Economy

Race to the bottom economics and the great BC natural gas giveaway

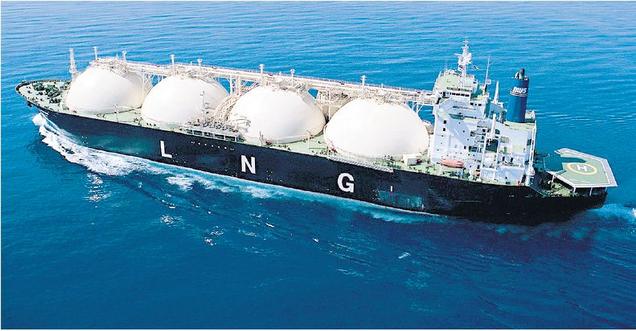

On Tuesday during budget estimates I had the opportunity to ask the Minister of Energy, Mines and Petroleum Resources a series of questions that quite clearly demonstrate the race for the bottom economics at play as BC continues to pursue an LNG industry. The exchange afforded me the opportunity to get on record the issues I raised earlier this year concerning the fact we are literally giving away a natural resource in order to blow through our greenhouse gas reduction targets.

I asked the Minister to explain the myriad natural gas royalty credit programs and to outline the aggregate amounts claimed under each program in recent years. I conclude with a question regarding deep well royalty credits and the Minister reveals that as of December 31, 2017 there are $3.1 billion in unclaimed credits.

Below I reproduce the text and video of the exchange.

Text of Exchange

A. Weaver: I don’t need the minister to read it. I’ll go afterwards and make sure I follow up with the people I’ve been communicating with to get access to the exact quote.

I have a number of questions with respect to natural gas royalties. I’ve provided these to the minister in advance. There’s a clear theme in here. My first question is this. Would the minister please describe the clean infrastructure royalty credit program?

The Chair: Just before the proceedings continue, I’d like to read to the members the section of Standing Order 17A(1). “Electronic devices must not be used by a Member who is in possession of the floor, or during the following proceedings: (a) Speech from the Throne; (b) Royal Assent; (c) Prayers; (d) Oral Question Period; (e) Speaker’s rulings; (f) divisions; (g) at any other designated time pursuant to instructions by the Speaker.” So the relevant piece is that when the member has possession of the floor, an electronic device shouldn’t be used. Thank you, Members.

Hon. M. Mungall: I’ll answer the question in two parts, essentially. First, I’ll kind of speak to the broader concept, and then secondly, I’ll speak specifically to how this particular program works.

The broader concept around this is a tool that governments in many jurisdictions often use to incentivize, whether it’s individual behavior or industrial behavior, to change. This type of incentivization, using financial incentives as well, is often used, particularly when we want to change behaviors or practices to make them more environmentally friendly.

Just as a really quick example…. I don’t want to use all the member’s time in giving these examples. But when I was on city council in Nelson, we wanted people to start recycling more — a good environmental practice. So we made the payment of garbage…. To just dispose of things into the landfill, we charged everybody $1 for a garbage bag. But putting recycling into a blue bag that we were then going to start to pick up from door to door — we made that free.

In this type of scenario, what we’ve done is made a royalty credit program to incentivize industry to advance clean technologies and solutions for reducing greenhouse gas emissions specifically that are linked to the development and production of the oil and natural gas resources. That’s specifically what this program is, and that’s the concept behind it. It’s accomplished through a provincial royalty deduction of up to 50 percent for eligible products that are approved by the ministry.

So applicants are required to, first off, fund the entire project themselves and then make applications. Then the ministry determines whether or not they’re eligible, and then how much they might be eligible, for a royalty credit.

A. Weaver: I’m wondering if the minister could please provide me with information as to how much was claimed under this program in the aggregate sense for 2014, 2015, 2016, 2017 and what is projected for 2018?

Hon. M. Mungall: This would be our newest royalty credit program. It started in 2016. The first installment had approved royalty deductions of $10.7 million to successful applicants. To date, no amount has been released, as the projects have not yet been completed. So that $10.7 million has not been released and will only be released once the projects are actually completed.

The second installment for 2018 is currently underway. We’re thinking we might be looking at $19.3 million, which to us means that it’s showing greater interest in terms of taking opportunities to reduce greenhouse gas emissions and receive the benefits of doing that. The incentivization is working as we hoped it would be.

A. Weaver: In my view, this is…. It’s the first of many credits that I’ll allude to, discuss. The first one. In my view, government is giving natural gas companies a royalty credit to clean up their own pollution. Remarkable that this was done in 2016.

A second credit that I’m hoping the minister could describe — as opposed to the clean infrastructure royalty credit program, just the infrastructure royalty program…. Could she please describe that program for me? To ask the second question at the same time, what was claimed under this program in the last five years?

Hon. M. Mungall: The infrastructure royalty program has a different focus, obviously, than the previous credit program that we were talking about, the clean infrastructure royalty credit program. This is for infrastructure in general that industry may have not been incentivized on their own to develop. So there is a variety of infrastructure that goes with the industry. Rather than minimizing the type of infrastructure that can benefit the community, we want to maximize the infrastructure. So this is part of the purpose behind all of this.

In terms of the numbers for the last few fiscal years, in 2014-15, the following royalty deductions have been released, and that was $56.8 million; in 2015-16, $54 million; ’16-17, $28.6 million; and in 2017, $1844.4.

A. Weaver: I very much appreciate the thoughtful and thorough answer from the minister. This is a royalty program, as the minister meant, that can pay up to 50 percent of the costs of building roads and pipelines, for example.

One of the concerns, of course, I have and that I raised to the minister is that there are concerns arising from this in terms of the destruction of natural habitat, which creates costs to society and wildlife populations because of predator routes and lack of biodiversity that is not paid for. We’re in some sense, through this program, incentivizing the buildings of roads, and the taxpayer is on the hook to deal with any concomitant effects on wildlife and ungulate populations in the affected regions.

Next credit program. This is the third one. I’m wondering if the minister could please describe the low-productivity well royalty reduction production program.

Because I suspect we’re going to have a recess after this, if we might, at the same time, get the projected revenues that were claimed for 2014 through to now as well.

Hon. M. Mungall: What we’re trying to incentivize with this particular royalty program is the continuation of a well rather than an early shutdown. To explain this, I’ll do my best.

For example, a well will have a predicted 30-year lifespan, right? So you get to year 25, and there’s less gas in the well. Rather than have a company just shut it down, walk away and start up something new, we want to keep that production going so that we have the full lifespan of the well. So we want to incentivize them continuing the work. There’s less gas in that well at that time, so it’s going generate less revenue. Rather than get nothing and still have this well that is there but is not operating, we want to get something out of that well and get some kind of revenue for it as well.

This incentivizes them to continue that well until its full lifespan, to make sure that they’re paying people to go there, inspect it and maintain it appropriately. That’s the purpose of this. And I would argue the effects of that make sure that the wells we have continue their full lifespan, rather than a shorter lifespan and then that company saying, “Okay, we’re going to go start up a new well that’s going to generate more gas right away,” and therefore increase the number of wells that we have in a particular area.

The amount of money that was claimed under this program in 2013-14 was $6.4 million; in ’14-15, $6.2 million; in 2015-16, $2 million; and ’16-17, $1.8 million.

A. Weaver: The fourth royalty credit program I’d like to discuss. I’m wondering if the minister could please describe the marginal well royalty reduction program, as opposed to the low-productivity well royalty reduction program that we just discussed, and if she could please let us know what was claimed under the program in the same years.

Hon. M. Mungall: The marginal well royalty reduction program is very similar to the one that I was just talking about, which is the low-productivity well royalty reduction program, except that it’s not at the end of the lifespan of a well. Rather, what’s happened is that the operator has drilled the well, and not much is coming out. Specifically, the natural gas is coming out at a rate below 23 cubic metres of gas per day, per metre of well depth.

We can pull out our calculators and do the math on that, but the point is that it’s producing very, very low. The same purpose behind the previous royalty reduction program that I spoke of is behind this one as well. It’s so that we don’t have a company just walking away, but rather, we’re incentivizing them to maintain operations of that well so that the taxpayer and British Columbians are getting something in return for that well.

The numbers associated with that particular program. In 2013-14, it was $43 million; ’14-15 is $41.9 million; ’15-16 was $12 million; and in ’16-17, $13.1 million.

A. Weaver: The fifth royalty credit program I’d like to get some information is the ultramarginal well, as opposed to the marginal well royalty reduction program. I’m wondering if the minister could please describe the ultramarginal well royalty reduction program and also let us know what was claimed under this program over the last five years.

Hon. M. Mungall: I thank the member for this line of questioning, because it allows us to get into describing the various types of wells that we have in our gas fields and also to give definition to some of the lingo in the industry.

An ultramarginal well is, I guess, kind of your next step below a marginal well. It’s slightly different in the sense that what makes it ultra-marginal is that it’s a shallow gas well and it’s a single vertical drill. That’s what makes it distinct from the previous types of wells that we’ve been talking about.

What was claimed over the last few years — I’ll give those numbers to the member. In 2013-14, it was $23.5 million, and in 2014-15, it was $24.6 million. In 2015-16, $6.1 million, and in ’16-17, $5.9 million.

Do you mind if we have a quick recess?

A. Weaver: Not at all.

Hon. M. Mungall: Chair, would we be able to have just a five-minute recess?

The Chair: This committee stands in recess for ten minutes.

A. Weaver: Thank you to the minister for her comprehensive answers to these. We’ve discussed a number of credit programs that were designed to incentivize marginal or unproductive wells to keep them going.

Now I would like to move on to some other credit programs. The next one I was hoping the minister could describe is the net profit royalty program. Again, as per the previous ones, if she could let us know what was claimed under this program for the last five years.

Hon. M. Mungall: The net profit royalty program is all about, in terms of timing, when we anticipate a well to be profitable. If a well starts off, and it’s not producing as much as it will in the future, we want to make sure that that well is still developed and that we get the economic benefits of that eventually. The program allows producers to pay a lower royalty rate in the initial stages of a project in exchange for higher royalty rates once the producers have recovered their initial capital costs.

What was claimed under this program in previous years? For 2013-14, it was $16.4 million. In 2014-15, it was $19.1 million. Then in 2015-16, something good must have happened, because it was only $2.9 million and, in 2016-17, $2.3 million.

A. Weaver: My understanding is that it’s also used to promote the development of high-risk resources that would otherwise unlikely be developed — in some sense, taking risk out of the investment nature of the natural gas sector. Again, thank you for the answer.

The next credit program I’d like to get some information on — hon. Chair, through you to the minister — is: I’m wondering if she could describe the natural gas deep re-entry credit program and, once more, let us know what was claimed under this program in the years 2014, 2015, 2016 and 2017.

Hon. M. Mungall: Before I get the answer for the next question, I will say that I just checked, and yes, your understanding for high-risk activity is correct as well. Sorry I missed that.

This particular program is for wells that already exist, and it’s to incentivize companies drilling further down, drilling deeper. Rather than a new well and all of the impacts that are associated with a new well and a new pad, we would keep the existing well, and we would incentivize the company to drill deeper.

Wells receiving this credit are subject to either a 3 percent or a 6 percent minimum royalty. So they will be having to definitely pay some kind of royalty. The figures for this are released within the public accounts. For 2013-14, it was $261.9 million; in ’14-15, $486.8 million; in 2015-16, $171.7 million; and in 2016-17, $178.3 million.

A. Weaver: Again, I think the minister is seeing the direction I’m heading with this line of questioning. These are some very big numbers here as credits. I’m only on the seventh, with more to come, of royalty credit programs that exist.

The next one is my favourite, which is called the natural gas deep-well credit program. I’m wondering if the minister could please describe what the natural gas deep-well credit program is prior to 2014, and what that program is after April 1, 2014? What occurred in the transition on April 1, 2014?

Hon. M. Mungall: I’m just going to go back to the numbers that I shared with the member in my previous answer about the natural gas deep-well re-entry credit program.

A. Weaver: Were those the deep-well credits?

Hon. M. Mungall: They’re both. They are both the deep-well credits as well as the deep-well re-entry program. Sorry to say, but the Ministry of Finance doesn’t separate the two out. So that actually is the total for two different credit programs.

For the natural gas deep-well credit program, the issue here is less the incentivizing that I was speaking to in some of the previous wells, where we were trying to incentivize a very distinct behavior. That means that the company is already here. They’re dedicated to setting up, and this is the type of behaviours or practices that we want from them as they are beginning their activity.

This particular one is addressing our competitiveness on the global stage — making sure that B.C.’s upstream in the northeast is competitive on that global stage. What it does is it provides a royalty credit for wells, for deep wells specifically.

The member wants to know…. There was a change that was made on April 1, 2014, and he wants to know what the change was specifically. What it was is that this credit program was expanded to cover wells with a vertical depth of less than 1,900 metres. Prior that that, it was 1,900 metres or more.

That’s not to say that you can drill 1,500 metres, and — that’s it — you’re eligible. What it is, is that you can drill less than 1,900 metres, but you still need to keep drilling. You just go horizontally rather than straight vertically. So there is less depth, but there still needs to be length in terms of accessing the actual resource.

A. Weaver: I assume that the numbers that were claimed are the numbers that were given earlier for the…. I believe the minister’s nodding, so I won’t ask what the numbers for the deep-well are.

Essentially, what we’ve got, in summary of these credit programs…. In British Columbia here, we provide a credit for infrastructure construction. We provide a credit for cleaning up your pollution. We have a credit to ensure marginal, cost-ineffective wells are kept in production. We provide a credit, actually, for deep wells, and we provide a credit for horizontal fracking as well. In essence, we provide credits in all areas of our natural gas sector here to incentivize natural gas drilling. Oh, were that to be the case in other sectors of our economy.

With that said then, credits are important to actually incentivize — and I get that — emerging technologies and sectors. Let’s take a look — and perhaps the minister can help us through illustration — at some of the revenues we’ve been getting, then, from the natural gas sector. I’m wondering if the minister could please provide the net royalties received by the province of British Columbia for natural gas for each of the fiscal years from 2007 through 2017.

Hon. M. Mungall: I’ll start with 2007 and the fiscal year 2007-2008. The net royalties received were $1.132 billion. The following year, ’08-09, was $1.314 billion; ’09-10, $406 million; 2010-11 was $313 million; 2011-12, $339 million; 2012-13, $169 million; 2013-14, $445 million; 2014-15, $493 million; 2015-16, $139 million; and 2016-17, $152 million.

A. Weaver: Thank you. I very much appreciate those answers. In essence, in summary, in 2009, we were at a high of $1.3 billion in royalties coming to the province of British Columbia. And in fiscal year ending 2017, were $152 million — almost ten times less.

The next question then is in the area of how much natural gas we have produced. I’m wondering if the minister could please let us know what the net production of natural gas in the province of British Columbia was in thousands of cubic metres for each of the fiscal years 2007 through to 2017.

Hon. M. Mungall: These are all in cubic metres. For 2007-2008, we have 27,084,782 cubic metres.

A. Weaver: Say that again.

Hon. M. Mungall: It’s 27 million. If the member wants, I can just round it out to the million rather than giving the entire number. If he likes, for the full detail right down to the last cubic metre, I’m happy to provide that in writing.

For 2008-2009, it was 28 million; 2009-2010, we’re at 27.6 million; 2010-2011, 31 million; 2011-2012, 36.5 million; 2012-2013, 35.8 million; 2013-2014, 39 million; 2014-2015, 42.5 million. And the last year that we have the available numbers is 2015-2016, at 44.7 million.

A. Weaver: I’ll have to get under…. Those numbers differ from the numbers that I have, being 32 million in 2007, 33 million in 2008, 33 million in 2009, 35 million in 2010, 41 million in 2011, 41 million in 2012, 44.5 million in 2013, 47 million in 2014, 49 million in 2015, 51 million in 2016 and 51.5 million in 2017. Hopefully we can, I can, reconcile where our differing sources are from, down the road.

The point here is that we’ve had close to a 50 percent increase in production over the last decade or so, at a time when in fact royalties have gone from $1.3 billion to $152 million.

My second-last question in this line of questioning is this. I’m wondering if the minister could please let us know what the net royalty per thousand cubic metres of natural gas produced in the province of British Columbia is for the fiscal years 2007 through 2017.

Hon. M. Mungall: I’ll answer this question, and then I think we’re going to have to wrap up for the day, if that works for the member. He has one more? Okay.

For B.C., the net royalty per 1,000 cubic metres for natural gas in 2007-08 was $40.45. I’ll do the same as I did before. I’ll round up or down, using those grade-school math skills.

In 2008-09, it was $45. In ’09-10, it was $14. In 2010-11, it was $10. In 2011-12, it was $9. In 2012-13, it was $4 — closer to $5, pardon me. In 2013-14, it was $11. In 2014-15, it was closer to $12; it was just $11.55. And then in 2015-16, it was $3. In 2016-17, it was $3.

This type of increase and decrease situation — if you look at Alberta numbers, it’s very similar. For example, in 2007-2008, the net royalty per thousand cubic metres was $38.30. Then, fast forward nine years into the future to 2016-17, it was $4.93. The reason why you see this, is that the royalties are not based necessarily on the volume of gas being extracted; it’s based on the price. And the price of gas is determined by the marketplace. So what we have here is that the price of gas was quite high in 2007-08, 2008-09 fiscal years, and it has come down quite substantially.

What I’d like to do for the member here, so that he has this information, is I’d just like to table this so that he can access it. Am I able to table in budget estimates?

D. Routley (Chair): I would ask you to share it informally. To properly table, we would have to do it in the main chamber.

Hon. M. Mungall: Okay. No problem. I’ll do that. Great. I’ll just hand that to the member opposite so that he has that as well.

A. Weaver: I do appreciate the response. We had slightly different numbers, from my calculations — again, based on the natural gas production estimates and the source of values — versus the sources you’ve got there.

The bottom line here is the net royalties, in using the government’s numbers, were $45 for every thousand cubic metres produced in B.C., and now it’s $3, despite a 50 percent increase in natural gas production over that same time. This is race-for-the-bottom economics at its finest.

My final question is this: what is the total accumulated and outstanding natural gas deep-well credits available to companies in British Columbia? When I asked this question in the fall, it was something of the order of $3.2 billion. I’m wondering what that number is now.

The Chair: Minister, and noting the hour.

Hon. M. Mungall: Absolutely, Chair.

The total outstanding deep-well royalty credits since the inception of the program as of December 2017, are estimated at $3.1 billion. Now, this includes all credits for all wells, whether or not they’re in production. So that’s what we have.

I just want to make sure that the public knows that a company can’t come up and say, “I have all these credits; pay me out,” and somehow they’re walking away with a bag full of money. That’s not how it works at all. They’re able to use their credits to reduce their royalties down to a 3 percent or 6 percent rate. They still have to pay royalties.

Noting the hour, I move that the committee rise, report completion of the resolutions of the Ministry of Advanced Education, Skills and Training and report progress on the Ministry of Energy, Mines and Petroleum Resources and ask leave to sit again.

Videos of Exchange

| Part 1 | Part 2 | |

| Part 3 |

On the future of the BC Hydro’s standing offer program for clean energy

Yesterday in budget estimates for the Ministry of Energy Mines and Petroleum Resources I took the opportunity to question the Minister on the status of BC Hydro’s clean energy Standing Offer Program.

The exchange is very illustrative of the problems I have been trying to raise with respect to the direction BC Hydro is taking. The decision to proceed with Site C has led BC Hydro to essentially grind the Standing Offer Program, and the BC NDP PowerBC Better Plan, Brighter Future energy and jobs campaign plan, to a halt.

Below I reproduce the text and video of the exchange.

Text of Exchange

A. Weaver: Thank you to the member for Surrey–White Rock for her line of questioning and the minister for the answers that we’ve been receiving. Very interesting.

I had a number of questions on the standing offer program that B.C. Hydro has ongoing. As the minister will know, the standing offer program for wind developers, at least, requires $1 million of investment over two years and over two years of studying permitting work to be done prior to the project achieving an electricity purchase agreement. The requirement for this up-front investment was done with the explicit intent of reducing program costs for the Crown, and when the BCUC approved the standing offer program, the BCUC stated that developers could expect to be offered an EPA if the project meets all the eligibility requirements and must be willing to incur the cost to prepare an application.

As the minister will know, the standing offer program was suspended in August 2017 with no warning. Despite that Hydro might suggest that…. Its only warning to industry was that there would be changes to price and volume of the SOP projects, not that the criteria itself would change or that the program would be completely redesigned. As the minister will know, developers that continue to invest in their products accepted that there would be changes to price and volume.

Hydro also implied that IPPs should have read market signals that there was an oversupply of energy and therefore infer that the standing offer program was a risky investment. However, the B.C. government legislated that the authority must maintain the standing offer program, and there was no indication the program would be suspended or cancelled or that there would be a change in the eligibility requirements.

There have been some recent public statements by the minister suggesting that there will be significant changes to the standing offer program and that there will be a First Nations focus. I have a number of questions on this. First, if this suspension leads to a material change to the policy, then is this suspension not actually a cancellation, because the new program is a different product?

Hon. M. Mungall: I appreciate the member’s question is: if this program doesn’t come back, isn’t this ultimately a cancellation? But I wouldn’t be able to say that at this time. Where it is at, as the member knows, is that it’s on hold. What is going on is…. A review was first started in 2016, and we’ve talked about that. That was attached to the rate revenue application and so on.

Industry was informed at the time, in 2016, that a review was taking place. That included the SOP, and of course, part of that was: well, does B.C. Hydro need the power? Do British Columbians need the power? So now review, review, right? Governments love to do these things.

With this government’s, the new government’s, review of energy procurement, as mentioned earlier, as part of the review that we just started in March, we’re looking at energy procurement, and if the SOP is a good program to continue on with. There’s been no decision one way or another at this time.

A. Weaver: The B.C. government legislated that the authority must maintain the standing offer program. When B.C. Hydro proposed the original SOP review, they set precedent for a review period length for prospective SOP participants, thus ensuring that important conditions such as price and eligibility would not change suddenly while they were preparing their projects.

Why wasn’t this put into practice for the recently announced review?

Hon. M. Mungall: I’m sorry, in the conversation I just had with staff, if I’ve missed and forgotten some of the member’s question. I’m sure he’ll remind me if I don’t get everything that he was hoping to get answers for.

Where things are at is that this government — and I know the member opposite and all members of the House as well — wants to make sure that rates are fair for British Columbians and for customers of B.C. Hydro. Whether they’re direct customers — they pay a B.C. Hydro bill — or, in my case, Nelson Hydro. We buy power from B.C. Hydro, as the city of Nelson does — and passes it on.

For all the B.C. Hydro customers, we want to make sure that rates are fair and affordable. Part of that issue is ensuring that we’re not purchasing power that we’re not able to then disperse at the time that that power becomes available. So we want to make sure that we have enough power for British Columbians, recognizing that we are able to sell on the spot market around North America, but then there’s the price that you get on the spot market that you also have to consider. So we want to make sure that we’re not putting an undue burden onto the backs of ratepayers by having more power than we’re able to disperse at the time at which we need it.

I hope that that’s making sense. For example, an IPP comes on line next year, but we actually have a surplus of power, perhaps, next year. So that would actually impact rates, because we’re obliged to pay that contract.

A. Weaver: Coming back, as I initiated with my questions on this topic, I noted that the SLP program required wind developers to invest $1 million over two years of the study permitting. Many wind developers have invested this money.

My question to the government, then, is how do they see this liability to companies who have made the required investment, sometimes with their own money, and have no program to participate in, in light of the fact that they were told that the program would exist, that they were required to make this investment and that they would get an electricity purchase agreement, although the price itself had not been set at that time?

Hon. M. Mungall: Ultimately, the impact on companies and the investments that they put in will depend on the outcome of the review. However, there are two things that B.C. Hydro has to balance in this.

One is obviously impact to ratepayers if we start purchasing power that we’re not going to need right now or in the immediate future and the risk that private investors take in the private market. Ultimately, B.C. Hydro is responsible to ratepayers, not to private investors in the private market.

A. Weaver: Thank you, and I appreciate the answer, but I would suggest that the government is responsible to both. I would suggest that the rules were put in place for investors, investors played by those rules and the rules changed and now the investors are left with a loss.

I would argue and suggest that government has accepted a potential liability through changing this program, particularly in light of the fact that the argument that the minister just put forth doesn’t hold water because the minister and her government recently approved continuation of the Site C dam to produce power for which there is no demand. So I’m sorry — the answer is quite unacceptable to me.

Nevertheless, let me continue. Was the minister aware that on March 14, 2018, the federal Minister of Environment and Climate Change, Catherine McKenna, announced the launch of the low-carbon-economy challenge? In particular, is she aware that this $500 million initiative will fund projects “aimed at reducing greenhouse gas emissions, saving energy and creating green jobs”? And that $162 million of that will be available to B.C. ?

Hon. M. Mungall: Yes. We are aware of the low-carbon-economy challenge and the fund associated with it. We’ve actually been able to access it.

The fund is going to be able to…. It’s contributed to other programs, but within this ministry specifically, it’s contributed an additional $12 million toward our building energy retrofit partnership, which will help communities across B.C., obviously, reduce carbon emissions associated with the built environment.

A. Weaver: Thank you, hon. Chair. Again through you to the minister: is she aware that the federal Minister of Environment Catherine McKenna chose Vancouver as the location to make the announcement for the program and that on that very same day, B.C. Hydro announced it would be further diminishing the standing offer program by suspending those applications already accepted into the program by B.C. Hydro, with only a few exceptions? And if so, why did B.C. Hydro do this?

Hon. M. Mungall: Yes, those two announcements were made on that day. It was purely coincidental, however. There was no purposeful reason why both of them were made that day. It’s just how things roll out sometimes.

A. Weaver: Purely coincidental but profoundly ironic.

I’m wondering if the minister is aware that some of the projects were already engaged in the B.C. Hydro interconnection process.

Hon. M. Mungall: The interconnection process is obviously part of the broader process in the standing offer program. The reason why it’s there is that it looks at the longer-term viability of connecting with that particular project. Sometimes projects go ahead, and sometimes they don’t. That’s just the broader, for people’s information. But, yeah, the ministry was aware that there were projects that were in that process at the time of the announcement on March 14.

A. Weaver: I’m just wondering if the minister could please provide two numbers. The first number is: what’s the accepted total megawatt capacity of accepted applications in the standing offer program? And the second number is: of this total megawatt capacity, how much is within the interconnection queue?

Hon. M. Mungall: Sorry about the delay to the member.

What’s the megawatt capacity of accepted applications in the SOP? For the standing offer program, it’s 137 megawatts. In the micro standing offer program, there are two megawatts. To answer the second part of his question, all of those projects — so therefore, all of those megawatts — are at varying stages in studying interconnection, so it’s the same number.

A. Weaver: My understanding is that 59 megawatts of the 137 are much further along in that process than the 137 itself.

With that said, I’m wondering if the minister could then briefly, in summary remarks, comment on the status of the following projects: the Nahwitti wind project in Port Hardy, 14 megawatts; Babcock Ridge wind project in Tumbler Ridge, 15 megawatts; Canoe Pass tidal project in Campbell River, two megawatts; Little Nitinat River project in Port Alberni, five megawatts; the English Creek hydro project in Revelstoke, 5.8 megawatts; the Fosthall Creek power project in Nakusp, 15 megawatts; the Sarita River project in Bamfield, 5.3 megawatts; the MacKay Creek project in Revelstoke, and I do apologize to Hansard who are trying to get this down here, 5.2 megawatts.

The East Hill project of my good friend from Kootenay East, in Cranbrook, a solar project, 15 megawatts; the Sukunka wind project of my good friend here from Peace River South in Chetwynd, 15 megawatts; the McKelvie Creek hydroelectric project in Tahsis on Vancouver Island, 5.4 megawatts; Newcastle Creek hydroelectric project, Sayward, 5.3 megawatts. Again, coming to the riding of my good friend from Peace River South, the Wartende wind project and the Zonnebeke wind project, both of which are 15 megawatts in those.

What is the status of these projects that have been approved and are sitting in the standing offer program?

Hon. M. Mungall: All of the projects are on hold, with the exception of the Sarita River hydro power project. They have been sent a draft energy purchase agreement, a draft EPA. The Sukunka wind energy project in Chetwynd is currently pursuing an electricity purchase agreement. Sorry. They are not. We are. B.C. Hydro is pursuing an EPA negotiation with the project. That’s the same result for the Zonnebeke wind energy project, also in Chetwynd. And the last one that is not on hold but unfortunately has been rejected is the McKelvie Creek hydroelectric project.

A. Weaver: Thank you, hon. Chair. I’m wondering if….

Hon. M. Mungall: Can I just ask…? Would you like a written copy of that?

The Chair: Members can redirect comments through the Chair, please.

Hon. M. Mungall: Mr. Chair, I’m just wondering if the member would like a written copy of that, if that would be helpful for him.

A. Weaver: That would be very helpful, and I do appreciate the response and the offer.

On this topic that I’m wondering about, hon. Chair, through you to the minister, if she’s aware that the Rocky Mountain solar project in Cranbrook has formed a B.C.-based research and innovation consortium that includes the UBC engineering Clean Energy Research Centre, the SFU chemistry department, the Natural Resource Council of Canada, Ballard Power, Schneider Electric, Iona Miller, Avalon Battery and others.

Hon. M. Mungall: B.C. Hydro wasn’t aware that RMS was forming a B.C.-based research and innovation consortium. They didn’t put that in their application, in their SOP application. That being said, ministry staff have been able to meet with several of the partners within this consortium and learned about it through those meetings. That’s my understanding.

A. Weaver: The Rocky Mountain solar project, as the minister will know, is the only solar project that’s gone through the standing offer program. They plan to build a living lab facility site that will focus on advancing next-generation energy solutions, in partnership with those organizations that I previously mentioned. As the minister may know, connectivity through the transmission line is not that difficult in light of the fact that it goes right through the property of the proposed solar facility in the Cranbrook region.

I’m wondering. Again, I’d like to suggest that the Rocky Mountain solar project is exactly the type of project that is being looked for under the low-carbon economy challenge that I spoke about earlier, and particularly, the clean growth fund that demonstrates a commitment to creating diversified clean energy. It ensures that we have reliable power, it promotes research R and D in the province, it helps establish B.C. as leaders, and it’s being supported by investor capital, not ratepayer-supported capital.

My question, then, is: what is the government doing to attract and retain a clean energy sector here in B.C., and in particular, whatever happened to the B.C. NDP PowerBC better plan, brighter future program they touted in the lead-up to and during the last provincial election campaign?

Hon. M. Mungall: Just for the member’s information, the Rocky Mountain Solar project is actually not the only approved solar application in the SOP. There’s also the Tsilhqot’in solar project, which is being advanced under the micro SOP. It’s smaller, yes, but it is another solar project. I know that the member is very interested in what kinds of projects are out there, so I wanted to share that with him.

In terms of his question, in terms of what we’re doing to attract and retain clean energy sector in B.C., as well as the PowerBC plan that our party launched while we were in opposition — where is all of that? Well, that’s a fair question. I mentioned earlier that we were talking about the energy road map. We only got a chance to mention it briefly. But that’s precisely where we have driven these very issues, is into building our energy road map. That road map is about planning for the future. It is about looking at ways in which we can address load and demand.

One of the things that we need to do, and I know the member’s very passionate about this and is very, very well versed on this, is obviously reducing carbon emissions. How do we electrify the economy using clean, renewable electricity that is carbon free? We already have 98 percent of the energy we produce in B.C. meeting that test of carbon free. But if we want to be able to produce more carbon-free energy, then we also need to look at the demand side, the load of what is being demanded by British Columbians.

We have to look at where we are going into the future, what kind of demand we are anticipating and what kind of demand we can grow. I know that the member knows a lot about electric vehicles. He has an electric vehicle, and he really wants to see the transportation shift from fossil fuels to clean electricity. I agree very much with that vision. That’s part of our energy road map and planning out for that.

How do we do that? We already have incentive programs. We’re already working on expanding charging stations. But what more can we do to ensure that we’re reducing costs for people, which is one of the barriers, as well as making sure we have good, solid infrastructure? BCUC right now, as I mentioned earlier, is looking into the utilities aspect and who can actually sell power so that we can build out the infrastructure so that it’s just as commonplace as what fossil fuel infrastructure has been in the past, and so on and so forth.

There are a lot of questions and planning, and that’s where that energy road map comes into play. That’s where we see that broader vision that we’ve expressed in the past funneling into. Earlier we were talking about that energy road map then leading into, obviously, how B.C. Hydro would be organizing itself and placing itself into that future demand — for example, around electric vehicles, around partnerships with the clean energy sector, the private clean energy sector, and so on.

A. Weaver: I appreciate the answer, although I’m not sure it directly addressed the question I was raising. I do take issue with the assertion that the Tsilhqot’in program is on par with the Rocky Mountain. Of course, it isn’t. I’m quite aware of the micro–standing offer program, which is quite different from the larger standing offer program.

In fact, on March 14, 2018, B.C. Hydro issued a statement on that saying:

“…electricity purchase agreements for five clean energy projects that are part of the impact benefit agreements with B.C. Hydro and/or are mature projects that have significant First Nations involvement. B.C. Hydro supports the government’s decision to take a closer look at energy procurement to ensure the best value for B.C. Hydro’s customers through their review of B.C. Hydro this year. As a result, there are no plans at this time to issue any additional electricity purchase agreements. The standing offer and micro–standing offer programs will remain on hold until the review is complete.“

The issue I have here, and the issue I continue to raise, is companies have invested millions upon millions upon millions of dollars in British Columbia in good faith directly in response to signals that government sent and B.C. Hydro sent, and they are now on the hook for this. This is not because of any uncertainty in the market. It’s exclusively because of uncertainty in terms of direction B.C. Hydro is….

I’m sure the government is aware, for example, that larger power projects, like in Alberta, have seen prices coming in at 3.7 cents a kilowatt hour for wind. We know that the next call is Saskatchewan, which is supposed to follow. It’s likely going to have, if it hasn’t come in yet, wind power coming in at 4 cents a kilowatt hour. We know that if there was a call for power at 10 cents or 8 cents, industry would meet that. We know that firm wind power can be delivered at around that price, and it’s being done around the world.

My question to the minister is this. Why hasn’t she instructed B.C. Hydro to explore cheaper alternatives to Site C, cheaper alternatives that could include firm power calls that link wind with storage?

Hon. M. Mungall: The member’s question was specifically: why didn’t I direct B.C. Hydro to look at alternatives, specifically wind with firm storage? He’s right to say that I didn’t direct, because they were already doing it. They did do that, and they put it as part of their submission to the B.C. Utilities Commission, I believe, originally back in 2014 — the original submission to, I believe, government in 2014. Pardon me if I’m not getting that correct. But definitely their submission to the B.C. Utilities Commission, in their review of Site C that we put forward last fall.

Video of Exchange

Extending protection for workers suffering mental disorders

Today during question period I rose to as the Minister of Labour when he was going to deliver on his commitment to more broadly extend the presumptive clause for work-related mental health disorders to other workers.

This was the first question that the minister has been asked since he was sworn in so he had a fair amount of “pent up answer” waiting for a question.

Below I reproduce the video and text of the exchange.

Video of Exchange

Question

A. Weaver: Mental disorders incurred from job-related trauma are serious injuries that can be debilitating. This government recently introduced protections by adding a presumptive clause for this kind of workplace injury. Now certain first responders are supported for injuries that can arise from the important work that they do.

While I am pleased that B.C. is extending protection for some workers, I’m concerned that others who suffer mental disorders on the job are being left out. Particularly, I’m profoundly troubled that professions such as nursing, teaching and social work — professions that employ disproportionate numbers of women compared to men — are being left out.

When I raised this issue earlier this year, the minister stated that he shared my concern and was committed to every worker getting the help and safety protection they need. What has the minister done to deliver on this commitment?

Answer

Hon. H. Bains: On the last day of the session, the last one to get a question, and I just want to tell you how thrilled I am to get that question. I want to thank the member for asking this question and giving me the opportunity to talk about the health and safety of workers in this province.

I share your passion about health and safety of workers in this province, Member. That’s why my goal is to make workplaces in British Columbia the safest in the country. You do that by having a strong preventative and training program so that we prevent injuries from happening in the first place. Then those who are injured or sick at workplace — that we treat them with respect and dignity and give them care and support when they need it so that they are able to go back to their pre-injury work as soon as they can.

That’s why we brought in Bill 9: to give protections to those workers who are first on the scene at a very dangerous and challenging situation. The first responders have been asking for these changes for a long time, and their requests have been ignored time and again. Well, we’re going to change that. I am considering expanding presumption to other groups of people, and as a result, I have been meeting with those groups — like nurses, CUPE, the dispatchers who are represented by CUPE — and other workers and with the member that asked this question so that we can continue to work to enhance and provide better working conditions for the working people of this province.

I believe and I know that everyone in this House believes that every worker deserves to go home healthy and safe at the end of their shift or their work. Anything less is unacceptable, and I do

Supplementary Question

A. Weaver: I’m beginning to regret asking these questions these last few days. Yet more pent-up answer looking for a question to deliver to.

I do have a supplemental. The supplemental is this. The Canadian Institute for Public Safety Research and Treatment at University of Regina undertook research that found that the percentage of 911 operators and dispatchers who suffer from post-traumatic disorder as a result of their work is comparable to those for police officers. But in B.C., affected 911 operators and dispatchers continue to fight for treatment and compensation while struggling with work-related mental health disorders.

We now have the tools to ensure they get the coverage they need. To the Minister of Labour: briefly, what concrete steps has the minister taken to expand the support we now offer to other first responders? And what steps are those now being applied to 911 dispatchers and call receivers?

Answer

Hon. H. Bains: Mr. Speaker, you can never be brief when you’re talking about the health or safety of working people in this province. The member knows that I’ve been discussing with him and other members of this House and all those workers who need better protection when they go to work. And they need protection when they are injured or sick at workplaces.

First responders have been asking for these changes for a long time. In fact, my colleague, the member now of Social Development and Poverty Reduction has put a private member’s bill in this House asking for just those changes that was ignored by the previous government.

UBCM 2016 passed a similar resolution and was ignored by this government. It doesn’t surprise me, member, because, if you’ve watched you watch for the last 16 years, the only time the members of that government stood up in this House to talk about workers was when they were ripping up their collective agreements, when they were eliminating the injured workers’ benefits, or when they were cutting their health and safety protection.

We said that we will do things differently. Workers know now that they have a government that respects them, a government that values their work. You know, we have taken some steps, and more is coming, Member — and everyone here — and workers know that

One year later, CASA continues to deliver strong, stable government that puts people first

Today the BC Green and BC NDP caucuses celebrated the one year anniversary of the signing of our historic Confidence and Supply Agreement.

The Premier and I took the opportunity to celebrate the event at the offices of Alacrity Foundation in Victoria. This was a fitting venue since Alacrity represents a stellar example of innovation in the new economy.

Alacrity has helped bring over $225 million to B.C.’s technology ecosystem through its investor readiness program and on April 19, 2018, the Province announced that it was investing more than $711,000 over the next three years in the Alacrity Foundation of B.C.’s Cleantech Scale-Up program.

Below I reproduce the brief remarks I gave at the event as well as our joint press release.

My remarks

I am delighted to be here to celebrate the one year anniversary of the announcement that we had reached a Confidence and Supply Agreement with the BC NDP.

The 2017 election was historic for our Party. We doubled our popular vote count and tripled our seat count.

When the results came in as a minority government, we felt an enormous weight on our shoulders. We took our decision very seriously.

In the end, we decided BC needed a change. It was clear that most British Columbians wanted things to be done differently.

There was a clear desire for bolder, forward-looking policies on a range of important issues:

affordability;

environmental protection;

investments like child care and public education that will give our children the best possible future.

CASA is the result of two distinct parties coming together around shared values.

Ultimately we want the same thing:

to improve the health and wellbeing of British Columbians;

to make government more responsive to the challenges and opportunities they face in their everyday lives;

and to set our province up for success.

There have been ups and downs in the first year, but like any relationship our Agreement has required us to work through our issues and come together to find solutions that we can both support.

This is a special opportunity – under majority governments, a party can get 100% of the power with as little as 39% of the vote and push through its agenda without having to consult or collaborate with any other parties.

This has often left British Columbians feeling disconnected and like their government is not listening to their concerns. In just the first year since signing our agreement, we have worked together to:

ban big money;

reform the lobbying industry;

make historic investments in childcare and public education;

advance key elements of the BC Greens’ economic vision for the province.

And we’re just getting started.

Right now, I am hard at work with Minister Heyman to develop a climate plan that puts a bold vision for BC’s economy centred around innovation at its core.

We have a unique opportunity to make BC a leader again in climate action.

While climate change poses significant risks and challenges, there are opportunities to be had as the world transitions to the low carbon economy.

But the benefits will only flow to those who are leaders – not the last adopters.

BC was once a leader in climate action, providing an example to the world that a strong economy and bold climate action are perfectly compatible.

I am looking forward to unveiling our plan to make BC a leader once again.

There are challenges that lie ahead, but I am deeply encouraged by our ability to come together to work through our differences.

John and I both know that there is more at stake than the future of our two parties – we are united in our love of this province and we want to set it up for the best possible future.

Our caucus remains committed to doing everything we can to work collaboratively to advance more solutions so that we can deliver on our shared commitments to the people of BC

Thank you.

Joint Media Release

| For Immediate Release 2018PREM0081-001062 May 29, 2018 |

Office of the Premier Office of the Leader of the B.C. Greens |

One year later, CASA continues to deliver strong, stable government that puts people first

|

|

| VICTORIA – Premier John Horgan and B.C. Green Caucus Leader, Andrew Weaver, marked the one-year anniversary of the Confidence and Supply Agreement (CASA) at the Alacrity Foundation in Victoria.

The leaders highlighted co-operation to put people first, and investment in clean tech, innovation and a resilient economy that creates good jobs for people in B.C. — now and into the future. “When we agreed to CASA, we agreed to make democracy work for people and focus on solutions to the challenges facing British Columbians,” said Premier Horgan. “By working together, we’ve accomplished a lot to make life more affordable, improve the services people count on, and build a strong, sustainable economy that works for people. And we will keep working together, every day, to make life better for people in B.C.” The Province recently announced support for the Alacrity Foundation to help clean tech companies expand. The support for Alacrity is part of the progress made on CASA commitments to advance innovation and technology, and the collaborative work on the climate action strategy that continues. “Over the last year, we’ve shown the people of B.C. that co-operative government can lead to better, evidence-based policies that will set our province up for a bright future,” said Weaver. “Core elements of our economic platform are part of CASA. With the establishment of the Emerging Economy Task Force and the appointment of B.C.’s first innovation commissioner, the province will be better positioned to adapt and prosper in the changing economy of the 21st century.” CASA commitments on climate action were emphasized by both leaders, as they stressed the importance of decisive action and ongoing work to ensure B.C. is a climate leader. “Climate change affects everyone, and our shared future depends on making B.C. a climate leader with a strong economy that works better for people and the environment,” said Premier Horgan. “The previous government stalled climate action and failed to meet targets. We are working collaboratively towards a credible and effective climate strategy that creates opportunities for people. I’m excited about what we can achieve together.” The Government of British Columbia recently introduced legislation to update the Province’s greenhouse gas reduction targets, setting the stage for a renewed climate action strategy to be released in the fall. “There is much more to be done, but I look forward to working together to make B.C. a leader in climate action once again,” said Weaver. “We have an incredible opportunity to build a thriving economy centred around innovation, and keep our commitment to younger generations. A climate plan that is a collaborative effort by two distinct parties is a unique chance to put people ahead of politics, to think beyond the typical electoral cycle and set our province up for the brightest possible future. British Columbia has so much to offer and we can and shall be a leader in the new economy.” In addition to growing B.C.’s tech economy, supporting innovation and making B.C. a leader in climate action, CASA lists child care, team-based health care and housing as priorities. Quick Facts:

Learn more: To learn more about the CASA Secretariat and agreement, visit: https://www2.gov.bc.ca/gov/content/governments/organizational-structure/ministries-organizations/central-government-agencies/government-communications/casa To learn more about Alacrity’s BC Cleantech Scale-Up program, visit: https://www.alacritycanada.com/programs/ |

|

Contacts: |

|

| Jen Holmwood Deputy Communications Director Office of the Premier 250 818-4881 |

Jillian Oliver Press Secretary B.C. Greens 778 650-0597 |

Finance budget estimates: Protecting the ALR from speculation

Over the last year or so I have twice (February 2017 and October 2017) introduced a bill to protect agricultural from continuing to be subject to speculative investment activity.

Today during budget estimates for the Ministry of Finance I asked the Minister why her government had neither applied the foreign buyers tax nor the speculation tax to land in the ALR. In particular, I sought answers to why her government is not stepping in to stop prime farmland being carved up and converted into mega mansions.

Below I reproduce the video and text of our exchange.

Video of Exchange

Text of Exchange

A. Weaver: I just have a couple of questions in two areas to finish my estimates questions to the Finance Minister. The first is in the area of ALR protection. The ALR was left unprotected from the measures announced in the budget to cool the market for the residential real estate sector, which has encouraged speculation in ALR. My first question is: why didn’t the foreign buyer tax and the speculation tax apply to the ALR? And why was, for example, foreign ownership not restricted to the ALR, like has been done in areas across Canada, including Alberta, Saskatchewan, Manitoba, Quebec and PEI?

Hon. C. James: Thank you to the member for the question. I think there are two pieces I just want to focus on.

I think the first one is…. As the member will know, there’s a comprehensive policy review going on with the Minister of Agriculture right now in looking at a whole range of issues related to agricultural land. We’re doing our policy work — side by side, I guess, is the best way to describe it — along with the work that’s being done in the Agriculture Ministry. So we don’t want to either get ahead or be duplicating work that’s going on.

As the member will know, there was a large consultation done, and so people were giving their feedback. To look at further work that needs to be done around the agricultural land, we’re doing that policy review, as I said, along with the Agriculture Minister.

But I think it’s important to note that both the foreign buyers tax and the speculation tax do apply to houses, to the residential property that’s on agricultural land. I know the member’s speaking about a broader base when it comes to the agricultural land, but in fact, those taxes do apply to the class 1 residential housing that is on agricultural land if they’re in the areas that are covered by those taxes.

A. Weaver: Yes indeed, I was concerned about the broad, bare land of agricultural land that can be purchased that does not have a foreign buyers tax. Then Richmond council can be approached, and that land could then have a mega-mansion put on it, which was the subject of the concern being expressed here.

In the budget, the minister stated that she’d be changing the tax treatment of residential property in the ALR in order to close property tax loopholes. My question is then: how are you changing property tax treatment, and when can we expect to see this done?

Hon. C. James: We’re looking at the changes. These are draft changes to the School Act to exclude ALR properties that are in the residential property class from the 50 percent land exemption. We’re going through that process right now, again, as I said, in tandem with the work that’s going on in the Agriculture Ministry. This would require changes, so we certainly hope it’ll come by the fall.

A. Weaver: Again, the review. We’ve been talking about the review, and the Minister of Agriculture is indeed undertaking such a review. But in fact, we’re not waiting for the results of the review before changing the tax treatment on residential property.

We know what’s happening in an ongoing fashion in Richmond is that the speculation and mega-mansions are devouring ALR there. For example, last year, Richmond lost 50 farms due to mega-mansions. We can’t, frankly, afford to wait a year to see more action.

Why are we not taking immediate steps now to impose the foreign buyers tax and the speculation tax on the ALR land? What is stopping the minister from doing that?

Hon. C. James: I certainly appreciate the urgency of this issue. I appreciate the examples that have come forward, particularly in Richmond, as the member mentions. They are issues right now and challenges right now. But there is, as I said, the comprehensive review going on. We need to make sure that…. Many of these changes have to happen through different acts, not through one act.

For example, the changes to the school tax related to the school tax on agricultural land also have to be changes to the Assessment Act. Again, we don’t want to piecemeal it. We want to make sure that the changes that we make are really going to make a difference. That’s why we’re working together with the Agriculture Ministry.

There is an opportunity, hopefully, in the fall to bring forward those changes, to have coordinated with the feedback that people gave and to be able to make a comprehensive change that will prevent the kinds of examples that the member has raised.