Poverty and Homelessness

Kicking off the 2016 Mustard Seed Pie Off

Today I had the honour of participating in the kick off to the 2016 Mustard Seed pie off challenge. The goal of their pie off campaign is to raise $100,000 and 100,000 lbs of food before October 31, 2016. Last year they raised $42,000 and 40,000 lbs of food in the 2015 pie off challenge.

Today I had the honour of participating in the kick off to the 2016 Mustard Seed pie off challenge. The goal of their pie off campaign is to raise $100,000 and 100,000 lbs of food before October 31, 2016. Last year they raised $42,000 and 40,000 lbs of food in the 2015 pie off challenge.

Mustard Seed has “been essential in fighting hunger and restoring faith to a large portion of people living in poverty, as well as the working poor, in greater Victoria since 1975″. And last year I rose in the Legislature to celebrate their more than 40 years of service to our community.

Attending the pie off commencement with me was Del Manak, Acting Chief Constable of the Victoria Police Department. Now it’s not often that you get a chance to put a pie in the face of the Chief Constable of your local police force. So shortly after Chief Constable Manak challenged all the principals in Great Victoria schools to initiate their own pie off, I took great pleasure in assisting Del Manak in completing his challenge. But I should have been a little less exuberant. A few minutes later, Chief Constable Manak pied me.

Attending the pie off commencement with me was Del Manak, Acting Chief Constable of the Victoria Police Department. Now it’s not often that you get a chance to put a pie in the face of the Chief Constable of your local police force. So shortly after Chief Constable Manak challenged all the principals in Great Victoria schools to initiate their own pie off, I took great pleasure in assisting Del Manak in completing his challenge. But I should have been a little less exuberant. A few minutes later, Chief Constable Manak pied me.

Just prior to being pied, and unbeknownst to them, I challenged:

- Jamie Cassels, President of the University of Victoria

- Tony Joe, Realtor with RE/MAX Camosun – Oak Bay

- Lisa Helps, Mayor of the City of Victoria.

Finally, for those who might be wondering what the pie was made of, I am saddened to report that it wasn’t pie at all. But of course it wasn’t, Mustard Seed could not be seen to be wasting food. The pie was actually nothing more than lightly fragranced (for sensitive skin) Gillette foamy!

Video of Pie Off

Protecting disability and education savings plans needs to happen

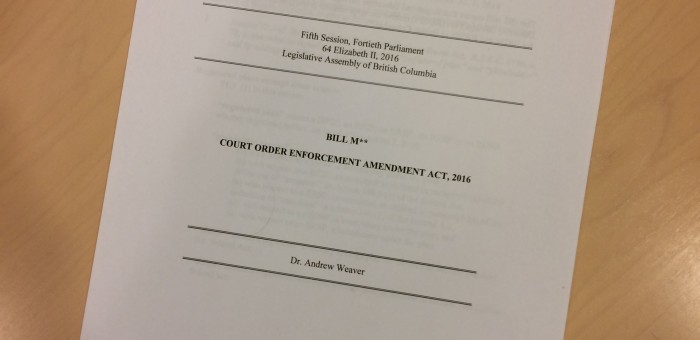

Media Release: March 15, 2016

Andrew Weaver – Protecting disability and education savings plans needs to happen

For Immediate Release

Victoria B.C. – Andrew Weaver, Leader of the B.C. Green Party and MLA for Oak Bay-Gordon Head, says the changes he proposes in protecting RESPs and RDSPs from creditors are needed in British Columbia.

“I asked the Minister of Justice about this problem in question period two years ago,” says Weaver. “At the time, the Minister said that it was an important issue and that she’d be glad to work with me to move it forward. Yet two years have now passed and still nothing has changed.”

Today Weaver introduced a private member’s bill intituled “Court Order Enforcement Amendment Act”. The bill would add Registered Disability Savings Plans (RDSPs) and Registered Education Savings Plans (RESPs) to the list of plans protected under the act.

Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs) are already protected in BC and most other provinces from creditors in the case of personal bankruptcy. Such protection provides a glimmer of hope that individuals undergoing bankruptcy will not be destitute in their old age.

“If a person files for bankruptcy in B.C., their RRSPs are protected from being seized by creditors,” says Weaver. “However, the same protection does not exist for RESPs or for RDSPs. A child should not have their education investment seized due to misfortune that befalls their parents. Alberta has protected RESPs; we should follow suit.”

“I’ve waited for action on this issue for two years. I haven’t seen any meaningful progress from the government on this simple legislative change, so that’s why I’m proposing it today. My hope is that they finally act on it.”

– 30 –

Media Contact

Mat Wright – Press Secretary Andrew Weaver MLA

1 250 216 3382

mat.wright@leg.bc.ca

BC Liberals Reject Progressive Approach on MSP Premiums

Today in the legislature we were debating an amendment to the motion that the Speaker do now leave the Chair for the House to go into Committee of Supply”. The BC NDP added the following text:

“That the government recognize the cumulative effect of the increases in MSP taxes, hydro rates, ICBC premiums, and other fees and hidden taxes, on British Columbia families.”

I took the opportunity to subamend the amendment by adding:

“And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue neutral manner to create a progressive health care levy.”

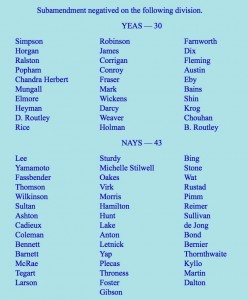

The BC NDP supported my subamendment which was defeated by the Liberal majority (vote reproduced below). I also supported the BC NDP amendment that was also defeated by the BC Liberals.

In voting the way they did on my subamendment, the BC Liberals made it very clear that they are not interested in fixing the regressive nature of the MSP premiums. I found this very odd in light of the fact that the Premier recently stated, “Here is the thing about the MSP system is it is antiquated, it is old, and the way people pay for it generally doesn’t make a whole tonne of sense…“. If you ask me, this is nothing short of a caucus vote of non confidence on the Premier’s position on the MSP Premium file.

Below is the text (and video) of my speech in support of the BC NDP amendment and my subamendment.

Text of my Speech

A. Weaver: It gives me great pleasure to rise in support of the motion put forward by the member for Nelson-Creston and seconded by the member for Port Coquitlam: “That the Speaker do now leave the Chair for the House to go into Committee of Supply be amended by adding the following, ‘That the government recognize the cumulative effect of the increases in MSP taxes, hydro rates, ICBC premiums, and other fees and hidden taxes, on British Columbia families.'”

I rise in support of this for numerous reasons. The first, of course, is that this government is proud of its triple-A credit rating and its balanced budget. I am proud of the balanced budget. However, the choices this government has made are such that it is those who can least afford it who are the ones paying the costs of balancing the budget.

It’s a biased budget, one that puts the poor, those with disabilities, those who can barely make ends meet and families second. It puts vested interests, the development industry, first and foremost.

This government touts the fact, through self-congratulatory rhetoric, that it is fiscally responsible. Let me be very clear: this government is fiscally reckless.

Take Site C, for example — the biggest item by far in the budget that is not being addressed in detail, an item with an $8.7 billion price tag that will almost certainly come around $12 billion to $13 billion when all is said and done. It’s a project that received virtually no attention in this budget and only had one line item to it. That’s Site C, as mentioned previously, by the minister before me.

The Premier recently stated that she wanted to move this project “past the point of no return,” but in her haste to get to yes, she is throwing fiscal caution to the wind. The government is pushing forward with a massive pet project that was created for a yet-to-materialize LNG industry — a project that has seen numerous cost overruns already, and yet it has barely started.

This government is plowing forward with a substantial risk that is borne on the backs of B.C. taxpayers — those who are not only paying the price through increases in MSP premiums, through increases in hydro rates, through increases in ICBC premiums, but who also being burdened with debt for years to come for a yet-to-materialize LNG industry, a project that has seen, as I mentioned, numerous cost overruns.

The government wants to appear to be fiscally responsible, but it’s gambling with our tax dollars. Why are we pushing ahead with a project that is riddled with legal challenges and massive environmental consequences? Why is the government not taking a step back and putting the interests of regular working people first and foremost? The British Columbians who actually vote the MLAs in here — why are they not putting their interests first?

Why is this government not taking that step back? British Columbians want this government to wait for the report from the Auditor General, who is currently examining the Site C project, and learn whether this project is actually fiscally sound. Frankly, to push ahead is simply reckless.

With Site C, it’s easy to see we’re going into a big debt for a project we don’t need, and in doing so we are flooding our energy market with taxpayer dollars that are actually driving investment out of our province. And again, to make ends meet, we increase MSP rates. We increase hydro rates and on and on and on.

Just two weeks ago, the Canadian Wind Energy Association announced that it was closing its office and leaving B.C. because the government and B.C. Hydro are just not interested. Last year we saw the same thing with EDP Renewables — no interest from the government for a roughly $1 billion wind power investment off southern Vancouver Island. That company has walked as well.

Despite the potential in this province, clean energy investment is leaving British Columbia in droves. The B.C. Liberals’ dream — they continue to dream of LNG — has not materialized, but they’re still using billions of taxpayer money to gamble on projects designed to support it. They are pushing risky projects past the point of no return and, in so doing, clean tech investment out of our province.

Let’s take a look at these LNG figures that the Minister of Environment has presented in the budget, figures that were supposed to help fuel a prosperity fund instead of it being fuelled through MSP premium increases and so forth, which this amendment is attempting to address.

I love talking about LNG. I love talking about it, just like I loved talking about the tooth fairy when I was a little child. Those of us outside the government’s self-congratulatory circle of hyperbola know that they had….

Hon. A. Wilkinson: Hyperbole. “Hyperbola” is a mathematical term.

A. Weaver: Hyperbole. Thank you to the Minister for Advanced Education for pointing out that hyperbola is a mathematical term.

Those of us outside of government’s self-congratulatory circle of hyperbole already know that they have no hope of tapping into an LNG market in the short term, no hope whatsoever. No amount of tax cuts, no amount of subsidies to the industry, no amount of praying to the LNG god…. We just know it’s not going to happen. They’ve tried and failed.

This year’s budget shifted the LNG story to a future supply-demand gap slotted to emerge ten years from now. Uh-oh. Never mind the “unforeseen global conditions.” So how are we going to make ends meet? We’re going to tax those who are least able to afford it through increases in MSPs, increases in hydro rates and so forth, which is exactly what this amendment is trying to quantify and recognize.

Now we’re talking about LNG in, say, the mid-2020s, something that I’ve been saying for quite some time. Yet the government’s track record of repeatedly failing to predict the LNG future even months in advance does not instill in me, let alone in British Columbians, with any confidence as to what their projected supply and demand will be like in 2030.

On the demand side, there are challenges as well. While the increasing competitiveness of the renewables, as recently highlighted by economists, it seems unlikely that demand projections, illustrated by the curious unlabelled graph in the 2016 budget document, will be accurate either. Simply making up numbers.

This government is chasing a falling market, in which it was a late player, and throwing good money after bad. Let’s take a look at this prosperity fund in a little more detail. This is a fund that the government promised to implement through vast amounts of moneys coming from LNG revenues. Instead, we see increases to the MSP premium, hydro rates, and so on, in order to fund the prosperity fund on the back of individual taxpayers.

I have always advocated that it’s our responsibility as legislators to not think merely of today’s British Columbians but also those of future generations who will follow us — though in a more responsible, realistic manner than the government’s “LNG for our grandchildren” rhetoric mantra.

Indeed, this is the main reason I chose to run for office in first place. But the fact is that if this government were serious about reducing the debt of this province, they would not grow the debt of this province each year. They would not create a loophole allowing them the ability to not pay down the debt with surplus revenues but, in fact, use taxpayer money for political posturing, which is what the prosperity fund is all about.

It gets worse. My fears were confirmed when I looked into the specifics of the prosperity fund being funded through taxes on those who can least afford it — the subject of the amendment before us. Let’s break it down. We have $100 million going into this prosperity fund this year and, according to this year’s budget, no further investments in our province’s savings account in any subsequent year. That’s hardly prudent fiscal planning. And curious, it’s in a year leading up to the election.

Of that $100 million, this government is putting a full half of it towards debt retirement. Hang on. That’s not $100 million. It’s $50 million in the prosperity fund. But then they actually say that only 25 percent of the $100 million will be saved, while the last 25 percent will go towards “government priorities.” Clearly, MSP premiums are not the government’s priority.

What is the government priority? Probably boutique handouts as we move into the election year in May of next year. In fact, when we tone down the self-congratulatory rhetoric that this government is issuing and tune into the actual numbers, we find that this government’s $100 million prosperity fund is actually a one-time investment of $25 million. This is a blatant misrepresentation of how tax dollars are being spent.

Also, the government tried to mislead the voters of B.C. that their empty promises are not actually empty. They’re doing this to create a potential political play to try to tempt the opposition to vote against prosperity. That’s shameful — nothing more than political posturing in the hope that they can turn around and say that the opposition votes against prosperity.

This opposition votes for prosperity. But prosperity is more than just the bottom line in the so-called prosperity fund. It’s prosperity in social prosperity. It’s environmental prosperity. It’s fiscal prosperity. It’s triple-bottom-line prosperity. For this government, prosperity simply means prosperity for those who happen to give them large donations to ensure that they remain in power. It is not a prosperity for all British Columbians. It is a very limited prosperity.

With that in mind, and in light of the fact that the motion to amend the statement “That the Speaker do now leave the Chair” is before us, I will, at this time, introduce notice to subamend that motion with the idea of adding the following:

I move the following subamendment:

[Be it resolved that the motion “That the Speaker do now leave the Chair” be amended by adding the following:

“That the government recognize the cumulative effect of increases in MSP taxes, hydro rates and ICBC premiums, and other fees and hidden taxes, on British Columbia families,”

And in order to ease the burden facing these families, support rolling the currently regressive and unfair MSP premiums into the income tax system in a revenue neutral manner to create a progressive health care levy.]

Deputy Speaker: So, Member, are you going to speak on the amendment to the amendment?

A. Weaver: Correct.

Deputy Speaker: Okay. Carry on.

On the subamendment.

A. Weaver: On the subamendment, I have but one statement. I am going to quote Tom Fletcher from Black Press, president of the legislative press gallery. The quote is this. “Green leader has it right.”

The Vote

Video of my Speech

am

65,721 Signatures and Counting – No More MSP Head Tax

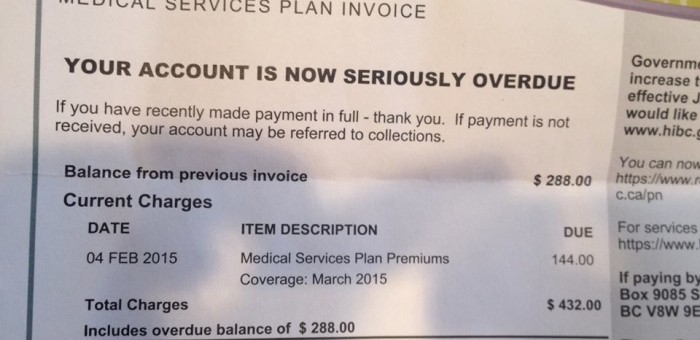

Today in the legislature I presented a petition by 65,721 British Columbians, started by Michelle Coulter in Ucluelet. The petition calls on government to abolish BC’s regressive approach to collecting MSP premiums and switch instead to a progressive system. As the petition states, “BC should follow the lead of other provinces in eliminating its flat-rate MSP premiums.”

Earlier this year I renewed my call to eliminate MSP premiums and pointed out that we don’t have to look far for alternatives. British Columbia should follow the path taken by Ontario in 2004 when they introduced the Ontario Health Premium (OHP), and rolled it into their income tax system.

In Ontario if you earn $20,000 or more a year you pay the OHP. It ranges from $0 if your taxable income is $20,000 or less, and goes up to $900 per year if your taxable income is more than $200,600. Instead of the mail-out system we have in BC, the OHP is deducted from the pay and pensions of those with employment or pension income that meets the minimum threshold. The full range of premium rates in Ontario for those at different incomes can be viewed here.

Remember – only Ontario’s top earners are paying $900 per year. Right now people in British Columbia are paying $900 a year regardless of whether they earn $30,000 or $3,000,000 a year.

Below are the text and video of my introduction of the petition. I also append a copy of the media release associated with it.

Petition Introduction Text

It gives me great pleasure to present a petition with 65,721 signatures from people across British Columbia calling on the government to abolish B.C.’s regressive approach to collecting MSP premiums. As the petition states, B.C. should follow the lead of other provinces in eliminating flat-rate MSP premiums

Petition Introduction Video

Media Release

Media Release: February 11, 2016

Andrew Weaver presents MSP petition with 65,721 names

For Immediate Release

Victoria, B.C. – Andrew Weaver, Leader of the B.C. Green Party and MLA for Oak Bay-Gordon Head, tabled a 65,721 signature petition in the legislature today calling on the government to eliminate B.C.’s regressive ‘one-size-fits-all’ approach to collecting MSP premiums.

“It is clear that too many British Columbians are struggling with the fixed and increasing cost of MSP Premiums in this province. It is a regressive fee that is hurting those who can least afford it,” said Weaver.

The petition, created by small business owner Michelle Coulter from Ucluelet, B.C., was started in December and has received widespread support from across the province.

“Right now whether you make $30,000 or $3,000,000 annually in you are paying $900 a year,” said Weaver. “In Ontario, only the top earners making more than $200,600 are paying this rate.”

The B.C. Green Party has proposed the introduction of a progressive system in which rates are determined by one’s earnings, mirroring the model used in Ontario. Rolling MSP premiums into the existing income tax system would allow the fee to be graduated and lead to a significant net administrative savings to taxpayers.

“The B.C. Government takes almost as much revenue from MSP Premiums as it does from corporate income tax,” said Weaver. “It’s time we followed the path Ontario has taken and rolled the MSP Premiums into our income tax system.”

In 2004 the Ontario government introduced the Ontario Health Premium (OHP), and incorporated it into their income tax system. In Ontario if you earn $20,000 or more a year you pay the OHP. It ranges from $0 if your taxable income is $20,000 or less, and goes up to a maximum of $900 per year if your taxable income is more than $200,600. Instead of the mail-out system we have in B.C., the OHP is deducted from the pay and pensions of those with employment or pension income that meets the minimum threshold.

“The government’s recently announced change for single parent families is a step in the right direction but doesn’t go far enough to help numerous British Columbians who cannot afford the increases,” said Weaver. “If the government is serious about easing the burden it is placing on low and fixed income British Columbians, then they need to properly fix the way MSP premiums are collected.”

-30-

Media Contact

Mat Wright

Press Secretary – Andrew Weaver MLA

Cell: 250 216 3382

Mat.wright@leg.bc.ca

Twitter: @MatVic

Lack of Poverty Reduction Plan in British Columbia Unacceptable

Media Statement: December 10, 2015

Andrew Weaver: Lack of Poverty Reduction Plan in British Columbia Unacceptable

For Immediate Release

Today, Andrew Weaver, MLA for Oak Bay Gordon Head and Leader of the BC Green Party, reiterated his call for the Provincial Government to develop a comprehensive strategy to end poverty in our province. British Columbia is now the only Province without a poverty reduction plan, yet is projected to have the fastest growing economy in the country.

“It is unacceptable that in a province with an economy as strong as ours that we are the only ones neglecting our responsibility to our citizens who are struggling to afford the cost of living,” said Andrew Weaver.

An October 2015 report by Citizens for Public Justice showed British Columbia had a 16.3% overall poverty rate and was the only province left that had not advanced a poverty reduction strategy. CIBC World Markets released a report in November predicting British Columbia would lead the country in terms of economic growth in 2016.

In response to the tent community on the lawn beside the Victoria Law Courts, the government has pledged more money for a new shelter in the region, and that campers would be asked to leave if they didn’t accept the province’s offer of housing. The Premier also suggested that the best way to fight poverty was to let the economy grow.

“This is what is wrong with our poverty reduction policy in British Columbia,” said Andrew Weaver. “We have a government that advances short term solutions like shelters, while suggesting for years that we need to wait for our economy to grow before we can take real action. Now we have the fastest growing economy in the country and we still haven’t advanced a plan.”

Other jurisdictions are finding ways to address poverty issues while saving the government money. Housing-first poverty strategies have been one of the foundational aspects of poverty reduction plans in Utah, Denver, Medicine Hat and a growing number of other jurisdictions. This approach recognizes housing insecurity as a key systemic issue contributing to poverty and shifts from emergency management of homelessness, to providing homes for those who need them. By addressing this issue head-on, rather than through a patchwork of services, government costs are ultimately reduced.

“A good place for a poverty reduction plan to start would be addressing the difficulties British Columbians are having finding affordable and supportive housing,” said Andrew Weaver. “This isn’t an either or – we need to continue to develop a strong economy, while ensuring that British Columbians aren’t being left out in the cold.”

-30-

Media Enquiries:

Mat Wright

Press Secretary – Andrew Weaver MLA

Cell: 250 216 3382

Mat.wright@leg.bc.ca

Twitter: @MatVic

Parliament Buildings

Room 027C

Victoria BC V8V 1X4