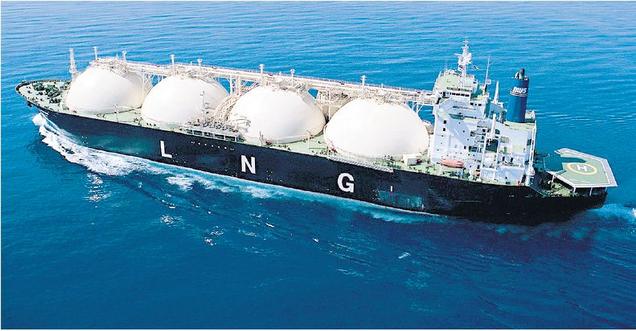

LNG

To the Premier: Fitting a square peg in a round hole. LNG vs 40% GHG reductions by 2030?

Today in the BC Legislature I rose during estimate debates for the Office of the Premier to ask the premier how he plans to reconcile a new two to four train LNG facility in Kitimat with the province’s recently announced commitment to reduce greenhouse gas emissions by 40% from 2007 levels by 2030. This task will be particularly onerous in the event that new bottom-up methane fugitive emissions measuring techniques are introduced in the province.

Below I reproduce both the video and text of my exchange with the Premier. As I noted in an earlier post, I believe it isn’t possible to do so.

Video of Exchange

Text of Exchange

A. Weaver: I have three questions for the Premier, concerning government policies on LNG development. Let me please start by saying I’m extremely encouraged by the work underway on developing a truly visionary climate plan, and I’m fully committed to delivering on the opportunity that this minority government has — to finally put a plan together that understands that addressing climate change and meeting our greenhouse gas reduction targets is an economic imperative, yet also an economic opportunity.

This will require hard work, thoughtful and innovative solutions and the engagement of all British Columbians. What we must never again allow is for the stated commitments to reduce emissions to be used as a cover for actions that undermine that commitment. That is what we see playing out federally. I believe this government is sincere in its commitments to meeting its greenhouse gas reduction targets, but they have some work to do in showing how the action they have taken — advancing a major expansion of a fossil fuel industry like LNG — is in line with these commitments.

Please let me explore with you three questions. First, in May 2015, the B.C. Liberal government signed a development deal with Pacific NorthWest LNG, in an aggressive move to spur the Malaysian-led project to become the first major Canadian exporter of LNG.

In response, the Premier, who at the time was the Leader of the Official Opposition, was sharply critical and said the provincial government had put too much on the table for industry. I just want to provide a quote. He said this: “My biggest concern is that we are tying the hands of future governments because a desperate government made commitments that they overpromised on.” He said in Victoria: “And now they want to get a deal at any cost.”

The B.C. NDP argued that the agreements the B.C. Liberals were offering to LNG companies were too one-sided and did not provide sufficient certainty for the owners of the resource, the general public. The NDP at the time charged that this was “a sellout for B.C.,” and they said also: “The LNG tax legislation was written by industry and for industry.”

Hon. Chair, are we not similarly now offering LNG Canada a deal that has been written explicitly for them, while ignoring the costs that this project will incur on British Columbians, including the costs to other sectors of our economy that will be forced to pay to accommodate the massive increase in our greenhouse gas emissions?

Hon. J. Horgan: I thank the member for his participation in the estimates today. I know there will be a series of questions on this issue. It’s one that is of critical importance to him and his colleagues, and also to all British Columbians.

When we formed a government, we were approached by industries — mining, forestry and any number of industries — to find out what the new government’s plan was on taxation and what regulatory regime would be in place for a range of issues.

We established a framework for the LNG industry. The member will know — we talked about this during the election campaign — that we wanted to ensure there was going to be a return to taxpayers for the resource that belonged to them. Ministry of Finance officials worked on the development of the framework to ensure that there would be a benefit to British Columbia’s treasury as a result of any LNG development in British Columbia, and that’s what the framework is designed to do.

We also made a commitment to the public, and reinforced that when I was in Asia talking to potential proponents, that Indigenous participation and meeting our climate action objectives were integral to any approval by the province of British Columbia.

I know the member’s participation in the development of our climate action plan going forward will be absolutely pivotal to our success. I look forward to his interventions.

I just want to say that as we look at the potential of a final investment decision in the north, we want to make sure…. Industry has said to us — leaders of industry — that they welcome this type of private sector investment. I’ve said to them, as I know the member has, that if there’s an increase in emissions as a result of this sector growing, then that means there’s going to need to be a concurrent reduction and more so in other industrial activity. The business community understands that.

We need to make sure that as we develop the plan, in concert with our colleagues here in the Legislature, that we know that industry understands that we need to reduce emissions over time. If we’re going to have a net increase from one project, that means concurrent decreases from other sectors.

A. Weaver: A key reason why I want to ask this question, the previous one and the next two, is that the financial regime that this government has brought forward is described by the Premier’s government as a better deal than what the B.C. Liberals were offering. When this was brought forward earlier this year, it was reported: “The tax breaks would water down LNG taxes enacted by then Premier Christy Clark after the 2013 election. Instead of the provincial treasury receiving an estimated $28 billion in revenue over 40 years if LNG were built, B.C. would take in only $22 billion.”

Put another way, we’re offering a project that would become the single largest source of new greenhouse gas emissions in Canada at a $6 billion discount from what the previous government was willing to offer, not the least of which is also including a reduction in electricity rates, PST and exemptions on carbon tax increase.

Why are we going out of our way to offer a better deal than even the B.C. Liberals were willing to consider to bring an LNG industry to British Columbia, in spite of the commitments we have made to a real climate plan?

Hon. J. Horgan: I thank the member for his questions.

Firstly, I think we have to look back at the market for natural gas in North America and the precipitous drop-off in prices here for a commodity we have in abundance in the northeast.

When the former government put in place their LNG tax, they had an expectation of higher market prices, which would have led to potentially more revenues coming to the province. But as prices continued to be soft and demand continued to be flat, the prospect of an investment started to fall away. We saw proponent after proponent after proponent leaving the province because with the framework that was in place from the previous government, it wasn’t possible to realize a final investment decision.

Again, working with Finance officials, we took a look at what was possible with tax changes, a repealing of the B.C. Liberal LNG tax and bringing in a tax that would allow us to continue to get revenue to the Crown and also allow the project to proceed.

With respect to electricity, again, the B.C. Liberals created…. Again trying to squeeze more juice out of what was a declining prospect because of prices internationally, they created a new tariff for electricity. We agreed with the industry that if you’re a pulp mill or a mine or any other industrial activity, there’s a tariff that you pay, and that should be the same tariff for an LNG manufacturing plant.

What we have done when it comes to electricity prices is put in place an industrial tariff that exists for all industrial activity. I think that’s a fairness question. On the energy-intensive, trade-exposed industries, I know the member and I have had long discussions about this. He understands the issue very well. If we are going to have a successful climate action plan and a robust economy, we have to keep our energy-intensive, trade-exposed industries in a position of being able to be positive and also meet our climate objectives.

This is not going to be an easy challenge. The member knows that better than anyone else in this Legislature. It’s for that reason that I’m grateful that he’s on board to try and help square this circle. But the investment opportunity is significant. Upstream electrification will help reduce emissions from wellhead to water line. These were issues that we debated in this Legislature when the previous administration brought forward their ideas. I think we’re in a better position now to make the changes that we need.

We’re not focusing on one, two, three, four or ten LNG plants. It’s two trains and a community that is receptive and that has almost complete First Nations participation. I believe that if we work very hard on this, we’ll be able to see a final investment decision by what is a very diverse group of proponents from China, Japan, Korea and Royal Dutch Shell. I think the opportunity is a positive one, but the challenges are significant, and no one knows that better than the member for Oak Bay–Gordon Head.

A. Weaver: Thank you for the answer. I certainly hope government is looking to support from the B.C. Liberals for repealing the LNG Income Tax Act because the B.C. Greens have been quite clear that we will not support the repealing of the LNG Income Tax Act, in light of the fact that the deal that was given by the B.C. Liberals was a rich deal at best, and this rich deal is being made richer. I look forward to the debates ahead as the B.C. Liberals stand in support of government repealing the LNG Income Tax Act that they brought in.

In 2016, the NDP concluded that plans for the $11.4 billion terminal at Lulu Island would generate an unacceptable increase in the province’s greenhouse gas emissions and filed a definitive position against the project with the federal environmental authorities. “The project,” the NDP noted in their March 2016 letter to the Canadian Environmental Assessment Agency, “would increase the province’s entire carbon footprint for industry, transport and residential activity combined by 8.5 percent. The proposal failed to meet the condition of air, land and water protection with respect to both the threat to marine habitat and species as well as to climate, through unacceptable high and inadequately regulated gases, greenhouse gas emissions,” the letter stated. “Until and unless those deficiencies are addressed, we urge you to withhold final recommendation for the approval.” Those are the NDP words.

As was reported in Times Colonist at the time, the key reason the opposition was citing, greenhouse gas emissions, is an issue with all the big LNG plants that have been under consideration in B.C. for the past several years. If the B.C. NDP applies its Pacific NorthWest LNG reasoning to all other proposals, it’s hard to imagine a scenario where the party would support LNG in general. “Unacceptable high emissions cited by the letter are in fact lower than the emissions projected to arise from LNG Canada. According to Pembina’s analysis, LNG Canada would increase our emissions by 14 percent of 2015 levels.”

Furthermore, the same analysis projects that upstream emissions from LNG Canada will be comparable to those outlined as unacceptable in the Canadian Environmental Assessment Agency letter. LNG Canada is about five megatonnes of CO2 equivalent a year. That’s for two trains — two then four. This would suggest the analysis that led the B.C. NDP to reject Pacific NorthWest LNG on climate grounds would equally, and more so, apply to LNG Canada. Again, I don’t have any philosophical objection to the LNG industry. LNG may be an important local transition fuel to meet our plans for commercial vehicles and other forms.

But what we can’t allow, and what I believe you were arguing yourself, hon. Premier, in the letter you filed with the Canadian Environmental Assessment Agency, was that the LNG industry cannot come at the expense of our commitments to reduce greenhouse gas emissions.

How does the Premier reconcile his strong opposition to Petronas with his support for LNG Canada? I don’t see how you can have it both ways.

Hon. J. Horgan: I thank the member for his question. Our analysis shows that the emission intensity of LNG Canada is significantly lower than the Petronas proposal or Pacific NorthWest LNG — 0.23 versus 0.15 in terms of with emission intensity. Also, LNG Canada proposes their upstream assets are largely in the Montney basin — the southern portion of the Montney basin — which will provide more opportunities for electrification to ensure that emissions at the wellhead are reduced so that the package from wellhead to waterline is significantly greater than the Petronas or the Pacific NorthWest LNG proposal.

I believe that new technologies that are proposed by LNG Canada also assist in reducing their profile, versus Pacific NorthWest LNG. The member will remember that the critical issue when it came to the Pacific NorthWest LNG issue was siting of the plant on Lelu Island, which was contested by the Lax Kw’alaams hereditary leadership as well as many very concerned about one of the most robust salmon rivers in North America at the mouth of the Skeena River. The putting at risk our wild salmon was a significant challenge that I believe Pacific NorthWest LNG wasn’t able to overcome.

When it comes to LNG Canada, they have the full support of the Haisla Nation. They have support virtually from Treaty 8 right through to Kitimat. The city of Kitimat is almost uniformly supportive. I believe that the fiscal framework we’ve put in place will allow a significant return to the people of British Columbia.

The challenge, as the member knows full well, is meeting our climate objectives. We’re going to need a lot of work by a lot of people to do that. Individuals are going to have to reduce their footprint. Industry is going to have to reduce their footprint to make space for this new emerging industry. But it will create significant employment growth, wealth for British Columbians and, I believe, will allow other jurisdictions to reduce their climate emissions by having a transition fuel in place.

I thank the member for his questions.

Race to the bottom economics and the great BC natural gas giveaway

On Tuesday during budget estimates I had the opportunity to ask the Minister of Energy, Mines and Petroleum Resources a series of questions that quite clearly demonstrate the race for the bottom economics at play as BC continues to pursue an LNG industry. The exchange afforded me the opportunity to get on record the issues I raised earlier this year concerning the fact we are literally giving away a natural resource in order to blow through our greenhouse gas reduction targets.

I asked the Minister to explain the myriad natural gas royalty credit programs and to outline the aggregate amounts claimed under each program in recent years. I conclude with a question regarding deep well royalty credits and the Minister reveals that as of December 31, 2017 there are $3.1 billion in unclaimed credits.

Below I reproduce the text and video of the exchange.

Text of Exchange

A. Weaver: I don’t need the minister to read it. I’ll go afterwards and make sure I follow up with the people I’ve been communicating with to get access to the exact quote.

I have a number of questions with respect to natural gas royalties. I’ve provided these to the minister in advance. There’s a clear theme in here. My first question is this. Would the minister please describe the clean infrastructure royalty credit program?

The Chair: Just before the proceedings continue, I’d like to read to the members the section of Standing Order 17A(1). “Electronic devices must not be used by a Member who is in possession of the floor, or during the following proceedings: (a) Speech from the Throne; (b) Royal Assent; (c) Prayers; (d) Oral Question Period; (e) Speaker’s rulings; (f) divisions; (g) at any other designated time pursuant to instructions by the Speaker.” So the relevant piece is that when the member has possession of the floor, an electronic device shouldn’t be used. Thank you, Members.

Hon. M. Mungall: I’ll answer the question in two parts, essentially. First, I’ll kind of speak to the broader concept, and then secondly, I’ll speak specifically to how this particular program works.

The broader concept around this is a tool that governments in many jurisdictions often use to incentivize, whether it’s individual behavior or industrial behavior, to change. This type of incentivization, using financial incentives as well, is often used, particularly when we want to change behaviors or practices to make them more environmentally friendly.

Just as a really quick example…. I don’t want to use all the member’s time in giving these examples. But when I was on city council in Nelson, we wanted people to start recycling more — a good environmental practice. So we made the payment of garbage…. To just dispose of things into the landfill, we charged everybody $1 for a garbage bag. But putting recycling into a blue bag that we were then going to start to pick up from door to door — we made that free.

In this type of scenario, what we’ve done is made a royalty credit program to incentivize industry to advance clean technologies and solutions for reducing greenhouse gas emissions specifically that are linked to the development and production of the oil and natural gas resources. That’s specifically what this program is, and that’s the concept behind it. It’s accomplished through a provincial royalty deduction of up to 50 percent for eligible products that are approved by the ministry.

So applicants are required to, first off, fund the entire project themselves and then make applications. Then the ministry determines whether or not they’re eligible, and then how much they might be eligible, for a royalty credit.

A. Weaver: I’m wondering if the minister could please provide me with information as to how much was claimed under this program in the aggregate sense for 2014, 2015, 2016, 2017 and what is projected for 2018?

Hon. M. Mungall: This would be our newest royalty credit program. It started in 2016. The first installment had approved royalty deductions of $10.7 million to successful applicants. To date, no amount has been released, as the projects have not yet been completed. So that $10.7 million has not been released and will only be released once the projects are actually completed.

The second installment for 2018 is currently underway. We’re thinking we might be looking at $19.3 million, which to us means that it’s showing greater interest in terms of taking opportunities to reduce greenhouse gas emissions and receive the benefits of doing that. The incentivization is working as we hoped it would be.

A. Weaver: In my view, this is…. It’s the first of many credits that I’ll allude to, discuss. The first one. In my view, government is giving natural gas companies a royalty credit to clean up their own pollution. Remarkable that this was done in 2016.

A second credit that I’m hoping the minister could describe — as opposed to the clean infrastructure royalty credit program, just the infrastructure royalty program…. Could she please describe that program for me? To ask the second question at the same time, what was claimed under this program in the last five years?

Hon. M. Mungall: The infrastructure royalty program has a different focus, obviously, than the previous credit program that we were talking about, the clean infrastructure royalty credit program. This is for infrastructure in general that industry may have not been incentivized on their own to develop. So there is a variety of infrastructure that goes with the industry. Rather than minimizing the type of infrastructure that can benefit the community, we want to maximize the infrastructure. So this is part of the purpose behind all of this.

In terms of the numbers for the last few fiscal years, in 2014-15, the following royalty deductions have been released, and that was $56.8 million; in 2015-16, $54 million; ’16-17, $28.6 million; and in 2017, $1844.4.

A. Weaver: I very much appreciate the thoughtful and thorough answer from the minister. This is a royalty program, as the minister meant, that can pay up to 50 percent of the costs of building roads and pipelines, for example.

One of the concerns, of course, I have and that I raised to the minister is that there are concerns arising from this in terms of the destruction of natural habitat, which creates costs to society and wildlife populations because of predator routes and lack of biodiversity that is not paid for. We’re in some sense, through this program, incentivizing the buildings of roads, and the taxpayer is on the hook to deal with any concomitant effects on wildlife and ungulate populations in the affected regions.

Next credit program. This is the third one. I’m wondering if the minister could please describe the low-productivity well royalty reduction production program.

Because I suspect we’re going to have a recess after this, if we might, at the same time, get the projected revenues that were claimed for 2014 through to now as well.

Hon. M. Mungall: What we’re trying to incentivize with this particular royalty program is the continuation of a well rather than an early shutdown. To explain this, I’ll do my best.

For example, a well will have a predicted 30-year lifespan, right? So you get to year 25, and there’s less gas in the well. Rather than have a company just shut it down, walk away and start up something new, we want to keep that production going so that we have the full lifespan of the well. So we want to incentivize them continuing the work. There’s less gas in that well at that time, so it’s going generate less revenue. Rather than get nothing and still have this well that is there but is not operating, we want to get something out of that well and get some kind of revenue for it as well.

This incentivizes them to continue that well until its full lifespan, to make sure that they’re paying people to go there, inspect it and maintain it appropriately. That’s the purpose of this. And I would argue the effects of that make sure that the wells we have continue their full lifespan, rather than a shorter lifespan and then that company saying, “Okay, we’re going to go start up a new well that’s going to generate more gas right away,” and therefore increase the number of wells that we have in a particular area.

The amount of money that was claimed under this program in 2013-14 was $6.4 million; in ’14-15, $6.2 million; in 2015-16, $2 million; and ’16-17, $1.8 million.

A. Weaver: The fourth royalty credit program I’d like to discuss. I’m wondering if the minister could please describe the marginal well royalty reduction program, as opposed to the low-productivity well royalty reduction program that we just discussed, and if she could please let us know what was claimed under the program in the same years.

Hon. M. Mungall: The marginal well royalty reduction program is very similar to the one that I was just talking about, which is the low-productivity well royalty reduction program, except that it’s not at the end of the lifespan of a well. Rather, what’s happened is that the operator has drilled the well, and not much is coming out. Specifically, the natural gas is coming out at a rate below 23 cubic metres of gas per day, per metre of well depth.

We can pull out our calculators and do the math on that, but the point is that it’s producing very, very low. The same purpose behind the previous royalty reduction program that I spoke of is behind this one as well. It’s so that we don’t have a company just walking away, but rather, we’re incentivizing them to maintain operations of that well so that the taxpayer and British Columbians are getting something in return for that well.

The numbers associated with that particular program. In 2013-14, it was $43 million; ’14-15 is $41.9 million; ’15-16 was $12 million; and in ’16-17, $13.1 million.

A. Weaver: The fifth royalty credit program I’d like to get some information is the ultramarginal well, as opposed to the marginal well royalty reduction program. I’m wondering if the minister could please describe the ultramarginal well royalty reduction program and also let us know what was claimed under this program over the last five years.

Hon. M. Mungall: I thank the member for this line of questioning, because it allows us to get into describing the various types of wells that we have in our gas fields and also to give definition to some of the lingo in the industry.

An ultramarginal well is, I guess, kind of your next step below a marginal well. It’s slightly different in the sense that what makes it ultra-marginal is that it’s a shallow gas well and it’s a single vertical drill. That’s what makes it distinct from the previous types of wells that we’ve been talking about.

What was claimed over the last few years — I’ll give those numbers to the member. In 2013-14, it was $23.5 million, and in 2014-15, it was $24.6 million. In 2015-16, $6.1 million, and in ’16-17, $5.9 million.

Do you mind if we have a quick recess?

A. Weaver: Not at all.

Hon. M. Mungall: Chair, would we be able to have just a five-minute recess?

The Chair: This committee stands in recess for ten minutes.

A. Weaver: Thank you to the minister for her comprehensive answers to these. We’ve discussed a number of credit programs that were designed to incentivize marginal or unproductive wells to keep them going.

Now I would like to move on to some other credit programs. The next one I was hoping the minister could describe is the net profit royalty program. Again, as per the previous ones, if she could let us know what was claimed under this program for the last five years.

Hon. M. Mungall: The net profit royalty program is all about, in terms of timing, when we anticipate a well to be profitable. If a well starts off, and it’s not producing as much as it will in the future, we want to make sure that that well is still developed and that we get the economic benefits of that eventually. The program allows producers to pay a lower royalty rate in the initial stages of a project in exchange for higher royalty rates once the producers have recovered their initial capital costs.

What was claimed under this program in previous years? For 2013-14, it was $16.4 million. In 2014-15, it was $19.1 million. Then in 2015-16, something good must have happened, because it was only $2.9 million and, in 2016-17, $2.3 million.

A. Weaver: My understanding is that it’s also used to promote the development of high-risk resources that would otherwise unlikely be developed — in some sense, taking risk out of the investment nature of the natural gas sector. Again, thank you for the answer.

The next credit program I’d like to get some information on — hon. Chair, through you to the minister — is: I’m wondering if she could describe the natural gas deep re-entry credit program and, once more, let us know what was claimed under this program in the years 2014, 2015, 2016 and 2017.

Hon. M. Mungall: Before I get the answer for the next question, I will say that I just checked, and yes, your understanding for high-risk activity is correct as well. Sorry I missed that.

This particular program is for wells that already exist, and it’s to incentivize companies drilling further down, drilling deeper. Rather than a new well and all of the impacts that are associated with a new well and a new pad, we would keep the existing well, and we would incentivize the company to drill deeper.

Wells receiving this credit are subject to either a 3 percent or a 6 percent minimum royalty. So they will be having to definitely pay some kind of royalty. The figures for this are released within the public accounts. For 2013-14, it was $261.9 million; in ’14-15, $486.8 million; in 2015-16, $171.7 million; and in 2016-17, $178.3 million.

A. Weaver: Again, I think the minister is seeing the direction I’m heading with this line of questioning. These are some very big numbers here as credits. I’m only on the seventh, with more to come, of royalty credit programs that exist.

The next one is my favourite, which is called the natural gas deep-well credit program. I’m wondering if the minister could please describe what the natural gas deep-well credit program is prior to 2014, and what that program is after April 1, 2014? What occurred in the transition on April 1, 2014?

Hon. M. Mungall: I’m just going to go back to the numbers that I shared with the member in my previous answer about the natural gas deep-well re-entry credit program.

A. Weaver: Were those the deep-well credits?

Hon. M. Mungall: They’re both. They are both the deep-well credits as well as the deep-well re-entry program. Sorry to say, but the Ministry of Finance doesn’t separate the two out. So that actually is the total for two different credit programs.

For the natural gas deep-well credit program, the issue here is less the incentivizing that I was speaking to in some of the previous wells, where we were trying to incentivize a very distinct behavior. That means that the company is already here. They’re dedicated to setting up, and this is the type of behaviours or practices that we want from them as they are beginning their activity.

This particular one is addressing our competitiveness on the global stage — making sure that B.C.’s upstream in the northeast is competitive on that global stage. What it does is it provides a royalty credit for wells, for deep wells specifically.

The member wants to know…. There was a change that was made on April 1, 2014, and he wants to know what the change was specifically. What it was is that this credit program was expanded to cover wells with a vertical depth of less than 1,900 metres. Prior that that, it was 1,900 metres or more.

That’s not to say that you can drill 1,500 metres, and — that’s it — you’re eligible. What it is, is that you can drill less than 1,900 metres, but you still need to keep drilling. You just go horizontally rather than straight vertically. So there is less depth, but there still needs to be length in terms of accessing the actual resource.

A. Weaver: I assume that the numbers that were claimed are the numbers that were given earlier for the…. I believe the minister’s nodding, so I won’t ask what the numbers for the deep-well are.

Essentially, what we’ve got, in summary of these credit programs…. In British Columbia here, we provide a credit for infrastructure construction. We provide a credit for cleaning up your pollution. We have a credit to ensure marginal, cost-ineffective wells are kept in production. We provide a credit, actually, for deep wells, and we provide a credit for horizontal fracking as well. In essence, we provide credits in all areas of our natural gas sector here to incentivize natural gas drilling. Oh, were that to be the case in other sectors of our economy.

With that said then, credits are important to actually incentivize — and I get that — emerging technologies and sectors. Let’s take a look — and perhaps the minister can help us through illustration — at some of the revenues we’ve been getting, then, from the natural gas sector. I’m wondering if the minister could please provide the net royalties received by the province of British Columbia for natural gas for each of the fiscal years from 2007 through 2017.

Hon. M. Mungall: I’ll start with 2007 and the fiscal year 2007-2008. The net royalties received were $1.132 billion. The following year, ’08-09, was $1.314 billion; ’09-10, $406 million; 2010-11 was $313 million; 2011-12, $339 million; 2012-13, $169 million; 2013-14, $445 million; 2014-15, $493 million; 2015-16, $139 million; and 2016-17, $152 million.

A. Weaver: Thank you. I very much appreciate those answers. In essence, in summary, in 2009, we were at a high of $1.3 billion in royalties coming to the province of British Columbia. And in fiscal year ending 2017, were $152 million — almost ten times less.

The next question then is in the area of how much natural gas we have produced. I’m wondering if the minister could please let us know what the net production of natural gas in the province of British Columbia was in thousands of cubic metres for each of the fiscal years 2007 through to 2017.

Hon. M. Mungall: These are all in cubic metres. For 2007-2008, we have 27,084,782 cubic metres.

A. Weaver: Say that again.

Hon. M. Mungall: It’s 27 million. If the member wants, I can just round it out to the million rather than giving the entire number. If he likes, for the full detail right down to the last cubic metre, I’m happy to provide that in writing.

For 2008-2009, it was 28 million; 2009-2010, we’re at 27.6 million; 2010-2011, 31 million; 2011-2012, 36.5 million; 2012-2013, 35.8 million; 2013-2014, 39 million; 2014-2015, 42.5 million. And the last year that we have the available numbers is 2015-2016, at 44.7 million.

A. Weaver: I’ll have to get under…. Those numbers differ from the numbers that I have, being 32 million in 2007, 33 million in 2008, 33 million in 2009, 35 million in 2010, 41 million in 2011, 41 million in 2012, 44.5 million in 2013, 47 million in 2014, 49 million in 2015, 51 million in 2016 and 51.5 million in 2017. Hopefully we can, I can, reconcile where our differing sources are from, down the road.

The point here is that we’ve had close to a 50 percent increase in production over the last decade or so, at a time when in fact royalties have gone from $1.3 billion to $152 million.

My second-last question in this line of questioning is this. I’m wondering if the minister could please let us know what the net royalty per thousand cubic metres of natural gas produced in the province of British Columbia is for the fiscal years 2007 through 2017.

Hon. M. Mungall: I’ll answer this question, and then I think we’re going to have to wrap up for the day, if that works for the member. He has one more? Okay.

For B.C., the net royalty per 1,000 cubic metres for natural gas in 2007-08 was $40.45. I’ll do the same as I did before. I’ll round up or down, using those grade-school math skills.

In 2008-09, it was $45. In ’09-10, it was $14. In 2010-11, it was $10. In 2011-12, it was $9. In 2012-13, it was $4 — closer to $5, pardon me. In 2013-14, it was $11. In 2014-15, it was closer to $12; it was just $11.55. And then in 2015-16, it was $3. In 2016-17, it was $3.

This type of increase and decrease situation — if you look at Alberta numbers, it’s very similar. For example, in 2007-2008, the net royalty per thousand cubic metres was $38.30. Then, fast forward nine years into the future to 2016-17, it was $4.93. The reason why you see this, is that the royalties are not based necessarily on the volume of gas being extracted; it’s based on the price. And the price of gas is determined by the marketplace. So what we have here is that the price of gas was quite high in 2007-08, 2008-09 fiscal years, and it has come down quite substantially.

What I’d like to do for the member here, so that he has this information, is I’d just like to table this so that he can access it. Am I able to table in budget estimates?

D. Routley (Chair): I would ask you to share it informally. To properly table, we would have to do it in the main chamber.

Hon. M. Mungall: Okay. No problem. I’ll do that. Great. I’ll just hand that to the member opposite so that he has that as well.

A. Weaver: I do appreciate the response. We had slightly different numbers, from my calculations — again, based on the natural gas production estimates and the source of values — versus the sources you’ve got there.

The bottom line here is the net royalties, in using the government’s numbers, were $45 for every thousand cubic metres produced in B.C., and now it’s $3, despite a 50 percent increase in natural gas production over that same time. This is race-for-the-bottom economics at its finest.

My final question is this: what is the total accumulated and outstanding natural gas deep-well credits available to companies in British Columbia? When I asked this question in the fall, it was something of the order of $3.2 billion. I’m wondering what that number is now.

The Chair: Minister, and noting the hour.

Hon. M. Mungall: Absolutely, Chair.

The total outstanding deep-well royalty credits since the inception of the program as of December 2017, are estimated at $3.1 billion. Now, this includes all credits for all wells, whether or not they’re in production. So that’s what we have.

I just want to make sure that the public knows that a company can’t come up and say, “I have all these credits; pay me out,” and somehow they’re walking away with a bag full of money. That’s not how it works at all. They’re able to use their credits to reduce their royalties down to a 3 percent or 6 percent rate. They still have to pay royalties.

Noting the hour, I move that the committee rise, report completion of the resolutions of the Ministry of Advanced Education, Skills and Training and report progress on the Ministry of Energy, Mines and Petroleum Resources and ask leave to sit again.

Videos of Exchange

| Part 1 | Part 2 | |

| Part 3 |

Probing the rationale behind recent changes to the Petroleum and Natural Gas Act

Yesterday during budget estimates for the Ministry of Energy, Mines & Petroleum Resources I asked the Minister a couple of questions concerning very recent changes to the Petroleum and Natural Gas Act. These new changes preclude detailed information about royalty revenues being publicly disclosed, and grant the Oil and Gas commission increased regulatory power.

This line of questioning followed the good news that Shirley Bond (MLA Prince George-Valemont) and I received about the proposed Borealis geothermal project near Valemont, BC. The Oil and Gas Commission recently approved their drilling permits and, to quote the Minister:

“The good news is that the ministry is already working with Borealis in terms of helping them navigate all the different funding opportunities, particularly from the federal government as well. “

Below I reproduce the video and text of the exchange.

Video of Exchange

Text of Exchange

A. Weaver: I would like follow the comments of the member for Prince George–Valemount and echo her thanks to the minister for this good news about Borealis. I, too, am thrilled with the news, and it’s great to see B.C. champion this demonstration project. It’s good for B.C. It’s good for Valemount. It’s good for all of us in this room, and I think it’s a great step forward.

I have a number of questions. I’ve given most of them to the minister in advance, because they were rather lengthy, and I thought rather than scrambling on the floor, I could give them time to prepare.

I have two that I wanted to ask first that I had not…. They just came to my attention very recently. They came to my attention when a member of the general public sought information that used to be available through a freedom of information request, and that was recently changed in the statutory miscellaneous stats law that was passed under this government.

Under section 122.1 of the Petroleum and Natural Gas Act now, information about royalty revenues must not be disclosed. It essentially means that British Columbians are denied the right to know about royalty payments on a resource that belongs to the citizens of this province. This is a very new addition.

My question to the minister: is she comfortable with this, given the stark contrast to the forest industry, in which the volume of timber harvested by specific companies is publicly available information? What is the justification for this level of secrecy around a publicly owned resource, exclusively for natural gas. Now you nor I, our friends here — nobody — can know which company gets how much natural gas out of the ground. Very unusual given that it only applies to the natural gas sector.

Hon. M. Mungall: The overall amount of royalties that are paid by the industry is aggregated and then made public through Public Accounts, but I believe the member opposite was talking about the specific amount of royalties per company and that not being shared.

My understanding is that this is very similar, actually, with mining in that Ministry of Finance has determined that a best practice is to treat royalties, in terms of their privacy, the same way as you would treat individual income tax. We want to protect that privacy information for industry in the same way that we would protect privacy information for individuals.

What that means is that we would know the information for the industry as a whole but not for individual companies.

A. Weaver: Is it then publicly available — the amount of a resource that is being extracted by a particular company? As of a few months ago, if a FOI was put forward, a member of the public could find out how much natural gas — a British Columbian owned resource — was extracted by a British Columbian natural gas company. Now they would be told that they’re subject to the section 122 and that information is not available. Is that correct?

Hon. M. Mungall: If the individual that the member has been speaking to is concerned about the actual volumes of gas tied to any well at all in British Columbia and wants to know how much volume of gas is being extracted for that one well, or for a group of wells or so on, that information is actually publicly available on the OGC, the Oil and Gas Commission’s, website. That is readily available. They don’t have to file an FOI, but it’s that financial component that has been now retained as private information.

A. Weaver: Thanks to the minister for the answer.

My second question in this area is: the board of the Oil and Gas Commission has the power to make regulations under the Oil and Gas Activities Act, and it has, in fact, exercised this power to make regulations related to consultation and notification requirements, geophysical activities, drilling and production activities, pipeline and liquefied natural gas facilities, and fees and levies and securities.

My question is this. Does the minister feel that it’s appropriate for a body, which is both a promoter and a regulator of the oil and gas industry, to have the ability to create regulations without cabinet or legislative approval?

Hon. M. Mungall: The member’s question, specifically, was if we, as a government, see it as permissible for an entity to be both regulator and promoter of an industry.

The answer to that is that the OGC is a regulator, full stop. That is very clearly laid out in section 4 of the act that governs the Oil and Gas Commission. If the member likes, I can read it out as a whole. But important to note is looking at….

The Chair: I’ll have to interject. The standing orders do not permit the use of a device.

Hon. M. Mungall: I’m sorry, Chair. My understanding is there was a ruling made in the last parliament that actually allowed members to read from an electronic device.

Interjection.

Hon. M. Mungall: Yeah, not during question period, but otherwise, at other times, I’ve seen members do that. But maybe the member doesn’t need me to read it.

The Chair: Pardon me, Minister. We’ll consult with the Clerk in the meantime.

Hon. M. Mungall: I’ll leave my answer at that, though. The member is able to use the Internet, so I’m sure he will.

A vision for a thriving, diverse 21st century economy in BC

Today in Kamloops I had the pleasure of giving a keynote presentation at the 2018 Annual General Meeting of the BC Chamber of Commerce.

I took the opportunity to outline our vision for a thriving, diverse 21st century economy that builds upon our strategic strengths.

Below I reproduce the text of my speech.

Text of Speech

Introduction

Thank you for inviting me to “the River City” to speak not only about some of the work we’ve been doing over the past year, but also about our vision of economic prosperity for BC.

It’s been almost exactly one year since we signed our confidence and supply agreement with the BC NDP, signalling our commitment to supporting them in a minority government.

It’s somewhat ironic that it’s also been almost exactly one year since the publication of your breakfast keynote speaker (Adam Kahane’s) book Collaborating with the Enemy: How to Work with People You Don’t Agree with or Like or Trust — a book I bought and read last summer.

The last year seems like a year on fast-forward.

The minority government produced by the election – the first in 65 years in BC – led to the BC Greens playing a role we’ve never before played in BC politics.

It provided us an opportunity to champion key aspects of our economic platform in our agreement with the NDP.

To be successful in the 21st century economy, we need to capitalize on our strategic strengths and position ourselves to be leaders in the new economy. Achieving this has been the focus of our efforts in BC’s minority government.

As many of you know, before running for office in 2013 I was a climate scientist at the University of Victoria for 25 years.

Year after year, my students would ask me why so little progress was being made to reduce greenhouse gas emissions given that the science on climate change was so clear.

I told them that if they didn’t like the decisions politicians were making, they should consider finding someone to run or consider running themselves.

In 2012, as I watched the dismantling of Gordon Campbell’s legacy of positioning BC as a leader in the new economy, I realized I had to take my own advice. So, what motivated me to get into politics is fundamentally the same thing that I’m sure motivates a lot of you to do what you do.

I believe we have a responsibility to the next generation.

I believe in British Columbia and want to contribute to building the brightest possible future for our province.

If we want to secure a bright future for BC, we will do ourselves no favours by doubling down on the economy of the last century.

Instead, we must take stock of global trends – climate change, technological innovation, the rise of the knowledge economy – and point ourselves in a clear direction of where we want to go.

This year, the auditor general confirmed BC will miss our legislated 2020 greenhouse gas reduction targets.

Without a plan we will almost certainly miss our recently legislated 2030 targets as well.

Last year, wildfires, which the scientific community agrees will become more extensive, cost our province $750 million. Communities in BC are still recovering from flooding. The effects of global warming are not in some distant future – they are here now. And they will get far worse.

In this context, it’s not acceptable to continue to ignore our greenhouse gas reduction targets, and to continue to expand the fossil fuel infrastructure of the last century thereby pushing our targets further out of reach.

And this isn’t just an environmental issue – It’s critical from a business perspective as well.

The cost of failing to reduce greenhouse emissions will be profound for all sectors of our economy, both here in BC and around the world.

The world is coming together to find innovative solutions to the energy challenges arising from the transition to the low carbon economy. Globally countries like Saudi Arabia, China and Germany are investing billions in alternative energy production to position themselves as leaders of tomorrow.

There are opportunities to be had from transitioning to the low carbon economy, but they will flow to those who lead, not to those who follow.

Climate/LNG

Global investment trends are being driven by the world’s shared Paris commitments, predicated on the fact that keeping global warming under 2 degrees Celsius is far more cost-effective than dealing with the effects of a temperature rise above that level.

In the next two decades, renewable energy sources like wind and solar will comprise almost three-quarters of the US$10.2 trillion in new global investment in power generating technology.

The cost of solar is already on par with coal in Germany, the U.S., Australia, Spain and Italy, and will reach parity in China, India, Mexico, the U.K. and Brazil in 2021, if not sooner.

This shift presents a significant opportunity for B.C.’s economy. Our province is well poised to bolster its leadership in the cleantech sector – Vancouver alone is home to a quarter of Canada’s cleantech companies. And we can thank the leadership of Gordon Campbell for bringing this to fruition.

In 2016, B.C. cleantech generated approximately 13,900 jobs with an average salary of $84,000. We have a strong competitive advantage in the building blocks required to foster a knowledge-based economy.

Natural gas – royalty credits

Despite the new opportunities we’re presented with, in BC today, our government is continuing to pursue the dream of exporting LNG, and is perpetuating a natural gas giveaway.

We have seen massively decreasing revenues to BC from gas extraction.

What the data shows is quite shocking – while gas production has gone from 25 billion cubic metres in 2001 to over 50 billion cubic meters in 2016/17, royalty and land lease revenues to the BC government have gone in the opposite direction, from a record $2.4 billion in 2008/09 down to only $139 million in 2015.

This is partly due to the fact that the B.C. government provides hundreds of millions of dollars every year to subsidize horizontal drilling in the northeast of our province, through the deep-well royalty credit program.

The deep well royalty credit program was originally meant to offset the cost of deep well drilling.

It was later extended to apply to horizontal drilling as well. Now both are common practice, so much so that companies have amassed more credits than they can spend.

The companies earn these credits by drilling qualified wells, and when the wells start to produce gas, the companies apply the credits to reduce or even eliminate provincial royalties that they normally pay on this public resource.

In recent years, the participating companies have amassed credits faster than they can spend them. The balance in their deep-drilling account has increased from $752 million in 2012 to an accumulated $3.2 billion today.

Not only are we not getting paid for this public resource, we are literally paying companies to take it from us.

In 2009, B.C. collected $1.3 billion in natural gas royalties. Last year, we collected a mere $152 million. Measured as a share of the value of oil and gas production in B.C., royalties collected by government has fallen from 44 percent in 2008 to just 4 percent last year.

In 2009, BC earned $39.90 in royalties for every 1000 cubic metres of natural gas. In 2017 it was $2.95.

This is a dismal return on the resources that are being extracted from our province. We are giving away more gas for less money while barrelling past our climate commitments. That’s race for the bottom economics at its finest.

Opportunity/innovation

The future of economic prosperity in BC lies in harnessing our innate potential for innovation and bringing new, more efficient technologies to bear in the resource sector.

BC will never compete in digging dirt out of the ground with jurisdictions that don’t internalize the same social and environmental externalities that we value.

We will excel through being smarter, more efficient, & cleaner.

This means that we not only export the dirt, but we also export the knowledge, technology and value added products associated with resource extraction.

A great example is Vancouver-based MineSense’s technology that saves mines between $20 million to $200 million per site, while also reducing electricity and water consumption by 20 to 25 per cent and tailings by up to 40 per cent.

Through MineSense’s innovation, B.C.’s economy grows by creating the technology that enables others to make this same transition.

Efficiency also means ensuring B.C. is getting the maximum value for our resources. The last two provincial budgets reported job losses in forestry, fisheries, mining and oil and gas.

My caucus and I hear a common theme from resource businesses, industry groups and local governments — the economic value of B.C.’s natural resources does not remain in our communities.

It’s profoundly ironic that many believe that doubling down on the approach of the BC Liberals is somehow good for the resource sector when in fact, the job losses, downturn in the resource sector, and economic troubles in rural BC have occurred precisely under the watch of the BC Liberals over the last six to eight years.

In forestry, sawmills close as raw log exports persist. In fisheries, quotas become concentrated in the hands of a few companies, pricing young fishers out of the market.

Seafood caught in Canadian waters is shipped to Asia, where it is processed, and then shipped back here to be sold.

The Trans Mountain Pipeline expansion seeks to export diluted bitumen, which must be refined abroad before it can be of any use to consumers.

Every time we ship a raw commodity overseas, we forgo opportunities to create well-paying jobs and grow our economy.

There is no need for this — B.C. has a highly educated workforce, a strong entrepreneurial spirit, and world-class research institutions.

Our high school students are consistently top ranked — with the OECD noting that BC is one of the smartest academic jurisdictions in the world. Our high quality of life and beautiful natural environment attract some of the best and brightest from around the globe.

In every corner of the province, innovative British Columbians are using these strengths to generate economic prosperity. After the Midway Mill closed in 2007, the town raised capital to invest in a technological overhaul and reinvigorate the mill.

At the Wood Innovation and Design Centre in Prince George, students learn how to bring design, technology and forestry products together to develop innovative high-performance wood products.

The centre was built using value-added wood products from Structurlam, a highly innovative Penticton-based company whose products have been used in award-winning buildings all over the world.

To get a fair value for our resources that deliver maximum benefits to our communities, we need to get smarter and more strategic when it comes to embracing innovation.

Government’s role

Government should be doing more to support these initiatives and create fertile ground for a sustainable, resilient, and diverse economy.

In our Confidence and Supply Agreement with the NDP, we included two key pieces from our 21st century economy platform to help us seize economic opportunities in the emerging economy.

The first piece is the Emerging Economy Task Force.

We proposed the Emerging Economy Task Force to enable government to adapt and respond to changes on the horizon.

We need to modernize government so that it is considerably more responsive to technological innovation.

In one example, six years since ride hailing attempted to enter our market, Vancouver is still stuck with fewer options than every other major city in North America. This shouldn’t be the case.

The role of the Emerging Economy Task Force is to look to the future, identify emerging trends and advise government on how to maintain our competitiveness and achieve prosperity amidst these changes.

The second item from our platform that we integrated into CASA is the Innovation Commission (now Innovate BC) as well as the appointment of an Innovation Commissioner.

The innovation commissioner was proposed to be an advocate and ambassador on behalf of the B.C. technology sector in Ottawa and abroad, to enable B.C. companies to more easily tap into existing federal programs and build key strategic relationships.

I’m confident that both of these initiatives will bolster key sectors of our economy as we go forward.

We should be using our strategic advantage as a destination of choice to attract industry to BC in highly mobile sectors, like tech, that have difficulty retaining employees in a competitive marketplace.

We should be using our boundless renewable energy resources to attract industry, including the manufacturing sector, that wants to brand itself as sustainable over its entire business cycle, just like Washington and Oregon have done.

We should be setting up seed funding mechanisms to allow the BC-based creative economy sector to leverage venture capital from other jurisdictions to our province.

Too often the only leveraging that is done is the shutting down of BC-based offices and opening of offices in the Silicon Valley.

We should fundamentally change the mandate of BC Hydro. BC Hydro should no longer be the builder of new power capacity.

Rather, it should be the broker of power deals, transmitter of electricity, and leveller of power load through improving British Columbia power storage capacity. Let industry risk their capital, not taxpayer capital, and let the market respond to demands for cheap power.

Similarly, by steadily increasing emissions pricing, we can send a signal to the market that incentivizes innovation and the transition to a low carbon economy. The funding could be transferred to municipalities across the province so that they might have the resources to deal with their aging infrastructure and growing transportation barriers.

Yes, we should be investing in trade skills, as described, for example, under the B.C. jobs plan. But we should also be investing further in education for 21st century industries like biotech, high tech and cleantech. It’s critical that we bring the typically urban-based tech and rural-based resource sectors together.

Natural gas has an important role to play.

But, we should use it to build our domestic market and explore options around using it to power local transport. BC businesses such as Westport Innovations and Vedder Transport have already positioned British Columbia as an innovative global leader in this area.

The digital technology supercluster provides another example of exactly the type of innovation government should be doing everything it can to support. The supercluster is estimated to generate up to 15,000 jobs and $15 billion in economic activity in the coming decade.

It offers an opportunity to bring together the private sector, our post-secondary institutions and government to solve problems and accelerate innovation in key sectors in our province, like health care, forestry and manufacturing.

The companies involved in the supercluster are diverse, innovative and deeply committed to seeing success in British Columbia, and their initiative will help B.C. be more competitive as we respond to changing global trends, and help us get a better return for our resources.

Benefit companies

Finally, I’d like to speak today to a recent initiative our office has undertaken, to have benefit company legislation passed in BC.

This legislation would support companies that choose to integrate economic sustainability and social responsibility into their business mandate, by enabling them to incorporate as benefit companies in BC.

By incorporating as benefit companies, businesses would achieve greater certainty for their directors and investors about their goals and mandate, enabling them to attract capital investment while staying true to their mission as they scale.

Benefit companies are critical because they recognize that in today’s new economy — with triple-bottom-line reporting, providing a workplace where you actually create an environment that is conducive to attracting and retaining employees in a very progressive manner — these are the types of companies that are attracting the millennial generation.

This legislation is an opportunity for B.C. to lead the country in supporting businesses that want to be a bigger part of developing innovative solutions to the challenges of the 21st century.

I am hopeful that government will support this legislation and that we will be the first jurisdiction in Canada to have benefit companies.

Conclusion

We will not solve the challenges of the 21st century by chasing 20th century solutions. In the shadows of the massive challenges that we face, our province needs a new direction.

But we can turn these challenges into opportunities if we have a forward-looking vision, an evidence-based approach to policy and political leadership that thinks beyond a four-year election cycle.

Most importantly, I believe that we must reject politically motivated attempts to pit the environment against the economy. Doing so will only short-change resource-dependent communities by justifying the race-to-the bottom economics of raw commodity exports.

Instead, we need a new direction that offers a realistic and achievable vision grounded in hope and real change.

A new direction that places the interests of the people of British Columbia first and foremost in decision-making. And it’s not only today’s British Columbians that we must think about, it’s also the next generation who are not part of today’s decision-making process.

I am truly excited about the prospects that lie ahead in this minority government. British Columbia has so much to offer and we can and shall be a leader in the new economy.

Thank you all again for having me here today to speak with you.

I look forward to more conversations to come.

Addressing delegates to the AVICC annual convention

Today I was afforded the opportunity to address delegates at the 69th annual convention of the Association of Vancouver Island and Coastal Communities. As noted on their website:

“The Association of Vancouver Island and Coastal Communities (AVICC) is the longest established area association under the umbrella of the Union of BC Municipalities (UBCM). The area association was established in 1950. It now has a membership of 53 municipalities and regional districts that stretches from the North Coast Regional District down to the tip of Vancouver Island and includes Powell River, the Sunshine Coast, the Central Coast and the North Coast. The Association deals with issues and concerns that affect large urban areas to small rural communities.“

Below I reproduce the text of my speech.

Text of Speech

I am delighted to be here this morning with all of you – and I think we share an essential trait as politicians, even if we are not always aligned in policy or vision.

Each of you, I expect, can identify the issue or the passion that motivated you to run for local government. It may have been an environmental issue, as it was for my colleague Sonia Furstenau, or it may have been a desire to see a project in your community to move forward.

And it is passionate leadership at the local government level that sees so much positive change come forward in our province.

Look at the Town of Gibsons – the first in North America to pass a natural asset management policy, showing extraordinary leadership in recognizing the indisputable logic of including natural assets in financial planning.

In Cowichan there is the Cowichan Watershed Board, laying the foundation for watershed co-governance with First Nations, and taking tangible, necessary steps toward reconciliation in the process.

Recognizing that healthy and happy communities – as Charles Montgomery so eloquently points out – have social connection and collaboration in their fibre, Oceanside and Mt. Waddington’s Health Networks are models for bringing people together to create long-term positive health outcomes.

It was my own commitment to action on climate that motivated me to run for MLA in 2013, after I had seen our province go from a climate leader under Gordon Campbell to a climate laggard under Christy Clark.

As a climate scientist, I had long encouraged my students to engage with decision makers – or become decision-makers themselves – if they wanted to see politicians take action on climate. I realized that I too had a responsibility to participate in the building of political will to act on climate – not as a voice of doom, but as a voice for the extraordinary possibility and opportunities that lie before us in this challenging time.

So much of the conversation around climate and the transition away from a fossil-fuel economy is backward-looking, focusing on the economy of the 20th-century.

Look at the hysteria and rhetoric around the kinder morgan expansion – the shocking doubling-down on a pipeline that would export heavy oil – diluted bitumen – out of Vancouver. In every way, this is the wrong direction for our economy, our environment, our relationship with First Nations, and our climate.

Now take the potential that lies in new technology and innovation. Shell has recently announced that it has the technology to extract vanadium from bitumen, and use the vanadium to build steel that can be used to manufacture battery cells that have the capacity to store energy.

Consider that potential! Rather than dumping yet another raw resource as quickly as we can into foreign markets that reap the rewards of jobs and revenue as they process it into a usable and far more valuable commodity, we could be looking at using this resource to develop and support steel manufacturing, innovative energy storage technology, and the renewable energy sector.

We could massively increase the return to our citizens and our economy, and we could be actively building the future energy systems that will sustain our children and grandchildren.

We sell ourselves short by looking backwards – when transformation and innovation are happening more and more rapidly, it is the worst possible time for us as a province or a nation to double down on the ever decreasing returns in a race to the bottom of early 20th-century economics.

And it’s smaller communities – like the ones that many of you represent – that could benefit immensely from the emerging economy that’s rooted in education and driven by innovation and technology.

Consider the potential of Terrace as a centre for manufacturing – we as a province should be reaching out to Elon Musk and encouraging him to see the potential benefits of a Tesla plant or battery manufacturing plant in Terrace, where shipments to Asia are easily accessible through Prince Rupert’s port, and shipments to Chicago are at the end of a rail line that runs straight through Terrace.

Here on the island, Victoria has already earned the moniker “Techtoria” – and the Cowichan Valley is situated perfectly to be the next destination region for an industry that is growing by leaps and bounds.

BC’s own digital technology supercluster was recently awarded $1.4 billion in federal funding – an investment that is expected to produce 50,000 jobs and add $15 billion to BC’s economy over the next ten years.

And the work being done will make the lives of British Columbians better – including creating a health and genetic platform that will allow medical specialists to create custom, leading-edge cancer treatments that are personalized to the unique genetic makeup of each patient.

This work – hi-tech innovation, research, education – this work can happen anywhere in our increasingly connected world. It’s the connectivity highways that we should be investing in – these will allow all communities to reap the rewards of the 21st-century economy.

At a reception for the BC Tech Association last week, I met Stacie Wallin. Her job is to nurture tech companies that have hit the 1 million dollar level in revenue to scale up to the 25 million dollar level.

And she is so busy that she has nearly a dozen people working with her to keep up with the work that’s coming her way. When pipelines and LNG plants crowd out our conversations about BC’s and Canada’s economy, we miss what’s actually happening – the exciting, innovative, emerging economy that is reshaping our communities.

And there’s so much more. The film industry, tourism, education, professional services, value-added forestry, innovation in mining, renewable energy – our potential in this beautiful province is as boundless as our stunning scenery – and squandering time and energy to prop up sunset industries is the wrong place to be putting our precious efforts and money.

And if governments double down on 20th-century carbon-based economics, it’s your communities that feel the impacts and pay the prices.

Floods, droughts, wildfires, damage from increasingly punishing storms, sea level rise & storm sureges – all of these cost your communities, and your citizens, more and more money.

Communities are hit with the costs of building infrastructure to prevent flooding during the melt season, at the same time as having to determine how to deal with depleted aquifers that won’t be able to sustain the residents who depend on them for drinking water, and another drought this summer will once again put Vancouver Island at severe risk for wildfires.

The impacts of climate change will continue to put severe pressures on all our communities – which is why it’s utterly irresponsible for our provincial government to be considering a 6 billion dollar subsidy of the LNG industry – including letting LNG Canada off the hook for paying their fair share of carbon pricing.

Consider that fact alone – that the potential single greatest emitter of greenhouse gases in BC would only ever have to pay $30/tonne for its carbon pollution, while the rest of us, including industry, will see carbon pricing rise by $5/tonne each year.

This is an unacceptable logic, and one that we can’t possibly support – and I urge you, as the elected representatives who will be seeing the costs and consequences of climate change in your communities – I urge you to also encourage this government to recognize that giving massive tax breaks to the LNG industry because it isn’t economically viable is not the direction BC should be heading right now.

Consider an alternative. Why not invest in the Squamish Clean Technology Association (SCTA) created to seek out leading edge ventures that will help create an innovation hub focused on clean energy. We could attract the best and brightest minds to come to BC to figure out how to harness the renewable energy that abounds in our province while encouraging the innovation that our world needs most right now.

In response to a question from the audience on Friday about how to get municipal staff to think beyond their standard frames of reference, I understand that Charles Montgomery pointed to new models for civic design, and suggested that politicians may need to “drag them kicking and screaming” into the 21st century.

This also applies to many of our provincial and federal representatives, who may say that they recognize our need to transition to the new economy, but then try to convince us that the way to reduce greenhouse gas emissions … is to increase greenhouse gas emissions.

Doubling down with doublespeak – let’s not let this become a new Canadian tradition.

We need our provincial and federal politics to reflect the best of what we see at the local government level.

Informed discussion and debate, listening to people who present differing opinions, allowing for compromise as a path forward, working from a place of shared values and finding solutions that best reflect those values.

And while it may not always feel this way at your council and board tables, the reality is that your level of government is one that is generally far less driven by partisanship and ideology.

We have an extraordinary opportunity to bring our electoral system into the 21st century in BC with the referendum that is happening this fall. And while there will be many discussions on both sides of this debate over the next several months, it’s essential to begin with what are we trying to solve with electoral reform in BC.

Currently, under First Past the Post, elections are geared towards a “winner take all” outcome. And that winner almost never has the support of the majority of the voters.

40% is often the magic number.

40% of the popular vote in BC can generally deliver to one party a majority of seats in the legislature, and 100% of the power for 4 years.

Informed discussion and debate, listening to differing opinions, compromise, collaboration, finding common ground based on shared values – that’s completely unnecessary when your party has enough votes to ram through any legislation and any agenda you like.

Compare this to almost any other human endeavour, where collaboration, cooperation, and respect deliver the outcomes that have moved us forward throughout history.

Yes – let’s compete to bring forward the best ideas, the boldest visions – but let’s not make competition the only value that underpins politics.

Charles Montgomery points out that the infrastructure of our cities and our communities can be a source for unhappiness, through creating mistrust, a sense of disconnect, and a lack of sociability.

It seems that our political infrastructure – and in particular a first past the post system that delivers 100% of the power with a minority of the votes – can also create mistrust, lack of sociability, and unhappiness. In our winner take all system, inflicting knock out blows to the other side becomes a normal part of our politics – but how much does this damage our governance?

How many good ideas, brought forward by opposition MLAs or MPs have died sad deaths on the order papers under a majority government that can’t be seen to work across party lines?

Electoral reform – particularly electoral reform that would bring in a form of proportional representation – would deliver more minority governments to BC.

And some may try to convince you that’s a terrible thing – but I ask, is working across party lines a terrible thing? Is collaboration on policies and legislation a terrible thing? Is having more minds engaged on solving problems a terrible thing?

Or could this change in our electoral infrastructure actually bring us politics that contribute to more sociability – the one factor that Charles Montgomery said was paramount to our happiness.

Premier Horgan mentioned in his address that there has been conflict between our two parties.

There has indeed – and the media will always focus on these points of tension – but if you look at how much legislation was passed in the fall, how many initiatives have moved forward over the past nine months and then consider the ratio of collaboration to conflict, you’ll recognize that – much like at your own council tables – when you work from a place of shared values, it’s possible to almost always find a path forward.

Our current electoral model has its origins in the Middle Ages, and it has undergone significant change over the centuries.

It was only 100 years ago that women were given the right to vote in BC, and as we discuss and debate extending that right to 16 and 17 year olds, let us remember that the world around us changes continuously, and it’s up to us to ensure our institutions – particularly our democratic institutions – adapt to meet the needs of our society.

Happy cities, happy communities, happy politics. Let’s dream big.

Thank you.