Health

On the importance of protecting RDSPs from creditors

In the legislature today during Private Members statements Stephanie Cadieux, the MLA for Surrey South, and I had a productive exchange on the topic of Registered Disability Savings Plans.

Ms. Cadiuex spoke for five minutes discussing the history and emphasizing benefits of the RDSP program. I followed up on the importance of protecting RDSPs from creditors, an issue I first raised in Question Period on March 13, 2014, provided more context to on June 26, 2014 and culminated in my bringing forward private members bills on both March 15, 2016 and again on February 28, 2017.

I plan to reintroduce the bill again shortly and hope that it will be put on the order papers to be debated in the legislature.

Below I reproduce the video and text of the entire exchange.

Video of Exchange

Text of Exchange

S. Cadieux: On December 1, 2008, the late Jim Flaherty, the then-Minister of Finance for the federal government, did a remarkable thing — a forward-thinking, first-in-the-world thing. He responded to the advocacy originating from South Surrey from Al Etmansky and the Planned Lifetime Advocacy folks, and he introduced the registered disability savings plan, or RDSP.

The first of its kind in the world, this new tax-deferred savings vehicle was designed specifically to assist people with disabilities and their families for planning for the long term for financial security.

I won’t need to tell members of this House about the reality that people with disabilities have higher rates of poverty and unemployment than their temporarily able-bodied counterparts. I hope I don’t also need to educate this House on the reality that living with a disability can add significant costs and expenses not faced by those who don’t have a disability.

While there are many social programs designed and provided by governments to assist, some of those programs are only available to individuals whose sole source of income is government benefits. Another less-known reality is that there are far more people with disabilities that are not dependent on — or even eligible for — government benefits than those who are.

That’s why the RDSP vehicle is so important. An RDSP allows you to save money for the future without paying tax on the earnings. The federal government will contribute as much as $90,000 to an individual’s account. It’s estimated that 500,000 people across Canada are eligible for the benefit.

The future impacts of the RDSP go well beyond a simple planning tool. They provide a path for security, for choice — for individual choice.

So far, since first becoming available in 2008, over 100,000 RDSPs have been opened. I’d like to read for you the Plan Institute’s top ten list — the top ten reasons why people with disabilities or their carers should open an RDSP:

(1) You choose where to invest your money. All of the major Canadian banks are offering RDSPs.

(2) The government contributes generously. For every dollar saved, they will match up to $3.

(3) If you have a low income and can’t invest yourself, the government will still save for you.

(4) An RDSP will not affect your disability benefits.

(5) It’s an easy way to save for big items like mortgage down payments, home renovations or cars.

(6) There are no restrictions. You can spend the money on anything you choose.

(7) When you close an RDSP, your contributions and investments gained are yours.

(8) With savings tucked away, the future becomes yours to imagine.

(9) You become more powerful economically. Decision-makers need to take you more seriously.

(10) The whole world is watching. What happens here in Canada may determine the future of people with disabilities in other countries.

As of December 2015, the total value of RDSPs in B.C. is over $460 million. British Columbians have personally contributed $163 million to their RSDPs, leveraging an additional $297 million in federal grants and bonds. I know, with talking with financial advisers and having financial planning education myself, there’s no better deal out there. People have nothing to lose and so very, very much to gain.

In 2015, British Columbians held 18 percent of all RSPDs in Canada, yet made up only 14 percent of eligible Canadians. Currently, 12 percent of all people with disabilities under 50, or 22,500 people, in B.C. have an RDSP, higher than any other province, which is great. But another 60,000 people in this age group could benefit, and they should.

Like most financial products, the rules are complicated, but there are plenty of experts available to help. It doesn’t need to be overwhelming. People should not be afraid to ask for help. There is too much to gain, especially if you have a low or modest income.

As an example, also from the Plan RDSP website…. An individual with an annual net income of $26,000. If they contribute $900 per year, they will earn $2,300 in federal RDSP grants and another $1,000 in a bond every year. So over your lifetime, you could receive $250,966 from your RDSP by contributing $18,000 in contributions, garnering $20,000 in federal bonds, $46,000 in federal grants and $166,000 in earned interest at 3 percent a year.

Understanding that even coming up with an initial contribution could be a challenge for some people, there are grants available through the endowment 150, which offers eligible people with disabilities a one-time savings grant of $150 to help get their RDSP, or registered disability savings plan, started and growing.

There’s no better time than now. October is RDSP Awareness Month, and the government of British Columbia has been a leader across the country in supporting the efforts of the advocates and the federal government in ensuring that British Columbians were first and most apt to take up this challenge. B.C. was first to exempt the income and earnings from an RDSP from affecting disability benefits, and on so many fronts, B.C. has been leading the country when it comes to providing supports to people with disabilities and looking to find ways to ensure that people with disabilities can claim their economic position, as well, in our society.

I think it’s tremendous. There’s a tremendous amount of work that has gone on. The RDSP action group, made up of advocates and groups that support people with disabilities, is doing a tremendous job making sure that British Columbians with disabilities stay at the forefront of this program so that B.C. continues to have the biggest uptake of RDSPs in the country. But there are so many people that still haven’t taken advantage of this vehicle and should, because they only have everything to gain.

A. Weaver: Thank you to the member opposite for her compelling narrative about the importance of the registered disability savings plan.

Unlike some other provinces, the province of British Columbia does not actually protect RDSPs from creditors. It’s something that…. I think we could expand upon the leadership that British Columbia has shown. Twice over the last couple of years, I brought in a bill to ensure that RDSPs, like RESPs and RRSPs and RIFs are protected from creditors. In the case where, through no fault of their own, somebody who is relying upon an RDSP — once perhaps their parents pass away —can have that taken from them because it can be accessed by creditors.

Now, the reason why that occurs is nothing more than for historical reasons. The RDSP a relatively new tool and was predated before that by the RESP and the RRSP. While we have no problem in British Columbia and Canada, that’s why protecting RRSPs and RESPs in some provinces — certainly RRSPs and RIFs…. The RSDP is not protected. There’s a national organization, whose name slips me at this moment, who have been pushing for this provincewide. Some jurisdictions, like Alberta, are taking a proactive response here.

I completely agree with the member opposite about the importance of RDSPs, allowing people to put aside some resources in case they need to be accessed sometime in the future. Fundamentally, those resources should be used for the purposes that they’re used, and they should not be used in terms of creditors potentially having access to them.

The analogy with our RESPs is direct. A child may have an RESP. Through no fault of their own, they might get into financial difficulty. In B.C., RESPs are not protected either. What can happen, then, is creditors can go after those — go after those designed specifically for the education of a child down the road. In the case of a disability plan, it’s analogous.

As we move forward, in light of the presence of the new government here, I hope that we can actually work across party lines to build the support for RDSPs that we’ve just heard, in terms of why they’re so important, to build support from all parties to bring credit protection for those in British Columbia blessed to have an RDSP so that they are protected, not only for today but also for tomorrow. They’re there for a specific reason.

With that, I thank the member opposite for her comments. I agree wholeheartedly with her comments, and I hope that we can take that to the next level and protect RDSPs for present and future and generations.

S. Cadieux: Thank you to the member for Oak Bay–Gordon Head for his comments. There are probably, I would say, few things that we have been in agreement on in the recent days, and yet, like the member’s desire to see us work towards basic income pilots, which I agree with him on, and I certainly agree with him on the need to look to expand creditor protection for RDSPs. These are, in my mind, no-brainers, as we look to modernize and ensure that all of our citizens engage fully in their economic citizenship as well as their social citizenship.

The reality is that the RDSP is such a significant tool for long-term financial security. Someone saving $1,500 a year over 30 years could find their RDSP worth nearly half a million dollars. An RDSP allows you to save money for the future without paying tax on the earnings, and I can think of no other program where the federal government will contribute as much as $90,000 to an individual’s account.

It’s true for many people with disabilities, who rely on government benefits, saving even a small amount can be too challenging, but it doesn’t mean that you can’t have an RDSP and benefit from the tax-free savings vehicle and the government’s contributions and the compounding interest. And compounding interest is just a beautiful thing.

In fact, the reality is that this vehicle is extra beneficial, in that anyone can contribute to an individual’s RDSP. Family, friends, neighbours, charities, foundations and organizations can all contribute dollars to an individual’s RDSP. The federal government encourages these contributions by matching each dollar contributed with up to $3 depending on the RDSP owner’s annual income.

This is an opportunity for us, as elected members, to use our platforms — the platforms provided to us — to amplify the message, to use our voices and our collective non-partisan voices to do our best to ensure that people with disabilities in our communities are aware of the RDSP; and for those who need it, that they’re aware of the grants available through endowment 150.

In case there’s any doubt from members in this House who is eligible for an RDSP, it’s people who are eligible for the disability tax credit federally, who are under the age of 60 and who are Canadian residents with a social insurance number. So it’s relatively easy for a person with a disability to qualify.

If people have any questions at all, in October, 2014, the provincial government created the RDSP action group. Their goal is to maintain B.C.’s position as the province with the highest per-capita uptake of RDSPs. They have a toll-free hotline, step-by-step guides to help people plan and even a dedicated website.

This will truly be a step forward in the journey to full inclusion for financial security for people with disabilities. It’s now up to people with disabilities and their allies to take the fullest advantage.

Statement on new bargaining unit for paramedics & dispatchers

Last year I introduced Bill M217: Fire and Police Services Collective Bargaining Ammendment Act in order to include paramedics and emergency dispatchers in the existing Act.

As it stands, paramedics and emergency dispatchers are not considered an essential service. By including them in the collective bargaining act, we would eliminate labour disputes and the use of strikes or lockouts. The bill would give them the ability to resolve disputes through binding arbitration.

Earlier this year, and after consultation with paramedics and their union, I gave notice that I had intended to introduce a variant of the Bill. The bill would have given the Paramedics and Emergency dispatchers their own bargaining unit.

As part of our roll out strategy, we had prepared a letter that we planned to submit to the Minister of Labour today. The timing was designed to coincide with the Annual General Meeting of the paramedics union (CUPE Local 873). To our delight, the BC government proactively announced precisely this today.

There will be no need for me to introduce the Bill. Instead, our health critic, Sonia Furstenau, issued the Media Release reproduced below.

Media Statement

B.C. Greens statement on new bargaining unit for paramedics and dispatchers to improve patient care

For immediate release

October 23, 2017

VICTORIA, B.C. – Sonia Furstenau, B.C. Green Party spokesperson for the Ministry of Health, welcomed the government’s establishment of a new bargaining unit for paramedics and dispatchers.

“I applaud this move to give standalone bargaining to the paramedics and dispatchers working tirelessly to serve our communities,” said Furstenau.

“Paramedics and dispatchers provide an essential service on the front lines of responding to medical emergencies. Now more than ever, we are indebted to them as they have shouldered the additional weight of a horrific drug overdose crisis. This bargaining unit will enable paramedics and dispatchers to advocate for issues such as response times, serving rural and remote communities and the opioid crisis.

“I also thank my colleague, Andrew Weaver, for his diligent work advancing this file. Andrew introduced the First Responder’s Act in February and has advocating for the bargaining rights of paramedics and dispatchers ever since. I am proud this important B.C. Green initiative that will make a difference in the lives of British Columbians has been adopted by government.”

-30-

Media contact

Jillian Oliver, Press Secretary

+1 778-650-0597 | jillian.oliver@leg.bc.ca

My Budget Debate Response to the BC Budget Update 2017

Today in the legislature I rose to speak in support of the BC NDP budget that was tabled earlier this week. As we have yet to be given official party status (I understand legislation is forthcoming imminently), I only had 1/2 hour to respond. Once we receive official party status, as a designated speaker I would have had a full two hours.

As you can see from my speech below, I ran out of time. I could have taken up the full two hours as there was so much more I wanted to discuss about this historic budget issued by the NDP minority government.

Below I reproduce the text and video of my speech.

Text of Speech

A. Weaver: It gives me great pleasure to rise to speak to this budget, Budget 2017. Before I start, please let me acknowledge the years of service that the former Premier, Christy Clark, gave to the Legislature. It is not without great personal sacrifice that someone serves as Premier of our province, and for that, I would suggest all British Columbia should be thankful and honoured that she served in such a way.

Now, I recognize that I’m sitting on the other side of this Legislature here, but I wish the Speaker to know that I do remain in opposition, although we have come to an agreement, through the confidence and supply agreement, with the B.C. NDP to support a B.C. NDP–led minority government. Please let me offer some highlights as to how we got there and why I’m speaking in strong support of this particular budget.

In the last election, the B.C. Green Party ran by offering British Columbians a vision on which to build a growing economy in the 21st century. We ran on ensuring that the health and well-being of British Columbians was put first and foremost in decision-making. We ran on building a sustainable economy, and we ran on strengthening trust in the government. In essence, we ran on the slogan of “Change you can count on,” and I would argue it’s turned into change you can count on for a better B.C.

The platform we presented this past spring articulated our philosophy, our vision and the actions that we believed could enrich the lives of all British Columbians. We were enthusiastic about a innovative and sustainable private sector, and we know that the health and well-being of British Columbians is inextricably linked to the economy. We believe that government should ensure that people are not just a factor of production working for the economy, but rather that the economy is working for people. We recognize that life is getting harder for many British Columbians, and we believe there is another way forward — one where people enjoy economic security in the new and emerging gig economy, one where our province’s resources are managed sustainably and one where equity is a fundamental value of government that operates in the best interests of this generation and future generations.

The B.C. Green platform set out a bold plan to achieve this vision. It was grounded in economic security and sustainability in the full and truest sense, we would argue. It provided clear steps, based on evidence, to move us towards greater well-being for all British Columbians.

If we’re going to make B.C. a more prosperous place for all people, not just those who already it is prosperous for but all people, we need to eliminate the fear of income insecurity, which has debilitating impacts on people’s health and well-being. We need to take our role as stewards of the environment seriously. We need to reset the relationship between people and government and communities and government. And we need to embrace the new economy and take measures to ensure that we all share in the benefits and that no one is left behind.

This is what we ran on, but we didn’t form a majority government. The B.C. Liberals ran on a different platform. They did not form a majority government. The B.C. NDP ran on something different. They did not receive a majority government.

All parties presented different ideas that resonated with some people — not all people but some people — and some communities — not all communities but some communities. None of us, clearly, had the right mixture to encapture a majority of British Columbians. That was indicated in the election results.

Instead, we have before us a minority government, one that I truly believe has the potential to be far more than the sum of its parts if parties choose to work together. We have something to offer on behalf of all British Columbians that voted for each of our visions for this province. We have a lot of shared priorities, and as the throne speech that was produced in the summer shows, there’s a lot of commonality in these shared priorities.

As we saw today through the introduction of legislation in a private member’s motion, we see an emergence and an agreement in the general principles of eliminating big money in B.C. politics. I think there are lots of commonalities there that we can build upon.

No one party will have all the solutions, but together we might be able to represent our different constituencies and work toward good public policy if we truly want to put good public policies front and centre in our decision-making instead of partisanship.

I think this budget is actually a great example of starting that in the right direction. It includes initiatives from all three parties. It was built fundamentally on the foundation of the B.C. Liberals February budget, and it retains a number of the very positive aspects of that February budget, such as the $20 million in funding the Liberals had announced in February for 4,100 new childcare spaces. It also includes important NDP priorities, like the $291 million investment to build, and the $170 million additional investment to operate, 2,000 new modular housing units for the homeless. This is a good initiative.

It features, also, some B.C. Green–led initiatives, like the importance of the emerging economy, through the creation of an emerging economy task force and an innovation commission, and to recognition that it’s important to get politics out of minimum-wage price-setting and to create a fair wage commission, much akin to what exists in Australia, to make recommendations to government on the path towards setting minimum wage. So $15 by 2021 was the B.C. NDP platform. The B.C. Green platform was to actually put it to the fair wage commission and, also, to actually move towards the concept of basic income.

What we have in this confidence and supply agreement is a recognition that for the B.C. NDP, $15is an important number. I understand that. We understand that. But why by 2021? Why not perhaps consider other alternatives?

Why would, perhaps, an independent commission not explore options after engagement with stakeholders about, perhaps, a system whereby the minimum wage might actually be different in Metro Vancouver relative to, say, the region of Port Hardy? Just making two states up, but one might be more appropriate in Penticton — to have a minimum wage that’s slightly different from the minimum wage in Burnaby. This is something that we should let a fair wage commission explore, to make recommendations to government, the ultimate decision-maker.

I think this is a bold step forward that only would happen as we brought together and came together to share ideas. Working with the B.C. NDP over the past several months has been a meeting of these ideas, I would argue, and going forward, I hope that the B.C. Liberals also share this importance, too, particularly in light of the fact….

I’ll come to that. I see the member for Prince George–Valemount look at me oddly. I would like to recognize that this did work as well. The Prince George–Valemount member knows full well that I thoroughly respected working with her, and continue to do so, on issues there. I think we have a lot of commonalities here.

But what we have to do…. We have an election coming up — sorry, not an election, a referendum. With respect to my colleagues on this side of the House, that was clearly a slip.

Interjections.

A. Weaver: Well, we do have a by-election coming up. The members opposite got very, very excited, hon. Speaker, over that slip-up.

We have a referendum coming up on the issue of proportional representation. Now, I understand that there’s a diversity in views in this House. There’s a diversity of views in the general public. But wouldn’t it be fascinating to show this province that a minority government can work by building on the good ideas from all political parties in the lead-up to a referendum on proportional representation?

I’d like to look a little bit further at some of the budget highlights, just to bring a focus on some specifics that I would like to applaud and some that I will say we don’t agree with. The budget provisions for education, child care, affordable housing and essential services are long overdue.

Now, I recognize, in speaking with members opposite and in listening to the throne speech, that the B.C. Liberal caucus heard that message loud and clear and came to us in the summer with the revised version of what we had expected to hear in a throne speech. They heard that from the people of British Columbia, particularly the people of the Metro Vancouver region, which is hurting because of the affordability issue. Those on the government side have also heard that and need to pay heed to the concerns of those in Metro Vancouver suffering under the issue of affordability.

I’m also delighted to see the implementation of a pathway towards the elimination of MSP. This has been an initiative we’ve been championing in the B.C. Green caucus — well, the caucus was really small up until now — for the last number of years. The first approach, using the B.C. Liberal budget of February, was to cut them by half this year. Something we can all get behind. It was in the B.C. Liberal budget. The B.C. NDP have agreed to it. We support it.

If we believe that we want to work on our commonalities and build upon that which we agree upon, the disagreements, of which there are some, are considered minor. I’ll continue with this to show how the CAS agreement came to be.

I’ll be straight up honest. After four years in opposition…. It was tough times going there, with the rest of the opposition. After an election campaign that I would describe as quite ugly and personal to me by the government now, I didn’t think it would be very easy for me to see a way that we could come together. I did not see that, but since the face-to-face meetings with the Finance Minister and the Premier, I’ve seen just how much we share in terms of our commonality, our vision and how we want to put good public policy and people first.

I will say that the working relationship that the small B.C. Green caucus has with the existing government has been nothing short of exceptional. For that, we are very, very grateful.

I’d like to go on and talk about a few more budget highlights that I think are important. I am a big fan of living within your means. I applaud the B.C. Liberals’ fiscal prudence in terms of producing balanced budgets. Now, I recognize that there’s some question as to how the budget was balanced in terms of priorities being made — increasing rate hikes versus personal tax rates, for example. But the fiscal prudence that was brought to British Columbia is something that I’m hoping — and we see in this budget — will be preserved under the present government, where a surplus budget to the tune of $246 million is projected for March 31, 2018, with a $300 million contingency built in as well.

The budget also plans to increase wealthy corporations and polluters, while providing more money for homelessness, rental housing and the overdose crisis. Now, I recognize the manifesto from the member for Chilliwack-Kent, the manifesto for the new leader of the B.C. Liberal Party, actually asks about a pathway to eliminate corporate income taxes. Frankly, I think this neo-liberal approach — if tax, then bad — has had its day. We saw that federally, where the federal Liberals won a strong majority, which no one expected, because they recognized that this neo-liberal approach — if corporation, then right; if tax, then wrong — has actually led to an income disparity between those who have and those who haven’t, which is not a healthy situation for any society to be in.

We see in this budget steps taken to start to mitigate that. Moving from 11 to 12 percent in a corporate income tax rate is not something that’s going to create a big upset in corporate Canada. We heard some threats and fearmongering on the opposite side. I know many, many CEOs in many corporations in Canada. To be quite frank, we’re one of the lowest — 11 to 12 percent. They want to pay their share. If they pay their share…. They’re concerned that government uses their money in a manner that’s fiscally prudent. They want to have a stable environment. It’s not healthy for anybody when you have a homeless situation in Vancouver. It’s not helpful for anyone when there’s ongoing tension between Indigenous rights and title, local communities and corporations. Nothing gets done.

It’s critical that you start to value people, build from the bottom up to develop a society that, actually, corporations want to be part of, and we see that emerging in this budget through the creation of things like the innovation commission, the emerging economy task force and so forth.

You know, one of the things in the budget that we are grateful to see is the commitment to develop a pilot project on basic income. This is critical as we move towards the gig economy, where the “One job, one life” idea of yesteryear becomes more and more precarious. People have more and more jobs in their lifetime with gaps in between, and the concept of basic income — one which would eliminate student debt, for example, one which eliminates the need for some programs down the road — is one that was experimented on in Dauphin, Manitoba in the 1970s and one which was shown to eliminate poverty in Dauphin, Manitoba.

So we look to the poverty reduction plan being put forward during the coming months as a means and ways of identifying a pathway to the implementation of a basic income pilot project, and that’s a really exciting opportunity in British Columbia.

To the child care plan. The B.C. NDP campaigned on the $10-a-day child care plan. We campaigned on a zero-dollar-a day child care plan, with a change in the taxation system, together with 25 hours of early childhood education, which we know is the single most important in terms of dollar-per-result investment that you can make in a society for education — in those critical years, where the payback is being shown through research to be profound.

That doesn’t mean that these disagreements between the two platforms are anything other than semantics. Why $10 a day? Well, it was because an advocacy group that spent a lot of time doing a lot of research came up with a plan of $10 a day. But you could make…. The number 10 — there’s nothing wedded to it. Zero a day, $10 a day, $15 a day. Why not means-test it? Would the CEO of a major corporation earning half a million dollars a year really need access to a child care system that’s free? I think their ability to pay should predetermine the amount that they actually get.

In our system, what we had approached is we had ensured that there was going to be no…. Money was not a barrier to access. Right now, if you access child care, you pay up front, and at the end of the year you file your income tax return and you get a child care tax credit. That’s great. But that means that you have to still pay up front, and for those struggling with affordability, that ability to pay up front is a barrier, which is why what we suggested is that you wouldn’t pay up front. It would be zero up front. And at the end of the year, if you so choose to take advantage of this universal daycare program and you earned over $80,000 a year, it would be viewed as a taxable benefit. So if you could pay, you would pay, as opposed to not being able to access the system because of your inability to make your monthly rent.

Now, the economists involved in the development of the $10-a-day child care plan told us our plan was better. So why wouldn’t we actually want to sit and negotiate and talk with stakeholders and, in particular, the civil service, the civil service that this government has promised to reinvigorate, to listen to all of the ideas that are brought to the table to ensure that we build upon our shared values of the importance of universal daycare, universal child care, and that we find the most efficient, effective ways of doing that, where those who advocated on behalf of the $10-a-day program have their voice? But they’re not the only voice at the table. There are other voices as well. And I’m excited that this will move forward.

As we move into these discussions, we know that the B.C. NDP will bring their $10-a-day child care program to the table. We’ll bring our refined zero dollars to the table. And we’ll discuss, hopefully with input from B.C. Liberals as well, as to how we can make this right, because we have the same shared value.

That’s how good public policy is formulated. Good public policy is not taken from third-party advocacy groups and determined to be the policy. It’s by using and engaging and tasking the civil service to reflect upon the complex issues that are involved in the development of good public policy and consulting with stakeholders and using their input to provide evidence and support for their development.

We see, today, a good example in question period, where I pointed out that the minister now walking in was quite firm in electioneering that we would do this right away. But it’s much more complex than that, because there are jurisdictional issues. There are legal issues. There are time frame issues. It’s a lot more difficult to implement good public policy if you’ve promised the world out here. When you get in, it’s pretty important that you get it right.

That’s what we see our role here is, as a minority government. It’s that we have shared values that will ensure that the fundamental principles will be supported, but we’re there as a check, to work together to ensure that other views also get listened to. Frankly, it’s working very well so far.

Here’s an example. One, it’s not “no surprises”, but…. We have in the agreement “no surprises” and best practices. If there was a surprise — it wasn’t really a surprise — it was a pleasant one.

In our election campaign, we campaigned on injecting $4 billion over four years into the public education system to ensure that those children in their early years had accesses to the services that they require in those critical formative years, those years where, over the last 16 years, cuts have been targeted — through the child psychologists, through the speech pathologists, for the in-class help for those children with special or alternate needs. That’s where the cuts have been.

We know that if we invest — what’s important is, I’m reiterating the word “invest” — in the support for our children in these critical years, we save. We get a return. We get a return when they age out and enter society, because we’re not having to pay for the social systems, the social crises, the things that we’re dealing with now because we provided them services when they were young. It’s an investment with a rate of return that is difficult to quantify in me talking right now, but it is one that we know pays off based on cumulative evidence over many, many years.

Why I was pleased was that I saw, in the B.C. NDP platform, they had a little bit… They had quite a lot, actually, for rebuilding schools but very little, apart from adult basic education — something like $30 million for increased funding for the K to 12 system — in the classroom, apart from that which was prescribed by the Supreme Court, which they agreed to implement, as, of course, we did.

To see this injection of new money into the education system precisely in the years when it’s needed is absolutely refreshing, in my view, and long overdue. We’re so grateful to see that there.

Let’s take a look. It was $681 million, actually. In fact, $521 million of that — $521 million — was to provide for improved classroom supports for children, in addition to the capital funding which was there.

Interjection.

A. Weaver: The former Minister of Education claims that that was in his budget — that $681 million.

Interjection.

A. Weaver: If it was in your budget, I would like to give you credit for that, too, and I’d like to give the NDP credit for actually continuing forward with that. Our top priority has always been public education.

Interjections.

A. Weaver: They’re high-fiving across the floor. Isn’t this a wonderful Legislature that we have here today?

Interjection.

A. Weaver: We’re not in a coalition.

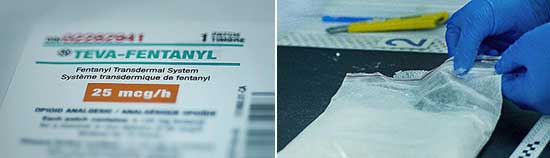

Let’s come to the fentanyl crisis. Now, the fentanyl crisis is another example of where we support the funding going in — $322 million dedicated to a comprehensive response, $265 million for the Ministry of Health, $32 million to increase police resources and address pressures at the B.C. Coroners Service and $25 million to establish a Ministry of Mental Health and Addictions.

Some of this, I recognize, was in the existing budget, but not the Ministry of Mental Health and Addictions until we had the throne speech in the summer, where things changed with the B.C. Liberals. You know, dealing with the fentanyl crisis and this cost pressure here is something we’d like to see go to zero dollars.

The reason why, over what we’re doing, is that we’re dealing with a crisis management point of view, but we haven’t been thinking over recent years about two aspects of mental health and addictions. One is the issue of prevention, and two, is the issue of recovery. And within our negotiations and discussions, it was so very refreshing to see shared values and shared interest in actually supporting investment in prevention and recovery, with the hope that the investment in harm reduction is not needed down the road.

We’re dealing with harm reduction. I would argue we’re dealing with harm reduction costs today because of cuts to our K-to-12 system yesterday, where children did not have the resources they needed at critical junctures. Cuts to our social services and MCFD, because the children did not have the resources they needed when they were young. Cuts to first responders and others. Cuts to prevention. Cuts to recovery programs.

These cuts have created a crisis on our streets, which we’re now paying for in other means. So my dream would be to see this budget item, this budget item of $322 million through a comprehensive response, go to zero over the course of four years. Because we don’t want to be responding to a crisis. We want to be preventing it in the first place. And we want those in the crisis now to have a pathway to get out of that crisis. And for that, I’m quite pleased with the discussions and the direction that this government is heading.

Housing. Again, another good example: $208 million over four years; 1,700 units of affordable rental housing; 291 over two years…. And over $170 million to operate the 2,000 lodging or housing units.

More importantly — well, maybe not more importantly. Also importantly, is the $7 million for the residential tenancy branch to deal with the backlog of issues that are arising in that office. I don’t know how many constituents have come to my office with complaint after complaint after complaint about issues arising from either access to the residential tenancy branch or unfair decisions in terms of landlords who rent on yearly contracts and have outrageous requirements for taking those forward. This is another good investment that we strongly support.

As I said here, one of our goals, we believe, is coming back to the issue that nobody won a majority government. Therefore, we must we must build upon our shared values to find commonalities to move forward.

I was pleased not to see the $400 per renter investment. And why I’d say that is there’s a shared value here. We share the values with government about the importance of affordability for renting. We would agree on an investment of $200 million, which is about what it would cost to do that. But I would argue, and the B.C. Green caucus would argue, that perhaps that is not the most effective way of dealing with the problem.

The problem is affordability. A $200 million distribution of cash with a bureaucratic overhead to administrate it, I would argue, is not effective. It’s akin to printing money, to the Bank of Canada saying: “We need people to have more money, so let’s print some more money.” The immediate response in economic terms is inflationary pressure, which causes inflation to go up, so you need to print more money. It’s not too dissimilar from what would happen by just giving out money for rent. As landlords suddenly realize that renters have more access to capital to pay the rent….In a zero percent rental rate market, all that happens is rents go up another $400.

So we have to be very, very careful how we incentivize money distribution that way.

I was disappointed to not see the elimination of the encouragement that the B.C. Liberals gave for people to irresponsibly take on more debt than they were actually able to fund, through this outrageous loan program that allowed for a zero percent interest loan to encourage people to burden themselves with more debt than they could afford. But hopefully, down the road this may or may not be removed.

Increasing the individual income tax rate for those earning $150,000, from 16.8 percent 14.7 percent, while bemoaned by those opposite and while certainly not consistent with the manifesto, the 65 items in the manifesto, from the member from Chilliwack Kent for the next Liberal leader, it’s exactly what people want to pay.

I have talked to person after person after person in my riding and across British Columbia. British Columbians don’t mind paying taxes.

The neoliberal view of “no taxes is good” is dated. They want to ensure that government uses their money wisely, which is why I found it very, very, very rich for this government to talk about their economic stewardship.

They’ve been very, very good at branding the B.C. NDP as irresponsible fiscal managers. They’ve been saying the same thing, and people on the street think this. But when you look a little more carefully at their fiscal management, you’ve got to ask a few pointed questions.

Site C dam. Why are you using taxpayer money to subsidize industry? Their view of good economic growth is using taxpayer money to subsidize corporate ventures. How is that free market? That’s picking winners and losers in the market.

Picking winners and losers — they picked the LNG. What a big mistake that was: 100,000 jobs, $1 trillion increase to GDP, $100 billion prosperity fund. That’s the winner they picked, and they went all in to do it. People were encouraged to build hotels in Terrace that are empty. They were encouraged to renovate their homes in Kitimat because of this influx of new employees.

With that, hon. Speaker, I do thank you. The only thing I wish in conclusion is that we had official party status already, because I could have talked for at least another hour and a half on this.

Video of Speech

Statement on International Overdose Awareness Day

Statement on International Overdose Awareness Day

For immediate release

August 31, 2017

Victoria – Andrew Weaver, Leader of the B.C. Green caucus and MLA for Oak Bay-Gordon Head, and Sonia Furstenau, MLA for Cowichan Valley, have issued the following statement to mark International Overdose Awareness Day:

“Today marks International Overdose Awareness Day, a global event held to raise awareness of overdose, reduce the stigma, and acknowledge the personal responsibility we all have to support our community members in need,” said MLA Weaver.

“One life lost is heartbreaking; the scale of this emergency can hardly be articulated in a way that respects and represents the grief felt around B.C.

“Fentanyl-related overdoses are happening all over the province and our ridings are no exception. The reach and magnitude of this crisis has been tragic. The fact that it has only continued to escalate since the B.C. Ministry of Health declared it a public health emergency over a year ago is horrific in its own right.”

MLA Furstenau continued, “We remember all those who have lost their lives to this epidemic and stand with the families, friends, and loved ones who mourn their loss.

“We must use compassion and understanding in approaching this issue. We must reduce the stigma and shame too often associated with addiction. Addiction is a health issue and must be treated as such.

“Today, we reaffirm our commitment to people struggling with addiction, the families and friends of drug-dependent loved ones, frontline workers, and the medical community. In our public and private lives, we commit to listening to you, learning from you, and doing everything we can to build a path out of this crisis.”

-30-

Media contact

Sarah Miller, Acting Press Secretary

+1 250-858-9891 | sarah.miller@leg.bc.ca

Probing the ability of British Columbians to trust the current BC Government

Today in the legislature I was up during question period. I took the opportunity to ask the government how they could be trusted in light of the fact that they did an about face in the throne speech. During the election campaign, the BC Liberals claimed that our platform was unaffordable. Yet now, the throne speech reads just like our platform!

Below I reproduce the text and video of my question period exchange.

Video of Exchange

Question

A. Weaver: February’s business-as-usual budget contained little, if anything, for childcare, education, affordability, those in need of social assistance or the fentanyl crisis. During the election campaign, the Minister of Finance told the Vancouver Sun: “We have resisted consistently the temptation to go out and make all these pledges and promises.” He argued that they would be unaffordable.

The Minister of Finance further argued this. He said: “The decision to forgo all toll revenues, in the way the NDP announced, will guarantee a credit downgrade.” Now we’re told that there’s $1 billion to spend on early childhood education. There’s money to increase social assistance rates, to invest in parks and to address the fentanyl crisis, and so on and so on. This can only be described as a rather dramatic change of heart.

My question to the Minister of Finance is this: how do you explain to British Columbians that you suddenly found over a billion dollars in the last couple of weeks to fund programs and initiatives that have been dismissed and starved of resources for years, and that this has only happened in the last couple of weeks?

Answer

Hon. M. de Jong: Thanks to the leader of the Third Party. Oops, can’t say that, can I? He voted against that, didn’t he?

Actually, I do appreciate the question, because the answer is pretty straightforward. The economy that was already leading the country, the economy that was already producing more jobs than anywhere else — in British Columbia — the economy that was already, in February, providing more opportunities to more families than anywhere else in Canada has actually gotten better.

I know the hon. member has made the decision to link hands with the official opposition, a party that in past opportunities, used to play a little trick called injecting fiscal optimism into their budgets. We didn’t do that. We didn’t have to do that, because the economy in British Columbia continues to lead Canada.

Supplementary Question

Mr. Speaker: The member has a supplemental.

A. Weaver: Yes, I understand why the economy is booming in British Columbia now. It’s in anticipation of the great stuff that will be coming forward in the next few weeks. Investment is coming to B.C. like never before.

Interjections.

Mr. Speaker: Members, the Chair will hear the question.

A. Weaver: Thank you, hon. Speaker.

Investors are lining up a mile deep to invest in B.C. in anticipation of a kinder, gentler province that will soon be put forward.

Last week, the Vancouver Sun noted that the Premier offered no apologies for dramatically flip-flopping on so many positions from the election. She said she hopes the NDP and the Green MLAs — oops, that’s the third-party MLAs — would feel embarrassed to vote against their own ideas, now embraced by the B.C. Liberals.

My question to the Deputy Premier is this. How can British Columbians trust a government that just wants to embarrass the opposition and holds one set of priorities during the election campaign and another set of priorities immediately following the campaign? And what guarantee do we have that if the B.C. Liberals gain the confidence of this House, those priorities won’t flip-flop and change yet again?

Answer

Hon. M. de Jong: I should provide the hon. member with the technical answer to the question he asked about the dramatic improvement in both economic performance and in the revenues that flow from that. It relates to the reliance that we place on the independent Economic Forecast Council, which for both ’16-’17 and ’17-’18 have adjusted their estimates and their forecasts by over an entire percentage point for the growth in our economy. That is dramatic. It is certainly providing government with more revenues, and the member will see the specifics of that in the days ahead when the results for ’16-’17 are presented.

British Columbia is performing at a remarkable level right now. I know there are members sitting opposite who are salivating at the prospect and — who knows? — may get that opportunity. Were they to get the keys to this car, let there be no doubt that the tank is full, the engine is running on all cylinders and British Columbians are enjoying the benefits of the strongest economy in Canada.