Economy

Exploring the mandate and expanded scope of Innovate BC

Today in the BC Legislature we debated Bill 4: British Columbia Innovation Council Amendment Act at the committee stage. As I discussed earlier, this bill renames the BC Innovation Council as Innovate BC and expands its mandate.

This bill represents further developments towards implementing an important initiative that formed a component of the BC Green economic plan in the last campaign.

In my exchange with the Minister of Jobs, Trade and Technology, I sought to explore his vision of Innovate BC. I was delighted with his thoughtful responses.

Below I reproduce the text and video of our exchange.

Text of Exchange

A. Weaver: Continuing with section 3, I have one somewhat technical question and a number of broader questions.

The Chair: Members, we are on section 5.

A. Weaver: Sorry, section 5 of Bill 4, section 3 that is being amended in the BCIC Amendment Act. Thank you for that clarification, hon. Chair.

The first question is with respect to section 3(e) of the act that is to be amended, not section 5 of the bill that’s the amendment act. It says specifically there that one of the purposes is to “gather and organize information on scientific research.” I’m questioning why the word “technological” was not added as well as “scientific research.” The question is: is this being left out explicitly, or is science to include technology here?

The reason why I do that is that a number of times in this section — that is, section 3 of the act that’s amended, section 5 of the act that’s doing the amending — “science” has been replaced by “science and technology.” And it’s really this one place where it hasn’t. So my question to the minister is: does this mean to include scientific and technological research, as it says, actually, earlier in the same section?

Hon. B. Ralston: I just wanted to clarify the member’s question. In the previous act, he seems to be referring to section 3(e), which reads: “…gather and organize information on scientific research.” Is that correct?

A. Weaver: That is correct. I’m wondering whether it should be “scientific and technological research,” because we’re changing it in (d) and (f) there. Also, earlier in that actual section 3 there, it talks about the importance of the “development and dissemination of scientific, technological and scholarly knowledge.”

I’m wondering whether the research is actually also technological here. It may sound like semantics, but I don’t know whether it’s just inadvertent or whether it’s deliberate.

Hon. B. Ralston: I better understand the member’s question now.

Section (e) focuses, in the previous act, on scientific research. The amendments are to (d) and (f), substituting for “science policy”, “science, technology and innovation policy.” The focus there is not on research but on policy.

I don’t think there was an intention to change (e). It was rather to expand the scope of the policy that would flow from, whether it’s, scientific research or technology in general. I think that’s the reason for the distinction.

A. Weaver: I appreciate the clarification. To further that, though, if the minister is able to look at section (c), it actually talks about the “development and dissemination of scientific, technological and scholarly information.”

I’m wondering whether there’s an inconsistency there. On the one hand, you’re disseminating and developing scientific, technological and scholarly research, but on the other, you’re just looking at the science aspect.

Hon. B. Ralston: I don’t think there’s an intention to emphasize or create a difficulty there. The focus is on the development of a broader policy beyond science policy, technological policy and innovation policy.

That’s clearly not the intention to…. I think the member has made a perceptive point, but I don’t think it really detracts from the purposes of the amendment.

A. Weaver: Thank you for the clarification.

I have a number of general questions about the role of Innovate B.C. In particular, I’m wondering if the minister could identify the relationship between the innovation commissioner and Innovate B.C., as reconstituted in this amended act here.

Hon. B. Ralston: Innovate B.C. and the innovation commissioner will be separate entities, but they will work closely together, obviously.

The commissioner is mandated to be an advocate for the tech industry, both here in British Columbia — to our federal counterparts — and, indeed, abroad. The commissioner will interact with board members and will be an ex officio member — will be invited to participate in Innovate B.C.’s board members as an ex officio member. There will be a close relationship, but the office of the innovation commissioner will be independent of the agency.

A. Weaver: Thank you for the answer. It actually answered my next question. Would the innovation commissioner be a member of the board or an ex officio member? That has been clarified as well.

My next question is with respect to…. With this new vision, as outlined in section 5 of the amendment act, pertaining to an amendment in section 3 of the original act, what is the…? If the minister could articulate in a few words what he would define as the new mission statement for Innovate B.C…. Has the minister got an idea in mind? If he were to succinctly express, in two sentences…. What is the mission statement of Innovate B.C., as reconstituted here?

Hon. B. Ralston: I’ve attended — and I’m sure, probably, the member has — board meetings or retreats of organizations where a mission statement will sometimes be worked on for days, if not weeks, and a lot of internal debate will take place about the exact wording of a mission statement. So to ask me to give a precise mission statement here is something that I approach with some caution.

The goal of the organization is to focus on and use innovation and support for innovation to catalyze companies to be more successful in what they do, or even research institutions to be more successful. It’s a broad look at the power and transformational force of innovation as applied to a wide range of human and societal problems.

A. Weaver: That’s very helpful, and I would never ask the minister to develop a mission statement in committee stage. It would simply be something that he could not be held accountable to — understandably so. I have, too, been in those board meetings that have taken days to decide whether it should be a “that’ or an “an” or “they.”

My next question that is following on that previous question…. Actually, as articulated here in section 5(b), where it uses the words “innovation policy,” I’m wondering if the minister would be able to define specifically what he means by innovation.

Hon. B. Ralston: I did have a discussion with the member before lunch, and I got an opportunity to think about the question, which he very kindly told me he was going to ask me in advance.

I don’t think I’d want to be confined to a single definition of innovation. One looks at different institutions, and innovation has different effects and consequences. For example, research institutions, whether it’s catalyzing or driving the creative and intellectual abilities of researchers and students or whether it’s the kind of innovation that drives companies of all sizes to develop either new products or new services that allow them to grow and fuel the economy.

Clearly, innovations can be big, can be huge, whether we’re thinking of a company like General Fusion, which I’ve met with and I’m sure the member is familiar with, where the innovation that they’re recommending would literally transform the world — I don’t think that’s an understatement — or whether there are small process innovations in the way in which a manufacturing process goes forward. Sometimes practitioners on the shop floor will think of a way that things might be improved. That, too, would be an innovation.

I think what we’re hoping to do is to take a wide view of innovation in all its aspects and look to it, in a competitive and rapidly changing world, to draw on the creativity and talent of the people of British Columbia and use innovation and creative change to solve human problems, make things better, make companies grow and prosper and generally enhance the quality of life of everyone in the province.

A. Weaver: Thank you for the very helpful response.

My last question is on the issue of technology. We’ve heard a lot of discourse. I thank the member for Shuswap, who asked a number of probing questions, and the minister for his responses.

We’ve heard a lot about innovation in technology. I’m wondering if the minister could expand upon what he means by technology, more for clarifying the public record. Many people often think that technology means apps and stuff that has chips on it. Here, the minister has a broader definition of what technology is — innovation in technology and innovation in general. In what areas other than just chips, computers or apps is he thinking when he’s talking about innovation, perhaps, in technology and elsewhere?

Hon. B. Ralston: I would adopt the answer that the member suggested, which is a broad scope of innovation. I agree with him that sometimes there’s a view that innovation is confined to software developers in downtown Vancouver. That is most assuredly not the case. Whether it’s in Kamloops at the Kamloops Innovation Centre, in Prince George at the clean-tech innovation hub that’s being developed by the economic director there at the city hall, or in Victoria here with Tectoria, it’s certainly geographically broad. The scope of the problems that are tackled — and what is meant by technology — is very broad indeed.

Technology is capable of revolutionizing and changing very traditional industries, such as the mining industry. I think I’ve repeatedly given a couple of examples. MineSense, which is a company using the Internet of things and sensors, devised a process to examine ore that’s been extracted and sort it more quickly, more thoroughly and more efficiently, thereby increasing the efficiency and, ultimately, the profit of the company. LlamaZOO, which has a visualization technology that looks at a mine before it’s developed, inputs all the data and then represents that in a visual display of the minesite itself, in a way that helps people to understand what the mine might look like, what the ore body might look like it or how it may be extracted more efficiently.

I don’t think I would want to be confined by that narrow definition of technology, certainly, whether it’s technology or it’s innovation solutions applied to climate change, or life sciences or ICT, across the board. Some people speak…. There’s an institution at Simon Fraser University that speaks of social innovation — in other words, applying some of the same techniques, some of the same inspiration and some of the same talent to major social problems, whether that might be addiction or the problems of aging.

I think there’s always room, and the hope is that there are lots of solutions coming that can be implemented to solve problems and make life better for everyone.

Video of Exchange

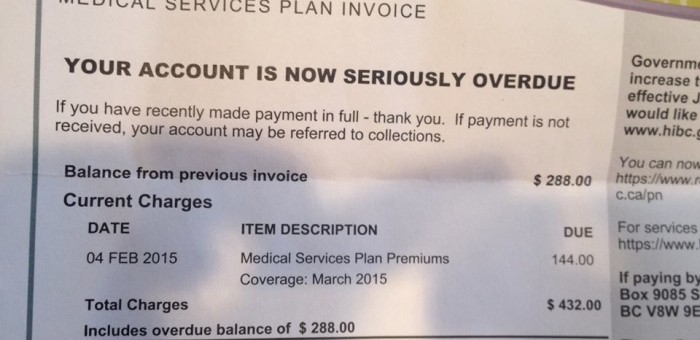

Why bother with the MSP task force if you aren’t willing to listen to them?

Yesterday I rose during Question Period to ask the Minister of Finance why she would forge ahead and announce the Employers’ Health Tax prior to her very own MSP task force submitting their final report.

Recall that on November 2, 2017, the BC Government announced the establishment of an MSP Task Force. The mandate of the Task Force is to provide government with advice on how to replace lost revenue when MSP premiums are eliminated. The Task Force will be issuing its final report on March 31, 2018.

I remain perplexed as to why the Minister of Finance rushed into the Employers’ Health Tax. In doing so, she has created a suite of unforeseen budgetary problems for schools, hospitals, municipalities and other large employers. In addition, she has ignored what the interim report from the MSP Task Force stated:

A payroll tax would reduce the competitiveness of B.C. businesses at a time when they are facing several competitiveness challenges.

and

We feel that it is important that revenue be replaced by a combination of measures in order to best mitigate the negative impacts of each.

The only conclusion one can reach is that the Minister of Finance either (a) read the MSP Task Force interim report but chose to ignore its key recommendations, or (b) rendered her decision to implement the employers health tax prior to the interim report actually being available.

Below I reproduce the video and text of my Question Period exchange with the Minister of Finance.

Video of Exchange

Question

A. Weaver: Yesterday I asked the Minister of Finance why her government forged ahead with the employers health tax without waiting just a few more weeks for the final report to come in from her MSP Task Force. In response, the minister assured us that she took the task force interim report into account when making her decision.

Okay, let’s take a look and see what the task force actually said in this interim report. They said this, “We are leaning towards a combination of a personal income tax surcharge, a small payroll tax and additional ideas” as the best way to replace the revenue. Instead, this government went in the exact opposite direction, putting the entire burden on employers through this payroll tax.

My question to the Minister of Finance is this: given that the expert task force recommended against exactly what you’ve chosen to do with the employers health tax, how do you justify this decision?

Answer

Hon. C. James: Thank you to the Leader of the Third Party for his question. We did receive the interim report. We felt it was important to move ahead on the elimination of medical service premiums on behalf of British Columbians. Leaving the regressive tax in place did not make sense, and we were able to manage it in this budget.

We had increased personal income tax for the top 2 percent of income earners in September’s budget. I’m not sure what the member is asking — whether he’s committed to increasing personal income taxes. But we felt that because we’d already made the decision around the top 2 percent of income earners that this was a balanced approach.

Supplementary Question

A. Weaver: Well, to enlighten the minister, what I’m asking is: why do you have a task force to do something if you’re not going to listen to what they’re doing and actually make decisions before they’ve done what they said they’re going to do?

In fact, the MSP Task Force had more to say. On the payroll tax, which is the direction this government has chosen to go, they said this. “A payroll tax would reduce the competitiveness of B.C. businesses at a time when they are facing several competitiveness challenges.” This concern about business competitiveness is precisely why the task force was leaning towards a combination of measures to make up the revenues, not just by a payroll tax.

They specifically stated this. “We feel that it is important that revenue be replaced by a combination of measures in order to best mitigate the negative impacts of each.“

My question to the Minister of Finance is this. Did the minister either:

a) read the MSP Task Force interim report but choose to ignore its key recommendations, or

b) render her decision to implement the employers health tax prior to the interim report actually being available?

It has to be one. Is it (a) or (b)?

Answer

Hon. C. James: As I already said to the member, we received the interim report. We are ultimately accountable as government. It is our job to receive the report, make a decision based on the information that was there. We received the interim report. We made our decision. We believe it’s a balanced approach, as I said. The member may have a difference of opinion. The member may be interested in looking at personal income tax, and that’s the member’s prerogative. We made a decision as government.

I would also remind the member that, if we are looking at competitiveness when it comes to businesses here in British Columbia, two of the key issues that businesses have been calling for action on over and over again are the issue of child care and the issue of housing. We moved on both of those to address competitiveness and recruitment and retention of employees in British Columbia.

Bill 4: BC Innovation Council Amendment Act

Yesterday in the Legislature we debated Bill 4: British Columbia Innovation Council Amendment Act. This bill renames the BC Innovation Council as Innovate BC and expands its mandate.

As noted in the government’s press release issued in conjunction with the tabling of the bill,

Innovate BC will absorb all the programs and services currently delivered by the BC Innovation Council, in addition to expanding its mandate. These changes will ensure that B.C. is more competitive nationally and globally, and can attract additional investment to scale up the provincial tech ecosystem.

Below I reproduce the text and video of my speech in support of this bill.

Text of Speech

A. Weaver: It gives me pleasure to rise and speak in support of Bill 4, British Columbia Innovation Council Amendment Act. As speakers before me have articulated, this act has two major changes. One, of course, is changing the name of the British Columbia Innovation Council Act to Innovate BC Act. This is important, and I’ll come to that in a second.

The second major change, which I think is very important to emphasize, is that the mandate of Innovate BC, the new organization, will be expanded. In particular, the details as outlined in the previous act, the specific objectives of the council per se in the previous act — that section 3 of the act that’s being modified — is going to have an addition now which says that Innovate B.C. will also “offer tools, resources and expert guidance to entrepreneurs and companies in British Columbia, including in respect of building capacity to access new markets and attract investment.”

Now this is important because, while not specifically stated there, what this is recognizing is the recent appointment of Alan Winter as British Columbia’s innovation commissioner. What the innovation commissioner, of course, is going to be the advocate for the B.C.’s new Innovate B.C. agency.

Why it’s important to change the name? There’s a couple of reasons. When a new organization comes in, it’s often the time to switch the directors of a new organization, to give it a sense of new purpose and new vision and new direction. And we’re quite inspired by Mr. Winter and all that he has done for British Columbia, both in his capacity as CEO of Genome B.C. as a small business, of a large business — just a wealth of experience in innovation across a diversity of areas.

The creation of an innovation commission and the position of innovation commissioner is something that was embedded in our confidence and supply agreement with the B.C. NDP, and we’re grateful to be able to work with them to move this forward. In fact, the so-called CASA agreement states that one of our goals, collectively, is to:

“Establish an innovation commission to support innovation and business development in the technology sector and appoint an innovation commissioner with a mandate to be an advocate ambassador on behalf of the B.C. technology sector in Ottawa and abroad. The mandate and funding of the innovation commission will be jointly established by representatives of both the B.C. Green caucus and the B.C. New Democratic government. And the innovation commission will be created in the first provincial budget tabled by the New Democratic government.”

That, indeed, has been met.

What’s important here is that when one looks at the establishment of the innovation commission, one recognizes that it’s actually at an opportune time, because the focus here in British Columbia is moving to mirror exactly what is happening in Ottawa, recognizing that we can compete in innovation like no one else. So the emergence of innovate B.C. and the commissioner comes at a time when Ottawa is putting money into these very same programs.

It is critical that we have one single point of contact in terms of melding these programs together, because historically, in British Columbia, innovation has been spread across six different and separate ministries — much like fish farms are, as we’ve discussed in question period.

Technology is exciting here, in British Columbia. In 2015, when we have the best data, there were over 100,000 jobs in more than 9,900 companies in B.C., with wages that, on average, were 75 percent higher than the B.C. industrial average; with average weekly earnings of almost $1,600 a week. It had the fifth consecutive year of growth in 2015, and about 5 percent of British Columbia’s workforce was in the tech sector. That’s more than mining, oil and gas, and forestry combined.

I’ll say that again for those riveted at home. There was 5 percent of British Columbia’s workforce in the tech sector in 2015. That is more than mining, oil, gas and forestry combined.

Now, it’s very odd that somehow, in British Columbia, we continue to perpetuate the notion that we are but hewers of wood and drawers of water and that our economy is based on oil and gas or our economy is based on the extraction of raw materials and shipping of those raw materials elsewhere.

In fact, a full 7 percent of our GDP comes from the tech sector. We know that the overwhelming component of our GDP comes from the real estate sector, a very high fraction of it, but 7 percent is from the tech sector. Again, I’ll come back to that in a second.

We know that in 2016, more than 106,000 people were working in the tech sector. By 2020, it’s projected to be more than 120,000. I would suggest that that will be an underestimate. We know that investment in B.C. tech will be increased by up to $100 million by 2020 and that recently — and I give both sides of the House credit here — there’s been an increase in talent pool and an increase in funding of actual post-secondary institution places to actually promote continued growth of training of highly-qualified personnel in this area. That was an initiative started by B.C. Liberals, continued by B.C. NDP, and one that we support all the way through.

We recognize as a caucus, as a small caucus here, that playing a key role in the tech sector is absolutely central to our economy. We will never, ever, ever compete with a jurisdiction like Angola or Namibia or Indonesia in terms of extracting raw resources straight from the ground, because we internalize social and environmental costs into the cost of doing business in B.C. that may not be internalized in other jurisdictions that don’t have the same social programs that we have and demand that we have here in B.C. or the same standard of environmental protection that we have and demand that we have in B.C.

For us to compete, we can compete by racing to the bottom. The journey into LNG tells us what that leads to — goose egg. Or, we can compete by being smarter and by building on our strategic advantages.

Today in the Legislature, we had a number of interns visiting from Washington state. Talking with these interns from Washington state, the idea of building on strategic strengths came up.

What was interesting is that I was reminded of a story when I was at the University of Washington. There was a fella there. His name was Ed Sarachik. He was my post-doctoral adviser. We were working in some climate modelling area, and Ed said to me: “You know, Andrew, we’re at the University of Washington. We’ve got an IBM 3090 here.” That dates me. It was a vector-based machine. It’s pretty old now. That was in the late 1980s. “We’re never going to compete with NCAR, Princeton or MIT in terms of the powerful computing that they have access to. But we can be smarter and more efficient and more clever, and we can win through efficiency and being smarter.”

He was right that by focusing strategically on things that we could do well, rather than the brute force, race to the bottom approach, we were able do some neat stuff. That’s exactly the same with the tech sector. We can’t compete through digging dirt out of the ground when we’re internalizing these costs. But we can be more efficient. We can be cleaner, and we can export in a more efficient and cleaner way the resources that have historically been a key component of British Columbia’s economy.

Now, one of my favourite companies is a company called MineSense in British Columbia. It turns out — and I didn’t realize that until with the mining delegation, when a bunch of my former students ended up lobbying me about mining — that one of the key founders of MineSense was another former student from UVic. This kind of blew me way. I’m sure as a former teacher, hon. Speaker, you know that you see these former students popping up everywhere, and you wonder how they got from where they were to where they are now.

I’m blown away by that company. It’s a company that’s developed technology to actually assess up front the quality of minerals to determine whether or not it is cost-effective to truck it a long distance to the crusher and process all of that grade, or just push it to the side to be used as fill later.

That’s innovation. That’s efficiency. That allows us to actually compete by actually mining our high-grade minerals without wasting the time of digging up all of the stuff that’s not economical. We can export the minerals and compete through efficiency. But we can also export the technology and compete through technology.

This is why it’s so critical to have Innovate B.C. and the innovation commissioner. Because in B.C., we have a disparate bunch of programs out there, many of which don’t match with programs that exist federally. In talking to CEOs of a diversity of small start-up companies, they’re frustrated. They’re frustrated by the fact that they’ll go through a process to apply for grants federally, and then they’ll have to go through the same process in a slightly different way to apply for grants provincially.

I was excited in speaking recently with the innovation commissioner, Alan Winter, who recognizes that there’s some duplication there that’s not necessary. By streamlining programs, not only do we let innovators be innovative, as opposed to writing the same thing twice, but we actually are able more efficiently to tap into federal money, which actually is good for our economy here in British Columbia.

Now I have some experience in this regard with something British Columbia has known as the B.C. Knowledge Development Fund, an exceptional fund that’s used to lever money from Ottawa through the Canada Foundation for Innovation, which provides funding for large pieces of equipment for universities. I don’t know what the process is like now. But I do know that when I applied and got a supercomputer a number of years back, again, it was a duplication of a process.

The CFI process was rigorous and onerous and took an enormous amount of work to bring together stakeholders from a diversity of groups and organizations. Then we had to just rematch that process with the B.C. Knowledge Development Fund. It seemed to me that if we follow the Quebec model that there’s some duplication there, and we recognized that one process could satisfy everything.

I’m hoping that the innovation commissioner will see, as we move forward, opportunities here. It’s clear to me that we are so very lucky to have Alan Winter as the innovation commissioner. He recognizes, as members opposite have raised, the importance of actually thinking beyond roads as just being things to take people from A to B, but in terms of broadband, it’s critical to getting information from A to B.

It’s clear to me that he recognizes that our rural communities will be empowered upon receiving access to broadband, not only singular broadband but redundancy, as some bigger communities will get.

This is how we’ll compete. When we bring our tech sector…. Tech doesn’t just mean coding apps for the smartphone. Tech means biomedical sciences. Tech means revised forestry handling tools. Tech means thinking of new engineered wood products. Tech means bringing together the forestry sector with innovators in technology who see that you can make new things like insulation from wood products or roofing beams from wood products.

Tech is about innovation, and innovation goes far beyond what often people think that it only is, which is the smartphone app.

Our biomedical industry, as I mentioned, is one. In the automotive industry, we should be having innovation in that here in British Columbia. We should be leaders in the adoption of EVs.

Quantum computing. In British Columbia, we have, in D-Wave, one of the world’s leading companies in quantum computing. This is tech. This is a way for the future. We’ve got fuel cell technology. That’s another form of tech.

Let’s not think that tech is just about smart people with lab coats who have engineering degrees. Tech also requires people to construct and build and highly trained people in a diversity of trades, whether it be electrical, whether it be mechanical, whether it be the construction using carpentry. You need all skills working together to actually take the idea from the lab bench to fruition.

You know, we look at the issue of clean energy, something that I’m desperately hoping this government will pick up. There is so much potential for innovation in British Columbia, whether it be Rocky Mountain Solar, a project that I hope to get the member for Kootenay East excited about shortly. Rocky Mountain Solar is a solar company that has private land. The transmission lines go right through the private land. They’ve passed the standing offer program. They gone through the standing offer program, but they can’t actually get going. They’ve got a partnership with UBC to actually have a research facility there. They could scale up to 45, 50, 75 megatonnes of capacity.

But again, if we’re stuck thinking the old way, the 20th-century way, companies like Rocky Mountain Solar, who want to invest their capital…. They want to construct and build, which requires carpenters and tradespeople, to build capacity for a solar field there — British Columbia’s first and only grid-scale solar facility. It needs innovation, and it needs a champion and a commission that actually can do that within government by bringing together the various diverse groups there.

You know, I’m excited by the Minister of Jobs, Trade and Technology. In particular….

Interjection.

A. Weaver: It’s a mouthful for a poor humble soul like me — Minister of Jobs, Trade and Technology.

Interjections.

A. Weaver: I thought I’d wake a few up there over that. Not allowed to speak if you’re not in your seat there, member from….

I’m excited because in meeting with the civil service who are working in this area, you can see the passion and the desire to make this work. I’m thrilled with the calibre of the civil service who are getting behind this Innovate B.C. initiative. I’m thrilled about what’s coming up in terms of the tech summit that’s going to be happening in the coming months.

We have a very exciting time, but we’ve got to get a handle on a couple things. The innovation commission, or Innovate B.C., the innovation commissioner, can’t do everything. Government is required to set a culture. Government is required to set an environment that allows them to innovate.

What does that mean? That means we’ve got to get a grip on the affordability crisis facing British Columbians. You can be the best innovative person in the world and have the most wonderful idea in the world, but if you can’t get anyone to work with you because they can’t afford to live here, it ain’t going to take off . It’s going to move to New Brunswick or somewhere else.

We also have to ensure that we have a competitive environment in terms of the tax and the education framework. I have some sympathy with members of the opposition who are raising concerns about the employers health tax. It’s not clear to me that the details have been expanded upon fully yet, but this needs to be explored a little more, for a number of reasons.

We have a very odd taxation system in British Columbia. We have this magical barrier of $500,000, above which you start paying, now, an employers health tax, and you also start paying corporate tax.

Now, the problem with that is there’s a natural ceiling which stops innovation and growth. Why would I, if I’m a company making $450,000 a year, want to move up to be a company that’s now making $550,000 a year? I cross that $500,000 threshold. It’s an artificial threshold, but now I’m paying corporate tax and paying the employers health tax.

We need to take a hard look at how we have our taxation system. Step functions are not as conducive to growth as perhaps small linear changes. Again, that will be the role of the government — to explore that more fully.

This is a short bill. It may seem like a minor change, but the implications are profound, because the implications are sending a signal to the market in British Columbia that we’re here for the 21st century. Innovation is going to be the engine and power of our economy, and we want to send a signal to British Columbia that there is an agency. There is a champion to actually ensure that innovation is able to emerge at the lab bench and move through to production down the road.

Let’s ensure that that happens in British Columbia. Let’s ensure that the stories that we hear time and time again of a company building it to $1 million a year and then selling out to a Silicon Valley company…. Let’s create an environment here in British Columbia, not only in Vancouver but across B.C.

The member for Kamloops–South Thompson talks about the tech sector in Kamloops. He’s right. Really exciting things are going on in Kamloops. We’ve got the tech sector in Kelowna — happening there as well. Some concerns about Kelowna in light of some changes to the distance and digital tax credits that were done, dismissed and retroactively applied. Nevertheless, there’s some excitement happening there. But it doesn’t have to stop in Kelowna and Kamloops.

Prince George. If we put broadband redundancy in there, it should be a capital of tech innovation, particularly with the forest and mining sectors. We could go to Terrace. We go to Prince Rupert. All across British Columbia, if we’re able to bring broadband and broadband redundancy in, we’re able to give the innovators in that community a way to actually access high-speed information. I tell you, it’s a lot easier to buy a house in Fort Nelson than it is to buy a house in Richmond.

The beauty and quality of what we offer here in British Columbia is second to none, whether it be in the north, in the east or the south as well.

I’m thrilled to see this emerge — Bill 4. It’s a small change but a mighty change, and I stand in strong support and thank you for your attention on this bill.

Video of Speech

Introducing Employers’ Health Tax before completion of MSP Tax Force report?

For more than three years I’ve been pressuring government to eliminate the unfair and regressive flat rate Medical Services Premium (MSP). In fact the promise to do so was a major BC Green Party platform commitment, and we outlined how we would recoup the lost income by following the lead of Ontario. We were very pleased when government also agreed to eliminate the MSP.

But rather than specifying how the lost revenue would be replaced, the BC NDP decided to set up an expert committee to provide it with advice. And so, on November 2, 2017, the BC Government announced the establishment of an MSP Task Force.

The Task Force will be issuing its final report on March 31, 2018.

Imagine my surprise when BC Budget 2018 outlined the creation of an Employers’ Health Tax to replace the MSP. It seemed very odd to me that government was making such an announcement prior to the Task Force producing their report.

Exploring this was the subject of my exchange in Question Period with the Minister of Finance today. Below I reproduce the video and text this discussion. I hope that government will reflect upon their decision and be open to revisiting it once the Task Force final report is made available.

Video of Exchange

Question

A. Weaver: Let’s be clear: government misled British Columbians on the B.C. Hydro rate. There’s no two ways of saying it. I find it remarkable that they’re trying to claim otherwise.

Government established an MSP Task Force in November to advise it on how best to eliminate the MSP premium and make up the revenue. The task force comprised experts in both economics and public policy. The team analyzed hundreds of submissions from individuals and stakeholders. They consulted with labour and business groups. They undertook an in-depth tax policy analysis. Their report advising on how best to eliminate MSP premiums isn’t due until the end of March. Rather than waiting for the report, government eliminated MSP premiums and instituted an employers health tax.

My question to the Minister of Finance is this. Government established the task force. Government selected the experts, the mandate and the reporting timeline. Why would government forge ahead on this tax change without waiting for the task force to submit their recommendations?

Answer

Hon. C. James: Thank you to the Leader of the Third Party for the question. As the member knows, part of my mandate as Finance Minister is to look at how we can ensure a more fair tax system. The outstanding piece in British Columbia, on an issue of a fair tax system in particular, was the MSP, the fact that MSP was not eliminated. It was the most regressive tax, and it needed to be addressed.

It became clear that this was something that we could accomplish in the budget. We looked at the interim report that came from the MSP panel. We, in fact, agreed with a couple of the pieces that they brought forward, which was to eliminate the premiums all at once, not to do a further phase out, as we had done with the first 50 percent, and to give some advanced notice. Again, that’s why we’ve given a year.

I look forward to their final report. We took into account their interim report. And I’m very proud that we are going to save families and individuals in this province by getting rid of MSP once and for all.

Supplementary Question

A. Weaver: Thank you to the minister for the answer. She’ll get no argument from us about MSP being a regressive form of taxation.

Since government announced the employers health tax, we’ve been hearing concerns from businesses, school boards and local governments regarding its potential negative impacts. We’re hearing concerns about everything, from impact on businesses’ bottom line to the ability of the public service to provide the services they are required to provide.

The MSP Task Force was going to issue a final report in just a few weeks, advising government on the best path to eliminating premiums. When the Minister of Finance established the task force, she said this: “Engaging a panel of respected experts in economics, law and public policy, we will ensure the path we take is fiscally responsible, fair and evidence-based.”

My question to the Minister of Finance is this. In light of the desire to ensure that public policy is informed by evidence, did government ask the task force to expedite their work in order to provide final recommendations before government made a decision on establishing the employer health tax?

Answer

Hon. C. James: We received an interim report from the committee. We made the decision, as government, to move ahead on getting rid of a regressive tax. We felt that was important. We were able to do it in this budget, and we thought this was the right time. We ensured that we gave a year’s notice so that we would be able to work through the challenges.

The member has raised some of the issues that we are hearing and discussing. We are going to continue those discussions to ensure we can cover those bases, but we will be eliminating MSP by 2020. People are saving money — $1.3 billion this year — by the reduction of MSP by 50 percent, and we look forward, as I said, to savings for families and individuals in this province, making life more affordable for the people of B.C.

Bill 2: Budget Measures Implementation Act, 2018

Yesterday in the BC Legislature we debated Bill 2: Budget Measures Implementation Act, 2018 at second reading. This bill amends 21 other pieces of legislation in order to implement a number of the tax measures proposed in the BC Government’s budget.

As you will see in the text and video of my second reading speech, I was generally supportive of the measures included in this bill. Nevertheless, I was critical (for reasons that I expand upon in detail in my speech) of the government not exempting zero-emission vehicles from the increase in PST that will now be applied to automobiles over $125,000.

I was also critical of government not closing the bare trust loophole that I’ve been pointing out for more than four years now is being used to avoid paying property transfer tax. In my speech I provide details as to how someone can simply avoid paying the proposed increase in property transfer tax on homes sold for over $3 million.

Below I reproduce the text and video of my speech.

Text Speech

A. Weaver: It gives me great pleasure to rise and speak, join debates here at second reading discussion of Bill 2, Budget Measures Implementation Act, 2018. As we’ve heard from members opposite and government, this bill is being brought forward to enact some of the measures that government is proposing to do.

I’ve heard a lot in the debate so far, discussions about the budget in general. We must recall that in fact, this bill is only dealing with a few aspects of what is actually contained in the budget. The speculation tax, which we’ll clearly be debating at some point, is not contained in the budget implementation act, but something that is contained that I haven’t heard a lot about is changes to the school tax, which we’ll discuss in a second.

Before I start, I think I would like to give notice to members opposite and to government that a press release was just issued by BCUC announcing that, in fact, B.C. Hydro rates will go up 3 percent this year, despite what the government claimed: that it was going to freeze B.C. Hydro rates. Why that’s important is that it makes us wonder to what extent this budget will be affected, in light of the debt that is being put on to British Columbians, despite the fact that we were told that rates were not going on.

The member for Surrey-Whalley and I did probe the Minister of Energy, Mines and Petroleum Resources on this topic, and we were assured that rates were not going to go up. In fact, they are going up. So it does not bode well for instilling confidence into the full suite of budget measure implementations that are being put forward.

The most notable changes in the act that we’re seeing here today are changes to the Income Tax Act, which I’ll come to — important changes with respect to reporting — and changes to the Land Tax Deferment Act and the Home Owner Grant Act. Again, much to do with reporting, to ensure that characters out there are not getting away with financial shenanigans in terms of claiming things like homeowner grants or avoiding taxes that they should otherwise pay.

There are changes to the Motor Fuel Tax Act, which are allowing Victoria regional transit to get an extra 2 cents per litre in gasoline. What’s remarkable about this is that gas taxes like that are very good for raising revenue for public transportation. The issue, of course, in Victoria is that we are the capital of the electric vehicle. I suspect that the government has over budgeted its expected revenues from this as the electrification of Victoria’s vehicular sector continues to grow.

Changes to property transfer tax are an important component of the Budget Measures Implementation Act — in particular, the additional levy being applied to properties over $3 million. I’ll come to that in a second, because again, as with many of these things, there needs to be careful analysis of the details. Of course, the Provincial Sales Tax Act to levy a surcharge on vehicles over $125,000 — I will come to that again in some detail.

I’ll start by recognizing what I could not find embedded within the budget implementation act itself, but it was mentioned directly by the Finance Minister in her opening remarks. It’s a very important change that’s being implemented for cruise ships in British Columbia. We know right now that cruise ships in British Columbia are at an unfair competitive disadvantage with cruise ships that come to Seattle. The reason why is that cruise ships in British Columbia pay a carbon tax when they use marine gas. Now, marine gas is more frequently used today than the traditional bunker fuels of yesteryear, which don’t have the carbon tax applied. The reason why they’re not applied is, if you’re an international carrier and you fly from one jurisdiction to another, international reporting regulations do not require you to actually count those emissions to your jurisdiction.

So this may not seem like a big change, but it is an incredibly important change. The cruise ships, the modern cruise ships, the cleaner cruise ships using marine gas are no longer at a disadvantage if they fill up in Victoria or British Columbia or Prince Rupert. So now they can actually make, in their decisions as to where to go, a financial windfall by not being penalized by coming to B.C. Thank you to the minister, and thank you to the Finance Committee. We recommended discussions about this — and the presentation that was made to us by steamship operators. This was an important addition. It won’t get the attention I think it deserves, but it certainly will make a big deal in terms of the cruise ship industry.

Coming to the Income Tax Act. What’s happening in that, which I think, generally, we can support — and this is embedded within sections 14 to 34 of the act — are important changes that parallel that which was done federally with respect to clamping down on anti-avoidance. That is, there are new definitions and new rules that are being put in place to ensure that the misuse or abuse of provisions in other acts, which the income tax relies upon, will be subject to the same rules as embedded here.

A lot of incidental changes here. A lot of this is actually not, per se, a fundamental part of the government’s budget but rather important work that needed to be done by the civil service — legislative additions — in order to mirror or match legislations that have clearly been brought in place federally.

Coming to the Land Tax Deferment Act, which is section 88, we notice in here that it provides for information-sharing and use of information provided under the Income Tax Act, and back and forth. In particular, there are changes to the Home Owner Grant Act to provide for the same information-sharing. Why this is important is a couple of things. It’s a welcome change, in my opinion. It’s a welcome change, because it actually, again, has significant implications for tackling tax avoidance through enabling information-sharing across multiple jurisdictions.

For example, there could be people that are claiming that a home is their principal residence and claiming the home owner grant for the purposes of either not paying — getting a grant — or deferring taxes, if they’re a senior, and they wish to defer taxes against the property until such time as they sell, as that property is sold. We now are requiring information be determined for tax purposes, whether they’re a resident and, in fact, if they’re paying income taxes here and, frankly, if they’re living here in British Columbia.

Coming to the Motor Fuel Tax Act — again, sections 42 to 50 of the bill…. It’s a large bill, more than 40 pages of very dense language and multiple sections that cross-reference each other — a very complex bill. It’s a component that was asked for by the region where I live, here in the capital region, to allow additional revenue sources for the regional transit authority. I’m sure that they’ll be pleased, and this becomes effective April 1, 2018, when we get a two-cent per litre addition here in Victoria, up from 3½ cents to 5.5 cents — again, for regional transit initiatives. My only hope is that we ensure that such initiatives actually start to represent the future and get us down towards bringing our communities in the West Shore and on the Saanich Peninsula closer together with rapid forms of transportation.

The Property Transfer Tax Act. There are some very important changes here. Some that are simple, just information-exchanging. For example, currently, the anti-avoidance rule that is being fixed here, only applies to the foreign buyers tax. So now what’s happening is the definition and the language that was only applied to the foreign buyers tax, which is being increased to 20 percent, is now broader. It’s now applying throughout the act to ensure that, avoidance is being captured.

There is also the important change, which is a revenue-generator here, which is additional levees on the property transfer tax for homes that exceed $3 million. Presently it’s $2 million above $200,000 to $3 million. Now it’s going to be an additional three percent, to take it to five percent of the value of the home above $3 million.

Again, one of the things I have a problem with is that property transfer tax is a very regressive form of taxation. In general, it’s essentially penalizing home ownership and moving up and down as you age. As your family grows, you typically get larger houses, and as the family shrinks or you retire, they typically get smaller. We’re taxing all the way along the lines there. Again, this was being used….

The idea here, of course, is to put a clamp on upper-end homes. But, as with all of the government’s measures to deal with housing, I, frankly, believe that they’ve missed the boat. What I mean by that is that it appears to me that government is using our housing crisis rather than as a source of revenue to build supply, affordable housing, which is part of their plan…. Why that’s problematic and why I believe that to be the case is if you look in the budget, budget revenues are expected to either remain constant or actually grow from things like property tax transfer tax, a speculation tax, foreign buyers tax.

If these tools were actually being designed to clamp down on the speculative market, you would expect, for example, a speculation tax to go to zero. But it doesn’t. It grows and then stays flat. This is troubling to me. I think we’re missing the boat as to what the issue is.

The issue, we know, is offshore capital flowing into B.C. in a highly unregulated manner, leading to speculation. And rather than dealing with the problem, we’re in a crisis. Critical times deserve decisive measures, not tepid responses like we see here. So the property transfer tax, five percent above $3 million. Again, why $3 million? Why not $2.2 million? Why $5 million? It seems to me somewhat arbitrary and a means, a way, to actually grabbing cash.

In some sense, you could view it almost along the lines of a form of an inheritance tax. People, as they get older and sell their homes for their children, are going to have a…. It’s typically if you’re living in Point Grey and you’re either or foreign buyer, you’re a multi-millionaire, or you’ve lived there all your life and you’re going to sell your home and move out, as some people have spoken to me about. This is viewed as a form of an inheritance tax.

This change takes effect February 21, which was pretty rapid after the budget, so it’s in place now. A tax may have the effect of exerting some downward pressure, but it’s actually not dealing with the problem as I articulated it. It’s not dealing with the issue at hand, the issue being offshore money flowing into our market.

We know about the laundering issue. We know about the link to the drugs and the money coming in from the drug trade and the fentanyl crisis into the real estate market. We’ve had excellent investigative reporting in that regard, and the government’s measures are not actually targeting that. They’re targeting everyday homeowners as well as other people.

Some of the members opposite have raised the issue of speculation tax. Now, as we’ve discussed the budget in general, and I understand and recognize that, the actual measures of implementation here about the speculation tax are not embodied and embedded in Bill 2. Nevertheless, I think it’s important to put on record that I share some of the concerns that opposition members have raised on the issue of a speculation tax.

To me, it’s actually not a speculation tax. It’s a form of a vacancy tax, a provincial vacancy tax. But the concern I have, and the concern that has been expressed to me, is multifold. I don’t think government has thought this through. I don’t think government has thought what problem they’re trying to solve.

They’re looking at this issue of affordability, whether it be through — what I just discussed — the property transfer tax changes or the speculation tax, and they’re viewing this as a means and way of grabbing revenue in order to build affordable housing or build campus housing. Now, I have no problem grabbing revenue if you have an outcome from somewhere, but we’re not dealing with the problem.

Coming to the speculation tax, as mentioned multiple times by members opposite, there are multiple problems with this. Many people, for example, have a home on a ski hill, which may be part of a rental pool. Let’s suppose I have a condo at Sun Peaks that I actually use a couple of weeks a year — I don’t, but if I did — but it’s in a rental pool. Perhaps it’s zoned tourist commercial, which means you can’t actually rent it for more than six months because of the individual zoning. Perhaps it’s in a pool. Is that exempted or not? We don’t know.

There are people who plan to retire out to B.C. They may have bought a condo here to protect themselves from the market, maybe a couple of years prior to them retiring. That condo may be vacant. It may be vacant for a short term. Should they be taxed? Why is it that the government’s targeting fellow Canadians? Why is it not recognizing that the problem is not people from Prince Edward Island or Saskatchewan? The problem is offshore money, bypassing due process in normal channels, flowing into our real estate sector.

Again, I have a lot of sympathy for the arguments raised opposite on this, even though specifically, right now, we’ll have to wait until we see legislation emerging, because it’s not actually in Bill 2.

Coming, again, to some of the requirements. Some might think this is onerous — the level of information that this bill is actually asking be done, be provided, as part of the property transfer tax act changes. They’re things like the date of birth of the buyer, the buyer’s social insurance number or individual tax number, the buyer’s citizenship and residency status, the foreign country of citizenship if they’re not a Canadian or permanent resident. Clearly, these are new additional pieces of information that government is grabbing. We also know now that there’s more sharing ability between income tax, property tax acts, etc., to allow cross-checking and target those avoiders.

Similarly for corporations, we’re now requiring more information in the transfer of properties. We could argue about the issues of privacy. What has to be front and centre, of course, in all of this, is that we’re careful with the data that we’re collecting. I understand and support government’s desire to crack down on people who are cheating the system. However, we also have to recognize that we are collecting a lot of very personal data on issues, and we have to be very careful how we do that.

We know that one of the biggest ways that we’re seeing our property escalate in value artificially is through offshore companies buying British Columbia real estate. I’m not sure whether or not partnerships are covered, because that is one of the ways that people are avoiding the foreign buyers tax. I’ll ask that when we get to committee stage.

For corporations, they now must return…. I guess partnerships should be included in that. They have to give information on the total number of directors; the number of directors who are Canadian citizens or permanent residents; and each of these directors, now, has to provide their citizen status or permanent resident status information, date of birth, social insurance number and, for people who are not Canadian, similar information from where they’re from.

I just got some notes given to me here — notes about the B.C. Hydro rate freeze that didn’t happen. We’ve just issued a press release, but I reserve that for other conversations and not here on Bill 2 right now.

One of the things I do like, of course, is also that the government is targeting the beneficial owners of bare trusts. Now, as we all know, this is another means that people have used to avoid, essentially, property transfer tax, at its very fundamental level. Also, it’s a way of hiding actual ownership. If property is purchased in a trust, the trust is owned by a corporation or an individual, and when you dispense of a property, rather than selling the property, you sell ownership of the trust. So there’s no transfer of title. In British Columbia, we still tax transfer of title instead of transfer of beneficial ownership. That bare trust loophole I raised three or four years ago here in the legislature, still, government hasn’t closed it.

I don’t understand why they haven’t closed it. They’re collecting more information here. When I stood opposite, the now Attorney General railed on the government of the day — day after day — on the need to actually clamp down on the ability of people to hide and not pay property transfer tax. Yet, here, we have an opportunity to close that loophole, and what does government do? It collects more data.

I assume we’re going to get a report from this at some point down the road too. Or we’re going to send it to a committee to study it and make a decision. Government didn’t need to do that. Government could have made that decision now, which puts us, of course, in a predicament.

Obviously, we want to move forward. But obviously, we must think of the collective when we determine whether we support or don’t support a budget or its implementation act. This could have and should have been fixed now. Obviously, I support the collection of additional data — the social insurance numbers of beneficial owners, etc. — for the purpose of clamping down. But we’re not actually doing anything. We’re not actually clamping down.

Still, if I’m a wealthy individual and I want to buy a property here and I want to not pay any property transfer tax, especially if I want to buy an expensive property, I would be a mug if I were to buy an expensive property in anything other than in bare trust. Nobody in British Columbia is going to pay that 5 percent tax if they’re actually smart.

Because what they’ll do is they’ll buy properties in a trust, and everybody will be selling beneficial ownership of the trust. Nobody will be paying property transfer tax, not even the 5 percent. They’ll be paying zero percent. The reason why they’ll be paying zero percent is because there’s no change of title when you change ownership of the actual bare trust.

Again, government could have closed this. They’re going to study it. I don’t understand it. I frankly don’t think British Columbians understand it. Frankly, I don’t think anybody who wants to game our system is going to actually go and…. Anyone who want to game it has got another loophole to game it in.

The best way to do it is to work a deal with someone where you’re buying a house for, oh…. Here’s the way to gain it right now, here and now. You have a house. You know it’s below market, and it would sell. But you want to sell it for a higher amount. So you sell it to buddy over here for $2.9 million.

But it may have been registered on title, and you want to change it into a trust. Okay. You’re changing the title there. You’re putting the trust on title. You paid $2.9 million for the property, put it into a trust. But you really want to sell it to this guy over here.

So what do you do? You turn around and sell the shares in your trust for $5 million, the true value of that house, to this guy over here. So this guy has bought a $5 million home and paid only the property transfer tax on the first $2.9 million. There are so many loopholes here that this should have been closed.

Frankly, it’s frustrating to sit down here and to have listened for four years to the now Attorney General, listened for four years to member after member after member hurl abuse at government for not closing this loophole. It’s also a bit ironic to listen to opposition members suddenly claim the government is not dealing with the problem properly, but that’s another story.

But the government had the opportunity, and they failed. They failed here. They’re collecting more data. Good for them. But frankly, we need action, not more reports, committees or subcommittees.

When we come forward, one of the other good changes is that now government may say, “Okay, in Bill 2, we’re now allowing government access at no charge to MLS information,” because in MLS, there might be more information that might give more information on fair market value.

But that way of gaming the system that I just outlined won’t be reflected here because…. “Let me list the property for $2.9 million on MLS. I can list it on MLS and sell the property right away on MLS. It’s gone through MLS — information there. I buy it in a trust, and I sell my shares in the trust for $5 million. Okay, I’ll wait six months. I’ll call it my principal residence, and I’ll pay no capital gains tax either.” It’s just that the system is messed up, and government has not dealt with that.

There are penalties, though. The government is now allowing the administrator to actually put penalties in place that are equivalent to 100 percent of the tax avoided if they catch a means and ways of avoiding it. But again, it has to be pretty blatant when there are clear legal loopholes right now that the government is not closing that will allow people to avoid (a) paying any property transfer tax or (b) paying the 5 percent.

To the changes to the provincial sales tax, again, the government missed an opportunity here. I sometimes wonder if the left hand is talking to the right when decisions are made in government in general. We have government recognizing that there are luxury cars — for example, a car worth over $125,000 — are really something that, perhaps, you might want to put a little bit of a tax on. Because there are costs associated with this, and people who can afford that…. You might think, if you can afford a Rolls-Royce, you can afford a little more sales tax than, perhaps, if you have a small, secondhand beater. Okay. I get that argument.

So you make changes to the Provincial Sales Tax Act to allow a 10 percent to 15 percent increase, of PST applied to vehicles worth $125,000 to $150,000, and for vehicles worth over $150,000, the tax increases from 10 percent to 20 percent.

We’re going: “What’s the problem with this?” It may sound okay. This is good. We’re taxing the rich. We’re Robin Hooding the system — taxing the rich and giving the poor, taxing the Maserati owners and giving it to the people who can’t afford a car. Okay. I get that. But I don’t think government actually understands that there are also segments of our economy where we rely upon people — the early adopters — to actually pay more for certain things to allow us to actually get into the market.

Let me give an example. The first people who bought cell phones paid a lot for their cell phones — the big, big cell phones. They paid a lot, and those so-called early adopters are the reason why we are able to buy cell phones so cheaply, because they paid the R-and-D costs of the companies, some of which went bankrupt, that created the technology that we use today.

The first people who bought laptops paid a fortune. The first people who bought LED-screen TVs…. Can you imagine the first people who were spending thousands of dollars for a flat screen TV? They were paying the R-and-D, research and development, costs that allowed the price to come down so much that they give them away in cornflakes boxes now, pretty much.

But what the government has failed to see here is that there are some new types of vehicular transport — hydrogen fuel cell vehicles and some high-end electric vehicles — that are actually new technologies, and there are extremely high R-and-D costs associated with them.

What we’re doing is, rather than government giving a handout to these companies to keep them going, we’re letting those who can afford it pay the R-and-D costs for these companies. It’s pretty clear to me that there should be an exemption here, and that exemption should be for cars that are zero-emitting vehicles, whether they be fuel cell or electric cars.

Some Teslas are in this price range. Tesla is now only able to deliver a sedan because all of those people were able to invest in the R and D of the earlier models — the Model X and the Model S. But now they can develop the sedan.

What about hydrogen fuel cell? That may be a technological pathway. I doubt it, but it may be. We shouldn’t be taxing those early adopters and putting in barriers that way. I hope the government is open to an amendment which excludes zero-emission vehicles in this regard.

Coming down to the municipal and regional district tax and the PST, we now have legislation happening here that’s allowing the accommodation platforms, like Airbnb and, say, VRBO, vacation rental by owner. We’re allowing these organizations and municipalities, as well, to actually start to collect municipal and regional district taxes and PSTs and submit them. This is enabling legislation. It doesn’t mean that if I’m renting my house on Craigslist for a week that I’m going to do it, but it would allow me to do it if I so chose to do so.

Coming to the school tax, now we have a two-tier system, a two-tier additional school tax on high-end properties. One threshold is $3 million, and the second threshold is $4 million — again, somewhat arbitrary numbers. I guess it applies to a lot of people who live on the waterfront here on Vancouver Island or in Shaughnessy or Point Grey. I’m sure the member from Vancouver-Quilchena will have concerned citizens in his riding.

Again, we have two new property school tax rates, and what’s happening now, of course, is there’s going to be an addition of a 0.2 percent additional school tax on the residential portion assessed between $3 million and $4 million and a 0.4 percent tax on the residential portion assessed over $4 million.

This exempts things like purpose-built rental housing, etc. Now, again, I can see the problem, and I can see some of the concerns. Increasing designated….

I won’t be much longer, hon. Speaker. Although I am the designated speaker on Budget Implementation Act, Bill 2, I do see the green light coming.

For many homeowners, taxes can be deferred, as we know. So if you’re a senior citizen, you don’t actually have to pay your property tax. You might want to defer it. But there are people who want to ensure that they’re not leaving debt in that way so there is some discomfort with this. I don’t know that it’s insurmountable, but there is some discomfort within senior groups, senior citizens, about what this means.

I don’t know about the unintended consequences. Let me give a specific example, which I hope government reflects upon. I know a specific case of an individual with special needs who lived with his parents in a home. Now, that home probably could have been worth pretty close to this amount of money. When the parents tragically were deceased, the individual stayed in the home. Now the individual would be, in this case, subject to taxation.

But that individual may not be a senior. That individual, in the case I’m talking about, was not a senior. It was a 40-something-year-old gentleman. That 40-something-year-old gentleman, who’s barely making ends meet, would now be subject to a punitive, additional tax. I hope government thinks about, in fact, exempting people who perhaps have special needs or special circumstances.

Nobody’s going to stand up here and call government out for increasing the tobacco tax — minor increases. I can’t believe that people still are willing to spend 12 bucks for a pack of cigarettes, but they do, and they’re going to pay more clearly, as this goes forward. What we didn’t see, of course, is any legislation yet on what kind of tax revenue we would expect from cannabis as it comes forward. Hopefully, government will be letting us know that as we move forward.

With that, I’ll say that by and large, obviously, I will support at second reading the Budget Implementation Act. I won’t speak for my colleagues, but we have had a brief discussion, and I’m pretty sure that they’re supportive as well. Well, I know they are, in fact.

But we’re not entirely happy with the implementation act. We don’t see the details on the speculation tax. We should have seen those details. The property transfer tax issue, of course, has been left out in terms of proper enforcement, of actually ensuring that people pay it. That’s a mistake. Government should have fixed that. The issue of electric and non-emitting vehicles over $125,000 — that’s a punitive tax of early adopters. It shouldn’t be there. Hopefully, government will reflect upon this as we move forward.

With that, hon. Speaker, I thank you for your attention, and I look forward to the remaining debate