Legislation

BC NDP & BC Liberals reveal they’re really two sides of the same coin

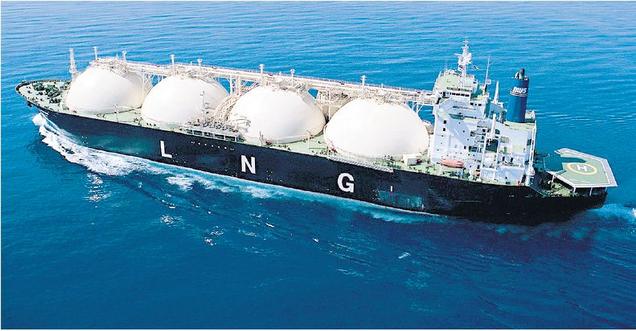

Last week the BC NDP and BC Liberals joined forces to pass Bill 10, Income Tax Amendment Act, 2019. This bill created tax credits and a fiscal regime for what will become the single largest point source of carbon emissions in Canada’s history two days after a government report confirmed that Canada is warming at twice the rate as the rest of the world, with the North, the Prairies and northern British Columbia pushing to nearly three times the global rate.

The BC Greens already voted against the Bill at first reading and at second reading (where we introduced three amendments to kill the bill that were all defeated). During our numerous speeches, Adam Olsen, Sonia Furstenau and I argued that it’s time politicians level with British Columbians about the economic and environmental consequences of this historic betrayal of future generations.

During committee stage of the bill, my BC Green colleagues and I voted against each section of the bill. It was during this stage that I was also able to find out that LNG Canada has no requirement to hire locally, despite BC NDP promises to the contrary. In addition, I was able to determine that the BC NDP have a moving definition of what “cleanest LNG in the world:” actually means.

| Section 1 | Section 2 | Section 3 | Section 5 | Title |

|---|---|---|---|---|

|

|

|

|

|

When section 4 of the bill was discussed at Committee Stage, the BC Liberals proposed an amendment that would strike out section 4b in the following:

4 The following Acts are repealed:

(a) Liquefied Natural Gas Income Tax Act, S.B.C. 2014, c. 34;

(b) Liquefied Natural Gas Project Agreements Act, S.B.C. 2015, c. 29.

That is, the BC Liberals did not want their Liquefied Natural Gas Project Agreements Act repealed.

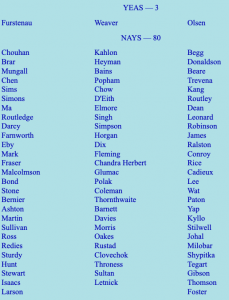

While the amendment was being debated there were a dozen or so MLAs in the chamber, and when the Assistant Deputy Speaker called for a verbal vote on the amendment the “Ayes” won. This simply means the MLAs in the chamber collectively said “Aye” louder than those saying “Nay” (I stayed silent). Given that the BC NDP lost the verbal vote, a number of them (and I) called for “Division” (a standing vote). Not interested in quibbling about how the deckchairs on the Titanic should be arranged as it starts to sink, I left the room. My colleagues Adam and Sonia were in other meetings in the building and were not present.

While the amendment was being debated there were a dozen or so MLAs in the chamber, and when the Assistant Deputy Speaker called for a verbal vote on the amendment the “Ayes” won. This simply means the MLAs in the chamber collectively said “Aye” louder than those saying “Nay” (I stayed silent). Given that the BC NDP lost the verbal vote, a number of them (and I) called for “Division” (a standing vote). Not interested in quibbling about how the deckchairs on the Titanic should be arranged as it starts to sink, I left the room. My colleagues Adam and Sonia were in other meetings in the building and were not present.

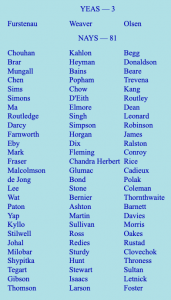

The standing vote led to a tie: 41 BC Liberals for the amendment; 41 BC NDP against it. The 3 greens were not interested in amending a section we were about to vote against and so were not present. The tie was broken by the Assistant Deputy Speaker (a BC Liberal) and so the amendment passed, but not without controversy. The Assistant Deputy Speaker is supposed to be a non-partisan role.

The standing vote led to a tie: 41 BC Liberals for the amendment; 41 BC NDP against it. The 3 greens were not interested in amending a section we were about to vote against and so were not present. The tie was broken by the Assistant Deputy Speaker (a BC Liberal) and so the amendment passed, but not without controversy. The Assistant Deputy Speaker is supposed to be a non-partisan role.

In cases where there is a tie, there is a convention that should be followed to preserve confidence in the impartiality of the Speaker’s office. But here, the Assistant Deputy Speaker voted her “conscience” and the amendment passed. Moments later the amended section was put to a vote. Adam Sonia and I voted against that.

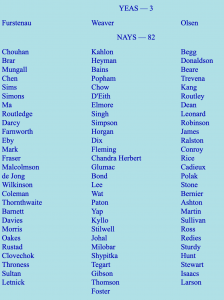

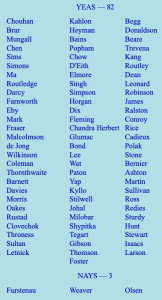

On Thursday last week the bill came up for third reading. Adam, Sonia and I rose to speak a final time. Sonia was shut down early by the speaker and so was unable to move an amendment to send the bill to a Legislative Committee. Adam and I both moved amendments, that Sonia spoke to, as we tried to persuade the BC NDP and BC Liberal MLAs the scale of the sellout embodied in Bill 10. Sadly, our two amendments failed and third reading passed.

| Amendment to Committee | Hoist Amendment | Third Reading |

|---|---|---|

|

|

|

Below I reproduce my third reading speech as well as my speech to Adam’s hoist motion in both text and video format. I also reproduce a copy of the media release that we issued once Bill 10 passed.

Without a doubt, witnessing the BC NDP and the BC Liberal MLAs collectively vote against the three BC Greens fourteen times on this bill made it abundantly clear to me:

The BC Liberals and the BC NDP are two sides of the same neo-liberal coin.

3rd Reading Videos

| 3rd Reading & Motion to Send to Committee | Hoist Motion |

Text of 3rd Reading Speech

A. Weaver: I must say I am deeply troubled and deeply disturbed by the precedent set today in this Legislature at a time when it is quite clear from the standing orders as to the rules and regulations with respect to reading at third reading. We have been following very clearly the rules as demonstrated in the standing orders. I rise to speak to speak at third reading against this same bill.

My colleague from Cowichan Valley didn’t have the opportunity to bring forward this important information that has been brought to light during the debate, important information that is required by members of this chamber in order to make their decision, important information that reflects on the very nature of the bill-debating before us. The natural gas tax credit. The changes in the calculations that are being put forward.

It is only through a complete understanding of the complexities of the nuances in this bill, in the context of the global picture, that we are able to make an informed decision in this House. To have my colleague — to have her shut down in debate because of an interpretation that I believe is flawed is simply outrageous.

I do apologize for my comments here, but never before have I — in sitting here for six years in this chamber — seen what I believe to see: an interference of a member’s right to enter a debate on an issue subject to the standing orders that we have had guide this place for generations. I continue, as to provide the important information.

I see the House Leader for the government. They’re talking to the Speaker. I would suggest that is out of order as well in this moment here. So I continue.

Deputy Speaker: Member, the Chair would welcome any comments related, relevant, to Bill 10. So nobody is stopping anybody making those comments. I would urge the member to limit those comments just to the bill. Please carry on.

A. Weaver: These comments are to Bill 10. Bill 10, as has being articulated here, introduces three things. One, it tries to repeal the LNG Income Tax Act.

I would like to publicly note that right now, the House Leader of the government is providing advice to the Speaker in the Chair. In my view, that is outrageous. That is not something that should be happening. This is a non-partisan position. To see witness the Speaker getting advice being provided is surprising.

On to Bill 10.

Deputy Speaker: Member, please take your seat. The Chair will again urge all members who wish to speak on this bill in third reading: keep your comments relevant to the bill. That’s all we are asking for. The member wishes to continue? Please proceed.

A. Weaver: I do wish to continue, and I do apologize for challenging the decision there. But as I said, it’s troubling. I will continue on focusing solely on the bill, the number of points raised in the bill.

As I pointed out, there are three points in there. The first, of course, is the repealing of the LNG Income Tax Act. The second is the repealing of the Petronas agreement, the LNG project development agreement, which we now know — through the rather interesting amendment put forward by the opposition that has passed — will not be repealed as part of this. We enjoyed watching those deliberations and interesting to see how that moved forward.

We also know that the B.C. NDP, in this bill, are trying to retain the giveaway, the natural gas tax credit giveaway that is embedded in the original LNG Income Tax Act. We have three aspects of this bill. We have articulated in second reading time and time again….

I see in the gallery a young group of children, and I welcome them to this place. I would suggest to them, as we continue to explore this bill and the ramifications of this bill, that members in this House actually think about their future, members in the House actually recognize that this generational sellout embodied in this giveaway is not doing their future any good. Frankly, it is a betrayal of their future.

As my colleague from Cowichan Valley tried to articulate, there have been a numerous number of articles appearing that have highlighted the reason why this bill and the actual elements in it are inconsistent with the government’s goal to try to reduce greenhouse gas emissions. It is inconsistent to give away a tax credit to this industry that would not otherwise be here in British Columbia in a desperate attempt to try to deliver what Christy Clark couldn’t. That’s it. That’s the only rationale I can see behind this moving forward.

As my colleague from Saanich North and the Islands, who will speak after me, brings forward information on the bill, I would hope that members opposite, members in the B.C. Liberals, who have been saying for so long that they do not believe that this giveaway is actually fiscally responsible…. The member for Langley East was quite clear in that regard. The member from Abbotsford — not only was the member for Abbotsford West clear, his deconstructing of the job narrative that was supposed to be here was compelling. This government did not provide any information to back its claims that this agreement embodied in this bill would actually hire British Columbians.

In fact, just today I received an email from a contractor up in the north who validated the concerns I raised about Boskalis hiring temporary foreign workers. Today I received that email.

We are going to vote on a bill at third reading where information provided at the committee stage was either not provided in entirety or not delivered. We have yet to be given information. We were told in committee stage that we had to ask the Minister of Jobs, Trade and Technology questions before we get answers to the issues of how this would affect jobs. Those questions were delivered to the Finance Minister in committee stage, yet we did not get answers to those questions. How is it possible that we could actually vote in favour of bill where the answers were not forthcoming to fundamental questions raised by members of opposition and by members in the Green Party at committee stage?

It seems to me that if ever there was a reason to actually not continue forward and vote on this, if ever there was a reason to actually send this bill to committee for further deliberation and debate, that information would be the fact we didn’t get answers. It’s for that reason that I move:

[That the motion for third reading of Bill (No. 10) intituled Income Tax Amendment Act, 2019 be amended by deleting all the words after “that” and substituting therefore the following:

“Bill (No. 10) not be read a third time now but that the subject matter be referred to the Select Standing Committee on Finance and Government Services.”]

A. Weaver: The rationale for proposing that this bill be sent to committee, as put forward to you a few seconds ago, is that the information we were trying to seek at committee stage was not forthcoming.

The information about jobs, the information about where the $23 billion was going to come from, the fiscal breakdown, was not forthcoming. The information on contractors, who was going to be contracting — not forthcoming. Information on emissions and whether this initial final investment decision is actually a pathway to a four-train system — not forthcoming.

It is only through the exploration of this matter further at committee stage, it is only by bringing in expert testimony — the expert testimony from people like Katharine Hayhoe, who my colleague from Cowichan Valley tried to bring forward here…. She tried to actually bring that information to this chamber, to allow members to actually inform themselves prior to a vote.

The only means and ways that members truly will be able to actually recognize the scale of climate change, the scale of what is before us here with this bill, in terms of the generational sellout of those young children and their friends up in the gallery…. It is only through exploring this at committee stage that we will actually be able to get to the bottom of whether or not this truly is in the best interest of British Columbians.

We know that members of government’s caucus have not even been briefed on the details of this bill, and we have, as three Green MLAs, had to brief them on the details of this bill. It is sad that we have, in this chamber, so many MLAs who have not spent the time to actually go and get the information on what we’re debating before us.

That is why a committee, a legislative committee exploring this issue, bringing forward recommendations, deliberations on what is supposed to be a big project for B.C. but is, in reality, the single biggest point source of emissions that this country has ever seen, at a time that this government’s claiming it’s championing climate change policy.

This needs to go to committee, and I certainly hope members in the government will join us in supporting this, for democracy is about seeking input. It’s about making decisions based on evidence. It’s about going to the communities across British Columbia — whether it be the farmers, the farmers in the Peace, who came to us, who came to our caucus to brief us on the profound issues they have with the way the fracking is happening on their farmland, that they are considered second-class citizens.

The fact that the committee would be able to explore the views of the youth of today — the views of the youth of today who today, across this country, are getting ready for Friday. It’s another day of walkouts in schools, another day of walkouts as youth point to the political leaders and say: “You are ignoring us. You’re not going to have to live the consequences of the decisions you are making. Yet we are, and you are not including us. You are not thinking about our future in your decisions. You are thinking about your re-election. You’re thinking about what it takes to score a tick box in a ‘I did what Christy Clark couldn’t.’ And you’re doing what you think is actually the best thing that you can do based on focus groups, polling testing, etc., not doing what’s right, not doing what’s principled.”

It is sad. The saddest moment, for me, again coming back to why this should be sent to committee, is I look to what was raised when I was interviewed by CFAX this morning…. I was challenged by Al Ferraby, and I enjoy being challenged. I was challenged by Al Ferraby, who said: “What’s this about you not wishing to participate in a vote?” And we talked about that. He said: “What’s this about the member for Abbotsford West with this phrase?”

Well, I could talk about this later. But the point I’m trying to make is that I’m hoping, for the first time in the six years I’ve been here, members in government, back bench, will reflect upon these words, reflect upon those children in the gallery, as they stand up at third reading and determine the future of this bill — the future of this bill which my colleagues, numerous times over the last few days, have pointed out betrays our climate commitments, betrays future generations, provides false promises to the people in northwestern B.C., who are already seeing the temporary foreign workers coming in.

We know that the only way to actually get to the bottom of these very important questions is through committee, because we did not get the answers at committee stage. We need to send this to a standing committee.

Again, wouldn’t it be a joyous occasion if members opposite, who have criticized this deal for being fiscally irresponsible…. We agree with them. We agree with them that it’s fiscally irresponsible. If they then joined us in voting to send this to committee, to allow a committee to actually explore the level of fiscal irresponsibility embodied in this bill, to challenge the claims, give us the chance to explore with the Minister of Jobs, Trades and Technology what the real job deals are. Have there been secret sweet deals signed with certain people about bringing in temporary foreign workers?

With that, I’ll take my place and certainly hope that others will join me in supporting this amendment

Text of Speech in Support of Hoist Amendment

A. Weaver: I rise to speak very briefly in support of my colleague’s, the member for Saanich North and the Islands, hoist amendment on the bill.

My colleague, I think, has made a very, very compelling case as to why we need the additional six months’ time to reflect upon it. More so, I would suggest, members in this House, have not received the information that they need to make a decision. I’ve heard many talk about the importance of evidence-based decision-making. It’s something that’s fundamental to who we are as members of the B.C. Green caucus. I’ve heard others in this place talk about the importance of that. Yet, we know that the information, the evidence on which to make such a decision, has not been presented to us here in committee stage.

We know that this bill has three components to it. It has a component to repeal the Liquefied Natural Gas Project Agreements Act. There’s a component to repeal the LNG Income Tax Act. And there was, at the same time, a component of the bill to retain the tax credit — the corporate welfare on steroids — that existed within the LNG Income Tax Act. We know, in what has got to be described as a bizarre set of things that have happened here, that we’ve broken precedent in this place. We’ve broken historical precedent in Westminster parliamentary democracies during the course of these debates, not once, but twice during the course of these debates. That, in and of itself, I would suggest should give us pause to reflect upon this bill with the additional time that we would get through this hoist amendment.

We had an amendment put forward by the B.C. Liberals, an amendment to quibble about where the deck chairs on the Titanic should be prior to the Titanic sinking to the bottom of the ocean. We had an amendment that actually led to a tie vote — 41-41. With respect, in the long, rich tradition of Westminster parliamentary democracies, we had a precedent set that goes directly against the historic nature of this building, where a Chair votes out of conscience in a partisan manner with the opposition. This is outrageous. It’s outrageous, given that we, at the same time in the U.K., had the ruling set out why the Speaker in the U.K. ruled with government. That is the role in a Westminster parliamentary democracy of a Chair, to ensure that the debates flow forward.

That was our first precedent-setting decision. Very, very unfortunate. But that was not the only one. The second one, too, gives reason to pause as to why we need to reflect upon this bill for a few more months, because clearly, the process in this place, leaves a lot to be desired. That was my colleague from the Cowichan Valley, who spent many, many hours going through the media to determine what information was missing, in order to inform members on the decision that was going to be made today — information that was not present, not given during committee stage, information that she took upon herself to find and bring forward. She was shut down at third reading. The member was told to sit down. Her voice was silenced. Outrageous.

Two times during the course of the last 48 hours, two times we’ve had such statements. That is why it’s critical for us to reflect upon this.

With that, I’ll take my place and suggest to members opposite that this is the time for us to actually reflect upon the implications of this. I certainly hope we’re joined in voting in support of my member’s amendment.

Media Release

BC enables landmark emissions source same week report finds Canada warming at twice the global rate

For immediate release

April 4, 2019

VICTORIA, B.C. – Today, the BC NDP and BC Liberals passed into law tax credits and the fiscal regime for what will become the single largest point source of carbon emissions in Canada’s history two days after a government report confirmed Canada is warming at twice the rate as the rest of the world, with the North, the Prairies and northern British Columbia pushing to nearly three times the global rate.

“This legislation is not only lacking vision to bring BC into a competitive economic future, it is compounding the massive challenges we have before us today in the form of extreme weather events: massive fires, droughts, and flooding,” said Dr. Andrew Weaver, leader of the BC Greens and award-winning lead author of four United Nations Intergovernmental Panel on Climate Change reports. “The BC NDP and BC Liberals are together sending BC down the wrong path with new fossil fuel subsidies and the expansion of the oil and gas sector while much of the world is transitioning to a clean economy based on innovation and sustainability.

“Our caucus used every tool at our disposal to oppose this legislation. We forced 14 votes in order to give MLAs repeated opportunities to stand up and vote against this bill, to vote with their conscience, and to question whether this was the path they support our province pursuing. When the BC Liberals brought forth an amendment to the bill itself, our caucus chose to abstain; we will take no part in debating, passing or defeating an amendment on a piece of legislation we fundamentally oppose. Every MLA who felt conflicted in supporting giving massive tax breaks to what will become the single largest point source of carbon emissions in Canada’s history right after endorsing CleanBC’s objectives to reduce BC’s emissions, should have voted against this legislation.”

The BC NDP have ignored the rising economic costs of the environmental impact from the increase in floods, forest fires and drought that this project’s emissions will contribute to when they talk about its potential benefits. Last year, BC’s forest-fire spending increased from an average of $214 million to $568 million. Floods cost $73 million last year and studies show a major Fraser River or coastal flood could cause damages up to $30 billion.

“What is so disappointing about the passage of this bill is not only that the costs will fall squarely on communities across the province – but that there is a viable alternative in front of us,” said MLA Sonia Furstenau of Cowichan Valley. “Rather than put our effort into working with communities and First Nations across the province to implement an economic roadmap that increases their resilience to climate change, we have yet another government that has worked hard to aggressively secure tax cuts for a new major fossil fuel development.”

“There were 83 legislators from both the BC Liberals and BC NDP who supported a project that will pollute until after our children have retired,” said MLA Adam Olsen. “Now, more than ever, BC needs the Greens to be here in government. We may just be three MLAs, but we will continue to do everything in our power to set BC on a sustainable course. We must allow science to inform our policy if we want to ensure our children inherit a world worth living in.”

-30-

Media contact

Macon McGinley, Press Secretary

+1 250-882-6187 | macon.mcginley@leg.bc.ca

Bill 20: Medicare Protection Amendment Act

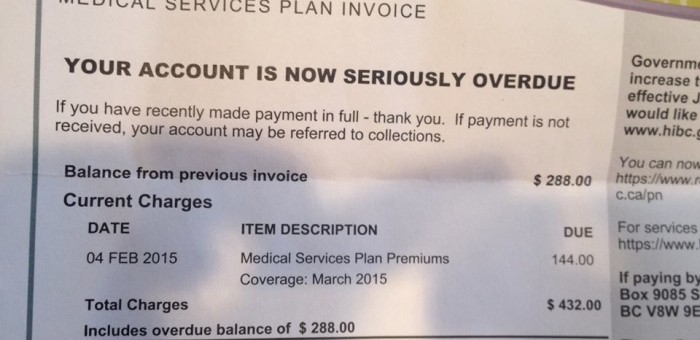

Yesterday in the legislature we debated Bill 20: Medicare Protection Amendment Act, 2019 at second reading. This bill eliminates the collection and payment of MSP premiums through several sectional repeals of the Medicare Protection Act. The bill also requires the commission to notify a beneficiary when their enrollment is being canceled. The bill introduces transitional provisions to allow the commission to collect outstanding premium debt.

As you will see from my second reading speech, reproduced in video and text below, MSP premiums have existed in British Columbia in one form or another since 1968. Successive NDP, Socred and BC Liberal governments retained or increased this form of regressive taxation for more than 50 years. It wasn’t until the BC Greens made this an issue in 2015 that the BC NDP and BC Liberals could not ignore that action was taken.

I am sincerely grateful to the seniors at the Monterey Centre in Oak Bay who brought this issue to my attention in 2014. As a consequence I initiated a campaign to eliminate the MSP in January 2015. Over the following two years I raised the issue numerous times in the Legislature including tabling a petition with over 65,000 signature on it, responding to myriad emails, and encouraging British Columbians to contact their local MLA to raise awareness on the issue.

In the end, all three parties agreed to move towards the elimination of MSP in the 2017 election campaign. No party could afford to ignore the regressive nature of this form of taxation in light of the widespread attention British Columbians were now giving it. Further details are provided in the speech below.

Video of Speech

Text of Speech

A. Weaver: It gives me great pleasure to rise and stand and speak in support of Bill 20, the Medicare Protection Amendment Act, 2019. This bill enables the elimination of the regressive approach to MSP premiums in the province of British Columbia.

I’d like to start by correcting history, because history is often overlooked. A lot of people are trying to take credit for what’s going on with MSP reform today. I can tell you that MSPs were introduced in British Columbia in 1968. That’s 51 years ago. Successive Socred governments, Liberal governments, NDP governments have come and gone, and each and every government has done nothing to eliminate MSPs. Not once.

It wasn’t until the mid-2000s that this form, this approach, this regressive approach, was turned into a form of indirect taxation, through the B.C. Liberals, a one-size-fits-all approach to taxation. In essence, a head tax, a head tax that led to rather myriad issues.

This issue became front and centre in British Columbia in January of 2015, an issue that the B.C. Green Party brought to the Legislature in January of 2015, with a call for the elimination of MSPs. Both the official opposition at the time and the government at the time will recall I introduced a petition with 65,721 signatures on it that was put together by Michelle Coulter, from Ucluelet.

I introduced another petition of about 7,000 names who contacted the B.C. Green Party. I also proposed at that time an alternate means of actually eliminating the MSP that maintained the revenue. It was at that time that overwhelming public support started pressuring the B.C. Liberal government at the time, and the NDP opposition jumped on it.

So as people reflect upon this historic event today, I would suggest to them that they should look no further than the influence of the B.C. Green caucus on government policy to get us to the elimination of MSPs when, as a single MLA sitting in this House in 2015-2016, we as a group turned this into a provincial election issue and had people fighting over themselves trying to determine who would eliminate it first.

I say that again with sincerity and by pointing to the history. So 1968 was when we introduced MSP premiums in British Columbia. The very progressive Barrett government of the 1970s didn’t touch MSP premiums. The Liberal and Socred governments thereafter didn’t touch…. I daren’t even say this, because I’m so sick and tired of hearing about the 1990s, but nevertheless, in the 1990s, another NDP government didn’t eliminate MSP premiums.

Those last 16 years that we’ve heard so often didn’t eliminate MSP premiums. But I would suggest that it was in those last 16 years that, actually, public pressure and public concern rose. The reason why is people started to recognize that this was tax creep. It was tax creep happening in a truly regressive fashion, in a one-size-fits-all fashion. Whether you earned $3 million a year or $30,000 a year, you were paying the same premium.

What we proposed, what the B.C. Greens proposed in 2015, was a different way of looking at the funding of the premium, a funding that mirrored what goes on now presently in Ontario. While we applaud that the government has eliminated MSP, we would not have done it this way. We would not have done it this way, because the way the government has chosen is to singularly pass that cost on through an employer health premium.

Now I recognize, and we support the notion, that there was room to grow the employer health premium in British Columbia, as we were by far the lowest employer health premium in terms of employee paying in the country — the payroll tax, in essence. However, the approach we took is that we believe it’s important to place a value on a service, but that value should actually reflect your ability to pay.

We had proposed a measure that followed and mirrored what is done in Ontario, where each and every person in Ontario has an item called an Ontario health care premium. That’s a progressive amount, much akin to what we see in employment insurance and the Canada Pension Plan. You have a third line. It’s called Ontario health premium, which, for low income, is precisely zero dollars, and if you earn over $200,900, I think it is, you pay something like $900 a year — a progressive amount. So there is a value to the health care services — a small cost, based on your ability to pay — which ensures, then, that revenue comes in, but in a progressive fashion. That was our approach.

That was an approach that would have actually not led to the double-dipping situation we have for this single fiscal year. It’s an approach that would have also recognized that across British Columbia, there are many collective agreements where the signing of those agreements has actually included costed benefits, which is the employer paying the medical services premiums. That’s a costed settlement against an agreement that a union, a collective bargaining unit, has actually costed against the salary settlement.

Now, unfortunately, through the elimination of the MSP premium, what has happened is that costed settlement against past settlements is now vaporized. So those benefits, which were accrued and negotiated away by unions from north to south and east to west…. They now can look back and say to their union members: “We have lost that ability to negotiate for that thousand or whatever dollars a year that was coming off.”

I’m actually quite shocked that the NDP decided to choose this approach, because they have thrown under the bus, in essence, every single member of a labour union in the province of British Columbia that had a negotiated settlement that included the medical services premium being costed against that settlement in terms of the actual past negotiations. That’s, in essence, something like $1,000 that has come off each worker’s costed rights. The unions in British Columbia should be up in arms over the NDP approach, because now that costed benefit has vaporized.

Those previous salary settlements could have had that extra amount that was costed to pay the premium added to salary and other benefits. I’m surprised, honestly. I’m surprised that we haven’t heard protests from the unions. Well, maybe not, in light of some of the other kinds of things we’ve seen in areas where they’ve been given…. But that, to me, is quite remarkable.

That progressive approach would have avoided many of the problems that we see with the implementation, particularly for this year. It is this year that there’s a problem with the double-dipping. It would have recognized the costed settlements that were in place with existing collective agreements. It would have respected that amount, moving forward, by allowing members who gave up that money, gave up that in a negotiation, the right to have that come back to their actual negotiated package.

You know, in 2001 and 2002, the B.C. Liberals rose the MSP premium something like 50 percent. Then they froze it for six years, and then again, in 2009 and 2010, they started to increase it again, 4 to 5 percent each year, until 2015. By 2017, all categories of MSP premiums — individuals, families of two, families of more than two — had doubled since the B.C. Liberals took office in 2001. That started to create dissent within the broader public in British Columbia — the sense that there was an unfairness, which is why we had so much support for this initiative that we took on in 2015. As I mentioned, 65,721 signatures were on a petition put forward by Michelle Coulter that I brought to this Legislature. I believe I introduced that in 2016.

It was an issue that I know there wasn’t a single MLA in this room that did not receive many thousands of emails on, from chain emails across the province.

I’m glad that government today and the opposition at the time, and the Greens, in the election campaign, were all climbing over ourselves to say who would eliminate MSP premiums first. I don’t think…. In fact, one of the moments in the 2017 leaders’ debate I thought was quite a fine moment, from my perspective — selfishly, he says — was when I asked the now Premier: “So let me get this right. In your campaigning for MSPs, what you’re planning…. You have a plan to develop a plan to come up with a plan.” That was the NDP approach. And he agreed, remarkably.

In fact, one of the plans to develop a plan to come up with a plan was to create a committee — an MSP Task Force. Government actually put such a committee together before the budget last year, and then decided that government knew best exactly how it was going to move forward with the elimination of the MSP, despite the fact that the committee had yet to actually return their reports.

So while the committee was talking about a variety of measures and metrics and ways that the revenue could be replaced, whether it be through a sugar tax or whether it be through a small employer health tax or whether it be through a health care premium, government decided to go its own way and go 100 percent with the health care premium.

That’s government’s prerogative and government’s choice. As I say, again, I’m surprised that there wasn’t uproar within the union movement in this province, because I can tell every single union member in this province that has had, historically, MSP premiums paid by their employers, that they’ve just lost out a thousand bucks plus, at least, for each and every one of them, from a negotiated previous costed settlement against what they were owed and deserved because that was costed against their settlement.

It’s actually quite remarkable that government has gone this way. And yes, I know this full well because I have acted as chief negotiator twice in bargaining agreements where we have actually costed our MSP premiums against a negotiated settlement. So yes, I know this to be true.

With that said, I do applaud the fact that we are, indeed, moving towards the elimination of MSP. The co-benefit that is not often talked about is that there’s an entire bureaucratic structure that is no longer needed. There are literally tens of thousands, maybe even hundreds of thousands, of letters that are emailed every month saying: “This is what your MSP premium for this month will be.” If you think about 100,000 letters going out at $1 a letter, that’s $100,000 a month for a start, but it’s much, much more than that.

We also know that there is a very serious problem in terms of collecting long-term debts that have been accrued in the MSP premium. Part of it is unknowing debt — there are those who can’t pay — but there are also those very egregious examples out there where people have gone away and not realized that they, apparently, owed MSP. They come back to rather large bills.

I’ll give you a real-world example. A student might be working in British Columbia for one summer after graduating from high school. Say they graduate from high school in June, they attend their convocation, and they work through the months of July and August. They might have a union job. They might actually be in a union job where they look at their paycheque and they realize that, as part of their employment, the employer was paying MSP.

So they go and take their job. It’s their first job straight out of high school. They see that the employer is paying the MSP, but they don’t really know what that is. Then they decide that they’re going to go to Europe for college. They go to Europe for four years; they leave the province of British Columbia. They may go to France or Britain or Germany or Sweden or Norway and attend a collage there for four years. Then, perhaps, they might want to come back to Victoria or Vancouver and work in British Columbia.

Well, guess what. The second they come back to British Columbia, they get a bill. They get a bill for four years of MSP premiums plus accrued interest because they did not opt out of MSP when they left the country to go to these other jurisdictions, for which they were 100 percent covered by the local jurisdiction. When you’re a student in England, you’re covered. If you’re a student in other jurisdictions across Europe, you’re covered. But you’re expected to continue to pay here unless you physically opt out.

Now, the number of people who physically opt out has been so small, you could almost count it on a hand, because people didn’t know they had to do that. The number of people who had these outrageous bills presented to them upon their return is huge. Therein lies the problem.

We know that what happens is that a young person — and there are many examples of this — will come back from abroad. They’ll get the bill, and they have a choice: do they pay this bill they think they owe, even though they weren’t eligible — or they may have been eligible, but they didn’t use it, or even know they did — or do they not? In many cases, they don’t.

What happens then is that collection agencies start to come after them. Then they have a credit rating…. They’re starting off in their life. They may have worked for one summer — one summer — in a union job. They didn’t that that company that was paying them actually was paying the MSP. They come back four years later, and they get a bill for thousands and thousands of dollars. They don’t know what this is about. And then the collection agent comes after them, and on and on it goes.

That’s no longer going to be the case, and that’s a good thing. That’s a good thing, because we don’t need those collection agencies. We have a lot of debt on the books that is going to have to be forgiven, I suspect, or collected by some other means, but at least we’re moving forward and beyond this.

Again, coming back to this. This was a campaign issue from the B.C. Liberals. They didn’t want to be left out. Fifty percent cut, they planned. When the B.C. NDP ran, they campaigned to eliminate….

They didn’t really articulate how. Frankly, I don’t think they actually figured it out, because their plan was to develop a plan to come up with a plan, and the plan was going to be first developed by a committee that was developing a plan that they ignored.

They staggered their way through, and they decided to come through with this employer health tax approach. That’s their prerogative. We understand that. We recognize that they are government, and they have these choices to make. While we support the overall notion of MSP being reformed, we don’t believe that that was the appropriate way to go in its entirety. A small component, yes.

The B.C. NDP campaigned on cutting the MSP, and they initially did it by 50 percent. In actual fact, what they did was basically leave in place the B.C. Liberal budget, which had already reduced it by 50 percent. They had promised to move on to the entire elimination, which is where we are right now.

The first step of the MSP premium, reducing by 50 percent, happened in Budget 2018. Here we are now moving forward with the completion, through this tax. Again, when I look at this…. We’ve had a platform issue even in 2013 — going back to the history. In 2013, we were calling on the elimination. It actually was formally put forward repeatedly in 2015 and 2016. As I stated, I’m very, very pleased that we’re actually at this position now.

Overall and in conclusion, since 2015, we’ve outlined a number of regressive natures…. One of the things that we’ve outlined, as well — and I hope the Minister of Health takes note — is that right now we’re penalized in British Columbia for being a destination of choice for elderly Canadians.

Why I say that is that it’s very simple to calculate the amount of money that is spent on health care and weight that as a function of age. We know that the average age in British Columbia is lower than the average age in other provinces. We know that the federal Canada health transfer is based on the number of people, with no age weighting to that number of people. So we know that when you do a simple weighted average….

We know how much health care money is spent as a function of age. We know it increases exponentially toward the latter years of your life. We know that when you take the age profile of the province and you weight the Canada health transfer by that age profile, B.C. is short by something in the order of $200 million of Canada health transfer money that should be coming to us, based on an age-related approach.

We know that people in British Columbia may work in the oil sands in Alberta during their younger years. They may be paying provincial taxes in Alberta. They may be working in the Hibernia fields. They may be working in a factory in Ontario. Then in the latter stages of their life, they may choose to come back and live in a place where there’s no snow in the winter. Where is that place? That place is often Vancouver Island.

We know this is going on in Canada. That is the beauty of this great nation that we have: we allow people to freely go from east to west and north to south. We encourage people to come here, and we have a long history of being a home…. In fact, Victoria — I’ve grown up here. I don’t know whether it’s still called this, but it certainly was called this when I was a younger person: the city of newlyweds and nearly deads. I’m one of those few people who has moved from the age of newlywed to nearly dead. There are not many of us out here, but I am….

Interjection.

A. Weaver: Maybe. The member for Chilliwack-Kent is suggesting I’m speaking too soon. I hope so. Certainly, I’ve watched the growth of this town over the last 57 years, and my goodness, it has grown. It has grown and become more diversified. It’s quite exciting.

But coming back to that Canada health transfer. I sincerely hope that we do have the pressure being put on the federal government to reflect upon the nature of the Canada health transfer and the unfairness of people paying their taxes in other provinces and then retiring to British Columbia.

I would suggest that it is entirely defensible to argue that the Canada health transfer should be weighted by age, based on the amount of health care spending we do as a function of age. I’ve done the calculation. And 200 million bucks? We could use that. I’m sure the minister could use 200 million bucks. We could fund all sorts of drugs, like Orkambi, for example. I’m just joking. But we could — $200 million is nothing to sneeze at. This is something that I hope they’ll encourage.

Anyway, with that said, I do commend the Minister of Health. I mean that sincerely. We in British Columbia are very lucky and fortunate to have a minister who goes so deep on files and is truly committed to this file. We’ve seen some very good things happen in this province. This is one of them. Again, I don’t necessarily like the way the funds are being replaced, but I do certainly have full confidence in the Minister of Health, the direction he’s taking this province in health care.

With that, I’ll take my place and thank him for his good work.

It turns out LNG Canada has no requirement to hire locally

Yesterday in the legislature Bill 10, Income Tax Amendment Act, 2019 was being debated at committee stage.

As I noted during my second reading speech, if enacted, this bill would repeal the LNG Income Tax Act as amended in April 2015, as well as the Liquefied Natural Gas Project Agreements Act. The bill also creates yet another tax credit for the natural gas sector.

During committee deliberations yesterday I took the opportunity to unpack an outrageous government claim that LNG Canada would be committed to hiring locals. Well to no surprise to those of us who have been following this for a while, there is no such requirement. In fact, and further, government has no tools at its disposal to insist that LNG Canada preferentially hire British Columbians during the construction phase.

Below I reproduce the video and text of my exchange with the Finance Minister.

We will resume committee stage debates today.

Video of Exchange

Text of Exchange

A. Weaver: I’ve been listening quite attentively, trying to get some information with respect to the jobs, because I have clearly witnessed the same language that was emanated from government, as well as LNG Canada. “We’re going to be hiring British Columbians.”

I know for a fact that right now Boskalis is dredging in Kitimat, and I know for a fact that Boskalis uses a Newfoundland company to bring in employees. That is a distance from LNG Canada, and I know for a fact that those employees are not from British Columbia. I know for a fact that those employees that were from British Columbia did not last very long on the Boskalis dredge because they were summarily fired for raising safety issues.

I come back to what the member for Abbotsford West was suggesting. Is the minister saying that she has no mechanism at all to ensure that any of these jobs are actually for British Columbia citizens other than the goodwill of LNG Canada because they said they’re going to try?

Hon. C. James: Thank you for the question. I think we’ve spoken about a great deal of this over the last few hours but happy to run through it again.

We have, as I said, a job strategy with LNG Canada, a commitment around the support that will be there for local hire first, including apprentices on this project. The job numbers, as I said, we have built in when it comes to assumptions around revenue — very conservative numbers. But we certainly expect thousands of jobs for British Columbians.

I can’t speak to the specifics that the member raises. I’m happy to take that information and have that conversation. But as I said, the local hire first, including the requirements around contractors using local hire first, is a very important piece that is in place. The contractor is bound by that local hire first, which I think, again, is a very important factor in making a decision around whether local jobs are going to be in place.

Then, again, there’s the work that’s already being done in Kitimat and the number of locals — 600 people — already working since December. You know, over 45 percent of those were from Kitimat alone, in that area. That’s, again, showing the support that needs to be in place for these jobs.

A. Weaver: I recognize that that’s been read in a couple of times to the record. My very specific question is this: is there a single mechanism that the government has to ensure that the jobs will be from B.C. — yes or no?

Hon. C. James: The answer is the jobs strategy, put together and negotiated with LNG Canada and negotiated together, which requires local first, which requires the contractors to also be utilizing the local first, which requires apprentices and makes a commitment around the dollars that have already been put in place by LNG Canada.

A. Weaver: So we now have an LNG jobs plan. What are the ramifications for LNG Canada if that document is ignored? Does the government have any teeth to that document — yes or no?

Hon. C. James: I think the biggest strategy is making sure that this project is successful. That is a commitment that not only we have as government but obviously LNG Canada has when it comes to their investment. The fact that they have a number of contracts with communities across the pipeline strengthens that kind of commitment as well.

A. Weaver: Again, coming back to the question, the question was: does government have a single measure to actually ensure that British Columbians are hired — yes or no?

Hon. C. James: I think I’ve answered that question. Again, the commitment is the four conditions that we put in place. The commitment is the agreement by LNG Canada to meet those four conditions and the commitment to the people of British Columbia to follow through on that.

A. Weaver: With respect, there is a duty in committee stage to get answers, to get answers to questions. The question was very simple. There is a jobs plan. I understand that. Let us suppose LNG Canada ignores that. What avenues, what teeth, does government have that will ensure that LNG Canada does make sure they hire British Columbians first?

The reason why I raise that is that the minister said that what’s critical is the success of this project. How do you define success? Well, success involves triple bottom line. There’s a social aspect to that, and one of those is hiring British Columbians. Because both the minister and the Premier, and several others, were very proud that this was going to bring 10,000 jobs.

Yet I come back to the question, and I think we are owed an answer to this: does government have any mechanism — yes or no? — to ensure that LNG Canada actually hires local? This is not a difficult question, and in this chamber, it is a duty and a responsibility of government to provide a yes or no answer to this question. I’m afraid it is not acceptable to pivot off to some kind of loosely worded commitment letter, which has no legal standing. I would like to know what legal tools this government has to ensure that British Columbians are hired first, because they said they would.

I’ve offered you one specific example, the example of Boskalis, a dredger up there that uses a contractor to get labour in Newfoundland. That labour is coming from all across Canada and elsewhere. It is not coming from British Columbia, and I know that for a fact, because I know people who were fired for raising safety issues.

What metrics does government have to ensure that LNG Canada is hiring British Columbians?

Hon. C. James: I know the member wants a simple yes-or-no answer, and I’m not being obstructionist. I’m being upfront with the member about the process that was utilized to come to our four conditions that had to be met by LNG Canada.

This was a back-and-forth process. This was a discussion around how important it was to meet the commitments, how important it was to reach these four conditions, how critical they were to us as a government and critical to British Columbians, we feel. I talked about the four conditions. One of those are jobs for British Columbians.

We did go back and forth around the letter. We did go back and forth around a strategy on jobs. We did go back and forth around the climate action and the importance of making sure that we address that in part of our CleanBC. We did go back and forth around First Nations and a real partnership with First Nations.

Again, on the jobs piece, the member has the copy of the letter. He will make his determination about whether that, from his perspective, holds LNG Canada to meet these commitments or not.

But, certainly, from our perspective as government, when you are taking a look at a project this large, when you are taking a look at the kind of investment that’s there, when you are taking a look at the reputation of the company coming in to do a long-term project in British Columbia, and when you’re taking a look at the fact that this project will not be successful unless the communities are engaged and taking part….

I think it’s part of the example that we’ve seen with the work that they did with First Nations along the pipeline. Again, we’ve seen many projects that have not come forward in British Columbia because they did not build that community partnership. They did not, in fact, engage the communities.

This is a very different project from that perspective. They have engaged the communities, and those communities will be critical for them to be able to be successful in this project. Therefore, as I said, we feel that the jobs strategy provides that support.

A. Weaver: I’m getting a little frustrated. I’ve asked a very simple question. What tools does government have at its disposal to ensure that the company follows through with its intention to actually hire British Columbians? I’m not asking for all the rhetoric around “my four conditions.” I’m asking for the specific tools that the government can use.

I’m asking the same question, and I recognize I’ve asked it several times. I have not got an answer to this question. I have got rhetoric about other stuff. The question is very direct and very simple. What tools does a government have at its disposal to ensure that the letter that they’re trusting LNG Canada to do is used to ensure that British Columbians are hired?

The minister can just say we don’t have any, and that’s fine. But I think she owes it to this chamber here to say what those tools are. Failing to do so, I think, frankly, is not what we’re meant to do at committee stage. We need answers to provide further guidance to the people of British Columbia.

Hon. C. James: I think that the biggest tool that government has is the success or non-success of the project. From my perspective, that is the biggest tool that is in place. In order to have the success or non-success of the project, it requires a relationship. It requires negotiations. It requires building that between the partners.

In fact, if you will speak to the Premier, I know he’ll also make those kind of comments around the work that that took to get to this place. The success of the project, from my perspective, and those relationships and the negotiations are the critical tools that government continues to have in this project.

A. Weaver: This is very frustrating, because now we have a circular argument. The success of the project is defined by bringing jobs to British Columbians, and the tools that the government has available to it are the success of the project. That’s a classic chicken and the egg. What is it? Is the project successful by definition, because they’re bringing it in? Therefore, it must have people in B.C.? It just doesn’t make sense. Clearly, the only take-home message I can have from this exchange is government has no tools.

What the statements are about hiring British Columbians is nothing short of unsubstantiated political rhetoric that, frankly, British Columbians should have cleared up. It’s quite embarrassing that this government would suggest to British Columbians that they’re going to be hiring British Columbians.

I’ve given you one example. The only example that I know of that is actually ongoing now, the dredging, where that company, Boskalis, is hiring a contractor in Newfoundland. The employees up there are not from B.C. Some of them are from Newfoundland, some from the oil patch, some temporary foreign from the Netherlands. And government has yet to provide any information as to how they’re going to ensure B.C. jobs.

But it gets worse than this. My final question on this: has the minister actually suggested that their four criteria were met? They never actually once, since prior to the 2017 election campaign, defined what those criteria were. What does it mean to say that it fits within our climate targets? What does it mean to say that truth and reconciliation has been looked at? What does it mean to say that it’s a good deal for British Columbia?

In essence, the question is, then, this. Why has the minister not, at any point in the last two years, at any time, ever once, put up metrics that would say: “These are how we’re defining success, and these are what we’re looking for to ensure that our four conditions are met”?

Frankly, all we’ve been told is, “Trust us,” and that is clearly what government’s wanting, for us to trust them. But it’s very difficult to do so when I look in this document here, which I won’t use as a prop. I’ll just read the title: “Operating Performance Payment Agreement.” I don’t see any requirement in there. When I look at some of this other stuff, “LNG Investment Fiscal Framework,” I don’t see a requirement there. I see a lot of rhetoric.

The question, coming back to it: what are the metrics? What metrics did government use to actually determine that their four criteria were met? Simple.

Hon. C. James: Thank you very much to the member. The member talks about what success will be. From my perspective, yes, success is meeting the four conditions. The Premier laid them out and talked about the four conditions. We will be held, as a government, accountable for meeting those commitments to British Columbians, as we should be — as we should be and as the company should be. That’s going to be critical.

I know the member was directly involved in the discussion around LNG emissions and including LNG emissions in our CleanBC program. Again, I expect the member to hold us accountable for that. I expect him to ensure that that occurs and that the discussion occurs.

Fair return. Again, I expect members to ask questions about whether we believe that’s a fair return or if they have other ideas or other approaches.

Partnerships with First Nations. Certainly the expectation around the elected bands along the route who have signed on to the LNG agreement and the work that continues to be done, I think, again, talks about how we will be successful.

So I think it is important to come back to those four conditions. I know the member felt that that didn’t provide him with an answer, but I think it’s critical and important, and I think we will be held accountable as to whether we’ve met those conditions or not.

A. Weaver: Well, this is the problem I’m having. It is impossible to hold the government to account when they’re not forthcoming with the answers to very simple questions that I’ve articulated. The four criteria, which, frankly, are nothing more than an election slogan, are this.

One, “Proposals must include express guarantees of jobs and training opportunities for British Columbians.” Well, we’ve heard today, from very extensive questioning from opposition and my further attempts to get something, that the government has no ability, clearly, no ability at all to guarantee any British Columbians any jobs. That clearly was never met. You could not have met criteria No. 1, because you’ve got no requirement of any jobs.

Two, “Proposals must provide a fair return for our resource.” Well, given that government has never once articulated since two years now what a “fair return” is, how do we know that we’ve got a fair return? I’ve suggested, through the analysis of the deep-well credits in second reading and elsewhere and through what I’ve described as a generational sellout and the giving away of this, that and the other in a desperate attempt to land what Christy Clark couldn’t, that, in fact, you’re not getting a fair return, because not once has government articulated what that return will be.

We haven’t seen the numbers, and it’s worse than that. We can’t even get information on simple questions like: “What is that $23 billion going to…? Where is it coming from?” We get rhetoric. We get no substance. So, clearly, criteria No. 2 was never met, because government actually hasn’t articulated what a fair return is.

Number 3: proposals must respect and make partners of First Nations. Well, we know that there are some, quite a lot, that have partnerships. Wet’suwet’en — still some issues, but government there abdicated its responsibility and essentially left it up to LNG Canada to deal with the Wet’suwet’en Unist’ot’en Camp, and what can they do? The only thing they can do is seek injunctive relief and get the police in there to move them. The government clearly did not do what you would expect on a leader-to-leader, government-to-government negotiation point of view, so I’m not so sure that No. 3 is being met.

Number 4: proposals must protect air, land, water, including living up to our climate commitments. Well, I’ve seen no analysis from government as to the air quality within the Terrace–Kitimat valley. As you know, Rio Tinto Alcan just did a substantive upgrade to their resource facility — increase sulphate emissions, reduce greenhouse gas emissions. There’s a very problem in terms of the air quality in that watershed. I’ve heard no discussion. I’ve heard no criteria, no check — “We can do it.”

I do recall a report that was written a number of years ago where the Liberals explored what the consequence to the air quality in the valley would be, and it was very troubling. It was very, very troubling — a number of years back. It was, actually, in terms of…. It was. You probably don’t remember it. I looked at it very well. I know the author of it.

And living up to our climate commitments. Well, that has yet to be seen. Certainly we know that we can only get, with all of the policies that have been identified, just 75 percent of the way there. So how can you say that it’s fitting into living up to our climate commitments when we still haven’t articulated the other 25 percent of getting to those climate commitments? That was the basis of my reasoned amendment.

What’s happening here today is a charade. It’s literally just a charade. We have no substantive, quantitative analysis of any of these criteria. We’re told: “Trust us. We’ve met it.” We’ve clearly tried to find what metrics government’s using. They haven’t. It’s embarrassing. And so I go back to my original second reading speech, and I think what happened is that LNG Canada walked in to the new government and said: “We’re out of here unless you do this.” And they said: “What do you want us to do?” And they said: “This, this, this, this, this.” And, out of their depth in negotiations, completely out of their depth, they said yes.

LNG Canada has got a good deal here. I’m not so sure you can actually articulate how British Columbia has, and we haven’t heard a single answer to any of the questions that I have raised. This is very troubling.

With that I’ll leave it. I know that the member for Abbotsford West was suggesting a break, and I’m perfectly open to such a break now as well, if the Chair believes we should do so.

Hon. C. James: I’ll just respond to the question, and then…. I know that the members want to take a break. And, you know, I think it’s…. I respect the member in bringing forward the issues. I respect the member. We know that our Green partners are against LNG development. We understand that, and I think the member is very articulate in raising his issues and concerns. But when we take a look at the success in meeting the four conditions and meeting our commitments to British Columbia as a government who looks at how we balance our promises, economically, socially, and environmentally, and our commitments to reconciliation, I, in fact, am very proud of the four conditions that we’ve put in place and the work that we’ve done to be able to address those.

Jobs for British Columbia. Again, I come back to the jobs strategy around, around “locals first” around the support for apprentices on the project. When it comes to partnerships with First Nations — 20 bands, all of the bands, elected bands, along the route who have signed on, who have partnerships, who see this as an opportunity for economic development and for growth for their communities and opportunities for their members to be able to be working.

The fair return for British Columbians — $23 billion when it comes to support for programs and services here in British Columbia, including action around climate. I think it’s critical. And I know we’ll get a chance to talk about those as well as we go through this process and other processes through the budget.

Protection for our air, land and water, the fact that we required LNG emissions to be included as part of CleanBC and brought forward a commitment around CleanBC, over $900 million in the budget to commit to environmental protections. I think it speaks to our commitment as a government around addressing environmental issues and the fact that we’ve been able to sit down with a large company and get to a final investment decision that recognizes how important that is and requires us to live up to this.

Do I expect the member to continue to raise concerns and continue to hold us accountable for this? Yes, I do. I expect that that’s exactly what the member will do and what other members will do and what the people of British Columbia should do as well.

With that, Chair, we will take a ten-minute break?

The Chair: The member has a question. Then we’ll have a break.

A. Weaver: A brief follow-up because the issue of $23 billion was raised again. Could the minister please articulate how that $23 billion is calculated and not just generally but actually specifically? That number has been batted around a lot. It used to be $40 billion; now it’s $23 billion.

Despite asking a multitude of times, not once have I got an answer as to what makes up the $23 billion and where that number came from.

Hon. C. James: I’m happy to answer that question when we come back from recess.

The Chair: The House is recessed for ten minutes.

The committee recessed from 5:31 to 5:44 p.m.

Hon. C. James: The member asked a question around the $23 billion and where the $23 billion came from. We did offer a briefing, an opportunity to go through that, but I know the member wasn’t able to make it. I just wanted to let the member know we can provide that opportunity, the documents around the generic LNG project and the highs and lows that we’ve been talking about. That information will be public. It’s going to go up on the site, so we can provide an opportunity for the member to get the materials and then ask questions as we go on. I expect committee stage will continue, and there will be an opportunity for the member to ask questions, if that works for the member.

Corporate welfare on steroids: the great BC NDP generational LNG sellout

Over the last two days we’ve been debating Bill 10, Income Tax Amendment Act, 2019 at second reading. As I noted earlier, if enacted, this bill would repeal the LNG Income Tax Act as amended in April 2015, as well as the Liquefied Natural Gas Project Agreements Act. The bill also creates yet another tax credit for the natural gas sector.

If passed, Bill 10 would enable the fiscally and environmentally reckless LNG project to move forward in Kitimat. Frankly, it’s time politicians level with British Columbians about the economic and environmental consequences of this historic betrayal of future generations. And that is precisely what my colleagues Adam Olsen, Sonia Furstenau and I tried to do in our speeches at second reading and our speeches to the amendments we introduced at second reading.

After my second reading speech, I moved a Reasoned Amendment that the bill not be read a second time as the BC government had not yet identified a pathway that brings us 100% to our 2030 target, and it is inconsistent to add significant new emissions sources even as we strive to show the world that it is possible to develop a low carbon, sustainable economy that can meet our targets. Below I reproduce the video and text of my speeches to both of these (the video is long – 1:46:38).

I also reproduce the videos and text of my speeches in support of amendments brought forward by my colleagues Adam and Sonia.

Sadly, all three amendments were defeated and the bill passed second reading with the Liberals and NDP voting in unison against the three BC Green MLAs (all four votes are reproduced below).

What’s most remarkable about what transpired this past week is the scale of hypocrisy exhibited by the BC NDP and, but to a lesser extent, the BC Liberal MLAs. Here are just two examples:

Example 1: Lana Popham, MLA Saanich South

On April 6, 2016 during second reading of Bill 19, Greenhouse Gas Industrial Reporting and Control Amendment Act, Lana Popham (now the agriculture minister) had this to say (in reference to the BC Liberals):

“They’re creating reckless legislation, which, in my mind, as someone who has always been an environmentalist, is absolutely reckless, irresponsible and disappointing. They’re creating this reckless legislation. They’re sweetening the deal as much as they possibly can, treating LNG like a loss-leader in a department store.”

“When you talk about the cleanest LNG or an LNG industry or opportunities that we have as a province, and you fail to address all the emissions coming from the LNG processing and extracting process, then you’re not there. You’re not doing our province any favours. You certainly don’t have the right, I don’t think, to stand up and talk about how much you care about children’s future in this province if you’re not taking into account 70 percent of emissions coming from an industry.

So the cleanest LNG? We’re going to have an industry that discounts 70 percent of emissions. How do the other members sleep at night knowing that that’s what they’re running on, that that’s okay?”

The irony is profound given that the BC NDP have exempted LNG Canada from any requirements that would have ensured that they were low greenhouse gas emitters (see 2nd reading speech for details).

Example 2: Michelle Mungall, MLA Nelson-Creston

When speaking at second reading to Bill 30, Liquified Natural Gas Project Agreements Act on July 14, 2015, Michelle Mungall piled on the rhetoric against the BC Liberals:

“Now, they wouldn’t understand what it means to say no to selling out this province. They put themselves in such a desperate position when it comes to negotiating for LNG that they had to say yes to any single thing that walked through the door. That’s exactly what they have done. This is the big sellout of British Columbia.”

The taxpayers have to foot that bill. It’s just utterly ridiculous and irresponsible and reprehensible to sell out British Columbians for the next 25 years, not just for this industry but potentially others as well.

“What we hear from this government is a big yes to selling out British Columbians, selling out British Columbians’ futures, selling out our future potential at reducing our impact on global warming and selling out future revenue sources. That’s what I hear from this government, and I don’t think that’s right for British Columbians.”

“We have a big sellout of British Columbia so somebody can stand up for a photo op around the next election.”

“British Columbians deserve better than what they got with this development agreement and with this bill. They should be demanding better, and they are demanding better.”

The irony is mind boggling in light of the fact that the BC NDP have taken the sellout to whole new levels (see 2nd reading speech for details).

As you will see from the speeches below, it is clear to me that the BC NDP were simply out of their depth when LNG Canada approached them for further concessions. The BC NDP literally took corporate welfare to whole new levels while neither guaranteeing LNG Canada be required to employ British Columbians nor source BC Gas. And the very same BC NDP MLAs who hurled abuse and vitriol at the BC Liberals for four years are now the same ones doling out this corporate welfare.

But what saddens me the most is the fact that I know full well that many BC NDP MLAs rose and supported this sellout as they were whipped into doing so. They voted against everything they apparently believed in.

I’ve sat in the legislature for almost six years now and there has not been a single instant when an NDP MLA has voted against their party. What is the point of electing local NDP MLA representatives if you know the backroom crowd are the ones who will be making all policy decisions. It’s become abundantly clear to me that the BC NDP and BC Liberals are simply two sides of the same coin. And it’s become abundantly clear to me that we have no hope of avoiding the collapse of western civilization as we know it as long as the same old neo-liberal paradigm of corporate welfare dominates our political discourse.

This brings me to the hypocrisy within the BC Liberals. During their second reading speeches they took great delight in arguing that the BC NDP are giving away the farm and the deal is not good for British Columbians. The BC Greens have always said that we will never support the generational sellout embodied in this corporate welfare. The BC Liberals have been presented with a golden opportunity to join us in rejecting this deal. If this bill fails, it is almost certain that the BC NDP would view this as a confidence measure and call an election. Given that the BC Liberals are struggling in the polls, and the BC NDP might view this as an opportunity to seize a majority government, it is unlikely that the BC Liberals will vote against this bill. The ball is in their court.

Videos

| 2nd Reading & Reasoned Amendment (1:46:38) | Hoist Motion (43:12) | |

| Motion to Send to Committee (26:19) |

The Votes

|

|

|

| Reasoned Amendment | Hoist Amendment | |

|

|

|

| Amendment to Committee | 2nd Reading |

Text of 2nd Reading Speech

A. Weaver: It gives me great pleasure to take my place in the second reading debates of Bill 10, Income Tax Amendment Act, 2019. This is a bill, hon. Speaker, that takes the LNG regime that the B.C. NDP have put forward and agreed to with LNG Canada, and in doing so, does a couple of things in this bill.

The first thing it does is it repeals the LNG Income Tax Act brought forward by the B.C. Liberal government in the last session. The second thing it does is repeal — these are towards the end of the bill, in section 4 — the Liquefied Natural Gas Project Agreements Act. That’s an act that enabled the Petronas project development agreement.

The third thing it does is it says: “Okay, well, buried within the Liquefied Natural Gas Income Tax Act, which had a number of components, was a tax credit that we want to retain.” So what the B.C. NDP are doing here is taking the LNG tax regime of the B.C. Liberals, repealing the income — a component of that — that would allow us to generate revenue but keeping in place the giveaway, the tax credit, that would enable, again, this what I call sell-out to continue at staggering levels.

You know, for many years, I’ve been speaking out against the fiscal folly of the B.C. Liberals at the time, trying to chase the pot of gold at the end of the rainbow — that’s the LNG pot of gold at the end of the rainbow. Early on in the mandate of the previous government, the B.C. NDP were a little cagey about what their views were with respect to liquefied natural gas. There were a number of backbench MLAs who purported to be quite concerned about the issue of climate change, quite concerned about some of the unregulated activity that was ongoing with respect to the widespread adoption of horizontal fracking technology in the northeast of our province and the kind of unregulated free-for-all — Wild West almost — that was going on in northern B.C.

We’re starting to see some of the consequences of that now. We’re talking about what we’re going to do to preserve our caribou stocks, as the natural habitat on which they’ve relied has degraded to such a level that we’re now worried about extirpation of various herds.

Again, the B.C. NDP, historically, have been quite concerned about that, and onwards we move to today. All along, consistent since 2013 and, in fact, in 2012, the PowerPoint presentations I was giving at the time — that’s seven years ago, seven years ago — are unchanged today. The essence of that is unchanged today.

Here’s the narrative that was being done in 2012 in the lead-up to the 2013 election. The B.C. Liberals, at the time, knew they had no hope of winning an election. In fact, the front page of the Vancouver Province had a picture of the now Minister of Health and said: “This man could kick a dog, and he would still be Premier.”

Well, when faced with such insurmountable challenges to victory, the B.C. Liberals had to come up with a new shtick, a new plan, something to offer British Columbians hope with. That was hope and prosperity from LNG: a $100 billion prosperity fund, 100,000 jobs, $1 trillion increase to our GDP, thriving schools, thriving hospitals, debt-free B.C. and on and on and on. So went the rhetoric of the B.C. Liberal government.

I sat opposite for four years as I watched the members now in government hurl abuse at the B.C. Liberals, hurl abuse. Not just a little bit of criticism here, a little bit of criticism there, but substantive vitriol was being hurled across the aisle to the members of the government at the time, claiming that there was a generational sellout, claiming that they were not looking out for the best interests of British Columbia, claiming that they were signing sweet deals with their corporate friends.