LNG

LNG & BC’s GHG reduction strategy: Trying to fit a square peg into a round hole

After a three week break, the 3rd session of the 41st parliament resumed today. In question period I quizzed the Premier as to how he could argue that British Columbia would meet its legislated greenhouse gas reduction targets while at the same time developing an LNG industry.

In late February I wrote an extended essay detailing the desperate, fiscally-irresponsible steps that the BC Liberals and subsequently the BC NDP have taken in an attempt to entice major LNG players to BC.

Below I reproduce the video and text of our exchange.

Video of Exchange

Question

A. Weaver: Government has committed to reducing greenhouse gas emissions by 40 percent from 2007 levels by 2030 and 80 percent from 2007 levels by 2050. This is why the government’s continued desperate push for LNG is so problematic.

LNG Canada’s proposed four-train LNG facility would add eight to ten megatonnes of carbon-dioxide-equivalent. That’s more than 50 percent of all of British Columbia’s present industrial emissions. And they’d add that to B.C.’s total emissions.

Our targets are such that by 2050, British Columbia can emit only 12.9 megatonnes of carbon-dioxide-equivalent. And at about 9.6 megatonnes, LNG Canada would yield the single largest source of those emissions. That’s three-quarters of all of British Columbia’s allowable emissions in just one LNG facility.

My question is to the Minister of Environment and Climate Change Strategy. How is it possible for British Columbia to meet its greenhouse gas reduction targets in light of these numbers?

Answer

Hon. J. Horgan: I thank the Leader of the Third Party for his question. I know his passion for climate action and his reason for being in this House is that very issue.

I’m committed, as I said during the election campaign and as I’ve said since forming the government…. We are going to put in place targets by 2030 to see our emissions go down by the 40 percent from what they were in 2007. I’m committed to doing that.

But at the same time, when investors come calling with proposals, it’s appropriate that we talk to them. It’s appropriate that we look at the fiscal framework and we put in place the terms of engagement.

That’s why I’ve said to the LNG community: “If you’re going to employ British Columbians, there’s going to be a fair return to B.C. for access to our resource. You’re going to work with Indigenous people in partnership” — and the member for Skeena can talk to us about that — “And if you’re going to ensure that you assist us in getting to our greenhouse gas objectives, we welcome that investment.”

Supplementary Question

A. Weaver: I do appreciate the response from the Premier. Nevertheless, it seems to me that rhetoric here in B.C. is not dissimilar from what we’re hearing nationally. On the one hand, Prime Minister Trudeau claims we need to build new pipelines and increase oils sands production multifold in order to reduce greenhouse gas emissions. Our government thinks we need to increase industrial emissions by 50 percent in order to meet greenhouse gas reduction targets.

Look, LNG Canada would not build a new LNG facility today just to tear it down tomorrow. A facility will be built to be around for decades to come. That means that for all other aspects of the British Columbia economy, emissions would have to drop by 52 percent by 2030 and — get this — 95 percent by 2050. Government is essentially saying that this one LNG plant and these 200 jobs are more important than everything else in our economy.

My question to the Premier is this. Is he prepared to tell Rio Tinto Alcan, Teck, Lafarge, Canfor, Catalyst and even the Greater Vancouver Sewerage and Drainage District that they all have to shut down because British Columbia’s emission budget is all but used up by that one LNG Canada facility?

Answer

Hon. J. Horgan: Well we have no final investment decision by anyone when it comes to developing liquefied natural gas, and the members on that side will know that full well, because they promised dozens and dozens of them and none of them materialised.

I don’t want to be glib with the member’s question, because he’s absolutely correct. If we’re going to meet the targets that we have set as a Legislature — or will be codified by the Legislature in the days, weeks and months ahead — we’re going to have to have the hard discussion with all members of society, not just the industrial sector but our families, our communities. Everyone’s going to have to weigh in and do their part to reduce emissions.

This is the challenge of our generation. I’m not telling the member anything he doesn’t already know. I’m committed, as the leader of this government, to realize those objectives, and I’m going to continue to fight for that.

Responding to the BC government’s new regulatory framework for LNG

The BC government today outlined its proposed regulatory framework for LNG proponents such as LNG Canada. In particular, the BC government sent a letter on Monday to Mr. Andy Calitz, CEO of LNG Canada, providing specific details. While the BC Green Caucus has not seen a copy of the letter that the BC Government sent, we were consulted on the government’s high level policy objectives as outlined in their media briefing and release today.

Given that the BC Green caucus believes in the importance of giving industry certainty as to our positions and intentions, we also sent Mr. Calitz a letter that is reproduced in text form below. In our letter we are very clear that:

- The B.C. Green Caucus does not, and will not, support exempting new LNG companies from carbon tax increases as this defeats the purpose of the carbon pricing.

- Extending the carbon tax to fugitive emissions is a core component of our confidence and supply agreement with the BC NDP.

- The confidence and supply agreement requires government to implement a climate action strategy to meet B.C.’s legislated emissions reduction targets of not less than 40% below 2007 levels by 2030 and 80% below 2007 level by 2050

Our firm position is that it is incumbent upon government to assess the LNG Canada project through the lens of meeting these greenhouse gas reduction targets and specifically identify a pathway to meet them. This should be done in a manner that protects existing industries that provide jobs and economic activity that British Columbians rely on.

As it stands, and despite being in office for 8 months, the BC Government still has not identified any concrete measures to reduce greenhouse gas emissions. As I pointed out in February, it is not possible to on the one hand claim you have a plan to meet our targets and then on the other hand start promoting the expansion of LNG.

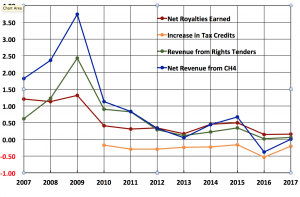

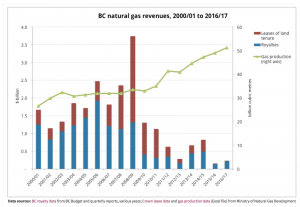

As noted in the essay I wrote, in 2016, British Columbia actually lost $383 million from exploration and development of our resource. That’s because the tax credits earned exceeded the sum of the income received from net royalties and rights tenders combined. In the fiscal year ending March 31, 2017, British Columbia earned total revenue of only $3.7 million, a 99.9% drop from 2010 (BC earned 1000 times more revenue in 2010 from natural gas than we did in the last fiscal year).

It makes no sense to continue the generational sellout and further extend the government handout to a hypothetical LNG industry by offering ratepayer-subsidized electricity (read Site C) of 5.4 ¢/kWh (less than half what you or I pay and less than half of what it will cost to produce the electricity from Site C). It makes no sense to exempt LNG companies from being required to use electric drives for compression of natural gas to achieve this discounted electricity rate.

And in addition, expectations are that the federal government would further exempt LNG Canada from tariffs on fabricated steel imports. This would ensure that most of the infrastructure would be built in Asia and shipped to BC. At the same time, the BC Government will exempt LNG proponents from the Provincial Sales Tax (PST) for construction. So much for the multi-billion dollar investment, revenue and job creator for British Columbia.

Finally, it remains to be seen if LNG demand will increase in light of the fact that Japan, the world’s largest LNG importer, is restarting nuclear reactors that were shutdown following the Fukushima incident. In fact, just this week a major Japanese electric power company is putting its LNG contracts up for sale.

In the ongoing saga of British Columbia’s desperate attempt to land a positive final investment decision from a major LNG proponent, the generational sellout continues. In a typical race-for-the-bottom fashion, the BC NDP are proposing still further subsidies to LNG proponents.

While I appreciate the Premier’s commitment to putting in place a plan to reduce emissions to 40% below 2007 levels by 2030 and 80% below 2007 levels by 2050 and to put a price on fugitive emissions, I cannot see how this is possible if the LNG Canada proposal goes ahead. It would require every aspect of our BC economy (except LNG Canada) to collectively cut emissions by more than half in twelve years and by 95% by 2050.

As outlined in our media release below, there are significant opportunities to grow B.C.’s economy while meeting our climate targets that do not include LNG. For instance, the supercluster funding announced last month is expected to generate 50,000 jobs and $15 billion in economic activity in B.C. in the next 10 years.

In summary, the BC Green Caucus will not support any legislation brought forward to grant the exemptions outlined above.

Media Release

B.C. Green Caucus releases letter to LNG Canada clarifying position on government’s LNG approach

For immediate release

March 22, 2018

VICTORIA, B.C. – The B.C. Green Caucus released a letter sent to LNG Canada clarifying the Caucus’ position on the government’s proposed LNG regulations. The letter, sent on Monday March 19, came after the Caucus was was made aware of the the details of the government’s proposed LNG regime. The letter is intended to give industry maximum clarity, as the minority government requires the B.C. Green Caucus’ votes for general stability and to pass legislation.

“There are significant opportunities to grow B.C.’s economy while meeting our climate targets,” said Andrew Weaver, leader of the B.C. Green Party. “For instance, the supercluster funding announced last month is expected to generate 50,000 jobs and $15 billion in economic activity in B.C. in the next 10 years. Future development must fit within our climate targets, and the numbers on LNG simply don’t add up.”

The B.C. Green Caucus does not support extending the proposed measures to support existing Emissions Intensive Trade Exposed (EITE) industries as currently conceived to prospective LNG companies – a policy that would in effect freeze the carbon tax at $30/tonne for certain facilities. CASA commits government to extend the carbon tax to fugitive emissions, and the Caucus expects that this will include the natural gas industry. Further, the Caucus is concerned that increasing B.C.’s emissions through LNG developments will place an undue burden on existing industries and the public to reduce their emissions beyond what is already required.

“Not only is a plan to meet our climate commitments a core component of our Confidence and Supply Agreement (CASA) which forms the stability of this government, it is essential for ensuring we do not betray our duty to future generations.” Weaver continued. “When it became clear that the government intended to propose measures that are incompatible with B.C.’s ability to meet our climate targets, we felt it was our responsibility to communicate to LNG Canada that if these measures were to go ahead unamended, we would no longer have confidence in government.

“To be clear – our Caucus is fully committed to working in partnership with the B.C. NDP government to enact a plan to meet our climate targets and in attracting the investments we need to build a 21st century economy. We will continue to hold this government to account on all its promises, including our responsibility to the next generation and our international commitments to act on climate change.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

Text of BC Green Caucus Letter

Mr. Andy Calitz

CEO, LNG Canada

March 16, 2018

Dear Mr. Calitz,

We are writing regarding your ongoing discussions with the Government of British Columbia on your proposed project, LNG Canada in Kitimat, B.C.

As you know, British Columbia currently has a minority government, where the votes of our three caucus members provide confidence in Premier Horgan’s NDP government. The basis of our confidence is the Confidence and Supply Agreement (“CASA”) signed May 30, 2017 which binds our two caucuses to act on the principle of “good faith and no surprises.” As such, the government must consult with our caucus on all matters, and it must uphold the agreed-upon policies and initiatives enshrined in it. Our caucus has been consulted on the letter sent from the government to LNG Canada. We are writing to let you know our position on the government’s proposal in order to provide you with the fullest possible scope of information.

First, extending the carbon tax to fugitive emissions is a core component of CASA. We have assurances from the government that this extension is forthcoming pending a determination of the necessary technologies and regulations to measure them. To be clear, it is our expectation that the carbon tax on fugitive emissions will be extended to all sources of these emissions. This will have impacts on a number of industries and future proposed projects, including yours.

Second, CASA requires government to implement a climate action strategy to meet B.C.’s legislated emissions reduction targets. Therefore, all future development must fit within our province’s commitment to the Pan-Canadian Climate framework to meet our emissions reduction targets, as well as soon to be legislated targets for British Columbia specifically. As such, it is incumbent upon government to assess your project through this lens and to specifically identify how it will accomplish the emission reductions required to meet our targets of not less than 40% below 2007 levels by 2030 and 80% below 2007 level by 2050. This must be done in a way that limits harm to other existing industries that provide jobs and economic activity that British Columbians rely on.

Finally, CASA commits government to implement an increase of the carbon tax by $5 per tonne per year beginning April 1, 2018. Our intention was to ensure that across the entire economy a clear market signal was sent that incentivized low GHG producing activity, as well as spurred innovation and investment in the new economy. We were made aware over the course of our consultations with government that the proposed measures to support Emissions Intensive Trade Exposed (EITE) industries would be extended to LNG as well. These measures would have the effect of rebating up to 100% of the carbon tax that was paid beyond the $30 per tonne, based on how the greenhouse gas production intensity compares to the global cleanest benchmark.

While our caucus is supportive of these measures for the many existing industries in B.C. that already provide jobs and economic activity for our province – many of whom made their investment decisions in a previous regulatory environment – our caucus does not support extending the EITE as currently conceived to a proposed LNG industry.

If such a measure goes forward without amendment we do not see how a climate action plan, as agreed to in CASA, would have any legitimate pathway forward to reach our GHG reduction targets. As such, our caucus would no longer have confidence in government, as they would not be living up to their commitments laid out in CASA.

We believe that British Columbia must make its GHG reduction targets and climate action plan the centerpiece of its economic strategy. Our focus must be on prioritizing innovation within our economy and seeing new investments that ensure we are leaving the next generation with real opportunities to prosper. We are deeply encouraged that the companies engaged in your joint venture are investing heavily in renewable energy and other clean technologies. B.C. has a highly educated workforce, world-class research institutions and a wide range of innovative companies. We would welcome the opportunity to work with you in a manner that builds on these opportunities while helping us meet B.C.’s GHG reduction targets, as committed to under the Paris Climate Accord.

We would be happy to discuss our position in detail with you.

Sincerely,

Andrew Weaver

MLA, Oak Bay Gordon Head and Leader, B.C. Green Party

Sonia Furstenau

MLA, Cowichan Valley and Deputy Leader, B.C. Green Party

Adam Olsen,

MLA, Saanich North and the Islands

It’s time politicians level with British Columbians about LNG

Over the last month there has been a flurry of media interest concerning whether or not British Columbia can meet it’s legislated and promised greenhouse gas reduction targets while simultaneously developing an LNG industry. The short answer is no, it’s impossible. In what follows I outline why this is so. I also outline why this is a defining issue for my continued support of this minority government.

1. British Columbia’s legislated greenhouse gas reduction targets

In 2007, at a time when British Columbia was emerging as an international leader in the quest to reduce greenhouse gases, the Greenhouse Gas Reduction Targets Act was passed. This act committed British Columbia to:

- reduce emissions by 2020 to at least 33% less than the level of those emissions in 2007;

- reduce emissions by 2050 to at least 80% less than the level of those emissions in 2007;

It further tasked the government with developing interim targets for 2012 and 2016.

Later that year the government set up a Climate Action Team whose mandate included, among other things, advising what these interim targets should be. The resulting report recommended:

-

- By 2012, the growth in emissions must be reversed and emissions must begin to decline significantly, to between five and seven per cent below 2007 levels;

- By 2016, the decline in emissions needs to accelerate. In order to ensure that B.C.’s 2020 target can be reached, emissions should fall to between 15 and 18 per cent below 2007 levels by 2016.

In November 2008, upon completion of the Climate Action Team’s report, the government announced that it would establish a greenhouse gas reduction target of 16% below 2007 levels by 2012 and 18% by 2016. And at the same time, a suite of policy measures were implemented. As can be seen in the figure below, annually-averaged British Columbia emissions began to reduce.

On November 3, 2010 Gordon Campbell resigned as premier which initiated a search for a new Leader of the BC Liberal Party. Christy Clark won the subsequent BC leadership race and was sworn in as premier on March 14, 2011. After an unsuccessful attempt to win a seat in the Point Grey riding during the May 2013 provincial election, now Premier Christy Clark was eventually elected in a July 10, 2013 Kelowna West byelection.

Why this political history is important is that the change in leadership immediately signaled a change in direction for British Columbia. Almost immediately, the new Christy Clark government started to dismantle the climate policies put in place by her predecessor. One of her very first pronouncements was that natural gas would now be defined as “clean” thereby signalling the beginning of the BC Liberals’ reckless quest to capture a pot of LNG gold at the end of an ever-moving rainbow.

This pronouncement became law on July 24, 2012 as British Columbia’s Clean Energy Act was modified to exclude natural gas used to power LNG facilities. As early as June 2012, journalists were already asking how on British Columbia could venture into the LNG export industry while at the same time meeting its legislated greenhouse gas reduction targets. The political spin began.

2. Why I agreed to run as a BC Green Party candidate in the 2013 provincial election

It was during this same post-Campbell period that I was heavily involved in the writing of Chapter 12: Long-term Climate Change: Projections, Commitments and Irreversibility of the soon to be released Working Group I contribution to the 5th Assessment Report of the Intergovernmental Panel on Climate Change (IPCC). The last thing on my mind was contemplation of a possible move to BC politics.

Several times during 2012 the then Leader of the BC Green Party, Jane Sterk, approached me about running for office in the 2013 provincial election. It wasn’t until September of that year, the 4th time I was asked, that I final agreed to do so.

Over the years I have given hundreds of public lectures on the science of global warming. I also developed a course at the University of Victoria entitled EOS 365: Climate and Society.

Over the years I have given hundreds of public lectures on the science of global warming. I also developed a course at the University of Victoria entitled EOS 365: Climate and Society.

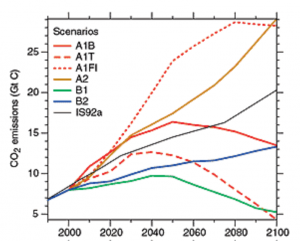

In my last lecture of that course, or towards the end of my public lectures, I typically provide a summary. I use the image to the right to boil the entire issue of global warming down to one question:

Do we, the present generation, owe anything to future generations in terms of the quality of the environment that we leave behind?

Science can’t answer that question. But science tell us why this is ultimately the question that needs to be asked.

The figure, taken from the 4th Assessment report of the IPCC shows six panels with three in each column. The first column shows projected change in annually-averaged surface air temperature (as averaged over many climate models) over the decade 2020-2029 relative to the 1980-1990 average. The second column shows the same thing over the decade 2090-2099 relative to the 1980-1990 average. The three rows show the results when the climate models are forced by human-produced greenhouse gas emissions that follow three distinct trajectories (B1, A1B, A2).

The first (B1) has carbon dioxide (CO2) emissions which peak mid century then decline to below 1990 levels by the end of the century (see figure to the left taken from the IPCC 3rd Assessmnet Report). The CO2 emissions used in the second row (A1B) grow significantly until mid century and then decline slightly thereafter. The third scenario (A2) reveals CO2 emissions that grow throughout the 21st century. Each of these scenarios were developed using assumptions of future population growth, economic growth, energy usage and numerous other socioeconomic factors.

The first (B1) has carbon dioxide (CO2) emissions which peak mid century then decline to below 1990 levels by the end of the century (see figure to the left taken from the IPCC 3rd Assessmnet Report). The CO2 emissions used in the second row (A1B) grow significantly until mid century and then decline slightly thereafter. The third scenario (A2) reveals CO2 emissions that grow throughout the 21st century. Each of these scenarios were developed using assumptions of future population growth, economic growth, energy usage and numerous other socioeconomic factors.

Since 2000, after which CO2 emissions were estimated in the figure above, humans have been following the higher trajectories. In 2017 emissions from industrial activities and changes in land use were 10.0 GtC (Gigatonnes of Carbon) and 1.1 GtC, respectively, for a total of 11.1 GtC.

The results shown in the six paneled-figure above tell us that the amount of warming over the next century is very sensitive to our future emissions of greenhouse gases. But they also tell us that policy decisions made today will have little effect on the warming over next several decades. The climate change we have in store for the next 20-30 years is pretty much in the cards because of past policy decisions. That’s because of something I like to call socioeconomic inertia (we don’t build a coal-fired power plant today just to tear it down tomorrow — our built infrastructure has a turnover time associated with it).

It’s no wonder that our political leaders are having such a difficult time introducing the policies needed to ensure a reduction in greenhouse gases. Politicians are typically elected for short terms. Every four years or so there is a new election.

Let’s suppose that there is a health care crisis in a particular city. A politician may get elected on the grounds that he or she will deal with this crisis. A hospital might get built. During the next election campaign the politician can point to the hospital and say to his or her constituents: “Look. I listened to you. We built a hospital to deal with your local health-care problem”. That politician may get reelected. Now let’s suppose you are a politician who introduces a regulation limiting greenhouse gases. Or you might add a tax or levy to greenhouse gas emissions. The effects of this policy would not be realized during your political career. In fact, they may not be realized in your entire lifetime. They would start to have an effect in the lifetime of the next generation. That’s hardly something you can point to in the next election campaign. There is no immediate benefit.

So if indeed we believe that we have any responsibility for the well-being of future generations in terms of the quality of the environment that we leave behind, we have no choice but to immediately start to implement the policy measures required to reduce greenhouse gas emissions. Waiting to act will mean waiting until its too late. There’s a very simple analogy that illustrates why.

Suppose you put a pot of cold water on a stove and turn the element to high. The water won’t boil right away. It takes time for the water to heat up. If suddenly it gets too hot, and you decide to turn the element down, it also won’t cool right away. That’s because of the large heat capacity of the water. The analogy to global warming is direct. The element on the stove corresponds to the level of greenhouse gases in the atmosphere whereas the pot of water represents the oceans which cover 71% of the Earth’s surface.

Students and members of the public in my classes and lectures would invariably ask: “What can I do to make a difference?”. I would respond that there are three things anyone and everyone can do:

- Use your purchasing power to send a signal to the market by buying products that when produced, delivered, or used, are low greenhouse-gas emitting.

- Exercise your right to vote and ensure you vote for someone who is willing to put in place the policy measures required to reduce greenhouse gas emissions.

- Education: tell everyone you know to do 1) and 2).

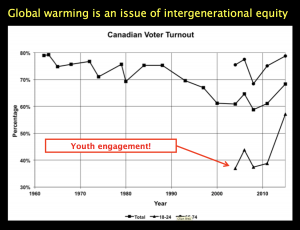

In my 3rd year Climate and Society class I would typically ask how many people voted in the last election. It wouldn’t be unusual to see only about 50% of the class put up their hands. I’d then ask why people chose not to vote and the answers included statements like: “my vote doesn’t matter” or “all politicians are the same, they just care about themselves and getting reelected.”

In my 3rd year Climate and Society class I would typically ask how many people voted in the last election. It wouldn’t be unusual to see only about 50% of the class put up their hands. I’d then ask why people chose not to vote and the answers included statements like: “my vote doesn’t matter” or “all politicians are the same, they just care about themselves and getting reelected.”

I’d show the figure to the right illustrating Canadian voter turnout as a function of time (now updated to include the 2015 general election). I’d talk about the fact that global warming is not really an issue that will affect seniors over the age of 65 (for reasons outlined above) and that 70-80% of this demographic typically vote. I’d suggest that it is important for those who will inherit the consequences of today’s decisions (or lack thereof) to participate in our democratic process to ensure that their interests (the long term consequences) are incorporated into decision-making. I’d suggest that if they didn’t like the names on the ballot then they should consider running themselves or encouraging someone to run that they can support.

Ultimately, when Jane Sterk approached me that 4th time in September 2012, I took a look in the mirror and told myself that I would be a hypocrite if I were not willing to follow the advice I was willing to offer others. And so I agreed to run as a matter of principle and on May 14, 2013 I was elected as a BC Green Party MLA representing the riding of Oak Bay Gordon Head. My journey from scientist to politician is the focus of the Robert Alstead’s feature documentary entitled Running on Climate.

3. British Columbia’s reckless efforts to land an LNG industry

By now, the results of the 2013 general election in British Columbia are but history. Campaigning on the promise of 100,000 jobs, a $100 billion prosperity fund, a $1 trillion increase in GDP, thriving schools and hospitals, and the potential elimination of the PST, Christy Clark and the BC Liberals won a bigger majority government than they had going into that election.

While the BC NDP were campaigning for “Change for the better, one practical step at a time” (whatever that means), I was busy calling out the BC Liberal promises as nothing more than unsubstantiated hyperbole. In one of my first blog posts as a newly elected MLA, I penned an article entitled: Living the Pipe Dream: Basing BC’s Economy on Bubble Economics. This was based on some Powerpoint presentations I had given during the election campaign. In that article I stated:

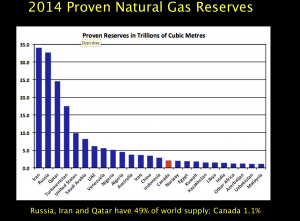

It is simply a pipe dream to believe that by the end of this decade, the same natural gas price differential will exist between North America and Asia. It is also much cheaper to pipe natural gas directly from Russia to China than it is to liquefy it and ship it from North America. And as we have seen above, there is much, much more natural gas located in Russia. British Columbians deserve better.

I pointed out that the widening of the Isthmus of Panama was about to be completed and that the southern US, a historical importer of LNG, already had the infrastructure on the coast to become an exporter. They were set to meet any upcoming supply gaps in the Asian market. I pointed out that Australia had massive LNG projects about to come online. I pointed out that Russia, with about 20 times all of Canada’s shale gas reserves, had entered into multi-decade contracts to deliver natural gas to China. And Russia’s natural gas reserves are largely conventional and so much cheaper to extract. More recently, I pointed out that Iran, containing the world’s largest reserves of natural gas, just had sanctions lifted. But that didn’t stop the BC Liberals from desperately trying to deliver the impossible.

I pointed out that the widening of the Isthmus of Panama was about to be completed and that the southern US, a historical importer of LNG, already had the infrastructure on the coast to become an exporter. They were set to meet any upcoming supply gaps in the Asian market. I pointed out that Australia had massive LNG projects about to come online. I pointed out that Russia, with about 20 times all of Canada’s shale gas reserves, had entered into multi-decade contracts to deliver natural gas to China. And Russia’s natural gas reserves are largely conventional and so much cheaper to extract. More recently, I pointed out that Iran, containing the world’s largest reserves of natural gas, just had sanctions lifted. But that didn’t stop the BC Liberals from desperately trying to deliver the impossible.

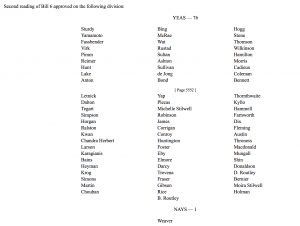

In the fall of 2016, the BC Liberals brought in Bill 6, the Liquefied Natural Gas Income Tax Act. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second reading (see the image to the right).

In the fall of 2016, the BC Liberals brought in Bill 6, the Liquefied Natural Gas Income Tax Act. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second reading (see the image to the right).

During the committee stage for the bill after 2nd reading, I identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC. And then, at third reading, I moved an amendment that would have sent Bill 6 to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises. The bill would have benefitted from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading. In my view they were still gun shy as being perceived as “the party of no” and against resource development.

Clearly the LNG Income Tax Act wasn’t generous enough and the pot had to be sweetened further with the introduction of the 109 page LNG Income Tax Amendment Act (Bill 26) a few months later. While this bill closed a few glaring loopholes I had identified in Bill 6, Bill 26 introduced what I considered to be an unacceptable revision that granted the minister the power to use regulation to allow corporations involved in the LNG industry to use their natural gas tax credit to pay an 8 percent corporate tax instead of 11 percent. Back in the fall, when I put an amendment to send this to committee, I specifically stated in speaking to that amendment that one of the reasons this had to go to committee was because “I would have wished to explore, in particular the one-half percent natural gas tax credit.”

But it doesn’t end there. The BC Liberals still could not land a positive investment decision for a major LNG facility. And so, the legislature was called back for an unusual summer session to pass Bill 30: Liquified natural gas project agreements act. As I noted earlier when I addressed the bill at second reading, in a ever more desperate attempt to fulfill outrageous election promises, the BC Liberals did what they could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come.

I offered a Reasoned Amendment to this bill. In speaking to the amendment I looked across the aisle to the MLAs opposite. I asked them to ask themselves one question. How do they think history will judge them? I argued that the generation of tomorrow will look back and will say: “This generation sold us out.” They will look back at this government’s decisions here to pass this bill with disdain, with shock, with disbelief and ask why?

By this time the BC NDP realized just how outrageous the sellout was becoming and they joined me in supporting my amendment and voting against the bill at second reading.

What we should do: Bill 30 should be repealed.

Bill 30 set the stage for the BC Government to approve the Project Development Agreement that it had already signed with Pacific Northwest LNG on May 20, 2015. One of the key conditions of the deal, however, was that Petronas had to make a final investment decision on Pacific Northwest LNG by June 2017. Petronas decided to kill the project instead.

In light of this, I recently asked the new Minister of Energy, Mines and Petroleum Resources if the long-term royalty agreement would be terminated as it was the government’s legal right to do so. In my view it literally gave away our resource and now it is being viewed as a starting point for negotiations with other companies who want to lower the bar still further. The Minister responded that she would have more information later. I await such information.

What we should do: This expired long term royalty agreement should be terminated.

If you thought the LNG deals couldn’t get any richer, you are in for a surprise. British Columbia has had in place a deep-well royalty program since 2003. It was designed to enable the provincial government to share the costs of drilling in B.C.’s deep gas basins. But recently it transformed into a massive subsidy to incentivize horizontal drilling, including shallow wells and hydraulic fracturing. There should be no surprise that British Columbia now earns very little in royalties from its natural gas royalties (see figure to the left taken from an article written by Marc Lee in PolicyNote.ca). Worse still is that there are more than $3.2 billion in unclaimed royalty credits than can be applied against future royalties.

If you thought the LNG deals couldn’t get any richer, you are in for a surprise. British Columbia has had in place a deep-well royalty program since 2003. It was designed to enable the provincial government to share the costs of drilling in B.C.’s deep gas basins. But recently it transformed into a massive subsidy to incentivize horizontal drilling, including shallow wells and hydraulic fracturing. There should be no surprise that British Columbia now earns very little in royalties from its natural gas royalties (see figure to the left taken from an article written by Marc Lee in PolicyNote.ca). Worse still is that there are more than $3.2 billion in unclaimed royalty credits than can be applied against future royalties.

What we should do: The deep-well royalty program should be terminated.

There is more. In Bill 19: Greenhouse Gas Industrial Reporting and Control Amendment Act, 2016, the BC Liberals repealed existing Cap and Trade enabling legislation and allowed new entrants in the LNG industry to have “flexible options” for their initial operations. The first 18 months of a new operation’s existence would “allow for time for testing and other initial activities that may affect emissions and production levels.” The bill also opened up the BC Carbon registry to non-regulated operations (companies and municipalities). The BC NDP and I voted together in opposition to this Bill.

What we should do: Cap and Trade enabling legislation for heavy emitters should be reintroduced.

Unfortunately, the BC Liberals committed even more to LNG proponents. As former Premier Christy Clark stated in the November 2014 announcement of an agreement between BC Hydro and LNG Canada “This agreement is an important step forward towards getting the LNG industry up and running”. Initially the agreement promised to provide power to LNG facilities at a rate of 8.3¢ per kilowatt hour (kWh), before applicable taxes. This rate subsequently dropped to 5.4¢ per kWh (the same as the industrial rate used by other heavy consumers) in the late fall of 2016.

But here’s the problem. In order for BC Hydro to deliver into these contracts, it would need new power. This is where Site C comes in. Site C, when completed, would produce 5,100 gigawatt hours (GWh) of electricity per year.

If you pick up your bi-monthly BC Hydro bill you will see that residential customers presently pay a Tier 1 rate of 8.3¢ per kWh for the first 1350 kiloWatts of electricity and a Tier 2 rate of 12.9¢ per kWh for everything in excess of that. Site C, is now projected to cost $10.7 billion (and rising). With BC hydro’s growing debt, one thing we can be certain of is that these rates will increase. In essence, what the BC Liberals started (and the BC NDP continued) was a massive ratepayer electric subsidy of a nonexistent LNG industry. You and I will pay more than twice what LNG proponents have to pay while at the same time taking on billions of dollars of ratepayer supported debt. If this sounds like a bad deal, it gets worse.

As early as October 2103, I pointed out that it no longer made any fiscal sense to proceed with Site C. Not only was its cost escalating, but the cost of renewables was plummeting. In the last eight years alone, costs for wind power declined by 66 percent. And the costs are predicted to continue to fall. Bloomberg, for example, predicts that onshore wind costs will fall by 47 percent by 2040 and offshore costs will fall by 71 percent. In fact, Alberta just announced it is proceeding with the development of 4000 megawatts of wind energy at a cost of only 3.7¢ per kilowatt hour, well below what Site C will end up costing.

Solar energy tells a similar story. Costs have decreased by 68 percent since 2009, and they’re projected to decrease by a further 27 percent in the next five years. We have a window of opportunity now to harness renewables and build power that puts us on the cutting edge of innovation and provides local jobs and benefits. Furthermore, we are not using our existing dams efficiently and they could be used to level the load from these intermittent sources (and so act like rechargeable batteries).

Building Site C will cost much more than just its construction price tag. It will also cost us lost opportunities in terms of distributed, stable, high paying, long term jobs in renewable energy production.

What we should do: Site C should not proceed.

I reiterate, the reality is that there is a global glut in natural gas supply and despite what some might claim, oil and gas activities play a very minor role in BC’s economy. As I mentioned earlier, the royalties and net revenue from the natural gas sector in British Columbia have plummeted in recent years (see also figure below). In fact in 2016, British Columbia actually lost $383 million from exploration and development of our resource. That’s because the tax credits earned exceeded the sum of the income received from net royalties and rights tenders combined. In the fiscal year ending March 31, 2017, British Columbia earned total revenue of only $3.7 million, a 99.9% drop from 2010 (BC earned 1000 times more revenue in 2010 from natural gas than we did in the last fiscal year).

Figure: Net royalties earned (after claiming tax credits) [red]; net increase of unclaimed tax credits [orange]; net revenue from tendering the rights to natural gas [green]; the sum of these three (i.e. the net revenue to the province from our natural gas resource) [blue]. The scale is in billions of dollars. Each year represents the fiscal year ending March 31 of that year. Thanks to Norman Farrell for providing me the data that he collated from BC Public Accounts, BC Budget and Fiscal Plans, and the Auditor General’s Information Bulletin 1 (May 2011).

What we should do: Stop doubling down on the economy of yesterday and instead focus on our strategic strengths as we diversify for the economy of tomorrow (see section 5).

4. Meeting our 2030 greenhouse gas reduction targets – the line in the sand

During the 2017 election campaign the BC NDP campaigned on a promise to introduce measures to dramatically reduce greenhouse gas emissions in our province. In particular, they promised:

Our plan commits to achieve BC’s legislated 2050 greenhouse gas emission reduction target of 80 percent below 2007 levels and will set a new legislated 2030 reduction target of 40 per cent below 2007 levels.

The BC Liberals had no plan. Obviously the BC Green plan for climate leadership was far reaching.

While the details of their plan were scant, there is no doubt that the BC NDP commitment to reduce greenhouse gas emissions to 40% below 2007 levels by 2030 was the defining issue for me when it came to determining who we would support in a minority government. And so, embedded within the confidence and supply agreement that we signed with the BC NDP is this:

a. Climate Action

As evidenced in the figure at the top of this post, British Columbia emitted 64.7 megatonnes of CO2 equivalent (CO2e) in 2007. By 2030, the BC NDP have committed to reducing emissions to 38.8 megatonnes CO2e and by 2050 this number drops to 12.9 megatonnes. As of today, British Columbia has no plan to reach either of these targets. So how does the addition of a major LNG facility muddy our ability to meet these targets?

Pembina Institute undertook a careful analysis of the emissions that would arise if the LNG Canada proposal in Kitimat would go ahead. Recall from the earlier discussion that in the race to the bottom, British Columbia continues to give away the farm in a desperate attempt to land this facility. Pembina conservatively calculated that when upstream (fugitive emissions from natural gas extraction) were included, the completed LNG Canada plant would add an additional 8.6 megatonnes CO2e by 2030 and 9.6 megatonnes CO2e by 2050.

Let’s look at these numbers a slightly different way. In 2015 British Columbia reported 63.3 megatonnes CO2e in emissions. If we add the emissions associated with the LNG Canada proposal, we would need to reduce emissions from 71.9 megatonnes CO2e to 38.8 megatonnes CO2e by 2030 and from 72.9 megatonnes CO2e to 12.9 megatonnes CO2e by 2050. That’s a 46% and 82% reduction, respectively.

We know that LNG Canada emissions would be in addition to existing emissions. LNG Canada would not build the new facility today just so that they can tear it down tomorrow. We can safely assume it would be producing emissions throughout the period from 2030-2050. This means that for all other aspects of the British Columbia economy, emissions would have to drop from 63.3 megatonnes CO2e in 2015 to 30.2 megatonnes CO2e in 2030 and to just 3.3 megatonnes CO2e in 2050. That’s a drop of 52% and 95%, respectively.

If the LNG Canada proposal goes ahead, then every aspect of our economy will have to collectively cut emissions by more than half in twelve years and by 95% by 2050. This is simply not feasible given socioeconomic inertia in our build infrastructure. I’ll expand on this more in a forthcoming post where i explore British Columbia’s sector specific emissions in more detail.

Some will argue that British Columbia should get credit for any potential emissions reductions that would occur if China, for example, were to use our natural gas and transition away from coal. The problem with this argument is two-fold.

1) International reporting mechanisms do not allow one nation to get credit for such fuel switching in another nation. China gets credit for their domestic emissions reductions, not British Columbia. British Columbia cannot simply rewrite international reporting rules developed through the United Nations Framework Convention on Climate Change (UNFCCC). In addition, it’s not even clear whether or not such fuel switching would occur.

2) More importantly, there is no evidence to suggest that when a lifecycle analysis is considered, replacing coal in China with LNG that originated in BC would actually reduce emissions.

Here’s why.

Methane has a global warming potential that is 84 times that of carbon dioxide over a 20 year horizon. This means that on a molecule per molecule basis, methane is 84 times more powerful than carbon dioxide in its warming ability. It’s 28 times more powerful over a 100 year time frame. And so, it’s important to ensure that the effects of methane are accounted for in a lifecycle analysis.

Unfortunately, it is well known that there are pervasive problems with the estimating and reporting of fugitive emissions in British Columbia. For example, a recent St. Francis Xavier study suggested that BC’s actual fugitive emissions were upwards of 2.5 times higher than what was being officially reported. A particularly policy-relevant and recently published study also highlights troubles and lack of consistency with subnational estimating and reporting of fugitive emissions. In fact, uncertainties are so high that in yet another insightful analysis, that estimated which nations it was best to ship BC LNG to in order to get the best bang for the buck in terms of GHG emissions, it specifically stated:

“It is critical to note that the significance of the results does not lie with the ultimate magnitude of the values, where uncertainties remain due to the evolving nature of upstream fugitive emissions measurements. Instead, the important conclusion is the potential for variability in carbon intensity of LNG across countries.“

That is, while the relative merits of shipping to one country over another was quantified, the authors recognized that uncertainties in fugitive emissions precluded a conclusion as to whether the lifecycle analysis led to a net greenhouse gas benefit. In particular they noted,

“Results include two Canadian studies, both of which report total life cycle greenhouse gas emissions notably lower than those reported by the others, ranking the lowest and second lowest values in the collected data.”

and

“The Canadian datasets would benefit from disaggregating emissions, such that areas in need of research and improvement can be identified.”

5. In Summary: A vision for the future

Over the course of this essay, I hope that I’ve been able to explain why my continued support of the BC NDP in this minority government is conditional on them implementing a realistic and achievable plan to meet the 2030 greenhouse gas reduction targets. I initially got into politics for the reasons articulated above. I could no longer look my family, friends, students and colleagues in the face knowing that I let future generations be sold out when I had the chance to stop it from happening. This is a principled decision for me and the reason why I refer to it as a line in the sand.

It is not possible to on the one hand claim you have a plan to meet our targets and then on the other hand start promoting the expansion of LNG. It’s a bit like Mr. Trudeau’s recent doublespeak where he says that we need to triple the capacity of the Kinder Morgan pipeline in order to meet our climate commitments. That is, we need to increase emissions to reduce emissions!

In section 3, I outlined the numerous ways the BC Government can take steps to stop the generational sellout embodied in the great LNG giveaway. I will continue to work to push them in this regard.

In the shadows of the massive challenges that we face, our province needs a new direction.

A new direction that offers a realistic and achievable vision grounded in hope and real change.

A new direction that places the interests of the people of British Columbia first and foremost in decision-making. And it’s not only today’s British Columbians that we must think about, it’s also the next generation who are not part of today’s decision-making process.

A new direction that will build our economy on the unique competitive advantages British Columbia possesses, not chase the economy of yesteryear by mirroring the failed strategies of struggling economies.

A new direction that will act boldly and deliberately to transition us to 21st century economy that is diversified and sustainable.

A new direction that doesn’t wait for public opinion — but rather builds it.

We have a unique opportunity in British Columbia to be at the cutting edge in the development of a 21st century economy.

Our high quality of life and beautiful natural environment attract some of the best and brightest from around the globe —we are a destination of choice. Our high school students are consistently top ranked — with the OECD specifying BC as one of the smartest academic jurisdictions in the world. And we have incredible potential to a create clean, renewable energy sector to sustain our growing economy. When we speak about developing a 21st century economy — one that is innovative, resilient, diverse, and sustainable — these are unique strengths we should be leveraging.

A 21st century economy is sustainable — environmentally, socially and financially. We should be investing in up-and-coming sectors like the clean tech sector, and creative economy that create well-paying, stable long-term, local jobs and that grow our economy without sacrificing our environment.

We should be using our strategic advantage as a destination of choice to attract industry to BC in highly mobile sectors that have difficulty retaining employees in a competitive marketplace. We should be using our boundless renewable energy resources to attract industry, including the manufacturing sector, that wants to brand itself as sustainable over its entire business cycle, just like Washington and Oregon have done.

We should be setting up seed funding mechanisms to allow the BC-based creative economy sector to leverage venture capital from other jurisdictions to our province. Too often the only leveraging that is done is the shutting down of BC-based offices and opening of offices in the Silicon Valley.

We should fundamentally change the mandate of BC Hydro. BC Hydro should no longer be the builder of new power capacity. Rather, it should be the broker of power deals, transmitter of electricity, and leveler of power load through improving British Columbia power storage capacity. Let industry risk their capital, not taxpayer capital, and let the market respond to demands of cheap power.

Similarly, by steadily increasing emissions pricing, we can send a signal to the market that incentivizes innovation and the transition to a low carbon economy. The funding could be transferred to municipalities across the province so that they might have the resources to deal with their aging infrastructure and growing transportation barriers.

By investing in the replacement of aging infrastructure in communities throughout the province we stimulate local economies and create jobs. By moving to this polluter-pays model of revenue generation for municipalities, we reduce the burden on regressive property taxes. Done right, this model would lead to municipalities actually reducing property taxes, thereby benefitting home owners, fixed-income seniors, landlords and their tenants.

Yes, we should be investing in trade skills, as described, for example, under the B.C. jobs plan. But we should also be investing further in education for 21st century industries like biotech, high tech and clean tech. It’s critical that we bring the typically urban-based tech and rural-based resource sectors together. Innovation in technology will lead to more efficient and clever ways of operating in the mining and forestry industries.

Natural gas has an important role to play. But, we should use it to build our domestic market and explore options around using it to power local transport. BC businesses such as Westport Innovations and Vedder Transport have already positioned British Columbia as an innovative global leader in this area.

We should be investing in innovation in the aquaculture industry, like the land-based technologies used by the Namgis First Nation on Vancouver Island who raise Atlantic salmon without compromising wild stocks.

In forestry we send record amounts of unprocessed logs overseas. Now is the time to retool mills to foster a value-added second growth forestry industry.

These are just a few ideas that could help us move to the cutting edge in 21st the century economy.

Fundamental to all of these ideas is the need to ensure that economic opportunities are done in partnership with First Nations. And that means working with First Nations through all stages of resource project development – from conception to completion.

I am truly excited about the prospects that lie ahead in this minority government. British Columbia has so much to offer and we can and shall be a leader in the new economy. And the recent announcement of the appointment of Dr. Alan Winter as the new Innovation Commissioner is an exciting step in this direction.

Exploring the outrageous taxpayer subsidies for natural gas exploration

On Thursday this week I rose in the Legislature to ask the Minister of Energy, Mines and Petroleum Resources once more about the outrageous taxpayer subsidies to companies that drill for gas in northeastern BC. I initially raised this issue two weeks ago during budget estimates for the Ministry. As I noted then, the province makes virtually no money on natural gas royalties. And we have an accumulated $3.2 billion dollar tax credit subsidy on the books for this industry.

Below I reproduce the video and text of our exchange.

Video of Exchange

Question

A. Weaver: I must say it’s a bit rich. It’s a bit rich to listen to members opposite, the Leader of the Official Opposition stand up and talk about failed promises when I sat and listened for four years to the promise of unicorns in all of our backyards from LNG. On that topic, every year the B.C. government…

Interjections.

Mr. Speaker: Members, we shall hear the question.

A. Weaver: …doles out hundreds of millions of dollars to oil and gas companies to subsidize horizontal drilling in the northeast of our province. The companies earn these credits by drilling qualified wells, and when the wells start to produce gas, the companies apply the credits to reduce or even eliminate provincial royalties that they normally pay on this public resource.

In recent years, the participating companies have amassed credits faster than they can spend them. The balance in their deep-drilling account has increased from $752 million in 2012 to an accumulated $3.2 billion today. Not only are we not getting paid for this public resource, we are literally paying companies to take it from us.

My question is to the Minister of Energy, Mines and Petroleum Resources. How can the minister justify continuing the deep-well royalty program when it is not needed by gas companies and it is such a staggering waste of taxpayer money?

Answer

Hon. M. Mungall: Thank you to the member for the question on what is a very important issue.

Let me start by saying that British Columbians want this government to ensure that projects are providing good family-supporting jobs, but they also want to make sure that projects are meeting high environmental standards — absolutely. They want to make sure that British Columbians are also getting a fair rate of return.

Last year the province received $145 million in royalty revenue from natural gas development. This money obviously goes to help support the services that British Columbians rely on every day.

We also want to ensure that, as I said, we’re meeting the highest standard of environmental protection. That’s why this government has announced that it will be moving forward with a hydraulic fracturing scientific review panel. That panel is going to be getting started in the new year, and we’ll have more details following January.

Most importantly, this government is committed to ensuring that all British Columbians benefit from safe and sustainable development in this province, and that’s what we’re going to be doing.

Supplementary Question

Mr. Speaker: Leader of the Third Party on a supplemental.

A. Weaver: It was so boisterous I couldn’t hear you acknowledging my standing here.

The deep-well royalty credit program was designed to enable the provincial government to share the costs of drilling in B.C.’s deep gas basins when it was a so-called risk-based industry. It’s not anymore. Horizontal fracturing is no longer a new technology. It’s become an industry norm.

In 2009 and again in 2014, the B.C. Liberals relaxed the requirements for deep-well credits so they could pay companies more money to drill. In the eight years prior to the 2009 changes, B.C. collected an average of $1.3 billion per year in natural gas royalties. In the eight years since, B.C. collected an average of $307 million per year. Last year, the minister told us, we collected a mere $145 million.

Measured as a share of the value of oil and gas production in B.C., royalties collected by government…

Interjections.

Mr. Speaker: Members.

A. Weaver: …has fallen from 44 percent in 2008 to just 4 percent last year. Our government is literally giving away our natural resource and paying oil and gas companies to extract it.

My question to the hon. Minister of Energy Mines and Petroleum Resources is this: how can your government continue with this giveaway when there is such an urgent need in our society to transition to a low-carbon economy?

Answer

Hon. M. Mungall: To speak to this particular program, I just want to make sure that the member knows that many of the credits that he speaks of will actually likely never be used as older wells are closed. Just as an example, one well earned a million dollars worth of credits, but it’s been shut for ten years. It’s not going to reopen, so it will not actually be realizing those credits.

There are quite a few other examples exactly like this. I would be happy to set up a briefing for the member so that he could get to the full details of this issue that, I’m very glad, he’s quite concerned about. Question period doesn’t allow the time to go over all the details.

Again, I will say that this government is committed to ensuring that British Columbians get a fair rate of return for their resources, that they have good family-supporting jobs and that we are protecting our environment.

The ongoing subsidy of natural gas extraction in BC

Today in the legislature I rose during budget estimate debates for the Ministry of Energy, Mines and Petroleum Resources to ask a number of questions concerning the natural gas industry in British Columbia. My questions were designed to explore whether or not the BC Government was going to continue giving away our natural resources.

As I have mentioned numerous times over the past few years, the BC Liberals were so desperate to try and land an LNG industry in British Columbia that they literally gave the resource away. This giveaway is embodied in a number of Acts that they passed including Bill 30 — Liquefied Natural Gas Project Agreements Act, 2015 and Bill 19: Greenhouse Gas Industrial Reporting and Control Amendment Act, 2016.

My first two questions were designed to see whether or not the BC Government would pull the plug on the agreement with Progress Energy and its partners which was predicated on Petronas making a positive final investment decision by June 2017. Petronas decided to walk away from the project in July 2017.

The remainder of the questions were designed to contrast the BC taxpayer subsidy to the natural gas industry as embodied in the “deep-well tax credits” with royalties that the province receives from the natural gas sector. As you will see in the discussion below, the province makes virtually no money on natural gas royalties. And we have an accumulated $3.2 billion dollar tax credit subsidy on the books for this industry.

Below I reproduce both the text and video of the exchange. I am sure you will be shocked by what you read.

Text of Exchange

A. Weaver: I have a number of questions on this subject matter. First off, I am troubled by some of the direction this conversation is going. We’re still trying to double down on the economy of the last century, while the rest of the world is moving forward. But with that said, let me ask a couple of issues with respect to the royalties that we’ll get.

The first is this. We know that the previous government made a deal with Progress Energy and its partners that would have locked in royalty rates, low rates, for years and would have cost British Columbians millions in lost revenue. One of the key conditions of the deal, however, was that Petronas had to make a final investment decision on Pacific Northwest LNG by June of 2017, and Petronas decided to kill that project in July of this year.

Our government now has the legal right to terminate this backroom deal, this bad backroom deal, which literally gave away our resource. My question to the minister is: can the minister tell us if the long-term royalty agreement with Progress Energy will be terminated?

Hon. M. Mungall: Thank you to the member for the question. I appreciate that he’s done his homework and he’s looked at the details of this particular project. What I can tell him right now is that the ministry has started looking into it and started to look at some of the legal aspects around that. We’ll be able to have a better idea later on. Apologies for not being able to have a more fulsome answer for him today.

A. Weaver: Can the minister let the House know if any other long-term royalty agreements are being negotiated with other oil and gas companies in line with using the Progress Energy agreement as the bar by which others will be judged?

Hon. M. Mungall: There’s nothing of that kind at this time.

A. Weaver: If we move now to the deep-well royalty program — a program that has, in my view, surpassed its usefulness, but we’ll come to that…. This deep-well royalty program was designed to enable the provincial government to share the costs of drilling in B.C.’s deep gas basins. It has since transformed into a massive subsidy for horizontal drilling and hydraulic fracturing.

It is my understanding that natural gas companies now receive hundreds of millions of dollars in “deep-well credits,” even for shallow wells, provided their horizontal sections are long enough. So five questions on this topic. One is: can the minister please tell the House what the amassed or outstanding value of these deep-well credits currently is?

Hon. M. Mungall: We’re getting that value of outstanding credits for the member. We don’t have it. We’re trying to find it in these big binders, so we’re getting that for him.

I just wanted to point out that in terms of how the program works…. I’m sorry if I missed it — perhaps the member already mentioned and he knows. What it is, is it’s credits against royalties owing. So it’s not money going to government. It’s just that we’re collecting less royalties based on a credit program that looks to incentivize industry for doing a particular task that government is hoping it will do.

A. Weaver: Very specifically, then: what is the value of the deep-well credits that were redeemed in 2016-2017?

Hon. M. Mungall: I’ll have to get back to the member on that as soon as possible. We’re just grabbing that for him.

A. Weaver: At the same time, I’d like to get the information as to what was the value of the royalties that the province of British Columbia earned from exploration in 2016 and 2017? And then I’d like to have the difference of those two numbers as well.

Hon. M. Mungall: We do have the first number for the member, and it’s the total of accumulated deep credits at $3.2 billion. That’s the total accumulation of all credits. Those credits are only available, however, to any company if their well is producing. So, if their well isn’t producing — say they earned credits as they did their exploration phase, but they didn’t produce the well — then they wouldn’t be able to access those royalty credits.

A. Weaver: The point I’m trying to get at here — and I really need the second part of those numbers — is that the credits that we give exploration companies from this deep-well program, these deep-well credits, essentially preclude us earning any money on royalties from the natural gas that is extracted.

Why it’s critical that we get the actual amount of money that we made from royalties for natural gas in 2016-2017 is we only have a cumulative total — $3.2 billion — that is yet to be claimed in the credit program. But we need to know the numbers based on an annual credit-versus-royalty gain to tell British Columbians how much we are actually making from our resource.

The reason why I think this is important — and I hope we can get these numbers before estimates end today — is that, frankly, I have no idea why this program is still needed. Why do we still need to have this deep-well credit program in light of the fact that horizontal fracturing is no longer a new technology? In fact, it’s in use all around the world. We had deep-well vertical fracturing, which my friend from Peace River South was referring to earlier, that went back decades.

Horizontal fracturing is not new. We don’t need those credits. So why do we continue to have this program? Because all that this ensures is that we earn nothing from our natural resource here in British Columbia.

Hon. M. Mungall: I’m going to make sure that we get all the correct numbers to the member opposite as soon as we possibly can, and if we’re not able to do that today for some odd reason, I’ll be sure to get it to him in the very near future.

On that, I appreciate his points. I think they’re fair points. I’ll take that into consideration.

A. Weaver: I was so dutifully notified that I was speaking at this microphone over here, where I should be speaking to my…. I’m standing at my desk, but the microphone was not pointed correctly. Corrected now.

The final question on this topic is: does the minister plan to continue this subsidy program? You know, we’ve talked about subsidies to the oil and gas industry in this province. This is a gigantic giveaway. It ensures that we essentially make no money from royalties because of the magnitude of the credit program that it can be claimed against.

In fact, my understanding is we’ve received virtually zero in 2016-2017 in natural gas royalties because of the deep-well credits that were claimed against those royalties. So will the minister continue this subsidy program?

Hon. M. Mungall: I’m terribly sorry. To the member, I didn’t catch the actual question because I got those numbers for him.

The total credits that were earned in 2016-2017 was $229 million, and the net of all royalty credits was $145 million. So we took in $145 million as government, in 2016-2017.

A. Weaver: And we gave away $229 million in the process. If I might add….

Interjection.

A. Weaver: Yes, because those credits were not claimed, were claimed against royalties — so that’s $229 million that could have come into our revenue here. We’re subsidizing the oil and gas sector to that amount.

Imagine this. If we actually subsidized renewable energy in British Columbia to the tune of $229 million a year, let alone the generational sellouts embodied in the Progress Energy agreement that we referred to earlier….

So my final question is: does the minister plan to continue this program, and if so, why does this industry still need a subsidy?

Hon. M. Mungall: In terms of reviewing the royalty credit program, there isn’t a plan to do so at this time.