Economy

Celebrating Earth Day during a global pandemic lock down

As we celebrate the 50th anniversary of Earth Day we recognize that we live in a world that is vastly different from what it was even just a few months ago. For the first time, Earth Day will be celebrated without large outdoor events where we come together and share our vision for a sustainable future. Instead, millions of people will come together via online platforms and global events featuring today’s scientific experts, thought leaders and our creative communities. Earth Day has been re-imagined by necessity due to the current crisis we all face.

The COVID-19 global pandemic has changed our lives profoundly and destabilized our economy in an unprecedented manner. Yet in every crisis, there is also opportunity and, in this crisis, we have an opportunity to rethink our way of life and how we live on this planet.

Although separate issues, there are parallels that can be drawn between the pandemic and the climate crisis. Both are global and require evidence-based solutions grounded in science. Both have laid bare the deficiencies and inequities in how we protect the most vulnerable in our society. Both require bold political leadership in a changing, threatened world.

Here in British Columbia, the response of our public health officials and the government to the COVID-19 crisis has shown our province to be a leader in acting quickly to avoid worst case scenarios. Strict measures like social distancing and non-essential business closures which were implemented early in BC appear to have ‘flattened the curve’. There has been a high degree of compliance to these measures and an outpouring of support in the community to assist those most vulnerable. While we are encouraged by the data we have seen, this is no time to let down our guard and relax the strict measures too quickly. Other jurisdictions in the world have shown that this has serious and life-threatening implications.

British Columbia has also proven to be a leader in response to climate change. We are well positioned to lead into the 21st century with CleanBC, the new economic vision for how BC will prosper in a changing and challenging world.

In the context of responding to the pandemic, we have an opportunity to embrace a new approach to transitioning the economy. While the pandemic has had a devastating effect on the economy due to radical business and industry shutdowns, there has been an unintended, but beneficial consequence of a sharp drop in global greenhouse gas emissions. As the economy revives, we have a chance to reset priorities and move more quickly to renewable resources as a cost-effective solution to fossil fuels. The major disruption caused by the pandemic is an opportunity to make transformational change for a cleaner, healthier future.

While the pandemic has appeared as a clear and present danger that will play out over weeks and months, the climate crisis is an existential threat that has been playing out over decades. The radical economic measures taken in response to the pandemic are not the way to combat climate change, however we have an opportunity to rethink our behaviour and approach to transitioning the economy for the long term. We have come together in new ways to fight the pandemic. Perhaps we can emerge with a deeper understanding of our interdependence as a global community. Something to ponder on Earth Day 2020.

Support for small business as the COVID-19 pandemic plays out

Over the last two weeks governments across Canada have introduced some of the most far reaching and ambitious programs in recent memory to deal with the economic fallout of COVID-19. The policymakers and civil servants behind these supports deserve to be commended for the speed at which they have acted and for their ingenuity. Despite these unprecedented government interventions into the economy it is becoming increasingly clear that the measures introduced so far are not enough. Many businesses are slipping through the cracks of the available supports and are struggling to make ends meet.

Statistics released by the BC Chamber of Commerce (BCC) and the Canadian Federation of Independent Business (CFIB) on the scale of the economic devastation brought about by COVID-19 are staggering. Two-thirds of the 1,900 businesses polled by the BCC have experienced at least a 50% decrease in revenue and over half are worried that they will face bankruptcy or be unable to resume operations when the crisis subsides. Almost 40 percent of independent businesses surveyed by the CFIB have said that the Canada Emergency Wage Subsidy will not help them and 56% said that they have no fiscal capacity to take on new debt. These statistics released by business advocacy groups are consistent with the daily emails my office has received informing us that the existing measures are not enough. Messages received by my constituency office, ongoing conversations with small businesses and reports from the media highlight gaps in the existing programs. Some of the gaps are outlined below.

Eligibility for the Canada Emergency Business Account

The Canada Emergency Business Account is open to businesses with a total payroll between $50,000.00 and $1,000,000.00 in 2019. However, there are many small businesses with 10 to 20 employees whose payroll exceeds the program’s upper limit. For instance, small health, technology and manufacturing companies whose growth the province has been trying to cultivate will be particularly hard hit by the program’s restrictions.

BC Hydro Small Business Credit

The BC Hydro Small Business Tax Credit defines “small business” as those that qualify for their Small General Service Rate. The effect of this restriction is that numerous businesses with narrow profit margins that use high amounts of electricity (i.e. local restaurants using the medium general service rate) will not be eligible for the benefit. Although BC Hydro does allow payments to be deferred, many of these bills will be due at precisely the same time when businesses will be trying to recover from the crisis.

Restrictions in the Wage Subsidy

The original structure of the Canada Emergency Wage Subsidy worked against small businesses who had experienced substantial declines in revenue but were still trying to stay open to provide services to people. Eligibility requirements originally restricted applications to businesses that have experienced at least a 30% drop in revenue when comparing one month this year to same month last year. This restriction would have meant that businesses whose revenue had decreased by 20% or even 29% would not qualify for the subsidy. The direct effects of restricting the availability of the program would have been further layoffs of workers which defeats the announced goal of the support. As it stands, within the foodservice industry 7 out of 10 businesses will continue to reduce staff hours or lay off more employees if their current situation does not improve. Recently announced changes to the bill will allow businesses to qualify for the subsidy if they can demonstrate a 15 percent drop in revenue in March. Companies will also be permitted use January or February as their base line in certain situations. These changes to the legislation show that the government is listening to business owners. However, continued monitoring is needed to determine if they adequately address the bill’s original flaws.

Profit margins and the use of a ‘one-size fits all’ approach

For many small businesses with narrow profit margins, the difference between remaining viable and facing insolvency is extremely thin, making a substantial decline in revenue potentially devastating. Given the financial position of many small businesses, the measures introduced so far may not be enough to keep them afloat. While the wage subsidy does offer some support, many businesses still have substantial fixed costs (i.e. rent, utilities). These businesses are seeing reduced revenue due to disruption in their supply chains and decreased demand in the economy. Furthermore, numerous already overextended business owners feel that they don’t have the fiscal capacity to take out additional loans. The structure of the existing programs also does little to support small businesses reliant on cyclical or seasonally dependent revenue who have recently seen their sales dry up. For businesses in this position tax deferrals or loans will become difficult to finance with their primary revenue source having evaporated.

Looking Ahead

Going forward, both the provincial and federal government will need to work together to quickly address the gaps in support measures introduced so far. Solutions which have been floated by business groups include: direct payments to business (especially those hardest-hit by the crisis), further reductions in taxes, and supports for businesses unable to pay rent. Other countries may provide models for how to respond as well. Both Norway and Demark have introduced schemes to help companies experiencing revenue losses to pay their fixed costs. Switzerland has launched a program where the small business can apply for interest free loans of up to 10 percent of their annual revenue (SFr500,000 maximum) which are fully backed by the government.

Right now, the current collapse in economic activity is happening at an unprecedented pace. Nearly one quarter of the businesses surveyed by the CFIB stated that they will be unable to make it through the next month without additional support. Within the foodservice industry almost 10 percent of restaurants have already closed and an additional 18 per cent could permanently close by the end of April if current conditions persist. Time is of the essence in getting businesses the support they need.

By expanding the available support programs for small businesses, governments will be reducing the amount of economic hardship experienced by countless numbers of people. Supporting hard-hit businesses will be an incredibly expensive in the short-term. There are major long-term benefits to ensuring that businesses are able to remain operational. Keeping more small businesses solvent throughout the pandemic will help to prevent businesses and workers from needing to re-establish their niches in the economy after the crisis abates. By acting now to support small businesses, governments will be saving central pillars within our communities. These businesses help to make our communities feel like home by providing us with a sense of place and identity. Given the importance of small businesses to our economy and communities, governments must take steps to ensure these businesses are able to emerge successfully from this crisis.

Statement from political leaders on COVID-19 financial aid package for people, businesses

Today Premier John Horgan, Opposition Leader Andrew Wilkinson, interim third party Leader Adam Olsen and I issued a joint statement about the emergency House sitting to support people and businesses affected by COVID-19. Below I reproduce the contents of this statement:

Media Statement

“COVID-19 threatens our health, our economy and our way of life. We must act now, and quickly, to slow the spread of COVID-19 and protect people in our communities.

“We know that people all across B.C. are stressed and anxious about the future. Families are struggling and businesses are hurting.

“Today, Members of the Legislative Assembly joined together to pass legislation to help people and businesses affected by COVID-19.

“There’s a long road ahead of us. But we are united in ensuring the health and safety of British Columbians are protected as we respond to this unprecedented challenge.

“As party leaders, we want to take this opportunity to speak with one voice and challenge every British Columbian to do their part to stop the spread of COVID-19.

“We expect everyone to follow the advice of the provincial health officer, Dr. Bonnie Henry, and take the steps needed to slow the spread of COVID-19.

“By washing our hands, keeping a safe distance from others, staying home if we are sick, and buying only what we need, we can flatten the curve.

“The actions of each of us determine the future for all of us. No matter our politics, now is the time to come together and do our part to stop the spread of COVID-19.”

Responding to Finance Minister James’ statement that she will not seek reelection

Today Carole James announced that she won’t be seeking reelection in the next provincial election. Carole has had an exemplary career as a politician both at the provincial and school board level. We have been very fortunate in British Columbia to have her steady hand guiding the province’s budget as Finance Minister for the last two years. While Carole’s voice in the legislature will surely be missed, I’m sure she’ll selflessly contribute to our community in so many other ways in the years ahead.

Thank you Carole for all that you have done for our province. You are an incredible role model to so many, including me, and I very much value your ongoing friendship.

Below I reproduce the text of the statement my office released in response to Minister James’ announcement.

Media Statement

MLA Andrew Weaver responds to Finance Minister James’ statement

For Immediate Release

March 5, 2020

Victoria, BC – Andrew Weaver, MLA for Oak Bay-Gordon Head, released the following statement in response to the announcement by Minister Carole James today that she will not be running again due to a diagnosis of Parkinson’s Disease:

“I am deeply saddened to hear the news of Minister James’ diagnosis and my thoughts are with her and her family during this difficult time. Minister James has had a distinguished career dedicated to the service of British Columbians and she has been a steady hand in this NDP government. “

“It has been a privilege to have known Minister James for over 20 years. I gained tremendous respect for her when she was Chair of the Greater Victoria Board of School Trustees and it has been an honour to work with her in the legislative assembly.”

“I am confident that she will face the challenges associated with this disease head-on and continue to be a positive influence on the direction of this province throughout the remainder of her term.”

-30-

Media Contact:

Judy Fainstein

Executive Director

Legislative Office of Andrew Weaver, MLA

+1 250-744-7615 | Judy.Fainstein@leg.bc.ca

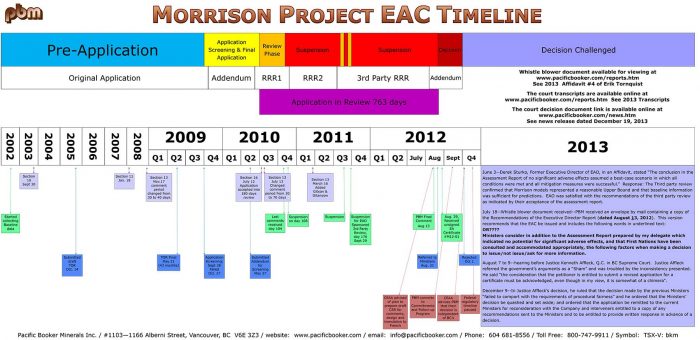

Exploring regulatory inconsistencies facing Pacific Booker’s Morrison mine project

Today during question period I rose to ask the Minister of Energy, Mines and Petroleum Resources about what appears to be regulatory inconsistencies facing the advancement of Pacific Booker’s Morrison Mine project. As you will see from the exchange below, I was not particularly impressed with the Minister’s response to my questions.

I intend to explore this issue further in the coming weeks.

Below I reproduce the video and text of the Question Period Exchange.

Video of Exchange

Question

A. Weaver: I’m sure every member of this House will agree that a stable regulatory environment is key to maintaining B.C.’s reputation as a welcoming place to do business. This means that the approval of natural resource projects must be based on scientific evidence and not politics. Yet in 2012, upon recommendation from the executive director of the environmental assessment office, the B.C. Liberals rejected the Morrison mine project proposed by Pacific Booker Minerals, despite it having received a positive environmental assessment. In justifying their decision, they cited environmental concerns about the effects of the mine on water quality in Morrison Lake and local salmon populations, despite already having a positive environmental assessment.

Despite their rejection of the Pacific Booker project, in 2013 the B.C. Liberals went to Ottawa to lobby the federal government to approve the Prosperity mine, a project that had received two negative assessments by federal review panels. There’s some suspicion that the decision around the Morrison mine had less to do with environmental concerns and more to do with political calculation.

My question is to the Minister of Energy, Mines and Petroleum Resources. Has this government been able to determine why this company was treated so differently from others at the time? And how will it prevent situations like this from happening in the future?

Answer

Hon. B. Ralston: I’d like to thank the member for Oak Bay–Gordon Head for his question. I’m sure the member will appreciate that I’m not in a position to advise what led the former government to make its decision about the proposed Morrison mine. What I can say, though, is that their approach was shortsighted and certainly didn’t bring certainty to the sector.

Our government has taken a different approach. My predecessor, as minister, initiated the Mining Jobs Task Force, which worked hard with First Nations, industry and communities to find ways to strengthen this fundamental, foundational industry.

There were 25 recommendations emanating from the task force. They’ve all been accepted by government, and almost all of them have now been implemented. We have made two mining tax credits permanent, bringing immediate benefits to the B.C. mineral exploration sector by adding more certainty. We’ve invested $1 million for the mining innovation roadmap, $1 million for the Regional Mining Alliance.

As further evidence of the strengthening of the sector, the Ontario Teachers Pension Plan just signed a $300 million investment deal to provide an investment in the New Afton mine, just outside the civic boundaries of Kamloops.

Supplementary Question

A. Weaver: I must admit that was a lot of information about a lot of mines that weren’t the mine I’m actually talking about. Maybe I can try again.

A key element of the previous government’s unrealistic strategy for natural resource development revolved around, as we all know, LNG. We know that certain natural gas projects were located in areas close to the Morrison mine. Comments from groups engaged in the Pacific Booker project have indicated that the province was facing significant pressure to avoid reopening discussions around the Morrison mine in order to obtain the support necessary for the Prince Rupert gas transmission line.

The decision to reject the project had serious repercussions for Pacific Booker. Their share price plummeted, from $14.95 to $4.95 in one day, and many investors lost their life savings. What’s more is that the ministry failed to inform Pacific Booker of its intention to issue an adverse recommendation and did not provide the company with an opportunity to respond to it.

After a legal battle in which the Supreme Court found that this conduct violated standards of procedural fairness and that the environmental assessment office recommendation be presented to cabinet for reconsideration, the government once again rejected the project in order to undergo further assessment. However, in its order, the government appeared to issue unclear directions that substantially delay the process. As of 2019, in September….

Interjections.

Mr. Speaker: Members.

A. Weaver: As of Sep 2019, Pacific Booker had yet to be fully provided with this opportunity. My question, again, is to the Minister of Energy, Mines and Petroleum Resources. When is this firm going to have the chance to have their project undergo further assessment, as put forward by the Supreme Court?

Answer

Hon. B. Ralston: The short answer is that the company is currently working through the required regulatory processes for further assessment. The further assessment for the proposed project includes the requirement for a supplemental application information requirement. There are a number of requirements. The EAO continues to work with the company on this, and I’m advised that the latest submission was received by the EAO in December 2019.