Economy

Responding to the Changes in the Government’s Speculation Tax

Earlier this month I was very critical, of the government’s ill thought through attempts to curb speculation in the housing market. In fact, I was entirely unsure as to what outcomes the government was seeking with the introduction of their so-called “speculation tax”. To the government’s credit, the Minister of Finance declared that she was willing to listen to British Columbians and make adjustments to her proposed policies. This was the opening that we were looking for.

Over the last few weeks we worked hard to solicit, listen to, and respond to the concerns of British Columbians about this tax. We brought these concerns directly to the table with the NDP and worked closely with them to identify and offer solutions to many of the unforeseen consequences that had arisen. In particular,

Over the last few weeks we worked hard to solicit, listen to, and respond to the concerns of British Columbians about this tax. We brought these concerns directly to the table with the NDP and worked closely with them to identify and offer solutions to many of the unforeseen consequences that had arisen. In particular,

- We wanted to ensure the tax did not unfairly impact British Columbians, including people with vacation homes, who are not speculating in our market.

- We wanted to ensure the tax did not apply to rural or vacation areas, where there are many part-time residents and they are significant to the local economy.

- We wanted to ensure that this tax truly targets speculators – people who park their money in our real estate market as if it’s the stock market – and that it effectively deals with satellite families and offshore money.

- We wanted to ensure adequate flexibility for rentals, allowing people to avoid the tax by renting their home out part of the year, and stay there the other part of the year.

- We wanted to ensure that people who can’t rent their place out, through restrictive zoning or strata bylaws, aren’t hit with the tax.

- We wanted to ensure that the tax actually reduces speculation, and does not provide a revenue windfall for government.

Yesterday Carole James, the Minister of Finance, announced revisions to the proposed speculation tax that will be introduced this fall. While the BC Greens would have taken much more aggressive action focused largely on foreign capital through a New Zealand style offshore buyers ban, as well as targetting speculation through a flipping tax and closing the bare trust loophole on residential sales, the government’s proposed changes go a long way to dealing with a number of concerns with the tax.

Below I reproduce the Media Statement that we released in response to the proposed government changes.

Media Release

B.C. Green Caucus responds to government’s speculation tax changes

For immediate release

March 26, 2018

VICTORIA, B.C. – Andrew Weaver, leader of the B.C. Green Party, issued the following statement in response to the government’s announced changes to the speculation tax.

“It’s a positive sign that this government is willing to listen to British Columbians and to make adjustments to policies,” said Weaver.

“In a minority government, we have an opportunity to do things differently by collaborating to improve public policy. We worked hard to champion British Columbians’ concerns and bring forth evidence-based solutions to this policy’s shortcomings. We agree with the B.C. NDP that we need to take action to address speculation in our real estate market. However, we have been clear that we needed to see changes to this tax in order to support the forthcoming legislation. In particular, the government’s policy must target speculation and empty homes in our urban centres without undue adverse effects on rural areas and on British Columbians who aren’t speculators.

“These changes go a long way to dealing with our initial concerns with the tax – they make it much more targeted and limit the effects on British Columbians with vacation homes. We look forward to the full details of the legislation to ensure it truly limits unintended consequences. We will continue to advocate for bolder policies to address speculation, including a flipping tax, the closing of the bare trust loophole and a New Zealand-style ban on foreign capital.”

Adam Olsen, MLA for Saanich North and the Islands added that he was pleased that many of his constituents’ concerns were addressed.

“I heard from many concerned Gulf Islanders who were worried about how the speculation tax might impact them and we kept pressure on the government to address these issues,” said Olsen.

“I’m glad that the government has recognized that this tax doesn’t make sense for rural areas like the Gulf Islands. The diversity of concerns in my riding demonstrates the need for a nuanced approach to the housing crisis. We have serious housing challenges in the Gulf Islands that need to be addressed, while recognizing that seasonal residents are valuable members of the community who contribute to the local economy. I will continue to work closely with the communities in my riding to bring locally-appropriate solutions to the table.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

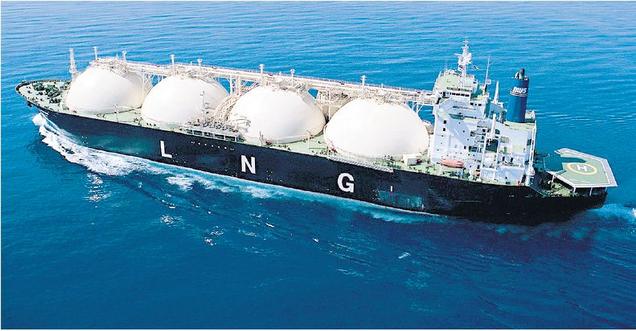

Responding to the BC government’s new regulatory framework for LNG

The BC government today outlined its proposed regulatory framework for LNG proponents such as LNG Canada. In particular, the BC government sent a letter on Monday to Mr. Andy Calitz, CEO of LNG Canada, providing specific details. While the BC Green Caucus has not seen a copy of the letter that the BC Government sent, we were consulted on the government’s high level policy objectives as outlined in their media briefing and release today.

Given that the BC Green caucus believes in the importance of giving industry certainty as to our positions and intentions, we also sent Mr. Calitz a letter that is reproduced in text form below. In our letter we are very clear that:

- The B.C. Green Caucus does not, and will not, support exempting new LNG companies from carbon tax increases as this defeats the purpose of the carbon pricing.

- Extending the carbon tax to fugitive emissions is a core component of our confidence and supply agreement with the BC NDP.

- The confidence and supply agreement requires government to implement a climate action strategy to meet B.C.’s legislated emissions reduction targets of not less than 40% below 2007 levels by 2030 and 80% below 2007 level by 2050

Our firm position is that it is incumbent upon government to assess the LNG Canada project through the lens of meeting these greenhouse gas reduction targets and specifically identify a pathway to meet them. This should be done in a manner that protects existing industries that provide jobs and economic activity that British Columbians rely on.

As it stands, and despite being in office for 8 months, the BC Government still has not identified any concrete measures to reduce greenhouse gas emissions. As I pointed out in February, it is not possible to on the one hand claim you have a plan to meet our targets and then on the other hand start promoting the expansion of LNG.

As noted in the essay I wrote, in 2016, British Columbia actually lost $383 million from exploration and development of our resource. That’s because the tax credits earned exceeded the sum of the income received from net royalties and rights tenders combined. In the fiscal year ending March 31, 2017, British Columbia earned total revenue of only $3.7 million, a 99.9% drop from 2010 (BC earned 1000 times more revenue in 2010 from natural gas than we did in the last fiscal year).

It makes no sense to continue the generational sellout and further extend the government handout to a hypothetical LNG industry by offering ratepayer-subsidized electricity (read Site C) of 5.4 ¢/kWh (less than half what you or I pay and less than half of what it will cost to produce the electricity from Site C). It makes no sense to exempt LNG companies from being required to use electric drives for compression of natural gas to achieve this discounted electricity rate.

And in addition, expectations are that the federal government would further exempt LNG Canada from tariffs on fabricated steel imports. This would ensure that most of the infrastructure would be built in Asia and shipped to BC. At the same time, the BC Government will exempt LNG proponents from the Provincial Sales Tax (PST) for construction. So much for the multi-billion dollar investment, revenue and job creator for British Columbia.

Finally, it remains to be seen if LNG demand will increase in light of the fact that Japan, the world’s largest LNG importer, is restarting nuclear reactors that were shutdown following the Fukushima incident. In fact, just this week a major Japanese electric power company is putting its LNG contracts up for sale.

In the ongoing saga of British Columbia’s desperate attempt to land a positive final investment decision from a major LNG proponent, the generational sellout continues. In a typical race-for-the-bottom fashion, the BC NDP are proposing still further subsidies to LNG proponents.

While I appreciate the Premier’s commitment to putting in place a plan to reduce emissions to 40% below 2007 levels by 2030 and 80% below 2007 levels by 2050 and to put a price on fugitive emissions, I cannot see how this is possible if the LNG Canada proposal goes ahead. It would require every aspect of our BC economy (except LNG Canada) to collectively cut emissions by more than half in twelve years and by 95% by 2050.

As outlined in our media release below, there are significant opportunities to grow B.C.’s economy while meeting our climate targets that do not include LNG. For instance, the supercluster funding announced last month is expected to generate 50,000 jobs and $15 billion in economic activity in B.C. in the next 10 years.

In summary, the BC Green Caucus will not support any legislation brought forward to grant the exemptions outlined above.

Media Release

B.C. Green Caucus releases letter to LNG Canada clarifying position on government’s LNG approach

For immediate release

March 22, 2018

VICTORIA, B.C. – The B.C. Green Caucus released a letter sent to LNG Canada clarifying the Caucus’ position on the government’s proposed LNG regulations. The letter, sent on Monday March 19, came after the Caucus was was made aware of the the details of the government’s proposed LNG regime. The letter is intended to give industry maximum clarity, as the minority government requires the B.C. Green Caucus’ votes for general stability and to pass legislation.

“There are significant opportunities to grow B.C.’s economy while meeting our climate targets,” said Andrew Weaver, leader of the B.C. Green Party. “For instance, the supercluster funding announced last month is expected to generate 50,000 jobs and $15 billion in economic activity in B.C. in the next 10 years. Future development must fit within our climate targets, and the numbers on LNG simply don’t add up.”

The B.C. Green Caucus does not support extending the proposed measures to support existing Emissions Intensive Trade Exposed (EITE) industries as currently conceived to prospective LNG companies – a policy that would in effect freeze the carbon tax at $30/tonne for certain facilities. CASA commits government to extend the carbon tax to fugitive emissions, and the Caucus expects that this will include the natural gas industry. Further, the Caucus is concerned that increasing B.C.’s emissions through LNG developments will place an undue burden on existing industries and the public to reduce their emissions beyond what is already required.

“Not only is a plan to meet our climate commitments a core component of our Confidence and Supply Agreement (CASA) which forms the stability of this government, it is essential for ensuring we do not betray our duty to future generations.” Weaver continued. “When it became clear that the government intended to propose measures that are incompatible with B.C.’s ability to meet our climate targets, we felt it was our responsibility to communicate to LNG Canada that if these measures were to go ahead unamended, we would no longer have confidence in government.

“To be clear – our Caucus is fully committed to working in partnership with the B.C. NDP government to enact a plan to meet our climate targets and in attracting the investments we need to build a 21st century economy. We will continue to hold this government to account on all its promises, including our responsibility to the next generation and our international commitments to act on climate change.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

Text of BC Green Caucus Letter

Mr. Andy Calitz

CEO, LNG Canada

March 16, 2018

Dear Mr. Calitz,

We are writing regarding your ongoing discussions with the Government of British Columbia on your proposed project, LNG Canada in Kitimat, B.C.

As you know, British Columbia currently has a minority government, where the votes of our three caucus members provide confidence in Premier Horgan’s NDP government. The basis of our confidence is the Confidence and Supply Agreement (“CASA”) signed May 30, 2017 which binds our two caucuses to act on the principle of “good faith and no surprises.” As such, the government must consult with our caucus on all matters, and it must uphold the agreed-upon policies and initiatives enshrined in it. Our caucus has been consulted on the letter sent from the government to LNG Canada. We are writing to let you know our position on the government’s proposal in order to provide you with the fullest possible scope of information.

First, extending the carbon tax to fugitive emissions is a core component of CASA. We have assurances from the government that this extension is forthcoming pending a determination of the necessary technologies and regulations to measure them. To be clear, it is our expectation that the carbon tax on fugitive emissions will be extended to all sources of these emissions. This will have impacts on a number of industries and future proposed projects, including yours.

Second, CASA requires government to implement a climate action strategy to meet B.C.’s legislated emissions reduction targets. Therefore, all future development must fit within our province’s commitment to the Pan-Canadian Climate framework to meet our emissions reduction targets, as well as soon to be legislated targets for British Columbia specifically. As such, it is incumbent upon government to assess your project through this lens and to specifically identify how it will accomplish the emission reductions required to meet our targets of not less than 40% below 2007 levels by 2030 and 80% below 2007 level by 2050. This must be done in a way that limits harm to other existing industries that provide jobs and economic activity that British Columbians rely on.

Finally, CASA commits government to implement an increase of the carbon tax by $5 per tonne per year beginning April 1, 2018. Our intention was to ensure that across the entire economy a clear market signal was sent that incentivized low GHG producing activity, as well as spurred innovation and investment in the new economy. We were made aware over the course of our consultations with government that the proposed measures to support Emissions Intensive Trade Exposed (EITE) industries would be extended to LNG as well. These measures would have the effect of rebating up to 100% of the carbon tax that was paid beyond the $30 per tonne, based on how the greenhouse gas production intensity compares to the global cleanest benchmark.

While our caucus is supportive of these measures for the many existing industries in B.C. that already provide jobs and economic activity for our province – many of whom made their investment decisions in a previous regulatory environment – our caucus does not support extending the EITE as currently conceived to a proposed LNG industry.

If such a measure goes forward without amendment we do not see how a climate action plan, as agreed to in CASA, would have any legitimate pathway forward to reach our GHG reduction targets. As such, our caucus would no longer have confidence in government, as they would not be living up to their commitments laid out in CASA.

We believe that British Columbia must make its GHG reduction targets and climate action plan the centerpiece of its economic strategy. Our focus must be on prioritizing innovation within our economy and seeing new investments that ensure we are leaving the next generation with real opportunities to prosper. We are deeply encouraged that the companies engaged in your joint venture are investing heavily in renewable energy and other clean technologies. B.C. has a highly educated workforce, world-class research institutions and a wide range of innovative companies. We would welcome the opportunity to work with you in a manner that builds on these opportunities while helping us meet B.C.’s GHG reduction targets, as committed to under the Paris Climate Accord.

We would be happy to discuss our position in detail with you.

Sincerely,

Andrew Weaver

MLA, Oak Bay Gordon Head and Leader, B.C. Green Party

Sonia Furstenau

MLA, Cowichan Valley and Deputy Leader, B.C. Green Party

Adam Olsen,

MLA, Saanich North and the Islands

Wondering why zero emission vehicles aren’t exempt from the PST surtax

Yesterday during committee stage of Bill 2: Budget Measures Implementation Act, 2018 I rose to ask the Minister of Finance why her ministry did not exempt zero emission vehicles from the PST surtax that they are now applying to higher end cars. As I note in the text and video exchange reproduced below, early adopters of new technology typically heavily subsidize the research and development (R and D) costs of such technology. These early adopters play a critical role in ensuring that new innovations ultimately become affordable for mainstream society.

In my opinion, zero emission vehicles should have been exempted from this surtax.

Text of Exchange

A. Weaver: The question I have for this section, I’ll ask it once and not repeat it for the other sections. It’s with respect to different types of classes of vehicles. I recognize that the minister had outlined the existing legislation and the taxes that apply below $125,000.

My question to the minister is this. To preface it, it’s that we know, in certain sectors, that early adopters are the ones that pay the R and D for new technology to emerge. If we go and look at flat screen televisions, the people who bought the first flat screens paid thousands and thousands of dollars. Now they’re literally giving them away when you sign deals — left, right and centre.

My question is: did the minister or her staff not think about exempting hydrogen fuel cell electric vehicles from this tax? That is, with recognition that it is those early adopters that are paying the R and D in this new and emerging technology that allows others to actually buy these technologies, which is a direction we want to go.

So my question is: why did the ministers not exempt zero-emission vehicles from this additional PST? Ultimately, we want to tax that which we don’t want, and we want to not tax that which we do want. These are zero-emitting vehicles.

Hon. C. James: Thank you to the member for the question. In fact, we did take a look at battery-electric vehicles available in British Columbia. We did look at prices. The member is quite right. It’s obviously an area we want to incent support for.

If you take a look…. I’ll just give you some prices of the base models. I recognize that there are models that could be much more extreme than this. But if you look at the base models, for example, of Teslas — a Model 3 or Model S or Model X — those are all under $125,000. We feel that that fits within the existing bill.

A Nissan LEAF, for example, is $35,000; a Fortwo electric drive, $29,000. If you take a look at the prices — a BMW i3 is $50,000 — they’re all well within the range and under the $125,000. We felt that that was a reasonable approach and didn’t penalize, as the member has suggested, the kind of behaviour that we want to incent.

A. Weaver: Just to follow up, though. In fact, as the technologies emerge…. You couldn’t buy a hydrogen fuel cell. We don’t know whether that’s going to be the technology of tomorrow. But suppose a company decides to put that on the market. It’s zero-emitting. We don’t know that that…. We would want to let the early adopters actually pay the price, if they want to have that niche article, and not tax them.

In addition, we’re now talking about driverless vehicles. The high-end Teslas…. The Model X actually has a driverless component to it, and to get $125,000…. It goes rather quickly, and also the other exemptions for above 50 and above 67 too.

Again, I recognize the minister says that they took a look at the cars. But the reality is that the reason why we can buy a Nissan LEAF now for $35,000 is precisely because people were willing to pay $100,000 plus for those Teslas, and you got the investment in the battery technology that led to the mass production of the smaller cars.

Again, I would hope that the minister would recognize that this has been viewed very negatively within the electric vehicle sector of our society because of the fact that it’s not differentiating between those cars that pollute and those cars that don’t. It’s being viewed simply as a punitive measure on those early adopters who are trying to actually get the market going in the direction they wish it to go.

Hon. C. James: Thanks to the member. I appreciate that. But again, when we’re taking a look at an increase in the purchase price of vehicles over $125,000 and over $150,000, I think that’s a reasonable approach. It doesn’t mean that those won’t be adjusted over time as additional vehicles come on the market.

I certainly know that most companies are looking at, when they get their vehicles on the market, as much affordability as they can. There are certainly other incentives that are often offered, whether it’s a rebate for an electric vehicle or otherwise. There are other kinds of rebates that occur as well.

We felt that this was a fair process. As I said, when I take a look at the models that are on the market, I think even Tesla…. When you’re looking at $122,600, that’s still a fairly pricey vehicle. We think $150,000 and $125,000 are a reasonable approach.

But I take the member’s point and understand that, always, there are opportunities to go back and take a look, as I said earlier, at a number of taxes we’ve talked about. There are always opportunities at the end of each year to take a look at their impact, to take a look at whether they’ve been effective or not and adjust as may or may not be needed.

Video of Exchange

Attempting to get clarity on the BC NDP “Speculation” Tax

Today in Question Period I took the opportunity to see if I could get more details from the Minister of Finance on the BC NDP’s so-called “Speculation Tax”.

Last week I was very critical of the way the BC NDP introduced this tax. Ironically it doesn’t even address speculation in the real estate sector.

I remain unconvinced that the BC NDP know what outcome they are trying to achieve with their tax measure. It’s clear to me from the Minister’s responses to my questions (reproduced in video and text below) that they don’t understand the difference between a vacancy tax and a speculation tax. In fact, under the Vancouver Charter, that city have already imposed a vacancy tax.

A better way forward would be to enable all local governments (not just Vancouver) to introduce vacancy taxes if they felt it was in their community’s interest. At the same time, a speculation tax could be applied exclusively to properties owned by offshore individuals and entities, the bare trust loophole could be closed and a flipping tax could be applied when the same property is sold multiple times in a short time period.

Fortunately there is still time to fix what the BC NDP have proposed.

Video of Exchange

Question

A. Weaver: There’s no doubt that we need to take bold action to address the drivers in our housing crisis. A fundamental component of this is clamping down on speculation. But the government’s botched speculation tax doesn’t in fact target speculation.

A speculator is someone who buys a property solely to flip it. A speculator is someone who parks offshore money in our real estate, hoping to protect themselves from the turmoil in global markets. A speculator is someone who uses bare trusts to avoid paying property transfer taxes, thereby allowing multiple sales and resales with no change in title.

A speculator is not someone who pays taxes here and owns a vacation cottage. These folk are not trying to capitalize on our out-of-control housing market.

My question to the Minister of Finance is this. The minister has said that her aim is to make sure she gets speculators out of the market. Does the minister consider British Columbians with vacation homes to be speculators? Or will she ensure that they are fully exempt from this tax? If so, how will she do it?

Answer

Hon. C. James: Thank you to the member, the Leader of the Third Party. I appreciate the question, and I appreciate his support for a speculation tax.

We were left, in this province, with a crisis when it comes to the housing market, because the other side ignored the issues and the crisis that people were facing around affordability. We’ve seen rents skyrocket. We’ve seen families who can’t afford to live in the community that they work in. So our goal is to ensure that British Columbians can afford to work and live in their own province.

We’re including measures in the speculation tax that will protect British Columbians. We are looking at getting people out of the market who are using our housing market as a stock market. The specifics will come. We’re continuing to listen to the issues that people raise, including the member at the end. We will make sure that housing is affordable for British Columbians. That’s our aim, and that’s what the speculation tax will do.

Supplementary Question

A. Weaver: The government has had years to consult with British Columbians. Instead, it brings in a poorly thought out tax measure whose interpretation seems to change every time the minister or Premier is in a press scrum.

As far as I can understand from the tax information sheet still on the government’s website, British Columbians with second homes have to pay the tax, and then they get a non-refundable tax credit after the fact. Low or moderate-income British Columbians will, in many cases, not even be able to use the tax credit. But if you’re very wealthy, you get the full benefit of the credit. That doesn’t make any sense. It penalizes people with moderate and low incomes and further entrenches the idea that home ownership is reserved only for the wealthiest.

Hon. Speaker, my question, through you to the Minister of Finance, is this: will the minister reconsider this tax credit model to ensure that British Columbians with vacation homes are actually protected from the effects of this speculation tax?

Answer

Hon. C. James: I would say to the member, once again, that we introduced the speculation tax as part of our 30-point plan to address affordable housing in British Columbia. I said in the budget lockup and on budget day that the details would be coming. We are listening to British Columbians, including the member and other people who have put forward ideas. We have been working on those issues since we introduced the speculation tax.

The specific concerns that the member raises are issues that are already on the table, which we are reviewing and looking at as we implement the tax. As I’ve said all along, details will come. The aim is to make sure that we get speculators out of the market.

I would say to the member that if you are an individual who owns four empty houses and you’re leaving them vacant in Vancouver, you are speculating in the housing market. We will be addressing that, and we will be addressing affordable housing for British Columbians.

Calling out BC NDP for botching up tax measures & nonexistent legislative agenda

In the legislature today, second reading of Bill 8 – 2018: Supply Act (No. 1), 2018 was up for debate.

The Supply Act is the bill that allows government to spend money. It is typical for the Supply Act to have two parts. The first, which was debated today, provides government the power to spend money for the next two months (April and May, 2018). The second, which will be debated once budget estimates have concluded, will allow government to spend for the rest of the fiscal year (to March 31, 2019).

There is a long history of all parties in the legislature supporting Supply Acts (both the BC Liberals and BC Greens continued the tradition with this Act). The reason is obvious. If they are not supported, government cannot spend money. All services stop and government shuts down. While this occurs periodically in the United States, it is not common in Canada.

Nevertheless, I took the second reading opportunity to outline how concerned my BC Green Caucus and I are with the lack of vision and legislative agenda these past 8 months. We are also profoundly troubled with the fact that the government has badly botched two recent tax measures which have created uncertainty and chaos in market.

I spent a fair amount of time specifically highlighting the “Speculation Tax” which is actually not a speculation tax. Rather, it is a “paper wealth tax” that has been poorly thought out, doesn’t deal with speculation, and hurts British Columbians. The BC NDP have badly botched this measure and its interpretation by the Minister has been changing on a near daily basis.

The BC Greens understand the importance of tempering exuberance in the out of control housing market and have specifically called for a New Zealand-style ban on foreign purchases as per our call for bold action. We also outlined numerous other measures that could be implemented including the importance of closing the Bare Trust loophole as was done in Ontario.

The BC Greens understand the importance of tempering exuberance in the out of control housing market and have specifically called for a New Zealand-style ban on foreign purchases as per our call for bold action. We also outlined numerous other measures that could be implemented including the importance of closing the Bare Trust loophole as was done in Ontario.

The Speculation Tax and Employer Health Tax both need the introduction of legislation prior to them taking effect. Such legislation is expected in the fall. Fortunately we have time to pressure government to fix the problems embedded in their poorly thought out approach to deal with speculation.

As evident in the speech reproduced in video and text below, I specifically ask the Minister of Finance to stop making up tax policy on the fly, in press conferences. Continuing to do so creates nothing but uncertainty and chaos in the market chaos. British Columbians deserve better.

Video of Speech

Text of Speech

A. Weaver: I rise to speak to the Supply Act. I thank the member for Prince George–Valemount for her comments and the minister for her introduction of the bill.

This bill, as the member for Prince George–Valemount pointed out, is, essentially, following tradition, where, after the budget is announced and estimates are brought forward, a portion of the budget getting us through this legislative period is requested up front to ensure that people get paid, in essence — that government can operate, that capital projects can go forward.

In this Supply Act, we’re approving 2/12, or 1/6 — quite remarkably, not to do fractional division, 2/12 is 1/6 — of the total amount of the main estimates, as well as one-third — you could have said 4/12, if you wanted, as opposed to one-third — of the capital budget. I won’t be proposing amendment on that, although I think it is sloppy mathematics.

On a slightly different note, I do have a number of concerns, serious concerns, with respect to the Supply Act because the Supply Act is making assumptions with respect to the implications of the budget. And, of course, the budget, which we’ve discussed, has got some assumptions in it.

You know, I and my colleagues are frustrated here in the B.C. Green caucus. We’re frustrated because on July 18 of 2017, this government was sworn in. We are now nearly eight months since government was sworn in, and we’re still questioning what legislation is going to be brought forward. In the 19 days of debate — we’re in our fourth week now, of debate here — here we are, and what’s being brought forward?

We’re getting the Supply Act to debate — fine. Fully four of the eight bills that the government has introduced, including this Supply Act, are really housekeeping bills or bills that every government has to bring in. We have the bill, of course, to ensure the supremacy of the parliament. I won’t talk to that, obviously, because that’s a different debate. We have the Budget Measures Implementation Act. Of course, I’m not going to speak to that bill, either. It’s another debate.

And we have the now famous Miscellaneous Statutes Amendment Act, which we’re all waiting with bated breath to debate as we define things like Pacific daylight-saving time. These are what the government’s agenda is. This is troubling.

Let’s go back to 1972 — July 24, 1972, when an election was called. On August 30, 1972, a new NDP government was formed. In the first session of that 30th parliament in the fall, they sat for nine days, and they passed 13 bills. In the second session, they passed 93 bills in 61 days — 93 bills.

This government has had 16 years in opposition to come up with an agenda, and now we’re being asked to approve a supply act when we don’t actually know what that agenda is. We’re 19 days in, and we’ve seen precisely four non-traditional bills to debate, one of which is the supply act.

You know, we’re troubled about a number of the assumptions in this bill that are leading to the supply act. We have seen government talk about an employers health tax. We’ve seen government talk about a speculative tax. We’re not sure what they mean when they’re talking about it.

I had thought, after conversations and reading the media, that a speculation tax wasn’t going to apply to British Columbians. Silly me for actually listening to the Premier and the Finance Minister say that in media scrums. But then I see an interpretive bulletin that actually says that what’s going to happen, leading to estimates that we have to approve here, is that in fact, if you’re a B.C. resident, you’re getting a tax credit. That’s what the interpretive bulletin says: you’re going to get a tax credit.

You tell that to the constituents of mine or other colleagues across who aren’t earning any income but happen to own a family cottage on a lake that happens to be in the boundary of Nanaimo regional district or on one of the Gulf Islands — that now that person is going to be charged $12,000 a year as a speculation tax. They’ll get a tax credit, sure, but they’ve got no income on which to apply that tax credit. How’s that a speculative tax?

This government clearly believes that this real estate market is a market from which they can sap revenue. We’ve asked: what is the outcome? What are the outcomes you’re looking for your measures? That has yet to be defined.

We see projected budget increases, and then stabilization of revenue, coming from things like this so-called speculation tax. If it was a speculation tax, you would hope it’d go to zero. It’s being applied, in our sense, as a paper wealth tax. We feel that what’s happening here is that policy and finance and tax measures are being made up in press scrums.

The market needs certainty. What are your outcomes? We have got a supply bill that’s made budget estimates assuming income from a speculation tax whose implementation has literally changed three times since the budget was announced.

Is it going to apply to Gulf Islands? Is it going to apply to the city of Kelowna? The city of Kelowna, where the rental accommodation right now is critically dependent on owners renting their houses to students for eight months of the year and using those houses in the summer for either vacation rentals or to live in themselves. This is critical for the Kelowna economy, yet we call that a speculation. No, they’re playing a critical role to rental properties there.

We understand that Vancouver’s out of control. We understand that the Vancouver market’s completely out of control, and we understand that it was far too long to deal with it. But the revenues here, we’re uncertain of. We’re frustrated, because we don’t know what the agenda of the government is, we don’t know the direction that they’re going in the housing market, and all they’ve done is signal to the market that it’s going to be chaotic times ahead because we haven’t articulated what this critical new measure is to broader society. That’s not how tax measures are going to be brought in.

We proposed, of course, dealing with the problem, which was the foreign capital that’s flowing into this province. This would have given certainty here, because we would have assumed that, when you start to tax that foreign capital or you actually eliminate the source, you know those revenues are going to go to zero.

But this government, in the supply bill, is actually counting on those revenues and basically taxing the grandmother in Oak Bay who happens to have a house from 150 years of family on Saltspring Island that they want to leave to their children.

How many MLAs here have properties on the Gulf Islands? How many government MLAs have properties on the Gulf Islands? Well, one just has to look through the disclosure. I can tell you it’s a number of them. Are they getting a surprise, knowing that they’re going to pay $12,000 a year, if it’s worth 600 bucks? So $12,000 a year, but they’ll get a tax credit. They get a healthy salary here. Okay, that’s fine. But most of them don’t.

We’re very worried down here. We’re worried that the government is actually falling into the trap that they have branded on themselves over many years, which is one of not being able to be fiscally responsible with the money, the hard-earned taxpayers’ money, in our economy. That is troubling. It’s very troubling.

You know, obviously, we support the supply bill. Obviously, we must have a continuation of the government operating and all the schools and hospitals around this province. Obviously we must support this bill. But we want government to stand back and reflect upon what it’s been doing.

It has had 16 years — or the dreaded 17 years, depending on where you count; 16 or 17 years — to develop a legislative agenda. We are now 19 days into this session, and we’ve had nothing.

We stuck our necks out. We recognized that British Columbians wanted a change. We recognized that they wanted to have people put first. We recognized that they wanted a child care plan, which we see in the Supply Act. We recognized they wanted real measures done in the housing market. We recognized that they wanted bold action in the housing market. What have we got? A tepid response that, frankly, is botched up from its first introductions through the present day we are here.

I’m worried, because let me say that the measures that are being brought forward are not dealing with the problem there. If you want to tax speculation, tax speculation. But we’re not actually taxing speculation here. You could still here: buy a townhouse; take possession; flip that townhouse four times; pay zero property transfer tax because you bought it in a bare trust.

Government has known about this for months and years and railed on the B.C. Liberals to close that bare trust loophole. Have they done it? No. Why? Because they have to collect more data. How much more do we need to study these issues? How much more studying do we need? Clearly, too much, in that case, but what about the employer health benefit? Well, we don’t need to study that, even though we have a MSP tax panel to actually do just that.

We decide, as reflected in this Supply Act, that we know what the answer is. We struck a panel of distinguished academics who put their careers and credibility on the line to write a report on which government is going to base decisions, and government determines the way it’s going to deal with before their interim report is there. And it had to, because you don’t make budgetary decisions two days after an interim report is done.

What does that say that government is actually doing? Is it listening to the experts? Only on what it wants to listen to. Only on what it wants to delay, what it wants to kick down the road.

It’s not listening on the employer health premium — again, a piece of tax policy that, as far as we can tell, was introduced, realized it was done inappropriately. Now we’ve got the MSP panel coming in with their final report clearly articulating that they don’t approve or recommend the direction government has taken. How’s government going to respond? They’ve boxed themselves into a corner. They’re going to respond in a way that going to hurt schools and hospitals all across this province.

Now, they’ll say: “Okay, we’re going to cut it for the average person.” Yes, they will. They’ll cut it for the average person. And I get that there are unions out there — I was one of those negotiators — who’ve negotiated MSPs as part of a collective agreement, and it was costed against the settlement. I understand that. But what you do then…. I mean, there are also unions right now going back to their employer, saying: “You’re not going to have to pay that. Give us the money back.” Now the employer is getting doubly hit, because they’re going to get a health care tax. Not only are they going to get a tax, they’re going to get an increased tax.

I don’t understand the logic of this government not thinking this through and not recognizing that there are models out there and that you don’t hit the economy with a baseball bat. You recognize that there are problems. You send a signal to market, and you do so slowly, and you don’t make policy up in each individual press scrum.

I will quote one of the legislative reporters here who accurately assessed some emails, which my constituency office was sending out, suggesting that in fact the speculation tax wasn’t going to apply to British Columbians — because we heard, in press conferences, this government say just that.

They said just that — that it’s not going to apply to British Columbians. But in fact, it does. It’s applying, through a tax credit, not only in the problem area of Vancouver but in downtown Kelowna, which will absolutely devastate their economy, and in Parksville. The member for Parksville-Qualicum talked about a development that likely won’t go ahead. Parksville is a community that caters to — guess what — snowbirds, people from the prairies who are trying to escape the cold winters and come to Parksville for four or six months a year to live. Sometimes they rent out their home in the summer, for summer vacations. It’s a community whose entire economy is based on tourism — snowbirds and others.

What about if we go to Cultus Lake? I had a passionate plea from a citizen from Langley who said they just bought a house. They’ve been saving their life for a place in Cultus Lake. They’ve entered into a contract, and now they have to move from the contract and get out of it, out of fear that the speculation tax will apply to them. They’re afraid that they’re going to be sued, because government hasn’t given the market certainty as to the direction it wants to go. This is unacceptable.

We’re debating the Supply Act, where the government is asking: “So give us 2/12.” It should be 1/6. That’s actually a beautiful demonstration, Hon. Speaker, of what I’m saying. Get the numbers right. British Columbians deserve that. They deserve a signal. They deserve a real estate sector that actually deals with the problem — not Whac-a-Mole, where you put a foreign buyers’ tax in Victoria, and one in Nanaimo regional district. Guess what. You go to Cowichan Valley regional district.

There’s no difference between Cowichan Valley, CVRD, GVRD and Nanaimo. There are just a few arbitrary roads in between. So we Whac-a-Mole down here; we Whac-a-Mole up there. When you Whac-a-Mole in Nanaimo regional district, you’re going into the rural communities of Coombs and Errington regions. They’re not actually communities that have any housing problem. You’re going into these rural communities and Whac-a-Moling there. Meanwhile, you’re leaving Cowichan Valley open — pristine farmland that is being bought up and turned into mansions. But you’re not dealing with that.

The CEO of the Royal Bank has identified what the problem is. We know what that problem is. CIBC has identified the problem, by clamping down on foreign mortgages. This government is actually not viewing what the problem is. Instead, they’re viewing this tax, to generate revenue in the Supply Act that we’re debating, solely as a form of income to fund its other expenditures. That is reckless, and we deserve better. We deserve government to declare its agenda. We’ve given them a full eight months now, and we are waiting. We continue to wait to know what direction: what are they going to introduce? You promised a bunch of things. I sat here for years and watched private member’s bill after private member’s bill being introduced.

I come back to Dave Barrett. Ironically and sadly, we celebrated his life last week. In his first session in the spring, his government passed 93 bills, many of which are around today — one bill every three days over the short term. Here we are, government saying: “Trust us. We have an agenda. Give us some money now. We’ll kick it down the can, and we’ll vote again later. But we’re not really going to tell what you that agenda is, even though we’ve had so much time to do so. What we’re going to do is make up tax policy, on the fly in press scrums, creating chaos in the market.”

We deserve better. So while I stand in support of this Supply Act, because we must pay the government, I could say we have very serious issues with the budget implementation.

Interjections.

A. Weaver: Well, people are joking: “Well, you have to support the Supply Act.” We have to. If we don’t support the Supply Act, basically, nobody gets paid, whether it be in schools or hospitals. The government shuts down. I mean, they do that in the U.S. all the time, and it seems to be okay, but we don’t want to do that here. We don’t want to do that here in Canada.

With that said, I say that now we have very serious issues with the way government is implementing the speculators tax and very serious issues with how the government is implementing the employers health tax. We have nothing now before us in legislation. We’re told it’s coming in the fall. Government has months to fix it. I expect them to fix it, because frankly, right now it’s unacceptable. Frankly, right now we need to have certainty.

I plead on government to stop making up tax policy on the fly, in press conferences. Give us certainty, so we know what’s going on, and stop scaring people across the province. They’re contacting me. They’re contacting our colleagues across…. They’re contacting members here. We deserve better.