Legislation

Bill 21: Fish and Seafood Act

Summary of the Bill

Yesterday, Bill 21, 2015: Fish and Seafood Act passed third reading and now awaits Royal Assent. All members in the Legislature supported it. The Fish and Seafood Act replaces and updates the Fish Inspection Act and the Fisheries Act, last updated in the 1960s, with a modern framework that builds on British Columbia’s local and international reputation as a source of sustainable and trusted seafood products. It further improves operating conditions for British Columbia’s seafood sector.

The new legislation will update the licensing and regulation of the buying, selling, handling, storing and processing of fish, shellfish and aquatic plants. The legislation will also include the following to support sustainability and consumer confidence in the safety of B.C. seafood:

- Enabling the creation of a seafood traceability system to ensure seafood processed in British Columbia is both safe and legally caught, cultured, bought and sold. The system will ensure British Columbia seafood products are responsibly produced and harvested, and can be traced from the processor to the consumer.

- Prohibiting the possession of illegally caught, cultured, harvested or processed seafood products, and the unlicensed sale of fish, ensuring only sustainably harvested and safely handled seafood products enter the food chain.

The new act also increases inspection and enforcement.

Banning the Sale, Trade and Distribution of Shark Fins

On November 19, 2014 I was visited by a remarkable group of students from Glenlyon Norfolk School who, together with their teacher, had been working tirelessly to do what they can to make people aware of the plight of the world’s shark population. Following my meeting with the students I asked the Minister of Agriculture two questions during Question Period:

1) Will the government introduce legislation to ban the sale, trade and distribution of shark fins in British Columbia?

2) Will the government commit to working with me and other MLAs to develop a strategy that would eventually lead to banning the sale, trade and distribution of shark fins in British Columbia?

In response, the Minister subsequently committed to meet with me to discuss the issue. We met and at the meeting I promised to put together a package of information that he committed to pass along to Ministry staff for a thorough review.

Shortly after the meeting, I presented the Minister with a binder containing detailed and comprehensive information outlining the rationale for implementing shark fin legislation. The response to my information package that I received from the Minister in February was disappointing. The Minister did not respond to my specific question as to whether the government would consider introducing legislation to ban the sale, trade and distribution of shark fins in British Columbia.

The good news and new reality is that the government has since introduced Bill 21: Fish and Seafood Act. This Bill opens the door for moving forward on a ban on the sale, trade and distribution of shark fins in British Columbia. The key and relevant aspects of this bill are contained in section 6:

Possession or distribution of restricted fish or aquatic plants

6 (1) In this section, “restricted fish or aquatic plants” means prescribed fish or aquatic plants that

(a) are subject to prohibitions or restrictions on harvesting under an enactment of Canada or an international agreement to which Canada is a party, or

(b) may be subject to harvesting practices that are inhumane or unsustainable.

(2) A person must not possess or distribute for human consumption restricted fish or aquatic plants except as authorized under

(a) a licence, permit or other authorization issued under an enactment of Canada, or

(b) a permit issued by a licensing officer.

Yesterday at committee stage for the Bill I probed the minister on the implications of section 6 with respect to the sale, trade and distribution of shark fin products in British Columbia. I pick up the questioning immediately after Gary Holman, the MLA for Saanich North and the Islands asked the Minister if the list of restricted species would be published in the regulations attached to Bill 21.

Please note that this was the first time that I stood to speak on Monday. I had surgery on my nose last Friday and showed up in the legislature wearing a nose splint. The beginning of our conversation involves some back and forth banter about the dangers of texting while you walk.

Bill 21 Committee Stage Questions/Answers

G. Holman: There’s this reference to “restricted fish or aquatic plants,” and there are references to prohibitions or restricted “under an enactment of Canada or international agreement.” Will this list of restricted species be published in the regulations?

Hon. N. Letnick: Yes.

A. Weaver: Could the minister please expand on what basis this list will be determined?

Hon. N. Letnick: Thank you to — I believe — the member opposite for the question. I’m not too sure. We’re going to have to get an explanation of that in a minute, I’m sure.

The restricted fish and aquatic plants are those that are under two categories: (a) are subject to national or international prohibitions or restrictions on harvesting, and (b) may be subject to harvesting practices that are inhumane or unsustainable.

A. Weaver: That was an opening for me. I recognize it’s very hard to take me seriously when I look like Beak Man here. There’s always a teachable moment in everything that we do in our lives, and the teachable moment that I have here is that one should not text and walk. We hear a lot about texting and driving and the dangers of texting and driving, but let me tell you, hon. Chair, also texting and walking can be very dangerous, particularly if you’re jogging downstairs quickly while texting and not looking where you’re going.

A. Weaver: That was an opening for me. I recognize it’s very hard to take me seriously when I look like Beak Man here. There’s always a teachable moment in everything that we do in our lives, and the teachable moment that I have here is that one should not text and walk. We hear a lot about texting and driving and the dangers of texting and driving, but let me tell you, hon. Chair, also texting and walking can be very dangerous, particularly if you’re jogging downstairs quickly while texting and not looking where you’re going.

With that, if I could continue on this. Does this mean that if an organization called the United Nations International Union for the Conservation of Nature, through their red list, were to deem a particular species to be protected and subject to international restrictions, this law would then apply in the province of British Columbia to those on the IUCN red list?

Hon. N. Letnick: Thanks to the member opposite for the question and the teachable moment. I’ve always thought — because I am one of those who is guilty of texting and reading messages while I’m walking — that someone should create an app so that while you are doing your thing, you can actually have a proximity indicator. So if you are about to bump into something, it would flash at you to look up. Or if not, at least maybe a little part of the screen with the camera in the front so that you can see before you bump into that pane of glass, or whatever else it is that caused that unfortunate accident on your face. I wish you the speediest of recoveries, hon. member. I honestly do. That must have hurt.

Back to the question. The answer is if the prohibition is part of an international agreement which Canada is a party of, then the answer is, yes, it could be.

The Chair: Member, perhaps we should keep the discussion and discourse to Bill 21. It would probably be in the best interest of all members.

A. Weaver: Hon. Chair, I will do that, but let me please point out that in British Columbia we have an incredible health care system too. I had a very luxurious time in the Royal Jubilee Hospital here on Friday last week, and I do compliment the staff there. On that note…

Interjection.

A. Weaver: I had a nurse-to-patient ratio of four nurses to one patient, too, and that was pretty impressive.

Anyway, back to the question. That is actually quite exciting. What’s interesting there is that…. You will recall that during the session last time, I raised a number of questions with respect to banning the sale, trade and distribution of a variety of shark fin products. In fact, there are a number of sharks that are actually protected on the red list of the IUCN to which Canada is a party.

So my question then, following this up, would be: to what extent will these laws be enforced, and what penalties will be put in place and how is the province going to enforce this legislation?

For example, if some people were to go in and purchase a product and have it genetically analyzed and that product was then determined to contain hammerhead sharks, for example, which we know are on the IUCN red list, would the province then step in ban the sale, trade and distribution of this? How would this be enforced?

Hon. N. Letnick: Thank you to the member opposite for the question, including his support for our health care system.

First of all, as I said before, this would be subject to Canada and the other parties being part of an international agreement. So that’s one. Then we could have this provision take effect. There would have to be genetic testing to make sure that the species is on the list. That would usually happen, I’m informed, at the point of purchase. It could be restaurants or a fish store or something like that. So the Ministry of Health would be involved.

If there’s an issue, an offence, then the maximum penalties are dealt with in section 57 of the act. We’ll canvas that, I’m sure, in a few minutes. Specific penalties, subordinate to the maximum penalties, will be described in regulations.

A. Weaver: My final question on this section is with respect to 6(1)(b) where it talks about harvesting practices that are “inhumane.”

My question on that is: inhumane is a value judgment. Who is making the value judgment as to what is or is not defined as inhumane?

Hon. N. Letnick: It would be defined in regulation. It’s not defined in the definitions of the act. And, of course, it would be applied by our inspectors, who would use their judgment in making that call.

Bill 23 – A MultiGenerational Sellout

In the not too distant future we will be moving to 2nd reading of Bill 23, The Miscellaneous Statutes Amendment Act. Included within the bill are three profoundly troubling sections.

If these sections pass, powers would be granted to the Minister to single handedly enter into secret agreements with oil and gas companies, without any clear oversight.

These agreements, parts of which can be withheld from the public, would dictate how much—or how little—British Columbians would benefit for our natural gas resources. And given what we’ve seen from this government so far on the natural gas file, it would not be unreasonable for us to be concerned about backroom deals that amount to hand outs of public resources at rock bottom prices.

Here’s what you need to know:

The most concerning points in Bill 23 pertain to changes to the way Royalty Agreements are managed under the Petroleum and Natural Gas Act. Under these changes, the Minister is granted the power to enter into secret agreements with oil and gas companies without the approval of Cabinet.

Once an agreement is signed, the Minister is not required to disclose any sections to the public that could reasonably be withheld under the Freedom of Information and Protection of Privacy Act (FOIPPA).

The question is: who decides? And what oversight exists to make sure our right to know is protected?

If the Minister is able to enter into these agreements without the approval of Cabinet, then does the rest of government even have access to them if they go unpublished?

My concern is that the act doesn’t specify any of this. So presumably right now, a secret agreement could be signed by the Minister without any oversight or approval from Cabinet. The Minister could then potentially keep important sections of that agreement from the public because he or she feels that would be okay under FOIPPA.

Yet, it goes even further.

Those agreements could lock us in for decades. In fact, it’s up to the Minister to determine how long they last, as long as the timeframe does not exceed the maximum timeframe set by Cabinet. The number that has been floating around is 25 years.

Under the agreement, the Minister can also set any terms or conditions he “considers necessary or advisable.” Presumably, these could include conditions the government must meet as well.

For instance, oftentimes agreements include exit clauses and penalties. So if a future government decides that an agreement signed by a current Minister is so egregious that we need to pull out, British Columbians may have to pay the company to do so. The problem, again, is that we may never know how much that would cost until it’s too late.

I am concerned that this is yet another attempt by this government to sell out British Columbians and their natural resources in an absolutely desperate attempt to fulfill their irresponsible election promises which at no time have ever been grounded in reality. The simple fact is – there is a global glut of natural gas in the market, demand is dropping as countries aggressively move to renewables, and BC is just not competitive enough in the LNG industry as we are so far behind other jurisdictions (not to mention that LNG prices have been plummeting and it is no longer economical to ship LNG from BC to Asia unless BC goes so far as to pay a company to do so). And Bill 23 takes the generational sellout, embodied in the Liquefied Natural Gas Income Tax Act, to a whole new level — A multigenerational sellout.

Even if this is not simply a handout for the LNG industry, the fact remains that there are legitimate concerns that the secret deals that this bill would allow could amount to handouts of public resources to companies. British Columbians should be outraged. And I will be vigourously opposing this bill in the weeks ahead.

Bill 26 – LNG Income Tax Amendment Act

On Wednesday, April 15 I rose to speak to Bill 26, Liquefied Natural Gas Income Tax Amendment Act 2015. Bill 26 introduces 109 pages of amendments to Bill 6, the Liquefied Natural Gas Income Tax Act that was introduced and subsequently granted Royal Assent in the 2014 Fall session.

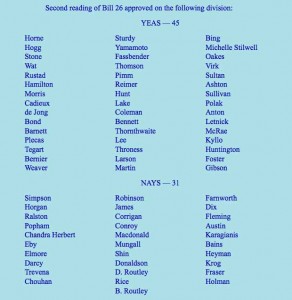

In the fall I stood alone in the house opposing Bill 6. During second reading of the bill I spoke out against it. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second writing (see the image to the right).

In the fall I stood alone in the house opposing Bill 6. During second reading of the bill I spoke out against it. I described it as a “generational sellout” that was incomplete and full of loopholes. I noted that in a desperate attempt to fulfill outrageous election promises, the BC Government did what it could to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Every single member of the legislature apart from me voted in support of the bill at second writing (see the image to the right).

During the committee stage for the bill after 2nd reading, I identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC. And then, at third reading, I moved an amendment that would have sent Bill 6 to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises. The bill would have benefitted from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

Imagine my surprise when the 109 page LNG Income Tax Amendment Act (Bill 26) was brought in for debate during this session. As I outline in my speech below, the actions taken by this Legislature in the fall, I believe firmly, were a dereliction of our duty. As MLAs, we should have explored the incomplete bill in greater detail. That could and should have been accomplished by sending it to the Select Standing Committee.

Bill 26 puts me in a quandary. I was fundamentally opposed to passing Bill 6 in the Fall. Yet the BC Liberals and the BC NDP voted to move it through quickly and so it is now law in British Columbia. Many of the objections I raised concerning the incompleteness of Bill 6, including the many loopholes and lack of completeness, were addressed in the LNG Income Tax Amendment Act (Bill 26). It is important that we fix bad law.

But at the same time, Bill 26 introduces an unacceptable revision to section 56. Now the minister is granted the power to use regulation to allow corporations involved in the LNG industry to use their natural gas tax credit to pay an 8 percent corporate tax instead of 11 percent. Obviously the government is so desperate to try and land an LNG industry that it is sweetening the pot still further. Back in the fall, when I put an amendment to send this to committee, I specifically stated in speaking to that amendment that one of the reasons this had to go to committee was because “I would have wished to explore, in particular the one-half percent natural gas tax credit.”

Section 56 represents one section of the bill that I will propose an amendment to during committee stage. I will propose to revert it back to its original fall version.

The BC NDP took a different approach. They too opposed changes to section 56. But instead of waiting to committee stage they decided to vote against the 2nd reading of the bill (which means all the Bill 6 loopholes would be left in place).

Below are the video and text of my speech.

Second Reading Speech Video

Second Reading Speech

A. Weaver: I find it, frankly, deeply troubling that we’re here debating Bill 26, LNG Income Tax Amendment Act. This is a 109-page act which is designed to amend an 87-page act — that is, Bill 6, which was introduced back in the fall. Bill 6, as you will recall, hon. Speaker, was the Liquefied Natural Gas Income Tax Act.

You will recall that in third reading of Bill 6, I moved a motion. I moved a motion to send the LNG Income Tax Act to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills for further review. The reason why I did that was because Bill 6 was incomplete. It was full of loopholes so big you could drive a bus through.

Let me read some of the concerns I had. The reason why I would like to do that is to point out that quite a number of these concerns have been addressed in this, the amendment act, this 109-page act — bigger than the original act.

In the fall, when I moved an amendment at third reading to send this to committee, I stated the following.

“There have been questions that would benefit exploration at committee stage. In particular, there are questions on revenue projections, the modelling, the assumptions into the modelling that have not been forthcoming and transparent in terms of us as a Legislature being able to assess this legislation.

“There’s section 32(c)” of Bill 6. “There are issues that came up…with respect to a loophole for earned credits that could be sold by a company, the income from that not being claimed as taxable, yet the person purchasing it can claim the income as a deduction.”

There were questions about section 46, with respect to the rate being left out. We never got guidance as to what the rate and the formula there was.

There were questions on section 47 regarding “a potential LNG loophole for tax avoidance through capital acquisitions and leaving the 1.5 percent net LNG tax rate for significant times.”

There were questions on section 122 with respect to the polluter-gets-paid instead of a polluter-pays model.

There were questions on section 172 that we did not have as much time as I would have liked to explore, in particular that one-half percent natural gas tax credit. Let me reiterate that. Back in the fall, when I put an amendment to send this to committee, I specifically stated in speaking to that amendment that one of the reasons this had to go to committee was because “I would have wished to explore, in particular the one-half percent natural gas tax credit.” Well, as we will discuss later in my speech here, we do have more details about that one-half percent tax credit.

I would have thought in the fall that this was such an important piece of legislation that government would have wanted to send this to committee to actually gain the insight of British Columbians, of First Nations, of industry from across the province. Instead, with the exception of the member for Delta South, every member in this Legislature stood and voted against sending this to committee, to rush this bill through when it wasn’t ready.

Today we stand here to debate Bill 26, the Liquefied Natural Gas Income Tax Amendment Act, a full 109 pages, compared to the 87-page act which was incomplete and introduced in the fall. This is troubling. This is very troubling. It, frankly, disturbs me that we have to be in this position here today.

Let me emphasize that the changes made in this bill are important. They’re important, and I’m in a quandary. They’re important because I stood passionately and spoke against the introduction of Bill 6 in the fall. But I recognize that we have passed Bill 6. Bill 6 has now received royal assent and is a matter of law within British Columbia. Bill 6 is incomplete. We cannot conduct business in the province of British Columbia with Bill 6 standing before us now. We either need to repeal it or we need to pass some form of legislation to fill those loopholes.

Let me address some of that. In essence, my own view is that this bill closes quite a number of those massive loopholes that I referred to earlier. In particular, if I could read the…. I have so many notes here. I’ll find it in a minute. Let me say it provides greater clarity on the administrative requirements, bankruptcy and insolvency issues and debt forgiveness rules. It sets requirements for registration, for filing tax returns and for paying and refunding taxes. It establishes penalties for failing to meet the requirements of the act.

Most importantly, it introduces section 124.412, which is the anti-avoidance rule, which was so critical in my criticism back in the fall, that there were so many loopholes that companies could avoid paying taxes even though they were hardly paying any taxes in the first place. This anti-avoidance rule introduction is critical legislation that needs to have been in place and should have been in place in the fall and should have been discussed and raised in committee, had we passed this legislation and sent it to committee. Instead, here it is now in the 109-page liquefied natural gas amendment act.

There are essential aspects in this bill for the tax regime. Without them, LNG income tax payers could avoid paying a significant amount of the tax because of the massive loopholes and others that I discussed earlier.

The real question is how the LNG Income Tax Act got passed last fall without any of these very basic provisions laid out for us to discuss, number one. Two, not sending this to committee so that we could have an opportunity to discuss it is deeply, deeply troubling. Frankly, in my view, this has been an abdication of the responsibility on behalf of this Legislature to do due diligence on the legislation that was tabled and brought to us. It doesn’t end there.

Here I do agree entirely with the official opposition — that is, with the concern they raised, which I agree with, concerning the problematic natural gas tax credit. Before I come to that, I think it’s important to set the context.

What is the context? Why is it now that in section 56 we essentially allow the minister, through regulation and in perpetuity, to allow corporations involved in the LNG industry to use this natural gas tax credit to pay 8 percent instead of 11 percent?

Let me tell you a little bit why we’re where we are. And this isn’t new. For two years now I’ve been saying the same thing. British Columbia’s hype of hope and wealth and prosperity for one and all from a hypothetical LNG industry was nothing more than a message of hope wrapped in hyperbole. The promises of 100,000 jobs, a $100 billion prosperity fund, a $1 trillion increase to GDP, debt-free B.C., no PST, thriving schools and hospitals and on and on were nothing more than a pipe dream.

The global markets, the economics, did not support these statements in the fall of 2012. They do not support these statements now. This is the reason why we’re seeing this natural gas tax credit — essentially, yet another generational sellout on top of the existing generational sellout — being brought to us for approval today.

What has happened since 2012 was entirely predictable — entirely predictable — given the fact that we are not the only ones in the world who have discovered horizontal fracking technology. Our shale gas reserves pale in comparison to others. We have massive reserves in Australia, in Russia, even in China, in the United States, in Iran, in Qatar. I could go on and on. There is shale gas all over the world. Yet somehow B.C. thinks that it, and it alone, is going to fill Asian markets with natural gas.

This is what happened. I’m reading here from a Reuters piece published on December 11, 2014. The title of that says this: “Asian LNG Prices Seen Falling by up to 30 Percent in 2015.” Well, they’re talking about LNG prices falling 30 percent in 2014. But in fact, they talk here about things like if brent crude trades at $85 next year, the price could be $12.60 per million Btu. It continues on that it could drop still further and further. If brent trades for $70 a barrel — $70 a barrel; hmm, lot of oil companies out there right now are looking for $70 a barrel — the price of low-sulphur oil will cap LNG spot prices at — guess what — $10.50 per million Btu.

I’ll repeat that. If brent trades at $70 a barrel — it doesn’t matter that we’re trading at $50 a barrel now — this Reuters article is quoting Wood Mackenzie’s Thompson as saying that LNG spot prices will be capped at $10.50 per million Btu. That makes sense.

Russia has just entered into long-term 30-year contracts at below that price. Yet British Columbia thinks that somehow companies will invest tens of billions of dollars to transport liquefied natural gas from our coast across the ocean, when it costs $7 to $8 per million Btu to do that. They’re going to have to pull this out of the ground at negative prices.

That is why we have this LNG tax legislation before us, because it introduces so many giveaways that, essentially, we avoid paying tax to British Columbians, and we give away a natural resource. Well, we try to. This is still not coming.

I reiterate, and I say it one last time. If brent trades at $70 a barrel, the price of low-sulphur oil will cap LNG spot prices at about $10.50 per million Btu.

It doesn’t end there. What other things have happened to cause this desperate Hail Mary pass of hope after the previous Hail Mary pass of hope was caught? They didn’t win the game. We thought they did, but they didn’t, because they can’t land this.

Let’s see what else has happened. I’ll read to you from a Toronto Star article entitled “Shell-BG Deal Could Dampen B.C. LNG Projects.” Well, that’s a surprise. I thought we were going to have Shell and BG and three others up and running by…. Well, one of them should have been this year, maybe a couple by next year.

The Shell and BG amalgamation is troubling. Why is that? Because they have…. Let me read here. British Gas, BG, has liquefication plants in Australia, Egypt, Trinidad and Tobago, and another being developed in Louisiana.

Shell has LNG operations under construction — not planned, under construction — in Russia, Qatar and Australia. We now have dropping demand. We have the amalgamation of two major players in the liquefied natural gas world with projects under construction. B.C. is not a player here. We can say goodbye to those companies.

Why would anyone invest in British Columbia right now? Why would anyone invest? Because they would need a supply gap. These companies don’t buy to fill spot prices. They buy to make long-term investments to fill in supply gaps down the road. Petronas had a supply gap — 2018-2019. They’ve deferred their investment decision, deferred it again and again. Do we really think Petronas is going to make a final investment decision to go ahead to meet a 2018-2019 supply gap? I don’t think so. They may be back in the mid-2020s, where another supply gap emerges there. But for the short term, this is nothing but hope.

Frankly, it’s irresponsible to put our entire provincial economy, to retool our education systems, to essentially send to business a message, a singular message, that if you want to come to British Columbia to do business in our province, you’ve got to hang your hat on LNG, an industry that doesn’t exist now, but we hope maybe someday will exist. What we’ll do for you, hypothetically, is retrain our education system. We’ll do whatever you want. We’ll create a natural gas credit, which is 1/2 percent plus some random number to bring it down to 8 percent — your corporate income tax that you pay.

Here’s another article, published on April 5. This one’s important, because this government has pointed out for us many, many times how proud they are to get the triple-A credit rating from Moody’s. Well, low and behold, here’s the title: “Moody’s Puts a Damper on B.C.’s LNG Dreams.” I’ll say it again. “Moody’s Puts a Damper on B.C.’s LNG Dreams” — published in the Canadian Press and syndicated across our beautiful country.

Meanwhile, what’s actually happening in the world? Well, we don’t have to go very far. Let’s go to Bloomberg Business today — not tomorrow, not yesterday but today’s Bloomberg Business newspaper. Let me quote the title article. It says this: “Fossil Fuels Just Lost the Race Against Renewables.”

Why is that the case? Because, around the world, people recognize that there are stranded carbon assets in the ground that cannot be extracted. The existing plans and development to extract those resources that are there are already meeting existing demand down the road, so there are no supply gaps.

Instead, places like China, Russia, Europe, Australia and America, whose emissions dropped last year, are going all into the renewable clean tech sector, a sector that British Columbia used to be a leader in.

Now this government is saying to British Columbians: “If you want to be a leader in an economy in B.C., forget everything else. Let’s go LNG.”

This article, which I recommend that all read, entitled “Fossil Fuels Just Lost the Race Against Renewables,” is published today in Bloomberg Business. There are actually some lovely charts and graphs in there too. It’s not just some person writing their opinion. It’s actually an analysis with graphs, bar charts. It’s quite interesting to read, because they’re saying what I have been saying for two years — that this is nothing but hyperbole.

This brings me to the most serious aspect of this bill again, and that is the natural gas tax credit. Under this tax credit, an LNG taxpayer can decrease their corporate income tax from 11 percent to 8 percent by claiming credits for the cost of natural gas. Under the old version from last fall, they could only claim 0.5 percent of their natural gas costs.

I agree with the opposition. This is simply unacceptable. This should’ve been brought in, in the fall. However, my approach to deal with this is to amend this at third reading and offer this Legislature an amendment to refer us back to the fall legislation, which had this fixed value of 0.5 percent — as opposed to voting against this at second reading.

Under the new version an LNG taxpayer can claim that amount as well as an additional prescribed amount that is to be set by the Lieutenant-Governor-in-Council. It could be 0.5 percent or, given that that brent crude drop is going to cap LNG prices, you might as well make it 0.5 percent plus minister’s 2½ percent to make it 3 percent to drop the corporate tax down to 8 percent. We weren’t told that in the fall, and it behooves us in this House to amend this, to take it back to what was given us in the fall with a straight face by this government that this number would be a half-percent.

What’s worse here is that if is a taxpayer claims for credits than they can use in a year, those additional tax credits will carry over to future years, which means that if the prescribed rate is high enough, a company could end up paying 8 percent corporate income tax in perpetuity. Yet another loophole is brought in here, and based on the changes that are being made, it’s is hard to imagine any other intention.

Clearly, the government did not think that 0.5 percent of a taxpayer’s natural gas costs was sufficient enough to lower their corporate income tax rate to 8 percent. It was not a sufficient enough gift — a piece of candy — to give to the LNG industry that they introduced greater cuts because the industry is not coming here. What is next? Are we going to have to promise them a free workforce? Are we going to promise them that they pay no tax? They’re not coming, even as we introduce this generational sellout of Bill 6, amended through Bill 26.

Let me discuss now the quandary we find ourselves in, because this is important. This bill puts us, all of the members in this Legislature, in a quandary, in a very difficult position. Last fall the government and the official opposition together passed the LNG Income Tax Act prematurely. At second reading I was the only member of this Legislature to stand in opposition to the generational sellout embodied in Bill 6. I would have argued that this should never have happened. But now we are debating an amendment that is longer than the actual act, and this amendment actually dramatically changes the original act.

The problem here we face is…. I tried in the fall to put this to committee, because it was clear that there were so many loopholes in this bill — loopholes, as I described, that you could drive a bus through. I was voted down by every member in this House except my dear friend from the riding of Delta South, who also recognized that while her position was that it was important to move forward with an LNG tax regime, we could not do so at this time in light of lacking information before us, and so sending this to committee was critical.

The problem now is that we’re not really able to debate the merits of the original act. We are debating the amendment act, with the original act now standing as a matter of law before all British Columbians. So I’m in a quandary, as I’m sure others are, and I say it again very clearly that I believe that the LNG Income Tax Act, Bill 6, should be repealed. It should never have passed.

Here we are today with a government not willing to do so, a government instead amending — amendments that I support — many of the loopholes in the previous act but introducing section 56, which, to me, is critically flawed in actually, essentially, giving regulation to the minister to allow him or her to grant 3 percent income tax cuts to LNG corporations in perpetuity.

As I said, the actions taken by this Legislature in the fall, I believe firmly, were an abdication of our duty, a dereliction of duty. As MLAs, we should have explored that in greater detail.

I am grateful to the minister for allowing me to be briefed by his staff, a briefing that I was able to probe many of the loopholes that I raised earlier and find that many of them have been addressed. I was satisfied with the answers I got, and I was pleased by the level of detail provided.

Clearly, I’m unhappy with section 56. While I support the amendments, I will not support section 56. But I will do that at the committee stage through the introduction of an amendment if the official opposition does not.

The Vote

Bill 15: Motor Vehicle Amendment Act

Today in the legislature I rose to speak to Bill 15: The Motor Vehicle Amendment Act. The amendments in this bill will affect the AirCare program and the Immediate Roadside Prohibition (IRP) program. It adds an official end to AirCare, which stopped running on December 31st 2014, for light duty passenger cars and trucks. For IRP it legislates mandatory participation in anti-drunk driving programs for repeat offenders (including ignition interlock systems).

Bill 15 would also make it harder for drivers to drive in the left lane of a high-speed highway, specify approved winter tires/use of chains, and allow municipalities to regulate motorcycle parking to within six metres of intersections with traffic control signs or signals.

Below is the text of my speech (note previously Leonard Krog from Nanaimo had me in stitches during his speech a few minutes earlier in the day. I continued the banter towards the end of my speech).

A. Weaver: I, too, echo the sentiments as expressed by the member for Delta South, particularly with respect to the burden of proof, which in several places in this legislation is being moved. “The burden of proof in a review of a driving prohibition” is now on the individual. This is not really consistent with what most British Columbians believe and want to happen in our province — that is, innocent until proven guilty. The implication here, of course, is guilty until proven innocent, and I wonder to what extent that actually would be held up under a legal challenge.

In fact, our Justice Minister admits that the government’s contentious drunk-driving penalties may again be challenged as unconstitutional. In the Vancouver Sun she was quoted as saying, “Yes, it may very well be challenged, but we have great confidence in the program and in the good that the program does for safety on British Columbia’s highways.” I would hope that during third reading we’ll be able to explore this and determine whether or not the Minister of Justice, via the Minister of Transportation, would be able to clarify some of the rationale behind their government getting legal opinion that would support this as actually standing up in courts.

Like the member for Nanaimo, I, too, had many, many groups of people not come to my office concerned about motorcycle parking six metres from the intersections. I gather that this is an issue in some jurisdictions. In Victoria, Oak Bay–Gordon Head, left-lane driving certainly is an issue, as every one of the members here will know, coming from either the ferries or the airport. I think left-lane driving started in Victoria and, in fact, despite this legislation, will never change here in the capital regional district.

There are rules in place already that can deal with left-lane drivers if they’re holding up traffic. I’m not sure that this emphasis on fines and fees is either enforceable or, in fact, will ever be enforceable. Our police system’s services are taxed at the best of times, and pulling over people driving in the left lane is probably not number one on their priorities.

I recognize this populist approach to introducing policy that people will hang their hat on and be all very pleased with. I know everybody at one time has been frustrated — as I was just yesterday, coming back from the airport — when two people are driving side by side on the highway at 70 kilometres an hour when the speed limit is 90. Does that mean we should be ticketing them? Does that mean we should be just maybe perhaps pulling them over and talking with them? There is legislation that would presently allow police to deal with such people if they do, in fact, believe that they are causing a hazard on the road.

One of the things that I was hoping to see in this legislation, which I recognize is minor tinkering with the Motor Vehicle Act, is some discussion about how repeat texters, repeat hand-held device users, are also dealt with. There’s a lot in here implied about drunk-driving legislation, but it really is not much different from repeat offenders of texting. There are those people out there who have been caught many times.

There are means and ways to actually have your phone linked into interlock programs, much like exist for drunk driving. I was wondering. I will explore further at third reading whether the government has actually explored this as perhaps also including interlock repeat texting offender programs. I do applaud the government in actually introducing text to ensure that the person requiring the ignition interlock program does, in fact, pay for it.

In terms of the AirCare program, you might expect someone from the B.C. Green Party to stand up here and criticize government for removing an AirCare program, but the reality of it is that cars have changed in the last decade. Most cars today on the streets have air quality emission standards that are far beyond anything that existed ten years ago. As pointed out in discussions on this legislation, there still is an ability to require people to fix their tailpipe if they are deemed to be driving a car that is creating unsightly or unhealthy air quality emissions.

With that, I do look forward to third reading. I do have some concerns with the left-lane legislation, despite the fact that I agree that it is something that people may consider. I will be likely amending that these be struck from the bill, as I believe they are awfully punitive and are unenforceable, and in fact, legislation already exists on the books to allow police to deal with this.

I believe that these left-lane-hog rules are nothing more than populist politics catering to a demographic that is perhaps not likely to consider voting in the future. This is rather cynical of me, but really, we’ve got some critical issues in this province to deal with. Motorcycle parking six metres from an intersection, left-lane driving….

I recognize that the member for Nanaimo likes the left and the Minister of Aboriginal Relations and Reconciliation likes to drive in the right. You’re not addressing my problem here. My problem is that I like to drive right in the middle in between both lanes, and this legislation ignores people like me.

L. Krog: You know what happens to chickens in the middle of the road.

A. Weaver: The member for Nanaimo has asked me if I know what happens with chickens in the middle of the road. I think it’s important for me to address that. They don’t last very long, but legislation could be brought in place to ensure that they do.

Deputy Speaker: Certainly, the member digresses.

A. Weaver: I’m sorry, hon. Speaker. It was truly, though, a defining moment of my time here in the Legislature when the Minister of Aboriginal Relations and Reconciliation came over and sat beside my colleague here, the member for Nanaimo, and discussed left- versus right-lane driving just a matter of moments ago.

With that, I thank you for your time, and I look forward to third reading.

Deputy Speaker: Seeing no further speakers, the minister closes debate.

Hon. S. Anton: I do appreciate the members’ comments on this important piece of legislation. I look forward to canvassing the issues during the committee stage. Although for the member for Oak Bay–Gordon Head, I’m not sure that we’re going to be able to deal with the middle-lane piece. But I’m confident that the other pieces of the legislation will be dealt with in an appropriate manner when the time comes.

With that, Mr. Speaker, I move second reading of Bill 15.

Bill 10 — Budget Measures Implementation Act, 2015

On Tuesday, March 24, I rose to speak to Bill 10, Budget Measures Implementation Act, 2015. The purpose of this bill is to implement the budget described in the government’s Budget Speech. Bill 10 contained amendments to the Carbon Tax Act, Income Tax Act, Motor Fuel Tax Act, Provincial Sales Tax Act, Small Business Venture Capital Act, and Tobacco Tax Act, together with a number of other general and consequential amendments. As noted in my speech at second reading (reproduced below), no one will agree with everything in the Bill and no one will disagree with everything in the Bill.

To give some context to my opening remarks, please note that George Heyman, MLA for Vancouver-Fairview, spoke immediately before me and ended with this statement:

Middle-class families, children and youth who are looking to their future, who are looking to jobs in a diverse, modern, growing B.C. economy — whether it’s in the tech sector, the creative sector or a cleaned-up resource sector — wait and continue to wait.

Apparently, it looks like they will have to wait a very, very long time, until at least 2017, before they see a government plan that builds an economy for the future.

A. Weaver: I do agree with the member, and I look forward, as either leader or someone in the Green Party forming that government, to offer British Columbians that vision that the member so eloquently put forward.

This Bill 10, Budget Measures Implementation Act, really contains no surprises. It outlines what the government has mentioned it would do as part of its budget speech. There’s some good and some bad, as there always is in all budget speeches. Of course, nobody in this House will agree with everything in here; no one in this House will disagree with everything in here.

Let me outline a few of the things that I think are worthy of highlighting, as I do believe they are important steps. For example, discharging liabilities from retroactive changes, in sections 1 and 2. Amending, through streamlining, the Carbon Tax Act. Coming over again to look at the B.C. mining flow-through expenditure, the flow-through of mining tax credits.

Now, on this particular case I would like to see some evidence that this actually is benefiting industry in British Columbia and not at the expense of small household investors. Without constraints added to the flow-through tax credit, there’s a danger that the capital can come in and that shares can be dumped on the market. Unsuspecting private investors buy up these shares at an above-market value and simply cannot sell them. So there is some concern about the flow-through mining tax credit, but overall, I think it does incentivize mining investment in British Columbia.

As the previous member pointed out, the digital post-production tax credit…. A very fine piece of legislation, I think, here as well as extending the training tax credits and changes to the Motor Fuel Tax Act.

This bill is…. It’s not so much troubling about what’s in it; it’s about what’s not in it. What we have in British Columbia is the second-highest income inequality in the country and the highest wealth inequality in the country. We’re the only province without a comprehensive poverty reduction plan. We have 500,000 people living in poverty, 160,000 of those being children.

This is a problem. As soon as you see a disparity between the wealthy and the poor growing with time and a decreasing middle class, you start to see the emergence of unstable societies. Human history is full of examples of where such unstable societies end up.

We look at some of the tax credits that are added in here, which make good headlines but, frankly, are boutique tax credits that are similar to what we’re seeing out of the federal Tories and that benefit very few. It benefits those who don’t need them.

A $12.65 per child for fitness equipment…. Now, the people who could benefit from $12.65 aren’t buying fitness equipment. They’re trying to put food on the table. And $12.65 in fitness equipment really is not doing much for anybody. It’s rewarding those who would actually be buying it anyway. By buying it anyway, they can afford to buy it anyway.

Coming to the B.C. education coaching tax credit. This is so egregious I don’t know where to start — $25.30. Picking on teachers who happen to volunteer to do some coaching or they’re an “eligible coach.”

What about all those teachers who buy art supplies out of their own pocket? What about all those teachers who buy school supplies out of their own pocket? These are not eligible deductions because they’re employees of the school board, yet they spend their own money on it. What about all those teachers who are volunteering and taking kids on field trips? What about all those other teachers who are struggling with class sizes and compositions that are so unbearable that the burnout rate is incredibly high?

Here we give $25.30 — that’s a case of beer after a soccer game — as a tax credit to coaches. To be honest, it’s insulting. It makes a good headline, “B.C. Government Rewarding Coaches,” and the subtext is: “by giving them $25.30 if they dedicate hundreds of hours to after-school coaching.” Hon. Speaker, $25.30 to somebody struggling to make ends meet is a big deal; $25.30 to a coach may buy that case of beer when they watch Sunday afternoon football.

There are other aspects in here that are troubling. As I outlined earlier, we have the highest wealth inequality in the country and the second-highest income inequality in the country. This does not bode well for a future society, one where the discrepancy between rich and poor grows.

There are real challenges for the middle class in British Columbia that we do not see in a budget measures act. These challenges are for small business owners struggling to make ends meet, struggling to pay bills, struggling to meet payroll, struggling to pay MSP for their families. There are those who are living and trying to afford a place to live in Vancouver or Victoria, where the rents are substantially higher than any income assistance they might get.

There are those who can afford to pay more in our society. Those in our society who can afford to pay more, when you talk to them, are willing to pay more, provided that they know where that money is being spent. This is a problem with this bill here. The government is actually finding little boutique credits to give away, but it does not outline a vision as to where it could actually better our society through the injection of funds that we so desperately need in issues like education, social services and others.

We have a very fine debt-to-GDP ratio. I will give the government that. But what we also have is a dramatically declining ratio of percentage of revenue to the government as a percentage of overall GDP. This government has made choices such that health care funding as a percentage of GDP has remained fixed, but education funding and social service funding as a percentage of GDP have dropped dramatically since this government came to power. Why is that the case? It’s because revenue has not kept pace.

Now we hear the mantra — you would expect to see this here — “We will help the middle class when B.C. is wealthy and prosperous” from hypothetical LNG that, as you know, will never materialize. But when it does, we will all be wealthy and prosperous. “We’ll wait until then.” Well, these people can’t wait until then. These people who are so desperately trying to make ends meet don’t find any tax break in here.

Well, I guess they have the increase, the $18,327 to $19,000, before anyone pays any provincial income tax. In fact, that’s a good thing, but one questions as to where this number comes from and what studies were actually done to determine that the 19 with three zeros after it was the appropriate number that should have been done.

With that said, I look forward to exploring the details of this further in committee stage. As I reiterate, in my view, the problem with this budget implementation act is not so much what’s in it, but what’s not in it. With that, I’ll sit, as I see the member for Surrey-Whalley has just arrived.