Legislation

Bill M205: Post-Secondary Sexual Violence Policies Act

Today in the legislature I introduced Bill M205: Post-Secondary Sexual Violence Policies Act. This bill, based on similar legislation in Ontario, aims to address the pervasive occurrence of sexualized violence plaguing universities, colleges and other post-secondary institutions in British Columbia. It creates a legal responsibility for them to develop and maintain policies that would work to prevent the occurrences of sexual violence and provide support for victims. The act would allow university- and college-specific policies to be developed that would meet the needs of students, including education and protection, while working to create a safe environment for all students to come forward to report a sexual assault.

The preponderance of sexualized violence on the campuses of post-secondary institutions affects all of us. It’s time for our government to stand up and say that enough is enough. With your support and collective voice we will be able to improve the safety of post-secondary experiences for everyone.

Below is the text and video of my introduction of the bill. If needed, the contact information for sexual assault support and crisis centers throughout British Columbia are also listed below.

Text of Bill Introduction

BILL M205 — POST-SECONDARY SEXUAL

VIOLENCE POLICIES ACT, 2016

A. Weaver: I move introduction of a bill intituled Post-Secondary Sexual Violence Policies Act, 2016.

Motion approved.

A. Weaver: It is estimated that one in four female university students will be sexually assaulted during the relatively short amount of time they spend on campus.

If that number seems startling, then keep in mind that when the University of Ottawa recently did a student survey on the issue, 44 percent of female students experienced some form of sexual violence or unwanted sexual touching. Within our province, we’ve heard of numerous assaults that have taken place over the last few weeks, with a variety of different responses.

It is with this in mind that I introduce the Post-Secondary Sexual Violence Policies Act. This bill requires colleges and universities to have sexual violence policies that set out the process that will apply when incidents and complaints of sexual violence are reported. It is critical that we establish a legal requirement for our post-secondary institutions to have sexual violence policies that educate, protect and support our students. This legislation would actively involve students in the development of these policies and ensure that universities are adequately reporting and responding to incidences of sexual assault.

I move that this bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Bill M205, Post-Secondary Sexual Violence Policies Act, 2016, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Video of my introduction of the bill in the legislature today.

Video of Bill Introduction

Online and Phone-in Resources

- VictimLinkBC is a toll-free, confidential, multilingual multilingual telephone service available across B.C. and the Yukon 24 hours a day, 7 days a week. It provides information and referral services to all victims of crime and immediate crisis support to victims of family and sexual violence, including victims of human trafficking exploited for labour or sexual services, 1-800-563-0808

- 24 hour sexual assault crisis and information line, based in Victoria, 250–383-3232

- Qmunity Resource Centre provides counselling, resources, programs and peer support to the lesbian, gay, transgender, bisexual communities. (604) 684-5307.

- Youth In BC, provides an online chat program to connect victims with support. Available noon to 1am in BC and the Yukon.

City Specific Support and Crisis Centers

Victoria Sexual Assault Centre

3060 Cedar Hill Road #201

(250) 383-3232

http://vsac.ca/

Kamloops Sexual Assault Counselling Center

235 First Avenue #601

(250) 372-0179

http://www.ksacc.ca/

Women Against Violence Against Women

Vancouver, BC V6J 5C2

(604) 255-6344

http://www.wavaw.ca/

B C Society for Male Survivors of Sexual Abuse

3126 W Broadway

(604) 682-6482

http://bc-malesurvivors.com/

Prince George Sexual Assault Centre

5130N Nechako Rd.

(250) 564-8302

https://clbc.cioc.ca/record/CLB0654

SOS Society

Prince George, 193 Quebec St

(250) 564-8302

http://www.sossociety.net/

Post-Secondary Sexual Violence Policies Act

Media Release: March 8th, 2016

Andrew Weaver Tables Post-Secondary Sexual Violence Policies Act

For Immediate Release

Victoria, B.C. – Today at the B.C. Legislature, Andrew Weaver, MLA for Oak Bay – Gordon Head and Leader of the B.C. Green Party, tabled the Post-Secondary Sexual Violence Policies Act, a bill that aims to address the pervasive occurrence of sexualized violence plaguing universities and colleges in British Columbia.

“It is estimated that one in four female university students will be sexually assaulted during the relatively short amount of time they spend on campus,” said Andrew Weaver. “It is unacceptable that we are not taking clearer steps as a Province to help create a safe environment for our students.”

Sexualized violence is an issue that impacts all genders and all ages. Being young and female, however, are the biggest risk factors for being sexually assaulted.

“The opportunity to succeed and thrive in university shouldn’t hinge on whether or not you are young, female and statistically likely to experience sexual violence,” said Weaver. “A staggering number of bright young women pursuing their academic ambitions are forced to deal with the threat of sexualized violence. It’s time for our government and universities to stand up and say enough is enough.”

Weaver brought forward the Post-Secondary Sexual Violence Policies Act to create a legal responsibility for universities and colleges in British Columbia to develop and maintain policies that would provide education for students, support for victims, and work to prevent the occurrences of sexual violence. The act would allow University specific policies to be developed that would meet the needs of students, including education and protection, while working to create a safe environment for students to come forward to report a sexual assault.

“The reality is that it is women who are most vulnerable at post-secondary institutions to being sexually assaulted or harassed, and that there simply isn’t the capacity for adequate prevention and support,” said Weaver. “While I chose International Women’s Day to table this bill, this is a societal issue and one that affects people of all gender identities. I hope our work will improve the safety of post-secondary experiences for everyone.”

-30-

Media Contact

Mat Wright – Press Secretary Andrew Weaver MLA

1 250 216 3382

mat.wright@leg.bc.ca

Bill 10 — Budget Measures Implementation Act, 2016

Today in the legislature I rose to speak at second reading on Bill 10, Budget Measures Implementation Act 2016. The budget implementation bill is an omnibus bill that proposes to bring into law the various measures outlined in the government’s budget.

In any budget there are always aspects that one can support and other aspects that one cannot support. You’ll see from my speech below that this budget implementation bill is no different.

For example, the budget implementation bill extends the BC Seniors’ Home Renovation Tax Credit to individuals with a disability. This is a welcome change. Extending the Tourism Accommodation Assessment Relief Act applicability to rural areas, something that was supported through a motion from the Union of BC Municipalities, is also an important step forward.

But unfortunately, the government has missed the boat on addressing the affordability crisis in Vancouver. And the Prosperity Fund is nothing more that a political stunt. Below I reproduce the text of my speech; I also link to its video.

You’ll see from the text that the Minister of Advanced Education was heckling me throughout my speech. Honestly, it was rather off putting and I would have expected better. It got so bad that when Leonard Krog, MLA for Naniamo, was speaking after me, I stood on a point of order as I could not even hear what he was saying.

Text of my Speech

A. Weaver: I was busy booking a flight to Vancouver, expecting a Liberal member opposite to stand up and defend their budget, offer insight as to why this budget implementation act is a good one. Instead, all they resort to is chirping little bits here and little bits there.

I rise to speak to Bill 10, Budget Measures Implementation Act, 2016. As you know, this bill essentially lays out the implementation across a diversity of bills — amendments here, amendments there — to implement government priorities as outlined in the budget speech.

There are a number of aspects to this. Number one, of course, is the introduction of the prosperity fund, the so-called $100 billion prosperity fund, a fund that was promised to British Columbians in the last election during a Hail Mary pass of hope that was given by this government to British Columbians in a desperate attempt to try to get elected — 100,000 jobs, $100 billion prosperity fund, debt-free B.C., elimination of PST, thriving schools and thriving hospitals, and on and on. A pot of gold at the end of the LNG rainbow was promised to each and every British Columbian.

In a desperate attempt to try to fulfil this outlandish promise — this promise that anybody in the natural gas industry knew was absurd, this promise that only the Liberals themselves convinced themselves had any dream of reality — when it finally….

Interjection.

A. Weaver: I hear sighing coming across the benches over there. The reality is, if you go back and look at the presentation given by the Deputy Minister of Energy and Mines to the clean energy conference in 2012, you would see, in that presentation, natural gas prices projected to increase into the $20 to $30 range in the months and years ahead.

There is not a single person internationally who would ever have thought natural gas prices were going to increase like that, in light of the fact that everybody has discovered horizontal fracking technology, that Russia is so close to China and has reserves almost 20 times those of natural gas, that Iran, which has the largest reserve in the world, would have its….

Interjection.

A. Weaver: The Minister of Advanced Education is truly quite pompous over there. What is so remarkable, is that I know his own colleagues think he’s a pompous person as well. So it would be quite…. It’s very difficult to actually continue with this.

Interjection.

Deputy Speaker: Order, please.

A. Weaver: Thank you, hon. Speaker. I’m glad to have some order back in here.

The prosperity fund is, as I pointed out, a desperate attempt to try to look like government is responding to its promise in the provincial election. When you actually look at this $100 million prosperity fund, it really is only $25 million, because 50 percent of that is going to be used to pay down debt. That’s $50 million. Another $25 million is going to be used for government priorities. What are those government priorities? Let me lay them out for you.

We’re going to see, over the course of the next year, a bunch of little tidbits — election tidbits — offered to British Columbians in the same vein as was offered in the last election, promises of this and promises of that. Say whatever it takes to get through lunch. Then say whatever it takes to get to dinner, and say whatever it takes again to get through to the next day.

There is also the Property Transfer Act that’s being modified in the budget implementation act. Government’s response to an affordability crisis in Vancouver, rather than standing back and recognizing that there are three reasons for this affordability crisis, or their speculative housing market: (1) lack of enforcement of the Real Estate Services Act; (2) a preponderance of vacant homes and owners of those vacant homes not being required to pay the true cost, the social cost, of leaving vacant properties…. That is — now, I know the Minister of Advanced Education has a hard time when I start to use economic language — the externalities associated with vacant homes have not been internalized to the people with those vacant homes. Those externalities are a social cost. And the third reason is the existence of loopholes that allow people to avoid paying property transfer tax or register on title where they live.

It was with the latter that I do appreciate the government introducing two aspects of policy. One is with respect to bare trustees now being required to say who they are. The second one, of course, is that on title, you will now have to declare if you are a Canadian citizen or not. The problem with this is that should have been extended to also require you to list if your primary residence is in another province, as other provinces do in British Columbia.

Interjection.

A. Weaver: Sorry — as other provinces do in Canada.

My goodness, I could only imagine having to live in a house with the Minister of Advanced Education. While I am straight, I would have divorced this man within a matter of moments, as he is simply intolerable. His hubris, his pomposity, his arrogance is so intolerable, it makes one want to be ill. But with that, I will move on.

Even the minister’s opposite are laughing, because they all agree with me as well, I know.

The property transfer tax. The government’s response, rather than dealing with the issue, is to incentivize further speculation. How do I say that? Well, one piece of policy that’s introduced is an elimination of property transfer taxes on new homes under $750,000. At first glance, one might think that’s a good thing.

But what is this incentivizing? What it’s incentivizing , but what it’s incentivizing is the purchase of older homes, the ripping down of those older homes and constructing of townhouse developments. Creating more supply may sound like a good thing, but unfortunately, it’s not addressing the critical issue, which is internalizing the social costs of leaving homes vacant.

It simply incentivizes our speculative economy, an economy that this government thinks is actually diversified and stable but, I would argue, is very, very flimsy, because it is being buttressed by an artificial, speculative housing market in greater Vancouver and now coming to the CRD. That is not a healthy situation. We only have to go to Scottsdale or Phoenix, Arizona, to see what happens to an economy that is built on a speculative housing market. It keeps going, and then there’s the big crash. And this government, like it has done with LNG, will blame global market foes that we have no control over. But they do have control. There are things that could be done now.

This government should be putting a price on leaving vacant properties empty. Putting a price on those vacant properties does two things. One, it incentivizes renting of those properties. It makes people want to rent those properties, which puts downward pressure on rental prices. Two, it actually reduces, then, the demand on new homes, because there are more people in rental homes.

Internalizing the externalities — making vacant homes have to pay the social cost. This can be done in a revenue-neutral fashion. The money raised through the tax of vacant homes could be used, for example, to help house the homeless. It could be used, for example, to give rental subsidies. It does not have to be a money grab for government.

Government has a responsibility to use the tools it has to ensure that the market is fair. The housing market in Vancouver is not a free market. It is a market failure. It’s a failure because the social cost is not being paid, and the only way to do that is actually put a price on leaving your homes vacant.

Bare trust is another one that I’ve mentioned over the last couple of years as a loophole that was originally put in place a long time ago — back in the 80s, I believe, even before the so-called dreaded 90s.

Hon. A. Wilkinson: That must have been around the 16th century

A. Weaver: Maybe it was around the 16th century, but I don’t believe anything the Minister of Advanced Education says, because he’s so pompous. Everything he says, you’re supposed to believe. And I believe none of it. He loses credibility when he continues to chirp that way.

The problem with registering properties in bare trusts and then flipping beneficial ownership of a bare trust means that you don’t change title. There is no change of title in the land title office, and that means there is no property transfer tax paid. Government has proposed to study this. But we know what result we’re going find out. We’re going to find that there’re a lot of houses out there that are flipping not on titled but through beneficial ownership.

Now, Ontario understands this. Ontario understands this. They are the other jurisdiction in Canada that has a property transfer tax. But where they apply the property transfer tax is on beneficial ownership change, not on title change. They don’t apply it on title change. They apply it on beneficial ownership change.

If I am foreign company and I’d like to buy a property and speculate it in Vancouver, here’s what I might do. I might purchase the property and put it in a bare trust. Then I might start flipping this bare trust, the ownership or the corporation that owns this bare trust, and sell it. It can be….

Interjection.

A. Weaver: Hon. Speaker, may I ask you to please address the Minister of Advanced Education and ask him that I have a right to speak in the Legislature without having to listen to his pomposity? Frankly, enough is enough.

Deputy Speaker: Order, Minister.

Interjection.

A. Weaver: Thank you, hon. Speaker.

I agree with the Minister of Health. They have to listen to him, but I don’t have to listen to him.

Coming back to the bare trust, coming back to the example I was giving, a company can put an individual…. I know there’re a whole bunch of entities can own the bare trust, and they can sell it. They can flip it a multitude of times. They can start to flip it amongst shell companies themselves. But never at any time are we changing title, and no property transfer tax has changed.

And this government has no idea who owns it, because they’re not tracking…. At least they will, coming up. But they were not tracking the bare trustees and those who have beneficial ownership. But rather than spending time tracking it, they should be actually disincentivizing by applying the property transfer tax on transfer of beneficial ownership.

Now, with that said, there are, of course, aspects of this budget implementation act that I do support. I mean, continuing the flow-through mining share credit, the flow-through share agreement, for another year seems reasonable. It has been working quite well to incentivize investment in the mining sector in British Columbia.

The Tourist Accommodation (Assessment Relief) Act changes are responding to a UBCM resolution to extend the assessment relief to rural regions.

The B.C. seniors home-renovation tax credit — extending that to individuals with a disability. It’s hard to find anything wrong with that proposal.

And the food donation tax credit — it’s an interesting idea, but I worry. I have spoken to people at Mustard Seed and elsewhere, food bank agencies. There’s a worry here — that has to be, actually, carefully regulated and examined — that this could be misused for dumping of product that has no value and is being used as a loophole to get a tax credit.

For example, let’s suppose I’m a company that has, in reserve, 10,000 barrels of molasses, and I can’t sell it. But now I give it to a food bank at fair market value. The market value is essentially zero because I can’t sell it, but there will be some nominal fee attached to it. This food bank is then ending up with 10,000 barrels of molasses that it has no use for.

What matters with this food donation tax credit is that the devil is in the details — that is, implementation is not being used as a means and a way of avoiding dealing with product that no one wants. How many litres of molasses do we need? And there are other examples that can occur like this.

I understand that it makes sense that, perhaps, the local farmer here in North Saanich has a few extra crates of, say, apples and, you know, he’d like to donate those to the local food bank and get a small tax credit. That seems reasonable. Why not just deal with the problem, however, in the first place?

Why are we actually having to deal with giving away food to food banks? What is wrong with our economy? What is wrong with our social programs? What is wrong with our society when we even have to introduce this tax credit in the first place? That’s the real question.

The question is not the food donation tax credit, which everybody can get behind in some way. The real question is: why is it that we, as our society here in British Columbia, one of the wealthiest places in the world — not just in North America but in the world — has to introduce a food donation tax credit? What next? A used clothes donation tax credit? Shoe donation tax credit? Used sportswear donation tax credit? It’s a slippery slope, and it’s not addressing, again, the fundamental inequities in our province that this budget should be addressing.

What’s not in this bill? A number of things are not in this bill, and I will look forward, in committee stage, to discussing some aspects of this.

I’ve had a number of people contact me, concerned about the increase in property transfer tax for homes valued over $2 million. That may seem like it’s a tax on the wealthy. It may seem at first glance, but let’s suppose you’re living in Vancouver. You grew up in Vancouver, and you’re a family of four.

Mom and Dad get pretty old, and Mom and Dad are so old that they need to leave their house. But Mom and Dad want to give their children their house. There’s concern that in doing so, those children, who could barely be affording to live in Vancouver anyway, would be subject to the increased property transfer tax and then move into a home that they couldn’t afford to buy, but it was a family home.

The problem, of course, here is that $2 million may seem like a lot, but it’s not a lot in Vancouver. So care has to be put in place to ensure that during the transfer of title between family members, this doesn’t occur.

Now, I get that if the house was put in a trust and it was transferred within family members, nobody would pay tax. But most of us don’t buy our houses in trusts. Most of us buy them as individuals, and we leave them to others or we try to give them to our children. There’s a little element there that government needs to some care over.

What is also not in this, in the budget implementation act and the budget in general…. There’s absolutely nothing to do with climate leadership. Now, I say that with some irony. I recognize that the Minister of Health has a Chevy Volt. It’s not a pure electric car, but it is pretty good. He lives in Kamloops — I get it — and he wants to drive to Victoria. I applaud him for a Chevy Volt.

Interjections.

A. Weaver: You have to. Yeah.

The electric car subsidy — that qualifies — is a good thing. I have a Nissan LEAF —100 percent electric. It’s a good thing.

Interjections.

A. Weaver: The Minister of Advanced Education goes off on a tangent again, because he wants to hear his own voice.

Do I pay road tax? Yes, I pay road tax. When I go over the Port Mann Bridge in Vancouver, I pay road tax.

Interjections.

Deputy Speaker: Members, order.

A. Weaver: Apart from the electric vehicle, there is nothing, zero, about climate leadership. Why is that important? Because right now, today, in Vancouver, first ministers are meeting with the Prime Minister to discuss climate leadership.

What do we have here in this House on that day? An introduction of another bill — another bill to give away our resource to the LNG industry, as we are continually desperate to try to find ways and means that they don’t have to account for their greenhouse gases. Or we can change the international rules to pretend that some greenhouse gases are not really greenhouse gases.

That is what this government thinks is climate leadership. The irony is that it’s on the day that we’re supposed to be talking about this in Vancouver.

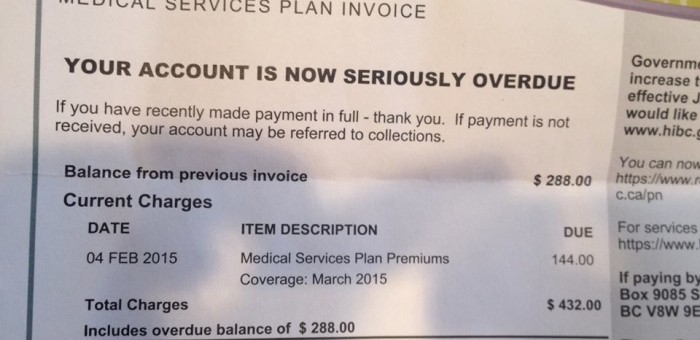

What’s also not in here, in this budget, is anything of substance in terms of MSP reform. This tinkering around the edges in the budget, not so much in the implementation act….

Where, for example, are steps being taken to fulfil government’s promise that each and every British Columbian would have a GP by the end of 2015? Each and every British Columbian would have access — this is a promise — to a general practitioner by 2015.

Well, I hope you aren’t looking for a GP in this area, because there is not a single GP south of Duncan that is accepting new patients.

While the government is quite desperate to fulfil its promise of wealth and prosperity through an industry that’s not going happen and basically gives away our resource in a desperate attempt to get an agreement, they’re not willing to deal with another promise — the “GP for everyone” promise.

I could go on and on, and I know the Minister of Advanced Education would love me to. But with that, I’ll conclude with one final statement.

When you look at this Budget Measures Implementation Act and you look at the individual boutique exemptions here or the little addition there, what you get is a sense of what this government is doing.

This government has lost its sense of vision. It has lost its sense of vision of what a prosperous British Columbia looks like. They’re fixated on a speculative housing market. They’re fixated on LNG.

They don’t understand what a diversified economy is. It’s not an economy that’s propped up with an artificial, speculative, Scottsdale-style housing market until we can maybe get LNG ten years from now or twenty years from now. That’s not a diversified economy.

They don’t understand what’s going on with the elements of our society that are struggling to make ends meet.

This budget, through its implementation, is something that cannot be supported for what’s not in it, not so much for the boutique tax credits that are in it but for what’s not in it: assistance to those who can barely make ends meet, structural changes to things like the MSP, dealing with the affordability crisis in means and ways that actually ensure that it’s dealt with, instead of incentivizing the problem still further, and dealing with an issue that was simply not addressed in the budget — education.

Who are we as a society if we don’t value the next generation, the generation in our schools and colleges today, as the important asset of our future? LNG is not important in the big picture. Our next generation is important. They are the citizens of tomorrow. They are the ones who will build the economy of tomorrow.

They are the ones who will take care of us when we’re older. They are the ones who will discover the cures for various diseases that you and I will get as we get older.

But there is nothing, nothing at all in this, for education, whether that be K to 12, whether that be early childhood education or whether that be post-secondary education. That is the single biggest disaster of this budget: it does not do anything for the next generation. That is why I cannot support it.

Video of my Speech

Introducing a Bill to Ensure Criminals Don’t Profit from Recounting Their Crimes

Today in the legislature I introduced a private members bill M204 entitled Profits of Criminal Notoriety Act, 2016. The purpose of this bill, based on a similar bill in Nova Scotia, is to ensure that criminals are unable to profit from recounting their crimes. Below is the text and video of my introduction of the bill. The accompanying media release is also appended below.

Text of my Speech

A. Weaver: I move introduction of the Profits of Criminal Notoriety Act, 2016.

Motion approved.

A. Weaver: I’m pleased to be introducing a bill intituled Profits of Criminal Notoriety Act. I’m sure many members in this chamber are aware of the recent revelation of Canada’s most prolific serial killer, Robert Pickton, publishing a book called Pickton: In His Own Words.

Madame Speaker, this has outraged many people in this province, and it has brought to light a glaring omission in our legal system. We have nothing in our legal system to prevent convicted criminals from making money through the recounting of their crimes. Other provinces in Canada have laws to prevent this type of activity, and British Columbia must follow suit

This bill I am introducing today draws heavily on the Nova Scotia legislation and would provide a means to prevent criminals from potentially profiting financially from the recounting of their crimes.

I move that the bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Bill M204, Profits of Criminal Notoriety Act, introduced, read a first time and ordered to be placed on orders of the day for second reading at the next sitting of the House after today.

Video of my Speech

Media Release

Media Release: February 25, 2016

Andrew Weaver – Bill to stop criminals from profiting from recounting their crimes

For Immediate Release

Victoria B.C. – Today Andrew Weaver, Leader of the B.C. Green Party and MLA for Oak Bay-Gordon Head, introduced a Private Member’s bill entitled the Criminal Notoriety Act which would prevent convicted criminals from profiting in recounting their crimes.

“It is immoral that a convicted serial killer can potentially gain from retelling their crime,” says Weaver. “I’m not talking about censorship or limiting freedom of speech, but offenders should not be able to financially benefit from such actions. I greatly sympathize with the continued anguish facing victim’s families in these tragic situations.”

While there is no legislation in British Columbia that prevents criminals from financially benefiting in recounting their crimes, Ontario, Alberta, Manitoba, Saskatchewan and Nova Scotia all have laws that specifically prevent it.

“It was a relatively simple piece of legislation to bring forward,” says Weaver. “The Criminal Notoriety Act is based off Nova Scotia’s model and is a practicable bill that the government should carry forward. I see no reason why it couldn’t be brought into legislation by the end of this session.”

-30-

Media Contact

Mat Wright

Press Secretary – Andrew Weaver MLA

Cell: 250 216 3382

Mat.wright@leg.bc.ca

Twitter: @MatVic

Parliament Buildings

Room 027C

Victoria BC V8V 1X4

BC Liberals Reject Progressive Approach on MSP Premiums

Today in the legislature we were debating an amendment to the motion that the Speaker do now leave the Chair for the House to go into Committee of Supply”. The BC NDP added the following text:

“That the government recognize the cumulative effect of the increases in MSP taxes, hydro rates, ICBC premiums, and other fees and hidden taxes, on British Columbia families.”

I took the opportunity to subamend the amendment by adding:

“And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue neutral manner to create a progressive health care levy.”

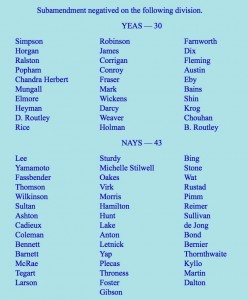

The BC NDP supported my subamendment which was defeated by the Liberal majority (vote reproduced below). I also supported the BC NDP amendment that was also defeated by the BC Liberals.

In voting the way they did on my subamendment, the BC Liberals made it very clear that they are not interested in fixing the regressive nature of the MSP premiums. I found this very odd in light of the fact that the Premier recently stated, “Here is the thing about the MSP system is it is antiquated, it is old, and the way people pay for it generally doesn’t make a whole tonne of sense…“. If you ask me, this is nothing short of a caucus vote of non confidence on the Premier’s position on the MSP Premium file.

Below is the text (and video) of my speech in support of the BC NDP amendment and my subamendment.

Text of my Speech

A. Weaver: It gives me great pleasure to rise in support of the motion put forward by the member for Nelson-Creston and seconded by the member for Port Coquitlam: “That the Speaker do now leave the Chair for the House to go into Committee of Supply be amended by adding the following, ‘That the government recognize the cumulative effect of the increases in MSP taxes, hydro rates, ICBC premiums, and other fees and hidden taxes, on British Columbia families.'”

I rise in support of this for numerous reasons. The first, of course, is that this government is proud of its triple-A credit rating and its balanced budget. I am proud of the balanced budget. However, the choices this government has made are such that it is those who can least afford it who are the ones paying the costs of balancing the budget.

It’s a biased budget, one that puts the poor, those with disabilities, those who can barely make ends meet and families second. It puts vested interests, the development industry, first and foremost.

This government touts the fact, through self-congratulatory rhetoric, that it is fiscally responsible. Let me be very clear: this government is fiscally reckless.

Take Site C, for example — the biggest item by far in the budget that is not being addressed in detail, an item with an $8.7 billion price tag that will almost certainly come around $12 billion to $13 billion when all is said and done. It’s a project that received virtually no attention in this budget and only had one line item to it. That’s Site C, as mentioned previously, by the minister before me.

The Premier recently stated that she wanted to move this project “past the point of no return,” but in her haste to get to yes, she is throwing fiscal caution to the wind. The government is pushing forward with a massive pet project that was created for a yet-to-materialize LNG industry — a project that has seen numerous cost overruns already, and yet it has barely started.

This government is plowing forward with a substantial risk that is borne on the backs of B.C. taxpayers — those who are not only paying the price through increases in MSP premiums, through increases in hydro rates, through increases in ICBC premiums, but who also being burdened with debt for years to come for a yet-to-materialize LNG industry, a project that has seen, as I mentioned, numerous cost overruns.

The government wants to appear to be fiscally responsible, but it’s gambling with our tax dollars. Why are we pushing ahead with a project that is riddled with legal challenges and massive environmental consequences? Why is the government not taking a step back and putting the interests of regular working people first and foremost? The British Columbians who actually vote the MLAs in here — why are they not putting their interests first?

Why is this government not taking that step back? British Columbians want this government to wait for the report from the Auditor General, who is currently examining the Site C project, and learn whether this project is actually fiscally sound. Frankly, to push ahead is simply reckless.

With Site C, it’s easy to see we’re going into a big debt for a project we don’t need, and in doing so we are flooding our energy market with taxpayer dollars that are actually driving investment out of our province. And again, to make ends meet, we increase MSP rates. We increase hydro rates and on and on and on.

Just two weeks ago, the Canadian Wind Energy Association announced that it was closing its office and leaving B.C. because the government and B.C. Hydro are just not interested. Last year we saw the same thing with EDP Renewables — no interest from the government for a roughly $1 billion wind power investment off southern Vancouver Island. That company has walked as well.

Despite the potential in this province, clean energy investment is leaving British Columbia in droves. The B.C. Liberals’ dream — they continue to dream of LNG — has not materialized, but they’re still using billions of taxpayer money to gamble on projects designed to support it. They are pushing risky projects past the point of no return and, in so doing, clean tech investment out of our province.

Let’s take a look at these LNG figures that the Minister of Environment has presented in the budget, figures that were supposed to help fuel a prosperity fund instead of it being fuelled through MSP premium increases and so forth, which this amendment is attempting to address.

I love talking about LNG. I love talking about it, just like I loved talking about the tooth fairy when I was a little child. Those of us outside the government’s self-congratulatory circle of hyperbola know that they had….

Hon. A. Wilkinson: Hyperbole. “Hyperbola” is a mathematical term.

A. Weaver: Hyperbole. Thank you to the Minister for Advanced Education for pointing out that hyperbola is a mathematical term.

Those of us outside of government’s self-congratulatory circle of hyperbole already know that they have no hope of tapping into an LNG market in the short term, no hope whatsoever. No amount of tax cuts, no amount of subsidies to the industry, no amount of praying to the LNG god…. We just know it’s not going to happen. They’ve tried and failed.

This year’s budget shifted the LNG story to a future supply-demand gap slotted to emerge ten years from now. Uh-oh. Never mind the “unforeseen global conditions.” So how are we going to make ends meet? We’re going to tax those who are least able to afford it through increases in MSPs, increases in hydro rates and so forth, which is exactly what this amendment is trying to quantify and recognize.

Now we’re talking about LNG in, say, the mid-2020s, something that I’ve been saying for quite some time. Yet the government’s track record of repeatedly failing to predict the LNG future even months in advance does not instill in me, let alone in British Columbians, with any confidence as to what their projected supply and demand will be like in 2030.

On the demand side, there are challenges as well. While the increasing competitiveness of the renewables, as recently highlighted by economists, it seems unlikely that demand projections, illustrated by the curious unlabelled graph in the 2016 budget document, will be accurate either. Simply making up numbers.

This government is chasing a falling market, in which it was a late player, and throwing good money after bad. Let’s take a look at this prosperity fund in a little more detail. This is a fund that the government promised to implement through vast amounts of moneys coming from LNG revenues. Instead, we see increases to the MSP premium, hydro rates, and so on, in order to fund the prosperity fund on the back of individual taxpayers.

I have always advocated that it’s our responsibility as legislators to not think merely of today’s British Columbians but also those of future generations who will follow us — though in a more responsible, realistic manner than the government’s “LNG for our grandchildren” rhetoric mantra.

Indeed, this is the main reason I chose to run for office in first place. But the fact is that if this government were serious about reducing the debt of this province, they would not grow the debt of this province each year. They would not create a loophole allowing them the ability to not pay down the debt with surplus revenues but, in fact, use taxpayer money for political posturing, which is what the prosperity fund is all about.

It gets worse. My fears were confirmed when I looked into the specifics of the prosperity fund being funded through taxes on those who can least afford it — the subject of the amendment before us. Let’s break it down. We have $100 million going into this prosperity fund this year and, according to this year’s budget, no further investments in our province’s savings account in any subsequent year. That’s hardly prudent fiscal planning. And curious, it’s in a year leading up to the election.

Of that $100 million, this government is putting a full half of it towards debt retirement. Hang on. That’s not $100 million. It’s $50 million in the prosperity fund. But then they actually say that only 25 percent of the $100 million will be saved, while the last 25 percent will go towards “government priorities.” Clearly, MSP premiums are not the government’s priority.

What is the government priority? Probably boutique handouts as we move into the election year in May of next year. In fact, when we tone down the self-congratulatory rhetoric that this government is issuing and tune into the actual numbers, we find that this government’s $100 million prosperity fund is actually a one-time investment of $25 million. This is a blatant misrepresentation of how tax dollars are being spent.

Also, the government tried to mislead the voters of B.C. that their empty promises are not actually empty. They’re doing this to create a potential political play to try to tempt the opposition to vote against prosperity. That’s shameful — nothing more than political posturing in the hope that they can turn around and say that the opposition votes against prosperity.

This opposition votes for prosperity. But prosperity is more than just the bottom line in the so-called prosperity fund. It’s prosperity in social prosperity. It’s environmental prosperity. It’s fiscal prosperity. It’s triple-bottom-line prosperity. For this government, prosperity simply means prosperity for those who happen to give them large donations to ensure that they remain in power. It is not a prosperity for all British Columbians. It is a very limited prosperity.

With that in mind, and in light of the fact that the motion to amend the statement “That the Speaker do now leave the Chair” is before us, I will, at this time, introduce notice to subamend that motion with the idea of adding the following:

I move the following subamendment:

[Be it resolved that the motion “That the Speaker do now leave the Chair” be amended by adding the following:

“That the government recognize the cumulative effect of increases in MSP taxes, hydro rates and ICBC premiums, and other fees and hidden taxes, on British Columbia families,”

And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue neutral manner to create a progressive health care levy.]

Deputy Speaker: So, Member, are you going to speak on the amendment to the amendment?

A. Weaver: Correct.

Deputy Speaker: Okay. Carry on.

On the subamendment.

A. Weaver: On the subamendment, I have but one statement. I am going to quote Tom Fletcher from Black Press, president of the legislative press gallery. The quote is this. “Green leader has it right.”

The Vote

Video of my Speech

am