Resource Development

Shawnigan Lot 21 Soil Sample Results

Late last week I received the results from the soil samples I collected on Lot 21 during the period that title reverted to the Crown.

As I discussed earlier, I collected a total of fives samples from five separate locations on Lot 21 (see image above left for precise locations). Since automated drilling instruments were not allowed under FLNRO policy on Crown Land Use Policy, we used shovels to dig the five samples at depths of 28″, 14″, 15″, 22″ and 0″, respectively,

As I discussed earlier, I collected a total of fives samples from five separate locations on Lot 21 (see image above left for precise locations). Since automated drilling instruments were not allowed under FLNRO policy on Crown Land Use Policy, we used shovels to dig the five samples at depths of 28″, 14″, 15″, 22″ and 0″, respectively,

The soil samples were analysed by Maxxam Analytics for Volatile Organic, Total Hydrocarbon and Elemental Metal analyses. The results are now available. While I recognize that my approach of taking a few samples is a bit like looking for a needle in a hay stack, the good news is that both volatile organic and total hydrocarbon content were below detectable levels in all samples.

As indicated in the Residential/Parkland column of the Soil Quality Guidelines of the Canadian Council of Ministers of the Environment, the only sample that revealed above-recommended values was Sample #3. In this case both Zinc and Copper were over the guidelines.

As indicated in the Residential/Parkland column of the Soil Quality Guidelines of the Canadian Council of Ministers of the Environment, the only sample that revealed above-recommended values was Sample #3. In this case both Zinc and Copper were over the guidelines.

While my tests are by no means exhaustive and do not address the fundamental question as to what, if anything, is buried deep under the surface in Lot 21, they add to the body of knowledge concerning the area.

Toad Road yet no Abode

Given the myriad challenges facing wildlife in our province, one of the best things we can do to protect biodiversity in B.C. is to leave key habitat areas intact. As the global climate warms and precipitation patterns shift, having a complete ecosystem within which animals and plants can try to adapt will be essential, and frankly the least we can do given the dire situation many species are in.

Given the myriad challenges facing wildlife in our province, one of the best things we can do to protect biodiversity in B.C. is to leave key habitat areas intact. As the global climate warms and precipitation patterns shift, having a complete ecosystem within which animals and plants can try to adapt will be essential, and frankly the least we can do given the dire situation many species are in.

This is not news to the government, of course. For species ranging from mountain caribou to spotted owls and goshawks, the Ministry of Environment is quick to reference habitat loss as a contributing, if not the main, factor in population declines:

“human activities associated with resource extraction are the ultimate threats to caribou in British Columbia. Human development fragments and alters caribou habitat…“

“[The spotted owl] is at risk in this province because much of its habitat has been adversely affected by logging or lost due to land development.“

“The laingi subspecies of Northern Goshawk requires large areas of old-growth and mature forest. Large-scale timber harvesting removes much suitable nesting and foraging habitat… Because of this, the laingi subspecies is believed to be in jeopardy, and is on the British Columbia Red List.“

Likewise, the government cites habitat destruction as one of the greatest impacts on western toad populations in B.C.

“Development in and around wetlands can destroy or isolate populations.“

To a lesser extent, though still of importance, migrating toads are often killed by traffic as they try to cross roads.

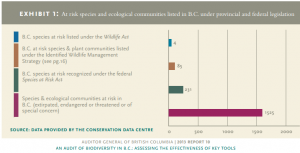

Western toads are considered a species of conservation concern by the government of British Columbia and have been designated a status of special concern by the Committee on the Status of Endangered Wildlife in Canada (COSEWIC). In theory, they are protected under the B.C.’s Wildlife Act.

While BC has the most biodiversity in Canada, it is also one of two provinces (the other being Alberta) that has no provincial endangered species legislation. Sadly, BC is the home of more than 1,500 species currently at risk of extirpation or extinction.

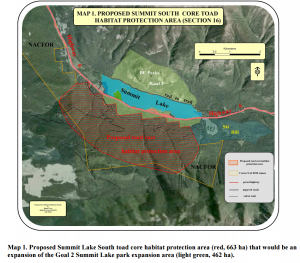

Summit Lake, just outside the village of Nakusp in the Kootenay region, is a key breeding area for western toads. Every year, usually around the end of August, young toadlets migrate from the shoreline of Summit Lake, across Highway 6, to upland habitat where they will live for four or five years before they return to the lake to breed. The mass migration sees upwards of a million little toads attempting the crossing, with tens of thousands getting run-over in the process.

Summit Lake, just outside the village of Nakusp in the Kootenay region, is a key breeding area for western toads. Every year, usually around the end of August, young toadlets migrate from the shoreline of Summit Lake, across Highway 6, to upland habitat where they will live for four or five years before they return to the lake to breed. The mass migration sees upwards of a million little toads attempting the crossing, with tens of thousands getting run-over in the process.

Hoping to help, nearby communities hold an annual Toadfest where people carrying the migrating western toads from the curb to the forest in buckets. The provincial government has also tried to address the problem by building directional fences leading to toad tunnels that allow the toads to safely cross under the highway. This amounts to an innovative solution and $200,000 investment in the protection of an increasingly threatened species. In the Ministry of Transportation and Infrastructure’s employee newsletter about their work they described the mass movement of western toads from Summit Lake to the forest as “among the great wildlife migrations in the world.”

Unfortunately, the story doesn’t end there. After being safely escorted across the highway, via toad tunnel or bucket, the toads will now find themselves in a forest slotted for logging. Road building began last week and there are plans in the works to clear cut the 30 hectares where the toads hibernate.

Unfortunately, the story doesn’t end there. After being safely escorted across the highway, via toad tunnel or bucket, the toads will now find themselves in a forest slotted for logging. Road building began last week and there are plans in the works to clear cut the 30 hectares where the toads hibernate.

To their credit, the Nakusp and Area Community Forest (NACFOR) logging company has drafted a toad management plan and identified small habitat features that they’ll try to leave intact. I commend NACFOR for exploring ways in which they can continue to harvest the timber while also being mindful of this species of special concern, but it is really the government that should be in the leadership role here.

Protection of core terrestrial habitat – defined as “the spatial delineation of 95% of the population that encompasses terrestrial foraging, breeding, and overwintering habitats rather than buffers” – is seriously recommended in the scientific literature for amphibians (Semlitsch and Bodie 2003, Browne and Paszkowski 2010, Crawford and Semlitsch 2007). If the existing provincial park at Summit Lake were expanded to include the forest within roughly two kilometers of the lake the protection of core terrestrial habitat would likely be achieved, wildlife biologist Wayne McCrory said in his analysis of the situation.

Protection of core terrestrial habitat – defined as “the spatial delineation of 95% of the population that encompasses terrestrial foraging, breeding, and overwintering habitats rather than buffers” – is seriously recommended in the scientific literature for amphibians (Semlitsch and Bodie 2003, Browne and Paszkowski 2010, Crawford and Semlitsch 2007). If the existing provincial park at Summit Lake were expanded to include the forest within roughly two kilometers of the lake the protection of core terrestrial habitat would likely be achieved, wildlife biologist Wayne McCrory said in his analysis of the situation.

The province has been criticized for failing to set aside adequate habitat to protect caribou, spotted owls and goshawks and this toad situation illustrates just how reluctant the B.C. government is to remove forest from the logging land base. The key western toad forest habitat around Summit Lake is a relatively small, very specific area that could be included into the existing provincial park. This would represent a minor exemption from their 9,816 hectare total operating base.

The creation of the toad tunnel represented an admirable step forward for the government’s approach to wildlife issues. Granting approval to log their core terrestrial habitat represents more of a smoking bulldozer ride back – squashing all their advancements in the process.

The creation of the toad tunnel represented an admirable step forward for the government’s approach to wildlife issues. Granting approval to log their core terrestrial habitat represents more of a smoking bulldozer ride back – squashing all their advancements in the process.

“Be an advocate for amphibians – protect toads and their habitat in your neighbourhood,” reads the government’s BC Frog Watch website.

Good advice, that I respectfully urge the BC government to follow by protecting western toad habitat around Summit Lake before it’s too late.

A Small Investment, a Boundless Return — Bringing Broadband Redundancy to Prince George

Earlier this month I toured the Prince George region to meet with a number of key stakeholders in the region. It became apparent from my visit that we have an incredible opportunity in British Columbia for continued innovation in our resource and tech sectors.

Prince George real estate is still reasonably priced, the surrounding environment is picturesque, there’s a first rate university in town. Prince George is a hub for northern BC and on the rail line from the Port of Prince Rupert to Chicago, one of greatest, if not the greatest, rail distribution centres in North America.

So what is missing? Why is there not a thriving and expanding hub of local technological innovation in partnership with the resource, forestry and agricultural sectors and capitalizing on the research expertise at UNBC? Why wouldn’t companies that are concerned about access to renewable energy, a skilled workforce and being able to attract and retain their workers not setup in Prince George? They’re located on the railway connecting Chicago’s North American rail distribution centre to Prince Rupert, a gateway to Asian markets.

The answer is simple. Broadband redundancy in the region precludes major investments in this area.

Today in the legislature I rose to question the Minister of Technology, Innovation and Citizen Services about government’s plans to introduce broadband redundancy in Prince George.

Question

A. Weaver: I wish to thank the members opposite for applauding my introduction of my question again.

It’s become perfectly clear to everyone in this House — and, frankly, everyone in British Columbia — that this government’s plans for LNG have been nothing short of a monumental failure. There’s no backup plan. The government is void of ideas and in desperate need of help.

As leader of the B.C. Green Party, a party that cares about social, economic and environmental prosperity for all British Columbians, I visited Prince George earlier this month. I was struck by the potential for this region.

Prince George is a home of a first-class research university, the hub for northern B.C.’s forestry and natural resource sectors and is on the rail line from Port of Prince Rupert to Chicago, one of the greatest distribution centres in North America. The cooler climate of Prince George, relative to other jurisdictions on the west coast, also offers it certain unique advantages.

My question to the Minister of Technology, Innovation and Citizens’ Services is simple. Has this government considered providing broadband redundancy for the Prince George region

Answer

Hon. A. Virk: I’d like to thank the member from Oak Bay for his leadership, first of all, and for the question. The fact that he has gone to Prince George and recognized the great universities and the great north of British Columbia. Perhaps those to his right could learn from that leadership and go realize that there’s more to this province than those four or eight or ten square blocks in downtown Vancouver.

But I digress. The question that the member for Oak Bay–Gordon Head poses…. I’ve had staff, in fact, look into that. There are actually multiple backbone fibre lines to Prince George — up 97, east on Highway 16 and south on Highway 5. So there are redundancy lines to Prince George.

We’re going to continue to work on connectivity all across the province. If the member so wishes, I can certainly have him have a briefing with our connectivity experts at his earliest availability.

Supplementary Question

A. Weaver: In fact, the broadband redundancy does not exist in Prince George as we speak. Bringing the typically urban-based tech and the typically rural-based resource sector together, through partnership and innovation, will play a vital role in a 21st century economy that builds on British Columbia’s strategic advantage.

Prince George is an obvious strategic location for such growth, but in order for this to happen, it’s critical that broadband redundancy exist in the region — high-speed broadband redundancy. The government launched a $5 million ad campaign promoting its actions this past November. But instead of the slogan “Our opportunity is here,” the government could actually create that opportunity in investing in needed infrastructure to benefit B.C.’s northern communities.

At $20,000 to $25,000 per kilometre, a 300-kilometre distance from Prince George to Chetwynd would cost a mere $6 million to $7.5 million to lay. Tech investors, data distribution centres and other innovators will not invest substantively in Prince George until broadband redundancy exists. The best part about this opportunity is that the cost to government is small and the potential benefits are unbounded.

To the Minister of Technology, Innovation and Citizens’ Services, my question is simple. Will the government commit to invest the $6 million to $7.5 million, today, required to ensure high-speed broadband redundancy for Prince George and real, sustainable and diversified economic prosperity to the north? And, if not, why not?

Answer

Hon. A. Virk: I know that the members from Prince George and members of the rural caucus certainly applaud the member for Oak Bay–Gordon Head in terms of his continued interest in rural British Columbia and continued interest in the north.

As I said, there is multiple backbone fibre lines to Prince George, but let’s look beyond that. The member will certainly recall the additional $10 million committed to increase connectivity all across British Columbia. We’re at 94 percent. We’re at 94 percent right now; 94 percent of British Columbians currently have access to high-speed Internet — considered in today’s technology environment.

We are committed to ensuring that every single British Columbian is connected to high-speed Internet because it’s become a stable item. We are committed that every single person in British Columbia by 2021 has access to high-speed Internet.

Video of Question Period

Media Release

Media Release: February 25, 2016

Andrew Weaver – Tech investment in Northern BC lacking

For immediate release

Victoria B.C. – Andrew Weaver, Leader of the B.C. Green Party and MLA for Oak Bay-Gordon Head, today offered government an untapped opportunity for job creation and technological innovation in northern British Columbia through the introduction of broadband redundancy into the region.

Prince George is home to a first class research university, the hub for northern BC’s forestry and natural resource sectors, and on the rail line from the Port of Prince Rupert to Chicago, one of greatest rail distribution centres in North America. The cooler climate of Prince George, relative to other jurisdictions on the west coast, also offers unique advantages for data centres.

“Bringing the typically urban-based tech and typically rural-based resource sectors together through partnership and innovation will play a vital role in building a 21st century economy that builds on British Columbia’s strategic advantages,” says Weaver. “In order for these to be possible, it is critical that broadband internet redundancy be brought to the region. This means investing in another line of broadband connectivity for Prince George.”

Broadband redundancy is when a city has at least two lines of connectivity to the rest of the world. Currently Prince George only has one direct highspeed line to Vancouver.

“Tech investors, data distribution centres, and other innovators will not invest substantively in Prince George until the infrastructure is there,” says Weaver. “The best part about this opportunity is that the cost to government is negligible and the potential benefits are unbounded.”

At a cost of about $20,000 to $25,000 per kilometre, the 300 km distance connecting Prince George to Chetwynd would cost between $6 million and $7.5 million to lay.

Telus invested $75m in a new data centre in Kamloops which opened in 2014.

“The fact that Kamloops has broadband redundancy is one of the key reasons they invested $75 million in a new data centre,” says Weaver. “This is just one example of the potential opportunities that could exist.”

Andrew Weaver asked the Minister of Technology and Innovation if he would support an investment in broadband redundancy for the city of Prince George today in Question Period.

-30-

Media contact

Mat Wright

Press Secretary – Andrew Weaver MLA

Cell: 250 216 3382

Mat.wright@leg.bc.ca

Twitter: @MatVic

Parliament Buildings

Room 027C

Victoria BC V8V 1X4

Eagerly Awaiting the Results of Lot 21 Soil Samples

Last Monday I noted that the Crown was now the new owner of Lot 21, c/o the surveyor of taxes. Lot 21, of course, is the property located immediately beside the site of the contaminated soil facility operating in the Shawnigan Lake watershed.

Last Monday I noted that the Crown was now the new owner of Lot 21, c/o the surveyor of taxes. Lot 21, of course, is the property located immediately beside the site of the contaminated soil facility operating in the Shawnigan Lake watershed.

In a media release that I issued on that day (February 15), I argued that the government no longer had any excuses to prevent it from thoroughly investigating the property. The government had previously told to me that drilling was not possible as the site was private property. But since Lot 21 returned to the Crown, I called upon government to undertake drilling to ensure residents, local and provincial governments and First Nations knew what, if anything, was buried on the site.

Doing so would have put an end to speculation circulating in a prevalence of anecdotal stories. It would also have allowed the following question I had previously been left with to be answered directly:

Doing so would have put an end to speculation circulating in a prevalence of anecdotal stories. It would also have allowed the following question I had previously been left with to be answered directly:

What, if anything, has been buried on Lot 21 that could produce the Thorium, Lead and other heavy metal enrichment in the sediments?

To my disappointment, the government failed to show the initiative to seek an answer to this question. As such, in order to address the concerns of my constituents who have property on Shawnigan Lake, I was forced to collect samples myself. And so, at 09:00 on February 19, my legislative assistant Aldous Sperl and I set off to the area to collect five soil samples.

To my disappointment, the government failed to show the initiative to seek an answer to this question. As such, in order to address the concerns of my constituents who have property on Shawnigan Lake, I was forced to collect samples myself. And so, at 09:00 on February 19, my legislative assistant Aldous Sperl and I set off to the area to collect five soil samples.

Upon our arrival at Stebbings Road we were greeted by a small group of local volunteers who were keen to help us out. Armed only with shovels, we set off on a several hundred metre hike to Lot 21.

This must have been the fourth or fifth time that I have now hiked along the boundary of Lot 23 (containing the contaminated soil facility). On this particular journey, while fondly remembering my first and rather more difficult hike, I remarked how there was now a well worn path that had been created on the CVRD parkland. It seems that the route has now become oft travelled path.

This must have been the fourth or fifth time that I have now hiked along the boundary of Lot 23 (containing the contaminated soil facility). On this particular journey, while fondly remembering my first and rather more difficult hike, I remarked how there was now a well worn path that had been created on the CVRD parkland. It seems that the route has now become oft travelled path.

Prior to setting out on our journey my legislature office checked with the Ministry of Forests Lands and Natural Resource Operations (FLNRO) to ensure that there were no regulations prohibiting us from collecting soil samples. The Ministry directed us to FLNRO policy on Crown Land Use Policy that specifically stated, under section 6.2.3.3 Investigative Activities on Crown Land that:

Given the green light that we were given by FLNRO, Aldous, CVRD Director Sonia Furstenau and I set out to collect a total of fives samples from five separate locations on Lot 21 (see image above left for precise locations). Since automated drilling instruments were not allowed under FLNRO policy, we used shovels to dig the five samples at depths of 28″, 14″, 15″, 22″ and 0″, respectively,

Early on in our sampling we discovered a rather odd metallic cylinder with a plastic tube emerging from it (above left). As we felt that it was important to clean any debris off crown land, one of the local volunteers picked the cylinder up to examine and dispose of it at a later date. All holes that I dug were carefully refilled to ensure no disruption to “natural habitat” in the area.

Today I dropped off my soil samples at Maxxam Analytics for Volatile Organic, Total Hydrocarbon and Elemental Metal analyses. I expect results on Wednesday next week and I will report back immediately upon their receipt.

The truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is — W. Churchill

Today in the legislature I rose to speak to the budget. Every MLA is give 30 minutes to respond to budget. My staff and I’d prepared so much material that I barely got through half of what I had planned to address. But there will be more opportunities in the weeks ahead to outline why I will not support this budget.

Below is the text of my speech. I also append a video further down.

Text of My Speech

A. Weaver: It gives me great pleasure to rise and speak to this debate, particularly after the member for Comox Valley, who classified the world and this House as one of two sides: the world of optimism on that side and arguably, in his mind, the world of pessimism on this.

I’d like to quote Winston Churchill:

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”

I am an optimist. I understand what it means to be an optimist, but unfortunately, I don’t think Winston Churchill was thinking of this government when he came up with that quote.

In fact, there is another quote attributed to Winston Churchill more applicable to the statements that emanated from the opposite side, and the quote is this:

“The truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is.”

What you are going to hear from this side of the House is a truthful assessment of the Budget 2016, not one filled with rhetoric, not one filled with promises, not one filled with half truth, but one that looks at it carefully and points out what is good and what is not good without the hyperbolic, hysterical rhetoric, so common, emanating from those on the other side.

I rise in this debate puzzled by the direction this government is heading. Frankly, it has become clear to me that this government is really out of new ideas — completely out of new ideas, lost, lost their way, given that LNG is not playing out the way they thought it would be.

The budget speech we heard on Tuesday was high on self-praise but represents little in terms of fundamental change. We continue to chase markets we are not part of with LNG while bringing forward no clear plan to build on our strengths let alone the challenges we face.

While it was encouraging that this government incorporated some policy changes that British Columbians have been advocating for, for the most part, they represented halfway measures that do little to attack the underlying issues that are presenting challenges for so many British Columbians.

First let me discuss the issue of housing. To make good policy, you need good data. I was encouraged to read the government has adopted additional tools that will allow them to gather much-needed contextual information about the housing market.

The new requirement for property purchasers to identify their nationality is a step forward that I’ve been urging this government to take for two years.

Frankly, I wonder how they’re going to do it without actually bringing the private member’s bill, which is precisely the same as what is being proposed by government. I look forward to debating the private member’s bill that’s before the House as we speak.

I’m glad that government listened on this. Likewise, I was also pleased to see that bare trusts will now face more examination, and the government will have the data it needs to address this. Gathering more information about bare trustees is certainly better than ignoring the problem all together. I’d like to stress this: this loophole still remains open — open to exploitation.

To say that we need to gather information from scratch implies we have an entirely different market to that of Ontario. Ontario’s housing market in Toronto is just as hot as that in Vancouver, with speculation running amok. Yet in Ontario, they have a mechanism to track this and actually generate revenue to limit the amount of speculation occurring.

While that may largely be true, for example, that we need to gather information from scratch for efficiency’s sake, I do think we have a promising opportunity to learn from what has happened in Ontario and to act pre-emptively to close this loophole.

For example, Ontario has a similar property transfer tax system in place, but they have plugged the loophole and they did it very simply. All they did was apply the property transfer tax upon change in beneficial ownership, not just change in title registered at the land title office.

The wealthy offshore buyers can flip houses numerous times by simply registering the first purchase as a bare trust owned by a corporation and flip the corporation shares from owner to owner to owner without ever changing land title and without ever paying a penny of property transfer tax.

I know this is being done because I have spoken to developers. I have spoken to mortgage lenders, and I’ve spoken to those who are involved in the real estate industry.

This change could and should be done in British Columbia to ensure everyone is treated fairly. However enlightening information may be in its own right, it’s meaningless without appropriate action. We need to get moving on these issues, and government doesn’t seem to have a plan, like so many other things.

This also seems to be the case with the government’s change to the property transfer tax. Increasing property transfer tax rates to 3 percent on homes over $2 million is another adjustment that I agree with in principle. But with affordability as the top issue on the minds for so many people across the province, making it more expensive to flip luxury homes is a progressive step. There’s no question it’s a progressive step forward.

Unfortunately, this too could be rendered meaningless if the loopholes in our housing markets are ignored. In fact, it may be that the government loses taxes in the short term as more sellers engage in and exploit those loopholes to avoid the increase in taxes.

Furthermore, with the $750,000 property tax break for new homes, the government is incentivizing housing development while doing nothing to dampen speculation — again, failing to close the loopholes affecting the market right now.

Contrary to the minister’s dismissive comment that this is a Point Grey issue, the housing problem is affecting communities across British Columbia and it is greatly impacting our provincial economy. On my street alone, where I live in Gordon Head, a house sold. The sold sign came on when the house was listed. It was sold to foreign buyers. Two months later, the sold sign came on again, as the house was flipped. It was cash transactions in both cases. This is not a problem exclusive to Metro Vancouver. It’s a problem now emerging in the capital regional district and other markets in British Columbia.

The costs we are shouldering in society are not just economic, they’re social. The passionate, determined, young people we need to support our communities and lead them into the future are being priced out by people who can afford to buy houses and leave them empty.

Ever wonder why there’s a traffic jam on the Second Narrows Bridge in Vancouver going north? It should make no sense, because people on the North Shore work, by and large, in Vancouver. The reason is because nobody who’s working in those homes — the electricians, the plumbers, the trades — are able to live in that region, and so they’re commuting from halfway across Vancouver across bridges. And the government’s response — rather than dealing with the problem, the affordability problem — is to start talking about building bigger roads and bigger bridges. Again, not addressing the problem, it’s avoiding the problem being dealt with and kicking the can down the road further.

The role of government is to take direct action and to direct the actions of citizens. We incentivize what we like, and we discourage that which we don’t. We need to close loopholes and disincentivize the preponderance of empty houses, because as it currently stands, the government is failing to do an adequate job of either. There’s a glaring market failure. The preponderance of vacant homes in Vancouver has a social cost attached to it. That externality needs to be internalized so that vacant owners pay the true cost of that vacant home.

The government’s response, rather than recognizing the market failure and internalizing externalities, incentivizes more development and further speculation. This is a government that is completely out of control and completely at a loss or understanding of fundamental market instruments. That does not deal with the imminent problem. It kicks the can down the road further, so to speak. The imminent crisis needs to be dealt with through the implementation of market instruments available to government. Those instruments alone will correct this market failure.

Frankly, the single most effective policy that government could do would be to implement a price, a levy or a tax on homes that are left vacant. This government is building the economy of Scottsdale in British Columbia as we speak. It’s an artificial economy, fuelled by speculation and requiring continued development and building of houses in order to sustain itself.

Government is misleading British Columbians by suggesting that we have a diversified economy. Our economy right now is being driven by wild speculation and offshore money coming into British Columbia to actually buy these homes, and developers building more — selling, flipping, buying, speculating.

There is only one end solution for that infinite growth in a finite system, and that will be a collapse, a collapse of pretty strong proportions that this government will start — as they have done with LNG — to blame on unforeseen global forces. Well, we can see it happening right now, and there’s nothing unforeseen about it. What is unforeseen is any will or any policy emanating from the government to actually address the key issues of today in British Columbia.

Putting up a levy on vacant homes will encourage more owners to lease their vacant homes, which in turn will put downward pressure on rent costs in Vancouver and elsewhere. The revenue generated from this levy could actually be used to pay the social costs arising from non-affordability within Metro Vancouver and emerging here in the capital regional district: the costs of the homeless, the enhanced judicial system process that is required to deal with the increasing homeless problem in our province. The reduction of services for mental health can be addressed. We can start to actually raise the living allowance, which hasn’t changed in I can’t even remember how many years.

One of the saddest moments in this House since I was elected in 2013 happened about 20 minutes ago when the member for Comox Valley stood and truly believed that somehow $11 a month is actually a great step forward, after seeing no increase in fees for years and years and years.

The people of British Columbia deserve better. They deserve a government that’s honest to them, a government that actually does not try to sell itself as something it’s not, a government that recognizes that there is a social problem out there and that $11 a month is not going to solve it. Frankly, the price of cauliflower has gone up $8, say, in about three months. Basically, what we’re saying is that you can almost meet the increase in your grocery bill, but not quite, with this $11 a month. Shameful, truly shameful that this was lauded as a sign of progress.

In summary, the government’s balanced budget increasingly is relying on revenue from an artificial, overinflated housing market. They are benefiting from the issues that are causing so many affordability concerns amongst British Columbians and taking no real concrete steps to address this. The government needs to address this market failure, and the 2016 budget represents another missed opportunity to do so.

Now to MSP. On MSP, the government has brought forward a small, half-step approach to making this fee a little bit more fair for the people of British Columbia. I commend them for taking that one small half-step. It may not be much, but at least we are moving in the right direction. Making children exempt from paying MSP premiums and increasing the assistance available are both positive changes to a fundamentally unfair system.

Despite the changes to MSP premiums announced on Tuesday, we still have a system that doesn’t work, however, for most British Columbians. To use the Premier’s words, as the opposition did so well earlier today in question period, it’s a system that is “antiquated…old, and the way people pay for it generally doesn’t make a whole ton of sense.” Those are the Premier’s words. I agree. The opposition agrees. But somehow the government doesn’t agree with itself. I’m not sure what’s going on.

Hundreds of thousands of people in this province are currently behind in their MSP payments. That’s a ton of bureaucracy, needlessly employed in enforcing an antiquated, old system. That’s what the Premier said. I agree. Bureaucracy — dare I say that’s red tape?

Shame if it is, because of course we know that the government doesn’t like red tape and in fact has gone so far that we now have red-tape-reduction day, making us truly a laughing stock across Canada. Every, single person that I have actually raised this to and mentioned that red-tape-reduction day is now on the same par as Terry Fox Day, Holocaust Memorial Day, Douglas Day, B.C. Day and Family Day looks at me and says: “What?” They couldn’t believe it. This government believes it, but it says whatever it takes to get through lunchtime.

The reality is, the biggest component of red tape in the entire sector of government is the administration of the MSP premium which the Premier, through her own words, says is antiquated, old and doesn’t make a whole lot of sense.

Okay, let’s remove some red tape. No, they create more red tape, more thresholds, more exemptions, etc. Absolutely unbelievable.

Plus, when we delve into the details of this policy change, what we see is actually a tax hike. The people of British Columbia have spoken loud and clear about how they are having trouble with this tax, yet this government has raised the amount of money they take from it — a new $111 million in taxes, a head tax. That’s what it is — a head tax, which, after the premium assistance is accounted for, makes it an increase of $77 million in revenue. That’s $77 million as a head tax, because that’s what it is — a poll tax or a head tax, nothing else.

Who is paying for this new revenue? Well, a couple that earns a combined $45,000 or more a year will see their Medical Services Plan increased by $240 a year. Whoa, hang on. That’s more, a greater MSP premium. I thought it was going down.

Senior couples with a slightly higher income face the same increase. Yet when I was at the Monterey centre, when this issue was first brought to me almost a year and a half ago, the demographic that brought it to me were the seniors who were struggling on fixed income to actually pay it. Here, the government is listening. It’s listening to its corporate funders. It’s not listening to the people of British Columbia, because the group that can least afford it — those on fixed income — are getting a $240-a-year hit. That’s hardly fair. That’s not fair at all.

A couple with two children will pay $72 more a year. These are significant increases in medical premiums. Let’s be clear that a combined income of $45,000 is not that much in Metro Vancouver or greater Victoria.

A single adult who earns less than $42,000 is eligible for premium assistance, but a couple earning $3,000 more is facing an increase of $240 a year. This is yet another example of how this government does not understand simple fundamental market instruments. You incentivize that which you like. You use your market instruments to put a tax or disincentivize that which you don’t.

This introduction of the MSP program is incentivizing divorce in the province of British Columbia. It’s saying to couples: “You should not be couples, because if you get married” — this is families first — “or you become common law, we’re going to charge you $240 a year more.” Does that make sense? No it doesn’t. But that’s what this government is putting forward.

Let’s look at Ontario as a case example in how we could charge MSP differently. In Ontario, health care premiums are paid through personal income tax systems. Rather than a flat-rate levy, this approach avoids the regressive nature of the monthly premium as rates rise with income to a maximum annual level.

For example, as I’ve outlined for a couple of years now, in Ontario, the current maximum annual rate is set at $900 for taxable incomes of $200,600 and higher, with those individuals earning less than $20,000 paying no premiums at all.

The argument that we need to keep this tax separate from other taxation methods so that British Columbians know that health care is not free is ridiculous. British Columbians know that health care is not free. They know that building bridges and highways is not free. They know that education is not free. To treat them as if they don’t is disrespectful. It is disrespectful of the people of British Columbia.

They know that their taxes go towards the services that government provides. If the government still insists that British Columbians need to understand how much health care is costing our province, then there is a simple solution — a simple line on the income tax return, like that exists for EI and CPP, called health care premium, which is progressively calculated just like EI and CPP are. It would solve the problem. It would deal with the issue that unions have negotiated benefits because it would still pay for it. It would be done in a progressive instead of a regressive system, just like it was done in Ontario.

In fact, this was the method advocated for in the 2002 Senate report that recommended the federal premium to help pay for health care costs — the health care of Canadians. The federal role made a strong case that premiums constituted a visible and equitable means of supported health care spending, so long as they varied in proportion to income. It’s not me making it up. It’s Senate expert panels that are providing information in forming this policy.

Now let’s turn to new services. Another item in this budget that received considerable attention was the boost to the Ministry of Children and Family Development. Now, without a doubt, I’m encouraged to see that the government seems to finally be paying attention to our most vulnerable — a topic that the official opposition has brought forward time and time and time again during question period.

It seems like they may have done more harm than good, unfortunately. For nine years, there’s been a freeze on the disability rate at $906 a month. At first glance, a $77 increase for disability assistance looks like a step in the right direction. If we take into consideration the loss of transportation subsidies, which in some cases amounts to $66 a month — the numbers were messed up in question period; I am assuming that tomorrow the minister will correct the numbers that she quoted out in question period — this budget represents an increase of only $11 a month — $11 a month — that the member for Comox Valley was so proud to tout to British Columbians in solving the social woes of those most unfortunate with disability in our society.

That’s hardly a success. In fact, with the increases in transportation in some areas going up — just look at the capital regional district, dramatic increases — this is actually a net loss, or will be a net loss, and government exempts itself from having to deal with the increasing costs of transportation. I am sure this was not their intention, but clearly this is not an outcome that will make life all that much better for the most vulnerable in B.C. In some cases, it will down the road make life a little more difficult.

On a more positive note, the $95 million set aside for wildfire protection, the $10 million for search and rescue plus the $55 million set aside for emergency preparedness and prevention initiatives are welcome news. Indeed, they’re among the only budget items I could find, although not attributed to, but that address one of the biggest threats to our province’s economy — climate change.

Let’s look at climate change. We are paying the cost of climate change in this province already. This past year, we saw record temperatures across our province. We saw drought precipitated by a lack of snow pack, and forest fires raged across our province. The January 2016 globally average temperature shattered the previous record by 0.16 degrees and was more than a full degree Celsius above the 20th-century average.

In B.C., we simply stand by and watch happen and go to Paris and say: “Look, we are leaders.” Others call you leaders; you don’t call yourself leaders. In British Columbia, we are not leaders on the mitigation of climate change. We were leaders, but that is long past.

I brought forward a motion, for example, to discuss a matter of urgent public importance last summer. At issue was whether we as legislators were acting with sufficient urgency and demonstrating the appropriate leadership on preparing for and mitigating the escalating impacts of climate change in our province. Unfortunately, my motion went nowhere.

Directing the actions of society through the fiscal instruments available to government is one of the most powerful tools we have. But here in 2016, we have a budget that barely mentions the biggest problem we face as a global society. We heard from the minister that “Budget 2016 continues to build on B.C.’s leadership in clean technology and climate action. Climate change is a global issue, and the Premier has made it clear that B.C. will remain a climate action leader. And we have been able to move forward with that leadership on climate change while also growing our economy” was another quote.

Yet in the budget itself, there is scant mention of climate change. And the funding put aside doesn’t so much build on B.C.’s leadership in clean tech, as they said, but only supports one policy: the continuation of their existing electric vehicle program. That’s it. No more. Climate leadership, to this government, means continuation of an electric vehicle incentive. Nothing more. Hardly going to help the majority of our society.

Admittedly, I did benefit from that. I did get an electric vehicle. But there are many who this will not benefit. And I wonder how many in government have actually taken this incentive and got an electric vehicle. Probably a small number. Very small number. I’d guess zero.

Interjections.

A. Weaver: It’s not true? So that’s good. I’d like to have a list of all government MLAs who own an electric vehicle come my way, and I’d be happy to praise them publicly. But we’ll see.

The construction of Site C dam has put the final nail in the coffin of the clean-tech sector in British Columbia. Shocking. The Canadian Wind Energy Association has just left B.C., citing the existence of greener pastures elsewhere. Well, let me tell you. There will be greener pastures here in just a little more than a year, when this government is sitting on this side of the bench and the rest of us are sitting on that side of the bench.

A $1 billion investment on Vancouver Island involving a partnership between EDP Renewables…. This isn’t pipedream stuff. This is real investment, not of taxpayer money but of industrial money, on Vancouver Island through partnership between EDP Renewables. First Nations and TimberWest,. It’s gone. They’ve walked from B.C. because of a lack of leadership by this government. Frankly, that’s reckless economics, in my view. It’s reckless mismanagement of our economic system.

British Columbians are fed up with this rhetoric. World leaders of this. World leaders of that. We’ll all be happy and wealthy and wise, blah, blah, blah. That’s what we’re hearing. But enough is enough. This government is out of ideas.

They’ve misled British Columbians about the prospects of LNG. They look out for their vested interests, and they say whatever it takes to get through lunch, whatever it takes to get to dinner, then whatever it takes to get through a day and on and on. They say whatever it is in the desperate hope that British Columbians are not paying attention. But they are.

The carbon tax remains flat, and leadership on climate change mitigation is largely absent. As I’ve heard nothing about this, I look forward to, hopefully, hearing something in the fall, where the government once more kicks another file down the road.

Government has ignored the agriculture sector until just recently, just like they ignored the tech sector until last August, when four civil servants were tasked to come up with a conference. That’s the government’s idea: “Let’s have a conference on agriculture. That’s leadership.” But we do have a leadership opportunity here in B.C. in the knowledge economy of the 21st century.

I was recently up in Prince George and saw firsthand how the tech industry could actually partner with our resource sector to take our strategic advantage and build our economy. Why is this government not investing $6 million to provide broadband redundancy to Prince George to allow Prince George to take advantage of its cooler climate to become a tech hub and bring the resource and tech sectors together, to be the home for data distribution centres like Google wants to be?

Six million dollars would be the biggest economic drive for that region, with the introduction of broadband redundancy, that that region has seen for decades.

Yet this government would rather spend $8 billion on a project for energy that’s not necessary because there’s no LNG and Alberta has said no. That’s their view of economics. What you got? My six million bucks is my view of economic prosperity.

Now let’s talk about the biggest item by far in this budget, an item with an $8.7 billion price tag. That’s kind of there in one line. The Premier recently stated that she wanted to move this project past the point of no return — another irresponsible statement by this Premier. Yet we have no LNG industry, and just today we hear from First Nations in the Peace region that they will soon be in court, as the injunction is coming to play out as B.C. Hydro tries to stop protesters.

I have so much more I could talk about, but I do see we’re on the green light. I could talk about LNG. I would love to talk about the prosperity fund. I have probably another half-hour speech, and I’m looking forward to being able to do that. Probably, I should be making an amendment right now to the budget speech so that I could actually talk about this stuff. But let me just say that what we should be doing in British Columbia is building on our strengths. We should be demonstrating leadership….

Some Hon. Members: More. More.

A. Weaver: If you would like more, members opposite….

Hon. Speaker, with your permission, I’ll speak for another half-hour. Would that be possible? Maybe I’ll give away too many ideas.

Finally, starting to take action, real action on the issues of affordability, directing our economy for the future prosperity rather than political talking points and making B.C. a leader on the issues of our time is what I had hoped this budget might do. Unfortunately, in my view, while there’s a lot of popular language in this, it’s found wanting on many, many points. Probably, the most cynical aspect of this budget is the prosperity fund, the $100 million prosperity fund, which, when you peel it down, is actually only a $25 million fund. And it’s a $25 million fund of taxpayer money.