Legislation

LNG tax legislation rushed at expense of British Columbians

Today, on the final day of the fall sitting, I used my last speaking opportunity in the House to offer MLAs an opportunity to reconsider what I believe to be prematurely introduced LNG tax legislation.

At third reading I moved an amendment that would have sent Bill 6 – The Liquefied Natural Gas Income Tax Act to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises.

This legislation would benefit from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

During the committee stage for the bill after 2nd reading, I also identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC.

In my view it was premature for us to consider passing a piece of tax legislation that contained no information about revenue projections and no substantive justification for the massive corporate tax breaks and incentives.

Our government has claimed that the revenue accruing from an LNG industry would bring British Columbia a $1 trillion boost to its GDP, a $100 million prosperity fund, 100,000 jobs, the elimination of its provincial debt, the elimination of the PST and thriving hospitals and schools. These are bold claims that so far have not been supported by any clear or reliable evidence.

Bill 6 was supposed to contain the details, supported by revenue projections, to substantiate these claims. Unfortunately, we never received anything of the sort. It is perplexing to me that both the government and the official opposition would vote to support this LNG tax legislation when absolutely no quantitative information has been provided about how it will impact British Columbians.

In moving the amendment I offered the government, the official opposition, and the public an opportunity to explore both the opportunities and possible pitfalls associated with this Bill in greater detail.

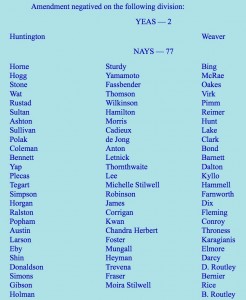

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

The fact that the two independent MLAs were the only ones to suggest this Bill is incomplete in its current state is startling. British Columbia deserves real political leadership that is honest about the opportunities and the risks associated with any hypothetical LNG development.

While the government has described British Columbia’s LNG opportunity as a generational opportunity, this bill can only be described as a generational sellout.

The Amendment

I move that the motion for third reading on Bill 6, Liquefied Natural Gas Income Tax Act be amended by deleting all the words after “That” and substitute the words “the bill be not now read a third time, that the order for third reading be discharged, the bill withdrawn from the Order Paper and the subject matter referred to the Select Standing Committee for Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills.”

Speech to the Amendment

I wish to speak to the amendment and the reason why I brought it forward.

Through this committee stage, a number of issues have been clarified. There have been questions that would benefit exploration at committee stage. In particular, there are questions on revenue projections, the modelling, the assumptions into the modelling that have not been forthcoming and transparent in terms of us, as a legislature, to be able to assess this legislation.

There is section 32(c). There are issues that came up there with respect to a loophole for earned credits that could be sold by a company and the income from that not being claimed as taxable, yet the person purchasing it can claim the income as a deduction.

There are questions in section 46 with respect to the rates being left out. We haven’t got some guidance as to what that rate is in the formula there.

There are questions with respect to section 47 regarding a potential LNG loophole for tax avoidance through capital acquisitions and leaving the 1.5 percent LNG tax rate for significant times.

There are questions on section 122 with respect to the polluter-gets-paid as a polluter-pay model.

There are questions on section 172 that we did not have as much time as I would have wished to explore, in particular the one-half percent natural gas tax credit.

I would think that with such an important piece of legislation, which a government believes is outlining a direction for this province for years ahead, this legislation would benefit from a more thoughtful analysis at committee stage, at which point third parties could be brought in for consultation, including the public, including First Nations and including the companies involved, so that all in this Legislature are able to see the negotiations and the input that is required for such legislation to move forward.

This is the reason that I brought this amendment forward now, hon. Speaker.

Thank you very much for your time.

The Vote

The passing of Bill 2 – an end of an era

After nine days of debate, Bill 2 – The Greenhouse Gas Industrial Reporting and Control Act, finally passed committee stage and the Bill will receive Royal Assent shortly. As I mentioned earlier, Bill 2 will lock us into a path of increasing greenhouse gas emissions, while foregoing the development of a truly diversified and sustainable 21st century economy.

During second reading I spoke passionately against the bill, arguing that it represents a betrayal of future generations. I highlighted the fact that the bill replaced British Columbia’s continent leading greenhouse gas reduction policies with a made-in-Alberta, Harper government approach to reducing greenhouse gas emissions intensity.

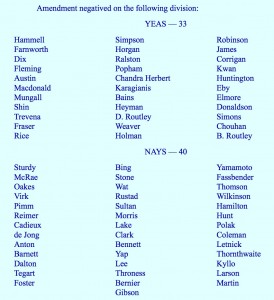

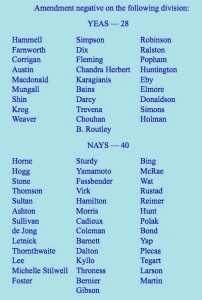

During the days of debate I moved a hoist amendment that called for the bill to be delayed by 6 months to give MLAs and the public more time to scrutinize it. The amendment was defeated.

During committee stage I asked numerous questions to explore the consequences of implementing Bill 2. I probed the government’s rationale for dismantling its previous climate policies. And I proposed several amendments to the Bill to improve its clarity but all were defeated.

In one final attempt to provide clarity to British Columbians about what the bill was really doing, I moved an amendment to change the title from:

Greenhouse gas industrial reporting and control act

to

Greenhouse gas increase and industrial reporting act

As you will see from Hansard (reproduced below), the rationale for introducing this amendment was to make it clear what the bill will actually do. The title of the bill suggests that there is going to be a control on industrial emissions. This is not the case. The control is only going to be on industrial emissions intensity. That is, instead of reducing carbon pollution, the bill just allows industrial emitters to pollute more efficiently. I was hoping to make the bill transparent in that it was providing for an increase in greenhouse gas emissions.

A. Weaver: At this stage I’d like to move an amendment:

[TITLE, by deleting the text shown as struck out and adding the text shown as underlined:

BILL 2 – 2014

GREENHOUSE GAS INCREASE AND INDUSTRIAL REPORTING AND CONTROL ACT]

We had in this debate, at third reading, a number of amendments put forward to try to improve the legislation. They’ve all been defeated. We’ve just had the most recent amendment put forward by the member for Vancouver–West End — a nice amendment that was designed specifically to make this the cleanest LNG in the world.

In framing a title, it’s very, very critical that the title actually reflect the legislation that it is actually representing. What we have here is a title that says Greenhouse Gas Industrial Reporting and Control Act. The reality is there is no control in the greenhouse gas emissions associated with this act, so the amendment that I put forward is to change the title to the greenhouse gas increase and industrial reporting act, as I submitted and put on notice a couple of days ago.

The Vote

Bill 6 — LNG Income Tax Act: A Generational Sellout

Today in the legislature I rose to speak strongly against Bill 6 — Liquefied Natural Gas Income Tax Act. In a desperate attempt to fulfill outrageous election promises, the BC Government does what it can to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come. Below is the text of my speech.

Second Reading Speech

Bill 6 — Liquefied Natural Gas Income Tax Act

In an election where the government was set to fail, a Hail Mary pass was thrown. That pass was the promise of an LNG windfall. It was packaged in a message of hope so compelling it couldn’t be ignored: 100,000 jobs, $1 trillion to the GDP, a 100 billion dollar prosperity fund, the elimination of our provincial debt, thriving schools and hospitals and, most of all, the end of the provincial sales tax.

As we all know, that pass was caught, and we now have a government that is desperate to deliver on its irresponsible political posturing. What we didn’t know until recently was just how far the government was willing to go to try and materialize its LNG pipedream. We had no idea how desperate the government was. We had no idea how costly it would be to give away our natural resources. Now we do, as sadly, those costs are coming to light.

We’re told we are going to “re-engineer B.C.’s education and apprenticeship systems.” You can’t make this step up. Orwellian messaging and actions that we’ve come to expect from the Harper Tories are now gushing forth from this government’s propaganda machine on a daily basis.

We’re being told that we need to dismantle our leadership in climate policy. In fact, perhaps the most ironic aspect of all of this is that those very same civil servants who put together B.C.’s revenue-neutral carbon tax legislation, a piece of legislation praised around the world, have been given the unenviable task of putting together the present tax legislation, which can only be regarded as a generational sellout.

Just today the government puts our Triple-A credit rating at risk in order to subsidize the LNG industry on the back of taxpayers and B.C. Hydro ratepayers.

Let me be very clear. British Columbia has a rich history of natural gas development. There was once a time when B.C. coffers were filled with royalties from this sector, but markets have changed. The revolution in horizontal fracking technology has created a glut of natural gas in the marketplace. Today’s Henry Hub spot price for natural gas is just $3.60 per million Btu. That makes it uneconomical to extract natural gas from the dry-gas fields in the Horn River shales near Fort Nelson, B.C., which require a North American natural gas spot price of around $5 per million Btu to be economical. Sadly, it’s pretty quiet around Fort Nelson right now.

The only reason we are still maintaining a vibrant sector in the Montney Formation around Fort St. John is because of the value in the liquids — not the gas, which in many cases, I’m told, is simply pumped right back into the ground and capped, as there’s no market for it. These so-called condensates are important for mixing with bitumen in order to reduce its viscosity and, hence, allow diluted bitumen to flow in pipes.

Hon. Speaker, I understand why the government wants to search for a market for B.C. gas. There isn’t one in North America, but let’s take a look at this in more detail, at precisely what the government is doing.

On October 29, 2012, the Deputy Minister of Energy, Mines and Natural Gas made a presentation entitled B.C.’s Energy Future at the annual B.C. clean energy conference. The deputy minister outlined B.C.’s plan and its LNG price projections from 2012 well into the future.

Domestic prices were projected to increase linearly from the $3 per million Btu range to about $7.50 per million Btu by the year 2035. Asian import prices for LNG were also projected to increase from about $13 per million Btu in 2013 to about $17 per million Btu in 2035. In essence, the government was predicting a sustained and constant $10 per million Btu spread in the price of domestic versus Asian prices for natural gas.

That $10 per million Btu spread is critical. It’s projected to cost about $6 to $8 per million Btu to get gas to Asia. If we drop much below that $10 spread, it’s not going to be economical for an LNG industry to get going in British Columbia.

For almost two years I have been saying the same thing, and consistently so. Canada has less than 1 percent of the world’s proven natural gas reserves. Russia has about 20 times as much natural gas as all of Canada combined — not only just B.C., but all of Canada. They recently signed 30-year agreements to provide natural gas to China. Their most recent agreements came in at the $9 to $10 per million Btu mark. That’s equivalent to a $5 to $6 spread from the Henry Hub price.

Australia has similar-sized shale gas reserves as Canada and is much farther ahead in the development of its LNG industry. The United States has more than twice the shale gas reserves as Canada, and the U.S. government recently decided to allow natural gas exports. The U.S. already has some of the necessary infrastructure in place on their coastline to facilitate a relatively quick development of an LNG export industry. China could soon be well positioned to take advantage of its own natural gas reserves, which are three times those of Canada.

The reality is that we are simply not competitive at this time. That doesn’t mean we won’t be at some point in the future. Let the market decide when that will be. The role of government is to ensure that externalities are internalized so that certainty exists for industry moving forward.

In this case, we are doing the exact opposite. What we are doing is externalizing internalities on the taxpayer and future generations. Government has the audacity, the arrogance, the hubris to call it itself “business friendly”.

Rather than acting like a pack of cheerleaders, the members opposite should be posing the difficult questions and proposing innovative solutions to create a diversified, sustainable 21st century economy. There is a disappointing lack of critical analysis on the benches across from me. Perhaps those members who cheer the loudest are trying to win favour with the Premier so that they might climb into the inner chamber of the LNG house of cards.

Six years ago our province took a bold step forward. Together, government, industry leaders and academics, as well as First Nations, came together to map out a new path for our province, one predicated on the notion that strong economic growth can and must go in hand with a sustainable environment. We accepted the undeniable truth that as long as we fail to address global warming, we are failing future generations, for we will be burdening them with the economic, social and environmental costs of our actions today.

Since we took that bold step in 2008 we have seen our economy outperform the Canadian average. We have seen up-and-coming industries like the technology sector become the second-largest contributor to private sector growth, supplying 84,000 jobs for British Columbians and revenues of $18 billion a year. We’ve seen mining output and exports double in the last ten years, and we’ve seen more than $18 billion added to our provincial GDP.

We did all this while reducing our carbon emissions by over 4 percent from 2007 to 2012. In fact, published studies have clearly concluded that the 2008 and subsequent climate policies have successfully reduced carbon emissions while still supporting economic growth.

In 2008 our province boldly strolled down a path that was grounded in real leadership and prosperous economic growth. That vision and those policies are being dismantled with this legislation that is now before the House. The fact is that this whole situation comes down to an absence of real leadership.

All of us in this room were elected to lead, yet real leadership demands of us the integrity to acknowledge what we all know: this bill was developed in the context of unspoken yet profound constraints that were imposed by overhyped election promises. In catching their Hail Mary pass, the B.C. Liberal government gave itself the impossible task of delivering on a promise that was never grounded in any realistic expectations or in sound economics.

How can a government ever deliver on the LNG windfall when the economics simply are not there? The answer, of course, is that they can’t. Instead, the government is selling out our future generation with bills like this one, in an effort to appease public expectations. They know, as we all do, that they cannot walk into the next election without having landed at least one LNG plant. Instead of coming clean and being accountable for their actions, the Liberal government is tabling bills like this one, which amounts to nothing more than a generational sellout.

Mark my words, when the B.C. Liberals look back, in 2016, they’ll tell future voters that the economics have changed, that their promises were reasonable until the LNG bubble burst. They will argue in defense that B.C. has one or two extremely small LNG plants in the works, and dozens of companies are still interested, and there will be hundreds of thousands of jobs, and there will be a trillion dollar hit to the GDP when this prosperity is realized “once you elect us back in.”

They will say: “It wasn’t our fault.” They will proclaim that other market measures came to be, to make LNG not a reality in time for this election. But as I’ve pointed out — and I have done so for the last two years — the economics wasn’t there before, it isn’t there now, and it won’t be there for a few years to come, and this hyperbole does not serve the interests of British Columbians at all.

The truth, of course, is that we have known all along that the economics would change, yet because our government is unwilling to show leadership and admit this, the challenge of delivering on their unfounded promise and the constraints that come with having to at least deliver something was passed on to our poor civil servants, who I believe have done their best with a near impossible task.

Indeed, much of the structure of this legislation is quite brilliant. Many of the technical details have been well-thought-out, and I must actually commend the civil servants who’ve drafted the legislation for doing a very fine job in light of the impossible situation in which they were placed.

That being said, the major problems with this bill aren’t in what the civil servants have done with it; they’re in the politics that led to it, the politics that continue and the politics that will take us into the 2017 election.

We cannot consider the LNG tax regime in isolation. It must be considered in the context of Bill 2, the Greenhouse Gas Industrial Reporting and Control Act. That is because together, Bills 2 and 6 help form an economic playing field for LNG companies. While Bill 6 enshrines the tax regime by which B.C.’s revenue sources are determined, Bill 2 enshrines the loopholes through which companies will jump to avoid ever having to cover the full economic costs of their carbon emissions. We cannot ignore that fact in this debate.

There are clear economic costs that come with not addressing global warming, and they are the untold debt that is conveniently, for our government, left out of our accounting books. But those costs will indeed be borne by future generations if those of us here today fail to act in a responsible manner.

Here’s just one example. As the former governor of the Bank of Canada and now governor of Bank of England said just over two weeks ago, “The vast majority of oil and gas reserves are unburnable,” if we wish to avoid the most profound consequences of global warming. He and many others have pointed out evaluations of major energy companies focused only on fossil fuels are potentially overinflated since their unburnable reserves should be viewed as stranded assets.

Yet in B.C. what do we do? We chase a falling market, through mortgaging our future and incurring ever-increasing amounts of generational debt.

I’ve said before that the economics aren’t there and have never been there. For an LNG industry to thrive in B.C. at this time, the truth of this statement and of the government’s LNG hype is perhaps best illustrated with the proposed LNG tax rate.

With the introduction of this bill, we saw the government cut this rate from 7 percent to 3½ percent, throwing out vague statements like: “Well, market conditions have changed since we brought it in.” In doing so, they’ve cut the projected revenue that British Columbians will receive from the LNG income tax by nearly half — if they receive anything, ever, at all.

Why is the government shifting from 7 percent to 3½ percent now? According to the government, it’s because LNG economics have changed. Among other things, they cite an increasing global LNG supply due to competition and a decrease in LNG demand — since China now has a natural gas supply agreement with Russia, and Japan is considering restarting its nuclear power program.

I was absolutely dumbfounded when I read this. I don’t know what the government’s been up to, but I’ve been saying the same thing for two years. Frankly, it’s irresponsible for the government to be saying this now. I wonder where they’ve been for the last two years — including reading a recent Peters and Co. report that estimates that while LNG demand will increase to more than 500 million tonnes per annum by 2030, LNG supply will reach 800 million tonnes per annum by that time.

Why should we be surprised at this? When we witness Russia sign a $400 billion, 30-year agreement with China, we should not be surprised. When we see the U.S. Gulf Coast become the most efficient place in America to build LNG plants and Japan to sign long-term contracts with U.S. suppliers at rates far below expectations in B.C., we should not be surprised. The supply gap is too narrow, and Russia, the United States, Australia, Malaysia and Qatar are places that already have exports and export industries. They’ll be able to fill the gap long before we can even get gas out of the ground and into ships.

None of this is new. Where has the government been for the last two years as everybody in the energy industry, academics and universities and at least one politician in this building have realized all along that this is nothing but a pipedream and B.C. has become the laughingstock of those in the Alberta oil and gas industry because of its approach in this regard? I say that after talking to people from within that industry.

Why is the government continuing to claim that LNG economics are the reason for its sudden decision to cut the proposed LNG income tax rate in half? If this was indeed a surprise for government, then where was it getting its data from before?

I find it concerning that it appears that the government is either only analyzing these strengths now, years after the fact, or that they’ve known about these trends for years, as I and many others have, including those in the Alberta oil and gas industry, which I would be most delighted to trot out in front of the Legislature here, given permission, to say exactly the same thing that I have been saying and this irresponsible government has ignored for the last two years.

Instead, they’ve chosen to pull the wool over British Columbians’ eyes about why they’re changing the rate now. Irresponsible, shameful, and not what we in British Columbia expect from a government that’s supposed to be truthful to the people of British Columbia.

Here’s another problem. The government has said over and over that it was necessary to lower the LNG income tax in order to keep B.C. competitive. Surely in arriving at that determination, the government would have completed economic projections, both in terms of revenue to the province and in terms of costs to the companies for the various tax levels they considered. Yet I haven’t seen any of these. I’m sure that the members beside me haven’t seen any of these.

What precisely is the government making their decisions on? Where are the revenue projections that lead the government to conclude that the lower tax rate would still provide British Columbians with a fair return on their resources? Is it because Shell told them so? Is it because Buddy down the street in the coffee house told them so? Not the oil and gas reps that I’ve talked to. They certainly don’t know where that’s coming from.

Has government made these projections? If so, where are they? If not, then why not? Without conducting realistic revenue projections, how can the government or we as members of this Legislature properly evaluate the validity of this tax regime? The reality is we can’t, and frankly, it’s irresponsible to proceed without this information.

Furthermore, because we don’t have this information, we also don’t have any realistic projections of how long it will take companies to pay off their net operating loss account and capital investment account balances. We therefore have no basis to determine how long the 1.5 percent tax rate will apply for or when the 3.5 percent tax rate will even ever kick in. These are impacts that we need to know if the government is going to make policy decisions grounded in evidence and analysis.

What about the corporate income tax rate? Of course, this isn’t the only tax cut proposed in this legislation. I’m referring here to the natural gas credit towards the B.C. corporate income tax, and under this legislation LNG companies will receive a tax credit equal to a half percent of the cost of natural gas owned by the LNG taxpayer at the LNG facility inlet, which can then be used to cut their B.C. corporate income tax rate from 11 percent to 8 percent.

I have several concerns about this. First, of course, is back to my previous point. We’ve been given no projections of the impact of this tax break. We have no idea what it will have on revenue, and, presumably, of course, the purpose of this tax break is to attract LNG companies to set up headquarters here in B.C. Yet, again, we already have some of the lowest corporate tax rates in Canada, and Canada has some of the lowest corporate tax rates in the world, so presumably, there must be some reason for this. Presumably, we already have competitive rates.

What’s being added by this? Why is the government doing this? Where are the revenue projections? Are there reliable projections on the impact that this will have? Will companies actually relocate because of this? And if so, what impact will that have on our revenue projections? Are these impacts worth the race to the bottom on corporate income taxes that we are engaging in with other jurisdictions that are also competing for those same headquarters?

Again, I find it concerning that I have not seen any analysis from the government as to the projected impacts of this reduction. To be perfectly blunt, I get the sense that the government is just making it up as they go along.

Meanwhile, this corporate tax break also begs the question: why is the government favouring one industry over others? This tax break for LNG industry puts the government’s LNG ambitions ahead of such things as film, tourism, high-tech, forestry, fishing and many other industries which are already here now. It puts a hypothetical fossil fuel industry, with its future stranded assets, ahead of existing 21st-century industries that are already employing many, many more British Columbians and that provide realistic hope for future growth.

Are we so desperate to attract LNG producers that we are willing to leave industries that are already thriving in our province? That already show promise for future prosperity? Are we just going to just throw them by the wayside? If we want to support economic growth through tax policy, why not instead explore measures of further growing these existing industries that have shown success in our province?

Let’s build on our demonstrated strengths and the jobs they provide for British Columbians, not a pipedream that clearly won’t do much for the B.C. economy for several decades to come.

Of course, leaving aside the values question, of whether we should be sacrificing so much to try to materialize an LNG industry, all of these issues ultimately come down to the basic question. Where is that line at which B.C. actually becomes competitive with other jurisdictions, and have we actually hit that line?

Will these tax cuts actually make us that much more competitive to the point that LNG companies would have walked away without them but will now be drawn to B.C. with them? Without the full information, it’s hard to answer these questions, since there is much more to the calculation than simply respective tax rates.

Let me offer one specific example. Regulatory filings show that both the Pacific NorthWest LNG and LNG Canada projects would each likely cost up to $15 billion to build, which would translate roughly to about $1,200 per metric tonne capacity. In contrast, the Cameron LNG project on the U.S. Gulf Coast could take advantage of an existing import facility and would only cost about $7 billion to complete, which is roughly equivalent to $600 per metric tonne capacity.

Several Asian buyers, including Japan, which recently signed contracts, South Korea, India and Indonesia have acknowledged that because of this, the U.S. is likely the most efficient place in North America to build LNG export facilities and have already committed to long-term contracts with the U.S. as a consequence, starting in 2016.

The reality is that the widening of the Isthmus of Panama should open sometime at the end of next year, allowing bigger ships to come into the Gulf ports to pick up LNG at a cheaper price.

Unfortunately, we have no actual revenue projections, again, that we can use as a basis for evaluating whether the tax cuts we are offering are necessary to close the competitive gap with jurisdictions like the U.S that have these added advantages. Instead, we’re being asked, simply based on trust, to take the government at its word that they got it right.

Based on what has become a train wreck of unfulfilled promises, it’s hard for me to do so. Without revenue projections, we cannot make an informed decision on the values question of whether we should be making these sacrifices in the hope that an LNG industry will somehow materialize.

Here’s one of the most egregious aspects of this bill. We’re actually paying firms to clean up their own mess, and my concerns don’t end there, for example. Not only does this legislation lay out a path to give away our natural resources through a series of tax cuts and breaks, it also goes so far as to provide a tax credit to companies when they finally clean up their mess, a mess they made over the course of their operations.

Under this legislation a company would receive a 5 percent tax break relating to the costs of reclamation, remediation and restoration of an LNG facility site. I mean, it should go without saying that LNG companies have a responsibility to restore, reclaim and remediate their sites. This should be a cost of doing business, not something that a company gets a pat on the back for and a cheque in their pocket for doing sometime hypothetically down the road.

I find it, again, deeply concerning that the government is passing some of these costs on to British Columbians through this tax credit. It’s the opposite of polluter pays. It’s polluter gets paid.

If we are so concerned that these companies are going to pack up and leave B.C. with a hazardous mess to clean up, why don’t we mandate that these costs be covered as upfront criteria for doing business in B.C.?

As a final point, I’m concerned about an inconsistency in this bill with respect to taxing emissions reductions initiative from Bill 2. Under Bill 2, as an initiative to reduce their emission intensity, the government is proposing to tax LNG companies for not meeting the emissions intensity benchmark of 0.16 per metric tonnes of carbon dioxide–equivalent per tonne of LNG produced. Mind you, that’s only on the downstream component.

Those taxes count as lost revenue. On the other hand, LNG producers would also be empowered to sell emissions credits that they receive for reducing their emissions below the 0.16 benchmark. This doesn’t make any sense. On the face of it might. It might seem like a good way to motivate firms to reduce their greenhouse gas emissions intensity. However, there’s a troubling inconsistency in how this policy is applied.

Under Bill 6, producers can count the costs of buying emissions credits as lost revenue and, hence, reduce their LNG income tax amount. However, when producers make revenue from selling the credits they receive for reducing their emissions intensity below 0.16 — that benchmark — that revenue is exempt from taxation. In other words, the government is letting the industry have its cake and eat it too, and it’s doing so on the backs of British Columbian taxpayers — who buy the ingredients, prepare the cake and pass it along to the industry.

In conclusion, I cannot help wondering why we aren’t talking — instead of about a regressive tax regime that essentially gives British Columbia’s assets for nothing to companies afar and puts the debt on future generations — about and supporting a diversified 21st-century sustainable economy. We could be debating legislation that would support a range of industries that provide local, well-paying and sustainable employment opportunities over the long term instead of tying our job and our children’s jobs to the boom and bust cycle of fossil fuel industries.

We should instead be looking at the long-term growth in new and up-and-coming industries. Rather than relying on a single industry in one part of the province to provide prosperity — hopeful prosperity, dreamful prosperity — for British Columbia’s future, we could show real leadership and take steps today to develop the diversity of opportunities that exist across the province and to prepare our youth for employment in industries that are already characterized by high growth — such as the clean and high-tech sectors, the film sector, the tourism sector, the forestry sector, the fishing sector. And I could go on and on.

This vision certainly includes innovation in how we develop and use our natural resources, but not in a bubble. Rather, it’s as part of a diversified and sustainable economy. It goes without saying that we must enact policies to ensure that British Columbians benefit from resource extraction when and where that extraction is appropriate.

But this tax regime instead lays out a means to give away our province’s resources in order to land an irresponsible, political promise filled with hyperbole, lacking of substance and void of information and detail.

As we continue to debate the role LNG might play in our economy, let us not forget the real opportunities, the real economic opportunities, of the future and that they lie in fostering long-term sustainable growth in our economy, growth that transitions us to a low-carbon economy. Let’s take that challenge seriously and develop a 21st-century economy for British Columbia. That economy may indeed have a place for a revitalized gas industry in B.C.

If I can leave one message with government, ultimately, it is this. That revitalized gas industry should arise if the market determines it is time for it to do so, not because the government hopes it is time for it to do so. That is a critical aspect of the flaw of this piece of legislation. The government is interfering with the market.

The government has decided that it knows best, that the market for LNG is here and now and is now trying to interfere with the market. Instead of doing what it should do, what it’s tasked to do, which is to internalize externalities and ensure that the market is regulated, they are externalizing internalities and putting those and that burden on the present generation and tomorrow’s generation as well.

We will look back in British Columbia a few years hence and realize that this is a defining time in our province — a province that used to be known as an innovative leader in the technology of today and tomorrow.

Instead, what we have done is we’ve taken a card from the regressive approach of Harper Tory politics, which has a base in the Alberta oil sands industry: “Come hell or high water, get the resource out of the ground and sell it afar. Throw a party today with the resources that we can extract and the money we can take from today’s resource-selling. Let’s not worry about tomorrow.”

Let’s look at places around the world — and the prosperity funds they have — and ask the question: “What is the prosperity fund that Canada has from all of the extraction of its oil and gas wealth over many, many decades?”

The answer is very simple: it is a big fat goose egg. British Columbia, through this legislation, has aligned itself with the federal government, and we, too, in British Columbia can expect this same big fat goose egg as a legacy for the irresponsible tax regime, the irresponsible policies and the irresponsible government we have here trying to force this LNG on a market that’s not ready for it.

Seeking Clarity on the Standing Orders

On Thursday, October 23 I rose in the house on a point of order. As you will see from the exchange below, there were some inconsistencies with respect to whether or not a member who moves an amendment at 2nd reading can return to speak on the original motion once the amendment has been dealt with (i.e. passed or defeated). The standing orders are certainly not clear on this except with respect to reasoned amendments.

Here is the exchange in the house. This exchange will be viewed as precedent setting and will be used as guidance in the application of the standing orders.

Point of Order

A. Weaver: I stand on a point of order.

Deputy Speaker: Proceed.

Point of Order

A. Weaver: I’m standing to seek clarity from you with respect to decisions regarding the banking of time subsequent to proposing an amendment by a member of this House. There has been inconsistent application of the rulings within this Legislature over the years, and I think the Legislature and our members would benefit from some clarity from the Speaker as to whether or not, once the amendment is introduced, the person introducing the amendment may stand and speak to the original motion after the amendment has been passed or defeated.

Deputy Speaker: Thank you, Member, for your point of order. I’ll take it under advisement.Madame Speaker: Hon. Members, on Thursday, October 23rd, the member for Oak Bay–Gordon Head rose on a point of order. His question focused on whether a member speaking to a main motion who then moves a second reading amendment can regain the floor after the defeat of his or her amendment to resume speaking on the main motion on any remaining or banked time.

The Deputy Speaker took the point of order under advisement, meaning the Speaker will return later with a ruling. In fact, the Speaker did provide such an interpretive ruling on Monday, October 27th.

Speaker’s Ruling

Point of Order

(Speaker’s Ruling)

Madame Speaker: Hon. Members, on Thursday, October 23, the member for Oak Bay–Gordon Head rose on a point of order. His question focused on whether a member speaking to a main motion who then moves a second reading amendment can regain the floor after the defeat of his or her amendment to resume speaking on the main motion on any remaining or banked time.

I can confirm that earlier this calendar year one member spoke to a main motion, moved a hoist amendment, which was debated and rejected by the House, and then resumed his speech on the main motion for a few more minutes before yielding the floor.

This instance was not a common application in British Columbia or other jurisdictions. A review of records as far back as 2001 found no other instances of what appears to be members speaking twice to the main question.

Standing Order 42 confirms that a member can speak only once to a question, but our rules do not provide the required clarity on whether a member may bank time to continue main motion remarks after the disposal of an amendment.

When procedural questions arise, our standards refer us to British practice. Erskine May’s Parliamentary Practice, 21st edition, notes: “A member who moves an amendment cannot speak again on the main question after the amendment has been withdrawn or otherwise disposed of, since he has already spoken when the main question was before the House.” It’s found on page 370.

Beauchesne’s Parliamentary Rules and Forms, sixth edition, an authoritative Canadian text, repeats the practice set out in May.

These sources confirm that a member moving an amendment at second reading stage cannot resume debate on the main motion following the disposal of the amendment. To do so, in essence, is permitting the member to speak twice to the same question. Of course, the member who has spoken to the main motion and moved an amendment has opportunities to speak to any additional amendments that are subsequently proposed by other members.

In closing, I thank all members for their attention and thank the member for Oak Bay–Gordon Head for raising the question.

Bill 2 – Harper Tories Masquerading as BC Liberals Destroy Legacy of Climate Leadership

Today marks the day when the BC Liberals revealed their true colors. Today marks a day when the BC Liberals took a page from the Harper Tories and destroyed a legacy of climate leadership in British Columbia. In what will become known as a defining moment in BC history, the BC Liberals introduced second reading of Bill 2 — Greenhouse Gas Industrial Reporting and Control Act, and subsequently spoke strongly in support of it. Bill 2 represents a shameful betrayal of future generations. It dismantles key elements of Premier Gordon Campbell’s climate policies. And it replaces these policies with a made-in-Alberta, Harper government approach to reducing greenhouse gas emissions intensity

Today the BC NDP, Vicki Huntington, the Independent member from Delta South, and I spoke together in unity and in opposition to this shameful piece of legislation. Just minutes before the vote, I tweeted to the BC Liberals that as they reflected on the hoist motion, they might want to view this:

Full text of speech

There are moments in our lives that serve as turning points. For me, one of those moments was on February 19, 2008. On that day, I sat on the floor of this chamber for the first time, as the hon. Carole Taylor presented a vision for British Columbia, one that attempted to redefine the legacy we would leave our children.

The vision wasn’t hers alone. It was the vision of then-Premier Gordon Campbell. It was a vision of his Environment Minister, the hon. Barry Penner, and it was the vision of the majority of British Columbians.

It was also the vision of the province’s Climate Action Team. Created in 2007, the province’s Climate Action Team comprised a body of experts around the province that included the now member for Cariboo-Chilcotin, who at the time was the mayor of the district of 100 Mile House. I, too, had the great privilege of serving on the Climate Action Team.

That day was a turning point for me. It was a day when I was incredibly proud to be a British Columbian. My government, our government, took a bold step forward in recognizing that while British Columbia may represent a drop in the proverbial bucket of international greenhouse gas emissions, it was important to demonstrate leadership in reducing greenhouse gas emissions. Government also realized that demonstrating leadership was an economic opportunity.

As I watched this progress start to unravel back in 2012, I decided I could no longer sit on the sidelines. I had to get involved myself. So here I am today, in part, thanks to the work that we did back in 2008.

That day was also a turning point in British Columbia’s history. It not only put us on a path to lead the continent in climate policy but stood as a testament to what could be accomplished when experts around the province come together with the government to help to answer an essential question: in the context of all the challenge we are facing, what can we do today to offer our children a brighter future?

When the Climate Action Team was assembled in 2007, it was tasked with three actions. First, to offer expert advice to the province’s cabinet committee on climate action on the most credible, aggressive and economically viable targets possible for 2012 and 2016. Second, to identify further actions in the short and medium term to reduce emissions and meet the 2020 target. Third, to provide advice on the provincial government’s commitment to become carbon-neutral by 2010.

Earlier in 2007 the provincial government had enacted the Greenhouse Gas Reduction Targets Act. I had the privilege of sitting in the gallery, again with the member for Cariboo-Chilcotin, the day the legislation was introduced and read for the first time. The government set a bold yet achievable 2020 target of reducing our emissions by 33 percent below 2007 levels and a 2050 target of reducing our emissions by 80 percent below 2007 levels.

Starting at roughly 64.3 million tonnes of emissions in 2007, by 2020 we were tasked with reducing our emissions to 42.9 million tonnes, and by 2050 we were tasked with reducing our emissions to 12.8 million tonnes. Those targets were enshrined in law precisely because they were grounded in necessity.

Together with business leaders, scientists and policy experts, the Climate Action Team reviewed existing scientific literature and best in practice economic and environmental policy options. We rose to the challenges to which we were tasked, and our efforts culminated in the publication of our final report on August 6, 2008.

The report balanced environmental needs with economic needs, and we determined that, to have an impact, our interim targets and policy recommendations needed to be bold yet practical. They needed to be grounded in climate science yet viable for business. Together government, academics, industry leaders and First Nations made recommendations on innovative policies to address one of the most pressing issues of our time, and that is, of course, global warming.

We did so in the context of strong economic policy. Since the rollout of those and other greenhouse gas mitigation policies began in 2008, we’ve seen our economy outperform the Canadian average.

We’ve seen up-and-coming sectors like the technology sector become the second-largest contributor to private sector job growth, supplying 84,000 jobs for British Columbians and revenues of $18 billion a year. We’ve seen mining output and exports double in the last ten years, and we have seen more than $18 billion added to our provincial GDP. We did all of this while reducing our carbon emissions by over 4 percent from 2007 to 2012, the most recent date, of course, for which official data are available.

In fact, published studies have clearly concluded that the 2008 and subsequent climate policies have successfully reduced climate emissions while still supporting economic growth. To quote the former Finance Minister, the hon. Carole Taylor, the government offered a new vision for our province that confronted and completely overturned “the outdated notion that you have choose either a healthy environment or a strong economy. That’s simply not the case. That either-or thinking belongs to the past.”

In 2008 our provincial boldly strode down a path that was grounded in real leadership and prosperous economic growth. That vision, those policies, are being dismantled with the legislation. I cannot stress this enough.

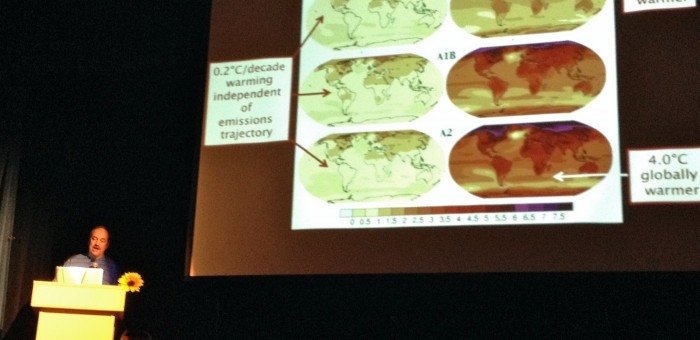

Just this week September 2014 was announced as the warmest September on record. This announcement came a month after a similar one citing August 2014 as the warmest August on record. Before that June 2014 was the warmest June on record. Before that May 2014, the warmest May on record. And April 2014, the warmest April on record.

In fact — this statistic is very important — the last time a monthly cold record was set was in December 1916. Yet every monthly heat record has been post-1997. All around us we see the impacts global warming is having on the magnitude and frequency of extreme weather events. It is therefore incumbent upon all of us to step up, to show leadership and to put our province back on the right course.

The simple fact is that we cannot build an LNG export industry governed by emissions intensity regulations like the ones proposed by the government and still meet our legislated climate targets. There are no two ways about it. The emissions from LNG are too big for accounting tricks and numbers games, and no bill can fix it.

According to estimates from the Pembina Institute, an LNG industry of the size proposed by the government would emit roughly 73 million tonnes of carbon pollution. That’s more than the emissions from every other sector of our economy combined. To meet our 2050 climate targets with an LNG industry of that size, we would have to reduce provincial emissions, which currently stand at 62 million tonnes, by 122 million tonnes. In other words, we would have to double the already bold commitments we set in 2008. That’s just simply not possible.

As a pundant told me, through LNG, the government has promised a Ferrari in everybody’s driveway. The reality is, if we want to meet these emissions, we’re really promising British Columbians a bicycle, because they cannot use cars if we’re going to have this LNG industry and actually meet our targets.

By Pembina’s estimates, even one LNG plant would likely emit 12 million tonnes of carbon pollution. That one LNG plant on its own would emit as much as our entire province under the 2050 target. I’m not making this stuff up. These are the numbers. You can pretend they don’t exist, or you can actually do the math yourself.

If we leave aside Pembina’s estimates for a moment and instead look at the government’s numbers, the story is the same. Even if we meet the government’s “cleanest LNG” — whatever that means— scenario, with an LNG emissions intensity of 0.16 carbon dioxide–equivalent tonnes for each tonne of liquefied natural gas produced, if B.C. exports 81 million tonnes of LNG each year, our downstream carbon emissions, on their own, would total 13 million tonnes.

To be clear, that calculation, as the member for Vancouver–West End pointed out, doesn’t even include upstream emissions, which account for roughly 70 percent of all emissions in the LNG supply chain. The downstream emissions on their own, and under the best case scenario, would equal the total provincial carbon emissions set for 2050.

I mean, I’m not making this stuff up. I just don’t understand where the government’s mind is when they think that they can meet their 2050 and 2020 emissions targets and have five LNG plants.

The upstream emissions could add well over 43 million tonnes to the numbers I just cited, in addition, entirely blowing our legislated climate targets out of the window. I mean, I chuckle. I shouldn’t chuckle, because this is very serious. But I chuckle at the absurdity of the government’s direction in this piece of legislation.

The fact is this bill is an attempt to pull the wool over British Columbians’ eyes, to make us think we are reducing carbon emissions when instead we would actually be doing the opposite. If we pass this bill, we may as well say goodbye to all of the progress we worked so hard for — including the member for Cariboo-Chilcotin, who sat on the Climate Action Team with me — in 2008. We will be stepping into an era as one of the most polluting provinces in Canada, joining our friends, Alberta and Saskatchewan, as laggards in the climate change mitigation game.

This legislation would see us make a distinct shift from an innovative, made-in-B.C. approach to absolute reductions in the magnitude of our gashouse gas emissions, to a made-in-Alberta, Harper government approach to reducing greenhouse gas emissions intensity — which, as we know from the Alberta experience, permits an overall increase in the magnitude of greenhouse gas emissions.

Of course, the climate system does not care about intensity. It cares about magnitude, and to pretend otherwise is not being truthful to oneself. It’s clear to me that this bill is ill-considered, misleading and a clear signal that we are losing our leadership in addressing global warming.

Thank you to the member for North Island here, who pointed out that actually we’ve lost our leadership — not losing.

When I read through the legislation before us, I couldn’t help but wonder why British Columbia has veered off its path towards substantive emissions reduction and instead moved down a road paved by Alberta.

What do I mean by a road paved in Alberta? Well, it’s truly remarkable to see the similarity between our new legislation here today and Alberta’s Climate Change and Emissions Management Act, as amended in 2007, together with its accompanying Specified Gas Emitters Regulation.

What this Alberta legislation and regulation did was require heavy emitters of greenhouse gases — and in the Alberta context I mean over 100,000 tonnes per year there — to reduce their emissions intensity, not their absolute magnitude of emissions, by 12 percent.

It gave large emitters four ways to accomplish this:

(1) making operating improvements;

(2) buying Alberta-based offsets;

(3) buying emissions performance credits — i.e., any excess emissions intensity reductions;

(4) paying $15 per tonne into a technology fund.

While the technology fund, as the member for Vancouver–West End pointed out, has not really worked in Alberta, it does set the stage for quite a number of photo opportunities for those claiming to actually be taking measures to mitigate climate change.

Does all of this sound familiar? It should. These are precisely the same four actions that this legislation will allow LNG facilities to take to meet their emissions intensity targets, at a slightly higher cost per tonne in B.C., although there have been musings in Alberta about raising the cost to 40 bucks per tonne.

Now here’s the problem. Again, our climate does not care about emissions intensity. It doesn’t care how much carbon is in a particular tonne of emissions coming from an LNG facility. Our climate cares about the overall magnitude of carbon pollution a facility would release and how much carbon pollution is in our atmosphere.

Under an emissions intensity model, the overall magnitude of emissions can increase substantially even while emissions intensity is falling. So why are we going down this path? Because the government knows, as any scientist does, that emissions are going to skyrocket if we develop our LNG industry.

An Alberta or Harper government–style emissions intensity model will provide the illusion of action — let me repeat, the illusion of action — on global warming at the same time as our overall magnitude of emissions continues to increase. That’s all this is: the illusion of action. To pretend otherwise is to be dishonest to ourselves. All one has to do is compare Alberta’s and B.C.’s emissions records over the last few years, and one will see that while B.C.’s emissions declined, Alberta’s continued to rise.

This government’s approach to Alberta or Harper government–style emissions intensity reductions is why this act will also repeal the Greenhouse Gas Reduction (Cap and Trade) Act . The 2008 Greenhouse Gas Reduction (Cap and Trade) Act was one of many pieces of legislation brought in by the provincial government under the leadership — and I say leadership — of Premier Campbell. The act was specifically designed as enabling legislation to allow British Columbia to join its Western Climate Initiative partners, like Washington, Oregon, California, Manitoba and Quebec, to create a larger market for carbon trading.

As economists will tell you, the larger the region, the more economically efficient the cap and trade system would be. In repealing the 2008 Greenhouse Gas Reduction (Cap and Trade) Act, this legislation attempts to take the elements of a good piece of well-thought-out legislation and embed it into a politically driven process. The government is doing this because a cap-and-trade model puts a limit on the magnitude of emissions, and any limit, as such, would be inconsistent with the dramatic increase in emissions that we will see with this proposed yet entirely hypothetical LNG industry.

Again, we may decrease the emissions intensity, but the atmosphere really does not care about that. It only cares about the magnitude of emissions, and this bill is systematically designed to allow for a dramatic increase in emissions, right down to the repealing of the Greenhouse Gas Reduction (Cap and Trade) Act.

On September 22 the government issued a media release entitled “Statements by West Coast on the United Nations 2014 Climate Summit.” In it the Premier proudly proclaimed: “British Columbia has proven that there’s no need to choose between protecting the environment and growing the economy. B.C.’s revenue-neutral carbon tax has helped reduce greenhouse gas emissions, while encouraging more sustainable economic development and competitive…rates.”

Compelling statements about the importance of dealing with global warming were incorporated in the press release from Governor Brown from California, Governor Kitzhaber from Oregon and Governor Inslee from Washington.

In the last few years we have made significant progress with our Pacific coast action plan on climate and energy partners, progress that would see the magnitude of emissions decline in a way that is consistent with continued, strong economic growth. This legislation would undermine that progress. I cannot stress this enough. Now is not the time to turn our backs on the progress that has been made. If we are not going to scrap this bill, then at the very least we should take the time necessary to properly consider its consequences.

With that in mind, hon. Speaker, I would like to table a hoist motion.

The Amendment

[I move that the motion for second reading on Bill 2, Greenhouse Gas Industrial Reporting and Control Act, 2014 be amended by deleting the word “now” and substituting the words “6 months hence”.]

The Amendment Speech

Please allow me to speak to the reason why I put this hoist motion forward.

I spent much of my life working to improve our understanding of the science in past, present and future climate change and variability. My work took me to the forefront of international efforts in climate science. I’ve helped create an understanding of how changes in radiative forcing, amplified through feedback mechanisms operating internal to the climate system, allow for an explanation of the variations of climate change over the last 130,000 years.

I have been involved in local, provincial, national and international efforts to provide decision-makers with up-to-date scientific assessments of how increasing greenhouse gas in aerosol emissions, together with land use change, will impact society both now and into the future.

This did not happen overnight. I spent more than two decades pointing out the risks associated with unmitigated global warming, and I’ve advised decision-makers at all levels of government and industry of both the consequences of taking imminent action to reduce greenhouse gas emissions and the opportunities that come when we do take action.

Now, I recognize that there are members on the government side of this House that believe — as calculated by Archbishop James Ussher, who lived from 1581 to 1656 — that the earth was created on Sunday the 23rd of October, 4,004 BC — making tomorrow particularly notable as the earth’s 6,017th birthday.

I also recognize that there are members on the government side of the House that believe that libertarian blog sites constitute primary sources for scientific information.

Nevertheless, it is a step forward that this government historically, and governments around the world, no longer believe it to be responsible, at least in words, to take the position that human-caused global warming is not changing the world and that mitigation and adaptation strategies aren’t an imperative.

Those jurisdictions that were the first to recognize the risks and also saw the opportunities that addressing climate change could offer are prospering. For example, Germany is far ahead of much of the world with its policies. It has made the adaptation and mitigation of climate change a key factor in how it develops its economy. China is also seizing the economic opportunities afforded by developing low-carbon technologies.

This is why we need the time to reflect upon the decisions that we are dealing with today — because what’s at stake is so incredibly important.

In the case of Germany, instead of focusing on one industry, Germany has developed clean technologies industry that permeates through their entire economy. As reported in Bloomberg in 2012, the clean tech industry in Germany is set to double in size by 2025, creating new jobs and new opportunities to reduce greenhouse gas emissions.

Germany’s massive effort to reduce its greenhouse gas emissions, while opening the doors to the development of a new industry, is called Energiewende and is among the world’s largest proposed shifts from carbon-based energy to renewable power. This is not to say that we can follow Germany’s example step by step. That, of course, isn’t desirable.

Instead, what we need to explore are made-in-B.C. solutions. In fact, until recently this is exactly what we were doing in B.C. British Columbia was once a leader in North America, bringing into law the first carbon tax on the continent. We established clear greenhouse gas emission targets and enshrined these into law. Again, this was done not as a cheap political talking point but because real, honest steps to address climate change were grounded in necessity if we wished future generations of British Columbians to prosper.

When we singularly focus on LNG, we fail to value the sectors in B.C. that actually exhibit promise for growth. For example, the Canadian clean tech sector tripled in size from 2012 to 2013. This was a sector that was growing in B.C. and one that we had all the tools necessary to develop further. The educated workforce; the cheap, renewable power; and the creativity and courage required to show leadership were at one point in British Columbia all present.

This industry, along with others that are becoming mainstays of our 21st century economy, requires a focus on developing diversified industries that provide local, well-paying and sustainable employment over the long term. They are also developed with an understanding that it is our responsibility to reduce greenhouse gas emissions, which is why the decision we are making today should not be taken lightly. Hence, the reason why more time needs to be put before this legislation is brought for a vote.

What is different about this path, this path of the LNG pipedream? What is different about this path of the LNG pipedream is that economic development goes hand in hand with reducing emissions. These are not separate initiatives brought together. Instead, they are addressed simultaneously. We can meet our greenhouse gas reduction targets by prioritizing the growth of this clean tech part of our economy.

The foil to this is the legislation we have before us, which is why we need more time to actually examine it. Rather than looking for win-win opportunities, this bill implies a massive increase in our greenhouse gas emissions stemming from LNG.

Government suggests that we’ll rely on other industries and individual British Columbians to take up the slack and reduce their emissions even further to account for the balance. As I said before, the reason why we need so much time to think about this piece of legislation is that while the government is promising a Ferrari in everybody’s backyard, the reality is that all we’re going to get is a bicycle or a scooter if we’re going to actually have our legislated targets being met.

Interjections.

It is, indeed, green, but you tell all the British Columbians that they are not allowed to drive a car because of inability of government to actually work out the numbers in the policy it’s developing. I don’t want to be that person. You can be that person. I want to give British Columbians hope — real hope, not hope based on a pipe dream, an economic windfall that will not happen and at the same time destroy the legislation that has been brought into our chamber here by true leaders in our economy — the former government of this province, not the present government.

I got off track there. I got moved to speak passionately against the heckling from afar, from a member who, I suspect, believes that the world is 6,017 years old, as opposed to the age of the earth actually starting about four billion years ago.

Again, without time to reflect upon this current bill, we will be turning our backs on our Pacific coast action plan partners and on the real climate leadership that we established in 2008. We need to take this very seriously. We need time to reflect upon this. Instead of reducing emissions and working our way towards a regional cap-and-trade framework, we will instead be shifting towards a made-in-Alberta emissions intensity framework, a made-by-Stephen-Harper emissions intensity framework.

Is this what the government wants to tell British Columbians — that our policy is being made in Alberta by Stephen Harper and his cronies in Alberta government? This is not what I would like to tell British Columbians, but the honesty before us is that this is what government should be telling British Columbians. This is not made-in-B.C. policy. This is mirroring Alberta policy to put in place emissions intensity arguments so that you don’t have to do anything about emissions reductions.

The sad fact is that passing the bill without us thinking about the consequences and delaying it before bringing it to vote is that in its current form we would essentially be turning our backs on the progress we’ve made in British Columbia and all the good work that has been done in terms of reducing emissions since 2008. When we consider the trends of our neighbours, this legislation — if we pass it today, as opposed to thinking about it and reconsidering it six months hence — represents a move away from the progress and hope that the Pacific action plan on climate and energy heralded just last year.

When our province came together with California, Washington and Oregon, the latter two states vowed to join California and B.C. in putting a price on carbon. This was a monumental step forward for both action on climate change and for building a 21st-century economy on the west coast of North America. Our carbon tax policies were held up as a shining example of how to take action on climate change without hurting the economy.

Washington and Oregon are already taking steps to follow our lead and California’s lead in putting a price on carbon. Currently they are actively determining precisely how they will do this and whether they will adopt a cap-and-trade framework or a carbon tax. The trouble is that we don’t have these details yet. This is a fast-moving area, and the developments are still unfolding. Why are we rushing to legislate major changes — including the repealing of the Greenhouse Gas Reduction (Cap and Trade) Act — that could undermine our partnerships with our friends to the south before we even know how our neighbours are going to proceed?

Surely they’re not looking to British Columbia for leadership now, as they used to. So why don’t we wait and see what leadership they will offer us, rather than throwing it all away from our past legislation?

We have a rare window of opportunity to come together with other west coast jurisdictions and live up to our word and our commitments to reduce greenhouse gas emissions. By seizing this opportunity, we will be able to move forward together in a united approach to tackling our emissions. We cannot do this if we rush this legislation through. We may be able to do it if we take more time to consider the ramifications of this bill.

However, there is more to this than simply reducing our carbon emissions. The steps we took in 2008 opened up a new and vast sector of our economy with vast economic opportunities for British Columbian businesses. Perhaps one of the best examples of this is our clean tech sector, which I’ve already discussed. This sector has experienced significant growth in the years following 2008.

When the details emerge as to how Washington and Oregon are going to enact carbon pricing, B.C. will be in a much better position to assess the economic opportunities that our partnerships with those U.S. states present.

Will they go cap-and-trade? We don’t know just yet. We know California has. We know Quebec has joined them. Why are we repealing cap-and-trade legislation in B.C. that was actually put in place so that we might join our partners? Washington and Oregon may go there, and we’ll be left out, yet again on the sidelines of international policy.

Instead of putting our current progress and these potential new opportunities at risk by rushing this legislation through, we could use this extra time to explore opportunities that are presented by collaborative cap-and-trade schemes with our neighbouring states. Our LNG industry — this hypothetical industry, which may or may not transpire — could actually participate in a broader economic jurisdiction in terms of capping emissions and trading emissions, efficiently reducing emissions broadly in the North American context, as opposed to the made-in-Alberta, Harper Tory, emissions-intensity-non-reduction policies that are being brought forward in this legislation.

In a time when international cooperation on climate change is rare, taking the time to properly consider the potential for such a harmonized carbon-pricing zone is well worth it. As our neighbours move forward and look to join us in putting a price on carbon, now is not the time to guarantee massive increases in emissions, to compromise the gains we have made or to abdicate the leadership role we previously had in this area.

It is also not sufficient to claim that this legislation, at some point down the road, will actually find offsets in other jurisdictions — perhaps in China, perhaps in Alberta. Who actually really knows?

There are ten pages of regulatory power in the legislation, which we have not had time and the general public have not had time to go through in detail to determine the consequences of. Yet these ten pages in the legislation essentially grant the government carte blanche to call whatever they want “an offset,” whenever they want “an offset,” whoever they want to do it with “an offset” at any time they want.

It essentially says: “Government makes up the rules as they want to go along.” And we’re trying to think about passing this legislation today without the time to properly reflect upon the consequences on British Columbia’s reputation not only in Canada, not only in North America but globally. Where once we were thought of as leaders, we will surely follow the way our federal government has gone and be viewed as laggards here.

You can pretend that we have these legislated targets on the books. You can pretend that this emissions-intensity legislation is going to somehow meet these targets. The reality is: it, along with the LNG hype, is nothing more than a pipedream.

And the reality is that this government today has lost credibility, through this legislation, on its past, present and future performance on any action to do with climate change mitigation. Because the reality is that you, the government, are trying to pull the wool over British Columbians’ eyes, trying to pull the wool over North Americans’ eyes, trying to pull the wool over the eyes of our friends around the world and claim that we are still leaders, when we are not.

We are moving away from leadership to becoming a laggard, as I have underlined several times, just like our federal government. Shame on the government. Shame on them for bringing this legislation forward.

I certainly hope that they will support this amendment and actually delay it six months, so that we — the opposition, the people of British Columbia, the people in Canada, our friends to the south, our friends elsewhere — will have time to look, reflect and think about this.

And to my friends and members opposite, this will also give you time to go and move past the conservative blog sites that you so love to look at to find the things you love to back the opinions you have and actually go and read a few scientific papers. Go to the peer review literature. Take a look and see the predicament that this world is in because of irresponsible legislation like that which you are putting forward today in our Legislature.

Shame on the government. Shame on the people who voted for this government. This bill needs to be delayed, and I urge you to support this hoist motion today.