Health

Amyotrophic Lateral Sclerosis and the ALS Society of BC

Today was my turn to read a member’s statement in the house. I took the opportunity to highlight the impressive work being done by the ALS Society of B.C. to promote ALS awareness, treatment and research.

There are somewhere between 2500 and 3000 Canadians presently afflicted by ALS. More generally, ALS strikes about 2 per 100,000 people each year. My first experience with ALS was while I was a graduate student at Cambridge University. When leaving a class I literally stumbled into and then onto Stephen Hawking who was being brought in to give a lecture by one of his graduate students. The father of one of my son’s friends has ALS and the father of one my son’s teachers also had ALS.

My Statement

Amyotrophic Lateral Sclerosis or ALS is a debilitating, progressive neurological disease that leads to the death of neurons that control voluntary muscles. Each of us in this chamber probably knows of at least one person who has struggled with this disease. In my case, it’s three.

Honourable Speaker, 2014 was a very busy year for the ALS Society of B.C.

Prior to last year’s Ice Bucket Challenge (which I had the distinct honour of participating in), the society found it challenging to raise awareness about ALS. They found it challenging to attract the type of funding required to advance ALS research. These challenges were literally ‘washed away’ temporarily in August last year. And a new era of hope has begun.

Three years ago the Society established a five-year goal to raise an additional $2 million for ALS research.

Remarkably, by itself, the 2014 Ice Bucket Challenge raised nearly that amount through the generosity of British Columbians. And the ALS Society of B.C. directed 100% of this windfall to ALS research. As a result, five new research grants have already been awarded in Canada, including one to Dr. Charles Krieger at Simon Fraser University for his studies concerning the use of bone marrow cells to deliver single chain antibodies in ALS.

In British Columbia, we are extremely fortunate to have some of the best ALS specialists in the world caring for patients at the GF Strong Rehabilitation Centre. The Province’s continued partnership with the Centre is crucial to providing the best quality of care service.

On August 6th, members of the International Alliance of ALS/ Motor Neurone Disease (MND) Associations will be staging events around the world to report back on how the funds from the Ice Bucket Challenge have been invested.

However, it is important to note that despite this recent fundraising success, ALS is still not a treatable disease. More patients are being diagnosed daily, and the cost of equipment and critical services increase every year. Until there is a cure, we cannot afford to let up.

Honourable speaker, June is ALS awareness month. There will be many events taking place across BC during this month. And if you’re looking for information, it can be found at the ALS BC website: www.alsbc.ca .

Video

Asking the Select Standing Committee on Health to Examine MSP Premiums

In January of this year I wrote about the importance of transforming our regressive approach to funding health care via flat-rate MSP premiums to a more progressive approach like that in place in Ontario. A month later I tabled a petition in the legislature of 6,662 British Columbians who agreed and then, during question period, I asked the Minister of Finance if the government would empower the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged in British Columbia. In his response, the Minister noted that he believed that the mandate of the committee was sufficiently broad for “members of the committee, and those that they might invite in, to have the kind of conversation that the member is alluding to”. He further offered “and it will be interesting to see what results from that conversation.”

On April 13th I followed up by formally writing to the Chair of the Select Standing Committee and asking two specific questions regarding the possibility of initiating a conversation with respect to the funding of MSP in British Columbia. Below is the text of my letter. I await a response.

Letter to the Select Standing Committee on Health

April 13th, 2015

Mrs. Linda Larson, MLA and Chair

Select Standing Committee on Health

Room 224, Parliament Buildings

Victoria, British Columbia

V8V 1X4

Dear Mrs. Larson,

I am writing to you with respect to the question that I raised during question period earlier this session concerning Medical Services Plan (MSP) premiums. Minister de Jong’s response suggested that this Select Standing Committee on Health’s mandate could include a discussion regarding how MSP Premiums are collected.

Every month single British Columbians earning over $30,000 pay $72 in MSP premiums. This health insurance plan plays an important role, providing funding for medically required services, however in the last fifteen years fees have doubled. Furthermore the cost remains the same whether someone makes $30,000 or $300,000 a year. British Columbia’s regressive approach to collecting MSP Premiums unfairly burdens those least able to bear it and increases pressure on small business owners.

I believe that it’s time for B.C. to replace MSP premiums with a more progressive and equitable approach to funding our health care system. Overhauling our current, regressive approach would be a positive step in addressing poverty and income inequality, and ensuring a sustainable health care system for now, and future generations.

With this in mind I stood in the house and asked the Finance Minister to expand the Select Standing Committee on Health’s terms of reference to allow for the committee to examine more progressive and more innovative ways of charging MSP Premiums. He responded,

“I think the power exists now. I think the committee, charged as it is to ‘examine the projected impact on the provincial health care system of demographic trends to the year 2036 on a sustainable health care system for British Columbians’ […] I think that’s probably sufficiently broad for members of the committee, and those that they might invite in, to have the kind of conversation that the member is alluding to, and it will be interesting to see what results from that conversation.”

He pointed to two specific sections of the terms of reference. The committee has been empowered to:

Outline potential alternative strategies to mitigate the impact of the significant cost drivers identified in the Report on the sustainability and improvement of the provincial health care system;

Consider health capital funding options.

I recognize that the committee has already begun reviewing submissions regarding rural health, addiction recovery, integrated teams and end of life care. I also recognize that the committee has decided to first look at the submissions it has received, in fairness to those who have given them. Going forward I have the following questions for the committee:

- The Select Standing Committee on Health has been given the task of examining the projected impact on the provincial health care system of demographic trends on a sustainable health care system for British Columbians. Their terms of reference came from the Finance Minister who has stated that, in his opinion, they are sufficiently broad for members of the discuss MSP Premiums. This regressive tax generates 2.3 billion dollars in government revenue, comparable to corporate income taxes. This tax can be charged in a more equitable fashion. I believe this is a conversation that British Columbians deserve and that this committee is an appropriate venue. Will the Select Standing Committee on Health agree to include MSP Premiums as part of their next discussion and call for submissions?

- When first given this new mandate the committee was given the option to consider both the original and the new mandates, concurrently. This option is still available. The committee can begin discussing their new terms of reference without taking away from the submissions review. This would allow for more clarity and could allow the committee to begin a new call for submissions while still reviewing those they have already received. I recognize that proper deliberation requires time and should not be rushed. With this in mind would the committee be open to discussing their expanded terms of reference at the same time as they review their current submissions?

I look forward to the committee’s response and thank the members for their time.

Sincerely,

Andrew Weaver

MLA Oak Bay-Gordon Head

Cc: Judy Darcy, Deputy Chair

Moving Forward with MSP Premium Reforms

On Monday, February 23 2015, I tabled the BC Green Party petition of 6,662 British Columbians calling on the government to replace the regressive MSP premium poll tax with a more fair and equitable option to fund health care services in British Columbia.

Today in the legislature I was up during Question Period. I used this opportunity to question government on the possibility of empowering the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged in British Columbia?

As you will see from the exchange below, I was pleasantly surprised by the answer that I received. My response to the Minister’s use of a quote from Tommy Douglas is that Quebec and Ontario bring Health Care Premiums into their progressive income tax system as a line item that shows people what they are paying.

QUESTION

A. Weaver: In early January the good health committee at the Monterey seniors’ centre invited me to a conversation on health care. Collectively, these seniors were profoundly concerned about the impact that our regressive approach of charging flat-rate MSP premiums was having on their ability to make ends meet. And this is in the rather affluent riding of Oak Bay–Gordon Head.

Since raising this issue last month, I have heard from thousands of British Columbians who agree with me that it’s time to replace MSP premiums with a fair and equitable option. Fortunately, just yesterday the Government House Leader activated the Select Standing Committee on Health, a committee that could be empowered to examine this issue.

My question to the Minister of Finance is this: will he empower the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged in British Columbia?

RESPONSE

Hon. M. de Jong: Thanks to the member for the question. There will, through the estimates process, be an opportunity to discuss the question of the amount we collect and some of the relief that exists for almost a million British Columbians from paying full premiums. The member’s question is more specific, and that is whether or not this is a legitimate or appropriate topic for discussion by the committee.

I took the liberty of quickly checking the terms of reference. I think the power exists now. I think the committee, charged as it is to examine the projected impact of the provincial health care system on demographic trends to the year 2036 on a sustainable health care system for British Columbians…. Similarly, the motion that was before the House just a few days ago asked the committee to “outline potential alternative strategies to mitigate the impact of the significant cost drivers” identified in the original report and “consider health capital funding options.”

I think that’s probably sufficiently broad for members of the committee, and those that they might invite in, to have the kind of conversation that the member is alluding to, and it will be interesting to see what results from that conversation.

SUPPLEMENTARY QUESTION

A. Weaver: I must admit I was not expecting that answer. I am pleasantly surprised, and I’m thrilled that the committee will, I hope, seek and explore means and ways of funding the MSP premium more progressively.

The reason why I’m asking this is that the time is right. The Maximus contract was renewed in 2013. I recognize there was a five-year renewable clause in it. Now is the time to work with Maximus to find new ways of not only saving government money — because this is about efficiency as much as it is about delivering services to people who can afford it, with means and ways that allow them to have these services affordably — but it’s about making it fair. It’s about bringing the revenue generation into the income tax system.

So my question to the minister is this. Will the minister consider, as every other province in the country does, bringing in our funding to MSP premiums through the income tax system, whether it be as a line item or as part of general revenues, to avoid the unnecessary bureaucracy associated with chasing after people who have recently lost their jobs and are being charged premiums based on last year’s income tax rate, chasing people who didn’t know they actually had to pay premiums because they are living abroad and so on? Will the minister consider this approach of using our income tax system for actually raising these premiums?

RESPONSE

Hon. M. de Jong: Two things come to mind. I don’t want to prejudge or presuppose what the committee might present in terms of thoughts or recommendations on this. I confess to a certain bias, and that runs counter to the suggestion that the member has offered about eliminating a very specific charge, tax levy, in favour of general taxation provisions.

If the committee is going to have the conversation…. I ran across this in anticipation of some of the conversations, and I wonder if I can share it with the House. It’s from a former Member of Parliament from B.C., an NDP Member of Parliament, who said this:

“I want to say that I think there is value in having every family and every individual make some individual contribution. I think it has psychological value. I think it keeps the public aware of the cost and gives the people a sense of personal responsibility.

I would say to members of this House that even if we could finance the plan without a per capita tax, I personally would strongly advise against it. I would like it to be a nominal tax, but I think there is psychological value in people paying something for their cards.“

That wasn’t just any Member of Parliament. Before he was a Member of Parliament he was the Premier of Saskatchewan. That was Tommy Douglas in 1961, addressing a special session that created.

I hope the committee will be mindful of all of these ideas as it considers these matters.

Following Question Period, we issued a media release on the exchange. It is reproduced below.

Media Release

Media Statement: February 26, 2015

Health Committee Empowered to Examine MSP Premium Reform

For Immediate Release

Victoria B.C. – Today, in response to a question from Andrew Weaver, MLA for Oak Bay-Gordon Head and Deputy Leader of the B.C. Green Party, the Government House Leader and Minister of Finance agreed that the Select Standing Committee on Health would have the power to examine progressive ways of financing the Medical Services Plan and report on its findings.

“There are clear, progressive alternatives to MSP premiums that would be efficient, cost effective and affordable,” said Andrew Weaver. “I was pleasantly surprised that the Minister agreed that part of the Committees mandate could be to examine these alternatives.”

Currently, British Columbia is the only province in Canada charging a separate, flat-rate fee for medical premiums. The MSP rate is rising under the 2015 Budget by 4% – from $72 to $75 per month for individuals and from $130.50 to $136 for families. The same fee applies to anyone, whether they earn $30,000 or $3,000,000 in a year.

In contrast, both Ontario and Quebec made medical premiums a line item in their personal income tax return. By doing so, they maintained an essential revenue source for health care while reducing the burden on low and fixed income individuals.

MSP premiums are forecast to bring in nearly $2.3 billion in the 2014/15 fiscal year approaching the amount of revenue that is accrued from corporate income taxes. Reforming how this revenue is collected by, for instance, making MSP a line-item in the annual personal income tax return, would turn this regressive tax into one that is fairly applied based on income, while saving costs associated with administration and non-payment collection.

“I understand that the government has concerns about how changes to this tax would affect their financial objectives,” said Andrew Weaver. “Empowering one of our standing committees allows these objectives to be preserved, while also exploring how MSP Premiums can be made to be more affordable for British Columbians. I look forward to presenting practical alternatives to this committee and working with them to bring reform to the way MSP Premiums are charged in our Province.”

-30-

Media Contact

Mat Wright – Press Secretary, Andrew Weaver MLA

Mat.Wright@leg.bc.ca

Cell: 1 250 216 3382

Presenting a Hopeful Vision for British Columbia

Today in the legislature I offered a new vision for British Columbia in my response to the Speech from the Throne.

It is clear from the Throne Speech and the NDP’s amendment, that we are lacking leadership and vision in the legislature. We have a government completely out of ideas and an Official Opposition that is more focused on pointing out the government’s failures than offering viable solutions.

In my speech, I laid out my vision for a diversified, sustainable, 21st century economy, in contrast to the Liberal government’s preoccupation with the elusive LNG industry. In offering my vision, I highlighted the importance of prioritizing affordability, health care, education and environmental regulation.

I presented evidence-based options to improve MSP, advance the cleantech and other sectors, bolster environmental regulation, and help B.C. teachers. I offered my ideas as a first step towards solving a large number of the province’s growing challenges.

In my view it is disrespectful to deliver a Speech from the Throne to British Columbians completely void of ideas when so many people are struggling to get by and when so many solutions exist. At the same time, opposition has to be more than standing on the sidelines and lobbing dirt at the government. I hope the ideas that I put forward can assist us move towards developing lasting solutions to the problems and challenges facing British Columbians.

Below is the text of my speech. I welcome your comments and ideas.

Preamble

Honourable speaker, last week as I sat through the throne speech it became apparent to me that this government is now without a vision, at a loss for new ideas and completely struggling for a new direction. Their promise of wealth and prosperity for one and all through an LNG message of hope wrapped in hyperbole has not materialized.

Honourable speaker, last year at this time, during the speech from the throne to open the 2nd session of this parliament, the government mentioned LNG ten times. LNG was mentioned only eight times in last fall’s throne speech and now, at the opening of the 4th session, we only find passing reference to LNG five times.

But here’s what’s different Honourable Speaker. In those two previous speeches the word ‘diverse’ was not used a single time. Now, as the government attempts to downplay their irresponsible LNG promises they’ve introduced reference to a diverse economy, sectors or resources eight times!

Honourable speaker, you will recall that for two years now I have been saying the same thing. The economics did not and still does not support the government’s reckless LNG promises in a market oversupplied with natural gas and in a jurisdiction that is years behind others in terms of developing an LNG industry. I’ve stood alone in this house repeatedly attempting to steer the government on a more sustainable path.

Last fall, I went so far as to propose an amendment to the throne speech by including the words:

And that the Legislative Assembly of British Columbia accepts the responsibility of demonstrating the leadership to choose growth, to move forward and create a legacy for our children, but also recognizes that this leadership means not gambling our future prosperity on a hypothetical windfall from LNG, and instead supports the development of a diversified, sustainable, 21st century economy.

In light of the new direction this government is struggling to find, I find it profoundly ironic that they voted against my amendment. What’s even more remarkable is so did the official opposition.

Today, in this chamber, I will offer British Columbians an alternate vision for the future of British Columbia — A vision that is grounded in evidence and at all times puts the interests of British Columbians first.

Introduction

It has been nearly two years since I decided to run for office.

When I made that decision, I did so because I saw an opportunity.

I had spent years studying the possibilities that are available to those societies who are first to act boldly in transitioning to a low carbon economy. In my classes, I would cite statistics, like how in the United States in 2011, green jobs grew at four times the rate of all other sectors combined. Or how between 2007 and 2010, the global market for environmental technology and resource efficiency expanded at an average rate of 11.8 percent per annum.

I advised governments at all levels on the policies they could take at the time to seize those opportunities. And I saw British Columbia begin to show leadership in doing just that.

But as the government then shifted all of its efforts, and all of its hopes, to the LNG pipedream, I saw us lose that leadership. I watched as we went from leaders in developing a 21st Century economy, to laggards, scurrying back to the 20th century, hoping for an out-dated and unrealistic LNG windfall.

As I watched that leadership unravel, I was reminded of something I would tell my students. If you want your government to show leadership on the issues you care about, I would tell them, you need to elect people who will act on your concerns. Or, if you feel like none of the candidates is seriously addressing the issues you are worried about, you should run for office yourself.

Ultimately, I decided that it was time to take my own advice. I ran for office because I saw an opportunity to use my role as an MLA to help build a vision that would put our province on a path to develop a 21st Century economy. Now, after nearly two years, I feel this is more important than ever.

In the shadows of the massive challenges that we face, our province needs new leadership.

Leadership that offers a vision for how to make peoples’ lives better.

Leadership that pushes boldly forward when no one else will, because they see the opportunities — economically, socially and environmentally — to be the first to end homelessness, the first to act on climate change and the first to transition to a 21st century economy.

Leadership that’s willing to be a lightning rod in the legislature, when that’s what’s necessary, and to advance reasonable, common sense ideas that can help address British Columbians’ pressing concerns.

Leadership doesn’t wait for public opinion — it builds it.

If there is one clear message from the Throne Speech it’s that this legislature has lost its leadership. And British Columbians are paying the price.

We have a government that is out of ideas and an Official Opposition that is bent on criticism when, more than ever, what we need is vision and an honest conversation about the challenges we face and the solutions available to address them.

We have built a political culture that puts personal ego, political games and partisan rhetoric ahead of the most important obligation we as elected representatives have: To provide leadership and direction to move British Columbia forward. We have been tasked with addressing the greatest challenges of our time — not adding to them.

Yet, too often the pursuit of narrow self interest trumps the interests of British Columbians. This is because most of us in this room will not have to live with the long-term consequences of the decisions that we make.

We have to do better. And doing better starts with a basic willingness to work across party lines.

I have always said that I will support a good idea when I see it, I will contribute to a poor idea when I can help make it better and I will oppose a bad idea when that’s what’s necessary.

But steadfast opposition is a last resort. Our challenges are too big, and the consequences are too profound. Opposition has to be more than standing on the sidelines and lobbing dirt until the government is buried and broken. There’s no vision—no leadership—in slinging mud. We don’t have to agree, but we do need to have honest discussions that extend beyond partisan squabbles. And we need to demonstrate the respect we expect to receive towards our ideas, when we consider the ideas of others.

We expect more from government. We expect a demonstrated commitment to govern for all British Columbians —not merely for those who voted for them—or funded them. This means an honest and open commitment to seek out the perspectives and ideas of others and evaluate them based on their merits, not on their source. It is disrespectful of British Columbians to be presented with a throne speech completely void of ideas when so many people are struggling to get by and when so many solutions exist. It speaks to the lack of leadership in this government that they did not do more to actively seek out and try to incorporate the ideas of others —particularly when they were so lacking on ideas themselves.

We have to do better. Being an MLA — whether in opposition or in government — has to be about more than partisan squabbles and staying in power.

I find myself between two parties, each of which has institutionalized disrespect for the ideas, and in some cases the existence, of the other. We must return to debating the challenges facing our province — including those that began under an NDP government, those that began under a Liberal government, and those that began before either was ever in power. Let us now demonstrate the leadership that British Columbians expect of us and begin to discuss concrete ideas that, by working together, we can turn into the solutions we need to the challenges we face.

21st Century Economy

Let’s start with the economy.

We have a unique opportunity in British Columbia to be at the cutting edge in the development of a 21st century economy.

Our high quality of life and beautiful natural environment attract some of the best and brightest from around the globe —we are a destination of choice. Our high school students are consistently top ranked — with the OECD specifying BC as one of the smartest academic jurisdictions in the world. And we have incredible potential to create clean, renewable energy sectors to sustain our growing economy. When we speak about developing a 21st century economy — one that is innovative, resilient, diverse, and sustainable — these are unique strengths we should be leveraging.

Unfortunately, instead of investing in a 21st Century economy, our government has banked all its hopes on an irresponsible, unrealistic fossil fuel windfall, with its Liquefied Natural Gas sector. We are already seeing these promises unravel. I’ve been saying this was inevitable for more than 2 years. Now more than ever, we have an urgency to invest in a 21st century economy, so B.C. can continue to prosper. Here’s where we could start:

A 21st Century economy is sustainable — environmentally, socially and financially. We should be investing in up-and-coming sectors like the clean tech sector that create well-paying, long-term, local jobs and that grow our economy without sacrificing our environment.

Similarly, by steadily increasing emissions pricing, we can send a signal to the market that incentivises innovation and the transition to a low carbon economy. The funding could be transferred to municipalities across the province so that they might have the resources to deal with their aging infrastructure and growing transportation barriers.

By investing in the replacement of aging infrastructure in communities throughout the province we stimulate local economies and create jobs. By moving to this polluter-pays model of revenue generation for municipalities, we reduce the burden on regressive property taxes. Done right, this model would lead to municipalities actually reducing property taxes, thereby benefitting home owners, fixed-income seniors, landlords and their tenants.

Yes, we should be investing in trade skills, as described, for example, under the B.C. jobs plan. But we should also be investing further in education for 21st century industries like biotech, high tech and clean tech.

Natural gas has an important role to play. But, we should use it to build our domestic market and explore options around using it to power local transport. BC businesses such as Westport Innovations and Vedder Transport have already positioned British Columbia as an innovative global leader in this area.

We could invest in innovation in the aquaculture industry, like the land-based technologies used by the Namgis First Nation on Vancouver Island who raise Atlantic salmon without compromising wild stocks.

The logging industry is booming as we send record amounts of unprocessed logs overseas. Now is the time to retool mills to foster a value-added second growth forestry industry.

These are just a few ideas that could help us move to the cutting edge in 21st the century economy. Fundamental to all of these ideas is the need to ensure that economic opportunities are done in partnership with First Nations.

Environment

The continued prosperity of 21st century extractive industries, like mining, which are critical to BC’s economy, require a strong and enduring social license to operate. Government has a crucial leadership role to play in this area. British Columbians are looking to their government to ensure that resource projects in B.C. prosper safely, responsibly and sustainably.

Unfortunately, over the last decade the BC government has weakened environmental monitoring expectations to dangerous levels that have cast dark shadows over our province’s extractive industries. From 2009 to 2014, the number of Government Licensed Science Officers – like foresters, geoscientists, and engineers — in government service dropped by 15 per cent and their work has been discontinued, diluted, or contracted out to the private sector.

When we fail to adequately monitor and inspect industrial activities, environmental disasters – like the tailings pond breach at the Mount Polley mine – occur, threatening the reputation of the entire industry and making it more difficult for projects to earn that essential social license. This needs to change.

Government Licensed Science Officers, have been, and could continue to be, our environmental safety net — when resourced properly they ensure that as our province prospers. And it does so with an eye to environmental stewardship and public safety. Reinvesting in keeping these positions in house, helps ensure government has the experience necessary to ensure we prosper safely.

If industries are going to thrive with a social license, we must ensure the environmental review process is stringent and upholds the highest standards, instead of being a symbolic or political rubber stamp process. We just have to look to the National Energy Board hearings on the Trans Mountain pipeline project to see how a poor review process can completely undermine any hope of earning a social license.

The costs of prospering safely in British Columbia should be borne by those who are prospering from our rich natural resources. That’s why we should look at financing these changes through a small increase in the corporate income tax. British Columbia already has one of North America’s most competitive tax climates for businesses with one of the lowest corporate tax rates in Canada. The Report of the Expert Panel on BC’s Business Tax Competitiveness found that a 0.5% increase of the general corporate income tax rate could generate $147 million a year.

These are small changes that could make a big difference in assuring British Columbians that their government is taking leadership to ensure resource industries prosper safely.

Affordability

A 21st century economy must also be an affordable one.

Right now, over half a million British Columbians are currently living in poverty. Of this number, over 160,000 are children. Four B.C. cities have recently been ranked among the five least affordable cities in Canada.

The government responds to these facts with the same old mantra: It can’t do more until the economy grows. Yet, we hear year after year from the government that the economy is growing, and this year we even have more than a $444 million budget surplus.

The fact is, we have seen growth, we have money to invest, and we know that if we invest capital smartly we will actually save in operating costs. So let me offer a few ideas of where we could start:

The Official Opposition has advocated for ending the atrocious policy of clawing back income supports for single mothers. It’s not an expensive change, but it’s an important one, so let’s start here.

Let’s also fix the Registered Disability Savings Plans and Registered Educational Savings Plans. Currently, RDSPs and RESPs do not receive the same protection that RRSPs and RRIFs do when a family or individual is faced with bankruptcy. This means that when faced with bankruptcy, these already vulnerable individuals lose the one thing that would otherwise provide a glimmer of hope for a financially stable future. By simply providing creditor protection for disabled individuals and children’s education funds we can make the pathway out of poverty that much easier for those individuals experiencing bankruptcy. And let me be clear: This is a policy change—it doesn’t cost anything.

At the same time we know from other jurisdictions, that by providing chronically homeless individuals with a home through Housing First Policies, we not only provide individuals with a basic human right – shelter – but also better health outcomes, all while realizing long-term, overall net savings to government.

Medicine Hat saw a 26% decrease in emergency shelter use in just four years and has housed over 800 people, including over 200 children. Utah has reduced chronic homelessness by 72% as of 2014. A housing first pilot project in Denver, Colorado found emergency related costs and incarceration costs declined by 72.95% and 76% respectively, while emergency shelter costs were reduced by an average of $13,600 per person. Canada’s own At Home/Chez Soi study found that for every $10 invested in housing first services there was an average savings of $21.72.

The solutions to our province’s affordability crisis are out there, and those solutions themselves are affordable. We just need to invest in them. Given everything we know, the question becomes this: how can we afford not to?

Health Care

The need for affordability must extend to quality health care too.

We can be proud that B.C. was recently ranked the healthiest province in Canada. This ranking shines a positive light on the healthy lifestyle choices British Columbians make each day. Yet, while we celebrate our successes, we must also remember that our health care system faces serious challenges.

With a highly regressive health care funding system, an aging population, major gaps in primary care, and surgery waitlists lasting anywhere from months to years, it is time for government to take a serious look at how our Health Care System is funded and administered.

British Columbia is the only province in Canada that continues to charge MSP premiums. Such premiums unfairly burden low and fixed income British Columbians with an overly heavy tax burden. With individuals earning a net annual income of $30,000 paying the same monthly flat fee as those earning $3,000,000 per year, it is evident that MSP premiums are perhaps the most regressive form of taxation in B.C.

Instead of charging MSP premiums, we could look at shifting to alternative, more progressive options such as was done in Ontario and Quebec. Rather than flat-rate fees, health premiums can be paid through the personal income tax systems. This avoids the regressive effects of flat-rate premiums and diminishes the additional costs associated with administering the MSP program.

But it can’t stop there. We also need to address the growing gaps in primary care. Doctor shortages and long wait times to get an appointment have led to increased use of walk-in clinics and emergency room services. Unfortunately, this can be costly for both patients and our health system, as a lack of follow-up and co-ordination can mean problems are missed or poorly managed.

Let’s look at investing more in Nurse Practitioners to help close some of these gaps and provide the high quality and timely care that British Columbians pay for and need. Let’s find more effective ways of funding these Nurse Practitioners. Let’s re-examine our approach to the delivery of chronic care services. Relying on acute care services, such as walk-in clinics and hospital emergency rooms, to deal with chronic health issues is both costly and inefficient.

Let’s consider increasing community and at-home care programs, which have been shown to provide better care at a more affordable cost. And let’s lobby the Federal government for our fair share of Canadian Health Transfer revenue, a share that reflects our demographics and the actual cost of delivering health services.

The possibilities for improving our health care system are plenty. As our population continues to age and gaps in primary health care continue to grow, it is more important now than ever to commit to re-examining how we provide affordable, quality health care in B.C.

Education

Public education represents perhaps the most important investment government can make for the prosperity of our province. Each and every one of us has attended school and that experience has shaped who we are, what we do and how we contribute to society. And public education is absolutely critical in teaching the next generation of British Columbians to think critically, contribute responsibly to society, and become the leaders of tomorrow.

Given this, why have we not shown more leadership in the Education sector?

At the end of the strike last fall, the government spoke about “an historic six-year agreement…which means five years of labour peace ahead of us.”

The implication of this sound bite is NOT that government is stepping up to the task of finding new ways to fund and deliver a leading public education system. The reality is that they are stepping back, allowing their dysfunctional relationship with teachers to simmer, only to boil over again in a few years.

We are stepping back despite an overall 18% and a whopping 44% aboriginal six-year high school non-completion rate. We have school boards at a loss for how to fund their operations due to seemingly endless budget cuts. Surely this is not indicative of a government properly valuing publication education.

It is time for the government to take leadership.

Leadership means ensuring that the resources needed for success are provided. Over the last 13 years, education funding as a percentage of provincial GDP has declined from a high of about 6.4% to an estimated low of about 5.0%. This is not indicative of a government that is prioritizing education. We need to find new, progressive funding sources to reinvest in education.

Leadership means acknowledging that behind the curtain of the BCPSEA is the provincial government. Yet it is the government, not BCPSEA, that draws the lines in the sand on funding. By dismantling the BCSPEA and bringing its operations back into government, a signal could be sent that government is serious in developing a new relationship with teachers.

Leadership also requires a clear eyed assessment of what’s working, and what isn’t – and clearly a ‘one size fits all’ approach isn’t working. The needs on Haida Gwaii, are different from those on Vancouver Island which in turn are different from those in Surrey or Prince George. Now is the time to explore whether or not class size and composition negotiations are better conducted at the school district level instead of the provincial level.

The status quo on education isn’t addressing the growing challenges. We cannot wait until the next labour dispute. Now is the time to sit down with all those involved and start a dialogue about what a 21st century education system looks like, including how it is funded.

Conclusion

Honourable speaker, I’ve outlined an alternate direction that the province of British Columbia could and should be taking.

It’s a direction that puts the interests of British Columbians first, whether they be resident hunters, fishers, farmers, forestry workers, miners, educators, engineers, students or labourers, to name just a few examples.

Honourable Speaker, we have a government that is out of ideas, lacking leadership, creativity and innovation, and void of a vision.

Honourable Speaker, we have an official opposition that is almost exclusively focused on pointing out the government’s failures without ever offering viable solutions. Witness the amendment before us as a perfect example of this. And I quote:

“and that the Legislative Assembly of British Columbia regrets that the families in the province have seen their wages fall as they pay more for their basic services, while the government gives a break to the highest two per cent of income earners; regrets that the government has failed to meet its commitment that all British Columbians will have access to a general practitioner by 2015; regrets that seniors still do not have flexible options for home care or assisted living; regrets that young people in the province face uncertain job prospects as the government has bet on one sector rather than working with businesses and workers across B.C. to reach their potential; and regrets that the government will not fulfill its commitment for at least one LNG pipeline and terminal online in B.C. by 2015.”

Where are the solutions? We cannot stop at the word “regrets”, the key word littered throughout the proposed NDP amendment. Solving the concerns of British Columbians requires us to find solutions. And that starts with new ideas and new leadership.

Honourable Speaker, we have an official opposition that is also out of ideas, lacking leadership, creativity and innovation, and void of a vision.

And ultimately, Honourable Speaker, it is British Columbians who are paying the price for this lack of leadership from both parties.

There are too many people struggling in British Columbia for us to accept this status quo. There are too many incredible economic opportunities passing us by as we put all of our eggs in the LNG basket. To quote Preston Manning, “we are counting our chickens before the rooster even enters the hen house.”

We need real leadership in British Columbia and that starts with a willingness to offer new ideas, and to approach other peoples’ ideas constructively and with the same respect that we hope others will approach our ideas with. And that leadership could start here today by passing my subamendment that proposes adding the words:

“and recognizes that leadership in government requires a commitment to seek out and incorporate ideas from others, while leadership in opposition requires a commitment to offering solutions, and hence calls on this House to collaborate on the development of a new vision for British Columbia that builds on the good ideas of all members, regardless of their party affiliation.”

Thank you Honourable Speaker.

New Ways of Funding BC’s Health Care System

“There is a difference between equity and equality and treating everyone exactly the same may not always be fair” – Dr. Livio Di Matteo

Over the past couple months, I have emphasized the need for government leadership and increased government funding if we are to truly tackle poverty and homelessness in our province. Over the course of the next few articles I will begin to outline what government leadership might look like and identify where that funding could come from. In this first post, I focus on health care funding and the Medical Services Plan premium that unfairly burdens low and fixed income British Columbians as well as small business owners with an overly heavy tax burden. In addition, I provide details concerning British Columbia’s under representation in the federal funding allocation for provincial Health Care via the Canada Health Transfer (CHT). As I will demonstrate, British Columbia is receiving $153 million less that it should through this program.

Regressive versus Progressive taxation.

The various forms of taxation available to government generally fall into two broad categories: 1) Progressive taxes; 2) Regressive taxes.

Progressive taxes, such as income or corporate tax, are based on the premise that those who can afford to pay more, should pay more. That is, higher income earners would pay larger taxes than lower earners. This premise forms the foundation of our income tax systems right across the country.

However, in recent years, there has been a general tendency towards reducing various forms of progressive taxation and replacing the lost revenue through increases in a variety of regressive taxes. Regressive taxes, such as the Provincial Sales Tax, are taxes that do not reflect one’s ability to pay. In other words, everyone pays the same, regardless of how much your earn. Perhaps the most obvious example of this is British Columbia’s Medical Services Plan (MSP) premiums.

What is the Medical Services Plan (MSP)?

As noted on the Ministry of Health website “The Medical Services Plan (MSP) insures medically-required services provided by physicians and supplementary health care practitioners, laboratory services and diagnostic procedures.” The MSP requires anyone living in BC for six months or longer to pay monthly premiums for health care coverage. While some individuals can apply for premium assistance, these subsidies dry out as soon as a person earns a net annual income of $30,000 or more. Those who earn more than $30,000 must currently pay a monthly flat fee of $72. This means that an individual who earns $30,000 per year pays the same MSP premium as an individual who earns $3,000,000 per year. And so, it is evident that MSP premiums are perhaps the most regressive form of taxation in BC.

MSP Premiums become even more regressive when you factor in who actually pays them. The fact is, many large employers pay all or part of an employee’s MSP premium as part of a negotiated taxable benefit of employment. But for many, if not most, low and fixed income British Columbians, as well as small business owners, they must pay the costs themselves.

In 2000, the MSP premium for a single individual was $36 per month. Today, that same individual pays twice as much (the same amount that a family of three or more paid 15 years ago). At the same time, personal and corporate income taxes have experienced significant cuts, the consequences of which I will explore further in future posts. The resulting major shifts in taxation have led to the provincial government now bringing in almost as much revenue from MSP premiums as it does from corporate income taxes. In the 2014/15 British Columbia budget, revenue from MSP premiums was expected to be 2.271 billion dollars whereas corporate tax revenue was estimated to be 2.348 billion dollars.

While one can make the argument that reducing MSP premiums allows for lower rates of other taxes, these benefits are often only felt by the wealthiest of the population. In fact, “when all personal taxes are considered (income, sales, property, carbon, and MSP premiums), the higher your income, the lower your total provincial tax rate”. So, while most BC households paid around the same total tax rate back in 2000, with those in the top income bracket paying slightly more, under the current system the wealthiest 20% of households now pay a lower total tax rate than the rest of the population.

Not only do these tax cuts not benefit the majority of British Columbians, but we also must then pay for these cuts in the form of reduced social services. Over an 11-year period, from 2000 to 2011, BC’s tax revenues fell by 1.6% relative to the size of the provincial economy (GDP) resulting in a revenue deficit of about $3.5 billion.

Why do we pay MSP Premiums?

Some may wonder why we have to pay provincial MSP premiums in the first place. After all, we are the only province in Canada to require them. The rest of Canada have moved away from monthly premium charges and instead use general tax revenues, primarily provincial income taxes that are based on taxpayers’ ability to pay, to acquire the funds needed to pay for Medicare services. In fact, after the Alberta government announced its plans to eliminate their premium charges for Medical Services Plan Coverage in 2008, BC was left as the only province to continue to charge these individual flat-rate premiums.

The answer is simple. It’s a choice that successive British Columbia governments have made. It’s a choice to favour regressive over progressive taxation. It’s a choice that puts the interests of the wealthy over the interests of low and fixed income British Columbians as well as small business owners. And the choice is made, in part, to maintain the illusion of low taxes.

The Canada Health Act and Canada Health Transfer

The federal Canada Health Act sets the standards for all provinces and requires coverage for all necessary care provided in hospitals and by physicians. But health care is ultimately the responsibility of the province.

General revenues from the Federal Government provide funding for health care to the provinces and territories through the Canada Health Transfer (CHT). Up until this past year, the CHT consisted of two components: a cash transfer and a tax transfer. Though CHT is allocated on a per capita basis, the cash transfer was not. Instead, the CHT cash transfer would take into account the value of provincial and territorial tax points and the fact that provinces do not have equal economies and, therefore, have unequal capacity to raise tax revenues. This meant that provinces with the highest revenue raising ability received lower per capita CHT cash payments than other provinces.

However, since January 2014, CHT allocations are now determined solely on an equal per capita cash basis. While this new system means that all provinces will receive equal transfer payments based on population size, I believe that this is not the most equitable way to proceed, particularly in light of provincial age demographics and associated health care costs. Take for example BC, a province many view as a popular retirement destination. It is common practice for individuals who have lived and worked – and therefore paid taxes – elsewhere, to move to BC later in life. However, with national trends showing that seniors’ health care costs more than that of any other age group, this can put a significant strain on our provincial health care system — one that cannot afford to go unaccounted for (see Figure 1).

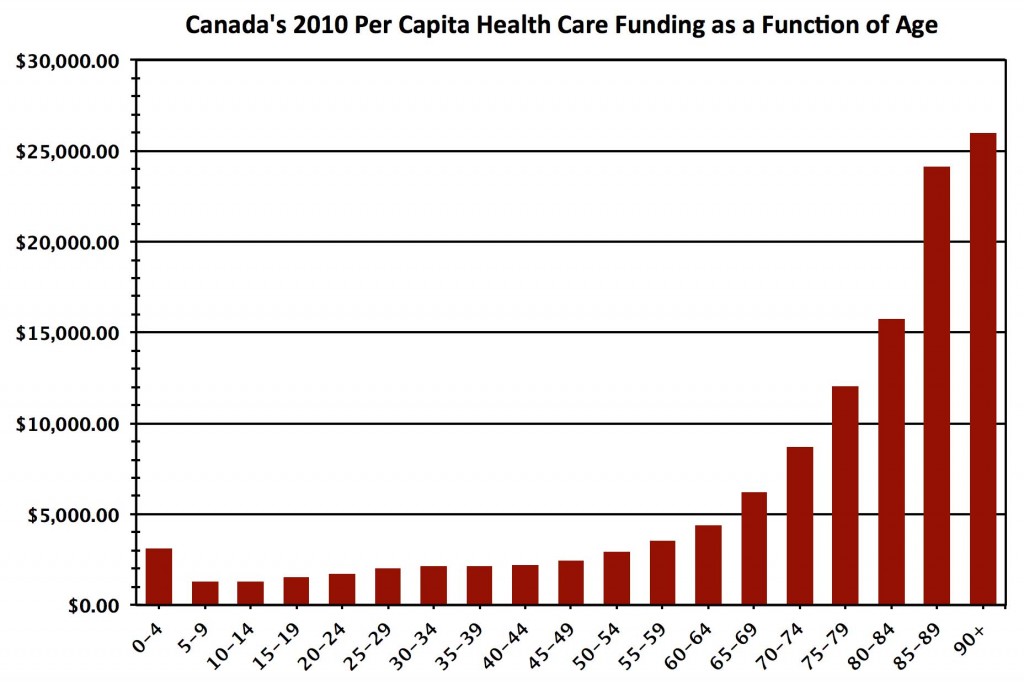

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Figure 1: Per capita funding of health care as a function of age. Note that as age increases, health care costs increase dramatically. Annually, more than $25,000 is spent on health care costs for a Canadian over the age of 90. Source: Canadian Institute for Health Information, National Health Expenditure Trends, 1975 to 2012.

Let’s unpack this further. In the 2014-15 budget year, the Federal Government Canada Health Transfer amounted to 32.1 billion dollars distributed across all provinces. In 2014 Canada’s population was estimated to be 35,540,400, and British Columbia’s population was estimated to be 4,631,300. Alberta has a similar population to that of British Columbia (see Table below).

| Province | Population | Ages 0-14 | Ages 15-64 | Ages 65+ |

| Alberta | 4,121,700 | 18.3% | 70.4% | 11.3% |

| BC | 4,631,300 | 14.6% | 68.4% | 17.0% |

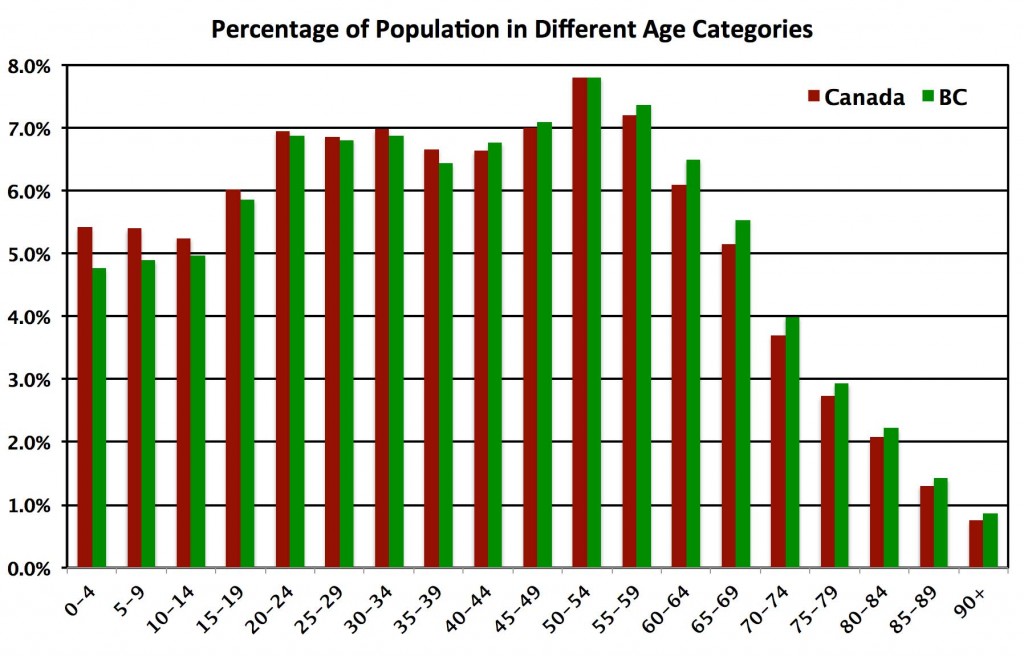

As clearly evident in Figure 2, British Columbia had a smaller percentage of its population in every age group under the age of forty than the Canadian average. The opposite is true for those over the age of forty. Compared to Alberta, British Columbia is home to nearly 70% more seniors. A quick glance back at Figure 1 immediately highlights the glaring inequity in the fixed CHT dollar per person transfer formula. British Columbia has a higher proportion of seniors than the rest of Canada and it is this age demographic that requires more health services. The funding should reflect the actual cost of service delivery.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

Figure 2: Percentage of overall population in separate age categories for Canada (Red) and British Columbia (Green). Note that the percentage of overall population under the age of 40 is greater in Canada in a whole than in British Columbia. The reverse occurs over the age of 40 when health care costs per capita start to increase. Source: BC Stats and Statistics Canada.

It’s a relatively straightforward calculation to weight the CHT transfer to each province by its age demographic and associated health care delivery cost. Rather than receiving 13.0% ($4.183 billion) of the total CHT funding (reflecting 13.0% of Canada’s population residing in British Columbia), we should receive 13.5%. While this may not seem like a lot, it translates into 153 million dollars that British Columbia must find from other sources.

Nevertheless, no matter the method that CHT payments are allocated, these federal transfers only cover a portion of BC’s annual healthcare expenditures. The remaining expenses are financed out of general revenues raised by tax and non-tax sources, with MSP premiums presently contributing over $2 billion per year.

Alternatives to MSP Premiums

While here in BC we do not have the fiscal resources to stop charging MSP premiums without replacing the revenues, there are alternative, and more progressive, options we could be exploring. We need look no further than provinces like Ontario and Quebec, where health premiums are paid through personal income tax systems, rather than flat-rate levies. This approach avoids the regressive effects of monthly premiums, as rates rise with income to a maximum annual level. For example, in Ontario the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums, and in Quebec the maximum annual contribution is $1,000 for taxable incomes over $150,000. At the same time the British Columbia government should lobby for its fair share of CHT revenue — a share that reflects our demographics and the actual cost of delivering health services.

It is time for BC to replace MSP premiums with a more progressive and equitable approach to financing our health care system. Whether this means following in the steps of Ontario and Quebec with an income tax-based approach, or simply raising other taxes, such as corporate tax rates, as the Canadian Centre for Policy Alternatives (CCPA) found after conducting extensive research on what British Columbians think about taxes:

“[British Columbians] know more revenues are required if we are going to tackle the major challenges we face, like growing inequality and persistent poverty, climate change, and the affordability crisis squeezing so many families. And we know higher revenues are needed to sustain and enhance the public services…In short, [we] are ready for a thoughtful, democratic conversation about how we raise needed revenues and ensure everyone pays a fair share.”