Media Release

Moving Forward with MSP Premium Reforms

On Monday, February 23 2015, I tabled the BC Green Party petition of 6,662 British Columbians calling on the government to replace the regressive MSP premium poll tax with a more fair and equitable option to fund health care services in British Columbia.

Today in the legislature I was up during Question Period. I used this opportunity to question government on the possibility of empowering the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged in British Columbia?

As you will see from the exchange below, I was pleasantly surprised by the answer that I received. My response to the Minister’s use of a quote from Tommy Douglas is that Quebec and Ontario bring Health Care Premiums into their progressive income tax system as a line item that shows people what they are paying.

QUESTION

A. Weaver: In early January the good health committee at the Monterey seniors’ centre invited me to a conversation on health care. Collectively, these seniors were profoundly concerned about the impact that our regressive approach of charging flat-rate MSP premiums was having on their ability to make ends meet. And this is in the rather affluent riding of Oak Bay–Gordon Head.

Since raising this issue last month, I have heard from thousands of British Columbians who agree with me that it’s time to replace MSP premiums with a fair and equitable option. Fortunately, just yesterday the Government House Leader activated the Select Standing Committee on Health, a committee that could be empowered to examine this issue.

My question to the Minister of Finance is this: will he empower the Select Standing Committee on Health to examine innovative, progressive ways of revising how MSP premiums are charged in British Columbia?

RESPONSE

Hon. M. de Jong: Thanks to the member for the question. There will, through the estimates process, be an opportunity to discuss the question of the amount we collect and some of the relief that exists for almost a million British Columbians from paying full premiums. The member’s question is more specific, and that is whether or not this is a legitimate or appropriate topic for discussion by the committee.

I took the liberty of quickly checking the terms of reference. I think the power exists now. I think the committee, charged as it is to examine the projected impact of the provincial health care system on demographic trends to the year 2036 on a sustainable health care system for British Columbians…. Similarly, the motion that was before the House just a few days ago asked the committee to “outline potential alternative strategies to mitigate the impact of the significant cost drivers” identified in the original report and “consider health capital funding options.”

I think that’s probably sufficiently broad for members of the committee, and those that they might invite in, to have the kind of conversation that the member is alluding to, and it will be interesting to see what results from that conversation.

SUPPLEMENTARY QUESTION

A. Weaver: I must admit I was not expecting that answer. I am pleasantly surprised, and I’m thrilled that the committee will, I hope, seek and explore means and ways of funding the MSP premium more progressively.

The reason why I’m asking this is that the time is right. The Maximus contract was renewed in 2013. I recognize there was a five-year renewable clause in it. Now is the time to work with Maximus to find new ways of not only saving government money — because this is about efficiency as much as it is about delivering services to people who can afford it, with means and ways that allow them to have these services affordably — but it’s about making it fair. It’s about bringing the revenue generation into the income tax system.

So my question to the minister is this. Will the minister consider, as every other province in the country does, bringing in our funding to MSP premiums through the income tax system, whether it be as a line item or as part of general revenues, to avoid the unnecessary bureaucracy associated with chasing after people who have recently lost their jobs and are being charged premiums based on last year’s income tax rate, chasing people who didn’t know they actually had to pay premiums because they are living abroad and so on? Will the minister consider this approach of using our income tax system for actually raising these premiums?

RESPONSE

Hon. M. de Jong: Two things come to mind. I don’t want to prejudge or presuppose what the committee might present in terms of thoughts or recommendations on this. I confess to a certain bias, and that runs counter to the suggestion that the member has offered about eliminating a very specific charge, tax levy, in favour of general taxation provisions.

If the committee is going to have the conversation…. I ran across this in anticipation of some of the conversations, and I wonder if I can share it with the House. It’s from a former Member of Parliament from B.C., an NDP Member of Parliament, who said this:

“I want to say that I think there is value in having every family and every individual make some individual contribution. I think it has psychological value. I think it keeps the public aware of the cost and gives the people a sense of personal responsibility.

I would say to members of this House that even if we could finance the plan without a per capita tax, I personally would strongly advise against it. I would like it to be a nominal tax, but I think there is psychological value in people paying something for their cards.“

That wasn’t just any Member of Parliament. Before he was a Member of Parliament he was the Premier of Saskatchewan. That was Tommy Douglas in 1961, addressing a special session that created.

I hope the committee will be mindful of all of these ideas as it considers these matters.

Following Question Period, we issued a media release on the exchange. It is reproduced below.

Media Release

Media Statement: February 26, 2015

Health Committee Empowered to Examine MSP Premium Reform

For Immediate Release

Victoria B.C. – Today, in response to a question from Andrew Weaver, MLA for Oak Bay-Gordon Head and Deputy Leader of the B.C. Green Party, the Government House Leader and Minister of Finance agreed that the Select Standing Committee on Health would have the power to examine progressive ways of financing the Medical Services Plan and report on its findings.

“There are clear, progressive alternatives to MSP premiums that would be efficient, cost effective and affordable,” said Andrew Weaver. “I was pleasantly surprised that the Minister agreed that part of the Committees mandate could be to examine these alternatives.”

Currently, British Columbia is the only province in Canada charging a separate, flat-rate fee for medical premiums. The MSP rate is rising under the 2015 Budget by 4% – from $72 to $75 per month for individuals and from $130.50 to $136 for families. The same fee applies to anyone, whether they earn $30,000 or $3,000,000 in a year.

In contrast, both Ontario and Quebec made medical premiums a line item in their personal income tax return. By doing so, they maintained an essential revenue source for health care while reducing the burden on low and fixed income individuals.

MSP premiums are forecast to bring in nearly $2.3 billion in the 2014/15 fiscal year approaching the amount of revenue that is accrued from corporate income taxes. Reforming how this revenue is collected by, for instance, making MSP a line-item in the annual personal income tax return, would turn this regressive tax into one that is fairly applied based on income, while saving costs associated with administration and non-payment collection.

“I understand that the government has concerns about how changes to this tax would affect their financial objectives,” said Andrew Weaver. “Empowering one of our standing committees allows these objectives to be preserved, while also exploring how MSP Premiums can be made to be more affordable for British Columbians. I look forward to presenting practical alternatives to this committee and working with them to bring reform to the way MSP Premiums are charged in our Province.”

-30-

Media Contact

Mat Wright – Press Secretary, Andrew Weaver MLA

Mat.Wright@leg.bc.ca

Cell: 1 250 216 3382

Site C Decision a Lost Opportunity

Media Statement December 16 2014

Site C Decision a Lost Opportunity

For Immediate Release

Victoria B.C. – Andrew Weaver, MLA for Oak Bay – Gordon Head and Deputy Leader of the B.C. Green Party is extremely disappointed with the announcement by the B.C. Government today to proceed with the construction of the proposed Site C dam.

“The government has engaged in some very creative accounting to make Site C look more competitive than it is,” said Weaver. “They are trying to suggest they have found savings when all they have really done is move the financial costs of this mega project into a different category. The fact is the costs have gone up and so has the burden on taxpayers.”

The updated cost of Site C on ratepayers has been reduced from $83/MWh to $58-$61MWh, with the majority of the change coming from a commitment from government to take less in dividends from BC Hydro. However, this merely shifts the capital costs of building the dam from ratepayers to taxpayers.

Andrew Weaver maintains that Site C is the wrong project at the wrong time. Alternative energy, including geothermal, wind, solar, small-scale hydro sources and biomass, coupled with existing dams would provide firm energy and capacity at a better cost to British Columbians. They would also provide better economic opportunities to local communities and First Nations, with lower impacts on traditional territory.

A recent report by the Canadian Geothermal Energy Association (CanGEA) noted British Columbia has substantial untapped potential for firm, on demand, geothermal power which could be developed as required, in locations close to where power is needed, or near distribution lines.

“I am gravely concerned that government did not compare apples to apples when they examined other alternatives to Site C,” said Weaver. “The rest of the world is taking advantage of the decreasing cost of alternatives such as geothermal, wind and solar technology, while we are effectively subsidizing the construction of another dam.”

“With LNG development not proceeding as promised now is not the time to be borrowing billions for a dam, potentially adversely affecting the provincial credit rating, when geothermal power especially appears far more cost effective. This is lost opportunity to explore alternatives to Site C and I am deeply disappointed in the government’s lack of foresight and leadership.”

Media Contact

Mat Wright – Press Secretary Andrew Weaver MLA

1 250 216 3382

mat.wright@leg.bc.ca

LNG tax legislation rushed at expense of British Columbians

Today, on the final day of the fall sitting, I used my last speaking opportunity in the House to offer MLAs an opportunity to reconsider what I believe to be prematurely introduced LNG tax legislation.

At third reading I moved an amendment that would have sent Bill 6 – The Liquefied Natural Gas Income Tax Act to the Select Standing Committee on Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills, so that British Columbians could get answers to unresolved questions about the government’s LNG promises.

This legislation would benefit from a more thoughtful analysis by the Select Standing Committee. Third parties could be brought in for consultation, including the public, including First Nations and including the companies involved.

During the committee stage for the bill after 2nd reading, I also identified a number of potential loopholes that could be exploited by LNG companies to further reduce the already meager amount of tax that they would pay to BC.

In my view it was premature for us to consider passing a piece of tax legislation that contained no information about revenue projections and no substantive justification for the massive corporate tax breaks and incentives.

Our government has claimed that the revenue accruing from an LNG industry would bring British Columbia a $1 trillion boost to its GDP, a $100 million prosperity fund, 100,000 jobs, the elimination of its provincial debt, the elimination of the PST and thriving hospitals and schools. These are bold claims that so far have not been supported by any clear or reliable evidence.

Bill 6 was supposed to contain the details, supported by revenue projections, to substantiate these claims. Unfortunately, we never received anything of the sort. It is perplexing to me that both the government and the official opposition would vote to support this LNG tax legislation when absolutely no quantitative information has been provided about how it will impact British Columbians.

In moving the amendment I offered the government, the official opposition, and the public an opportunity to explore both the opportunities and possible pitfalls associated with this Bill in greater detail.

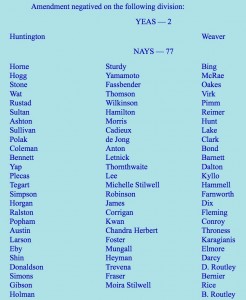

When it came to the vote, only independent MLA Vicky Huntington (Delta South) stood with me in the Chamber in calling for more time. The official opposition and the government voted together. It was truly remarkable to witness the opposition collectively stand in favour of this bill. So many of them had offered scathing condemnations of it during second reading.

The fact that the two independent MLAs were the only ones to suggest this Bill is incomplete in its current state is startling. British Columbia deserves real political leadership that is honest about the opportunities and the risks associated with any hypothetical LNG development.

While the government has described British Columbia’s LNG opportunity as a generational opportunity, this bill can only be described as a generational sellout.

The Amendment

I move that the motion for third reading on Bill 6, Liquefied Natural Gas Income Tax Act be amended by deleting all the words after “That” and substitute the words “the bill be not now read a third time, that the order for third reading be discharged, the bill withdrawn from the Order Paper and the subject matter referred to the Select Standing Committee for Parliamentary Reform, Ethical Conduct, Standing Orders and Private Bills.”

Speech to the Amendment

I wish to speak to the amendment and the reason why I brought it forward.

Through this committee stage, a number of issues have been clarified. There have been questions that would benefit exploration at committee stage. In particular, there are questions on revenue projections, the modelling, the assumptions into the modelling that have not been forthcoming and transparent in terms of us, as a legislature, to be able to assess this legislation.

There is section 32(c). There are issues that came up there with respect to a loophole for earned credits that could be sold by a company and the income from that not being claimed as taxable, yet the person purchasing it can claim the income as a deduction.

There are questions in section 46 with respect to the rates being left out. We haven’t got some guidance as to what that rate is in the formula there.

There are questions with respect to section 47 regarding a potential LNG loophole for tax avoidance through capital acquisitions and leaving the 1.5 percent LNG tax rate for significant times.

There are questions on section 122 with respect to the polluter-gets-paid as a polluter-pay model.

There are questions on section 172 that we did not have as much time as I would have wished to explore, in particular the one-half percent natural gas tax credit.

I would think that with such an important piece of legislation, which a government believes is outlining a direction for this province for years ahead, this legislation would benefit from a more thoughtful analysis at committee stage, at which point third parties could be brought in for consultation, including the public, including First Nations and including the companies involved, so that all in this Legislature are able to see the negotiations and the input that is required for such legislation to move forward.

This is the reason that I brought this amendment forward now, hon. Speaker.

Thank you very much for your time.

The Vote

Geothermal more economical than Site C

Today I attended a press conference hosted by the Canadian Geothermal Energy Association (CanGEA) announcing the release of a new report entitled: “Geothermal Energy: The Renewable and Cost Effective Alternative to Site C”. Immediately following the start of the press conference, we released the press statement below.

Over the last two years, I have repeatedly called on the government to explore innovative new opportunities in the clean technology sector. Most recently, I issued a press release calling on the provincial government to broaden BC Hydro’s scope to allow for the development of a geothermal power capacity in the province of British Columbia.

I’ve also expressed concern regarding the effect of burgeoning debt on our overall credit rating should Site C be approved. This is particularly relevant in light of the existence of more cost-effective alternatives.

Below is the text of our press release.

Media Statement: November 25, 2014

Geothermal more economical than Site C

For immediate release

Victoria, B.C. – Andrew Weaver, MLA for Oak Bay – Gordon Head and Deputy Leader of the B.C. Green Party welcomes the findings of the Canadian Geothermal Energy Association (CanGEA) report, released today, entitled “Geothermal Energy: The Renewable and Cost Effective Alternative to Site C”.

Key findings of the report include:

- Geothermal unit energy cost conservatively estimated at 7.3¢/kWh compared to BC Hydro’s 8.3¢/kWh for Site C.

- Geothermal plant construction equalling the energy output of the proposed Peace River dam is estimated at $3.3 billion compared to at least $7.9 billion for Site C.

- Geothermal plants provide more permanent jobs that are distributed across British Columbia.

- For the same power production, the total physical and environmental footprint of geothermal projects would be substantially smaller than Site C.

British Columbia has significant potential to develop geothermal and other renewable energy projects throughout the province. Such projects would distribute energy production where it is required and allow power to be brought online as demand increases.

“This is a timely report that clearly validates geothermal energy as a viable, more cost-effective alternative to Site C,” notes Andrew Weaver. “Geothermal projects are cheaper to build, provide power at a more economical rate, have a minimal environmental footprint, and generate more permanent jobs throughout the province.”

“In light of this new announcement, it’s clear that the government should not proceed with the Site C project at this time,” said Weaver. “There are simply too many cheaper alternatives available to protect the ratepayer. The clean energy sector is eagerly awaiting a more fiscally-responsible investment decision that would provide employment and development opportunities across the province.”

The full CanGEA report can be found at www.cangea.ca.

-30-

Media Contact

Mat Wright – Press Secretary, Andrew Weaver MLA

Mat.Wright@leg.bc.ca

Cell: 1 250 216 3382

Made-in-BC Environmental Assessment Required for Pipeline Project

Media Statement: November 3, 2014

Made-in-BC Environmental Assessment Required for Trans Mountain Pipeline Expansion Project

For immediate release

Victoria, B.C. – With evidence mounting that the National Energy Board hearings on the Trans Mountain pipeline has lost its legitimacy, Andrew Weaver, MLA for Oak Bay-Gordon Head and Deputy Leader of the BC Green Party, is calling on the BC government to immediately issue the 30 day notice, required to cancel its equivalency agreement with the Federal government, and launch its own, separate, environmental assessment process.

“In the past week alone we have seen Kinder Morgan sue Burnaby residents for trespassing on parkland and one of the most credible intervenors, Marc Eliesen, fully withdraw from the hearing process,” says Andrew Weaver. “These are the latest indications that British Columbians simply do not trust the federal review process.”

Mr. Eliesen, an expert with over 40 years experience in the energy sector, including as a former board member of Suncor Energy, former CEO of B.C. Hydro, former Chair of Manitoba Hydro and deputy minister in several federal and provincial governments, issued a scathing letter to the National Energy Board outlining the reasons for his exit. His letter cites concerns that the NEB is failing to fulfill its role as an impartial, transparent review body.

This comes following months of jurisdictional disputes in the City of Burnaby and ongoing frustration expressed by other intervenors over a flawed hearing process.

As the only B.C. MLA with intervenor status in the hearings, Andrew Weaver has been among those intervenors who have been advocating for a better process.

“We have been voicing our concerns about the review process for months and every time we do we get shut down by the National Energy Board. At some stage you have to recognize that the federal process is simply stacked against British Columbians and the only way to change that is for our provincial government to step up and reclaim its right to have its own, made-in-BC hearing process.”

The June 2010 equivalency agreement signed between the federal government and province set the review process for major pipeline and energy projects under the the National Energy Board, with final approval to be determined by the federal cabinet. The equivalency agreement for the Trans Mountain project can be cancelled with 30 days notice.

“The BC government needs to stand up for British Columbians,” says Weaver. “What we need is a made-in-BC environmental assessment that is controlled by British Columbians to ensure our concerns get respected and that our questions get answered.”

-30-

Media Contact

Mat Wright – Press Secretary, Andrew Weaver MLA

Mat.Wright@leg.bc.ca

Cell: 1 250 216 3382