Energy and Mines

Presentation to Clean Energy BC’s Global Electrification Summit

Today I was afforded the distinct honour of giving a keynote presentation at Clean Energy BC’s Global Electrification Summit. I took the opportunity to take the audience on a journey from the past to the future — from where we were when Gordon Campbell was BC’s Premier, to where we went when Christy Clark was BC’s Premier, to where we are in this minority government guided by our Confidence and Supply Agreement, to where we can go, when we focus on our potential in the Clean Energy sector.

Below I reproduce the text of my speech.

Text of Speech

Introduction

Thank you. It’s a distinct honour for me to be here and I am grateful for the opportunity to speak at Clean Energy BC’s Global Electrification Summit.

I entered politics via an unusual route. Prior to my election as the MLA for Oak Bay – Gordon Head (and subsequently becoming leader of the B.C. Green Party), I was Lansdowne Professor and Canada Research Chair in Climate Modelling and analysis at the University of Victoria.

With a PhD in applied mathematics I’d spent 25 years working in the field of atmosphere/ocean/climate science.

I decided to seek election with the BC Green Party in 2012 as I could no longer stand by and watch the dismantling of British Columbia’s climate policies and leadership in clean energy innovation.

Over these past 25 years Clean Energy B.C. has been the voice of British Columbia’s Clean Energy sector and I am sincerely grateful for your contributions to our province.

The BC Green Party and I share your goal to support the growth of British Columbia’s clean energy sector and we will continue to do what we can to improve the regulatory and economic environments for clean energy production through our work in the B.C. legislature.

Clean Energy B.C.’s vision statement is to have British Columbia, Western Canada and the Western US all having access to clean, reliable, cost effective energy produced by the private sector.

It’s to see British Columbia leading the world in modelling a sustainable way of life.

That too is my vision for British Columbia, and the subject on which I would like to speak to you today.

Over the next 20 minutes I’d like to take you on a journey from the past to the future.

From where we were when Gordon Campbell was BC’s Premier,

to where we went when Christy Clark was BC’s Premier,

to where we are in this minority government guided by our Confidence and Supply Agreement,

to where we can go, when we focus on our potential in the Clean Energy sector.

Where we were, with Campbell

Last month I rose in the legislature to speak to Bill 34, the Greenhouse Gas Reduction Targets Amendment Act. The Act made a number of amendments to the original Greenhouse Gas Reduction Targets Act, which first became law on November 29, 2007.

Speaking to that bill brought me back to a very important time in my life. 2007 was the year in which the IPCC — the Intergovernmental Panel on Climate Change — released its Fourth Assessment Report.

It was the fourth consecutive report for which I served as a Leader Author in Working Group I’s volume on future projections of climate change.

It was also the year the B.C. government, under the leadership of Premier Gordon Campbell, decided that acting on climate change was an opportunity that B.C. could not afford to miss out on.

Mr. Campbell recognized that the first piece of legislation needed prior to taking steps to mitigate greenhouse gases was to set a clear target for where we were heading. In doing so, he sent a signal to the market that B.C. was going to be a leader in the new economy.

He set the stage for the emergence of a clean tech sector, a renewable energy sector and created a climate that saw companies starting to invest in reducing their greenhouse gas emissions.

I had the honour of participating as a member of BC’s first Climate Action Team. We were tasked with coming up with interim targets for 2012 and 2016.

We recommended that government should seek to reduce emissions by 6 percent, relative to 2007, by 2012. And for 2016, we recommended an 18 percent reduction.

I sat in the legislative gallery as the Greenhouse Gas Reduction Targets Act was introduced in 2007 and listened to Minister Penner speak to its purpose. I felt proud to be a British Columbian that day and told my climate science colleagues around the world to look at the example our jurisdiction was setting for the world.

In 2008, Mr. Campbell’s government developed and entrenched in law the Climate Action Plan. The Plan was, at the time, the most progressive plan to address greenhouse gas emissions in North America, largely due to its revenue-neutral carbon tax.

Government was on track. In fact, we made the 2012 target, thanks, in part, to the policy measures put in place.

Nevertheless, at the time we knew, and government knew, through their wedge analyses, that proposed policies alone were not going to take us to the 33% reductions by 2020 — let alone an 80% reduction by 2050.

More needed to be done.

But we were well positioned to meet the challenge because BC had emerged as a leader internationally in both dealing with the challenge and recognizing the economic opportunity associated with greenhouse gas mitigation.

Where we went, with Clark

But all of our successes started to be overturned when British Columbia’s provincial leadership changed.

In every year since the 2011 change of leadership, emissions have gone up.

Why? Because of the signal government sent to the market that our emissions reductions targets no longer mattered — that economic prosperity would be found in industries from the last century, and that they would help take us back there.

The BC Liberals under Christy Clark stifled clean innovation and introduced policies that further entrenched “dig-it and ship-it” oil and gas development.

And when the market no longer supported these activities, they doubled done by creating more and more subsidies in a desperate attempt to squeeze water from a stone.

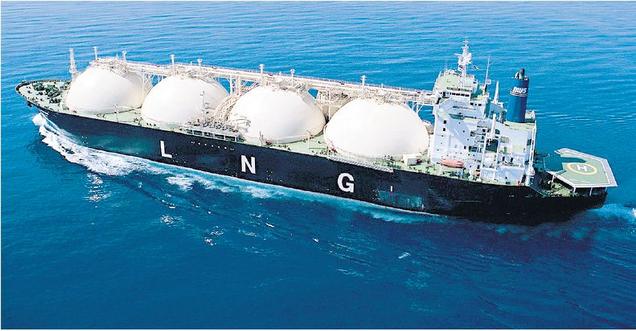

The first crack in our wall of climate policies started in July of 2012 when then Premier Christy Clark excluded LNG from the Clean Energy Act. From there, the dismantling of policies became far more aggressive.

I became so frustrated with the direction Ms. Clark’s government was taking B.C., that I ran for office and was elected in 2013.

I felt it was my job to ensure that there was a voice, and a party, that was going to stand up to the government on this issue and try to get government to once again commit to the climate leadership.

Unfortunately, the generational sellout continued, culminating in 2014 with the Greenhouse Gas Industrial Reporting and Control Act, where the Legislature repealed the Greenhouse Gas Reduction (Cap and Trade) Act from 2008.

All of this was done with the promise that LNG would make British Columbians rich and give the B.C. government a significant new revenue stream. This just hasn’t materialized.

Indeed, despite government doing everything in their power to position B.C. with a booming oil and gas economy, we have seen massively decreasing revenues to B.C. from increasing gas extraction.

What the data shows is quite shocking – while gas production has gone from 25 billion cubic metres in 2001 to over 50 billion cubic meters in 2016/17, royalty and land lease revenues to the B.C. government have gone in the opposite direction, from a record $2.4 billion in 2008/09 down to only $139 million in 2015.

Not only are we not getting paid for this public resource, we are literally paying companies to take it from us.

In 2009, B.C. collected $1.3 billion in natural gas royalties.

Last year, we collected a mere $152 million. Measured as a share of the value of oil and gas production in B.C., royalties collected by government has fallen from 44 percent in 2008 to just 4 percent last year.

In 2009, B.C. earned $39.90 in royalties for every 1000 cubic metres of natural gas. In 2017 it was $2.95.

This is a dismal return on the resources that are being extracted from our province.

We are literally giving away more gas for less money while barrelling past our climate commitments. That’s race for the bottom economics at its worst.

While we became sidetracked with developing an LNG industry and expanding our oil and gas production, other jurisdictions began to emerge and surpass B.C. as climate action trailblazers.

In 2016 leaders around the world signed the Paris accord, which committed signatories to reduce emissions and keep global warming to below 2 degrees relative to pre-industrial levels.

This agreement laid out, in the starkest terms, the choice facing the global community.

We’ve already warmed by 1.1 degrees with another 0.6 degrees in the cards if we do no more than maintain atmospheric greenhouse gas levels at present values.

Add to this, another 0.2 degrees or so from the permafrost carbon feedback and we have a commitment to about 1.9° warming already in store.

The Paris accord essentially translates to this: effective immediately, we must turn the corner and stop investing in new fossil fuel infrastructure that will continue to be around for decades to come.

That’s because of socioeconomic inertia. We don’t build an LNG facility in Kitimat, for example, today to tear it down tomorrow. We build it to last 40 to 50 years. We build it to last past our 2050 greenhouse gas reduction targets.

The scientific community is clear, the international community is clear, much of the business community is clear: we need to make the right choice of investments today because they will affect tomorrow.

Which brings us to where we are now, with our confidence and supply agreement in the present minority government.

Where we are now, with CASA

CASA – the confidence and supply agreement – underpins B.C.’s minority government. It is an agreement to work in good faith, with no surprises, with the B.C. NDP.

CASA has provided the B.C. Green caucus with an opportunity to champion key aspects of our economic platform, and the ability to work closely with government on priority issues like climate policy.

From our perspective, these two files are largely one in the same.

For example, we included two key pieces from our 21st century economy platform in the CASA agreement to help us seize economic opportunities in the emerging economy.

The first piece is the Emerging Economy Task Force.

We proposed the Emerging Economy Task Force to enable government to adapt and respond to changes on the horizon.

We need to modernize government so that it is considerably more responsive to technological innovation.

The Emerging Economy Task Force is looking to the future, identifying emerging trends & advising government on how to maintain our competitiveness & achieve prosperity amidst these changes.

The second item from our platform integrated into CASA is the Innovation Commission (now Innovate B.C.) as well as the appointment of an Innovation Commissioner.

The innovation commissioner serves as an advocate and ambassador for the B.C. technology sector in Ottawa and abroad, to enable B.C. companies to more easily tap into existing federal programs and build key strategic relationships internationally.

I’m confident that both of these initiatives will bolster and grow key sectors of our economy.

Since government was sworn in last July, I have had regular meetings with the Environment, Minister George Heyman, to discuss BC’s climate plan.

Over the past few months, our senior staff has been meeting weekly to further these goals.

I know the Minister cares deeply about this issue and I’m impressed by the expertise of the public service supporting his ministry.

It has been a pleasure to be working with them and I’m optimistic about what we can accomplish collectively.

The B.C. Green Caucus and government both agree that a meaningful climate plan will require careful planning, innovative ideas, and a new economic vision for how B.C. will prosper in a changing and challenging world.

We agree the principles of the UN Declaration on the Rights of Indigenous Peoples need to be front and centre as we chart a course forward.

Rights, title, lands, territories, culture, traditional knowledge and identities must be protected by, and included in, B.C.’s clean growth strategy.

We want to create a strategy that will treat reducing greenhouse gas emissions as an economic priority and a key driver of our plan to create sustainable jobs and log-term prosperity.

We know responding to the challenge of climate change is both an intergenerational opportunity and responsibility.

I am working directly with the BC NDP to ensure a climate plan is put together that doesn’t simply show a plausible pathway to meeting our targets – but drives a return to the vision of a clean 21st century economy.

We have one of the best public services in the world and for a long time they have had the policies ready to get us there.

What has been missing is political leadership. This minority government must – and will – show that leadership.

I’m hopeful, but still wary of our starting point and the strength of the status quo.

In preparation for this speech, I reread parts of The Weather Makers by Tim Flannery – one of the books said to have inspired Mr. Campbell’s climate action ambitions.

In it Flannery writes; “Climate change is difficult for people to evaluate dispassionately because it entails deep political and industrial implications, and because it arises from the core processes of our civilization’s success.”

I think that speaks to the crossroads many governments face today.

Despite the new opportunities we’re presented with in B.C., some fractions of the B.C. government are continuing to entertain the dream of exporting LNG and are continuing the natural gas giveaway started by the previous administration.

Acknowledging that we need to transform our energy systems, with a plan for our environment, our economy and our communities – and that a climate action strategy is also an exciting economic strategy – is a big step. But it is not enough.

And that is where you come in: Where we can go, working in partnership with the Clean Energy sector.

Where we can go, with Clean Energy

If we are to meet our legislated targets – we will be doing so with clean energy — likely following the lead of people in this room.

In that regard, B.C. is setup to succeed. From our access to cheap, renewable energy, to our educated workforce, to our innovative business community, to the quality of life we can offer here, together with British Columbia’s natural beauty, we have an opportunity to develop our Province into one of the most prosperous jurisdictions in the world.

Our challenges are too big, and the consequences too profound, to ignore this opportunity.

We stand to gain by building on the expertise that our neighbours have already developed in these areas. And yet, there is still so much room to grow in this sector, to improve upon current technologies and policy innovations.

We need to learn from what has worked for our neighbours, and craft them into a “made in B.C. approach” that respects the unique characteristics of our economy, our environment and our energy needs.

The approval Site C was a terribly disappointing decision for me because I believe small-scale, distributed energy projects are the way of the future for B.C. and that we should fundamentally change the mandate of B.C. Hydro.

B.C. Hydro should no longer be the builder of new power capacity.

Rather, it should be the broker of power deals, transmitter of electricity, and leveller of power load through improving British Columbia power storage capacity.

Let industry risk their capital, not taxpayer capital, and let the market respond to demands for cheap power.

We need to optimize support for clean energy development, including grid storage for community or privately generated power and work with neighbouring jurisdictions to expedite the phase out of fossil fuel powered electricity generation.

The future of economic prosperity in B.C. lies in harnessing our innate potential for innovation and bringing new, more efficient technologies to bear in the resource sector.

B.C. will never compete in digging dirt out of the ground with jurisdictions that don’t internalize the same social and environmental externalities that we value.

We will excel through being smarter, more efficient, cleaner and by working together to solve our problems.

This means that we not only export the dirt, but we also export the knowledge, technology and value added products associated with resource extraction.

To get a fair value for our resources that deliver maximum benefits to our communities, we need to get smarter and more strategic when it comes to embracing innovation.

Government should be doing more to support these initiatives and create fertile ground for a sustainable, resilient, and diverse economy.

We should be using our boundless renewable energy resources to attract industry, including the manufacturing sector, that wants to brand itself as sustainable over its entire business cycle, just like Washington and Oregon have done.

We should be setting up seed funding mechanisms to allow the B.C.-based creative economy sector to leverage venture capital from other jurisdictions to our province.

By steadily increasing emissions pricing, we can send a signal to the market that incentivizes innovation and the transition to a low carbon economy.

The funding could be transferred to municipalities across the province so that they might have the resources to deal with their aging infrastructure and growing transportation barriers.

Yes, we should be investing in trade skills, as described, for example, under the B.C. jobs plan.

But we should also be investing further in education for 21st century industries like biotech, high tech and cleantech. It’s critical that we bring the typically urban-based tech and rural-based resource sectors together.

Similarly natural gas has an important role to play, but we should use it to use in our domestic market and explore options around using it to power local transport.

Global investment trends are being driven by the world’s shared Paris commitments, predicated on the fact that keeping global warming under 2 degrees Celsius is far more cost-effective than dealing with the effects of a temperature rise above that level.

This shift presents a significant opportunity for B.C.’s economy.

Our province is well poised to bolster its leadership in the cleantech sector – we have a strong competitive advantage in the building blocks required to foster a knowledge-based economy.

In Closing

I am truly excited about the prospects that lie ahead for this minority government. I am working every day to ensure that this government embraces the opportunity in front of it. British Columbia has so much to offer and we can and should be a leader in the new economy.

The years ahead will require all of us to come together to look for areas where we can be partners – to drive the innovation that will enable us to conquer what lies ahead. I don’t doubt many of solution we need will come from the people in this room.

Thank you all again for having me here today to speak with you. And for all your work to build a better future for our province.

To the Premier: Fitting a square peg in a round hole. LNG vs 40% GHG reductions by 2030?

Today in the BC Legislature I rose during estimate debates for the Office of the Premier to ask the premier how he plans to reconcile a new two to four train LNG facility in Kitimat with the province’s recently announced commitment to reduce greenhouse gas emissions by 40% from 2007 levels by 2030. This task will be particularly onerous in the event that new bottom-up methane fugitive emissions measuring techniques are introduced in the province.

Below I reproduce both the video and text of my exchange with the Premier. As I noted in an earlier post, I believe it isn’t possible to do so.

Video of Exchange

Text of Exchange

A. Weaver: I have three questions for the Premier, concerning government policies on LNG development. Let me please start by saying I’m extremely encouraged by the work underway on developing a truly visionary climate plan, and I’m fully committed to delivering on the opportunity that this minority government has — to finally put a plan together that understands that addressing climate change and meeting our greenhouse gas reduction targets is an economic imperative, yet also an economic opportunity.

This will require hard work, thoughtful and innovative solutions and the engagement of all British Columbians. What we must never again allow is for the stated commitments to reduce emissions to be used as a cover for actions that undermine that commitment. That is what we see playing out federally. I believe this government is sincere in its commitments to meeting its greenhouse gas reduction targets, but they have some work to do in showing how the action they have taken — advancing a major expansion of a fossil fuel industry like LNG — is in line with these commitments.

Please let me explore with you three questions. First, in May 2015, the B.C. Liberal government signed a development deal with Pacific NorthWest LNG, in an aggressive move to spur the Malaysian-led project to become the first major Canadian exporter of LNG.

In response, the Premier, who at the time was the Leader of the Official Opposition, was sharply critical and said the provincial government had put too much on the table for industry. I just want to provide a quote. He said this: “My biggest concern is that we are tying the hands of future governments because a desperate government made commitments that they overpromised on.” He said in Victoria: “And now they want to get a deal at any cost.”

The B.C. NDP argued that the agreements the B.C. Liberals were offering to LNG companies were too one-sided and did not provide sufficient certainty for the owners of the resource, the general public. The NDP at the time charged that this was “a sellout for B.C.,” and they said also: “The LNG tax legislation was written by industry and for industry.”

Hon. Chair, are we not similarly now offering LNG Canada a deal that has been written explicitly for them, while ignoring the costs that this project will incur on British Columbians, including the costs to other sectors of our economy that will be forced to pay to accommodate the massive increase in our greenhouse gas emissions?

Hon. J. Horgan: I thank the member for his participation in the estimates today. I know there will be a series of questions on this issue. It’s one that is of critical importance to him and his colleagues, and also to all British Columbians.

When we formed a government, we were approached by industries — mining, forestry and any number of industries — to find out what the new government’s plan was on taxation and what regulatory regime would be in place for a range of issues.

We established a framework for the LNG industry. The member will know — we talked about this during the election campaign — that we wanted to ensure there was going to be a return to taxpayers for the resource that belonged to them. Ministry of Finance officials worked on the development of the framework to ensure that there would be a benefit to British Columbia’s treasury as a result of any LNG development in British Columbia, and that’s what the framework is designed to do.

We also made a commitment to the public, and reinforced that when I was in Asia talking to potential proponents, that Indigenous participation and meeting our climate action objectives were integral to any approval by the province of British Columbia.

I know the member’s participation in the development of our climate action plan going forward will be absolutely pivotal to our success. I look forward to his interventions.

I just want to say that as we look at the potential of a final investment decision in the north, we want to make sure…. Industry has said to us — leaders of industry — that they welcome this type of private sector investment. I’ve said to them, as I know the member has, that if there’s an increase in emissions as a result of this sector growing, then that means there’s going to need to be a concurrent reduction and more so in other industrial activity. The business community understands that.

We need to make sure that as we develop the plan, in concert with our colleagues here in the Legislature, that we know that industry understands that we need to reduce emissions over time. If we’re going to have a net increase from one project, that means concurrent decreases from other sectors.

A. Weaver: A key reason why I want to ask this question, the previous one and the next two, is that the financial regime that this government has brought forward is described by the Premier’s government as a better deal than what the B.C. Liberals were offering. When this was brought forward earlier this year, it was reported: “The tax breaks would water down LNG taxes enacted by then Premier Christy Clark after the 2013 election. Instead of the provincial treasury receiving an estimated $28 billion in revenue over 40 years if LNG were built, B.C. would take in only $22 billion.”

Put another way, we’re offering a project that would become the single largest source of new greenhouse gas emissions in Canada at a $6 billion discount from what the previous government was willing to offer, not the least of which is also including a reduction in electricity rates, PST and exemptions on carbon tax increase.

Why are we going out of our way to offer a better deal than even the B.C. Liberals were willing to consider to bring an LNG industry to British Columbia, in spite of the commitments we have made to a real climate plan?

Hon. J. Horgan: I thank the member for his questions.

Firstly, I think we have to look back at the market for natural gas in North America and the precipitous drop-off in prices here for a commodity we have in abundance in the northeast.

When the former government put in place their LNG tax, they had an expectation of higher market prices, which would have led to potentially more revenues coming to the province. But as prices continued to be soft and demand continued to be flat, the prospect of an investment started to fall away. We saw proponent after proponent after proponent leaving the province because with the framework that was in place from the previous government, it wasn’t possible to realize a final investment decision.

Again, working with Finance officials, we took a look at what was possible with tax changes, a repealing of the B.C. Liberal LNG tax and bringing in a tax that would allow us to continue to get revenue to the Crown and also allow the project to proceed.

With respect to electricity, again, the B.C. Liberals created…. Again trying to squeeze more juice out of what was a declining prospect because of prices internationally, they created a new tariff for electricity. We agreed with the industry that if you’re a pulp mill or a mine or any other industrial activity, there’s a tariff that you pay, and that should be the same tariff for an LNG manufacturing plant.

What we have done when it comes to electricity prices is put in place an industrial tariff that exists for all industrial activity. I think that’s a fairness question. On the energy-intensive, trade-exposed industries, I know the member and I have had long discussions about this. He understands the issue very well. If we are going to have a successful climate action plan and a robust economy, we have to keep our energy-intensive, trade-exposed industries in a position of being able to be positive and also meet our climate objectives.

This is not going to be an easy challenge. The member knows that better than anyone else in this Legislature. It’s for that reason that I’m grateful that he’s on board to try and help square this circle. But the investment opportunity is significant. Upstream electrification will help reduce emissions from wellhead to water line. These were issues that we debated in this Legislature when the previous administration brought forward their ideas. I think we’re in a better position now to make the changes that we need.

We’re not focusing on one, two, three, four or ten LNG plants. It’s two trains and a community that is receptive and that has almost complete First Nations participation. I believe that if we work very hard on this, we’ll be able to see a final investment decision by what is a very diverse group of proponents from China, Japan, Korea and Royal Dutch Shell. I think the opportunity is a positive one, but the challenges are significant, and no one knows that better than the member for Oak Bay–Gordon Head.

A. Weaver: Thank you for the answer. I certainly hope government is looking to support from the B.C. Liberals for repealing the LNG Income Tax Act because the B.C. Greens have been quite clear that we will not support the repealing of the LNG Income Tax Act, in light of the fact that the deal that was given by the B.C. Liberals was a rich deal at best, and this rich deal is being made richer. I look forward to the debates ahead as the B.C. Liberals stand in support of government repealing the LNG Income Tax Act that they brought in.

In 2016, the NDP concluded that plans for the $11.4 billion terminal at Lulu Island would generate an unacceptable increase in the province’s greenhouse gas emissions and filed a definitive position against the project with the federal environmental authorities. “The project,” the NDP noted in their March 2016 letter to the Canadian Environmental Assessment Agency, “would increase the province’s entire carbon footprint for industry, transport and residential activity combined by 8.5 percent. The proposal failed to meet the condition of air, land and water protection with respect to both the threat to marine habitat and species as well as to climate, through unacceptable high and inadequately regulated gases, greenhouse gas emissions,” the letter stated. “Until and unless those deficiencies are addressed, we urge you to withhold final recommendation for the approval.” Those are the NDP words.

As was reported in Times Colonist at the time, the key reason the opposition was citing, greenhouse gas emissions, is an issue with all the big LNG plants that have been under consideration in B.C. for the past several years. If the B.C. NDP applies its Pacific NorthWest LNG reasoning to all other proposals, it’s hard to imagine a scenario where the party would support LNG in general. “Unacceptable high emissions cited by the letter are in fact lower than the emissions projected to arise from LNG Canada. According to Pembina’s analysis, LNG Canada would increase our emissions by 14 percent of 2015 levels.”

Furthermore, the same analysis projects that upstream emissions from LNG Canada will be comparable to those outlined as unacceptable in the Canadian Environmental Assessment Agency letter. LNG Canada is about five megatonnes of CO2 equivalent a year. That’s for two trains — two then four. This would suggest the analysis that led the B.C. NDP to reject Pacific NorthWest LNG on climate grounds would equally, and more so, apply to LNG Canada. Again, I don’t have any philosophical objection to the LNG industry. LNG may be an important local transition fuel to meet our plans for commercial vehicles and other forms.

But what we can’t allow, and what I believe you were arguing yourself, hon. Premier, in the letter you filed with the Canadian Environmental Assessment Agency, was that the LNG industry cannot come at the expense of our commitments to reduce greenhouse gas emissions.

How does the Premier reconcile his strong opposition to Petronas with his support for LNG Canada? I don’t see how you can have it both ways.

Hon. J. Horgan: I thank the member for his question. Our analysis shows that the emission intensity of LNG Canada is significantly lower than the Petronas proposal or Pacific NorthWest LNG — 0.23 versus 0.15 in terms of with emission intensity. Also, LNG Canada proposes their upstream assets are largely in the Montney basin — the southern portion of the Montney basin — which will provide more opportunities for electrification to ensure that emissions at the wellhead are reduced so that the package from wellhead to waterline is significantly greater than the Petronas or the Pacific NorthWest LNG proposal.

I believe that new technologies that are proposed by LNG Canada also assist in reducing their profile, versus Pacific NorthWest LNG. The member will remember that the critical issue when it came to the Pacific NorthWest LNG issue was siting of the plant on Lelu Island, which was contested by the Lax Kw’alaams hereditary leadership as well as many very concerned about one of the most robust salmon rivers in North America at the mouth of the Skeena River. The putting at risk our wild salmon was a significant challenge that I believe Pacific NorthWest LNG wasn’t able to overcome.

When it comes to LNG Canada, they have the full support of the Haisla Nation. They have support virtually from Treaty 8 right through to Kitimat. The city of Kitimat is almost uniformly supportive. I believe that the fiscal framework we’ve put in place will allow a significant return to the people of British Columbia.

The challenge, as the member knows full well, is meeting our climate objectives. We’re going to need a lot of work by a lot of people to do that. Individuals are going to have to reduce their footprint. Industry is going to have to reduce their footprint to make space for this new emerging industry. But it will create significant employment growth, wealth for British Columbians and, I believe, will allow other jurisdictions to reduce their climate emissions by having a transition fuel in place.

I thank the member for his questions.

Race to the bottom economics and the great BC natural gas giveaway

On Tuesday during budget estimates I had the opportunity to ask the Minister of Energy, Mines and Petroleum Resources a series of questions that quite clearly demonstrate the race for the bottom economics at play as BC continues to pursue an LNG industry. The exchange afforded me the opportunity to get on record the issues I raised earlier this year concerning the fact we are literally giving away a natural resource in order to blow through our greenhouse gas reduction targets.

I asked the Minister to explain the myriad natural gas royalty credit programs and to outline the aggregate amounts claimed under each program in recent years. I conclude with a question regarding deep well royalty credits and the Minister reveals that as of December 31, 2017 there are $3.1 billion in unclaimed credits.

Below I reproduce the text and video of the exchange.

Text of Exchange

A. Weaver: I don’t need the minister to read it. I’ll go afterwards and make sure I follow up with the people I’ve been communicating with to get access to the exact quote.

I have a number of questions with respect to natural gas royalties. I’ve provided these to the minister in advance. There’s a clear theme in here. My first question is this. Would the minister please describe the clean infrastructure royalty credit program?

The Chair: Just before the proceedings continue, I’d like to read to the members the section of Standing Order 17A(1). “Electronic devices must not be used by a Member who is in possession of the floor, or during the following proceedings: (a) Speech from the Throne; (b) Royal Assent; (c) Prayers; (d) Oral Question Period; (e) Speaker’s rulings; (f) divisions; (g) at any other designated time pursuant to instructions by the Speaker.” So the relevant piece is that when the member has possession of the floor, an electronic device shouldn’t be used. Thank you, Members.

Hon. M. Mungall: I’ll answer the question in two parts, essentially. First, I’ll kind of speak to the broader concept, and then secondly, I’ll speak specifically to how this particular program works.

The broader concept around this is a tool that governments in many jurisdictions often use to incentivize, whether it’s individual behavior or industrial behavior, to change. This type of incentivization, using financial incentives as well, is often used, particularly when we want to change behaviors or practices to make them more environmentally friendly.

Just as a really quick example…. I don’t want to use all the member’s time in giving these examples. But when I was on city council in Nelson, we wanted people to start recycling more — a good environmental practice. So we made the payment of garbage…. To just dispose of things into the landfill, we charged everybody $1 for a garbage bag. But putting recycling into a blue bag that we were then going to start to pick up from door to door — we made that free.

In this type of scenario, what we’ve done is made a royalty credit program to incentivize industry to advance clean technologies and solutions for reducing greenhouse gas emissions specifically that are linked to the development and production of the oil and natural gas resources. That’s specifically what this program is, and that’s the concept behind it. It’s accomplished through a provincial royalty deduction of up to 50 percent for eligible products that are approved by the ministry.

So applicants are required to, first off, fund the entire project themselves and then make applications. Then the ministry determines whether or not they’re eligible, and then how much they might be eligible, for a royalty credit.

A. Weaver: I’m wondering if the minister could please provide me with information as to how much was claimed under this program in the aggregate sense for 2014, 2015, 2016, 2017 and what is projected for 2018?

Hon. M. Mungall: This would be our newest royalty credit program. It started in 2016. The first installment had approved royalty deductions of $10.7 million to successful applicants. To date, no amount has been released, as the projects have not yet been completed. So that $10.7 million has not been released and will only be released once the projects are actually completed.

The second installment for 2018 is currently underway. We’re thinking we might be looking at $19.3 million, which to us means that it’s showing greater interest in terms of taking opportunities to reduce greenhouse gas emissions and receive the benefits of doing that. The incentivization is working as we hoped it would be.

A. Weaver: In my view, this is…. It’s the first of many credits that I’ll allude to, discuss. The first one. In my view, government is giving natural gas companies a royalty credit to clean up their own pollution. Remarkable that this was done in 2016.

A second credit that I’m hoping the minister could describe — as opposed to the clean infrastructure royalty credit program, just the infrastructure royalty program…. Could she please describe that program for me? To ask the second question at the same time, what was claimed under this program in the last five years?

Hon. M. Mungall: The infrastructure royalty program has a different focus, obviously, than the previous credit program that we were talking about, the clean infrastructure royalty credit program. This is for infrastructure in general that industry may have not been incentivized on their own to develop. So there is a variety of infrastructure that goes with the industry. Rather than minimizing the type of infrastructure that can benefit the community, we want to maximize the infrastructure. So this is part of the purpose behind all of this.

In terms of the numbers for the last few fiscal years, in 2014-15, the following royalty deductions have been released, and that was $56.8 million; in 2015-16, $54 million; ’16-17, $28.6 million; and in 2017, $1844.4.

A. Weaver: I very much appreciate the thoughtful and thorough answer from the minister. This is a royalty program, as the minister meant, that can pay up to 50 percent of the costs of building roads and pipelines, for example.

One of the concerns, of course, I have and that I raised to the minister is that there are concerns arising from this in terms of the destruction of natural habitat, which creates costs to society and wildlife populations because of predator routes and lack of biodiversity that is not paid for. We’re in some sense, through this program, incentivizing the buildings of roads, and the taxpayer is on the hook to deal with any concomitant effects on wildlife and ungulate populations in the affected regions.

Next credit program. This is the third one. I’m wondering if the minister could please describe the low-productivity well royalty reduction production program.

Because I suspect we’re going to have a recess after this, if we might, at the same time, get the projected revenues that were claimed for 2014 through to now as well.

Hon. M. Mungall: What we’re trying to incentivize with this particular royalty program is the continuation of a well rather than an early shutdown. To explain this, I’ll do my best.

For example, a well will have a predicted 30-year lifespan, right? So you get to year 25, and there’s less gas in the well. Rather than have a company just shut it down, walk away and start up something new, we want to keep that production going so that we have the full lifespan of the well. So we want to incentivize them continuing the work. There’s less gas in that well at that time, so it’s going generate less revenue. Rather than get nothing and still have this well that is there but is not operating, we want to get something out of that well and get some kind of revenue for it as well.

This incentivizes them to continue that well until its full lifespan, to make sure that they’re paying people to go there, inspect it and maintain it appropriately. That’s the purpose of this. And I would argue the effects of that make sure that the wells we have continue their full lifespan, rather than a shorter lifespan and then that company saying, “Okay, we’re going to go start up a new well that’s going to generate more gas right away,” and therefore increase the number of wells that we have in a particular area.

The amount of money that was claimed under this program in 2013-14 was $6.4 million; in ’14-15, $6.2 million; in 2015-16, $2 million; and ’16-17, $1.8 million.

A. Weaver: The fourth royalty credit program I’d like to discuss. I’m wondering if the minister could please describe the marginal well royalty reduction program, as opposed to the low-productivity well royalty reduction program that we just discussed, and if she could please let us know what was claimed under the program in the same years.

Hon. M. Mungall: The marginal well royalty reduction program is very similar to the one that I was just talking about, which is the low-productivity well royalty reduction program, except that it’s not at the end of the lifespan of a well. Rather, what’s happened is that the operator has drilled the well, and not much is coming out. Specifically, the natural gas is coming out at a rate below 23 cubic metres of gas per day, per metre of well depth.

We can pull out our calculators and do the math on that, but the point is that it’s producing very, very low. The same purpose behind the previous royalty reduction program that I spoke of is behind this one as well. It’s so that we don’t have a company just walking away, but rather, we’re incentivizing them to maintain operations of that well so that the taxpayer and British Columbians are getting something in return for that well.

The numbers associated with that particular program. In 2013-14, it was $43 million; ’14-15 is $41.9 million; ’15-16 was $12 million; and in ’16-17, $13.1 million.

A. Weaver: The fifth royalty credit program I’d like to get some information is the ultramarginal well, as opposed to the marginal well royalty reduction program. I’m wondering if the minister could please describe the ultramarginal well royalty reduction program and also let us know what was claimed under this program over the last five years.

Hon. M. Mungall: I thank the member for this line of questioning, because it allows us to get into describing the various types of wells that we have in our gas fields and also to give definition to some of the lingo in the industry.

An ultramarginal well is, I guess, kind of your next step below a marginal well. It’s slightly different in the sense that what makes it ultra-marginal is that it’s a shallow gas well and it’s a single vertical drill. That’s what makes it distinct from the previous types of wells that we’ve been talking about.

What was claimed over the last few years — I’ll give those numbers to the member. In 2013-14, it was $23.5 million, and in 2014-15, it was $24.6 million. In 2015-16, $6.1 million, and in ’16-17, $5.9 million.

Do you mind if we have a quick recess?

A. Weaver: Not at all.

Hon. M. Mungall: Chair, would we be able to have just a five-minute recess?

The Chair: This committee stands in recess for ten minutes.

A. Weaver: Thank you to the minister for her comprehensive answers to these. We’ve discussed a number of credit programs that were designed to incentivize marginal or unproductive wells to keep them going.

Now I would like to move on to some other credit programs. The next one I was hoping the minister could describe is the net profit royalty program. Again, as per the previous ones, if she could let us know what was claimed under this program for the last five years.

Hon. M. Mungall: The net profit royalty program is all about, in terms of timing, when we anticipate a well to be profitable. If a well starts off, and it’s not producing as much as it will in the future, we want to make sure that that well is still developed and that we get the economic benefits of that eventually. The program allows producers to pay a lower royalty rate in the initial stages of a project in exchange for higher royalty rates once the producers have recovered their initial capital costs.

What was claimed under this program in previous years? For 2013-14, it was $16.4 million. In 2014-15, it was $19.1 million. Then in 2015-16, something good must have happened, because it was only $2.9 million and, in 2016-17, $2.3 million.

A. Weaver: My understanding is that it’s also used to promote the development of high-risk resources that would otherwise unlikely be developed — in some sense, taking risk out of the investment nature of the natural gas sector. Again, thank you for the answer.

The next credit program I’d like to get some information on — hon. Chair, through you to the minister — is: I’m wondering if she could describe the natural gas deep re-entry credit program and, once more, let us know what was claimed under this program in the years 2014, 2015, 2016 and 2017.

Hon. M. Mungall: Before I get the answer for the next question, I will say that I just checked, and yes, your understanding for high-risk activity is correct as well. Sorry I missed that.

This particular program is for wells that already exist, and it’s to incentivize companies drilling further down, drilling deeper. Rather than a new well and all of the impacts that are associated with a new well and a new pad, we would keep the existing well, and we would incentivize the company to drill deeper.

Wells receiving this credit are subject to either a 3 percent or a 6 percent minimum royalty. So they will be having to definitely pay some kind of royalty. The figures for this are released within the public accounts. For 2013-14, it was $261.9 million; in ’14-15, $486.8 million; in 2015-16, $171.7 million; and in 2016-17, $178.3 million.

A. Weaver: Again, I think the minister is seeing the direction I’m heading with this line of questioning. These are some very big numbers here as credits. I’m only on the seventh, with more to come, of royalty credit programs that exist.

The next one is my favourite, which is called the natural gas deep-well credit program. I’m wondering if the minister could please describe what the natural gas deep-well credit program is prior to 2014, and what that program is after April 1, 2014? What occurred in the transition on April 1, 2014?

Hon. M. Mungall: I’m just going to go back to the numbers that I shared with the member in my previous answer about the natural gas deep-well re-entry credit program.

A. Weaver: Were those the deep-well credits?

Hon. M. Mungall: They’re both. They are both the deep-well credits as well as the deep-well re-entry program. Sorry to say, but the Ministry of Finance doesn’t separate the two out. So that actually is the total for two different credit programs.

For the natural gas deep-well credit program, the issue here is less the incentivizing that I was speaking to in some of the previous wells, where we were trying to incentivize a very distinct behavior. That means that the company is already here. They’re dedicated to setting up, and this is the type of behaviours or practices that we want from them as they are beginning their activity.

This particular one is addressing our competitiveness on the global stage — making sure that B.C.’s upstream in the northeast is competitive on that global stage. What it does is it provides a royalty credit for wells, for deep wells specifically.

The member wants to know…. There was a change that was made on April 1, 2014, and he wants to know what the change was specifically. What it was is that this credit program was expanded to cover wells with a vertical depth of less than 1,900 metres. Prior that that, it was 1,900 metres or more.

That’s not to say that you can drill 1,500 metres, and — that’s it — you’re eligible. What it is, is that you can drill less than 1,900 metres, but you still need to keep drilling. You just go horizontally rather than straight vertically. So there is less depth, but there still needs to be length in terms of accessing the actual resource.

A. Weaver: I assume that the numbers that were claimed are the numbers that were given earlier for the…. I believe the minister’s nodding, so I won’t ask what the numbers for the deep-well are.

Essentially, what we’ve got, in summary of these credit programs…. In British Columbia here, we provide a credit for infrastructure construction. We provide a credit for cleaning up your pollution. We have a credit to ensure marginal, cost-ineffective wells are kept in production. We provide a credit, actually, for deep wells, and we provide a credit for horizontal fracking as well. In essence, we provide credits in all areas of our natural gas sector here to incentivize natural gas drilling. Oh, were that to be the case in other sectors of our economy.

With that said then, credits are important to actually incentivize — and I get that — emerging technologies and sectors. Let’s take a look — and perhaps the minister can help us through illustration — at some of the revenues we’ve been getting, then, from the natural gas sector. I’m wondering if the minister could please provide the net royalties received by the province of British Columbia for natural gas for each of the fiscal years from 2007 through 2017.

Hon. M. Mungall: I’ll start with 2007 and the fiscal year 2007-2008. The net royalties received were $1.132 billion. The following year, ’08-09, was $1.314 billion; ’09-10, $406 million; 2010-11 was $313 million; 2011-12, $339 million; 2012-13, $169 million; 2013-14, $445 million; 2014-15, $493 million; 2015-16, $139 million; and 2016-17, $152 million.

A. Weaver: Thank you. I very much appreciate those answers. In essence, in summary, in 2009, we were at a high of $1.3 billion in royalties coming to the province of British Columbia. And in fiscal year ending 2017, were $152 million — almost ten times less.

The next question then is in the area of how much natural gas we have produced. I’m wondering if the minister could please let us know what the net production of natural gas in the province of British Columbia was in thousands of cubic metres for each of the fiscal years 2007 through to 2017.

Hon. M. Mungall: These are all in cubic metres. For 2007-2008, we have 27,084,782 cubic metres.

A. Weaver: Say that again.

Hon. M. Mungall: It’s 27 million. If the member wants, I can just round it out to the million rather than giving the entire number. If he likes, for the full detail right down to the last cubic metre, I’m happy to provide that in writing.

For 2008-2009, it was 28 million; 2009-2010, we’re at 27.6 million; 2010-2011, 31 million; 2011-2012, 36.5 million; 2012-2013, 35.8 million; 2013-2014, 39 million; 2014-2015, 42.5 million. And the last year that we have the available numbers is 2015-2016, at 44.7 million.

A. Weaver: I’ll have to get under…. Those numbers differ from the numbers that I have, being 32 million in 2007, 33 million in 2008, 33 million in 2009, 35 million in 2010, 41 million in 2011, 41 million in 2012, 44.5 million in 2013, 47 million in 2014, 49 million in 2015, 51 million in 2016 and 51.5 million in 2017. Hopefully we can, I can, reconcile where our differing sources are from, down the road.

The point here is that we’ve had close to a 50 percent increase in production over the last decade or so, at a time when in fact royalties have gone from $1.3 billion to $152 million.

My second-last question in this line of questioning is this. I’m wondering if the minister could please let us know what the net royalty per thousand cubic metres of natural gas produced in the province of British Columbia is for the fiscal years 2007 through 2017.

Hon. M. Mungall: I’ll answer this question, and then I think we’re going to have to wrap up for the day, if that works for the member. He has one more? Okay.

For B.C., the net royalty per 1,000 cubic metres for natural gas in 2007-08 was $40.45. I’ll do the same as I did before. I’ll round up or down, using those grade-school math skills.

In 2008-09, it was $45. In ’09-10, it was $14. In 2010-11, it was $10. In 2011-12, it was $9. In 2012-13, it was $4 — closer to $5, pardon me. In 2013-14, it was $11. In 2014-15, it was closer to $12; it was just $11.55. And then in 2015-16, it was $3. In 2016-17, it was $3.

This type of increase and decrease situation — if you look at Alberta numbers, it’s very similar. For example, in 2007-2008, the net royalty per thousand cubic metres was $38.30. Then, fast forward nine years into the future to 2016-17, it was $4.93. The reason why you see this, is that the royalties are not based necessarily on the volume of gas being extracted; it’s based on the price. And the price of gas is determined by the marketplace. So what we have here is that the price of gas was quite high in 2007-08, 2008-09 fiscal years, and it has come down quite substantially.

What I’d like to do for the member here, so that he has this information, is I’d just like to table this so that he can access it. Am I able to table in budget estimates?

D. Routley (Chair): I would ask you to share it informally. To properly table, we would have to do it in the main chamber.

Hon. M. Mungall: Okay. No problem. I’ll do that. Great. I’ll just hand that to the member opposite so that he has that as well.

A. Weaver: I do appreciate the response. We had slightly different numbers, from my calculations — again, based on the natural gas production estimates and the source of values — versus the sources you’ve got there.

The bottom line here is the net royalties, in using the government’s numbers, were $45 for every thousand cubic metres produced in B.C., and now it’s $3, despite a 50 percent increase in natural gas production over that same time. This is race-for-the-bottom economics at its finest.

My final question is this: what is the total accumulated and outstanding natural gas deep-well credits available to companies in British Columbia? When I asked this question in the fall, it was something of the order of $3.2 billion. I’m wondering what that number is now.

The Chair: Minister, and noting the hour.

Hon. M. Mungall: Absolutely, Chair.

The total outstanding deep-well royalty credits since the inception of the program as of December 2017, are estimated at $3.1 billion. Now, this includes all credits for all wells, whether or not they’re in production. So that’s what we have.

I just want to make sure that the public knows that a company can’t come up and say, “I have all these credits; pay me out,” and somehow they’re walking away with a bag full of money. That’s not how it works at all. They’re able to use their credits to reduce their royalties down to a 3 percent or 6 percent rate. They still have to pay royalties.

Noting the hour, I move that the committee rise, report completion of the resolutions of the Ministry of Advanced Education, Skills and Training and report progress on the Ministry of Energy, Mines and Petroleum Resources and ask leave to sit again.

Videos of Exchange

| Part 1 | Part 2 | |

| Part 3 |

On the future of the BC Hydro’s standing offer program for clean energy

Yesterday in budget estimates for the Ministry of Energy Mines and Petroleum Resources I took the opportunity to question the Minister on the status of BC Hydro’s clean energy Standing Offer Program.

The exchange is very illustrative of the problems I have been trying to raise with respect to the direction BC Hydro is taking. The decision to proceed with Site C has led BC Hydro to essentially grind the Standing Offer Program, and the BC NDP PowerBC Better Plan, Brighter Future energy and jobs campaign plan, to a halt.

Below I reproduce the text and video of the exchange.

Text of Exchange

A. Weaver: Thank you to the member for Surrey–White Rock for her line of questioning and the minister for the answers that we’ve been receiving. Very interesting.

I had a number of questions on the standing offer program that B.C. Hydro has ongoing. As the minister will know, the standing offer program for wind developers, at least, requires $1 million of investment over two years and over two years of studying permitting work to be done prior to the project achieving an electricity purchase agreement. The requirement for this up-front investment was done with the explicit intent of reducing program costs for the Crown, and when the BCUC approved the standing offer program, the BCUC stated that developers could expect to be offered an EPA if the project meets all the eligibility requirements and must be willing to incur the cost to prepare an application.

As the minister will know, the standing offer program was suspended in August 2017 with no warning. Despite that Hydro might suggest that…. Its only warning to industry was that there would be changes to price and volume of the SOP projects, not that the criteria itself would change or that the program would be completely redesigned. As the minister will know, developers that continue to invest in their products accepted that there would be changes to price and volume.

Hydro also implied that IPPs should have read market signals that there was an oversupply of energy and therefore infer that the standing offer program was a risky investment. However, the B.C. government legislated that the authority must maintain the standing offer program, and there was no indication the program would be suspended or cancelled or that there would be a change in the eligibility requirements.

There have been some recent public statements by the minister suggesting that there will be significant changes to the standing offer program and that there will be a First Nations focus. I have a number of questions on this. First, if this suspension leads to a material change to the policy, then is this suspension not actually a cancellation, because the new program is a different product?

Hon. M. Mungall: I appreciate the member’s question is: if this program doesn’t come back, isn’t this ultimately a cancellation? But I wouldn’t be able to say that at this time. Where it is at, as the member knows, is that it’s on hold. What is going on is…. A review was first started in 2016, and we’ve talked about that. That was attached to the rate revenue application and so on.

Industry was informed at the time, in 2016, that a review was taking place. That included the SOP, and of course, part of that was: well, does B.C. Hydro need the power? Do British Columbians need the power? So now review, review, right? Governments love to do these things.

With this government’s, the new government’s, review of energy procurement, as mentioned earlier, as part of the review that we just started in March, we’re looking at energy procurement, and if the SOP is a good program to continue on with. There’s been no decision one way or another at this time.

A. Weaver: The B.C. government legislated that the authority must maintain the standing offer program. When B.C. Hydro proposed the original SOP review, they set precedent for a review period length for prospective SOP participants, thus ensuring that important conditions such as price and eligibility would not change suddenly while they were preparing their projects.

Why wasn’t this put into practice for the recently announced review?

Hon. M. Mungall: I’m sorry, in the conversation I just had with staff, if I’ve missed and forgotten some of the member’s question. I’m sure he’ll remind me if I don’t get everything that he was hoping to get answers for.

Where things are at is that this government — and I know the member opposite and all members of the House as well — wants to make sure that rates are fair for British Columbians and for customers of B.C. Hydro. Whether they’re direct customers — they pay a B.C. Hydro bill — or, in my case, Nelson Hydro. We buy power from B.C. Hydro, as the city of Nelson does — and passes it on.

For all the B.C. Hydro customers, we want to make sure that rates are fair and affordable. Part of that issue is ensuring that we’re not purchasing power that we’re not able to then disperse at the time that that power becomes available. So we want to make sure that we have enough power for British Columbians, recognizing that we are able to sell on the spot market around North America, but then there’s the price that you get on the spot market that you also have to consider. So we want to make sure that we’re not putting an undue burden onto the backs of ratepayers by having more power than we’re able to disperse at the time at which we need it.

I hope that that’s making sense. For example, an IPP comes on line next year, but we actually have a surplus of power, perhaps, next year. So that would actually impact rates, because we’re obliged to pay that contract.

A. Weaver: Coming back, as I initiated with my questions on this topic, I noted that the SLP program required wind developers to invest $1 million over two years of the study permitting. Many wind developers have invested this money.

My question to the government, then, is how do they see this liability to companies who have made the required investment, sometimes with their own money, and have no program to participate in, in light of the fact that they were told that the program would exist, that they were required to make this investment and that they would get an electricity purchase agreement, although the price itself had not been set at that time?

Hon. M. Mungall: Ultimately, the impact on companies and the investments that they put in will depend on the outcome of the review. However, there are two things that B.C. Hydro has to balance in this.

One is obviously impact to ratepayers if we start purchasing power that we’re not going to need right now or in the immediate future and the risk that private investors take in the private market. Ultimately, B.C. Hydro is responsible to ratepayers, not to private investors in the private market.

A. Weaver: Thank you, and I appreciate the answer, but I would suggest that the government is responsible to both. I would suggest that the rules were put in place for investors, investors played by those rules and the rules changed and now the investors are left with a loss.

I would argue and suggest that government has accepted a potential liability through changing this program, particularly in light of the fact that the argument that the minister just put forth doesn’t hold water because the minister and her government recently approved continuation of the Site C dam to produce power for which there is no demand. So I’m sorry — the answer is quite unacceptable to me.

Nevertheless, let me continue. Was the minister aware that on March 14, 2018, the federal Minister of Environment and Climate Change, Catherine McKenna, announced the launch of the low-carbon-economy challenge? In particular, is she aware that this $500 million initiative will fund projects “aimed at reducing greenhouse gas emissions, saving energy and creating green jobs”? And that $162 million of that will be available to B.C. ?

Hon. M. Mungall: Yes. We are aware of the low-carbon-economy challenge and the fund associated with it. We’ve actually been able to access it.

The fund is going to be able to…. It’s contributed to other programs, but within this ministry specifically, it’s contributed an additional $12 million toward our building energy retrofit partnership, which will help communities across B.C., obviously, reduce carbon emissions associated with the built environment.

A. Weaver: Thank you, hon. Chair. Again through you to the minister: is she aware that the federal Minister of Environment Catherine McKenna chose Vancouver as the location to make the announcement for the program and that on that very same day, B.C. Hydro announced it would be further diminishing the standing offer program by suspending those applications already accepted into the program by B.C. Hydro, with only a few exceptions? And if so, why did B.C. Hydro do this?

Hon. M. Mungall: Yes, those two announcements were made on that day. It was purely coincidental, however. There was no purposeful reason why both of them were made that day. It’s just how things roll out sometimes.

A. Weaver: Purely coincidental but profoundly ironic.

I’m wondering if the minister is aware that some of the projects were already engaged in the B.C. Hydro interconnection process.

Hon. M. Mungall: The interconnection process is obviously part of the broader process in the standing offer program. The reason why it’s there is that it looks at the longer-term viability of connecting with that particular project. Sometimes projects go ahead, and sometimes they don’t. That’s just the broader, for people’s information. But, yeah, the ministry was aware that there were projects that were in that process at the time of the announcement on March 14.

A. Weaver: I’m just wondering if the minister could please provide two numbers. The first number is: what’s the accepted total megawatt capacity of accepted applications in the standing offer program? And the second number is: of this total megawatt capacity, how much is within the interconnection queue?

Hon. M. Mungall: Sorry about the delay to the member.

What’s the megawatt capacity of accepted applications in the SOP? For the standing offer program, it’s 137 megawatts. In the micro standing offer program, there are two megawatts. To answer the second part of his question, all of those projects — so therefore, all of those megawatts — are at varying stages in studying interconnection, so it’s the same number.

A. Weaver: My understanding is that 59 megawatts of the 137 are much further along in that process than the 137 itself.

With that said, I’m wondering if the minister could then briefly, in summary remarks, comment on the status of the following projects: the Nahwitti wind project in Port Hardy, 14 megawatts; Babcock Ridge wind project in Tumbler Ridge, 15 megawatts; Canoe Pass tidal project in Campbell River, two megawatts; Little Nitinat River project in Port Alberni, five megawatts; the English Creek hydro project in Revelstoke, 5.8 megawatts; the Fosthall Creek power project in Nakusp, 15 megawatts; the Sarita River project in Bamfield, 5.3 megawatts; the MacKay Creek project in Revelstoke, and I do apologize to Hansard who are trying to get this down here, 5.2 megawatts.

The East Hill project of my good friend from Kootenay East, in Cranbrook, a solar project, 15 megawatts; the Sukunka wind project of my good friend here from Peace River South in Chetwynd, 15 megawatts; the McKelvie Creek hydroelectric project in Tahsis on Vancouver Island, 5.4 megawatts; Newcastle Creek hydroelectric project, Sayward, 5.3 megawatts. Again, coming to the riding of my good friend from Peace River South, the Wartende wind project and the Zonnebeke wind project, both of which are 15 megawatts in those.

What is the status of these projects that have been approved and are sitting in the standing offer program?

Hon. M. Mungall: All of the projects are on hold, with the exception of the Sarita River hydro power project. They have been sent a draft energy purchase agreement, a draft EPA. The Sukunka wind energy project in Chetwynd is currently pursuing an electricity purchase agreement. Sorry. They are not. We are. B.C. Hydro is pursuing an EPA negotiation with the project. That’s the same result for the Zonnebeke wind energy project, also in Chetwynd. And the last one that is not on hold but unfortunately has been rejected is the McKelvie Creek hydroelectric project.

A. Weaver: Thank you, hon. Chair. I’m wondering if….

Hon. M. Mungall: Can I just ask…? Would you like a written copy of that?

The Chair: Members can redirect comments through the Chair, please.

Hon. M. Mungall: Mr. Chair, I’m just wondering if the member would like a written copy of that, if that would be helpful for him.

A. Weaver: That would be very helpful, and I do appreciate the response and the offer.

On this topic that I’m wondering about, hon. Chair, through you to the minister, if she’s aware that the Rocky Mountain solar project in Cranbrook has formed a B.C.-based research and innovation consortium that includes the UBC engineering Clean Energy Research Centre, the SFU chemistry department, the Natural Resource Council of Canada, Ballard Power, Schneider Electric, Iona Miller, Avalon Battery and others.

Hon. M. Mungall: B.C. Hydro wasn’t aware that RMS was forming a B.C.-based research and innovation consortium. They didn’t put that in their application, in their SOP application. That being said, ministry staff have been able to meet with several of the partners within this consortium and learned about it through those meetings. That’s my understanding.

A. Weaver: The Rocky Mountain solar project, as the minister will know, is the only solar project that’s gone through the standing offer program. They plan to build a living lab facility site that will focus on advancing next-generation energy solutions, in partnership with those organizations that I previously mentioned. As the minister may know, connectivity through the transmission line is not that difficult in light of the fact that it goes right through the property of the proposed solar facility in the Cranbrook region.

I’m wondering. Again, I’d like to suggest that the Rocky Mountain solar project is exactly the type of project that is being looked for under the low-carbon economy challenge that I spoke about earlier, and particularly, the clean growth fund that demonstrates a commitment to creating diversified clean energy. It ensures that we have reliable power, it promotes research R and D in the province, it helps establish B.C. as leaders, and it’s being supported by investor capital, not ratepayer-supported capital.

My question, then, is: what is the government doing to attract and retain a clean energy sector here in B.C., and in particular, whatever happened to the B.C. NDP PowerBC better plan, brighter future program they touted in the lead-up to and during the last provincial election campaign?

Hon. M. Mungall: Just for the member’s information, the Rocky Mountain Solar project is actually not the only approved solar application in the SOP. There’s also the Tsilhqot’in solar project, which is being advanced under the micro SOP. It’s smaller, yes, but it is another solar project. I know that the member is very interested in what kinds of projects are out there, so I wanted to share that with him.

In terms of his question, in terms of what we’re doing to attract and retain clean energy sector in B.C., as well as the PowerBC plan that our party launched while we were in opposition — where is all of that? Well, that’s a fair question. I mentioned earlier that we were talking about the energy road map. We only got a chance to mention it briefly. But that’s precisely where we have driven these very issues, is into building our energy road map. That road map is about planning for the future. It is about looking at ways in which we can address load and demand.

One of the things that we need to do, and I know the member’s very passionate about this and is very, very well versed on this, is obviously reducing carbon emissions. How do we electrify the economy using clean, renewable electricity that is carbon free? We already have 98 percent of the energy we produce in B.C. meeting that test of carbon free. But if we want to be able to produce more carbon-free energy, then we also need to look at the demand side, the load of what is being demanded by British Columbians.

We have to look at where we are going into the future, what kind of demand we are anticipating and what kind of demand we can grow. I know that the member knows a lot about electric vehicles. He has an electric vehicle, and he really wants to see the transportation shift from fossil fuels to clean electricity. I agree very much with that vision. That’s part of our energy road map and planning out for that.

How do we do that? We already have incentive programs. We’re already working on expanding charging stations. But what more can we do to ensure that we’re reducing costs for people, which is one of the barriers, as well as making sure we have good, solid infrastructure? BCUC right now, as I mentioned earlier, is looking into the utilities aspect and who can actually sell power so that we can build out the infrastructure so that it’s just as commonplace as what fossil fuel infrastructure has been in the past, and so on and so forth.

There are a lot of questions and planning, and that’s where that energy road map comes into play. That’s where we see that broader vision that we’ve expressed in the past funneling into. Earlier we were talking about that energy road map then leading into, obviously, how B.C. Hydro would be organizing itself and placing itself into that future demand — for example, around electric vehicles, around partnerships with the clean energy sector, the private clean energy sector, and so on.

A. Weaver: I appreciate the answer, although I’m not sure it directly addressed the question I was raising. I do take issue with the assertion that the Tsilhqot’in program is on par with the Rocky Mountain. Of course, it isn’t. I’m quite aware of the micro–standing offer program, which is quite different from the larger standing offer program.

In fact, on March 14, 2018, B.C. Hydro issued a statement on that saying:

“…electricity purchase agreements for five clean energy projects that are part of the impact benefit agreements with B.C. Hydro and/or are mature projects that have significant First Nations involvement. B.C. Hydro supports the government’s decision to take a closer look at energy procurement to ensure the best value for B.C. Hydro’s customers through their review of B.C. Hydro this year. As a result, there are no plans at this time to issue any additional electricity purchase agreements. The standing offer and micro–standing offer programs will remain on hold until the review is complete.“

The issue I have here, and the issue I continue to raise, is companies have invested millions upon millions upon millions of dollars in British Columbia in good faith directly in response to signals that government sent and B.C. Hydro sent, and they are now on the hook for this. This is not because of any uncertainty in the market. It’s exclusively because of uncertainty in terms of direction B.C. Hydro is….

I’m sure the government is aware, for example, that larger power projects, like in Alberta, have seen prices coming in at 3.7 cents a kilowatt hour for wind. We know that the next call is Saskatchewan, which is supposed to follow. It’s likely going to have, if it hasn’t come in yet, wind power coming in at 4 cents a kilowatt hour. We know that if there was a call for power at 10 cents or 8 cents, industry would meet that. We know that firm wind power can be delivered at around that price, and it’s being done around the world.

My question to the minister is this. Why hasn’t she instructed B.C. Hydro to explore cheaper alternatives to Site C, cheaper alternatives that could include firm power calls that link wind with storage?

Hon. M. Mungall: The member’s question was specifically: why didn’t I direct B.C. Hydro to look at alternatives, specifically wind with firm storage? He’s right to say that I didn’t direct, because they were already doing it. They did do that, and they put it as part of their submission to the B.C. Utilities Commission, I believe, originally back in 2014 — the original submission to, I believe, government in 2014. Pardon me if I’m not getting that correct. But definitely their submission to the B.C. Utilities Commission, in their review of Site C that we put forward last fall.

Video of Exchange

Probing the rationale behind recent changes to the Petroleum and Natural Gas Act

Yesterday during budget estimates for the Ministry of Energy, Mines & Petroleum Resources I asked the Minister a couple of questions concerning very recent changes to the Petroleum and Natural Gas Act. These new changes preclude detailed information about royalty revenues being publicly disclosed, and grant the Oil and Gas commission increased regulatory power.