Youth

Welcoming a Class from South Island Distance Education

One of the joys of being an MLA is welcoming students of all ages to the Legislature, showing them some of the history and beauty of the building and on occasion introducing them in the House. Today was one of those pleasurable days.

I had the distinct pleasure of meeting a class of special needs students from the South Island Distance Education School (SIDES). These are young adults transitioning from high school who are learning life and social skills, increasing their reading and math levels and learning about the community. SIDES offers a wide range of courses and classes, often through the internet, to students throughout the province with a teaching and support staff dedicated to ensuring school children and young adults of all abilities can obtain the education credits to graduate, and skills to enter the work force or post-secondary courses.

Thank you to the teachers Elaine Ethier and Dana (pronounced as in banana) Crow for bringing the students Becky Hansen, Joel Wright, Ben Vanlierop and Emily Medwid. It was a delight to be able to introduce all of you in the House today.

Constituency Report – October 2015

Constituency Report is a public service that Shaw TV graciously offers MLAs. This month’s video is provided below.

Judy Fainstein and I tried something different this time. For the first segment we discussed legislative issues relevant to Oak Bay-Gordon Head and British Columbia in general. In the second segment, I introduced Rory Hills, a recent graduate from Oak Bay High School. Rory and I had a wide-ranging discussion on the topic of youth engagement in politics.

I’d be interested in your feedback on this constituency report.

Constituency Report

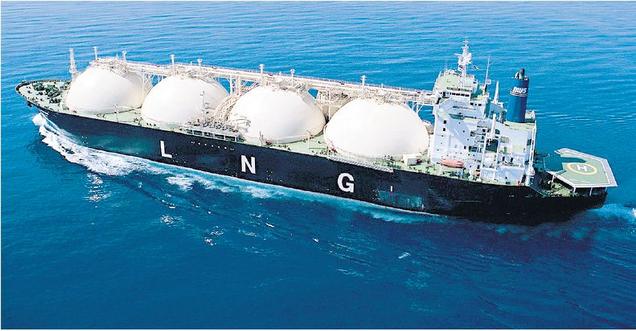

Bill 30 – Liquefied Natural Gas Project Agreements Act

Yesterday in the legislature I rose to speak strongly against Bill 30 — Liquefied Natural Gas Project Agreements Act. In a desperate attempt to fulfill outrageous election promises, the BC Government does what it can to give away our natural resources with little, if any, hope of receiving LNG tax revenue for many, many years to come.

Below is the text of my speech. You will see that at the end of my speech I offered a Reasoned Amendment. In speaking to the amendment I looked across the aisle to the MLAs opposite. I asked them to ask themselves one question. How do they think history will judge them? I argued that the generation of tomorrow will look back and will say: “This generation sold us out.” They will look back at this government’s decisions here to pass this bill with disdain, with shock, with disbelief and ask why?

Both the BC NDP and I stood together in support of my amendment and against passing second reading.

Second Reading Speech

A. Weaver: I rise today to take part in the debate on Bill 30, the Liquefied Natural Gas Project Agreements Act, or PDA. That I’ll refer to later. This is a bill that our Premier has indicated will have historic implications.

Before I begin, I’d like to acknowledge the Minister of Finance’s efforts to ensure that my office received the necessary briefings and had an opportunity to ask questions prior to debating this bill in the Legislature. I’d also like to acknowledge that, true to the Minister of Natural Gas’s word, we are indeed debating the PDA in the Legislature, providing MLAs an opportunity to examine and debate its implications. While I may not like what I see, I do feel I need to acknowledge my gratitude for the opportunity to voice my concerns publicly.

Now I’d like it make two confessions. First, I’m surprised in how the government is choosing to frame the debate on this bill. In her introduction of the bill, our Premier noted this: “It is not every day in this House that we get the chance to really make our mark in history.”

Those words ring oddly familiar to me, having heard similar remarks from a previous Finance Minister back in 2008.

“Or we can seize the opportunity before us to be the generation of British Columbians who made the right decisions, who chose to take action and who, by doing so, showed their respect for the earth, for the atmosphere, for those who came before us and for those who will follow in the decades to come. Let’s rise to the occasion, and let’s work together to shape the next proud chapter in the history of British Columbia.”

These are, of course, the words of Finance Minister Carole Taylor as she introduced the 2008 budget in British Columbia, which laid out a path towards a sustainable and resilient future for our province with the climate action plan.

It is in this that I must admit my surprise. I’m surprised at how far this government’s ambition has fallen, from striving to achieve a place of global leadership on the most pressing issue of our time — namely, the transition to a diversified, resilient 21st-century economy — to declare that we are “building our future” on the bedrock of a fossil fuel industry. I hope the irony is not lost on the government.

The second confession I must make is that I was wrong about the government. Three years ago, when our Premier began her all-in sales pitch on LNG, I was certain that the reality of the global market conditions, the uncertainty we see in neighbouring jurisdictions like Alberta — when they have tried to build a province around a single industry — and the greenhouse gas reduction commitments the previous administration had made, that this would force the government to dial back on the rhetoric and accept that it was unlikely that we would attract an LNG investment. But the rhetoric was never dialed back.

I couldn’t possibly imagine what this government was willing to give away in order to potentially land an LNG facility: our climate leadership; the ability of future governments to re-negotiate tax rates in the interests of the province; a fair price for the resource that belongs to the people of British Columbia.

Back in the fall of 2012, the then deputy minister of Energy, Mines and Natural Gas gave a presentation at the 2012 annual Clean Energy B.C. conference, entitled Fuelling Our Economy: British Columbia’s LNG Strategies. The government’s expectations at that time were revealed, and this was in 2012. At the time, Japan LNG was trading at $16 per million Btu, and the government was promising rising global LNG prices for many years to come.

So what’s happened to the global market since 2012? Well, we all know, and it was entirely predictable, given the fact that we are not the only ones in the world who have discovered horizontal fracking technology. Our shale gas reserves pale in comparison to those of other countries. There are massive reserves in Australia, in Russia, in Iran, in Qatar, in China and in the United States. Shale gas exists all around the world, yet somehow B.C. thought that it, and only it alone, was going to fill Asian market supply gas with our natural gas.

Well, as I’ve been pointing out for almost three years now, there is a global market oversupply, and we are latecomers to the game. Today the LNG East Asia index is trading July 2016 delivery contracts at $7.35 per million Btu. August 2015 contracts are even lower — $7.25 per million Btu. It’s more than a 50 percent drop from just three years ago, but it’s not going to end there.

Sanctions are about to be lifted on Iran, and with Iran being the home of the world’s second-largest natural gas reserves that are in order of magnitude that’s more than a factor of ten, that’s larger than Canada’s reserves — let alone British Columbia’s — it’s clear that downward price pressures will continue in the natural gas and LNG markets.

As the reality of this government’s irresponsible election promises became more and more transparent, the government became more and more desperate to land one positive final investment decision. That is why this legislation and the project development agreement it is meant to enable represent, as I outline below, a generational sell-out, a public display of affection between Petronas and the B.C. Liberals.

We may eventually get an LNG facility in this province, but at what cost? As Martyn Brown, former B.C. Premier Gordon Campbell’s long-serving chief of staff and the top strategic adviser of three provincial party leaders, so aptly noted in an article published on Monday: “The fine print of that deal will commit our province to a course that is environmentally reckless, fiscally foolhardy and socially irresponsible. I say that as someone who is generally supportive of the merits of LNG development, to the extent that it is invited without giving up more than we can collectively stand to gain.”

Please let me explore this cost in some detail to illuminate what this government is asking us to give up to ensure they deliver on an over-the-top election promise. Start with the LNG tax. In the fall, we passed the Liquefied Natural Gas Income Tax Act, a bill that laid out the tax regime for LNG. With its introduction, we saw the LNG income tax slashed from a proposed 7 percent to only 3½ percent.

We also learned that companies would only be paying a 1.5 percent tax while they paid off their capital investment costs and that the tax they paid in that period could be applied as a credit on future taxes at the 3.5 percent rate. The LNG income tax legislation was a clear reflection of the unrealistic economics behind the government’s hyperbolic LNG promises.

In the spring, only a few short months after we passed the Liquefied Natural Gas Income Tax Act, the government introduced the Liquefied Natural Gas Income Tax Amendment Act. At 109 pages, this amendment act was longer than the original act, and the purpose of the amendment act was to close many of the massive loopholes that were left open when the original act was signed.

The key point to acknowledge here is the very fact that the government had to introduce the bill in two stages. They couldn’t introduce the complete income tax legislation all at once because it wasn’t ready, and they were in a rush. The government had to get the skeleton passed so that LNG companies would know, more or less, what they were going to have to pay, but they were operating on such a tight timeline that they didn’t have the time to have the fully finished legislation available in the fall.

I appreciate that the government is acting swiftly to try to meet what it perceives to be a limited window of opportunity before the 2017 election as Petronas tries to firm up supply for its mid-2020s supply gap. My concern is that in trying to meet that window, we may be opening ourselves up to making colossal errors.

The truth is we have no idea at this stage if we have closed all of the loopholes in the LNG Income Tax Act. Our first-rate civil servants, of course, have been doing their best to remediate the act’s shortcomings, but it’s not uncommon for tax legislation to be amended in the future to account for unforeseen loopholes, even years after it’s been introduced. In this case, of course, we won’t have years to fix it. In fact, we won’t have any time to fix it. If we pass this bill, the LNG Income Tax Act will be locked in for 25 years.

Now, I know that the government would respond by saying it has reserved the power to make amendments for administrative and technical matters for enforcement measures and to respond to tax avoidance issues, but I’m not talking about tax avoidance. I’m talking about tax planning. I’m talking about an LNG taxpayer identifying and exploiting a legitimate loophole in the legislation such that they could, for example, pay tax at the 1.5 percent rate well past the originally intended period. If it deemed that the taxpayer’s actions are legitimate and therefore do not constitute tax avoidance, then under this agreement any change you make to close that loophole could trigger the indemnity clause, requiring the province to potentially pay that producer millions in damages.

If we pass this bill, we won’t get another chance to close those loopholes, so we’d better have gotten it right the first time. Given how quickly LNG income tax bills were developed and the manner in which they were introduced, I’m deeply concerned that we didn’t get it right the first time. In fact, I raised serious issues myself during the debates about potential loopholes.

Yet it’s not just about the loopholes. It’s about the legislation itself. This is an LNG giveaway designed to attract an industry that wouldn’t otherwise come to B.C. By passing this legislation, we are locking the province into LNG income tax rates that have been widely criticized as being too low, and we won’t have another chance to reconsider those rates for 25 years. What if the government got it wrong? Twenty-five years is a long time. It’s too long for British Columbians to wait to fix the government’s error.

Let me turn to the natural gas tax credit. The same is true for this. B.C. already has the lowest corporate income tax rates in the country, but apparently that wasn’t low enough for the LNG companies, so we gave them an additional 3 percent back through the natural gas tax credit. What makes LNG companies so special that they need an additional 3 percent corporate income tax cut on their corporate income tax? What makes them so special? Do they not make enough money to pay themselves, like all other corporations do? Are their profits so low that they need government assistance in the form of tax breaks?

Consider this. Petronas by itself funds 45 percent of the Malaysian government’s revenue, so why are we giving them an additional 3 percent off of their corporate income tax? My concern is that is inconsistent and an arbitrary policy that is a result of government negotiating from a weak position to fulfil a campaign promise that never should have been made. And British Columbians today and in the future will bear the cost.

Let’s turn to the Greenhouse Gas Industrial Reporting and Control Act. The day the project development agreement comes into force is the day that we officially give up on our climate targets. There’s no debate there. Government can spin this any way they want, but there is simply no debate there. It’s a simple fact. We cannot have an LNG industry and meet our climate targets.

If constructed, Pacific NorthWest LNG alone, one company, would emit nearly as much carbon as the rest of our entire province, in every single sector, would emit in 2050 — one LNG facility — if we actually take those targets seriously. When we hear the rhetoric about “we have targets, and we will meet them,” let’s be clear: those targets, if we are to meet, mean we cannot have an LNG industry. You can’t have it both ways. The facts are clear.

Unfortunately, this isn’t a surprise. When we debated the Greenhouse Gas Industrial Reporting and Control Act back in the fall, it was clear that this government was no longer serious about addressing climate change. Instead of strengthening our policies, they repealed the cap-and-trade legislation and introduced a new focus on emissions intensity, a scheme that would allow you to pollute as much as you want so as long as you did so efficiently, a scheme directly out of legislation that exists in Alberta.

On Monday the government released further details on its environmental incentive program. The sellout continues. The program essentially gives yet more tax breaks to LNG companies to pay for the costs of their emissions offset. What’s particularly noteworthy is that the government’s new “environmental incentive program” has made it even easier for LNG companies to qualify for tax breaks by making the qualifying threshold higher. Originally under the GGIRC, a company had to have an emissions intensity of 0.23 to qualify for a tax break. Now the actual emissions intensity can be substantially higher than that because the company can discount all of its “entrained” CO2 emissions before it is assessed for the tax break.

What are entrained CO2 emissions? In any natural gas stream, there’s unwanted carbon dioxide that can now be freely released to the atmosphere — that’s fugitive greenhouse gas emissions — at the site of the LNG facility. Fugitive greenhouse gas emissions are not covered by the carbon tax.

So this is not the cleanest LNG in the world. This is the cleanest LNG if you have a whole bunch of loopholes and don’t account greenhouse gas emissions in the world. But nobody takes that seriously. It’s a bit rich for this government to continue the rhetoric that it is dealing with the climate issue and at the same time building the cleanest LNG in the world.

Emissions from the gas stream can be very large. They’re not subject, as I mentioned, to the carbon tax. Even those LNG companies that have emissions intensities well above 0.23, far from the so-called cleanest LNG of 0.16, now can qualify for an additional tax break. What even makes this worse is that once this bill passes, we can’t change it. Should we decide that low emitters that actually hit the 0.16 intensity mark deserve any kind of bonus, we would still have to pay those other higher emitters anyway under the indemnity clause. It makes no sense.

Similarly, should we decide that 0.16 is too high an emissions intensity, we’ll have to pay the LNG companies under the indemnity clause to lower it. So there’s no real point in improving those standards.

Contrary to what’s suggested by the name LNG environmental incentive program, by signing this agreement, we are giving away any incentive for these companies to actually lower their emissions under the GGIRC for the next 25 years because we won’t have a way of steadily and predictably increasing costs of emissions. That’s hardly encouraging the development of the cleanest LNG in the world.

As I’ve mentioned earlier, the current carbon tax applies only to emissions from combustive fossil fuels. A major gap is the methane and CO2 leakages from upstream natural gas operations and pipelines which are not taxed but now could be because of audited information from British Columbia’s greenhouse gas–reporting regulation.

While I recognize that this bill specifically states that any indemnity only applies to regulatory changes specific to the LNG facility itself, my fear is that in eventually plugging the regulatory gap on methane leakage emissions, which will increase the cost of gas at the LNG facility, Petronas would litigate. Now, government will surely claim that this was not the intent of its agreement. Petronas is a powerful resource state-owned multinational corporation, and even the threat of litigation could frighten future governments from regulating emissions.

Perhaps most worrisome of all is the framework in which all these pieces are embedded: the project development agreement. With the PDA, the government is setting a new precedent for how it will manage investments into our province. I’m concerned that this may put British Columbia in a very weak negotiating position on any future negotiations.

Please let me explain. Under this PDA, companies have the ability to negotiate for more favourable deals and piggyback on those secured by future proponents.

If the province doesn’t have this ability, in fact there are only two options for the province: maintain the relatively low standards of this PDA and hope other companies agree to them or lower them further to attract other LNG investors, in which case we have to lower the standards for everyone. These are precisely the conditions that risk exacerbating a race to the bottom. Furthermore

Furthermore, while the province will be locked in for 25 years with no exit clause, the proponent can pull out at any time with 90 days’ notice. I understand, of course, that when a company is making a large investment, they would like to have added certainty. However, if we are to provide that added certainty — and I caution that, in my view, a 25-year time frame seems a bit rich — then I would expect significant concessions in return.

In essence, we are transferring risk from the company to our province, which, in turn, is de facto transferred to the British Columbia taxpayers. If British Columbians are to take on that risk, then we should be adequately compensated for it.

Yet with this PDA, we are locking in tax rates that have been criticized as being far too low, thereby limiting the revenue we receive from the industry while also establishing no guarantees regarding jobs, training or other — for the lack of a better term — non-monetary commitments.

This, unfortunately, isn’t surprising, because the market conditions aren’t there to support these commitments, and our government was never in a strong negotiating position to demand them to begin with. I fear what we’ve done is we’ve transferred risk to the province and to British Columbians without gaining a fair return in exchange.

In addition, what is particularly concerning about this approach is that there doesn’t appear to be a clear, consistent policy on when a company can get a PDA. Businesses and our economy prosper best under a level, transparent playing field and certainty. Yet here we have a new policy tool, a project development agreement, that’s being applied to one company with no clear criteria for conditions under which another company could apply for a similar agreement.

The government likes to tout Pacific NorthWest LNG as constituting a $36 billion investment. I’ve heard it time and time again through the debates. It states that the scale of this investment is the reason that it qualifies for a PDA. The PDA only applies to the LNG facility, though. There are separate, other long-term royalty agreements that govern upstream natural gas extraction, and other measures to govern the pipeline.

Let’s break down these numbers. Let’s unpack them for all those riveted to their television screens across British Columbia. If you actually break down the numbers, the LNG facility only counts for $11 billion in investment. And guess what — $8 billion of that will be spent overseas. They’re not going to build the facility here. They’re going to build it in Asia, bring it in on tidewater and put it in British Columbia. So really, we’re actually talking about $3 billion, maybe $4 billion invested in B.C.

Let’s put that in context. While this is clearly a significant amount, the northern gateway pipeline was a $7.9 billion investment. Should we be giving them a PDA? The Trans Mountain pipeline was a $5.4 billion investment. Should they get one? EDP Renewables, TimberWest and First Nations on Vancouver Island want to invest $1 billion today, not hypothetically in the mid-2020s, yet the government has turned its nose on that, and they’re walking. Should they get a PDA?

I don’t believe we should be bringing forward a new policy tool such as PDAs without first establishing how they’re used. The last thing we want is either an unfair playing field for business or a proliferation of PDAs that facilitate the fire sale of our resources while constricting the ability of future governments to make necessary changes.

To First Nations. I’m disconcerted about how little we have heard from this government about its negotiations with First Nations. I’m left with many unanswered questions and a concern that we may be failing our fiduciary responsibility toward aboriginal people.

Is the PDA established even constitutional? Have we got legal opinion that section 35 of the Constitution Act — which limits provincial or federal government’s ability to legislate in a way that results in a meaningful diminuation of aboriginal or treaty rights — is not being violated? Would the law that we are debating today that would tie hands of future governments also purport to limit the aboriginal groups’ ability to negotiate the revenue they will receive from a project? Is this in line with what has been established in the Tsilhqot’in decision? There are many unanswered questions that we have yet to have answers given to us by government.

Are we setting up a regime where First Nations are partners in the development? Or are we foisting the development of an LNG facility on an ecologically sensitive island that would deprive future generations of the benefit of the land and the salmon that spawn, which the eelgrass nearby is critical for?

Signing agreements while committing to further engagement is not the way to reconcile relations with First Nations. It’s not rising to the challenge before us to chart a better path. We must instead engage and partner with First Nations, proceeding to sign agreements and move development forward when we can do so together.

In conclusion, I’ve lost track of the number of times the government has stressed that LNG is a generational opportunity. Indeed, the impacts of our decisions this week will be felt for generations to come. Yet I fear those impacts will not be positive. The fact we need this PDA should underscore how much this government has had to put on the table to buy this industry.

This legislation is highly illustrative of the shaky and desperate LNG climate that currently exists in B.C. and is embedded in the larger pattern of industry giveaways. We’ve already locked ourselves into long-term royalty agreements and changed municipal tax laws to allow for the special treatment of LNG facilities. We’ve dedicated years of government resources to develop a single industry, instead of investing in a diversified, resilient economy that is based on the multitude of strong, existing and up-and-coming industries we have in B.C.

For example, government proudly proclaims that if and when it becomes operational, the Petronas facility could — not likely but could — support 500 long-term jobs. Let’s put that number in context. Hootsuite, the rapidly growing Vancouver-based social media company, already employs more than 700. So 700 jobs and growing weekly, yet government is touting 500 jobs.

In the last legislative session, I voiced my concerns about Bill 12, the Federal Port Development Act. As I previously explained, on its own, Bill 12 is not inherently problematic. But when considered in conjunction with Bill C-43 federally, issues arose, as Bill 12 did not account for any of the regulatory holes left open by the federal bill.

As I continue down this path, it’s very troubling that the recently proposed Port of Prince Rupert liquefied natural gas facilities regulations put forward by Transport Canada and recently posted in the Canada Gazette, plan to put the B.C. Oil and Gas Commission in charge of regulation of LNG terminals on federal lands. Talk about putting the fox in charge of the hen house.

Especially worrisome are the broad exclusions described in section 11 of these federal regulations now in the Canada Gazette. This is what they say: “Unless otherwise provided by these regulations, a provision of an incorporated law that imposes an obligation, liability or penalty on an owner, occupier, public authority, public body or unspecified person or entity does not apply to Her Majesty in right of Canada or to the Prince Rupert Port Authority”

It’s essentially saying that laws that would generally apply to the port will only do so if expressly required by regulations — regulations set by the Oil and Gas Commission. The effect of this provision would be that laws of general application would no longer apply to the port, making it above the law. It could mean that the port could operate nearly independently of the Oil and Gas Activities Act.

Deputy Speaker: We seem to be straying from the bill at hand. If the member could draw it back.

A. Weaver: Hon. Speaker, I’ll bring it right back. I’m trying to give an example of the desperate efforts that this government has taken to actually land this, as embodied in the PDA. This desperate measure, one of them, I raised last session and is actually coming to fruition as we speak. In fact, it just came in the Canada Gazette, and it’s very relevant, hon. Speaker. I’ll finish with one sentence.

What I wanted to say is that it means now that the port could operate nearly independently of the Oil and Gas Activities Act, the Drinking Water Protection Act, the Environmental Management Act, the Species at risk Act and any other laws that could be required to protect the environment and public health. This is the extent of the giveaway embodied in the PDA, embodied in all the other pieces of legislation that this government has brought forward. And sadly, this is just the tip of the iceberg as far as these regulations are concerned.

Now with the passing of this bill, we will be locking ourselves into an untested LNG income tax regime and signing away our ability to fix any unforeseen problems. We will be solidifying tax rates demanded by industry in negotiations with a desperate government. We’ll be throwing away our climate targets and the commitments we made to them and selling out the next generation. An LNG export industry and our climate targets never could have coexisted. You don’t have to believe me. Government can ask its own civil servants, who’ve been advising them of the same thing for several years.

An LNG export industry, as I said, cannot coexist with our climate targets. We could have done more to mitigate the increased emissions. Instead, we saw the definition of “cleanest LNG” that we were pitched two years ago gutted to remove upstream and midstream emissions.

But still, you know, I’m an optimist, and still I’m a firm believer that it’s not too late. I still believe we have the opportunity to change directions. There’s still time to redirect our efforts into building a diversified, resilient economy, one that builds on our potential in clean tech, high tech and the creative economy, that embodies our strength in tourism and small business and that is based on the sustainable and thoughtful development of our natural resources, including forestry, mining, fisheries and natural gas, to name a few.

It is with this hope in mind and with these concerns laid out that I move a reasoned amendment on Bill 30, Liquefied Natural Gas Project Agreements Act. I submit to the House the following motion.

[That the motion for second reading on Bill 30, Liquefied Natural Gas Project Agreement Act, be amended by deleting all the words after “That” and substitute the words “be not now read a second time as Project Development Agreements inappropriately limit the ability of future governments to use their legislative prerogative to respond to the future environmental, social and economic challenges that will face both an LNG industry and our Province.”]

Text of my Speech to the Amendment

A. Weaver: Very briefly, on the amendment all I would like to say is I’ve laid the case out there. I look across the aisle to the MLAs opposite, and I ask them to ask themselves one question. When they open a history book 20 years from now, those of them who are still around, I will ask them this: how do they think history will judge them?

I will tell you how history will judge them. The generation of tomorrow will look back and will say: “This generation sold us out.” They will look back at this government’s decisions here to pass this bill with disdain, with shock, with disbelief and ask why. That is why I’m giving government a last chance.

Some of its MLAs…. There must be truly one or two Liberals left in the Liberal Party of Canada. For them to think that this can pass and for them to think that they are Liberals — it’s just simply not possible because Liberals, true Liberals, federal Liberals, would not do this. They would recognize the importance of meeting our climate targets. They would recognize the importance of working for a sustainable economy. They would not sell out the future generation, as this government is about to do.

Video of my Speech

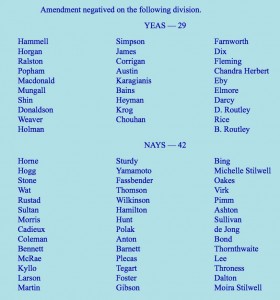

Vote on the Amendment

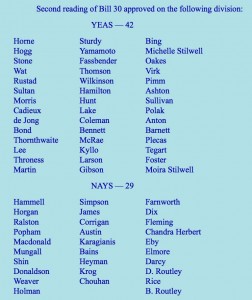

Vote on Second Reading

The Need for Government Leadership

This is the final installment of a seven week series examining the topic of child and youth mental health in B.C. As this is a complex and multifaceted topic, I will be narrowing my focus to a few popular beliefs and areas of concern that I have witnessed in my role as MLA. The purpose of this series is to debunk these beliefs, increase awareness of these concerns, end the stigma of mental health in our society and provide opportunities for you to impact what is happening in your community.

“Considering that the well-being of our most vulnerable children and youth is at stake, I expect more from government and I think most British Columbians do as well” – Mary Ellen Turpel-Lafond, Representative for Children and Youth

Popular Belief Eight: The government is addressing the issue

Reality: While some progress has been made to promote and address issues relating to mental health, British Columbia has a long way to go. If we are to truly improve our child and youth mental health profile here in B.C. we need strong government leadership to guide us there. Something we are lacking in this province today.

A decade ago B.C. and the Ministry of Children and Family Development (MCFD) were seen as a Canadian leader in child and youth mental health services. This was thanks in large part to the 2003 Child and Youth Mental Health Plan – the first of its kind in Canada – which included strategies focused on providing treatment and support, reducing risk, building community capacity and improving performance. Even though the plan did not deliver as significantly as was hoped in all areas, a 2008 internal evaluation did find notable progress had been made in the area of preventative measures.

While the five-year plan arguably needed some tweaking, it was certainly a step in the right direction. Despite this, the plan was replaced in 2010 with the government’s new ten-year plan to address mental health and substance use in British Columbia, entitled Healthy Minds, Healthy People.

Though this new plan does respond to some of the concerns that have been raised around child and youth mental health services in B.C., it falls short of improving upon the 2003 plan. Not only is it not specific to children and youth – instead taking a lifespan approach with strategies for supporting children, youth, adults and seniors – it also does not contain any operational details of how the plan might be implemented. Nor does it specifically address any of the shortfalls found by the internal review of the 2003 plan. Thus leaving B.C. without a clear and measurable guide for providing substantive support to youth and their families.

Representative for Children and Youth

In 2006, B.C. appointed Mary Ellen Turpel-Lafond as its first Representative for Children and Youth. The Representative is an independent expert oversight body tasked with supporting children, youth and families who need help in dealing with the child-serving system.

Between the years of 2008 and 2013 the Representative’s office made a total of 148 recommendations to the provincial government to improve the lives of B.C’s most vulnerable children. While 72% of these recommendations have been acted upon, a number of the most important ones remain unfulfilled – including her recommendation for government to create a Minister of State of Youth Mental Health.

During this same five-year time period, MCFD’s budget was reduced by more than $37 million – this amounts to nearly $100 million when inflation is accounted for. While the current state of our mental health system is not solely a budget-shortage problem, it certainly plays a role. As the report points out “it is difficult to improve services on a shrinking budget.”

Furthermore, the fact that MCFD’s budget has shrunk despite the mounting evidence that our youth mental health system is in serious need of a redesign, shows just how misguided our approach thus far has been.

Where do we go from here?

Instead of cutting MCFD’s funding, we should be investing more in a Ministry that is mandated with providing crucial services to one of our most vulnerable populations.

Instead of disregarding key recommendations made by an office dedicated to protecting children and youth in B.C., we should be working with the Representative for Children and Youth to ensure our mental health system is providing current, best-practice services for all levels of care.

We need to understand that by investing in these services now, we lessen the need for more acute and expensive services in the future. And that by supporting the mental health of our children today, we are giving them the tools they need to support themselves tomorrow.

It is time for the B.C. government to recommit to the mental health and well-being of our young people and to once again become a leader in child and youth mental health services.

Weekly Action Item

I have always said that if you don’t like the way your government is addressing an issue – or not addressing one – then you need to get involved, you need to express your concerns and make your voice heard. In fact, that is precisely why I ran for office in the first place.

So this week, for our final action item, I am asking you to vote. I strongly believe that one of the most powerful tools we have at our disposal is our power to vote. With the Federal Election just around the corner and the next Provincial Election less than two years away now is the time to let your politicians know that issues surrounding Mental Health and Mental Illness are of top priority to you as a voter.

When you are contacted by campaigners, ask what their party is doing to address these concerns. Research your local candidates to find out their policies around child and youth mental health. Encourage your friends and relatives to do the same. And most importantly, when election day arrives get out and vote.

Cost-Savings of Investing in Mental Health

This is the sixth in a seven week series examining the topic of child and youth mental health in B.C. As this is a complex and multifaceted topic, I will be narrowing my focus to a few popular beliefs and areas of concern that I have witnessed in my role as MLA. The purpose of this series is to debunk these beliefs, increase awareness of these concerns, end the stigma of mental health in our society and provide opportunities for you to impact what is happening in your community.

“The cost of not mending our services to provide adequate support to vulnerable children is huge. The human cost of suffering and despair is immeasurable. The economic costs of preventable long-term use of public services, unfulfilled human resources and drain on productivity are very clear. There are many more reasons to act than not.” – Mary Ellen Turpel-Lafond, Representative for Children and Youth

Popular Belief Seven: We can’t afford to put more money into the mental health care system

Reality: Mental health problems not only have devastating emotional, physical and social impacts on individuals and their families, they can also place an enormous burden on our economy. Conservative estimates find the direct costs (ie: health care, certain social services and income support) of mental health problems and illnesses to Canada to be at least $50 billion per year – with the total cost to the economy adding up to more than $2.5 trillion over the next 30 years.

However, the true economic cost is likely much higher as current estimates exclude expenses such as costs of caregiving and costs to the judicial system. In fact, if estimates in Ireland and Wales hold true for Canada, the current cost of mental illness is approximately $192 billion dollars.

In addition to these direct costs, there are also high indirect costs of mental illness. It is estimated that approximately 21.4% of the working population experienced a mental illness in 2011, resulting in the annual productivity impact of mental illness in the workplace to be over $6.4 billion. Similarly, a report out of the United States estimated the total lifetime economic cost of childhood mental health problems and illnesses to be $2.1 trillion. When translated to our smaller population, the cost in Canada would be roughly $200 billion.

And these expenses are not just felt by the public sector. With mental health problems and illnesses accounting for 79% of long-term disability claims and 75% of short-term disability claims, the costs for disability due to mental illness are the fastest-growing disability costs for Canadian employers. It is estimated that the private sector spends between $180 and $300 billion on short-term disability claims and $135 billion on long-term disability claims due to mental illness. With evidence suggesting that mental illness will be the leading cause of disability in high-income countries by 2030.

At this rate, the total cost of mental illness to society could soon be greater than the entire cost of the health care system in Canada.

Cost-savings of addressing the issue

While the economic costs of mental illness are evident, the savings that can be gleaned from improving services and supporting upstream initiatives can be harder to prove. For one, the benefits of reducing the rates of mental health problems are often not seen until the longer term. Because of this, the costs of mental health promotion and prevention are much easier to evaluate than the benefits. Similarly, cost-savings are not necessarily seen where the money was invested. For example, savings from investing in mental health education in schools are more likely to be seen down-the-line with reduced costs to the judicial and health care systems. As a result, it is hard to put an exact number on just how beneficial such programs can be.

That being said, there is a fair amount of evidence to show that the promotion of mental health and prevention of mental illness can go a long way in combating the rising costs of mental health problems and illnesses. A recent study by the Canadian Institute for Health Information suggests that there is a return on investment (ROI) for some mental health promotion and mental illness prevention interventions. The strongest ROI evidence can be seen for children and adolescents, where promotion and prevention programs have shown to provide huge and long-term impacts.

Although more detailed research and evidence within Canada is lacking, countries such as the U.K., U.S. and Australia have produced extensive economic evaluations of childhood and youth interventions. One study found cost-savings from $1.80 to $17.07 for every dollar spent on programming. While more research is needed to understand exactly how cost-beneficial such programs can be, it is clear that by investing in mental health we benefit both the economy, and society as a whole.

Weekly Action Item

As an MLA, I have witnessed first-hand the impact that public opinion and engagement can have on encouraging the BC government to focus on a specific issue. With this in mind, please consider taking time this week to communicate to decision-makers the importance of making child and youth mental health a priority. A good place to start might be to contact your local MLA and let them know that you would like British Columbia to take more action to address the mental health needs of our youth. Perhaps starting with the recommendations made to government by the Representative for Children and Youth.

Please also consider urging your friends and family to write letters or emails to local Mayors, Councilors, MLAs and MPs, and the offices of the Premier and the Prime Minister. It is time for us to take long-lasting, substantive steps to ensure the necessary supports and resources are in place to support the mental health and well-being of our young people.