Legislation

Bill 34 — Red Tape Reduction Day Act

Today was a day I never thought I would ever see in the BC Legislature. It was a day when the BC Liberals, void of ideas and a vision, introduced the most ridiculous bill I have ever seen — a bill that I voted against being read even a first time. The sole purpose of the two-line Bill was to enshrine in law that in British Columbia, the first Wednesday in March would be declared Red Tape Reduction Day.

Now voting against a bill at first reading is not something you do lightly. There is a tradition and an unwritten rule in the legislature that MLAs unanimously vote for all bills (government or private member) to be read a first time so that they can see it printed. Substantive debate typically follows during second reading deliberations. But after hearing the introductory remarks from Coralee Oakes, the Minister of Small Business and Red Tape Reduction and Minister Responsible for the Liquor Distribution Branch, both Vicki Huntington (Delta South) and I felt we were left with no choice.

Below I reproduce the introductory remarks for the Bill.

Introductory Text for Bill 34

Hon. C. Oakes: I am pleased to introduce Bill 34, the Red Tape Reduction Day Act for 2015. Bill 34 introduces a commitment by our government to host an honorary day devoted to reducing red tape through regulatory reform and the repeal of outdated or unnecessary regulatory requirements on the first Wednesday of March of each year. This legislation institutionalizes accountability and transparency of regulatory reform. It demonstrates our government’s commitment to ongoing…

Interjections.

Madame Speaker: Members.

Hon. C. Oakes: …commitment to reduce the red-tape burden imposed on citizens and small businesses.

Since 2001, we have reduced regulatory requirements by over 43 percent. Bill 34 will impose on government a requirement to reduce red tape and demonstrate its continued commitment to regulatory reform on the first Wednesday in March of each year. Reducing the regulatory burden on citizens and small businesses is critical to ensuring British Columbia’s economic competitiveness and providing all citizens with easy access to government services and programs.

Interjections.

Madame Speaker: Members

Hon. C. Oakes: Bill 34 will also make positive and effective shifts in the management and continuous improvement of our regulatory environment to ensure that it continues to meet the needs of citizens and businesses while maintaining our cap on the number of regulatory requirements.

The legislation solidifies British Columbia as the Canadian leader in regulatory reforms by being the first Canadian jurisdiction to enshrine in law a commitment to reduce red tape and repeal outdated, unnecessary requirements on an annual basis.

Madame Speaker, I move that this bill be placed on the orders of the day for second reading at the next sitting after today.

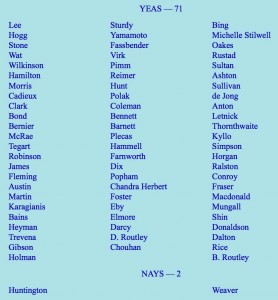

Vicki Huntington, MLA for Delta South, and I were taken aback by the hyper partisan rhetoric embodied in this bill. Below is the result of the vote at first reading. I am reasonably confident that the NDP will vote against the Bill at second reading.

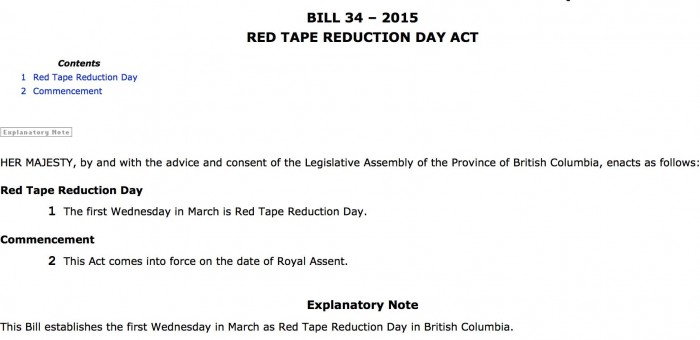

For interest, I also reproduce the printed text of the entire Bill which became available once it passed first reading.

The question I ask you is this: do you think that BC MLAs should spend their time debating this Bill? The government spent an enormous amount of money holding a special summer session designed to try and land a project development agreement and hence final investment decision with Petronas. Surely that money could have been better used and we could have instead debated Bill 30, Liquefied Natural Gas Project Agreements Act during the present session.

The 1st Reading Vote

Full Text of Bill 34

HER MAJESTY, by and with the advice and consent of the Legislative Assembly of the Province of British Columbia, enacts as follows:

Red Tape Reduction Day

1 The first Wednesday in March is Red Tape Reduction Day.

Commencement

2 This Act comes into force on the date of Royal Assent.

Bill 29 – Property Taxation (Exemptions) Statutes Amendment Act

Today in the Legislature I rose to speak in support of Bill 29 – Property Taxation (Exemptions) Statutes Amendment Act, 2015.

Bill 29 ensures that there is consistent treatment across the province with respect to the way independent schools are subjected to municipal property taxation. Presently only the land immediately under a school building is exempt from municipal taxation. While most municipalities extend the exemption to the rest of the school property (playgrounds, playing fields etc.) there have been a few exceptions and some municipalities are contemplating the idea.

Below is the text of my speech at second reading.

Text of 2nd Reading Speech

A. Weaver: It gives me great pleasure to stand and speak in support of Bill 29, Property Taxation (Exemptions) Statutes Amendment Act. My riding is particularly interesting in that there are presently six…. Well, there are five high schools now, but after the election boundaries are redefined, there’ll be six high schools. Three of them are public schools, and three of them are independent schools. Oak Bay, Lambrick, Mount Doug — public schools. St. Michaels and Maria Montessori are presently in the riding and independent schools. Glenlyon Norfolk, soon to be in the riding, as well, is another independent school.

We have much to be proud of, of our education system in British Columbia. Despite what some might have said, Canada ranks at the very top, internationally, in the program for international student assessment scores, particularly in the area of sciences and reading. If we look at the 2012 science rankings, worldwide, No. 1 was Shanghai, China. No. 2, Hong Kong, China. No. 3, Singapore. No. 4, Japan. No. 5, Finland. And No. 6, British Columbia.

Now, when you compare that to 2003, in fact, two of those — Shanghai and Singapore — were not part of the 2003 assessment. So in essence, British Columbia would have been ranked No. 4, worldwide, in terms of science achievement, whereas in 2003, British Columbia was ranked No. 6. So we have much to be proud of in British Columbia with respect to our science education.

The same is true with our language arts. In 2003, No. 1 in the world was Finland. Alberta was No. 2, and British Columbia, No. 3. Since 2002, a number of other jurisdictions have participated in the international PISA. So we see Shanghai and Singapore moving up. British Columbia dropped to No. 6, which would have been fifth if you accounted other jurisdictions that weren’t there.

But what is really important to note is how it did relative to other provinces in Canada and the much-touted Finnish education system. I’ll come to Finland in a second, because in 2003, Finland ranked No. 1 in science, No. 3 in mathematics and No. 1 in reading. British Columbia was sixth in science, fifth in mathematics and third in reading.

Now, what’s indicative of a government that has somewhat lost touch with developing advancements in education, for reasons unknown to anybody, the B.C. government sent a young person to Finland to study the Finnish system. I understand that if you’re looking at the 2003 PISA assessments, you might want to understand the Finnish system. But in 2012, British Columbia was above Finland in mathematics, was above Finland in reading and was tied, statistically so, in science. There’s much to be proud of about our education system in British Columbia, and we do not need to study the Finnish system to find that out.

We are the top-ranked province in Canada, in terms of science education as well as reading, and yet that was not the case in 2003. Alberta was the top-ranked province in all three areas covered by PISA. But there is one area that B.C. does have some trouble with and I would argue that this has nothing to do with the quality of our teachers in British Columbia, but rather as the quality of the means and the ways they’re being trained to teach mathematics.

Mathematics is the one subject where B.C. has dropped, relative to other jurisdictions, in the move that has moved mathematics from learning the times tables by rote memorizing — learning by memorization, a critical aspect of learning mathematics — and moving into trying to understand what that means. You should know that seven times eight is 56, right off the bat. That’s a critical building block. But you shouldn’t necessarily have to know in grade 3 that….

M. Farnworth: Nine times seven?

A. Weaver: Sixty-three, and nine times nine is 81.

But today in school you’re not taught nine times seven is 63. You’re taught that nine times seven is ten times seven minus one times seven. Now, that’s an abstract idea that many people in elementary education simply can’t grasp. If you want to know why we’re going down in maths, you have only to look at the way our teachers are being trained in the universities, not the quality of the teachers themselves. Apart from mathematics, we rank at the very top internationally.

I will not listen to those who bemoan the state of our education system in B.C. We rank second to no other province in terms of quality, and we’re one of the top nations internationally and certainly the top nation in the western hemisphere.

What does that have to do with the bill? Well, it has to do with treating independent schools the same as public schools. Presently, the contents of this bill are actually in play in the Vancouver Charter already. The Vancouver Charter is quite specific in terms of what can or cannot be included in property taxation. This bill essentially says to the rest of the province that we’re going to be consistent. Whether you be in Victoria, Prince George, Kelowna, whether you be in Fernie, whether you be in Haida Gwaii, Prince Rupert, schools will be treated one and the same in terms of their property taxation.

Many people often don’t realize that we’ve had independent schools in Canada since the 17th century when the first Catholic schools were established in Quebec. In many jurisdictions, we have publicly funded school boards that fall along denominational lines. In Ontario and Alberta, for example, we have Catholic school boards and we have non-Catholic school boards. They’re both public school systems that go back to Confederation days. Here in B.C., we would call Catholic schools independent schools, where in other provinces, they’re considered part of the public system.

We have other potential problems which exist presently. Let’s suppose right now that we have a Catholic school on church property. How does that fall within the property taxation realm? Is it a church? Is it an independent school? Is it in the Catholic school board? No. This needs to be cleared up. While this bill is very short in terms of length, it’s important in terms of substance, because it actually closes a lot of potential problems that could create a potpourri of odd property taxations across the province.

One of the things that I support in this bill is the fact that it does not apply to things like endowment lands, things like houses for staff, for example, if there may be some independent schools that provide housing for their teachers. There may be some other independent schools that have large endowment lands. These are not being covered under this legislation. It’s simply the school and that which is typically used in school.

There are benefits for that. A school in my riding, Glenlyon — well, soon to be my riding; half the school is in my riding — for example, has a lovely Astro Turf field that is used by the local community in partnership, the Bays United soccer community. They have a public relationship with the independent school, yet there is a potential — it’s not right now — for that to be taxed, even though the public is benefiting from this field that is used by all.

In summary, then, first off I would like to recognize that we do have an outstanding education system. It does not help our education system when we continue to bemoan the problems in it instead of celebrating the successes in it. Sure, there are problems in our education system. There are problems in everything around us. But we will not move this education system forward if all we do is fixate on the negative that’s in it.

Secondly, I think fairness is critical. This bill provides fairness, recognizing that there are other provinces where independent schools, like the Catholic system, are actually part of the public system, whereas in B.C. we’ve never had Catholic school boards. Finally, it does not exclude some of the extraneous properties attached with an independent school. Those will be subject to municipal taxes.

With that, I thank you for your time. I’m only sad that the new Minister of Education is no longer sitting beside me, but across the hall. I do appreciate your office, hon. Speaker, and of those House Leaders, in preparing me here in the Legislature for two upcoming by-elections so that my colleagues can sit beside me.

Video of 2nd Reading Speech

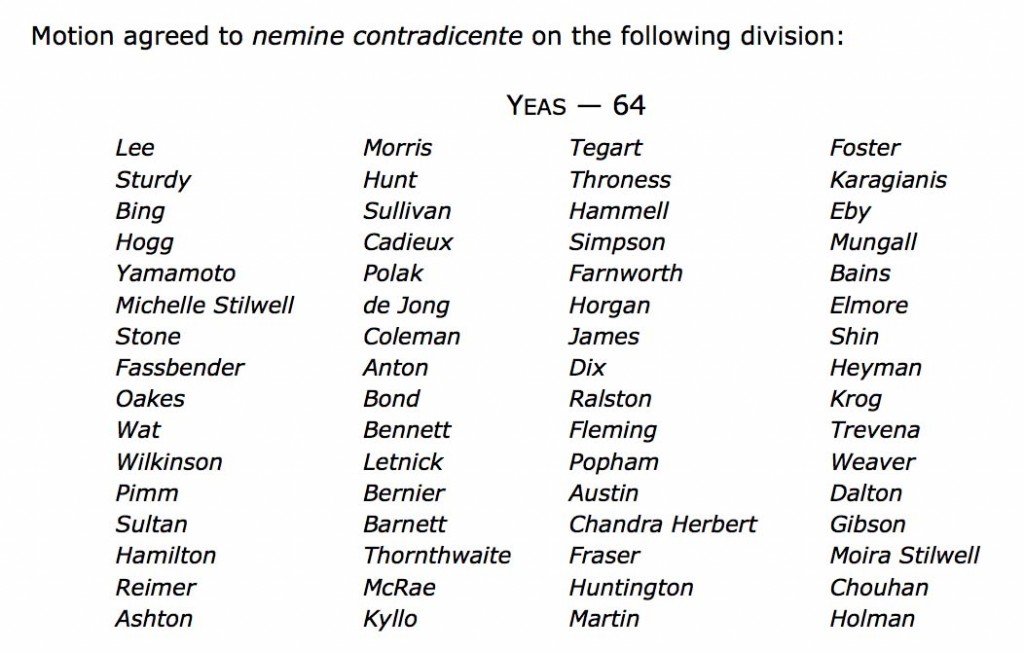

The Vote

Second reading of Bill 29 approved unanimously on a division.

Bill M229 — Energy and Water Efficiency Act, 2015

Today in the legislature I rose to table Private Members’ Bill entitled: Bill M229 — Energy and Water Efficiency Act, 2015. As I noted in introducing it, this Bill was originally tabled by the Liberal government in 2012 as Bill 32 — Energy and Water Efficiency Act. The Bill received support from all sides of the legislature when it was introduced in 2012. Unfortunately, it was never brought to the Committee of the whole house and subsequently third reading. We missed an opportunity in 2012 to pass this legislation. I hope that the government chooses to pick this up at this time.

Text of the Introduction of my Bill

I’m pleased to introduce a bill intituled the Energy and Water Efficiency Act. If this title sounds familiar, it’s because the act was initially introduced in 2012 and passed second reading with the support of the official opposition on April 24, 2012, but the Committee of the Whole House was never called during the fourth session of the 39th Parliament and so the bill died on the order paper.

This bill reflects the new language in the Greenhouse Gas Industrial Reporting and Control Act. As noted by the Minister of Energy and Mines at the time, this bill would reduce consumers’ energy bills and lower operating costs for B.C. businesses. This legislation replaces the current Energy Efficiency Act and would enable administrative penalties to ensure manufacturers, distributors and retailers comply with energy efficiency guidelines, broaden the scope of energy efficiency requirements to include commercial energy systems, industrial reporting on water efficiency and enable the minister responsible to enact regulations for technical standards.

It was a fine, widely supported piece of legislation that was introduced after engaging more than 40 organizations and 60 individuals representing industry, utilities, governments, public interest and academia.

I move the bill be placed on the orders of the day for second reading at the next sitting of the House after today.

Video of the Introduction of my Bill

Bill M227 — Land Title Amendment Act, 2015

Today in the legislature I introduced a Private Member’s Bill. If enacted, the Bill, entitled Land Title Amendment Act, 2015 would amend the Land Title Act to reintroduce and expand provisions that were previously in the Act. Such provisions will help determine who is purchasing property in BC. It would allow the government to determine foreign investment flows, the role corporations are playing, and whether we are seeing speculation in our market coming from other regions of Canada.

Text of my Speech

A. Weaver: I’m pleased to be introducing a bill that offers government one of the tools it needs to begin to properly assess and act upon the affordability and housing crisis affecting Metro Vancouver and emerging here in the capital regional district.

There’s been significant conversation in the past few months about the role that speculation is playing in our market. The government came out with a number of documents purporting that foreign investment wasn’t a factor. These studies were vague and lacked any links to clear, rigorous evidence that supported the claim.

It’s with this in mind that I bring this bill forward today. The bill amends the Land Title Act to provide the government with the means of determining who is purchasing property in B.C. This includes determining both foreign investment flows, the role that corporations are playing in purchasing property and if we have significant speculation coming from other places in Canada.

To be clear, this bill is not about identifying what specifically is driving housing prices to unsustainable rates but, rather, to ensure that government is informing itself so that any future policy measures are based on a better understanding of what is happening with our provincial real estate industry.

Video of my Speech

Press Release on Introduction of Bill

Media Statement: July 16, 2015

MLA Weaver Introduces Bill to help inform solutions to Affordability Crisis in Vancouver

Victoria B.C. -Victoria B.C. – Today, Andrew Weaver, MLA for Oak Bay-Gordon Head and Deputy Leader of the B.C. Green Party, tabled his private members bill that provides government with a tool to begin measuring the impact that speculation is having on affordability in Metro Vancouver.

“This is not about stopping the flow of investment or preventing growth in the real estate sector,” said Andrew Weaver. “We need to take serious and deliberate steps to smooth the rate of increase in prices to ensure that the region can manage the growth in a sustainable manner.”

If enacted, this Bill would amend the Land Title Act to reintroduce and expand provisions that were previously in the Act, which can help determine who is purchasing property in BC. It would allow the government to determine foreign investment flows, the role corporations are playing, and whether we are seeing speculation coming from other regions of Canada.

“Smart public policy requires good information about what action is needed,” said Andrew Weaver. “I am concerned that this government isn’t taking seriously the challenge of affordability that many people are experiencing in the Metro Vancouver. Strong, resilient communities are worth protecting.”

-30-

Media Contact

Mat Wright – Press Secretary, Andrew Weaver MLA

Mat.Wright@leg.bc.ca

Cell: 1 250 216 3382

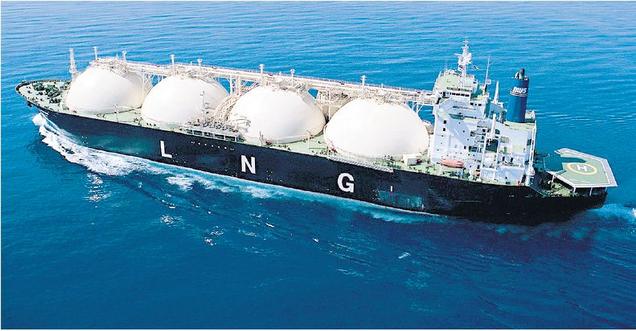

Bill 30 – Liquefied Natural Gas Project Agreements Act

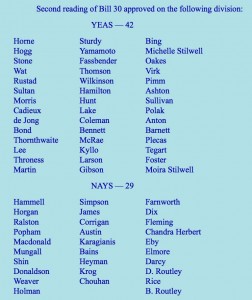

Yesterday in the legislature I rose to speak strongly against Bill 30 — Liquefied Natural Gas Project Agreements Act. In a desperate attempt to fulfill outrageous election promises, the BC Government does what it can to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come.

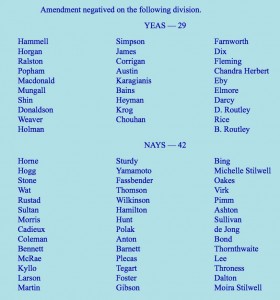

Below is the text of my speech. You will see that at the end of my speech I offered a Reasoned Amendment. In speaking to the amendment I looked across the aisle to the MLAs opposite. I asked them to ask themselves one question. How do they think history will judge them? I argued that the generation of tomorrow will look back and will say: “This generation sold us out.” They will look back at this government’s decisions here to pass this bill with disdain, with shock, with disbelief and ask why?

Both the BC NDP and I stood together in support of my amendment and against passing second reading.

Second Reading Speech

A. Weaver: I rise today to take part in the debate on Bill 30, the Liquefied Natural Gas Project Agreements Act, or PDA. That I’ll refer to later. This is a bill that our Premier has indicated will have historic implications.

Before I begin, I’d like to acknowledge the Minister of Finance’s efforts to ensure that my office received the necessary briefings and had an opportunity to ask questions prior to debating this bill in the Legislature. I’d also like to acknowledge that, true to the Minister of Natural Gas’s word, we are indeed debating the PDA in the Legislature, providing MLAs an opportunity to examine and debate its implications. While I may not like what I see, I do feel I need to acknowledge my gratitude for the opportunity to voice my concerns publicly.

Now I’d like it make two confessions. First, I’m surprised in how the government is choosing to frame the debate on this bill. In her introduction of the bill, our Premier noted this: “It is not every day in this House that we get the chance to really make our mark in history.”

Those words ring oddly familiar to me, having heard similar remarks from a previous Finance Minister back in 2008.

“Or we can seize the opportunity before us to be the generation of British Columbians who made the right decisions, who chose to take action and who, by doing so, showed their respect for the earth, for the atmosphere, for those who came before us and for those who will follow in the decades to come. Let’s rise to the occasion, and let’s work together to shape the next proud chapter in the history of British Columbia.”

These are, of course, the words of Finance Minister Carole Taylor as she introduced the 2008 budget in British Columbia, which laid out a path towards a sustainable and resilient future for our province with the climate action plan.

It is in this that I must admit my surprise. I’m surprised at how far this government’s ambition has fallen, from striving to achieve a place of global leadership on the most pressing issue of our time — namely, the transition to a diversified, resilient 21st-century economy — to declare that we are “building our future” on the bedrock of a fossil fuel industry. I hope the irony is not lost on the government.

The second confession I must make is that I was wrong about the government. Three years ago, when our Premier began her all-in sales pitch on LNG, I was certain that the reality of the global market conditions, the uncertainty we see in neighbouring jurisdictions like Alberta — when they have tried to build a province around a single industry — and the greenhouse gas reduction commitments the previous administration had made, that this would force the government to dial back on the rhetoric and accept that it was unlikely that we would attract an LNG investment. But the rhetoric was never dialed back.

I couldn’t possibly imagine what this government was willing to give away in order to potentially land an LNG facility: our climate leadership; the ability of future governments to re-negotiate tax rates in the interests of the province; a fair price for the resource that belongs to the people of British Columbia.

Back in the fall of 2012, the then deputy minister of Energy, Mines and Natural Gas gave a presentation at the 2012 annual Clean Energy B.C. conference, entitled Fuelling Our Economy: British Columbia’s LNG Strategies. The government’s expectations at that time were revealed, and this was in 2012. At the time, Japan LNG was trading at $16 per million Btu, and the government was promising rising global LNG prices for many years to come.

So what’s happened to the global market since 2012? Well, we all know, and it was entirely predictable, given the fact that we are not the only ones in the world who have discovered horizontal fracking technology. Our shale gas reserves pale in comparison to those of other countries. There are massive reserves in Australia, in Russia, in Iran, in Qatar, in China and in the United States. Shale gas exists all around the world, yet somehow B.C. thought that it, and only it alone, was going to fill Asian market supply gas with our natural gas.

Well, as I’ve been pointing out for almost three years now, there is a global market oversupply, and we are latecomers to the game. Today the LNG East Asia index is trading July 2016 delivery contracts at $7.35 per million Btu. August 2015 contracts are even lower — $7.25 per million Btu. It’s more than a 50 percent drop from just three years ago, but it’s not going to end there.

Sanctions are about to be lifted on Iran, and with Iran being the home of the world’s second-largest natural gas reserves that are in order of magnitude that’s more than a factor of ten, that’s larger than Canada’s reserves — let alone British Columbia’s — it’s clear that downward price pressures will continue in the natural gas and LNG markets.

As the reality of this government’s irresponsible election promises became more and more transparent, the government became more and more desperate to land one positive final investment decision. That is why this legislation and the project development agreement it is meant to enable represent, as I outline below, a generational sell-out, a public display of affection between Petronas and the B.C. Liberals.

We may eventually get an LNG facility in this province, but at what cost? As Martyn Brown, former B.C. Premier Gordon Campbell’s long-serving chief of staff and the top strategic adviser of three provincial party leaders, so aptly noted in an article published on Monday: “The fine print of that deal will commit our province to a course that is environmentally reckless, fiscally foolhardy and socially irresponsible. I say that as someone who is generally supportive of the merits of LNG development, to the extent that it is invited without giving up more than we can collectively stand to gain.”

Please let me explore this cost in some detail to illuminate what this government is asking us to give up to ensure they deliver on an over-the-top election promise. Start with the LNG tax. In the fall, we passed the Liquefied Natural Gas Income Tax Act, a bill that laid out the tax regime for LNG. With its introduction, we saw the LNG income tax slashed from a proposed 7 percent to only 3½ percent.

We also learned that companies would only be paying a 1.5 percent tax while they paid off their capital investment costs and that the tax they paid in that period could be applied as a credit on future taxes at the 3.5 percent rate. The LNG income tax legislation was a clear reflection of the unrealistic economics behind the government’s hyperbolic LNG promises.

In the spring, only a few short months after we passed the Liquefied Natural Gas Income Tax Act, the government introduced the Liquefied Natural Gas Income Tax Amendment Act. At 109 pages, this amendment act was longer than the original act, and the purpose of the amendment act was to close many of the massive loopholes that were left open when the original act was signed.

The key point to acknowledge here is the very fact that the government had to introduce the bill in two stages. They couldn’t introduce the complete income tax legislation all at once because it wasn’t ready, and they were in a rush. The government had to get the skeleton passed so that LNG companies would know, more or less, what they were going to have to pay, but they were operating on such a tight timeline that they didn’t have the time to have the fully finished legislation available in the fall.

I appreciate that the government is acting swiftly to try to meet what it perceives to be a limited window of opportunity before the 2017 election as Petronas tries to firm up supply for its mid-2020s supply gap. My concern is that in trying to meet that window, we may be opening ourselves up to making colossal errors.

The truth is we have no idea at this stage if we have closed all of the loopholes in the LNG Income Tax Act. Our first-rate civil servants, of course, have been doing their best to remediate the act’s shortcomings, but it’s not uncommon for tax legislation to be amended in the future to account for unforeseen loopholes, even years after it’s been introduced. In this case, of course, we won’t have years to fix it. In fact, we won’t have any time to fix it. If we pass this bill, the LNG Income Tax Act will be locked in for 25 years.

Now, I know that the government would respond by saying it has reserved the power to make amendments for administrative and technical matters for enforcement measures and to respond to tax avoidance issues, but I’m not talking about tax avoidance. I’m talking about tax planning. I’m talking about an LNG taxpayer identifying and exploiting a legitimate loophole in the legislation such that they could, for example, pay tax at the 1.5 percent rate well past the originally intended period. If it deemed that the taxpayer’s actions are legitimate and therefore do not constitute tax avoidance, then under this agreement any change you make to close that loophole could trigger the indemnity clause, requiring the province to potentially pay that producer millions in damages.

If we pass this bill, we won’t get another chance to close those loopholes, so we’d better have gotten it right the first time. Given how quickly LNG income tax bills were developed and the manner in which they were introduced, I’m deeply concerned that we didn’t get it right the first time. In fact, I raised serious issues myself during the debates about potential loopholes.

Yet it’s not just about the loopholes. It’s about the legislation itself. This is an LNG giveaway designed to attract an industry that wouldn’t otherwise come to B.C. By passing this legislation, we are locking the province into LNG income tax rates that have been widely criticized as being too low, and we won’t have another chance to reconsider those rates for 25 years. What if the government got it wrong? Twenty-five years is a long time. It’s too long for British Columbians to wait to fix the government’s error.

Let me turn to the natural gas tax credit. The same is true for this. B.C. already has the lowest corporate income tax rates in the country, but apparently that wasn’t low enough for the LNG companies, so we gave them an additional 3 percent back through the natural gas tax credit. What makes LNG companies so special that they need an additional 3 percent corporate income tax cut on their corporate income tax? What makes them so special? Do they not make enough money to pay themselves, like all other corporations do? Are their profits so low that they need government assistance in the form of tax breaks?

Consider this. Petronas by itself funds 45 percent of the Malaysian government’s revenue, so why are we giving them an additional 3 percent off of their corporate income tax? My concern is that is inconsistent and an arbitrary policy that is a result of government negotiating from a weak position to fulfil a campaign promise that never should have been made. And British Columbians today and in the future will bear the cost.

Let’s turn to the Greenhouse Gas Industrial Reporting and Control Act. The day the project development agreement comes into force is the day that we officially give up on our climate targets. There’s no debate there. Government can spin this any way they want, but there is simply no debate there. It’s a simple fact. We cannot have an LNG industry and meet our climate targets.

If constructed, Pacific NorthWest LNG alone, one company, would emit nearly as much carbon as the rest of our entire province, in every single sector, would emit in 2050 — one LNG facility — if we actually take those targets seriously. When we hear the rhetoric about “we have targets, and we will meet them,” let’s be clear: those targets, if we are to meet, mean we cannot have an LNG industry. You can’t have it both ways. The facts are clear.

Unfortunately, this isn’t a surprise. When we debated the Greenhouse Gas Industrial Reporting and Control Act back in the fall, it was clear that this government was no longer serious about addressing climate change. Instead of strengthening our policies, they repealed the cap-and-trade legislation and introduced a new focus on emissions intensity, a scheme that would allow you to pollute as much as you want so as long as you did so efficiently, a scheme directly out of legislation that exists in Alberta.

On Monday the government released further details on its environmental incentive program. The sellout continues. The program essentially gives yet more tax breaks to LNG companies to pay for the costs of their emissions offset. What’s particularly noteworthy is that the government’s new “environmental incentive program” has made it even easier for LNG companies to qualify for tax breaks by making the qualifying threshold higher. Originally under the GGIRC, a company had to have an emissions intensity of 0.23 to qualify for a tax break. Now the actual emissions intensity can be substantially higher than that because the company can discount all of its “entrained” CO2 emissions before it is assessed for the tax break.

What are entrained CO2 emissions? In any natural gas stream, there’s unwanted carbon dioxide that can now be freely released to the atmosphere — that’s fugitive greenhouse gas emissions — at the site of the LNG facility. Fugitive greenhouse gas emissions are not covered by the carbon tax.

So this is not the cleanest LNG in the world. This is the cleanest LNG if you have a whole bunch of loopholes and don’t account greenhouse gas emissions in the world. But nobody takes that seriously. It’s a bit rich for this government to continue the rhetoric that it is dealing with the climate issue and at the same time building the cleanest LNG in the world.

Emissions from the gas stream can be very large. They’re not subject, as I mentioned, to the carbon tax. Even those LNG companies that have emissions intensities well above 0.23, far from the so-called cleanest LNG of 0.16, now can qualify for an additional tax break. What even makes this worse is that once this bill passes, we can’t change it. Should we decide that low emitters that actually hit the 0.16 intensity mark deserve any kind of bonus, we would still have to pay those other higher emitters anyway under the indemnity clause. It makes no sense.

Similarly, should we decide that 0.16 is too high an emissions intensity, we’ll have to pay the LNG companies under the indemnity clause to lower it. So there’s no real point in improving those standards.

Contrary to what’s suggested by the name LNG environmental incentive program, by signing this agreement, we are giving away any incentive for these companies to actually lower their emissions under the GGIRC for the next 25 years because we won’t have a way of steadily and predictably increasing costs of emissions. That’s hardly encouraging the development of the cleanest LNG in the world.

As I’ve mentioned earlier, the current carbon tax applies only to emissions from combustive fossil fuels. A major gap is the methane and CO2 leakages from upstream natural gas operations and pipelines which are not taxed but now could be because of audited information from British Columbia’s greenhouse gas–reporting regulation.

While I recognize that this bill specifically states that any indemnity only applies to regulatory changes specific to the LNG facility itself, my fear is that in eventually plugging the regulatory gap on methane leakage emissions, which will increase the cost of gas at the LNG facility, Petronas would litigate. Now, government will surely claim that this was not the intent of its agreement. Petronas is a powerful resource state-owned multinational corporation, and even the threat of litigation could frighten future governments from regulating emissions.

Perhaps most worrisome of all is the framework in which all these pieces are embedded: the project development agreement. With the PDA, the government is setting a new precedent for how it will manage investments into our province. I’m concerned that this may put British Columbia in a very weak negotiating position on any future negotiations.

Please let me explain. Under this PDA, companies have the ability to negotiate for more favourable deals and piggyback on those secured by future proponents.

If the province doesn’t have this ability, in fact there are only two options for the province: maintain the relatively low standards of this PDA and hope other companies agree to them or lower them further to attract other LNG investors, in which case we have to lower the standards for everyone. These are precisely the conditions that risk exacerbating a race to the bottom. Furthermore

Furthermore, while the province will be locked in for 25 years with no exit clause, the proponent can pull out at any time with 90 days’ notice. I understand, of course, that when a company is making a large investment, they would like to have added certainty. However, if we are to provide that added certainty — and I caution that, in my view, a 25-year time frame seems a bit rich — then I would expect significant concessions in return.

In essence, we are transferring risk from the company to our province, which, in turn, is de facto transferred to the British Columbia taxpayers. If British Columbians are to take on that risk, then we should be adequately compensated for it.

Yet with this PDA, we are locking in tax rates that have been criticized as being far too low, thereby limiting the revenue we receive from the industry while also establishing no guarantees regarding jobs, training or other — for the lack of a better term — non-monetary commitments.

This, unfortunately, isn’t surprising, because the market conditions aren’t there to support these commitments, and our government was never in a strong negotiating position to demand them to begin with. I fear what we’ve done is we’ve transferred risk to the province and to British Columbians without gaining a fair return in exchange.

In addition, what is particularly concerning about this approach is that there doesn’t appear to be a clear, consistent policy on when a company can get a PDA. Businesses and our economy prosper best under a level, transparent playing field and certainty. Yet here we have a new policy tool, a project development agreement, that’s being applied to one company with no clear criteria for conditions under which another company could apply for a similar agreement.

The government likes to tout Pacific NorthWest LNG as constituting a $36 billion investment. I’ve heard it time and time again through the debates. It states that the scale of this investment is the reason that it qualifies for a PDA. The PDA only applies to the LNG facility, though. There are separate, other long-term royalty agreements that govern upstream natural gas extraction, and other measures to govern the pipeline.

Let’s break down these numbers. Let’s unpack them for all those riveted to their television screens across British Columbia. If you actually break down the numbers, the LNG facility only counts for $11 billion in investment. And guess what — $8 billion of that will be spent overseas. They’re not going to build the facility here. They’re going to build it in Asia, bring it in on tidewater and put it in British Columbia. So really, we’re actually talking about $3 billion, maybe $4 billion invested in B.C.

Let’s put that in context. While this is clearly a significant amount, the northern gateway pipeline was a $7.9 billion investment. Should we be giving them a PDA? The Trans Mountain pipeline was a $5.4 billion investment. Should they get one? EDP Renewables, TimberWest and First Nations on Vancouver Island want to invest $1 billion today, not hypothetically in the mid-2020s, yet the government has turned its nose on that, and they’re walking. Should they get a PDA?

I don’t believe we should be bringing forward a new policy tool such as PDAs without first establishing how they’re used. The last thing we want is either an unfair playing field for business or a proliferation of PDAs that facilitate the fire sale of our resources while constricting the ability of future governments to make necessary changes.

To First Nations. I’m disconcerted about how little we have heard from this government about its negotiations with First Nations. I’m left with many unanswered questions and a concern that we may be failing our fiduciary responsibility toward aboriginal people.

Is the PDA established even constitutional? Have we got legal opinion that section 35 of the Constitution Act — which limits provincial or federal government’s ability to legislate in a way that results in a meaningful diminuation of aboriginal or treaty rights — is not being violated? Would the law that we are debating today that would tie hands of future governments also purport to limit the aboriginal groups’ ability to negotiate the revenue they will receive from a project? Is this in line with what has been established in the Tsilhqot’in decision? There are many unanswered questions that we have yet to have answers given to us by government.

Are we setting up a regime where First Nations are partners in the development? Or are we foisting the development of an LNG facility on an ecologically sensitive island that would deprive future generations of the benefit of the land and the salmon that spawn, which the eelgrass nearby is critical for?

Signing agreements while committing to further engagement is not the way to reconcile relations with First Nations. It’s not rising to the challenge before us to chart a better path. We must instead engage and partner with First Nations, proceeding to sign agreements and move development forward when we can do so together.

In conclusion, I’ve lost track of the number of times the government has stressed that LNG is a generational opportunity. Indeed, the impacts of our decisions this week will be felt for generations to come. Yet I fear those impacts will not be positive. The fact we need this PDA should underscore how much this government has had to put on the table to buy this industry.

This legislation is highly illustrative of the shaky and desperate LNG climate that currently exists in B.C. and is embedded in the larger pattern of industry giveaways. We’ve already locked ourselves into long-term royalty agreements and changed municipal tax laws to allow for the special treatment of LNG facilities. We’ve dedicated years of government resources to develop a single industry, instead of investing in a diversified, resilient economy that is based on the multitude of strong, existing and up-and-coming industries we have in B.C.

For example, government proudly proclaims that if and when it becomes operational, the Petronas facility could — not likely but could — support 500 long-term jobs. Let’s put that number in context. Hootsuite, the rapidly growing Vancouver-based social media company, already employs more than 700. So 700 jobs and growing weekly, yet government is touting 500 jobs.

In the last legislative session, I voiced my concerns about Bill 12, the Federal Port Development Act. As I previously explained, on its own, Bill 12 is not inherently problematic. But when considered in conjunction with Bill C-43 federally, issues arose, as Bill 12 did not account for any of the regulatory holes left open by the federal bill.

As I continue down this path, it’s very troubling that the recently proposed Port of Prince Rupert liquefied natural gas facilities regulations put forward by Transport Canada and recently posted in the Canada Gazette, plan to put the B.C. Oil and Gas Commission in charge of regulation of LNG terminals on federal lands. Talk about putting the fox in charge of the hen house.

Especially worrisome are the broad exclusions described in section 11 of these federal regulations now in the Canada Gazette. This is what they say: “Unless otherwise provided by these regulations, a provision of an incorporated law that imposes an obligation, liability or penalty on an owner, occupier, public authority, public body or unspecified person or entity does not apply to Her Majesty in right of Canada or to the Prince Rupert Port Authority”

It’s essentially saying that laws that would generally apply to the port will only do so if expressly required by regulations — regulations set by the Oil and Gas Commission. The effect of this provision would be that laws of general application would no longer apply to the port, making it above the law. It could mean that the port could operate nearly independently of the Oil and Gas Activities Act.

Deputy Speaker: We seem to be straying from the bill at hand. If the member could draw it back.

A. Weaver: Hon. Speaker, I’ll bring it right back. I’m trying to give an example of the desperate efforts that this government has taken to actually land this, as embodied in the PDA. This desperate measure, one of them, I raised last session and is actually coming to fruition as we speak. In fact, it just came in the Canada Gazette, and it’s very relevant, hon. Speaker. I’ll finish with one sentence.

What I wanted to say is that it means now that the port could operate nearly independently of the Oil and Gas Activities Act, the Drinking Water Protection Act, the Environmental Management Act, the Species at risk Act and any other laws that could be required to protect the environment and public health. This is the extent of the giveaway embodied in the PDA, embodied in all the other pieces of legislation that this government has brought forward. And sadly, this is just the tip of the iceberg as far as these regulations are concerned.

Now with the passing of this bill, we will be locking ourselves into an untested LNG income tax regime and signing away our ability to fix any unforeseen problems. We will be solidifying tax rates demanded by industry in negotiations with a desperate government. We’ll be throwing away our climate targets and the commitments we made to them and selling out the next generation. An LNG export industry and our climate targets never could have coexisted. You don’t have to believe me. Government can ask its own civil servants, who’ve been advising them of the same thing for several years.

An LNG export industry, as I said, cannot coexist with our climate targets. We could have done more to mitigate the increased emissions. Instead, we saw the definition of “cleanest LNG” that we were pitched two years ago gutted to remove upstream and midstream emissions.

But still, you know, I’m an optimist, and still I’m a firm believer that it’s not too late. I still believe we have the opportunity to change directions. There’s still time to redirect our efforts into building a diversified, resilient economy, one that builds on our potential in clean tech, high tech and the creative economy, that embodies our strength in tourism and small business and that is based on the sustainable and thoughtful development of our natural resources, including forestry, mining, fisheries and natural gas, to name a few.

It is with this hope in mind and with these concerns laid out that I move a reasoned amendment on Bill 30, Liquefied Natural Gas Project Agreements Act. I submit to the House the following motion.

[That the motion for second reading on Bill 30, Liquefied Natural Gas Project Agreement Act, be amended by deleting all the words after “That” and substitute the words “be not now read a second time as Project Development Agreements inappropriately limit the ability of future governments to use their legislative prerogative to respond to the future environmental, social and economic challenges that will face both an LNG industry and our Province.”]

Text of my Speech to the Amendment

A. Weaver: Very briefly, on the amendment all I would like to say is I’ve laid the case out there. I look across the aisle to the MLAs opposite, and I ask them to ask themselves one question. When they open a history book 20 years from now, those of them who are still around, I will ask them this: how do they think history will judge them?

I will tell you how history will judge them. The generation of tomorrow will look back and will say: “This generation sold us out.” They will look back at this government’s decisions here to pass this bill with disdain, with shock, with disbelief and ask why. That is why I’m giving government a last chance.

Some of its MLAs…. There must be truly one or two Liberals left in the Liberal Party of Canada. For them to think that this can pass and for them to think that they are Liberals — it’s just simply not possible because Liberals, true Liberals, federal Liberals, would not do this. They would recognize the importance of meeting our climate targets. They would recognize the importance of working for a sustainable economy. They would not sell out the future generation, as this government is about to do.