Energy and Mines

Bill 23: An Act of Desperation

Last week I wrote about the very serious concerns I had with Bill 23, The Miscellaneous Statutes Amendment Act. Today I spoke against the Bill at second reading. Included within the bill are three profoundly troubling sections and below I outline my objections to these in greater detail.

I begin my speech by discussing what can only be described as one of the most bizarre moments for me in the Legislature since being elected. It has to do with the government promising, in their throne speech, to create a medal that already exists.

I then move to outline a number of outrageous steps that government is taking in a desperate attempt to land a single positive LNG final investment decision. It is truly remarkable to witness how desperate government is becoming. Sadly, government’s attempt to fulfill their irresponsible election promise of wealth and prosperity for one and all from a hypothetical LNG industry is coming at the expense of future generations.

Video of Second Reading Speech

Second Reading Speech

A. Weaver: Thank you to the previous speakers for highlighting some of the issues I too would like to speak to, and against. in similar cases.

First off, I do wish to thank the Minister of Natural Gas Development for making staff available for a briefing today, which we found very helpful in explaining some of the rationale behind the royalty amendments that I will discuss later.

As was mentioned by the member from Nanaimo, this Miscellaneous Statutes Amendment Act, like previous acts, is always interesting because there’s a potpourri of topics in here, some of which some members in this House will approve. Others, some members in this House will not approve. There’s many different angles that one could take with this bill. In voting yes or no on the second reading, one has to weigh the pros and the cons. One might actually think that the ways of dealing with some of these are at the committee stage, which I certainly will explore in more detail, some of the ideas there.

There are a couple of sections that concern me quite profoundly. But I will start, and I want to preface that there is one section here that is actually good and something that I find very easy to support, and it’s an election promise that the B.C. Liberals will be able to keep. The irony here should not be lost on many people.

I’ve had the privilege of serving in this Legislature for two years. In that two years I’ve heard a lot about the 1990s. I’ve heard it referenced time and time again about what happened in the 1990s. Well, did you know that in the 1990s, the Provincial Symbols and Honours Act was brought in place?

Guess what is there in section 19 of that act. Section 19 states this: “The Lieutenant Governor in Council may award the British Columbia Medal of Good Citizenship to recognize persons who have acted in a particularly generous, kind or self-sacrificing manner for the common good without expectation of reward.”

This was one of the prime announcements in the throne speech — that government would actually bring forward a B.C. Medal of Good Citizenship that already exists. This has got to be one of the most bizarre moments for me in this Legislature, to see the hubris, the narcissism of a government that thinks that it’s okay to make a big deal about bringing in a medal that’s been on the books for almost 20 years. It’s truly, truly…. I mean, you can’t make this stuff up. It’s happening in B.C. politics here in the House

You know, what is so sad about this is that British Columbians are paying the price. British Columbians are paying the price for a government that clearly does not have an legislative agenda this session, apart from desperately trying to fulfil its election promise about LNG.

We watch one after another after another of the big players in the LNG market cite what I have been saying for two years: the growing glut of natural gas. The price is dropping. Japan is bringing on nuclear reactors again. Australia is well ahead. Companies are merging. The price of oil is dropping. And B.C., rather than recognizing that we are late players in this game, that we do not have a competitive advantage, that we will maybe one day find a use for this natural gas….

I see some small little additions here, which I call the methanol and the refining amendments, where there are some kinds of ideas that perhaps we should do something in case it doesn’t pan out, and there are other projects that we might go for. What this government is doing with amendments, two of them in this act, is continuing this generational sellout which my friend from Nanaimo–North Cowichan and I describe as a generational sellout. I cannot take credit for the term “multigenerational sellout.” That goes to the member for Nanaimo–North Cowichan. But it’s far beyond that.

We see this taking another step. Not only are we letting the minister enter into royalty agreements that will hamper future generations, not only government but future generations, by irresponsible promises made by a government that had no idea what it was doing during an election campaign except for offering a message of hope wrapped in hyperbole in a desperate attempt to get elected.

“Say anything. We’re not going to get elected, but let’s hope we get a few seats.” And lo and behold, we have a majority over here, a government that does not know what they’re doing on this file and that has become an embarrassment internationally on the LNG file. We’ve watched company after company after company look at us and say: “What’s going on?”

Here we now have, in this bill, the greatest, most serious insult that future generations could have, which is saying: “We are going to lock you into royalty rates with one company. We’re also going to forget municipal charter acts.” We’re going to go over that too, and we’re going to do what we can to write legislation so that this one company may — may possibly, perhaps — if things go well, make an investment decision by June of this year. And they’re the only one thinking of doing it.

The level of irresponsibility here — I cannot underestimate it. British Columbians should be walking in the streets over this legislation. I know they’re not going to pay attention to miscellaneous statutes amendment acts. Buried within that is not only an intergenerational or a multigenerational sellout, it’s a historic one. It’s a historic sellout to foreign multinationals of the rights of British Columbians and future generations to gain value from our natural resources.

It’s a very sad day in British Columbia if we were to pass the relevant sectors in here. Sadly, as this government no longer listens to constituents, to small business owners — we see it in the liquor legislations — to the opposition, to independent members, they are marching to the beat of their own drum, because they think that by being elected as a majority they have carte blanche to do whatever they want, with no accountability.

But there will be accountability when British Columbians do realize this, and we can see it happening around the province. There will be accountability in 2017 for this multigenerational, historic sellout that is continuing here in British Columbia.

Let’s move directly to section 23, the Port Edward tax agreement. Now, where is this coming from? The Port Edward tax agreement. For those riveted at home to the debates that are happening now, Port Edward is near Prince Rupert. It’s where Petronas and BG and Shell…. It’s in the area where there was going to be an LNG facility.

It’s an area where there used to be a vibrant pulp mill, but of course that shut down because we’re not nurturing our forest industry; instead, we’re natural gas. It’s LNG or nothing in B.C. right now. It’s a message that’s being sent to business in B.C. I recognize the minister is troubled by those words, but the reality is business in B.C. has heard the message: you’re either with us on LNG or we’re not interested in where you’re going.

That is the signal, because the government here is picking winners and losers in the marketplace — a so-called free enterprise government picking winners and losers in the marketplace. The winner they’ve picked is LNG. But it’s even worse than that. It’s not winners and losers; it’s winning companies and losing companies, because we see legislation at the scale of individual municipalities. We’re amending the Municipalities Enabling and Validating Act to allow the district of Port Edward to enter multi-year agreements with Pacific NorthWest LNG.

What is going on here? We’re introducing law so that a municipality can forget the rest of the law that’s applied to municipalities in the province so that they can negotiate and do special deals with one company. We’re picking the winning technology and the winning sector, and we’re picking the winning company.

This is no longer a government that has any credibility as a free enterprise government. This is a government that is really a pick-a-winner-and-loser government. They’re picking losers as we go along, and it’s continuing to manifest itself with this legislation.

To be able to have this agreement last up to 25 years and establish an amount or formula to be used for the duration of that agreement for one company may give business certainty for that one company. Sure, Pacific NorthWest is going to have business certainty, and we all know business needs certainty, but this is giving an intergenerational sellout at the same time.

There’s no certainly for British Columbians here. This government was elected to represent British Columbians, not elected to represent Pacific NorthWest natural gas and Petronas and market that company to British Columbians, which is what is happening here in this legislation.

There are many other examples in this. I have another couple on this particular section.

You know, we see Port Edward being given the power to set a unique tax rate for Pacific NorthWest LNG that could be different from other class 4 properties. No, we’re picking one company over another. You want to develop this land, your class 4 property? Guess what. If you’re LNG, it’s one thing. If you’re forestry, you’re another. This is sending a message to industry that you are either…. You want to do industry in B.C.? You’re with LNG. We’ll do anything we can for you. But if you’re a struggling industry in another sector, maybe not. It’s LNG or nothing here in British Columbia.

A government that has the audacity to claim leadership on climate. The audacity for a Premier to be invited by the World Bank and to claim, in this province, that she is leading a government that has leadership on climate policy does nothing but make the government of British Columbia a laughingstock within credible people across Canada.

This government has no credibility on the issue of climate policy. It was the previous administration, under the leadership of Mr. Campbell and the leadership of Barry Penner, the Environment Minister, that built that credibility that this government has destroyed in the matter of two-and-a-half short years.

Now, I recognize the Minister of Health did his bit. He was a very fine Minister of Environment when he was there, but he’s no longer there. The Minister of Environment is doing what she can. Unfortunately, they are but a few within a caucus of many who are doing everything they can to unravel the leading climate policy that existed in this province.

Interjections.

A. Weaver: The truth does hurt. When the members opposite start heckling, they recognize that the truth does hurt — the truth to try to claim leadership on greenhouse gas emissions.

Interjection.

A. Weaver: The Minister of Health suggests I’m losing credibility by telling the truth. I would suggest to the minister that the government has lost credibility by not telling the truth for two years.

You can check my page: andrewjweaver.ca. It’s there from December 2012. That’s on Facebook prior to the election and during the campaign. I’ve said the same thing about LNG. I haven’t changed my tune. The government has — a $100 billion prosperity fund, a $1 trillion hit to GDP, “Debt-free B.C.,” no PST, thriving schools and hospitals. La, la, la. Come to B.C. We’ll tell you what you want to hear, not what you need to hear. Unfortunately, here we are in B.C. with yet another generational sellout happening before us.

Subsection (4)(b) exempts agreements from cabinet regulations that prescribe limits on tax rates, relationships between tax rates, formulas for calculating tax rates and so on.

Section (4)(c), another exemption for PNW properties, allows an exemption for them being prescribed as port land under the Assessment Act. That, again, means that cabinet regulations that prescribe the actual value of the port land — or they establish rates, formulas, rules or principles for determining the actual value of the port land — would not apply. Let’s just throw that out. It might not give a company certainty.

Subsection (4)(d) exempts PNW properties under an agreement from the Ports Property Tax Act. We wouldn’t want to tax LNG, which generally outlines property tax provisions for ports.

Whose needs are actually being served here? Is it British Columbia’s needs? Is it this government that is voted and tasked to represent British Columbians and provide the oversight that British Columbians want? Or is it the winner that they chose in the winning sector, in an economy, in a market that’s falling? When other jurisdictions are diversifying their economy, we are not.

The Community Charter was written to provide fairness and a level playing field for businesses. This act seems to empower Port Edward to create an unfair playing field.

It gets worse, with the royalty agreement section in sections 44 to 56. Sections 44 through 66 have received a lot of focus already, as they appear to be particularly troubling. They appear to allow the minister to enter into royalty agreements with natural gas producers. The minister can enter into an agreement without approval from the Lieutenant-Governor-in-Council if the agreement is “in respect of a prescribed class of agreements” — whatever that means.

There are several concerning points here. The entire purpose of this section appears to allow this government — a government that’s lost credibility on the LNG file, if it ever had any in the first place — to lock future governments into royalty agreements without offering as much as any way of oversight or checks and balances to protect British Columbians from, frankly, irresponsible decision-making that is ongoing in British Columbia today on this file.

We already have a royalty regime in place. The problem, of course, is that as far as the government is concerned and, perhaps, the industry is concerned, this royalty regime may not be certain in future governments. Perhaps the government is worried. Perhaps the government is worried that in 2017 the B.C. Green Party will be sitting over there, and they’ll be sitting over here. There’ll be a lot of my friends to the right over there and a few of you over here.

Perhaps they’re worried about that, and they want to give Petronas, or PNW, some certainty by locking in 25-year royalty rates at some rate that is to be prescribed at some point by a minister, if he or she wants, with some consultation — maybe, maybe not. Who knows? Because we’re not going to be actually bringing this forward in a very public fashion.

You know, the powers that have been given to the minister in this amendment act with respect to royalty creation in the natural gas sector are enormous. Not only are they enormous, they’re enormous powers to one minister — not the minister in the next government or the government after that but the minister in this government, a minister who’s part of the government that is so desperate to fulfil their irresponsible election promises.

The media are not going to…. They’re going to start probing. They may have given the government a few years of grace on this, but mark my word, when people start looking into this, it’s going to come a cropper if it’s not already starting to. This is egregious — what’s going on in this particular amendment.

Under the changes, the minister also has to disclose information that would be required to be disclosed under the Freedom of Information and Protection of Privacy Act. However, the section in here does not clarify who determines if the information needs to be disclosed or not. Is it an independent body that’s at arm’s length from the ministry? Or could the minister theoretically decide what should be or should not be disclosed? It’s not clear.

There are other aspects of this act that I’ll just very briefly speak to, that I’d be interested in exploring further at committee stage. That’s with respect to the oil and gas activities changes, section 48, where we have (e.1) and (e.2) to include two types of oil and gas activities, and these are “the construction or operation of a manufacturing plant designed to convert natural gas into other organic compounds” and “the construction or operation of a petroleum refinery.”

Again, it’s seeming to me, in light of the fact that I know of one proposal that’s been brought to government on (e.1) and one proposal that has been brought to government on (e.2), the government again is going forward and trying to pick winners and losers in a marketplace before actually letting the market decide who those winners and losers should be. I’m curious about what the government is intending here, and I will, indeed, speak to it at committee stage.

With that, I do thank you for the time. I look forward to further discussions in committee stage. At this point, I’m still in a quandary, with respect to the vote at second reading, not because I support everything in it, but I’m not sure at this point and I still need time to reflect on whether or not the merits of supporting it at second reading or not supporting it at second reading are more on the positive or negative.

Clearly, the egregious royalty and Port Edward changes that are the government desperately trying to pick winners and losers in the marketplace to fulfil election promises are unsupportable.

Obviously, I support the B.C. Medal of Good Citizenship — again. It’s already been on the books for nearly 20 years, and the irony of this…. Again, it’s one of these priceless moments that you get in this place, in the Legislature, after listening as an independent here for two years to “in the 1990s this” and “in the 1990s that.”

Well, one of the things that happened in the 1990s is that this B.C. Medal of Good Citizenship was brought into place. Obviously, I support that. Obviously, there are other aspects in this updating of various acts that I support. But these two changes are very, very troubling.

With that, I’ll pass and look forward to hear the continuing debates.

Bill 23 – A MultiGenerational Sellout

In the not too distant future we will be moving to 2nd reading of Bill 23, The Miscellaneous Statutes Amendment Act. Included within the bill are three profoundly troubling sections.

If these sections pass, powers would be granted to the Minister to single handedly enter into secret agreements with oil and gas companies, without any clear oversight.

These agreements, parts of which can be withheld from the public, would dictate how much—or how little—British Columbians would benefit for our natural gas resources. And given what we’ve seen from this government so far on the natural gas file, it would not be unreasonable for us to be concerned about backroom deals that amount to hand outs of public resources at rock bottom prices.

Here’s what you need to know:

The most concerning points in Bill 23 pertain to changes to the way Royalty Agreements are managed under the Petroleum and Natural Gas Act. Under these changes, the Minister is granted the power to enter into secret agreements with oil and gas companies without the approval of Cabinet.

Once an agreement is signed, the Minister is not required to disclose any sections to the public that could reasonably be withheld under the Freedom of Information and Protection of Privacy Act (FOIPPA).

The question is: who decides? And what oversight exists to make sure our right to know is protected?

If the Minister is able to enter into these agreements without the approval of Cabinet, then does the rest of government even have access to them if they go unpublished?

My concern is that the act doesn’t specify any of this. So presumably right now, a secret agreement could be signed by the Minister without any oversight or approval from Cabinet. The Minister could then potentially keep important sections of that agreement from the public because he or she feels that would be okay under FOIPPA.

Yet, it goes even further.

Those agreements could lock us in for decades. In fact, it’s up to the Minister to determine how long they last, as long as the timeframe does not exceed the maximum timeframe set by Cabinet. The number that has been floating around is 25 years.

Under the agreement, the Minister can also set any terms or conditions he “considers necessary or advisable.” Presumably, these could include conditions the government must meet as well.

For instance, oftentimes agreements include exit clauses and penalties. So if a future government decides that an agreement signed by a current Minister is so egregious that we need to pull out, British Columbians may have to pay the company to do so. The problem, again, is that we may never know how much that would cost until it’s too late.

I am concerned that this is yet another attempt by this government to sell out British Columbians and their natural resources in an absolutely desperate attempt to fulfill their irresponsible election promises which at no time have ever been grounded in reality. The simple fact is – there is a global glut of natural gas in the market, demand is dropping as countries aggressively move to renewables, and BC is just not competitive enough in the LNG industry as we are so far behind other jurisdictions (not to mention that LNG prices have been plummeting and it is no longer economical to ship LNG from BC to Asia unless BC goes so far as to pay a company to do so). And Bill 23 takes the generational sellout, embodied in the Liquefied Natural Gas Income Tax Act, to a whole new level — A multigenerational sellout.

Even if this is not simply a handout for the LNG industry, the fact remains that there are legitimate concerns that the secret deals that this bill would allow could amount to handouts of public resources to companies. British Columbians should be outraged. And I will be vigourously opposing this bill in the weeks ahead.

Bill 26 – LNG Income Tax Amendment Act

On Wednesday, April 15 I rose to speak to Bill 26, Liquefied Natural Gas Income Tax Amendment Act 2015. Bill 26 introduces 109 pages of amendments to Bill 6, the Liquefied Natural Gas Income Tax Act that was introduced and subsequently granted Royal Assent in the 2014 Fall session.

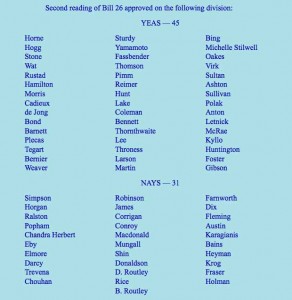

In the fall I stood alone in the house opposing Bill 6. During second reading of the bill I spoke out against it. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second writing (see the image to the right).

In the fall I stood alone in the house opposing Bill 6. During second reading of the bill I spoke out against it. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second writing (see the image to the right).

During the committee stage for the bill after 2nd reading, I identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC. And then, at third reading, I moved an amendment that would have sent Bill 6 to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises. The bill would have benefitted from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

Imagine my surprise when the 109 page LNG Income Tax Amendment Act (Bill 26) was brought in for debate during this session. As I outline in my speech below, the actions taken by this Legislature in the fall, I believe firmly, were a dereliction of our duty. As MLAs, we should have explored the incomplete bill in greater detail. That could and should have been accomplished by sending it to the Select Standing Committee.

Bill 26 puts me in a quandary. I was fundamentally opposed to passing Bill 6 in the Fall. Yet the BC Liberals and the BC NDP voted to move it through quickly and so it is now law in British Columbia. Many of the objections I raised concerning the incompleteness of Bill 6, including the many loopholes and lack of completeness, were addressed in the LNG Income Tax Amendment Act (Bill 26). It is important that we fix bad law.

But at the same time, Bill 26 introduces an unacceptable revision to section 56. Now the minister is granted the power to use regulation to allow corporations involved in the LNG industry to use their natural gas tax credit to pay an 8 percent corporate tax instead of 11 percent. Obviously the government is so desperate to try and land an LNG industry that it is sweetening the pot still further. Back in the fall, when I put an amendment to send this to committee, I specifically stated in speaking to that amendment that one of the reasons this had to go to committee was because “I would have wished to explore, in particular the one-half percent natural gas tax credit.”

Section 56 represents one section of the bill that I will propose an amendment to during committee stage. I will propose to revert it back to its original fall version.

The BC NDP took a different approach. They too opposed changes to section 56. But instead of waiting to committee stage they decided to vote against the 2nd reading of the bill (which means all the Bill 6 loopholes would be left in place).

Below are the video and text of my speech.

Second Reading Speech Video

Second Reading Speech

A. Weaver: I find it, frankly, deeply troubling that we’re here debating Bill 26, LNG Income Tax Amendment Act. This is a 109-page act which is designed to amend an 87-page act — that is, Bill 6, which was introduced back in the fall. Bill 6, as you will recall, hon. Speaker, was the Liquefied Natural Gas Income Tax Act.

You will recall that in third reading of Bill 6, I moved a motion. I moved a motion to send the LNG Income Tax Act to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills for further review. The reason why I did that was because Bill 6 was incomplete. It was full of loopholes so big you could drive a bus through.

Let me read some of the concerns I had. The reason why I would like to do that is to point out that quite a number of these concerns have been addressed in this, the amendment act, this 109-page act — bigger than the original act.

In the fall, when I moved an amendment at third reading to send this to committee, I stated the following.

“There have been questions that would benefit exploration at committee stage. In particular, there are questions on revenue projections, the modelling, the assumptions into the modelling that have not been forthcoming and transparent in terms of us as a Legislature being able to assess this legislation.

“There’s section 32(c)” of Bill 6. “There are issues that came up…with respect to a loophole for earned credits that could be sold by a company, the income from that not being claimed as taxable, yet the person purchasing it can claim the income as a deduction.”

There were questions about section 46, with respect to the rate being left out. We never got guidance as to what the rate and the formula there was.

There were questions on section 47 regarding “a potential LNG loophole for tax avoidance through capital acquisitions and leaving the 1.5 percent net LNG tax rate for significant times.”

There were questions on section 122 with respect to the polluter-gets-paid instead of a polluter-pays model.

There were questions on section 172 that we did not have as much time as I would have liked to explore, in particular that one-half percent natural gas tax credit. Let me reiterate that. Back in the fall, when I put an amendment to send this to committee, I specifically stated in speaking to that amendment that one of the reasons this had to go to committee was because “I would have wished to explore, in particular the one-half percent natural gas tax credit.” Well, as we will discuss later in my speech here, we do have more details about that one-half percent tax credit.

I would have thought in the fall that this was such an important piece of legislation that government would have wanted to send this to committee to actually gain the insight of British Columbians, of First Nations, of industry from across the province. Instead, with the exception of the member for Delta South, every member in this Legislature stood and voted against sending this to committee, to rush this bill through when it wasn’t ready.

Today we stand here to debate Bill 26, the Liquefied Natural Gas Income Tax Amendment Act, a full 109 pages, compared to the 87-page act which was incomplete and introduced in the fall. This is troubling. This is very troubling. It, frankly, disturbs me that we have to be in this position here today.

Let me emphasize that the changes made in this bill are important. They’re important, and I’m in a quandary. They’re important because I stood passionately and spoke against the introduction of Bill 6 in the fall. But I recognize that we have passed Bill 6. Bill 6 has now received royal assent and is a matter of law within British Columbia. Bill 6 is incomplete. We cannot conduct business in the province of British Columbia with Bill 6 standing before us now. We either need to repeal it or we need to pass some form of legislation to fill those loopholes.

Let me address some of that. In essence, my own view is that this bill closes quite a number of those massive loopholes that I referred to earlier. In particular, if I could read the…. I have so many notes here. I’ll find it in a minute. Let me say it provides greater clarity on the administrative requirements, bankruptcy and insolvency issues and debt forgiveness rules. It sets requirements for registration, for filing tax returns and for paying and refunding taxes. It establishes penalties for failing to meet the requirements of the act.

Most importantly, it introduces section 124.412, which is the anti-avoidance rule, which was so critical in my criticism back in the fall, that there were so many loopholes that companies could avoid paying taxes even though they were hardly paying any taxes in the first place. This anti-avoidance rule introduction is critical legislation that needs to have been in place and should have been in place in the fall and should have been discussed and raised in committee, had we passed this legislation and sent it to committee. Instead, here it is now in the 109-page liquefied natural gas amendment act.

There are essential aspects in this bill for the tax regime. Without them, LNG income tax payers could avoid paying a significant amount of the tax because of the massive loopholes and others that I discussed earlier.

The real question is how the LNG Income Tax Act got passed last fall without any of these very basic provisions laid out for us to discuss, number one. Two, not sending this to committee so that we could have an opportunity to discuss it is deeply, deeply troubling. Frankly, in my view, this has been an abdication of the responsibility on behalf of this Legislature to do due diligence on the legislation that was tabled and brought to us. It doesn’t end there.

Here I do agree entirely with the official opposition — that is, with the concern they raised, which I agree with, concerning the problematic natural gas tax credit. Before I come to that, I think it’s important to set the context.

What is the context? Why is it now that in section 56 we essentially allow the minister, through regulation and in perpetuity, to allow corporations involved in the LNG industry to use this natural gas tax credit to pay 8 percent instead of 11 percent?

Let me tell you a little bit why we’re where we are. And this isn’t new. For two years now I’ve been saying the same thing. British Columbia’s hype of hope and wealth and prosperity for one and all from a hypothetical LNG industry was nothing more than a message of hope wrapped in hyperbole. The promises of 100,000 jobs, a $100 billion prosperity fund, a $1 trillion increase to GDP, debt-free B.C., no PST, thriving schools and hospitals and on and on were nothing more than a pipe dream.

The global markets, the economics, did not support these statements in the fall of 2012. They do not support these statements now. This is the reason why we’re seeing this natural gas tax credit — essentially, yet another generational sellout on top of the existing generational sellout — being brought to us for approval today.

What has happened since 2012 was entirely predictable — entirely predictable — given the fact that we are not the only ones in the world who have discovered horizontal fracking technology. Our shale gas reserves pale in comparison to others. We have massive reserves in Australia, in Russia, even in China, in the United States, in Iran, in Qatar. I could go on and on. There is shale gas all over the world. Yet somehow B.C. thinks that it, and it alone, is going to fill Asian markets with natural gas.

This is what happened. I’m reading here from a Reuters piece published on December 11, 2014. The title of that says this: “Asian LNG Prices Seen Falling by up to 30 Percent in 2015.” Well, they’re talking about LNG prices falling 30 percent in 2014. But in fact, they talk here about things like if brent crude trades at $85 next year, the price could be $12.60 per million Btu. It continues on that it could drop still further and further. If brent trades for $70 a barrel — $70 a barrel; hmm, lot of oil companies out there right now are looking for $70 a barrel — the price of low-sulphur oil will cap LNG spot prices at — guess what — $10.50 per million Btu.

I’ll repeat that. If brent trades at $70 a barrel — it doesn’t matter that we’re trading at $50 a barrel now — this Reuters article is quoting Wood Mackenzie’s Thompson as saying that LNG spot prices will be capped at $10.50 per million Btu. That makes sense.

Russia has just entered into long-term 30-year contracts at below that price. Yet British Columbia thinks that somehow companies will invest tens of billions of dollars to transport liquefied natural gas from our coast across the ocean, when it costs $7 to $8 per million Btu to do that. They’re going to have to pull this out of the ground at negative prices.

That is why we have this LNG tax legislation before us, because it introduces so many giveaways that, essentially, we avoid paying tax to British Columbians, and we give away a natural resource. Well, we try to. This is still not coming.

I reiterate, and I say it one last time. If brent trades at $70 a barrel, the price of low-sulphur oil will cap LNG spot prices at about $10.50 per million Btu.

It doesn’t end there. What other things have happened to cause this desperate Hail Mary pass of hope after the previous Hail Mary pass of hope was caught? They didn’t win the game. We thought they did, but they didn’t, because they can’t land this.

Let’s see what else has happened. I’ll read to you from a Toronto Star article entitled “Shell-BG Deal Could Dampen B.C. LNG Projects.” Well, that’s a surprise. I thought we were going to have Shell and BG and three others up and running by…. Well, one of them should have been this year, maybe a couple by next year.

The Shell and BG amalgamation is troubling. Why is that? Because they have…. Let me read here. British Gas, BG, has liquefication plants in Australia, Egypt, Trinidad and Tobago, and another being developed in Louisiana.

Shell has LNG operations under construction — not planned, under construction — in Russia, Qatar and Australia. We now have dropping demand. We have the amalgamation of two major players in the liquefied natural gas world with projects under construction. B.C. is not a player here. We can say goodbye to those companies.

Why would anyone invest in British Columbia right now? Why would anyone invest? Because they would need a supply gap. These companies don’t buy to fill spot prices. They buy to make long-term investments to fill in supply gaps down the road. Petronas had a supply gap — 2018-2019. They’ve deferred their investment decision, deferred it again and again. Do we really think Petronas is going to make a final investment decision to go ahead to meet a 2018-2019 supply gap? I don’t think so. They may be back in the mid-2020s, where another supply gap emerges there. But for the short term, this is nothing but hope.

Frankly, it’s irresponsible to put our entire provincial economy, to retool our education systems, to essentially send to business a message, a singular message, that if you want to come to British Columbia to do business in our province, you’ve got to hang your hat on LNG, an industry that doesn’t exist now, but we hope maybe someday will exist. What we’ll do for you, hypothetically, is retrain our education system. We’ll do whatever you want. We’ll create a natural gas credit, which is 1/2 percent plus some random number to bring it down to 8 percent — your corporate income tax that you pay.

Here’s another article, published on April 5. This one’s important, because this government has pointed out for us many, many times how proud they are to get the triple-A credit rating from Moody’s. Well, low and behold, here’s the title: “Moody’s Puts a Damper on B.C.’s LNG Dreams.” I’ll say it again. “Moody’s Puts a Damper on B.C.’s LNG Dreams” — published in the Canadian Press and syndicated across our beautiful country.

Meanwhile, what’s actually happening in the world? Well, we don’t have to go very far. Let’s go to Bloomberg Business today — not tomorrow, not yesterday but today’s Bloomberg Business newspaper. Let me quote the title article. It says this: “Fossil Fuels Just Lost the Race Against Renewables.”

Why is that the case? Because, around the world, people recognize that there are stranded carbon assets in the ground that cannot be extracted. The existing plans and development to extract those resources that are there are already meeting existing demand down the road, so there are no supply gaps.

Instead, places like China, Russia, Europe, Australia and America, whose emissions dropped last year, are going all into the renewable clean tech sector, a sector that British Columbia used to be a leader in.

Now this government is saying to British Columbians: “If you want to be a leader in an economy in B.C., forget everything else. Let’s go LNG.”

This article, which I recommend that all read, entitled “Fossil Fuels Just Lost the Race Against Renewables,” is published today in Bloomberg Business. There are actually some lovely charts and graphs in there too. It’s not just some person writing their opinion. It’s actually an analysis with graphs, bar charts. It’s quite interesting to read, because they’re saying what I have been saying for two years — that this is nothing but hyperbole.

This brings me to the most serious aspect of this bill again, and that is the natural gas tax credit. Under this tax credit, an LNG taxpayer can decrease their corporate income tax from 11 percent to 8 percent by claiming credits for the cost of natural gas. Under the old version from last fall, they could only claim 0.5 percent of their natural gas costs.

I agree with the opposition. This is simply unacceptable. This should’ve been brought in, in the fall. However, my approach to deal with this is to amend this at third reading and offer this Legislature an amendment to refer us back to the fall legislation, which had this fixed value of 0.5 percent — as opposed to voting against this at second reading.

Under the new version an LNG taxpayer can claim that amount as well as an additional prescribed amount that is to be set by the Lieutenant-Governor-in-Council. It could be 0.5 percent or, given that that brent crude drop is going to cap LNG prices, you might as well make it 0.5 percent plus minister’s 2½ percent to make it 3 percent to drop the corporate tax down to 8 percent. We weren’t told that in the fall, and it behooves us in this House to amend this, to take it back to what was given us in the fall with a straight face by this government that this number would be a half-percent.

What’s worse here is that if is a taxpayer claims for credits than they can use in a year, those additional tax credits will carry over to future years, which means that if the prescribed rate is high enough, a company could end up paying 8 percent corporate income tax in perpetuity. Yet another loophole is brought in here, and based on the changes that are being made, it’s is hard to imagine any other intention.

Clearly, the government did not think that 0.5 percent of a taxpayer’s natural gas costs was sufficient enough to lower their corporate income tax rate to 8 percent. It was not a sufficient enough gift — a piece of candy — to give to the LNG industry that they introduced greater cuts because the industry is not coming here. What is next? Are we going to have to promise them a free workforce? Are we going to promise them that they pay no tax? They’re not coming, even as we introduce this generational sellout of Bill 6, amended through Bill 26.

Let me discuss now the quandary we find ourselves in, because this is important. This bill puts us, all of the members in this Legislature, in a quandary, in a very difficult position. Last fall the government and the official opposition together passed the LNG Income Tax Act prematurely. At second reading I was the only member of this Legislature to stand in opposition to the generational sellout embodied in Bill 6. I would have argued that this should never have happened. But now we are debating an amendment that is longer than the actual act, and this amendment actually dramatically changes the original act.

The problem here we face is…. I tried in the fall to put this to committee, because it was clear that there were so many loopholes in this bill — loopholes, as I described, that you could drive a bus through. I was voted down by every member in this House except my dear friend from the riding of Delta South, who also recognized that while her position was that it was important to move forward with an LNG tax regime, we could not do so at this time in light of lacking information before us, and so sending this to committee was critical.

The problem now is that we’re not really able to debate the merits of the original act. We are debating the amendment act, with the original act now standing as a matter of law before all British Columbians. So I’m in a quandary, as I’m sure others are, and I say it again very clearly that I believe that the LNG Income Tax Act, Bill 6, should be repealed. It should never have passed.

Here we are today with a government not willing to do so, a government instead amending — amendments that I support — many of the loopholes in the previous act but introducing section 56, which, to me, is critically flawed in actually, essentially, giving regulation to the minister to allow him or her to grant 3 percent income tax cuts to LNG corporations in perpetuity.

As I said, the actions taken by this Legislature in the fall, I believe firmly, were an abdication of our duty, a dereliction of duty. As MLAs, we should have explored that in greater detail.

I am grateful to the minister for allowing me to be briefed by his staff, a briefing that I was able to probe many of the loopholes that I raised earlier and find that many of them have been addressed. I was satisfied with the answers I got, and I was pleased by the level of detail provided.

Clearly, I’m unhappy with section 56. While I support the amendments, I will not support section 56. But I will do that at the committee stage through the introduction of an amendment if the official opposition does not.

The Vote

Probing the “Dereliction of Duty” in Site C Approval

Today in the house I rose in question period to ask the government once more about the economics of the Site C dam project in light of recent revelations. Since elected I’ve continued to point out the economic folly of moving forward with Site C at this time. I’ve expressed concerns on the effect it will have on our credit rating; I’ve pointed out that there are cheaper alternatives like wind or geothermal which would allow supply to keep pace with demand. I’ve also called on the government to broaden BC Hydro’s scope to allow for production of geothermal power.

Earlier this week Emma Gilchrist, Executive Director of DeSmogBlog Canada, authored a two part series on the economic justification for the Site C project. The two articles were based on an extensive interview she had with Harry Swain, former co-chair of the federal-provincial Site C review panel:

- B.C. Government Should Have Deferred Site C Dam Decision, Says Chair of Joint Review Panel

- ‘Dereliction of Duty’: Chair of Site C Panel on B.C.’s Failure to Investigate Alternatives to Mega Dam

Below is the text of my exchange with the Minister of Energy Mines. Our press release is reproduced at the end of this post.

Question

A. Weaver: Earlier this week Harry Swain, co-chair of the joint review panel appointed for the Site C dam and a former Deputy Minister of Industry Canada and Indian and Northern Affairs Canada, raised some very serious concerns about the government’s approach to approving Site C. Mr. Swain was very clear that the government was rushed in approving Site C, and British Columbians will pay for their haste. As Mr. Swain said: “Wisdom would have been waiting for two, three, four years to see whether the projections they” — that’s B.C. Hydro — “were making had any basis in fact.” That’s not exactly a glowing endorsement for the fiscal underpinning of Site C.

The review panel predicted that by building it now, Site C will actually produce more electricity than we’ll need for the first four years, costing taxpayers $800 million. My goodness, we could use that money to build a state-of-the-art sewage system in Victoria.

Mr. Swain is only the most recent person to suggest waiting a few years to see if electricity demand for the project materializes. We could still build Site C down the road if necessary, but we could use the additional time to properly explore cheaper alternatives like our vast geothermal potential in B.C. We have the time. LNG final investment decisions are delayed or not happening at all or somewhere down the yellow brick road or perhaps in never-never land.

My question to the Minister of Energy and Mines is this. Given the massive costs associated with rushing into Site C, will he hit the pause button on construction for two to four years, as recommended by Mr. Swain, and use the time to save British Columbians money and explore viable alternatives?

Answer

Hon. B. Bennett: I will answer the question. I categorically disagree with the premise of the question, but I do have to thank the member for the question. We as government announced this project in December of 2014. It’s certainly one of the largest public infrastructure projects in the province’s history, and it’s an extremely important project to the future of this of province. So I appreciate having the opportunity to stand in the House and talk about it. I’m not sure if I have a critic with the opposition. He hasn’t asked me any questions about Site C to date.

Fair enough questions about the need for the electricity, the cost of the project. These are all legitimate issues that we should be debating in this House.

I’d like to quote from the panel that Mr. Swain chaired. One of the things that Mr. Swain said was that Site C “would be the least expensive of the alternatives, and its cost advantages would increase with passing decades as inflation makes alternatives more costly.” He went on to say, in terms of debt: “The panel concludes that the risk of Site C to the province’s debt management plan is entirely manageable by a prudent B.C. government.” He went on to say: “There is little doubt about the competence of B.C. Hydro to build and operate the project efficiently.” That’s what the panel report stated.

With respect to need, the forecast that Hydro had done, this is what the panel said. The panel said that B.C. Hydro’s forecasting techniques are sound that and B.C. Hydro “has done a responsible job in forecasting.”

Supplementary Question

A. Weaver: Well, we have seen Site C pushed throughout without adequate consideration of the cost effective-effective alternatives. I’d like to quote Harry Swain again. He called this a dereliction of duty. Those are very strong words from a very highly regarded senior official from the Canadian government. To be even more blunt, it’s recklessness on the part of the government. We have a sense of the costs: a $800 million loss in the first four years of operation because of construction timing.

What we need right now is a government that is willing to show leadership on this, willing to put good policy ahead of ideological politics. My question to the minister is this. Will he listen to the call from every member of this side of the House, along with the expert opinion of the joint review panel and countless others, to send the Site C project to the British Columbia Utilities Commission for a proper regulatory review?

Answer

Hon. B. Bennett: Again, I appreciate the question from the member. I actually haven’t heard a peep from anybody on the other side of the House about Site C other than this member, but that’s fine.

They don’t seem to want to talk about economic issues for some reason or other.

B.C. Hydro has been working on this project for the last seven years. They forecasted a demand for electricity that will require the province to have 1,100 megawatts of electricity by 2024. Their forecasting methodology has been tested by the BCUC. That’s the agency that this side of the House loves so much. The BCUC has actually said that B.C. Hydro’s forecasting methodology is state of the art.

B.C. Hydro figures that we’re going to need 1,100 megawatts of electricity in 2024. We set about, over the past two years, to determine what’s the best way to get that 1,100 megawatts of electricity. We looked at absolutely everything, and the decision that we made on this side of the House was to honour the ratepayer. We chose the option that is the fairest, lowest cost to the ratepayer, but that side of the House wants us to do something different.

Media Statement – March 12, 2015

Andrew Weaver Calls for Pause on Site C Dam Development

For Immediate Release

Victoria B.C. – Andrew Weaver, MLA for Oak Bay – Gordon head and Deputy Leader of the B.C. Green Party says its time to hit the pause button on the Site C dam before British Columbians have to foot the $800 million bill for this government’s rushed decision.

Dr. Weaver’s call follows “unprecedented” comments from Harry Swain, chair of the Joint Review Panel that reviewed the Site C Dam proposal. In an interview with DeSmog Blog Canada, Mr. Swain called the government’s failure to properly consider alternatives to the dam a “dereliction of duty”.

“Mr. Swain is a highly respected former public servant. When someone like him raises such serious concerns, we need to listen,” said Andrew Weaver.

Mr. Swain, is a former Deputy Minister of Industry Canada and Indian and Northern Affairs Canada. He is concerned the government was irresponsible in rushing into its decision on Site C and instead should be taking the time to explore alternatives.

According to the panel’s report, by building Site C now the government will end up saturating the electricity market to the point where it will cost B.C. Hydro more to produce electricity than it will get from selling it. The result would cost British Columbians at least $800 million in the first four years of operation.

“The question that needs to be asked is what’s the rush?” said Andrew Weaver. “LNG isn’t materializing along the timeline promised by government. Even if B.C. Hydro’s current projections are true, we still have up to four years before we need to start building the dam. We should use that time to explore alternatives before embarking on the largest infrastructure project in B.C. history.”

Mr. Swain made it clear that alternatives to Site C exist and should have been considered. The panel, however, was not empowered to do so.

“The Minister’s talking points are missing the point.This dam didn’t make sense for BC thirty years ago, and it doesn’t make sense now.”

Andrew Weaver also joined numerous others in calling on the government to send the Site C project to the BCUC for a full, regulatory review.

Media Contact

Mat Wright

Press Secretary – Andrew Weaver MLA

Cell: 250 216 3382

Mat.wright@leg.bc.ca

Bill 12 is Bad for British Columbians

Bill 12, The Federal Port Development Act, passed second reading on Tuesday March 3, despite my objections and the objections of Vicki Huntington, MLA Delta South.

On its own, Bill 12 is not inherently problematic. However, Bill 12 cannot be taken in isolation. It must be considered in conjunction with the recent passing of the federal omnibus Bill C-43. Buried within this more than 475 page bill was Division 16, Canada Marine Act.

As noted in a legal backgrounder put together by West Coast Environmental Law, Division 16 of Bill C-43 poses

“a serious threat to legal protection from and public oversight of environmental threats from activities that occur in ports, like coal storage and LNG facilities.“

The explanatory note to Bill 12 states that

“This bill provides authority to the Lieutenant-Governor-in-Council to authorize a member of the Executive Council to enter into an agreement contemplated by section 64.6 of the Canada Marine Act.

Let’s go to section 64.6 of the Canada Marine Act. It says this:

“The [federal] Minister may enter into agreements with any person or body, including the government of a province, with respect to the administration and enforcement of a regulation made under subsection 64.1(1).“

And so we move to 64.1(1). It states:

“The Governor in Council may make regulations respecting any undertaking or class of undertakings that is situated or proposed to be situated in a port, including regulations respecting the development, use and environmental protection of the port as it relates to the undertaking or class of undertakings.“

Now, this may seem all very innocuous — a short bill, two pages, a couple of definitions, not that much — but the implications are profound not because of what’s in Bill 12 but because of what’s not in it and what is implied if we adopt it.

I’m profoundly troubled that the federal government has opened up significant gaps in our regulatory framework with the passing of Bill C-43, and with the introduction of Bill 12 our government is complacent in this deregulation.

Let me provide a very specific example. With the passage of Bill C-43, the federal government can now sell its federal land to a port authority. In doing so, the Canadian Environmental Assessment Act, 2012 and the Species at Risk Act both no longer apply. Since British Columbia does not have species at risk legislation, this is quite problematic. British Columbia does have environmental assessment legislation but jurisdictional issues would almost certainly exist.

At the same time, the port authority can lease their newly acquired land to an industrial client. If Bill C-12 is enacted, the federal government can enter into an agreement with the Province of British Columbia to administer and enforce the industrial activities at this port. Unless also specifically transferred, in my view the federal government would retain the power of regulation creation and the province would be stuck enforcing and administering such regulations.

What’s also deeply troubling is that section 64.1(2) (k) and (l) grant the federal government powers to:

(k) prescribe rules respecting the confidentiality or disclosure of any information obtained under the regulations;

(l) provide for the retention or the disposal, including the destruction, of documents, regardless of medium, that are created or submitted under the regulations.

As noted in the West Coast Environmental Law backgrounder mentioned above, through the passage of Bill C43, the federal cabinet now has the power to:

“Hand over regulatory, administrative or even judicial control of industrial activities in ports to any person, including a province, port authority or even industry itself.”

If Bill 12 passes, the province could then enter in an agreement with the federal government to take over regulatory, administrative or judicial control of industrial activities in BC ports. Again, in an of itself, this may not seem like a bad idea. But in my view it’s critical that the province ensure that requirements under the Canadian Environmental Assessment Act, 2012 and the Species at Risk Act are not bypassed. At the same time, its critical in my view to ensure that industrial activities in British Columbia ports are conducted in an open and transparent way to ensure that the interests of British Columbians are protected.

Earlier today I issued a press release. I will be introducing a number of amendments to Bill 12 momentarily.

Media Release: March 5, 2015

Bill 12 could exempt LNG plants from species at risk act; allow destruction of key documents

For Immediate Release

Victoria B.C. – Bill 12 could exempt LNG plants from scrutiny under the species at risk act and allow for the destruction of important documents according to Andrew Weaver, MLA for Oak Bay-Gordon Head and Deputy Leader of the B.C. Green Party.

“Right now, the provincial government is quietly pushing through legislation that could seriously undermine public oversight and environmental regulation of LNG ports,” says Andrew Weaver.

Bill C-43 gave the federal government the power to sell port land to port authorities. Once sold, that land no longer qualifies as ‘federal’ land and therefore no longer triggers a review under federal environmental regulations, including the Canadian Environmental Assessment Act 2012 and the terrestrial species protections under the Species at Risk Act. Bill C-43 also empowers the new body overseeing the port to destroy important documents or keep them confidential.

Under Bill 12 the province could take authority for these former port lands to administer projects like LNG terminals. The province would be authorized to empower LNG plants to destroy important documents or keep them confidential, as they see fit. The B.C. Liberal’s coveted LNG industry could also take advantage of essential regulatory loopholes, by not having to undergo federal environmental assessments or meeting basic standards such as terrestrial species protections under the Species at Risk Act. B.C. currently has no comparable legislation covering endangered species.

“My concern is that this shows a possible willingness to land an LNG industry at the expense of British Columbians’ interests,” says Weaver. “Why would LNG terminals need the potential power to destroy documents or keep them confidential?”

Dr. Weaver will table and support several amendments to Bill 12 this afternoon when it is debated in committee stage. The purpose of the amendments is to protect public oversight of the LNG industry and to close the regulatory loopholes created by Bill C-43.

“Bill 12 opens us up to massive loopholes from federal conservative legislation. We should be amending this bill to close those loopholes and protect the interests of British Columbians.”

-30-

Attached: Bill C-43 and backgrounder by West Coast Environmental Law

Media Contact

Mat Wright

Press Secretary – Andrew Weaver MLA

Cell: 250 216 3382

Mat.wright@leg.bc.ca