establishing an MSP Task Force. The mandate of the task force was to provide government with advice on how to replace lost revenue when MSP premiums were eliminated. The task force issued its final report on March 31, 2018. The problem with that is, in the February budget, instead of waiting for the MSP Task Force recommendations, the minister outlined exactly how it was going to replace the tax.

Now, I understand it’s difficult in budgetary discussions. You can’t start consulting widely and having leaks about what you’re exploring. And I understand that government vowed to eliminate MSP premiums right at the get-go. And I understand that if you’re going to do that you have to find where the lost billions of dollars are going to come from.

But what I don’t understand is why government would have created a committee just for the sake of it, and then had it go through a process, when it had already decided what had been done. I think that’s most unfortunate, because some of the recommendations of that committee are things I can get behind.

Tax on sugary drinks — there’s a health cost. That’s about taxing behaviour that you think that might have a cost with it. There’s a health cost to our society from a preponderance of sugary drinks being drunk, and a little tax on that might have been something that government could have got behind, if it listened to its task force.

A small employer payroll tax might have been part of a package — well, it was part of a package — recommended by the committee, smaller than is done here. Perhaps some personal responsibility as well. A small adjustment in terms of either through a levy or an income tax rate could have been done.

As I said, I still haven’t really got a satisfactory understanding as to why the Minister of Finance would’ve rushed into doing this or would’ve struck the committee beforehand and, essentially, moved forward without listening or waiting until the report was done.

You know, we have comments directly in the MSP Task Force report that say this: “A payroll tax would reduce the competitiveness of B.C. businesses at a time when they are facing several competitiveness challenges.” The report also said this: “We feel that it is important that revenue be replaced by a combination of measures in order to best mitigate the negative impacts of each.”

As I said, the only conclusion one can reach is that the Minister of Finance either read the MSP Task Force interim report but chose to ignore its key recommendations or rendered her decision to implement the employers health tax prior to the interim report actually being available. I suspect it’s more of the latter, in light of the fact that budget deliberations are often done in the fall and must be done in a confidential environment. Still, it’s most unfortunate.

On May 17, 2018, I stood again and rose and asked a question on medical service premiums. I asked again about the savings the province was going to realize as a direct consequence of eliminating MSP, and the answer I got from the minister at the time was that it looked like it would save about $175 million annually. So that’s a good thing.

In eliminating MSP premiums, we often get focused on the costs, and we often tend to ignore the savings. Well, maybe we can celebrate this, this year, on Red Tape Reduction Day. That savings of $175 million is a very real savings in red-tape bureaucracy inefficiency — good conservative fiscal economics.

It’s a real savings of having to mail out monthly bills. It’s a real savings of no longer requiring collection agencies to chase after past debt. Although I’m still unsure as to what government’s going to do about the existing debt from unpaid bills. That might be something to explore at committee stage in this debate.

Coming back to the support of this bill. We are faced with the following challenge. This is not how we would’ve done it. We understand that government is moving forward and piling all of the costs on a payroll tax. We unequivocally support the elimination of MSP premiums by replacing a regressive into a progressive form of taxation.

What we would rather have seen, as I mentioned earlier, is one that attached a bit of personal responsibility in there, a health care levy along the lines of what was done in Ontario, one that had a progressive amount attached to an individual’s ability to pay.

That’s not there, but we are but three MLAs in this Legislature, with government on one side and Official Opposition on the other. In each and every decision we make, we must render an analysis of the benefits of going with or the costs of going against.

As I outlined earlier, the benefits of eliminating this form of regressive taxation outweigh the costs that are going to occur or the problems that will arise by piling that on to a payroll tax. In essence, that payroll tax isn’t going to go…. It’s still going to be the second-lowest in the country, and my colleague from Saanich North and the Islands will explore that a bit further in the next debate.

We did that balance, and I really sincerely hope, for once, that members opposite in the Official Opposition stand back and ask the same question. On balance, if you put a scale there…. We recognize this wouldn’t be how you’d do it. It’s not how we’d do it. Do you really think it is better to eliminate the bureaucracy and red tape of this inefficient tax, this regressive tax, one that piles on all British Columbians…? Do you think it’s really worse to actually…? Do you think it is better to eliminate that? Or do you think it is better to vote against this bill, recognizing that that tax will still be the same as it is?

It’s a soul searching issue, and I really hope they do think about this. Think about this, not from a “Oh, we’re going to try to score it with our friends,” but from an actual governing sense — not just complaining and saying no for the sake of it.

Think about governance here. We are elected to govern in this province. We are elected to make tough decisions. Can they actually stand up and recognize that this isn’t the way they would do it, as we are? We recognize this is not the way we would’ve done it. But we’re going to support it, because, on balance, people in British Columbia are better off.

I don’t know that they can. This will be very telling in the debates ahead, whether, for once, we can actually have a debate in this Legislature that puts people first — people — in a fair manner that eliminates a regressive approach with one that is still progressive but not one that we would do.

Let’s see what happens over the next coming days. I sincerely hope government and opposition and the Third Party can stand united on this. I would love to stand there with the opposition and say: “No, neither of us would have done it this way, but we recognize it’s the right thing to do at this stage.”

Video of Speech

Protecting BC nurses from mental injuries

Shortly after reading a Member Statement outlining Bonnie Christie’s story about the trauma she experienced as an ICU nurse at BC Children’s hospital, I rose during question period to ask the Minister of Labour when he will ensure that the presumptive clause for work-related mental health disorders will be applied to nursing.

Below I reproduce the video and text of our exchange.

Video of Exchange

Question

A. Weaver: Mental disorders incurred from job-related trauma are serious injuries that can be debilitating. Last spring this government introduced protections by adding a presumptive clause for this kind of workplace injury. Now certain first responders are supported for injuries that can arise from the important work they do.

While I’m pleased that B.C. is extending protection for some workers, I’m concerned that others who suffer mental disorders on the job are being left out. In particular, I’m profoundly troubled that professions, such as nursing, teaching, social work, 911 responders, that employ disproportionate numbers of women when compared to men are being left out.

When I raised this issue this past spring, the minister stated that he shared my concern and was committed to every worker getting the help and safety they need. What has the minister done — to the Minister of Labour — to deliver on this commitment?

Answer

Hon. H. Bains: I want to thank the member for the question, and I really want to thank him for his passion about workers’ health and safety, because I do share that passion.

I must say that I’m proud to say in this House that as one of the first actions as a minister, I changed the WCB act to make it easier for the first responders to access benefits for those who are suffering from mental health injuries, because first responders have been asking for these changes for a long time.

They were ignored by the previous government. We couldn’t ask them to wait any longer.

Bill 9 also, as the member mentioned, enabled me to add other groups of workers and provide them with better protection. That’s why I am meeting with all those groups of people that the member had mentioned, including CUPE, the nurses and dispatchers, about how to add them onto the list.

But I also understand that workers suffering from mental health injuries need help now. That’s why changes are being made at the WCB right now. With additional staff, more mental health claims are accepted now, in a timely fashion. Support is provided to them as and when they need it because this is in view that health and safety is my number one priority. I will continue to work to make all workplaces in B.C. the safest in the country, and those who are injured at workplaces are treated with respect and dignity.

Supplementary Question

A. Weaver: I might suggest to the minister when he asks how to make such changes, it’s quite easy. It’s through order-in-council. So I would encourage the minister to direct that passion that he talked about to actually ensuring that the workers are given the protection that they need.

For example, a few moments ago, I read the story of registered nurse Bonnie Christie. Her doctor filed a WorkSafe BC claim and referred her to a psychiatrist who confirmed the diagnosis. But the WorkSafeBC process to evaluate her claim took four months and made her relive the traumas time and time again.

This is what Bonnie says:

“The core problem I had with WorkSafeBC is that nursing isn’t one of the occupations that presume mental disability because of work trauma. To get my claim accepted, I had to retell my story over and over to WorkSafeBC” — a story that I told you a few minutes ago. “Every time I retold it, I relived what I went through. During that time, I was crying all day long and had so much anxiety I couldn’t leave the house.“

My question is to the Minister of Labour, when will he ensure that the presumptive clause for work-related mental health disorders is applied to nursing? The trauma Bonnie has experienced is no different — no different — from the trauma that is experienced by firefighters and police officers, professions that are dominated by men, not women. The Nurses Union has provided the evidence to the minister. It’s time for the minister to act. When will he act?

Answer

Hon. H. Bains: I must say that, unlike the previous government, health and safety of workers is my number one priority. That’s why we made the changes. I’m so proud of those changes, and we realize more needs to be done.

The legislation was our first step. It allows me to add other groups of workers onto the list. That’s why we are actively working with those, and I will be meeting with nurses later on today who will be providing me with more evidence of why they should be added onto that list.

So we are actively working with those groups. But WorkSafe is working with those groups right now by adding more staff and helping those people suffering from mental health injuries. I just want to say to the House here as well, that every worker in this province is entitled to mental health coverage through WorkSafe. We are adding more resources to help them as we go forward.

But I am working with nurses. I am working with other groups so that we can add them onto that list to provide them better protection. I want to ensure that all workers go home after the end of their shift safe and healthy.

Bonnie Christie’s story: Why nurses need a presumptive clause for work-related mental health disorders

Today I introduced to the legislature Christine Sorensen, President of the BC Nurses’ Union, Roger MacQuarrie, Communications and Campaigns Officer with the BC Nurses’ Union and Bonnie Christie, a Registered Nurse. They were in the gallery during Question Period and Member Statements.

Prior to me asking the Minister of Labour when he will ensure that the presumptive clause for work-related mental health disorders will be applied to nursing, I read out Bonnie’s incredibly moving story of mental injury acquired as a Registered Nurse.

Below I reproduce the text and video of that the story. My exchange with the Minister is available elsewhere.

Video of Statement

Text of my Statement

A phone rang in the intensive care unit at the BC Children’s Hospital. The call was from a rural BC hospital and they needed to transfer an 8 year old boy to the Children’s ICU right away.

Bonnie Christie was a senior Registered Nurse in the ICU that evening. When the boy arrived she started removing his bandages and blood began flowing like a waterfall. He had been ripped apart at the legs in a car accident while he delivered newspapers to his neighbours. He died shortly afterwards as he bled to death in the ICU.

In 21 years of children’s ICU nursing Bonnie has seen a lot of death and injury.

Bonnie remembers when two young girls were brought to the children’s ICU covered in third-degree burns. The girl’s mother died in the fire as her estranged husband tried to burn down their house and kill the family.

Bonnie remembers another young girl with burns so severe that they had to transfer her to a specialty hospital in the US. The girl’s mother set had her on fire while she was doing drugs.

She also remembers a young boy who was admitted with head wounds. When she took off his bandages part of his brain fell on the floor. His father tried to kill him with an axe.

Bonnie remembers other children who were sick and injured. And she remembers some who died horrible deaths. She can’t even count the number of horrible things she saw as a children’s ICU nurse.

After 21 years of critical care nursing Bonnie started having nightmares. She dreamt of pools of blood and people hanging on chain link fences with hooks through their scalps. At first she thought she only needed to get away from critical care nursing so she transferred to less acute roles. But after several transfers she kept having panic attacks. And anxiety. And more nightmares.

“I love nursing, but I’m still burdened by the events I went through,” says Bonnie. “I can never work in health care again and I don’t want any of my colleagues to go through what I did with WorkSafe BC. What we do is too important and too stressful for us to be re-injured in the process of trying to get help for ourselves.”

That was Bonnie Christie’s story.

Bill 45 – 2018: Budget Measures Implementation (Speculation and Vacancy Tax) Act

Today in the legislature we debated at second reading Bill 45 – 2018: Budget Measures Implementation (Speculation and Vacancy Tax) Act.

Earlier in the day the Finance Minister and I held a joint press conference (see press release reproduced below). In this press conference we provided details concerning the agreement that we had reached in order to assure that the bill passed. In particular, government has agreed to support three BC Green amendments:

- The first amendment requires that mayors from affected municipalities be part of an annual review process with the Minister of Finance;

- The second amendment requires that revenue raised by the tax will be used for housing initiatives within the region it came from;

- The third amendment equalizes rates for Canadians and British Columbians – it brings the rate for Canadians down to 0.5%.

As I note in my second reading speech (reproduced below), these amendments, combined with the modifications government has already implemented in its tabled legislation, are such that the BC Green Caucus will now support the bill.

Text of Speech

A. Weaver: Please let me start by acknowledging the remarks, and thoughtful remarks they were, from the member for Kelowna West. I hope to be addressing some of the concerns he raised in the process of him outlining some of the issues from his particular riding and some of the concerns he received which were similar to some that I received. I also want to acknowledge the talk from the member for Powell River–Sunshine Coast who also brought some important information to this debate.

In this debate, I’ll say to start, I’m the designated speaker on this issue. I’m not going to be too long, but I will probably go just beyond the half-hour mark. I’m going to outline my comments in a number of ways, in a format that starts with a broad introduction to what I would argue is a crisis here in terms of affordability in British Columbia. I’ll follow that up with a little bit of a discussion about how the speculation tax was rolled out.

I think my comments will jibe with some of the comments made by the member for Kelowna West in particular. I’ll highlight some statements made in the messaging early on and some of the subsequent changes that occurred leading up to the actual legislation being introduced. Then I’ll move, in my address, to discuss some of the concerns I’ve raised consistently, such as treating Canadians equally, as well as the concerns I’ve had with respect to meaningful consultation with local governments.

And some of the concerns I’ve had with the ability of some strata, for example, or some districts that have no rental, secondary suite or tourist commercial zoning, so you can’t actually, even if you wanted to, rent out your unit because of existing laws, legislation or bylaws. Then I’ll talk a little bit about some of the land under development issue, an issue that I spent a good deal of time on, as the member from Kelowna West raised, specifically with respect to the uncertainty that this created in the development sector. Some of the other issues I raised were the impacts on British Columbians who, frankly, aren’t speculators. I’ll go through a number of personal stories. I’ll then move towards the whole issue of reaching this agreement with respect to amendments that I’ll be putting forward with government, and trying to address how those came about, to provide a public record of the process.

Then finally, I’ll conclude with what I believe is critical: the need for ongoing monitoring of what’s being implemented, to ensure that we are not, as legislators, overly interfering in the market but rather that we ensure the purpose of this tax. This, fundamentally, is to recognize that leaving homes vacant in a market with zero vacancies creates a social externality that should be internalized, somehow, to those leaving the properties vacant, until such time as vacancy rates improve.

To the introduction of the housing crisis: without any doubt in my mind, there are a number of communities where affordability has reached crisis proportions. Those are, predominantly, the urban centres in our province — in particular, the regions of Victoria and Kelowna — Vancouver is the poster child of this issue — and Nanaimo. This is a crisis facing an entire generation of millennials, who literally cannot find a place to rent, who literally cannot afford a place to purchase, who are struggling to actually live anywhere near where they can work.

We’re seeing a generation starting to move away. We just had the community move into Oak Bay — the tent community, just yesterday, of homeless people in Victoria who cannot get a place to live. This is an issue that’s moving around the province. We’ve got, in talking to business, a crisis in terms of attracting and retaining highly skilled workers. If you talk to those in the tech sector, the single biggest issue for the tech sector is the attraction and retention of highly skilled workers. They cannot pay the salaries that other jurisdictions are paying, yet the cost of living has gone through the roof.

This isn’t a problem in parts of British Columbia. There’s no doubt that for some parts of British Columbia, this isn’t an issue, but certainly, in some of our urban issues, affordability has reached crisis levels. We know the offshore money that has been flowing into our market — both in terms of speculation as well as through some nefarious activities that the Attorney General has been looking at — needs to be dealt with, but I’ve always argued that in doing so, in trying to treat the issue of foreign capital coming into British Columbia, we need to be sure that we protect Canadians and British Columbians.

Now the government’s approach was to introduce something called a speculation tax, initially. It’s now changed, and I’m actually pleased with the change of the name. I think it’s far more appropriate. It’s now called the speculation and vacancy tax. The vacancy component is critical, because the speculation component, in my view, largely applies to the offshore money.

We wouldn’t have done this. I’ve already pointed out that the approach of our party would have been to bring in place a New Zealand–style approach — to actually say: “You know what? If you want to own property in our nation or in our jurisdiction, you must be paying taxes here.” This is what New Zealand does, this is what Australia has done, and this is what many European countries do.

The idea here, of course, is that we are not living in a free market for investment in real estate and land. You and I cannot buy a home in New Zealand. We cannot buy a home in Denmark. We cannot buy a home on the coast of Mexico. We cannot buy a home in Australia. The idea here, of course, is that these other jurisdictions have recognized that when there are small local population centres and seven billion people in the world, the influence of external capital on small domestic markets can be profound. This happened in British Columbia.

Our approach was to be different from what was the government’s approach. We wanted to initiate that ban on foreign purchase. When I say “foreign,” it doesn’t matter what passport you own. It means where you’re living and paying taxes.

Now, we’re not government. There are three B.C. Green MLAs in this Legislature that got elected by 17 percent of the popular vote in British Columbia. We recognize that in not forming government, we are not able to actually initiate a ban, New Zealand–style, on foreign capital flow.

But we’ve certainly supported, and I have certainly supported all the way through, government’s efforts to deal with some of the aspects of foreign money coming in, whether it be through dealing with money laundering, whether it be through the foreign buyer tax and, more importantly, dealing with the issue of satellite families.

Now, satellite families are defined in this legislation, and we’ll be exploring that further at committee stage…. These are families where you might have one person in the family working elsewhere, paying all their taxes elsewhere, living in, say, Point Grey or Oak Bay or Vancouver-Quilchena, living in a $5 million home and declaring taxable income of $20, accessing our health care system, accessing our social services, accessing our education system but paying taxes in other jurisdictions which are not declared here in British Columbia.

To me, this so-called satellite family is actually…. Again, the cost of them actually being part of our society and living in these homes is not being internalized. The taxes are paid elsewhere, but the benefits are collected here. The government’s approach here — I wholeheartedly, and I have done so since day one…. This is dealing with the so-called satellite family.

Over the months, I’ve pointed out numerous concerns to government. This decision we came to today to introduce three amendments was not something that was taken lightly. I saw this legislation for the first time when it was introduced…. It’s likely…. It’s been such a blur with these, like burning the midnight oil. It could have been yesterday or the day before now. It’s just been one big, long blur, in terms of negotiation.

But when it was first introduced, I saw this, and I was pleased with some of the additions. One of these critical additions was identified by the member from West Kelowna. As the member from West Kelowna pointed out, when government first introduced this speculation tax, I would argue the details had not been thought through.

One of those critical details was: what about development of land? What about, if you have accumulated some land and you’re going to build townhouses and condos to sell to British Columbians, to Canadians, and, in doing so, you’re waiting for permits, you’re waiting to actually ensure that you get construction built? It takes a few years. That’s not speculation.

I’m absolutely thrilled — after meeting with the UDI, developers in Vancouver and Kelowna and all across B.C., bringing these concerns directly to government — the government listened and the government has actually included in here exemption, during the development of land, of a speculation tax. That was critical.

I suspect some, but not all, of the correspondence that the member from West Kelowna had — with respect to uncertainty and construction on hold — is a direct consequence of the uncertainty. We have now seen certainty.

I agree with the member from West Kelowna. It would’ve been awfully nice if, when the tax was first implemented or announced back in March, the certainty had been given to the market. Because I, like the member from West Kelowna, believe that market uncertainty is not a good thing, because you have projects going on hold. You have projects potentially walking. You have people then speculating on the uncertainty. So I completely agree there. But I am pleased that this has been dealt with.

Not all the concerns have been dealt with. Not everything has been addressed. I spent, after seeing this, a bill come out — and I’ll come to some of the things that have been addressed — many, many hours. My staff spent many, many hours trying to actually get to the a fundamental position where we could actually support the overarching structure of this bill, recognizing that there’s still work that needs to be done. I’ll also identify some of those things, and there is time to fix some of these things.

In my view, good government works when people work together. I recognize that it’s a much more difficult position for official opposition, and I recognized that when this government now was in opposition. It’s more difficult for official opposition to actually constructively work with government because of the setup we have in our legislative structure.

As a small third party, we have a duty and a responsibility to British Columbians to be responsible with the so-called power, the so-called influence, that we have. That duty and responsibility is to ensure that we listen and communicate our concerns and do what we can, through collaboration and compromise, to come to a situation, to come to development of good legislation, to policy that we think tempers some of what was introduced and reflects some of the concerns, but not all, that allows us to support the policy moving forward — with the recognition that this is not what we would have done. This is not what we have done.

What happened with the speculation tax and the budget rollout? Again, the member for Kelowna West articulated this quite well. When it was first announced, nobody knew the details. I didn’t know the details. The member for Kelowna West didn’t know the details. In fact, government suggested to the media — the Premier suggested — that British Columbians were fully exempt from the tax. I thought they were fully exempt from the tax. In fact, my constituency office sent out an email assuring my constituents and those who contacted me that British Columbians were exempt from the tax, based on the information I received directly from listening to the Premier.

Well, you can imagine I was a little bit surprised when I read Vaughn Palmer’s article pointing out that I was sending out incorrect information. He was right, and I acknowledged he was right. He was right in that an information bulletin had been put out that was inconsistent with the messaging and the language that had been said by government. This is not good for certainty.

This was, quite frankly, from my perspective, somewhat embarrassing. I don’t like to send out wrong information. We did our best to correct it, to do that, and, at that point, realized that we were going to have to spend a lot of time on this file.

We started pushing government to fix some things. We recognized that the issue of the housing crisis is not a rural issue. It is largely an urban issue. So in the act, you’ll see that, for example, we pushed to get some of these islands out. There were islands in the Nanaimo regional district — which was excluded — that had no electricity and no power and no rental market which were included because of what was done in the metrics to determine it. They were used, basically, over broad, regional districts, instead of over urban areas.

What we were able to do was to get government to focus this initially on the urban areas, where there is more of a problem. Some areas, like Saltspring Island, do have rental issues. However, it’s a very complex issue there, as well, and ongoing work with the rental task force, I understand. My good colleague here from Saanich North and the Islands will be discussing that, I’m sure, when he speaks to this bill. There are issues that still need to be worked out.

In March, government announced a few changes that it had made. These included reducing the rates for British Columbians and Canadians, and ensuring, in particular, that the tax didn’t apply to rural and vacation areas. One of the issues, again…. This was very relevant to the member for Chilliwack-Kent. Cultus Lake, in the initial version, was included. I think Harrison Hot Springs may have been included as well.

Again, these we pointed out. We directly took the emails from your constituents — I’m sure you probably did as well — do not pass go, to government, saying: “How does it make sense for Cultus Lake, which is not an urban centre, for Harrison Hot Springs, to actually be included in a speculation tax, when their markets are quite different from, say, South Surrey or Tsawwassen or Burnaby or Nanaimo or Victoria?”

So government did remove much of the rural aspects and focused on the urban. That was signalled out in March.

Even since then, I pointed out that I’m struggling, because the speculation tax was first introduced in the budget. I’ve heard scores and scores of stories of individual cases, over the last eight months or so, of people who’s asked: “Am I included? Am I not included? Am I here? Am I not there? What does this mean?”

This took a lot of work, honestly. It took a lot of work to try to put together a detailed understanding of the complexity of this issue, of the complexity of what government was trying to accomplish with the introduction of a tax that essentially says that we want to create an internalization of that externality associated with leaving vacant property in areas that have low vacancy rates.

Many of these examples were brought forward. Many, many meetings were had. But the issue, of course, was that we didn’t know to what extent government was listening. We didn’t know to what extent government was listening until this bill was actually introduced, sometime in the last 72 hours, which have been a complete blur to me based on the fact that…. When was it?

Interjection.

A. Weaver: Tuesday. Thank you. This was introduced on Tuesday.

When this came out, I was, as I mentioned, glad to see that government had listened — in many, but not all, examples. For example, there were exemptions for people who obviously should not be hit, where being hit with the tax would cause significant financial hardship. Some of the specific cases I raised to government were included.

For example, people that own a second home in a city because they need medical treatment. There are people in British Columbia who have to go and own a home in a particular area because they’re required for medical reasons to come and report periodically to that area. They have been exempted.

People who have secondary suites. For example, if you are in the community of Kelowna West and you live in Alberta and use your home in the summer but you have a secondary suite on your property, that secondary suite would grant exemption for the entire property. This isn’t without its own problems. For example, in the district of Oak Bay, where I am from, or where I represent, rather, the district does not allow secondary suites. So there are some issues there that we still need to canvass.

Government listened in terms of examples brought forward about couples who own two homes. One home is where one spouse works; one home is where the other spouse works. They don’t work in the same city, but they’re still together. It seemed outrageous to penalize married or partners who happen to come together and formally, you know, take vows and commit to marriage — to penalize them because they had two properties, one of which was being used by one spouse and one by the other. Government listened.

The issue of strata properties, areas zoned as commercial, where you can’t rent out places. Again, government listened. Lands that are vacant or under development. Again, government listened. I’m pleased that the UDI, whom I met with numerous times on this file…. Ann McMullin recently said that when they saw the legislation, they were pleased that government committed today that they will exempt lands under development from this tax. So the UDI is actually pleased. This is a very, very important exemption, because we cannot address affordability if we start passing on a speculation tax to purchasers of condos and townhouses which were actually being built for affordability purposes. It’s a good government lesson there.

There are still issues to deal with. Let me go through a few personal stories first, because I think it’s important to get a sense of some of the issues that I’m going to canvass more extensively in committee stage. Committee stage, as is known in this House, is critical for us to get interpretation of this legislation for broader application. There are some real subtleties as to how this tax will be introduced that government obviously has yet to capture.

In a briefing we had on the introduction of the tax plus some hours in72…. Again, it’s been a blur. I was asking some of the issues directly in the briefing. It’s clear that government has attempted a commonsense approach not to harm people who are not speculating. However, there are going to be examples that have yet to be dealt with. I can think of one example that needs to be discussed where, for no reason other than you’ve actually got a house that’s old, your house happens to be built on two city lots. In terms of the registration of your city lots, you have one house, but there are two lots. It doesn’t make a lot of sense to pay a spec tax because 100 years ago the lot zoning was the way it was. So there are some oddities there where we have to look out.

I don’t know to what extent there are other jurisdictions out there where boundaries of actual lots span multiple zones. For example, there are houses in Oak Bay that have some of their property in Oak Bay and part of the property in Victoria. Now, to what extent does that exist in the province of British Columbia on the edges of the areas covered? I’m sure there are properties in Nanaimo, in the CRD, in Kelowna West and elsewhere where most of the property is in the contained area but some of it isn’t.

These are issues that government may have not yet thought through and that hopefully will be canvassed during committee stage to get some clarification.

I’ve had people who own a house, a strata building that doesn’t allow rentals, contact me. I’ve had people who’ve invested in Victoria, in places that are zoned tourist commercial — specifically designed for short-term rentals. The zoning actually requires short-term rentals and doesn’t allow long-term rentals.

Again, this was partly dealt with in this legislation, essentially by saying that in the affected years 2018 and 2019, these areas — tourist commercial–type zoning or stratas with no rental clause — are not going to be subject. I still have issues there with respect to secondary suites in municipalities that don’t allow secondary suites officially to be zoned. Can you officially declare a secondary suite when, officially, you’re not allowed to have one? There are issues there that I hope to canvass.

I’m hoping that my good friend from the riding of Vancouver–West End and also my good friend from the riding of Saanich North and the Islands will be thinking about the issue of stratas and actually whether or not we in British Columbia are getting close to getting to where Ontario already is. In Ontario, you cannot actually have a no-rental clause, a long-term rental clause in a strata. Stratas are empowered with the power of eviction. That’s important. You can say — and it has been tested in court — no short-term rentals. But you cannot own property and put a no-rental clause on it.

I’m hoping that this committee takes a good, hard look at that because it is an issue. It’s an important issue. If you’re going to apply a speculation tax on somebody because they’re not renting it out but the strata has said you can’t rent it out, there are two components here that are important. One, there’s a real investment opportunity here for British Columbia, if we’re able to invest in new construction in strata units that allow rentals, there’s the ability to attract capital to our province to create new investment. But secondly, there’s a lot of stock in the market that potentially could be sold, if people are friends of this speculation tax, and that would otherwise not be sold and would be rented out. So it’s win-win-win, if we start to think about this in greater detail.

One of the other issues I’ve had e-mails on is…. There have been issues with respect to transition of home ownership. I’ve had couples who own two homes, in the midst of trying to sell one and move to another. One example was a constituent that had a house in Surrey, moving to Saanich. Actually, the housing crisis in our area is largely associated with people saying: “I can cash in, in the Metro Vancouver region and get a lot more over here and live well thereafter.”

This particular family had a house in Surrey and one in Saanich. They wanted to move, both areas subject to a spec tax. They were concerned that in trying to sell their home, they would be subject to a spec tax on one of their homes. Well, in fact, here we have that transition clause, which I think is important to canvass further in committee stage but which does address this particular issue.

I’ve had similar ones with a couple coming from Kelowna, moving to Victoria. Again, same thing. We seem to get a lot of people coming to Victoria to retire, and they’ve lived in other parts of B.C. They’re really worried about selling a home in one place and buying it in another. That transition amount is actually critical there, and we’re seeing that legislation brought forward in what we were shown on Tuesday.

A couple of people have told me similar stories, from the Kootenays, buying in Victoria to retire here. They recently bought. They’re worried that they’ll be hit by a speculation tax. Their child is actually living in the home now, but they’re worried that they’ll be subject to this. There are issues here with respect to whether or not that arms-length or non-arms-length allowance of the son living in the house while he might be attending the University of Victoria, for example, while they’re planning to return, was considered speculation or not.

It turns out, again, people like this have some coverage as per the legislation. Again, we have to canvass this further in committee stage.

One of the most profound issues brought to me was Canadians saying that this is not fair. “I am being taxed at a different rate living in Ontario, compared to living in B.C. Why is it that the rate is 1 percent for me in Ontario to one-half a percent for me in B.C.?” This one really struck it hard. I’m a Canadian first, I’m a British Columbian second, and third, I am actually a person from the riding of Oak Bay–Gordon Head. We are all Canadians, and to me and our party it’s critical that we treat Canadians equally.

One of the issues here that really took midnight oil being burned was working with government to ensure that they recognized that the tax rate for British Columbians and Canadians — making that difference was simply not acceptable.

This, again, will not deal with all of the issues raised by the member for Kelowna West, but I can say that when it goes 1 percent to one-half a percent, that actually affects a lot of decision-making for people that I know who have homes in West Kelowna but may live in Alberta and spend four months of the year there. The one-half a percent makes a significant difference in terms of the amount that one would pay. It’s not perfect. It’s not what we would do, but it’s significantly less than what would otherwise be.

One could argue, as government does, that what it’s doing is while it’s still encouraging development through this exemption of land under development, at the same time, it’s saying: “You know what? There’s an external social cost to developing property that is vacant that needs to be internalized by those who leave the property vacant.”

That external cost now is not differentiated between the rate…. It’s not differentiated between British Columbians and other Canadians. That is one of the amendments, which I’m working on now with legislative drafters, that we’ve kindly been given access to through this government to ensure it’s brought forward at committee stage for this bill.

I agreed with these Canadians that they pay taxes. They may not have paid taxes in B.C., but they pay taxes in Canada. I have a problem with the way the taxation system is in Canada, and we can come to this more in question period. I’m sure we will. Right now we know that a lot of people retire in British Columbia. Part of the reason why we have an affordability crisis is that we are the destination of choice in Canada for retirement.

If you look at the amount of money spent as a function of age in the health care system, it’s also really clear that you spend more as people get closer and closer to the end of their life. The older they are, the more they cost the health care system. We also know that the demographic of places like Vancouver Island and B.C. as a whole is older than other jurisdictions in Canada. So people are paying taxes in other jurisdictions and accessing our health care system here, but our Canada health transfer does not recognize age. It is not weighted by age.

Our Canada health transfer shorts British Columbia to the tune of $200 million to $300 million. Based on a simple calculation, we should be getting age-weighted cost transfers, not per-person cost. Had we been getting $200 million to $300 million more in health care transfers under the Canada Health Act, we’d have $200 million to $300 million more we could put directly into health care.

It means $200 million to $300 million more not coming out of other budgets and going into health care. It means we could have been spending $200 million to $300 million more in affordability and housing every single year. This needs to be dealt with, and this is something we will continue to push on in the years ahead.